As filed with the Securities and Exchange Commission on October 15, 2010

Registration No. 333- 166611

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO . 2

TO

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| 中国产权平台控股(集团)有限公司 |

| (Exact name of Registrant as specified in its charter) |

CHINA EQUITY PLATFORM HOLDING GROUP LIMITED |

| (Translation of Registrant’s name into English) |

| British Virgin Islands | 7380 | Not Applicable |

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Room 1506-1509 Rongchao Landmark, 4028 Jintian Road Futian District, Shenzhen, People’s Republic of China 518026 Tel: 86-755-82210238,86-755-82577718 |

| (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) |

OFFSHORE INCORPORATIONS LIMITED P.O. BOX 957 OFFSHORE INCORPORATIONS CENTRE, ROAD TOWN TORTOLA, BRITISH VIRGINS ISLANDS |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Richard A. Friedman, Esq.

Benjamin A. Tan, Esq.

Sichenzia Ross Friedman Ference LLP61 Broadway, 32nd Floor

New York, NY 10006

Tel: (212) 930 9700

Fax: (212) 930 9725

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

1

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered (1) | Proposed maximum offering price per unit | Proposed maximum aggregate offering price (2) | Amount of registration fee | ||||||||||||

| Common Stock, par value $0.01 | 52,315,000 | $ | 0.05 | $ | 2,615,750 | $ | 186.50 | |||||||||

| (1) | Pursuant to Rule 416(a) of the Securities Act, this registration statement shall be deemed to cover additional securities that may be offered or issued to prevent dilution resulting from splits, dividends or similar transactions. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(e) under the Securities Act of 1933. |

*Previously paid

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

2

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. |

PROSPECTUS

CHINA EQUITY PLATFORM HOLDING GROUP LIMITED

50,840,000 Common Shares

This prospectus relates to the resale, from time to time, by the selling shareholders named in this prospectus of up to 50,840,000 shares of our common stock, which includes (i) 40,000,000 shares of our common stock issued in connection with the joint venture agreement we entered into with Uni Core Holdings Corporation and certain investors in February 2008, (ii) 9,500,000 shares of our common stock issued in our December 2009 private placement and (iii) 1,340,000 shares of our common stock issued to certain our employees, consultants and service providers. This is the initial registration of shares of our common stock. The selling shareholders will sell the shares from time to time at $0.05 per share. 0; The selling shareholders may be deemed underwriters of the shares of common stock, which they are offering. We will pay the expenses of registering these shares.

There is presently no public market for our shares. We intend to begin discussions with various market makers in order to arrange for an application to be made with respect to our common stock to be approved for quotation on the Over-The-Counter Bulletin Board (“the OTC Bulletin Board”) upon the effectiveness of this prospectus. If our shares become quoted on the OTC Bulletin Board, sales will be made at prevailing market prices or privately negotiated prices.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on Page 5 to read about factors you should consider before buying shares of our common stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus before making an investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus. We have not authorized any dealer, salesperson or other person to provide you with information concerning us, except for the information contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date on the front cover page of this prospectus, regardless when the time of delivery of this prospectus or the sale of any common stock. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, our common stock in any jurisdiction in which the offer or sale is not permitted.

3

TABLE OF CONTENTS

| Page | |||

| PART I | |||

| Prospectus Summary | 6 | ||

| Risk Factors | 12 | ||

| Special Note Regarding Forward-Looking Statements | 21 | ||

| Use of Proceeds | 21 | ||

| Dividend Policy | 21 | ||

| Dilution | 21 | ||

| Exchange Rate Information | 22 | ||

| Selected Consolidated Financial and Operating Data | 22 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 | ||

| Business | 36 | ||

| Properties | 41 | ||

| Legal Proceedings | 41 | ||

| Directors, Executive Officers, Promoters and Control Persons | 41 | ||

| Related Party Transactions | 45 | ||

| Principal Shareholders | 45 | ||

| Description of Securities | 47 | ||

| Taxation | 53 | ||

| Enforceability of Civil Liabilities | 62 | ||

| Expenses Relating to This Offering | 63 | ||

| Legal Matters | 63 | ||

| Experts | 63 | ||

| Where You Can Find Additional Information | 63 | ||

| Index to Combined Financial Statements | F - 1 | ||

| PART II | |||

| Indemnification of Directors and Officers | 64 | ||

| Recent Sales of Unregistered Securities | 64 | ||

| Exhibits and Financial Statement Schedules | 65 | ||

| Undertakings | 66 | ||

| Signatures | 67 | ||

4

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information or to make any representations about us, the selling shareholders, the securities or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us or any selling shareholder.

The selling shareholders are offering to sell and seeking offers to buy shares of our Common Shares only in jurisdictions where offers and sales are permitted. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy the securities in any circumstances under which the offer or solicitation is unlawful.

The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Shares. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus. The prospectus will be updated and updated prospectuses made available for delivery to the extent required by the federal securities laws.

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including “Risk Factors” and our consolidated financial statements, including the notes to the financial statements appearing elsewhere in this prospectus. As used throughout this prospectus, the terms “we,” “us,” and “our” and words of like import refer to China Equity Platform Holding Group Limited and its direct and indirect subsidiaries but do not include the selling shareholders.

Certain Other Terms Used in This Prospectus

Currency, exchange rate, and “China” and other references

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan, which is also known as the Renminbi. According to the currency exchange website www.oanda.com, on July 6, 2010, $1.00 was equivalent to 6.7855 yuan.

References to “PRC” are to the People’s Republic of China.

Unless otherwise specified or required by context, references to “we,” “the Company”, “our” and “us” refer collectively to (i) China Equity Platform Holding Group Limited and (ii) the subsidiaries of China Equity Platform Holding Group Limited, namely Chinae.com Technology (Shenzhen) Co., Ltd (财纳易科技(深圳)有限公司), Chinae.com Investment Consultant (Shenzhen) Co., Ltd (财纳易投资顾问(深圳)有限公司), Chinae.com E-Commerce Co., Ltd (& #28145;圳市中贸网网络技术开发有限公司), Shenzhen International Hi-Tech Equity Exchange (深圳国际高新技术产权交易所), and Chinae.com Focus Advertising Co., Ltd (深圳市财纳易视点广告有限公司). We are in the midst of acquiring an equity stake in the Hainan Special Economic Zone Property Rights Exchange Center (海南经济特区产权交易中心).

