UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a 6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a 12 |

Business Development Corporation of America

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Q3 2018 Investor Presentation

Q3 2018 Investor Presentation

Disclosures This presentation was prepared exclusively for the benefit and use of Business Development Corporation of America (“BDCA”) investors to whom it is directly addressed and delivered and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only. Neither this presentation nor any of its contents may be distributed or used for any other purpose without the prior written consent of BDCA Adviser, LLC (“BDCA Adviser”) and is incomplete without reference to, and should be viewed in conjunction with, the oral briefing provided by BDCA Adviser. BDCA Adviser is an affiliate of Benefit Street Partners L.L.C. (“Benefit Street” or “BSP”). The sole purpose of this presentation is to provide investors with an update on BDCA. The description of certain aspects of BDCA in this presentation is a condensed summary only. This summary does not purport to be complete, and no obligation to update or otherwise revise such information is being assumed. This summary is not an offer to sell securities and is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is not permitted. This summary is not advice, a recommendation or an offer to enter into any transaction with BDCA or any of their affiliated funds. The following slides contain summaries of certain financial information about BDCA. The information contained in this presentation is summary information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from time to time. We undertake no duty or obligation to publicly update or revise the information contained in this presentation. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of BDCA, or information about the market, as indicative of BDCA’s future results. The information contained in this presentation will be superseded by, and is qualified in its entirety by reference to, the BDCA’s Annual Report and Form 10-K, which will contain information about the investment objective, terms and conditions of an investment in BDCA. Investors should consider the investment objectives, risks, and charges and expenses of BDCA carefully before investing. BDCA’s Annual Report and Form 10-K contain this and other information about the investment company. You may obtain a copy of the most recent Annual Report by calling 844-785-4393 and/or visiting www.bdcofamerica.com. There is no guarantee that any of the estimates, targets or projections illustrated in this summary will be achieved. Any references in this presentation to any of BDCA’s past or present investments, portfolio characteristics, or performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objective of BDCA will be achieved. Any investment entails a risk of loss. An investor could lose all or substantially all of his or her investment. Please refer to BDCA’s Annual Report on Form 10-K for a more complete list of risk factors. There can be no assurances that future dividends will match or exceed historic ones, or that they will be made at all. It should not be assumed that investments made in the future will be profitable or will equal the performance of investments in this document. Net returns give effect to all fees and expenses. Unless otherwise noted, information included herein is presented as of the date indicated on the cover page and may change at any time without notice. BDCA is subject to certain significant risks relating to its business and investment objective. For more detailed information on risks relating to BDCA, see the latest Form 10-K and subsequent quarterly reports filed on Form 10-Q. An affiliate of Benefit Street acquired BDCA Adviser on November 1, 2016. The investments, portfolio characteristics and performance shown for periods prior to this date are for investments, portfolio characteristics and performance achieved by BDCA Adviser prior to this acquisition. As a result, there is no guarantee that BDCA Advisor will make similar investments or that BDCA will achieve similar portfolio characteristics or performance as it achieved for periods prior to such date. AUM refers to the assets under management for funds and separately managed accounts managed by Providence Equity Partners L.L.C., Providence Equity Capital Markets L.L.C. (“PECM”), BDCA Adviser, Benefit Street and Merganser Capital Management, LLC (collectively, “Providence”). For private debt funds and other drawdown funds and separately managed accounts, AUM generally represents the sum of the total investments at fair value plus available capital (undrawn commitments plus distributions subject to recall). For hedge funds and non-drawdown funds and separately managed accounts, AUM represents the NAV (net asset value) of each fund or separately managed account. For CLOs, AUM represents the total amount of the debt tranches and subordinated notes (equity) at closing. For long-only liquid accounts, AUM represents the gross asset value of the investments managed by Providence. AUM amounts are unaudited. Certain amounts are preliminary and remain subject to change. Benefit Street’s private debt/opportunistic credit strategy refers to certain accounts that invest in an opportunistic private debt strategy and are managed by Benefit Street or PECM. BDCA has different investment restrictions, risk tolerances, tax approaches, leverage limitations, regulatory and fund structures than that of the accounts comprising the private debt strategy and was invested under different market conditions than the funds and separately managed accounts comprising the private debt strategy, and as such, the performance and portfolio characteristics of the accounts comprising these strategies should not be considered indicative of BDCA’s prospects. Certain information contained in this presentation (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by BDCA, Benefit Street or their affiliates, and BDCA, Benefit Street and their affiliates make no representations concerning and do not assume responsibility for the accuracy of such information. Except where otherwise indicated in this presentation, the information provided is based on matters as it exists as of the date of preparation and not as of any future date. Such information will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date of this presentation. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal, ERISA or tax advice or investment recommendations. Investors should also seek advice from their own independent tax, accounting, financial, ERISA, investment and legal advisors to properly assess the merits and risks associated with their investment in light of their own financial condition and other circumstances. Forward Looking Statements and Risk Factors This presentation contains “forward looking statements” that are subject to risks and uncertainties. Actual outcomes and results could differ materially from those suggested by this presentation due to the impact of many factors beyond the control of BDCA, including those listed in the “Risk Factors” section of our filings with the Securities and Exchange Commission (“SEC”). Any such forward-looking statements are made pursuant to the safe harbor provisions available under applicable securities laws and BDCA assumes no obligation to update or revise any such forward looking statements. BDCA has based these forward-looking statements on its current expectations and projections about future events. BDCA believes that the expectations and assumptions that have been made with respect to these forward-looking statements are reasonable. However, such expectations and assumptions may prove to be incorrect. A number of factors could lead to results that may differ from those expressed or implied by the forward-looking statements. Given this level of uncertainty, investors should not place undue reliance on any forward-looking statements. Important Additional Information and Where to Find It BDCA has filed a definitive proxy statement on Schedule 14A with the SEC in connection with the solicitation of proxies for its Special Meeting of Shareholders related to the approval of the new investment advisory agreement in connection with Franklin Resources, Inc.’s (“Franklin Templeton”) pending acquisition of BSP (the "Definitive Proxy Statement"). BDCA, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the Special Meeting. Information regarding the new investment advisory agreement and the names of BDCA’s directors and executive officers and their respective interests in BDCA by security holdings or otherwise is set forth in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF BDCA ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING BDCA’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that BDCA files with the SEC from the SEC's website at www.sec.gov or BDCA’s website at www.bdcofamerica.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. 1

Today’s Speakers Richard J. Byrne Chief Executive Officer and President of BDCA Richard Byrne is President of Benefit Street Partners and is based in our New York office. Mr. Byrne is also Chief Executive Officer and Chairman of Benefit Street Partners Realty Trust, Inc. Prior to joining BSP in 2013, Mr. Byrne was Chief Executive Officer of Deutsche Bank Securities Inc. He was also the Global Head of Capital Markets at Deutsche Bank as well as a member of the Global Banking Executive Committee and the Global Markets Executive Committee. Before joining Deutsche Bank, Mr. Byrne was Global Co-Head of the Leveraged Finance Group and Global Head of Credit Research at Merrill Lynch. He was also a perennially top-ranked credit analyst. Mr. Byrne earned a Masters of Business Administration from the Kellogg School of Management at Northwestern University and a Bachelor of Arts from Binghamton University. Corinne D. Pankovcin Chief Financial Officer and Treasurer of BDCA Ms. Pankovcin has served as Chief Financial Officer and Treasurer of BDCA since December 2015. Prior to joining BDCA, Ms. Pankovcin was the Chief Financial Officer and Treasurer of BlackRock Capital Investment Corporation (formerly, BlackRock Kelso Capital Corporation) (NASDAQ: BKCC), an externally-managed business development company, and a Managing Director of Finance at BlackRock Investment Management LLC from January 2011 until August 2015. Prior to that, Ms. Pankovcin was a senior member of Finance & Accounting of Alternative Investments and served as Chief Financial Officer for the Emerging Markets products group at PineBridge Investments (formerly AIG Investments). Ms. Pankovcin earned her B.S. in Business Administration, with honors, from Dowling College and her M.B.A from Hofstra University. She is a Certified Public Accountant. 2

Table of Contents Executive Summary Section I Overview of Adviser Section II Overview of BDCA Section III Strategic Initiatives Section IV Special Meeting 3

Executive Summary

Executive Summary: Key Highlights New Investments • BDCA made $352.4 million in new investments in Q3 2018, including $188.1 million relating to the Triangle Capital Corporation (“TCAP”) asset purchase. 1 • BDCA has invested approximately $2.3 billion since November 2016. • Investments originated by BSP represented approximately 80% of BDCA's portfolio. Net Investment Income ▪ Net Investment Income was $25.8 million or $0.14 per share in Q3 2018 which was unchanged vs. Q2. NAV ▪ NAV was $8.20 per share at 9/30/18 which was unchanged vs. 6/30/18. ▪ $2.5 billion total fair value of investments across 221 portfolio companies. Portfolio 2 ▪ At the end of Q3 2018, four legacy BDCA investments were on non-accrual with a fair value of $43.4 million or 1.7% of the portfolio. ▪ Five investments from TCAP were also on non-accrual with a fair value of $2.1 million or 0.1% of the portfolio. Franklin Templeton Transaction On October 24, Franklin Resources, Inc. (NYSE: BEN) and affiliates (“Franklin Templeton”) entered into an agreement to acquire Benefit Street Partners L.L.C. (“BSP”), the parent of the adviser to BDCA. 3 All BSP employees will be offered continued employment with Franklin Templeton. Investment in BDCA ▪ On November 1, Franklin Templeton and BSP made a $90 million investment in BDCA. ▪ Together with BSP’s existing $10 million investment in BDCA 4, this further aligns the adviser with the shareholders of BDCA, with a total of investment of $100 million. Source: SEC filings as of 11/14/18. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. 1 On July 31, 2018, BSP completed its acquisition of TCAP’s investment portfolio. In accordance with BSP’s allocation policy, BDCA acquired approximately 24% of such portfolio for an aggregate purchase price of approximately $188.1 million. 2 The number of non-accruals is presented at the portfolio company level. 3 The transaction remains subject to customary closing conditions, including BDCA shareholder approval of the new investment advisory agreement between BDCA Adviser and BDCA. See Slide 26 for more information. 4 Includes investments of affiliates of BSP. 5

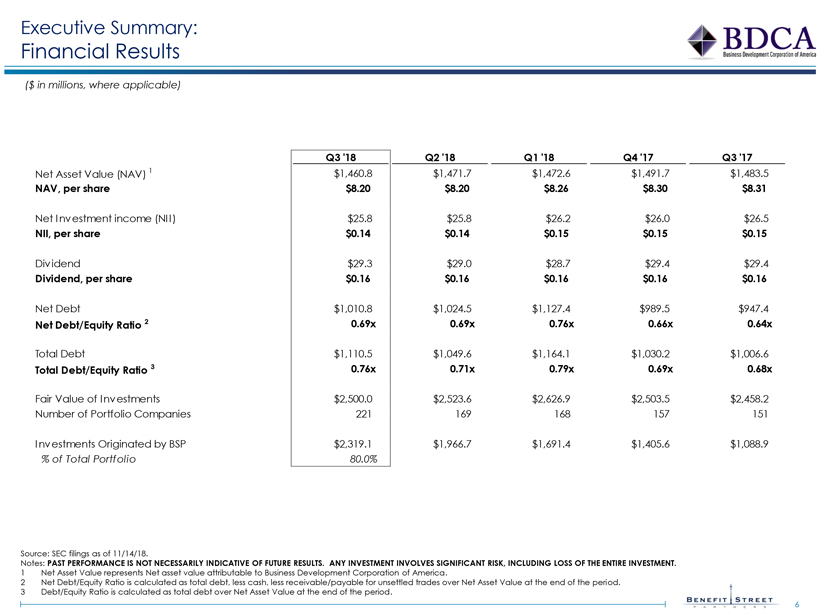

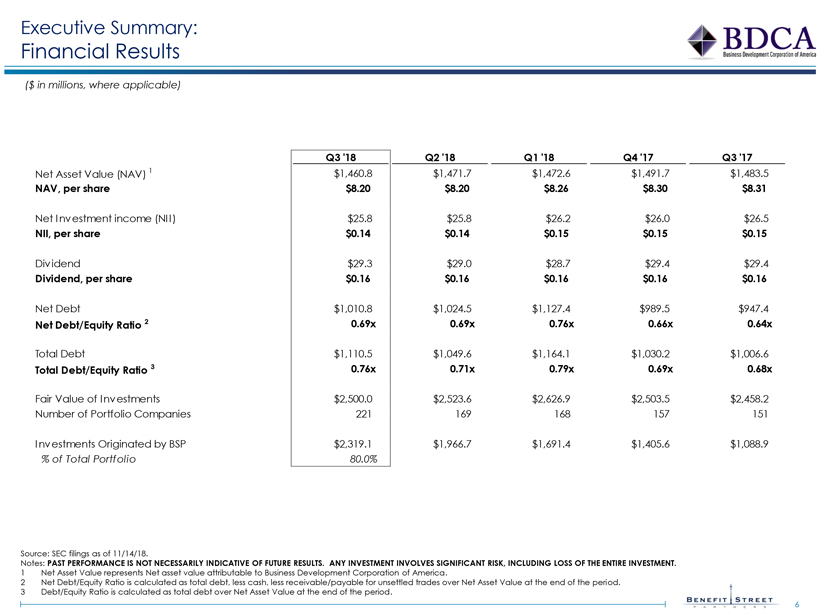

Executive Summary: Financial Results ($in millions, where applicable) Q3 '18 Q2 '18 Q1 '18 Q4 '17 Q3 '17 Net Asset Value (NAV) 1 $1,460.8 $1,471.7 $1,472.6 $1,491.7 $1,483.5 NAV, per share $8.20 $8.20 $8.26 $8.30 $8.31 Net Investment income (NII) $25.8 $25.8 $26.2 $26.0 $26.5 NII, per share $0.14 $0.14 $0.15 $0.15 $0.15 Dividend $29.3 $29.0 $28.7 $29.4 $29.4 Dividend, per share $0.16 $0.16 $0.16 $0.16 $0.16 Net Debt $1,010.8 $1,024.5 $1,127.4 $989.5 $947.4 Net Debt/Equity Ratio 2 0.69x 0.69x 0.76x 0.66x 0.64x Total Debt $1,110.5 $1,049.6 $1,164.1 $1,030.2 $1,006.6 Total Debt/Equity Ratio 3 0.76x 0.71x 0.79x 0.69x 0.68x Fair Value of Investments $2,500.0 $2,523.6 $2,626.9 $2,503.5 $2,458.2 Number of Portfolio Companies 221 169 168 157 151 Investments Originated by BSP $2,319.1 $1,966.7 $1,691.4 $1,405.6 $1,088.9% of Total Portfolio 80.0% Source: SEC filings as of 11/14/18. Notes: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. 1 Net Asset Value represents Net asset value attributable to Business Development Corporation of America. 2 Net Debt/Equity Ratio is calculated as total debt, less cash, less receivable/payable for unsettled trades over Net Asset Value at the end of the period. 3 Debt/Equity Ratio is calculated as total debt over Net Asset Value at the end of the period. 6

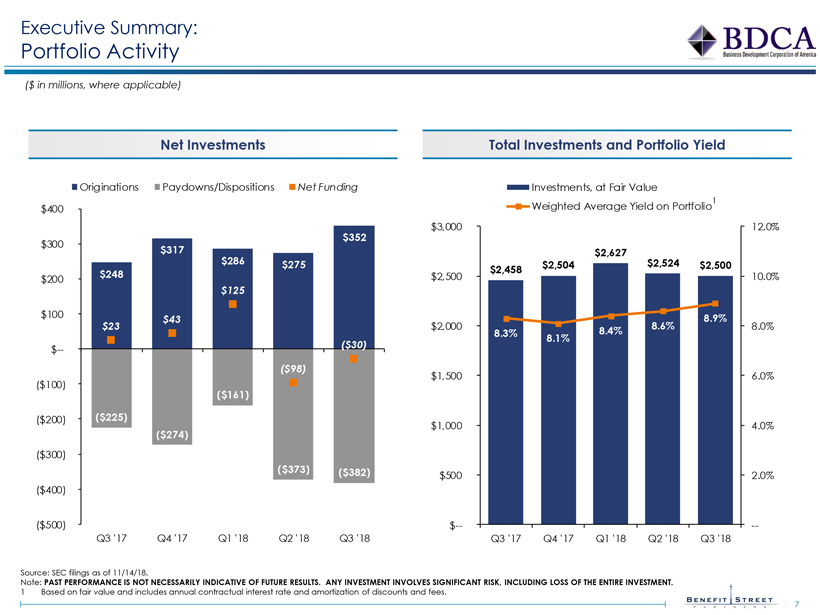

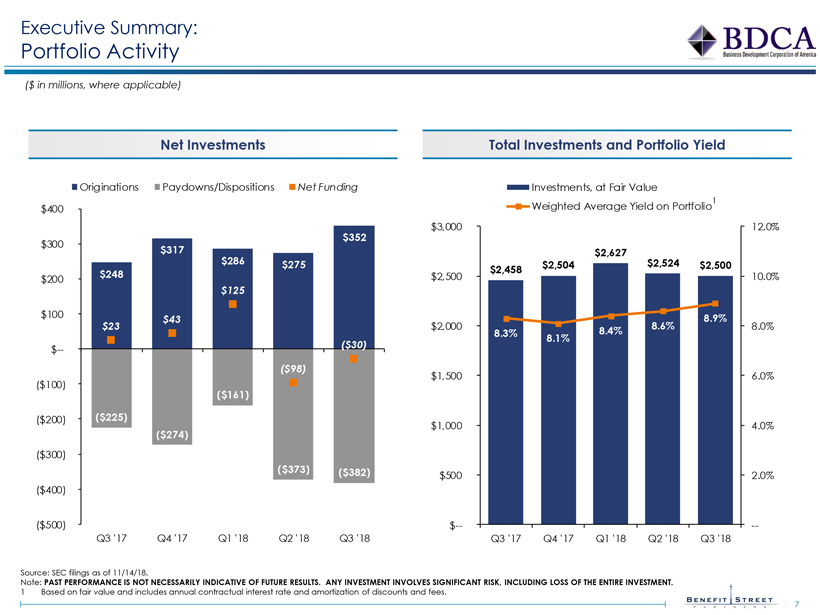

Executive Summary: Portfolio Activity ($in millions, where applicable) Net Investments Total Investments and Portfolio Yield Originations Paydowns/Dispositions Net Funding $400 $300 $352 $317 $3,000 12.0% $200 $248 $286 $275 $125 $2,458 $2,504 $2,524 $2,500 $2,500 10.0% $100 $-- ($100) ($200) ($300) ($400) ($500) Investments, at Fair Value Weighted Average Yield on Portfolio1 $23 $43 ($30) ($98) ($161) ($225) ($274) ($373) ($382) Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 $2,000 8.6% 8.9% 8.4% 8.3% 8.1% $1,500 $1,000 $500 $-- Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 8.0% 6.0% 4.0% 2.0% -- Source: SEC filings as of 11/14/18. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. 1 Based on fair value and includes annual contractual interest rate and amortization of discounts and fees. 7

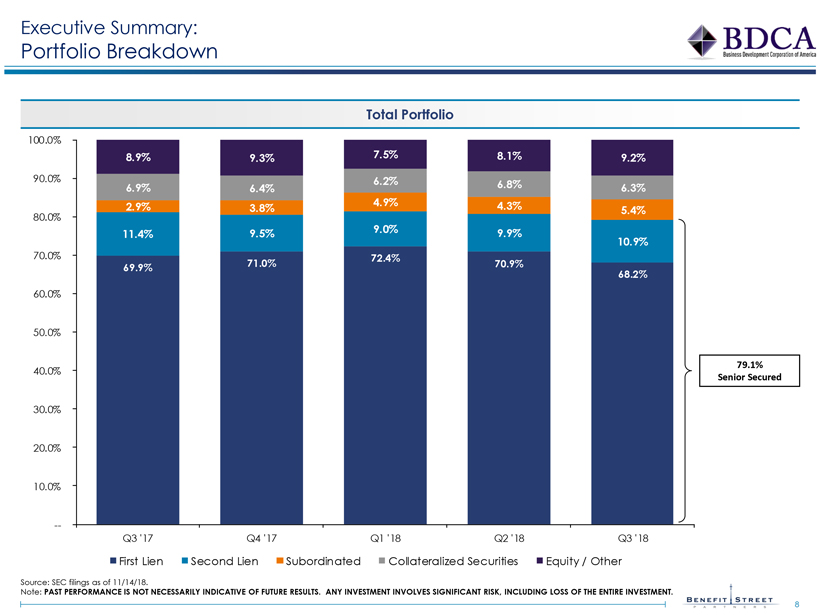

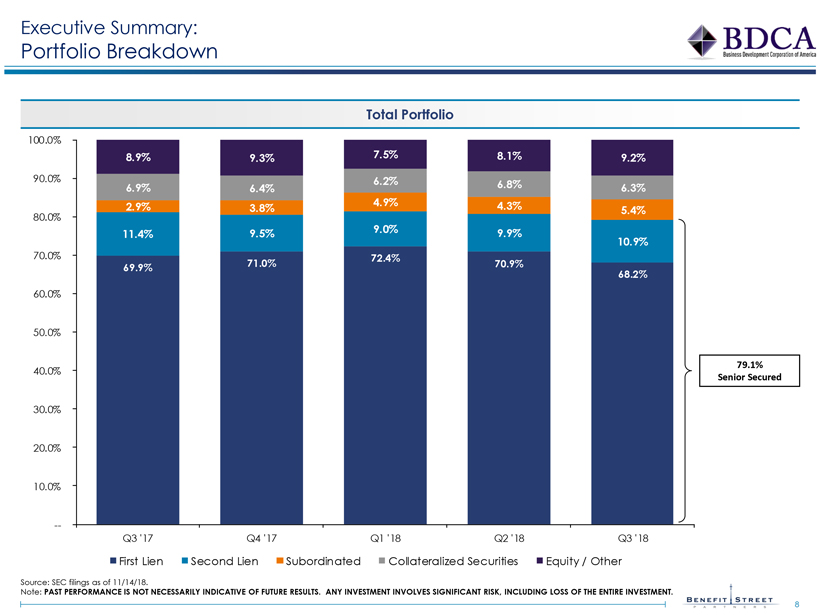

Executive Summary: Portfolio Breakdown Total Portfolio 100.0% 8.9% 9.3% 7.5% 8.1% 9.2% 90.0% 6.2% 6.8% 6.9% 6.4% 6.3% 2.9% 3.8% 4.9% 4.3% 5.4% 80.0% 11.4% 9.5% 9.0% 9.9% 10.9% 70.0% 71.0% 72.4% 70.9% 69.9% 68.2% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% -- Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 First Lien Second Lien Subordinated Collateralized Securities Equity / Other Source: SEC filings as of 11/14/18. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. 79.1% Senior Secured 8

