UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrantx | Filed by a Party other than the Registrant¨ |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

BUSINESS DEVELOPMENT CORPORATION OF AMERICA

(Name of Registrant as Specified In Its Charter)

(Name of person(s) filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

Peter M. Budko Chief Executive Officer Business Development Corporation of America Richard J. Byrne President Benefit Street Partners Corinne Pankovcin Chief Financial Officer Business Development Corporation of America

Investing in America’s Growth Disclosures 2 This presentation was prepared exclusively for the benefit and use of the Business Development Corporation of America (“BDCA”) investors to whom it is directly addressed and delivered and does not carry any right of publication or disclosure, in whole or in part, to any other party . This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by BDCA employees . Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of BDCA Adviser, LLC . BDCA Adviser, LLC is indirectly, wholly - owned by the sponsor, AR Global Investments, LLC The sole purpose of this presentation is to provide investors with an update on BDCA . The description of certain aspects of BDCA herein is a condensed summary only . This summary does not purport to be complete and no obligation to update or otherwise revise such information is being assumed . Nothing shall be relied upon as a promise or representation as to the future performance of BDCA . This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted . This summary is not advice, a recommendation or an offer to enter into any transaction with BDCA or any of their affiliated funds . There is no guarantee that any of the goals, targets or objectives described in this summary will be achieved . Certain information included in this presentation (including certain information relating to portfolio companies) was derived from third party sources and has not been independently verified and, accordingly, BDCA makes no representation or warranty in respect of this information . The following slides contain summaries of certain financial and statistical information about BDCA . The information contained in this presentation is summary information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from time to time . We undertake no duty or obligation to publicly update or revise the information contained in this presentation . In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured . You should not view the past performance of BDCA, or information about the market, as indicative of BDCA’s future results . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities of BDCA . The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations . Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances . Forward Looking Statements and Risk Factors This presentation contains “forward looking statements” that are subject to risks and uncertainties . Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of BDCA, including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”) . Any such forward - looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and BDCA assumes no obligation to update or revise any such forward looking statements . BDCA has based these forward - looking statements on its current expectations and projections about future events . BDCA believes that the expectations and assumptions that have been made with respect to these forward - looking statements are reasonable . However, such expectations and assumptions may prove to be incorrect . A number of factors could lead to results that may differ from those expressed or implied by the forward - looking statements . Given this level of uncertainty, prospective investors should not place undue reliance on any forward - looking statements .

Investing in America’s Growth 3 What is Happening? Why Now? Enhanced Opportunities for BDCA and its Stockholders □ Over the past five years, BDCA stockholders have enjoyed consistent performance delivered by BDCA Adviser, LLC (“the Adviser”) and its personnel . The Adviser believes that to achieve optimal results going forward, it would need to draw upon additional resources . □ In consideration of what would provide the best foundation for future success, BDCA Adviser has determined that Benefit Street Partners, L . L . C . (“Benefit Street”) and its affiliate, Providence Equity Partners, L . L . C . (“Providence Equity”) will deliver the resources and expertise necessary to attain our core objectives and to successfully achieve the liquidity we expect to realize within the next several years . □ Our Board has assessed Benefit Street’s capabilities and historical performance and believes that stockholders will benefit from Benefit Street’s institutional presence, larger existing origination and investment management teams and sophisticated infrastructure . Benefit Street’s credit capabilities and expertise are further strengthened by Providence Equity’s global reach .

Investing in America’s Growth 4 Proposed Transfer of Our Investment Adviser, BDCA Adviser, to Benefit Street Partners □ AR Global Investments, LLC (“AR Global”), the parent of the Adviser has entered into a membership interest purchase agreement with an affiliate of Benefit Street, pursuant to which Benefit Street will acquire all of the outstanding limited liability company interests of the Adviser . □ Stockholders are being asked to approve BDCA’s entry into a new investment advisory agreement which is required due to the change of control of the Adviser . □ Proxies are being distributed to all BDCA stockholders which further outline the details of this transaction . What is Happening? Why Now?