References to “registered capital” are to the equity of each of the PRC-registered subsidiaries, which under PRC law is measured not in terms of shares owned but in terms of the amount of capital that has been contributed to a company by a particular shareholder or all shareholders. The portion of a limited liability company’s total capital contributed by a particular shareholder represents that shareholder’s ownership of the company, and the total amount of capital contributed by all shareholders is the company’s total equity. Capital contributions are made to a company by deposits into a dedicated account in the company’s name, which the company may access in order to meet its financial needs. When a company’s accountant certifies to PRC authorities that a capital contribution has been made an d the company has received the necessary government permission to increase its contributed capital, the capital contribution is registered with regulatory authorities and becomes a part of the company’s “registered capital.”

5

THE COMPANY

Overview of Our Business

We are, through our subsidiaries, a high-tech financial services provider based in the People’s Republic of China (“China” or the “PRC”). We bridge the Chinese and international capital markets by investing technology and capital into regional private equity institutions. We have a nationwide equity service platform that provides both online and offline financial services. We also provide business consulting and project management services for PRC companies seeking capital funds.

Presently there are over 230 private equity exchanges in the PRC. Generally, the over-the-counter equity market quotation, or OTC for short, refers to securities trading quotation display services for primarily stocks of high-tech companies and high-growth companies and delisted corporate stocks to display quotation out of stock exchanges. As a result of contrasting economic system and development, China's OTC equity market quotation system is a comparatively comprehensive one and the term generally refers to quotation services where unlisted stocks or equities are display other than in Shanghai Stock Exchange and Shenzhen Stock Exchange. China's OTC equity market primarily includes the Property Rights Exchange Market, Stock Transfer Systems and Stock Equity Exchange Market (Source: http://www.zero2ipo.com.cn/en/n/2009-2-24/2009224132931.shtml). However only 65 of them have been approved to participate in the privatization of state assets and only approximately 10% of the transactions at these quotation systems involves foreigners and all the quotation systems are loosely connected. At this time the various equity exchanges quotation services in the PRC work, for the most part, independently of one another, which we believe is very inefficient.

We believe that we are, through our software technology, able to provide an equity exchange quotation service platform that we hope will bridge all these regional exchanges quotation systems in one cohesive network. Additionally, we hope that our platform will also enable the flow of information regarding rights transfers and payments among the different exchanges, including the Shenzhen International Hi-Tech Equity Exchange, an exchange quotation system in which we have an indirect equity stake in. Our software is presently being reviewed and its use will be subject to the PRC’s government approval before it may be implemented. Our aim is to be the most heavily displayed equity exchange quotation platform for non-listed quality assets in the PRC and the largest source of information about such ass ets through our internet portal, www.chinae.com.

In addition to our plans to implement an equity service platform as described above, we also provide consulting services to small to medium sized enterprises (“SMEs”). We assist SMEs in streamlining their operations, reduce costs and improve management and we draw revenue in the form of consulting fees.

We have received approximately US$39,500 in revenue in relation to consulting services provided to customers last year. Our major customers include Shenzhen Fang Yuan Xing Ye Technology Co., Ltd. Shenzhen Bullingas Gas Equipment Co., Ltd., Shenzhen Most Network Technology Co., Ltd., Grand TG Gold Holdings Limited and Shenzhen Venture Capital Association.

Finally, we provided assistance to SMEs with fund-raising services. We seek to understand our clients’ capital needs and assist them in meeting them by means of introducing them to sources of funds e.g. investment banks and individual investors. The financing may be in the form of a bridge loan or private investment in public equity (“PIPE”). We have received US$43,911 on January 11, 2010 for services rendered to Shenzhen Tech and Ecology and Environment Co., Ltd. We have signed approximately 16 contracts in 2009 and 4 contracts in 2008 in relation to our services acting as a fund-raising agency. Generally, we receive 3-6% of the actual amount involved in the transactions as commission for our services provided.

We were incorporated on March 5, 2008 under the laws of the British Virgins Islands. Our Company was formed as the result of a joint venture agreement (the “JV Agreement”) entered into by and between Uni Core Holdings Corporation (formerly known as “Intermost Corporation”) (“Uni Core”) and certain investors (the “Investors”). Pursuant to the JV Agreement, Uni Core and the Investors agreed to form a new holding company named “China Equity Platform Holding Group Limited” into which certain former subsidiaries of Uni Core would be contributed in exchange for shares of common stock of the newly formed entity. The intention of Uni Core and the Investors was seek quotation of our Company on the OTC Bulletin Board. Uni Core, which is quoted on the OTC Bulletin Board under the symbol “UCHC” (formerly traded as “IMOT”) received 60,000,000 shares of our common stock pursuant to the JV Agreement, which as of October 14, 2010 amounts to 53.42% of our outstanding common stock. As of October 14, 2010, Uni Core is our single largest shareholder. We intend to begin discussions with various market makers in order to arrange for an application to be made with respect to our common stock to be approved for quotation on the OTC Bulletin Board upon the effectiveness of this prospectus.

