As filed with the Securities and Exchange Commission on June 21, 2010

Registration No. 333-_______

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7372 | 35-2181508 |

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

| | | |

| | 9711 Washingtonian Boulevard Gaithersburg, MD 20878 (301) 340-4000 | |

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| | John Duvall, Senior Vice President and Chief Financial Officer Richard B. Nash, Senior Vice President and General Counsel GXS Worldwide, Inc. 9711 Washingtonian Boulevard Gaithersburg, MD 20878 (301) 340-4000 | |

| (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

|

Deanna L. Kirkpatrick Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o __________________________________

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o __________________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company o

| CALCULATION OF REGISTRATION FEE |

Title Of Each Class Of Securities To Be Registered | Amount To Be Registered | Proposed Maximum Offering Price Per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount Of Registration Fee |

| 9.75% New Senior Secured Notes due 2015 | $785,000,000 | 100% | $785,000,000 | $55,971 |

| Guarantees of the New Senior Secured Notes by each of the Additional Registrants | $ — | — % | $ — | $ — (2) |

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| (2) | Pursuant to Rule 457(n) under the Securities Act, no registration fee is payable with respect to the guarantees. |

The registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

Exact Name of Registrant as Specified in its Charter(1) | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | Industrial Classification Code Number |

GXS, Inc. | Delaware | 52-1865641 | 7372 |

GXS International, Inc. | Delaware | 52-1875179 | 7372 |

GXS Investments, Inc. | Delaware | 52-2253731 | 7372 |

HAHT Commerce, Inc. | Delaware | 56-1929876 | 7372 |

| (1) | The address and telephone number of each co-registrant’s principal executive offices is 9711 Washingtonian Boulevard, Gaithersburg, MD 20878, (301) 340-4000. |

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted. |

PROSPECTUS (SUBJECT TO COMPLETION, DATED JUNE 21, 2010)

GXS Worldwide, Inc.

Offer to Exchange

9.75% Senior Secured Notes due 2015

for

9.75% New Senior Secured Notes due 2015

We are offering to exchange up to $785,000,000.00 of our 9.75% New Senior Secured Notes due 2015 (the “New Notes”) for up to $785,000,000.00 of our existing 9.75% Senior Secured Notes due 2015 (the “Old Notes”). The terms of the New Notes are identical in all material respects to the terms of the Old Notes, except that the New Notes will be issued in a transaction registered under the Securities Act of 1933, as amended (the “Securities Act”), and the transfer restrictions and registration rights relating to the Old Notes will not apply to the New Notes. The New Notes will represent the same debt as the Old Notes and we will issue the New Notes under the same indenture.

To exchange your Old Notes for New Notes:

| · | you are required to make the representations described on page 160 to us |

| · | you must complete and send the letter of transmittal that accompanies this prospectus to the exchange agent, U.S. Bank National Association, by 5:00 p.m., New York time, on _______, 2010 |

| · | you should read the section called “The Exchange Offer” for further information on how to exchange your Old Notes for New Notes |

See “Risk Factors” beginning on page 17 for a discussion of risk factors that should be considered by you prior to tendering your Old Notes in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in the exchange offer or passed upon the adequacy or accuracy of this Prospectus. Any representation to the contrary is a criminal offense.

_____________, 2010

Page

| iv |

| v |

| v |

| 1 |

| 15 |

| 17 |

| 35 |

| 36 |

| 37 |

| 45 |

| 47 |

| 65 |

| 74 |

| 84 |

| 88 |

| 90 |

| 91 |

| 93 |

| 154 |

| 162 |

| 162 |

| 163 |

| 163 |

| 163 |

| F-1 |

You should rely only on information contained in this prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any of the notes offered hereby by any person in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the notes. No other person is making any representation or warranty, express or implied, as to the accuracy or completeness of the informatio n contained in this prospectus. Nothing contained in this prospectus is, or shall be relied upon as, a promise or representation, whether as to the past or the future.

THE NOTES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The contents of this prospectus are not to be considered as legal, business or tax advice. You must inform yourself about and observe all applicable laws and regulations in force in any jurisdiction in connection with the possession or distribution of this prospectus and the exchange of the notes, and you must obtain any consent, approval or permission required to be obtained by you for the exchange of the notes. We shall not have any responsibility therefor.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A LICENSE HAS BEEN FILED UNDER CHAPTER 421-B OF THE NEW HAMPSHIRE UNIFORM SECURITIES ACT

(“RSA 421-B”) WITH THE STATE OF NEW HAMPSHIRE NOR THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN THE STATE OF NEW HAMPSHIRE CONSTITUTES A FINDING BY THE SECRETARY OF STATE OF THE STATE OF NEW HAMPSHIRE THAT ANY DOCUMENT FILED UNDER RSA 421-B IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT THAT AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION MEANS THAT THE SECRETARY OF STATE OF THE STATE OF NEW HAMPSHIRE HAS PASSED IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN APPROVAL TO, ANY PERSON, SECURITY OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

The common stock of GXS, Inc., GXS Worldwide, Inc.’s only subsidiary, is collateral for the notes. Securities and Exchange Commission Rule 3-16 of Regulation S-X (“Rule 3-16”) requires financial statements for each of the registrant’s affiliates whose securities constitute a substantial portion of the collateral. The common stock of GXS, Inc. is considered to constitute a substantial portion of the collateral for the notes being registered hereby. Accordingly, the financials statements of GXS, Inc. would be required by Rule 3-16. Management does not believe the GXS, Inc. financial statements would add meaningful disclosure and has not included those financial statements herein, because they are substantially identical to the GXS Worldwide, Inc. financi al statements and the total assets, revenues, operating income, net income (loss) and cash flows of GXS, Inc. are expected to continue to constitute substantially all of the corresponding amounts for GXS Worldwide, Inc. and its subsidiaries.

This prospectus contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on these statements. These forward-looking statements include, among other things, information concerning possible or assumed future results of operations, capital expenditures, goals and objectives for future operations. These statements are typically identified by words such as “believe,” “anticipate,” “expect,” “plan,” “intend,” “estimate,” “may,” “will” and similar expressions. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry in which we operate, as well as management’s beli efs and assumptions. These statements are affected by risks, uncertainties and assumptions. Accordingly, actual results or outcomes may differ materially from those expressed in the forward-looking statements. We believe that the risks, uncertainties and assumptions include, but are not limited to, the factors discussed below under the heading “Risk Factors” and the following:

| · | our ability to maintain our prices at an acceptable level; |

| · | increasing price and product and services competition by U.S. and foreign competitors, including new entrants and in-house information technology departments; |

| · | rapid technological developments and changes and our ability to introduce competitive new products and services on a timely, cost-effective basis; |

| · | our mix of products and services; |

| · | customer demand for our products and services; |

| · | general domestic and international economic conditions and growth rates, including sluggish and recessionary economic conditions and exposure to customers in high economic risk sectors, such as the financial services and automotive industries; |

| · | declines in the creditworthiness of our customers; |

| · | currency exchange rate fluctuations; |

| · | our ability to market our products and services effectively; |

| · | the length of life cycles for the products and services we offer; |

| · | our ability to protect our intellectual property rights; |

| · | our ability to protect against data security breaches and to protect our data centers from damage; |

| · | our ability to attract and retain talent in key technological areas; |

| · | changes in U.S. and foreign governmental regulations; |

| · | the continued availability of financing in the amounts, at the times and on the terms required to support our future operations and our levels of indebtedness; |

| · | our ability to comply with existing and future loan agreements; |

| · | our ability to implement effectively our growth strategy; |

| · | the outcome of existing or future litigation; |

| · | our ability to negotiate acquisitions and dispositions and to integrate acquired companies and realize synergies successfully, including the Merger; and |

| · | higher than expected costs or expenses arising from our acquisitions, including the Merger. |

In addition, new risks and uncertainties could arise from time to time that could cause actual results or outcomes to differ from those expressed in the forward-looking statements, and it is impossible to predict these events or how they may affect us. All forward-looking statements speak only as of the date made, and, except as otherwise required by applicable securities laws, we undertake no obligation to update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this prospectus.

