2 Forward-looking statements and other information 2 The statements contained in this presentation that refer to plans and expectations for the next quarter, the full year or the future are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), including statements regarding the Company’s future results of operations and financial position, business strategy and plans and the Company’s objectives for future operations and future liquidity. The words “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “aim,” “continue” and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect the Company’s financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve risks and uncertainties that could cause the Company actual results to differ materially from those expressed or implied in the Company’s forward-looking statements. Such risks and uncertainties include, but are not limited to, the Company’s ability to execute and achieve the expected benefits of the Company’s go-forward strategy; execution of the Company’s business and marketing strategies; volatility in the Company’s operating results; challenges arising from the Company’s international operations, including fluctuations in currency exchange rates, tax, legal and regulatory developments in the jurisdictions in which the Company operates and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures; any impact from U.S. and international financial reform legislation and regulations, and any potential trade protection measures, such as new or incremental tariffs; retaining and adding high quality merchants and third-party business partners; retaining existing customers and adding new customers; competing successfully in the Company’s industry; providing a strong mobile experience for the Company’s customers; managing refund risks; retaining and attracting members of the Company’s executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; the Company’s reliance on email, Internet search engines and mobile application marketplaces to drive traffic to the Company’s marketplace; cybersecurity breaches; maintaining and improving the Company’s information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting the Company’s intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA and other privacy-related laws and regulations of the Internet and e-commerce; classification of the Company’s independent contractors, agency workers, or employees; the Company’s ability to remediate the Company’s material weakness over internal control over financial reporting; risks relating to information or content published or made available on the Company’s websites or service offerings we make available; exposure to greater than anticipated tax liabilities; adoption of tax laws; the Company’s ability to use the Company’s tax attributes; impacts if we become subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; the Company’s ability to raise capital if necessary; risks related to the Company’s access to capital and outstanding indebtedness, including the Company’s 1.125% Convertible Senior Notes due 2026 (the “2026 Notes”); the Company’s Common Stock, including volatility in the Company’s stock price; the Company’s ability to realize the anticipated benefits from the capped call transactions relating to the 2026 Notes; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of our Annual Report on Form 10-K for the year-ended December 31, 2023, and Part II, Item 1A. Risk Factors on our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, as well as in our condensed consolidated financial statements, related notes, and the other financial information appearing elsewhere in this report and our other filings with the Securities and Exchange Commission (the “SEC”). Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to publicly update any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. As used herein, “Groupon,” “the Company,” “we,” “our,” “us” and similar terms include Groupon, Inc. and its subsidiaries, unless the context indicates otherwise.

