BARCLAYS CAPITAL HIGH YIELD BOND AND SYNDICATED LOAN CONFERENCE COMPANY PRESENTATION March 26, 2012

FORWARD LOOKING STATEMENTS 2 Certain information contained in this presentation includes “forward-looking” statements (as defined in the Private Securities Litigation Reform Act of 1995 and the federal securities law). Forward-looking statements include statements regarding our expectations, beliefs, intentions, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not statements of historical facts. These statements may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. Forward-looking statements in this presentation also include all statements regarding expected future financial position, results of operations, cash flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends and distributions, projected expenses and capital expenditures, competitive position, growth opportunities, potential acquisitions and plans and objectives of management for future operations. These statements are made as of the date hereof and are subject to known and unknown risks, uncertainties, assumptions and other factors—many of which are out of the Company’s control and difficult to forecast—that could cause actual results to differ materially from those set forth in or implied by our forward-looking statements. These risks and uncertainties include but are not limited to: our dependence on the operating success of our tenants; changes in general economic conditions and volatility in financial and credit markets; the dependence of our tenants on reimbursement from governmental and other third- party payors; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to make acquisitions, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; our ability to raise capital through equity financings; the relatively illiquid nature of real estate investments; competitive conditions in our industry; the loss of key management personnel or other employees; the impact of litigation and rising insurance costs on the business of our tenants; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance costs and liabilities; our ability to qualify and maintain our status as a REIT; compliance with REIT requirements and certain tax matters related to status as a REIT; and other factors discussed from time to time in our news releases, public statements and/or filings with the Securities and Exchange Commission (the “SEC”), especially the “Risk Factors” sections of our Annual and Quarterly Reports on Forms 10-K and 10-Q. The Company assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise required by law. TENANT INFORMATION This presentation includes information regarding Sun. Sun is subject to the reporting requirements of the SEC and is required to file with the SEC annual reports containing audited financial information and quarterly reports containing unaudited financial information. Sun’s filings with the SEC can be found at www.sec.gov. This presentation also includes information regarding each of our other tenants that lease properties from us. The information related to these tenants that is provided in this presentation has been provided by the tenants or, in the case of Sun, derived from Sun’s public filings or provided by Sun. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only.

NON-GAAP FINANCIAL MEASURES 3 This presentation includes the following financial measures defined as non-GAAP financial measures by the SEC: EBITDA, EBITDAR, EBITDARM, funds from operations (“FFO”), adjusted FFO (“AFFO”) and normalized AFFO, FFO per diluted share, AFFO per diluted share and normalized AFFO per diluted share. These measures may be different than non-GAAP financial measures used by other companies and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. Facility EBITDAR(M) is defined as earnings before interest, taxes, depreciation, amortization, rent (“EBITDAR”) and management fees (“EBITDARM”) for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. Facility EBITDAR(M) Coverage is defined as Facility EBITDAR(M) divided by the same period cash rent for a particular facility. Tenant EBITDAR is defined as Facility EBITDAR, as defined herein, plus EBITDAR for the period presented for all other operations of any entities that guarantee the tenants’ lease obligations to the Company. Tenant EBITDAR Coverage is defined as Tenant EBITDAR divided by the same period rent for all of our facilities plus rent expense for other operations of any entity that guarantees the tenant’s lease obligations to the Company. EBITDA is defined as earnings before interest, taxes, and depreciation and amortization. FFO is calculated in accordance with The National Association of Real Estate Investment Trusts’ (“NAREIT”) definition of “funds from operations,” and is defined as net income, computed in accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization. AFFO is defined as FFO excluding non-cash revenues (including straight-line rental income adjustments and amortization of acquired above/below market lease intangibles), non-cash expenses (including stock-based compensation expense and amortization of deferred financing costs), and acquisition pursuit costs. Normalized AFFO represents AFFO adjusted for one-time start-up costs and non-recurring income and expenses. Reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included under “Reconciliation of Net Income to EBITDA, Funds from Operations (FFO), Adjusted Funds from Operations (AFFO) and Normalized AFFO” in this presentation.