Market and industry data and forecasts used in this prospectus have been obtained from independent industry sources. Some data is also based on our good faith estimates. Although we believe these third party sources to be reliable, we have not independently verified the data obtained from these sources and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources and our estimates are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus.

The Gartner Reports described herein (the “Gartner Reports”) represent data, research opinion or viewpoints published as part of a syndicated subscription service by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this prospectus) and the opinions expressed in the Gartner Reports are subject to change without notice.

The Magic Quadrant is copyrighted November 20, 2009 by Gartner, Inc. and is reused with permission. The Magic Quadrant is a graphical representation of a marketplace at and for a specific time period. It depicts Gartner’s analysis of how certain vendors measure against criteria for that marketplace, as defined by Gartner. Gartner does not endorse any vendor, product or service depicted in the Magic Quadrant, and does not advise technology users to select only those vendors placed in the “Leaders” quadrant. The Magic Quadrant is intended solely as a research tool, and is not meant to be a specific guide to action. Gartner disclaims all warranties, express or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

We own or have rights to use various trademarks, trade names and service marks in conjunction with the operation of our business, including, but not limited to, TRADING GRID®, Inovis, Inovis Catalogue, BetweenMarkets, BizLink, BizManager, BizConnect, TrustedLink and, in certain foreign jurisdictions, GXS and TRADANET.

The following summary highlights certain information contained elsewhere in this prospectus. This summary is not intended to be complete and it may not contain all of the information that may be important to you. We urge you to read the following summary together with the more detailed information and financial statements and the related notes that are included elsewhere in this prospectus. We encourage you to read the entire prospectus, including the section captioned “Risk Factors.” All references to “our,” “us,” “we,” “the company” and “GXS” refer to GXS Worldwide, Inc. and its subsidiaries as a consolidated entity, which after June 2, 2010, includes Inovis International, Inc., which we acquired on June 2, 2010. Un less the context otherwise requires or indicates, all reference to the “notes” refer to both the Old Notes and the New Notes (as defined herein).

Notes Offered | | We are offering up to $785,000,000.00 aggregate principal amount of 9.75% New Senior Secured Notes due 2015 (the “New Notes”), which will be registered under the Securities Act. |

| | | |

The Exchange Offer | | We are offering to issue the New Notes in exchange for a like principal amount of your 9.75% Senior Secured Notes due 2015 (the “Old Notes”). We are offering to issue the New Notes to satisfy our obligations contained in the registration rights agreement entered into when the Old Notes were sold in transactions permitted by Rule 144A under the Securities Act and therefore not registered with the SEC. For procedures for tendering, see “The Exchange Offer.” |

| | | |

| Tenders, Expiration Date, | | |

Withdrawal | | The exchange offer will expire at 5:00 p.m. New York City time on _________, 2010 unless it is extended. If you decide to exchange your Old Notes for New Notes, you must acknowledge that you are not engaging in, and do not intend to engage in, a distribution of the New Notes. If you decide to tender your Old Notes in the exchange offer, you may withdraw them at any time prior to __________, 2010. If we decide for any reason not to accept any Old Notes for exchange, your Old Notes will be returned to you without expense to you promptly after the exchange offer expires. You may only exchange Old Notes in denominations of $2,000 and integral multiples of $1,000 in excess thereof. |

| | | |

| Certain U.S. Federal Income Tax | | |

| Consequences | | Your exchange of Old Notes for New Notes in the exchange offer will not result in any income, gain or loss to you for United States federal income tax purposes. See “Material United States Federal Income Tax Consequences of the Exchange Offer.” |

| | | |

Use of Proceeds | | We will not receive any proceeds from the issuance of the New Notes in the exchange offer. |

Exchange Agent | | U.S. Bank National Association, which is also the trustee under the indenture, is the exchange agent for the exchange offer. |

| | | |

Failure to Tender Your Old Notes | | If you fail to tender your Old Notes in the exchange offer, you will not have any further rights under the registration rights agreement, including any right to require us to register your Old Notes or to pay you additional interest. All untendered Old Notes will continue to be subject to the restrictions on transfer set forth in the Old Notes and in the indenture. In general, the Old Notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not currently anticipate that we will register such untendered Old Notes under the Securities Act and, following this exchange offer, will be under no obligation to do so. |

You will be able to resell the New Notes without registering them with the SEC if you meet the requirements described below.

Based on interpretations by the SEC’s staff in no-action letters issued to third parties, we believe that New Notes issued in exchange for Old Notes in the exchange offer may be offered for resale, resold or otherwise transferred by you without registering the New Notes under the Securities Act or delivering a prospectus, unless you are a broker-dealer receiving securities for your own account, so long as:

| · | you are not one of our “affiliates”, which is defined in Rule 405 of the Securities Act; |

| · | you acquire the New Notes in the ordinary course of your business; |

| · | you do not have any arrangement or understanding with any person to participate in the distribution of the New Notes; and |

| · | you are not engaged in, and do not intend to engage in, a distribution of the New Notes. |

If you are an affiliate of GXS, or you are engaged in, intend to engage in or have any arrangement or understanding with respect to, the distribution of New Notes acquired in the exchange offer, you (1) should not rely on our interpretations of the position of the SEC’s staff and (2) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

If you are a broker-dealer and receive New Notes for your own account in the exchange offer:

| · | you must represent that you do not have any arrangement with us or any of our affiliates to distribute the New Notes; |

| · | you must acknowledge that you will deliver a prospectus in connection with any resale of the New Notes you receive from us in the exchange offer; the letter of transmittal states that by so acknowledging and by delivering a prospectus, you will not be deemed to admit that you are an “underwriter” within the meaning of the Securities Act; and |

| · | you may use this prospectus, as it may be amended or supplemented from time to time, in connection with the resale of New Notes received in exchange for Old Notes acquired by you as a result of market-making or other trading activities. |

For a period of 90 days after the expiration of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any resale described above.

Summary Description of the New Notes

The terms of the New Notes and the Old Notes are identical in all material respects, except that the New Notes have been registered under the Securities Act, the transfer restrictions and registrations rights relating to Old Notes do not apply to the New Notes and certain additional interest provisions relating to the Old Notes do not apply to the New Notes. The New Notes will represent the same debt as the Old Notes and will be governed by the same indenture under which the Old Notes were issued.

