UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended: December 31, 2011 | ||

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT | |

| For the transition period from _________ to ________ | ||

Commission file number: 333-167777 | ||

| Net Profits Ten Inc. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | 77-0716386 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1736 Angel Falls Street Las Vegas, NV | 89142-1230 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 1-209-694-4885 | |

| Securities registered under Section 12(b) of the Exchange Act: | |

| None. | |

| Securities registered under Section 12(g) of the Exchange Act: | |

| None. | |

1

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B not contained in this form, and no disclosure will be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o Non-accelerated filer oSmaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No o

The issuer's revenues for the most recent fiscal year ended December 31, 2011 were $0.

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter was $0, as there was no public market for the registrant’s common stock as of June 30, 2011.

State the number of shares of the issuer’s common stock outstanding, as of the latest practicable date:

4,808,000 shares of common stock issued and outstanding as of February 29, 2012.

DOCUMENTS INCORPORATED BY REFERENCE

NONE.

2

TABLE OF CONTENTS

| Page | |

| Part I | |

| Item 1. Business | 4 |

| Item 1A. Risk Factors | 13 |

| Item 2. Properties | 27 |

| Item 3. Legal Proceedings | 27 |

Item 4. Mine Safety Disclosures | 27 |

Part II

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 28 |

| Item 6. Selected Financial Data | 29 |

| Item 7. Management's Discussion and Analysis or Plan of Operation | 29 |

| Item 8. Financial Statements and Supplementary Data | 34 |

| Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 34 |

| Item 9A. Controls and Procedures | 34 |

| Item 9B. Other Information | 36 |

Part III

| Item 10. Directors, Executive Officers and Corporate Governance | 37 |

| Item 11. Executive Compensation | 40 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 42 |

| Item 13. Certain Relationships and Related Transactions | 42 |

| Item 14. Principal Accountant Fees and Services | 44 |

| Part IV | |

| Item 15. Exhibits, Financial Statement Schedules | 45 |

3

PART I

Item 1. Business

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

We caution you that this report contains forward-looking statements regarding, among other things, financial, business, and operational matters.

All statements that are included in this Annual Report, other than statements of historical fact, are forward-looking statements. Forward-looking statements involve known and unknown risks, assumptions, uncertainties, and other factors. Statements made in the future tense, and statements using words such as “may,” “can,” “could,” “should,” “predict,” “aim’” “potential,” “continue,” “opportunity,” “intend,” “goal,” “estimate,” “expect,” “expectations,” “project,” “projections,” “plans,” “anticipates,” “believe,” “think,” “confident” “scheduled” or similar expressions are intended to identify forward-looking statements. Forward-looking statements are not a guarantee of performance and are subject to a number of risks and uncertainties, many of which are difficult to predict and are beyond our control. These risks and uncertainties could cause actual results to differ materially from those expressed in or implied by the forward-looking statements, and therefore should be carefully considered. We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update any of these forward-looking statements as a result of new information, future events, or otherwise, except as expressly required by law. References in this Form 10-K, unless another date is stated, are to December 31, 2011. As used herein, the “Company,” “Net Profits,” “we,” “us,” “our” and words of similar meaning refer to Net Profits Ten Inc.

Our Business

Overview of the Company

We were incorporated on March 24, 2008 in the State of Nevada. We are focused on marketing and distributing user-friendly interactive yearbook software for the military. We have been doing business as Mil Yearbook. Our offices are currently located at: 1736 Angel Falls Street, Las Vegas, Nevada 89142-1230. Our telephone number is 1-209-694-4885. We have secured a domain name –www.netprofitsten.com, which is not functional and requires further development as of the date of this report, which website includes information we do not desire to be incorporated by reference herein.

4

Objectives

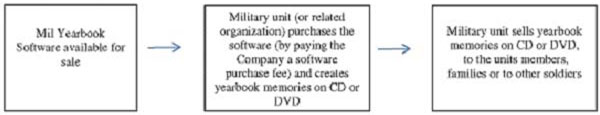

We are in the business of marketing and distributing user-friendly interactive yearbook software for the military. The software is planned to allow our customers to create and burn their own interactive digital memories on CD/DVD, as a “Mil Yearbook”, assuming we are able to complete the design and development of the software. Once a CD/DVD is created, customers will be able to sell this Mil Yearbook as a fundraising venture for their particular organization (see also the flow chart below). They will be able to watch and play with their digital memories on a personal computer or DVD, or sell it to their friends and family. Our software is planned to allow for uploading photos, video, music and text to their Mil Yearbook. The finalization and design and development of our software is subject to certain risks, as described in greater detail above under “Risk Factors,” and we may not be able to execute on our business plan and/or complete the development of the software in the future.

Assuming we are able to complete our business plan and finalize the development and design of our software, the software will enable the military, as well as other military related organizations (including veterans associations, any other Military related organizations as defined below in the description of the Licensing Agreement) to turn their videos, music and digital photos into an interactive yearbook on CD/DVD, which may include pictures and videos featuring vacations, field trips, sporting events, or for military personnel, may include pictures and videos of such personnel’s basic training, special ops, war games and other military activities for their friends and family to view. Our target market is primarily the military, who may desire to capture their military, base or basic training life or events on CD/DVD’s who wish to capture their memories, trips, and events, in a fun and interesting way, and to be able to save those memories to watch and play for years to come. Our software is also intended to serve as a way for groups and organizations to raise money through the sale of the CD/DVD’s created with our software.

In May 2010, we generated approximately $5,000 in revenues from the sale of 10 copies of a basic version of our Mil Yearbook product at $500 per copy, none of which sales were made to related parties. In September 2010, we generated $2,599 in revenues from the sale of five copies of a basic version of our Mil Yearbook product (at $500 per copy) and $99 in customization fees charged to one customer for additional functionality which was requested by such customer and in October 2010 we generated $1,099 in revenues from the sale of 2 copies of a basic version of our Mil Yearbook product (at $500 per copy) and $99 in customization fees charged to one customer for additional functionality which was requested by such customer and in December 2010 we generated approximately $1,500 in revenues from the sale of 3 copies of a basic version of our Mil Yearbook product. Moving forward we plan to complete our website (which is currently functional, but which we plan to further refine and expand) and the development of our product, which is functional, but requires further development to include the processes and modules described below. We currently market our Mil Yearbook product on google.com, but plan to expand such marketing efforts in the future, funding permitting, as described below.

