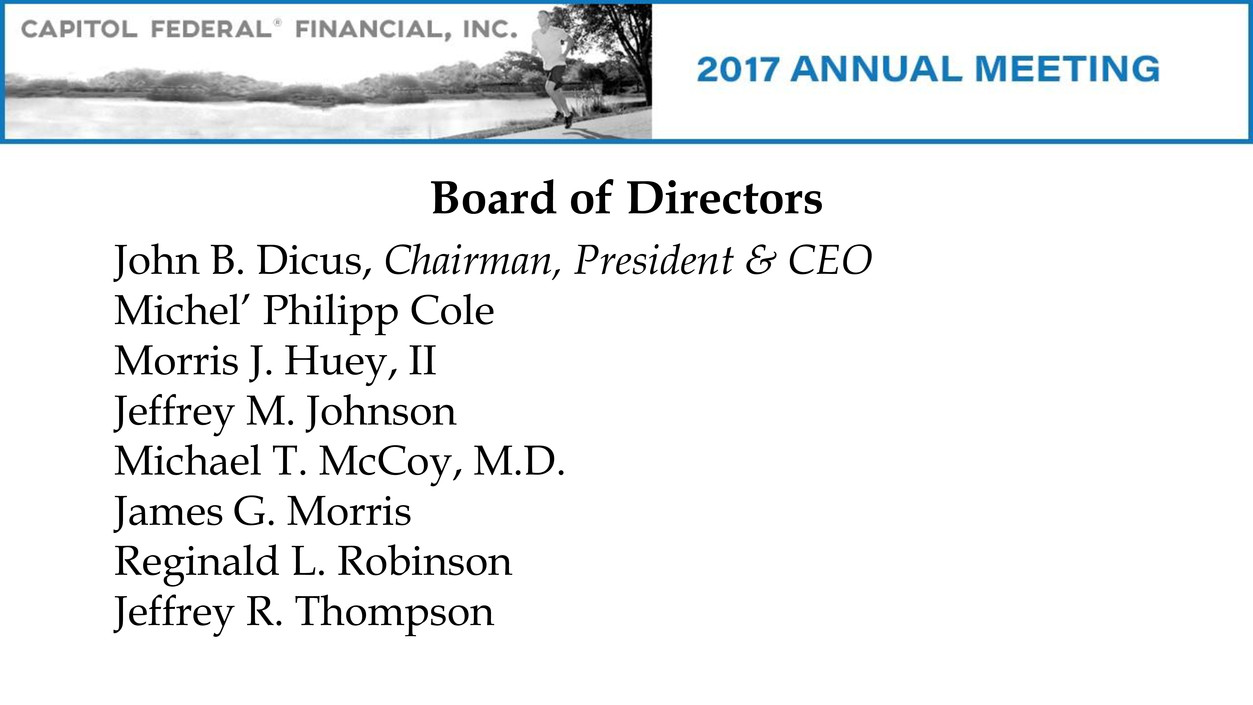

Board of Directors John B. Dicus, Chairman, President & CEO Michel’ Philipp Cole Morris J. Huey, II Jeffrey M. Johnson Michael T. McCoy, M.D. James G. Morris Reginald L. Robinson Jeffrey R. Thompson

Management John B. Dicus, Chairman, President & CEO Natalie G. Haag, Executive Vice President & Corporate Secretary Rick C. Jackson, Executive Vice President Daniel L. Lehman, Executive Vice President Carlton A. Ricketts, Executive Vice President Kent G. Townsend, Executive Vice President

