MAY 2015 ERICKSON OVERVIEW

This presentation contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical fact are forward-looking statements, such as statements regarding our growth opportunities, our potential acquisitions, our future operations, financial position and revenues, and our other prospects, plans and management objectives, are forward-looking statements. You can identify forward-looking statements by words such as ‘‘believe,’’ ‘‘may,’’ ‘‘estimate,’’ ‘‘continue,’’ ‘‘anticipate,’’ ‘‘intend,’’ ‘‘plan,’’ ‘‘expect,’’ ‘‘predict,’’ “position,” ‘‘potential,’’ or the negative of these terms or other comparable terminology. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Numerous factors could cause actual results or events to differ materially from the plans, intentions and expectations disclosed in our forward-looking statements, including: our ability to realize the benefits of the recent Air Amazonia and Evergreen Helicopters, Inc. (“EHI”) acquisitions on a timely basis or at all; our ability to integrate these businesses successfully or in a timely and cost-efficient manner; our ability to successfully expand these businesses, enter new markets and manage international expansion; that we do not have extensive operating history in the aerial services segments, in the geographic areas, or with the types of aircraft historically operated by EHI and Air Amazonia; that the anticipated reduction in troops in Afghanistan in the near-term may adversely affect us; that we operate in certain dangerous and war-affected areas, which may result in hazards to our fleet and personnel; the hazards associated with our helicopter operations, which involve significant risks and which may result in hazards that not be covered by our insurance or may increase the cost of our insurance; our safety record; our substantial indebtedness; that we and our subsidiaries may still incur significant additional indebtedness; our failure to obtain any required financing on favorable terms; compliance with debt obligations, which could adversely affect our financial condition and impair our ability to grow and operate our business; cancellations, reductions or delays in customer orders; our ability to collect on customer receivables; weather and seasonal fluctuations that impact aerial services activities; competition; reliance on a small number of large customers; the impact of short-term contracts; the availability and size of our fleet; the impact of government spending; the impact of product liability and product warranties; the ability to attract and retain qualified personnel; the impact of environmental and other regulations, including FAA regulations and similar international regulations; our ability to accurately forecast financial guidance; our ability to convert backlog into revenues and appropriately plan expenses; worldwide economic conditions (including conditions in the geographic areas in which we operate); our reliance on a small number of manufacturers; the necessity to provide components or services to owners and operators of aircraft; our ability to effectively manage our growth; our ability to keep pace with changes in technology; our ability to adequately protect our intellectual property; our ability to successfully enter new markets and manage international expansion; our ability to expand and market manufacturing and maintenance, repair and overhaul services; the potential unionization of our employees; fluctuations in the price of fuel; the impact of changes in the value of foreign currencies; the risks of doing business in developing countries and politically or economically volatile areas; and other risks and uncertainties more fully described under the heading “Risk Factors” in our most recently filed Annual Report on Form 10-K as well as the other reports we file with the SEC from time to time. All of the information provided in this presentation is as of today’s date and we undertake no duty to update this information, except as required by law. This presentation contains financial measures not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), including EBITDA and Adjusted EBITDA. These measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Further information regarding our non-GAAP financial measures, including a reconciliation to the most directly comparable GAAP financial measures, are included in our most recently filed Annual Report on Form 10-K and the other reports we file with the SEC from time to time. DISCLAIMER

• Former Group President, CAE, Inc. • Former President & CEO of GE Capital Simuflite Training International • 30 Years of experience in Aerospace and Defense Jeff Roberts CEO & President TODAY’S PRESENTERS INTRODUCTION • Over 20 years of relevant experience • Former Vice President of Finance for Remy International Eric Struik CFO 2

SUMMARY COMPANY OVERVIEW • Erickson is one of the most diverse global providers of utility helicopter solutions — Wide range of aerial services solutions ranging from heavy-lift to light-lift — Market leading positions in key end markets • Service offering: — Heavy, Medium, Light-Lift and Fixed-Wing Aerial Services and precision placement — Transportation, product support, specialty aerospace manufacturing and MRO • Erickson’s expansion across both services and geographies positions the company for further penetration of high growth end markets Utility Helicopter SolutionsHighlights INTRODUCTION ERICKSON’S UNIQUE CAPABILITY AND LONG HISTORY POSITION THE COMPANY FOR FUTURE GROWTH 3