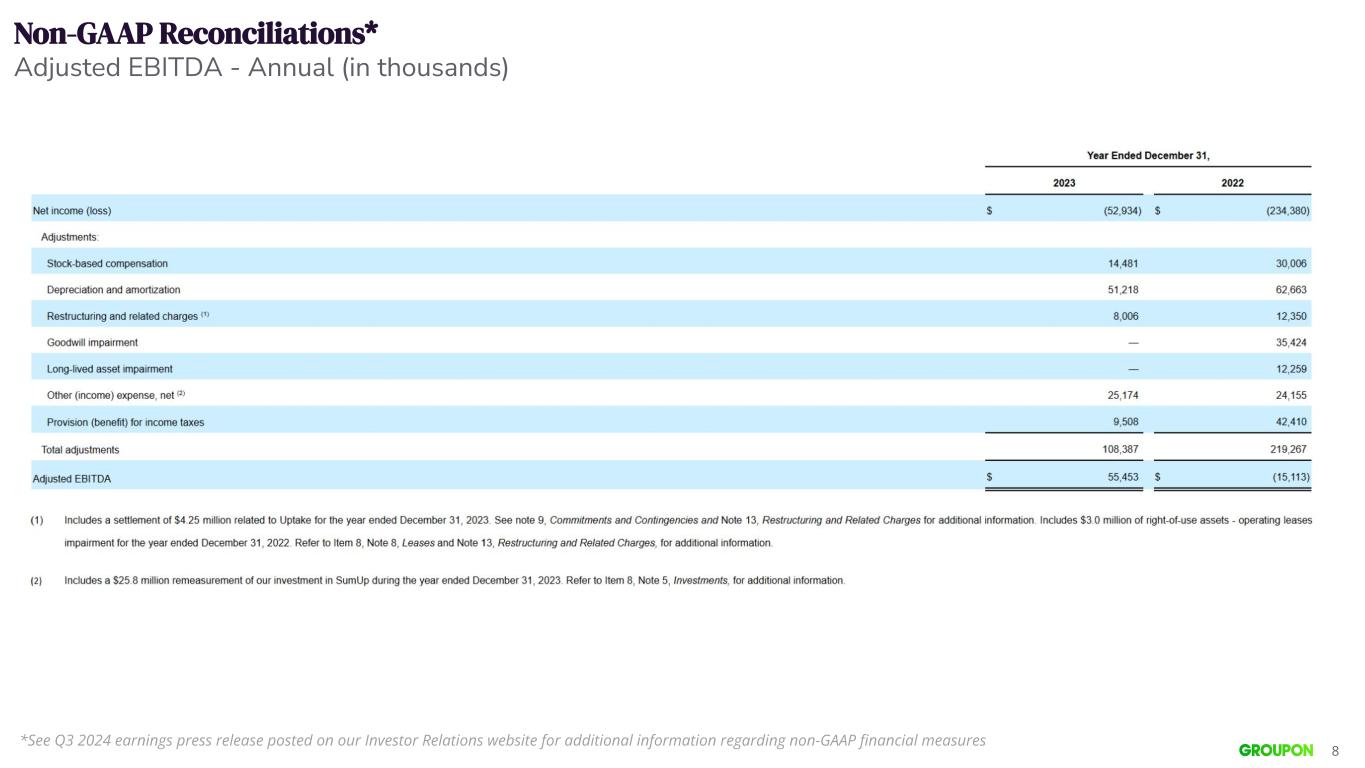

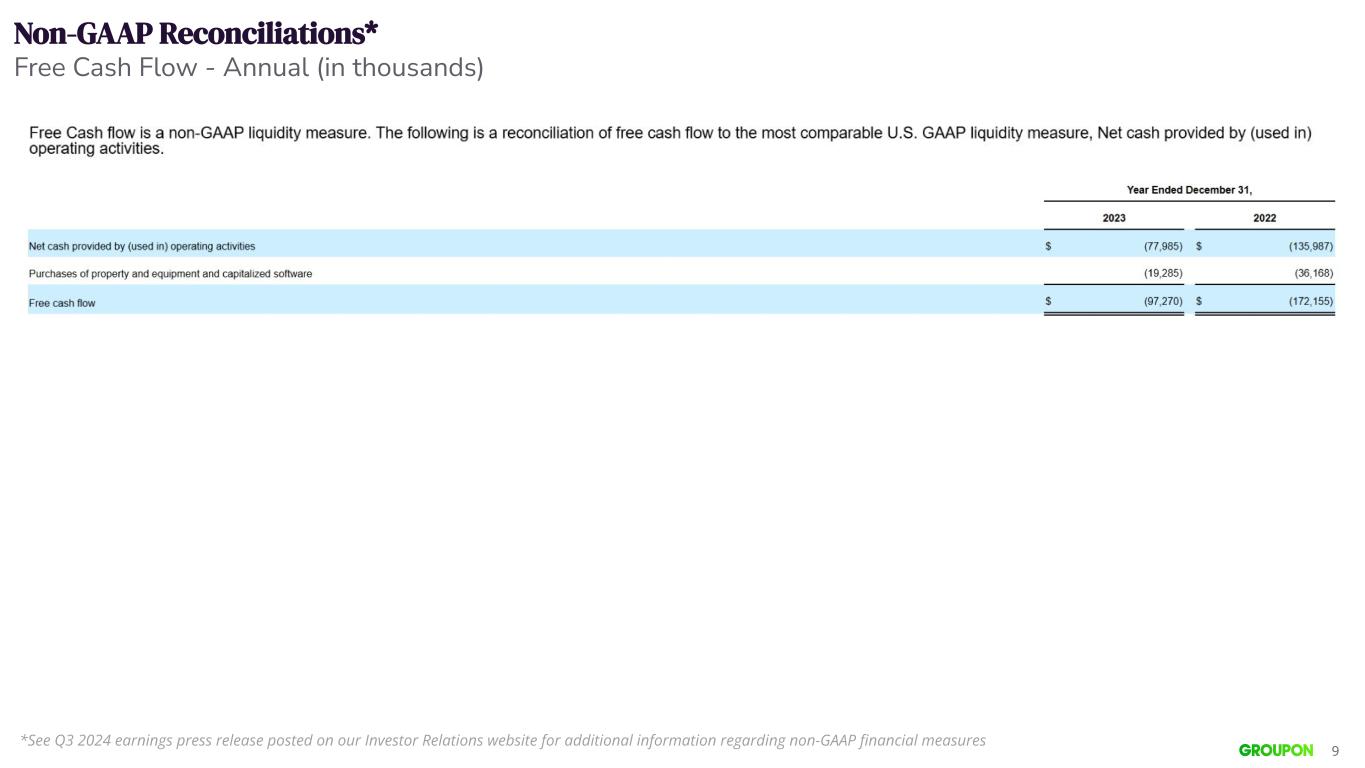

3 1) Active Customers are defined as unique user accounts that have made a purchase during the trailing twelve months ("TTM") either through one of our online marketplaces or directly with a merchant for which we earned a commission 2) Adjusted EBITDA (AEBITDA) and Free Cash Flow are non-GAAP financial measures. See the appendix for a reconciliation to the most comparable U.S. GAAP financial measure, “Net income (loss)” and "Net cash provided by (used in) operating activities” Groupon is a leading online curated experience marketplace 3 Our Mission Value proposition Financial Snapshot To empower people to discover and enjoy amazing experiences through unbeatable value, delivered with trust and ease. Consumers Merchants Dedicated to helping you discover more while saving more, with the support you need every step of the way. Your strategic marketing partner to achieve your revenue and traffic objectives in a pay-for-performance based model 400,000+ Active Live Deals(2) $500M Q3 2024 TTM Revenue $1.5B Q3 2024 TTM Billings $78M Q3 2024 TTM Adjusted EBITDA2 ~16M Active Customers(1) ~$500M Market Capitalisation $160M Q3 2024 Cash & Cash Equivalents 14 Countries Beauty & Wellness Things To Do Aesthetic Medical Services Hair, Face, Skin & Body Treatments Spas & Massages Local Activities Tours & Attractions Live Events Auto & Home Services Travel Food & Drink Key Verticals Goods Current Footprint Australia, Belgium, Canada, Germany, France, Italy, Ireland, Poland, Netherlands, Spain, Australia, UAE, UK, USA 50k+ Merchants f Online Shopping Local 150k+ Experiences