|

Quarter Ended March 31, 2020 |

Company Profile

Low-latency, secure and reliable access to Amazon, Microsoft, Google, Alibaba Cloud, Oracle and IBM from all eight key North American Markets.

| | | | | |

ONE DATA CENTER PROVIDER. EVERYTHING YOU NEED. |

|

| | |

CONNECTIVITY TO NETWORKS AND CLOUDS | | LOW LATENCY, EDGE MARKETS, GLOBAL REACH |

| | |

Connecting to cloud and network providers within the same data center campus can save thousands of dollars a month in networking and data egress fees while reducing latency • Optionality to connect to 775+ cloud, IT and network service providers as business needs evolve • 28,000+ interconnections • Peering and cloud exchanges • The CoreSite Interconnect GatewaySM allows customers to rapidly optimize application performance with a 100% managed solution • CoreSite’s Inter-Site Connectivity allows SDN connectivity between its markets, enabling access to its national ecosystem | | The closer a business is to end users, the easier it is to provide a high quality experience • 23 operating data centers in eight major metros that provide access to 75% of US businesses within 5 milliseconds • National footprint with international cloud and data center partnerships for multi-market requirements • Subsea cables for international reach |

HIGH GROWTH, HIGH-DENSITY SOLUTIONS | | THE BEST CUSTOMER EXPERIENCE |

| | |

Cloud connectivity is important, and so is the ability for a data center campus to grow as business evolves • The ability to cost-effectively scale from a single cabinet to a large-scale deployment • Data center campuses that connect our buildings via short-run dark fiber to a network/cloud dense campus ecosystem • Flexible and high-density solutions | | 450+ team dedicated to ensuring optimal data center performance and meeting the needs of our 1,350+ customers at all times of day • Consistent customer satisfaction demonstrated by customer expansion and retention • Dedicated move-in and service representatives, and in-house 24/7 data center operations personnel • 100% uptime Service Level Agreement with a minimum of six-nines portfolio uptime goal • Prepared to support and respond to our customers, employees, and communities during the COVID-19 pandemic |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 3 |

Summary of Financial Data

(in thousands, except per share, NRSF and MRR data)

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | For the period of | | Growth % | | Growth % |

Summary of Results | | Q1 2020 | | Q4 2019 | | Q1 2019 | | Q/Q | | Y/Y |

GAAP Financial Measures | | | | | | | | | | | | | | | |

Operating revenues | | $ | 147,362 | | $ | 146,035 | | $ | 138,895 | | 0.9 | % | | 6.1 | % |

Net income | | | 22,988 | | | 24,745 | | | 25,905 | | (7.1) | | | (11.3) | |

Net income attributable to common shares | | | 17,848 | | | 19,194 | | | 19,661 | | (7.0) | | | (9.2) | |

Net income per share attributable to common shares - diluted | | $ | 0.48 | | $ | 0.51 | | $ | 0.54 | | (5.9) | | | (11.1) | |

| | | | | | | | | | | | | | | |

REIT Financial Measures(1) | | | | | | | | | | | | | | | |

Funds from operations (FFO) to shares and units | | $ | 62,403 | | $ | 62,935 | | $ | 60,092 | | (0.8) | % | | 3.8 | % |

Adjusted funds from operations (AFFO) | | | 60,110 | | | 62,193 | | | 60,651 | | (3.4) | | | (0.9) | |

EBITDAre | | | 75,179 | | | 75,421 | | | 71,079 | | (0.3) | | | 5.8 | |

Adjusted EBITDA | | | 78,661 | | | 79,024 | | | 74,511 | | (0.5) | | | 5.6 | |

FFO per common share and OP unit - diluted | | $ | 1.29 | | $ | 1.30 | | $ | 1.25 | | (0.8) | | | 3.2 | |

| | | | | | | | | | | | | | | |

Other Financial Ratios | | | | | | | | | | | | | | | |

EBITDAre Margin | | | 51.0 | % | | 51.6 | % | | 51.2 | % | (60) | bps | | (20) | bps |

Adjusted EBITDA Margin | | | 53.4 | % | | 54.1 | % | | 53.6 | % | (70) | bps | | (20) | bps |

| | | | | | | | | | | | | | | | | |

| | As of | | |

| | Q1 2020 | | Q4 2019 | | Q3 2019 | | Q2 2019 | | Q1 2019 | | |

| | | | | | | | | | | | | | | | | |

Dividend Activity | | | | | | | | | | | | | | | | | |

Dividends declared per share and OP unit | | $ | 1.22 | | $ | 1.22 | | $ | 1.22 | | $ | 1.22 | | $ | 1.10 | | |

TTM FFO payout ratio | | | 95.2 | % | | 93.7 | % | | 92.1 | % | | 88.8 | % | | 84.9 | % | |

TTM AFFO payout ratio | | | 95.9 | % | | 93.2 | % | | 91.2 | % | | 88.6 | % | | 87.1 | % | |

| | | | | | | | | | | | | | | | | |

Operating Portfolio Statistics | | | | | | | | | | | | | | | | | |

Operating data center properties | | | 23 | | | 23 | | | 23 | | | 22 | | | 22 | | |

Stabilized data center NRSF | | | 2,482,660 | | | 2,406,512 | | | 2,335,962 | | | 2,277,668 | | | 2,320,538 | | |

Stabilized data center NRSF occupied | | | 2,183,751 | | | 2,179,854 | | | 2,110,574 | | | 2,078,752 | | | 2,128,820 | | |

Stabilized data center % occupied | | | 88.0 | % | | 90.6 | % | | 90.4 | % | | 91.3 | % | | 91.7 | % | |

| | | | | | | | | | | | | | | | | |

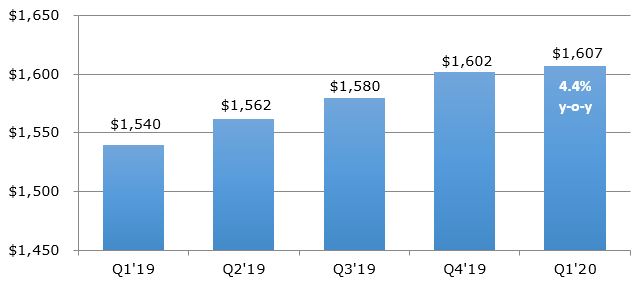

Turn-Key Data Center ("TKD") Same-Store Statistics | | | | | | | | | | | | | | | | | |

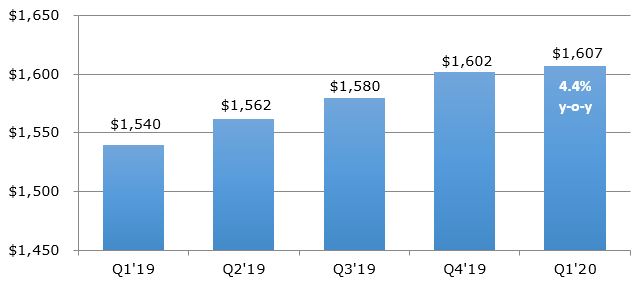

MRR per cabinet equivalent | | $ | 1,607 | | $ | 1,602 | | $ | 1,580 | | $ | 1,562 | | $ | 1,540 | | |

TKD NRSF % occupied | | | 83.4 | % | | 83.6 | % | | 83.3 | % | | 84.4 | % | | 84.4 | % | |

| | | | | | | | | | | | | | | | | |

Market Capitalization & Net Principal Debt | | | | | | | | | | | | | | | | | |

Total enterprise value | | $ | 7,218,678 | | $ | 6,919,211 | | $ | 7,287,403 | | $ | 6,895,883 | | $ | 6,401,725 | | |

Total net principal debt outstanding | | $ | 1,577,193 | | $ | 1,484,452 | | $ | 1,382,547 | | $ | 1,314,414 | | $ | 1,213,706 | | |

| | | | | | | | | | | | | | | | | |

Net Principal Debt to: | | | | | | | | | | | | | | | | | |

Annualized adjusted EBITDA | | | 5.0 | x | | 4.7 | x | | 4.4 | x | | 4.3 | x | | 4.1 | x | |

Annualized adjusted EBITDA, including GAAP backlog(2) | | | 4.7 | x | | 4.5 | x | | 4.1 | x | | 3.9 | x | | 4.0 | x | |

Enterprise value | | | 21.8 | % | | 21.5 | % | | 19.0 | % | | 19.1 | % | | 19.0 | % | |

| | | | | | | | | | | | | | | | | |

| (1) | | See reconciliations of non-GAAP measures on page 12 and a discussion of the non-GAAP disclosures in the Appendix. |

| (2) | | Backlog is the annualized rent for data center leases that were signed, but have not yet commenced during the quarter. Backlog for the quarter ended March 31, 2020, was $17.6 million on a GAAP basis and $22.3 million on a cash basis. |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 4 |

CoreSite Reports First Quarter 2020 Financial Results

-- Delivered $12.0 Million of New and Expansion Sales for Quarter --

-- Achieved Highest Core Retail Colocation Sales in Three and a Half Years --

-- Continued Progress on Capacity Development Pipeline --

DENVER, CO – April 30, 2020 – CoreSite Realty Corporation (NYSE:COR) (“the Company”), a premier provider of secure, reliable, high-performance data center, cloud access and interconnection solutions across the U.S., today announced financial results for the first quarter ended March 31, 2020.

Q1 2020 Quarterly Highlights

| o | | Grew operating revenues to $147.4 million, an increase of 6.1% year over year and 0.9% sequentially |

| o | | Delivered net income of $0.48 per common diluted share, a decrease of $0.06 year over year and $0.03 sequentially |

| o | | Generated Funds From Operations “FFO” of $1.29 per diluted share and unit, an increase of $0.04, or 3.2% year over year and a decrease of $0.01 sequentially, or 0.8% |

| o | | Commenced 112 new and expansion leases for 45,322 net rentable square feet (“NRSF”), representing $9.7 million of annualized GAAP rent, for an average rate of $214 per square foot |

| o | | Signed 117 new and expansion leases for 59,354 NRSF and $12.0 million of annualized GAAP rent, for an average rate of $202 per square foot |

| o | | Renewed 280 leases for 120,943 NRSF and $17.3 million of annualized GAAP rent, for an average rate of $143 per square foot, reflecting an increase of 1.4% in cash rent and 7.2% in GAAP rent, and 3.3% churn |

Q1 2020 Notable Events

| · | | Placed into service approximately 35,000 square feet at NY2, a data center expansion in New Jersey |

| · | | Pre-leased approximately 11% of SV8, Phase 3, a data center expansion in Santa Clara |

“We delivered strong sales, placed into service new data center capacity, advanced our two major ground up developments and other capacity projects, while continuing to deliver exceptional customer service,” said Paul Szurek, CoreSite’s President and Chief Executive Officer. “Our preparations over the years and agile responses enabled us to safely maintain operations in a challenging pandemic environment while continuing to support customer success. We turned up services quickly, solved for rapidly emerging customer needs, demonstrated the value and effectiveness of our remote capabilities for customers, and continued to meet their mission critical needs.

