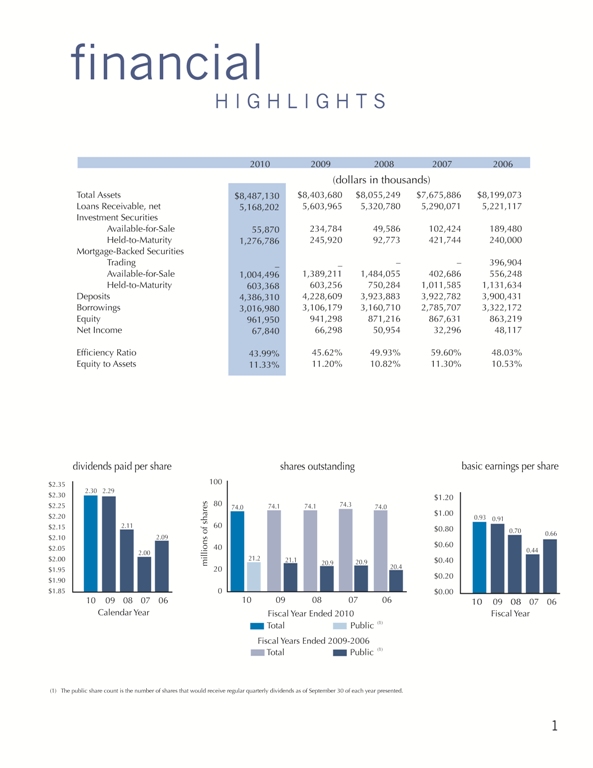

SELECTED CONSOLIDATED FINANCIAL DATA

The summary information presented below under "Selected Balance Sheet Data" and "Selected Operations Data" for, and as of the end of, each of the years ended September 30 is derived from our audited consolidated financial statements. The following information is only a summary and you should read it in conjunction with our consolidated financial statements and notes beginning on page 44.

| | | September 30, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | (Dollars in thousands, except per share amounts) | |

| Selected Balance Sheet Data: | | | | | | | | | | | | | | | |

| Total assets | | $ | 8,487,130 | | | $ | 8,403,680 | | | $ | 8,055,249 | | | $ | 7,675,886 | | | $ | 8,199,073 | |

| Loans receivable, net | | | 5,168,202 | | | | 5,603,965 | | | | 5,320,780 | | | | 5,290,071 | | | | 5,221,117 | |

| Investment securities: | | | | | | | | | | | | | | | | | | | | |

| Available-for-sale (“AFS”) | | | 55,870 | | | | 234,784 | | | | 49,586 | | | | 102,424 | | | | 189,480 | |

| Held-to-maturity (“HTM”) | | | 1,276,786 | | | | 245,920 | | | | 92,773 | | | | 421,744 | | | | 240,000 | |

| Mortgage-backed securities (“MBS”): | | | | | | | | | | | | | | | | | | | | |

| Trading | | | -- | | | | -- | | | | -- | | | | -- | | | | 396,904 | |

| AFS | | | 1,004,496 | | | | 1,389,211 | | | | 1,484,055 | | | | 402,686 | | | | 556,248 | |

| HTM | | | 603,368 | | | | 603,256 | | | | 750,284 | | | | 1,011,585 | | | | 1,131,634 | |

| Capital stock of Federal Home Loan Bank (“FHLB”) | | | 120,866 | | | | 133,064 | | | | 124,406 | | | | 139,661 | | | | 165,130 | |

| Deposits | | | 4,386,310 | | | | 4,228,609 | | | | 3,923,883 | | | | 3,922,782 | | | | 3,900,431 | |

| Advances from FHLB | | | 2,348,371 | | | | 2,392,570 | | | | 2,447,129 | | | | 2,732,183 | | | | 3,268,705 | |

| Other borrowings | | | 668,609 | | | | 713,609 | | | | 713,581 | | | | 53,524 | | | | 53,467 | |

| Stockholders’ equity | | | 961,950 | | | | 941,298 | | | | 871,216 | | | | 867,631 | | | | 863,219 | |

| Book value per share | | | 13.11 | | | | 12.85 | | | | 11.93 | | | | 11.88 | | | | 11.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended September 30, | |

| | | | 2010 | | | | 2009 | | | | 2008 | | | | 2007 | | | | 2006 | |

| | | (Dollars and counts in thousands, except per share amounts) | |

| Selected Operations Data: | | | | | | | | | | | | | | | | | | | | |

| Total interest and dividend income | | $ | 374,051 | | | $ | 412,786 | | | $ | 410,806 | | | $ | 411,550 | | | $ | 410,928 | |

| Total interest expense | | | 204,486 | | | | 236,144 | | | | 276,638 | | | | 305,110 | | | | 283,905 | |

| Net interest income | | | 169,565 | | | | 176,642 | | | | 134,168 | | | | 106,440 | | | | 127,023 | |

| Provision (recovery) for loan losses | | | 8,881 | | | | 6,391 | | | | 2,051 | | | | (225 | ) | | | 247 | |

| Net interest income after provision | | | | | | | | | | | | | | | | | | | | |

| (recovery) for loan losses | | | 160,684 | | | | 170,251 | | | | 132,117 | | | | 106,665 | | | | 126,776 | |

| Retail fees and charges | | | 17,789 | | | | 18,023 | | | | 17,805 | | | | 16,120 | | | | 17,007 | |

| Other income | | | 16,622 | | | | 10,571 | | | | 12,222 | | | | 7,846 | | | | 7,788 | |

| Total other income | | | 34,411 | | | | 28,594 | | | | 30,027 | | | | 23,966 | | | | 24,795 | |

| Total other expenses | | | 89,730 | | | | 93,621 | | | | 81,989 | | | | 77,725 | | | | 72,868 | |

| Income before income tax expense | | | 105,365 | | | | 105,224 | | | | 80,155 | | | | 52,906 | | | | 78,703 | |

| Income tax expense | | | 37,525 | | | | 38,926 | | | | 29,201 | | | | 20,610 | | | | 30,586 | |

| Net income | | | 67,840 | | | | 66,298 | | | | 50,954 | | | | 32,296 | | | | 48,117 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic earnings per share | | $ | 0.93 | | | $ | 0.91 | | | $ | 0.70 | | | $ | 0.44 | | | $ | 0.66 | |

| Average shares outstanding | | | 73,270 | | | | 73,144 | | | | 72,939 | | | | 72,849 | | | | 72,595 | |

| Diluted earnings per share | | $ | 0.93 | | | $ | 0.91 | | | $ | 0.70 | | | $ | 0.44 | | | $ | 0.66 | |

| Average diluted shares outstanding | | | 73,287 | | | | 73,208 | | | | 73,013 | | | | 72,970 | | | | 72,854 | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Selected Performance and Financial Ratios | | | | | | | | | | | | | | | |

| and Other Data: | | | | | | | | | | | | | | | |

| Performance Ratios: | | | | | | | | | | | | | | | |

| Return on average assets | | | 0.80 | % | | | 0.81 | % | | | 0.65 | % | | | 0.41 | % | | | 0.58 | % |

| Return on average equity | | | 7.09 | | | | 7.27 | | | | 5.86 | | | | 3.72 | | | | 5.58 | |

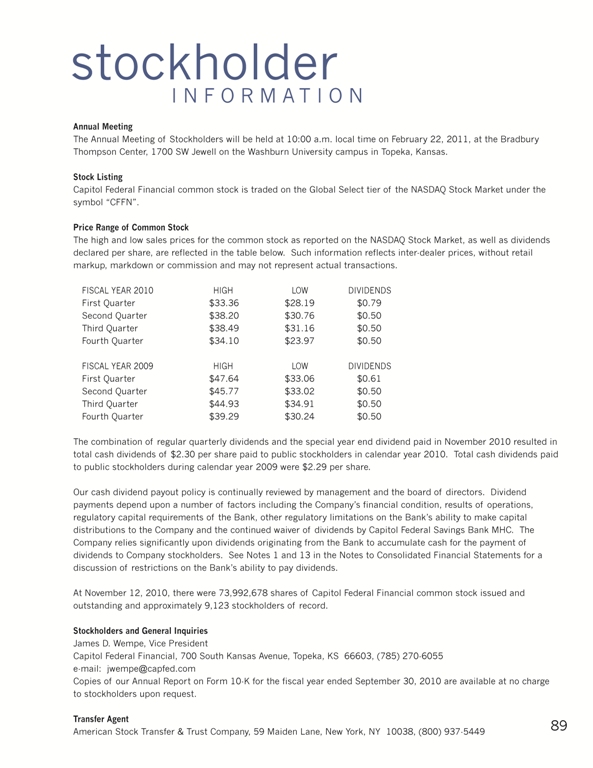

Dividends paid per public share (1) | | $ | 2.29 | | | $ | 2.11 | | | $ | 2.00 | | | $ | 2.09 | | | $ | 2.30 | |

