| |

| SECURE, RELIABLE, HIGH-PERFORMANCE DATA CENTER SOLUTIONS |

| ®2018 CoreSite Realty Corporation, All Rights Reserved |

Quarter Ended March 31, 2018 |

2

CoreSite Reports First-Quarter 2018 Financial Results Reflecting Revenue Growth of 12.8% Year over Year

DENVER, CO – April 26, 2018

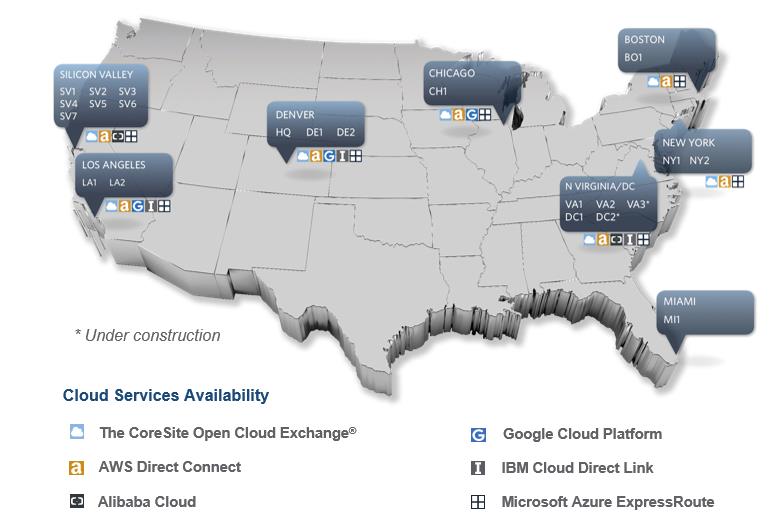

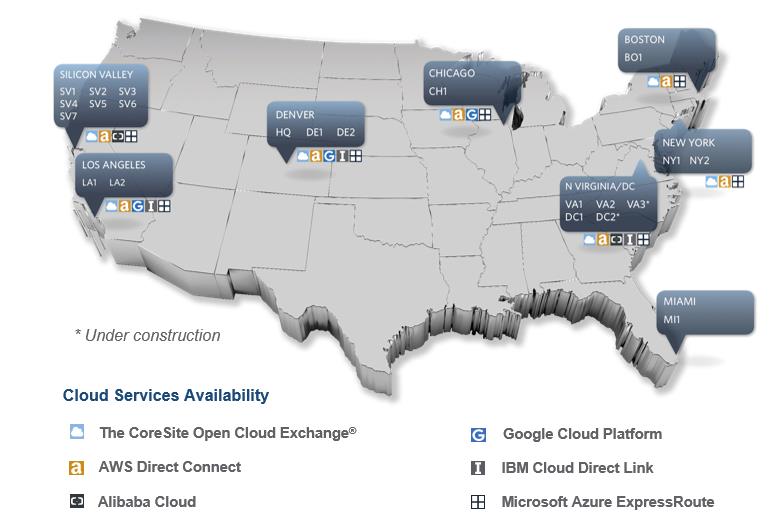

CoreSite Realty Corporation (NYSE:COR), a premier provider of secure, reliable, high-performance data center and interconnection solutions across the U.S., today announced financial results for the first quarter ended March 31, 2018.

Quarterly and Subsequent Highlights

| · | | First-quarter total operating revenues were $129.6 million, a 12.8% increase year over year |

| · | | First-quarter net income per diluted share was $0.59, a 22.9% increase year over year |

| · | | First-quarter funds from operations (“FFO”) was $1.27 per diluted share and unit, a 12.4% increase year over year |

| · | | Commenced 81,636 net rentable square feet (NRSF) of new and expansion leases representing $16.2 million of annualized GAAP rent at an average rate of $184 per square foot |

| · | | Renewed leases with annualized GAAP rent of $20.2 million, with rent growth of 5.6% on a cash basis and 11.5% on a GAAP basis, resulting in rental churn of 1.9% in the first quarter |

| · | | Executed 136 new and expansion data center leases for 29,624 NRSF, representing $7.1 million of annualized GAAP rent at an average rate of $239 per square foot, including 47 new customer logos |

| · | | On April 19, 2018, CoreSite closed on an amended and expanded credit facility with total borrowing capacity of $1.05 billion under all arrangements with its syndicate of banks, and extended the maturity of its credit line to 2022 |

| · | | On April 20, 2018, CoreSite closed on the acquisition of U.S. Colo, a carrier-neutral, network-dense colocation provider, located in Los Angeles, California, for approximately $8.6 million. The acquisition provides CoreSite with 120+ new customers, increases its economies of scale in downtown Los Angeles, and ends litigation that had been ongoing between CoreSite and U.S. Colo |

“Our financial results demonstrate consistent execution and solid growth, with revenue, adjusted EBITDA, and FFO per share increasing 13%, 13%, and 12% year over year, respectively,” said Paul Szurek, CoreSite’s Chief Executive Officer. “We had a number of positives this quarter, including strong cash rent growth on renewals, solid commencement activity and a 9% year-over-year increase in same-store monthly recurring revenue per cabinet equivalent, all leading to healthy organic growth. While demand remains strong, we entered the quarter with approximately 32% less available capacity in our four largest markets, limiting our sales opportunities for the quarter. The $7.1 million in annualized GAAP rent signed includes 47 new high-quality logos added to our ecosystem. Fortunately, near the end of the quarter, we restored capacity in these markets to more normal levels, which has increased our actionable sales funnel, and our construction pipeline is very active.”

Financial Results

CoreSite’s net income attributable to common shares was $20.3 million, or $0.59 per diluted share, for the three months ended March 31, 2018, compared to $16.3 million, or $0.48 per diluted share for the three months ended March 31, 2017. Net income per diluted share increased 34.1% on a sequential-quarter basis.

CoreSite’s FFO per diluted share and unit was $1.27 for the three months ended March 31, 2018, an increase of 12.4% compared to $1.13 per diluted share and unit for the three months ended March 31, 2017. FFO per diluted share and unit increased 16.5% on a sequential-quarter basis. Excluding the non-cash expense related to the

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 3 |

original issuance costs of CoreSite’s redeemed Preferred Stock in the fourth quarter of 2017, FFO per share increased 7.6% sequentially.

Total operating revenues for the three months ended March 31, 2018, were $129.6 million, a 12.8% increase year over year and an increase of 2.9% on a sequential-quarter basis.

Commencements and Renewals

CoreSite’s first-quarter data center lease commencements totaled 81,636 NRSF at a weighted average GAAP rental rate of $184 per NRSF, which represents $16.2 million of annualized GAAP rent.

CoreSite’s renewal leases signed in the first quarter totaled $20.2 million in annualized GAAP rent, comprised of 118,876 NRSF at a weighted-average GAAP rental rate of $170 per NRSF, a 5.6% increase in rent on a cash basis and an 11.5% increase on a GAAP basis. The first-quarter rental churn rate was 1.9%.

As a result of renewals and growth in interconnection and power revenues, monthly recurring revenue per cabinet equivalent increased 9.3% over the prior-year period.

Sales Activity

CoreSite executed 136 new and expansion data center leases representing $7.1 million of annualized GAAP rent during the first quarter, comprised of 29,624 NRSF at a weighted-average GAAP rental rate of $239 per NRSF.

Development and Acquisition Activity

During the first quarter, CoreSite placed into service 87,263 square feet of turn-key data center capacity at LA2 in Los Angeles and 26,413 square feet of turn-key data center capacity at VA3 Phase 1A in Reston, Virginia.

In addition, as of March 31, 2018, CoreSite had a total of 108,151 square feet of turn-key data center capacity under construction and had spent $39.7 million of the estimated $131.1 million required to complete the projects, which consist of the following.

Reston – CoreSite had 49,837 square feet of turn-key data center capacity under construction at VA3 (Phase 1B), inclusive of 9,837 square feet of the infrastructure building to support this phase of the data center campus. As of the end of the first quarter, CoreSite had incurred $31.4 million of the estimated $100.2 million required to complete VA3 Phase 1B and the infrastructure building, and expects to complete development in the first quarter of 2019.

Washington D.C. – CoreSite had 24,563 square feet of turn-key data center capacity under construction at DC2. As of the end of the first quarter, CoreSite had spent $5.6 million of the estimated $17.4 million required to complete the project, and expects to complete development in the third quarter of 2018.

Denver – CoreSite had 15,630 square feet of turn-key data center capacity under construction at DE1. As of the end of the first quarter, CoreSite had spent $1.5 million of the estimated $7.5 million required to complete this expansion, and expects to complete construction in the third quarter of 2018.

New York – CoreSite had 18,121 square feet of turn-key data center capacity under construction at NY2. CoreSite has spent $1.2 million of the estimated $6.0 million required to complete this expansion, and expects to complete development in the third quarter of 2018.

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 4 |

On April 20, 2018, CoreSite closed on the acquisition of U.S. Colo, a carrier-neutral, network-dense colocation provider, located in Los Angeles, California, for approximately $8.6 million. The acquisition provides CoreSite with more than 120 additional customers, increased economies of scale in downtown Los Angeles, and ends litigation that had been ongoing between CoreSite and U.S. Colo. CoreSite acquired all of the equity interests in U.S. Colo and its affiliates, resulting in the addition of two colocation suites in One Wilshire (LA1) and a colocation space in 800 South Hope Street, cumulatively totaling approximately 30,000 net rentable square feet.

Balance Sheet and Liquidity

As of March 31, 2018, CoreSite had net principal debt outstanding of $988.4 million, correlating to 3.4 times first-quarter annualized adjusted EBITDA.