Overview of Adviser

Overview of Adviser: Benefit Street Partners’ Transaction with Franklin Templeton 1 On October 24, 2018, Franklin Templeton entered into an agreement to acquire BSP, the parent of the adviser to BDCA. Overview ― Under the terms of the agreement, Franklin Templeton has agreed to acquire 100% of BSP’s operations. All BSP employees will be offered continued employment with Franklin Templeton. Highlights BSP believes Franklin Templeton’s pedigree, global reach and extensive investment capabilities will provide BDCA with increased resources and investment opportunities. BSP believes the affiliation with Franklin Templeton will also be additive to achieving a future successful liquidity event. 1 The transaction remains subject to customary closing conditions, including BDCA shareholder approval of the new investment advisory agreement between BDCA Adviser and BDCA. See Slide 26 for more information. 10

Overview of Adviser: Benefit Street Partners’ Transaction with Franklin Templeton 1 $90 Million Investment On November 1, 2018, Franklin Templeton and BSP made a $90 million investment in BDCA. The shares were purchased at BDCA’s NAV per share of $8.20. Together with BSP’s $10 million investment in BDCA made on November 7, 2016, BSP and Franklin Templeton have invested $100 million into BDCA. 2 On a combined basis, the $100 million investment represents 6.4% of BDCA’s outstanding shares 3 BSP and Franklin Templeton are the largest shareholders of BDCA This serves to strengthen the alignment between BSP, Franklin Templeton, and the shareholders of BDCA. 1 The transaction remains subject to customary closing conditions. 2 Includes investments of affiliates of BSP. 3 As of November 5, 2018. 11

Overview of Adviser: Benefit Street Partners’ Transaction with Franklin Templeton 1 Key Points Impact of Transaction BDCA Officers No Change Investment Committee No Change Management Agreement & No Change Fees BDCA Strategy No Change 1 The transaction remains subject to customary closing conditions. 12

Overview of Adviser: Franklin Templeton’s Global Platform 1 Total Assets Under Management: US$717.1 Billion 2,3 Equity Fixed Income Multi-Asset/Balanced Alternatives 4 AUM: US$305.4 Billion US$258.9 Billion US$126.8 Billion US$16.7 Billion CAPABILITIES: • Value • Government • Income • Commodities • Deep Value • Municipals • Real Return • Infrastructure • Core Value • Corporate Credit • Balanced/Hybrid • Real Estate • Blend • Bank Loans • Total Return • Hedge Funds • GARP • Securitized • Target Date/Risk • Private Equity • Growth • Multi-Sector • Absolute Return • Convertibles • Currencies • Tactical Asset Allocation • Sector • Sukuk • Managed Volatility • Shariah • Smart Beta INVESTMENT • Templeton Global Equity TEAMS: Group (1940) Franklin Equity Group (1947) Franklin Mutual Series (1949) Franklin Templeton Emerging Markets Equity (1987) Franklin LAM – Developed Markets Equity (1982) • Franklin Templeton Fixed • Franklin Templeton Multi-Asset • Franklin Real Asset Advisors Income Group (1970) Solutions (1996) (1984) • Templeton Global Macro • Franklin SystematiQ (2012) • Darby Overseas Investments (1986) (1994) • Franklin LAM – Fixed Income • K2 Advisors (1994) (1993) • Pelagos (2005) 1 The transaction remains subject to customary closing conditions. 2 Source: Franklin Templeton Investments (FTI), as of 9/30/18, based on latest available data. Total combined Assets Under Management (Total AUM) combines U.S. and non-U.S. AUM of the investment management subsidiaries of the parent company, Franklin Resources, Inc. (FRI) [NYSE: BEN], a global investment management organization operating as FTI. Total and platform AUM includes discretionary and non-discretionary accounts, including pooled investment vehicles, separate accounts and other vehicles. Total and platform AUM may also include advisory accounts with or without trading authority. In addition, assets for which certain FTI advisers provide limited asset allocation advisory services, and assets that are not allocated to FTI products are not included in the AUM figures shown. Each local asset manager may be considered as an entity affiliated with or associated to FTI by virtue of being a direct or indirect wholly-owned subsidiary of FRI, an entity or joint venture in which FRI owns a partial interest, which may be a minority interest, or a third party asset management company to which investment advisory services have been delegated by an FTI adviser. 3 Includes US$9.3 billion in cash management AUM. 4 The Alternative Investments Lead CIO Group does not manage all products reported as alternative. FRI alternative product AUM is $17.7 billion. 13

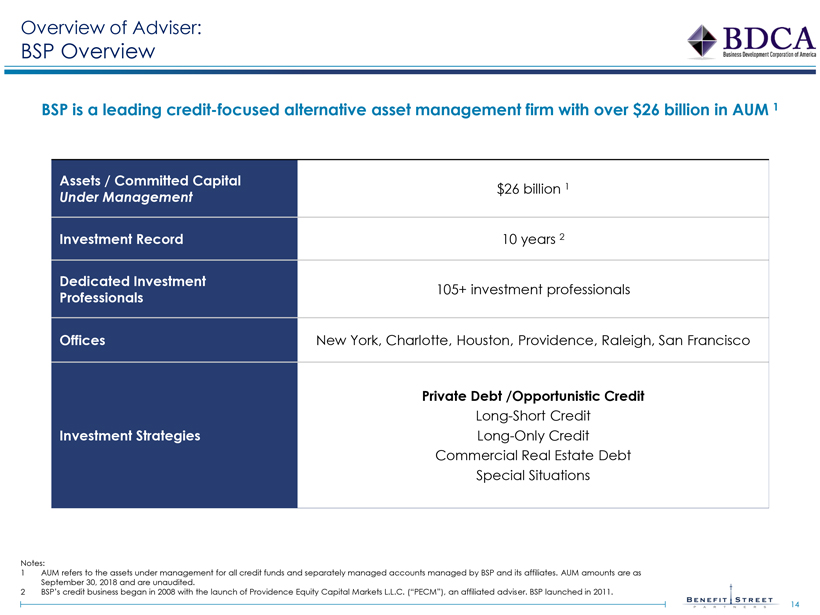

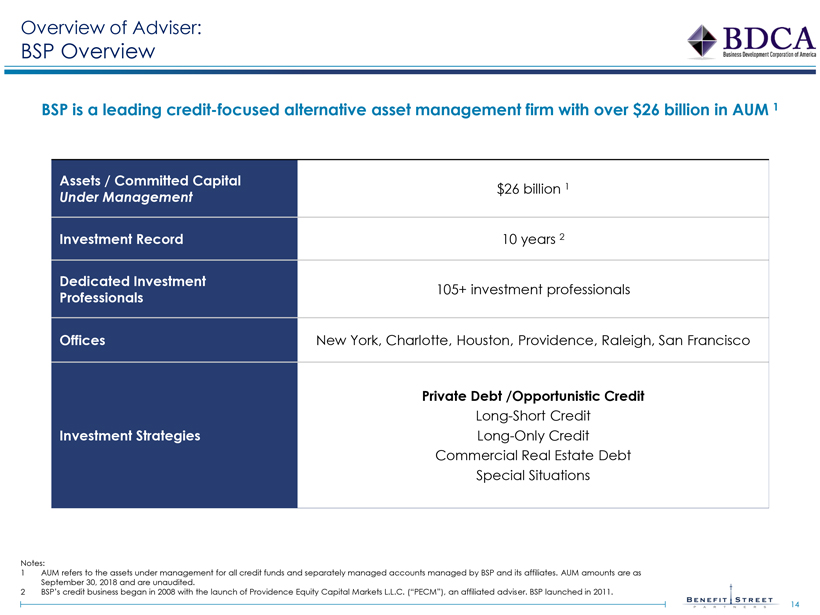

Overview of Adviser: BSP Overview BSP is a leading credit-focused alternative asset management firm with over $26 billion in AUM 1 Assets / Committed Capital $26 billion 1 Under Management Investment Record 10 years 2 Dedicated Investment 105+ investment professionals Professionals Offices New York, Charlotte, Houston, Providence, Raleigh, San Francisco Private Debt /Opportunistic Credit Long-Short Credit Investment Strategies Long-Only Credit Commercial Real Estate Debt Special Situations Notes: 1 AUM refers to the assets under management for all credit funds and separately managed accounts managed by BSP and its affiliates. AUM amounts are as September 30, 2018 and are unaudited. 2 BSP’s credit business began in 2008 with the launch of Providence Equity Capital Markets L.L.C. (“PECM”), an affiliated adviser. BSP launched in 2011. 14

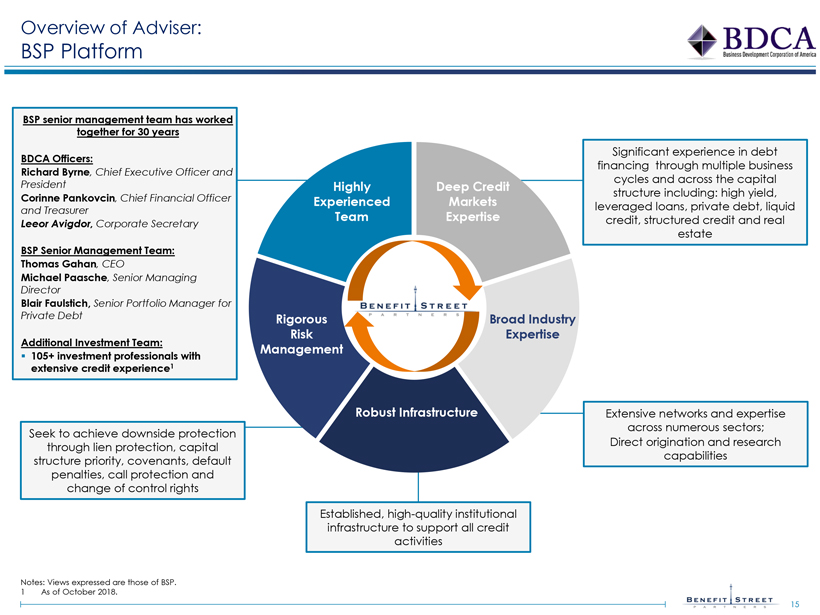

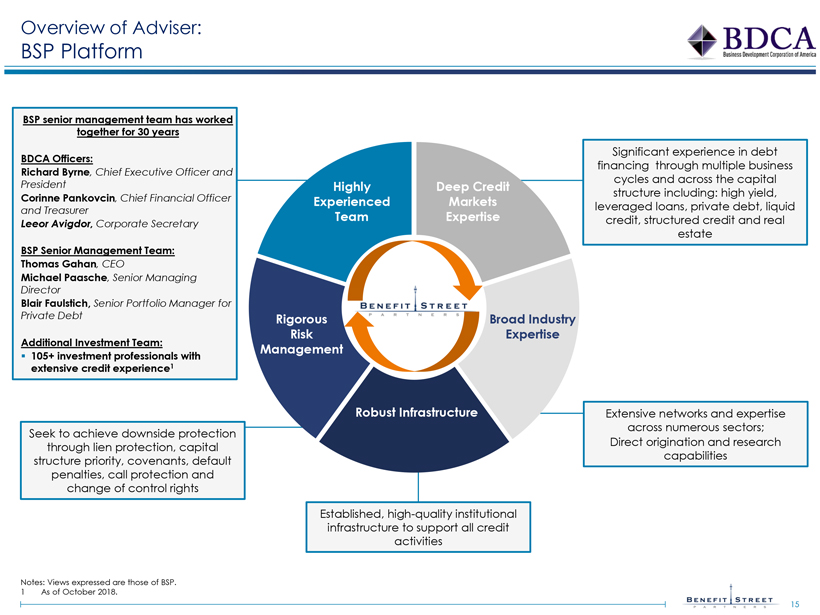

Overview of Adviser: BSP Platform BSP senior management team has worked together for 30 years BDCA Officers: Richard Byrne, Chief Executive Officer and President Corinne Pankovcin, Chief Financial Officer and Treasurer Leeor Avigdor, Corporate Secretary BSP Senior Management Team: Thomas Gahan, CEO Michael Paasche, Senior Managing Director Blair Faulstich, Senior Portfolio Manager for Private Debt Additional Investment Team: 105+ investment professionals with extensive credit experience1 Highly Experienced Team Rigorous Risk Management Deep Credit Markets Expertise Significant experience in debt financing through multiple business cycles and across the capital structure including: high yield, leveraged loans, private debt, liquid credit, structured credit and real estate Broad Industry Expertise Robust Infrastructure Extensive networks and expertise across numerous sectors; Direct origination and research capabilities Seek to achieve downside protection through lien protection, capital structure priority, covenants, default penalties, call protection and change of control rights Established, high-quality institutional infrastructure to support all credit activities Notes: Views expressed are those of BSP. 1 As of October 2018. 15

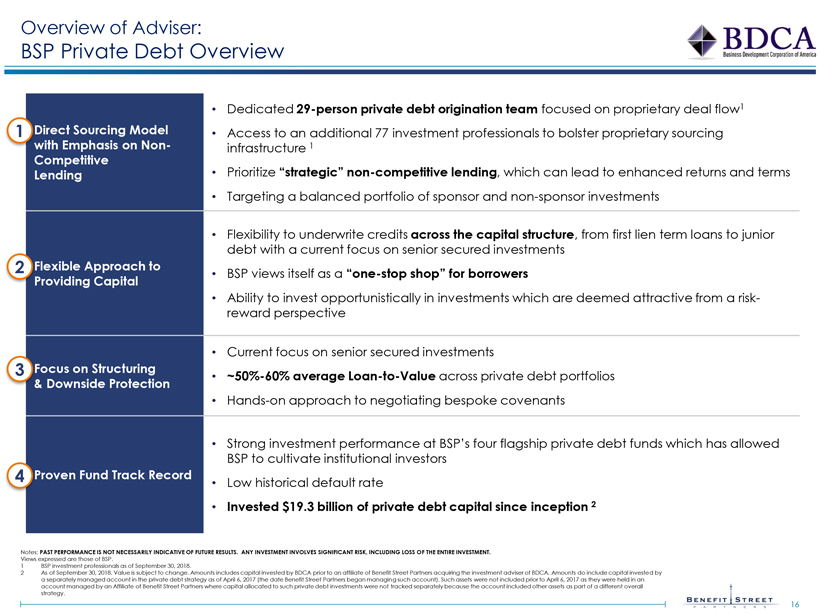

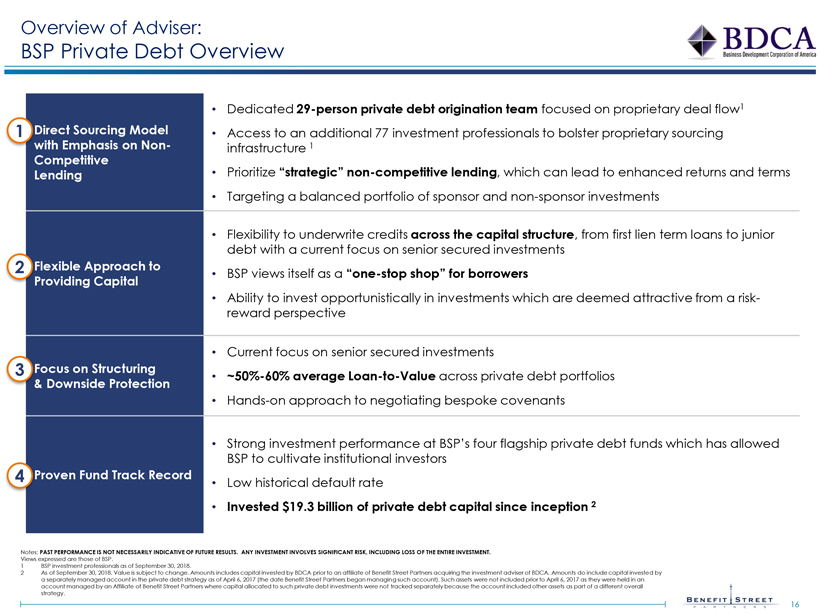

Overview of Adviser: BSP Private Debt Overview 1 Direct Sourcing Model with Emphasis on Non- Competitive Lending • Dedicated 29-person private debt origination team focused on proprietary deal flow1 • Access to an additional 77 investment professionals to bolster proprietary sourcing infrastructure 1 Prioritize “strategic” non-competitive lending, which can lead to enhanced returns and terms • • Targeting a balanced portfolio of sponsor and non-sponsor investments 2 Flexible Approach to Providing Capital • Flexibility to underwrite credits across the capital structure, from first lien term loans to junior debt with a current focus on senior secured investments • BSP views itself as a “one-stop shop” for borrowers • Ability to invest opportunistically in investments which are deemed attractive from a risk- reward perspective 3 Focus on Structuring & Downside Protection • Current focus on senior secured investments • ~50%-60% average Loan-to-Value across private debt portfolios • Hands-on approach to negotiating bespoke covenants 4 Proven Fund Track Record • Strong investment performance at BSP’s four flagship private debt funds which has allowed BSP to cultivate institutional investors • Low historical default rate • Invested $19.3 billion of private debt capital since inception 2 Notes: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. Views expressed are those of BSP. 1 BSP investment professionals as of September 30, 2018. 2 As of September 30, 2018. Value is subject to change. Amounts includes capital invested by BDCA prior to an affiliate of Benefit Street Partners acquiring the investment adviser of BDCA. Amounts do include capital invested by a separately managed account in the private debt strategy as of April 6, 2017 (the date Benefit Street Partners began managing such account). Such assets were not included prior to April 6, 2017 as they were held in an account managed by an Affiliate of Benefit Street Partners where capital allocated to such private debt investments were not tracked separately because the account included other assets as part of a different overall strategy. 16

Overview of BDCA

Overview of BDCA: Investment Thesis Focused on lending to middle market businesses, primarily in the United States BDCA seeks to: 1 Preserve and protect capital; Provide monthly cash distributions; and Generate capital appreciation, where possible BDCA Seeks to Provide: 1 2 3 Capital Monthly Cash Capital Appreciation Preservation Distributions Notes: Views expressed are those of BSP. 1 There is no guarantee these objectives will be met. 18

Overview of BDCA: Portfolio Snapshot 221 Portfolio Companies $2.7 Billion in Total 79.1% Senior Secured 87.8% Floating Rate Assets 8.9% Weighted Average Current Yield on Total Portfolio 1 9.8% Weighted Average Current Yield on Income Producing Securities 1 Security Mix 6% 6% First Lien 9% Second Lien 11% Equity/Other CLOs 68% Subordinated Industry Diversification Health Care 11% Diversified Investment Vehicles Business Services 25% Hotels, Restaurants & Leisure 10% Aerospace & Defense Media Diversified Telecom. Services 8% Chemicals 2% Energy Equipment & Services 3% Food Products 3% 6% Technology Metals & Mining 3% Real Estate Mgmt. & Development 3% 6% Health Care Providers & Services 3%3% 4% 4% 5% Consumer Products Other Source: SEC filings as of 11/14/2018. Notes: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. Views expressed are those of BSP. 1 Based on fair value and includes annual contractual interest rate and amortization of discounts and fees; income producing securities excludes equities and non-accrual investments. 19

Overview of BDCA: Credit Quality ($in millions, where applicable) At the end of Q3 2018, four legacy BDCA investments were on non-accrual with a cost of $116.2 million or 4.5% of the portfolio and a fair value of $43.4 million or 1.7%. 1 Five investments from TCAP were also on non-accrual with a cost of $2.3 million or 0.1% of the portfolio and a fair value of $2.1 million or 0.1%. 1 The below charts present non-accruals on an aggregate basis. Amortized Cost $140.0 6.0% $124.8 $120.0 $116.2 $113.3 $118.4 5.0% 4.9% $97.6 $100.0 4.6% 4.4% 4.3% 4.0% $80.0 3.8% 3.0% $60.0 2.0% $40.0 1.0% $20.0 $-- -- Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18 Value Fair Market Value $140.0 6.0% $120.0 5.0% $100.0 4.0% $80.0 3.0% $60.0 $48.2 $45.5 $41.4 $40.0 $39.2 2.0% 2.0% 1.8% 1.6% 1.6% $21.0 1.0% $20.0 0.8% $-- -- Q3 '17 Q4 '17 Q1 '18 Q2 '18 Q3 '18% of Total Source: SEC filings as of 11/14/2018. Note: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. Note: Q3 ’18 metrics include investments from TCAP. 1 The number of non-accruals is presented at the portfolio company level. 20

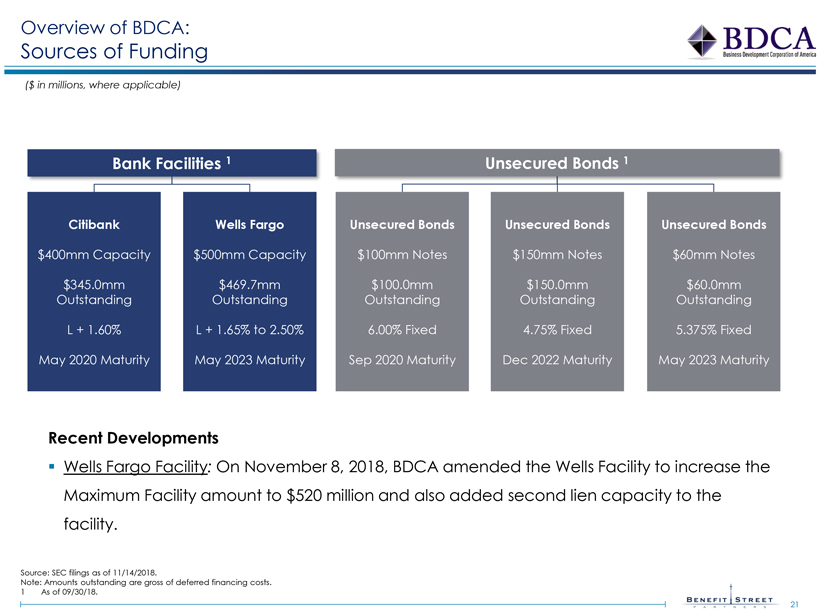

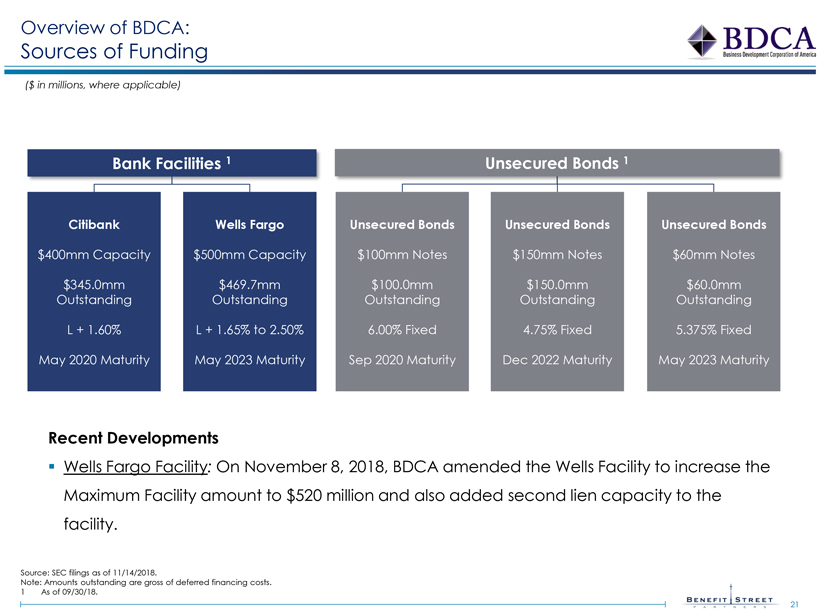

Overview of BDCA: Sources of Funding ($in millions, where applicable) Bank Facilities 1 Citibank Wells Fargo $400mm Capacity $500mm Capacity $345.0mm $469.7mm Outstanding Outstanding L + 1.60% L + 1.65% to 2.50% May 2020 Maturity May 2023 Maturity Unsecured Bonds 1 Unsecured Bonds Unsecured Bonds Unsecured Bonds $100mm Notes $150mm Notes $60mm Notes $100.0mm $150.0mm $60.0mm Outstanding Outstanding Outstanding 6.00% Fixed 4.75% Fixed 5.375% Fixed Sep 2020 Maturity Dec 2022 Maturity May 2023 Maturity Recent Developments Wells Fargo Facility: On November 8, 2018, BDCA amended the Wells Facility to increase the Maximum Facility amount to $520 million and also added second lien capacity to the facility. Source: SEC filings as of 11/14/2018. Note: Amounts outstanding are gross of deferred financing costs. 1 As of 09/30/18. 21

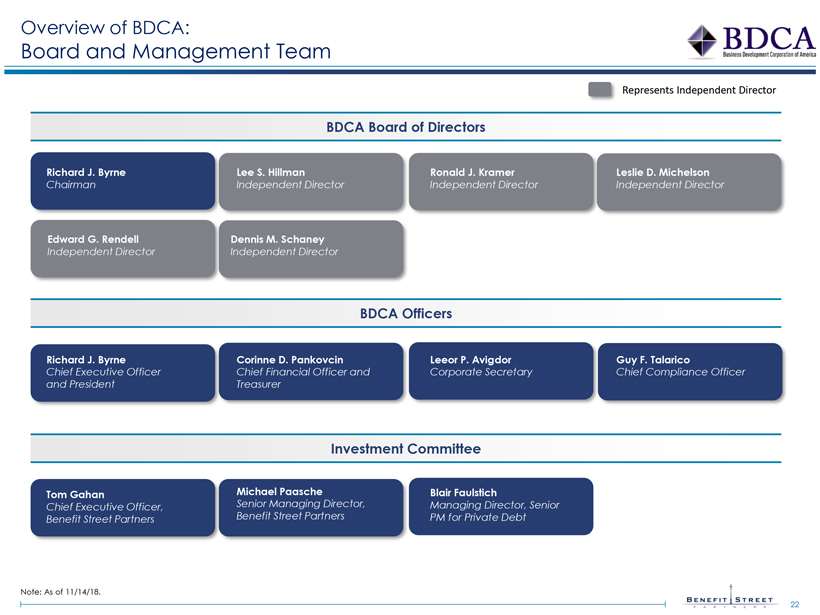

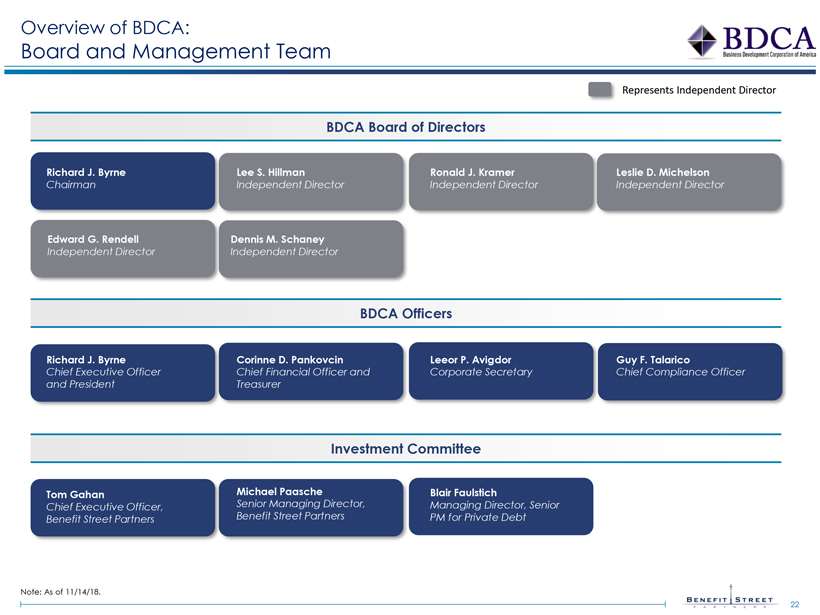

Overview of BDCA: Board and Management Team Represents Independent Director BDCA Board of Directors Richard J. Byrne Lee S. Hillman Ronald J. Kramer Leslie D. Michelson Chairman Independent Director Independent Director Independent Director Edward G. Rendell Dennis M. Schaney Independent Director Independent Director BDCA Officers Richard J. Byrne Corinne D. Pankovcin Leeor P. Avigdor Guy F. Talarico Chief Executive Officer and President Chief Financial Officer and Treasurer Corporate Secretary Chief Compliance Officer Investment Committee Tom Gahan Michael Paasche Blair Faulstich Chief Executive Officer, Benefit Street Partners Senior Managing Director, Benefit Street Partners Managing Director, Senior PM for Private Debt Note: As of 11/14/18. 22

Strategic Initiatives

Strategic Initiatives: Key Strategic Priorities Establish BDCA as a Best-In-Class business development company. Position BDCA for a liquidity event. Leverage Franklin Templeton and BSP origination platform 1 Optimize balance sheet Prudently invest capital Focus on governance Align dividend with earnings Conform with public company peers Stabilize net asset value Transparent investor relations Improve quality of earnings Robust regulatory compliance Note: Views expressed are those of BSP. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS ANY INVESTMENT INVOLVES SIGNIFICANT RISK, INCLUDING LOSS OF THE ENTIRE INVESTMENT. There is no guarantee the investment strategy or initiatives above will be met. 1 The Benefit Street Partners transaction with Franklin Templeton remains subject to customary closing conditions. 24

Special Meeting

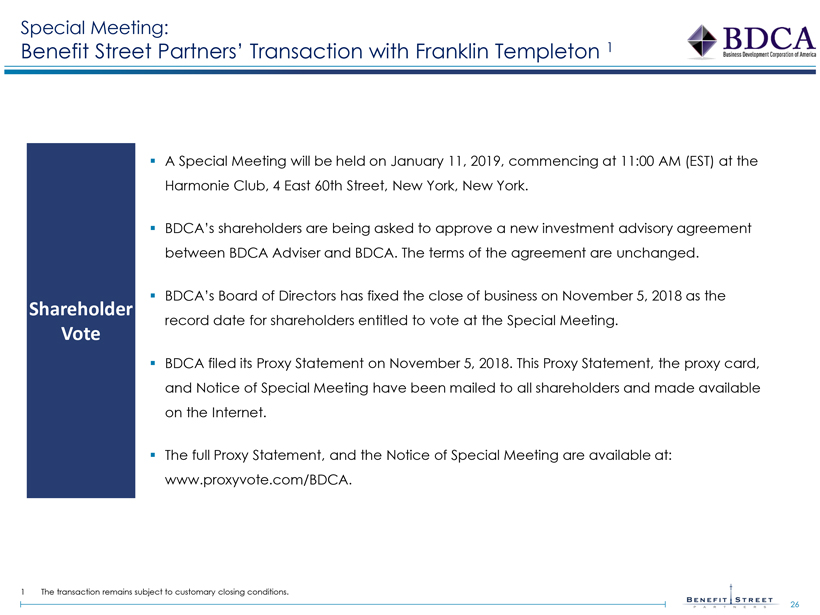

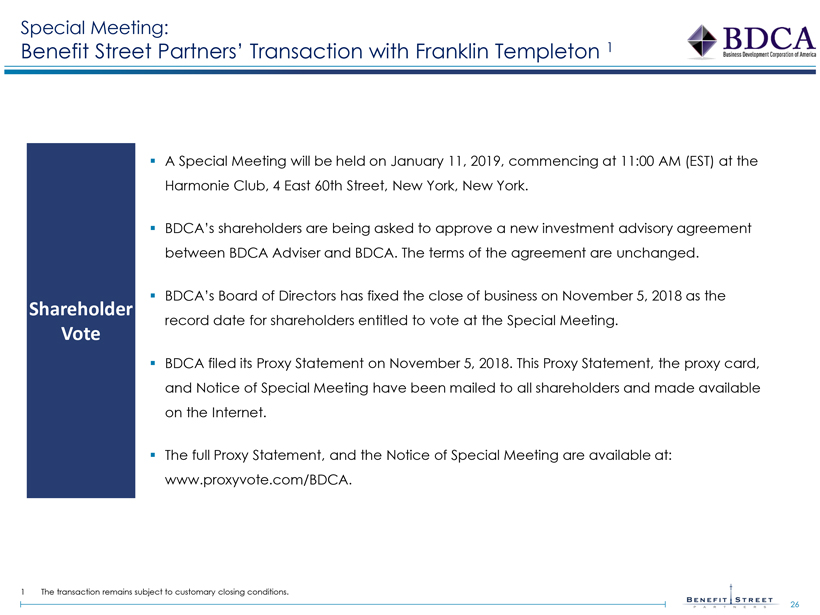

Special Meeting: Benefit Street Partners’ Transaction with Franklin Templeton 1 Shareholder Vote A Special Meeting will be held on January 11, 2019, commencing at 11:00 AM (EST) at the Harmonie Club, 4 East 60th Street, New York, New York. BDCA’s shareholders are being asked to approve a new investment advisory agreement between BDCA Adviser and BDCA. The terms of the agreement are unchanged. BDCA’s Board of Directors has fixed the close of business on November 5, 2018 as the record date for shareholders entitled to vote at the Special Meeting. BDCA filed its Proxy Statement on November 5, 2018. This Proxy Statement, the proxy card, and Notice of Special Meeting have been mailed to all shareholders and made available on the Internet. The full Proxy Statement, and the Notice of Special Meeting are available at: www.proxyvote.com/BDCA. 1 The transaction remains subject to customary closing conditions. 26

Special Meeting: Proposals & Board of Directors Recommendation The Board of Directors unanimously recommends a vote “FOR” the Proposals Proposal 1: Transaction with Franklin Templeton The Board unanimously recommends that you vote “FOR” the New Advisory Agreement Proposal to Approve the New Advisory Agreement between BDCA and BDCA Adviser, to take effect upon consummation of the Transaction between BSP and Franklin Templeton. Proposal 2: Adjournment of the Special Meeting The Board unanimously recommends that you vote “FOR” this proposal to adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies. 27

Special Meeting: Voting Information VOTING OPTIONS MAIL: By mail by completing, signing, dating and returning their proxy card in the pre-paid envelope sent in the Proxy Statement. PHONE: By calling (800) 690-6903 with your control number available. INTERNET: By visiting www.proxyvote.com/BDCA. Enter your control number and follow the prompts. If you have questions about the proposals or would like additional copies of the proxy statement, please contact our proxy solicitor, Broadridge Investor Communication Solutions, Inc. at (855) 486-7909. 28

Risk Factors The following is a summary of risk factors for Business Development Corporation of America. You should not expect to be able to sell your shares regardless of how we perform. If you are able to sell your shares, you will likely receive less than your purchase price. Our adviser and its affiliates, including our officers and some of our directors, will face conflicts of interest caused by compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our stockholders. We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, and we do not expect a secondary market in the shares to develop. We may borrow funds to make investments. As a result, we would be exposed to the risks of borrowing, also known as leverage, which may be considered a speculative investment technique. Leverage increases the volatility of investments by magnifying the potential for gain and loss on amounts invested, thereby increasing the risks associated with investing in our securities. Moreover, any assets we may acquire with leverage will be subject to management fees payable to our Adviser; thus our Adviser may have an incentive to increase portfolio leverage in order to earn higher management fees. Because you will be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. Our distributions may be funded from any sources of funds available to us, including offering proceeds and borrowings as well as expense support payments from our Adviser that are subject to reimbursement to it, which may constitute a return of capital and reduce the amount of capital available to us for investment. We have not established limits on the amount of funds we may use from available sources to make distributions. The Adviser has no obligation to make expense support payments in the future. Any capital returned to stockholders through distributions will be distributed after payment of fees and expenses. Our Adviser may also waive reimbursements by us for certain expenses paid by it to fund our distributions. The waived reimbursements may be subject to repayment in the future, reducing future distributions to which our stockholders may be entitled. For more detailed information on risks relating to BDCA, see the latest Form 10-K and quarterly reports filed on Form 10-Q. Note: Please note that the above factors should not be relied upon as a comprehensive and complete list of all risk factors. Certain schedules may not foot due to rounding. 29

For account information, including balances and the status of submitted paperwork, please call Investor Relations at (844) 785-4393 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com www.bdcofamerica.com Shareholders may access their accounts at www.bdcofamerica.com 30