KEY INVESTMENT HIGHLIGHTS Diverse Portfolio of Aircraft with Flexible End Markets Aerospace MRO & Manufacturing Services to Support Legacy Airframes Vertical Integration of Services & MRO drives Revenue and Margin Opportunity Ability To Be Self Sustaining in Remote and Austere Environments Balanced End Markets and Global Profile Growth Not Constrained by Market Size 40+ Years of Experience 1 2 4 5 6 7 3 4

BUSINESS UNITS COMPANY OVERVIEW 5 GOVERNMENT AVIATION COMMERCIAL AVIATION MANUFACTURING & MRO Defense and Security Firefighting, O&G, Construction, and Timber Harvesting In-House Engineering 5

COMPETIT IVE LANDSCAPE COMPANY OVERVIEW Competitor COMMERCIAL DEFENSE MRO Firefighting Construction Timber Harvesting Oil & Gas Transport Search & Rescue MRO Manufacturing MOST DIVERSIFIED UTILITY PROVIDER IN THE INDUSTRY 6

OVERVIEW OF ERICKSON AIRCRAFT COMPANY OVERVIEW Picture Aircraft Description Picture Aircraft Description Erickson S-64 (20) (E & F models) • Heavy-lift aircraft • Twin-engine • Civil version of the United States Army's CH-54 Tarhe S76C+ (2) • Medium-lift aircraft • Oil & Gas configured • 12 passengers Sikorsky S-61 (2) • Medium-lift aircraft • Twin-engine • 2 pilots and up to 30 passengers • Same model as Marine One Eurocopter AS350 (7) • Light-lift aircraft • Single-engine • 1 pilot and up to 6 passengers Eurocopter AS332 Super Puma (4) • Medium-lift aircraft • Four-bladed, twin-engine, utility • 2 crew and up to 19 passengers Bell 206 (5) • Light-lift aircraft • Two-bladed, single- or twin- engined • 5 seat capacity Bell 214ST (12) • Medium-lift aircraft • 2 bladed, single engine • 1- 2 crew and up to 17 passengers Eurocopter BO-105 (1) • Light-lift aircraft • Four-blade, twin-engine • 1 - 2 pilots, total capacity of 5 Eurocopter 300J Puma (11) • Medium-lift aircraft • Four-bladed, twin-engined • 2 crew and up to 20 passengers CASA 212 (5) • Fixed wing • Two turbo propeller engine aircraft, for light transportation • Cargo compartment can carry up to 18 passengers Bell 412 EP / SP (5) • Medium-lift aircraft • 1- 2 pilots and up to 13 passengers Beechcraft 1900D (5) • Fixed wing • Twin turboprop regional aircraft • Up to 19 passengers Bell 212 (3) • Medium-lift aircraft • Two-blade, twin-engine • 1 pilot and up to 14 passengers Lear 35 (1) • Fixed wing • Two turbofan engines • Cabin can be arranged for up to 8 passengers 7UNIQUE FLEET MIX ENHANCES DIVERSE OPERATING CAPABILITIES