Safe Harbor Disclosure Except for the historical information contained in this presentation, the matters discussed may be deemed to be forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions. The words "may," "could," "should," "would," "will," "believe," "anticipate," "estimate," "expect," "intend," "plan," and similar expressions are intended to identify forward-looking statements. Forward-looking statements that involve risks and uncertainties, including changes in economic conditions in Capitol Federal Financial, Inc.’s market area, changes in policies by regulatory agencies and other governmental initiatives affecting the financial services industry, fluctuations in interest rates, demand for loans in Capitol Federal Financial, Inc.’s market area, the future earnings and capital levels of Capitol Federal Savings Bank, which would affect the ability of Capitol Federal Financial, Inc. to pay dividends in accordance with its dividend policies, competition, and other risks detailed from time to time in documents filed or furnished by Capitol Federal Financial, Inc. with the SEC. Actual results may differ materially from those currently expected. These forward-looking statements represent Capitol Federal Financial, Inc.’s judgment as of the date of this presentation. Capitol Federal Financial, Inc. disclaims, however, any intent or obligation to update these forward-looking statements.

Selected Balance Sheet Data September 30, 2017 2016 (in thousands) Total Assets $ 9,192,916 $ 9,267,247 Total Loans $ 7,195,071 $ 6,958,024 Total Deposits $ 5,309,868 $ 5,164,018 Total Borrowings $ 2,373,808 $ 2,572,389 Total Stockholders' Equity $ 1,368,313 $ 1,392,964