“We believe the strategic nature of our diverse, network-and-cloud-dense campuses, and the interoperability we enable for customers in major metropolitan areas, continues to position us well to benefit from the secular tailwinds for data center services which drive demand for powerful, scalable cloud and cloud adjacent solutions as well as network and content capacity.”

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 5 |

Sales Activity

CoreSite achieved new and expansion sales of $12.0 million of annualized GAAP rent for the quarter, driven primarily by expansions from existing customers.

“We delivered strong new and expansion sales in the first quarter, including ongoing growth in core retail colocation with sales of $8.4 million, about three quarters of which came from deployments of 1,000 to 5,000 square feet, and $3.6 million in scale leasing,” said Steve Smith, CoreSite’s Chief Revenue Officer. “Our sales included our highest core retail colocation sales in three and a half years, driven by the strength of our platform, including our network and cloud-dense data centers, ongoing traction with enterprises moving to high performance hybrid and multi cloud architectures, and our ability to anticipate and solve our customers’ business needs.”

Development Activity

CoreSite continues to execute on its property development pipeline. The Company advanced construction on its data center expansion and ground-up development projects, and is on track for completion of the construction projects noted below, assuming local jurisdictions are able to be timely with inspections and permits working under COVID-19 conditions.

During the first quarter, the Company completed and placed into service a computer room of approximately 35,000 NRSF at NY2, Phase 3 in New Jersey, supported by the existing power structure, while continuing an infrastructure power expansion supporting that and other future capacity at NY2.

| · | | Construction in Progress |

As of March 31, 2020, CoreSite had a total of approximately 161,000 NRSF of turn-key data center capacity under construction, as detailed below.

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Costs Incurred | | Estimated | | | | | |

| | | | | | | Estimated | | To-Date | | Total Costs | | | Percent | | |

| Market | | Building | | NRSF | | Completion | | (in millions) | | (in millions) | | | Leased | | |

| | | | | | | | | | | | | | | | | | | |

| Under Construction: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Data center expansion | | | | | | | | | | | | | | | | | | |

| New York - NY2 Power | | NY2, Phase 3 | | — | | | Q3 2020 | | $ | 19.4 | | $ | 38.8 | | | — | % | |

| San Francisco Bay | | SV8, Phase 3 | | 54,056 | | | Q2 2020 | | | 15.8 | | | 42.0 | | | 11.0 | | |

| Total data center expansion | | | | 54,056 | | | | | $ | 35.2 | | $ | 80.8 | | | 11.0 | % | |

| | | | | | | | | | | | | | | | | | | |

| New development | | | | | | | | | | | | | | | | | | |

| Chicago | | CH2, Phase 1 | | 56,000 | | | Q2 2020 | | $ | 106.3 | | $ | 120.0 | | | — | % | |

| Los Angeles | | LA3, Phase 1 | | 51,000 | | | Q3 / Q4 2020 | | | 68.9 | | | 134.0 | | | 74.3 | | |

| Total new development | | | | 107,000 | | | | | $ | 175.2 | | $ | 254.0 | | | 35.4 | % | |

| | | | | | | | | | | | | | | | | | | |

| Total under construction | | | | 161,056 | | | | | $ | 210.4 | | $ | 334.8 | | | 27.2 | % | |

| | | | | | | | | | | | | | | | | | | |

arch |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 6 |

| · | | CoreSite’s ongoing data center development and operational position includes – |

| o | | the ability to increase its occupied footprint of land and buildings, both owned or leased, by approximately 2.0 million NRSF, or about 92.3%, including space unoccupied, under construction, pre-construction or held for development, and |

| o | | owning (versus leasing) 92.4% of its current and developable 4.3 million data center NRSF, supporting operational control, expansion and long-term expense management |

Balance Sheet and Liquidity

The Company’s balance sheet remains strong, with a ratio of net principal debt to first quarter annualized adjusted EBITDA of 5.0 times. As of the end of the first quarter, CoreSite had $291.8 million of total liquidity, including $3.3 million of cash and $288.5 million of available capacity on its revolving credit facility. The Company’s liquidity will fully fund its 2020 data center expansion plans, including $124.4 million of remaining construction costs on its properties currently under development.

To capitalize on a market opportunity and reduce the variability to its near-term interest costs, the Company executed $450 million of interest rate swap agreements during the quarter at attractive rates. The Company increased its percentage of fixed rate debt from 71% as of December 31, 2019 to approximately 95% as of March 31.

Financing Subsequent Event

On April 15, the Company priced a 7-year $150 million unsecured private placement of notes, at an interest rate of 3.75%. The notes are scheduled to close on May 6th, with $100 million funding at closing and the remaining $50 million on July 14th. CoreSite plans to use the proceeds to repay outstanding amounts on its revolving credit facility and for general working capital. The private placement is subject to customary closing conditions. The Company does not have any debt maturities until April 2022. Pro forma for this transaction the Company’s total liquidity as of March 31, was $441.8 million.

2020 Guidance

CoreSite is maintaining its 2020 Guidance, which can be found in the Company’s first quarter 2020 Supplemental Earnings Information on page 23.

arch |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 7 |

Upcoming Conferences and Events

CoreSite’s management will participate virtually in the RBC Capital Markets Data Center & Connectivity Conference on May 27, and also participate virtually on June 2 and 3 in the Nareit ReitWeek 2020 Investor Conference.

Conference Call Details

CoreSite will host its first quarter 2020 earnings call on Thursday, April 30, 2020, at 12:00 p.m. (Eastern Time). The call will be accessible by dialing 1-877-407-3982 (domestic) or 1-201-493-6780 (international).

A replay will be available after the call until May 7, 2020, and can be accessed dialing 1-844-512-2921 (domestic) or 1-412-317-6671 (international). The passcode for the replay is 13701528.

The quarterly conference call also will be offered as a simultaneous webcast, accessible by visiting CoreSite.com and clicking on the “Investors” link. An on-line replay will be available for a limited time immediately following the call.

Concurrently with issuing its financial results, the Company will post its first quarter 2020 Supplemental Information on its website at CoreSite.com, under the “Investors” link.

About CoreSite

CoreSite Realty Corporation (NYSE:COR) delivers secure, reliable, high-performance data center and interconnection solutions to a growing customer ecosystem across eight key North American markets. More than 1,350 of the world’s leading enterprises, network operators, cloud providers, and supporting service providers choose CoreSite to connect, protect and optimize their performance-sensitive data, applications and computing workloads. Our scalable, flexible solutions and 450+ dedicated employees consistently deliver unmatched data center options — all of which leads to a best-in-class customer experience and lasting relationships. For more information, visit www.CoreSite.com.

CoreSite Contact

Carole Jorgensen

Vice President Investor Relations and Corporate Communications

303-405-1012

InvestorRelations@CoreSite.com

arch |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 8 |

Forward Looking Statements

This earnings release and accompanying supplemental information may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond CoreSite’s control that may cause actual results to differ significantly from those expressed in any forward-looking statement. These risks include, without limitation: the geographic concentration of the Company’s data centers in certain markets and any adverse developments in local economic conditions or the level of supply of or demand for data center space in these markets; fluctuations in interest rates and increased operating costs; difficulties in identifying properties to acquire and completing acquisitions; significant industry competition, including indirect competition from cloud service providers; failure to obtain necessary outside financing; the ability to service existing debt; the failure to qualify or maintain its status as a REIT; financial market fluctuations; changes in real estate and zoning laws and increases in real property tax rates; the effects on our business operations, demand for our services and general economic conditions resulting from the spread of the novel coronavirus (“COVID-19”) in our markets, as well as orders, directives and legislative action by local, state and federal governments in response to such spread of COVID-19; and other factors affecting the real estate industry generally. All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause the Company’s future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors” in its most recent annual report on Form 10-K, and other risks described in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission.

arch |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 9 |

Consolidated Balance Sheets

(in thousands, except per share data)

| | | | | | | |

| | March 31, | | December 31, | |

| | 2020 | | 2019 | |

Assets: | | | | | | | |

Investments in real estate: | | | | | | | |

Land | | $ | 94,593 | | $ | 94,593 | |

Buildings and improvements | | | 2,015,530 | | | 1,989,731 | |

| | | 2,110,123 | | | 2,084,324 | |

Less: Accumulated depreciation and amortization | | | (756,025) | | | (720,498) | |

Net investment in operating properties | | | 1,354,098 | | | 1,363,826 | |

Construction in progress | | | 437,794 | | | 394,474 | |

Net investments in real estate | | | 1,791,892 | | | 1,758,300 | |

Operating lease right-of-use assets, net | | | 175,999 | | | 172,976 | |

Cash and cash equivalents | | | 3,307 | | | 3,048 | |

Accounts and other receivables, net | | | 24,260 | | | 21,008 | |

Lease intangibles, net | | | 3,600 | | | 3,939 | |

Goodwill | | | 40,646 | | | 40,646 | |

Other assets, net | | | 104,555 | | | 101,082 | |

Total assets | | $ | 2,144,259 | | $ | 2,100,999 | |

| | | | | | | |

Liabilities and equity: | | | | | | | |

Liabilities | | | | | | | |

Debt, net | | $ | 1,572,007 | | $ | 1,478,402 | |

Operating lease liabilities | | | 190,759 | | | 187,443 | |

Accounts payable and accrued expenses | | | 102,148 | | | 123,304 | |

Accrued dividends and distributions | | | 61,637 | | | 62,332 | |

Acquired below-market lease contracts, net | | | 2,462 | | | 2,511 | |

Unearned revenue, prepaid rent and other liabilities | | | 50,798 | | | 33,119 | |

