16035269 IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION In re: ERICKSON INCORPORATED, et al., Debtors. § § § § § Chapter 11 Case No. 16-34393-hdh (Jointly Administered) ______________________________________________________________________________ SECOND AMENDED DISCLOSURE STATEMENT IN SUPPORT OF THE SECOND AMENDED JOINT PLAN OF REORGANIZATION OF ERICKSON INCORPORATED, ET AL., PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE ______________________________________________________________________________ Kenric D. Kattner State Bar No. 11108400 Kourtney Lyda State Bar No. 24013330 HAYNES AND BOONE, LLP 1221 McKinney Street, Suite 2100 Houston, TX 77010 Telephone: 713.547.2000 Facsimile: 713.547.2600 Email: kenric.kattner@haynesboone.com Email: kourtney.lyda@haynesboone.com ATTORNEYS FOR DEBTORS Ian T. Peck State Bar No. 24013306 David L. Staab State Bar No. 24093194 HAYNES AND BOONE, LLP 2323 Victory Avenue, Suite 700 Dallas, TX 75219 Telephone: 214.651.5000 Facsimile: 214.651.5940 Email: ian.peck@haynesboone.com Email: david.staab@haynesboone.com Dated: February 3, 2017

i TABLE OF CONTENTS ARTICLE I. INTRODUCTION ............................................................................................................................1 A. Summary of Plan .........................................................................................................................1 B. Filing of the Debtors’ Chapter 11 Cases .....................................................................................4 C. Purpose of Disclosure Statement.................................................................................................4 D. Hearing on Approval of the Disclosure Statement .....................................................................5 E. Hearing on Confirmation of the Plan .........................................................................................5 F. Disclaimers ..................................................................................................................................5 ARTICLE II. EXPLANATION OF CHAPTER 11 ...............................................................................................7 A. Overview of Chapter 11 ..............................................................................................................7 B. Chapter 11 Plan ..........................................................................................................................7 ARTICLE III. VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS ....................................8 A. Ballots and Voting Deadline ........................................................................................................8 B. Voting Procedures for Existing Second Lien Secured Claims ....................................................9 1. Beneficial Holder who is also a Record Holder ..................................................................9 2. Nominees .............................................................................................................................9 3. Beneficial Holder who holds in “Street Name” through a Nominee ................................ 10 4. Beneficial Holder who holds in “Street Name” through multiple Nominees ........................................................................................................................... 10 C. Holders of Claims Entitled to Vote ........................................................................................... 11 D. Definition of Impairment .......................................................................................................... 11 E. Classes Impaired or Unimpaired Under the Plan..................................................................... 12 F. Information on Voting and Vote Tabulations........................................................................... 12 1. Transmission of Ballots to Holders of Claims and Interests ............................................ 12 2. Ballot Tabulation Procedures ........................................................................................... 13 3. Execution of Ballots by Representatives ........................................................................... 15 4. Waivers of Defects and Other Irregularities Regarding Ballots ...................................... 16 5. Withdrawal of Ballots and Revocation ............................................................................. 16 G. Confirmation of Plan ................................................................................................................ 16 1. Solicitation of Acceptances ............................................................................................... 16 2. Requirements for Confirmation of the Plan ..................................................................... 17 3. Acceptances Necessary to Confirm the Plan .................................................................... 18 4. Cramdown......................................................................................................................... 19 5. Conditions Precedent to Confirmation and Effectiveness of the Plan ............................. 20 ARTICLE IV. BACKGROUND OF THE DEBTORS ........................................................................................ 20 A. Description of Debtors’ Businesses ........................................................................................... 20 1. Background ....................................................................................................................... 20

ii 2. Aircraft Fleet ..................................................................................................................... 21 B. Helicopter Services .................................................................................................................... 21 1. Global Defense and Security ............................................................................................. 22 2. Civil Aviation Services ...................................................................................................... 22 3. Manufacturing & MRO .................................................................................................... 23 C. Corporate Information and Debtors’ Relationship to Subsidiaries ......................................... 24 D. Events Leading to the Chapter 11 Cases .................................................................................. 24 E. The Debtors’ Prepetition Restructuring Initiatives .................................................................. 25 ARTICLE V. DEBTORS’ ASSETS AND LIABILITIES.................................................................................... 27 A. Prepetition Capital Structure Arrangements ........................................................................... 27 1. Existing First Lien Credit Facility .................................................................................... 27 2. Second Priority Notes ....................................................................................................... 28 3. Summary of Subsidiary Roles Under Existing First Lien Credit Agreement and Existing Second Lien Indenture .............................................................. 28 4. Seller Notes........................................................................................................................ 28 5. Promissory Note and Relationship with Bell Helicopter Textron Inc. and Textron Innovations, Inc............................................................................................ 29 6. Trade Debt ........................................................................................................................ 29 7. Equity Interests ................................................................................................................. 30 B. Debtors’ Scheduled Amount of Claims ..................................................................................... 31 ARTICLE VI. BANKRUPTCY CASE ADMINISTRATION ............................................................................. 31 A. First and Second Day Motions .................................................................................................. 31 B. Bar Date for Filing Proofs of Claim .......................................................................................... 32 C. Meeting of Creditors ................................................................................................................. 32 D. Official Committee of Unsecured Creditors ............................................................................. 32 E. The DIP Revolving Facility, the DIP Term Facility and Use of Cash Collateral ..................... 33 F. Professionals Employed by the Debtors .................................................................................... 34 G. Aircraft Leases .......................................................................................................................... 34 H. Stipulation with the United States ............................................................................................ 35 ARTICLE VII. DESCRIPTION OF THE PLAN ................................................................................................ 36 A. Introduction .............................................................................................................................. 36 B. Designation of Claims and Interests/Impairment ..................................................................... 36 C. Allowance and Treatment of Administrative Claims and Priority Claims .............................. 37 1. Administrative Claims ...................................................................................................... 37 2. DIP Revolving Facility Claims .......................................................................................... 38 3. DIP Term Facility Claims ................................................................................................. 38 4. Professional Compensation Claims .................................................................................. 38 (a) Final Fee Applications and Payment of Professional Compensation Claims ................... 38 (b) Post-Confirmation Fees and Expenses ............................................................................. 39 5. Priority Unsecured Tax Claims ........................................................................................ 39

iii D. Allowance and Treatment of Classified Claims and Interests .................................................. 39 1. Allowance and Treatment of Other Priority Unsecured Claims (Class- 1) 39 2. Allowance and Treatment of Other Secured Claims (Class - 2)....................................... 40 3. Allowance and Treatment of Secured Tax Claims (Class - 3) .......................................... 40 4. Allowance and Treatment of Existing First Lien Credit Facility Claims (Class - 4) ........................................................................................................................... 40 5. Allowance and Treatment of Existing Second Lien Secured Claims (Class - 5) ........................................................................................................................... 41 6. Allowance and Treatment of General Unsecured Claims (Class - 6) ............................... 41 7. Allowance and Treatment of Intercompany Claims (Class - 7) ....................................... 42 8. Allowance and Treatment of Erickson Incorporated Interests (Class - 8) 42 9. Allowance and Treatment of Intercompany Interests (Class - 9)..................................... 42 E. Procedures For Resolving Contingent, Unliquidated, and Disputed Claims ........................... 42 1. Claims Administration Responsibilities ........................................................................... 42 2. Estimation of Claims and Interests ................................................................................... 43 3. Adjustment to Claims or Interests without Objection ..................................................... 43 4. Time to File Objections to Claims .................................................................................... 43 5. Disallowance of Claims or Interests .................................................................................. 43 6. Amendment to Claims or Interests ................................................................................... 44 7. No Distributions Pending Allowance ................................................................................ 44 8. Distributions After Allowance .......................................................................................... 44 F. Treatment of Executory Contracts and Unexpired Leases ...................................................... 44 1. Assumption and Rejection of Executory Contracts Under the Plan ................................ 44 2. Indemnification Obligations ............................................................................................. 45 3. Claims Based on Rejection of Executory Contracts or Unexpired Leases ................................................................................................................................ 46 4. Cure of Defaults for Assumed Executory Contracts and Unexpired Leases ................................................................................................................................ 46 5. Preexisting Obligations to the Debtors under Executory Contracts and Unexpired Leases .............................................................................................................. 47 6. Insurance Policies ............................................................................................................. 47 7. Modifications, Amendments, Supplements, Restatements, or Other Agreements ....................................................................................................................... 47 8. Reservation of Rights ........................................................................................................ 47 9. Non-occurrence of Effective Date ..................................................................................... 48 10. Contracts and Leases Entered into after the Petition Date .............................................. 48 ARTICLE VIII. MEANS FOR EXECUTION AND IMPLEMENTATION OF THE PLAN ............................ 48 A. Corporate Existence .................................................................................................................. 48 B. Reorganized Debtors ................................................................................................................. 48 C. Restructuring Transactions ...................................................................................................... 48 D. Sources of Plan Distributions .................................................................................................... 49 1. Issuance of New Common Stock ....................................................................................... 49 2. New First Lien Credit Facility .......................................................................................... 50 3. New Second Lien Credit Facility ...................................................................................... 50

