UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14C INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

| [X] | Preliminary Information Statement |

| [ ] | Definitive Information Statement |

| [ ] | Confidential, of the Use of the Commission Only (as permitted by Rule 14c-5(d) (2)) |

World Moto, Inc.

(Name of Registrant as Specified In Its Charter)

______________________________________________________

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

WORLD MOTO, INC.

| NOTICE OF ACTION TAKEN BY WRITTEN CONSENT OF STOCKHOLDERS October 14, 2015 |

October _, 2015

Dear World Moto, Inc. Stockholders:

This Information Statement is furnished by the Board of Directors (the “Board”) of World Moto, Inc., a Nevada corporation (the “Company”), to holders of record as of the close of business on October 14, 2015 (the “Stockholders”) of the Company’s common stock, $0.0001 par value per share (the “Common Stock), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of this Information Statement is to inform our Stockholders that, on October 14, 2015, holders of a majority of the voting power of the outstanding capital stock of the Company, acted by written consent in lieu of a special meeting of stockholders in accordance with Section 78.320 of the Nevada Revised Statutes (“NRS”) to authorize and approve an amendment to the Articles of Incorporation (the “Amendment”) of the Company increasing the amount of authorized shares of Common Stock to 4,000,000,000 shares. A copy of the Amendment is attached asAnnex A to this Information Statement.

The approval of the Amendment will not become effective until at least 20 calendar days after the initial mailing of this Information Statement (the “Effective Date”).

No action is required by you. The accompanying Information Statement is furnished to inform our Stockholders of the action described above before it takes effect in accordance with Rule 14c-2 promulgated under the Exchange Act. This Information Statement is being first mailed to you on or about October _, 2015.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE AMENDMENT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR THIS MATTER UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER, SO NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE ACTIONS.

By Order of the Board of Directors

_/s/ Paul Giles

Paul Giles

Chief Executive Officer

Pathumthani, Thailand

October _, 2015

TABLE OF CONTENTS

ANNEX A: AMENDMENT TO ARTICLES OF INCORPORATION

WORLD MOTO, INC.

131 Thailand Science Park INC-1 #214

Phahonyothin Road

Klong1, Klong Luang

Pathumthani 12120

Thailand

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C PROMULGATED THEREUNDER |

INTRODUCTORY STATEMENT

World Moto, Inc. (the “Company”) is a Nevada corporation with principal executive offices located at 131 Thailand Science Park, INC-1 #214, Phahonyothin Road, Klong1, Klong Luang, Pathumthani 12120, Thailand. Our telephone number is (646) 840-8781. On October 13, 2015, the Company’s Board of Directors (the “Board”), after careful consideration, unanimously deemed advisable and approved and adopted an amendment to our articles of incorporation (the “Amendment”) increasing the number of authorized shares of Common Stock to 4,000,000,000 shares. This Information Statement is being sent to holders of record (the “Stockholders”) of the Company’s Common Stock as of October 14, 2015 (the “Record Date”), by the Board to notify them about actions that the holders of a majority of the voting power of the outstanding capital stock of the Company (the “Consenting Stockholders”) entitled to vote on the Amendment (the “Required Vote”), have taken by written consent, in lieu of a special meeting of the Stockholders. The Required Vote was obtained on October 14, 2015 in accordance with the relevant sections of the Nevada Revised Statutes (“NRS”) and our Articles of Incorporation and our By-laws.

Accordingly, all necessary corporate approvals in connection with the Amendment have been obtained. This Information Statement is furnished solely for the purpose of informing the Stockholders, in the manner required under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) of the Amendment. Pursuant to Rule 14c-2 under the Exchange Act, the Amendment will not be effective, until at least twenty (20) days after the initial mailing of this Information Statement to the Stockholders. Therefore, this Information Statement is being sent to you for informational purposes only.

We are not asking you for a proxy and you are requested not to send us a proxy.