Below is a flow chart describing in greater detail the Company’s planned distribution steps for its Mil Yearbook software:

5

For example: each CD/DVD costs less than a $1 to produce and the Company believes that each can possibly be sold for approximately $12-$25 per unit, with each CD being sold for approximately $12 and each DVD (which holds more information being sold for $20). The above sample prices represent the Company’s estimates and beliefs of the fair values of the resulting products; however, the Company does not have any evidence that such products will be able to be sold for those prices, and final prices will be determined by individual customers, based on their own estimation of the value of the product created and the ultimate market for such product. Each group will keep 100% of the profits of any sales, and as such, the ultimate price at which customers determine to sell the products will not have any effect on the Company’s revenues.

Our software (which is still in development) involves the following simple three-step process for the creation of the interactive Mil Yearbook:

We intend for our customers to use a simple three step process for the creation of the interactive Mil Yearbook as follows:

| ● | Add Media |

Creates galleries to put their pictures into. They then import photos and videos from a digital camera, scanner, hard drive and the internet to the galleries they have created.

| ● | Add Text |

There will be different sections or categories built in to the CD/DVD where they can add text such as:

| 1) | The Phone Book – they will be able to add the names, phone numbers and addresses of their fellow enlisted, commanding officer and emergency numbers. |

| 2) | The Personnel Page – this section lets them add the names and rank of their friends and family. |

| 3) | The Galleries – this is where they will be able to add text naming their Galleries of pictures and add names or stories to each individual picture. |

| ● | Add Audio |

6

This section lets the enlisted member add his or her favorite music or sound to the digital memories software.

We plan to develop a user friendly software product.

We plan to develop our software to be user friendly for all users, without the use of manuals and hours of practice. Regardless of the user’s level of computer literacy, our software will be designed to be easy to install, provide useful features, contain help support, be extremely easy to navigate and be fun and interactive.

We intend to concentrate our efforts on Software Functions

The software is planned to contain basic functions, including:

| ● | Easy and fast uploading, supporting a wide variety of formats such as: BMP, GIF, JPG, AVI, MPG, WMV, MP3, MP4, M4A, and M4V. |

| ● | Photo, video and text preview at any time. |

| ● | Adding text to various sections of the Mil Yearbook. |

| ● | Ability to burn their digital Mil Yearbook onto CD/DVD. |

When completed, our website will enable customers to place orders, purchase and download the software. Once the customer selects to purchase our product they are then directed to our order fulfillment page to complete their order, billing, and shipping information if they request a hard copy, rather than download the software from our website. The customer is then asked to agree with our terms and conditions of sale, and if in agreement, they are directed to the checkout page where PayPal information is requested. On completion, a final step displays the order and payment information for final confirmation by the customer. The customer then receives an email summarizing the order, shipping and payment information. We receive an identical email for order processing and fulfillment.

Once we set up our website and complete our software development, customers will be able to purchase and download our software directly from our website. We plan to price our software at between $499 for the simple stripped down version of the software and $1,299 including additional functions which are not operational yet including a private-chat function, multiple party capabilities and templates, in US dollars and we also plan to offer a downloadable version and a slightly higher priced boxed or hard copy version, depending on several factors including the final features which make it into the product and overall demand. Currently, we are offering the basic version of our software at $500; however, that price may change in the future. Our revenues will come from online sales of our software.

Status of Software Development

We currently have made limited sales of a basic stripped down operational version for our Mil Yearbook software based on the Technology (defined below). The software is however currently being further refined to include additional capabilities which may include a private-chat like feature as well as the ability of the software to be used by multiple parties (i.e., so that more than one person can work on the same project), which the programmer engaged by the Company as provided below under “Material Agreements,” is in the process of completing. The Company hopes to have those items completed by the end of 2012, funding permitting; however the Company may require additional time for beta-testing the completed product. We also anticipate that our website (which is currently operational in a limited capacity) will be fully operational by the end of 2012.

7

Material Agreements

In June 2010, we entered into an agreement with a programmer, pursuant to which the programmer is to complete the development of the Mil Yearbook software and the Company’s website in consideration for an aggregate of $3,500 which was due and payable by June 14, 2010, and which funds have been paid to date, and $4,500 which was due and payable by December 1, 2010, subject to the programmer completing the development of the Mil Yearbook software as described in the agreement. The Company had not remitted payment to the unrelated third party as of the date of this filing, since the programmer had not completed the development of the software. The Company will remit the $4,500 to the third party upon the completion of the development of the software, which the Company anticipates to be completed by 2012.

On October 11, 2010, the Company entered into a Licensing Agreement (the “Licensing Agreement”) with RN Consulting Services, d/b/a YearBook Alive Software, an entity controlled by Ruthy Navon, our promoter and former Secretary (“RN Consulting”). The Licensing Agreement amended, replaced and superseded a prior Reseller Agreement entered into between RN Consulting (in the name of Yearbook Alive Software) and the Company on or around March 1, 2008.

Pursuant to the Licensing Agreement, RN Consulting agreed to provide us an exclusive, limited, non-transferable (except in connection with the sale of our products) license to use, market, sell and distribute certain software which RN Consulting owns, which allows users to create and burn interactive digital memories on CD/DVD (the “Technology”) in software and products we sell and plan to sell to the Military (the “License”). “Military” is defined in the Licensing Agreement as military personnel, servicepersons, persons in the military reserves; persons in training for a career in and/or service in the military (including cadets and the ROTC (Reserve Officers’ Training Corp); military organizations (located throughout the world), organizations with functions similar to the military such as the coast guard, national guard or foreign legion); and current, former or retired military personnel.