iv 4. Rights Offering ................................................................................................................. 51 (a) Rights Offering Procedures .............................................................................................. 51 5. Vesting of Assets in the Reorganized Debtors .................................................................. 52 E. Cancellation of Existing Securities and Agreements ................................................................ 52 F. Corporate Action ...................................................................................................................... 53 G. New Organizational Documents ............................................................................................... 54 H. Directors and Officers of the Reorganized Debtors .................................................................. 54 I. Effectuating Documents; Further Transactions ....................................................................... 55 J. Section 1146 Exemption ............................................................................................................ 55 K. Director and Officer Liability Insurance .................................................................................. 55 L. Management Incentive Plan...................................................................................................... 56 M. Employee and Retiree Benefits ................................................................................................. 56 N. Retained Causes of Action ........................................................................................................ 56 O. Litigation Trust ......................................................................................................................... 56 P. Release of Debtors ..................................................................................................................... 58 Q. Release of Liens ......................................................................................................................... 59 R. Releases by Debtors ................................................................................................................... 60 S. Releases by Holders of Claims and Interests ............................................................................ 60 T. Exculpation ............................................................................................................................... 61 U. Injunction .................................................................................................................................. 61 V. Protections against Discriminatory Treatment ........................................................................ 62 W. Reimbursement or Contribution .............................................................................................. 62 X. Retention of Jurisdiction ........................................................................................................... 62 Y. Modifications and Amendments, Revocation, or Withdrawal of the Plan ............................... 64 Z. Miscellaneous ............................................................................................................................ 65 ARTICLE IX. LEGAL PROCEEDINGS ............................................................................................................ 66 A. Recovery on Preference Actions and Other Avoidance Actions............................................... 66 B. Retained Causes of Action or Litigation Trust Causes of Actions ........................................... 67 ARTICLE X. DISTRIBUTIONS TO CREDITORS ........................................................................................... 67 A. Allowed Administrative Claims ................................................................................................ 67 B. Allowed Priority Unsecured Tax Claims .................................................................................. 67 C. Allowed Other Priority Unsecured Claims ............................................................................... 68 D. Allowed Existing Second Lien Claims ...................................................................................... 68 E. Allowed General Unsecured Claims ......................................................................................... 68 ARTICLE XI. PROVISIONS GOVERNING DISTRIBUTIONS ....................................................................... 68 A. Timing and Calculation of Amounts to Be Distributed ............................................................ 68 B. Disbursing Agent ....................................................................................................................... 69 C. Rights and Powers of Disbursing Agent ................................................................................... 69 1. Powers of Disbursing Agent .............................................................................................. 69 2. Expenses Incurred On or After the Effective Date........................................................... 69 D. Delivery of Distributions and Undeliverable or Unclaimed Distributions ............................... 69 1. Record Date for Distributions........................................................................................... 69 2. Delivery of Distributions in General ................................................................................. 70 3. Minimum Distributions .................................................................................................... 70

v 4. Undeliverable Distributions and Unclaimed Property ..................................................... 70 E. Manner of Payment ................................................................................................................... 70 F. Distributions to Holders of Class 6 General Unsecured Claims ............................................... 71 G. Section 1145 Exemption ............................................................................................................ 71 H. Compliance with Tax Requirements ......................................................................................... 72 I. Allocations ................................................................................................................................. 72 J. No Postpetition Interest on Claims ........................................................................................... 72 K. Foreign Currency Exchange Rate ............................................................................................. 72 L. Setoffs and Recoupment ............................................................................................................ 73 M. Claims Paid or Payable by Third Parties ................................................................................. 73 1. Claims Paid by Third Parties ........................................................................................... 73 2. Claims Payable by Third Parties ...................................................................................... 73 3. Applicability of Insurance Policies ................................................................................... 74 ARTICLE XII. ALTERNATIVES TO THE PLAN ............................................................................................ 74 A. Chapter 7 Liquidation ............................................................................................................... 74 B. Dismissal .................................................................................................................................... 75 C. Exclusivity and Alternative Plan Potential ............................................................................... 75 ARTICLE XIII. FEASIBILITY AND ESTIMATED VALUATION .................................................................. 76 A. Financial Projections and Feasibility ........................................................................................ 76 B. Estimated Valuation of the Debtors .......................................................................................... 76 ARTICLE XIV. CERTAIN RISK FACTORS TO BE CONSIDERED .............................................................. 76 A. Bankruptcy Law Considerations .............................................................................................. 77 1. Parties in Interest May Object to the Plan’s Classification of Claims and Interests ...................................................................................................................... 77 2. The Conditions Precedent to the Effective Date of the Plan May Not Occur ................................................................................................................................. 77 3. The Debtors May Fail to Satisfy Vote Requirements ....................................................... 77 4. The Debtors May Not Be Able to Secure Confirmation of the Plan ................................ 78 5. The Debtors May Object to the Amount or Classification of a Claim ............................. 78 6. Risk of Non-Occurrence of the Effective Date .................................................................. 79 7. Contingencies Could Affect Votes of Impaired Classes to Accept or Reject................................................................................................................................. 79 8. Releases, Injunctions, and Exculpation Provisions May not be Approved ........................................................................................................................... 79 B. Failure to Confirm or Consummate the Plan ........................................................................... 79 C. Claim Estimates May Be Incorrect ........................................................................................... 80 D. Risks Related to Debtors’ Business and Industry Conditions .................................................. 80 E. Risks Relating to the Securities to be Issued Under the Plan ................................................... 81 1. No Current Public Market for Securities ......................................................................... 81 2. Implied Valuation of New Common Stock Not Intended to Represent the Trading Value of the New Common Stock ................................................................. 81 3. No Intention to Pay Dividends .......................................................................................... 82