4 Company Update and Investment Highlights

SABRA HAS COMPETITIVE INDUSTRY PRESENCE 5 Formed by Opco / Propco split of Sun Healthcare Group Independently traded as of November 2010 (NASDAQ: SBRA) Structured as an UPREIT B+/B2 rating (S&P / Moody’s) – S&P upgrade from B on September 30, 2011 97 health care investments(1) 76 skilled nursing facilities 86 leased to Sun Presence in 23 states(1) $608.1mm equity market cap(2) $949.2mm total enterprise value(3) $211.6mm of capital invested(1)(4) $200.0mm revolver with $150.0mm accordion feature $242.3 liquidity(5) Experienced management team Rick Matros, Chairman & CEO Harold Andrews, CFO Talya Nevo-Hacohen, CIO Formation Portfolio Capitalization Management (1) As of March 1, 2012. (2) As of March 20, 2012. (3) Based on December 31, 2011 Net Debt which consists of $42.3 million cash and $383.4 million debt, and closing share price of $16.43 as of March 20, 2012. (4) Amount excludes an unfunded allowance of up to $1.6 million primarily for facility improvements in regards to the Creekside acquisition. (5) Availability under the credit facility and available liquidity were $200.0 million and $243.3 million, respectively, on a pro forma basis taking into account the amendment to the secured revolving credit facility on February 10, 2012.

OPPORTUNITY TO BE CAPITAL PROVIDER OF CHOICE Few capital providers serving the smaller operators Over 90% of senior housing facilities are owned in portfolios of less than 10 properties(1) Larger health care REITs have made transformational deals and grown significantly Limited debt sources for Sabra deal size candidates Experience provides ability to navigate uncertainty surrounding government reimbursement (Medicare and Medicaid) Opportunities for quality, accretive acquisitions 6 (1) Source: NIC MAP Q3 2011 Ownership Summary for MAP 100 as of Q3 2011. Statistic includes assisted living, independent living and nursing care facilities. Be the capital provider of choice to local and regional operators of health care facilities

SABRA CAPITALIZES ON OPPORTUNITY 7 Focused Tactics Execution Diversification from original tenant Exposure to diverse property types within health care sector Increased AFFO Lower cost of capital Sale/ leaseback transactions Focus on deals < $100 mm Triple-net lease structure Broad spectrum of properties: senior housing, skilled nursing facilities and hospitals Focused Tactics Execution

ACQUISITIONS YIELD DIVERSIFICATION Strong acquisition activity since inception with approximately $211.6 million(1) of capital invested through December 31, 2011 6 new operator relationships 11 new assets in 4 new states (9 SNFs, 1 AL and 1 Hospital) Steady pipeline across spectrum of health care real estate 8 Sabra formed with 86 properties in 19 states Sabra closes multiple acquisitions: Hillside Terrace Mortgage Note for $5.3mm(2) TRMC for $62.7mm Oak Brook for $11.3mm Sabra decreases exposure to Sun through acquisitions: Cadia Portfolio for $97.5mm Aurora Portfolio for $18.0mm Encore Portfolio for $14.2mm Creekside Senior Living for $2.6mm(1) Q4 2010 Q1 & Q2 2011 Q3 & Q4 2011 Q1 2012 Sabra begins 2012 with a strong acquisition potential 97 investments in 23 states $350mm pipeline (as of March 1, 2012) (1) Amount excludes an unfunded allowance of up to $1.6 million primarily for facility improvements in regards to the Creekside acquisition. (2) On December 5, 2011, the Hillside Terrace Mortgage Note was repaid in full at $8.3 million.