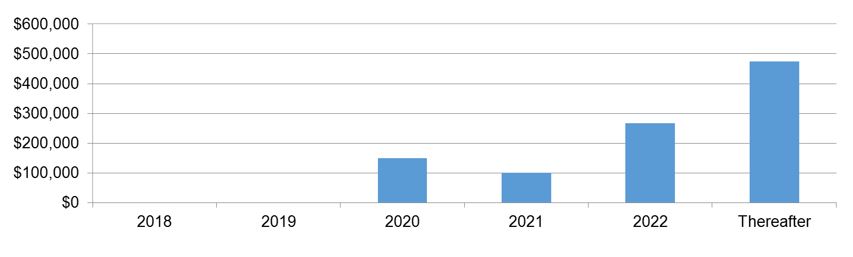

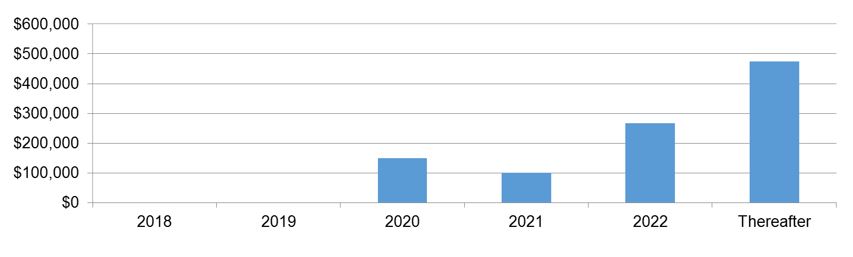

On April 19, 2018, CoreSite closed on an amended and expanded credit facility with $1.05 billion of total borrowing capacity under all arrangements with its syndicate of banks. As a result of the amendment, CoreSite extended its debt maturity profile, with its next tranche of debt not maturing until June 2020.

The revolving credit facility amendment provides an incremental $100 million of borrowing capacity, bringing the capacity to $450 million and extends the primary term of the facility to April 2022, with a one-year extension option.

In addition, CoreSite entered into a new five-year, $150 million term loan under the amended credit facility. This new loan matures in April 2023, and bears interest at a variable rate based on LIBOR. CoreSite elected to swap the variable interest rate associated with $75 million of the new term loan facility, to a fixed rate of approximately 4.11%. As of March 31, 2018, pro forma for the financing and related swap, CoreSite’s ratio of fixed versus variable rate debt would be 47% fixed versus 53% variable, in line with CoreSite’s stated goal of maintaining a balance between fixed and variable-priced instruments within its capital structure.

The proceeds from the term loan are expected to be used to pay down a portion of the current revolving credit facility balance, to fund continued development across its portfolio, and for general corporate purposes.

Including the increased liquidity resulting from the recent financing transactions, CoreSite had $381.7 million of total available liquidity, including cash on the balance sheet at March 31, 2018.

Dividend

On March 9, 2018, CoreSite announced a dividend of $0.98 per share of common stock and common stock equivalents for the first quarter of 2018. The first-quarter dividend was paid on April 16, 2018, to shareholders of record on March 29, 2018.

2018 Guidance

CoreSite is maintaining its 2018 guidance of net income attributable to common shares in the range of $2.15 to $2.27 per diluted share. In addition, CoreSite is maintaining its guidance of FFO per diluted share and unit in the range of $4.92 to $5.04, with the difference between net income and FFO being real estate depreciation and amortization.

This outlook is based on current economic conditions, internal assumptions about CoreSite’s customer base, and the supply and demand dynamics of the markets in which CoreSite operates. The guidance does not include the impact of any future financing, investment or disposition activities, beyond what has already been disclosed.

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 5 |

Upcoming Conferences and Events

CoreSite management will participate in the following investor conferences and events:

| · | | A non-deal roadshow covering the Mid-Atlantic region and Boston on May 8-9, 2018; |

| · | | The J.P. Morgan 46th Annual Global Technology, Media and Communications Conference on May 16, 2018, at The Westin Boston Waterfront in Boston, Massachusetts; |

| · | | REITWeek: NAREIT's Investor Forum from June 5-7, 2018, at the New York Hilton Midtown in New York, New York; and |

| · | | The 6th Annual William Blair Technology Company Growth Conference on June 13, 2018, at the Four Seasons Hotel in Chicago, Illinois. |

Conference Call Details

CoreSite will host a conference call on April 26, 2018, at 12:00 p.m., Eastern Time (10:00 a.m., Mountain Time), to discuss its financial results, current business trends and market conditions.

The call will be accessible by dialing +1-877-407-3982 (domestic) or +1-201-493-6780 (international). A replay will be available until May 10, 2018, and can be accessed shortly after the call by dialing + 1-844-512-2921 (domestic) or + 1-412-317-6671 (international). The passcode for the replay is 13677832.

Interested parties may also listen to a simultaneous webcast of the conference call by logging on to CoreSite’s website at www.CoreSite.com and clicking on the “Investors” link. The on-line replay will be available for a limited time beginning immediately following the call.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure, reliable, high-performance data center and interconnection solutions to a growing customer ecosystem across eight key North American markets. More than 1,250 of the world’s leading enterprises, network operators, cloud providers, and supporting service providers choose CoreSite to connect, protect and optimize their performance-sensitive data, applications and computing workloads. Our scalable, flexible solutions and 450+ dedicated employees consistently deliver unmatched data center options — all of which leads to a best-in-class customer experience and lasting relationships. For more information, visit www.CoreSite.com.

CoreSite Contact

Greer Aviv

Vice President of Investor Relations and Corporate Communications

+1 303.405.1012

+1 303.222.7276

Greer.Aviv@CoreSite.com

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 6 |

Forward Looking Statements

This earnings release and accompanying supplemental information may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond CoreSite’s control, that may cause actual results to differ significantly from those expressed in any forward-looking statement. These risks include, without limitation: the geographic concentration of the company’s data centers in certain markets and any adverse developments in local economic conditions or the demand for data center space in these markets; fluctuations in interest rates and increased operating costs; difficulties in identifying properties to acquire and completing acquisitions; significant industry competition; the company’s failure to obtain necessary outside financing; the company’s ability to service existing debt; the company’s failure to qualify or maintain its status as a REIT; financial market fluctuations; changes in real estate and zoning laws and increases in real property tax rates; and other factors affecting the real estate industry generally. All forward-looking statements reflect the company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Furthermore, the company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause the company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in the company’s most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the company from time to time with the Securities and Exchange Commission.

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 7 |

Company Profile

CoreSite delivers secure, reliable, high-performance data center and interconnection solutions to a growing customer ecosystem at 20 operating data centers across eight key North American Markets.

| | | | | |

Secure, Reliable and Compliant | | Scalable |

• | 100% uptime Service Level Agreement guarantees our reliability commitment to customer applications | | • | Serving customer requirements from half cabinet to full buildings |

• | Physical security standards and rigorous internal security training enable compliance with regulatory requirements | | • | 20 operating data centers in eight of the largest commercial and data center markets in the United States |

• | Consistent compliance across all properties | | • | Ability to increase occupied data center footprint on land and buildings currently owned and under contract, including current space unoccupied, under construction and held for development, by approximately 1.7 million NRSF, or 79% of currently occupied space |

| • | SOC 1 & SOC 2 Type 2 reviews | | |

| • | ISO 27001 certified | | |

| • | Payment Card Industry Data Security Standard compliant | | |

| • | HIPAA validation | | |

High-Performance Interconnection | | High-Quality Customer Experience |

| | | | |

• | Cloud-enabled, network-rich data center buildings and campuses | | • | 450+ professionals with dedicated industry expertise supporting over 1,250 customers |

• | Over 420 network service providers supported by robust interconnection services to key public clouds | | • | Experienced and committed operations, facilities and security personnel |

• | 25,000+ interconnections | | • | 24/7 customer support and remote hands |

• | Enabling enterprises with support ecosystems | | • | Dedicated implementation resources to ensure a successful onboarding process |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 8 |

Summary of Financial Data

(in thousands, except per share, NRSF and MRR data)

| | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| | March 31, | | December 31, | | March 31, | | Growth % | |

Summary of Results | | 2018 | | 2017 | | 2017 | | Y/Y | |

GAAP Financial Measures | | | | | | | | | | | | | |

Operating revenues | | $ | 129,619 | | $ | 125,946 | | $ | 114,921 | | 12.8 | % | |

Net income | | | 28,566 | | | 27,008 | | | 25,060 | | 14.0 | | |

Net income attributable to common shares | | | 20,302 | | | 14,912 | | | 16,292 | | 24.6 | | |

Net income attributable to common shares per share - diluted | | $ | 0.59 | | $ | 0.44 | | $ | 0.48 | | 22.9 | | |

| | | | | | | | | | | | | |

REIT Financial Measures | | | | | | | | | | | | | |

Funds from operations (FFO) to shares and units | | $ | 60,998 | | $ | 52,224 | | $ | 54,005 | | 12.9 | % | |

Funds from operations (FFO) to shares and units, as adjusted(1) | | | 60,998 | | | 56,550 | | | 54,005 | | 12.9 | | |

Adjusted funds from operations (AFFO) | | | 57,045 | | | 43,675 | | | 48,294 | | 18.1 | | |

EBITDAre | | | 70,113 | | | 66,296 | | | 62,602 | | 12.0 | | |

Adjusted EBITDA | | | 72,878 | | | 68,755 | | | 64,404 | | 13.2 | | |

FFO per common share and OP unit - diluted | | $ | 1.27 | | $ | 1.09 | | $ | 1.13 | | 12.4 | | |

FFO per common share and OP unit - diluted, as adjusted(1) | | $ | 1.27 | | $ | 1.18 | | $ | 1.13 | | 12.4 | | |

| (1) | | FFO available to shares and units, as adjusted, during the three months ended December 31, 2017, excludes $4.3 million, or $0.09 per share and unit, of non-cash charge related to the original issuance costs associated with our redeemed preferred stock. |

| | | | | | | | | | | | | | | | |

| | As of | |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | |

| | 2018 | | 2017 | | 2017 | | 2017 | | 2017 | |

| | | | | | | | | | | | | | | | |

Dividend Activity | | | | | | | | | | | | | | | | |

Dividends declared per share and OP unit | | $ | 0.98 | | $ | 0.98 | | $ | 0.90 | | $ | 0.90 | | $ | 0.80 | |

TTM FFO payout ratio | | | 82.6 | % | | 81.0 | % | | 77.4 | % | | 72.4 | % | | 66.9 | % |

