Exhibit 99(a)(1)(B)

BDCA BUSINESS DEVELOPMENT CORPORATION OF AMERICA LET TER OF TRANSMIT TAL PURSUANT TO THE OFFER TO PURCHASE DATED May 30, 2017 THE OFFER WILL EXPIRE AT 11:59 P.M. EASTERN TIME, ON JULY 6, 2017, UNLESS THE OFFER IS EXTENDED ANY QUESTIONS CONCERNING THE OFFER OR THIS LETTER OF TRANSMITTAL CAN BE DIRECTED TO THE FOLLOWING ADDRESS: Our website: www.bdcofamerica.com Our telephone: Investor Relations at (844) 785-4393 U.S. mail: c/o DST Systems, Inc., Ste. 219943 430 W 7th St, Kansas City, MO 64105-1407 DELIVERY OF THIS LETTER OF TRANSMITTAL AND ALL OTHER DOCUMENTS TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE WILL NOT CONSTITUTE A VALID DELIVERY TO BUSINESS DEVELOPMENT CORPORATION OF AMERICA (THE “COMPANY”). THE OFFER TO PURCHASE AND THIS ENTIRE LETTER OF TRANSMITTAL, INCLUDING THE ACCOMPANYING INSTRUCTIONS, SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED. IF YOU WANT TO RETAIN YOUR SHARES, YOU DO NOT NEED TO TAKE ANY ACTION.

BDCA BUSINESS DEVELOPMENT CORPORATION OF AMERICA LET TER OF TRANSMIT TAL PURSUANT TO THE OFFER TO PURCHASE DATED May 30, 2017 LADIES AND GENTLEMEN: This letter of transmittal is provided in connection with the Company’s offer dated May 30, 2017 to purchase up to 9,010,785 shares of common stock of the Company (“Shares”). This amount represents approximately 5.0% of the weighted average number of Shares outstanding for the calendar year ended December 31, 2016. During any calendar year, we intend to limit the number of shares we repurchase to 10.0% of the weighted average number of shares outstanding during the prior calendar year, or 5.0% at each semi-annual tender offer. In addition, in the event of a stockholder’s death or disability, any repurchases of shares made in connection with a stockholder’s death or disability may be included within the overall limitation imposed on tender offers during the relevant redemption period, which provides that the Company may limit the number of shares to be repurchased during any redemption period to the number of shares of common stock the Company is able to repurchase with the proceeds received from the sale of shares of common stock under the DRIP during such redemption period. The person(s) signing this Letter of Transmittal (the “Signatory”) hereby tender(s) to the Company, which is an externally managed, non-diversified, closed-end management investment company incorporated in Maryland, the number of Shares specified above for purchase by the Company at a price equal to the Company’s then-current net asset value per Share as of March 31, 2017 (the “Purchase Price”), in cash, under the terms and subject to the conditions set forth in the Offer to Purchase, receipt of which is hereby acknowledged, and in this Letter of Transmittal (which Offer to Purchase and Letter of Transmittal together with any amendments or supplements thereto collectively constitute the “Offer”). Subject to, and effective upon, acceptance for payment of, or payment for, Shares tendered herewith in accordance with the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms or conditions of any such extension or amend-ment), the Signatory hereby sells, assigns and transfers to, or upon the order of, the Company, all right, title and interest in and to all of the Shares that are being tendered hereby that are purchased pursuant to the Offer, and hereby irrevocably constitutes and appoints the Company as attorney-in-fact of the Signatory with respect to such Shares, with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest), to receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares all in accordance with the terms and subject to the conditions set forth in the Offer. The name(s) of the registered owner(s) should be printed exactly as on the subscription agreement accepted by the Company in connection with purchase of the Shares. The Signatory recognizes that, under certain circumstances as set forth in the Offer to Purchase, the Company may amend, extend or terminate the Offer or may not be required to purchase any of the Shares tendered hereby. In any such event, the Signatory understands that the Shares not purchased, if any, will continue to be held by the Signatory and will not be tendered. The Signatory understands that acceptance of Shares by the Company for payment will constitute a binding agreement between the Signatory and the Company upon the terms and subject to the conditions of the Offer. The Signatory understands that the payment of the Purchase Price for the Shares accepted for purchase by the Company will be made as promptly as practicable by the Company following the conclusion of the Offer and that in no event will the Signatory receive any interest on the Purchase Price. Payment of the Purchase Price for the Shares tendered by the undersigned will be made on behalf of the Company by check or ACH to the account identified by the undersigned below. All authority herein conferred or agreed to be conferred shall survive the death or incapacity of the Signatory and all obligations of the Signatory hereunder shall be binding upon the heirs, personal representatives, successors and assigns of the Signatory. Except as stated in the Offer, this tender is irrevocable. The Signatory hereby acknowledges that capitalized terms not defined in this Letter of Transmittal shall have the meanings ascribed to them in the Offer to Purchase.