Total liabilities | | | 1,979,811 | | | 1,887,111 | |

| | | | | | | |

Stockholders' equity | | | | | | | |

Common stock, par value $0.01 | | | 374 | | | 373 | |

Additional paid-in capital | | | 516,133 | | | 512,324 | |

Accumulated other comprehensive loss | | | (19,158) | | | (6,026) | |

Distributions in excess of net income | | | (376,835) | | | (348,509) | |

Total stockholders' equity | | | 120,514 | | | 158,162 | |

Noncontrolling interests | | | 43,934 | | | 55,726 | |

Total equity | | | 164,448 | | | 213,888 | |

Total liabilities and equity | | $ | 2,144,259 | | $ | 2,100,999 | |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 10 |

Consolidated Statements of Operations

(in thousands, except per share data)

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2020 | | 2019 | | 2019 | |

Operating revenues: | | | | | | | | | | |

Data center revenue:(1) | | | | | | | | | | |

Rental, power, and related revenue | | $ | 124,505 | | $ | 123,597 | | $ | 117,853 | |

Interconnection revenue | | | 20,085 | | | 19,477 | | | 18,416 | |

Total data center revenue | | | 144,590 | | | 143,074 | | | 136,269 | |

Office, light-industrial and other revenue | | | 2,772 | | | 2,961 | | | 2,626 | |

Total operating revenues | | | 147,362 | | | 146,035 | | | 138,895 | |

| | | | | | | | | | |

Operating expenses: | | | | | | | | | | |

Property operating and maintenance | | | 40,183 | | | 39,865 | | | 38,110 | |

Real estate taxes and insurance | | | 6,190 | | | 5,709 | | | 6,196 | |

Depreciation and amortization | | | 40,991 | | | 39,737 | | | 35,646 | |

Sales and marketing | | | 6,144 | | | 5,527 | | | 5,652 | |

General and administrative | | | 11,267 | | | 10,641 | | | 10,170 | |

Rent | | | 8,399 | | | 8,872 | | | 7,688 | |

Total operating expenses | | | 113,174 | | | 110,351 | | | 103,462 | |

Operating income | | | 34,188 | | | 35,684 | | | 35,433 | |

Interest expense | | | (11,183) | | | (10,917) | | | (9,498) | |

Income before income taxes | | | 23,005 | | | 24,767 | | | 25,935 | |

Income tax expense | | | (17) | | | (22) | | | (30) | |

Net income | | | 22,988 | | | 24,745 | | | 25,905 | |

Net income attributable to noncontrolling interests | | | 5,140 | | | 5,551 | | | 6,244 | |

Net income attributable to common shares | | $ | 17,848 | | $ | 19,194 | | $ | 19,661 | |

| | | | | | | | | | |

Net income per share attributable to common shares: | | | | | | | | | | |

Basic | | $ | 0.48 | | $ | 0.51 | | $ | 0.54 | |

Diluted | | $ | 0.48 | | $ | 0.51 | | $ | 0.54 | |

| | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | |

Basic | | | 37,336 | | | 37,291 | | | 36,348 | |

Diluted | | | 37,504 | | | 37,489 | | | 36,547 | |

| (1) | | Below is a breakout of our contractual data center rental, power, and tenant reimbursements and other revenue: |

| | | | | | | | | | |

| | Three Months Ended | |

| | March 31, | | December 31, | | March 31, | |

| | 2020 | | 2019 | | 2019 | |

Rental revenue | | $ | 80,886 | | $ | 79,257 | | $ | 74,930 | |

Power revenue | | | 41,278 | | | 41,804 | | | 40,503 | |

Tenant reimbursement and other | | | 2,341 | | | 2,536 | | | 2,420 | |

Rental, power, and related revenue | | $ | 124,505 | | $ | 123,597 | | $ | 117,853 | |

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 11 |

Reconciliations of Net Income to FFO, AFFO, EBITDAre and Adjusted EBITDA

(in thousands, except per share data)

|

Reconciliation of Net Income to FFO |

| | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | | December 31, | | March 31, | | |

| | 2020 | | 2019 | | 2019 | | |

Net income | | $ | 22,988 | | $ | 24,745 | | $ | 25,905 | | |

Real estate depreciation and amortization | | | 39,415 | | | 38,190 | | | 34,187 | | |

FFO available to common shareholders and OP unit holders | | $ | 62,403 | | $ | 62,935 | | $ | 60,092 | | |

| | | | | | | | | | | |

Weighted average common shares outstanding - diluted | | | 37,504 | | | 37,489 | | | 36,547 | | |

Weighted average OP units outstanding - diluted | | | 10,796 | | | 10,797 | | | 11,600 | | |

Total weighted average shares and units outstanding - diluted | | | 48,300 | | | 48,286 | | | 48,147 | | |

| | | | | | | | | | | |

FFO per common share and OP unit - diluted | | $ | 1.29 | | $ | 1.30 | | $ | 1.25 | | |

|

Reconciliation of FFO to AFFO |

| | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | | December 31, | | March 31, | | |

| | 2020 | | 2019 | | 2019 | | |

FFO available to common shareholders and unit holders | | $ | 62,403 | | $ | 62,935 | | $ | 60,092 | | |

| | | | | | | | | | | |

Adjustments: | | | | | | | | | | | |

Amortization of deferred financing costs and hedge amortization | | | 1,029 | | | 970 | | | 611 | | |

Non-cash compensation | | | 3,482 | | | 3,603 | | | 3,432 | | |

Non-real estate depreciation | | | 1,576 | | | 1,547 | | | 1,459 | | |

Straight-line rent adjustment | | | (419) | | | 671 | | | 1,250 | | |

Amortization of above and below market leases | | | (34) | | | (35) | | | (86) | | |

Recurring capital expenditures | | | (1,418) | | | (3,468) | | | (2,243) | | |

Tenant improvements | | | (966) | | | (1,173) | | | (1,096) | | |

Capitalized leasing costs | | | (5,543) | | | (2,857) | | | (2,768) | | |

AFFO available to common shareholders and OP unit holders | | $ | 60,110 | | $ | 62,193 | | $ | 60,651 | | |

|

Reconciliation of Net Income to EBITDAre and Adjusted EBITDA |

| | | | | | | | | | | |

| | Three Months Ended | | |

| | March 31, | | December 31, | | March 31, | | |

| | 2020 | | 2019 | | 2019 | | |

Net income | | $ | 22,988 | | $ | 24,745 | | $ | 25,905 | | |

Adjustments: | | | | | | | | | | | |

Interest expense | | | 11,183 | | | 10,917 | | | 9,498 | | |

Income taxes | | | 17 | | | 22 | | | 30 | | |

Depreciation and amortization | | | 40,991 | | | 39,737 | | | 35,646 | | |

EBITDAre | | $ | 75,179 | | $ | 75,421 | | $ | 71,079 | | |

Non-cash compensation | | | 3,482 | | | 3,603 | | | 3,432 | | |

Transaction costs / litigation | | | — | | | — | | | — | | |

Adjusted EBITDA | | $ | 78,661 | | $ | 79,024 | | $ | 74,511 | | |

For additional discussion of these non-GAAP measures, see the Appendix starting on page 24.

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 12 |

Operating Properties

| | | | | | | | | | | | | | | | | | | | | | |

| | Data Center Operating NRSF | | | | | | | |

| | Annualized | | Stabilized | | Pre-Stabilized | | Total | | | | Held for | | | |

| | Rent | | | | Percent | | | | Percent | | | | Percent | | NRSF Under | | Development | | | |

Market / Facilities | | ($000)(1) | | Total | | Occupied(2) | | Total | | Occupied(2) | | Total | | Occupied(2) | | Construction | | NRSF | | Total NRSF | |

| | | | | | | | | | | | | | | | | | | | | | |

San Francisco Bay | | | | | | | | | | | | | | | | | | | | | | |

SV1 | | $ | 6,034 | | 88,251 | | 76.2 | % | — | | — | % | 88,251 | | 76.2 | % | — | | — | | 88,251 | |

SV2 | | | 3,919 | | 76,676 | | 48.2 | | — | | — | | 76,676 | | 48.2 | | — | | — | | 76,676 | |

Santa Clara campus (SV3 - SV9) | | | 94,989 | | 723,181 | | 96.6 | | — | | — | | 723,181 | | 96.6 | | 54,056 | | 200,000 | | 977,237 | |

San Francisco Bay Total | | | 104,942 | | 888,108 | | 90.4 | | — | | — | | 888,108 | | 90.4 | | 54,056 | | 200,000 | | 1,142,164 | |

| | | | | | | | | | | | | | | | | | | | | | |

Los Angeles | | | | | | | | | | | | | | | | | | | | | | |

One Wilshire campus | | | | | | | | | | | | | | | | | | | | | | |

LA1* | | | 31,683 | | 145,776 | | 94.0 | | 17,238 | | 31.6 | | 163,014 | | 87.4 | | — | | 10,352 | | 173,366 | |

LA2 | | | 52,428 | | 424,890 | | 86.4 | | — | | — | | 424,890 | | 86.4 | | — | | — | | 424,890 | |

LA3 | | | — | | — | | — | | — | | — | | — | | — | | 51,000 | | 109,000 | | 160,000 | |

LA4* | | | 1,188 | | 21,850 | | 92.6 | | — | | — | | 21,850 | | 92.6 | | — | | — | | 21,850 | |

Los Angeles Total | | | 85,299 | | 592,516 | | 88.5 | | 17,238 | | 31.6 | | 609,754 | | 86.9 | | 51,000 | | 119,352 | | 780,106 | |

| | | | | | | | | | | | | | | | | | | | | | |

Northern Virginia | | | | | | | | | | | | | | | | | | | | | | |

VA1 | | | 25,938 | | 201,719 | | 80.8 | | — | | — | | 201,719 | | 80.8 | | — | | — | | 201,719 | |

VA2 | | | 22,738 | | 188,446 | | 99.6 | | — | | — | | 188,446 | | 99.6 | | — | | — | | 188,446 | |

VA3 | | | 4,877 | | 79,171 | | 89.2 | | 51,233 | | 16.3 | | 130,404 | | 60.6 | | — | | — | | 130,404 | |

DC1* | | | 3,042 | | 22,137 | | 74.9 | | — | | — | | 22,137 | | 74.9 | | — | | — | | 22,137 | |

DC2* | | | 2,308 | | 9,810 | | 100.0 | | 14,753 | | 7.8 | | 24,563 | | 44.6 | | — | | — | | 24,563 | |

Reston Campus Expansion(3) | | | — | | — | | — | | — | | — | | — | | — | | — | | 809,742 | | 809,742 | |

