Q4 2018 02.12.2019 Dear Fellow Stockholders, 2018 was a critical year for Groupon’s transformation as we took key steps in building the daily habit for local commerce. Progress is rarely linear or easy, however, and in many ways 2018 was our hardest fought year yet. As I reflect on the year, I’m pleased with the progress we’ve made in our efforts to transform the business into a daily utility for consumers and in delivering solid Adjusted EBITDA growth. On the other hand, I’m not pleased with our traffic or Gross Profit performance from the back half of the year. I am proud of our team’s efforts to begin transforming Groupon, but, as a fellow stockholder, I’m deeply unsatisfied with our share performance. I believe our competitive position, assets and size are not fully appreciated at this point, nor is our ability to consistently deliver significant Adjusted EBITDA and Free Cash Flow. We believe we are on a path to change this. Groupon stands out for its competitive position, assets, economic scale and consumer and traffic volumes. We believe there is significant opportunity for stockholders in bringing our value more in line with our assets and longer-term potential. Our transformation will take time, but 2018 showed more signs of progress. We entered 2018 with great momentum strategically and operationally, and we saw some of our transformational steps start to bear fruit. We delivered $2 million in Net Income and $191 million in Operating Cash Flow for the year. We also delivered $270 million of Adjusted EBITDA

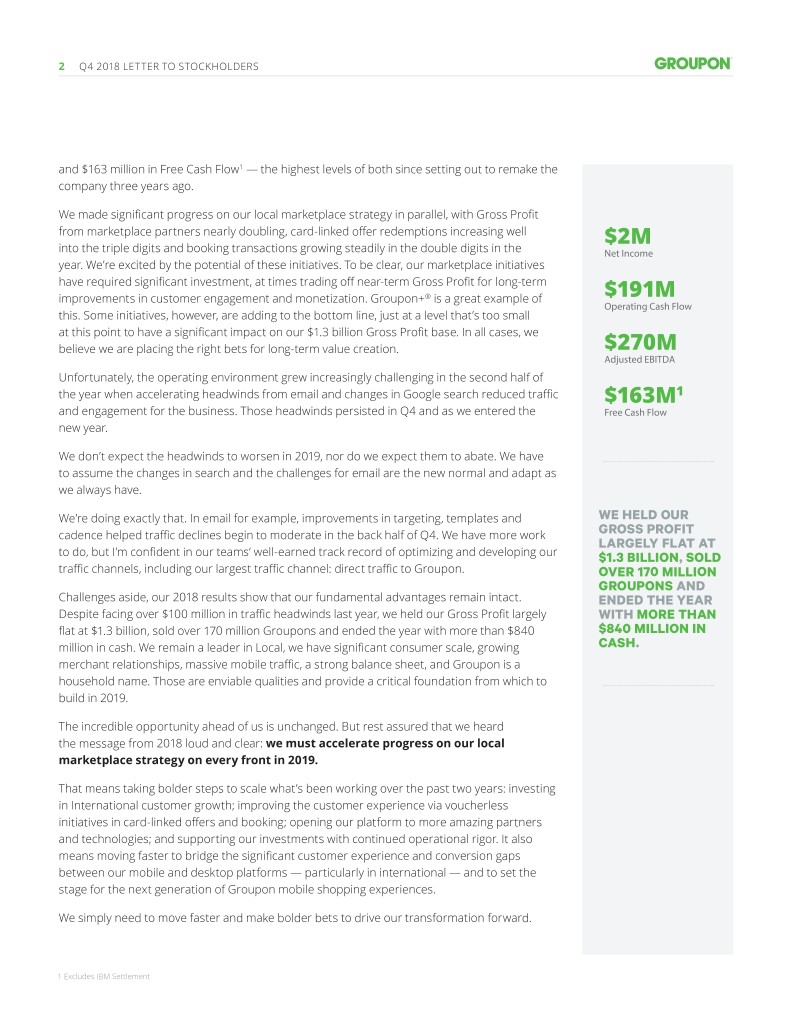

2 Q4 2018 LETTER TO STOCKHOLDERS and $163 million in Free Cash Flow1 — the highest levels of both since setting out to remake the company three years ago. We made significant progress on our local marketplace strategy in parallel, with Gross Profit from marketplace partners nearly doubling, card-linked offer redemptions increasing well $2M into the triple digits and booking transactions growing steadily in the double digits in the Net Income year. We’re excited by the potential of these initiatives. To be clear, our marketplace initiatives have required significant investment, at times trading off near-term Gross Profit for long-term improvements in customer engagement and monetization. Groupon+® is a great example of $191M Operating Cash Flow this. Some initiatives, however, are adding to the bottom line, just at a level that’s too small at this point to have a significant impact on our $1.3 billion Gross Profit base. In all cases, we believe we are placing the right bets for long-term value creation. $270M Adjusted EBITDA Unfortunately, the operating environment grew increasingly challenging in the second half of the year when accelerating headwinds from email and changes in Google search reduced traffic $163M1 and engagement for the business. Those headwinds persisted in Q4 and as we entered the Free Cash Flow new year. We don’t expect the headwinds to worsen in 2019, nor do we expect them to abate. We have to assume the changes in search and the challenges for email are the new normal and adapt as we always have. We’re doing exactly that. In email for example, improvements in targeting, templates and WE HELD OUR GROSS PROFIT cadence helped traffic declines begin to moderate in the back half of Q4. We have more work LARGELY FLAT AT to do, but I’m confident in our teams’ well-earned track record of optimizing and developing our $1.3 BILLION, SOLD traffic channels, including our largest traffic channel: direct traffic to Groupon. OVER 170 MILLION GROUPONS AND Challenges aside, our 2018 results show that our fundamental advantages remain intact. ENDED THE YEAR Despite facing over $100 million in traffic headwinds last year, we held our Gross Profit largely WITH MORE THAN flat at $1.3 billion, sold over 170 million Groupons and ended the year with more than $840 $840 MILLION IN million in cash. We remain a leader in Local, we have significant consumer scale, growing CASH. merchant relationships, massive mobile traffic, a strong balance sheet, and Groupon is a household name. Those are enviable qualities and provide a critical foundation from which to build in 2019. The incredible opportunity ahead of us is unchanged. But rest assured that we heard the message from 2018 loud and clear: we must accelerate progress on our local marketplace strategy on every front in 2019. That means taking bolder steps to scale what’s been working over the past two years: investing in International customer growth; improving the customer experience via voucherless initiatives in card-linked offers and booking; opening our platform to more amazing partners and technologies; and supporting our investments with continued operational rigor. It also means moving faster to bridge the significant customer experience and conversion gaps between our mobile and desktop platforms — particularly in international — and to set the stage for the next generation of Groupon mobile shopping experiences. We simply need to move faster and make bolder bets to drive our transformation forward. 1 Excludes IBM Settlement