In December 2010, the Company entered into a First Addendum to the Licensing Agreement, effective as of the effective date of the Licensing Agreement, to clarify and confirm that RN Consulting would provide technical software support to the Company and to customers of the Company, at no cost to the Company.

We have used and plan to continue to use the Technology (which RN Consulting, through YearBook Alive, mainly markets to schools and school related organizations) as a framework on which to add additional modules and functions and to expand the functionality of such Technology in order to better market our products to and make such products more appealing to the Military. The License also provides us the right to use any and all of RN Consulting’s trademarks and tradenames in connection with the marketing, advertising and sale of products during the term of the License.

8

Pursuant to the Licensing Agreement, no fees were due to RN Consulting under the License until July 31, 2011, subsequent to which we agreed to pay RN Consulting 10% of any of our net sales (i.e., total sales after taxes) related to the use of the Technology, payable monthly in arrears

during the term of the License. The License terminates immediately upon the termination of the Licensing Agreement. As of December 31, 2011, the Company had generated no sales pursuant to this Licensing Agreement; therefore, no royalties were due to RN Consulting.

The License remains in effect until the earlier of (a) the mutual written consent of the parties; (b) the occurrence of any act, which by law, would require the License to terminate; (c) the bankruptcy of either party; or (d) upon thirty days written notice by a non-breaching party, upon the material breach of a material obligation of or the gross negligence in connection with the fulfillment of the duties of such party in connection with the Licensing Agreement by the other party, provided that such breaching party does not cure such breach within such 30 day notice period. Upon termination of the License, we are provided the right of ownership to any refinements, additional modules, enhancements or modifications to the Technology which we create, provided that such refinements do not otherwise infringe on the License.

Pursuant to the Licensing Agreement, and in an effort to avoid conflicts of interest and competition between the Company and RN Consulting, we agreed to refer any non-Military customers or potential customers to RN Consulting and RN Consulting agreed to refer any Military customers or potential customers to us. Furthermore, both parties agreed not to compete with the other.

Industry Background

Internet-based transactions between shoppers and merchants have grown rapidly in recent years. This growth is the result of the penetration of broadband technologies and increased Internet usage and the emergence of compelling commerce opportunities and a growing awareness among shoppers of the convenience and other benefits of online shopping.

Industry estimates of the Growing Internet Population and Internet Penetration Levels

Based on a research report prepared by Morgan Stanley:

- We believe that the Internet is still in the early stages of becoming a central communications, information, commerce, and entertainment medium. We estimate there are over 800+ million Internet users worldwide using the Internet an estimated average of 30-45 minutes per day.

- We expect the number of Internet users to grow at 10-15% annually for the next several years, with stronger growth in non-US markets.

9

- And we believe that usage growth (in part because of ongoing broadband adoption) should continue to be higher (perhaps 20-30%), thus demonstrating compelling underlying growth trends.

Source: Mary Meeker, Brian Pitz, and Brian Fitzgerald, "Internet Trends," (April 2004) a Morgan Stanley Research Report.

Growth of Electronic Commerce

Forrester Research believes that electronic commerce activity in the United States will grow at a compounded annual growth rate of approximately 10% from 2009 to 2014.

US online retail reached $155.2 billion in 2009 and is projected to grow to $248.7 billion by 2014.

(Source: Forrester Research, US Online Retail Forecast: 2009 to 2014, “Executive Summary”, March 5, 2010, Forrester Research, Inc., last reviewed July 27, 2010).

Marketing Strategy

We plan to market our software with a web-based marketing campaign. We have budgeted $5,000 for this web-based campaign which will include the following:

E-mail Marketing

We have budgeted $3,000 from our marketing budget for an e-mail campaign. Emails will be sent only to those which have asked for or shown an interest in receiving information about our software.

Catalogue Advertising

One of our planned sources for advertising our software is by placing ads in software distributor catalogues. These catalogues are distributed to military units and military organizations across the United States as well as Europe and Australia and to retail outlets selling software. Moving forward, and funding permitting, we plan to advertise our products in software distributor catalogues.

Given the ease with which statistics can be collected on the number of times catalogue ads have been successful by users, there is strong evidence that they can be very effective. Nevertheless, it is difficult to determine whether these catalogue ads are more or less effective than other forms of advertising.

We budgeted $2,000 from our marketing budget for software distributor catalogue advertising moving forward. We intend to place ads in catalogues that specifically target the military.

Submission to Directories and Search Engines

We plan to submit our website to directories and search engines in order to increase our presence on the Internet, as well as to get better rankings on search results. There are many directories to which we plan to submit our website for free, such as Google (http://www.google.com)(which is the only search engine which we currently market on), Yahoo (http://www.yahoo.com – regional Yahoos also exist), AltaVista (http://www.altavista.com) and Excite (http://www.excite.com). There are also numerous directories where we can list our software at no cost to the Company, including many military-specific sites.

10

Distribution of Software

We plan to price our software at between $499 and $1,299 in US dollars offering a downloadable version and a slightly higher priced boxed or hard copy version, depending on several factors including the final features which make it into the product and overall demand. Currently, we are offering the basic version of our software at $500, however, that price may change in the future. We hope that the majority of our sales moving forward will come from online sales of our software. We hope to finalize the final version of the software by the end of 2012.

Moving forward, we plan to enter into an agreement with PayPal to act as our credit card merchant. PayPal is a financial company that accepts and clears all customer credit card payments on behalf of participating merchants, such as our Company. There are no short or long term contracts or obligations associated with the use of PayPal. PayPal accepts all major credit cards (Visa, MasterCard, Discover, American Express, ECheque, and transfer of funds to and from bank accounts.)

Sources and Availability of Products and Supplies

There are no constraints on the sources or availability of products and supplies related to our business. We are producing our own software product and the distribution of the software product and services will be primarily over the internet.

Dependence on One or a Few Major Customers

We plan on selling our software products and services directly to our target market over the internet. Our software will be priced for mass market consumption. Therefore, we do not anticipate dependence on one or a few major customers for at least the next 12 months or the foreseeable future. We have had only limited sales of our product to date.