Issuer | | GXS Worldwide, Inc. |

| | | |

Notes Offered | | $785.0 million in aggregate principal amount of 9.75% New Senior Secured Notes due 2015. |

| | | |

Maturity Date | | June 15, 2015. |

| | | |

Interest Rate | | 9.75% per annum. |

| | | |

Interest Payment Dates | | June 15 and December 15 of each year, commencing on the interest payment date next occurring after issuance of the New Notes. Interest will accrue from the most recent date to which interest has been paid or provided. |

| | | |

Guarantees | | The notes will be jointly and severally and fully and unconditionally guaranteed on a senior secured basis by all of our existing and future wholly-owned domestic subsidiaries and all other domestic subsidiaries that guarantee our other indebtedness. |

| | | |

Collateral | | The notes and the guarantees will be secured on a senior basis by a security interest granted to the collateral trustee on substantially all of our properties and assets and substantially all of the properties and assets of the guarantors (including stock and intercompany notes of our subsidiaries); provided that the collateral will only include 65% of the stock of our first tier foreign subsidiaries and will not include any properties or assets of any of our foreign subsidiaries. The pledge of equity interests (other than the pledge of equity interests of GXS, Inc.) may be released as described below under the caption “Description of the Notes—Limitations on Collateral in the Form of Securities.” |

| | | |

Ranking | | The notes will be our senior secured obligations and each subsidiary guarantee will be the senior secured obligations of each guarantor. The notes and subsidiary guarantees will in each case be secured on a senior basis equally and ratably with all of our and the guarantors’ other existing and future first priority senior secured indebtedness by security interests granted to the collateral trustee on the collateral; provided, however, that the notes and subsidiary guarantees will in each case be effectively junior to our indebtedness incurred under our revolving credit |

| | | facility (and related hedging and cash management obligations), which have “first out” status pursuant to the distribution provisions of the security documents, to the extent of the value of the collateral. The notes and subsidiary guarantees will be pari passu in right of payment to all of our and the guarantors’ existing and future indebtedness that is not subordinated and senior in right of payment to all of our and the guarantors’ future senior subordinated and subordinated indebtedness. The notes and subsidiary guarantees will be effectively subordinated to all of our and the guarantors’ existing and future indebtedness secured by assets other than the collateral to the extent of the value of the assets securing such indebtedness and effectively senior to any of our and the guarantors’ future senior unsecured or junior lien obligations to the extent of the value of the collateral securing the notes. The notes and the subsidiary guarantees will be structurally subordinated to all existing and future liabilities, including trade payables, of each of our subsidiaries that do not guarantee the notes. See “Description of the Notes—Brief Description of the Notes and the Subsidiary Guarantees.” |

| | | |

| | | At the consummation of the Merger, we had no outstanding borrowings under the revolving credit facility but we did have letters of credit totaling $11.7 million supported by the facility. We borrowed $23.0 million under the revolving credit facility on June 14, 2010 to make a portion of our semi-annual interest payment on the notes. These borrowings and any future borrowings under the revolving credit facility (and related hedging and cash management obligations) will constitute “first out” revolver debt obligations that would be effectively senior to the notes. |

| | | |

| | | Non-guarantor subsidiaries generated approximately 51.6% of our revenues for the year December 31, 2009, did not carry indebtedness and held approximately 20.8% of our total assets as of December 31, 2009. |

| | | |

Collateral Trust Agreement | | On the date of the indenture, we entered into a collateral trust agreement by and among the grantors, the collateral trustee, Wells Fargo Foothill, Inc. as administrative agent under our revolving credit facility, and the trustee under the indenture governing the notes, that sets forth the terms on which the collateral trustee will receive, hold, administer, maintain, enforce and distribute the proceeds of all of its liens upon the collateral. See “Description of the Notes—Collateral Trust Agreement.” |

Optional Redemption | | We may at our option redeem: · up to 35% of the aggregate principal amount of the notes with the proceeds of certain equity offerings at the redemption price set forth in this prospectus, at any time prior to June 15, 2012; · some or all of the notes at a price equal to 100% of their principal amount plus a “make-whole” premium as set forth in this prospectus, at any time prior to June 15, 2012; · some or all of the notes at the redemption prices set forth in this prospectus, at any time on or after June 15, 2012; and · at any time, prior to June 15, 2012, up to 10% of the original aggregate principal amount of the notes during any twelve-month period at a redemption price of 103%. |

| | | |

| | | In each case, we must also pay accrued and unpaid interest, if any, to the redemption date. See “Description of the Notes—Optional Redemption.” |

| | | |

Change of Control Offer | | In the event of a change of control, we must offer to purchase the notes at a purchase price equal to 101% of the principal amount of the notes, plus accrued and unpaid interest, if any, to, but not including, the date of purchase. The term “Change of Control” is defined under “Description of the Notes—Certain Definitions.” |

Asset Sale Offer | | If we sell assets under certain circumstances and do not use the proceeds for specified purposes, we must offer to repurchase the notes at 100% of the principal amount of the notes repurchased, plus accrued and unpaid interest, if any, to the applicable repurchase date. See “Description of the Notes—Repurchase at the Option of Holders—Asset Sales.” |

Certain Covenants | | The indenture governing the notes contains covenants that among other things, restrict our ability and the ability of our restricted subsidiaries to: · pay dividends, redeem stock or make other distributions or restricted payments; · make certain investments; · incur indebtedness; |

| | | · create liens on the collateral; · agree to dividend and payment restrictions affecting restricted subsidiaries; · merge, consolidate or sell assets; · designate subsidiaries as unrestricted; · change our or our subsidiaries’ line of business; and · enter into transactions with our affiliates. |

| | | |

| | | These covenants are subject to a number of important exceptions and qualifications. For more details, see “Description of the Notes—Certain Covenants.” |

| | | |

| Absence of Public Market for | | |

the Notes | | To the extent that Old Notes are tendered and accepted in the exchange offer, your ability to sell untendered, and tendered but unaccepted, Old Notes could be adversely affected. There may be no trading market for the Old Notes. We cannot assure you that an active public market for the New Notes will develop or as to the liquidity of any market that may develop for the New Notes, the ability of holders to sell the New Notes, or the price at which holders would be able to sell the New Notes. We do not intend to apply for a listing of the New Notes or the Old Notes on any securities exchange or any automated dealer quotation system. |

Risk Factors | | You should carefully consider the information and risks under the heading “Risk Factors” for a description of some of the risks you should consider. You should also carefully consider all other information in this prospectus before exchanging your Old Notes for New Notes. |

Our Company

We are a leading global provider of B2B e-commerce and integration services and solutions that simplify and enhance business process integration, synchronization and collaboration among businesses. Our services and solutions enable our customers to manage mission critical supply chain functions and financial transactions related to the exchange of goods and services. By utilizing these services our customers realize a number of key benefits such as lower total cost of ownership, accelerated time to market and enhanced reliability and security. Approximately 30,000 global customers and their trading partners do business together via Trading Grid, a globally-accessible, cloud-computing platform specifically designed for B2B e-commerce. Our business model is characterized by substantial operating leverage, strong cash flo w generation and a recurring revenue model attributable to our transaction processing and software maintenance fees.

Our services and solutions help our customers manage the information flow throughout their supply chain. We manage a wide variety of transactions, such as purchase orders, delivery confirmations, invoices, product data and payment information, for many of the world’s largest supply chains. In recent years, the global adoption of the Internet has vastly increased the variety of communication protocols and has also spawned new, complex industry standard data formats. Trading Grid alleviates the complexities of data standards and protocol proliferation and therefore reduces the associated implementation and ongoing maintenance costs inherent in operating and managing global supply chains.