Encore Portfolio (Closed November 1, 2011) - Texas 9 Purchase Price: $14.2mm Number of Properties: 2 Windcrest Alzheimer’s Care Center Wesley Woods Alzheimer’s Care Center Investment Type: Equity Property Type: SNF Available Beds: 240 combined Facility Ages: 7-12 years Annualized GAAP Rental Income: $1.7mm Initial Cash Yield: 9.40% Purchase Price: $18.0mm Number of Properties: 2 Manokin Manor Nursing & Rehabilitation Center Honey Hill Care Center Investment Type: Equity Available Beds: 285 combined Property Type: SNF Facility Ages: 19-25 years Annualized GAAP Rental Income: $2.2mm Initial Cash Yield: 10.61% Aurora Portfolio (Closed September 30, 2011) – Connecticut & Maryland RECENT INVESTMENT HIGHLIGHTS Purchase Price: $4.2mm (1) Investment Type: Equity Property Type: AL Available Units: 59 Facility Age: 8 years Annualized GAAP Rental Income: $0.3 - $0.4mm (1) Initial Cash Yield: 9.25% * Creekside Senior Living (Closed November 22, 2011) - Wisconsin * * 1 1 (1)Amount includes an unfunded allowance of up to $1.6 million primarily for facility improvements. The annual GAAP revenue will range from $0.3 to $0.4 million depending on the amount and timing of the allowance.