Our Target Market

We plan to market our interactive digital software to the military, as well as other military organizations who routinely undertake fund raising activities throughout the United States and then Australia and Europe. This gives us the opportunity to estimate the number of potential customers within our target market.

According to the following surveys in the United States, our target market in the United States alone is very large:

According to the Association of Military Colleges and Schools of the United States, www.amcsus.com there are approximately 30 private secondary schools dedicated to Military Education (www.amcus.com, “Directory of Schools”, retrieved July 27, 2010).

According to The Military Zone, there are over 200 hundred military bases (including camps, forts and facilities) within the United State alone

11

(http://themilitaryzone.com/military_bases.html, “Information about US Military Installations,” retrieved July 27, 2010).

The American Legion is a community service organization with close to 3 million members, men and women, organized in nearly 14,000 local American Legion Posts, worldwide (http://en.wikipedia.org/wiki/American_Legion, “American Legion”, retrieved July 27, 2010).

An additional Veterans Organization is the American Red Cross, which according to their website www.redcross.org has nearly 700 American Red Cross chapters in the United States alone (www.redcross.org, “About Us”, retrieved July 27, 2010).

The U.S. Census Bureau’s estimate for the number of veterans in 2008, is over 23 million people (www.census.gov/compendia/statab/cats/national_security_veterans_affairs/veterans.html, “508 – Veterans by Sex, Period of Service and State, 2008”, retrieved July 27, 2010).

Based on the foregoing information, we believe that if we are able to make our products attractive to only a small percentage of our target market in North America we will be able to generate the revenues we believe we require to sustain our operations. There can be no assurance, however, that our software products will appeal to our target market.

Competition

Net Profits Ten’s competition comes from several industry participants which include companies such as Yearbook Warehouse (http://www.yearbookwarehouse.com) and E-Yearbook (http://www.e-yearbook.com), however, we are not aware of any military yearbook suppliers offering digital services at this time.

Intellectual Property

The Company does not have any patents, trademarks, licenses, or franchises other than its rights in connection with the License, described above. We also however maintain a website, as discussed above.

We intend, in due course, subject to legal advice, to apply for trademark protection and/or copyright protection in the United States and other jurisdictions.

We intend to aggressively assert our trademark rights and copyright laws, if any, moving forward, to protect our intellectual property, including product design, product research and concepts and recognized trademarks. These rights are protected through the acquisition of trademark registrations, the maintenance of copyrights, and, where appropriate, litigation against those who are, in our opinion, infringing on these rights.

While there can be no assurance that registered trademarks and copyrights we plan to apply for in the future, will protect our proprietary information, we intend to assert our intellectual property rights against any infringer. Although any assertion of our rights can result in a substantial cost to, and diversion of effort by, our Company, management believes that the protection of our intellectual property rights is a key component of our operating strategy.

12

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations of our software products. We are subject to the laws and regulations of those jurisdictions in which we plan to sell our product, which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes. In general, the development and operation of our website is not subject to special regulatory and/or supervisory requirements.

Employees

We have no other employees other than our officers and Directors.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

Item 1A. Risk Factors.

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this report and our Annual Report on Form 10-K, before deciding to invest in our Company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Because we have not generated revenues sufficient to cover our operating expenses and have incurred losses for the period from March 24, 2008 (inception) to December 31, 2011 there is an uncertainty about whether we will be able to continue as a going concern and, as a result, a possibility that shareholders may lose some or all of their investment in our Company.

We generated revenues of $10,188 during the period from inception (March 24, 2008) through December 31, 2010, and did not generate any revenues for the year ended December 31, 2011. As of December 31, 2011, we had a working capital deficit of $33,655 and a total accumulated deficit of $72,101. We anticipate generating losses for the next 12 months. Therefore, we may be unable to continue operations in the future as a going concern. If financing is available, it may involve issuing securities senior to our common stock. In addition, in the event we do not raise additional capital from conventional sources, such as our existing investors or commercial banks, there is every likelihood that our growth will be restricted and we may be forced to scale back or curtail implementing our business plan.

13

No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities, which adjustment may have to be made, should we be unable to continue as a going concern. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in the Company.

We have only generated minimal revenues to date and we face many obstacles as a startup venture. We may never be able to execute our business plan.

We were incorporated on March 24, 2008. We are focused on the development and marketing of an interactive “yearbook” software product for the military, for the purpose of fundraising. This product is called, “Mil Yearbook", which we have been doing business as. Although we have begun the development, marketing and sale of Mil Yearbook, we may not be able to fully execute our business plan unless and until we are successful in raising additional funds.

We may not be able to obtain additional necessary funding. We generated revenues of $10,188 during the period from inception (March 24, 2008) through December 31, 2010, and did not generate any revenues for the year ended December 31, 2011. There can be no assurance that we will ever achieve any profitability or revenues sufficient to support our operations. The revenue and income potential of our proposed business and operations are unproven, and the lack of an operating history makes it difficult to evaluate the future prospects of our business.

Because our business plan may be unsuccessful, we may not be able to continue operations as a going concern.

Our ability to continue as a going concern is dependent upon our generating cash flow sufficient to fund operations and reduce operating expenses. Our business plans may not be successful in addressing these issues.

The success of our business plan is dependent on our further developing and marketing of the Mil Yearbook. Our ability to market such software is unproven, and the lack of an operating history makes it difficult to validate our business plan. If we cannot continue as a going concern, our stockholders may lose their entire investment in our Company.

Because we expect to incur losses over the next 12 months, our stockholders may lose their entire investment in us.

We generated revenues of $10,188 during the period from inception (March 24, 2008) through December 31, 2011, which were not sufficient to offset the expenses associated with our operations, and the marketing of, our software.

14

We cannot guarantee that we will ever be successful in generating sufficient revenues to support our operations in the future. We recognize that if we are unable to generate sufficient revenues, we will not be able to earn profits or continue operations.