The majority of our customers utilize our services and solutions through two primary services-based models. Messaging Services is our largest service offering and enables our customers to automate their supply chain transactions through our centralized platform which can connect them to nearly any business globally. Managed Services, our B2B outsourcing suite of services, enables our customers to fully outsource the management of their B2B e-commerce networks to us. Managed Services is our fastest growing segment as customers adopt our solutions in order to manage their B2B supply chains more efficiently and effectively. Managed Services also includes multiple value-added services such as mapping and translation, linking trading partners, managing trading partner communications, supply chain visibility and trading part ner performance reporting. In addition, our Managed Services customers also have access to industry specific and process specific applications that enable them to improve their supply chain efficiency and effectiveness. We also offer Data Synchronization, B2B Software and Services and Custom Outsourcing Services.

The majority of our revenue is generated through transaction processing fees and subscriptions for access to our platform. We process more than 8 billion electronic transactions per year and support an estimated 6 million trading partner relationships. We have substantial vertical expertise in a variety of key industries such as retail, consumer products, financial services, automotive and high technology. Following the Merger, our platforms link over 40,000 customers across 50 countries with support in 11 different languages. As a result, customers view our services and solutions as essential to their day-to-day supply chain operations and typically enter into long-term contracts with us. Revenue attributable to transaction processing and software maintenance fees, which tend to be recurring in nature, repr esented approximately 88% of our total revenue for the year ended December 31, 2009. Additionally, of our top 50 customers in fiscal 2009, 92% have been customers for five or more years.

On June 2, 2010, GXS Holdings, Inc. (“GXS Holdings”), a Delaware corporation and our direct parent company, which directly owns 100% of our issued and outstanding common stock, acquired Inovis International, Inc. (“Inovis”), a leading provider of fully integrated B2B solutions and services that manage the flow of critical e-commerce information for global trading communities, which we refer to as the “Merger”. Inovis’s core business has historically been the provision of messaging services to approximately 16,000 customers worldwide with approximately one billion transactions per year, primarily on a fee-per-transaction basis. Following the Merger, Inovis was merged with and into GXS, Inc. (“GXSI”), one of our indirect wholly-owned subsidiaries and a guar antor of the notes, and we became an indirect wholly-owned subsidiary of GXS Group, Inc. (previously known as Griris Holding Company, Inc.). Certain foreign subsidiaries of Inovis became wholly owned subsidiaries of GXSI.

B2B E-Commerce and Integration Industry

The multi-enterprise B2B e-commerce and integration industry covers the electronic exchange of data between organizations. There are a variety of global, industry-specific and regionally defined standards which govern the ability to deliver this information electronically. The most popular is Electronic Data Interchange (“EDI”) but there are many alternatives and variants. By enabling the efficient flow of information between businesses, the industry can help businesses address supply chain inefficiencies and improve their agility and business results. Based on market sizing data from a variety of sources including industry analysts, we believe the total market for the B2B infrastructure segment was approximately $3.9 billion in 2009 and will grow to approximately $5.4 billion in 2012. The overall market al so includes the PMDM segment.

The process of integrating information between businesses is central to a company’s ability to build and manufacture products with speed and quality, coordinate timely logistics and shipping activity, and better serve customers. With the advent of Internet-based communications, the increasing number of communication protocols and standards beyond EDI, and the challenges working with businesses in remote regions of the world, multi-enterprise integration is increasingly complex and costly. However, the benefits from integration are substantial, including gaining end-to-end supply chain visibility, eliminating excess inventory, tracking global shipments, optimizing the launch of a new product, understanding customer purchasing trends and managing payments and cash flow.

Examples of multi-enterprise business processes include order-to-cash, electronic invoicing, global shipping and global payments. In the order-to-cash process, one business will place orders to one or more other businesses. In response, the partner businesses acknowledge an order, provide shipment details and ultimately invoice the customer. Businesses gain speed advantages and reduce costs when this information is exchanged electronically versus delivered via postal mail, e-mail or by facsimile. To deliver these benefits, the industry offers four primary solution segments: global messaging services, B2B managed services, B2B gateway software, and PMDM.

Global Messaging. The exchange of a business document from one business to another forms the basis of the global messaging segment. Similar to the role of a post office for physical mail, companies using global messaging services receive a virtual mailbox to store electronic documents. Every company participating in global messaging has one or more mailboxes. Service providers host these mailboxes and provide the capability to deliver the message to other mailboxes over a network, often referred to as a value-add network. Managed file transfer is a component of global messaging which focuses on the exchange of bulk or large files, such as three-dimensional computer-aided design files for engineering or bank check image files. This differs from standard global messaging and is typically delivered to customers as a software license sale or, increasingly, a hosted or software-as-a-service sale (“SAAS”). Industry analyst firm Gartner estimated that the integration-as-a-service segment was approximately $1 billion in 2008 (Gartner “Predicts 2010: Application Infrastructure for Cloud Computing,” by Yefim Natis, November 30, 2009).

Managed Services. Within the multi-enterprise integration market, the fastest growing segment is B2B managed services, also known as Business Integration Outsourcing. B2B managed services is the outsourcing of all or a portion of the management of a company’s B2B program. A B2B program includes all of the hardware, software and staff required to support a company’s business partners electronically, including customers, suppliers, shipment carriers and banks. Managed services offer an alternative delivery model designed for companies either struggling to achieve returns from B2B integration software investments or unable to handle the considerable tasks associated with worldwide B2B programs. In the managed services model, there is n o software to purchase or manage. Instead, corporations leverage an on-demand B2B integration platform by outsourcing the management of the underlying server hardware, storage platforms and B2B translation technology. Through this model, companies are able to achieve their B2B integration goals faster and cheaper than through in-house and software-based approaches. Gartner estimates that companies have spent more than $500 million on Business Integration Outsourcing, and that this segment will register a compound annual growth rate of 20%, at least through 2010 (Gartner “Hype Cycle for e-Commerce, 2009” by Benoit Lheureux and Paolo Malinverno September 11, 2009).

B2B Gateways. B2B gateway software is deployed within a business and can be used to complement global messaging VAN services or as a stand-alone messaging platform to connect directly to business partners. B2B gateway software provides communication and integration technology to enable a business to connect its internal systems and processes with its partners. B2B gateway is typically sophisticated software, including data translation, visibility and monitoring, communication and community management components, which often require significant trained resources to implement and maintain. A company must keep current every integration point both within and outside its enterprise, creating significant ongoing staffing and resource requirements. We believe the market for B2B gateway software was approximately $1.1 billion in 2009 and will grow to approximately $1.3 billion in 2012.

Product Master Data Management. Given the applicability of the multi-enterprise B2B industry to impact global supply chain operations, we also participate in the PMDM, or data synchronization, segment. Businesses often struggle to gain a consistent, complete and accurate single view of products or services across their global enterprises. This issue is further compounded by the fact that a retailer can have hundreds or thousands of suppliers and exchanging accurate product data from so many sources is highly complex and often prone to error. With consistent, accurate product data, a business can reduce its costs, improve decision making, ensure regulatory compliance and grow revenue faster. Gartner estimates the PMDM segment was approximately $ 500 million in 2009, and will grow to over $860 million in 2012 (Gartner “Market Trends: Master Data Management Exhibits Sustained Growth, 2008-2013” by Chad Eschinger, September 21, 2009).