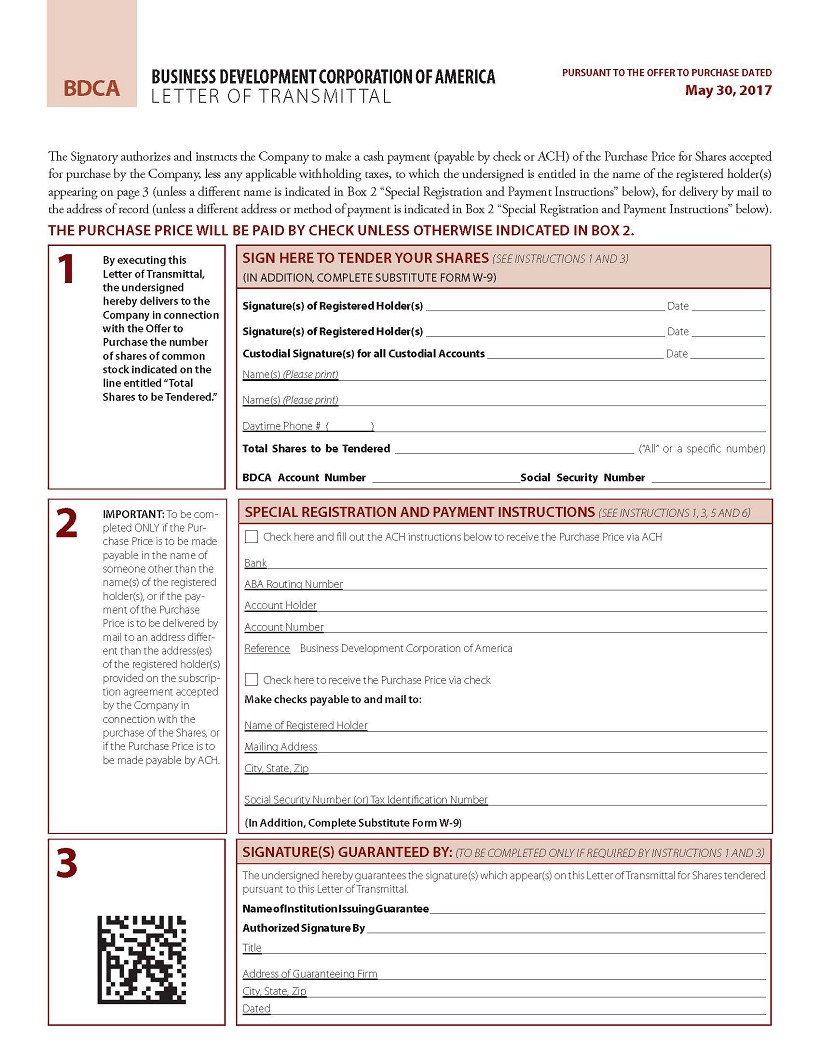

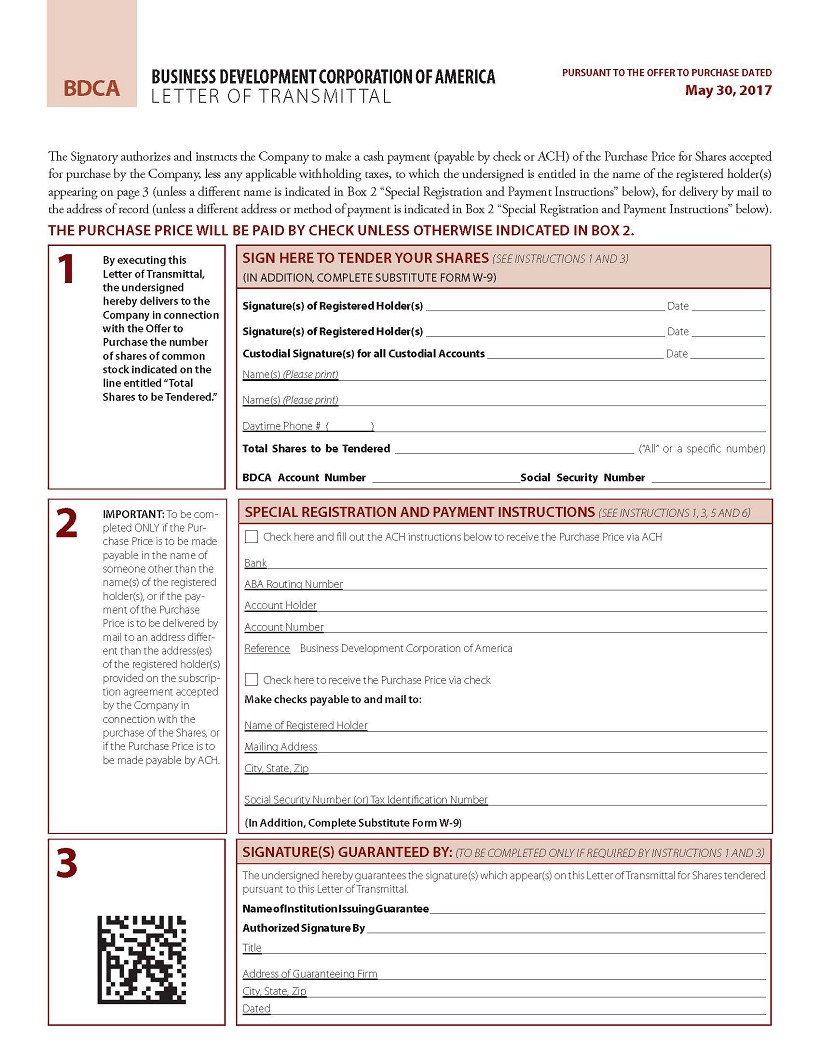

BDCA BUSINESS DEVELOPMENT CORPORATION OF AMERICA LET TER OF TRANSMIT TAL PURSUANT TO THE OFFER TO PURCHASE DATED May 30, 2017 The Signatory authorizes and instructs the Company to make a cash payment (payable by check or ACH) of the Purchase Price for Shares accepted for purchase by the Company, less any applicable withholding taxes, to which the undersigned is entitled in the name of the registered holder(s) appearing on page 3 (unless a different name is indicated in Box 2 “Special Registration and Payment Instructions” below), for delivery by mail to the address of record (unless a different address or method of payment is indicated in Box 2 “Special Registration and Payment Instructions” below). THE PURCHASE PRICE WILL BE PAID BY CHECK UNLESS OTHERWISE INDICATED IN BOX 2. 1 By executing this Letter of Transmittal, the undersigned hereby delivers to the Company in connection with the Offer to Purchase the number of shares of common stock indicated on the line entitled “Total Shares to be Tendered.” SIGN HERE TO TENDER YOUR SHARES (SEE INSTRUCTIONS 1 AND 3) (IN ADDITION, COMPLETE SUBSTITUTE FORM W-9) Signature(s) of Registered Holder(s) __________________________________________ Date _____________ Signature(s) of Registered Holder(s) __________________________________________ Date _____________ Custodial Signature(s) for all Custodial Accounts _______________________________ Date _____________ Name(s) (Please print) Name(s) (Please print) Daytime Phone # ( ) Total Shares to be Tendered __________________________________________ (“All” or a specific number) BDCA Account Number __________________________Social Security Number ____________________ 2 IMPORTANT: To be completed ONLY if the Purchase Price is to be made payable in the name of someone other than the name(s) of the registered holder(s), or if the payment of the Purchase Price is to be delivered by mail to an address different than the address(es) of the registered holder(s) provided on the subscription agreement accepted by the Company in connection with the purchase of the Shares, or if the Purchase Price is to be made payable by ACH. SPECIAL REGISTRATION AND PAYMENT INSTRUCTIONS (SEE INSTRUCTIONS 1, 3, 5 AND 6) Check here and fill out the ACH instructions below to receive the Purchase Price via ACH Bank ABA Routing Number Account Holder Account Number Reference Business Development Corporation of America Check here to receive the Purchase Price via check Make checks payable to and mail to: Name of Registered Holder Mailing Address City, State, Zip Social Security Number (or) Tax Identification Number (In Addition, Complete Substitute Form W-9) 3 SIGNATURE(S) GUARANTEED BY: (TO BE COMPLETED ONLY IF REQUIRED BY INSTRUCTIONS 1 AND 3) The undersigned hereby guarantees the signature(s) which appear(s) on this Letter of Transmittal for Shares tendered pursuant to this Letter of Transmittal. Name of Institution Issuing Guarantee ___________________________________________________________ Authorized Signature By ______________________________________________________________________ Title Address of Guaranteeing Firm City, State, Zip Dated

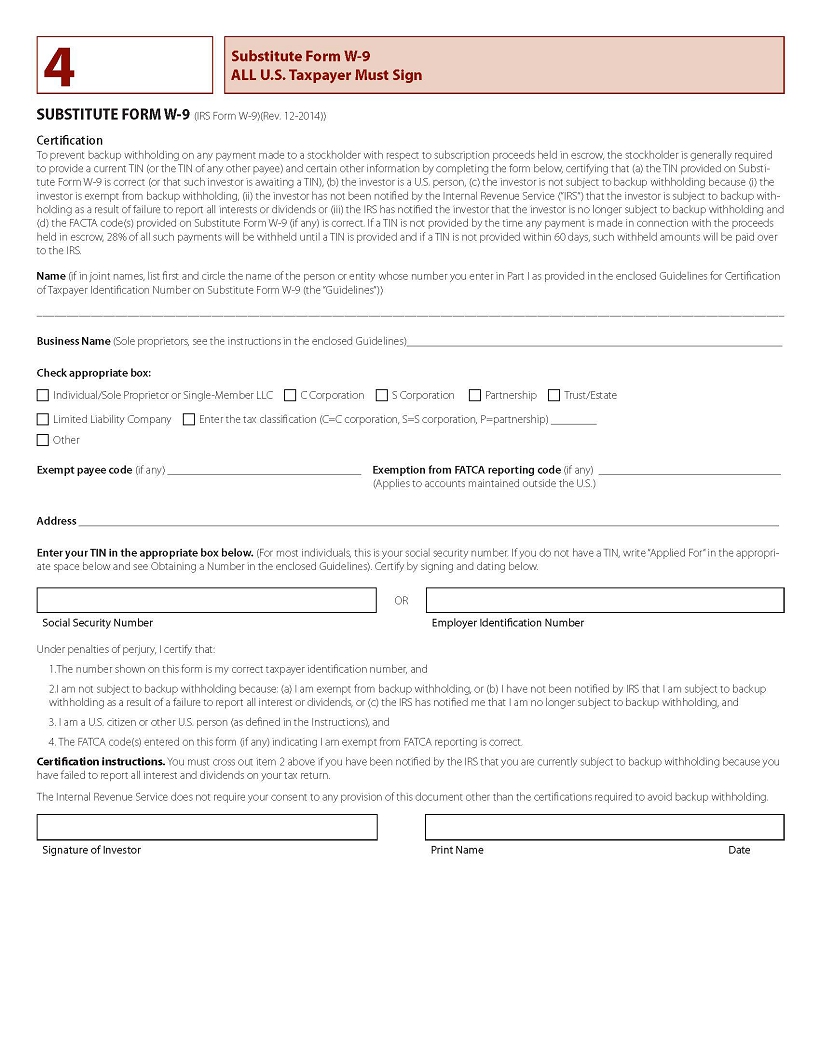

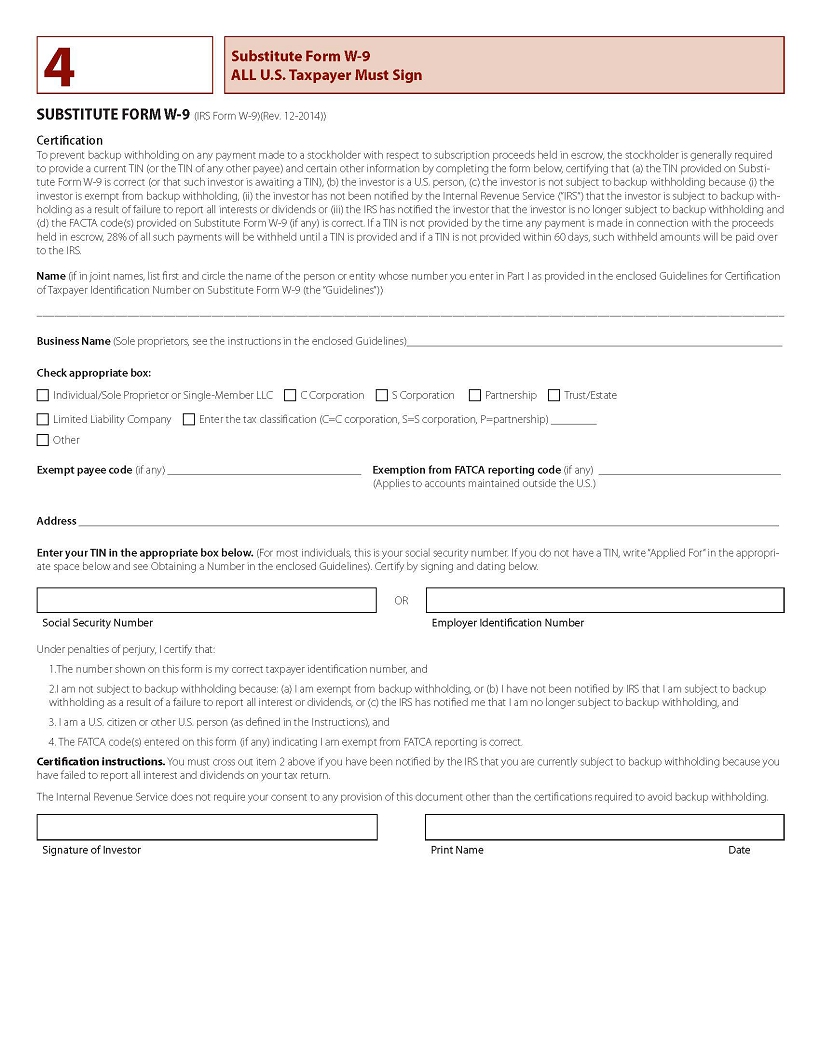

4 Substitute Form W-9 ALL U.S. Taxpayer Must Sign SUBSTITUTE FORM W-9(IRS Form W-9)(Rev. 12-2014)) Certification To prevent backup withholding on any payment made to a stockholder with respect to subscription proceeds held in escrow, the stockholder is generally required to provide a current TIN (or the TIN of any other payee) and certain other information by completing the form below, certifying that (a) the TIN provided on Substitute Form W-9 is correct (or that such investor is awaiting a TIN), (b) the investor is a U.S. person, (c) the investor is not subject to backup withholding because (i) the investor is exempt from backup withholding, (ii) the investor has not been notified by the Internal Revenue Service (¡§IRS¡¨) that the investor is subject to backup withholding as a result of failure to report all interests or dividends or (iii) the IRS has notified the investor that the investor is no longer subject to backup withholding and (d) the FACTA code(s) provided on Substitute Form W-9 (if any) is correct. If a TIN is not provided by the time any payment is made in connection with the proceeds held in escrow, 28% of all such payments will be withheld until a TIN is provided and if a TIN is not provided within 60 days, such withheld amounts will be paid over to the IRS. Name (if in joint names, list first and circle the name of the person or entity whose number you enter in Part I as provided in the enclosed Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9 (the ¡§Guidelines¡¨)) ____________________________________________________________________________________________________________________________ Business Name (Sole proprietors, see the instructions in the enclosed Guidelines)__________________________________________________________________ Check appropriate box: Ó Individual/Sole Proprietor or Single-Member LLC Ó C Corporation Ó S Corporation Ó Partnership Ó Trust/Estate Ó Limited Liability Company Ó Enter the tax classification (C=C corporation, S=S corporation, P=partnership) ________ Ó Other Exempt payee code (if any) __________________________________ Exemption from FATCA reporting code (if any) ________________________________ ( Applies to accounts maintained outside the U.S.) Address ___________________________________________________________________________________________________________________________ Enter your TIN in the appropriate box below. (For most individuals, this is your social security number. If you do not have a TIN, write ¡§Applied For¡¨ in the appropriate space below and see Obtaining a Number in the enclosed Guidelines). Certify by signing and dating below. OR Social Security Number Employer Identification Number Under penalties of perjury, I certify that: 1.The number shown on this form is my correct taxpayer identification number, and 2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (as defined in the Instructions), and 4. The FATCA code(s) entered on this form (if any) indicating I am exempt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Signature of Investor Print Name Date

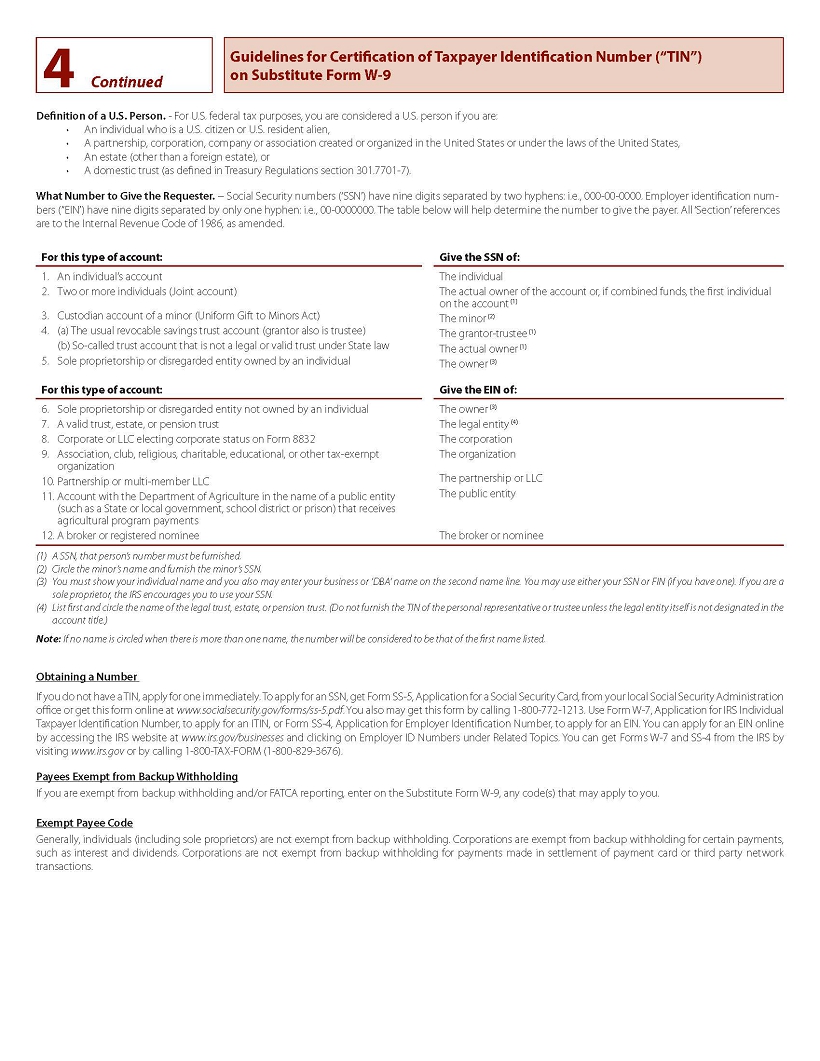

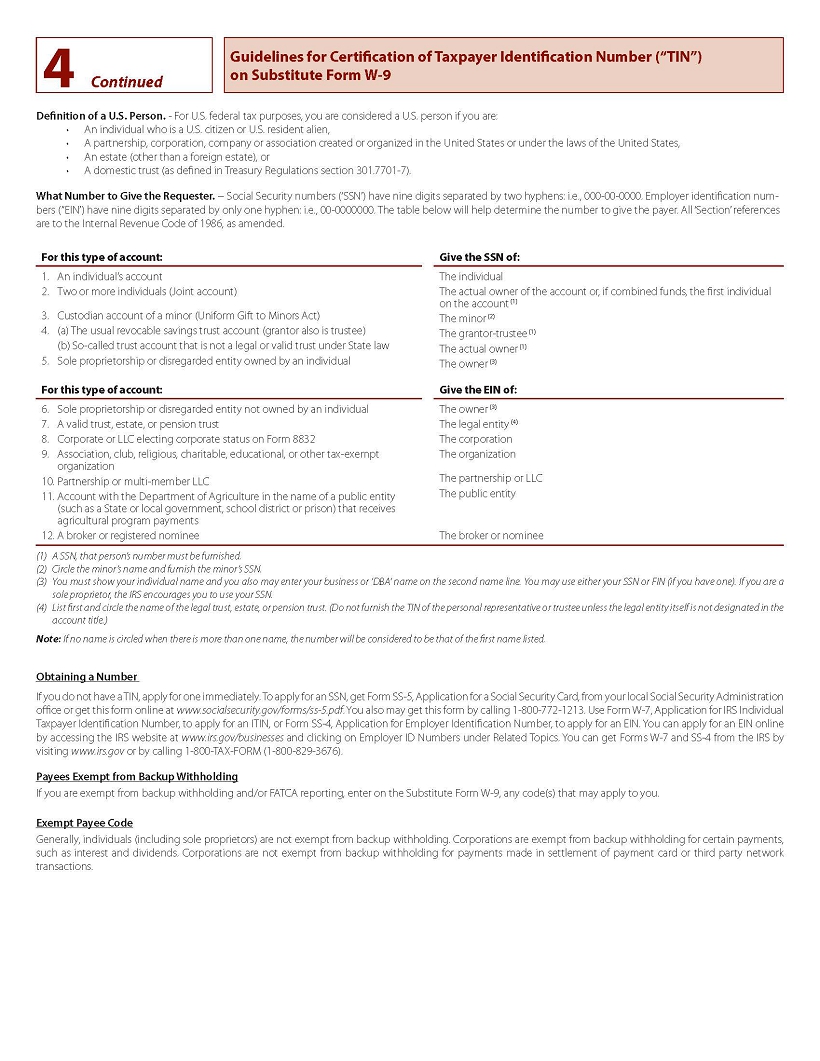

4Continued Guidelines for Certification of Taxpayer Identification Number (“TIN”) on Substitute Form W-9 Definition of a U.S. Person. - For U.S. federal tax purposes, you are considered a U.S. person if you are: •An individual who is a U.S. citizen or U.S. resident alien, •A partnership, corporation, company or association created or organized in the United States or under the laws of the United States, •An estate (other than a foreign estate), or •A domestic trust (as defined in Treasury Regulations section 301.7701-7). What Number to Give the Requester. - Social Security numbers (‘SSN’) have nine digits separated by two hyphens: i.e., 000-00-0000. Employer identification numbers (“EIN’) have nine digits separated by only one hyphen: i.e., 00-0000000. The table below will help determine the number to give the payer. All ‘Section’ references are to the Internal Revenue Code of 1986, as amended. For this type of account: Give the SSN of: 1. An individual’s account 2. Two or more individuals (Joint account) 3. Custodian account of a minor (Uniform Gift to Minors Act) 4. (a) The usual revocable savings trust account (grantor also is trustee) (b) S o-called trust account that is not a legal or valid trust under State law 5. Sole proprietorship or disregarded entity owned by an individual The individual The actual owner of the account or, if combined funds, the first individual on the account (1) The minor (2) The grantor-trustee (1) The actual owner (1) The owner (3) For this type of account: Give the EIN of: 6. Sole proprietorship or disregarded entity not owned by an individual 7. A valid trust, estate, or pension trust 8. Corporate or LLC electing corporate status on Form 8832 9. Association, club, religious, charitable, educational, or other tax-exempt organization 10. Partnership or multi-member LLC 11. Account with the Department of Agriculture in the name of a public entity (such as a State or local government, school district or prison) that receives agricultural program payments 12. A broker or registered nominee The owner (3) The legal entity (4) The corporation The organization The partnership or LLC The public entity The broker or nominee (1) A SSN, that person’s number must be furnished. (2) Circle the minor’s name and furnish the minor’s SSN. (3) You must show your individual name and you also may enter your business or ‘DBA’ name on the second name line. You may use either your SSN or FIN (if you have one). If you are a sole proprietor, the IRS encourages you to use your SSN. (4) List first and circle the name of the legal trust, estate, or pension trust. (Do not furnish the TIN of the personal representative or trustee unless the legal entity itself is not designated in the account title.) Note: If no name is circled when there is more than one name, the number will be considered to be that of the first name listed. Obtaining a Number If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local Social Security Administration office or get this form online at www.socialsecurity.gov/forms/ss-5.pdf. You also may get this form by calling 1-800-772-1213. Use Form W-7, Application for IRS Individual Taxpayer Identification Number, to apply for an ITIN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/businesses and clicking on Employer ID Numbers under Related Topics. You can get Forms W-7 and SS-4 from the IRS by visiting www.irs.gov or by calling 1-800-TAX-FORM (1-800-829-3676). Payees Exempt from Backup Withholding If you are exempt from backup withholding and/or FATCA reporting, enter on the Substitute Form W-9, any code(s) that may apply to you. Exempt Payee Code Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

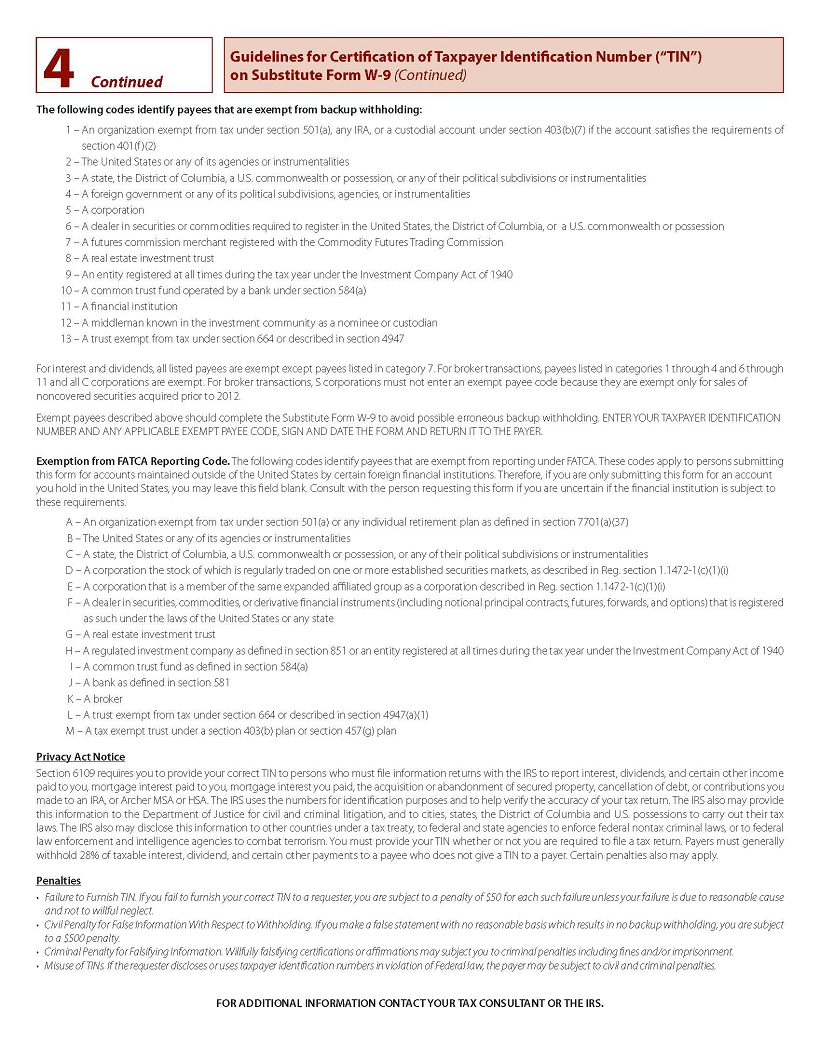

4Continued Guidelines for Certification of Taxpayer Identification Number (“TIN”) on Substitute Form W-9 (Continued) The following codes identify payees that are exempt from backup withholding: 1 – An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2) 2 – The United States or any of its agencies or instrumentalities 3 – A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities 4 – A foreign government or any of its political subdivisions, agencies, or instrumentalities 5 – A corporation 6 – A dealer in securities or commodities required to register in the United States, the District of Columbia, or a U.S. commonwealth or possession 7 – A futures commission merchant registered with the Commodity Futures Trading Commission 8 – A real estate investment trust 9 – An entity registered at all times during the tax year under the Investment Company Act of 1940 10 – A common trust fund operated by a bank under section 584(a) 11 – A financial institution 12 – A middleman known in the investment community as a nominee or custodian 13 – A trust exempt from tax under section 664 or described in section 4947 For interest and dividends, all listed payees are exempt except payees listed in category 7. For broker transactions, payees listed in categories 1 through 4 and 6 through 11 and all C corporations are exempt. For broker transactions, S corporations must not enter an exempt payee code because they are exempt only for sales of noncovered securities acquired prior to 2012. Exempt payees described above should complete the Substitute Form W-9 to avoid possible erroneous backup withholding. ENTER YOUR TAXPAYER IDENTIFICATION NUMBER AND ANY APPLICABLE EXEMPT PAYEE CODE, SIGN AND DATE THE FORM AND RETURN IT TO THE PAYER. Exemption from FATCA Reporting Code. The following codes identify payees that are exempt from reporting under FATCA. These codes apply to persons submitting this form for accounts maintained outside of the United States by certain foreign financial institutions. Therefore, if you are only submitting this form for an account you hold in the United States, you may leave this field blank. Consult with the person requesting this form if you are uncertain if the financial institution is subject to these requirements. A – An organization exempt from tax under section 501(a) or any individual retirement plan as defined in section 7701(a)(37) B – The United States or any of its agencies or instrumentalities C – A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities D – A corporation the stock of which is regularly traded on one or more established securities markets, as described in Reg. section 1.1472-1(c)(1)(i) E – A corporation that is a member of the same expanded affiliated group as a corporation described in Reg. section 1.1472-1(c)(1)(i) F – A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state G – A real estate investment trust H – A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940 I – A common trust fund as defined in section 584(a) J – A bank as defined in section 581 K – A broker L – A trust exempt from tax under section 664 or described in section 4947(a)(1) M – A tax exempt trust under a section 403(b) plan or section 457(g) plan Privacy Act Notice Section 6109 requires you to provide your correct TIN to persons who must file information returns with the IRS to report interest, dividends, and certain other income paid to you, mortgage interest paid to you, mortgage interest you paid, the acquisition or abandonment of secured property, cancellation of debt, or contributions you made to an IRA, or Archer MSA or HSA. The IRS uses the numbers for identification purposes and to help verify the accuracy of your tax return. The IRS also may provide this information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia and U.S. possessions to carry out their tax laws. The IRS also may disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your TIN whether or not you are required to file a tax return. Payers must generally withhold 28% of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to a payer. Certain penalties also may apply. Penalties • Failure to Furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect. • Civil Penalty for False Information With Respect to Withholding. If you make a false statement with no reasonable basis which results in no backup withholding, you are subject to a $500 penalty. • Criminal Penalty for Falsifying Information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment. • Misuse of TINs. If the requester discloses or uses taxpayer identification numbers in violation of Federal law, the payer may be subject to civil and criminal penalties. FOR ADDITIONAL INFORMATION CONTACT YOUR TAX CONSULTANT OR THE IRS.

BDCA BUSINESS DEVELOPMENT CORPORATION OF AMERICA LET TER OF TRANSMIT TAL PURSUANT TO THE OFFER TO PURCHASE DATED May 30, 2017 1. Guarantee of Signatures. Signatures on this Letter of Transmittal must be guaranteed in Box 3 in accordance with Rule 17Ad-15 (promulgated under the Securities Exchange Act of 1934, as amended) by an eligible guarantor institution which is a participant in a stock transfer association recognized program, such as a firm that is a member of a registered national securities exchange, a member of the Financial Industry Regulatory Authority, by a commercial bank or trust company having an office or correspondent in the United States or by an international bank, securities dealer, securities broker or other financial institution licensed to do business in its home country (an “Eligible Institution”) unless (i) the Letter of Transmittal is signed by the registered holder(s) of the Shares tendered therewith and such holder(s) have not completed Box 2 “Special Registration and Payment Instructions” above or (ii) the Shares described above are delivered for the account of an Eligible Institution. IN ALL OTHER CASES ALL SIGNATURES MUST BE GUARANTEED BY AN ELIGIBLE INSTITUTION. 2. Delivery of Letter of Transmittal. This Letter of Transmittal, properly completed and duly executed, should be sent by mail or courier or delivered by hand to the Company, in each case at the address set forth on the front page of this Letter of Transmittal, in order to make an effective tender. A properly completed and duly executed Letter of Transmittal must be received by the Company at the address set forth on the front page of this Letter of Transmittal by 11:59 P.M, Eastern Time, on July 6, 2017 unless the Offer is extended. The Purchase Price will be paid and issued in exchange for the Shares tendered and accepted for purchase by the Company pursuant to the Offer to Purchase in all cases only after receipt by the Company of a properly completed and duly executed Letter of Transmittal. The method of delivery of all documents is at the option and risk of the undersigned and the delivery will be deemed made only when actually received. If delivery is by mail, registered mail with return receipt requested, properly insured, is recommended. 3. Signatures on this Letter of Transmittal, Powers of Attorney and Endorsements. (a) If this Letter of Transmittal is signed by the registered holder(s) of the Shares to be tendered, the signature(s) of the holder on this Letter of Transmittal must correspond exactly with the name(s) on the subscription agreement accepted by the Company in connection with the purchase of the Shares, unless such Shares have been transferred by the registered holder(s), in which event this Letter of Transmittal should be signed in exactly the same form as the name of the last transferee indicated on the stock ledger maintained in book-entry form by DST Systems, Inc., the Company’s transfer agent. (b) If any Shares tendered with this Letter of Transmittal are owned of record by two or more joint owners, all such owners must sign this Letter of Transmittal. (c) If this Letter of Transmittal is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, such person must so indicate when signing, and proper evidence satisfactory to the Company of their authority to so act must be submitted. (d) If this Letter of Transmittal is signed by a person other than the registered holder(s) of the Shares listed, the Letter of Transmittal must be endorsed or accompanied by appropriate stock powers, in either case signed exactly as the name(s) of the registered holder(s) appear(s) on the subscription agreement accepted by the Company in connection with the purchase of the Shares. Signatures must be guaranteed in Box 3 by an Eligible Institution (unless signed by an Eligible Institution). 4. Withholding. The Company is entitled to deduct and withhold from the Purchase Price otherwise payable to any holder of Shares whose Shares are accepted for purchase by the Company any amounts that the Company is required to deduct and withhold with respect to the making of such payment under the Internal Revenue Code of 1986, as amended (the “Code”), or any provision of state, local or foreign tax law. To the extent that amounts are withheld, the withheld amounts shall be treated for all purposes as having been paid and issued to the holder of Shares in respect of which such deduction and withholding was made. 5. Transfer Taxes. The Company will pay any transfer taxes payable on the transfer to it of Shares purchased pursuant to the Offer; provided, however, that if payment of the Purchase Price is to be made to, or (in the circumstances permitted by the Offer) unpurchased Shares are to be registered in the name(s) of, any person(s) other than the registered owner(s), the amount of any transfer taxes (whether imposed on the registered owner(s) or such other person(s)) payable on account of the transfer to such person(s) will be deducted from the Purchase Price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted herewith. 6. Special Registration and Payment Instructions and Special Delivery Instructions. If the Purchase Price is to be paid and issued to a person other than the person(s) signing the Letter of Transmittal, then Box 2 must be completed. If the Purchase Price is to be mailed or wired to someone other than the person(s) signing the Letter of Transmittal, or to the person(s) signing the Letter of Transmittal at an address other than that shown above, then Box 2 must be completed. INSTRUCTIONS TO LETTER OF TRANSMITTAL FORMING PART OF TERMS AND CONDITIONS OF THIS LETTER OF TRANSMITTAL