Northern Virginia Total | | | 58,903 | | 501,283 | | 89.3 | | 65,986 | | 14.4 | | 567,269 | | 80.6 | | — | | 809,742 | | 1,377,011 | |

| | | | | | | | | | | | | | | | | | | | | | |

New York | | | | | | | | | | | | | | | | | | | | | | |

NY1* | | | 6,059 | | 48,404 | | 91.0 | | — | | — | | 48,404 | | 91.0 | | — | | — | | 48,404 | |

NY2 | | | 17,596 | | 101,742 | | 93.0 | | 52,710 | | 23.6 | | 154,452 | | 69.3 | | — | | 81,799 | | 236,251 | |

New York Total | | | 23,655 | | 150,146 | | 92.4 | | 52,710 | | 23.6 | | 202,856 | | 74.5 | | — | | 81,799 | | 284,655 | |

| | | | | | | | | | | | | | | | | | | | | | |

Boston | | | | | | | | | | | | | | | | | | | | | | |

BO1 | | | 15,560 | | 122,730 | | 75.1 | | 19,961 | | — | | 142,691 | | 64.6 | | — | | 110,985 | | 253,676 | |

| | | | | | | | | | | | | | | | | | | | | | |

Chicago | | | | | | | | | | | | | | | | | | | | | | |

CH1 | | | 14,951 | | 178,407 | | 80.2 | | — | | — | | 178,407 | | 80.2 | | — | | — | | 178,407 | |

CH2 | | | — | | — | | — | | — | | — | | — | | — | | 56,000 | | 113,000 | | 169,000 | |

Chicago Total | | | 14,951 | | 178,407 | | 80.2 | | — | | — | | 178,407 | | 80.2 | | 56,000 | | 113,000 | | 347,407 | |

| | | | | | | | | | | | | | | | | | | | | | |

Denver | | | | | | | | | | | | | | | | | | | | | | |

DE1* | | | 4,417 | | 14,154 | | 89.4 | | 15,630 | | 40.2 | | 29,784 | | 63.6 | | — | | — | | 29,784 | |

DE2* | | | 476 | | 5,140 | | 74.0 | | — | | — | | 5,140 | | 74.0 | | — | | — | | 5,140 | |

Denver Total | | | 4,893 | | 19,294 | | 85.3 | | 15,630 | | 40.2 | | 34,924 | | 65.1 | | — | | — | | 34,924 | |

| | | | | | | | | | | | | | | | | | | | | | |

Miami | | | | | | | | | | | | | | | | | | | | | | |

MI1 | | | 1,579 | | 30,176 | | 62.0 | | — | | — | | 30,176 | | 62.0 | | — | | 13,154 | | 43,330 | |

Total Data Center Facilities | | $ | 309,782 | | 2,482,660 | | 88.0 | % | 171,525 | | 19.6 | % | 2,654,185 | | 83.5 | % | 161,056 | | 1,448,032 | | 4,263,273 | |

| | | | | | | | | | | | | | | | | | | | | | |

Office & Light-Industrial | | | 8,483 | | 364,941 | | 76.6 | | — | | — | | 364,941 | | 76.7 | | — | | — | | 364,941 | |

Reston Office & Light-Industrial(3) | | | 1,029 | | 69,470 | | 100.0 | | — | | — | | 69,470 | | 100.0 | | — | | (69,470) | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Portfolio | | $ | 319,294 | | 2,917,071 | | 86.8 | % | 171,525 | | 19.6 | % | 3,088,596 | | 83.1 | % | 161,056 | | 1,378,562 | | 4,628,214 | |

* Indicates properties in which we hold a leasehold interest.

| (1) | | On a gross basis, our total portfolio annualized rent was approximately $324.8 million as of March 31, 2020, which includes $5.5 million in operating expense reimbursements under modified gross and triple-net leases. |

| (2) | | Includes customer leases that have commenced as of March 31, 2020. If all leases signed during the current and prior periods had commenced, the percent occupied would have been as follows: |

| | | | | | | |

Percent Leased | | Stabilized | | Pre-Stabilized | | Total | |

Total Data Center Facilities | | 89.4 | % | 24.3 | % | 85.2 | % |

Total Portfolio | | 88.2 | % | 24.3 | % | 84.6 | % |

| (3) | | Included within our Reston Campus Expansion held for development space is 69,470 NRSF which is currently operating as office and light-industrial space. |

See Appendix for definitions.

|

Quarter Ended March 31, 2020 |

| | | | | | | | |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 13 |

Leasing Statistics

|

Data Center Leasing Activity |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | GAAP | | | | | GAAP | | Cash | | | | | |

| | Leasing | | Number | | Annualized | | Total | | | Annualized | | Rental | | Cash | | GAAP | |

| | Activity | | of | | Rent | | Leased | | | Rent per | | Churn | | Rent | | Rent | |

| | Period | | Leases(1) | | ($000) | | NRSF | | | Leased NRSF | | Rate | | Growth | | Growth | |

| | | | | | | | | | | | | | | | | | | | |

New / expansion leases commenced | | Q1 2020 | | 112 | | $ | 9,678 | | 45,322 | | | $ | 214 | | | | | | | |

| | Q4 2019 | | 130 | | | 16,613 | | 86,187 | | | | 193 | | | | | | | |

| | Q3 2019 | | 130 | | | 15,660 | | 78,244 | | | | 200 | | | | | | | |

| | Q2 2019 | | 140 | | | 10,248 | (2) | 65,193 | | | | 176 | (2) | | | | | | |

| | Q1 2019 | | 119 | | | 5,826 | | 24,040 | | | | 242 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

New / expansion leases signed | | Q1 2020 | | 117 | | $ | 12,006 | | 59,354 | | | $ | 202 | | | | | | | |

| | Q4 2019 | | 129 | | | 6,642 | | 30,770 | | | | 216 | | | | | | | |

| | Q3 2019 | | 122 | | | 14,424 | | 73,144 | | | | 197 | | | | | | | |

| | Q2 2019 | | 135 | | | 27,291 | | 142,824 | | | | 191 | | | | | | | |

| | Q1 2019 | | 121 | | | 6,622 | | 31,975 | | | | 207 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Renewal leases signed | | Q1 2020 | | 280 | | $ | 17,334 | | 120,943 | | | $ | 143 | | 3.3 | % | 1.4 | % | 7.2 | % |

| | Q4 2019 | | 323 | | | 21,921 | | 151,057 | | | | 145 | | 2.9 | | (0.8) | | 0.1 | |

| | Q3 2019 | | 299 | | | 20,365 | | 123,445 | | | | 165 | | 3.1 | | (2.2) | | 4.2 | |

| | Q2 2019 | | 328 | | | 24,102 | | 121,809 | | | | 198 | | 2.4 | | 2.6 | | 7.4 | |

| | Q1 2019 | | 264 | | | 11,873 | | 68,605 | | | | 173 | | 2.7 | | 3.2 | | 5.9 | |

| (1) | | Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

| (2) | | During Q2 2019, a customer’s lease for reserved expansion space commenced. The contractual reservation payment was included in a prior quarter’s GAAP annualized rent. As such, it is excluded from the Q2 GAAP annualized rent; however, the rent per leased NRSF includes the reservation payment. |

|

New / Expansion Leases Signed by Deployment Size by Period |

| | | | | | | | | | | | | | | | |

| | | Q1 2020 | | Q4 2019 | | Q3 2019 | | Q2 2019 | | Q1 2019 |

GAAP Annualized Rent ($000) | | | | | | | | | | | | | | | | |

Core Retail Colocation | | | | | | | | | | | | | | | | |

< 1,000 NRSF | | | $ | 2,040 | | $ | 2,532 | | $ | 2,509 | | $ | 2,943 | | $ | 3,921 |

1,000 - 5,000 NRSF | | | | 6,374 | | | 4,110 | | | 2,064 | | | 2,376 | | | 2,701 |

Total Core Retail Colocation | | | $ | 8,414 | | $ | 6,642 | | $ | 4,573 | | $ | 5,319 | | $ | 6,622 |

Scale Colocation | | | | | | | | | | | | | | | | |

> 5,000 NRSF | | | | 3,592 | | | — | | | 9,851 | | | 21,972 | | | — |

Total GAAP Annualized Rent | | | $ | 12,006 | | $ | 6,642 | | $ | 14,424 | | $ | 27,291 | | $ | 6,622 |

| |

MRR per Cabinet Equivalent Billed (TKD Occupied Same-Store)(1) |

| (1) | | During the first quarter of 2020, we updated the same-store turn-key data center pool to include all space available for lease that existed as turn-key data center space as of December 31, 2018. The MRR per Cabinet Equivalent for all periods reported was updated to reflect the new same-store pool. |

|

Quarter Ended March 31, 2020 |

| | | | | | | | |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 14 |

Leasing Statistics

|

Lease Distribution (total portfolio, including total data center and office and light-industrial “OLI”) |

| | | | | | | | | | | | | | |

| | | | | | Total | | Percentage | | | | | Percentage | |

| | Number | | Percentage | | Operating | | of Total | | Annualized | | of Total | |

| | of | | of All | | NRSF of | | Operating | | Rent | | Annualized | |

NRSF Under Lease | | Leases | | Leases | | Leases | | NRSF | | ($000) | | Rent | |

Unoccupied data center | | — | | — | % | 436,741 | | 14.1 | % | $ | — | | — | % |