6

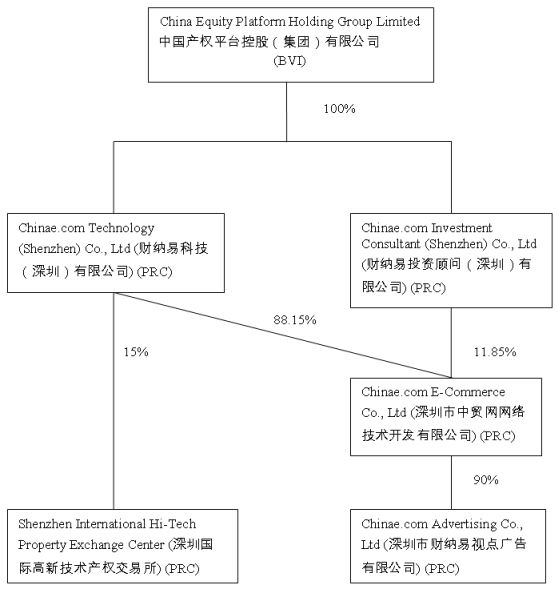

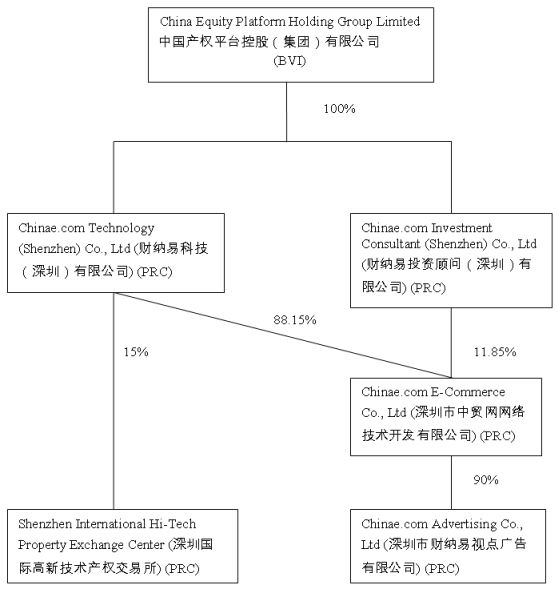

Organization Structure

The following chart shows the organizational structure of our Company and its principal operating subsidiaries, including joint venture ownerships. The location of the headquarters of each company is indicated in parentheses under the company’s name (“BVI” for the British Virgin Islands and “PRC” for the People’s Republic of China)

Corporate Information

Our principal offices are located at Room 1506-1509, Rongchao Landmark, 4028 Jintian Road, Futian District, Shenzhen, People’s Republic of China (518026), and our telephone number is 86-755-82210238 and 86-755-82577718. We are incorporated under the laws of the British Virgin Islands. Further information on the Company is also available on our website at http://www.chinae.com. Unless specifically provided herein, we do not intend for the information on our website to be incorporated by reference in this prospectus.

7

SUMMARY FINANCIAL INFORMATION

You should read the following summary financial data in conjunction with our consolidated financial statements and the related notes, "Selected Consolidated Financial Data" on page 15, and our “Management’s Discussion & Analysis of Financial Condition and Results of Operations” on page 16. Our financial statements are reported in United States Dollars and presented in accordance with United States generally accepted accounting principles. The financial reports for the year ended March 31, 2010 and 2009 have been audited by Albert Wong & Co., Certified Public Accountants.

| Year Ended March 31, | ||||||||||||

| 2008 | 2009 | 2010 | ||||||||||

| (Proforma) | (Proforma) | |||||||||||

| Consolidated Income Statement | ||||||||||||

| Revenue | 87,176 | 1,482 | 71,810 | |||||||||

| Cost of Revenue | (89,327 | ) | (6,678 | ) | (64,342 | ) | ||||||

| Gross Profits(Loss) | (2,151 | ) | (5,196 | ) | 7,468 | |||||||

| Expenses | (345,113 | ) | (1,195,026 | ) | (770,656 | ) | ||||||

| Interest (net of interest expenses) | 1,917 | (241 | ) | 517 | ||||||||

| Other Income | 271,102 | 145 | 326,523 | |||||||||

| Operating from continue operation before income tax | (74,245 | ) | (1,200,318 | ) | (436,147 | ) | ||||||

| Income tax | - | - | - | |||||||||

| Net Loss | (74,245 | ) | (1,200,318 | ) | (436,147 | ) | ||||||

| Earnings Per Share - Basic | (0.00074 | ) | (0.0120 | ) | (0.0042 | ) | ||||||

| Earnings Per Share - Diluted | (0.00074 | ) | (0.0120 | ) | (0.0042 | ) | ||||||

| Weighted Average Number of basic shares outstanding | 100,000,000 | 100,000,000 | 103,645,274 | |||||||||

| Weighted Avenue Number of dilute shares outstanding | 100,000,000 | 100,000,000 | 103,645,274 | |||||||||

| As of March, 31 | ||||||||||||

| 2008 | 2009 | 2010 | ||||||||||

| (Proforma) | (Proforma) | |||||||||||

| Consolidated Balance Sheet Data | ||||||||||||

| Cash | 1,009,661 | 96,834 | 312,896 | |||||||||

| Current assets | 1,437,313 | 845,359 | 751,280 | |||||||||

| Other assets | 3,533,536 | 3,629,061 | 3,594,494 | |||||||||

| Total assets | 5,980,510 | 4,571,254 | 4,658,670 | |||||||||

| Total current liabilities | 3,579,181 | 258,516 | 250,413 | |||||||||

| Total shareholders’ equity | 2,401,329 | 4,312,738 | 4,408,257 | |||||||||

| Total liabilities and shareholders’ equity | 5,980,510 | 4,571,254 | 4,658,670 | |||||||||

8

THE OFFERING

In making your decision on whether to invest in our securities, you should take into account the backgrounds of the members of our management team. You should also carefully consider the risks set forth under “Risk Factors” beginning on page 12 of this Prospectus.

This prospectus relates to the 50,840,000 shares of common stock of China Equity Platform Holding Group Limited.

| Common Shares outstanding prior to offering | 112,315,000 |

| Common Shares offered by Company | 0 |

| Total Common Shares offered by selling shareholders | 50,840,000 |

| Common Shares to be outstanding after the offering | 112,315,000 |

| Use of Proceeds | We will not receive any of the proceeds of sale of the shares of common stock by the selling shareholders. The offering price of the shares has been arbitrarily determined by us based on the last private placement of Common Shares to 13 individual shareholders December 2, 2009. Selling shareholders may sell Common Shares at this set price of $0.05 per share until such time as our shares are quoted on the OTC Bulletin Board, and then thereafter, at prevailing market prices or privately negotiated prices. The offering price of the shares bears no relationship to the assets, earnings or book value of us, or any other objective standard of value. We believe that no shares will be sold by any of the selling shareholders prior to our becoming a publicly traded company, at which time the selling shareholders will sell shares based on the market price of such shares. We are not selling any shares of our common stock, and are only registering the re-sale of Common Shares previously sold by us. |

See “Risk Factors” beginning on page 5 and other information included in this prospectus for a discussion of factors you should consider before deciding to invest in shares of our common stock. | |

| No Market | There has not been any market for our securities in the U.S. or any foreign markets in the past, and no market currently exists for our securities in the U.S. or in any foreign markets. No assurance is provided that a market will be created for our securities in the future, or at all. If in the future a market does exist for our securities, it is likely to be highly illiquid and sporadic. |

9

RISK FACTORS

In addition to other information in this financial statement, including many risks presented in our Management’s Discussion and Analysis of Financial Condition and Results of Operations beginning on page 16, the following risk factors should be carefully considered in evaluating our business since it operates in a highly changing and complex business environment that involves numerous risks, some of which are beyond our control. The following discussion highlights a few of these risk factors, any one of which may have a significant adverse impact on our business, operating results and financial condition. As a result of the risk factors set forth below actual results could differ materially from those projected in any forward-looking statements.