| Dividend payout ratio | | | 71.34 | % | | | 66.47 | % | | | 81.30 | % | | | 133.14 | % | | | 97.41 | % |

| Ratio of operating expense to | | | | | | | | | | | | | | | | | | | | |

| average total assets | | | 1.06 | | | | 1.14 | | | | 1.04 | | | | 0.98 | | | | 0.88 | |

| Efficiency ratio | | | 43.99 | | | | 45.62 | | | | 49.93 | | | | 59.60 | | | | 48.03 | |

| Ratio of average interest-earning assets | | | | | | | | | | | | | | | | | | | | |

| to average interest-bearing liabilities | | | 1.11 | x | | | 1.12 | x | | | 1.12 | x | | | 1.12 | x | | | 1.11 | x |

| Interest rate spread information: | | | | | | | | | | | | | | | | | | | | |

| Average during period | | | 1.78 | % | | | 1.86 | % | | | 1.35 | % | | | 0.93 | % | | | 1.19 | % |

| End of period | | | 1.76 | | | | 1.89 | | | | 1.70 | | | | 0.89 | | | | 1.07 | |

| Net interest margin | | | 2.06 | | | | 2.20 | | | | 1.75 | | | | 1.36 | | | | 1.57 | |

| Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

| Non-performing assets to total assets | | | 0.49 | | | | 0.46 | | | | 0.23 | | | | 0.12 | | | | 0.10 | |

| Non-performing loans to total loans | | | 0.62 | | | | 0.55 | | | | 0.26 | | | | 0.14 | | | | 0.11 | |

| Allowance for loan losses to | | | | | | | | | | | | | | | | | | | | |

| non-performing loans | | | 46.60 | | | | 32.83 | | | | 42.37 | | | | 56.87 | | | | 79.03 | |

| Allowance for loan losses to | | | | | | | | | | | | | | | | | | | | |

| loans receivable, net | | | 0.29 | | | | 0.18 | | | | 0.11 | | | | 0.08 | | | | 0.08 | |

| Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

| Equity to total assets at end of period | | | 11.33 | | | | 11.20 | | | | 10.82 | | | | 11.30 | | | | 10.53 | |

| Average equity to average assets | | | 11.30 | | | | 11.08 | | | | 11.05 | | | | 10.91 | | | | 10.47 | |

| | | | | | | | | | | | | | | | | | | | | |

| Regulatory Capital Ratios of Bank: | | | | | | | | | | | | | | | | | | | | |

| Tangible equity | | | 9.8 | | | | 10.0 | | | | 10.0 | | | | 10.3 | | | | 9.5 | |

| Tier 1 (core) capital | | | 9.8 | | | | 10.0 | | | | 10.0 | | | | 10.3 | | | | 9.5 | |

| Tier I risk-based capital | | | 23.5 | | | | 23.2 | | | | 23.1 | | | | 22.9 | | | | 22.6 | |

| Total risk-based capital | | | 23.8 | | | | 23.3 | | | | 23.0 | | | | 22.8 | | | | 22.5 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Data: | | | | | | | | | | | | | | | | | | | | |

| Number of traditional offices | | | 35 | | | | 33 | | | | 30 | | | | 29 | | | | 29 | |

| Number of in-store offices | | | 11 | | | | 9 | | | | 9 | | | | 9 | | | | 9 | |

(1) For all years shown, Capitol Federal Savings Bank MHC, which owns a majority of the outstanding shares of Capitol Federal Financial common stock, waived its right to receive dividends paid on the common stock with the exception of the $0.50 per share dividend paid on 500,000 shares in February 2010. Public shares exclude shares held by Capitol Federal Savings Bank MHC, as well as unallocated shares held in the Capitol Federal Financial Employee Stock Ownership Plan (“ESOP”). See page 27 for additional information.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General Overview

Capitol Federal Financial (the “Company”) is the mid-tier holding company and the sole shareholder of Capitol Federal Savings Bank (the “Bank”). Capitol Federal Savings Bank MHC (“MHC”), a federally chartered mutual holding company, is the majority owner of the Company. MHC owns 52,192,817 shares of the 73,992,678 voting shares outstanding on September 30, 2010. The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol “CFFN.” The Bank comprises almost all of the consolidated assets and liabilities of the Company and the Company is dependent primarily upon the performance of the Bank for the results of its operations. Because of this relationship, references to management actions, strategies and resu lts of actions apply to both the Bank and the Company.

Private Securities Litigation Reform Act—Safe Harbor Statement

We may from time to time make written or oral "forward-looking statements", including statements contained in our filings with the Securities and Exchange Commission (“SEC”). These forward-looking statements may be included in this annual report to stockholders and in other communications by the Company, which are made in good faith by us pursuant to the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements include statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond our control. The words "may", "could", "should", "would", "believe", "anticipate", "estimate", "expect", "intend", "plan" and similar expressions are intended to identify forward-looking statements. The following factors, among others, could cause our future results to differ materially from the plans, objectives, goals, expectations, anticipations, estimates and intentions expressed in the forward-looking statements:

| · | our ability to continue to maintain overhead costs at reasonable levels; |

| · | our ability to continue to originate a significant volume of one- to four-family mortgage loans in our market areas; |

| · | our ability to acquire funds from or invest funds in wholesale or secondary markets; |

| · | the future earnings and capital levels of the Bank, which could affect the ability of the Company to pay dividends in accordance with its dividend policies; |

| · | fluctuations in deposit flows, loan demand, and/or real estate values, which may adversely affect our business; |

| · | the credit risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses (“ALLL”); |

| · | results of examinations of the Bank by its primary regulator, the Office of Thrift Supervision (the “OTS”), including the possibility that the OTS may, among other things, require the Bank to increase its ALLL; |

| · | the strength of the U.S. economy in general and the strength of the local economies in which we conduct operations; |

| · | the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; |

| · | the effects of, and changes in, foreign and military policies of the United States government; |

| · | inflation, interest rate, market and monetary fluctuations; |

| · | our ability to access cost-effective funding; |

| · | the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users, including the features, pricing and quality compared to competitors’ products and services; |

| · | the willingness of users to substitute competitors’ products and services for our products and services; |

| · | our success in gaining regulatory approval of our products and services and branching locations, when required; |

| · | the impact of changes in financial services laws and regulations, including laws concerning taxes, banking securities and insurance and the impact of other governmental initiatives affecting the financial services industry; |

| · | implementing business initiatives may be more difficult or expensive than anticipated; |

| · | acquisitions and dispositions; |

| · | changes in consumer spending and saving habits; and |

| · | our success at managing the risks involved in our business. |

This list of important factors is not exclusive. We do not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company or the Bank.

The following discussion is intended to assist in understanding the financial condition and results of operations of the Company. The discussion includes comments relating to the Bank, since the Bank is wholly owned by the Company and comprises the majority of assets and is the principal source of income for the Company.

Executive Summary

The following summary should be read in conjunction with our Management’s Discussion and Analysis of Financial Condition and Results of Operations in its entirety.

The Boards of Directors of MHC, the Company and the Bank adopted a Plan of Conversion and Reorganization (“the Plan”) on May 5, 2010. Pursuant to the Plan, MHC intends to convert from the mutual holding company form of organization to a stock form of organization. MHC will be merged into the Company, and MHC will no longer exist. As part of the conversion, MHC’s ownership interest of the Company is being offered for sale in a public offering. The existing publicly held shares of the Company, which represent the remaining ownership interest in the Company, will be exchanged for new shares of common stock of Capitol Federal Financial, Inc., a new Maryland corporation. When the conversion and public offering are completed, all of the outstanding capital stock of the Bank will be owned by Capitol Federal Financial, Inc. and all of the outstanding capital stock of Capitol Federal Financial, Inc. will be owned by the public.

Our principal business consists of attracting deposits from the general public and investing those funds primarily in permanent loans secured by first mortgages on owner-occupied, one- to four-family residences. To a much lesser extent, we also originate home equity and other consumer loans, loans secured by first mortgages on non-owner-occupied one- to four-family residences and commercial properties, construction loans secured by one- to four-family residences, commercial real estate loans, and multi-family real estate loans. While our primary business is the origination of one- to four-family loans funded through retail deposits, we also purchase whole loans and invest in certain investment securities and MBS and use FHLB advances, repurchase agreements and other borrowings as additional funding sources.