TTM AFFO payout ratio(1) | | | 93.9 | % | | 93.4 | % | | 90.2 | % | | 84.0 | % | | 75.1 | % |

| | | | | | | | | | | | | | | | |

Operating Portfolio Statistics | | | | | | | | | | | | | | | | |

Operating data center properties | | | 20 | | | 20 | | | 20 | | | 20 | | | 20 | |

Stabilized data center NRSF | | | 2,164,778 | | | 2,067,257 | | | 2,025,594 | | | 2,025,594 | | | 1,987,231 | |

Stabilized data center NRSF occupied | | | 2,021,268 | | | 1,951,491 | | | 1,891,014 | | | 1,900,699 | | | 1,881,908 | |

Stabilized data center % occupied | | | 93.4 | % | | 94.4 | % | | 93.4 | % | | 93.8 | % | | 94.7 | % |

| | | | | | | | | | | | | | | | |

Turn-Key Data Center ("TKD") Same-Store Statistics | | | | | | | | | | | | | | | | |

MRR per Cabinet Equivalent | | $ | 1,458 | | $ | 1,446 | | $ | 1,414 | | $ | 1,369 | | $ | 1,334 | |

TKD NRSF % occupied | | | 89.1 | % | | 88.7 | % | | 85.2 | % | | 85.6 | % | | 84.8 | % |

| | | | | | | | | | | | | | | | |

Market Capitalization, Principal Debt & Preferred Stock | | | | | | | | | | | | | | | | |

Total enterprise value | | $ | 5,832,403 | | $ | 6,420,488 | | $ | 6,288,910 | | $ | 5,866,955 | | $ | 5,164,449 | |

Total principal debt outstanding | | $ | 991,500 | | $ | 944,500 | | $ | 794,000 | | $ | 775,000 | | $ | 723,000 | |

Total principal debt and preferred stock outstanding(2) | | $ | 991,500 | | $ | 944,500 | | $ | 909,000 | | $ | 890,000 | | $ | 838,000 | |

| | | | | | | | | | | | | | | | |

Net Principal Debt to: | | | | | | | | | | | | | | | | |

Annualized Adjusted EBITDA | | | 3.4 | x | | 3.4 | x | | 3.0 | x | | 2.9 | x | | 2.8 | x |

Enterprise Value | | | 16.9 | % | | 14.6 | % | | 12.6 | % | | 12.8 | % | | 14.0 | % |

| | | | | | | | | | | | | | | | |

Net Principal Debt & Preferred Stock(2) to: | | | | | | | | | | | | | | | | |

Annualized Adjusted EBITDA | | | 3.4 | x | | 3.4 | x | | 3.5 | x | | 3.3 | x | | 3.2 | x |

Enterprise Value | | | 16.9 | % | | 14.6 | % | | 14.4 | % | | 14.8 | % | | 16.2 | % |

| (1) | | The TTM AFFO payout ratio included $13.1 million, $11.9 million, $3.3 million, and $3.0 million as of March 31, 2018, December 31, 2017, September 30, 2017, and June 30, 2017, respectively, of recurring capital expenditures associated with replacing our chiller plant at LA2 that we expect to generate a significant return on investment. |

| (2) | | On December 12, 2017 we redeemed our preferred stock at par value plus accrued dividends. |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 9 |

Consolidated Balance Sheets

(in thousands, except per share data)

| | | | | | | |

| | March 31,

2018 | | December 31,

2017 (1) | |

Assets: | | | | | | | |

Investments in real estate: | | | | | | | |

Land | | $ | 97,295 | | $ | 97,258 | |

Buildings and improvements | | | 1,651,967 | | | 1,561,056 | |

| | | 1,749,262 | | | 1,658,314 | |

Less: Accumulated depreciation and amortization | | | (500,961) | | | (473,141) | |

Net investment in operating properties | | | 1,248,301 | | | 1,185,173 | |

Construction in progress | | | 121,989 | | | 162,903 | |

Net investments in real estate | | | 1,370,290 | | | 1,348,076 | |

Operating lease right-of-use assets | | | 88,781 | | | 92,984 | |

Cash and cash equivalents | | | 3,079 | | | 5,247 | |

Accounts and other receivables, net | | | 25,078 | | | 28,875 | |

Lease intangibles, net | | | 5,727 | | | 6,314 | |

Goodwill | | | 40,646 | | | 40,646 | |

Other assets, net | | | 106,813 | | | 103,501 | |

Total assets | | $ | 1,640,414 | | $ | 1,625,643 | |

| | | | | | | |

Liabilities and equity: | | | | | | | |

Liabilities | | | | | | | |

Debt, net | | $ | 986,974 | | $ | 939,570 | |

Operating lease liabilities | | | 97,308 | | | 102,912 | |

Accounts payable and accrued expenses | | | 64,036 | | | 77,170 | |

Accrued dividends and distributions | | | 48,678 | | | 48,976 | |

Acquired below-market lease contracts, net | | | 3,314 | | | 3,504 | |

Unearned revenue, prepaid rent and other liabilities | | | 36,778 | | | 34,867 | |

Total liabilities | | | 1,237,088 | | | 1,206,999 | |

| | | | | | | |

Stockholders' equity | | | | | | | |

Common stock, par value $0.01 | | | 340 | | | 338 | |

Additional paid-in capital | | | 460,404 | | | 457,495 | |

Accumulated other comprehensive income | | | 1,163 | | | 753 | |

Distributions in excess of net income | | | (191,013) | | | (177,566) | |

Total stockholders' equity | | | 270,894 | | | 281,020 | |

Noncontrolling interests | | | 132,432 | | | 137,624 | |

Total equity | | | 403,326 | | | 418,644 | |

Total liabilities and equity | | $ | 1,640,414 | | $ | 1,625,643 | |

| (1) | | Adoption of the new lease accounting standard required that we adjust the consolidated balance sheet as of December 31, 2017, to include the recognition of additional right-of-use assets and lease liabilities for operating leases. See the filed Form 10-Q for additional information. |

|

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 10 |

Consolidated Statements of Operations

(in thousands, except share and per share data)

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Operating revenues: | | | | | | | | | | |

Data center revenue:(1) | | | | | | | | | | |

Rental revenue | | $ | 71,033 | | $ | 68,373 | | $ | 64,251 | |

Power revenue | | | 36,403 | | | 36,528 | | | 30,861 | |

Interconnection revenue | | | 16,560 | | | 16,255 | | | 14,512 | |

Tenant reimbursement and other | | | 2,572 | | | 1,847 | | | 2,276 | |

Total data center revenue | | | 126,568 | | | 123,003 | | | 111,900 | |

Office, light-industrial and other revenue | | | 3,051 | | | 2,943 | | | 3,021 | |

Total operating revenues | | | 129,619 | | | 125,946 | | | 114,921 | |

| | | | | | | | | | |

Operating expenses: | | | | | | | | | | |

Property operating and maintenance | | | 33,848 | | | 34,722 | | | 29,226 | |

Real estate taxes and insurance | | | 4,937 | | | 3,963 | | | 4,504 | |

Depreciation and amortization | | | 33,776 | | | 32,629 | | | 32,338 | |

Sales and marketing | | | 5,080 | | | 4,616 | | | 4,503 | |

General and administrative | | | 9,185 | | | 10,157 | | | 8,124 | |

Rent | | | 6,400 | | | 6,155 | | | 5,962 | |

Transaction costs | | | 56 | | | 37 | | | — | |

Total operating expenses | | | 93,282 | | | 92,279 | | | 84,657 | |

Operating income | | | 36,337 | | | 33,667 | | | 30,264 | |

Interest expense | | | (7,738) | | | (6,635) | | | (5,107) | |

Income before income taxes | | | 28,599 | | | 27,032 | | | 25,157 | |

Income tax expense | | | (33) | | | (24) | | | (97) | |

Net income | | | 28,566 | | | 27,008 | | | 25,060 | |

Net income attributable to noncontrolling interests | | | 8,264 | | | 6,099 | | | 6,684 | |

Net income attributable to CoreSite Realty Corporation | | | 20,302 | | | 20,909 | | | 18,376 | |

Preferred stock dividends | | | — | | | (1,671) | | | (2,084) | |

Original issuance costs associated with redeemed preferred stock | | | — | | | (4,326) | | | — | |

Net income attributable to common shares | | $ | 20,302 | | $ | 14,912 | | $ | 16,292 | |

| | | | | | | | | | |

Net income per share attributable to common shares: | | | | | | | | | | |

Basic | | $ | 0.60 | | $ | 0.44 | | $ | 0.49 | |

Diluted | | $ | 0.59 | | $ | 0.44 | | $ | 0.48 | |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | | 33,935,564 | | | 33,893,021 | | | 33,558,787 | |

Diluted | | | 34,164,235 | | | 34,145,280 | | | 33,981,776 | |

| (1) | | Upon the anticipated issuance by the Financial Accounting Standards Board (“FASB”) and adoption of proposed targeted improvements to the new lease accounting standard, we intend to combine data center rental, power, and tenant reimbursements and other revenue into a single line item. We expect the FASB to approve these changes during the later part of Q2 2018 and will then incorporate the following changes during our Q2 2018 reporting: |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Rental revenue | | $ | 71,033 | | $ | 68,373 | | $ | 64,251 | |

Power revenue | | | 36,403 | | | 36,528 | | | 30,861 | |

Tenant reimbursement and other | | | 2,572 | | | 1,847 | | | 2,276 | |

Rental, power, and related revenue | | $ | 110,008 | | $ | 106,748 | | $ | 97,388 | |

|

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 11 |

Reconciliations of Net Income to FFO, AFFO, EBITDAre and Adjusted EBITDA

(in thousands, except per share data)

|

Reconciliation of Net Income to FFO |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Net income | | $ | 28,566 | | $ | 27,008 | | $ | 25,060 | |

Real estate depreciation and amortization | | | 32,432 | | | 31,213 | | | 31,029 | |

FFO | | $ | 60,998 | | $ | 58,221 | | $ | 56,089 | |

Preferred stock dividends | | | — | | | (1,671) | | | (2,084) | |

Original issuance costs associated with redeemed preferred stock | | | — | | | (4,326) | | | — | |