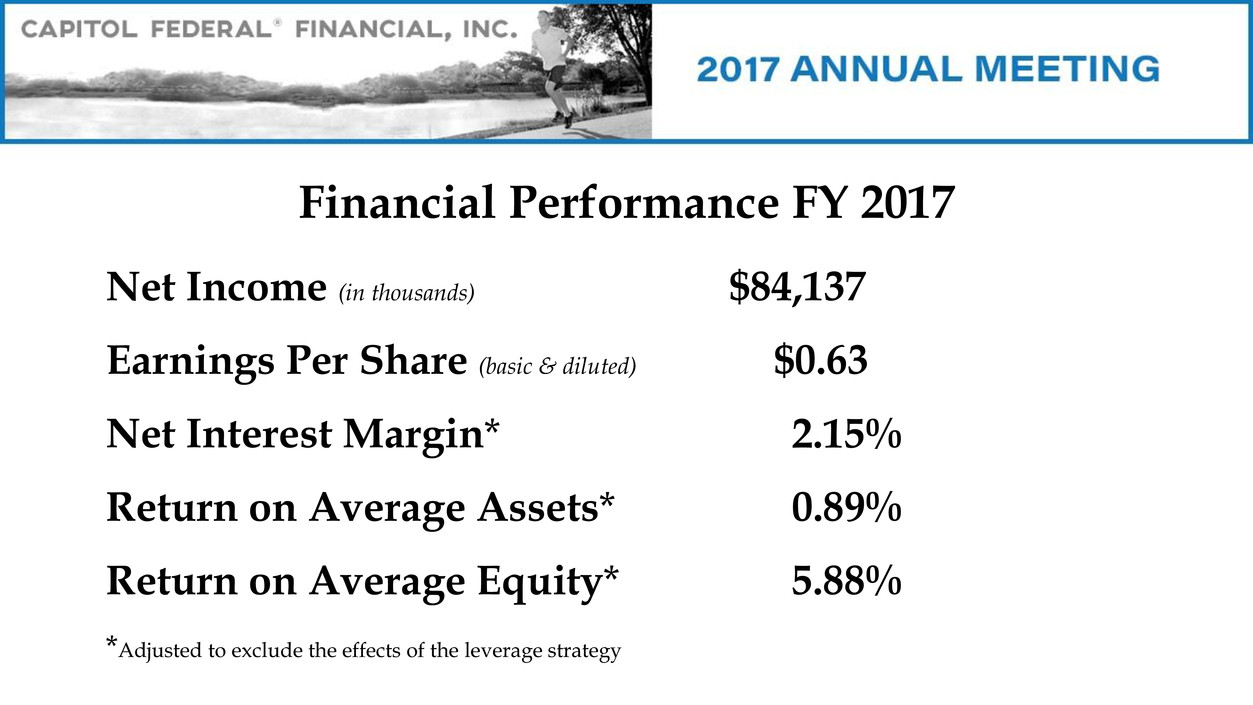

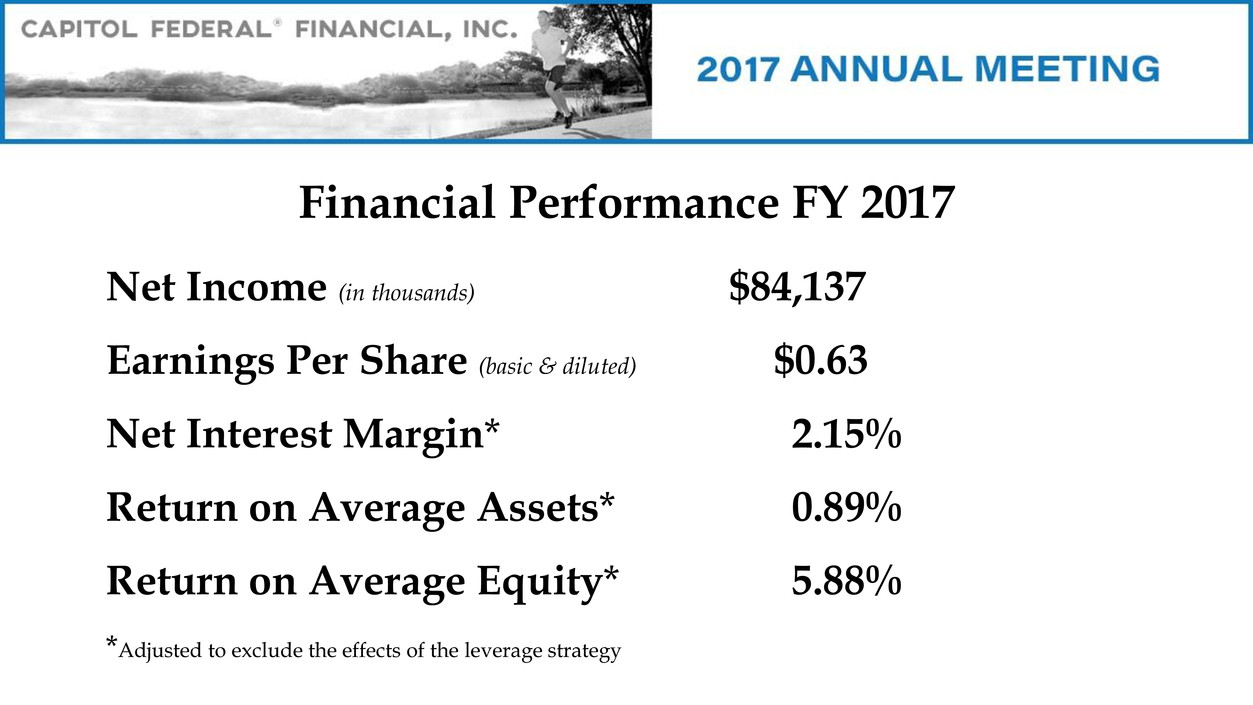

Financial Performance FY 2017 Net Income (in thousands) $84,137 Earnings Per Share (basic & diluted) $0.63 Net Interest Margin* 2.15% Return on Average Assets* 0.89% Return on Average Equity* 5.88% *Adjusted to exclude the effects of the leverage strategy

