Velti Q3 2012

This presentation contains forward-looking information about the Company’s business and financial outlook, including statements regarding financial guidance for the fourth quarter and fiscal year; our expectations to be operating cash flow positive and free cash flow neutral during the fourth quarter and to achieve increasing positive free cash flows thereafter; and the impact of the divestment of Greek, Balkan and other assets. The achievement or success of the matters covered by such forward-looking statements involve risks and uncertainties that could cause our results to differ materially from these forward looking statements, including - but not limited to – risks concerning the collectability of outstanding accounts receivable, our ability to reduce DSOs, our ability to achieve the benefits of the divestment of non-core assets and businesses, and achieve the benefits of our acquisitions, and potential liability resulting from pending or future litigation. We also face the impact of Hurricane Sandy, as well as the global political and economic uncertainties, and in particular the impact of economic uncertainties in Europe in general and in Greece in particular. WWW.VELTI.COM SAFE HARBOR STATEMENT 2 Q3 2012

Revenue, Margin, Adjusted EBITDA Growth Growth Summary Margin Revenue breakdown by type and geography Cash Flow, Cash Positions, and Comprehensive DSOs GAAP, Adjusted EBITDA & Adjusted Net Income reconciliation Divestiture Q4 2012 and FY 2012 guidance Contents 3 Q3 2012

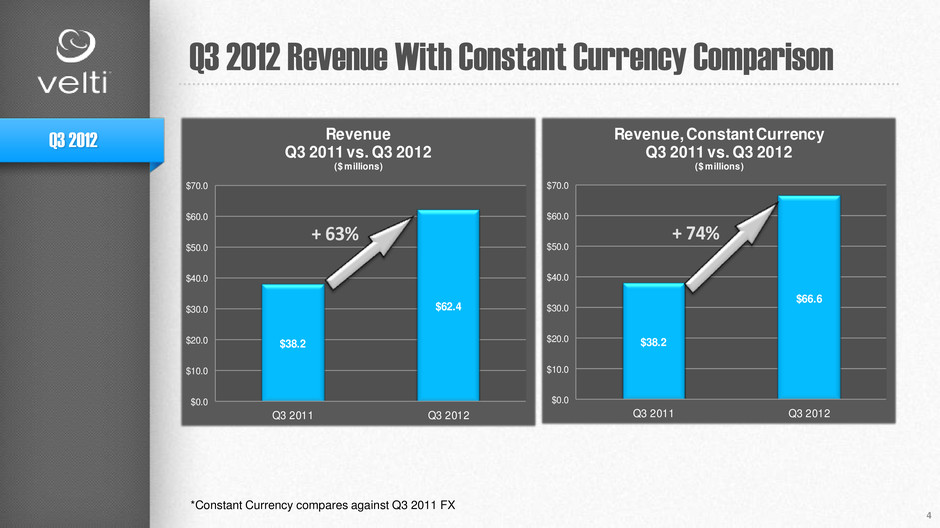

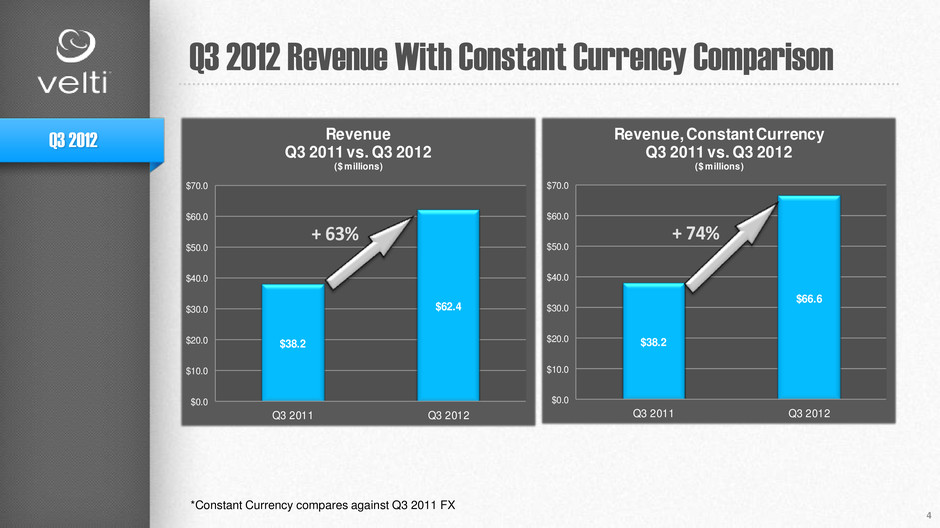

4 Q3 2012 Revenue With Constant Currency Comparison $38.2 $62.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q3 2011 Q3 2012 Revenue Q3 2011 vs. Q3 2012 ($ millions) + 63% $38.2 $66.6 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q3 2011 Q3 2012 Revenue, Constant Currency Q3 201 vs. Q3 2012 ($ millions) + 74% *Constant Currency compares against Q3 2011 FX Q3 2012

5 Q3 2012 Revenue & Revenue Less 3rd Party Costs Mix $30.7 $48.4 $7.5 $14.0 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q3 2011 Q3 2012 Revenue Mix Q3 2011 vs. Q3 2012 ($ millions) Marketing Advertising 20% 22% 80% 78% $23.1 $36.3 $1.4 $3.4 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q3 2011 Q3 2012 Revenue Less 3rd Party Costs Mix 3 2011 vs. Q3 2012 ($ millions) Marketing Advertising 6% 9% 94% 91% • Advertising represents an increasing portion of both revenue and revenue less 3rd party costs Q3 2012