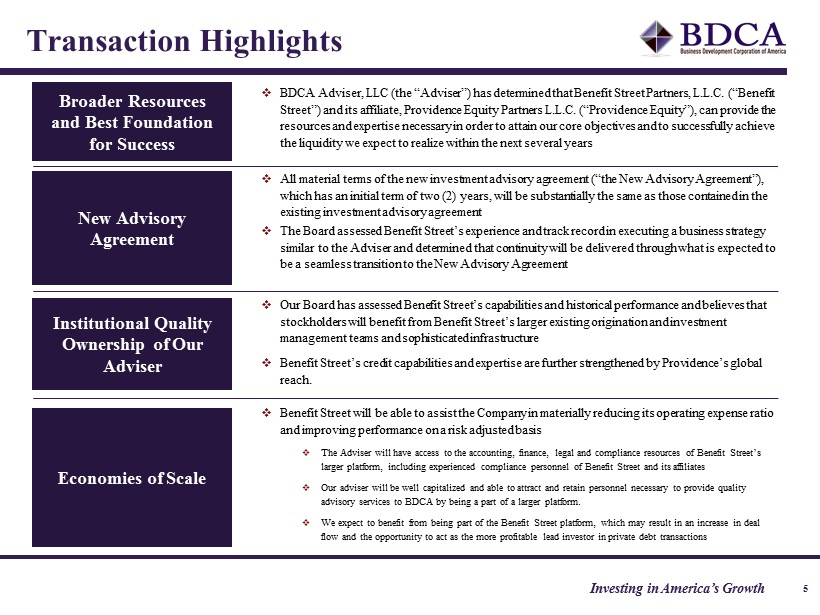

Investing in America’s Growth 5 Transaction Highlights □ BDCA Adviser, LLC (the “Adviser”) has determined that Benefit Street Partners, L.L.C. (“Benefit Street”) and its affiliate, Providence Equity Partners L.L.C. (“Providence Equity”), can provide the resources and expertise necessary in order to attain our core objectives and to successfully achieve the liquidity we expect to realize within the next several years □ All material terms of the new investment advisory agreement (“the New Advisory Agreement”), which has an initial term of two (2) years, will be substantially the same as those contained in the existing investment advisory agreement □ The Board assessed Benefit Street’s experience and track record in executing a business strategy similar to the Adviser and determined that continuity will be delivered through what is expected to be a seamless transition to the New Advisory Agreement □ Our Board has assessed Benefit Street ’s capabilities and historical performance and believes that stockholders will benefit from Benefit Street ’s larger existing origination and investment management teams and sophisticated infrastructure □ Benefit Street ’s credit capabilities and expertise are further strengthened by Providence’s global reach. □ Benefit Street will be able to assist the Company in materially reducing its operating expense ratio and improving performance on a risk adjusted basis □ The Adviser will have access to the accounting, finance, legal and compliance resources of Benefit Street’s larger platform, including experienced compliance personnel of Benefit Street and its affiliates □ Our adviser will be well capitalized and able to attract and retain personnel necessary to provide quality advisory services to BDCA by being a part of a larger platform. □ We expect to benefit from being part of the Benefit Street platform, which may result in an increase in deal flow and the opportunity to act as the more profitable lead investor in private debt transactions Broader Resources and Best Foundation for Success Economies of Scale New Advisory Agreement Institutional Quality Ownership of Our Adviser

Investing in America’s Growth 6 □ Benefit Street is a leading credit - focused alternative asset management firm with over $ 13 . 0 billion in assets under management, including $ 3 . 9 billion in private corporate debt . □ Benefit Street was formed in 2008 as the credit investment platform of Providence Equity, a leading global private equity firm with more than $ 46 billion in assets under management . □ Benefit Street manages funds for institutions and high - net - worth investors, including private funds with strategies substantially similar to the investment strategy of BDCA . Its funds invest globally across various credit funds and strategies including private debt, long - short liquid credit, long - only credit and commercial real estate debt . □ Benefit Street has over 115 professionals, including 73 investment and research professionals . Who is Benefit Street Partners? As of July 31, 2016