The Company is significantly affected by prevailing economic conditions including federal monetary and fiscal policies and federal regulation of financial institutions. Deposit balances are influenced by a number of factors including interest rates paid on competing personal investment products, the level of personal income, and the personal rate of savings within our market areas. Lending activities are influenced by the demand for housing and other loans, changing loan underwriting guidelines, as well as interest rate pricing competition from other lending institutions. The primary sources of funds for lending activities include deposits, loan repayments, investment income, borrowings, and funds provided from operations.

The Company’s results of operations are primarily dependent on net interest income, which is the difference between the interest earned on loans, MBS, investment securities and cash, and the interest paid on deposits and borrowings. On a weekly basis, management reviews deposit flows, loan demand, cash levels, and changes in several market rates to assess all pricing strategies. We generally price our loan and deposit products based upon an analysis of our competition and changes in market rates. The Bank generally prices its first mortgage loan products based on secondary market and competitor pricing. Generally, deposit pricing is based upon a survey of competitors in the Bank’s market areas, and the need to attract funding and retain maturing deposits. The majority of our loans are fixed-rate products with maturities up to 30 years, while the majority of our deposits have maturity or repricing dates of less than two years.

During fiscal year 2010, the economy began to show signs of recovery, as evidenced by increases in consumer spending and the stabilization of the labor market, the housing sector, and financial markets. However, unemployment levels remained elevated and unemployment periods prolonged, housing prices remained depressed and demand for housing was weak, due to distressed sales and tightened lending standards. In an effort to support mortgage lending and housing market recovery, and to help improve credit conditions overall, the Federal Open Market Committee of the Federal Reserve has maintained the overnight lending rate between zero and 25 basis points since December 2008. At the November 2010 Federal Open Market Committee meeting, the Committee announced a second round of quantitative easing. Un der this new program, the Federal Reserve is committed to purchasing $600 billion, or approximately $75 billion per month, of Treasury securities over the next eight months. By doing this, the Federal Reserve will effectively increase the amount of excess reserves in the banking system and reduce long-term interest rates in an effort to help stimulate the economy.

The historically low interest rate environment during the past two fiscal years spurred an increased demand for our loan modification program and mortgage refinances. Our loan modification program allows existing loan customers, whose loans have not been sold to third parties and who have been current on their contractual loan payments for the previous 12 months, the opportunity to modify, for a fee, their original loan terms to current loan terms being offered. During fiscal years 2010 and 2009, the Bank modified $545.1 million and $1.14 billion of

originated loans, respectively, with a weighted average rate decrease of 87 basis points for both periods. Additionally, the Bank refinanced $153.6 million and $267.4 million of its loans during fiscal years 2010 and 2009, respectively. In an effort to mitigate the net interest income impact from the repricing of our loan portfolio to lower rates, the Bank refinanced $200.0 million and $875.0 million of FHLB advances during fiscal years 2010 and 2009, respectively. Additionally, our deposit portfolio repriced down 59 basis points from September 30, 2009 to a weighted average rate of 1.61% at September 30, 2010.

Total assets increased $83.5 million, from $8.40 billion at September 30, 2009 to $8.49 billion at September 30, 2010, due primarily to growth in the deposit portfolio, which was used primarily to fund investment security purchases and repay maturing debt. During the first quarter of fiscal year 2010, $194.8 million of originated fixed-rate mortgage loans were swapped for MBS (“loan swap transaction”). The MBS were sold and the proceeds were primarily reinvested into investment securities with terms shorter than that of the loans swapped. The transaction was executed as a means of reducing future interest rate risk sensitivity as measured at that time.

The loans receivable portfolio decreased $435.8 million from $5.60 billion at September 30, 2009 to $5.17 billion at September 30, 2010. During fiscal year 2010, principal repayments on loans have exceeded originations, refinances, and purchases by $225.6 million. Mortgage origination volume, in general, has decreased from the prior year as the market demand for lending has decreased. The balance of loans 30 to 89 days delinquent decreased $2.1 million from $26.8 million at September 30, 2009 to $24.7 million at September 30, 2010. Non-performing loans increased $1.1 million from $30.9 million at September 30, 2009 to $32.0 million at September 30, 2010. The balance of non-performing loans continues to remain at historically high levels due to the continued high level of unemployment coupled with th e decline in real estate values, particularly in some of the states in which we have purchased loans. Despite the current economic operating environment and some deterioration in our loan portfolio we believe that our overall credit quality continued to compare favorably to the industry and our peers.

The balance of MBS decreased $384.6 million from $1.99 billion at September 30, 2009 to $1.61 billion at September 30, 2010. The decrease in the balance was a result of the majority of the cash flows from the MBS portfolio being reinvested into the investment securities portfolio. Investment securities increased $852.0 million, from $480.7 million at September 30, 2009 to $1.33 billion at September 30, 2010. The investment security portfolio balance increased as a result of purchases funded with proceeds from the loan swap transaction, MBS and loan principal repayments and, to a lesser extent, from an increase in retail deposits. The investment securities purchased had a weighted average life (“WAL”) of less than 2 years at the time of purchase. If market rates were to ri se, the short-term nature of these securities may allow management the opportunity to reinvest the maturing funds at a higher rate.

Total liabilities increased $62.8 million from $7.46 billion at September 30, 2009 to $7.53 billion at September 30, 2010, due primarily to an increase in deposits of $157.7 million. The increase in deposits was primarily in money market and checking accounts. Also during fiscal year 2010, $200.0 million of FHLB advances were refinanced, $100.0 million of maturing FHLB advances were replaced in their entirety, and $50.0 million of maturing FHLB advances and $45.0 million of maturing repurchase agreements were not replaced.

The Company recognized net income of $67.8 million for the fiscal year ended September 30, 2010, compared to net income of $66.3 million for the fiscal year ended September 30, 2009. The $1.5 million increase in net income was primarily a result of a $5.8 million increase in other income, a $3.9 million decrease in other expenses and a $1.4 million decrease in income tax expense, partially offset by a $7.1 million decrease in net interest income and a $2.5 million increase in provision for loan losses. The $5.8 million increase in other income was due primarily to the $6.5 million gain on the sale of trading MBS received in conjunction with the loan swap transaction. The $3.9 million decrease in other expenses was due primarily to an impairment and valuation allowance taken on the mortgage-servicing right s asset in the prior year period, compared to a net recovery in the current period. The $1.4 million decrease in income tax expense was a result of a decrease in the effective tax rate to 35.6% in the current fiscal year compared to 37.0% in the prior fiscal year. The net interest margin for fiscal year 2010 was 2.06% compared to 2.20% for fiscal year 2009. The 14 basis point decrease in the net interest margin was primarily a result of an increase in the average balance of interest-earning assets at lower yields compared to the prior year. The $8.9 million provision for loan losses recorded during fiscal year 2010 is composed of $5.0 million related to increases in certain loss factors in our general valuation allowance model and $3.9 million related to establishing or increasing specific valuation allowances.

The Bank has opened three new branches in our Kansas City market area and a new branch in the Wichita market area since the beginning of fiscal year 2010. The Bank continues to consider expansion opportunities in all of its market areas.

Critical Accounting Policies

Our most critical accounting policies are the methodologies used to determine the ALLL, other-than-temporary declines in the value of securities and fair value measurements. These policies are important to the presentation of our financial condition and results of operations, involve a high degree of complexity, and require management to make difficult and subjective judgments that may require assumptions or estimates about highly uncertain matters. The use of different judgments, assumptions, and estimates could cause reported results to differ materially. These critical accounting policies and their application are reviewed at least annually by our audit committee. The following is a description of our critical accounting policies and an explanation of the methods and assumptions underlying t heir application.

Allowance for Loan Losses. Management maintains an ALLL to absorb known and inherent losses in the loan portfolio based upon ongoing quarterly assessments of the loan portfolio. Our methodology for assessing the appropriateness of the ALLL consists of a formula analysis for general valuation allowances and specific valuation allowances for identified problem and impaired loans. The ALLL is maintained through provisions for loan losses which are charged to income. The methodology for determining the ALLL is considered a critical accounting policy by management because of the high degree of judgment involved, the subjectivity of the assumptions used, and the potential for changes in the economic environment that could result in changes to th e amount of the recorded ALLL.

