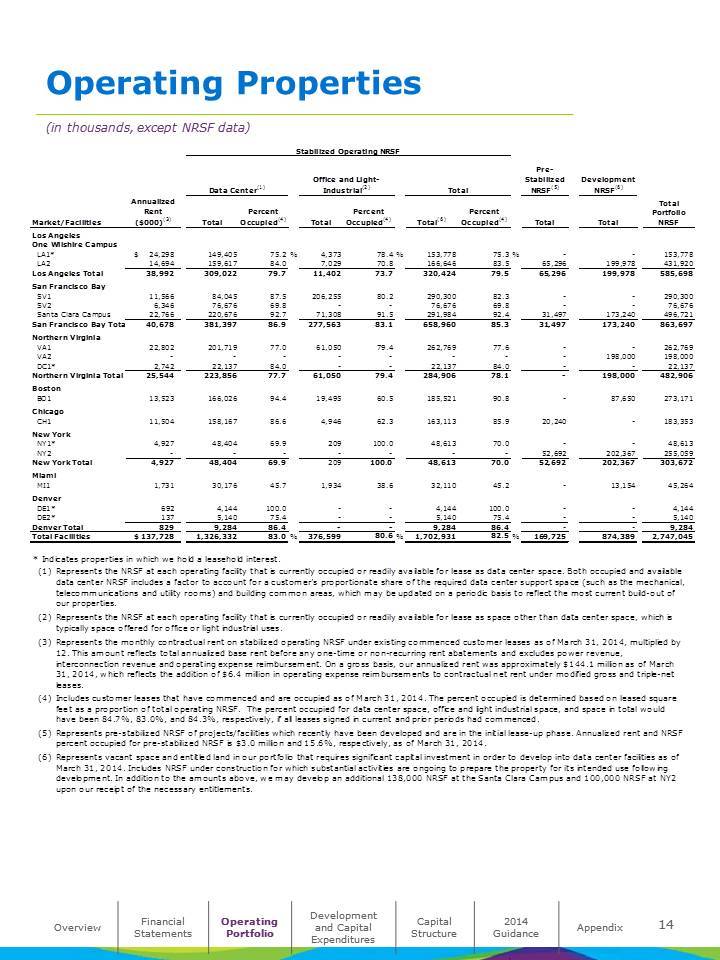

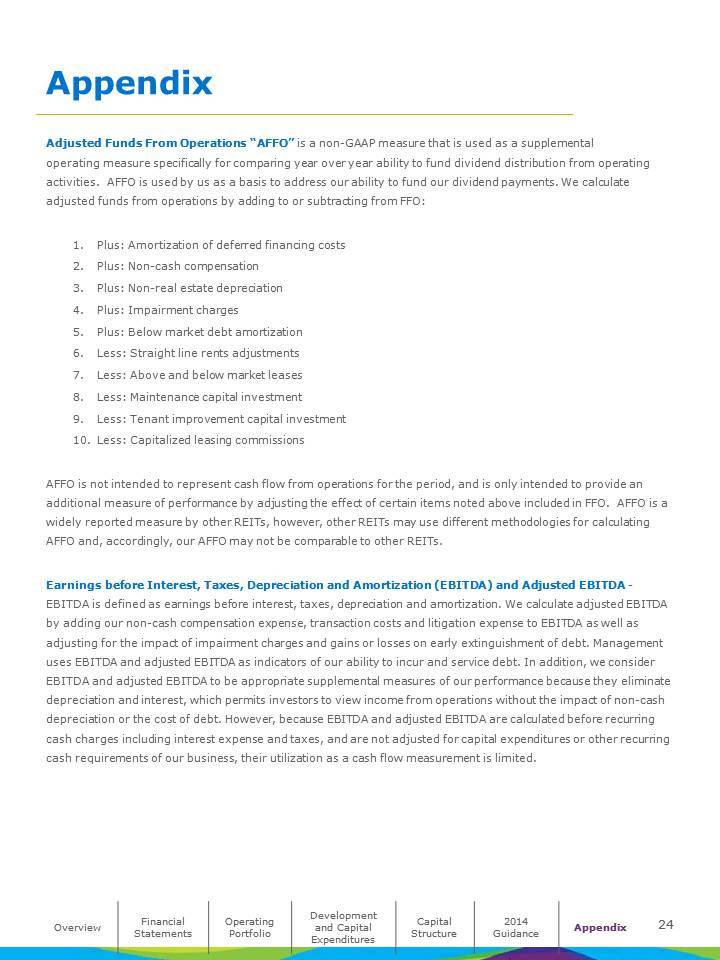

| Operating Properties (in thousands, except NRSF data) Stabilized Operating NRSF Pre- Office and Light- Stabilized Development Data Center(1) Industrial(2) Total NRSF(5) NRSF(6) Annualized Total Rent Percent Percent Percent Portfolio Market/Facilities ($000)(3) Total Occupied(4) Total Occupied(4) Total(6) Occupied(4) Total Total NRSF Los Angeles One Wilshire Campus LA1* $ 24,298 149,405 75.2 % 4,373 78.4 % 153,778 75.3 % - - 153,778 LA2 14,694 159,617 84.0 7,029 70.8 166,646 83.5 65,296 199,978 431,920 Los Angeles Total 38,992 309,022 79.7 11,402 73.7 320,424 79.5 65,296 199,978 585,698 San Francisco Bay SV1 11,566 84,045 87.5 206,255 80.2 290,300 82.3 - - 290,300 SV2 6,346 76,676 69.8 - - 76,676 69.8 - - 76,676 Santa Clara Campus 22,766 220,676 92.7 71,308 91.5 291,984 92.4 31,497 173,240 496,721 San Francisco Bay Tota 40,678 381,397 86.9 277,563 83.1 658,960 85.3 31,497 173,240 863,697 Northern Virginia VA1 22,802 201,719 77.0 61,050 79.4 262,769 77.6 - - 262,769 VA2 - - - - - - - - 198,000 198,000 DC1* 2,742 22,137 84.0 - - 22,137 84.0 - - 22,137 Northern Virginia Total 25,544 223,856 77.7 61,050 79.4 284,906 78.1 - 198,000 482,906 Boston BO1 13,523 166,026 94.4 19,495 60.5 185,521 90.8 - 87,650 273,171 Chicago CH1 11,504 158,167 86.6 4,946 62.3 163,113 85.9 20,240 - 183,353 New York NY1* 4,927 48,404 69.9 209 100.0 48,613 70.0 - - 48,613 NY2 - - - - - - - 52,692 202,367 255,059 New York Total 4,927 48,404 69.9 209 100.0 48,613 70.0 52,692 202,367 303,672 Miami MI1 1,731 30,176 45.7 1,934 38.6 32,110 45.2 - 13,154 45,264 Denver DE1* 692 4,144 100.0 - - 4,144 100.0 - - 4,144 DE2* 137 5,140 75.4 - - 5,140 75.4 - - 5,140 Denver Total 829 9,284 86.4 - - 9,284 86.4 - - 9,284 Total Facilities $ 137,728 1,326,332 83.0 % 376,599 80.6 % 1,702,931 82.5 % 169,725 874,389 2,747,045 * Indicates properties in which we hold a leasehold interest. (1) Represents the NRSF at each operating facility that is currently occupied or readily available for lease as data center space. Both occupied and available data center NRSF includes a factor to account for a customer’s proportionate share of the required data center support