Our ability to continue as a going concern is dependent upon our generating cash flow sufficient to fund operations and reduce operating expenses. Our business plans may not be successful in addressing these issues.

The success of our business plan is dependent on our improvement and marketing of the Mil Yearbook. Our ability to market such software is unproven, and the lack of an operating history makes it difficult to validate our business plan. If we cannot continue as a going concern, our stockholders may lose their entire investment in our Company.

Because we have no operating history there is no assurance that our future operations will result in profitable operations.

There is no operating history upon which to base any assumption as to the likelihood that we will prove successful, and we cannot provide investors with assurances that we will generate operating revenues sufficient to support our operations or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We were incorporated on March 24, 2008, and have very limited operations. While we have not realized any material revenues to date, a beta version of the Mil Yearbook is ready for commercial sale, however we do not expect the full version to be completed until the end of 2012. We have no operating history at all upon which an evaluation of our future success or failure can be made. As of December 31, 2011, we had a working capital deficit of $33,655 and a total accumulated deficit of $72,101, and expect to have net losses over the next 12 months. These losses will come due to substantial costs and expenses associated with the further development, marketing and distribution of our software.

In the future, our success will be dependent upon the success of our efforts to gain market acceptance of our Mil Yearbook. If we cannot attract a significant number of customers due to the target market not being as responsive as we anticipate, we cannot guarantee that we will ever be successful in generating revenues to support our operations in the future to ensure our continuation.

Because we have not generated any significant revenue from our business and we will need to raise funds in the near future, which may be difficult to obtain when required, we might be forced to discontinue our business.

As of December 31, 2011, we had a working capital deficit of $33,655 and a total accumulated deficit of $72,101, and we anticipate incurring costs of at least $40,000 for the next 12 months, which we hope to raise through the sale of debt or equity securities and/or through traditional bank funding.

15

Because we have not generated any revenue from our business, we will need to raise additional funds for the future development of our business and to be able to respond to unanticipated requirements or expenses. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. The most likely source of future funds presently available to us will be through the sale of equity

capital. Any sale of share capital will result in dilution to existing shareholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay our future indebtedness or that we will not default on our future debts, jeopardizing our business viability.

We may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct business, which might result in the loss of some or all of your investment in our common stock. There can be no assurance that additional financing will be available to us on terms that are acceptable. Consequently, we may not be able to proceed with our intended business plans. Substantial additional funds will still be required if we are to reach our goals that are outlined in this filing. Without additional funding, we may not continue our planned business operations.

Because we are dependent on contracting with third party firm(s) to maintain our software for us, our operations and financial stability may be adversely affected.

We intend to hire a software development firm(s) to maintain our Mil Yearbook software. We have estimated the total costs for this purpose at $8,000 (as of December 31, 2011 we had paid $3,500 of this cost). If we are unable to contract qualified software development firm(s) to maintain our software, whether because we cannot find them, cannot attract them to our Company, or cannot afford them, we will not be able to continue our planned business operations.

If we are not able to finalize the further development and marketing of our website or if the developed website contains defects, we may not be able to generate significant revenues and shareholders will lose their investment.

The success of our business in part will depend on the marketing, completion and acceptance of our website by our online target market. Achieving such acceptance will require significant marketing investment. We have estimated the costs for the further development of our website at $5,000.

Our website may contain undetected design faults and software errors that are discovered only after it has been viewed and used by customers. Any such default or error could cause delays and further expenses and could adversely affect our competitive position and cause us to lose potential customers or opportunities. If this is the case, we may not generate revenues at sufficient levels to support our operations and build our business and our business will likely fail.

If we are not able to find significant retail suppliers, re-sellers or distributors, we may not be able to generate significant revenues and shareholders may lose their investment.

The success of our business in part will depend on developing and maintaining relationships with retail suppliers, re-sellers and/or distributors. Achieving such acceptance will require significant time and marketing investment.

16

If we are unable to build these relationships with retail suppliers, re-sellers or distributors to sell our software, this could adversely affect our competitive position and cause us to lose potential customers or opportunities. Also, if we are accepted by retail suppliers, re-sellers or distributors but do not generate revenues at sufficient levels to support our operations and build our business, our business will fail.

Because we rely on subcontractors for the programming and maintenance of critical elements of our website, the loss of these services will adversely affect our operations and ability to generate revenues.

We rely on subcontractors for the programming and maintenance of critical elements of our website, including integrating the billing process, tracking of the online sales and the basic maintenance and backup of our servers. If one of these subcontractors no longer provides service to us or there is a delay in their services, our business may be harmed. We rely on subcontractors for the maintenance and ongoing upgrades of the Net Profits Ten Inc. website. We also will rely on subcontractors for tasks such as firewall protection, application of security patches and regular backup of our servers' data.

After contracting with these subcontractors there is no assurance that they will continue to reliably deliver the above services. Should a subcontractor cease to provide their services to us, our operations will be terminated until such time as we can locate and retain a replacement subcontractor. During such time our business will suffer.

Risks Related to our Company

Our executive officers control a majority of our voting securities and therefore they have the ability to influence matters affecting our shareholders.

Our executive officers beneficially own approximately 83.19% of the issued and outstanding shares of our common stock. As a result, they have the ability to influence matters affecting our shareholders and will therefore exercise control in determining the outcome of all corporate transactions or other matters, including the election of Directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. Any investor who purchases shares will be a minority shareholder and as such will have little to no say in the direction of the Company and the election of Directors. Additionally, it will be difficult if not impossible for investors to remove our current Directors, which will mean they will remain in control of who serves as officers of the Company as well as whether any changes are made in the Board of Directors. As a potential investor in the Company, you should keep in mind that even if you own shares of the Company's common stock and wish to vote them at annual or special shareholder meetings, your shares will likely have little effect on the outcome of corporate decisions. Because our executive officers control such shares, investors may find it difficult to replace our management if they disagree with the way our business is being operated.

Because our executive officers and Directors live outside of the United States, you may have no effective recourse against them for misconduct and may not be able to enforce judgment and civil liabilities against them. Investors may not be able to receive compensation for

17

damages to the value of their investment caused by wrongful actions by our Directors and officers.