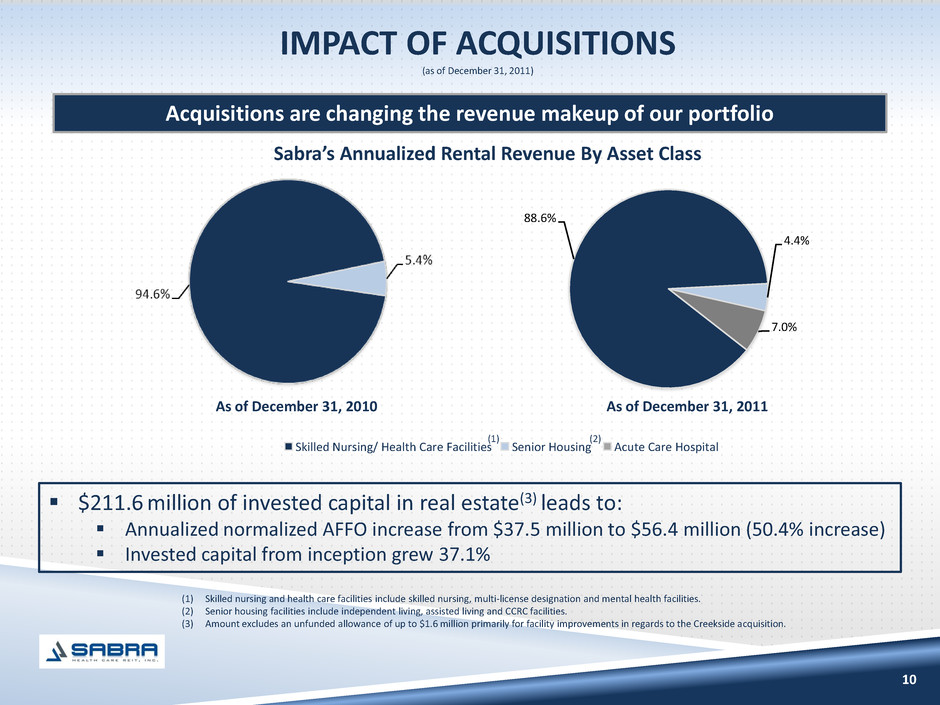

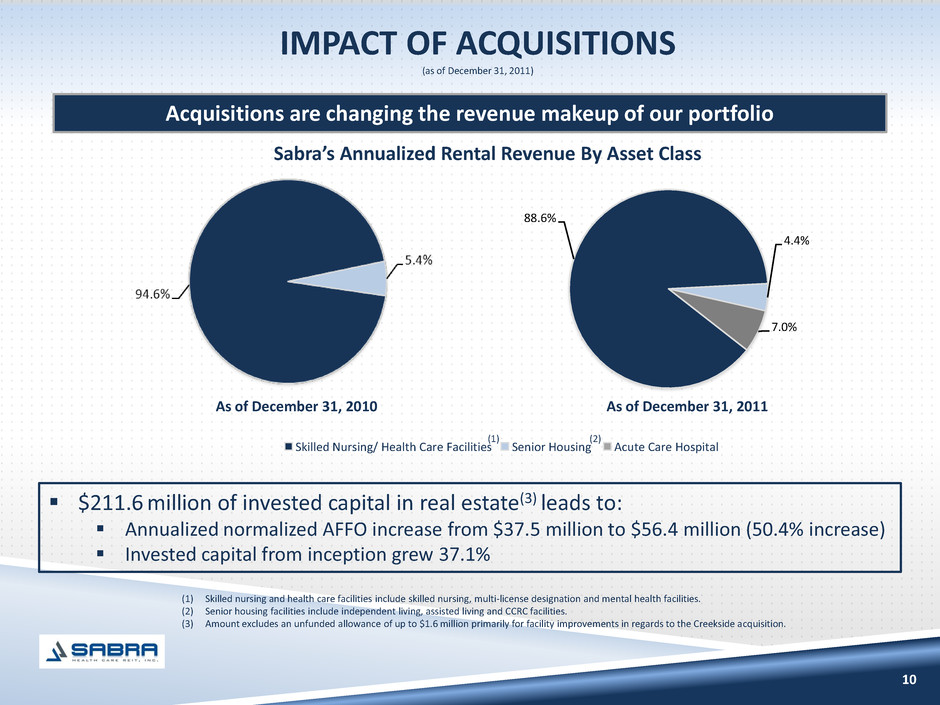

10 88.6% 4.4% 7.0% As of December 31, 2010 As of December 31, 2011 Acquisitions are changing the revenue makeup of our portfolio (1) Skilled nursing and health care facilities include skilled nursing, multi-license designation and mental health facilities. (2) Senior housing facilities include independent living, assisted living and CCRC facilities. (3) Amount excludes an unfunded allowance of up to $1.6 million primarily for facility improvements in regards to the Creekside acquisition. Sabra’s Annualized Rental Revenue By Asset Class $211.6 million of invested capital in real estate(3) leads to: Annualized normalized AFFO increase from $37.5 million to $56.4 million (50.4% increase) Invested capital from inception grew 37.1% IMPACT OF ACQUISITIONS (as of December 31, 2011) Skilled Nursing/ Health Care Facilities Senior Housing Acute Care Hospital (1) (2)

11 Sun 100.0% Sun 76.1% Texas Regional Medical Center 7.0% Cadia Portfolio 11.2% Aurora Portfolio 2.4% Other 3.3% As of December 31, 2010 As of December 31, 2011 Acquisitions are changing the revenue makeup of our portfolio Sabra’s Annualized Rental Revenue By Tenant IMPACT OF ACQUISITIONS Future acquisitions of $150 - $200 million at a GAAP yield of 10.0% could reduce the Sun concentration to 65.7% - 62.8%.

12 Sabra’s Portfolio & Primary Tenant

13 90.1% 88.2% 87.7% 88.2% 87.4% 20% 40% 60% 80% 100% 2009 2010 2011 Q4 2010 Q4 2011 90.0% 88.2% 87.5% 88.2% 87.3% 20% 40% 60% 80% 100% 2009 2010 2011 Q4 2010 Q4 2011 89.0% 87.3% 87.7% 88.1% 88.4% 20% 40% 60% 80% 100% 2009 2010 2011 Q4 2010 Q4 2011 39.2% 39.3% 41.4% 39.0% 39.5% 10% 20% 30% 40% 50% 2009 2010 2011 Q4 2010 Q4 2011 Historical skilled nursing/ health care facilities occupancy (1) Historical overall occupancy Historical senior housing occupancy (2) Historical SNF portfolio skilled mix (3) Strong occupancy and skilled mix trends in Sabra’s portfolio STRONG PORTFOLIO PERFORMANCE (as of December 31, 2011) (1) Skilled nursing and health care facilities consists of skilled nursing, multi-license designation and mental health facilities, which total 88 properties. (2) Senior housing facilities consists of independent living, assisted living and CCRC facilities, which total 8 properties. (3) Skilled mix is defined as the total Medicare and non-Medicaid managed care patient revenues divided by the total skilled nursing revenues of our properties for any given period.