We face significant risks, and the risks described below may not be the only risks we face. Additional risks that we do not know of or that we currently consider immaterial may also impair our business operations. If any of the events or circumstances described in the following risks actually occurs, our business, financial condition or results of operations could be harmed and the trading price of our common stock could decline.

RISKS RELATED TO OUR BUSINESS

There is no assurance that we will be able to execute our future plans successfully, or that our future plans will result in commercial success.

Our success is largely dependent on our executing our future plans successfully, including without limitation: identifying and integrating our equity trading platform with the private equity exchanges throughout the PRC, negotiating and structuring transactions that are beneficial to us, closing those transactions, finding suitable partners and management to operate those businesses and collaborating and developing with these partners. Since there is no guarantee that we can successfully implement our plans, there is no guarantee that will we be successful and be profitable in the future.

We are engaged in business in a country with a planned economy that is heavily influenced by government authorities. Actions by the Chinese government in the future may have significant adverse effects on the operations of our Company.

We are engaged in business in a country with a planned economy heavily influenced by government activities and we must work cooperatively with a variety of national, federal, regional, state, provincial, and local government authorities and entities. The economy of China differs significantly from the economies of the “western” industrialized nations in such respects as structure, level of development, gross national product, growth rate, capital reinvestment, resource allocation, self-sufficiency, rate of inflation and balance of payments position, among others. Only recently has the Chinese government encouraged substantial private economic activities. The Chinese economy has experienced significant growth in the past several years, but such growth has been uneven among various sectors of th e economy and geographic regions. Actions by the Chinese government to control inflation have significantly restrained economic expansion in the recent past. Similar actions by the Chinese government in the future could have a significant adverse effect on economic conditions in China and the results of operations of the Company.

10

If we deliver products with defects, our credibility will be harmed and the sales and market acceptance of our products will decrease.

Our products and services are complex and may at times contain errors, defects and bugs, especially in our software technology. Instability in our software system may interrupt our client’s use of our system. If errors, bugs or defects occur in our software updates or new product developments, interruptions in service may occur during the time it takes us to address these issues. If we deliver products with errors, defects or bugs, our credibility and the market acceptance and sales of our products would be harmed. Further, if our products contain errors, defects or bugs, we may be required to expend significant capital and resources to alleviate such problems. We may agree to indemnify our customers in some circumstances against liability arising from defects in our products. Defects could also lead to product liability as a result of product liability lawsuits against us or against our customers. We do not carry product and information liability and errors and omissions insurance, and in the event that we are required to defend more than a few such actions, or in the event that we are found liable in connection with such an action, our business and operations may be severely and materially adversely affected. To cope with this problem, we need to constantly update our software. Secondly, the software shall be able to meet the integrity to run out smoothly without significant problems. Thirdly, we need to enhance our software’s security aspiration which shall be able to defend against bellicose hacker or contagious computer virus attacks. Lastly, we need to upgrade our hardware facilities to meet the requirements of addition functions and user consumption.

Failure to compete effectively in a competitive environment may affect our profitability.

We operate in a highly competitive industry. We face a huge number of potential competitors. In relation to our equity exchange platform services, potential competitors include other software technology providers that might in the future develop and provide an equity exchange platform similar to ours. After we became a nationwide equity exchange platform, we may also face international competitors from abroad, such as the Hong Kong GEM board, the London AIM stock exchange and the OTC Bulletin Board. In relation to our consulting services, we face high competition from numerous business consulting and advisory firms in China. Although we believe that some of our technology is unique, can be protected, and, i f adopted, will confer benefits that will be otherwise unavailable for some time, we face very large competitors with greater resources who may adopt various strategies to block or slow our market penetration, thereby straining our more limited resources. We are aware of efforts by competitors to introduce doubt about our financial stability as we compete to make sales and win customers and business. Large competitors may also seek to hinder our operations through attempts to recruit key staff with exceptionally attractive terms of employment, including signing bonuses, or by offer of highly competitive terms to potential or newly acquired customers.

If we are unable to protect our intellectual property, our competitive position would be adversely affected.

We may rely on patent protection, as well as trademark and copyright law, trade secret protection and confidentiality agreements with our employees and others to protect our intellectual property. Despite our precaution, unauthorized third parties may copy our products and services or reverse engineer or obtain and use information that we regard as proprietary. We currently have three Software Products Registration Certificates (軟件產品登記證書) from Shenzhen Technology and Telecommunication Bureau and three Computer Software Copyright Registration C ertificates (計算機軟件著作權登記證書) from the People’s Republic of China National Copyright Administrative Bureau. We intend to apply for more protection for our intellectual property. However, we do not know if future applications will be granted or whether we will be successful in prosecuting any future claims against infringers of our intellectual property rights. In addition, the laws of some foreign countries do not protect proprietary rights to the same extent, as do the laws of the PRC. Our means of protecting our proprietary rights may not be adequate and third parties may infringe or misappropriate our patents, copyrights, trademarks and similar proprietary rights. If we fail to protect our intellectual property and proprietary rights, our business, financial condition and results of operations would suffer. We believe that we do not infringe upon the proprietary rights of any third party, and no third party has asserted an infringement claim against us. It is possible, however, that such a claim might be asserted successfully against us in the future. We may be forced to suspend our operations to pay significant amounts to defend our rights, and a substantial amount of the attention of our management may be diverted from our ongoing business, all of which would materially adversely affect our business.

11

There can be no assurance that we will continue to be successful in the development and marketing of new technology.

We are presently focusing on the research and development of our proprietary technology in our software for the equity service platform. We believe that this technology is the basis for the marketability of our equity service platform. However, there can be no assurance that we will continue to successfully develop new technology and it is possible that our proprietary technology and products will have no commercial benefit or potential. In addition, from our inception to the present, we have not recognized any substantial operating revenue.