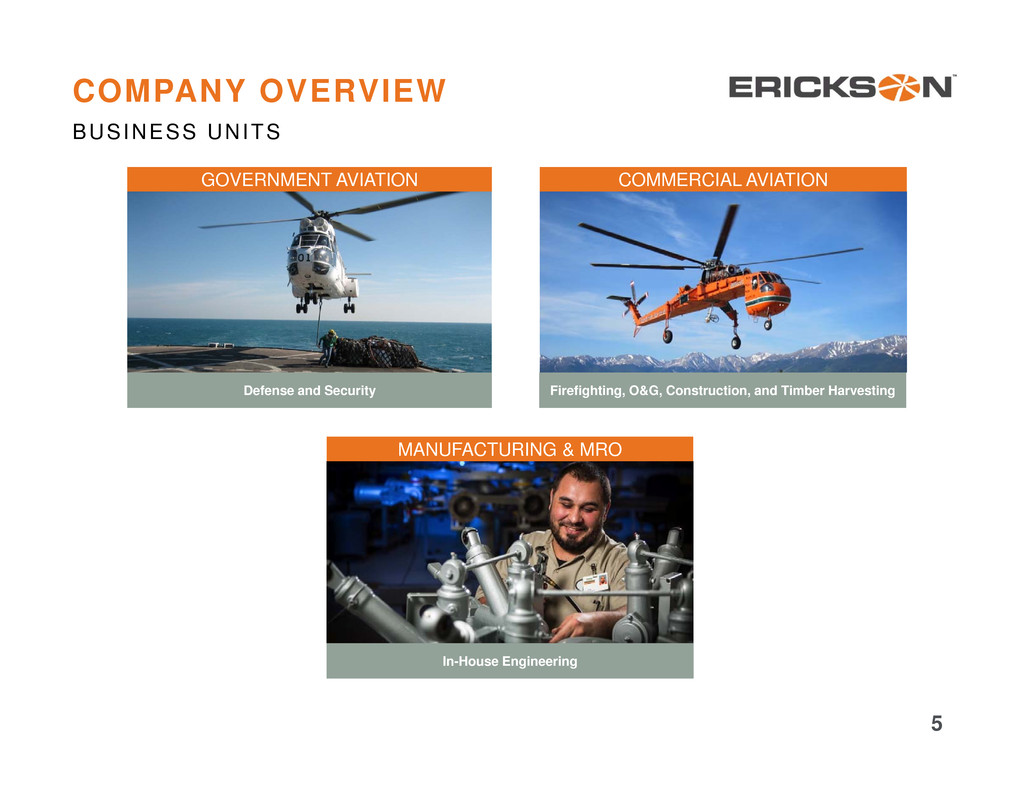

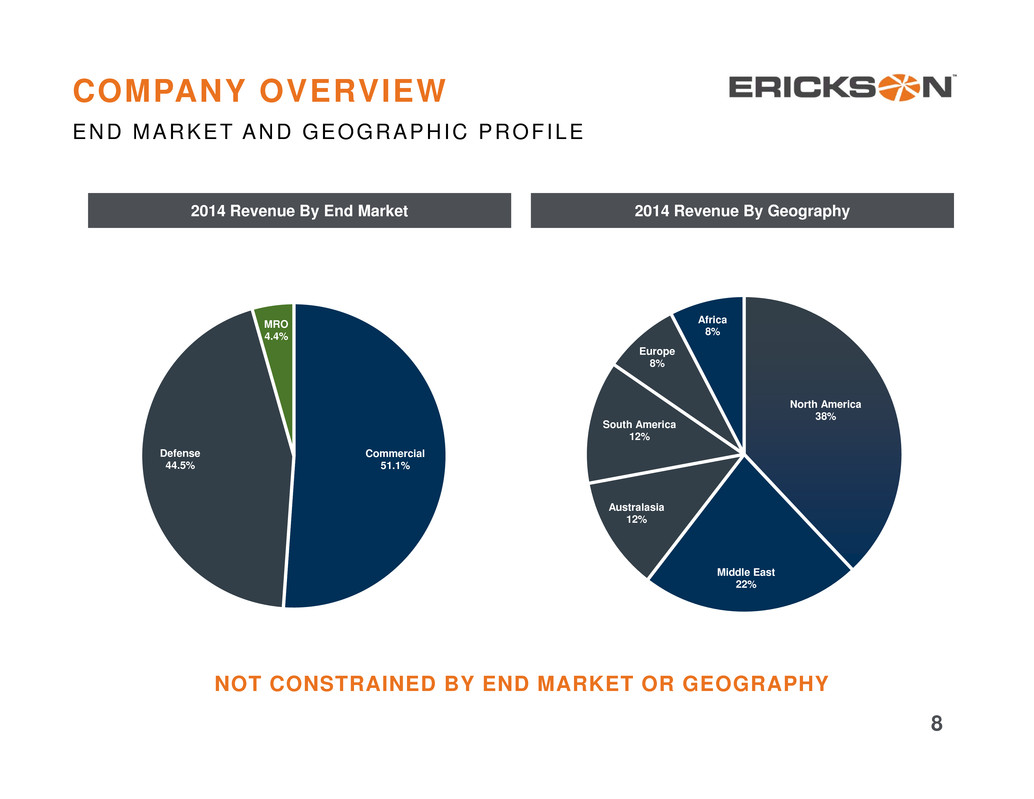

END MARKET AND GEOGRAPHIC PROFILE COMPANY OVERVIEW 2014 Revenue By End Market 2014 Revenue By Geography NOT CONSTRAINED BY END MARKET OR GEOGRAPHY 8 North America 38% Middle East 22% Australasia 12% South America 12% Europe 8% Africa 8% Commercial 51.1% Defense 44.5% MRO 4.4%