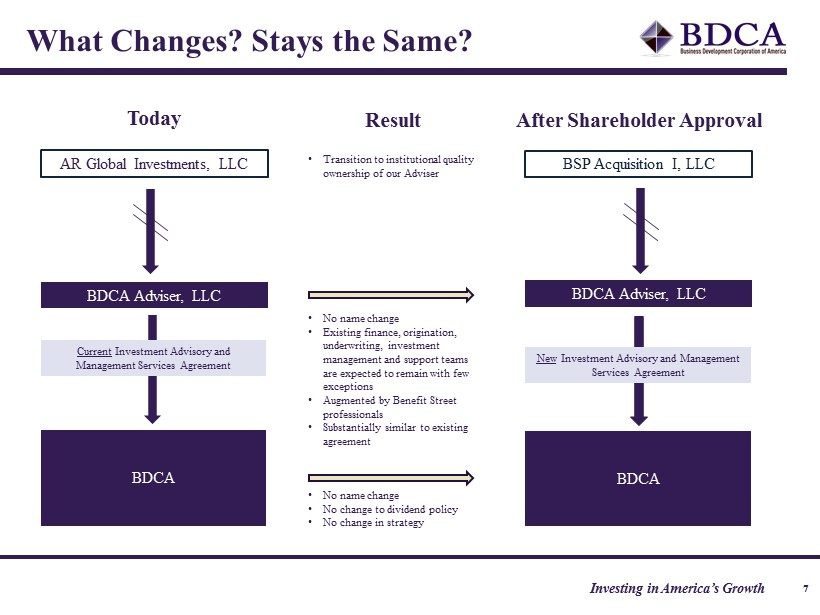

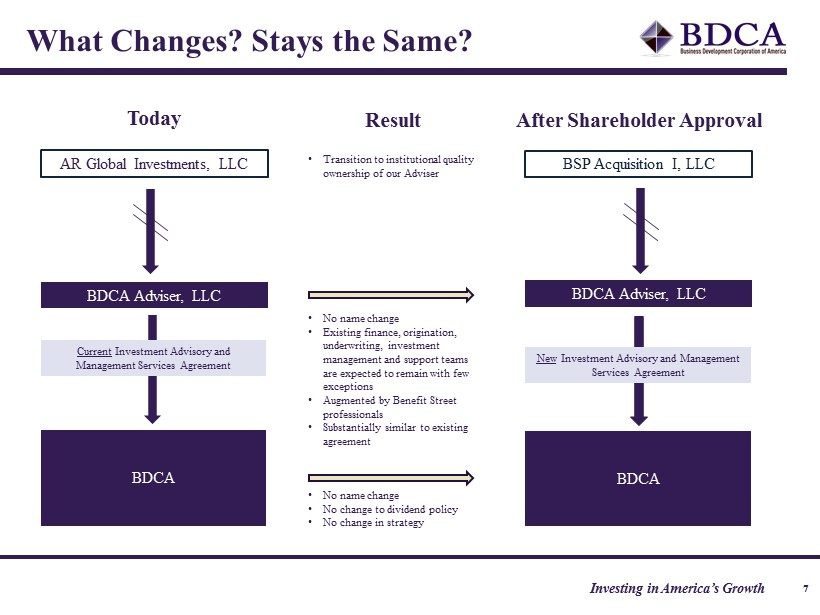

Investing in America’s Growth What Changes? Stays the Same? 7 BDCA Adviser, LLC BDCA Today • Transition to institutional quality ownership of our Adviser After Shareholder Approval BSP Acquisition I, LLC Current Investment Advisory and Management Services Agreement BDCA Adviser, LLC BDCA AR Global Investments, LLC New Investment Advisory and Management Services Agreement Result • No name change • Existing finance, origination, underwriting, investment management and support teams are expected to remain with few exceptions • Augmented by Benefit Street professionals • Substantially similar to existing agreement • No name change • No change to dividend policy • No change in strategy

Investing in America’s Growth 8 □ Investors Will Not Bear Any Costs Associated with the Special Meeting of Stockholders □ All costs associated with the transaction and the proxy are borne by the Adviser, AR Global and Benefit Street. □ Fees Paid to the Adviser do not change under the proposed New Advisory Agreement □ The management and incentive fees under the New Advisory Agreement will be calculated in a manner identical to that of the existing investment advisory agreement. What Transaction Costs will be Borne by BDCA or BDCA Stockholders?

Investing in America’s Growth 9 □ The transition to institutional quality ownership of the Adviser will provide greater opportunities for BDCA and its stockholders to achieve on attractive liquidity event in the near term . □ BDCA’s investment objective, which is to generate both current income and to a lesser extent long - term capital appreciation through debt and equity investments will remain unchanged . □ As part of the Benefit Street platform, we expect to realize an increase in deal flow and the opportunity to act as the more profitable lead investor in private debt transactions . □ The Adviser will be well capitalized and able to attract and retain personnel necessary to provide quality advisory services to BDCA by being a part of a larger platform . □ The Adviser will have access to the accounting, finance, legal and compliance resources of Benefit Street’s larger platform . □ Key personnel including Corinne Pankovcin, our CFO, and a majority of our current origination, underwriting, investment management and support teams are expected to continue to play key roles for BDCA . □ They will be complemented by Benefit Street’s private debt origination team, industry - focused experts and broad investment product expertise . These professionals are expected to provide the Adviser with additional resources in origination, underwriting and portfolio management . □ BDCA will benefit from Benefit Street’s larger existing teams and sophisticated infrastructure . Benefit Street’s credit capabilities and expertise are further strengthened by Providence’s global reach . What are Some Key Benefits of the Transaction?

