UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrantx | Filed by a Party other than the Registrant¨ |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

BUSINESS DEVELOPMENT CORPORATION OF AMERICA

(Name of Registrant as Specified In Its Charter)

(Name of person(s) filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

2017 Annual Meeting

Disclosures 2 FORWARD - LOOKING STATEMENTS Statements included herein and in the Proxy Statement filed by Business Development Corporation of America (“BDCA ”, “our”, “we”, or the “Company”) on March 16, 2017 (the “Proxy Statement”) may constitute “forward - looking statements,” which relate to future events or the future performance or financial condition of BDCA. BDCA cautions readers that any forward - looking information is not a guarantee of future performance, conditio n or results and involves a number of risks and uncertainties. Actual results and condition may differ materially from those in the forward - looking statemen ts as a result of a number of factors. Such forward - looking statements include, but are not limited to, statements about the benefits of the proposals and oth er statements that are not historical facts. Factors that may affect future results and condition are described in BDCA’s filings with the SEC, which are available at the SE C’s website at http://www.sec.gov or www.bdcofamerica.com . BDCA disclaims any obligation to update and revise statements made herein base on new information or otherwise. The following slides contain summaries of certain financial and statistical information about BDCA. The information contained in this presentation is summary information that is intended to be considered in the context of the Proxy Statement and BDCA’s SEC filings and other public a nno uncements that it may make, by press release or otherwise, from time to time. In addition, information related to past performance, while helpful as an e val uative tool, is not necessarily indicative of BDCA’s future results, the achievement of which cannot be assured. You should not view the past performance of BDC A, or information about the market, as indicative of BDCA’s future results. IMPORTANT ADDITIONAL INFORMATION FILED WITH THE SEC This communication is being made in respect of certain proposals to be voted on at BDCA’s 2017 annual meeting of stockholders . I n connection with such proposals, BDCA has filed with the SEC the Proxy Statement. BDCA mailed to the Proxy Statement to its stockholders on or abou t M arch 17, 2017. THIS PRESENTATION IS MEANT ONLY TO BE A SUMMARY OF INFORMATION SET FORTH IN THE PROXY STATEMENT AND DOES NOT PURPORT TO BE CO MPL ETE. THESE MATERIALS ARE SUBJECT TO AND ARE QUALIFIED BY REFERENCE TO THE PROXY STATEMENT IN ITS ENTIRETY. YOU ARE URGED TO READ THE PRO XY STATEMENT BECAUSE IT, AND NOT THESE MATERIALS, SETS FORTH A COMPLETE DESCRIPTION OF THE PROPOSALS TO BE PRESENTED AT BDCA’S 2017 ANNUAL MEETING OF STOCKHOLDERS. Investors and security holders can obtain free copies of the Proxy Statement and other documents filed with the SEC by BDCA t hro ugh the web site maintained by the SEC at http://www.sec.gov . Free copies of the Proxy Statement can also be obtained at http://www.proxyvote.com/BDCA . PROXY SOLICITATION BDCA and its respective directors, executive officers and certain other members of management and employees, including manage men t and employees of BDCA’s investment adviser and its affiliates may be soliciting proxies from BDCA’s stockholders in favor of the proposals set fo rth in this Proxy Statement. Information regarding BDCA’s executive officers, directors and other persons who may, under the rules of the SEC, be consider ed participants in the solicitation of BDCA’s stockholders in connection with such proposals are set forth in the Proxy Statement. You can obtain free copies of the Pr oxy Statement from BDCA in the manner set forth above.

3 Section I Proxy Overview Section II Board Recommendations Section III Voting Information Table of Contents

4 Section I – Proxy Overview

5 ▪ BDCA’s Board of Directors has fixed the close of business on March 15, 2017 as the record date for shareholders entitled to vote at the Annual Meeting . ▪ BDCA filed the Proxy Statement on March 16, 2017 . This Proxy Statement, the proxy card, Notice of Annual Meeting and our 2016 Annual Report have been mailed to you and made available on the Internet. ▪ The Annual Meeting will be held on May 19, 2017, commencing at 10:00 AM (EST) at the Harmonie Club, 4 East 60 th Street, New York, New York. ▪ The full Proxy Statement, the Notice of Annual Meeting and our 2016 Annual Report are available at: www.proxyvote.com/BDCA. Section I – Proxy Overview: Proxy Details