FFO available to common shareholders and OP unit holders | | $ | 60,998 | | $ | 52,224 | | $ | 54,005 | |

Original issuance costs associated with redeemed preferred stock | | | — | | | 4,326 | | | — | |

FFO available to common shareholders and OP unit holders, as adjusted(1) | | $ | 60,998 | | $ | 56,550 | | | 54,005 | |

| | | | | | | | | | |

Weighted average common shares outstanding - diluted | | | 34,164 | | | 34,145 | | | 33,982 | |

Weighted average OP units outstanding - diluted | | | 13,835 | | | 13,836 | | | 13,851 | |

Total weighted average shares and units outstanding - diluted | | | 47,999 | | | 47,981 | | | 47,833 | |

| | | | | | | | | | |

FFO per common share and OP unit - diluted | | $ | 1.27 | | $ | 1.09 | | $ | 1.13 | |

| | | | | | | | | | |

FFO per common share and OP unit - diluted, as adjusted(1) | | $ | 1.27 | | $ | 1.18 | | $ | 1.13 | |

(1) FFO available to shares and units, as adjusted, during the three months ended December 31, 2017, excludes $4.3 million, or $0.09 per share and unit, of non-cash charge related to the original issuance costs associated with our redeemed preferred stock.

|

Reconciliation of FFO to AFFO |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

FFO available to common shareholders and unit holders | | $ | 60,998 | | $ | 52,224 | | $ | 54,005 | |

| | | | | | | | | | |

Adjustments: | | | | | | | | | | |

Amortization of deferred financing costs | | | 566 | | | 445 | | | 369 | |

Non-cash compensation | | | 2,626 | | | 2,401 | | | 1,802 | |

Non-real estate depreciation | | | 1,344 | | | 1,416 | | | 1,309 | |

Original issuance costs associated with redeemed preferred stock | | | — | | | 4,326 | | | — | |

Straight-line rent adjustment | | | (1,450) | | | (677) | | | (1,566) | |

Amortization of above and below market leases | | | (175) | | | (170) | | | (124) | |

Recurring capital expenditures(1) | | | (3,172) | | | (10,949) | | | (2,582) | |

Tenant improvements | | | (1,437) | | | (1,466) | | | (1,848) | |

Capitalized leasing costs | | | (2,255) | | | (3,875) | | | (3,071) | |

AFFO available to common shareholders and OP unit holders | | $ | 57,045 | | $ | 43,675 | | $ | 48,294 | |

(1) Recurring capital expenditures for the three months ended March 31, 2018, and December 31, 2017, includes $1.2 million and $8.6 million, respectively, of recurring capital expenditures associated with replacing our chiller plant at LA2 that we expect to generate a significant return on investment.

|

Reconciliation of Net Income to EBITDAre and Adjusted EBITDA(1) |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Net income | | $ | 28,566 | | $ | 27,008 | | $ | 25,060 | |

Adjustments: | | | | | | | | | | |

Interest expense | | | 7,738 | | | 6,635 | | | 5,107 | |

Income taxes | | | 33 | | | 24 | | | 97 | |

Depreciation and amortization | | | 33,776 | | | 32,629 | | | 32,338 | |

EBITDAre | | $ | 70,113 | | $ | 66,296 | | $ | 62,602 | |

Non-cash compensation | | | 2,626 | | | 2,401 | | | 1,802 | |

Transaction costs / litigation | | | 139 | | | 58 | | | — | |

Adjusted EBITDA | | $ | 72,878 | | $ | 68,755 | | $ | 64,404 | |

(1) We have adopted the NAREIT defined definition of EBITDAre, see the appendix for additional information.

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 12 |

Operating Properties

| | | | | | | | | | | | | | | | | | | | | | |

| | Data Center Operating NRSF | | | | | | | |

| | Annualized | | Stabilized | | Pre-Stabilized | | Total | | | | Held for | | | |

| | Rent | | | | Percent | | | | Percent | | | | Percent | | NRSF Under | | Development | | | |

Market/Facilities | | ($000)(1) | | Total | | Occupied(2) | | Total | | Occupied(2) | | Total | | Occupied(2) | | Construction | | NRSF | | Total NRSF | |

| | | | | | | | | | | | | | | | | | | | | | |

San Francisco Bay | | | | | | | | | | | | | | | | | | | | | | |

SV1 | | $ | 6,241 | | 85,932 | | 84.7 | % | — | | — | % | 85,932 | | 84.7 | % | — | | — | | 85,932 | |

SV2 | | | 8,359 | | 76,676 | | 94.3 | | — | | — | | 76,676 | | 94.3 | | — | | — | | 76,676 | |

Santa Clara campus | | | 68,350 | | 538,615 | | 96.6 | | 76,885 | | 67.5 | | 615,500 | | 92.9 | | — | | 175,000 | | 790,500 | |

San Francisco Bay Total | | | 82,950 | | 701,223 | | 94.9 | | 76,885 | | 67.5 | | 778,108 | | 92.1 | | — | | 175,000 | | 953,108 | |

| | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | | | | | | | | | | | | | | | | | | | | | |

One Wilshire campus | | | | | | | | | | | | | | | | | | | | | | |

LA1* | | | 30,096 | | 139,053 | | 95.9 | | — | | — | | 139,053 | | 95.9 | | — | | 10,352 | | 149,405 | |

LA2 | | | 42,089 | | 333,230 | | 95.1 | | 61,890 | | 24.9 | | 395,120 | | 84.1 | | — | | 29,770 | | 424,890 | |

LA3 | | | — | | — | | — | | — | | — | | — | | — | | — | | 180,000 | | 180,000 | |

Los Angeles Total | | | 72,185 | | 472,283 | | 95.3 | | 61,890 | | 24.9 | | 534,173 | | 87.2 | | — | | 220,122 | | 754,295 | |

| | | | | | | | | | | | | | | | | | | | | | |

Northern Virginia | | | | | | | | | | | | | | | | | | | | | | |

VA1 | | | 29,581 | | 198,632 | | 90.3 | | 3,087 | | — | | 201,719 | | 88.9 | | — | | — | | 201,719 | |

VA2 | | | 17,865 | | 164,006 | | 94.4 | | 24,440 | | 52.2 | | 188,446 | | 88.9 | | — | | — | | 188,446 | |

VA3 | | | 1,025 | | 52,758 | | 100.0 | | 26,413 | | — | | 79,171 | | 66.6 | | — | | — | | 79,171 | |

DC1* | | | 3,326 | | 22,137 | | 79.4 | | — | | — | | 22,137 | | 79.4 | | — | | — | | 22,137 | |

DC2* | | | — | | — | | — | | — | | — | | — | | — | | 24,563 | | — | | 24,563 | |

Reston Campus Expansion(3) | | | — | | — | | — | | — | | — | | — | | — | | 49,837 | | 524,138 | | 573,975 | |

Northern Virginia Total | | | 51,797 | | 437,533 | | 92.5 | | 53,940 | | 23.7 | | 491,473 | | 84.9 | | 74,400 | | 524,138 | | 1,090,011 | |

| | | | | | | | | | | | | | | | | | | | | | |

New York | | | | | | | | | | | | | | | | | | | | | | |

NY1* | | | 5,296 | | 48,404 | | 75.2 | | — | | — | | 48,404 | | 75.2 | | — | | — | | 48,404 | |

NY2 | | | 13,543 | | 101,742 | | 88.7 | | — | | — | | 101,742 | | 88.7 | | 18,121 | | 116,388 | | 236,251 | |

New York Total | | | 18,839 | | 150,146 | | 84.4 | | — | | — | | 150,146 | | 84.4 | | 18,121 | | 116,388 | | 284,655 | |

| | | | | | | | | | | | | | | | | | | | | | |

Chicago | | | | | | | | | | | | | | | | | | | | | | |

CH1 | | | 19,479 | | 178,407 | | 93.0 | | — | | — | | 178,407 | | 93.0 | | — | | — | | 178,407 | |

CH2(4) | | | — | | — | | — | | — | | — | | — | | — | | — | | 175,000 | | 175,000 | |

Chicago Total | | | 19,479 | | 178,407 | | 93.0 | | — | | — | | 178,407 | | 93.0 | | — | | 175,000 | | 353,407 | |

| | | | | | | | | | | | | | | | | | | | | | |

Boston | | | | | | | | | | | | | | | | | | | | | | |

BO1 | | | 18,418 | | 180,057 | | 96.8 | | 13,735 | | — | | 193,792 | | 89.9 | | — | | 59,884 | | 253,676 | |

| | | | | | | | | | | | | | | | | | | | | | |

Denver | | | | | | | | | | | | | | | | | | | | | | |

DE1* | | | 2,806 | | 9,813 | | 99.5 | | 4,341 | | 63.1 | | 14,154 | | 88.4 | | 15,630 | | — | | 29,784 | |

DE2* | | | 465 | | 5,140 | | 96.7 | | — | | — | | 5,140 | | 96.7 | | — | | — | | 5,140 | |

Denver Total | | | 3,271 | | 14,953 | | 98.6 | | 4,341 | | 63.1 | | 19,294 | | 90.6 | | 15,630 | | — | | 34,924 | |

| | | | | | | | | | | | | | | | | | | | | | |

Miami | | | | | | | | | | | | | | | | | | | | | | |

MI1 | | | 1,512 | | 30,176 | | 66.0 | | — | | — | | 30,176 | | 66.0 | | — | | 13,154 | | 43,330 | |

Total Data Center Facilities | | $ | 268,451 | | 2,164,778 | | 93.4 | % | 210,791 | | 39.3 | % | 2,375,569 | | 88.6 | % | 108,151 | | 1,283,686 | | 3,767,406 | |

| | | | | | | | | | | | | | | | | | | | | | |

Office & Light-Industrial | | | 8,238 | | 361,575 | | 79.7 | | — | | — | | 361,575 | | 79.7 | | — | | — | | 361,575 | |

Reston Office & Light-Industrial(3) | | | 2,123 | | 150,375 | | 100.0 | | — | | — | | 150,375 | | 100.0 | | — | | (150,375) | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Portfolio | | $ | 278,812 | | 2,676,728 | | 91.9 | % | 210,791 | | 39.3 | % | 2,887,519 | | 88.1 | % | 108,151 | | 1,133,311 | | 4,128,981 | |

* Indicates properties in which we hold a leasehold interest.

| (1) | | On a gross basis, our total portfolio annualized rent was approximately $285.7 million as of March 31, 2018, which includes $6.9 million in operating expense reimbursements under modified gross and triple-net leases. |

| (2) | | Includes customer leases that have commenced as of March 31, 2018. If all leases signed during the current and prior periods had commenced, the percent occupied would have been as follows: |

| | | | | | | |

Percent Leased | | Stabilized | | Pre-Stabilized | | Total | |

Total Data Center Facilities | | 94.3 | % | 41.2 | % | 89.6 | % |

Total Portfolio | | 92.7 | % | 41.2 | % | 89.0 | % |

| (3) | | Included with our Reston Campus Expansion held for development space is 150,375 NRSF which is currently operating as office and light-industrial space. |

| (4) | | On January 29, 2018, we acquired a two-acre land parcel located in Chicago, Illinois, with a total real estate cost of $4.5 million. We plan to build a turn-key data center on the acquired land parcel, which we refer to as CH2, upon the receipt of necessary permits and entitlements. |

See Appendix for definitions.