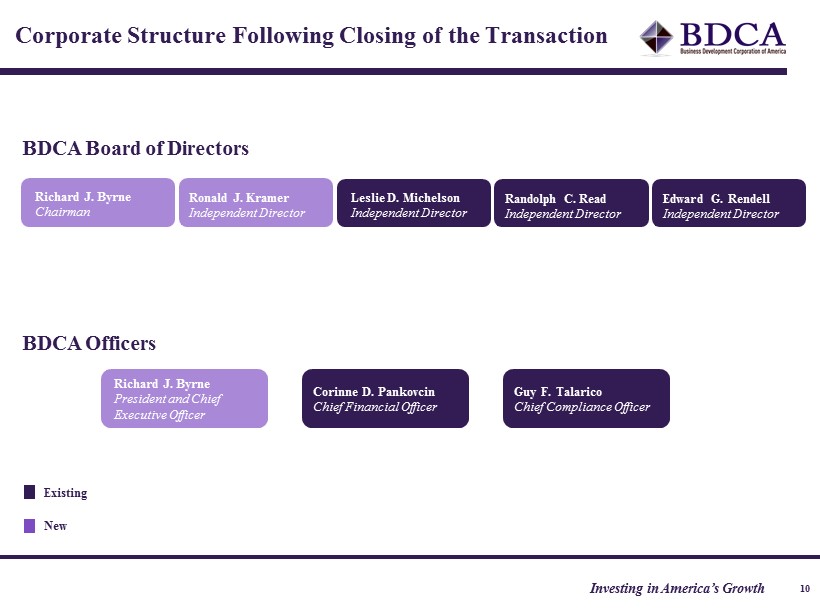

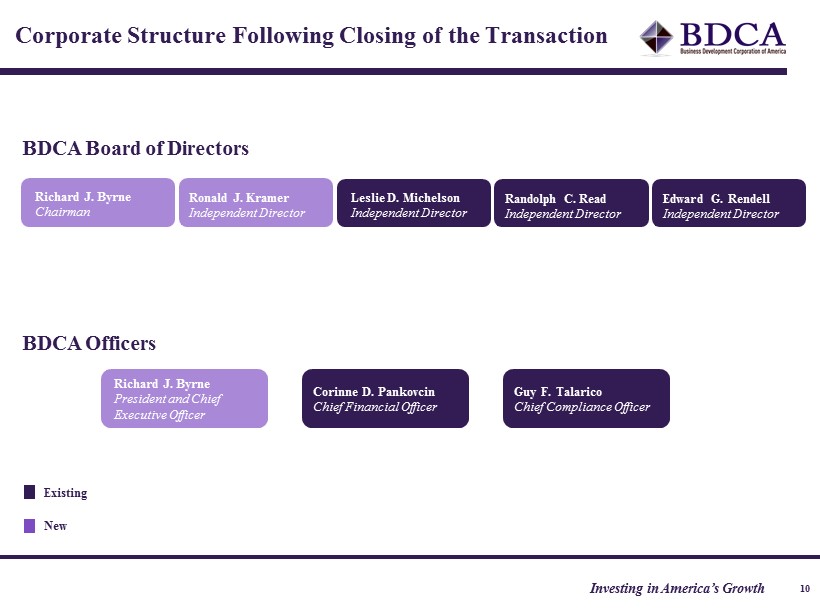

Investing in America’s Growth 31 10 Richard J. Byrne President and Chief Executive Officer Richard J. Byrne Chairman Leslie D. Michelson Independent Director Randolph C. Read Independent Director BDCA Officers BDCA Board of Directors Corinne D. Pankovcin Chief Financial Officer Edward G. Rendell Independent Director Ronald J. Kramer Independent Director Guy F. Talarico Chief Compliance Officer Existing New Corporate Structure Following Closing of the Transaction

Investing in America’s Growth 11 □ Our current distribution is approximately $ 0 . 868 per share on an annualized basis . Our current per share net asset value is $ 8 . 84 per share . □ There is no current intention to change our distribution policy . Our distributions may exceed earnings . As a result, a portion of the distributions you receive may be considered a return of capital for U . S . federal income tax purposes . The amount of our distributions, if any, will continue to be determined by our Board . Monthly Distributions Existing Dividend Policy

Investing in America’s Growth 12 □ The anticipated holding period for BDCA shares is five to seven years from the close of the initial public, non - listed offering of securities, which occurred in April of 2015 . □ The Board believes at this time that a stock exchange listing whereby our stock has the potential to ultimately trade at a premium to net asset value is likely to be the most favorable liquidity event for stockholders . The Board feels that Benefit Street, as a highly respected institutional investment manager, is well positioned to optimize BDCA’s portfolio performance and expense structure and has the requisite access to institutional capital and relationships that could produce such an outcome . When will BDCA Provide Liquidity for Stockholders?