We depend on our key personnel and may have difficulty attracting and retaining the skilled staff we need to execute our growth plans.

Our success will be dependent largely upon the efforts of Mr. Xiangxiong Deng, our Chief Executive Officer, and Ms. Jieyun Yu, our Chief Financial Officer . The loss of Mr. Xiangxiong Deng or Ms. Jieyun Yu could have a material adverse effect on our business and prospects. To execute our plans, we will have to retain current employees. Competition for highly skilled employees with technical, management, marketing, sales, product development and other specialized training is intense. We may not be successful in retaining such qualified personnel. Specifically, we may experience increased costs in order to retain skilled employees. If we are unable to retain experienced employees as needed, we would be unable to execute our business plan.

Our future success will depend upon our ability to continue to enhance our existing products and to develop, manufacture and market new products and services.

The market for our products and services may be characterized by rapidly changing technology, extensive research and the introduction of new products and services. We believe that our future success will depend in part upon our ability to continue to enhance our existing products and to develop, manufacture and market new products and services. As a result, we expect to continue to make a significant investment in computer network, software technology, research and development. There can be no assurance that we will be able to develop and introduce new products and services or enhance our initial products in a timely manner to satisfy customer needs, achieve market acceptance or address technological changes in our target markets. Failure to develop products and services and introduce them successfully and in a timely manner c ould adversely affect our competitive position, financial condition and results of operations.

There can be no assurance that we will be able to effectively achieve or manage any future growth, and our failure to do so could have a material adverse effect on our financial condition and results of operations.

We may experience substantial growth in the size of our staff and the scope of our operations, resulting in increased responsibilities for management. To manage this possible growth effectively, we will need to continue to improve our operational, financial and management information systems, will possibly need to create entire departments that do not now exist, and hire, train, motivate and manage a growing number of staff. Due to a competitive employment environment for qualified technical, marketing and sales personnel, we expect to experience difficulty in filling our needs for qualified personnel. There can be no assurance that we will be able to effectively achieve or manage any future growth, and our failure to do so could delay product development cycles and market penetration or otherwise have a material adverse effect on our financial condition and results of operations.

12

We could face information and product liability risks and may not have adequate insurance.

Our products, in particular our equity exchange platform, software and network technology may be used in connection with critical business applications. We may become the subject of litigation alleging that one or more of our products are ineffective or disruptive in our treatment of data, or with regard to critical business information. Thus, we may become the target of lawsuits from injured or disgruntled businesses or other users. In the event that we are required to defend more than a few such actions, or in the event that it is found liable in connection with such an action, our business and operations may be severely and materially adversely affected.

There is no assurance that we will be able to execute our future plans successfully, or that our future plans will result in commercial success.

We intend to expand our operations and production capacity in the PRC by investing in becoming a strategic partner of key equity exchanges. Our expansion plans involve a number of risks, including the costs of investment in fixed assets, costs of working capital, as well as other working capital requirements. Our expansion will also depend on our ability to secure new customers. Failure to secure new customers would materially and adversely affect our business and financial performance.

There is no assurance that our future plans will result in commercial success. If we are unable to execute our expansion plans successfully, our business and financial performance would be materially and adversely affected.

Changes to financial accounting standards may affect our results of operations and cause us to change business practices.

We prepare financial statements in conformity with U.S. generally accepted accounting principles. These accounting principles are subject to interpretation by the American Institute of Certified Public Accountants, the Public Company Accounting Oversight Board, the SEC and various other bodies formed to interpret and create appropriate accounting principles. A change in those principles can have a significant effect on our reported results and may affect our reporting of transactions completed before a change is announced. Changes to those rules or the questioning of current practices may adversely affect our reported financial results or the way we conducts business. For example, accounting principles affecting many aspects of our business, including rules relating to equity-related compensati on, have recently been revised. The Financial Accounting Standards Board and other agencies finalized changes to U.S. generally accepted accounting principles that required us, starting January 1, 2006, to record a charge to earnings for employee stock option grants and other equity incentives. We will have significant ongoing accounting charges resulting from option grant and other equity incentive expensing that could reduce net income or increase losses. In addition, since we intend to use equity-related compensation as a component of our total employee compensation program, the accounting change could make the use of equity-related compensation less attractive and therefore make it more difficult to attract and retain employees.

We currently lack an independent board of directors, which may result in the approval of transactions and policies without independent review.

We currently do not have any independent directors on our board. However, we intend to appoint at least two after the completion of this offering.

In the absence of a majority of independent directors, our executive officers could establish policies and enter into transactions without independent review and approval thereof, subject to certain restrictions under our Memorandum & Articles of Association. In addition, although we intend to establish audit and compensation committees which will consist entirely of outside directors, until those committees are established, transactions and compensation policies could be approved without independent review. These and other transactions could present the potential for a conflict of interest between our Company and its stockholders generally and the controlling officers, stockholders or directors.

13

Future profitability is not guaranteed.

We have not recognized any substantial operating revenue to date. Even if we were able to successfully attract sufficient financing, and revenues increased, there would be no assurance that our plans would be realized or we would achieve break-even status or profitability in the future. We also experienced negative cash flow from operations. We will need to raise additional capital to fund our operations, and will continue to attempt to raise capital resources until such time as we are able to generate revenues sufficient to maintain ourselves as a viable entity. There is no guarantee that we can continue as a going concern. There is no assurance that we will be able to raise additional capital or achieve profitability.

We have a limited operating history, as well as a history of operating losses

We have a limited operating history. We cannot assure you that we can achieve revenue or sustain revenue growth. We have a history of operating losses. We had a net loss of $74,245, $1,200,318, and $436,174 for the years ended March 31, 2008, 2009 and 2010, respectively. Our accumulated operating loss as of March 31, 2010 were $1,710,710. We will require approximately $700,000 over the next 12 months for our operations and further development. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all.

Our independent auditors have expressed doubt about our ability to continue as a going concern.

In their report dated June 27, 2010, our independent auditors stated that our consolidated financial statements for the two years ended March 31, 2010 and 2009 were prepared assuming that we would continue as a going concern, and that they have doubt about our ability to continue as a going concern. Our auditors’ doubts are based on our accumulated losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including by the sale of our securities, or obtaining loans from financial institutions, where possible. Our continued net operating losses and our auditors’ doubts increase the difficulty of our meeting such goals and our efforts to continue as a going concern may not prove successful.