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 13 |

Leasing Statistics

|

Data Center Leasing Activity |

| | | | | | | | | | | | | | | | | | | |

| | | | | | GAAP | | | | GAAP | | | | | | | |

| | Leasing | | Number | | Annualized | | Total | | Annualized | | Rental | | Cash | | GAAP | |

| | Activity | | of | | Rent | | Leased | | Rent per | | Churn | | Rent | | Rent | |

| | Period | | Leases(1) | | ($000) | | NRSF | | Leased NRSF | | Rate | | Growth | | Growth | |

| | | | | | | | | | | | | | | | | | | |

New/expansion leases commenced | | Q1 2018 | | 129 | | $ | 16,184 | (2) | 81,636 | | $ | 184 | (2) | | | | | | |

| | Q4 2017 | | 126 | | | 8,219 | | 52,221 | | | 157 | | | | | | | |

| | Q3 2017 | | 122 | | | 8,855 | | 21,617 | | | 410 | (3) | | | | | | |

| | Q2 2017 | | 129 | | | 6,580 | | 25,712 | | | 256 | | | | | | | |

| | Q1 2017 | | 118 | | | 9,121 | | 37,352 | | | 244 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

New/expansion leases signed | | Q1 2018 | | 136 | | $ | 7,067 | | 29,624 | | $ | 239 | | | | | | | |

| | Q4 2017 | | 128 | | | 7,219 | | 41,521 | | | 174 | | | | | | | |

| | Q3 2017 | | 103 | | | 10,099 | | 40,842 | | | 247 | (3) | | | | | | |

| | Q2 2017 | | 119 | | | 11,918 | (2) | 51,568 | | | 208 | (2) | | | | | | |

| | Q1 2017 | | 128 | | | 9,701 | | 46,484 | | | 209 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Renewal leases signed | | Q1 2018 | | 243 | | $ | 20,213 | | 118,876 | | $ | 170 | | 1.9 | % | 5.6 | % | 11.5 | % |

| | Q4 2017 | | 241 | | | 11,156 | | 78,577 | | | 142 | | 0.5 | | 3.5 | | 6.2 | |

| | Q3 2017 | | 280 | | | 14,370 | | 80,818 | | | 178 | | 1.4 | | 5.5 | | 10.9 | |

| | Q2 2017 | | 172 | | | 12,934 | | 83,097 | | | 156 | | 2.6 | (4) | 2.6 | | 6.5 | |

| | Q1 2017 | | 178 | | | 13,885 | | 95,108 | | | 146 | | 1.1 | | 1.9 | | 5.5 | |

| (1) | | Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

| (2) | | GAAP annualized rent includes contractual payments related to reserved dedicated expansion space, however, such amount is excluded in calculating the GAAP annualized rent per leased NRSF rate. |

| (3) | | During Q3 2017, we signed and commenced a highly dense capacity expansion at our Santa Clara campus. |

| (4) | | During Q2 2017, $4.1 million in annualized rent associated with a previously restructured lease at our Santa Clara campus expired resulting in rental churn of 1.7%. |

|

New/Expansion Leases Signed by Deployment Size by Period |

| | | | | | | | | | | | | | | | |

| | Q1 2018 | | Q4 2017 | | Q3 2017 | | Q2 2017 | | Q1 2017 | |

GAAP Annualized Rent ($000) | | | | | | | | | | | | | | | | |

Core Retail Colocation | | | | | | | | | | | | | | | | |

< 1,000 NRSF | | $ | 2,657 | | $ | 3,521 | | $ | 2,180 | | $ | 3,208 | | $ | 3,292 | |

1,000-5,000 NRSF | | | 1,829 | | | 2,053 | | | 2,001 | | | 1,667 | | | 3,050 | |

Total Core Retail Colocation | | $ | 4,486 | | $ | 5,574 | | $ | 4,181 | | $ | 4,875 | | $ | 6,342 | |

Scale Colocation | | | | | | | | | | | | | | | | |

> 5,000 NRSF | | | 2,581 | | | 1,645 | | | 5,918 | | | 7,043 | | | 3,359 | |

Total GAAP Annualized Rent | | $ | 7,067 | | $ | 7,219 | | $ | 10,099 | | $ | 11,918 | | $ | 9,701 | |

| |

MRR per Cabinet Equivalent Billed (TKD Same-Store)(1) |

| (1) | | During the first quarter of 2018, we updated the same-store turn-key data center pool to include all space available for lease that existed as turn-key data center space as of December 31, 2016. The MRR per Cabinet Equivalent for all periods reported was updated to reflect the new same-store pool. |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 14 |

Leasing Statistics

|

Lease Distribution (total portfolio, including total data center and office and light-industrial “OLI”) |

| | | | | | | | | | | | | | |

| | | | | | Total | | Percentage | | | | | Percentage | |

| | Number | | Percentage | | Operating | | of Total | | Annualized | | of Total | |

| | of | | of All | | NRSF of | | Operating | | Rent | | Annualized | |

NRSF Under Lease | | Leases | | Leases | | Leases | | NRSF | | ($000) | | Rent | |

Unoccupied data center | | — | | — | % | 271,497 | | 9.4 | % | $ | — | | — | % |

Unoccupied OLI | | — | | — | | 73,266 | | 2.5 | | | — | | — | |

Data center NRSF: | | | | | | | | | | | | | | |

5,000 or less | | 2,085 | | 90.6 | | 761,273 | | 26.4 | | | 129,635 | | 46.5 | |

5,001 - 10,000 | | 41 | | 1.8 | | 276,269 | | 9.6 | | | 42,063 | | 15.1 | |

10,001 - 25,000 | | 22 | | 1.0 | | 353,846 | | 12.3 | | | 42,518 | | 15.2 | |

Greater than 25,000 | | 5 | | 0.2 | | 223,598 | | 7.7 | | | 37,303 | | 13.4 | |

Powered shell | | 17 | | 0.7 | | 489,086 | | 16.9 | | | 16,932 | | 6.1 | |

OLI | | 130 | | 5.7 | | 438,684 | | 15.2 | | | 10,361 | | 3.7 | |

Portfolio Total | | 2,300 | | 100.0 | % | 2,887,519 | | 100.0 | % | $ | 278,812 | | 100.0 | % |

|

Lease Expirations (total portfolio, including total data center and office and light-industrial “OLI”) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | Total | | | | | | | | | | | | | Annualized | |

| | Number | | Operating | | Percentage | | | | | Percentage | | Annualized | | Annualized | | Rent Per | |

| | of | | NRSF of | | of Total | | Annualized | | of Total | | Rent Per | | Rent at | | Leased | |

| | Leases | | Expiring | | Operating | | Rent | | Annualized | | Leased | | Expiration | | NRSF at | |

Year of Lease Expiration | | Expiring(1) | | Leases | | NRSF | | ($000) | | Rent | | NRSF | | ($000)(2) | | Expiration | |

Unoccupied data center | | — | | 271,497 | | 9.4 | % | $ | — | | — | % | $ | — | | $ | — | | $ | — | |

Unoccupied OLI | | — | | 73,266 | | 2.5 | | | — | | — | | | — | | | — | | | — | |

2018 | | 879 | | 415,892 | | 14.5 | | | 68,131 | | 24.5 | | | 164 | | | 68,513 | | | 165 | |

2019 | | 774 | | 477,802 | | 16.5 | | | 65,220 | | 23.4 | | | 137 | | | 67,672 | | | 142 | |

2020 | | 278 | | 295,771 | | 10.2 | | | 47,785 | | 17.1 | | | 162 | | | 50,435 | | | 171 | |

2021 | | 123 | | 126,323 | | 4.4 | | | 16,293 | | 5.8 | | | 129 | | | 21,729 | | | 172 | |

2022 | | 70 | | 169,150 | | 5.9 | | | 18,730 | | 6.7 | | | 111 | | | 20,714 | | | 122 | |

2023-Thereafter | | 46 | | 619,134 | | 21.4 | | | 52,292 | | 18.8 | | | 83 | | | 71,368 | | | 113 | |

OLI (3) | | 130 | | 438,684 | | 15.2 | | | 10,361 | | 3.7 | | | 24 | | | 10,915 | | | 25 | |

Portfolio Total / Weighted Average | | 2,300 | | 2,887,519 | | 100.0 | % | $ | 278,812 | | 100.0 | % | $ | 109 | | $ | 311,346 | | $ | 122 | |

| (1) | | Includes leases that upon expiration will automatically be renewed, primarily on a year-to-year basis. Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

| (2) | | Represents the final monthly contractual rent under existing customer leases as of March 31, 2018, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and excludes operating expense reimbursements, power revenue and interconnection revenue. Leases expiring during 2018 include annualized rent of $13.5 million associated with lease terms currently on a month-to-month basis. |

| (3) | | The office and light-industrial leases are scheduled to expire as follows: |

| | | | | | |

| | NRSF of | | Annualized | |

| | Expiring | | Rent | |

Year | | Leases | | ($000) | |

2018 | | 53,846 | | $ | 1,170 | |

2019 | | 55,929 | | | 1,360 | |

2020 | | 67,002 | | | 1,246 | |

2021 | | 38,723 | | | 1,168 | |

2022 | | 70,014 | | | 1,216 | |

2023-Thereafter | | 153,170 | | | 4,201 | |

Total OLI | | 438,684 | | $ | 10,361 | |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 15 |