vi 4. Conditions Precedent to the Rights Offering Could Fail to be Satisfied .......................... 82 F. Inability to Obtain Financing for Exit Financing ..................................................................... 82 G. Certain Tax Implications of the Plan ........................................................................................ 82 ARTICLE XV. CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN ........................................................................................................................................................... 82 A. U.S. Federal Income Tax Consequences Under the Plan ......................................................... 84 1. Cancellation of Indebtedness Income ............................................................................... 84 2. Gain or Loss from the Disposition of Assets ..................................................................... 85 3. Limitations on NOLs and Other Tax Attributes .............................................................. 85 (a) General Section 382 Limitation ........................................................................................ 85 (b) Built-in Gains and Losses ................................................................................................. 86 (c) Special Bankruptcy Exception .......................................................................................... 87 4. Alternative Minimum Tax ................................................................................................ 87 B. Federal Income Tax Consequences to Holders of Claims ........................................................ 88 1. Treatment of a Debt Instrument as a Security ................................................................. 88 2. Treatment of U.S. Holders of Existing Second Lien Notes Claims................................... 88 3. Treatment of U.S. Holders of General Unsecured Claims ............................................... 89 C. Other Considerations for U.S. Holders ..................................................................................... 90 1. Accrued Interest................................................................................................................ 90 2. Market Discount ............................................................................................................... 90 3. Limitation on Use of Capital Losses ................................................................................. 91 4. Net Investment Income Tax .............................................................................................. 91 D. Information Reporting and Back-Up Withholding .................................................................. 91 E. Consequences of Ownership and Disposition of the New Common Stock ............................... 92 F. Consequences of Litigation Trust ............................................................................................. 92 G. U.S. Federal Income Tax Consequences for Non-U.S. Holders ................................................ 95 1. Gain Recognition............................................................................................................... 95 2. Interest .............................................................................................................................. 95 3. Dividends on New Common Stock .................................................................................... 96 4. FATCA .............................................................................................................................. 97 ARTICLE XVI. SECURITIES LAW CONSIDERATIONS ............................................................................... 97 A. Transfer Restrictions and Consequences under Federal Securities Law ................................. 97 B. Listing; SEC Filings .................................................................................................................. 99 C. Legends...................................................................................................................................... 99 D. Book-Entry Form ...................................................................................................................... 99 ARTICLE XVII. CONCLUSION ...................................................................................................................... 100

vii EXHIBITS TO THE DISCLOSURE STATEMENT Chapter 11 Plan............................................................................................................. Exhibit 1 Corporate Organization Chart ..................................................................................... Exhibit 2 Notice of Confirmation Hearing ................................................................................... Exhibit 3 Rights Offering Procedures .......................................................................................... Exhibit 4 Liquidation Analysis ..................................................................................................... Exhibit 5 Financial Projections..................................................................................................... Exhibit 6 Valuation Analysis ........................................................................................................ Exhibit 7 Recovery Analysis ......................................................................................................... Exhibit 8

1 ARTICLE I. INTRODUCTION The Debtors1 hereby submit this Second Amended Disclosure Statement for use in the solicitation of votes on the Second Amended Joint Plan of Reorganization of Erickson Incorporated, et al., Pursuant to Chapter 11 of the Bankruptcy Code (i.e., the Plan). The Plan is annexed as Exhibit 1 to this Disclosure Statement. This Disclosure Statement sets forth certain relevant information regarding the Debtors’ prepetition operations and financial history, the need to seek chapter 11 protection, significant events that have occurred during the Chapter 11 Cases, and the resultant analysis of the expected return to the Debtors’ Creditors. This Disclosure Statement also describes terms and provisions of the Plan, including certain alternatives to the Plan, certain effects of confirmation of the Plan, certain risk factors associated with the Plan, and the manner in which distributions will be made under the Plan. Additionally, this Disclosure Statement discusses the confirmation process and the voting procedures that holders of Claims and Interests must follow for their votes to be counted. All descriptions of the Plan set forth in this Disclosure Statement are for summary purposes only. To the extent of any inconsistency between this Disclosure Statement and the Plan, the Plan shall control. You are encouraged to review the Plan in full. YOU ARE BEING SENT THIS DISCLOSURE STATEMENT BECAUSE YOU ARE A CREDITOR OR OTHER PARTY IN INTEREST OF THE DEBTORS. THIS DOCUMENT DESCRIBES A CHAPTER 11 PLAN WHICH, WHEN CONFIRMED BY THE BANKRUPTCY COURT, WILL GOVERN HOW YOUR CLAIM OR INTEREST WILL BE TREATED. THE DEBTORS URGE YOU TO REVIEW THE DISCLOSURE STATEMENT AND THE PLAN CAREFULLY. THE DEBTORS BELIEVE THAT ALL CREDITORS SHOULD VOTE IN FAVOR OF THE PLAN. A. Summary of Plan The Plan provides for the resolution of Claims against and Interests in the Debtors and implements a distribution scheme pursuant to the Bankruptcy Code. Distributions under the Plan shall be made with: (1) Cash on hand, including Cash from operations; (2) the New Common Stock; (3) the New First Lien Credit Facility (4) the New Second Lien Credit Facility; (5) the Rights; (6) the proceeds from the Rights Offering; and (7) interests in the Litigation Trust, as applicable. Under the Plan, Claims and Interests are classified and each class has its own treatment. The table below describes each class of Claims and Interests, which holders of Claims and 1Except as otherwise provided in this Disclosure Statement, capitalized terms herein have the meaning ascribed to them in the Plan. Any capitalized term used herein that is not defined in the Plan shall have the meaning ascribed to that term in the Bankruptcy Code or Bankruptcy Rules, whichever is applicable.

2 Interests belong in each class, the treatment of each class of Claims or Interests, and the expected recovery of each holder of Claims or Interests in the respective class.2 Summary of Plan Treatment Class Description Treatment Class 1 - Other Priority Unsecured Claims At the option of the applicable Debtor, with the consent of the Required Investor Parties, each holder of an Allowed Other Priority Unsecured Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Other Priority Unsecured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Other Priority Unsecured Claim, the following: (i) payment in full in Cash of its Allowed Class 1 Claim; or (ii) such other treatment as is consistent with the requirements of section 1129(a)(9) of the Bankruptcy Code. Estimated total Allowed Class 1 Claims: $0 Projected recovery: 100% Class 2 – Other Secured Claims At the option of the applicable Debtor, with the consent of the Required Investor Parties, each holder of an Allowed Other Secured Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Other Secured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Other Secured Claim, the following: (i) payment in full in Cash of its Allowed Class 2 Claim; (ii) the collateral securing its Allowed Class 2 Claim; provided, however, any collateral remaining after satisfaction of such Allowed Class 2 Claim shall revest in the applicable Reorganized Debtor pursuant to the Plan; or (iii) reinstatement of its Allowed Class 2 Claim. Estimated total Allowed Class 2 Claims: $0 Projected recovery: 100% Class 3 – Secured Tax Claims At the option of the applicable Debtor, with the consent of the Required Investor Parties, each holder of an Allowed Secured Tax Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Secured Tax Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Secured Tax Claim, the following: (i) payment in full in Cash of its Allowed Class 3 Claim; (ii) the collateral securing its Allowed Class 3 Claim; provided, however, any collateral remaining after satisfaction of such Allowed Class 3 Claim 2 The estimated totals contained in the Summary of Plan Treatment are based upon the Debtors’ Schedules of Assets and Liabilities, unless otherwise provided.

3 Class Description Treatment shall revest in the applicable Reorganized Debtor pursuant to the Plan; or (iii) such other treatment consistent with the requirements of section 1129(a)(9) of the Bankruptcy Code. Estimated total Allowed Class 3 Claims: $0 Projected recovery: 100% Class 4 – Existing First Lien Credit Facility Claims On the Effective Date, each holder of an Allowed Existing First Lien Credit Facility Claim shall receive, except to the extent that a holder of an Allowed Existing First Lien Credit Facility Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Existing First Lien Credit Facility Claim, Payment in Full, in Cash, of its Allowed Class 4 Claim; provided, however, there shall be no distribution for or on account of the Refinancing Accommodation Fee to the extent not payable pursuant to the Creditor Support Agreement. Upon the indefeasible Payment in Full of the Allowed Existing First Lien Credit Facility Claims in accordance with the terms of the Plan, on the Effective Date, all liens and security interests granted to secure such Allowed Existing First Lien Credit Facility Claims shall be terminated and of no further force and effect. Estimated total Allowed Class 4 Claims: $72,466,239.673 Projected recovery: 100% Class 5 - Existing Second Lien Secured Claims On the Effective Date, except to the extent that a holder of an Allowed Existing Second Lien Secured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Existing Second Lien Secured Claim, each holder of an Allowed Class 5 Claim shall receive its Pro Rata share of the Second Lien Equity Distribution; provided, that if Class 5 votes to reject the Plan, the entire amount of Allowed Existing Second Lien Claims shall be deemed to be Allowed Existing Second Lien Deficiency Claims and treated as Claims in Class 6. Estimated total Allowed Class 5 Claims: $370,205,428 Projected recovery: 1.32% to 6.28% Class 6 - General Unsecured Claims Except to the extent that a holder of an Allowed General Unsecured Claim agrees to less favorable treatment, in full 3 The scheduled amount of Existing First Lien Credit Facility Claims is $130,763,848. Pursuant to the effective “roll-up” feature of the Existing First Lien Credit Facility and the DIP Revolving Facility, the outstanding balance of Existing First Lien Credit Facility Claims has been reduced to $72,466,239.67 as of January 20, 2017, and is subject to further reduction prior to the Effective Date. In addition, the Existing First Lien Credit Facility Claims will be increased by accrued and unpaid interest (at the default rate) and other applicable fees, costs, and charges.