Copies of this Information Statement are expected to be mailed on or about October _, 2015, to the holders of record on the Record Date of our outstanding shares. The matters that are subject to approval of the Stockholders will not be completed until at least 20 calendar days after the initial mailing of this Information Statement. This Information Statement is being delivered only to inform you of the corporate actions described herein before they take effect in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We have asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of our capital stock held of record and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenting Stockholders

Under Nevada Law, our dissenting stockholders are not entitled to appraisal rights with respect to the approval of the Amendment, and we will not independently provide our stockholders with any such right.

Information Statement Costs

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE AMENDMENT. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH MATTER UNDERAPPLICABLE LAW AND THE COMPANY’S CHARTER, SO NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THIS ACTION.

FORWARD-LOOKING STATEMENTS

Certain statements included in this Information Statement regarding the Company are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Information Statement will in fact occur. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

VOTE REQUIRED TO APPROVE THE PROPOSAL

As of the Record Date, there were 5,000,000 shares of Series A Convertible Preferred Stock issued and outstanding. The holders of the Series A Preferred Stock are entitled to 51% voting power on all matters requiring the vote of stockholders of the Company.

CONSENTING STOCKHOLDERS

On the Record Date, 2 stockholders holding an aggregate of 5,000,000 shares of the Company’s issued and outstanding Series A Convertible Preferred Stock (51% of the voting power of the outstanding capital stock and 100% of the outstanding preferred stock), consented in writing to the approval of the Amendment.

Under Section 14(c) of the Exchange Act, the transactions cannot become effective until the expiration of the 20-day Period.

APPROVAL OF THE AMENDMENT TO

THE COMPANY’S ARTICLES OF INCORPORATION

General Information

As of the date hereof, pursuant to our Articles of Incorporation, as amended, we are authorized to issue up to Two Billion (2,000,000,000) shares of Common Stock. We propose to increase our authorized shares of Common Stock from Two Billion (2,000,000,000) to Four Billion (4,000,000,000) shares of Common Stock.

The Consenting Stockholders representing a majority of the Company’s outstanding voting stock and all of the outstanding preferred stock have given their written consent to increase the authorized number of shares of Common Stock. Under the NRS, the consent of the holders of a majority of the voting power is effective as stockholders’ approval. We have filed the Amendment with the Nevada Secretary of State in order to increase the number of authorized shares of Common Stock to Four Billion (4,000,000,000) shares of Common Stock, and such Amendment shall not be effective earlier than (20) calendar days from the date of the initial mailing of this Information Statement. A copy of the form of Amendment is attached hereto asAnnex A.

The Amendment will not result in any changes to the issued and outstanding shares of Common Stock of the Company and will only affect the number of shares that may be issued by the Company in the future.

Reasons for the Amendment

The primary purpose of this amendment to increase the number of authorized shares of Common Stock is to make available for future issuance by us additional shares of Common Stock and to have a sufficient number of authorized and unissued shares of Common Stock to maintain flexibility in our corporate strategy and planning. We believe that it is in the best interests of our Company and its stockholders to have additional authorized but unissued shares available for issuance to meet business needs as they arise. The Board of Directors believes that the availability of additional shares will provide our Company with the flexibility to issue Common Stock for possible future financings, stock dividends or distributions, acquisitions, stock option plans, and other proper corporate purposes that may be identified in the future by the Board of Directors, without the possible expense and delay of a special stockholders’ meeting. The issuance of additional shares of Common Stock may have a dilutive effect on earnings per share and, for stockholders who do not purchase additional shares to maintain their pro rata interest in our Company, on such stockholders’ percentage voting power.

The authorized shares of Common Stock in excess of those issued will be available for issuance at such times and for such corporate purposes as the Board of Directors may deem advisable, without further action by our stockholders, except as may be required by applicable law or by the rules of any stock exchange or national securities association trading system on which the securities may be listed or traded. Upon issuance, such shares will have the same rights as the outstanding shares of Common Stock. Holders of Common Stock have no preemptive rights. The availability of additional shares of Common Stock is particularly important in the event that the Board of Directors determines to undertake any actions on an expedited basis and thus to avoid the time, expense and delay of seeking stockholder approval in connection with any potential issuance of Common Stock of which we have none contemplated at this time other than as discussed herein.