6 Q3 2012 TTM* Revenue & Revenue Less 3rd Party Costs Growth *TTM= Trailing Twelve Months $159.6 $260.0 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 Q3 2011 Q3 2012 Revenue (TTM) Q3 2011 vs. Q3 2012 ($ millions) + 63% $105.9 $180.6 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 Q3 2011 Q3 2012 Revenue Less 3rd Party Costs (TTM) Q3 2011 vs. Q3 2012 ($ millions) + 71% Q3 2012

7 Q3 2012 Pro Forma Adjusted EBITDA • Q3 2012 Pro Forma Adj. EBITDA of $7.9M includes $1.2M in capitalization had R&D been capitalized at comparable levels to Q2 2012 • Q3 2012 Adj. EBITDA was also negatively impacted by an estimated $0.8 million as a result of currency fluctuations • In Q3 2012, there was also +$0.9M spent in incremental Sales & Marketing investment vs. Q2 2012 Q3 2012 $6.7 $1.2 $6.7 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 Q3 2012 Q3 2012 Pro Forma Pro Forma Adjusted EBITDA Q3 2012 ($ millions) $7.9

8 Adjusted EBITDA Growth Note: Adjusted EBITDA defined as net income (loss) plus (i) income tax expense (benefit) (ii), interest expense, (iii) loss from equity method investments, (iv) foreign exchange (gains) losses, (v) depreciation and amortization, (vi) non-cash share based compensation, (vii) non-recurring expenses and (viii) “other” income or expense. *Q3 2012 Pro Forma Adjusted EBITDA reflect results had R&D been capitalized at comparable levels to Q2 2012. Q3 2012 $5.6 $7.9 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 Q3 2011 Q3 2012 Pro Forma Adjusted EBITDA Q3 2011 vs. Q3 2012 ($ millions) + 40% $32.5 $61.7 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 Q3 2011 Q3 2012 Pro Forma Adjusted EBITDA (TTM) Q3 2011 vs. Q3 2012 ($ millions) + 90%

9 Annual Growth Summary Note: Adjusted EBITDA defined as net income (loss) plus (i) income tax expense (benefit), (ii) interest expense, (iii) loss from equity method investments, (iv) foreign exchange (gains) losses, (v) depreciation and amortization, (vi) non-cash share based compensation, (vii) non-recurring expenses and (viii) “other” income or expense. $16.4 $49.5 $90.0 $116.3 $189.2 $14.0 $16.7 $62.3 $79.6 $135.3 $0.9 $5.8 $24.7 $27.2 $53.0 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 $160.0 $180.0 $200.0 2007 2008 2009 2010 2011 Key Annual Metrics ($ millions) Revenue Revenue Less 3rd Party Costs Adj. EBITDA Q3 2012

10 Quarterly Growth Summary: TTM Note: Adjusted EBITDA defined as net income (loss) plus (i) income tax expense (benefit) (ii) interest expense, (iii) loss from equity method investments, (iv) foreign exchange (gains) losses, (v) depreciation and amortization, (vi) non-cash share based compensation (vii) non-recurring expenses and (viii) “other” income or expense. Q3 2012 TTM Adjusted EBITDA is not Pro Forma. $129.6 $142.0 $159.6 $189.2 $211.4 $235.8 $260.0 $86.3 $97.1 $105.9 $135.3 $151.3 $165.4 $180.6 $28.0 $30.1 $32.5 $53.1 $56.4 $59.5 $60.6 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Key Quarterly Metrics (TTM) ($ millions) Revenue Revenue Less 3rd Party Costs Adj. EBITDA Q3 2012

11 Margin: Revenue less 3rd Party Costs Q3 2012 18% 25% 0% 5% 10% 15% 20% 25% 30% Q3 2011 Q3 2012 Advertising Margin Improvement % Q3 2011 vs. Q3 2012 75% 75% 70% 71% 72% 73% 74% 75% 76% Q3 2011 Q3 2012 Mark ting Margin % Q3 2011 vs. Q3 2012

12 Geographic Breakdown of Revenue • The Americas remain the fastest organically growing region, while the UK benefits from the acquisition of MIG. 37% 27% 26% 10% % Contribution to Revenue by Region Q3 2012 Europe w/o UK UK Americas Asia/Africa Q3 2012 $18.7 $22.9 $5.3 $17.1 $9.0 $16.2 $5.2 $6.2 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 Q3 2011 Q3 2012 Revenue by Region Q3 2011 vs. Q3 2012 ($ millions) Europe w/o UK UK Americas Asia/Africa + 20% + 81% + 22% + 224% $38.2 $62.4