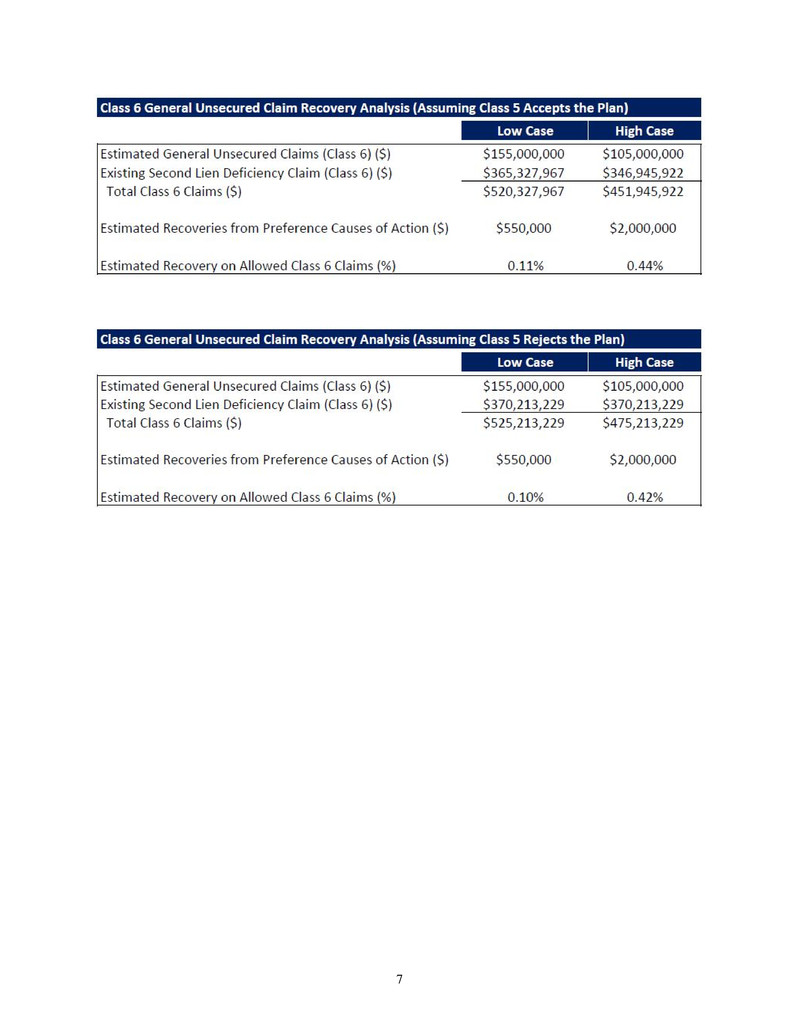

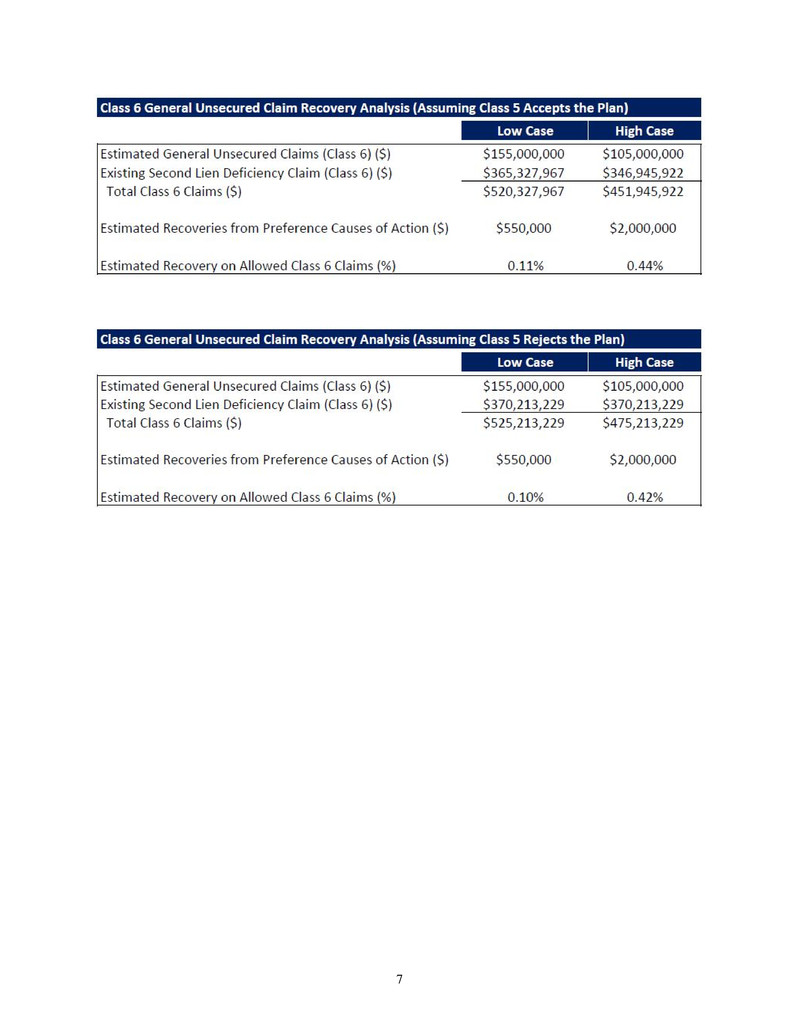

4 Class Description Treatment and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each General Unsecured Claim, each holder of an Allowed Class 6 Claim shall receive its Pro Rata share of the Litigation Trust Interests. The Debtors have provided a preliminary estimate of General Unsecured Claims, including rejection damages, in the Recovery Analysis attached hereto as Exhibit 8. Estimated total Allowed Class 6 Claims, including Existing Second Lien Deficiency Claims: $452.0 million to $520.3 million (if Class 5 votes to accept the Plan) $475.2 million to $525.2 million (if Class 5 votes to reject the Plan) Projected recovery: .11% to.44% (if Class 5 votes to accept the Plan) .10% to .42% (if Class 5 votes to reject the Plan) Class 7 - Intercompany Claims On the Effective Date, Class 7 Claims shall be, at the option of the Debtors, with the consent of the Required Investor Parties, either Reinstated or cancelled and released without any distribution. Class 8 - Erickson Incorporated Interests On the Effective Date, Class 8 Interests shall be cancelled and released without any distribution. Class 9 - Intercompany Interests Intercompany Interests shall receive no distribution and shall be Reinstated for administrative purposes only at the election of the Reorganized Debtors. More detail regarding the Debtors’ estimates of distributions on account of the Existing Second Lien Secured Claims and the General Unsecured Claims are provided in the Recovery Analysis attached as Exhibit 8 (the “Recovery Analysis”). B. Filing of the Debtors’ Chapter 11 Cases On November 8, 2016 (i.e., the Petition Date), the Debtors Filed voluntary petitions for relief under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Northern District of Texas, Dallas Division. The Debtors Filed the Chapter 11 Cases to preserve the value of their estates and to restructure their financial affairs. To such end, the Debtors have continued to manage their properties and are operating and managing their businesses as debtors in possession in accordance with sections 1107 and 1108 of the Bankruptcy Code. No trustee or examiner has been appointed in the Chapter 11 Cases. C. Purpose of Disclosure Statement Section 1125 of the Bankruptcy Code requires the Debtors to prepare and obtain court approval of the Disclosure Statement as a prerequisite to soliciting votes on the Plan. The purpose of the Disclosure Statement is to provide information to holders of Claims and Interests that will assist them in deciding how to vote on the Plan.