space (such as the mechanical, telecommunications and utility rooms) and building common areas, which may be updated on a periodic basis to reflect the most current build-out of our properties. (2) Represents the NRSF at each operating facility that is currently occupied or readily available for lease as space other than data center space, which is typically space offered for office or light industrial uses. (3) Represents the monthly contractual rent on stabilized operating NRSF under existing commenced customer leases as of March 31, 2014, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and excludes power revenue, interconnection revenue and operating expense reimbursement. On a gross basis, our annualized rent was approximately $144.1 million as of March 31, 2014, which reflects the addition of $6.4 million in operating expense reimbursements to contractual net rent under modified gross and triple-net leases. (4) Includes customer leases that have commenced and are occupied as of March 31, 2014. The percent occupied is determined based on leased square feet as a proportion of total operating NRSF. The percent occupied for data center space, office and light industrial space, and space in total would have been 84.7%, 83.0%, and 84.3%, respectively, if all leases signed in current and prior periods had commenced. (5) Represents pre-stabilized NRSF of projects/facilities which recently have been developed and are in the initial lease-up phase. Annualized rent and NRSF percent occupied for pre-stabilized NRSF is $3.0 million and 15.6%, respectively, as of March 31, 2014. (6) Represents vacant space and entitled land in our portfolio that requires significant capital investment in order to develop into data center facilities as of March 31, 2014. Includes NRSF under construction for which substantial activities are ongoing to prepare the property for its intended use following development. In addition to the amounts above, we may develop an additional 138,000 NRSF at the Santa Clara Campus and 100,000 NRSF at NY2 upon our receipt of the necessary entitlements. Development Financial Operating Capital 2014 14 Overview and Capital Appendix Statements Portfolio Structure Guidance Expenditures |