Both of our Directors and officers live outside of the United States.

Mr. Gilad David, our President, Treasurer and Director, is a citizen and a resident of Israel, and all or a substantial portion of his assets are located outside of the United States.

Mr. Fouad Dasuka, our Director, is a citizen and a resident of Israel, and all or a substantial portion of his assets are located outside of the United States.

As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our Directors or officers, or obtain judgments against them outside of the United States that are predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Investors may not be able to receive compensation for damages to the value of their investment caused by wrongful actions by our Directors and officers.

Our officers and Directors lack experience in and with publicly-traded companies.

While we rely heavily on Mr. Gilad David, our President, Treasurer and Director and Mr. Fouad Dasuka, our Director, they have no experience serving as an officer or Director of a publicly-traded company, or experience with the reporting requirements which public companies are subject to. Consequently, our operations, earnings and ultimate financial success could suffer irreparable harm due to their ultimate lack of experience with publicly-traded companies in general.

Because we have two Directors, deadlocks may occur in our board’s decision-making process, which may delay or prevent critical decisions from being made.

Since we currently have an even number of Directors, deadlocks may occur when such Directors disagree on a particular decision or course of action. Our Articles of Incorporation and By-Laws do not contain any mechanisms for resolving potential deadlocks. While our Directors are under a duty to act in the best interest of our Company, any deadlocks may impede the further development of our business in that such deadlocks may delay or prevent critical decisions regarding our development.

Because our executive officers are unable to devote their services to our company on a full time basis, the performance of our business may suffer, our business could fail and investors could lose their entire investment.

Mr. Gilad David, our President, Treasurer and a Director, currently devotes approximately 20 to 25 hours per week to our Company.

Mr. Fouad Dasuka, our Director, currently devotes 20 to 25 hours a week to our Company.

18

We depend heavily on the services of our executive officers and Directors. As a result, the management of our Company could under-perform, our business could fail and investors could lose their entire investment.

Shareholders who hold unregistered shares of our common stock are subject to resale restrictions pursuant to Rule 144, due to our status as a “shell company.”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we are a “shell company” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 are not able to be made until 1) we have ceased to be a “shell company”; 2) we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” has been filed with the Commission reflecting the Company’s status as a non-“shell company.” Because none of our non-registered securities can be sold pursuant to Rule 144, until at least a year after we cease to be a “shell company”, any non-registered securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after we cease to be a “shell company” and have complied with the other requirements of Rule 144, as described above. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

Because our executive officers have no experience or technical training in the development, maintenance and marketing of internet websites or in operating businesses that license software or services over the internet, we are likely to make inexperienced or uninformed decisions that will have bad results for us.

Our executive officers have no experience or technical training in the development, maintenance and marketing of internet websites or in operating businesses that market software or services over the internet. Due to their lack of experience and knowledge in these areas, our executive officers could make the wrong decisions regarding the development, operation and marketing of our website and the operation of our business, which could lead to irreparable damage to our business. Consequently, our operations could suffer irreparable harm from mistakes made by our executive officers and we may have to suspend or cease operations, which could cause investors to lose their entire investment.

Because we depend heavily on our executive officers, the loss of either person will have a substantial negative effect on our business and may cause our business to fail.

19

We depend entirely on our executive officers for all of our operations. The loss of either person will have a substantial negative effect on us and may cause our business to fail. Our executive officers did not receive any compensation for their services and it is highly unlikely that they will receive any compensation unless and until we generate substantial revenues.

We do not have any employment agreements or maintain key person life insurance policies on our executive officers. If our executive officers do not devote sufficient time towards our business, we may never be able to effectuate our business plan.

Shareholders may be diluted significantly through our efforts to obtain financing and satisfy obligations through the issuance of additional shares of our common stock.

We have no committed source of financing. Wherever possible, our Board of Directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our Board of Directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders, may further dilute common stock book value, and that dilution may be material. Such issuances may also serve to enhance existing management’s ability to maintain control of the Company because the shares may be issued to parties or entities committed to supporting existing management.

Nevada law and our articles of incorporation authorize us to issue shares of stock, which shares may cause substantial dilution to our existing shareholders.

We have authorized capital stock consisting of 100,000,000 shares of common stock, $0.0001 par value per share and 50,000,000 shares of preferred stock, $0.0001 par value per share. As of the date of this report, we have 4,808,000 shares of common stock issued and outstanding and – 0 – shares of preferred stock issued and outstanding. As a result, our Board of Directors has the ability to issue a large number of additional shares of common stock without shareholder approval, which if issued could cause substantial dilution to our then shareholders. Additionally, shares of preferred stock may be issued by our Board of Directors without shareholder approval with voting powers, and such preferences and relative, participating, optional or other special rights and powers as determined by our Board of Directors, which may be greater than the shares of common stock currently outstanding. As a result, shares of preferred stock may be issued by our Board of Directors which cause the holders to have super majority voting power over our shares, provide the holders of the preferred stock the right to convert the shares of preferred stock they hold into shares of our common stock, which may cause substantial dilution to our then common stock shareholders and/or have other rights and preferences greater than those of our common stock shareholders. Investors should keep in mind that the Board of Directors has the authority to issue additional shares of common stock and preferred stock, which could cause substantial dilution to our existing shareholders. Additionally, the dilutive effect of any preferred stock, which we may issue may be exacerbated given the fact that such preferred stock

20

may have super majority voting rights and/or other rights or preferences which could provide the preferred shareholders with voting control over us subsequent to this filing and/or give those holders the power to prevent or cause a change in control. As a result, the issuance of shares of common stock and/or preferred stock may cause the value of our securities to decrease and/or become worthless.

Risks Related to Developing our Software

Because we may not be successful in further developing software that will achieve market acceptance, we may not be able to achieve profitable operations.