Our primary lending emphasis is the origination and purchase of one- to four-family mortgage loans on residential properties, and, to a lesser extent, home equity and second mortgages on one- to four-family residential properties, resulting in a loan concentration in residential first mortgage loans. As a result of our lending practices, we also have a concentration of loans secured by real property located in Kansas and Missouri. At September 30, 2010, approximately 75% and 15% of the Bank’s loans were secured by real property located in Kansas and Missouri, respectively. Based on the composition of our loan portfolio, we believe the primary risks inherent in our portfolio are the continued weakened economic conditions, continued high levels of unemployment or underemployment, and a continuing decl ine in real estate values. Any one or a combination of these events may adversely affect borrowers’ ability to repay their loans, resulting in increased delinquencies, non-performing assets, loan losses, and future levels of loan loss provisions. Although management believes that the Bank has established and maintained the ALLL at appropriate levels, additions may be necessary if economic and other conditions continue or worsen substantially from the current operating environment.

Management considers quantitative and qualitative factors when determining the appropriateness of the ALLL. Such factors include the trend and composition of delinquent and non-performing loans, results of foreclosed property and short sale transactions (historical losses and net charge-offs), the current status and trends of local and national economies, particularly levels of unemployment, trends and current conditions in the real estate and housing markets, and loan portfolio growth and concentrations. Since our loan portfolio is primarily concentrated in one- to four-family real estate, we monitor one- to four-family real estate market value trends in our local market areas and geographic sections of the U.S. by reference to various industry and market reports, economic releases and surveys, and our general and specific kn owledge of the real estate markets in which we lend, in order to determine what impact, if any, such trends may have on the level of our ALLL. We also use ratio analyses as a supplemental tool for evaluating the overall reasonableness of the ALLL. We consider the observed trends in the ratios, taking into consideration the composition of our loan portfolio compared to our peers, in combination with our historical loss experience. In addition, the OTS reviews the adequacy of the Company’s ALLL during its examination process. We consider any comments from the OTS when assessing the appropriateness of our ALLL. Reviewing these quantitative and qualitative factors assists management in evaluating the overall reasonableness of the ALLL and whether changes need to be made to our assumptions. We seek to apply ALLL methodology in a consistent manner; however, the methodology can be modified in response to changing conditions.

Our loan portfolio is segregated into categories in the formula analysis based on certain risk characteristics such as loan type (one- to four-family, multi-family, etc.), interest payments (fixed-rate, adjustable-rate), loan source (originated or purchased), loan-to-value (“LTV”) ratios, borrower’s credit score and payment status (i.e. current or number of days delinquent). Consumer loans, such as second mortgages and home equity lines of credit, with the same underlying collateral as a one- to four-family loan are combined with the one- to four-family loan in the formula analysis to calculate a combined LTV ratio. All loans that are not impaired are included in a formula analysis. Impaired loans are defined as non-accrual loans, loans classified as substandard, loans with specific valu ation allowances and troubled debt restructurings that have not yet performed under the restructured terms for 12 consecutive months. Quantitative loss factors are applied to each loan category in the formula analysis based on the historical net loss experience and current specific valuation allowances, adjusted for such factors as loan delinquency trends, for each respective loan category. Additionally, qualitative loss factors that management believes impact the collectability of the loan portfolio as of the evaluation date are applied to certain loan categories. Such qualitative factors include changes in collateral values, unemployment rates, credit scores and delinquent loan trends. Loss factors increase as loans become classified or delinquent.

The qualitative and quantitative factors applied in the formula analysis are reviewed quarterly by management to assess whether the factors adequately cover probable and estimable losses inherent in the loan portfolio. Our ALLL methodology permits modifications to the formula analysis in the event that, in management’s judgment, significant

factors which affect the collectability of the portfolio or any category of the loan portfolio, as of the evaluation date, are not reflected in the current formula analysis. Management’s evaluation of the qualitative factors with respect to these conditions is subject to a higher degree of uncertainty because they are not identified with a specific problem loan or portfolio segments. During fiscal year 2010, management adjusted certain loss factors in the formula analysis to account for lingering negative economic conditions and the relatively recent loss experience on our purchased loan portfolio. If our future loss experience requires additional increases in our loss factors, this may result in increased levels of loan loss provisions.

Specific valuation allowances are established in connection with individual loan reviews of specifically identified problem and impaired loans. Since the majority of our loan portfolio is composed of one- to four-family real estate, determining the estimated fair value of the underlying collateral is important in evaluating the amount of specific valuation allowances required for problem and impaired loans. Generally, once a purchased loan is 90 days delinquent new collateral values are obtained through automated valuation models or broker price opinions. An updated automated valuation model or broker price opinion is then requested every 6 months while the loan is greater than 90 days delinquent. Due to the relatively stable home values in Kan sas and Missouri, we do not obtain new collateral values on originated loans until they enter foreclosure. If the estimated fair value of the collateral, less estimated costs to sell, is less than the current loan balance, a specific valuation allowance is established for the difference.

Loans with an outstanding balance of $1.5 million or more are individually reviewed annually if secured by property in one of the following categories: multi-family (five or more units) property, unimproved land, other improved commercial property, acquisition and development of land projects, developed building lots, office building, single-use building, or retail building. Specific valuation allowances are established if the individual loan review determines a quantifiable impairment.

Securities Impairment. Management monitors the securities portfolio for other-than-temporary impairments on an ongoing basis and performs a formal review quarterly. The process involves monitoring market events and other items that could impact the issuers’ ability to perform. The evaluation includes, but is not limited to such factors as: the nature of the investment, the length of time the security has had a fair value less than the amortized cost basis, the cause(s) and severity of the loss, expectation of an anticipated recovery period, recent events specific to the issuer or industry including the issuer’s financial condition and the current ability to make future payments in a timely manner, external credit ratings and re cent downgrades in such ratings, the Company’s intent to sell and whether it is more likely than not the Company would be required to sell a security prior to recovery for debt securities.

Management determines whether other-than-temporary impairment losses should be recognized for impaired securities by assessing all known facts and circumstances surrounding the securities. If the Company intends to sell an impaired security or if it is more likely than not that the Company will be required to sell an impaired security before recovery of its amortized cost basis, an other-than-temporary impairment will be recognized and the difference between amortized cost and fair value will be recognized as a loss in earnings. At September 30, 2010, no securities had been identified as other-than-temporarily impaired.

Fair Value Measurements. The Company uses fair value measurements to record fair value adjustments to certain assets and to determine fair value disclosures, per the provisions of Accounting Standards Codification (“ASC”) 820, Fair Value Measurements and Disclosures. In accordance with ASC 820, the Company groups its assets at fair value in three levels, based on the markets in which the assets are traded and the reliability of the underlying assumptions used to determine fair value, with Level 1 (quoted prices for identical assets in an active market) being considered the most reliable, and Level 3 having the most unobservable inputs and therefore being considered the least reliable. � 60;The Company bases its fair values on the price that would be received to sell an asset in an orderly transaction between market participants at the measurement date. As required by ASC 820, the Company maximizes the use of observable inputs and minimizes the use of unobservable inputs when measuring fair value. The Company did not have any liabilities that were measured at fair value at September 30, 2010.

The Company’s AFS securities are our most significant assets measured at fair value on a recurring basis. Changes in the fair value of AFS securities are recorded, net of tax, in accumulated other comprehensive income, which is a component of stockholders’ equity. As part of determining fair value, the Company obtains fair values for all AFS securities from independent nationally recognized pricing services. Various modeling techniques are used to determine pricing for the Company’s securities, including option pricing and discounted cash flow models. The inputs to these models may include benchmark yields, reported trades, broker/dealer quotes, issuer spreads, benchmark securities, bids, offers and reference data. There are some AFS securities in the AFS portfolio that have significant unobservable inputs requiring the independent pricing services to use some judgment in pricing the related securities. These AFS securities are classified as Level 3. All other AFS securities are classified as Level 2.

Loans receivable and real estate owned (“REO”) are the Company’s significant assets measured at fair value on a non-recurring basis. These non-recurring fair value adjustments involve the application of lower-of-cost-or-fair value accounting or write-downs of individual assets. Fair value for these assets is estimated using current appraisals, automated valuation models, broker price opinions, or listing prices. Fair values may be adjusted by management to reflect current economic and market conditions and, as such, are classified as Level 3.

Recent Accounting Pronouncements. For a discussion of Recent Accounting Pronouncements, see “Notes to Financial Statements - Note 1 - Summary of Significant Accounting Policies.”