Geographic and Vertical Diversification

|

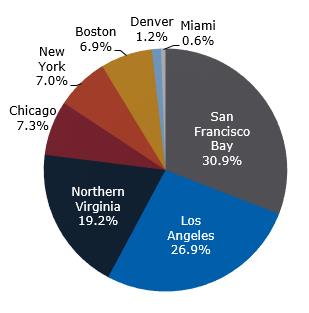

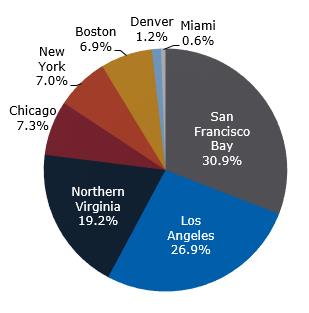

Geographical Diversification |

| | | | | |

| | | | Percentage of Total Data |

| Metropolitan Market | | Center Annualized Rent |

| San Francisco Bay | | 30.9 | % |

| Los Angeles | | 26.9 | |

| Northern Virginia | | 19.2 | |

| Chicago | | 7.3 | |

| New York | | 7.0 | |

| Boston | | 6.9 | |

| Denver | | 1.2 | |

| Miami | | 0.6 | |

| Total | | 100.0 | % |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| | | | |

| | | |

| | | | |

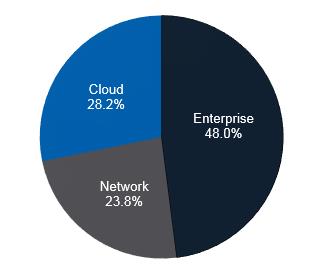

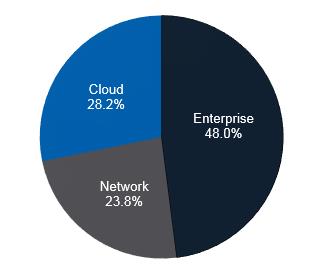

| | | Percentage of Total Data |

| Vertical | | Center Annualized Rent |

| Enterprise | | 48.0 | % |

| Cloud | | 28.2 | |

| Network | | 23.8 | |

| Total | | 100.0 | % |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 16 |

10 Largest Customers

|

10 Largest Customers (total portfolio, including data center and office and light-industrial) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Weighted | |

| | | | | | | | Percentage | | | | Percentage | | Average | |

| | | | Number | | Total | | of Total | | Annualized | | of Total | | Remaining | |

| | | | of | | Occupied | | Operating | | Rent | | Annualized | | Lease Term in | |

| CoreSite Vertical | Customer Industry | | Locations | | NRSF | | NRSF(1) | | ($000) | | Rent(2) | | Months(3) | |

1 | Cloud | Public Cloud | | 6 | | 90,779 | | 3.1 | % | $ | 17,805 | | 6.4 | % | 95 | |

2 | Cloud | Public Cloud | | 11 | | 293,197 | | 10.2 | | | 16,387 | | 5.9 | | 57 | |

3 | Enterprise | Travel / Hospitality | | 3 | | 90,330 | | 3.1 | | | 15,344 | | 5.5 | | 26 | |

4 | Cloud | Public Cloud | | 3 | | 116,045 | | 4.0 | | | 11,045 | | 4.0 | | 59 | |

5 | Enterprise | SI & MSP | | 3 | | 63,003 | | 2.2 | | | 8,886 | | 3.2 | | 21 | |

6 | Enterprise | Digital Content | | 6 | | 86,175 | | 3.0 | | | 7,903 | | 2.8 | | 48 | |

7 | Enterprise | Hardware / Electronics | | 3 | | 16,184 | | 0.6 | | | 5,951 | | 2.1 | | 8 | |

8 | Enterprise | SI & MSP | | 2 | | 22,051 | | 0.8 | | | 5,617 | | 2.0 | | 20 | |

9 | Network | Global Carrier | | 6 | | 27,989 | | 1.0 | | | 5,029 | | 1.8 | | 13 | |

10 | Enterprise | Software | | 1 | | 30,453 | | 1.0 | | | 4,466 | | 1.6 | | 7 | |

| Total/Weighted Average | | | | | 836,206 | | 29.0 | % | $ | 98,433 | | 35.3 | % | 46 | |

| (1) | | Represents the customer’s total occupied square feet divided by the total operating NRSF in the portfolio as of March 31, 2018. |

| (2) | | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of March 31, 2018. |

| (3) | | Weighted average based on percentage of total annualized rent expiring calculated as of March 31, 2018. |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 17 |

Capital Expenditures and Completed

Pre-Stabilized Projects

(in thousands, except NRSF and cost per NRSF data)

|

Capital Expenditures and Repairs and Maintenance |

| | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | |

| | 2018 | | 2017 | | 2017 | | 2017 | | 2017 | |

Data center expansion(1) | | $ | 44,977 | | $ | 45,518 | | $ | 46,282 | | $ | 29,966 | | $ | 22,644 | |

Non-recurring investments(2) | | | 1,577 | | | 2,679 | | | 2,960 | | | 2,724 | | | 3,301 | |

Tenant improvements | | | 1,437 | | | 1,466 | | | 1,252 | | | 2,198 | | | 1,848 | |

Recurring capital expenditures(3) | | | 3,172 | | | 10,949 | | | 3,219 | | | 6,975 | | | 2,582 | |

Total capital expenditures | | $ | 51,163 | | $ | 60,612 | | $ | 53,713 | | $ | 41,863 | | $ | 30,375 | |

| | | | | | | | | | | | | | | | |

Repairs and maintenance expense(4) | | $ | 3,158 | | $ | 3,682 | | $ | 4,476 | | $ | 3,508 | | $ | 3,109 | |

| (1) | | Data center expansion capital expenditures include new data center construction, development projects adding capacity to existing data centers and other revenue generating investments. Data center expansion also includes investment of Deferred Expansion Capital. During the three months ended September 30, 2017, we incurred $12.2 million to acquire a two acre land parcel adjacent to our existing Santa Clara campus, which we refer to as SV8. During the three months ended March 31, 2018, we incurred $4.5 million to acquire a two acre land parcel located in Chicago, Illinois, which we refer to as CH2. |

| (2) | | Non-recurring investments include upgrades to existing data center or office space and company-wide improvements that are ancillary to revenue generation such as internal system development and system-wide security upgrades, which have a future economic benefit. |

| (3) | | Recurring capital expenditures include required equipment upgrades within our operating portfolio, which have a future economic benefit. During the three months ended March 31, 2018, December 31, 2017, September 30, 2017, and June 30, 2017, we incurred $1.2 million, $8.6 million, $0.3 million, and $3.0 million, respectively, or $13.1 million in aggregate, associated with replacing our chiller plants at LA2 that we expect to generate a significant return on investment. |

| (4) | | Repairs and maintenance expense is classified within property operating and maintenance expense in the consolidated statements of operations. These expenditures represent recurring maintenance contracts and repairs to operating equipment necessary to maintain current operations. |

|

Completed Pre-Stabilized Projects |

| | | | | | | | | | | | | | | | | |

| | Metropolitan | | | | | | | | | Cost Per | | Percent | | Percent | |

Projects/Facilities | | Market | | Completion | | NRSF | | Cost(1) | | NRSF | | Leased(2) | | Occupied | |

LA2 | | Los Angeles | | Q2 2016 | | 21,965 | | $ | 7,717 | | $ | 351 | | 72.0 | % | 70.2 | % |

VA2 Phase 4 | | Northern Virginia | | Q2 2016 | | 24,440 | | | 13,706 | | | 561 | | 56.8 | | 52.2 | |

SV7 | | San Francisco Bay | | Q4 2016 | | 76,885 | | | 58,272 | | | 758 | | 70.7 | | 67.5 | |

DE1 | | Denver | | Q3 2017 | | 4,341 | | | 6,206 | | | 1,430 | | 65.8 | | 63.1 | |

BO1 | | Boston | | Q4 2017 | | 13,735 | | | 7,000 | | | 510 | | — | | — | |

VA1 | | Northern Virginia | | Q4 2017 | | 3,087 | | | 1,263 | | | 409 | | — | | — | |

LA2 | | Los Angeles | | Q1 2018 | | 39,925 | | | 11,248 | | | 282 | | — | | — | |

VA3 Phase 1A | | Northern Virginia | | Q1 2018 | | 26,413 | | | 17,208 | | | 651 | | — | | — | |

Total completed pre-stabilized | | | | | | 210,791 | | $ | 122,620 | | $ | 582 | | 41.2 | % | 39.3 | % |

| (1) | | Cost includes capital expenditures related to the specific project / phase and, for VA2, also includes allocations of capital expenditures related to land and building shell that were incurred during the first phase of the overall project. |

| (2) | | Includes customer leases that have been signed as of March 31, 2018, but have not commenced. The percent leased is determined based on leased NRSF as a proportion of total pre-stabilized NRSF. |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 18 |

Development Summary

(in thousands, except NRSF)

| | | | | | | | | | | | | | | | | | | | |

| | Under Construction | | | Held for Development(1) |

| | | | | | Costs | | | | | Estimated |

| | Estimated | | | | Incurred to- | | Estimated | | Percent | | | | | | | Power |