Investing in America’s Growth 13 The Special Meeting of Stockholders is being held for the following purposes: To transact such other business as may properly come before the Special Meeting, or any postponement or adjournment thereof . What is Proposed in the Proxy? 2 1 Special Meeting of Stockholders 3 To approve the New Advisory Agreement between BDCA and the Adviser, to take effect upon the consummation of the Transaction ; 4 To vote on the election of the one additional Independent Director nominee named in the Proxy Statement and in the proxy card to serve on the Board of Directors for the term specified in the Proxy Statement, to take effect upon consummation of the Transaction ; To approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies ; and

Investing in America’s Growth 14 Board Recommendations □ In evaluating Mr . Kramer, the new Independent Director nominee, our Board reviewed his experience and set of skills, and believes electing Mr . Kramer is in the best interests of the Company and its stockholders . Please see “ What are the benefits of the Transaction to the Company and its stockholders?” in the proxy statement . Accordingly, after careful consideration, our Board unanimously recommends that you vote “FOR” the proposal to elect Mr . Kramer to the Board . Does the Board Recommend the proposed Non - Interested Director? □ In evaluating the New Advisory Agreement, the Board reviewed extensive materials furnished separately by the Adviser, Benefit Street and their affiliates . The Board discussed the Adviser’s and Benefit Street’s philosophies of management, historical performance, and methods of operations, and believes the New Advisory Agreement is in the best interests of BDCA and its stockholders . Please see “ What are the benefits of the Transaction to BDCA and its stockholders? Accordingly, after careful consideration, the Board unanimously recommends that you vote “FOR” the proposal to approve the New Advisory Agreement . What Does the Board Recommend with respect to the New Advisory Agreement?

Investing in America’s Growth 15 What do I do Next? □ If you have any questions about voting your shares in connection with the special meeting being held on October 28 , 2016 , please contact our proxy solicitor, Broadridge Investor Communication Solutions, Inc . at ( 855 ) 928 - 4496 . Stockholders also have the following options for authorizing a proxy to vote their shares . Vote by Phone at 1 - 800 - 690 - 6903 and please have your control number available. Vote by Mail by completing, signing and dating the enclosed proxy ballot and returning it in the pre - paid envelope provided in this package. Vote by Internet at www .pr o x yvo te . com/ BDCA and enter the contr ol number on the voting instructions f orm and foll ow the promp ts.

Investing in America’s Growth The following is a summary of risk factors for Business Development Corporation of America . Risk Factors 16 □ You should not expect to be able to sell your shares regardless of how we perform . □ If you are able to sell your shares, you will likely receive less than your purchase price . □ Our Adviser and its affiliates, including our officers and some of our directors, will face conflicts of interest caused by compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our stockholders . □ We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, and we do not expect a secondary market in the shares to develop . □ We may borrow funds to make investments . As a result, we would be exposed to the risks of borrowing, also known as leverage, which may be considered a speculative investment technique . Leverage increases the volatility of investments by magnifying the potential for gain and loss on amounts invested, thereby increasing the risks associated with investing in our securities . Moreover, any assets we may acquire with leverage will be subject to management fees payable to our Adviser ; thus our Adviser may have an incentive to increase portfolio leverage in order to earn higher management fees . □ Because you will be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. □ Our distributions may be funded from any sources of funds available to us, including offering proceeds and borrowings as well as expense support payments from our Adviser that are subject to reimbursement to it, which may constitute a return of capital and reduce the amount of capital available to us for investment . We have not established limits on the amount of funds we may use from available sources to make distributions . The Adviser has no obligation to make expense support payments in the future . Any capital returned to stockholders through distributions will be distributed after payment of fees and expenses . Our Adviser may also waive reimbursements by us for certain expenses paid by it to fund our distributions . The waived reimbursements may be subject to repayment in the future, reducing future distributions to which our stockholders may be entitled .

Investing in America’s Growth www.BDCA.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com