Unoccupied OLI | | — | | — | | 85,342 | | 2.8 | | | — | | — | |

Data center NRSF: | | | | | | | | | | | | | | |

5,000 or less | | 2,329 | | 91.4 | | 819,254 | | 26.5 | | | 135,650 | | 42.4 | |

5,001 - 10,000 | | 39 | | 1.5 | | 267,834 | | 8.7 | | | 42,946 | | 13.5 | |

10,001 - 25,000 | | 20 | | 0.8 | | 320,853 | | 10.4 | | | 47,839 | | 15.0 | |

Greater than 25,000 | | 8 | | 0.3 | | 386,777 | | 12.5 | | | 66,798 | | 20.9 | |

Powered shell | | 17 | | 0.7 | | 422,726 | | 13.7 | | | 16,549 | | 5.2 | |

OLI | | 135 | | 5.3 | | 349,069 | | 11.3 | | | 9,512 | | 3.0 | |

Portfolio Total | | 2,548 | | 100.0 | % | 3,088,596 | | 100.0 | % | $ | 319,294 | | 100.0 | % |

|

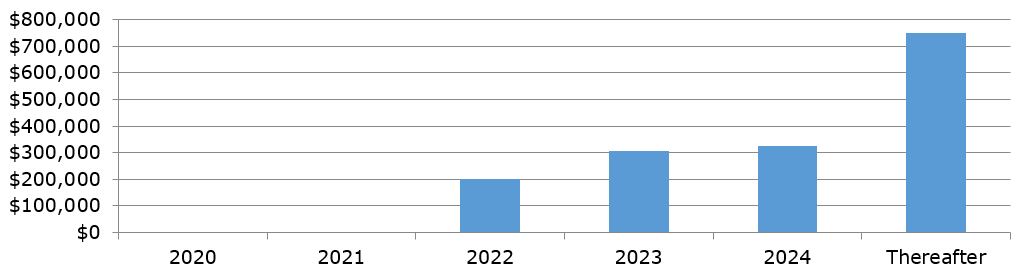

Lease Expirations (total portfolio, including total data center and office and light-industrial “OLI”) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | Total | | | | | | | | | | | | | Annualized | |

| | Number | | Operating | | Percentage | | | | | Percentage | | Annualized | | Annualized | | Rent Per | |

| | of | | NRSF of | | of Total | | Annualized | | of Total | | Rent Per | | Rent at | | Leased | |

| | Leases | | Expiring | | Operating | | Rent | | Annualized | | Leased | | Expiration | | NRSF at | |

Year of Lease Expiration | | Expiring(1) | | Leases | | NRSF | | ($000) | | Rent | | NRSF | | ($000)(2) | | Expiration | |

Unoccupied data center | | — | | 436,741 | | 14.1 | % | $ | — | | — | % | $ | — | | $ | — | | $ | — | |

Unoccupied OLI | | — | | 85,342 | | 2.8 | | | — | | — | | | — | | | — | | | — | |

2020 | | 984 | | 497,764 | | 16.1 | | | 77,036 | | 24.1 | | | 155 | | | 77,428 | | | 156 | |

2021 | | 843 | | 413,255 | | 13.4 | | | 65,547 | | 20.5 | | | 159 | | | 67,344 | | | 163 | |

2022 | | 343 | | 336,352 | | 10.9 | | | 51,045 | | 16.0 | | | 152 | | | 52,431 | | | 156 | |

2023 | | 113 | | 234,302 | | 7.6 | | | 32,956 | | 10.3 | | | 141 | | | 34,672 | | | 148 | |

2024 | | 80 | | 113,573 | | 3.7 | | | 14,896 | | 4.7 | | | 131 | | | 16,693 | | | 147 | |

2025-Thereafter | | 50 | | 622,198 | | 20.1 | | | 68,302 | | 21.4 | | | 110 | | | 83,309 | | | 134 | |

OLI (3) | | 135 | | 349,069 | | 11.3 | | | 9,512 | | 3.0 | | | 27 | | | 10,084 | | | 29 | |

Portfolio Total / Weighted Average | | 2,548 | | 3,088,596 | | 100.0 | % | $ | 319,294 | | 100.0 | % | $ | 124 | | $ | 341,961 | | $ | 133 | |

| (1) | | Includes leases that upon expiration will automatically be renewed, primarily on a year-to-year basis. Number of leases represents each agreement with a customer; a lease agreement could include multiple spaces and a customer could have multiple leases. |

| (2) | | Represents the final monthly contractual rent under existing customer leases as of March 31, 2020, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and excludes power revenue, interconnection revenue and operating expense reimbursement. Leases expiring during 2020 include annualized rent of $12.4 million associated with lease terms currently on a month-to-month basis. |

| (3) | | The office and light-industrial leases are scheduled to expire as follows: |

| | | | | | |

| | NRSF of | | Annualized | |

| | Expiring | | Rent | |

Year | | Leases | | ($000) | |

2020 | | 32,026 | | $ | 998 | |

2021 | | 44,799 | | | 1,499 | |

2022 | | 65,890 | | | 1,326 | |

2023 | | 140,829 | | | 3,954 | |

2024 | | 9,190 | | | 218 | |

2025 - Thereafter | | 56,337 | | | 1,517 | |

Total OLI | | 349,069 | | $ | 9,512 | |

|

Quarter Ended March 31, 2020 |

| | | | | | | | |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 15 |

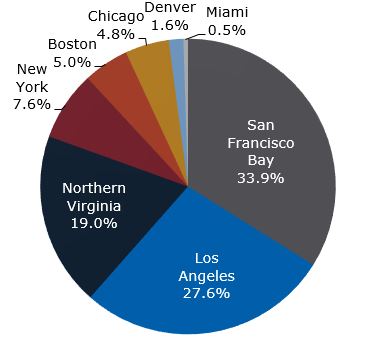

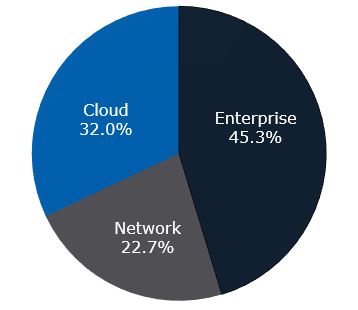

Geographic and Vertical Diversification

|

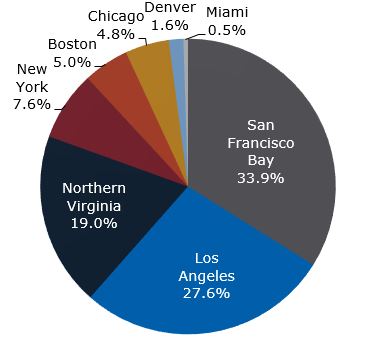

Geographical Diversification |

| | | | | |

| | | | Percentage of Total Data |

| Metropolitan Market | | Center Annualized Rent |

| San Francisco Bay | | 33.9 | % |

| Los Angeles | | 27.6 | |

| Northern Virginia | | 19.0 | |

| New York | | 7.6 | |

| Boston | | 5.0 | |

| Chicago | | 4.8 | |

| Denver | | 1.6 | |

| Miami | | 0.5 | |

| Total | | 100.0 | % |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| | | | |

| | | |

| | | | |

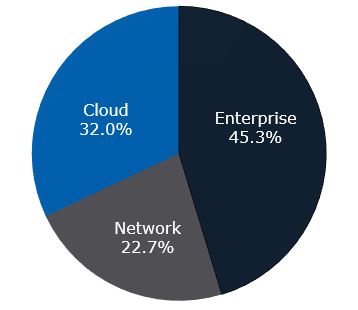

| | | Percentage of Total Data |

| Vertical | | Center Annualized Rent |

| Enterprise | | 45.3 | % |

| Cloud | | 32.0 | |

| Network | | 22.7 | |

| Total | | 100.0 | % |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

Quarter Ended March 31, 2020 |

| | | | | | | | |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 16 |

10 Largest Customers

|

10 Largest Customers (total portfolio, including data center and office and light-industrial “OLI”) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Weighted | |

| | | | | | | | Percentage | | | | | Percentage | | Average | |

| | | | Number | | Total | | of Total | | Annualized | | of Total | | Remaining | |

| | | | of | | Occupied | | Operating | | Rent | | Annualized | | Lease Term in | |

| CoreSite Vertical | Customer Industry | | Locations | | NRSF | | NRSF(1) | | ($000) | | Rent(2) | | Months(3) | |

1 | Cloud | Public Cloud | | 9 | | 204,734 | | 6.6 | % | $ | 40,405 | | 12.7 | % | 92 | |

2 | Cloud | Public Cloud | | 11 | | 305,446 | | 9.9 | | | 18,312 | | 5.7 | | 55 | |

3 | Enterprise | Digital Content | | 6 | | 119,447 | | 3.9 | | | 17,812 | | 5.6 | | 34 | |

4 | Enterprise(4) | Travel / Hospitality | | 2 | | 72,286 | | 2.3 | | | 15,077 | | 4.7 | | 12 | |

5 | Cloud | Public Cloud | | 3 | | 118,691 | | 3.8 | | | 13,419 | | 4.2 | | 44 | |

6 | Enterprise | SI & MSP | | 3 | | 62,268 | | 2.0 | | | 9,271 | | 2.9 | | 3 | |

7 | Network | Global Service Provider | | 8 | | 32,694 | | 1.1 | | | 6,662 | | 2.1 | | 25 | |

8 | Network | US National Service Provider | | 16 | | 42,905 | | 1.4 | | | 5,246 | | 1.7 | | 39 | |

9 | Enterprise | SI & MSP | | 1 | | 17,709 | | 0.6 | | | 4,627 | | 1.4 | | 23 | |

10 | Enterprise | Colocation / Reseller | | 5 | | 35,397 | | 1.1 | | | 4,590 | | 1.4 | | 5 | |

| Total / Weighted Average | | | | | 1,011,577 | | 32.7 | % | $ | 135,421 | | 42.4 | % | 49 | |

| (1) | | Represents the customer’s total occupied square feet divided by the total operating NRSF in the portfolio as of March 31, 2020. |

| (2) | | Represents the customer’s total annualized rent divided by the total annualized rent in the portfolio as of March 31, 2020. |

| (3) | | Weighted average based on percentage of total annualized rent expiring calculated as of March 31, 2020. |

| (4) | | This customer has $8.3 million of annualized rent expiring in Q4 2020, and $6.7 million of annualized rent expiring in Q4 2021, which will not be renewed. |

|

Quarter Ended March 31, 2020 |

| | | | | | | | |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 17 |

Capital Expenditures and Completed

Pre-Stabilized Projects

(in thousands, except NRSF and cost per NRSF data)

|

Capital Expenditures and Repairs and Maintenance |

| | | | | | | | | | | | | | | |

| | Three Months Ended |

| | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| | 2020 | | 2019 | | 2019 | | 2019 | | 2019 |

