125. In early January 2023, Anson and Murchinson continued to make coordinated purchases of Nano ADSs:

a. On January 9, 2023, Anson purchased 600,000 shares on the same day that Murchinson purchased 100,000 shares.

b. On January 10, 2023, Anson purchased 500,000 shares on the same day that Murchinson purchased 250,000 shares.

c. On January 11, 2023, Anson purchased 500,000 shares on the same day that Murchinson purchased 391,640 share.

d. On January 12, 2023, Murchinson purchased a total of 1,314,035 shares.

126. In short, between January 1, 2023 and January 21, 2023, Defendants purchased an additional 5,719,323 Nano ADS, bringing their holdings from at least 18,393,975 (7.12%) at 2022 year-end to at least 24,113,298 (9.34%) by January 21, 2023.

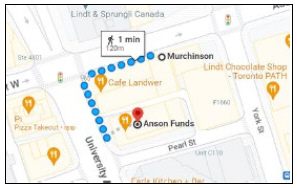

127. These purchases are just a few examples of Defendants’ coordinated activity. All told, between January 1 and February 15, 2023, Murchinson purchased at least 3,196,660 shares, bringing its admitted beneficial ownership of Nano above 5%—although in reality Murchinson had crossed this threshold months earlier by virtue of its coordination with Anson and Boothbay. These purchases are set forth in Murchinson’s Schedule 13Ds, which are attached as Exhibit 1.

128. Meanwhile, between January 1 and March 9, 2023, Anson purchased at least 6,317,757 ADSs, bringing its admitted beneficial ownership above 5% (although, like Murchinson, Anson had passed this threshold months earlier). These purchases are set forth in Anson’s Schedule 13Ds, which are attached as Exhibit 2.

129. On January 22, 2023, Murchinson purported to demand a special meeting of Nano’s shareholders, seeking to amend Nano’s articles of association and oust four of its board members.

28