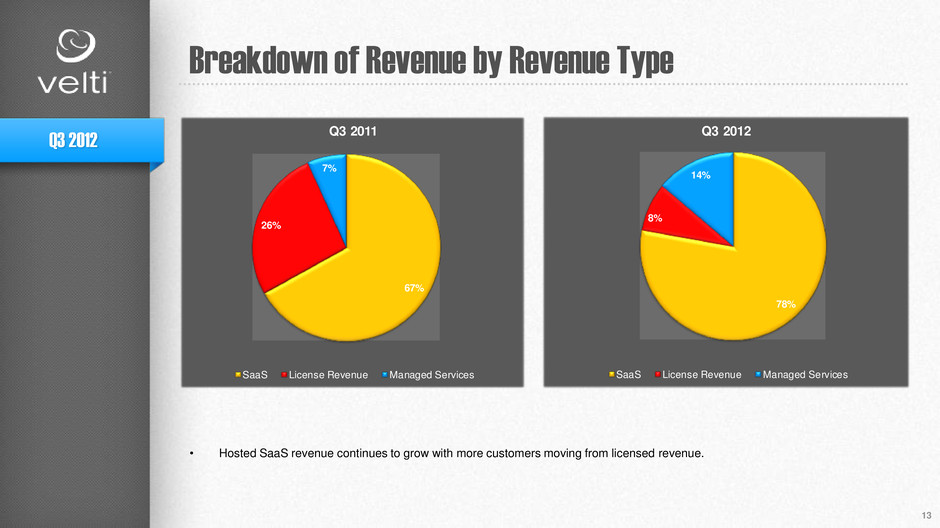

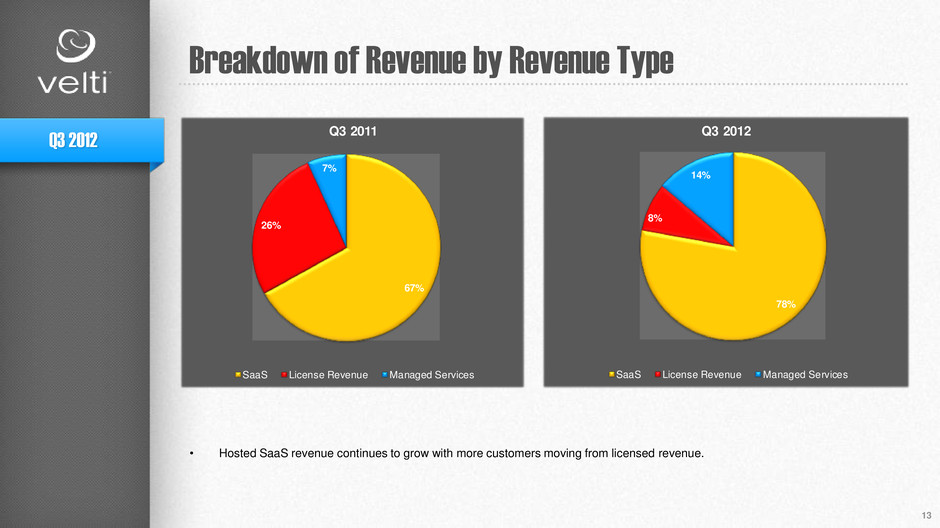

13 Breakdown of Revenue by Revenue Type 67% 26% 7% Q3 2011 SaaS License Revenue Managed Services 78% 8% 14% Q3 2012 SaaS Lice se Revenu Managed Services Q3 2012 • Hosted SaaS revenue continues to grow with more customers moving from licensed revenue.

14 Trade Receivables Aging Q3 2012 As of September 30th. The age of our trade receivables as presented above is derived from the individual aging of our material subsidiaries. For certain amounts which we have historically tracked based on due date, we have made certain estimates in adjusting to present these items based on the age from the invoice date, to achieve consistent global presentation. 45% 16% 15% 11% 5% 1% 7% 40% 10% 8% 15% 7% 9% 11% 1-30 Days 31-60 Days 61-90 Days 91-120 Days 120-150 Days 150-180 Days 180 Days + Trade Receivables Aging Q2 vs. Q3 2012 Q2 2012 Q3 2012