Data center expansion(1) | | $ | 66,578 | | $ | 96,820 | | $ | 77,325 | | $ | 106,253 | | $ | 102,363 |

Non-recurring investments(2) | | | 909 | | | 2,106 | | | 1,701 | | | 1,248 | | | 1,374 |

Tenant improvements | | | 966 | | | 1,173 | | | 1,001 | | | 997 | | | 1,096 |

Recurring capital expenditures(3) | | | 1,418 | | | 3,468 | | | 2,365 | | | (672) | | | 2,243 |

Total capital expenditures | | $ | 69,871 | | $ | 103,567 | | $ | 82,392 | | $ | 107,826 | | $ | 107,076 |

| | | | | | | | | | | | | | | |

Repairs and maintenance expense(4) | | $ | 3,880 | | $ | 3,634 | | $ | 3,059 | | $ | 3,196 | | $ | 3,532 |

| (1) | | Data center expansion capital expenditures include new data center construction, development projects adding capacity to existing data centers and other revenue generating investments. Data center expansion also includes investment of Deferred Expansion Capital. During the quarter ended June 30, 2019, we incurred $26 million to acquire SV9. |

| (2) | | Non-recurring investments include upgrades to existing data center or office space and company-wide improvements that are ancillary to revenue generation, such as internal system development for on-premises IT infrastructure and system-wide security upgrades, which have a future economic benefit. |

| (3) | | Recurring capital expenditures include required equipment upgrades within our operating portfolio, which have a future economic benefit. The three months ended June 30, 2019, included and, therefore, was reduced due to a $1.7 million energy efficiency rebate received from the power utility related to the replacement of our chiller plant at LA2. |

| (4) | | Repairs and maintenance expense is classified within property operating and maintenance expense in the consolidated statements of operations. These expenditures represent recurring maintenance contracts and repairs to operating equipment necessary to maintain current operations. |

|

Completed Pre-Stabilized Projects |

| | | | | | | | | | | | | | | | | |

| | Metropolitan | | | | | | | | | Cost Per | | Percent | | Percent | |

Projects / Facilities | | Market | | Completion | | NRSF | | Cost(1) | | NRSF | | Leased(2) | | Occupied | |

DE1 | | Denver | | Q2 2018 | | 15,630 | | $ | 7,581 | | $ | 485 | | 41.6 | % | 40.2 | % |

NY2 | | New York | | Q2 2018 | | 18,121 | | | 13,407 | | | 740 | | 68.6 | | 68.6 | |

DC2(3) | | Northern Virginia | | Q4 2018 | | 14,753 | | | 12,921 | | | 876 | | 7.8 | | 7.8 | |

LA1 | | Los Angeles | | Q2 2019 | | 17,238 | | | 11,635 | | | 675 | | 32.6 | | 31.6 | |

VA3 Phase 1B | | Northern Virginia | | Q2 2019 | | 51,233 | | | 53,393 | | | 1,042 | | 28.6 | | 16.3 | |

BO1 | | Boston | | Q4 2019 | | 19,961 | | | 7,124 | | | 357 | | — | | — | |

NY2 | | New York | | Q1 2020 | | 34,589 | | | 16,476 | | | 476 | | 3.8 | | — | |

Total completed pre-stabilized | | | | | | 171,525 | | $ | 122,537 | | $ | 714 | | 24.3 | % | 19.6 | % |

| (1) | | Cost includes capital expenditures related to the specific project / phase and, for NY2 and VA3 Phase 1B projects, also includes allocations of capital expenditures related to land, building shell, and infrastructure that were incurred at the beginning of the overall project. |

| (2) | | Includes customer leases that have been signed as of March 31, 2020, but have not commenced. The percent leased is determined based on leased NRSF as a proportion of total pre-stabilized NRSF. |

| (3) | | During Q1 2020, one computer room of 9,810 NRSF at DC2, which was placed into service in Q4 2018, moved from pre-stabilized to stabilized on the operating properties tables because it was 100% occupied. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 18 |

Development Summary

|

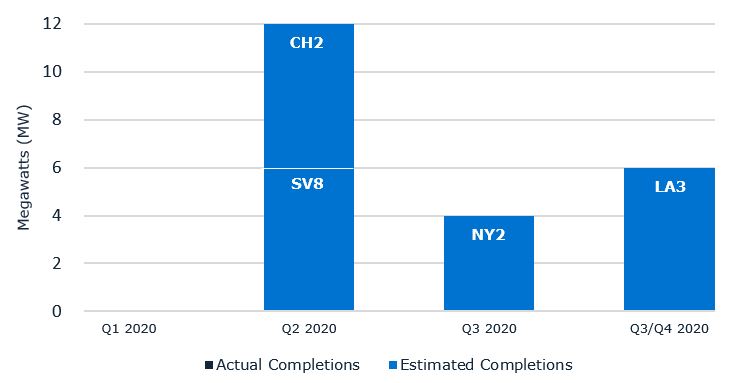

Development Completion Timeline |

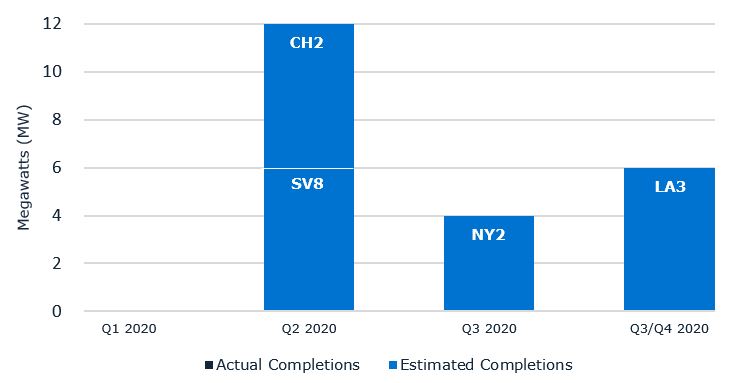

The following chart sets forth the estimated development timeline of megawatts planned to be completed and placed into service in 2020 and the actual megawatts placed into service during Q1 2020:

(in thousands, except NRSF and power data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Under Construction | | Held for Development | | Total |

| | | | | | Costs | | | | | | Estimated | | Estimated |

| | Estimated | | | | Incurred | | Estimated | | Percent | | Power | | | | | | Power | | | | | |

Projects/Facilities | | Completion | | NRSF | | To- Date | | Total | | Leased | | (MW) | | NRSF | | Total Cost | | (MW) | | NRSF | | | Cost |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Data center expansion | | | | | | | | | | | | | | | | | | | | | | | | |

BO1 | | — | | — | | $ | — | | $ | — | | — | % | — | | 110,985 | | $ | 71,200 | | 9.0 | | 110,985 | | $ | 71,200 |

LA1 | | — | | — | | | — | | | — | | — | | — | | 10,352 | | | 1,250 | | 0.5 | | 10,352 | | | 1,250 |

MI1 | | — | | — | | | — | | | — | | — | | — | | 13,154 | | | 7,500 | | 1.0 | | 13,154 | | | 7,500 |

NY2 | | | | | | | | | | | | | | | | | | | | | | | | | | |

Phase 3 - Power Infrastructure | (1) | Q3 2020 | | — | | | 19,396 | | | 38,824 | | — | | 4.0 | | — | | | — | | — | | — | | | 38,824 |

Phase 4 | | — | | — | | | — | | | — | | — | | — | | 46,699 | | | 14,000 | | 5.0 | | 46,699 | | | 14,000 |

Phase 5 | | — | | — | | | — | | | — | | — | | — | | 35,100 | | | 28,000 | | 4.0 | | 35,100 | | | 28,000 |

SV8 | | | | | | | | | | | | | | | | | | | | | | | | | | |

Phase 3 | | Q2 2020 | | 54,056 | | | 15,751 | | | 42,000 | | 11.0 | | 6.0 | | — | | | — | | — | | 54,056 | | | 42,000 |

VA3 | | | | | | | | | | | | | | | | | | | | | | | | | | |

Phase 1C | | — | | — | | | — | | | — | | — | | — | | 49,316 | | | 30,000 | | 6.0 | | 49,316 | | | 30,000 |

Total data center expansion | | 54,056 | | $ | 35,147 | | $ | 80,824 | | 11.0 | % | 10.0 | | 265,606 | | $ | 151,950 | | 25.5 | | 319,662 | | $ | 232,774 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

New development | | | | | | | | | | | | | | | | | | | | | | | | |

Ground-up construction | | | | | | | | | | | | | | | | | | | | | | | | | | |

CH2 Phase 1 | | Q2 2020 | | 56,000 | | $ | 106,319 | | $ | 120,000 | | — | % | 6.0 | | 113,000 | | $ | 80,000 | | 12.0 | | 169,000 | | $ | 200,000 |

LA3 Phase 1 | | Q3 / Q4 2020 | | 51,000 | | | 68,935 | | | 134,000 | | 74.3 | | 6.0 | | 109,000 | | | 72,000 | | 12.0 | | 160,000 | | | 206,000 |

Reston Campus Expansion | | | | | | | | | | | | | | | | | | | | | | | | | | |

Future Phases | | — | | — | | | — | | | — | | — | | — | | 760,426 | | | 815,000 | | 90.0 | | 760,426 | | | 815,000 |