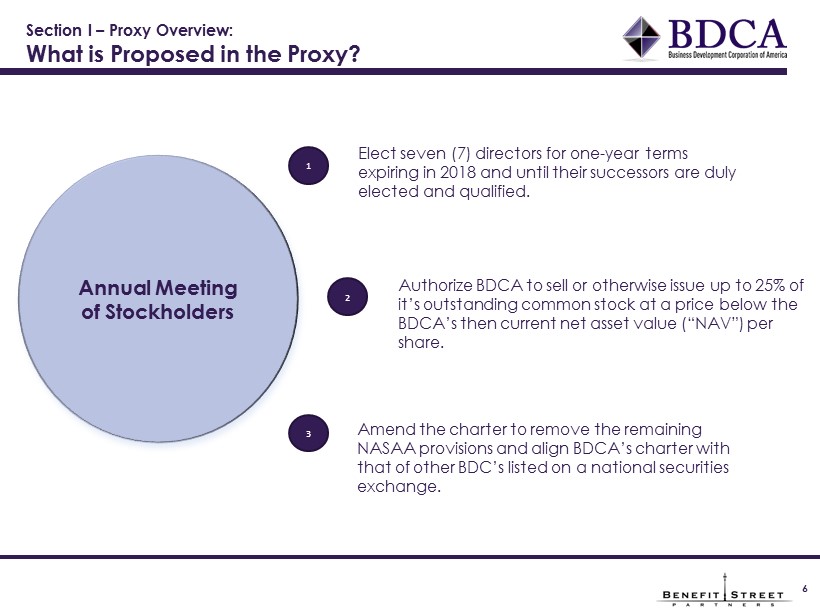

6 Section I – Proxy Overview: What is Proposed in the Proxy? Annual Meeting of Stockholders 2 1 3 Elect seven (7) directors for one - year terms expiring in 2018 and until their successors are duly elected and qualified. Authorize BDCA to sell or otherwise issue up to 25% of it’s outstanding common stock at a price below the BDCA’s then current net asset value (“NAV”) per share. Amend the charter to remove the remaining NASAA provisions and align BDCA’s charter with that of other BDC’s listed on a national securities exchange.

7 Section I – Proxy Overview: Proposal 1: Election of Directors ▪ We believe the experience and backgrounds of all our directors make them well qualified to serve as members of our Board of Directors. ▪ The Board of Directors is responsible for monitoring and supervising the performance of our day - to - day operations. ▪ The Board of Directors has proposed the following nominees for election as directors, each to serve for a term ending at the 2018 annual meeting of stockholders and until his or her successor is duly elected and qualifies. – Richard J. Byrne – Lee S. Hillman – Ronald J. Kramer – Leslie D. Michelson – Randolph C. Read – Edward G. Rendell – Dennis M. Schaney Chairman Independent Director Independent Director Independent Director Independent Director Independent Director Independent Director

8 Section I – Proxy Overview: Proposal 2: Issue Shares Below NAV Description of Proposal ▪ We are requesting authorization to issue our shares at a price below BDCA’s then current NAV per share, subject to certain conditions: – The number of shares issued cannot exceed 25% of BDCA’s then outstanding shares immediately prior to each such sale. – A majority of our independent directors would be required to make a determination as to whether each such sale would be in the best interests of BDCA. – The authorization would be effective for a one - year period or approximately May 2018.

9 Section I – Proxy Overview: Proposal 2: Issue Shares Below NAV Rationale ▪ We believe this proposal will provide flexibility to raise capital from institutional investors thus enhancing BDCA’s prospects for a future favorable liquidity event. – We believe best - in - class listed BDC’s have significant institutional ownership. ▪ Consistent access to additional source of capital may provide: – Opportunities to invest at attractive risk - adjusted returns during periods of disruption, uncertainty and volatility in the capital markets. – Flexibility to prudently issue stock below NAV in certain circumstances provide a “safety net”. ▪ BDCA has no immediate plans to sell any shares of its common stock at a price below NAV.