Management Strategy

We are a retail-oriented financial institution dedicated to serving the needs of customers in our market areas. Our commitment is to provide qualified borrowers the broadest possible access to home ownership through our mortgage lending programs and to offer a complete set of personal banking products and services to our customers. We strive to enhance stockholder value while maintaining a strong capital position. To achieve these goals, we focus on the following strategies:

| · | Residential Portfolio Lending. We are one of the largest originators of one- to four-family loans in the state of Kansas. We have originated these loans primarily for our own portfolio, rather than for sale, and generally we service the loans we originate. We provide retail customers with alternatives for their borrowing needs by offering both fixed- and adjustable-rate products with various terms to maturity and pricing alternatives. We offer special programs to individuals who may be first time home buyers, have low or moderate incomes or may have certain credit risk concerns in order to maximize our ability to deliver home ownership opportunities. Through our marketing efforts that reflect our reputation and pricing, and strong relationshi ps with real estate agents, we attract mortgage loan business from walk-in customers, customers that apply online, and existing customers. We also purchase from correspondent lenders one- to four-family loans secured by property primarily located within our market areas and select market areas in Missouri, as well as one- to four-family loans from nationwide lenders. |

| · | Retail Financial Services. We offer a wide array of deposit products and retail services for our customers. These products include checking, savings, money market, certificates of deposit and retirement accounts. These products and services are provided through a branch network of 46 locations, including traditional branch and retail store locations, our call center which operates on extended hours, telephone bill payment services and Internet-based transaction services. |

| · | Cost Control. We generally are very effective at controlling our costs of operations. By using technology, we are able to centralize our lending and deposit support functions for efficient processing. We have located our branches to serve a broad range of customers through relatively few branch locations. Our average deposit base per traditional branch at September 30, 2010 was approximately $114.2 million. This large average deposit base per branch helps to control costs. The average deposit base per traditional branch decreased the past two years due to the opening of new traditional branches; however, the deposit base at our existing traditional branches increased during the same time period which helped to offset the impact of the new branches. Our one- to four-family lending strategy and our effective management of credit risk allows us to service a large portfolio of loans at efficient levels because it costs less to service a portfolio of performing loans. For the year ended September 30, 2010, our efficiency ratio was 43.99%. |

| · | Asset Quality. We utilize underwriting standards for our lending products that are designed to limit our exposure to credit risk. We require complete documentation for both originated and purchased loans, and make credit decisions based on our assessment of the borrower’s ability to repay the loan in accordance with its terms. See additional discussion of asset quality in Part I, Item 1 of the Annual Report on Form 10-K. |

| · | Capital Position. Our policy has always been to protect the safety and soundness of the Bank through conservative credit and operational risk management, balance sheet strength, and sound operations. The end result of these activities is a capital ratio in excess of the well-capitalized standards set by the OTS. We believe that maintaining a strong capital position safeguards the long-term interests of the Bank, the Company and our stockholders. |

| · | Stockholder Value. We strive to enhance stockholder value while maintaining a strong capital position. One way that we continue to provide returns to stockholders is through our dividend payments. Total dividends declared and paid during fiscal year 2010 were $2.29 per public share, which consisted of the regular quarterly dividends of $0.50 per public share and a special year-end dividend of $0.29 per public share. In October 2010, the Board of Directors declared a $0.50 per share quarterly dividend and $0.30 per share special year-end dividend which were paid on November 5, 2010 to holders of record on October 29, 2010. Due to MHC's waiver of dividends, the dividends were paid only on public shares. The Company’s cash dividend p ayout policy is reviewed quarterly by management and the Board of Directors, and the ability to pay dividends under the policy depends upon a number of factors, including the Company’s financial condition and results of operations, the Bank’s regulatory capital requirements, regulatory limitations on the Bank’s ability to make capital distributions to the Company, the amount of cash at the holding company and the continued waiver of dividends by MHC. It is management’s and the Board of Directors’ intentions to continue to pay regular quarterly dividends for the foreseeable future and a special dividend each year, to the extent justified by earnings. |

| · | Interest Rate Risk Management. Changes in interest rates are our primary market risk as our balance sheet is almost entirely comprised of interest-earning assets and interest-bearing liabilities. As such, fluctuations in interest rates have a significant impact not only upon our net income but also upon the cash flows related to those assets and liabilities and the market value of our assets and liabilities. In order to maintain acceptable levels of net interest income in varying interest rate environments, we take on a moderate amount of interest rate risk consistent with board policies. |

Quantitative and Qualitative Disclosure about Market Risk

Asset and Liability Management and Market Risk

The rates of interest the Bank earns on assets and pays on liabilities generally are established contractually for a period of time. Fluctuations in interest rates have a significant impact not only upon our net income, but also upon the cash flows of those assets and liabilities and the market value of our assets and liabilities. Our results of operations, like those of other financial institutions, are impacted by these changes in interest rates and the interest rate sensitivity of our interest-earning assets and interest-bearing liabilities. The risk associated with changes in interest rates on the earnings of the Bank and the market value of its financial assets and liabilities is known as interest rate risk. Interest rate risk is our most significant market risk and our ability to adapt to changes in interest rates is known as interest rate risk management.

The general objective of our interest rate risk management is to determine and manage an appropriate level of interest rate risk while maximizing net interest income, in a manner consistent with our policy to reduce, to the extent possible, the exposure of our net interest income to changes in market interest rates. The Asset and Liability Committee (“ALCO”) regularly reviews the interest rate risk exposure of the Bank by forecasting the impact of hypothetical, alternative interest rate environments on net interest income and market value of portfolio equity (“MVPE”) at various dates. The MVPE is defined as the net of the present value of the cash flows of an institution’s existing assets, liabilities and off-balance sheet instruments. The present values are determined based upon market conditions as of the date of the analysis as well as in alternative interest rate environments providing potential changes in MVPE under those alternative interest rate environments. Net interest income is projected in the same alternative interest rate environments as well, both with a static balance sheet and with management strategies considered. MVPE and net interest income analysis is also conducted that estimates sensitivity to rates for future time horizons based upon market conditions as of the date of the analysis. The Bank’s analysis of its net interest income and MVPE at September 30, 2010 indicated a general decrease in its risk exposure compared to September 30, 2009, primarily due to lower market interest rates at September 30, 2010.

Based upon management’s recommendations, the Board of Directors sets the asset and liability management policies of the Bank. These policies are implemented by ALCO. The purpose of ALCO is to communicate, coordinate and control asset and liability management consistent with board-approved policies. ALCO’s objectives are to manage assets and funding sources to produce the highest profitability balanced against liquidity, capital adequacy and risk management objectives. At each monthly meeting, ALCO recommends appropriate strategy changes. The Chief Financial Officer, or his designee, is responsible for executing, reviewing and reporting on the results of the policy recommendations and strategies to the Board of Directors, generally on a monthly basis.

The ability to maximize net interest income is dependent largely upon the achievement of a positive interest rate spread that can be sustained despite fluctuations in prevailing interest rates. The asset and liability repricing gap is a measure of the difference between the amount of interest-earning assets and interest-bearing liabilities which either reprice or mature within a given period of time. The difference provides an indication of the extent to which an institution's interest rate spread will be affected by changes in interest rates. A gap is considered positive when the amount of interest-earning assets exceeds the amount of interest-bearing liabilities, maturing or repricing during the same period. A gap is considered negative when the amount of interest-bearing liabilities exceeds the amount of interest-earning assets maturing or repricing during the same period. Generally, during a period of rising interest rates, a negative gap within shorter repricing periods adversely affects net interest income, while a positive gap within shorter repricing periods results in an increase in net interest income. During a period of falling interest rates, the opposite would generally be true. As of September 30, 2010, the ratio of our one-year gap to total assets was a positive 21.06%.

Management recognizes that dramatic changes in interest rates within a short period of time can cause an increase in our interest rate risk relative to the balance sheet. At times, ALCO may recommend increasing our interest rate risk exposure in an effort to increase our net interest margin, while maintaining compliance with established board limits for interest rate risk sensitivity. Management believes that maintaining and improving earnings is the best way to preserve a strong capital position. Management recognizes the need, in certain interest rate environments, to limit the Bank's exposure to changing interest rates and may implement strategies to reduce our interest rate risk which could, as a result, reduce earnings in the short-term. To minimize the potential for adverse effects of mat erial and prolonged changes in interest rates on our results of operations, we have adopted asset and liability management policies to better balance the maturities and repricing terms of our interest-earning assets and interest-bearing liabilities based on existing local and national interest rates.

During periods of economic uncertainty, rising interest rates or extreme competition for loans, the Bank’s ability to originate or purchase loans may be adversely affected. In such situations, the Bank alternatively may invest its funds into investment securities or MBS. These investments may have rates of interest lower than rates we could receive on loans, if we were able to originate or purchase them, potentially reducing the Bank’s interest income.