Pre-construction | | | | | | | | | | | | | | | | | | | | | | | | | | |

SV9 | | — | | — | | | — | | | — | | — | | — | | 200,000 | | | 300,000 | | 24.0 | | 200,000 | | | 300,000 |

Total new development | | 107,000 | | $ | 175,254 | | $ | 254,000 | | 35.4 | % | 12.0 | | 1,182,426 | | $ | 1,267,000 | | 138.0 | | 1,289,426 | | $ | 1,521,000 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total development(2)(3) | | 161,056 | | $ | 210,401 | | $ | 334,824 | | 27.2 | % | 22.0 | | 1,448,032 | | $ | 1,418,950 | | 163.5 | | 1,609,088 | | $ | 1,753,774 |

| (1) | | In order to meet customer demand and deploy capital efficiently, the NY2 Phase 3 development project was separated into two projects, including (1) a 34,589 NRSF computer room, which was placed into service in Q1 2020 (refer to the Completed Pre-Stabilized Project table on Page 18), which can be supported with existing building power infrastructure, and (2) a 4MW power infrastructure project expected to be completed in Q3 2020, which will ultimately support the 34,589 NRSF computer room as we lease the space and customers utilize the power and future computer rooms. |

| (2) | | In addition to new development and incremental capacity in existing core and shell buildings, we have land adjacent to our NY2 facility, in the form of an existing parking lot. By utilizing this land, we believe we can build approximately 100,000 NRSF of data center capacity in Secaucus, New Jersey, upon receipt of necessary entitlements. |

| (3) | | We have an estimated $29.5 million in deferred expansion capital under construction at multiple properties as of March 31, 2020, of which $9.6 million has been incurred to-date. We estimate approximately $35 million of additional deferred expansion capital may be required in the future to support existing or anticipated future customer utilization. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 19 |

Market Capitalization and Debt Summary

(in thousands, except per share data)

| | | | | | | | | |

| | Shares or | | | | | | |

| | Equivalents | | Market Price as of | | Market Value | |

| | Outstanding | | March 31, 2020 | | Equivalents | |

Common shares | | 37,906 | | $ | 115.90 | | $ | 4,393,298 | |

Operating partnership units | | 10,770 | | | 115.90 | | | 1,248,187 | |

Total equity | | | | | | | | 5,641,485 | |

Total net principal debt outstanding(1) | | | | | | | | 1,577,193 | |

Total enterprise value | | | | | | | $ | 7,218,678 | |

| | | | | | | | | |

Net principal debt to enterprise value | | | | | | | | 21.8 | % |

| (1) | | Net principal debt outstanding includes total principal debt outstanding net of $3.3 million of cash and cash equivalents. |

| | | | | | | | | | | |

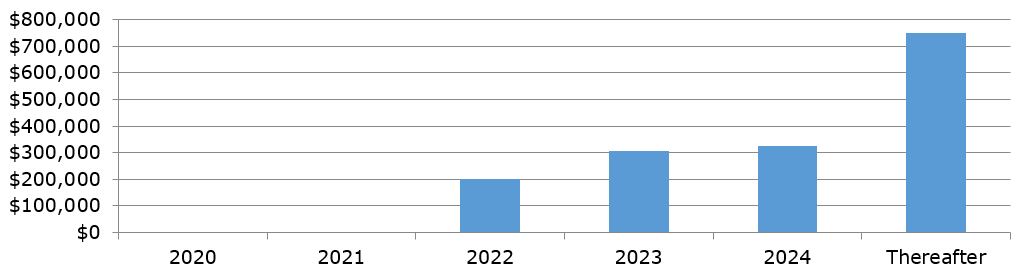

| | | | | | Outstanding as of: | |

| | | | Maturity | | March 31, | | December 31, | |

Instrument | | Rate(2) | | Date(3) | | 2020 | | 2019 | |

Revolving credit facility | | 2.45 | % | 11/8/2023 | | $ | 155,500 | | $ | 62,500 | |

2022 Senior unsecured term loan | | 1.76 | | 4/19/2022 | | | 200,000 | | | 200,000 | |

2023 Senior unsecured notes | | 4.19 | | 6/15/2023 | | | 150,000 | | | 150,000 | |

2024 Senior unsecured term loan | | 2.86 | | 4/19/2024 | | | 150,000 | | | 150,000 | |

2024 Senior unsecured notes | | 3.91 | | 4/20/2024 | | | 175,000 | | | 175,000 | |

2025 Senior unsecured term loan | | 2.32 | | 4/1/2025 | | | 350,000 | | | 350,000 | |

2026 Senior unsecured notes | | 4.52 | | 4/17/2026 | | | 200,000 | | | 200,000 | |

2029 Senior unsecured notes | | 4.31 | | 4/17/2029 | | | 200,000 | | | 200,000 | |

Total principal debt outstanding | | | | | | | 1,580,500 | | | 1,487,500 | |

Unamortized deferred financing costs | | | | | | | (8,493) | | | (9,098) | |

Total debt | | | | | | $ | 1,572,007 | | $ | 1,478,402 | |

Weighted average interest rate | | 3.20 | % | | | | | | | | |

| | | | | | | | | | | |

Floating rate vs. fixed rate debt | | | | | | | 5% / 95% | | | 29% / 71% | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| (1) | | See the filed Form 10-K and 10-Q for information on specific debt instruments. |

| (2) | | The interest rates above reflect the impacts of interest rate swap agreements. |

| (3) | | The revolving credit facility contains a one-time extension option, which, if exercised, would extend the maturity date to November 2024. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 20 |

Interest Summary and Debt Covenants

(in thousands)

|

Interest Expense Components |

| | | | | | | | | | |

| | Three Months Ended |

| | March 31, | | December 31, | | March 31, | |

| | 2020 | | 2019 | | 2019 | |

Interest expense and fees | | $ | 13,620 | | $ | 13,630 | | $ | 11,516 | |

Amortization of deferred financing costs and hedge amortization | | | 1,029 | | | 970 | | | 611 | |

Capitalized interest | | | (3,466) | | | (3,683) | | | (2,629) | |

Total interest expense | | $ | 11,183 | | $ | 10,917 | | $ | 9,498 | |

| | | | | | | | | | |

Percent capitalized | | | 23.7 | % | | 25.2 | % | | 21.7 | % |

| | | | | | | | | | | | | | | | | | |

| | Revolving Credit Facility and Senior Unsecured Term Loans and Notes | |

| | | | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | |

| | Required Compliance | | 2020 | | 2019 | | 2019 | | 2019 | | 2019 | |

| | | | | | | | | | | | | | | | | | |

Fixed charge coverage ratio | | Greater than 1.50x | | | 5.8 | x | | 5.9 | x | | 5.9 | x | | 6.1 | x | | 6.6 | x |

Total indebtedness to gross asset value | | Less than 60% | | | 31.2 | % | | 29.0 | % | | 29.3 | % | | 27.4 | % | | 26.3 | % |

Secured debt to gross asset value | | Less than 40% | | | — | % | | — | % | | — | % | | — | % | | — | % |

| | | | | | | | | | | | | | | | | | |

Revolving credit facility availability | | | | $ | 450,000 | | $ | 450,000 | | $ | 450,000 | | $ | 450,000 | | $ | 450,000 | |

Borrowings outstanding | | | | | (155,500) | | | (62,500) | | | (62,250) | | | (67,250) | | | (291,000) | |

Outstanding letters of credit | | | | | (6,053) | | | (4,879) | | | (4,879) | | | (4,879) | | | (4,879) | |

Current availability | | | | $ | 288,447 | | $ | 382,621 | | $ | 382,871 | | $ | 377,871 | | $ | 154,121 | |

| | | | | | | | | | | | | | | | | | |

Cash | | | | | 3,307 | | | 3,048 | | | 4,703 | | | 2,836 | | | 2,294 | |

Current liquidity | | | | $ | 291,754 | | $ | 385,669 | | $ | 387,574 | | $ | 380,707 | | $ | 156,415 | |

| | | | | | | | | | | | | | | | | | |

Subsequent debt financing(1) | | | | | 150,000 | | | - | | | - | | | 75,000 | | | 325,000 | |

Pro forma liquidity | | | | $ | 441,754 | | $ | 385,669 | | $ | 387,574 | | $ | 455,707 | | $ | 481,415 | |

| | | | | | | | | | | | | | | | | | |

| (1) | | On April 15, 2020 the Company priced a 7-year $150 million unsecured private placement of notes, at an interest rate of 3.75%. The notes are scheduled to close on May 6, 2020 and are reflected within our pro forma liquidity as of March 31, 2020. During April 2019, we issued $325 million of senior notes, and during July 2019, we issued $75 million of senior notes, which are also reflected within pro forma liquidity as of March 31, 2019, and June 30, 2019, respectively. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 21 |

Components of Net Asset Value (NAV)

(in thousands)

|

Cash Net Operating Income |

| | | | | | |

Reconciliation of Net Operating Income (NOI) | | Q1 2020 | | Annualized |

Operating Income | | $ | 34,188 | | $ | 136,752 |

Adjustments: | | | | | | |

Depreciation and amortization | | | 40,991 | | | 163,964 |

General and administrative | | | 11,267 | | | 45,068 |

Net Operating Income | | $ | 86,446 | | $ | 345,784 |

| | | | | | |

Cash Net Operating Income (Cash NOI) | | | | | | |

Net Operating Income | | $ | 86,446 | | $ | 345,784 |

Adjustments: | | | | | | |

Straight-line rent | | | (419) | | | (1,674) |

Amortization of above and below-market leases | | | (34) | | | (136) |

Cash NOI | | $ | 85,993 | | $ | 343,974 |

| | | | | | |

Cash NOI with cash backlog (84.6% leased)(1) | | $ | 89,517 | | $ | 358,066 |

Cash stabilized NOI (93% leased) | | $ | 98,405 | | $ | 393,620 |

| | | | | | |

Data Center Projects Under Construction | | | | | | |

TKD construction in progress(2) | | $ | 210,401 | | | |

Remaining spend(2) | | | 124,423 | | | |

Total | | $ | 334,824 | | | |

| | | | | | |

Targeted stabilized annual yields | | | 12 - 16 | % | | |

Annualized pro forma NOI range | | $ | 40,200 - 54,000 | | | |

| | | | | | |

|

Other Assets and Liabilities |

| | | | | | |

Other Assets | | | | | | |

Remaining construction in progress(3) | | $ | 227,393 | | | |

Cash and cash equivalents | | | 3,307 | | | |

Accounts and other receivables | | | 24,260 | | | |

Other tangible assets | | | 33,770 | | | |

Total other assets | | $ | 288,730 | | | |

| | | | | | |

Liabilities | | | | | | |

Principal debt | | $ | 1,580,500 | | | |

Accounts payable, accrued expenses and other liabilities | | | 152,946 | | | |

Accrued dividends and distributions | | | 61,637 | | | |

Total liabilities | | $ | 1,795,083 | | | |

| | | | | | |

Weighted average common shares and units - diluted | | | 48,300 | | | |

| (1) | | Cash NOI with backlog includes cash backlog as of March 31, 2020, less any leasing of currently occupied NRSF and data center projects under development. |

| (2) | | Does not include spend associated with leasing commissions. See page 19 for further breakdown of data center projects under construction. |

| (3) | | Represents the book value of in-progress capital projects, including land and shell building, of future data center expansion, non-recurring investments, tenant improvements and recurring capital expenditures. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 22 |