The following table sets forth certain information regarding the Common Stock as of October 1, 2015 and subsequent to the increase in authorized shares of Common Stock:

| Number of Shares of Common Stock as | Number of Shares of Common Stock | |

| of October 1, 2015 | Subsequent to Increase in Authorized | |

| Shares | ||

| Authorized | 2,000,000,000 | 4,000,000,000 |

| Issued and Outstanding | 712,157,315 | 712,157,315 |

| Reserved for Issuance(1) | 1,482,749,118 | 1,482,749,118 |

| Authorized but Unissued/Not Reserved | 0 | 1,805,093,567 |

| (1) | These amounts reflect the number of shares of Common Stock required to be reserved for issuance pursuant to outstanding convertible securities of the Company. |

Other than as described above, we have no arrangements, agreements, understandings, or plans at the current time for the issuance or use of the additional shares of Common Stock proposed to be authorized. The Board of Directors does not intend to issue any Common Stock except on terms which the Board of Directors deems to be in the best interests of our Company and its then existing stockholders.

Principal Effects on Outstanding Common Stock

The proposal to increase the authorized Common Stock will affect the rights of existing holders of Common Stock to the extent that future issuances of Common Stock will reduce each existing stockholder’s proportionate ownership and may dilute earnings per share of the shares outstanding at the time of any such issuance.

For instance, if the debenture (the “Debenture”) issued to an accredited investor (the “Investor”) on March 5, 2015 is converted into shares of Common Stock, the Investor will receive a greater percentage of the outstanding Common Stock and the existing stockholders will hold a smaller percentage of the outstanding Common Stock. Depending on market liquidity at the time, the issuance of a substantial number of shares of our Common Stock to the Investor, and the resale of such shares by the Investor into the public market, or the perception that such sales may occur, could cause the trading price of our Common Stock to decline, result in substantial dilution to existing stockholders and make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

The following table sets forth the total number of shares of Common Stock issuable to the Investor upon conversion of the Debenture at various conversion prices, without taking into account the percentage ownership restrictions included in the Debentures.

| Assumed | Total Number of | Percentage of | ||||||

| Conversion | Shares of Common Stock to be | Outstanding | ||||||

| Price | Issued | Shares of Common Stock(1) | ||||||

| $ | 0.01 | 23,000,000 | 3.23% | |||||

| $ | 0.02 | 11,500,000 | 1.61% | |||||

| $ | 0.03 | 7,666,667 | 1.08% |

| (1) | The denominator is based on 712,157,315 of Common Stock outstanding as of October 1, 2015. The numerator is based on the number of shares of Common Stock issuable to the Investor under the Debenture at the corresponding assumed conversion price set forth in the adjacent column. |

Other than the potential reduction in proportionate ownership, the dilutive effect on earnings per share, and other effects mentioned above, the proposed issuances, if completed, will not have any other material effects on the Company’s existing stockholders.

The Amendment will be effective upon expiration of the 20 calendar day waiting period after the mailing of this Information Statement.

Potential Anti-Takeover Aspects and Possible Disadvantages of Stockholder Approval of the Increase

The increase in the authorized number of shares of Common Stock could have possible anti-takeover effects. These authorized but unissued shares could (within the limits imposed by applicable law) be issued in one or more transactions that could make a change of control of the Company more difficult, and therefore more unlikely. The additional authorized shares could be used to discourage persons from attempting to gain control of the Company by diluting the voting power of shares then outstanding or increasing the voting power of persons that would support the Board of Directors in a potential takeover situation, including by preventing or delaying a proposed business combination that is opposed by the Board of Directors although perceived to be desirable by some stockholders. The Board of Directors does not have any current knowledge of any effort by any third party to accumulate our securities or obtain control of the Company by means of a merger, tender offer, solicitation in opposition to management or otherwise.

While the Amendment may have anti-takeover ramifications, our Board of Directors believes that the financial flexibility offered by the Amendment outweighs any disadvantages. To the extent that the Amendment may have anti-takeover effects, the Amendment may encourage persons seeking to acquire our Company to negotiate directly with the Board of Directors enabling the Board of Directors to consider the proposed transaction in a manner that best serves the stockholders’ interests.

Other than as described above, there are currently no plans, arrangements, commitments or understandings for the issuance of additional shares of Common Stock.

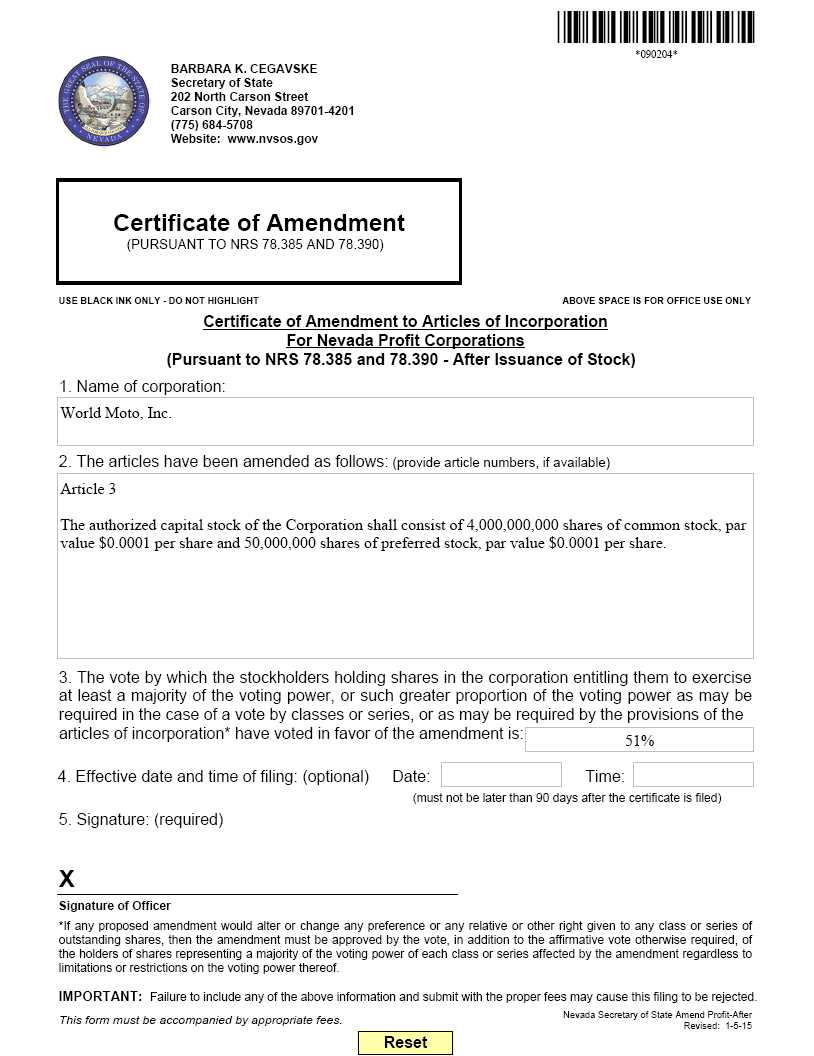

Amendment

The Third Article of the Company’s Articles of Incorporation will be amended to read as follows:

“The authorized capital stock of the Corporation shall consist of Four Billion (4,000,000,000) shares of common stock, par value $0.0001. ”

A copy of the Amendment to the Articles of Incorporation is attached asAnnex A.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS, DIRECTORS, AND OFFICERS