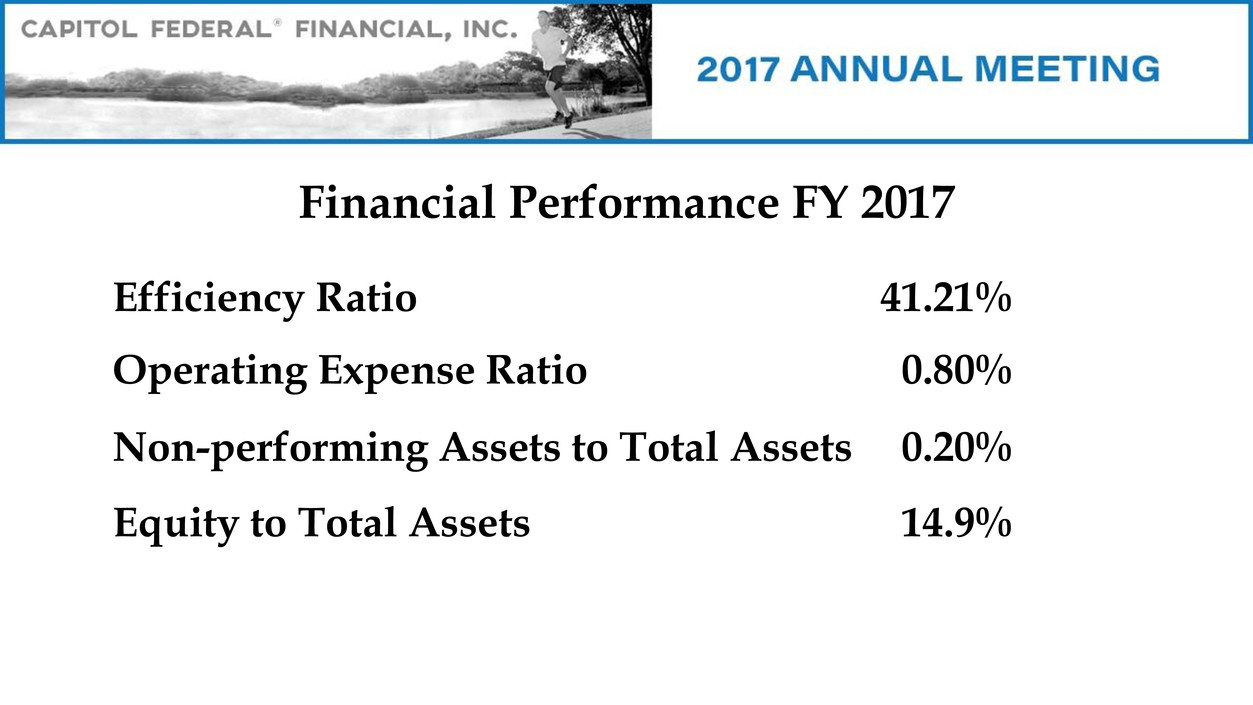

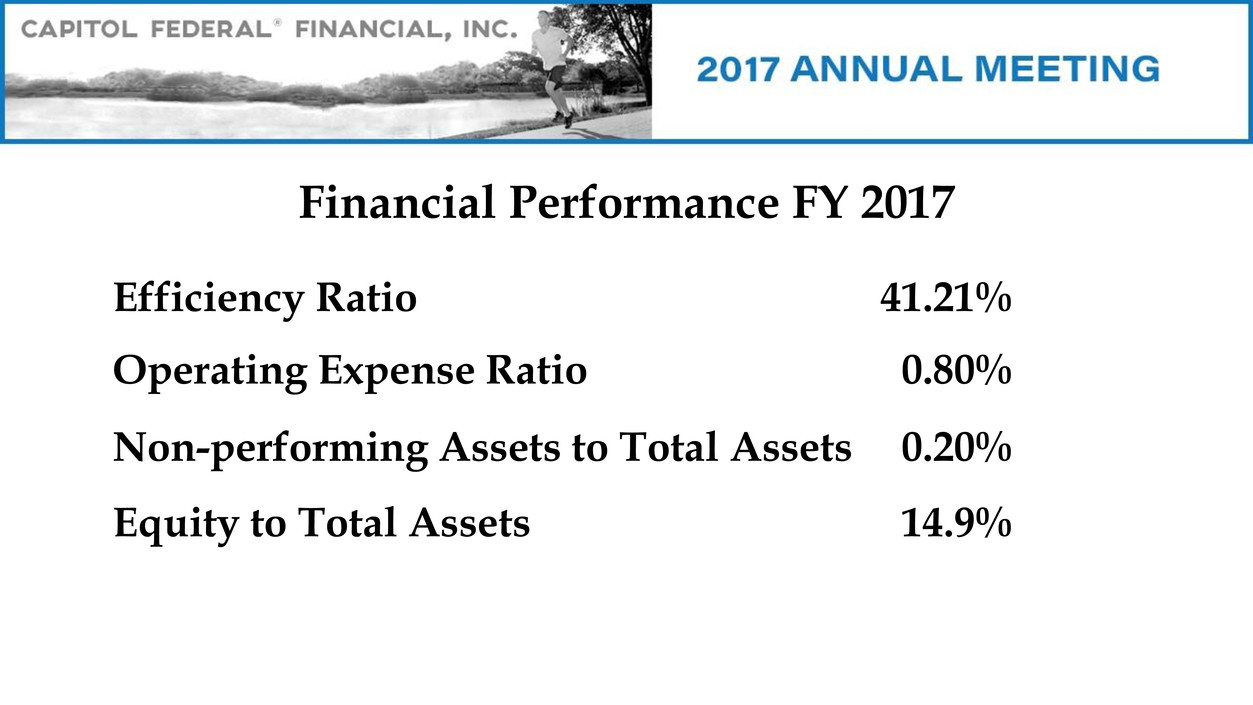

Efficiency Ratio 41.21% Operating Expense Ratio 0.80% Non-performing Assets to Total Assets 0.20% Equity to Total Assets 14.9% Financial Performance FY 2017