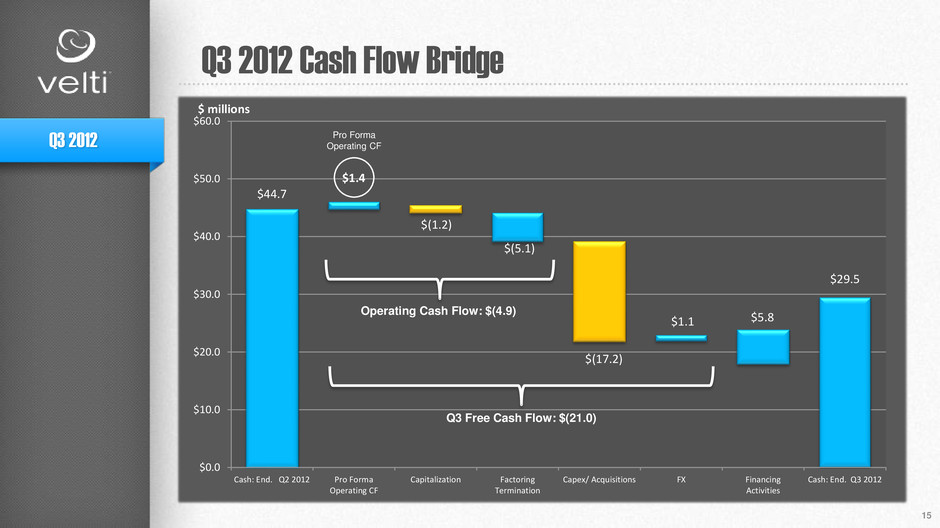

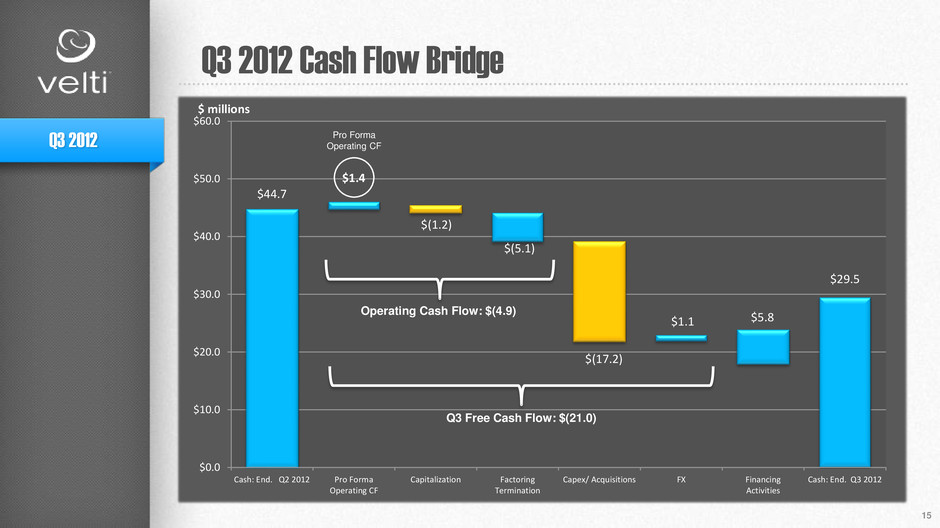

15 Q3 2012 Cash Flow Bridge Q1 FCF: $(27.8) Q2 FCF: $7.0 ($ millions) Q1 FCF: $(27.8) Q3 2012 $44.7 $29.5 $1.1 $1.4 $(1.2) $(5.1) $(17.2) $5.8 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 Cash: End. Q2 2012 Pro Forma Operating CF Capitalization Factoring Termination Capex/ Acquisitions FX Financing Activities Cash: End. Q3 2012 $ millions Q3 Free Cash Flow: $(21.0) Operating Cash Flow: $(4.9) Pro Forma Operating CF

16 Net Cash Position Net Cash $36.4 Q3 2012 Debt $8.3 Debt $15.5 Cash & Cash Equivalents $44.7 Cash & Cash Equivalents $29.5 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 Q2 2012 Q3 2012 Net Cash Position Q2 vs. Q3 2012 $ millions Factoring Arrangement Termination $5.1 Net Cash $36.4 Net Cash $14.0

17 Q3 2012 US GAAP To Pro Forma Reconciliation Q3 2012 in (000's) GAAP Share- Based Comp Excluding Share-Based Comp Other Pro Forma items Pro Forma GAAP Share-Based Comp Excluding Share-Based Comp Other Pro Forma items Pro Forma GAAP Share-Based Comp Excluding Share-Based Comp Other Pro Forma items Pro Forma Software as a service (SaaS) revenue $ 46,768 $ - $ 46,768 $ - $ 46,768 $ 48,946 $ - $ 48,946 $ - $ 48,946 $ 48,540 $ - $ 48,540 $ - $ 48,540 License revenue 1,505 - 1,505 - 1,505 2,898 - 2,898 - 2,898 5,229 - 5,229 - 5,229 Managed Services 3,520 - 3,520 - 3,520 6,847 - 6,847 - 6,847 8,624 - 8,624 - 8,624 Total revenue 51,793 - 51,793 - 51,793 58,691 - 58,691 - 58,691 62,393 - 62,393 - 62,393 Costs and expenses: Third-party costs 16,862 - 16,862 - 16,862 20,979 - 20,979 - 20,979 22,701 - 22,701 - 22,701 Datacenter and direct project costs 7,892 (972) 6,920 (100) 6,820 7,585 (778) 6,807 (100) 6,707 6,894 (775) 6,119 (100) 6,019 General and administrative expenses 15,132 (3,660) 11,472 (1,075) 10,397 16,140 (3,113) 13,027 (1,247) 11,780 15,516 (2,601) 12,915 (1,307) 11,608 Sales and marketing expenses 12,753 (2,392) 10,361 (195) 10,166 12,520 (2,117) 10,403 (195) 10,208 13,193 (1,925) 11,268 (195) 11,073 Research and development expenses 4,684 (1,584) 3,100 (160) 2,940 4,336 (1,336) 3,000 (160) 2,840 5,724 (1,277) 4,447 (160) 4,287 Acquisition related and other charges 2,197 - 2,197 (2,197) - 2,131 - 2,131 (2,131) - 5,622 - 5,622 (5,622) - Expected loss on assets held for sale 9,626 - 9,626 (9,626) - Depreciation and amortization 7,269 - 7,269 (2,637) 4,632 8,022 - 8,022 (2,587) 5,435 8,707 - 8,707 (2,717) 5,990 Total costs and expenses 66,789 (8,608) 58,181 (6,364) 51,817 71,713 (7,344) 64,369 (6,420) 57,949 87,983 (6,578) 81,405 (19,727) 61,678 Income (loss) from operations (14,996) 8,608 (6,388) 6,364 (24) (13,022) 7,344 (5,678) 6,420 742 (25,590) 6,578 (19,012) 19,727 715 Interest expense, net (743) - (743) (743) (416) - (416) - (416) (257) - (257) - (257) Gain (loss) from foreign currency transactions 1,375 - 1,375 (1,375) - (2,449) - (2,449) 2,449 - 3,210 - 3,210 (3,210) - Other Expense 6,174 - 6,174 (6,028) 146 (187) - (187) - (187) (34) - (34) - (34) Income (loss) before income taxes, investment in associates and non-controlling interests (8,190) 8,608 418 (1,039) (621) (16,074) 7,344 (8,730) 8,869 139 (22,671) 6,578 (16,093) 16,517 424 Income tax (expense) benefit (278) - (278) - (278) (862) - (862) - (862) (46) - (46) - (46) Gain or (loss) from equity investments (371) - (371) 133 (238) (785) - (785) 569 (216) (2,023) - (2,023) (151) (2,174) Net income (loss) (8,839) 8,608 (231) (906) (1,137) (17,721) 7,344 (10,377) 9,438 (939) (24,740) 6,578 (18,162) 16,366 (1,796) Net loss attributable to non-controlling interest (21) - (21) - (21) (22) - (22) - (22) (23) - (23) - (23) Net income (loss) attributable to Velti (8,818)$ 8,608$ (210)$ (906)$ (1,116)$ (17,699)$ 7,344$ (10,355)$ 9,438$ (917)$ (24,717)$ 6,578$ (18,139)$ 16,366$ (1,773)$ Net income (loss) attributable to Velti per share: Basic (and Diluted if Net Loss) (0.14) 0.14 (0.00) (0.01) (0.02) (0.28) 0.11 (0.16) 0.15 (0.01) (0.38) 0.10 (0.28) 0.25 (0.03) Diluted (Assuming we have net income) (0.14) 0.13 (0.00) (0.01) (0.02) (0.27) 0.11 (0.16) 0.14 (0.01) (0.37) 0.10 (0.27) 0.25 (0.03) Weighted average number of shares outstanding: Basic (and Diluted if Net Loss) 61,816 61,816 61,816 61,816 61,816 63,916 63,916 63,916 63,916 63,916 64,684 64,684 64,684 64,684 64,684 Diluted 63,949 63,949 63,949 63,949 63,949 65,779 65,779 65,779 65,779 65,779 66,176 66,176 66,176 66,176 66,176 EBITDA (7,727)$ 8,608$ 881$ 3,727$ 4,608$ (5,000)$ 7,344$ 2,344$ 3,833$ 6,177$ (16,883)$ 6,578$ (10,305)$ 17,010$ 6,705$ 3/31/2012 6/30/2012 9/30/2012