3 Q4 2018 LETTER TO STOCKHOLDERS To support our faster pace and bolder bets, we will remain disciplined and focused on improving our operating efficiency and plan to direct as many cost savings opportunities as possible toward fueling growth and continuing our strong track record of Adjusted EBITDA and Free Cash Flow generation. Over time, as legacy headwinds subside and we execute against our strategy, I believe the FOR 2019 WE EXPECT power of our assets and potential will be more appreciated. As we look ahead, we expect 2019 will be a year defined by investments in our future. $270M OF ADJUSTED For 2019 we expect $270 million of Adjusted EBITDA, which includes sizeable investments EBITDA in expanding our card-linked offers products, booking and partner integrations. These investments will be most significant in the first half of the year, where we will see some pressure on Gross Profit while setting the stage for stronger performance as we exit the year and build to 2020. Importantly, we anticipate that the investments we’re making now, along with Importantly, we anticipate that the investments we’re making now, along with continued cost continued cost discipline, discipline, will put us on the path to achieving $300 million or more of Adjusted EBITDA in will put us on the path to 2020 -- with significant upside potential over time should our initiatives on voucherless and achieving conversion drive purchase frequency higher, as we have seen in early testing. $300M OR MORE OF A more detailed recap of 2018, along with a broader view on our 2019 plan follows. We hope ADJUSTED that current and prospective investors find that it’s a helpful tool for understanding where EBITDA IN 2020 we’re heading and why we’re optimistic about Groupon’s future. Thank you for your continued support and for being a part of our transformation. Best regards, Rich Williams CEO

4 Q4 2018 LETTER TO STOCKHOLDERS 2018 Recap PERFORMANCE HIGHLIGHTS Strong performance on our operating efficiency initiative helped us grow 8% on the bottom line and deliver $270 million of Adjusted EBITDA, albeit on lower Gross Profit than we anticipated at the beginning of the year. We leaned into our traffic headwinds during Q4 and invested in top of the funnel and promotional marketing that helped bolster our holiday peak around Black Friday, where we delivered much stronger unit performance and further reinforced Groupon’s position as a trusted holiday shopping destination. IMPROVED MARKETING TARGETING AND EFFICIENCY % Over the course of the year, based on improvements in data and customer analytics, we began +6 making finer grained decisions with our marketing spend -- both for customer acquisition and 2018 International Gross Profit customer retention. While it’s uncomfortable to see our active customer counts decline, we made the call to allow for some customer attrition when the economics didn’t make sense. +5% 2018 International In the relative short term, this means fewer overall, but more profitable, customers in North customers America. That is playing out as we expect, with customers down 6% and Gross Profit per customer up 3%. We expect our customer count to begin stabilizing in 2020. +6% Q4 2018 Local Gross CONSISTENT INTERNATIONAL GROWTH Profit We continue to see great opportunity and solid returns in International where we are actively growing our customer base and the business. For the year, we grew our International segment Gross Profit by 6%, as reported, and customers by 5%, and we exited the year growing Local Gross Profit by 6%. Importantly, we are applying what we’ve learned in North America and have been consistently growing Gross Profit per Customer in parallel with expanding the base. We expect these trends to continue for the foreseeable future. PROGRESS ON CUSTOMER EXPERIENCE AND OPEN PLATFORM INITIATIVES We continued to move our strategy forward and delivered strong progress in our initiatives to enhance the customer experience