5 Approval of this Disclosure Statement does not constitute a judgment by the Bankruptcy Court as to the desirability of the Plan or as to the value or suitability of any consideration offered thereunder. The Bankruptcy Court’s approval does indicate, however, that the Bankruptcy Court has determined that the Disclosure Statement contains adequate information to permit a Creditor to make an informed judgment regarding acceptance or rejection of the Plan. D. Hearing on Approval of the Disclosure Statement The Bankruptcy Court has set February 2, 2017 at 1:30 p.m. (prevailing Central Time) (the “Disclosure Statement Hearing”), as the time and date for the hearing to consider approval of this Disclosure Statement. Once commenced, the Disclosure Statement Hearing may be adjourned or continued by announcement in open court with no further notice. E. Hearing on Confirmation of the Plan The Bankruptcy Court has set March 21, 2017 at 9:00 a.m. Central Time (the “Confirmation Hearing”), as the date and time for a hearing to determine whether the Plan has been accepted by the requisite number of holders of Claims, and whether the other standards for confirmation of the Plan have been satisfied. Once commenced, the Confirmation Hearing may be adjourned or continued by announcement in open court with no further notice. F. Disclaimers THIS DISCLOSURE STATEMENT IS PROVIDED FOR USE SOLELY BY HOLDERS OF CLAIMS AND INTERESTS AND THEIR ADVISERS IN CONNECTION WITH THEIR DETERMINATION TO ACCEPT OR REJECT THE PLAN. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY OTHER ENTITY FOR ANY OTHER PURPOSE. THIS DISCLOSURE STATEMENT CONTAINS IMPORTANT INFORMATION THAT MAY BEAR ON YOUR DECISION REGARDING ACCEPTING THE PLAN. PLEASE READ THIS DOCUMENT WITH CARE. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS THE REPRESENTATION OF THE DEBTORS ONLY AND NOT OF THEIR ATTORNEYS, ACCOUNTANTS OR OTHER PROFESSIONALS. FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN SUBJECTED TO AN AUDIT BY AN INDEPENDENT CERTIFIED PUBLIC ACCOUNTANT. THE FINANCIAL PROJECTIONS AND OTHER FINANCIAL INFORMATION, WHILE PRESENTED WITH NUMERICAL SPECIFICITY, NECESSARILY WERE BASED ON A VARIETY OF ESTIMATES AND ASSUMPTIONS THAT ARE INHERENTLY UNCERTAIN AND MAY BE BEYOND THE CONTROL OF THE DEBTORS’ MANAGEMENT. THE DEBTORS ARE NOT ABLE TO CONFIRM THAT THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT DOES NOT INCLUDE ANY INACCURACIES. HOWEVER, THE DEBTORS HAVE MADE THEIR BEST EFFORT TO PROVIDE ACCURATE INFORMATION AND ARE NOT AWARE OF ANY INACCURACY IN THIS DISCLOSURE STATEMENT.

6 THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN INDEPENDENTLY INVESTIGATED BY THE BANKRUPTCY COURT AND HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT. IN THE EVENT THIS DISCLOSURE STATEMENT IS APPROVED, SUCH APPROVAL DOES NOT CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT OF THE FAIRNESS OR MERITS OF THE PLAN OR OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT. THE ONLY REPRESENTATIONS THAT ARE AUTHORIZED BY THE DEBTORS CONCERNING THE DEBTORS, THE VALUE OF THEIR ASSETS, THE EXTENT OF THEIR LIABILITIES, OR ANY OTHER FACTS MATERIAL TO THE PLAN ARE THE REPRESENTATIONS MADE IN THIS DISCLOSURE STATEMENT. REPRESENTATIONS CONCERNING THE PLAN OR THE DEBTORS OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT ARE NOT AUTHORIZED BY THE DEBTORS. HOLDERS OF CLAIMS AND INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND ALL SUCH HOLDERS OF CLAIMS AND INTERESTS SHOULD CONSULT WITH THEIR OWN ADVISERS. THE DEBTORS HAVE NO ARRANGEMENT OR UNDERSTANDING WITH ANY BROKER, SALESMAN, OR OTHER PERSON TO SOLICIT VOTES FOR THE PLAN. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE PLAN OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE DEBTORS. THE DELIVERY OF THIS DISCLOSURE STATEMENT SHALL NOT UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AS OF ANY TIME AFTER THE DATE HEREOF OR THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION SET FORTH HEREIN OR IN THE AFFAIRS OF THE DEBTORS SINCE THE DATE HEREOF. ANY ESTIMATES OF CLAIMS AND INTERESTS SET FORTH IN THIS DISCLOSURE STATEMENT MAY VARY FROM THE FINAL AMOUNTS OF CLAIMS OR INTERESTS ALLOWED BY THE BANKRUPTCY COURT. SIMILARLY, THE ANALYSIS OF ASSETS AND THE AMOUNT ULTIMATELY REALIZED FROM THEM MAY DIFFER MATERIALLY. THE DESCRIPTION OF THE PLAN CONTAINED HEREIN IS INTENDED TO BRIEFLY SUMMARIZE THE MATERIAL PROVISIONS OF THE PLAN AND IS SUBJECT TO AND QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE PROVISIONS OF THE PLAN. THE DEBTORS ARE MAKING THE STATEMENTS AND PROVIDING THE FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT AS OF THE DATE HEREOF, UNLESS OTHERWISE SPECIFICALLY NOTED. ALTHOUGH THE DEBTORS MAY SUBSEQUENTLY UPDATE THE INFORMATION IN THIS DISCLOSURE STATEMENT, THE DEBTORS HAVE NO AFFIRMATIVE DUTY TO DO

7 SO, AND EXPRESSLY DISCLAIM ANY DUTY TO PUBLICLY UPDATE ANY FORWARD LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE. HOLDERS OF CLAIMS OR INTERESTS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER THAT, AT THE TIME OF THEIR REVIEW, THE FACTS SET FORTH HEREIN HAVE NOT CHANGED SINCE THIS DISCLOSURE STATEMENT WAS FILED. INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION, MODIFICATION, OR AMENDMENT. THE DEBTORS RESERVE THE RIGHT TO FILE AN AMENDED OR MODIFIED PLAN AND RELATED DISCLOSURE STATEMENT FROM TIME TO TIME, SUBJECT TO THE TERMS OF THE PLAN. ARTICLE II. EXPLANATION OF CHAPTER 11 A. Overview of Chapter 11 Chapter 11 is the principal reorganization chapter of the Bankruptcy Code. Under chapter 11, a debtor in possession may seek to reorganize its business or to sell the business for the benefit of the debtor’s Creditors and other interested parties. The commencement of a chapter 11 case creates an estate comprising all of the debtor’s legal and equitable interests in property as of the date the petition is filed. Unless the bankruptcy court orders the appointment of a trustee, a chapter 11 debtor may continue to manage and control the assets of its estate as a “debtor in possession,” as the Debtors have done in the Chapter 11 Cases since the Petition Date. Formulation of a chapter 11 plan is the principal purpose of a chapter 11 case. Such plan sets forth the means for satisfying the Claims of Creditors against, and interests of equity security holders in, the debtor. B. Chapter 11 Plan After a plan has been filed, the holders of claims against, or equity interests in, a debtor are permitted to vote on whether to accept or reject the plan. Chapter 11 does not require that each holder of a claim against, or equity interest in, a debtor vote in favor of a plan in order for the plan to be confirmed. At a minimum, however, a plan must be accepted by a majority in number and two-thirds in dollar amount of those claims actually voting from at least one class of claims impaired under the plan. The Bankruptcy Code also defines acceptance of a plan by a class of equity interests as acceptance by holders of two-thirds of the number of shares actually voted. Classes of claims or equity interests that are not “impaired” under a chapter 11 plan are conclusively presumed to have accepted the plan, and therefore are not entitled to vote. A class is “impaired” if the plan modifies the legal, equitable, or contractual rights attaching to the claims or equity interests of that class. Modification for purposes of impairment does not include curing defaults and reinstating maturity or payment in full in cash. Conversely, classes of claims or equity interests that receive or retain no property under a plan of reorganization are conclusively presumed to have rejected the plan, and therefore are not entitled to vote.