We may need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all.

We have limited funds. We may not be able to execute our current business plan and fund business operations long enough to achieve profitability. Our ultimate success may depend upon our ability to raise additional capital. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us.

We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. Future financings through equity investments are likely to be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other derivative securities, and the issuances of incentive awards under equity employee incentive plans, which may have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations.

Our ability to obtain needed financing may be impaired by such factors as the condition of the economy and capital markets, both generally and specifically in our industry, the fact that we are not profitable, and the going concern opinion issued by our auditors, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

There is currently no market for our common stock. Any failure to develop or maintain a trading market could negatively affect the value of our shares and make it difficult or impossible for you to sell your shares.

Prior to this offering, there has been no public market for our common stock and a public market for our common stock may not develop upon completion of this offering. While we will attempt to have our common stock quoted on the OTC Bulletin Board, since the OTC Bulletin Board is a dealer system we will have to seek market-makers to provide quotations for the common stock and it is possible that no market-maker will want to provide such quotations. Failure to develop or maintain an active trading market could negatively affect the value of our shares and make it difficult for you to sell your shares or recover any part of your investment in us. Even if a market for our common stock does develop, the market price of our common stock may be highly volatile. In addition to the unce rtainties relating to our future operating performance and the profitability of our operations, factors such as variations in our interim financial results, or various, as yet unpredictable factors, many of which are beyond our control, may have a negative effect on the market price of our common stock.

Even if our common stock is quoted on the OTC Bulletin Board, the OTC Bulletin Board provides a limited trading market. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock, or the prices at which holders may be able to sell our common stock.

Our common stock may be deemed a “penny stock,” which would make it more difficult for our investors to sell their shares.

Our common stock may be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or another national securities exchange and trades at less than $4.00 per share, other than companies that have had average revenues of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in these securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

We have not paid dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

14

RISKS RELATED TO DOING BUSINESS IN CHINA

Our operations in the PRC are subject to the laws and regulations of the PRC.

As our business is carried out in the PRC, we are subject to and have to operate within the framework of the PRC legal system. Any changes in the laws or policies of the PRC or the implementation thereof, for example, in areas such as foreign exchange controls, tariffs, trade barriers, taxes, export license requirements and environmental protection, may have a material impact on our operations and financial performance.

The corporate affairs of our companies in the PRC are governed by their articles of association and the corporate and foreign investment laws and regulations of the PRC. The principles of the PRC laws relating to matters such as the fiduciary duties of directors and other corporate governance matters and foreign investment laws in the PRC are relatively new. Hence, the enforcement of investors or shareholders' rights under the articles of association of a PRC company and the interpretation of the relevant laws relating to corporate governance matters remain largely untested in the PRC.

Introduction of new laws or changes to existing laws by the PRC government may adversely affect our business.

The laws of the PRC govern our businesses and operations that are located in the PRC. The PRC legal system is a codified system of written laws, regulations, circulars, administrative directives and internal guidelines. The PRC government is still in the process of developing its legal system to encourage foreign investment and to align itself with global practices and standards. As the PRC economy is undergoing development at a faster rate than the changes to its legal system, some degree of uncertainty exists in connection with whether and how existing laws and regulations apply to certain events and circumstances. Some of the laws and regulations and the interpretation, implementation and enforcement of such laws and regulations are also at an experimental stage and are subject to policy changes. Hence, precedents on the interpretatio n, implementation and enforcement of certain PRC laws are limited and court decisions in the PRC do not have a binding effect on lower courts. Accordingly, the outcome of dispute resolutions and litigation may not be as consistent or predictable as in other more developed jurisdictions and it may be difficult to obtain swift and equitable enforcement of the laws in the PRC, or to obtain enforcement of a judgment by a court or another jurisdiction.

15

In particular, on 8 August 2006, six PRC regulatory bodies (including MOFCOM and the China Security and Regulatory Commission (“CSRC”)) jointly promulgated the new “Regulations on Foreign Investors Merging with or Acquiring Domestic Enterprises”, which took effect on September 8, 2006 (“2006 M&A Rules”). The 2006 M&A Rules regulate, inter alia, the acquisition of PRC domestic companies by foreign investors.

On 21 September 2006, the CSRC promulgated the “Guidelines on Domestic Enterprises Indirectly Issuing or Listing and Trading their Stocks on Overseas Stock Exchanges” (the “CSRC Guidelines”).

Under the 2006 M&A Rules and the CSRC Guidelines, the listing of overseas special purpose vehicles (“SPV”) which are controlled by PRC entities or individuals are subject to the prior approval of the CSRC.

The 2006 M&A Rules and the CSRC Guidelines do not provide any express requirement for an SPV to retroactively obtain CSRC approval where the restructuring steps had been completed prior to September 8, 2006.

Deheng Law Firm, the legal adviser to our Company on PRC Law, is of the opinion that our group has obtained all the necessary governmental approvals from PRC authorities and the requirement to obtain CSRC approval is not applicable to us and it is not necessary for us to comply retroactively with the requirement of obtaining the prior approval of the CSRC for a listing on the Over-the Counter Bulletin Board or any national exchange in the United States.

There is no assurance that these PRC authorities will not issue further directives, regulations, clarifications or implementation rules requiring us to obtain further approvals in relation to our proposed listing on Over-the Counter Bulletin Board or any national exchange in the United States.

Because our officers and directors reside outside of the United States, it may be difficult for you to enforce your rights against them or enforce United States court judgments against them in the PRC.

Our directors and our executive officers reside in the PRC and all of our assets are located in the PRC. It may therefore be difficult for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under federal securities laws. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement of criminal penalties of the federal securities laws.

We may have limited legal recourse under PRC law if disputes arise under contracts with third parties.