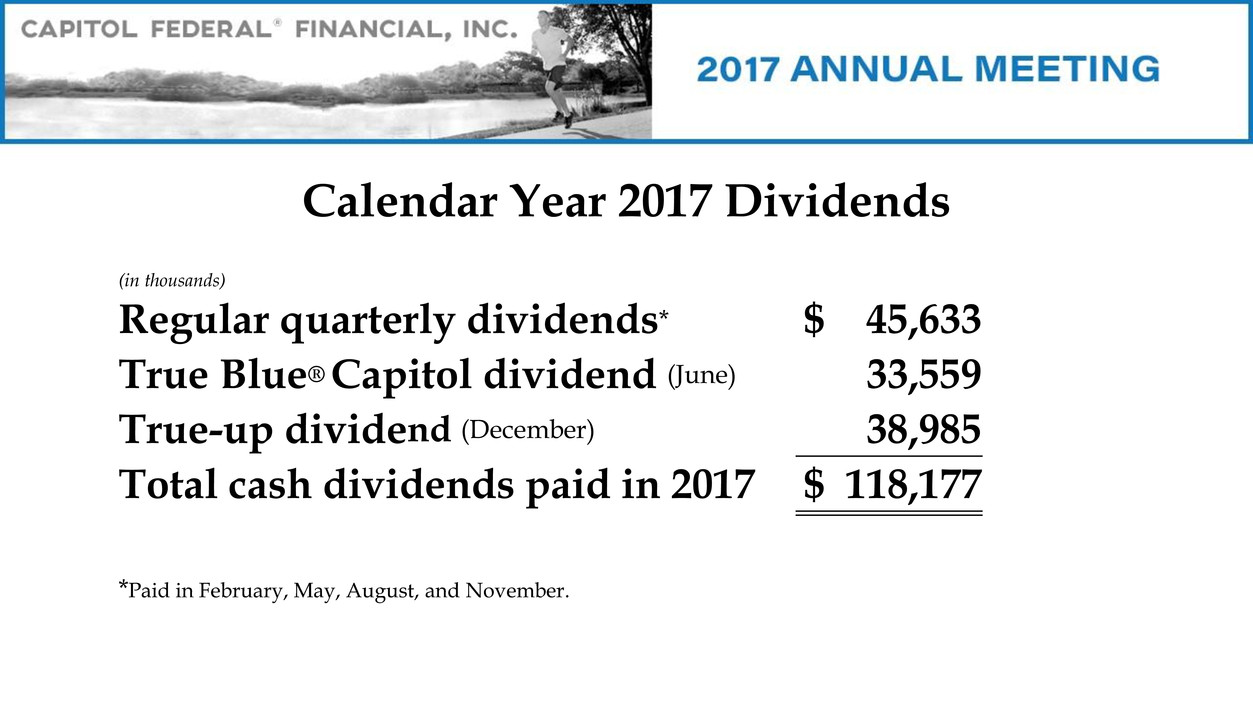

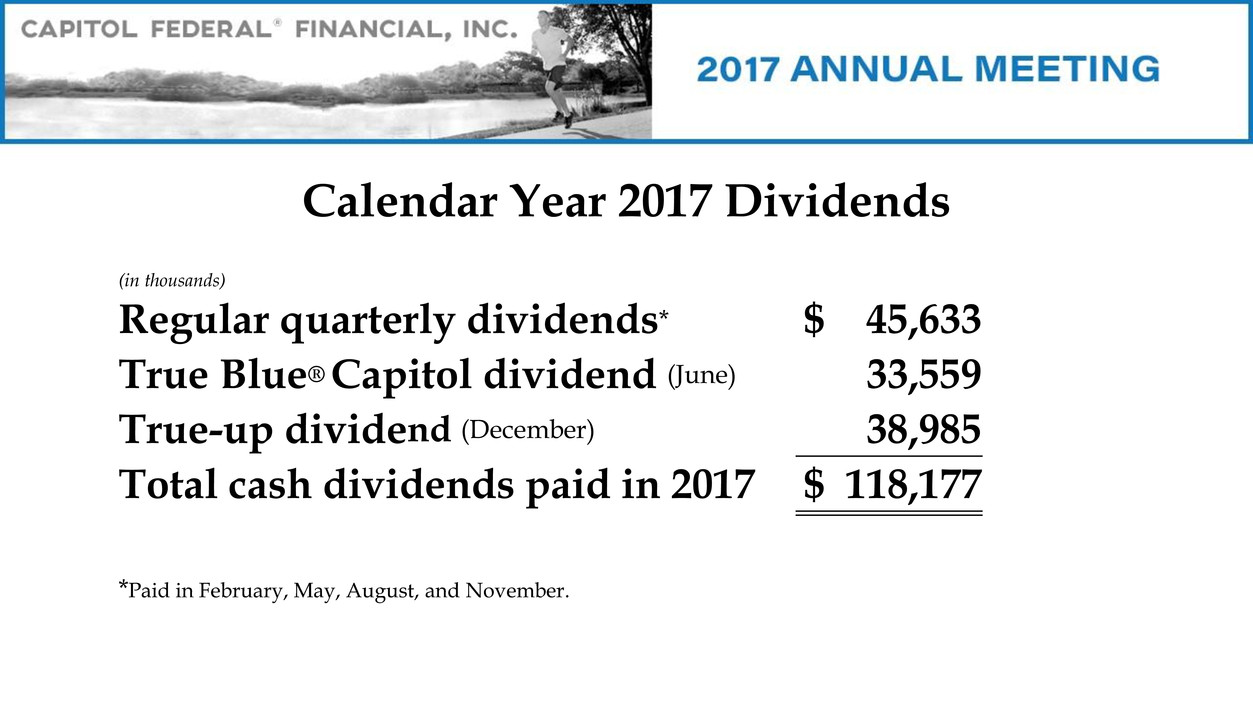

Calendar Year 2017 Dividends (in thousands) Regular quarterly dividends* $ 45,633 True Blue® Capitol dividend (June) 33,559 True-up dividend (December) 38,985 Total cash dividends paid in 2017 $ 118,177 *Paid in February, May, August, and November.