in the marketplace. For example: • Card-Linked Offers: We added more than 4 million cards and nearly tripled our consumer card-linked enrollment while nearly doubling merchant participation in card-linked with over 7,000 locations now active. • Compelling New Partnerships: We signed and onboarded amazing new partnerships with great brands that are fueling the growth of our open platform, and we grew Gross Profit from marketplace partners by about 70% year over year. • Booking: Partnerships also helped fuel our booking growth, which we increased by 12% year over year. In all, we sat tens of millions of diners, concert goers, spa visitors and more over the course of 2018. Our initiatives have required significant investment, at times trading off near-term Gross Profit for long-term improvements in customer engagement and monetization, including continued scaling of Groupon+ and rapid growth of open-platform partnerships. We believe these are the right tradeoffs given the potential for sizeable long-term value creation as a result of improved purchase frequency and engagement with our products.

5 Q4 2018 LETTER TO STOCKHOLDERS CUSTOMER EXPERIENCE IMPROVED THE release posted on the Investor Relations site, http://investor.groupon.com 1 Adjusted EBITDA is a non-GAAP performance measure. For a reconciliation to the most comparable U.S. GAAP performance measure, “Net income (loss) from continuing operations,” see the tables to the Company’s second quarter earnings earnings quarter second Company’s the to tables the see operations,” continuing from (loss) income “Net measure, performance GAAP U.S. comparable most the to a reconciliation For measure. performance a non-GAAP is EBITDA Adjusted and American Express network partners 5.1M cards linked in Groupon+ with Visa, Mastercard in our more than 25 Groupon+ markets second quarter alone and continued to deepen supply Enrolled ~1 million new cards in Groupon+ during the 2019 Plan EBITDA ADJUSTED GLOBAL $56.2M PROFIT GROSS GLOBAL $324M For any scaled marketplace to thrive, it needs three core things: scaled distribution/consumer WE ARE BUILDING THE DAILY HABIT FOR LOCAL COMMERCE relationships, robust supply/merchant relationships, and a better-than-original experience based on convenience and supported by price. Together they create a virtuous cycle. Q2 2018 HIGHLIGHTS . SUPPLY PARTNERSHIP WITH VIATOR UK INTERNATIONAL THIRD�PARTY FIRST LAUNCHED +120,000 INTERNATIONAL NEW CUSTOMERS INTERNATIONAL PROFIT GROSS +11% Y�Y Our strategy is designed to establish these same pillars that have enabled successful ¹ marketplaces to thrive time and time again. In 2019, we will continue focusing on four key areas PUBLIC FACT SHEET — improving the customer experience, expanding our open platform, realizing the potential in Express, CourseHorse, Viator and more with Grubhub, Major League Baseball, American American with League Baseball, Major Grubhub, parties, having or expanded partnerships launched parties, Brought in significant additional inventory from third third from inventory additional significant in Brought PLATFORM INVENTORY our International business and continuing our history of operational rigor. INCREASED SIGNIFICANTLY ON MOBILE MOBILE ON >70% TRANSACTIONS OF GROSS BILLINGS GROSS GLOBAL $1.3B IMPROVING THE CUSTOMER EXPERIENCE: DELIVER BEST-IN-CLASS MOBILE EXPERIENCES AND CONVERSION, SCALE VOUCHERLESS Best-in-class mobile apps; room for improvement on mobile web Entering 2019, we have the third most visited retail app in the U.S. and the 6th highest rated iOS app of all time2,3. This is a rare and powerful distribution platform with over 100 million monthly users. We maintain this scale while actively reducing the size of our customer base to increase its quality and efficiency — which we expect to continue at a similar pace through this year. rd With all of our traffic, massive opportunity remains to make it easier to buy on Groupon. Given 3 80% of our traffic is mobile, we expect that we’re ahead of the curve and nearing the end of our MOST transition from desktop to mobile. VISITED RETAIL APP Our mobile app is one of the highest rated iOS apps ever, yet it has room for improvement and will IN THE U.S.2 continue to see enhancements as we revamp the experience to better reflect our marketplace, make it easier to search our increasingly large catalog, and ultimately make it easier to buy. Our mobile web experience likely has even more significant opportunity for improvement and monetization than our mobile app. Mobile web is our