All of our agreements, which are made by our PRC subsidiaries, are governed by the laws of the PRC. The PRC legal system is a civil law system based on written statutes. Accordingly decided legal cases have little precedential value. The government of the PRC has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, these laws are relatively new and their experience in implementing, interpreting and enforcing these laws and regulations is limited. Therefore, our ability to enforce commercial claims or to resolve commercial disputes may be uncertain. The resolution of these matters may be subject to the exercise of considerable discretion by the parties charged with enforcement of the applicable laws. Any rights we may have to speci fic performance or to seek an injunction under PRC law may be limited, and without a means of recourse, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

| · | Level of government involvement in the economy; |

| · | Control of foreign exchange; |

| · | Methods of allocating resources; |

| · | Balance of payments position; |

| · | International trade restrictions; and |

| · | International conflict. |

16

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Our business is largely subject to the uncertain legal environment in the PRC and your legal protection could be limited.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 30 years has been to enhance the protections afforded to foreign invested enterprises in the PRC. However, these laws, regulations and legal requirements are relatively recent and are evolving rapidly, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold licenses and permits such as requisite business licenses. In addition, all our executive officers and our directors are residents of China an d not of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against our Chinese operations and subsidiaries.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in the PRC may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in the PRC are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in the PRC may inhibit our ability to conduct business in the PRC.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in the PRC has been as high as 20.7% and as low as -2.2%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in the PRC, and thereby harm the market for our products.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The majority of our revenues will be settled in Renminbi and U.S. dollars, and any future restrictions on currency exchanged may limit our ability to use revenue generated in Renminbi to fund any future business activities outside the PRC or to make dividend or other payments in the U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the Renminbi for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in the PRC authorized to conduct foreign exchange business. In addition, conversion of Renminbi for capital account items, including direct investment and loans, is subject to governmental ap proval in the PRC, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the Renminbi.

17

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and Renminbi.

The value of our common stock will be effected by the foreign exchange rate between U.S. dollars and Renminbi, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operational needs and should the Renminbi appreciate against the U.S. dollar at that time, our financial position, the business of the company, and the price of our common stock may be harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of our earnings from our subsidiaries in the PRC would be reduced.

PRC tax treatments may adversely affect our operations or financial condition |

Certain of our PRC companies enjoy preferential tax treatments, in the form of reduced tax rates or tax holidays, provided by the PRC government or its local agencies or bureaus. On March 16, 2007, the National People’s Congress of the PRC, or NPC, passed the new PRC Enterprise Income Tax Law (the “New EIT Law”). Under the New EIT Law, effective January 1, 2008, China adopted a uniform tax rate of 25% for all enterprises (including foreign-invested enterprises) and revoked the then current tax exemption, reduction and preferential treatments applicable to foreign-invested enterprises. However, there is a transition period for enterprises, whether foreign-invested or domestic, that were receiving preferential tax treatments granted by relevant tax authorities at the time the New EIT Law became effective. Enterp rises that are subject to an enterprise income tax, or EIT, rate lower than 25% may continue to enjoy the lower rate and gradually transition to the new tax rate within five years after the effective date of the New EIT Law. Enterprises that are currently entitled to exemptions or reductions from the standard income tax rate for a fixed term may continue to enjoy such treatment until the fixed term expires. Preferential tax treatments will continue to be granted to industries and projects that are strongly supported and encouraged by the state, and enterprises otherwise classified as such “encouraged” high-tech enterprises will be entitled to a 15% EIT rate. On April 14, 2008, the Measures for the Recognition and Administration of New and High-tech Enterprises (the “Measures”), were promulgated jointly by the Ministry of Science and Technology of the PRC, the Ministry of Finance of the PRC and the State Administration of Taxation of the PRC and became retroactively effective from January 1, 2008. Under the Measures, the term “high-tech enterprise” is defined as a resident enterprise that has been registered in the PRC (excluding Hong Kong, Macao or Taiwan) for more than one year, conducts business in the new and high-tech fields encouraged by government as listed in an appendix to the Measures, continuously undertakes research and development and technology conversion, and relies on self-owned intellectual property rights as the basis of its business operation. Such new and high-tech enterprises may apply for tax incentives. None of our subsidiaries currently qualifies for the tax incentives.

The New EIT Law and any other changes to our effective tax rate could have a material and adverse effect on our business, financial condition and results of operations. We cannot assure you that we will continue to enjoy these preferential tax treatments in the future. The discontinuation or reduction of these preferential tax treatments or government financial incentives could materially and adversely affect our business, financial condition and results of operations.

New labor law legislation in the PRC may adversely affect our operations or financial condition

In June 2007, the National People’s Congress of the PRC enacted new labor law legislation called the Labor Contract Law, which became effective on January 1, 2008. It formalizes workers’ rights concerning overtime hours, pensions, layoffs, employment contracts and the role of trade unions. Considered one of the strictest labor laws in the world, among other things, this new law requires an employer to conclude an “open-ended employment contract” with any employee who either has worked for the employer for ten years or more or has had two consecutive fixed-term contracts. An “open-ended employment contract” is in effect a lifetime, permanent contract, which is terminable only in specified circumstances, such as a material breach of the employer’s rules and regulations, or for a serious dereliction of duty. Such employment contracts with qualifying workers would not be terminable if, for example, the Company determined to downsize its workforce in the event of an economic downturn. Under the new law, downsizing by 20% or more may occur only under specified circumstances, such as a restructuring undertaken pursuant China’s Enterprise Bankruptcy Law, or where a company suffers serious difficulties in production and/or business operations. Any of the Company’s staff employed to work exclusively within the PRC are covered by the new law and thus, the Company’s ability to adjust the size of its operations when necessary in periods of recession or less severe economic downturns has been curtailed. Accordingly, if the Company faces future periods of decline in business activity generally or adverse economic periods specific to the Company’s business, this new law can be expected to exacerbate the adver se effect of the economic environment on the Company’s results of operations and financial condition.

18

RISKS RELATED TO THE MARKET FOR OUR STOCK

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our stock price.

Section 404 of the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC require annual management assessments of the effectiveness of our internal control over financial reporting and a report by our independent registered public accounting firm attesting to and reporting on these assessments. If we fail to adequately maintain compliance with, or maintain the adequacy of, our internal control over financial reporting, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC. If we cannot favorably assess, or our independe nt registered public accounting firm is unable to provide an unqualified attestation report on our assessment of the effectiveness of our internal control over financial reporting, investor confidence in the reliability of our financial reports may be adversely affected, which could have a material adverse effect on our stock price.

We are a “foreign private issuer,” and have disclosure obligations that are different than those of other U.S. domestic reporting companies so you should not expect to receive the same information about us at the same time as a U.S. domestic reporting company may provide.