The following table sets forth certain information as of October 1, 2015, with respect to the beneficial ownership of our common stock and preferred stock for (i) each director and officer, (ii) all of our directors and officers as a group, and (iii) each person known to us to own beneficially five percent (5%) or more of the outstanding shares of our common stock. As of October 1, 2015, there were 712,157,315 shares of common stock outstanding and 5,000,000 shares of Series A Preferred Stock outstanding.

| Shares | ||||||

| Name and Address of | Class of | Beneficially | Percentage | |||

| Beneficial Owner(1) | Securities | Owned | Owned(2) | |||

| Directors and Executive Officers | ||||||

| Paul Giles, Chief Executive Officer, President and | ||||||

| Director | Common Stock | 174,756,615 (6) | 24.54% | |||

| 25/1 Soi Sii Dan 14 Moo Baan Laddawan, Sri | ||||||

| Nakarin, Bang Kaeow, Bang | Series A Preferred Stock | 4,000,000 | 80%(7) | |||

| PreeSamut Prakan, Bangkok, Thailand 10540 | ||||||

| Lisa Ziomkowski-Boten, Secretary and Treasurer | Common Stock | 611,420 | 0.09% | |||

| 1777 Moo 5 Soi Sukhumvit 107 Sukhumvit Rd | ||||||

| North Sumrong, Amphur | Series A Preferred Stock | 0 | 0% | |||

| Muang, Samut Prakan, Bangkok W1 10270 | ||||||

| Chris Ziomkowski, Chief Technical Officer | Common Stock | 42,303,511 (3)(6) | 5.94% | |||

| 1777 Moo 5 Soi Sukhumvit 107 Sukhumvit Rd | ||||||

| North Sumrong, Amphur | Series A Preferred Stock | 1,000,000 | 20%(7) | |||

| Muang, | ||||||

| Samut Prakan, Bangkok W1 10270 | ||||||

| Julpas Kruesopon, Director | Common Stock | 0 (4) | 0% | |||

| 1777 Moo 5 Soi Sukhumvit 107 Sukhumvit Rd | ||||||

| North Sumrong, Amphur | Series A Preferred Stock | 0 | 0% | |||

| Muang, | ||||||

| Samut Prakan, Bangkok W1 10270 | ||||||

| All Officers and Directors | Common Stock | 217,671,546 | 30.57% | |||

| Series A Preferred Stock | 5,000,000 | 100%(7) | ||||

| 5% Stockholders | ||||||

| Paul Giles | Common Stock | 174,756,615 (6) | 24.54% | |||

| 25/1 Soi Sii Dan 14 Moo Baan Laddawan, Sri | ||||||

| Nakarin, Bang Kaeow, Bang | Series A Preferred Stock | 4,000,000 | 80%(7) | |||

| PreeSamut Prakan, Bangkok, Thailand 10540 | ||||||

| Lucky Twins Ventures Co., Ltd.(5) | Common Stock | 42,303,511 (6) | 5.94% | |||

| 209/123 Muang Ake Phase 5, T. Lkhak A. Muang | ||||||

| Pathumthani, 12000 Thailand | ||||||

| Chris Ziomkowski | Series A Preferred Stock | 1,000,000 | 20%(7) | |||

| 1777 Moo 5 Soi Sukhumvit 107 Sukhumvit Rd | ||||||

| North Sumrong, Amphur | ||||||

| Muang, | ||||||

| Samut Prakan, Bangkok W1 10270 |

| (1) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Pursuant to the rules of the SEC, shares of common stock which an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be beneficially owned and outstanding for the purpose of computing the percentage ownership of any other person shown in the table. |

| (2) | Based on 712,157,315 shares of our common stock and 5,000,000 shares of Series A Preferred Stock issued and outstanding as October 1, 2015. |