fastest growing traffic platform, so bringing our mobile web experience and performance more in line with our mobile app has the potential to unlock significant value. We need to move our winning app features to mobile web faster, and operate with a relentless focus on increasing conversion rates on the platform. This requires more investment in product and engineering resources focused on mobile conversion, which is already underway. We expect progress and contribution from these efforts to build in the second half of the year. th Scaling voucherless experiences on Groupon 6 We have long discussed the need for Groupon to become voucherless. Today’s consumer HIGHEST wants more convenience and great prices, not great prices with more hassle. We need to test, RATED iOS learn and move faster to give consumers the kinds of experiences they deserve and which they reward with higher use and loyalty. APP OF ALL TIME3 Booking and card-linking remain central to the opportunity for us in Local. We will experiment with bolder changes across both booking and card-linking in a number of markets throughout the year. Bolstered by the increasing capabilities we now have via our partnerships in ticketing and booking, 2 Mobile Metrix Media, April 2018 3 According to App Store Users, 2018

6 Q4 2018 LETTER TO STOCKHOLDERS as well as our proprietary lightweight booking solution, we intend to begin the journey of making booking a requirement on our platform for a number of service categories in health and beauty, things to do and fine dining. Requiring booking on Groupon is a big change, though we believe it’s in line with the trends in local overall, with the vast majority of our target merchants actively using or having access to booking technologies today. In cases where merchants don’t have a booking solution already in place, we plan to offer booking solutions through our marketplace partners or provide access to the Groupon booking tool at no cost. Our booking tool, which is live in Europe, is used by thousands of restaurants and spas in the region and helped seat millions of customers last year. We plan to extend this tool to North America and across more categories as needed. Whereas booking is more prevalent in our customers’ daily routines, card-linking is earlier in its development cycle. As our first foray into card-linking, Groupon+ has shown us the potential of the technology and experience on our platform, and we are already a leader in the space with relatively large scale consumer and merchant participation. Rolling out Groupon+ entailed building the technology, infrastructure and processes that can now allow us to expand card linking as a core purchase, redemption and loyalty experience across our business. Accordingly, you should expect to see card-linked offers -- and not Groupon+ -- in more verticals soon. In addition, we expect a number of key changes to card-linking on Groupon: • Rebranding Groupon+: We will rebrand Groupon+ in favor of focusing our energies on Cash Back Offers in order to better reflect how consumers think about the product and support the additional ways card-linking will be available for our customers later in the year. The low discounts that Groupon+ enabled will continue to live on in Cash Back Offers and we expect to enhance them with both deeper discount and loyalty offers that customers can redeem via their credit cards. • Tapping into loyalty: We will begin rolling out one of the most popular features of Groupon+ to both merchants and consumers: loyalty offers. These offers typically reward consumers with cash back for repeat visits. Nearly all of our Groupon+ merchants utilize loyalty offers for their campaigns today, and those offers make up a sizeable percentage of the redemptions and frequency lift on the product. By providing a loyalty offering on Groupon, we see the opportunity to increase engagement and repeat purchase rates on our platform while providing merchants rich and precise ROI data that closes the loop on their acquisition campaigns in a way that few advertising platforms can provide. We have already begun rolling out loyalty offers to our health and beauty vertical, and expect to expand to other parts of our Local business later in the year. • Converting deep discount vouchers: We will begin tests to convert our traditional deep discounted deals to card-linked redemption. This could be one of our biggest opportunities to accelerate the adoption of card-linked at Groupon given the sheer unit scale of our voucher business.