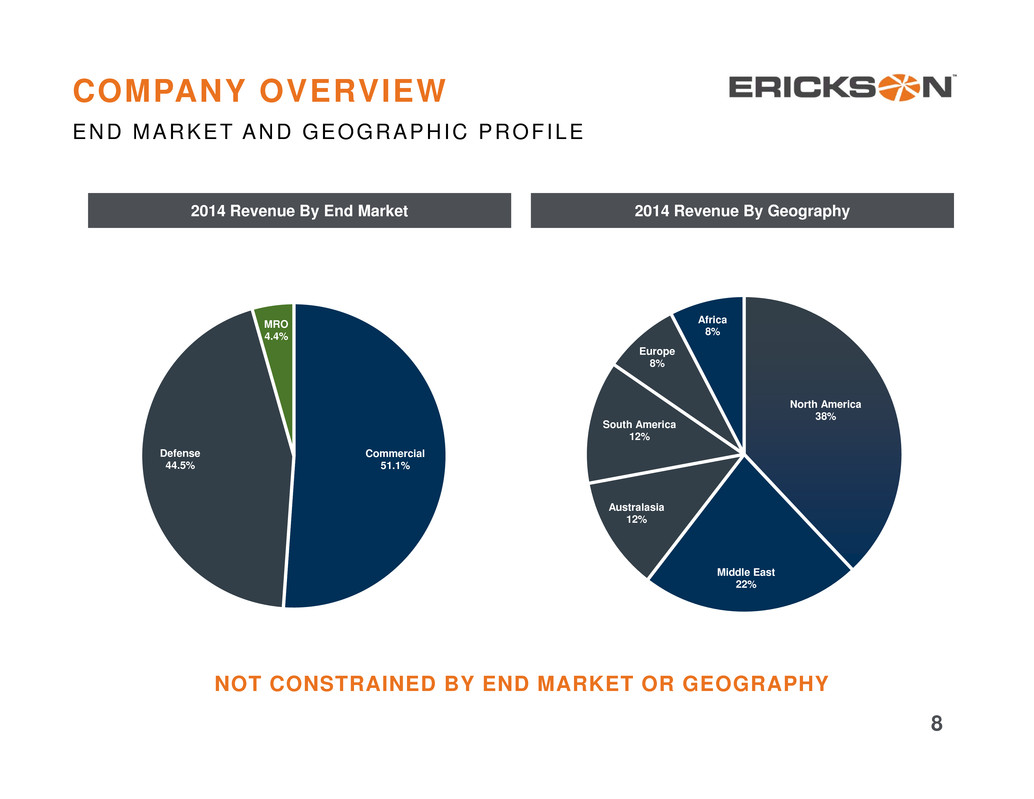

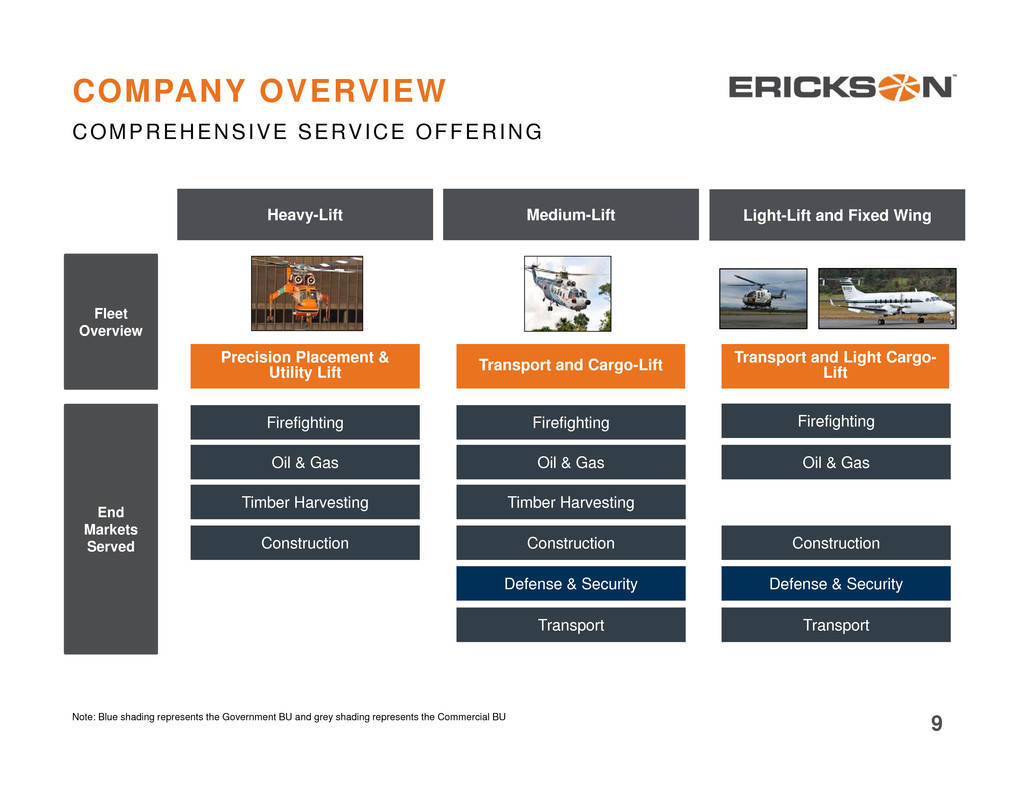

COMPREHENSIVE SERVICE OFFERING COMPANY OVERVIEW Note: Blue shading represents the Government BU and grey shading represents the Commercial BU Heavy-Lift Medium-Lift Fleet Overview End Markets Served Firefighting Defense & Security Transport Timber Harvesting Construction Oil & Gas Oil & Gas Firefighting Transport Oil & Gas Precision Placement & Utility Lift Transport and Cargo-Lift Transport and Light Cargo- Lift Light-Lift and Fixed Wing Defense & Security Timber Harvesting Construction Firefighting Construction 9

GLOBAL GEOGRAPHY AND MARKETS COMPANY OVERVIEW OPERATIONS VERTREPOFFICES GLOBAL OFFERING AND SIGNIFICANT GEOGRAPHIC OPERATING PRESENCE 10

GOVERNMENT - FIREFIGHTINGBUSINESS UNIT SNAPSHOT COMMERCIAL AVIATION • Consists of Firefighting, Oil & Gas ,Timber Harvesting, and Construction - primarily utilizing Heavy Lift • Stable legacy business with significant room for growth in emerging markets • China and India are multi-billion dollar growth markets targeted for future expansion • Diverse fleet and vertically integrated MRO capabilities provide customers with a compelling service offering • Well positioned for long term Oil & Gas opportunities despite short term pressures FOCUSED ON GROWTH IN EMERGING MARKETS Capabilities 11 EAC 2014 Revenue Mix (% of total) Market Opportunities / Considerations 51%

Capabilities GOVERNMENT - DEFENSE EAC 2014 Revenue Mix (% of total) BUSINESS UNIT SNAPSHOT GOVERNMENT AVIATION HISTORY & CAPABILITIES DRIVE FUTURE GROWTH 12 • Traditionally focused on the Department of Defense Airlift market • Looking beyond Iraq and Afghanistan • Non-asset based services and logistics support is a new opportunity estimated at $10 billion per year • Strong MRO capabilities and ability to operate in remote austere environments provides a competitive advantage • Primed to move into new markets and capture market share in existing ones Market Opportunities / Considerations 44%

COMMERCIAL - OIL & GASBUSINESS UNIT SNAPSHOT MRO & MANUFACTURING Capabilities FASTEST GROWING BUSINESS OVER THE NEXT SEVERAL YEARS 13 Market Opportunities / Considerations EAC 2014 Revenue Mix (% of total) • Best in class product support for Aircrane and B214 platforms • Large and growing legacy aircraft MRO market ($700 million) • Certified aerospace manufacturing facility which provides the ability to enter multiple adjacent markets • Ability to manufacture Aircranes and Engines • Investment in composite rotor-blade technology improves competitiveness 4%