| (3) | Mr. Ziomkowski is the direct holder of 1,000,000 shares of Series A Preferred Stock and the indirect beneficial owner of shares of common stock held by a Lucky Twins Ventures Co. Ltd. (“Lucky Ltd.”). Mr. Ziomkowski’s spouse, Ms. Nutchanoot Ziomkowski, is a director of Lucky Ltd. |

| (4) | Does not include 500,000 shares of restricted stock that were to be issued and vested on December 19, 2014, to Mr. Kruesopon. |

| (5) | The business address of Lucky Ltd. is 209/123 Muang Ake Phase 5, T. Lkhak A. Muang, Pathumthani, 12000, Thailand. The principal business of Lucky Ltd. is that of a private investment firm. Mrs. Nutchanoot Ziomkowski has power to vote or to direct the vote and power to dispose or to direct the disposition of all securities owned directly by Lucky Ltd. |

| (6) | Includes shares of common stock issuable upon conversion of Series A Preferred Stock. |

| (7) | The holders of Series A Preferred Stock are entitled to (i) a number of votes equal to 51% of the total number of votes entitled to be cast by holders of common stock and preferred stock voting together; and (ii) vote on all matters on which the holders of common stock are entitled to vote. |

Change in Control

There are no existing arrangements that may result in a change in control of the Company.

REASONS WE USED STOCKHOLDER CONSENT AS OPPOSED TO SOLICITATION OF STOCKHOLDER

APPROVAL VIA PROXY STATEMENT AND SPECIAL MEETING

The Amendment requires stockholder approval. Stockholder approval could have been obtained by us in one of two ways: (i) by the dissemination of a proxy statement and subsequent majority vote in favor of the actions at a stockholders meeting called for such purpose, or (ii) by a written consent of the holders of a majority of our voting securities. However, the latter method, while it represents the requisite stockholder approval, is not deemed effective until twenty (20) days after this Information Statement has been sent to all of our stockholders giving them notice of and informing them of the actions approved by such consent.

Given that we have already secured the affirmative consent of the holders of a majority of the voting power of the outstanding capital stock of the Company to the Amendment, we determined that it would be a more efficient use of limited corporate resources to forego the dissemination of a proxy statement and subsequent majority vote in favor of the actions at a stockholders meeting called for such a purpose, and rather proceed through the written consent of the holders of a majority of our voting securities. Spending the additional company time, money and other resources required by the proxy and meeting approach would have been potentially wasteful and, consequently, detrimental to completing the Amendment in a manner that is timely and efficient for us and our stockholders.

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS ACTED UPON

No director, officer, nominee for election as a director, associate of any director, officer of nominee or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, resulting from the matters described herein which is not shared by all other stockholders pro rata in accordance with their respective interest. No director has informed the Company that he intends to oppose any of the corporate actions to be taken by the Company as set forth in this Notice and Information Statement.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one copy of this Information Statement is being delivered to multiple stockholders sharing an address, unless the Company has received contrary instructions from one or more of the stockholders. The Company will deliver promptly, upon written or oral request, a separate copy of this Information Statement to a stockholder at a shared address to which a single copy of this document was delivered. A stockholder may mail a written request to World Moto, Inc., Attention: Secretary, 131 Thailand Science Park, INC-1 #214, Phahonyothin Road, Klong1, Klong Luang, Pathumthani 12120, Thailand, to request:

| • | a separate copy of this Information Statement; | |

| • | a separate copy of Information Statements in the future; or | |

| • | delivery of a single copy of Information Statements, if such stockholder is receiving multiple copies of those documents. |

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

We file annual, quarterly, curren and other reports and other information with the SEC. Certain of our SEC filings are available over the Internet at the SEC’s web site atwww.sec.gov. You may also read and copy any document we file with the SEC at its public reference room by writing to the Public Reference Room of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Callers in the United States can also call 1-800-SEC-0330 for further information on the operations of the public reference facilities.

Dated: October _, 2015

ANNEX A

AMENDMENT TO ARTICLES OF INCORPORATION