Cumulative Cash Returned to Stockholders †Includes named capital dividends paid (in millions) $1,244.2 Share Repurchases Stockholder Dividends $368.0 31,009,944 Shares Avg. Price of $11.87 $6.14 Per Share $0.0 $250.0 $500.0 $750.0 $1,000.0 $1,250.0 Since 2nd Step Corporate Reorganization † $876.2

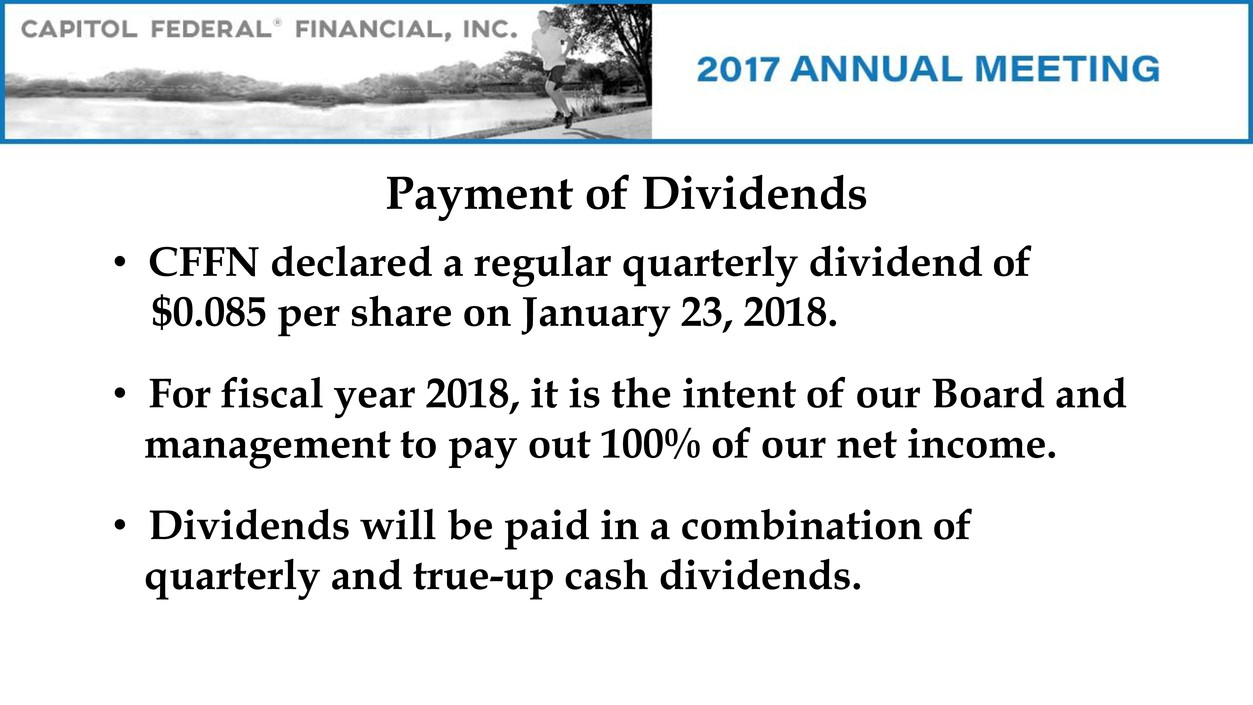

Payment of Dividends • CFFN declared a regular quarterly dividend of $0.085 per share on January 23, 2018. • For fiscal year 2018, it is the intent of our Board and management to pay out 100% of our net income. • Dividends will be paid in a combination of quarterly and true-up cash dividends.

A Proven Path • Single-Family Portfolio Lender • Retail Financial Services • Excellent Asset Quality • Strong Cost Controls • Strong Capital Position • Stockholder Value • Interest Rate Risk Management

• Continued growth of our commercial real estate loan portfolio primarily through loan participations with our correspondent lending relationships. • Continued the leverage strategy during fiscal year 2017, which added $2.8 million to net income. • Continued focus on cost controls through technology efficiencies and enhancements. A Proven Path

Questions & Answers

Thank you for attending