18 Consolidated Statement of Operations Q3 2012 3-Month Period Ended: 3-Month Period Ended: 3-Month Period Ended: March 31, 2010 June 30, 2010 Sept. 30, 2010 Dec. 31, 2010 FY 2010 March 31, 2011 June 30, 2011 Sept. 30, 2011 Dec. 31, 2011 FY 2011 March 31, 2012 June 30, 2012 Sept. 30, 2012 Software as a service (SaaS) revenue $ 7,573 $ 13,788 $ 14,987 $ 40,854 $ 77,202 $ 23,279 $ 27,550 $ 25,545 $ 62,650 $ 139,024 $ 46,768 $ 48,946 $ 48,540 License revenue 4,881 5,540 3,883 12,282 26,586 2,791 4,077 10,091 19,746 36,705 1,505 2,898 5,229 Managed Services 3,777 2,601 1,752 4,351 12,481 3,480 2,731 2,552 4,710 13,473 3,520 6,847 8,624 Total revenue 16,231 21,929 20,622 57,487 116,269 29,550 34,358 38,188 87,106 189,202 51,793 58,691 62,393 Costs and expenses: Third-party costs 4,024 9,059 4,997 18,578 36,658 10,633 10,717 13,746 18,805 53,901 16,862 20,979 22,701 Datacenter and direct project costs (1) 1,333 1,467 1,570 1,942 6,312 2,951 5,140 4,127 5,734 17,952 7,892 7,585 6,894 General and administrative expenses (1) 5,371 3,909 5,882 7,322 22,484 9,468 14,409 10,260 11,121 45,258 15,132 16,140 15,516 Sales and marketing expenses (1) 4,689 6,263 6,179 5,918 23,049 7,993 11,586 7,785 10,369 37,733 12,753 12,520 13,193 Research and development expenses (1) 1,282 1,701 1,656 3,201 7,840 2,830 3,563 2,814 3,853 13,060 4,684 4,336 5,724 Acquisition related and other charges - - - 5,364 5,364 1,461 6,142 - 2,787 10,390 2,197 2,131 5,622 Expected loss on assets held for sale - - 9,626 Depreciation and amortization 2,569 2,684 2,843 4,035 12,131 3,754 4,108 5,788 7,250 20,900 7,269 8,022 8,707 Total costs and expenses 19,268 25,083 23,127 46,360 113,838 39,090 55,665 44,520 59,919 199,194 66,789 71,713 87,983 Income (loss) from operations (3,037) (3,154) (2,505) 11,127 2,431 (9,540) (21,307) (6,332) 27,187 (9,992) (14,996) (13,022) (25,590) Interest expense, net (1,062) (1,305) (2,826) (2,876) (8,069) (3,483) (1,398) (1,482) (1,026) (7,389) (743) (416) (257) Gain (loss) from foreign currency transactions (861) (1,195) 1,004 (674) (1,726) 378 (2,181) 8,777 (774) 6,200 1,375 (2,449) 3,210 Other Expense - - - - - (76) 162 (120) (15) (49) 6,174 (187) (34) Income (loss) before income taxes, investment in associates and non-controlling interests (4,960) (5,654) (4,327) 7,577 (7,364) (12,721) (24,724) 843 25,372 (11,230) (8,190) (16,074) (22,671) Income tax (expense) benefit 212 228 (1,110) (3,101) (3,771) (2,237) (721) (482) (368) (3,808) (278) (862) (46) Gain or (loss) from equity investments (499) (978) (630) (2,508) (4,615) (965) 320 262 183 (200) (371) (785) (2,023) Net income (loss) (5,247) (6,404) (6,067) 1,968 (15,750) (15,923) (25,125) 623 25,187 (15,238) (8,839) (17,721) (24,740) Net loss attributable to non-controlling interest (24) (17) (19) (21) (81) (51) (49) 25 205 130 (21) (22) (23) Net income (loss) attributable to Velti $ (5,223) $ (6,387) $ (6,048) $ 1,989 $ (15,669) $ (15,872) $ (25,076) $ 598 $ 24,982 $ (15,368) $ (8,818) $ (17,699) $ (24,717) Net income (loss) attributable to Velti per share: Basic (and Diluted if Net Loss) $ (0.14) $ (0.17) $ (0.16) $ 0.05 $ (0.41) $ (0.34) $ (0.47) $ 0.01 $ 0.40 $ (0.28) $ (0.14) $ (0.28) $ (0.38) Diluted (Assuming we have net income) $ (0.14) $ (0.17) $ (0.16) $ 0.05 $ (0.41) $ (0.34) $ (0.47) $ 0.01 $ 0.40 $ (0.28) $ (0.14) $ (0.28) $ (0.38) Weighted average number of shares outstanding: Basic 37,530 37,704 38,160 38,297 37,933 47,099 53,047 61,595 61,718 55,865 61,816 63,916 64,684 Diluted 37,530 37,704 38,160 39,551 37,933 47,099 53,047 63,926 62,921 55,865 63,949 65,779 66,176 (1) Includes share-based compensation as follows: Datacenter and direct project costs $ 67 $ 107 $ 183 $ 87 $ 443 $ 628 $ 1,751 $ 601 $ 568 $ 3,549 $ 972 $ 778 $ 775 General and administrative expenses 224 498 1,010 880 2,613 3,244 5,632 1,342 1,516 11,735 3,660 3,113 2,601 Sales and marketing expenses 485 678 1,388 (321) 2,231 1,876 4,019 1,127 1,266 8,288 2,392 2,117 1,925 Research and development expenses 149 199 339 299 985 814 1,889 703 650 4,055 1,584 1,336 1,277 Total Share-based compensation $ 925 $ 1,482 $ 2,920 $ 945 $ 6,272 $ 6,562 $ 13,291 $ 3,773 $ 4,000 $ 27,627 $ 8,608 $ 7,344 $ 6,578