The success or failure of further developing and marketing of the interactive military software for fundraising, Mil Yearbook, depends in large part on its desirability and ease of application in the target market. We cannot be sure that our development efforts will produce software that will fulfill the needs and appeal to the tastes of our expectant customers and clients.

The software industry is characterized by technological change, frequent product introductions and evolving industry standards. Our success will depend, to a significant extent, on our ability to introduce upgrades or new software products to satisfy an expanding range of customer needs and achieve market acceptance.

Because we may never be able to achieve sales revenues sufficient to become profitable, we could experience continual losses and eventually fail in our business plan.

There can be no assurance that our software will achieve a level of market acceptance that will make us profitable.

We believe that the acceptance of our software products will depend on our ability to:

| ● | Develop a user-friendly software product that appeals to our potential clients and customers. | |

| ● | Effectively market our software through our website as well as, resellers and distributors. | |

| ● | Price and license the software products in a manner that is appealing to potential customers. | |

| ● | Develop and maintain a favorable reputation among our potential clients and customers. | |

| ● | Develop brand recognition. | |

| ● | Have the financial ability to withstand downturns in the general economic environment or conditions that would slow the licensing of our software products. |

Commerce over the internet is an emerging market that is characterized by rapid changes in customer requirements, frequent introductions of new and enhanced products and services, and continuing and rapid technological advancement.

21

To compete successfully in this emerging market, we must continue to design, develop, and sell new and enhanced software and services that provide increasingly higher levels of performance and reliability at an acceptable and reasonable cost.

The software and services must take advantage of technological advancements and changes, and respond accordingly to new and changing customer requirements. Our success in designing, developing, and selling such software and services will depend on a variety of factors, including:

| o | Success of promotional and marketing efforts. | |

| o | The identification of market demands for new or upgraded software and services. | |

| o | Timely implementation of software and services offering. | |

| o | Software and service performance. | |

| o | Cost-effectiveness of software and service. |

We license the right to software which forms the framework for our Mil Yearbook software from RN Consulting, which is owned by Ruthy Navon, our promoter, and which software our current Mil Yearbook software is dependent on.

On October 11, 2010, the Company entered into a Licensing Agreement, which was amended in December 2010 (the “Licensing Agreement”), with RN Consulting Services, d/b/a YearBook Alive Software, an entity controlled by Ruthy Navon, our promoter (as described below) and former Secretary (“RN Consulting”). The Licensing Agreement amended, replaced and superseded a prior Reseller Agreement entered into between RN Consulting (in the name of Yearbook Alive Software) and the Company on or around March 1, 2008. Pursuant to the Licensing Agreement, RN Consulting agreed to provide us an exclusive, limited, non-transferable (except in connection with the sale of our products) license to use, market, sell and distribute certain software which RN Consulting owns, which allows users to create and burn interactive digital memories on CD/DVD (the “Technology”) in software and products we sell and plan to sell to the Military (the “License”). “Military” is defined in the Licensing Agreement as military personnel, servicepersons, persons in the military reserves; persons in training for a career in and/or service in the military (including cadets and the ROTC (Reserve Officers’ Training Corp); military organizations (located throughout the world), organizations with functions similar to the military such as the coast guard, national guard or foreign legion; and current, former or retired military personnel. Pursuant to the Licensing Agreement, no fees are due to RN Consulting under the License until July 31, 2011, subsequent to which we agreed to pay RN Consulting 10% of any of our net sales (i.e., total sales after taxes) related to the use of the Technology, payable monthly in arrears during the term of the License. The License terminates immediately upon the termination of the Licensing Agreement. As of December 31, 2011, the Company had generated no sales pursuant to this Licensing Agreement; therefore, no royalties were due to RN Consulting.

In the event the Licensing Agreement is terminated for any reason, we could lose the rights to the License, which could force us to cease selling our Mil Yearbook software, which would cause a material adverse effect on the Company, could force the Company to suspend or curtail its operations and could cause any investment in the Company to become worthless.

22

Pursuant To The License, We Are Only Allowed To Market And Sell Our Software To Military Customers.

As described above, we received a License to use certain technology as a result of the Licensing Agreement. Pursuant to the Licensing Agreement, we are only allowed to market and sell our software to Military (as defined above) customers. Additionally, pursuant to the Licensing Agreement, and in an effort to avoid conflicts of interest and competition between the Company and RN Consulting, we agreed to refer any non-Military customers or potential customers to RN Consulting and RN Consulting agreed to refer any Military customers or potential customers to us. As such, we will not be able to offer our software to any non-Military customers, which may limit the overall market for our software and products and limit our ability to compete with and against competitors which offer their software and products to all segments of the marketplace. Furthermore, we may miss out on potential cross-promotional opportunities as a result of our requirement to only sell to Military customers. Due to such requirements, our overall results of operations and future growth may be limited, and we may be forced to curtail or abandon our business plan.

Protecting our Proprietary Technology and Other Intellectual Property Rights

If we are unable to protect our proprietary technology and other intellectual property rights, or our licensing partners are unable to protect the intellectual property which we license, our ability to compete in the marketplace may be substantially reduced.

If we are unable to protect our intellectual property and/or if our licensing partners are unable to protect the intellectual property which we license, our competitors could use our intellectual property to market software similar to ours, which could decrease demand for our software, thus decreasing our revenues. We plan to rely on a combination of copyright, trademark and trade secret laws to protect our intellectual property rights. These protections may not be adequate to prevent our competitors from copying or reverse-engineering our interactive digital software.

In addition, our competitors may independently develop technologies that are substantially equivalent or superior to our technology. To protect our trade secrets and other proprietary information, we plan to require employees, consultants, advisors and collaborators to enter into confidentiality agreements. These agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Existing copyright laws afford only limited protection for our intellectual property rights and may not protect such rights in the event competitors independently develop similar software products. Policing unauthorized use of our products is very difficult, and litigation could become necessary in the future to enforce our intellectual property rights. Any policing or litigation could be time consuming and expensive to resolve or prosecute, result in substantial diversion of management attention and resources, and materially harm our business or financial condition.