Qualitative Disclosure about Market Risk

Percentage Change in Net Interest Income. For each period end presented in the following table, the estimated percentage change in the Bank’s net interest income based on the indicated instantaneous, parallel and permanent change in interest rates is presented. The percentage change in each interest rate environment represents the difference between estimated net interest income in the 0 basis point interest rate environment (“base case”, assumes the forward market and product interest rates implied by the yield curve are realized) and estimated net interest income in each alternative interest rate environment (assumes market and product interest rates have a parallel shift in rates across all maturities by the indicated change in rates). ; Estimations of net interest income used in preparing the table below are based upon the assumptions that the total composition of interest-earning assets and interest-bearing liabilities does not change materially and that any repricing of assets or liabilities occurs at anticipated product and market rates for the alternative rate environments as of the dates presented. The estimation of net interest income does not include any projected gain or loss related to the sale of loans or securities, or income derived from non-interest income sources, but does include the use of different prepayment assumptions in the alternative interest rate environments. It is important to consider that the estimated changes in net interest income are for a cumulative four-quarter period. These do not reflect the earnings expectations of management.

| Change | | | Percentage Change in Net Interest Income | |

| (in Basis Points) | | | At September 30, | |

in Interest Rates (1) | | | 2010 | | | 2009 | |

| | -100 | bp | | | N/A | | | | N/A | |

| | 000 | bp | | | -- | | | | -- | |

| | +100 | bp | | | 6.44 | % | | | 0.84 | % |

| | +200 | bp | | | 4.56 | % | | | -0.54 | % |

| | +300 | bp | | | 0.93 | % | | | -2.41 | % |

| (1) | Assumes an instantaneous, permanent and parallel change in interest rates at all maturities. |

At September 30, 2010, the percentage change in the net interest income projections increased from September 30, 2009 in all the interest rate shock scenarios. The primary reason for the projected increase in net interest income projections over this time period was due to a significant decrease in interest rates from September 30, 2009 to September 30, 2010. The decrease in interest rates caused the WAL of mortgage-related assets and callable agency debentures to shorten significantly as borrowers have an economic incentive to refinance their mortgages into lower interest rate loans and agency debt issuers have an economic incentive to exercise their call options and issue lower costing debt. The cash flows from mortgage-related assets and callable agency debentures are reinvested into higher yielding in terest-earning assets as interest rates rise resulting in the yield on interest-earning assets increasing faster than the anticipated cost of interest-bearing liabilities. However, as interest rates rise, the financial incentive to refinance mortgages or call agency debentures is diminished resulting in reduced cash flows that could be reinvested at higher market rates.

Percentage Change in MVPE. The following table sets forth the estimated percentage change in the MVPE at each period end presented based on the indicated instantaneous, parallel and permanent change in interest rates. The percentage change in each interest rate environment represents the difference between MVPE in the base case and MVPE in each alternative interest rate environment. The estimations of MVPE used in preparing the table below are based upon the assumptions that the total composition of interest-earning assets and interest-bearing liabilities does not change, that any repricing of assets or liabilities occurs at current product or market rates for the alternative rate environments as of the dates presented, and that different prepayment rates are used in each alternative interest rate environment. The estimated MVPE results from the valuation of cash flows from financial assets and liabilities over the anticipated lives of each for each interest rate environment. The table presents the effects of the change in interest rates on our assets and liabilities as they mature, repay or reprice, as shown by the change in the MVPE in changing interest rate environments.

| Change | | | Percentage Change in MVPE | |

| (in Basis Points) | | | At September 30, | |

in Interest Rates (1) | | | 2010 | | | 2009 | |

| | -100 | bp | | | N/A | | | | N/A | |

| | 000 | bp | | | -- | | | | -- | |

| | +100 | bp | | | 0.10 | % | | | -4.92 | % |

| | +200 | bp | | | -8.76 | % | | | -18.11 | % |

| | +300 | bp | | | -22.42 | % | | | -34.32 | % |

| (1) | Assumes an instantaneous, permanent and parallel change in interest rates at all maturities. |

Changes in the estimated market values of our financial assets and liabilities drive changes in estimates of MVPE. The market value of shorter term-to-maturity financial instruments are less sensitive to changes in interest rates than the market value of longer term-to-maturity financial instruments. Because of this, our certificates of deposit (which have relatively short average lives) tend to display less sensitivity to changes in interest rates than do our mortgage-related assets (which have relatively long average lives). The average life expected on our mortgage-related assets varies under different interest rate environments because borrowers have the ability to prepay their mortgage loans.

The Bank’s MVPE declines in the +200 and +300 interest rate environments. As rates increase to these levels, the estimated fair values of the liabilities with short average lives do not respond to rates in the same manner as the longer maturity assets, such as our fixed-rate loans, which have longer average lives. The prepayment assumptions on the fixed-rate loans in particular, and all mortgage-related assets in general, are expected to slow down significantly as interest rate rise such that projected prepayments would likely only be realized through normal changes in borrowers lives, such as divorce, death, job-related relocations, and other life changing events. The lower prepayment assumptions extend the expected average lives on these assets, relative to assumptions in the base case, thereby increasing their sensitivity to changes in interest rates. The net effect of these characteristics of short-lived liabilities and long-lived assets is to increase the sensitivity of the Bank to changes in interest rates the more interest rates increase.

The sensitivity of the MVPE decreased from September 30, 2009 to September 30, 2010. This was due to the decrease in interest rates from September 30, 2009 to September 30, 2010. The decrease in interest rates resulted in a significant decrease in the WAL of all mortgage-related assets as borrowers have an increased economic incentive to refinance their mortgages into lower interest rate loans and agency debt issuers have an economic incentive to exercise their call options and issue lower costing debt. This caused a decrease in the price sensitivity of all mortgage-related assets and callable agency debentures, and as a result, in interest-earning assets as a whole. Since the price sensitivity of assets is reduced in the base case, the adverse impact to rising interest rates is thus reduced in all scenarios presented.

General assumptions used by management to evaluate the sensitivity of our financial performance to changes in interest rates presented in the tables above are utilized in, and set forth under, the gap table and related notes beginning on page 17. Although management finds these assumptions reasonable given the constraints described above, the interest rate sensitivity of our assets and liabilities and the estimated effects of changes in interest rates on our net interest income and MVPE indicated in the above tables could vary substantially if different assumptions were used or actual experience differs from these assumptions.

Gap Table. The gap table summarizes the anticipated maturities or repricing of our interest-earning assets and interest-bearing liabilities as of September 30, 2010, based on the information and assumptions set forth in the notes below.

| | | Within | | | Three to | | | More Than | | | More Than | | | | | | | |

| | | Three | | | Twelve | | | One Year to | | | Three Years | | | Over | | | | |

| | | Months | | | Months | | | Three Years | | | to Five Years | | | Five Years | | | Total | |

| Interest-earning assets: | | (Dollars in thousands) | |

Loans receivable: (1) | | | | | | | | | | | | | | | | | | |

| Mortgage loans: | | | | | | | | | | | | | | | | | | |

| Fixed | | $ | 374,893 | | | $ | 1,095,187 | | | $ | 1,236,438 | | | $ | 472,149 | | | $ | 907,068 | | | $ | 4,085,735 | |

| Adjustable | | | 91,365 | | | | 563,604 | | | | 186,734 | | | | 39,865 | | | | 6,002 | | | | 887,570 | |

| Other loans | | | 136,829 | | | | 16,334 | | | | 19,364 | | | | 11,848 | | | | 8,947 | | | | 193,322 | |

Investment securities (2) | | | 257,703 | | | | 667,652 | | | | 152,418 | | | | 245,296 | | | | 10,238 | | | | 1,333,307 | |

MBS (3) | | | 251,456 | | | | 658,831 | | | | 351,527 | | | | 125,597 | | | | 168,578 | | | | 1,555,989 | |

| Other interest-earning assets | | | 45,094 | | | | -- | | | | -- | | | | -- | | | | -- | | | | 45,094 | |

| Total interest-earning assets | | | 1,157,340 | | | | 3,001,608 | | | | 1,946,481 | | | | 894,755 | | | | 1,100,833 | | | | 8,101,017 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | | | | | | | | | | | | |

Checking (4) | | | 11,132 | | | | 44,767 | | | | 119,670 | | | | 63,008 | | | | 243,851 | | | | 482,428 | |

Savings (4) | | | 93,670 | | | | 9,370 | | | | 21,606 | | | | 16,758 | | | | 92,881 | | | | 234,285 | |

Money market (4) | | | 41,568 | | | | 114,712 | | | | 276,455 | | | | 143,079 | | | | 366,614 | | | | 942,428 | |

| Certificates | | | 362,265 | | | | 1,164,310 | | | | 876,117 | | | | 322,313 | | | | 2,164 | | | | 2,727,169 | |

Borrowings (5) | | | 353,609 | | | | 176,000 | | | | 1,170,000 | | | | 770,000 | | | | 575,000 | | | | 3,044,609 | |

| Total interest-bearing liabilities | | | 862,244 | | | | 1,509,159 | | | | 2,463,848 | | | | 1,315,158 | | | | 1,280,510 | | | | 7,430,919 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Excess (deficiency) of interest-earning assets over | | | | | | | | | | | | | | | | | | | | | | | | |

| interest-bearing liabilities | | $ | 295,096 | | | $ | 1,492,449 | | | $ | (517,367 | ) | | $ | (420,403 | ) | | $ | (179,677 | ) | | $ | 670,098 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative excess (deficiency) of interest-earning | | | | | | | | | | | | | | | | | | | | | | | | |

| assets over interest-bearing liabilities | | $ | 295,096 | | | $ | 1,787,545 | | | $ | 1,270,178 | | | $ | 849,775 | | | $ | 670,098 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative excess (deficiency) of interest-earning | | | | | | | | | | | | | | | | | | | | | | | | |

| assets over interest-bearing liabilities as a | | | | | | | | | | | | | | | | | | | | | | | | |

| percent of total assets at September 30, 2010 | | | 3.48 | % | | | 21.06 | % | | | 14.97 | % | | | 10.01 | % | | | 7.90 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative one-year gap at September 30, 2009 | | | | | | | 6.78 | % | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cumulative one-year gap at September 30, 2008 | | | | | | | 1.90 | % | | | | | | | | | | | | | | | | |

(1) Adjustable-rate mortgage (“ARM”) loans are included in the period in which the rate is next scheduled to adjust or in the period in which repayments are expected to occur, or prepayments are expected to be received, prior to their next rate adjustment, rather than in the period in which the loans are due. Fixed-rate loans are included in the periods in which they are scheduled to be repaid, based on scheduled amortization and prepayment assumptions. Balances have been reduced for non-performing loans, which totaled $32.0 million at September 30, 2010.

(2) Based on contractual maturities, terms to call date or pre-refunding dates as of September 30, 2010, and excludes the unrealized loss adjustment of $651 thousand on AFS investment securities.

(3) Reflects estimated prepayments of MBS in our portfolio, and excludes the unrealized gain adjustment of $51.9 million on AFS MBS.

(4) Although our checking, savings and money market accounts are subject to immediate withdrawal, management considers a substantial amount of such accounts to be core deposits having significantly longer effective maturities. The decay rates (the assumed rate at which the balance of existing accounts would decline) used on these accounts are based on assumptions developed from our actual experience with these accounts. If all of our checking, savings and money market accounts had been assumed to be subject to repricing within one year, interest-earning assets which were estimated to mature or reprice within one year would have exceeded interest-bearing liabilities with comparable characteristics by $443.6 millio n, for a cumulative one-year gap of 5.23% of total assets.

(5) Borrowings exclude $28.3 million of deferred prepayment penalty costs and $632 thousand of deferred gain on the terminated interest rate swap agreements.

The change in the one-year gap to 21.06% at September 30, 2010 from 6.78% at September 30, 2009 was a result of a significant decrease in interest rates between year ends. The decrease in interest rates resulted in an increase in projected cash flows from mortgage-related assets and callable agency debentures which resulted in shorter WALs and quicker repricing of interest-earning assets at September 30, 2010 compared to September 30, 2009.

The gap table summarizes the anticipated maturities or repricing of our interest-earning assets and interest-bearing liabilities as of September 30, 2010, based on the information and assumptions set forth in the notes above. Cash flow projections for mortgage loans and MBS are calculated based on current interest rates. Prepayment projections are subjective in nature, involve uncertainties and assumptions and, therefore, cannot be determined with a high degree of accuracy. Although certain assets and liabilities may have similar maturities or periods to repricing, they may react differently to changes in market interest rates. Assumptions may not reflect how actual yields and costs respond to market changes. The interest rates on certain types of assets and liabilities may fluctuate in advance of changes in market interest rates, while interest rates on other types of assets and liabilities may lag behind changes in market interest rates. Certain assets, such as ARM loans, have features that restrict changes in interest rates on a short-term basis and over the life of the asset. In the event of a change in interest rates, prepayment and early withdrawal levels would likely deviate significantly from those assumed in calculating the gap table. For additional information regarding the impact of changes in interest rates, see the Percentage Change in Net Interest Income and Percentage Change in MVPE tables above.

Financial Condition

Total assets increased $83.5 million from $8.40 billion at September 30, 2009 to $8.49 billion at September 30, 2010, due primarily to growth in the deposit portfolio, which was used primarily to fund investment security purchases and repay maturing debt.

Total liabilities increased $62.8 million from $7.46 billion at September 30, 2009 to $7.53 billion at September 30, 2010, due primarily to an increase in deposits of $157.7 million. The increase in deposits was primarily in money market and checking accounts. During fiscal year 2010, $200.0 million of FHLB advances with a weighted average contractual rate of 4.63% were refinanced and replaced with $200.0 million of fixed-rate FHLB advances with a weighted average contractual interest rate of 3.17%. Also during fiscal year 2010, $100.0 million of maturing FHLB advances with a rate of 3.94% were replaced with $100.0 million of FHLB advances with a rate of 3.23% and $50.0 million of maturing FHLB advances and $45.0 million of maturing repurchase agreements were not replaced.

Stockholders’ equity increased $20.7 million, from $941.3 million at September 30, 2009 to $962.0 million at September 30, 2010. The increase was due primarily to net income of $67.8 million, partially offset by dividend payments of $48.4 million during the current fiscal year.

Loans Receivable. The loans receivable portfolio decreased $435.8 million from $5.60 billion at September 30, 2009 to $5.17 billion at September 30, 2010. During fiscal year 2010, principal repayments on loans have exceeded originations, refinances, and purchases by $225.6 million. Mortgage origination volume, in general, has decreased from the prior year as the market demand for lending has decreased. Additionally, the Bank has been purchasing fewer loans under the Bank’s nationwide purchase loan program during fiscal year 2010 due to the lack of loans meeting our underwriting criteria from our existing relationships. The Bank is working to expand the number of relationships with third parties from whom it may buy loans i n the future. The decrease in the loan portfolio was also due the $194.8 million loan swap transaction during the first quarter of the current fiscal year.

The weighted average rate of the loan portfolio decreased 22 basis points from 5.29% at September 30, 2009 to 5.07% at September 30, 2010. The decrease in the weighted average portfolio rate was due to loan modifications and refinances, originations and purchases at market rates lower than the existing portfolio, and repayments of loans with rates higher than the portfolio.

During fiscal year 2010, $44.1 million of one- to four-family loans were purchased from nationwide lenders. One- to four-family loans purchased from nationwide lenders during the current fiscal year had a weighted average credit score of 723 at origination and a weighted average LTV ratio of 47%, based upon the loan balance at the time of purchase and the lower of the purchase price or appraisal at origination. Loans purchased from nationwide lenders represented approximately 10% of the loan portfolio at September 30, 2010 compared to 12% at September 30, 2009, and were secured by properties located in 47 of the continental states. At September 30, 2010, purchased loans from nationwide lenders in the following states comprised 5% or greater of total purchased loans: Illinois 11%; Texas 8%, Florida and New York 7%. As of September 30, 2010, the average balance of a nationwide purchased one- to four-family loan was approximately $340 thousand, the average balance of an originated one- to four-family loan was approximately $125 thousand, and the average balance of correspondent purchased one- to four-family loans was approximately $275 thousand.

Included in the loan portfolio at September 30, 2010 were $198.0 million of ARM loans that were originated as interest-only. Of these interest-only loans, $154.3 million were purchased from nationwide lenders, primarily during fiscal year 2005. Interest-only ARM loans do not typically require principal payments during their initial term, and have initial interest-only terms of either five or ten years. The $154.3 million of purchased interest-only ARM loans had a weighted average credit score of 736 at origination and a weighted average LTV ratio of 74%, based upon the loan balance at the time of purchase and the lower of purchase price or appraisal at origination. The Bank has not purchased any interest-only ARM loans since 2006 and discontinued offering the product in its local markets during 2008 to reduce future credit risk. At September 30, 2010, $121.6 million, or 61%, of interest-only loans were still in their interest-only payment term. As of September 30, 2010, $27.7 million will begin to amortize principal within two years, $62.3 million will begin to amortize principal within two-to-five years, $27.2 million will begin to amortize principal within five-to-seven years and the remaining $4.4 million will begin amortizing in seven-to-ten years. At September 30, 2010, $13.2 million, or 41% of non-performing loans, were interest-only ARMs and $3.2 million was reserved in the ALLL for these loans. Of the $13.2 million non-performing interest-only ARM loans, $6.5 million, or 49%, were still in the interest-only payment term. Non-performing interest-only ARM loans represented approximately 7% of the total interest-only ARM loan portfolio at September 30, 2010. See discussion regarding the ALLL in “Critical Accounting Policies – Allowance for Loan Losses.”

Historically, the Bank’s underwriting guidelines have provided the Bank with loans of high quality and low delinquencies, and low levels of non-performing assets compared to national levels. Of particular importance is the complete documentation required for each loan the Bank originates and purchases. This allows the Bank to make an informed credit decision based upon a thorough assessment of the borrower’s ability to repay the loan, compared to underwriting methodologies that do not require full documentation. Non-performing loans increased $1.1 million from $30.9 million at September 30, 2009 to $32.0 million at September 30, 2010. Our ratio of non-performing loans to total loans increased from 0.55% at September 30, 2009 to 0.62% at September 30, 2010. At September 30, 2010 , our ALLL was $14.9 million or 0.29% of the total loan portfolio and 47% of total non-performing loans. This compares with an ALLL of $10.2 million or 0.18% of the total loan portfolio and 33% of total non-performing loans as of September 30, 2009. See additional discussion of asset quality in Part I, Item 1 of the Annual Report on Form 10-K.

The Bank generally prices its one- to four-family loan products based upon prices available in the secondary market and competitor pricing. During fiscal year 2010, the average daily spread between the Bank’s 30-year fixed-rate one- to four-family loan offer rate, with no points paid by the borrower, and the 10-year Treasury rate was approximately 160 basis points, while the average daily spread between the Bank’s 15-year fixed-rate one- to four-family loan offer rate and the 10-year Treasury rate was approximately 100 basis points.

Conventional one- to four-family loans may be sold on a bulk basis for portfolio restructuring or on a flow basis as loans are originated to reduce interest rate risk and/or maintain a certain liquidity position. The Bank generally retains the servicing on these sold loans. ALCO determines which conventional one- to four-family loans are to be originated as held for sale or held for investment. Conventional loans originated as held for sale are to be sold in accordance with policies set forth by ALCO. Conventional loans originated as held for investment are generally not eligible for sale unless a specific segment of the portfolio qualifies for asset restructuring purposes.

The following table summarizes the activity in the loan portfolio for the periods indicated, excluding changes in loans in process, deferred fees, and ALLL. Loans that were paid-off as a result of refinances are included in repayments. Purchased loans include purchases from correspondent and nationwide lenders. Loan modification activity is not included in the activity in the following table because a new loan is not generated at the time of modification. During fiscal year 2010 and 2009, the Bank modified $545.1 million and $1.14 billion loans, respectively, with a weighted average decrease in rate of 87 basis points for both years. The modified balance and rate are included in the ending loan portfolio balance and rate. The weighted average contractual life of our mortga ge loan portfolio was 23 years at both September 30, 2010 and 2009.

| | | For the Three Months Ended | |

| | | September 30, 2010 | | | June 30, 2010 | | | March 31, 2010 | | | December 31, 2009 | |

| | | Amount | | | Rate | | | Amount | | | Rate | | | Amount | | | Rate | | | Amount | | | Rate | |

| | | (Dollars in thousands) | |

| Beginning balance | | $ | 5,361,472 | | | | 5.14 | % | | $ | 5,425,458 | | | | 5.19 | % | | $ | 5,463,744 | | | | 5.23 | % | | $ | 5,646,950 | | | | 5.29 | % |

| Originations and refinances: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 94,048 | | | | 4.64 | | | | 137,012 | | | | 4.96 | | | | 107,694 | | | | 4.93 | | | | 156,507 | | | | 4.95 | |

| Adjustable | | | 39,170 | | | | 4.33 | | | | 34,033 | | | | 4.62 | | | | 38,779 | | | | 4.44 | | | | 37,885 | | | | 4.57 | |

| Purchases: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed | | | 6,850 | | | | 5.05 | | | | 8,590 | | | | 5.15 | | | | 12,417 | | | | 5.03 | | | | 20,149 | | | | 5.09 | |

| Adjustable | | | 1,417 | | | | 4.40 | | | | 10,737 | | | | 5.58 | | | | 14,011 | | | | 4.03 | | | | 44,930 | | | | 3.69 | |

| Repayments | | | (288,626 | ) | | | | | | | (250,098 | ) | | | | | | | (208,015 | ) | | | | | | | (243,087 | ) | | | | |

| Transfer of loans to | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

loans held-for-sale (“LHFS”), net (1) | | | -- | | | | | | | | -- | | | | | | | | -- | | | | | | | | (194,759 | ) | | | | |

Other (2) | | | (5,018 | ) | | | | | | | (4,260 | ) | | | | | | | (3,172 | ) | | | | | | | (4,831 | ) | | | | |

| Ending balance | | $ | 5,209,313 | | | | 5.07 | % | | $ | 5,361,472 | | | | 5.14 | % | | $ | 5,425,458 | | | | 5.19 | % | | $ | 5,463,744 | | | | 5.23 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended | |

| | | 2010 | | | 2009 | |

| | | Amount | | | Rate | | | Amount | | | Rate | |

| | | (Dollars in thousands) | |

| Beginning balance | | $ | 5,646,950 | | | | 5.29 | % | | $ | 5,379,845 | | | | 5.66 | % |

| Originations and refinances: | | | | | | | | | | | | | | | | |

| Fixed | | | 495,261 | | | | 4.89 | | | | 988,375 | | | | 5.12 | |

| Adjustable | | | 149,867 | | | | 4.48 | | | | 131,306 | | | | 4.91 | |

| Purchases: | | | | | | | | | | | | | | | | |

| Fixed | | | 48,006 | | | | 5.08 | | | | 109,813 | | | | 5.21 | |

| Adjustable | | | 71,095 | | | | 4.05 | | | | 223,619 | | | | 5.01 | |

| Repayments | | | (989,826 | ) | | | | | | | (1,079,777 | ) | | | | |

Transfer of loans to LHFS, net (1) | | | (194,759 | ) | | | | | | | (94,672 | ) | | | | |

Other (2) | | | (17,281 | ) | | | | | | | (11,559 | ) | | | | |

| Ending balance | | $ | 5,209,313 | | | | 5.07 | % | | $ | 5,646,950 | | | | 5.29 | % |

| (1) | Transfer of loans to LHFS in the December 31, 2009 quarter includes loans with a principal balance of $194.8 million related to the loan swap transaction. |

| (2) | Other consists of transfers to REO, modification fees advanced and reductions in commitments. |

The following table presents our fixed-rate one- to four-family loan portfolio, including our fixed-rate one- to four-family construction loans, and the annualized prepayment speeds for the quarter ending September 30, 2010 by interest rate tier. Loan modifications and refinances are considered a prepayment and are included in the prepayment speeds presented below. During the quarter ended September 30, 2010, $236.7 million of fixed-rate loans were modified and $74.3 million of fixed-rate loans were refinanced.

| | | | Original Term | |

| | | | 15 years or less | | | More than 15 years | |

| | | | | | | Prepayment | | | | | | Prepayment | |

| | | | Principal | | | Speed | | | Principal | | | Speed | |

| Rate Range | | | Balance | | | (annualized) | | | Balance | | | (annualized) | |

| | | | (Dollars in thousands) | |

| | | | | | | | | | | | | | |

| < =4.50% | | | $ | 221,872 | | | | 14.46 | % | | $ | 162,804 | | | | 7.14 | % |

| | 4.51 - 4.99 | % | | | 357,383 | | | | 37.97 | | | | 185,251 | | | | 31.36 | |

| | 5.00 - 5.50 | % | | | 311,286 | | | | 50.01 | | | | 1,838,750 | | | | 29.69 | |

| | 5.51 - 5.99 | % | | | 68,084 | | | | 54.79 | | | | 438,103 | | | | 66.56 | |

| | 6.00 - 6.50 | % | | | 30,108 | | | | 27.07 | | | | 332,462 | | | | 60.16 | |