19 Consolidated Statement of Operations Q3 2012 3-Month Period Ended: 3-Month Period Ended: 3-Month Period Ended: March 31, 2010 June 30, 2010 Sept. 30, 2010 Dec. 31, 2010 FY 2010 March 31, 2011 June 30, 2011 Sept. 30, 2011 Dec. 31, 2011 FY 2011 March 31, 2012 June 30, 2012 Sept. 30, 2012 Adjusted Net Income (Loss) & Adjusted EBITDA Reconcilation Net loss before non-controlling interest $ (5,247) $ (6,404) $ (6,067) $ 1,968 $ (15,750) $ (15,923) $ (25,125) $ 623 $ 25,187 $ (15,238) $ (8,839) $ (17,721) $ (24,740) Adjustments: Foreign exchange (gains) losses 861 1,195 (1,004) 674 1,726 (378) 2,181 (8,777) 774 $ (6,200) (1,375) 2,449 (3,210) Non-cash share based compensation 925 1,482 2,920 945 6,272 6,562 13,291 3,773 4,000 $ 27,627 8,608 7,344 6,578 Non-recurring and acquisition-related expenses - - - 6,364 6,364 2,282 6,995 2,404 4,641 $ 16,322 (2,301) 3,833 7,384 (Gain) Loss from equity method investments - - - 2,776 2,776 1,458 (169) 109 490 $ 1,888 133 569 (151) Expected loss on assets held for sale 9,626 Depreciation and amortization - acquisition related 276 280 295 784 1,635 795 797 795 2,220 $ 4,607 2,637 2,587 2,717 Adjusted net income (loss) $ (3,185) $ (3,447) $ (3,856) $ 13,511 $ 3,023 $ (5,204) $ (2,030) $ (1,073) $ 37,312 $ 29,005 $ (1,137) $ (939) $ (1,796) (Gain) loss from equity method investments - other 499 978 630 (268) 1,839 (493) (151) (371) (673) (1,688) 238 216 2,174 Depreciation and amortization - other 2,293 2,404 2,548 3,251 10,496 2,959 3,311 4,993 5,030 16,293 4,632 5,435 5,990 Income tax expense (benefit) (212) (228) 1,110 3,101 3,771 2,237 721 482 368 3,808 278 862 46 Interest expense, net 1,062 1,305 2,826 2,876 8,069 1,704 1,398 1,482 1,026 5,610 743 416 257 Other (income) expense - - - - - 76 (162) 120 15 49 (146) 187 34 Adjusted EBITDA $ 457 $ 1,012 $ 3,258 $ 22,471 $ 27,198 $ 1,279 $ 3,087 $ 5,633 $ 43,078 $ 53,077 $ 4,608 $ 6,177 $ 6,705 Summary Data Total Revenue 16,231 21,929 20,622 57,487 116,269 29,550 34,358 38,188 87,106 189,202 51,793 58,691 62,393 Third-party costs 4,024 9,059 4,997 18,578 36,658 10,633 10,717 13,746 18,805 53,901 16,862 20,979 22,701 Total revenue less: third party costs 12,207 12,870 15,625 38,909 79,611 18,917 23,641 24,442 68,301 135,301 34,931 37,712 39,692 % Margin 75% 59% 76% 68% 68% 64% 69% 64% 78% 72% 67% 64% 64% Pro Forma Operating Expenses (1) Datacenter and direct project costs 1,266$ 1,360$ 1,387$ 1,785$ 5,798$ 2,390$ 3,389$ 3,526$ 5,166$ 14,471$ 6,820$ 6,707$ 6,019$ General and administrative expenses 5,147$ 3,411$ 4,872$ 6,031$ 19,461$ 6,617$ 7,924$ 6,514$ 8,178$ 29,233$ 10,397$ 11,780$ 11,608$ Sales and marketing expenses 4,204$ 5,585$ 4,791$ 5,879$ 20,459$ 6,462$ 7,567$ 6,658$ 8,847$ 29,534$ 10,166$ 10,208$ 11,073$ Research and development expenses 1,133$ 1,502$ 1,317$ 2,743$ 6,695$ 2,169$ 1,674$ 2,111$ 3,032$ 8,986$ 2,940$ 2,840$ 4,287$ Total 11,750$ 11,858$ 12,367$ 16,438$ 52,413$ 17,638$ 20,554$ 18,809$ 25,223$ 82,224$ 30,323$ 31,535$ 32,987$ Adjusted EBITDA Margin 3% 5% 16% 39% 23% 4% 9% 15% 49% 28% 9% 11% 11% (1) Excludes share-based compensation and non-recurring expenses otherwise allocable to given expense category.