If a third party asserts that we infringed upon its proprietary rights, we could be required to redesign our software, pay significant royalties or enter into license agreements.

23

Although presently we are not aware of any such claims, a third party may assert that our technology or technologies of entities we acquire or license violates its intellectual property rights. As the number of software products in our market increases and the functionality of those software products further overlap, we believe that infringement claims will become more common. Any claims against us, regardless of their merit, could:

| o | Be Expensive and time consuming to defend. | |

| o | Result in negative publicity. | |

| o | Force us to stop licensing our software products that incorporate the challenged intellectual property. | |

| o | Require us to redesign our software products. | |

| o | Require us to enter into royalty or licensing agreements in order to obtain the right to use necessary technologies, which may not be available on terms acceptable to us, if at all. |

We believe that any successful challenge to our use of a trademark or domain name could substantially diminish our ability to conduct business in a particular market or jurisdiction and thus decrease any revenues and result in possible losses to our business.

Regulatory and Legal Risks

Because marketing and making our software product available on the internet may expose us to regulatory and legal issues, we may be forced out of business.

A range of exposures may exist due to how we intend to market our software. If we create and utilize a web site and sell through the retail industry, as we plan to do, online access through a company-operated web site and retail regulations requires careful consideration of legal and regulatory compliance requirements and issues. This may require extensive legal services that may become an increased cost component when considering the development of our software and technologies.

Risks Related To Competition

We face competition from other businesses or competitors that currently market interactive fundraising software.

Competition will possibly come not only from those who deliver their products through traditional retail establishments but also from those who deliver their products and software through the internet. Our competitors will possibly have longer operating histories, greater brand recognition, larger marketing budgets and installed customer bases. In addition, these companies are able to field full-time, directly employed sales personnel to better cover certain markets and customers. They may also invest greater resources in the development of technology, content and research which will allow them to react to market changes faster, putting us at a possible competitive disadvantage.

24

Some of our competitors may have significantly more financial resources, which could allow them to develop software that could render our software inferior.

Our competition may have software or may develop software that will render our software inferior. We will likely need to obtain and maintain certain advantages over our competitors in order to be competitive, which require resources. There can be no assurance that we will have sufficient financial resources to maintain our research and development, marketing, sales and customer support efforts on a competitive basis, or that we will be able to make the improvements necessary to maintain a competitive advantage with respect to our software products.

Risks Related to Our Securities

Because there is no public market for our common stock, our stockholders may not be able to resell their shares at or above the price at which they purchased their shares, or at all.

Our common stock was approved for quotation on the Over-The-Counter Bulletin Board in February 2011, however, there is currently no market for our common stock and we can provide no assurance that a market will develop. If for any reason a public trading market does not develop, purchasers of our shares may have difficulty selling their common stock should they desire to do so.

Even if a trading market develops, we cannot predict how liquid that market might become. The trading price of our common stock is likely to be highly volatile and could be subject to wide fluctuations in price in response to various factors, some of which are beyond our control.

These factors include:

| o | Quarterly variations in our results of operations or those of our competitors; | |

| o | Announcements by us or our competitors of acquisitions, new software products, significant contracts, commercial relationships or capital commitments; | |

| o | Disruption to our operations; | |

| o | Commencement of, or our involvement in, litigation; | |

| o | Any major change in our board or management; | |

| o | Changes in governmental regulations or in the status of our regulatory approvals; and | |

| o | General market conditions and other factors, including factors unrelated to our own operating performance. |

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of such public companies. These broad market and industry factors may seriously harm the market price of our common stock, regardless of our actual operating performance. In addition, in the past, following periods of volatility in the overall market and the market price of a company’s securities, securities class action litigation has often been instituted against these companies. This type of litigation, if instituted against us, could result in substantial costs and a diversion of our management’s attention and resources.

25

Because future sales by our stockholders could cause the stock price to decline, our investors may lose money on the purchase of our stock.

No predictions can be made of the effect, if any, that market sales of shares of our common stock or the availability of such shares for sale will have on the market price prevailing from time to time. Nevertheless, sales of significant amounts of our common stock could adversely affect the prevailing market price of the common stock, as well as impair our ability to raise capital through the issuance of additional equity securities.

State securities laws may limit secondary trading, which may restrict the states in which you can sell our shares.

If you purchase shares of our common stock you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state, or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and limit a stockholder's ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder's risk of losing some or all of his investment.

Because we are subject to the “Penny Stock” rules the level of trading activity in our stock may be reduced.

If a trading market does develop for our stock, it is likely we will be subject to the regulations applicable to "Penny Stock." The regulations of the SEC promulgated under the Exchange Act that require additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The SEC regulations define penny stocks to be any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Unless an exception is available, those regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a standardized risk disclosure schedule prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the purchaser’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that becomes subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our

26

securities. We believe that the penny stock rules discourage market investor interest in and limit the marketability of our common stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Our executive and principal office is located at 1736 Angel Falls Street, Las Vegas, Nevada 89142-1230. We lease the space pursuant to a Lease Agreement which is in effect from June 1, 2010 to December 31, 2012 (the “Term”), subject to renewal with the mutual consent of the parties. Total rent due under the lease for the Term was $200, which funds have been paid to date. Pursuant to the Lease Agreement, we are provided the shared use of the landlord’s residence for our principal office location.

This location will serve as our primary executive offices for the foreseeable future. We believe that our office space and facilities are sufficient to meet our present needs and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to us.

We also lease an office space which includes the use of a boardroom and break area at 5348 Vegas Dr., Las Vegas, Nevada 89108, which has a monthly rental cost of $75 per month. The lease has a one year term from April 14, 2010 to April 13, 2012, and is automatically renewed for additional one year terms if not terminated with thirty days prior written notice by either party prior to the termination date of the then term.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our Company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

27

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

In February 2011, we obtained quotation for our common stock on the Over-The-Counter Bulletin Board (“OTCBB”) under the symbol NPFT.OB; however, there is currently no market for our common stock, and no shares of our common stock have traded on the OTCBB to date.

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.