2020 Guidance

(in thousands, except per share data)

The annual guidance provided below represents forward-looking projections, which are based on current economic conditions, internal assumptions about our existing customer base and the supply and demand dynamics of the markets in which we operate. Please refer to the press release for additional information on forward-looking statements.

| | | | | | | | | | | | | | | | |

| | | | | 2020 | | | | | | | | | Implied | |

| | Low | | High | | Mid | | | 2019 | | Growth(1) | |

Net income attributable to common diluted shares | | $ | 1.74 | | $ | 1.84 | | $ | 1.79 | | | $ | 2.05 | | (12.7) | % |

Real estate depreciation and amortization | | | 3.36 | | | 3.36 | | | 3.36 | | | | 3.05 | | | |

FFO per common share and OP unit - diluted | | $ | 5.10 | | $ | 5.20 | | $ | 5.15 | | | $ | 5.10 | | 1.0 | % |

| | | | | | | | | | | | | | | | |

Projected operating results: | | | | | | | | | | | | | | | | |

Total operating revenues | | $ | 600,000 | | $ | 610,000 | | $ | 605,000 | | | $ | 572,727 | | 5.6 | % |

Interconnection revenues | | | 80,000 | | | 86,000 | | | 83,000 | | | | 75,751 | | 9.6 | |

General and administrative expenses | | | 44,000 | | | 48,000 | | | 46,000 | | | | 43,764 | | 5.1 | |

Property taxes and insurance | | | 26,000 | | | 28,000 | | | 27,000 | | | | 22,866 | | 18.1 | |

| | | | | | | | | | | | | | | | |

Net Income | | $ | 84,000 | | $ | 89,000 | | $ | 86,500 | | | $ | 99,037 | | (12.7) | % |

Depreciation and amortization | | | 169,000 | | | 169,000 | | | 169,000 | | | | 152,925 | | 10.5 | |

Other adjustments(2) | | | 65,000 | | | 66,000 | | | 65,500 | | | | 56,170 | | 16.6 | |

Adjusted EBITDA | | $ | 318,000 | | $ | 324,000 | | $ | 321,000 | | | $ | 308,132 | | 4.2 | % |

| | | | | | | | | | | | | | | | |

Guidance drivers: | | | | | | | | | | | | | | | | |

Annual rental churn rate | | | 9.0 | % | | 11.0 | % | | 10.0 | % | | | 11.1 | % | | |

Cash rent growth on data center renewals | | | — | % | | 2.0 | % | | 1.0 | % | | | 0.4 | % | | |

Capitalized interest | | | 20.0 | % | | 25.0 | % | | 22.5 | % | | | 24.7 | % | | |

Sales and marketing expense as a percentage of revenue | | | 3.9 | % | | 4.1 | % | | 4.0 | % | | | 3.9 | % | | |

| | | | | | | | | | | | | | | | |

Capital expenditures: | | | | | | | | | | | | | | | | |

Data center expansion | | $ | 215,000 | | $ | 250,000 | | $ | 232,500 | | | $ | 382,761 | | | |

Non-recurring investments | | | 2,500 | | | 7,500 | | | 5,000 | | | | 6,429 | | | |

Tenant improvements | | | 2,500 | | | 7,500 | | | 5,000 | | | | 4,267 | | | |

Recurring capital expenditures | | | 5,000 | | | 10,000 | | | 7,500 | | | | 7,404 | | | |

Total capital expenditures | | $ | 225,000 | | $ | 275,000 | | $ | 250,000 | | | $ | 400,861 | | | |

| (1) | | Implied growth is based on the midpoint of 2020 guidance. |

| (2) | | Refer to the appendix for the adjustments made to net income to calculate adjusted EBITDA. |

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 23 |

Appendix

Definitions

This document includes certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other Real Estate Investment Trusts (“REITs”) and therefore may not be comparable. The non-GAAP measures should not be considered an alternative to net income as an indicator of our performance and should be considered only a supplement to net income, cash flows from operating, investing or financing activities as measures of profitability and/or liquidity, computed in accordance with GAAP.

Adjusted Funds From Operations “AFFO” is a non-GAAP measure that is used as a supplemental

operating measure specifically for comparing year over year ability to fund dividend distribution from operating activities. We use AFFO as a basis to address our ability to fund our dividend payments. AFFO is calculated by adding to or subtracting from FFO:

| 1. | | Plus: Amortization of deferred financing costs and hedge amortization |

| 2. | | Plus: Non-cash compensation |

| 3. | | Plus: Non-real estate depreciation |

| 4. | | Plus: Impairment charges |

| 5. | | Plus: Below market debt amortization |

| 6. | | Plus: Original issuance costs associated with redeemed preferred stock |

| 7. | | Plus / Less: Net straight line rent adjustments (lessor revenue and lessee expense) |

| 8. | | Plus / Less: Net amortization of above and below market leases |

| 9. | | Less: Recurring capital expenditures |

| 10. | | Less: Tenant improvements |

| 11. | | Less: Capitalized leasing costs |

Capitalized leasing costs consist of commissions payable to third parties, including brokers, leasing agents, referral agents, and internal sales commissions payable to employees. Capitalized leasing costs are accrued and deducted from AFFO generally in the period the lease is executed. Leasing costs are generally paid a) to third party brokers and internal sales employees 50% at customer lease signing and 50% at lease commencement and b) to referral and leasing agents monthly over the lease term as and to the extent we receive payment from the end customer.

AFFO is not intended to represent cash flow from operations for the period, and is only intended to provide an additional measure of performance by adjusting for the effect of certain items noted above included in FFO. Other REITs widely report AFFO, however, other REITs may use different methodologies for calculating AFFO and, accordingly, our AFFO may not be comparable to other REITs.

Annualized Rent

Monthly contractual rent under existing commenced customer leases as of quarter-end, multiplied by 12. This amount reflects total annualized base rent before any one-time or non-recurring rent abatements and excludes power revenue, interconnection revenue and operating expense reimbursement.

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 24 |

Appendix

Data Center Leasing Metrics

| · | | Cash Rental Churn Rate – represents data center leases which are not renewed or are terminated during the period. Rental churn is calculated based on the annualized cash rent of data center expired leases terminated in the period, compared with total data center annualized rent at the beginning of the period. |

| · | | Cash and GAAP Rent Growth – represents the change in rental rates on renewed data center leases signed during the period, as compared with the previous rental rates for the same space. Cash and GAAP rent growth are calculated based on annualized rent from the renewed data center lease compared to annualized rent from the expired data center lease. |

Data Center Net Rentable Square Feet (“NRSF”)

Both occupied and available data center NRSF includes a factor based on management’s estimate of space to account for a customer’s proportionate share of required data center support space (such as the mechanical, telecommunications and utility rooms) and building common areas, which may be updated on a periodic basis to reflect the most current build-out of our properties.

Deferred Expansion Capital

As we construct data center capacity, we work to optimize both the amount of the capital we deploy on power and cooling infrastructure and the timing of that capital deployment; as such, we generally construct our power and cooling infrastructure supporting our data center NRSF based on our estimate of customer utilization. This practice can result in our investment at a later time in Deferred Expansion Capital. We define Deferred Expansion Capital as our estimate of the incremental capital we may invest in the future to add power or cooling infrastructure to support existing or anticipated future customer utilization of NRSF within our operating data centers. From time to time, we may revise our estimate of Deferred Expansion Capital as well as the potential time period during which we may invest it. See the Development Summary for more detail.

Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) and Adjusted EBITDA

EBITDAre is calculated in accordance with the standards established by the National Association of Real Estate Investment Trusts (“Nareit”). EBITDAre is defined as earnings before interest, taxes, depreciation and amortization, gains or losses from the sale of depreciated property, and impairment of depreciated property. We calculate adjusted EBITDA by adding our non-cash compensation expense, transaction costs from unsuccessful deals and business combinations and litigation expense to EBITDAre as well as adjusting for the impact of other impairment charges, gains or losses from sales of undepreciated land and gains or losses on early extinguishment of debt. Management uses EBITDAre and adjusted EBITDA as indicators of our ability to incur and service debt. In addition, we consider EBITDAre and adjusted EBITDA to be appropriate supplemental measures of our performance because they eliminate depreciation and interest, which permits investors to view income from operations without the impact of non-cash depreciation or the cost of debt. However, because EBITDAre and adjusted EBITDA are calculated before recurring cash charges including interest expense and taxes, and are not adjusted for capital expenditures or other recurring cash requirements of our business, their utilization as a cash flow measurement is limited.

|

Quarter Ended March 31, 2020 |

Overview | Financial

Statements | Operating

Portfolio | Development | Capital

Structure | Components

of NAV | Guidance | Appendix | 25 |

Appendix

Funds From Operations (“FFO”) is a supplemental measure of our performance which should be considered

along with, but not as an alternative to, net income and cash provided by operating activities as a measure of operating performance. We calculate FFO in accordance with the standards established by Nareit. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and undepreciated land and impairment write-downs of depreciable real estate, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures.

Our management uses FFO as a supplemental performance measure because, by excluding real estate related depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs.

We offer this measure because we recognize that investors use FFO as a basis to compare our operating performance with that of other REITs. However, the utility of FFO as a measure of our performance is limited because FFO excludes depreciation and amortization and captures neither the changes in the value of our properties that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our properties, all of which have real economic effect and could materially impact our financial condition and results from operations. FFO is a non-GAAP measure and should not be considered a measure of liquidity, an alternative to net income, cash provided by operating activities or any other performance measure determined in accordance with GAAP, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. In addition, our calculations of FFO are not necessarily comparable to FFO as calculated by other REITs that do not use the same definition or implementation guidelines or interpret the standards differently from us. Investors in our securities should not rely on these measures as a substitute for any GAAP measure, including net income.

GAAP Annualized Rent