8 Even if all classes of claims and equity interests accept a chapter 11 plan, the bankruptcy court may nonetheless deny confirmation. Section 1129 of the Bankruptcy Code sets forth the requirements for confirmation and, among other things, requires that a plan be in the “best interest” of impaired and dissenting Creditors and interestholders and that the plan be feasible. The “best interest” test generally requires that the value of the consideration to be distributed to impaired and dissenting Creditors and interestholders under a plan may not be less than those parties would receive if the debtor were liquidated under a hypothetical liquidation occurring under chapter 7 of the Bankruptcy Code. A plan must also be determined to be “feasible,” which generally requires a finding that there is a reasonable probability that the debtor will be able to perform the obligations incurred under the plan and that the debtor will be able to continue operations without the need for further financial reorganization or liquidation. The bankruptcy court may confirm a chapter 11 plan even though fewer than all of the classes of impaired Claims and equity interests accept it. The bankruptcy court may do so under the “cramdown” provisions of section 1129(b) of the Bankruptcy Code. In order for a plan to be confirmed under the cramdown provisions, despite the rejection of a class of impaired claims or interests, the proponent of the plan must show, among other things, that the plan does not discriminate unfairly and that it is fair and equitable with respect to each impaired class of claims or equity interests that has not accepted the plan. The bankruptcy court must further find that the economic terms of the particular plan meet the specific requirements of section 1129(b) of the Bankruptcy Code with respect to the subject objecting class. If the proponent of the plan proposes to seek confirmation of the plan under the provisions of section 1129(b) of the Bankruptcy Code, the proponent must also meet all applicable requirements of section 1129(a) of the Bankruptcy Code (except section 1129(a)(8) of the Bankruptcy Code). Those requirements include the requirements that (i) the plan comply with applicable Bankruptcy Code provisions and other applicable law, (ii) that the plan be proposed in good faith, and (iii) that at least one impaired class of Creditors or interestholders has voted to accept the plan. ARTICLE III. VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS A. Ballots and Voting Deadline Holders of Claims and Interests entitled to vote on the Plan will receive instructions for submitting a Ballot to vote to accept or reject the Plan. After carefully reviewing the Disclosure Statement, including all exhibits, each holder of a Claim or Interest (or its authorized representative) entitled to vote should follow the instructions to indicate its vote on the Ballot. All holders of Claims or Interests (or their authorized representatives) entitled to vote must (i) carefully review the Ballot and the instructions for completing it, (ii) complete all parts of the Ballot, and (iii) submit the Ballot by the deadline (i.e., the Voting Deadline) for the Ballot to be considered. Holders of Claims or Interests entitled to vote must mail the Ballot(s) to Kurtzman Carson Consultants LLC (i.e., the Claims and Balloting Agent) at the following address: Erickson Ballot Processing Center, c/o KCC, 2335 Alaska Avenue, El Segundo, CA 90245. Holders of Claims or Interests may contact the Claims and Balloting Agent by telephone at (877)

9 725-7539 or (424) 236-7247 (if outside of the United States or Canada), or by email at EricksonInquiries@kccllc.com. The Bankruptcy Court has directed that, in order to be counted for voting purposes, Ballots for the acceptance or rejection of the Plan must be received by the Claims and Balloting Agent by no later than March 13, 2017 at 4:00 p.m. prevailing Central Time. BALLOTS MUST BE SUBMITTED IN PAPER FORM SO AS TO BE ACTUALLY RECEIVED BY THE CLAIMS AND BALLOTING AGENT NO LATER THAN MARCH 13, 2017 AT 4:00 P.M. PREVAILING CENTRAL TIME. ANY BALLOTS SUBMITTED AFTER THE VOTING DEADLINE WILL NOT BE COUNTED. B. Voting Procedures for Existing Second Lien Secured Claims The Debtors are providing a notice (which contains a link to the Plan, Disclosure Statement, and Disclosure Statement Approval Order, including any amendment, attachment, exhibit, or supplement related thereto) and related materials and a Ballot (i.e., the Solicitation Materials) to record holders (as of the Voting Record Date) of the Claims in Classes 1 through 6. Record holders of Existing Second Lien Notes may include Nominees. Nominees may hold such claims as beneficial holders, or may be record holders holding such Claims for their beneficial holder in “street name.” The Debtors propose the procedures below regarding Nominees and beneficial holders of the Existing Second Lien Notes. Such holders shall have Existing Second Lien Secured Claims in Class 5, and Existing Second Lien Deficiency Claims in Class 6 with the General Unsecured Claims Any holder of an Allowed Class 6 Existing Second Lien Deficiency Claim will receive a Ballot allowing such holder to vote its Allowed Class 5 Existing Second Lien Secured. Such holder will not receive a separate Ballot for its Class 6 Claim, and such Class 6 Claim shall be deemed voted consistent with such holder’s vote on its Class 5 Ballot. The Indenture Trustee will not vote on behalf of their respective holders. Each beneficial holder of the Existing Second Lien Secured Claims must submit its own Ballot as described below. 1. Beneficial Holder who is also a Record Holder A beneficial holder who holds Existing Second Lien Secured Claims as a record holder in its own name should vote on the Plan by completing and signing the Beneficial Holder Ballot and returning it directly to the Claims and Balloting Agent on or before the Voting Deadline using the enclosed self-addressed, postage-paid envelope. 2. Nominees A Nominee that, on the Voting Record Date, is the record holder of an Existing Second Lien Note for one or more beneficial holders shall obtain the votes of the beneficial holders, consistent with customary practices for obtaining the votes of securities held in “street name.” The Nominee shall forward to the beneficial holder of Existing Second Lien Notes Beneficial Holder Ballots, together with the Solicitation Materials, a pre-addressed, postage-paid return