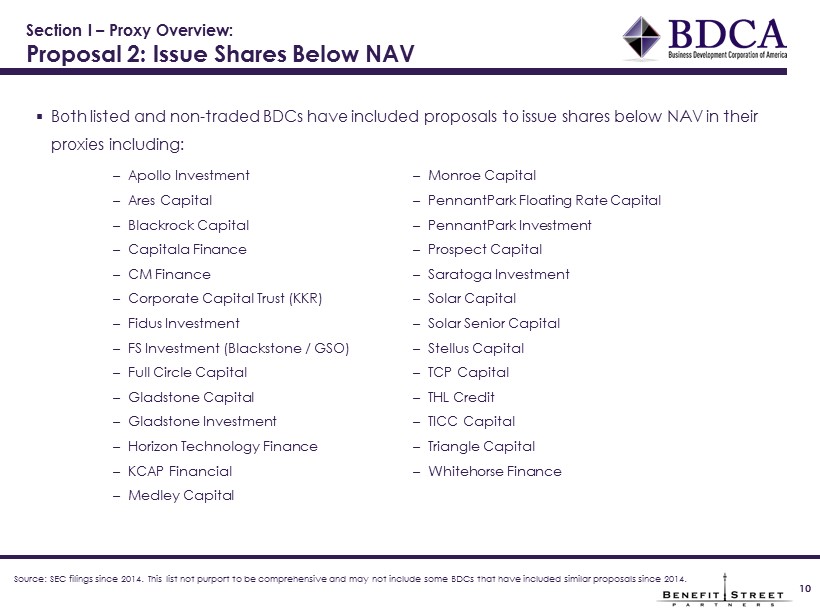

10 Section I – Proxy Overview: Proposal 2: Issue Shares Below NAV ▪ Both listed and non - traded BDCs have included proposals to issue shares below NAV in their proxies including: – Apollo Investment – Ares Capital – Blackrock Capital – Capitala Finance – CM Finance – Corporate Capital Trust (KKR) – Fidus Investment – FS Investment (Blackstone / GSO) – Full Circle Capital – Gladstone Capital – Gladstone Investment – Horizon Technology Finance – KCAP Financial – Medley Capital – Monroe Capital – PennantPark Floating Rate Capital – PennantPark Investment – Prospect Capital – Saratoga Investment – Solar Capital – Solar Senior Capital – Stellus Capital – TCP Capital – THL Credit – TICC Capital – Triangle Capital – Whitehorse Finance Source: SEC filings since 2014. This list not purport to be comprehensive and may not include some BDCs that have included similar proposals since 2014.

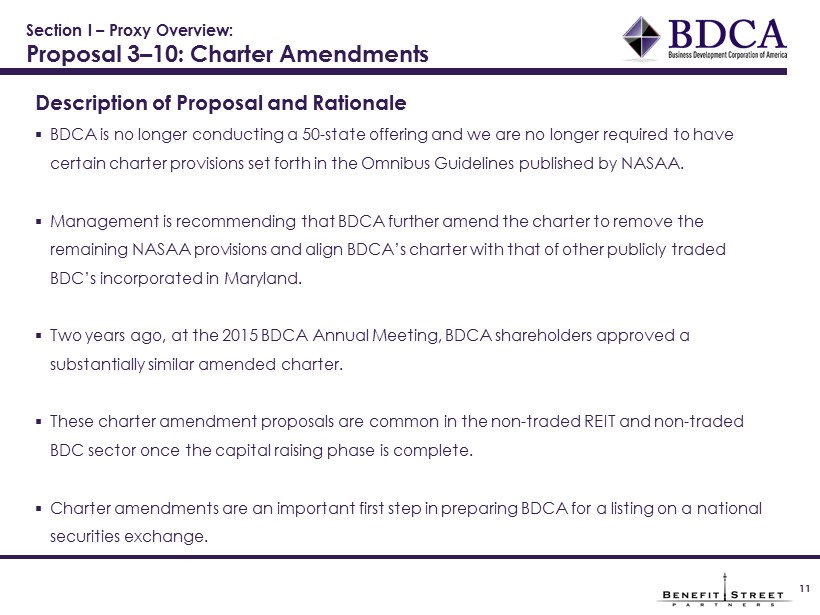

11 Section I – Proxy Overview: Proposal 3 – 10: Charter Amendments Description of Proposal and Rationale ▪ BDCA is no longer conducting a 50 - state offering and we are no longer required to have certain charter provisions set forth in the Omnibus Guidelines published by NASAA. ▪ Management is recommending that BDCA further amend the charter to remove the remaining NASAA provisions and align BDCA’s charter with that of other publicly traded BDC’s incorporated in Maryland. ▪ Two years ago, at the 2015 BDCA Annual Meeting, BDCA shareholders approved a substantially similar amended charter. ▪ These charter amendment proposals are common in the non - traded REIT and non - traded BDC sector once the capital raising phase is complete. ▪ Charter amendments are an important first step in preparing BDCA for a listing on a national securities exchange.