Competitive Strengths

A Leader in the Industry. We are a leading global provider of B2B e-commerce and integration services and solutions. In business for more than 40 years, we have extensive industry experience, comprehensive solutions, a secure and reliable global network, and a large, global customer base. We believe we have consistently led innovation in the industry by introducing and delivering services and solutions that enable our customers to automate many of their mission-critical supply chain processes, driving higher business responsiveness, lowering operating costs and broadening the reach of supply chain networks. Gartner placed us in the Leaders Quadrant of its November 2009 Magic Quadrant of Integration Services Providers and Forrester Research, Inc ., a leading independent industry analyst firm, positioned us as a leader in their Forrester Wave for B2B Service Providers in October 2009 (Gartner “Magic Quadrant for Integration Service Providers” by Benoit Lheureux and Paolo Malinverno, November 20, 2009; “The Forrester Wave™: B2B Service Providers, Q4, 2009,” Forrester Research, Inc., October, 2009).

Robust Technology Platform. In 2004, we developed a vision for the next generation B2B e-commerce and integration platform, which became known as our Trading Grid. Since 2003, we have invested more than $100 million in building a cloud computing platform in our data centers, a service oriented architecture which supports our ability to quickly build and maintain products that can be shared with multiple customers and a suite of software-as-a-service (“SaaS”) applications for supply chain professionals and business users. Customers benefit from our cloud computing platform resulting in reduced hardware and software costs, flexible, subscription-based pricing and dynamic provisioning for peak loads. We believe that the Merger will als o broaden and add depth to this platform, particularly providing managed file transfer, or MFT, an improved rules engine and improved catalogue functionality.

Scalable Global Business Infrastructure. Businesses are continuously seeking cost advantages through the globalization of their supply chains while, at the same time, entering new markets and attracting new customers. We have a leading capability to directly serve every industrialized country and most emerging markets. Our expertise in various communication protocols, domain expertise in B2B business standards and localized country-insight into best practice, culture and language enable us to provide a leading global solution for our B2B customers. We have direct presence in 20 countries, with 24x7 operations support and local language support in 11 languages. In addition, we leverage a network of partners and distributors which enables us to s upport customers in over 50 countries around the world.

Diversified Business Mix. Our business and revenues are highly diversified, ensuring that we are not reliant on any individual customer, industry or geography. No customer accounted for more than 4% of our revenues during the year ended December 31, 2009. We have extensive industry leadership, particularly in retail, consumer products, financial services, automotive and high technology. However, no single vertical accounted for more than

20% of our total revenues in fiscal 2009. In addition, we believe we have an unmatched international presence in our industry. We generated approximately 51.6% of our revenues for the year ended December 31, 2009 from customers outside the United States. Following the Merger, we have a large customer base of more than 40,000 companies, including over 70% of the companies in the Fortune 500.

Substantial Recurring Revenue Base and Significant Free Cash Flow Generation. Our revenue has a high degree of visibility and stability due to the recurring nature of transaction processing and software maintenance. In addition, we typically enter into multi-year contracts with our customers. As a result of our contract-based revenue and high renewal rates, we have a predictable business model. Revenue attributable to transaction processing and software maintenance fees, which tend to be recurring in nature, represented approximately 88% of our total revenue for the year ended December 31, 2009. The combination of our recurring revenue base, along with our scale, technology, minimal working capital needs and moderate capital expenditures, has a llowed us to generate significant free cash flow.

Highly Experienced Management Team. We have an experienced and proven executive and management team. On average, our senior management team has more than 20 years of experience in the software and service industries. Our executive management team has led various businesses through periods of rapid growth, organizational restructuring and strategic change, and has a proven record of increasing productivity and reducing costs, making strategic acquisitions and developing and maintaining strong customer relationships.

Business Strategy

Our mission is to extend our segment leading position by providing innovative, industry-focused B2B e-commerce and integration services and solutions that enable our customers to achieve their business priorities and goals. Our customers trust us with their mission-critical supply chain processes and hence we must operate a service that is highly reliable, scalable, and flexible. Specifically, our strategy focuses on four main themes:

Expand the Trading Grid. The economics of our hosted service model enable us to scale incremental volumes and customers at low marginal costs. In addition, we believe the value that we deliver to customers is enhanced as the number of trading partners, supported standards, and communications protocols are increased. We intend to focus on expanding the use of the Trading Grid by further penetrating our existing customer base, expanding into new industries and geographies, and adding new features and capabilities to our network. We will go to market primarily through our direct sales force, supplemented by key strategic channel partners, including Verizon, Accenture and Microsoft.

| · | On average, we believe our customers have less than 50% of their trading partners today electronically connected. We believe there is a significant opportunity to expand by connecting to partners not presently on our network. |

| · | We believe that there is significant opportunity to expand our business in Europe, Asia and Brazil as demand for B2B e-commerce and integration services and solutions increase. We also believe our direct sales force in these historically underserved regions presents a significant opportunity to distribute Inovis software products. |

| · | While we have a diverse industry portfolio, we believe there are incremental new growth opportunities in the healthcare, government, transportation and energy sectors. |

| · | We believe our services and solutions portfolio can be broadened to enhance the value that we provide to our customers. For example, we have access to a large repository of data related to business transactions and process flows that we believe can be leveraged to provide business analytics tools and dashboards for our customers. |

Capitalize on Growth in Demand for Managed Services. B2B outsourcing is the fastest growing segment in our industry, driven in large part by the need for customers to effectively manage the increasing complexity and cost of their global supply chains. Our Managed Services solution enables customers to effectively off-load the

management of their B2B e-commerce operations, allowing them to focus on their core business processes. Our strategy leverages our leading global footprint and process domain knowledge to provide an integrated, outsourced solution at lower cost, with high quality and increased scalability. We believe this value proposition is most attractive to large, global enterprises and regional players with extensive trading partner and customer communities.

We intend to further enhance our Managed Services platform by adding industry-specific applications that can be delivered via a SaaS business model. These services are designed to further integrate our solutions into the core business processes of our customers, enhancing the value of our offerings and our ability to lock-in longer term contracts with improved margins.

Optimize and Modernize our Global Infrastructure. We have already made significant investments to modernize our commercial infrastructure, investing more than $150 million since 2003. The Merger will also help modernize our commercial infrastructure by leveraging Inovis’s systems and platforms, which we expect to integrate with our existing infrastructure. Our next generation, cloud computing infrastructure supports continuous real-time information flows, while delivering lower unit costs, enhanced scalability and high platform availability. We will continue to invest in the enhancement of our platforms and in ongoing systems migrations designed to reduce platform complexity, lower operating costs and further improve system throughput and performance.

Selectively Pursue Strategic Acquisitions. We intend to grow the scope and scale of our business by selectively pursuing acquisitions of companies with complementary products and technologies. Our strategy focuses on acquiring businesses that will provide entry into new geographic and industry segments. We will also look to acquire businesses that will increase our operational scale in existing markets as well as extend our core Managed Services offering capabilities, such as the recently completed acquisition of Inovis.

We believe we have developed an internal competency regarding post-acquisition integration that allows us to achieve significant operating leverage when combining with the businesses that we acquire. This leverage is primarily achieved through a reduction in back-office expenses as well as the migration of the acquired company’s platform to our processing network. We believe our recent experience in integrating Interchange, a provider of EDI and related services to customers in Brazil that we acquired in 2008, demonstrates our capability to acquire and successfully integrate an acquisition.