10 envelope provided by, and addressed to, the Nominee, and other materials requested to be forwarded by the Debtors. Each such beneficial holder must then indicate its vote on the Beneficial Holder Ballot, complete the information requested on the Beneficial Holder Ballot, review the certifications contained on the Beneficial Holder Ballot, execute the Beneficial Holder Ballot, and return the Beneficial Holder Ballot to the Nominee. After collecting the Beneficial Holder Ballots, the Nominee should, in turn, complete a Master Ballot compiling the votes and other information from the Beneficial Holder Ballots, execute the Master Ballot, and deliver the Master Ballot to the Claims and Balloting Agent so that it is received by the Claims and Balloting Agent on or before the Voting Deadline. All copies of Beneficial Holder Ballots returned by beneficial holders should be kept by the Nominee for one year after the Voting Deadline. Nominees may transmit all documents to record holders electronically in accordance with their customary practice. 3. Beneficial Holder who holds in “Street Name” through a Nominee A beneficial holder who holds Existing Second Lien Notes in “street name” through a Nominee may indicate its vote on the Beneficial Holder Ballot, complete the information requested on the Beneficial Holder Ballot, review the certifications contained on the Beneficial Holder Ballot, execute the Beneficial Holder Ballot, and return the Beneficial Holder Ballot to the Nominee as promptly as possible and in sufficient time to allow the Nominee to process and return a completed Master Ballot to the Claims and Balloting Agent by the Voting Deadline. The beneficial holder must comply with the Nominee’s deadline by which to return the Beneficial Holder Ballot to the Nominee. Any Beneficial Holder Ballot returned to a Nominee by a beneficial holder will not be counted for purposes of acceptance or rejection of the Plan until such Nominee properly and timely completes and delivers to the Claims and Balloting Agent a Master Ballot casting the vote of such beneficial holder. 4. Beneficial Holder who holds in “Street Name” through multiple Nominees If any beneficial holder holds Existing Second Lien Notes through more than one Nominee, such beneficial holder may receive multiple mailings containing the Beneficial Holder Ballots. The beneficial holder shall execute a separate Beneficial Holder Ballot for each block of the Existing Second Lien Notes that it holds through any particular Nominee and return each Beneficial Holder Ballot to the respective Nominee in the return envelope provided therewith (or otherwise follow each Nominee’s instructions). Beneficial holders who execute multiple Beneficial Holder Ballots with respect to Existing Second Lien Notes held through more than one Nominee must indicate on each Beneficial Holder Ballot the names of all such other Nominees and the additional amounts of such Existing Second Lien Notes so held and voted. A beneficial holder who executes multiple Beneficial Holder Ballots must vote the same on each Beneficial Holder Ballot for the votes to be counted.

11 C. Holders of Claims Entitled to Vote Any holder of a Claim of the Debtors whose Claim is Impaired under the Plan is entitled to vote if either (i) the Claim has been listed in the Schedules of Assets and Liabilities in an amount greater than zero (and the Claim is not scheduled as disputed, contingent, or unliquidated) or (ii) the holder of a Claim has Filed a Proof of Claim (that is not contingent or in an unknown amount) on or before the Voting Record Date. Any holder of an Allowed Class 6 Existing Second Lien Deficiency Claim will receive a Ballot allowing such holder to vote its Allowed Class 5 Existing Second Lien Secured Claim. Such holder will not receive a separate Ballot for its Class 6 Claim, and such Class 6 Claim shall be deemed voted consistent with such holder’s vote on its Class 5 Ballot. Any holder of a Claim as to which an objection has been Filed (and such objection is still pending) is not entitled to vote, unless the Bankruptcy Court (on motion by a party whose Claim is subject to an objection) temporarily allows the Claim in an amount that it deems proper for the purpose of accepting or rejecting the Plan. Such motion must be heard and determined by the Bankruptcy Court on or before the Voting Deadline. In addition, a vote may be disregarded if the Bankruptcy Court determines that the acceptance or rejection was not solicited or procured in good faith or in accordance with the applicable provisions of the Bankruptcy Code. D. Definition of Impairment Under section 1124 of the Bankruptcy Code, a class of Claims or equity interests is impaired under a chapter 11 plan unless, with respect to each Claim or equity interest of such class, the plan: (1) leaves unaltered the legal, equitable, and contractual rights to which such Claim or interest entitles the holder of such Claim or interest; or (2) notwithstanding any contractual provision or applicable law that entitles the holder of such Claim or interest to demand or receive accelerated payment of such Claim or interest after the occurrence of a default: (a) cures any such default that occurred before or after the commencement of the case under this title, other than a default of a kind specified in section 365(b)(2) of the Bankruptcy Code or of a kind that section 365(b)(2) of the Bankruptcy Code expressly does not require to be cured; (b) reinstates the maturity of such Claim or interest as such maturity existed before such default; (c) compensates the holder of such Claim or interest for any damages incurred as a result of any reasonable reliance by such holder on such contractual provision or such applicable law;

12 (d) if such Claim or such interest arises from any failure to perform a nonmonetary obligation, other than a default arising from failure to operate a nonresidential real property lease subject to section 365(b)(1)(A) of the Bankruptcy Code, compensates the holder of such Claim or such interest (other than the debtor or an insider) for any actual pecuniary loss incurred by such holder as a result of such failure; and (e) does not otherwise alter the legal, equitable, or contractual rights to which such Claim or interest entitles the holder of such Claim or interest. E. Classes Impaired or Unimpaired Under the Plan Classes 1, 2, 3, 4, 5, and 6 are Impaired under the Plan. Therefore, holders of Claims in Classes 1, 2, 3, 4, 5, and 6 are eligible, subject to the voting requirements described above, to vote to accept or reject the Plan. Classes 1, 2, and 3 are Impaired because one or more of the proposed potential alternative treatments of Classes 1, 2, and 3 alters the legal, equitable, or contractual rights of holders of Allowed Claims in such Classes. Class 4 is Impaired because, among other reasons, holders of Allowed Class 4 Claims will not receive the Refinancing Accommodation Fee to the extent not payable pursuant to the Creditor Support Agreement. Class 7 may be Impaired or Unimpaired, based on the treatment provided to such holders at the option of the Debtors. To the extent that such holders of Claims are Impaired, such holders will not receive a distribution under the Plan and, therefore, will be conclusively presumed to reject the Plan pursuant to section 1126(g) of the Bankruptcy Code. To the extent that such holders of Claims are Unimpaired, such holders will have their Claims Reinstated, and, therefore, will be conclusively presumed to accept the Plan pursuant to section 1126(f) of the Bankruptcy Code. Interests in Class 8 are Impaired and will not be entitled to a distribution under the Plan. Holders of Interests in Class 8 are, therefore, conclusively deemed to have rejected the Plan. Holders of Interests in Class 8 will not be entitled to vote on the Plan pursuant to section 1126(g) of the Bankruptcy Code. Claims in Class 9 are Unimpaired and holders of Claims in Class 9 are conclusively presumed to have voted to accept the Plan. Holders of Claims in Class 9, therefore, will not be entitled to vote on the Plan pursuant to section 1126(f) of the Bankruptcy Code. F. Information on Voting and Vote Tabulations 1. Transmission of Ballots to Holders of Claims and Interests Instructions for completing and submitting Ballots are being provided to all holders of Claims entitled to vote on the Plan in accordance with the Bankruptcy Rules. Those holders of Claims or Interests whose Claims or Interests are unimpaired under the Plan are conclusively presumed to have accepted the Plan under section 1126(f) of the Bankruptcy Code, and therefore need not vote with regard to the Plan. Under section 1126(g) of the Bankruptcy Code, holders of

13 Claims or Interests who do not either receive or retain any property under the Plan are deemed to have rejected the Plan. In the event a holder of a Claim or Interest does not vote, the Bankruptcy Court may deem such holder of a Claim or Interest to have accepted the Plan. 2. Ballot Tabulation Procedures The Claims and Balloting Agent shall count all Ballots filed on account of (1) Claims in the Schedules of Assets and Liabilities, that are not listed as contingent, unliquidated or disputed, and are listed in an amount in excess of $0.00; and (2) Proofs of Claim Filed by the Voting Record Date that are not asserted as contingent or unliquidated, and are asserted in an amount in excess of $0.00. If no Claim is listed in the Schedules of Assets or Liabilities, and no Proof of Claim is Filed by the Voting Record Date, such Creditor shall not be entitled to vote on the Plan on account of such Claim, subject to the procedures below. Further, the Claims and Balloting Agent shall not count any votes on account of Claims that are subject to an objection which has been Filed (and such objection is still pending), unless and to the extent the Court has overruled such objection by the Voting Record Date. The foregoing general procedures will be subject to the following exceptions and clarifications: (a) if a Claim is Allowed under the Plan or by order of the Court, such Claim is Allowed for voting purposes in the Allowed amount set forth in the Plan or the order; (b) if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is not listed or asserted as contingent, unliquidated, or disputed, and is listed or asserted in an amount in excess of $0.00, such Claim is temporarily Allowed for voting purposes in the amount set forth in the Debtors’ Schedules of Assets and Liabilities or as asserted in the Proof of Claim; (c) if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is only partially listed or asserted as contingent, unliquidated, or disputed, such Claim is temporarily Allowed for voting purposes only in the amount not listed or asserted as contingent, unliquidated or disputed in the Debtors’ Schedules of Assets and Liabilities or in the Proof of Claim; (d) if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is listed or asserted as contingent, unliquidated, or disputed, or is listed or asserted for $0.00 or an undetermined amount, such Claim shall not be counted for voting purposes; (e) if a Claim is not listed in the Debtors’ Schedules of Assets and Liabilities and a Proof of Claim is Filed after the Voting Record Date, such Claim is temporarily Allowed for voting purposes only if such Creditor obtains an order of the Court temporarily allowing the Claim for voting purposes prior to the Voting Deadline;