Projects/Facilities | | Completion | | NRSF | | Date | | Total | | Leased | | | NRSF | | Total Cost | | (Megawatts) |

| | | | | | | | | | | | | | | | | | | | |

Data center expansion | | | | | | | | | | | | | | | | | | |

BO1 | | — | | — | | $ | — | | $ | — | | — | % | | 59,884 | | $ | 32,200 | | 4.5 |

DC2 | | Q3 2018 | | 24,563 | | | 5,616 | | | 17,400 | | — | | | — | | | — | | — |

DE1 | | Q3 2018 | | 15,630 | | | 1,473 | | | 7,500 | | 4.9 | | | — | | | — | | — |

LA1 | | — | | — | | | — | | | — | | — | | | 10,352 | | | 1,250 | | 0.5 |

LA2 | | — | | — | | | — | | | — | | — | | | 29,770 | | | 10,000 | | 3.0 |

MI1 | | — | | — | | | — | | | — | | — | | | 13,154 | | | 7,500 | | 1.0 |

NY2 Phase 3-4 | | Q3 2018 | | 18,121 | | | 1,154 | | | 6,000 | | — | | | 69,176 | | | 51,000 | | 7.0 |

NY2 Phase 5 | | — | | — | | | — | | | — | | — | | | 47,211 | | | 35,000 | | 5.0 |

Total | | | | 58,314 | | $ | 8,243 | | $ | 30,900 | | 1.3 | % | | 229,547 | | $ | 136,950 | | 21.0 |

Deferred expansion capital | | — | | | 3,942 | | | 7,400 | | — | | | — | | | 25,000 - 35,000 | | — |

Total data center expansion | | 58,314 | | $ | 12,185 | | $ | 38,300 | | 1.3 | % | | 229,547 | | $ | 161,950 - 171,950 | | 21.0 |

| | | | | | | | | | | | | | | | | | | | |

New development | | | | | | | | | | | | | | | | | | |

CH2(2) | | — | | — | | $ | — | | $ | — | | — | % | | 175,000 | | $ | 190,000 - 210,000 | | 18.0 |

LA3 | | — | | — | | | — | | | — | | — | | | 180,000 | | | 190,000 - 210,000 | | 18.0 |

SV8 | | — | | — | | | — | | | — | | — | | | 175,000 | | | 190,000 - 210,000 | | 18.0 |

VA3 | | | | | | | | | | | | | | | | | | | | |

Phase 1B & C(3) | | Q1 2019 | | 49,837 | | | 31,421 | | | 100,200 | | — | | | 49,837 | | | 25,000 - 35,000 | | 6.0 |

Future Phases(4) | | — | | — | | | — | | | — | | — | | | 474,301 | | | 320,000 - 400,000 | | 48.0 |

Total new development | | 49,837 | | $ | 31,421 | | $ | 100,200 | | — | % | | 1,054,138 | | $ | 915,000 - 1,065,000 | | 108.0 |

| | | | | | | | | | | | | | | | | | | | |

Total development(5) | | 108,151 | | $ | 43,606 | | $ | 138,500 | | 0.7 | % | | 1,283,685 | | $ | 1,076,950 - 1,236,950 | | 129.0 |

| (1) | | These estimates are based on our current construction plans and expectations regarding entitlements. These estimates are subject to change based on current economic conditions, final zoning approvals, and the supply and demand dynamics of the market. |

| (2) | | On January 29, 2018, we acquired a two-acre land parcel located in Chicago, Illinois, with a total real estate cost of $4.5 million. We plan to build a turn-key data center on the acquired land parcel, which we refer to as CH2, upon the receipt of necessary permits and entitlements. |

| (3) | | As part of VA3 Phase 1B, we will build the shell of an 80,000 NRSF, 12 megawatt building, and a 77,000 NRSF centralized infrastructure building which will serve the entire VA3 property. Upon completion of VA3 Phase 1B, we will deliver 6 megawatts and 49,837 TKD NRSF. The centralized infrastructure building represents approximately $24 million of the estimated Phase 1B cost. The full construction of the 12 megawatt TKD building (Phase 1B and Phase 1C) will cost approximately $1,306 per NRSF, of which 6 megawatts is planned to be delivered with Phase 1C. |

| (4) | | The Reston Campus Expansion project is estimated to deliver 611,000 NRSF of incremental data center capacity (of which 26,413 NRSF was placed into service in Q1 2018 and 49,837 NRSF is under construction) across multiple phases with new buildings and as existing light-industrial / flex office leases expire and customers vacate. Based on our entitlement application, we believe we may be able to build an additional 286,000 NRSF for a total of 897,000 NRSF of incremental data center capacity. These estimates are subject to change based on current economic conditions, final zoning approvals, and the supply and demand dynamics of the market. The chart assumes the minimum expected zoning entitlement. |

| (5) | | In addition to new development and incremental capacity in existing core and shell buildings, we have available acreage we own adjacent to our existing NY2 building in the form of an existing parking lot. By utilizing this land, we believe we can build approximately 100,000 NRSF of data center capacity in Secaucus, New Jersey, upon receipt of necessary entitlements. |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 19 |

Market Capitalization and Debt Summary

(in thousands, except per share data)

| | | | | | | | | |

| | Shares or | | Market Price / | | | | |

| | Equivalents | | Liquidation Value as of | | Market Value | |

| | Outstanding | | March 31, 2018 | | Equivalents | |

Common shares | | 34,454 | | $ | 100.26 | | $ | 3,454,379 | |

Operating partnership units | | 13,829 | | | 100.26 | | | 1,386,524 | |

Total equity | | | | | | | | 4,840,903 | |

Total principal debt outstanding | | | | | | | | 991,500 | |

Total enterprise value | | | | | | | $ | 5,832,403 | |

| | | | | | | | | |

Net principal debt to enterprise value | | | | | | | | 16.9 | % |

| | | | | | | | | | | |

| | | | | | Outstanding as of: | |

| | | | Maturity | | March 31, | | December 31, | |

Instrument | | Rate | | Date(2) | | 2018 | | 2017 | |

Revolving credit facility (3) | | 3.43 | % | 6/24/2019 | | $ | 216,500 | | $ | 169,500 | |

2020 Senior unsecured term loan (4) | | 3.16 | | 6/24/2020 | | | 150,000 | | | 150,000 | |

2021 Senior unsecured term loan (3) | | 3.38 | | 2/2/2021 | | | 100,000 | | | 100,000 | |

2022 Senior unsecured term loan (5) | | 3.28 | | 4/19/2022 | | | 200,000 | | | 200,000 | |

2023 Senior unsecured notes | | 4.19 | | 6/15/2023 | | | 150,000 | | | 150,000 | |

2024 Senior unsecured notes | | 3.91 | | 4/20/2024 | | | 175,000 | | | 175,000 | |

Total principal debt outstanding | | | | | | | 991,500 | | | 944,500 | |

Unamortized deferred financing costs | | | | | | | (4,526) | | | (4,930) | |

Total debt | | | | | | $ | 986,974 | | $ | 939,570 | |

Weighted average interest rate | | 3.55 | % | | | | | | | | |

| | | | | | | | | | | |

Floating rate vs. fixed rate debt | | | | | | | 55% / 45% | | | 52% / 48% | |

| (1) | | During April 2018, we amended our credit agreement to increase the revolving credit facility by $100 million and enter into a new five-year $150 million senior unsecured term loan maturing in April 2023, which was used to pay down a portion of the current revolving credit facility balance. See the filed Form 10-K, 10-Q, and 8-K filed on April 20, 2018, for information on specific debt instruments. |

| (2) | | In accordance with the amended credit agreement, the maturity date of the revolving credit facility will be extended to April 2022, with a one-time extension option, which, if exercised, would extend the maturity date to April 2023. |

| (3) | | The revolving credit facility and 2021 senior unsecured term loan interest rates are based on 1-month LIBOR at March 31, 2018, plus applicable spread. |

| (4) | | Represents the effective interest rate as a result of the interest rate swap associated with $75 million in 1-month LIBOR variable rate debt and $75 million unhedged debt based on 1-month LIBOR plus applicable spread. |

| (5) | | Represents the effective interest rate as a result of the interest rate swap associated with $50 million in 1-month LIBOR variable rate debt and $150 million unhedged debt based on 1-month LIBOR plus applicable spread. |

|

Debt Maturities (including subsequent financing transactions and use of proceeds to pay down a portion of the revolving credit facility and extend the maturity date of the revolving credit facility) |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 20 |

Interest Summary and Debt Covenants

(in thousands)

|

Interest Expense Components |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31 | | March 31, | |

| | 2018 | | 2017 | | 2017 | |

Interest expense and fees | | $ | 8,275 | | $ | 7,241 | | $ | 5,298 | |

Amortization of deferred financing costs | | | 566 | | | 445 | | | 369 | |

Capitalized interest | | | (1,103) | | | (1,051) | | | (560) | |

Total interest expense | | $ | 7,738 | | $ | 6,635 | | $ | 5,107 | |

| | | | | | | | | | |

Percent capitalized | | | 12.5 | % | | 13.7 | % | | 9.9 | % |

| | | | | | | | | | | | | | | | | | | |

| | Revolving Credit Facility and Senior Unsecured Term Loans and Notes | |

| | | | March 31, | | | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| | Required Compliance | | 2018 (1) | | | 2017 | | | 2017 | | | 2017 | | | 2017 | |

| | | | | | | | | | | | | | | | | | | |

Fixed charge coverage ratio(2) | | Greater than 1.70x | | | 8.6 | x | | | 6.5 | x | | 7.4 | x | | 7.6 | x | | 8.6 | x |

Total indebtedness to gross asset value | | Less than 60% | | | 26.8 | % | | | 26.7 | % | | 23.8 | % | | 23.6 | % | | 22.4 | % |

Secured debt to gross asset value | | Less than 40% | | | — | % | | | — | % | | — | % | | — | % | | — | % |

Unhedged variable rate debt to gross asset value(3) | | Less than 30% | | | 14.6 | % | | | 13.9 | % | | 10.3 | % | | 9.8 | % | | 12.2 | % |

| | | | | | | | | | | | | | | | | | | |

Revolving credit facility availability | | | | $ | 450,000 | | | $ | 350,000 | | $ | 350,000 | | $ | 350,000 | | $ | 350,000 | |

Borrowings outstanding | | | | | (66,500) | | | | (169,500) | | | (19,000) | | | — | | | (223,000) | |

Outstanding letters of credit | | | | | (4,879) | | | | (4,879) | | | (3,480) | | | (4,480) | | | (4,480) | |