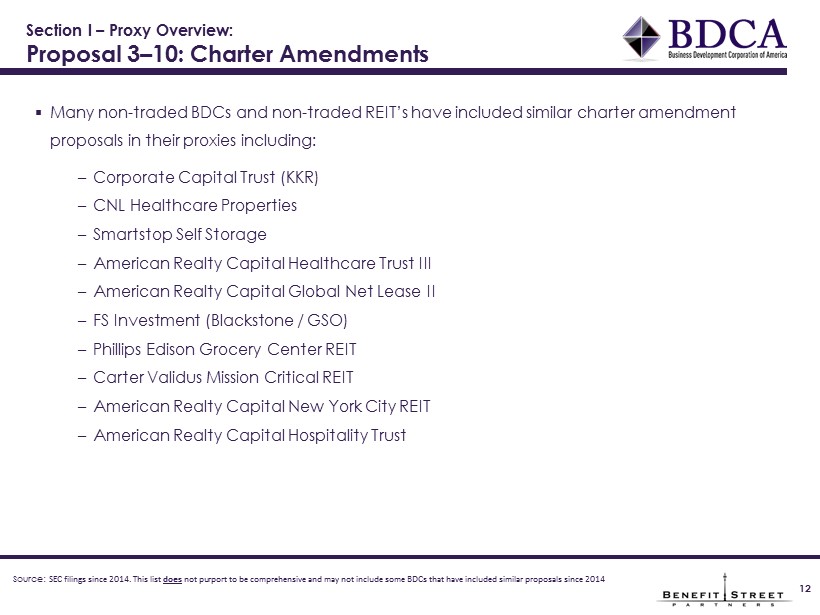

12 Section I – Proxy Overview: Proposal 3 – 10: Charter Amendments ▪ Many non - traded BDCs and non - traded REIT’s have included similar charter amendment proposals in their proxies including: – Corporate Capital Trust (KKR) – CNL Healthcare Properties – Smartstop Self Storage – American Realty Capital Healthcare Trust III – American Realty Capital Global Net Lease II – FS Investment (Blackstone / GSO) – Phillips Edison Grocery Center REIT – Carter Validus Mission Critical REIT – American Realty Capital New York City REIT – American Realty Capital Hospitality Trust Source: SEC filings since 2014. This list does not purport to be comprehensive and may not include some BDCs that have included similar proposals since 2014