We are a foreign private issuer and, as a result, we are not subject to certain of the requirements imposed upon U.S. domestic issuers by the SEC. For example, we are not required to issue quarterly reports or proxy statements. Through the fiscal year ending March 31, 2010, we are allowed six months to file our annual report with the SEC and thereafter must file our annual report within four months of our fiscal year end. We are not required to disclose certain detailed information regarding executive compensation that is required from U.S. domestic issuers. Further, our directors and executive officers are not required to report equity holdings under Section 16 of the Securities Act. As a foreign private issuer, we are also exempt from the requirements of Regulation FD (Fair Disclosure) which, gener ally, are meant to ensure that select groups of investors are not privy to specific information about an issuer before other investors. We are, however, still subject to the anti-fraud and anti-manipulation rules of the SEC, such as Rule 10b-5. Since many of the disclosure obligations required of us as a foreign private issuer are different than those required by other U.S. domestic reporting companies, our shareholders should not expect to receive information about us in the same amount and at the same time as information is received from, or provided by, other U.S. domestic reporting companies. We are liable for violations of the rules and regulations of the SEC which do apply to us as a foreign private issuer. Violations of these rules could affect our business, results of operations and financial condition.

You may have difficulty enforcing judgments obtained against us.

We are a BVI company and substantially all of our assets are located outside of the United States. Virtually all of our assets and a substantial portion of our current business operations are conducted in the PRC. In addition, almost all of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments obtained in U.S. courts including judgments based on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, many of whom are not r esidents in the United States and whose assets are located in significant part outside of the United States. The courts of the BVI would recognize as a valid judgment, a final and conclusive judgment in personam obtained in the federal or state courts in the United States against the Company under which a sum of money is payable (other than a sum of money payable in respect of multiple damages, taxes or other charges of a like nature or in respect of a fine or other penalty) and would give a judgment based thereon provided that (a) such courts had proper jurisdiction over the parties subject to such judgment, (b) such courts did not contravene the rules of natural justice of the BVI, (c) such judgment was not obtained by fraud, (d) the enforcement of the judgment would not be contrary to the public policy of the BVI, (e) no new admissible evidence relevant to the action is submitted prior to the rendering of the judgment by the courts of the BVI and (f) there is due compliance with the correct procedur es under the laws of the BVI. In addition, there is uncertainty as to whether the courts of the BVI or the PRC, respectively, would recognize or enforce judgments of U.S. courts against us or such persons predicated upon the civil liability provisions of the securities laws of the United States or any state. In addition, it is uncertain whether such BVI or PRC courts would entertain original actions brought in the courts of the BVI or the PRC, against us or such persons predicated upon the securities laws of the United States or any state.

Because we are incorporated under the laws of the BVI, it may be more difficult for our shareholders to protect their rights than it would be for a shareholder of a corporation incorporated in another jurisdiction.

Our corporate affairs are governed by our Memorandum and Articles of Association, by the BVI Business Companies Act, 2004, and by the common law of the BVI. Principles of law relating to such matters as the validity of corporate procedures, the fiduciary duties of management and the rights of our shareholders differ from those that would apply if we were incorporated in the United States or another jurisdiction. The rights of shareholders under BVI law may not be as clearly established as are the rights of shareholders in the United States or other jurisdictions. Under the laws of most jurisdictions in the United States, majority and controlling shareholders generally have certain fiduciary responsibilities to the minority shareholders. Shareholder action must be taken in good faith, and actions by controlling shareholders which are obviously unreasonable may be declared null and void. BVI law protecting the interests of minority shareholders may not be as protective in all circumstances as the law protecting minority shareholders in US jurisdictions. In addition, the circumstances in which a shareholder of a BVI company may sue the company derivatively, and the procedures and defenses that may be available to the company, may result in the rights of shareholders of a BVI company being more limited than those of shareholders of a company organized in the US. Furthermore, our directors have the power to take certain actions without shareholder approval which would require shareholder approval under the laws of most US jurisdictions. The directors of a BVI corporation, subject in certain cases to court approval but without shareholder approval, may implement a reorganization, merger or consolidation, the sale of any assets, property, part of the business, or securities of the corporation, subject to a limit of up to 50% of such assets. The ability of our board of directors to create new classes or series of shares and the rights attached by amending our Memorandum of Association and Articles of Association without shareholder approval could have the effect of delaying, deterring or preventing a change in our control without any further action by the shareholders, including a tender offer to purchase our ordinary shares at a premium over then current market prices. Thus, our shareholders may have more difficulty protecting their interests in the face of actions by our board of directors or our controlling shareholders than they would have as shareholders of a corporation incorporated in another jurisdiction.

We may be classified as a passive foreign investment company, which could result in adverse United States federal income tax consequences to U.S. shareholders.

We do not currently expect to be classified as a “passive foreign investment company,” or PFIC, for United States federal income tax purposes for our tax year ending March 31, 2010. However, the PFIC test is an annual test that, as discussed below, depends upon the composition of our gross income for the year and the percentage, based on a quarterly average for the year, of our gross assets that constitutes “passive” assets. Accordingly, it is not possible to determine whether we will not be classified as a PFIC for our tax year ending March 31, 2010 until after the year has ended. In addition, even if we are not classified as a PFIC for our taxable year ending Marc h 31, 2010, because the PFIC test is annual, we cannot assure you that we will not be a PFIC for any following tax ye ar. A non-U.S. corporation will be classified as a PFIC for the taxable year if (i) at least 75% of its gross income is passive income for such year or (ii) at least 50% of the fair market value of its assets (based on an average of the quarterly values of the assets during such year) is attributable to assets that produce or are held for the production of passive income. The fair market value of our assets may be determined to a large extent by the market price of our ordinary shares, which may fluctuate after this offering. Furthermore, how we spend as well as how quickly we spend the proceeds from this offering will affect the composition of our income and assets. If we are treated as a PFIC for any tax year during which U.S. shareholders hold ordinary shares, certain adverse United States federal income tax consequences could apply to such U.S. shareholders. See “Taxation—U.S. Federal Incom e Taxation—Passive Foreign Investment Company Rules.”

19

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus that are not purely historical are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this prospectus. You should read this prospectus and the documents that we reference in this prospectus, or that we filed as exhibits to the registration statement of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect.