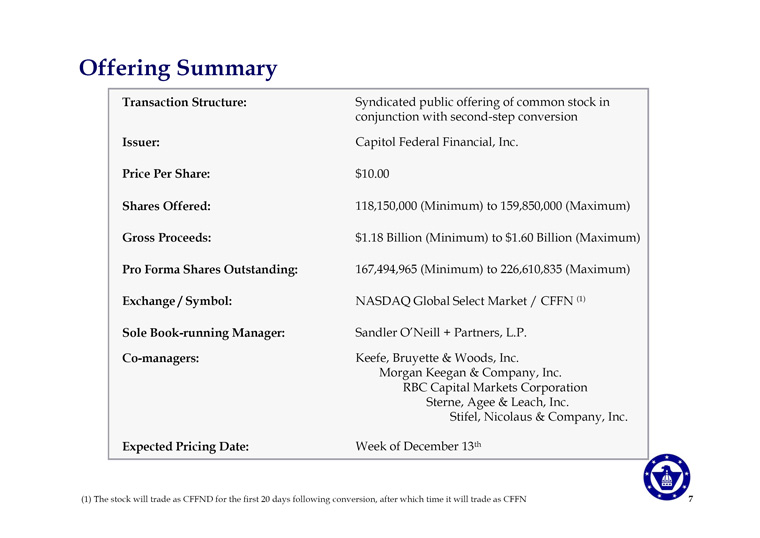

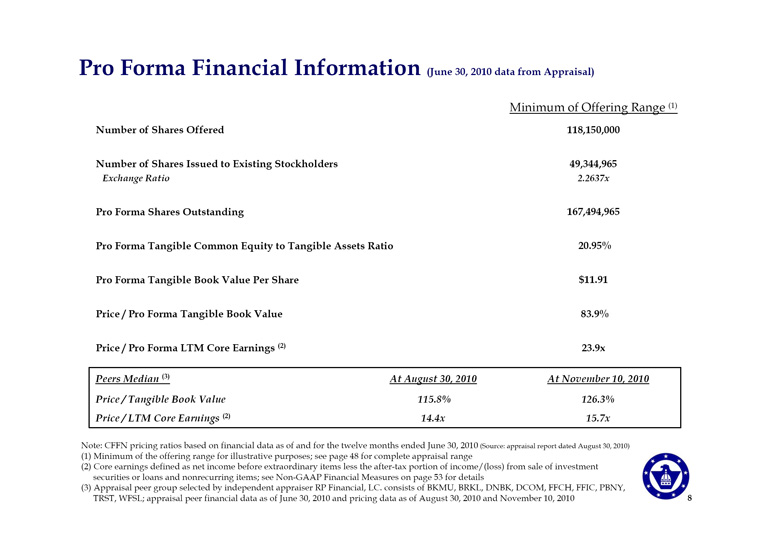

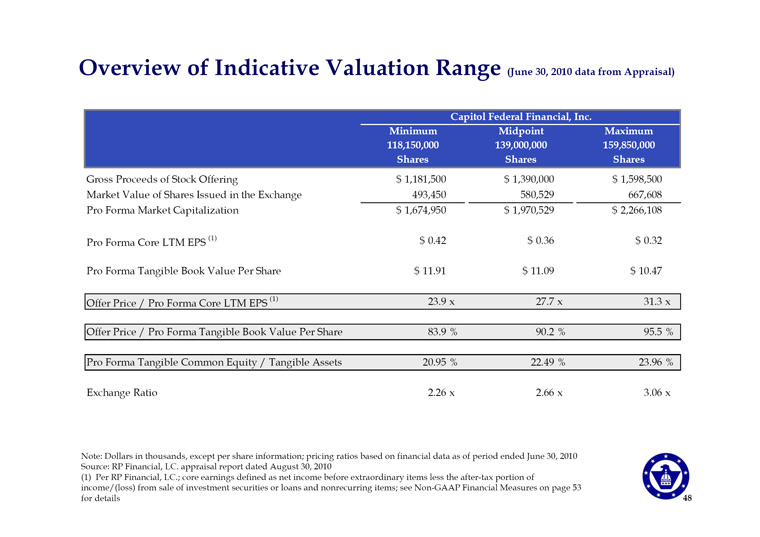

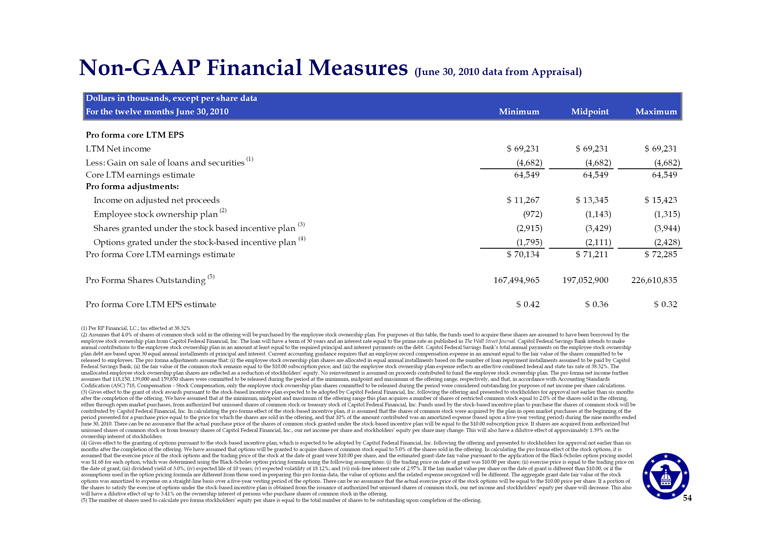

Non-GAAP Financial Measures (June 30, 2010 data from Appraisal) Dollars in thousands, except per share data For the twelve months June 30, 2010 Minimum Midpoint Maximum Pro forma core LTM EPS LTM Net income $ 69,231 $ 69,231$ 69,231 Less: Gain on sale of loans and securities (1) (4,682) (4,682) (4,682) Core LTM earnings estimate 64,549 64,549 64,549 Pro forma adjustments: Income on adjusted net proceeds $ 11,267 $ 13,345 $ 15,423 Employee stock ownership plan (2) (972) (1,143) (1,315) Shares granted under the stock based incentive plan (3) (2,915) (3,429) (3,944) Options grated under the stock-based incentive plan (4) (1,795) (2,111) (2,428) Pro forma Core LTM earnings estimate $ 70,134 $ 71,211 $ 72,285 Pro Forma Shares Outstanding (5) 167,494,965 197,052,900 226,610,835 Pro forma Core LTM EPS estimate $ 0.42 $ 0.36 $ 0.32 (1) Per RP Financial, LC.; tax effected at 38.32% (2) Assumes that 4.0% of shares of common stock sold in the offering will be purchased by the employee stock ownership plan. For purposes of this table, the funds used to acquire these shares are assumed to have been borrowed by the employee stock ownership plan from Capitol Federal Financial, Inc. The loan will have a term of 30 years and an interest rate equal to the prime rate as published in The Wall Street Journal. Capitol Federal Savings Bank intends to make annual contributions to the employee stock ownership plan in an amount at least equal to the required principal and interest payments on the debt. Capitol Federal Savings Bank’s total annual payments on the employee stock ownership plan debt are based upon 30 equal annual installments of principal and interest. Current accounting guidance requires that an employer record compensation expense in an amount equal to the fair value of the shares committed to be released to employees. The pro forma adjustments assume that: (i) the employee stock ownership plan shares are allocated in equal annual installments based on the number of loan repayment installments assumed to be paid by Capitol Federal Savings Bank; (ii) the fair value of the common stock remains equal to the $10.00 subscription price; and (iii) the employee stock ownership plan expense reflects an effective combined federal and state tax rate of 38.32%. The unallocated employee stock ownership plan shares are reflected as a reduction of stockholders’ equity. No reinvestment is assumed on proceeds contributed to fund the employee stock ownership plan. The pro forma net income further assumes that 118,150, 139,000 and 159,850 shares were committed to be released during the period at the minimum, midpoint and maximum of the offering range, respectively, and that, in accordance with Accounting Standards Codification (ASC) 718, Compensation - Stock Compensation, only the employee stock ownership plan shares committed to be released during the period were considered outstanding for purposes of net income per share calculations. (3) Gives effect to the grant of stock awards pursuant to the stock-based incentive plan expected to be adopted by Capitol Federal Financial, Inc. following the offering and presented to stockholders for approval not earlier than six months after the completion of the offering. We have assumed that at the minimum, midpoint and maximum of the offering range this plan acquires a number of shares of restricted common stock equal to 2.0% of the shares sold in the offering, either through open market purchases, from authorized but unissued shares of common stock or treasury stock of Capitol Federal Financial, Inc. Funds used by the stock-based incentive plan to purchase the shares of common stock will be contributed by Capitol Federal Financial, Inc. In calculating the pro forma effect of the stock-based incentive plan, it is assumed that the shares of common stock were acquired by the plan in open market purchases at the beginning of the period presented for a purchase price equal to the price for which the shares are sold in the offering, and that 10% of the amount contributed was an amortized expense (based upon a five-year vesting period) during the nine months ended June 30, 2010. There can be no assurance that the actual purchase price of the shares of common stock granted under the stock-based incentive plan will be equal to the $10.00 subscription price. If shares are acquired from authorized but unissued shares of common stock or from treasury shares of Capitol Federal Financial, Inc., our net income per share and stockholders’ equity per share may change. This will also have a dilutive effect of approximately 1.39% on the ownership interest of stockholders. (4) Gives effect to the granting of options pursuant to the stock-based incentive plan, which is expected to be adopted by Capitol Federal Financial, Inc. following the offering and presented to stockholders for approval not earlier than six months after the completion of the offering. We have assumed that options will be granted to acquire shares of common stock equal to 5.0% of the shares sold in the offering. In calculating the pro forma effect of the stock options, it is assumed that the exercise price of the stock options and the trading price of the stock at the date of grant were $10.00 per share, and the estimated grant-date fair value pursuant to the application of the Black-Scholes option pricing model was $1.68 for each option, which was determined using the Black-Scholes option pricing formula using the following assumptions: (i) the trading price on date of grant was $10.00 per share; (ii) exercise price is equal to the trading price on the date of grant; (iii) dividend yield of 3.0%; (iv) expected life of 10 years; (v) expected volatility of 18.12%; and (vi) risk-free interest rate of 2.97%. If the fair market value per share on the date of grant is different than $10.00, or if the assumptions used in the option pricing formula are different from those used in preparing this pro forma data, the value of options and the related expense recognized will be different. The aggregate grant date fair value of the stock options was amortized to expense on a straight-line basis over a five-year vesting period of the options. There can be no assurance that the actual exercise price of the stock options will be equal to the $10.00 price per share. If a portion of the shares to satisfy the exercise of options under the stock-based incentive plan is obtained from the issuance of authorized but unissued shares of common stock, our net income and stockholders’ equity per share will decrease. This also will have a dilutive effect of up to 3.41% on the ownership interest of persons who purchase shares of common stock in the offering. (5) The number of shares used to calculate pro forma stockholders’ equity per share is equal to the total number of shares to be outstanding upon completion of the offering. 54 |