Current availability | | | | $ | 378,621 | | | $ | 175,621 | | $ | 327,520 | | $ | 345,520 | | $ | 122,520 | |

| (1) | | During April 2018, we amended our credit agreement which increased our revolving credit facility availability by $100 million and we entered into a new five-year $150 million senior unsecured term loan maturing in April 2023, which was used to pay down a portion of the current revolving facility balance. The revolving credit facility availability, borrowings outstanding, and current availability as of March 31, 2018, have been adjusted to reflect these subsequent debt financing transactions. |

| (2) | | During April 2018, we amended our credit agreement which reduced the required compliance on our fixed charge coverage ratio to greater than 1.50x for our revolving credit facility and senior unsecured term loans. |

| (3) | | During April 2018, we amended our credit agreement which removed the debt covenant related to unhedged variable rate debt to gross asset value for our revolving credit facility and senior unsecured term loans. |

8 |

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 21 |

Components of Net Asset Value (NAV)

(in thousands)

|

Cash Net Operating Income |

| | | | | | |

Reconciliation of Net Operating Income (NOI) | | Q1 2018 | | Annualized |

Operating Income | | $ | 36,337 | | $ | 145,348 |

Adjustments: | | | | | | |

Depreciation and amortization | | | 33,776 | | | 135,104 |

General and administrative (includes litigation expenses) | | | 9,185 | | | 36,740 |

Transaction costs | | | 56 | | | 224 |

Net Operating Income | | $ | 79,354 | | $ | 317,416 |

| | | | | | |

Cash Net Operating Income (Cash NOI) | | | | | | |

Net Operating Income | | $ | 79,354 | | $ | 317,416 |

Adjustments: | | | | | | |

Straight-line rent | | | (1,450) | | | (5,800) |

Amortization of above and below-market leases | | | (175) | | | (700) |

Cash NOI | | $ | 77,729 | | $ | 310,916 |

| | | | | | |

Cash NOI with backlog (89.0% leased)(1) | | $ | 81,371 | | $ | 325,484 |

Cash stabilized NOI (93% leased) | | $ | 85,028 | | $ | 340,112 |

| | | | | | |

Data Center Projects Under Construction | | | | | | |

TKD construction in progress(2) | | $ | 39,664 | | | |

Remaining spend(2) | | | 91,436 | | | |

Total | | $ | 131,100 | | | |

| | | | | | |

Targeted annual yields | | | 12 - 16 | % | | |

Annualized pro forma NOI range | | $ | 15,700 - 21,000 | | | |

| | | | | | |

Deferred Expansion Capital in progress | | $ | 3,942 | | | |

Remaining spend(3) | | | 3,458 | | | |

Total | | $ | 7,400 | | | |

|

Other Assets and Liabilities |

| | | | | | |

Other Assets | | | | | | |

Remaining construction in progress(4) | | $ | 78,383 | | | |

Cash and cash equivalents | | | 3,079 | | | |

Accounts and other receivables | | | 25,078 | | | |

Other tangible assets | | | 34,416 | | | |

Total other assets | | $ | 140,956 | | | |

| | | | | | |

Liabilities | | | | | | |

Principal debt | | $ | 991,500 | | | |

Accounts payable, accrued expenses and other liabilities | | | 100,814 | | | |

Accrued dividends and distributions | | | 48,678 | | | |

Total liabilities | | $ | 1,140,992 | | | |

| | | | | | |

Weighted average common shares and units - diluted | | | 47,999 | | | |

| (1) | | Cash NOI with backlog is adjusted to include one quarter of the cash backlog as of March 31, 2018, less any leasing of currently occupied NRSF and data center projects under development. |

| (2) | | Does not include spend associated with leasing commissions. See page 19 for further breakdown of data center projects under construction. |

| (3) | | Does not include spend associated with future Deferred Expansion Capital. |

| (4) | | Represents the book value of in-progress capital projects, including land and shell building, of future data center expansion, non-recurring investments, tenant improvements and recurring capital expenditures. |

|

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 22 |

2018 Guidance

(in thousands, except per share data)

The annual guidance provided below represents forward-looking projections, which are based on current economic conditions, internal assumptions about our existing customer base and the supply and demand dynamics of the markets in which we operate. Please refer to the press release for additional information on forward-looking statements.

| | | | | | | | | | | | | | | | |

Projected per share and OP unit information: | | | | | 2018 | | | | | | | | | Implied | |

| | Low | | High | | Mid | | | 2017 | | Growth(1) | |

Net income attributable to common shares | | $ | 2.15 | | $ | 2.27 | | $ | 2.21 | | | $ | 1.84 | | 20.1 | % |

Real estate depreciation and amortization | | | 2.77 | | | 2.77 | | | 2.77 | | | | 2.77 | | | |

Original issuance costs associated with redeemed preferred stock | | | — | | | — | | | — | | | | (0.09) | | | |

FFO, as adjusted | | $ | 4.92 | | $ | 5.04 | | $ | 4.98 | | | $ | 4.52 | | 10.2 | % |

| | | | | | | | | | | | | | | | |

Projected operating results: | | | | | | | | | | | | | | | | |

Total operating revenues | | $ | 535,000 | | $ | 545,000 | | $ | 540,000 | | | $ | 481,821 | | 12.1 | % |

General and administrative expenses | | | 38,000 | | | 40,000 | | | 39,000 | | | | 37,548 | | 3.9 | % |

| | | | | | | | | | | | | | | | |

Net Income | | $ | 103,743 | | $ | 109,527 | | $ | 106,635 | | | | 100,491 | | 6.1 | % |

Depreciation and amortization | | | 137,847 | | | 137,847 | | | 137,847 | | | | 129,251 | | 6.7 | % |

Other adjustments(2) | | | 49,410 | | | 48,626 | | | 49,018 | | | | 33,464 | | 46.5 | % |

Adjusted EBITDA | | $ | 291,000 | | $ | 296,000 | | $ | 293,500 | | | | 263,206 | | 11.5 | % |

| | | | | | | | | | | | | | | | |

Guidance drivers: | | | | | | | | | | | | | | | | |

Annual rental churn rate | | | 6.0 | % | | 8.0 | % | | 7.0 | % | | | 5.5 | % | | |

Cash rent growth on data center renewals | | | 3.0 | % | | 5.0 | % | | 4.0 | % | | | 3.4 | % | | |

| | | | | | | | | | | | | | | | |

Capital expenditures: | | | | | | | | | | | | | | | | |

Data center expansion | | $ | 228,000 | | $ | 263,000 | | $ | 245,500 | | | $ | 144,410 | | | |

Non-recurring investments | | | 7,500 | | | 12,500 | | | 10,000 | | | | 11,664 | | | |

Tenant improvements | | | 2,000 | | | 7,000 | | | 4,500 | | | | 6,764 | | | |

Recurring capital expenditures | | | 12,500 | | | 17,500 | | | 15,000 | | | | 23,725 | | | |

Total capital expenditures | | $ | 250,000 | | $ | 300,000 | | $ | 275,000 | | | $ | 186,563 | | | |

| (1) | | Implied growth is based on the midpoint of 2018 guidance. |

| (2) | | Refer to the appendix for the adjustments made to net income to calculate adjusted EBITDA. |

The following assumptions are included in CoreSite’s 2018 guidance:

| 1. | | Interconnection revenue growth – CoreSite expects the 2018 growth rate to be between 11% and 14%, correlating to interconnection revenue in the range of $69-$71 million. |

| 2. | | Adjusted EBITDA margin – CoreSite’s guidance for adjusted EBITDA implies adjusted EBITDA margin of approximately 54.4% based on the midpoint of guidance, and revenue flow-through to adjusted EBITDA of approximately 52%. |

| 3. | | New accounting standards – CoreSite’s 2018 guidance of FFO per share reflects the company’s adoption of two new accounting standards – revenue recognition and lease accounting, which are cumulatively expected to reduce FFO per share by approximately $0.06, inclusive of the impact from accelerated straight-line rent expense. |

| 4. | | GAAP backlog – CoreSite’s projected annualized GAAP rent from signed but not yet commenced leases was $3.7 million as of March 31, 2018. CoreSite expects substantially all of the GAAP backlog to commence during the second quarter of 2018. |

| 5. | | Capitalized interest – CoreSite expects the percentage of interest capitalized in 2018 to be in the range of 12%-18%, slightly elevated compared to the 2017 level based on CoreSite’s expectations regarding its development pipeline. |

| 6. | | Commencements – CoreSite expects lease commencements of approximately $40 million in annualized GAAP rent in 2018. |

|

Quarter Ended March 31, 2018 |

Overview | Financial Statements | Operating Portfolio | Development | Capital Structure | Components of NAV | Guidance | Appendix | 23 |

Appendix

Definitions

This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other Real Estate Investment Trusts (“REITs”) and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, cash flows from operating, investing or financing activities as measures of profitability and/or liquidity, computed in accordance with GAAP.

Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental

operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. We use AFFO as a basis to address our ability to fund our dividend payments. AFFO is calculated by adding to or subtracting from FFO:

| 1. | | Plus: Amortization of deferred financing costs |

| 2. | | Plus: Non-cash compensation |

| 3. | | Plus: Non-real estate depreciation |

| 4. | | Plus: Impairment charges |

| 5. | | Plus: Below market debt amortization |

| 6. | | Plus: Original issuance costs associated with redeemed preferred stock |

| 7. | | Less: Straight line rents adjustment |

| 8. | | Less: Amortization of above and below market leases |

| 9. | | Less: Recurring capital expenditures |

| 10. | | Less: Tenant improvements |

| 11. | | Less: Capitalized leasing costs |

Capitalized leasing costs consist of commissions payable to third parties, including brokers, leasing agents, referral agents, and internal sales commissions payable to employees. Capitalized leasing costs are accrued and deducted from AFFO generally in the period the lease is executed. Leasing costs are generally paid a) to third party brokers and internal sales employees 50% at customer lease signing and 50% at lease commencement and b) to referral and leasing agents monthly over the lease term as and to the extent we receive payment from the end customer.

AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting for the effect of certain items noted above included in FFO. Other REITs widely report AFFO, however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs.

Annualized Rent