14 (f) any Claim to which there remains a pending objection as of the Voting Deadline, or an order has been entered granting such objection, such Claim shall not be counted for voting purposes; (g) if a Creditor has Filed duplicate Proofs of Claim by the Voting Record Date against one or more Debtors, such Creditor’s Claim shall only be counted once for the Debtor at which the Creditor’s Claim is pending for voting purposes unless the Debtors determine there is a Claim pending against multiple Debtors; and (h) if a Proof of Claim has been amended by a later-Filed Proof of Claim, the earlier-Filed Claim will not be entitled to vote, and to the extent the later-Filed Proof of Claim is filed after the Voting Record Date, such later-Filed Proof of Claim must have been temporarily allowed for voting purposes by the Voting Record Date to be counted. The following procedures shall apply for tabulating votes: (a) any Ballot that is otherwise timely completed, executed, and properly cast to the Claims and Balloting Agent but does not indicate an acceptance or rejection of the Plan, or that indicates both an acceptance and rejection of the Plan, shall not be counted; if no votes to accept or reject the Plan are received with respect to a particular Class that is entitled to vote on the Plan, such Class shall be deemed to have voted to accept the Plan; (b) a Creditor who holds Claims in Class 4 against more than one Debtor, shall cast a single Ballot, which shall be counted separately with respect to each such Debtor; (c) a Creditor who holds Claims in Classes 5 and 6 against more than one Debtor, shall have the option to cast a vote on a straight ticket basis on a single Ballot, and such vote shall be counted separately, but consistently with respect to each such Debtor, and the vote on Class 6 Claims shall be deemed voted consistent with the Class 5 Claims. Otherwise, a Creditor who holds Claims in Classes 5 and 6 may vote on the Ballot separately against each Debtor and separately with respect to Classes 5 and 6; (d) if a Creditor casts more than one (1) Ballot voting the same Claim before the Voting Deadline, the last properly cast Ballot received before the Voting Deadline shall be deemed to reflect the voter’s intent and thus supersede any prior Ballots; (e) Creditors must vote all of their Claims within a particular Class to either accept or reject the Plan, and may not split their votes within a particular Class and thus a Ballot (or group of Ballots) within a particular Class that partially accepts and partially rejects the Plan shall not be counted;

15 (f) a Creditor who votes an amount related to a Claim that has been paid or otherwise satisfied in full or in part shall only be counted for the amount that remains unpaid or not satisfied, and if such Claim has been fully paid or otherwise satisfied, such vote will not be counted for purposes of amount or number; and (g) for purposes of determining whether the numerosity and amount requirements of sections 1126(c) and 1126(d) of the Bankruptcy Code have been satisfied, the Debtors will tabulate only those Ballots received by the Voting Deadline. For purposes of the numerosity requirement of section 1126(c) of the Bankruptcy Code, separate Claims held by a single Creditor in a particular Class shall be aggregated as if such Creditor held one (1) Claim against the Debtors in such Class, and the votes related to such Claims shall be treated as a single vote to accept or reject the Plan. The following Ballots shall not be counted or considered for any purpose in determining whether the Plan has been accepted or rejected: (a) any Ballot received after the Voting Deadline, unless the Debtors, in their discretion, grant an extension of the Voting Deadline with respect to such Ballot; (b) any Ballot that is illegible or contains insufficient information to permit identification of the voter; (c) any Ballot cast by a Person that does not hold a Claim or Interest in a Class that is entitled to vote to accept or reject the Plan; (d) any duplicate Ballot will only be counted once; (e) any unsigned Ballot or paper Ballot that does not contain an original signature; and (f) any Ballot transmitted to the Claims and Balloting Agent by facsimile or electronic mail, unless the Debtors, in their discretion, consent to such delivery method. 3. Execution of Ballots by Representatives To the extent applicable, if a Ballot is submitted by trustees, executors, Nominees, administrators, guardians, attorneys-in-fact, officers of corporations, or others acting in a fiduciary or representative capacity, such Persons must indicate their capacity when submitting the Ballot and, at the Debtors’ request, must submit proper evidence satisfactory to the Debtors of their authority to so act. For purposes of voting tabulation, a Ballot submitted by a representative shall account for the total number of represented parties with respect to the numerosity requirement set forth in this Article.

16 4. Waivers of Defects and Other Irregularities Regarding Ballots Unless otherwise directed by the Bankruptcy Court, all questions concerning the validity, form, eligibility (including time of receipt), acceptance, and revocation or withdrawal of Ballots will be determined by the Debtors in their sole discretion, whose determination will be final and binding. The Debtors reserve the right to reject any and all Ballots not in proper form, the acceptance of which would, in the opinion of the Debtors or their counsel, be unlawful. The Debtors further reserve the right to waive any defects or irregularities or conditions of delivery as to any particular Ballot. Unless waived, any defects or irregularities in connection with deliveries of Ballots must be cured within such time as the Debtors (or the Bankruptcy Court) determine. Neither the Debtors nor any other Person will be under any duty to provide notification of defects or irregularities with respect to deliveries of Ballots, nor will any of them incur any liability for failure to provide such notification; provided, however, that the Debtors will indicate on the ballot summary the Ballots, if any, that were not counted, and will provide copies of such Ballots with the ballot summary to be submitted at the Confirmation Hearing. Unless otherwise directed by the Bankruptcy Court, delivery of such Ballots will not be deemed to have been made until any irregularities have been cured or waived. Unless otherwise directed by the Bankruptcy Court, Ballots previously furnished, and as to which any irregularities have not subsequently been cured or waived, will be invalidated. 5. Withdrawal of Ballots and Revocation The Debtors may allow any claimant who submits a properly completed Ballot to supersede or withdraw such Ballot on or before the Voting Deadline. In the event the Debtors do permit such supersession or withdrawal, the claimant, for cause, may change or withdraw its acceptance or rejection of the Plan in accordance with Bankruptcy Rule 3018(a). G. Confirmation of Plan 1. Solicitation of Acceptances The Debtors are soliciting your vote. NO REPRESENTATIONS OR ASSURANCES, IF ANY, CONCERNING THE DEBTORS OR THE PLAN ARE AUTHORIZED BY THE DEBTORS, OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT. ANY REPRESENTATIONS OR INDUCEMENTS MADE BY ANY PERSON TO SECURE YOUR VOTE, OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT, SHOULD NOT BE RELIED ON BY YOU IN ARRIVING AT YOUR DECISION, AND SUCH ADDITIONAL REPRESENTATIONS OR INDUCEMENTS SHOULD BE REPORTED TO DEBTORS’ COUNSEL FOR APPROPRIATE ACTION. THIS IS A SOLICITATION SOLELY BY THE DEBTORS, AND IS NOT A SOLICITATION BY ANY SHAREHOLDER, ATTORNEY, ACCOUNTANT, OR OTHER PROFESSIONAL FOR THE DEBTORS. THE REPRESENTATIONS, IF ANY, MADE IN THIS DISCLOSURE STATEMENT ARE THOSE OF THE DEBTORS AND NOT OF SUCH