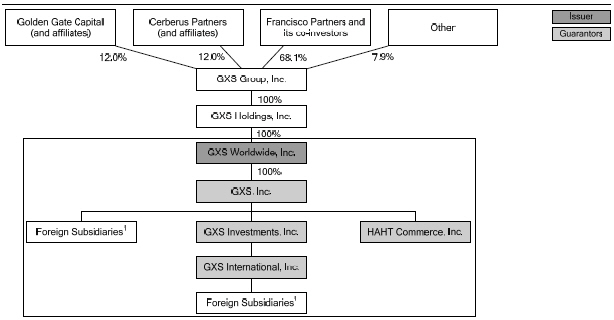

Corporate Structure

Our corporate structure can be summarized as follows:

________________

| 1 | Direct foreign subsidiaries of GXS, Inc. include foreign entities that were subsidiaries of Inovis International, Inc. prior to the Merger, which became wholly owned subsidiaries of GXS, Inc. following the Merger. GXS, Inc. is a 100% shareholder of the majority of its direct and indirect foreign subsidiaries with the primary exceptions of GXS, Inc. (Korea) (85%) and EC1 Pte Ltd. (Singapore) (81%). |

Percentages are based on outstanding common stock. Francisco Partners and its co-investors indirectly own approximately 68.1% of our outstanding common stock and Golden Gate Capital (and its affiliates) and Cerberus Partners (and its affiliates), private equity firms and the principal investors in Inovis prior to the Merger, indirectly own approximately 12.0% and 12.0% of our outstanding common stock, respectively. One member of our board of directors is appointed by and is a partner of Golden Gate Capital and one member is appointed by and is a partner of Cerberus Partners. The remaining seven members are appointed by Francisco Partners.

Our principal executive offices are located at 9711 Washingtonian Boulevard, Gaithersburg, Maryland 20878, and our telephone number is (301) 340-4000. We maintain a website at www.gxs.com. Information contained on our website does not constitute part of this prospectus and you should rely only on the information contained in this prospectus when making a decision to exchange your Old Notes for New Notes.

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION AND OTHER DATA

The following summary unaudited pro forma condensed combined financial information and other data gives effect to the (i) the debt refinancing accomplished via the Old Notes (the “Refinancing”) and (ii) the Merger (collectively, the “Transactions”).

The summary unaudited pro forma condensed combined financial information and other data for the year ended December 31, 2009 and for the three months ended March 31, 2010, have been prepared to give effect to the Transactions in the manner described under “Unaudited Pro Forma Condensed Combined Financial Information” and the notes thereto as if they occurred on January 1, 2009, in the case of the pro forma statement of operations data for the year ended December 31, 2009 and the three months ended March 31, 2010. The summary unaudited pro forma condensed combined financial information and other data as of March 31, 2010 has been prepared to give affect to the Merger in the manner described under “Unaudited Pro Forma Condensed Combined Financial Information” and the notes thereto as if it occurred on March 31, 2010, in the case of the pro forma balance sheet data as of March 31, 2010. The summary unaudited pro forma condensed combined financial information and other data does not purport to represent what our results of operations or financial condition would have been had the Transactions actually occurred on the dates indicated, and it does not purport to project our results of operations or financial condition for any future period or as of any future date.

The summary unaudited pro forma condensed combined financial information and other data should be read in conjunction with “Capitalization,” “Selected Historical Consolidated Financial Information and Other Data,” “Unaudited Pro Forma Condensed Combined Financial Information” and the notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements and notes thereto of the company and Inovis and the unaudited interim condensed consolidated financial statements and notes thereto of the company and Inovis included elsewhere in this prospectus.

| | | | |

| | | Year Ended December 31, 2009 | | | Three Months Ended March 31, 2010 | |

| | | (in thousands of dollars) | |

| Operating Data: | | | | | | |

Revenues | | $ | 487,248 | | | $ | 116,612 | |

| Costs and operating expenses: | | | | | | | | |

Costs of revenue | | | 260,071 | | | | 60,003 | |

Sales and marketing | | | 59,302 | | | | 15,322 | |

General and administrative | | | 72,717 | | | | 19,393 | |

Restructuring and related charges | | | 8,247 | | | | 286 | |

Operating income | | | 86,911 | | | | 21,608 | |

| Other income (expense): | | | | | | | | |

Interest expense | | | (93,591 | ) | | | (23,452 | ) |

Other expense, net | | | 908 | | | | (1,337 | ) |

Income (loss) before income taxes | | | (5,772 | ) | | | (3,181 | ) |

Income tax expense (benefit) | | | (1,259 | ) | | | 676 | |

Net income (loss) | | | (4,513 | ) | | | (3,857 | ) |

Less net income (loss) attributable to noncontrolling interest | | | (29 | ) | | | (29 | ) |

Net income (loss) attributable to GXS Worldwide, Inc. | | $ | (4,484 | ) | | $ | (3,828 | ) |

| | | | | | | | | |

| Balance Sheet Data (at end of period): | | | | | | | | |

Total assets | | | | | | $ | 690,803 | |

Total debt, net of original issue discount of $17,874 | | | | | | | 767,126 | |

Equity (deficit) | | | | | | | (260,958 | ) |

| | | | | | | | | |

| Other Data: | | | | | | | | |

EBITDA(1) | | $ | 157,158 | | | $ | 32,630 | |

Depreciation and amortization | | | 69,339 | | | | 12,364 | |

Capital expenditures(2) | | | 34,146 | | | | 9,653 | |

Ratio of earnings to fixed charges(3) | | | — | | | | — | |

| (1) | EBITDA represents net income (loss) before interest expense, income tax expense (benefit) and depreciation and amortization. EBITDA is a measure commonly used in our industry and we present EBITDA to enhance your understanding of our operating performance. We use EBITDA as one criterion for evaluating our performance relative to our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. However, EBITDA is not a measurement of financial performance under U.S. GAAP, and our EBITDA may not be comparable to similarly titled measures of other companies. The table below reconciles net income (loss) to EBITDA for the periods presented. |

| | | Year Ended December 31, 2009 | | | Three Months Ended March 31, 2010 | |

| | | (in thousands of dollars) | |

| | | | | | | |

Net income (loss) | | $ | (4,513 | ) | | $ | (3,857 | ) |

Interest expense, net | | | 93,591 | | | | 23,452 | |

Income tax expense (benefit) | | | (1,259 | ) | | | 676 | |

Depreciation and amortization | | | 69,339 | | | | 12,364 | |

EBITDA | | $ | 157,158 | | | $ | 32,635 | |

| (2) | Pro forma capital expenditures for the year ended December 31, 2009 consist of GXS’s capital expenditures of $31.8 million and Inovis’s capital expenditures of $2.3 million, respectively. Pro forma capital expenditures for the three months ended March 31, 2010 consist of GXS’s capital expenditures of $9.1 million and Inovis’s capital expenditures of $0.6 million, respectively. |

| (3) | The ratio of earnings to fixed charges was calculated by dividing earnings by fixed charges. Earnings used in computing the ratio of earnings to fixed charges consists of income (loss) before income taxes plus fixed charges. Fixed charges consist of interest on indebtedness, amortization of debt issuance costs and debt discount and that portion of lease expense representative of interest expense. For the year ended December 31, 2009, our pro forma earnings were insufficient to cover fixed charges by $5.8 million. Pro forma results for the year ended December 31, 2009 include depreciation and amortization of $69.3 million. For the three months ended March 31, 2010, our pro forma earnings were insufficient to cover fixed charges by $3.2 million. Pro forma results for the three months ended March 31, 20 10 include depreciation and amortization of $12.4 million. |