Controls Key Inputs in Supply Chain • Capability to manufacture Aircranes on existing S-64 and CH-54 airframes • Erickson’s services fully address the needs of legacy platforms, including supply chain management, component manufacturing and reliability engineering Collaboration Between Product Engineers & Operations Personnel • Researched and developed a Composite Main Rotor Blade Program (CMRB) to replace original Sikorsky design Investments in R&D • Company purchased the Type and Production Certificates for the Aircrane and the Pratt & Whitney engine • Engine makes up roughly 40% of the maintenance operating cost of the helicopter and ownership yields better engine availability MANUFACTURING CAPABIL IT IES COMPANY OVERVIEW MRO & MANUFACTURING CAPABILITIES PROVIDE COMPETITIVE ADVANTAGE 14

FINANCIAL SUMMARY

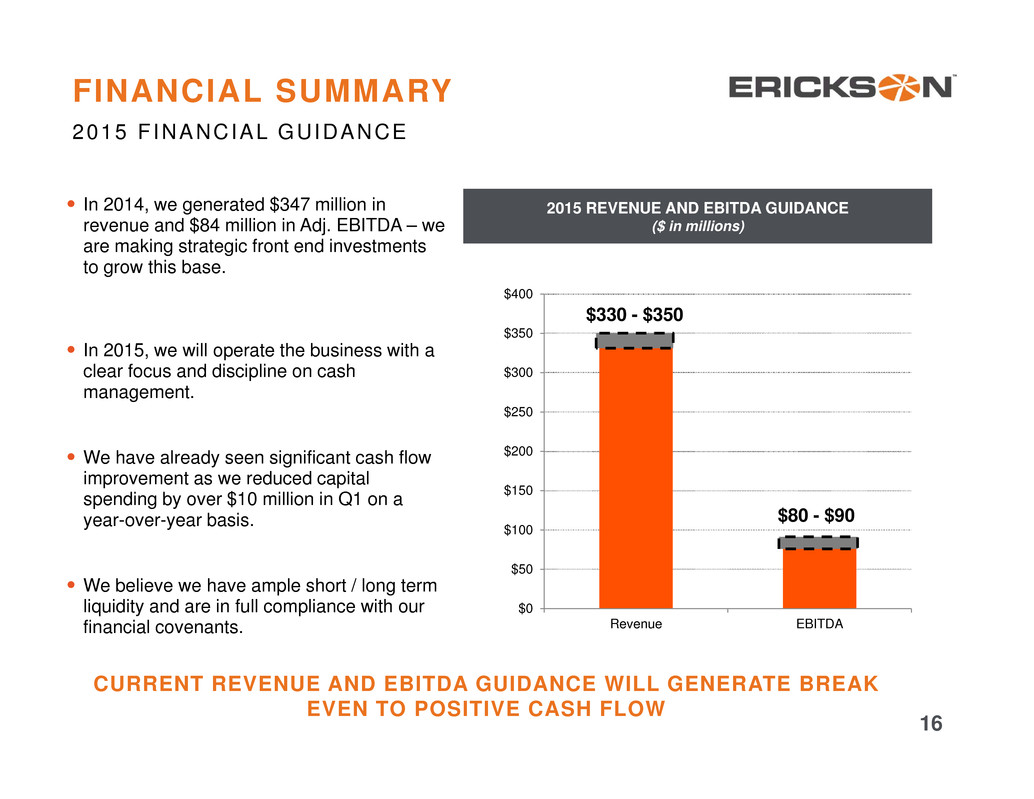

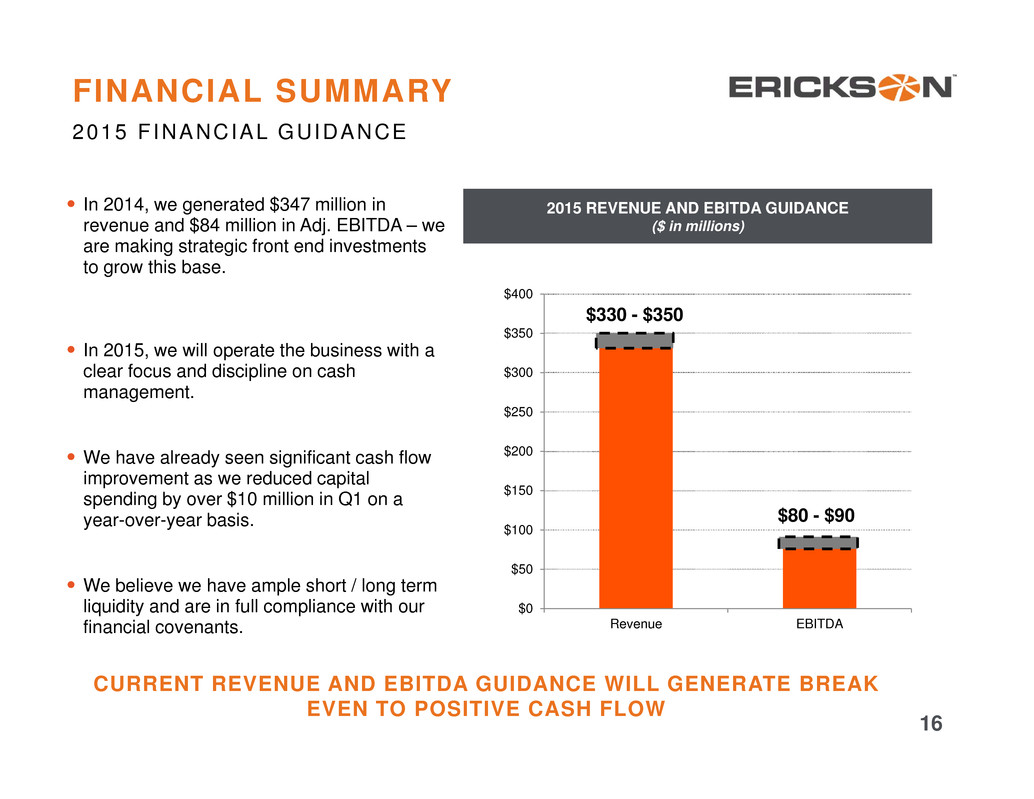

$0 $50 $100 $150 $200 $250 $300 $350 $400 Revenue EBITDA 2015 REVENUE AND EBITDA GUIDANCE ($ in millions) 2015 F INANCIAL GUIDANCE FINANCIAL SUMMARY $330 - $350 $80 - $90 CURRENT REVENUE AND EBITDA GUIDANCE WILL GENERATE BREAK EVEN TO POSITIVE CASH FLOW • In 2014, we generated $347 million in revenue and $84 million in Adj. EBITDA – we are making strategic front end investments to grow this base. • In 2015, we will operate the business with a clear focus and discipline on cash management. • We have already seen significant cash flow improvement as we reduced capital spending by over $10 million in Q1 on a year-over-year basis. • We believe we have ample short / long term liquidity and are in full compliance with our financial covenants. 16