7 Q4 2018 LETTER TO STOCKHOLDERS We anticipate that these changes will initially slow our progress with enrollments and merchant participation as we redirect our teams from a singular focus on Groupon+ to a broader rollout of card-linked at Groupon. We expect our efforts to result in accelerating adoption as we move through the back half of this year and into 2020. EXPANDING OUR OPEN PLATFORM: INCREASE MONETIZATION OPPORTUNITIES THROUGH PARTNERSHIPS AND MARKET RATE INVENTORY We have amassed one of the largest catalogs of transactable local supply in our markets and yet we remain in the single digits in most markets across our target categories. We know we need to multiply our current inventory to give customers what they’re looking for when they’re searching on Groupon to buy — something that happens more than two billion times per year. The opportunity for scale is immense. We will continue going to market with our increasingly efficient internal sales force, and we “OUR CONVICTION intend to accelerate aggregating massive supply through our open platform partnership IS HIGH BECAUSE model. In addition, we will begin expanding merchant self service options on our platform to OUR FUTURE, make it even easier to work with Groupon. VOUCHERLESS EXPERIENCES Integrating and engaging new partners ARE GROWING AND DELIVERING We entered 2019 with a backlog of partners to onboard to Groupon and significant demand THE KINDS OF from prospective partners. This is exciting as even our signed partners have the potential to EXPERIENCES add tens of thousands of locations and services to our supply. TODAY’S CONSUMER DEMANDS.” We expect to focus our energy in the first half of the year on clearing our partner integration backlog and simplifying the onboarding process so that we can carry our momentum through to new partners in the second half and beyond. Importantly, we expect these efforts to significantly increase not only our selection and inventory, but to accelerate our push to voucherless as the vast majority of our partners are bookable and fully digital for redemption. Not just a discount site It’s important to call out that a large percentage of our new inventory will be market rate inventory with little or no discounting. We believe low and no discount offers are critical to building the robust supply we need. We have seen that our customers are more than willing to buy this inventory from us and we sell millions of dollars of this inventory every month. Don’t expect fewer deep discount offers, however. Deep discounts will continue to be on our platform moving forward but our goal is to convert more and more of them to voucherless experiences via card-linked or booking. UNLOCKING INTERNATIONAL’S POTENTIAL: INVEST IN CUSTOMER ACQUISITION AND PROVEN PRODUCT ENHANCEMENTS TO FUEL GROWTH With roughly twice the addressable population as North America and about half the total penetration rate at Groupon, we believe untapped potential remains in our International business. We saw strong returns on our International marketing investments in 2018 and expect to continue to migrate marketing dollars toward International customer acquisition in 2019. In parallel, we plan to accelerate our product efforts and process enhancements to deliver proven successful product and supply initiatives from North America.

8 Q4 2018 LETTER TO STOCKHOLDERS CONTINUED OPERATIONAL RIGOR: FREE UP CAPITAL TO INVEST We’ve made great strides in improving the efficiency of our operations and streamlining the company. Our efforts here have provided more opportunities to invest in our future and stronger earnings for our stockholders. Importantly, a sharp focus on efficiency and cost is part of our culture at this point. As we expect headwinds in email and search to continue this year, it’s critical that we remain just as committed to efficiency as we are to our growth-oriented strategic initiatives. We still have significant opportunities to apply technology and automation throughout our organization to improve productivity, and we expect to see more advancements on this front in 2019.