Set forth below is our summary historical consolidated financial information and other data at the dates and for the periods indicated. Our summary historical consolidated financial information and other data, except for the ratio of earnings to fixed charges, for the fiscal years ended December 31, 2007, 2008 and 2009 and as of December 31, 2008 and 2009 were derived from our audited consolidated financial statements included herein. Our summary historical consolidated financial information and other data, except for the ratio of earnings to fixed charges, as of December 31, 2007, was derived from our audited consolidated financial statements not included herein. The summary historical financial information and other data, except for the ratio of earnings to fixed charges, for the three months ended Mar ch 31, 2009 and 2010 and as of March 31, 2010 have been derived from our unaudited condensed consolidated financial statements included herein, which have been prepared on a basis consistent with our audited consolidated financial statements. In the opinion of management, such unaudited consolidated financial data reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly our financial position for those periods. The summary historical financial information and other data below does not give effect to the Merger, which occurred subsequent to the periods presented. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period. The summary historical consolidated financial information and other data set forth below should be read in conjunction with, and is qualified by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Opera tions” and the audited and unaudited consolidated financial statements and accompanying notes thereto, included herein.

| | | | | | Three Months Ended March 31, | |

| | | | | | | | | | | | | | | | |

| | | (in thousands of dollars) | |

| Operating Data: | | | | | | | | | | | | | | | |

Revenues | | $ | 382,743 | | | $ | 371,634 | | | $ | 350,176 | | | $ | 83,846 | | | $ | 84,686 | |

| Costs and operating expenses: | | | | | | | | | | | | | | | | | | | | |

Cost of revenues | | | 210,904 | | | | 203,380 | | | | 194,234 | | | | 49,507 | | | | 44,056 | |

Sales and marketing | | | 44,883 | | | | 47,038 | | | | 43,295 | | | | 10,708 | | | | 11,481 | |

General and administrative | | | 53,981 | | | | 51,331 | | | | 46,216 | | | | 13,554 | | | | 13,337 | |

Restructuring and related charges | | | 11,268 | | | | 5,959 | | | | 7,549 | | | | 420 | | | | 286 | |

Asset impairment charges(1) | | | 960 | | | | 2,974 | | | | — | | | | — | | | | — | |

Operating income | | | 60,747 | | | | 60,952 | | | | 58,882 | | | | 9,657 | | | | 15,526 | |

| Other income (expense): | | | | | | | | | | | | | | | | | | | | |

Loss on extinguishment of debt(2) | | | (17,493 | ) | | | — | | | | (9,588 | ) | | | — | | | | — | |

Interest expense, net | | | (71,029 | ) | | | (50,353 | ) | | | (74,357 | ) | | | (11,776 | ) | | | (22,182 | ) |

Other expense, net | | | (1,241 | ) | | | (2,108 | ) | | | (1,728 | ) | | | (1,723 | ) | | | (3,337 | ) |

Income (loss) before income taxes | | | (29,016 | ) | | | 8,491 | | | | (26,791 | ) | | | (3,842 | ) | | | (9,993 | ) |

Income tax expense (benefit) | | | 3,121 | | | | 2,945 | | | | (1,259 | ) | | | 497 | | | | 676 | |

Net income (loss) | | | (32,137 | ) | | | 5,546 | | | | (25,532 | ) | | | (4,339 | ) | | | (10,669 | ) |

| Less net income (loss) attributable to noncontrolling interest | | | (36 | ) | | | (130 | ) | | | (29 | ) | | | 8 | | | | (29 | ) |

| Net income (loss) attributable to GXS Worldwide, Inc. | | $ | (32,101 | ) | | $ | 5,676 | | | $ | (25,503 | ) | | $ | (4,347 | ) | | $ | (10,640 | ) |

| Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 352,642 | | | $ | 367,218 | | | $ | 574,022 | | | | | | | $ | 577,899 | |

Total debt | | | 535,712 | | | | 536,336 | | | | 766,450 | | | | | | | | 767,129 | |

Restricted cash(2) | | | — | | | | — | | | | 227,580 | | | | | | | | 227,580 | |

Equity (deficit) | | | (314,742 | ) | | | (327,426 | ) | | | (338,762 | ) | | | | | | | (349,555 | ) |

| Other Data: | | | | | | | | | | | | | | | | | | | | |

EBITDA(3) | | $ | 115,894 | | | $ | 116,162 | | | $ | 110,666 | | | $ | 22,817 | | | $ | 20,744 | |

Depreciation and amortization | | | 56,388 | | | | 57,318 | | | | 53,512 | | | | 14,883 | | | | 8,555 | |

Capital expenditures | | | 37,389 | | | | 35,208 | | | | 31,829 | | | | 6,571 | | | | 9,091 | |

Net cash provided by operating activities | | | 43,142 | | | | 71,945 | | | | 42,596 | | | | 13,192 | | | | 20,109 | |

Net cash used in investing activities | | | (37,389 | ) | | | (42,946 | ) | | | (259,409 | ) | | | (6,571 | ) | | | (9,094 | ) |

| Net cash (used in) provided by financing activities | | | (19,002 | ) | | | (8,411 | ) | | | 193,486 | | | | (838 | ) | | | (50 | ) |

Ratio of earnings to fixed charges(4) | | | — | | | | 1.1 | | | | — | | | | — | | | | — | |

| (1) | During the years ended December 31, 2007, 2008 and 2009, we recorded asset impairment charges related to intangible assets acquired in a previous acquisition and certain internal-use software. The asset impairment charges for the year ended December 31, 2007 of $1.0 million related to certain internal-use software projects that were not completed. The asset impairment charges for the year ended December 31, 2008 consisted of $2.9 million related to intangible assets acquired in a previous acquisition and $0.1 million related to certain internal-use software projects that were not completed. There were no impairment charges for the year ended December 31, 2009. |

| (2) | In October 2007, we refinanced all of our debt with a new lending group. In connection with the refinancing, we wrote off $12.4 million of deferred financing costs and expensed payments of $5.1 million made to the former lenders upon retirement of the debt. On December 23, 2009, we issued the Old Notes and used the proceeds to retire all of the outstanding debt under the 2007 credit facility, $35 million of GXS Holdings outstanding subordinated notes and pay debt issuance costs. Under the terms of the indenture, the Company placed $227.6 million in an escrow account to fund the pending Merger, which was subsequently released from escrow to fund the Merger on June 2, 2010. In connection with the refinancing, we wrote off $9.6 million of deferred financing costs. |

| (3) | EBITDA represents net income (loss) before interest expense, net, income tax expense (benefit), depreciation and amortization and loss on extinguishment of debt. We use EBITDA as one criterion for evaluating our performance relative to our peers. We believe that EBITDA is an operating performance measure, and not a liquidity measure, that provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles and ages of related assets among otherwise comparable companies. However, EBITDA is not a measurement of financial performance under U.S. GAAP, and our EBITDA may not be comparable to similarly titled measures of other companies. The table below reconciles net income (loss) to our EBITDA for each of the periods presented. |

| | | | | | Three Months Ended March 31, | |

| | | | | | | | | | | | | | | | |

| | | (in thousands of dollars) | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (32,137 | ) | | $ | 5,546 | | | $ | (25,532 | ) | | $ | (4,339 | ) | | $ | (10,669 | ) |