20 Rationale • Following up on our commitment to improve DSOs and cash flows, Velti contemplated completely shutting down these customers, which were not converging to the right payment terms, but local management stepped up and bid for the business • Divested assets have ~450 days Comprehensive DSOs • Local-management led, ~75 employees (for which we incur no severance costs) • Divested revenue expected to decline materially in 2013 The markets in which these assets reside are uniformly characterized by: • Weak macro and micro-economic trends and contracting economies • Significantly reduced budgets and weakening local credit profiles • Declining revenue and high CAPEX requirements; and • High comprehensive DSOs, all of which contribute to poor working capital characteristics in these regions It is in the best interest of the Company to focus exclusively on its core markets which are characterized by: • High growth • Significantly lower DSOs and lower CAPEX requirements • Improved free cash flow in 2013 and beyond These market opportunities are larger with substantially more attractive payment and consumer characteristics Why this is very positive: • We are able to monetize assets as opposed to just shutting down these customers and • We are also able to maintain upside if the region recovers • We are focusing our cash investments on regions that are more aligned with our growth strategy • We are able to eliminate any future severance or other downside liabilities Divestiture Q3 2012

21 Divestiture Structure Acquirer • 100% regional management & employees that are responsible for these customers and subsidiaries today Consideration • Minimum: ~$23.5 million cash • Potential upside in case of over-performance: 3x 2014 divested Adj. EBITDA • Velti 3-year option / warrants for 45% of equity in the event of a change of control at nominal strike Deferred Consideration Installments • $3.0 million up front, Q4 2012 • $5.2 million (35% less up front) payable Dec. 31, 2013 • $15.3 million (65%) payable Dec. 31, 2014 Q3 2012