BDCA BUSINESS DEVELOPMENT CORPORATION OF AMERICA LET TER OF TRANSMIT TAL PURSUANT TO THE OFFER TO PURCHASE DATED May 30, 2017 7. Determinations of Validity. All questions as to the form of documents and the validity of Shares will be resolved by the Company in its sole discretion, whose determination shall be final and binding. The Company reserves the absolute right to reject any deliveries of any Shares that are not in proper form, or the acceptance of which would, in the opinion of the Company or its counsel, be unlawful. The Company reserves the absolute right to waive any defect or irregularity of delivery for exchange with regard to any Shares, provided that any such waiver shall apply to all tenders of Shares. NEITHER THE COMPANY, ITS BOARD OF DIRECTORS, BDCA ADVISER, LLC, NOR ANY OTHER PERSON IS OR WILL BE OBLIGATED TO GIVE ANY NOTICE OF ANY DEFECT OR IRREGULARITY IN ANY TENDER, AND NONE OF THEM WILL INCUR ANY LIABILITY FOR FAILURE TO GIVE ANY SUCH NOTICE. 8. Requests for Assistance or Additional Copies. Requests for assistance or for additional copies of this Letter of Transmittal may be directed to the Company at the address or the telephone number set forth on the cover page of this Letter of Transmittal. Stockholders who do not own Shares directly may also obtain such information and copies from their broker, dealer, commercial bank, trust company or other nominee. Stockholders who do not own Shares directly are required to tender their Shares through their broker, dealer, commercial bank, trust company or other nominee and should NOT submit this Letter of Transmittal to the Company. 9. Backup Withholding. Each holder that desires to tender Shares must, unless an exemption applies, provide the Company with the holder’s taxpayer identification number on the Substitute Form W-9 set forth in this Letter of Transmittal, with the required certifications being made under penalties of perjury. If the holder is an individual, the taxpayer identification number is his or her social security number. If the Company is not provided with the correct taxpayer identification number, the holder may be subject to a $50 penalty imposed by the Internal Revenue Service in addition to being subject to backup withholding. Holders are required to give the Company the taxpayer identification number of the record owner of the Shares by completing the Substitute Form W-9 included with this Letter of Transmittal. If the Shares are registered in more than one name or are not in the name of the actual owner, consult the “Guidelines for Certification of Taxpayer Identification Number on Substitute Form W-9,” which immediately follow the Substitute Form W-9. If backup withholding applies, the Company is required to withhold 28% of any payment made to the Stockholder with respect to Shares tendered. Backup withholding is not an additional tax. Rather, the U.S. federal income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund may be obtained by the holder from the Internal Revenue Service. Certain holders (including, among others, most corporations and certain foreign persons) are exempt from backup withholding requirements. To qualify as an exempt recipient on the basis of foreign status, a holder must generally submit a properly completed Form W-8BEN, Form W-8IMY or Form W-8ECI, signed under penalties of perjury, attesting to that person’s exempt status. A holder would use a Form W-8BEN to certify that it is neither a citizen nor a resident of the United States and would use a Form W-8ECI to certify that (1) it is neither a citizen nor resident of the United States, and (2) the proceeds of the sale of the Shares are effectively connected with a U.S. trade or business. A foreign person, or a foreign branch of a U.S. person, would use a Form W-8IMY to establish that it is a qualified intermediary that is not acting for its own account. A foreign holder (a “Non-U.S. holder”) may also use a Form W-8BEN to certify that it is eligible for benefits under a tax treaty between the United States and such foreign person’s country of residence. To claim treaty benefits, a Non-U.S. holder will generally be required to provide a taxpayer identification number issued by the Internal Revenue Service. A HOLDER SHOULD CONSULT HIS OR HER TAX ADVISOR AS TO HIS OR HER QUALIFICATION FOR EXEMPTION FROM THE BACKUP WITHHOLDING REQUIREMENTS OR FOR TREATY BENEFITS AND THE PROCEDURE FOR OBTAINING AN EXEMPTION OR TREATY BENEFIT, INCLUDING THE APPROPRIATE FORM TO PROVIDE TO CLAIM SUCH EXEMPTION OR TREATY BENEFIT. * * * IMPORTANT: THIS LETTER OF TRANSMITTAL PROPERLY COMPLETED AND BEARING ORIGINAL SIGNATURE(S) AND THE ORIGINAL OF ANY REQUIRED SIGNATURE GUARANTEE(S) MUST BE RECEIVED BY THE COMPANY PRIOR TO THE EXPIRATION OF THE OFFER. INSTRUCTIONS TO LETTER OF TRANSMITTAL (CONTINUED)