Interest expense, net | | | 71,029 | | | | 50,353 | | | | 74,357 | | | | 11,776 | | | | 22,182 | |

Income tax expense (benefit) | | | 3,121 | | | | 2,945 | | | | (1,259 | ) | | | 497 | | | | 676 | |

Depreciation and amortization | | | 56,388 | | | | 57,318 | | | | 53,512 | | | | 14,883 | | | | 8,555 | |

Loss on extinguishment of debt | | | 17,493 | | | | — | | | | 9,588 | | | | — | | | | — | |

EBITDA | | $ | 115,894 | | | $ | 116,162 | | | $ | 110,666 | | | $ | 22,817 | | | $ | 20,744 | |

| (4) | The ratios of earnings to fixed charges were calculated by dividing earnings by fixed charges. Earnings used in computing the ratio of earnings to fixed charges consists of income (loss) before income taxes plus fixed charges. Fixed charges consist of interest on indebtedness, amortization of debt issuance costs and debt discount and that portion of lease expense representative of interest expense. For the years ended December 31, 2007 and 2009, our earnings were insufficient to cover fixed charges by $29.2 million and $26.8 million, respectively. For the three months ended March 31, 2009 and 2010, our earnings were insufficient to cover fixed charges by $3.8 million and $10.0 million, respectively. |

If any of the followings risks occur, our business, results of operations or financial condition could be materially adversely affected. You should read the section captioned “Forward-looking Statements” for a discussion of what types of statements are forward-looking as well as the significance of such statements in the context of this prospectus. The risks described below are not the only ones we face. Additional risks of which we are not presently aware or that we currently believe are immaterial may also harm our business, results of operations or financial condition.

Risk factors related to the exchange offer

If you choose not to exchange your Old Notes in the exchange offer, the transfer restrictions currently applicable to your Old Notes will remain in force and the market price of your Old Notes could decline.

If you do not exchange your Old Notes for New Notes in the exchange offer, then you will continue to be subject to the transfer restrictions on the Old Notes as set forth in the confidential offering memorandum distributed in connection with the private offering of the Old Notes. In general, the Old Notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the Old Notes under the Securities Act. You should refer to “Prospectus Summary—Summary of the Exchange Offer” and “The Exchange Offer” for information about how to tender your Old Notes.

The tender of Old Notes under the exchange offer will reduce the principal amount of the Old Notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market price of the Old Notes due to reduction in liquidity.

You must follow the exchange offer procedures carefully in order to receive the New Notes.

If you do not follow the procedures described herein, you will not receive any New Notes. The New Notes will be issued to you in exchange for Old Notes only after timely receipt by the exchange agent of:

| · | your Old Notes and either: |

| · | a properly completed and executed letter of transmittal and all other required documents; or |

| · | a book-entry delivery by electronic transmittal of an agent’s message through the Automated Tender Offer Program of DTC. |

If you want to tender your Old Notes in exchange for New Notes, you should allow sufficient time to ensure timely delivery. No one is under any obligation to give you notification of defects or irregularities with respect to tenders of Old Notes for exchange. For additional information, see the section captioned “The Exchange Offer” in this prospectus.

There are state securities law restrictions on the resale of the New Notes.

In order to comply with the securities laws of certain jurisdictions, the New Notes may not be offered or resold by any holder, unless they have been registered or qualified for sale in such jurisdictions or an exemption from registration or qualification is available and the requirements of such exemption have been satisfied. We currently do not intend to register or qualify the resale of the New Notes in any such jurisdictions. However, generally an exemption is available for sales to registered broker-dealers and certain institutional buyers. Other exemptions under applicable state securities laws also may be available.

Risk factors related to our business

We have experienced, and expect to continue to experience, erosion in the prices for our core business messaging services. As a result of this and other factors, we have incurred substantial losses since inception and we cannot guarantee that we will become profitable in the future.

Competitive pricing pressures as a result of the commoditization of the Messaging Services business, as well as our strategy of obtaining multi-year contract commitments in exchange for lower prices, has adversely affected our revenues and margins and we expect such adverse effects to continue and that revenues associated with our Messaging Services business will continue to decline over time. In addition, as a result of the recent economic downturn, messaging volume has decreased domestically and abroad, which has had a further adverse effect on revenues. During the past several years, we have undertaken a series of expense reduction initiatives in response to this decrease in revenues. During each of 2007, 2008 and 2009, we reduced workforce and consolidated certain facilities as part of our restructuring plans. As a result of these actions, we incurred restructuring costs of $11.3 million in 2007, $6.0 million in 2008 and $7.5 million in 2009. Furthermore, we have incurred substantial losses since our acquisition by Francisco Partners and its co-investors in September 2002 primarily as a result of interest expenses related to our indebtedness, restructuring and asset impairment charges, debt restructuring charges and valuation allowances with respect to our deferred tax assets. As a result, we had a total deficit of $339 million as of December 31, 2009. In order to remain competitive, we need to continue decreasing costs, investing in sales and marketing and research and development and further expanding our business through our Managed Services business and selective acquisitions. We may continue to incur losses and we cannot guarantee that we will report net income in the future.

The reluctance of companies to make significant expenditures on information technology has reduced demand for our products and services and caused our revenue to decline.

There can be no assurance that the level of spending on information technology in general will increase or remain at current levels in future periods. Lower spending on information technology or companies ceasing to outsource these services could result in reduced sales, reduced overall revenue and diminished margin levels and could impair our operating results in future periods. Over time, we have seen a trend among many of our customers to delay their investments in new technology solutions and reduce overall their ongoing investments in software systems. A continued delay in capital expenditures by our customers may cause a decrease in sales and may result in additional pricing pressure, which could have a material adverse effect on our business, results of operations and financial condition.

The markets in which we compete are highly competitive.

The markets for our products and services are increasingly global and competitive. As a result, we encounter intense competition in all parts of our business. We expect competition to increase in the future both from existing competitors and new companies that may enter our markets. In addition, we experience competition from in-house information technology departments when companies are determining whether to continue to outsource these services or perform them in-house. To remain competitive, we will need to invest continuously in product development, marketing, customer service and support and our service delivery infrastructure. However, we cannot be certain that new or established competitors or in-house information technology departments will not offer products and services that are superior to or lower in price than ours. We may not have sufficient resources to continue to invest in all areas of product development and marketing needed to maintain our competitive position. Although we have traditionally had a high customer retention and renewal rate, there can be no guarantee that we will continue to maintain this rate of retention and renewal in the future. In addition, in order to retain certain customers we have had to make certain pricing concessions and we expect this trend to continue.

We may need to change our pricing models to compete successfully.

The intense competition we face in the sales of our products and services and general economic and business conditions can put pressure on us to lower our prices. For example, as our Messaging Services business has become more commoditized, we have experienced pressure to reduce prices. In addition, although many of our customers in our Managed Services business are subject to long-term contracts, they expect to share in the benefits of the decreasing cost of providing some of the services on the Managed Services platform. This often results in additional price pressure when these contracts come up for renewal.