9 Q4 2018 LETTER TO STOCKHOLDERS APPENDIX WEBCAST CONFERENCE CALL DETAILS Groupon will hold a conference call to discuss its fourth quarter 2018 financial results on Wednesday, February 13, 2019, at 10:00am EST. The webcast can be accessed WEDNESDAY, live at investor.groupon.com. A replay of the webcast will be available through the same link following the conference call, along with the earnings press release, financial FEBRUARY 13, 2019 tables and slide presentation. 10:00 A.M. EST Non-GAAP Financial Measures and Operating Metrics This letter contains references to the following non-GAAP financial measures: Adjusted EBITDA and Free Cash Flow excluding IBM patent litigation. These non-GAAP financial measures, which are presented on a continuing operations basis, are intended to aid investors in better understanding our current financial performance and prospects for the future as seen through the eyes of management. We believe that these non-GAAP financial measures facilitate comparisons with our historical results and with the results of peer companies who present similar measures (although other companies may define non-GAAP measures differently than we define them, even when similar terms are used to identify such measures). However, these non-GAAP financial measures are not intended to be a substitute for those reported in accordance with U.S. GAAP. For additional information regarding these non-GAAP financial measures and reconciliations of these measures to the most applicable financial measures under U.S. GAAP, see “Non-GAAP Reconciliation Schedules” and “Supplemental Financial and Operating Metrics” included in the tables accompanying the earnings press release announcing our financial results for the quarter ended December 31, 2018 posted to our Investor Relations site, investor.groupon.com. With respect to the Company’s forecasted Adjusted EBITDA for 2020, the Company cannot provide a reconciliation to net income from continuing operations for 2020, the most directly comparable GAAP measure, without unreasonable effort due to the unavailability of reliable estimates for certain items for periods beyond 2019. Note on Forward-Looking Statements The statements contained in this letter that refer to plans and expectations for the next quarter, the full year or the future are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our future results of operations and financial position, business strategy and plans and our objectives for future operations. The words “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “continue” and other similar expressions are intended to identify forward-looking statements. We have based these forward looking statements largely on current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, but are not limited to, risk related to volatility in our operating results; execution of our business and marketing strategies; retaining existing customers and adding new customers; challenges arising from our international operations, including fluctuations in currency exchange rates, legal and regulatory developments and any potential adverse impact from the United Kingdom’s likely exit from the European Union; retaining and adding high quality merchants; our voucherless offerings; cybersecurity breaches; competing successfully in our industry; changes to merchant payment terms; providing a strong mobile experience for our customers; maintaining our information technology infrastructure; delivery and routing of our emails; claims related to product and service offerings; managing inventory and order fulfillment risks; litigation; managing refund risks; retaining and attracting members of our executive team; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; tax liabilities; tax legislation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR and regulation of the Internet and e-commerce; classification of our independent contractors; protecting our intellectual property; maintaining a strong brand; customer and merchant fraud; payment-related risks; our ability to raise capital if necessary and our outstanding indebtedness; global economic uncertainty; our common stock, including volatility in our stock price; our convertible senior notes; and our ability to realize the anticipated benefits from the hedge and warrant transactions. For additional information regarding these and other risks and uncertainties, we urge you to refer to the factors included under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2018, and our other filings with the Securities and Exchange Commission, copies of which may be obtained by visiting the company’s Investor Relations web site at investor.groupon.com or the SEC’s web site at www.sec.gov. Groupon’s actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance. You should not rely upon forward-looking statements as predictions of future events. Although Groupon believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither Groupon nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect our expectations as of February 12, 2019. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this letter to conform these statements to actual results or to changes in our expectations. About Groupon Groupon (NASDAQ: GRPN) is building the daily habit in local commerce, offering a vast mobile and online marketplace where people discover and save on amazing things to do, eat, see and buy. By enabling real-time commerce across local businesses, travel destinations, consumer products and live events, shoppers can find the best a city has to offer. Groupon is redefining how small businesses attract and retain customers by providing them with customizable and scalable marketing tools and services to profitably grow their businesses. To download Groupon’s top-rated mobile apps, visit www.groupon.com/mobile. To search for great deals or subscribe to Groupon emails, visit www.groupon.com. To learn more about the company’s merchant solutions and how to work with Groupon, visit www.groupon.com/merchant.