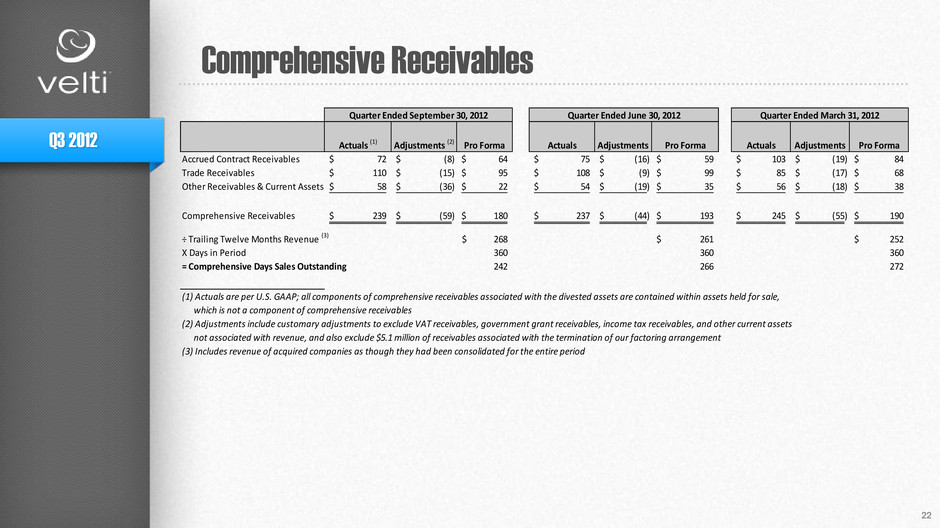

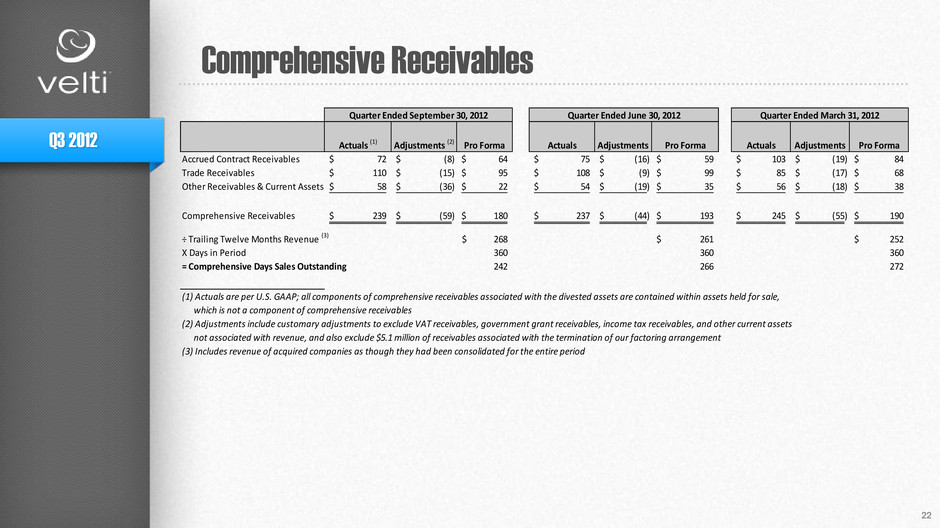

22 Comprehensive Receivables Q3 2012 Quarter Ended September 30, 2012 Quarter Ended June 30, 2012 Quarter Ended March 31, 2012 Quarter Ended December 31, 2011 Actuals (1) Adjustments (2) Pro Forma Actuals Adjustments Pro Forma Actuals Adjustments Pro Forma Accrued Contract Receivables 72$ (8)$ 64$ ## 75$ (16)$ 59$ # 103$ (19)$ 84$ Trade Receivables 110$ (15)$ 95$ ## 108$ (9)$ 99$ # 85$ (17)$ 68$ Other Receivables & Current Assets 58$ (36)$ 22$ ## 54$ (19)$ 35$ # 56$ (18)$ 38$ Comprehensive Receivables 239$ (59)$ 180$ 237$ (44)$ 193$ 245$ (55)$ 190$ ÷ Trailing Twelve Months Revenue (3) 268$ 261$ 252$ X Days in Period 360 360 360 = Comprehensive Days Sales Outstanding 242 266 272 (1) Actuals are per U.S. GAAP; all components of comprehensive receivables associated with the divested assets are contained within assets held for sale, which is not a component of comprehensive receivables (2) Adjustments include customary adjustments to exclude VAT receivables, government grant receivables, income tax receivables, and other current assets not associated with revenue, and also exclude $5.1 million of receivables associated with the termination of our factoring arrangement (3) Includes revenue of acquired companies as though they had been consolidated for the entire period

23 Comprehensive Receivables Balance Q3 2012 $59 $95 $22 $64 $99 $35 Accrued Contract Receivables Trade Receivables Other Receivables & Current Assets Comprehensive Receivables Balance, Q2 vs. Q3 2012 ($ millions) Quarter Ended June 30, 2012 Quarter Ended September 30, 2012 -$4, -4% +$5, +8% -$13, -37%

24 4th Quarter and Fiscal Year 2012 Guidance Q3 2012 (1) Quarter ended Dec. 31st equals FYE Dec. 31st less YTD revenue (2) Qtr. End. Dec. 31st Low equals FYE Dec. 31st Low less YTD at end of Q2 less high guidance for Q3. Qtr. End. Dec. 31st High equals FYE Dec. 31st High less YTD at end of Q2 less low guidance for Q3 (3) Quarter ended Dec. 31st equals low and high guidance for FYE Dec. 31st less YTD Adj. EBITDA less Q3 reduction in internal S/W Dev. Capitalization Qtr. End. Dec. 31st FYE Dec. 31st ($ millions) Low High Low High Adjusted Revenue Guidance $ 97.1 $ 113.1 $ 270.0 $ 286.0 Add: Divested Revenue 15.0 10.0 15.0 10.0 Comparable Revenue Guidance (1) $ 112.1 $ 123.1 $ 285.0 $ 296.0 Revenue Guidance (Q2 Call; Implied for Q4 based on Annual) (2) $ 110.5 $ 125.5 $ 285.0 $ 296.0 Change vs. Comparable $ 1.6 $ (2.4) $ - $ - Adjusted EBITDA Guidance $ 50.8 $ 59.8 $ 68.3 $ 77.3 Add: Q4 Divested Adj. EBITDA 9.0 6.0 9.0 6.0 Add: Q4 Est. Reduction in Internal S/W Dev. Capitalization 3.5 3.5 3.5 3.5 Add: Q3 Reduction in Internal S/W Dev. Capitalization - - $ 1.2 $ 1.2 Comparable Adj. EBITDA Guidance (3) $ 63.3 $ 69.3 $ 82.0 $ 88.0 Adjusted EBITDA Guidance (Q2 Call; Implied for Q4 based on Annual) (2) $ 60.7 $ 68.7 $ 82.0 $ 88.0 Change vs. Comparable $ 2.6 $ 0.6 $ - $ -

25 Velti Forward Greatly improved cash flow conversion in 2013 • Velti’s goal is to reduce DSOs to below 180 days from Q1 2012 (272 days) to Q4 2013 • Materially reduced CapEx, by ~$6 million per year from divested assets, $10m+ from internally capitalized software • Velti continues to focus on incremental improvement to its cash conversion cycle, focusing its resources on key Americas, U.K. and Asian markets, dropping high-DSO customers More balanced geographical revenue footprint and seasonality • Americas and U.K. expected to grow to 55-60% for FY 2012 and 65%-70% for FY 2013 as a percentage of revenue • Greece, Balkan and high-DSO North Africa and Middle Eastern revenue dropping by ~75%, to 2-3% of revenue • Reduced seasonality, with Q4 contribution dropping in 2013 to mid-30 percent range from 46% Growth rate acceleration • 2013 and 2014 growth rates to reach mid-30 percent range in both years (2013 vs. pro forma 2012, excluding divested assets), up from 29% and 25% respectively, based on consensus Allows Velti to reinvest in high-growth opportunities in U.S., Western Europe and Asia markets • Solutions such as our recently announced $27 million, multi-year loyalty campaign for a major U.S. brand are sustainably high margin, have high barriers to entry and are highly scalable as customers utilize incremental facets of the mGage platform • Customers include major brands in regions that are less susceptible to global economic downturn and are highly focused on mobile performance based marketing Q3 2012