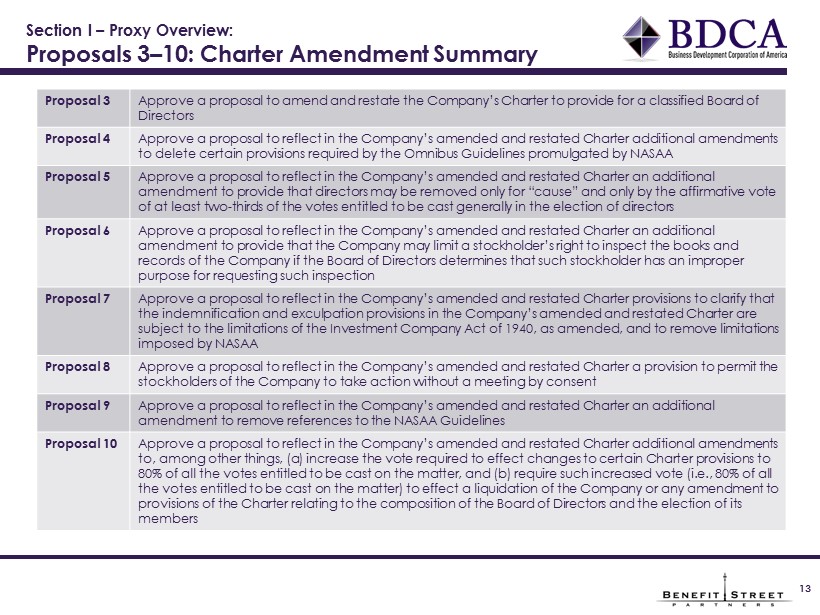

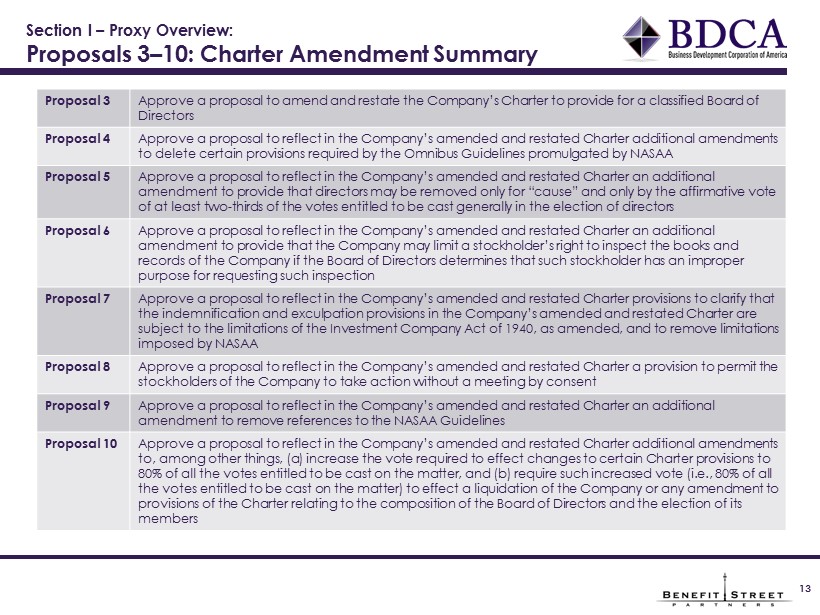

13 Section I – Proxy Overview: Proposals 3 – 10: Charter Amendment Summary Proposal 3 Approve a proposal to amend and restate the Company’s Charter to provide for a classified Board of Directors Proposal 4 Approve a proposal to reflect in the Company’s amended and restated Charter additional amendments to delete certain provisions required by the Omnibus Guidelines promulgated by NASAA Proposal 5 Approve a proposal to reflect in the Company’s amended and restated Charter an additional amendment to provide that directors may be removed only for “cause” and only by the affirmative vote of at least two - thirds of the votes entitled to be cast generally in the election of directors Proposal 6 Approve a proposal to reflect in the Company’s amended and restated Charter an additional amendment to provide that the Company may limit a stockholder’s right to inspect the books and records of the Company if the Board of Directors determines that such stockholder has an improper purpose for requesting such inspection Proposal 7 Approve a proposal to reflect in the Company’s amended and restated Charter provisions to clarify that the indemnification and exculpation provisions in the Company’s amended and restated Charter are subject to the limitations of the Investment Company Act of 1940, as amended, and to remove limitations imposed by NASAA Proposal 8 Approve a proposal to reflect in the Company’s amended and restated Charter a provision to permit the stockholders of the Company to take action without a meeting by consent Proposal 9 Approve a proposal to reflect in the Company’s amended and restated Charter an additional amendment to remove references to the NASAA Guidelines Proposal 10 Approve a proposal to reflect in the Company’s amended and restated Charter additional amendments to, among other things, (a) increase the vote required to effect changes to certain Charter provisions to 80% of all the votes entitled to be cast on the matter, and (b) require such increased vote (i.e., 80% of all the votes entitled to be cast on the matter) to effect a liquidation of the Company or any amendment to provisions of the Charter relating to the composition of the Board of Directors and the election of its members

14 Section II – Board Recommendations

15 Proposal 1: Board Members • The Board of Directors recommends that the stockholders vote “FOR” the election of Messrs. Byrne, Hillman, Kramer, Michelson, Read, Rendell and Schaney as members of the Board of Directors to serve until the 2018 Annual Meeting and until their successors are duly elected and qualified. Proposal 2: Issuing Additional Shares • The Board of Directors recommends a vote “FOR” the proposal to authorize the Company, pursuant to approval of the Board of Directors of the Company, to sell or otherwise issue shares of its common stock during the next year at a price below the Company’s then current net asset value per share, subject to certain conditions as set forth in this proxy statement (including that the cumulative number of shares sold pursuant to such authority does not exceed 25% of its then outstanding common stock immediately prior to each such sale ). Proposal 3 – 10: Charter Amendments • The Board of Directors recommends a vote “FOR” the Charter Amendment Proposals 1 - 8 . Section II – Board Recommendations: What does the Board Recommend? The Board of Directors recommends a vote “FOR” Proposals 1 – 10

16 Section III – Voting Information

VOTING OPTIONS 17 Section III – Voting Information Important Numbers/Website MAIL : Stockholders may submit their votes by mail by completing, signing, dating and returning their proxy card in the pre - paid envelope sent in the Proxy Statement. PHONE : By calling (800) 690 - 6903 with your control number available. INTERNET : www.proxyvote.com/BDCA . Enter your control number and follow the prompts. If you have questions about the proposals or would like additional copies of the proxy statement, please contact our proxy solicitor, Broadridge Investor Communication Solutions, Inc. (“ Broadridge ”) at (855) 486 - 7909.

18 www.bdcofamerica.com ▪ For account information, including balances and the status of submitted paperwork, please call Investor Relations at (844) 785 - 4393 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.bdcofamerica.com