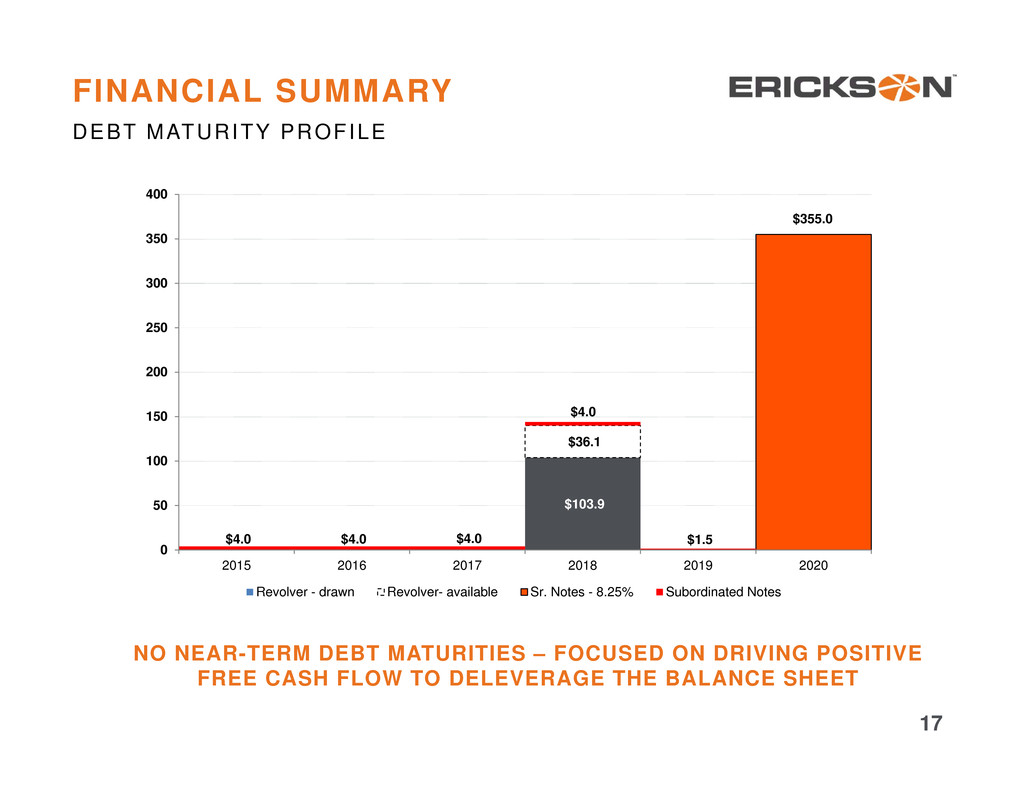

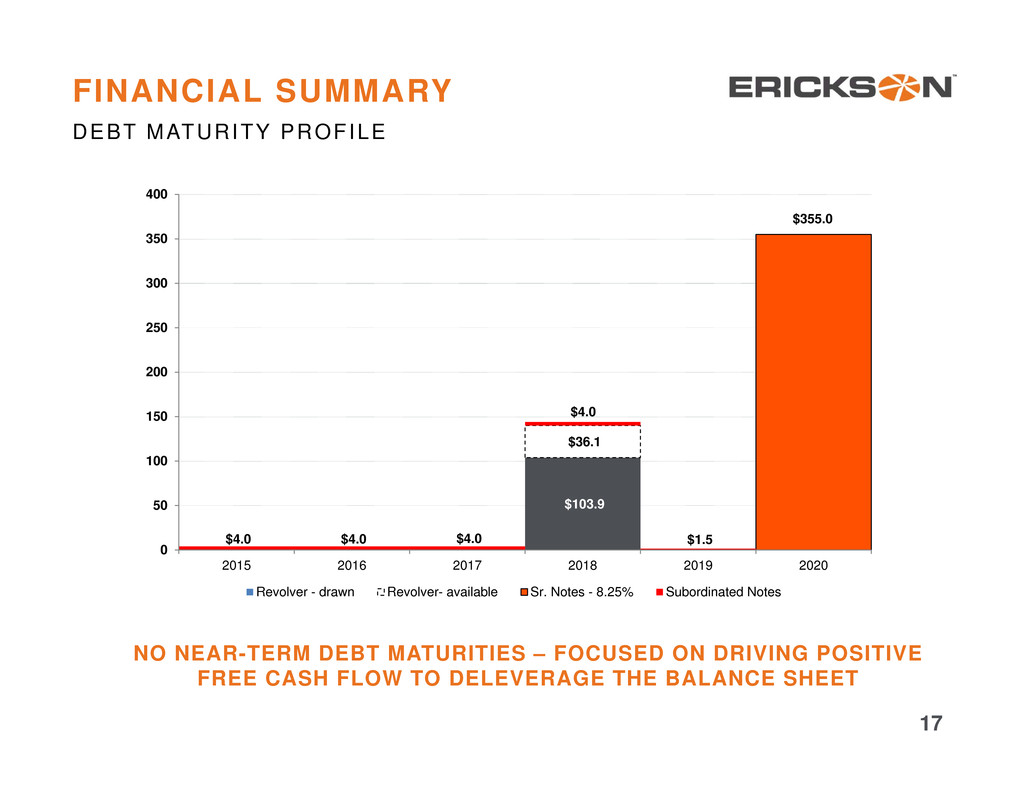

DEBT MATURITY PROFILE FINANCIAL SUMMARY NO NEAR-TERM DEBT MATURITIES – FOCUSED ON DRIVING POSITIVE FREE CASH FLOW TO DELEVERAGE THE BALANCE SHEET $103.9 $36.1 $355.0 $4.0 $4.0 $4.0 $4.0 $1.5 0 50 100 150 200 250 300 350 400 2015 2016 2017 2018 2019 2020 Revolver - drawn Revolver- available Sr. Notes - 8.25% Subordinated Notes 17