PROPERTY DIVERSIFICATION (as of March 1, 2012) 1 1 1 1 3 2 2 1 4 3 1 1 5 2 1 1 2 2 11 2 1 8 5 2 8 3 2 9 1 1 States with existing facilities (Equity investments – 97 total) CCRC (total: 1) Multi-Licensed Designation (total: 10) Mental Health (total: 2) Assisted Living (total: 6) Skilled Nursing (total: 76) Independent Living (total: 1) Key real estate portfolio information Investments: Skilled Nursing Multi-License Designation Assisted Living Mental Health Independent Living CCRC Acute Care Hospital 76 10 6 2 1 1 1 TOTAL Investments 97 Bed/ Unit Count: Skilled Nursing Assisted Living Independent Living Mental Health Acute Care Hospital 9,633 971 121 82 70 TOTAL Beds/ Units 10,877 Geographically diversified portfolio of skilled nursing and senior housing assets 3 1 Acute Care Hospital (total: 1) 4 1 14 1

GEOGRAPHICALLY DIVERSE PORTFOLIO New Hampshire Connecticut Kentucky Ohio Florida Texas Montana Delaware Other States 97 equity investments in 23 states $94.6 mm annualized rental revenue 13.8% 12.5% 10.5% 5.5% 8.3% 10.1% 22.6% Properties/ facilities by state 5.5% New Hampshire Connecticut Kentucky Ohio Florida Texas Montana Delware Oklahoma Other States 15.5% 11.3% 15.5% 8.2% 5.2% 26.8% 4.1% 5.2% 4.1% 11.2% 15 Annualized rental revenue by state 4.1% (as of March 1, 2012) Highest geographic concentration of revenues (in New Hampshire) declined from 18.1% at December 31, 2010 to 13.8% at March 1, 2012.

16 LEASE STRUCTURE SUMMARY Triple Net Master lease cross defaulted Maturities Escalators Renewal Options Minimum Cap Ex Purchase Option Guarantee Sun 2020-2025 Lessor of CPI or 2.5% annually (2) 5 yr. renewal options NO TRMC N/A 2034 6.0% every 5 yrs. (2) 5 yr. renewal options Good Repair NO Oak Brook N/A 2026 2.5% annually (3) 10 yr. renewal options NO NO Cadia Portfolio 2026 3.0% annually (2) 5 yr. renewal options NO NO Aurora Portfolio 2026 2.79% annually commencing on the first day of the 3rd lease yr. (2) 5 yr. renewal options NO Encore Portfolio 2026 Greater of CPI or 3.0% annually (2) 5 yr. renewal options YES (shared upside) NO Creekside N/A 2021 Greater of CPI or 3.0% annually (2) 5 yr. renewal options YES (shared upside) NO

RENT COVERAGE ANALYSIS 17 (1) All coverages calculated one month in arrears. (2) Sun’s Tenant EBITDAR Coverage for the three months and year ending December 31, 2011 was 1.53x and 1.70x respectively. On January 4, 2012, Sun issued a press release announcing its 2012 financial outlook and guidance, in which Sun stated that it expected the net impact of the final rule in 2012 to be between $40 million to $45 million after mitigation strategies were implemented to partially offset the impact of the CMS final rule. Based on Sun’s expected 2012 consolidated EBITDAR (earnings before interest, taxes, depreciation, amortization and rent) of between $222.0 and $228.0 million and expected consolidated rents across all of its facilities totaling $148.0 million, Sun’s expected 2012 consolidated EBITDAR coverage (Tenant EBITDAR Coverage) would be between 1.50x and 1.54x (Sun’s expected 2012 EBITDAR coverage would be between 1.46x and 1.50x before eliminating assets Sun expects to transition to held for sale status in 2012). In addition to Sun, other tenants have undertaken cost and patient mix mitigation activities intended to partially offset the impact of the CMS final rule. (3) Facility EBITDARM, Facility EBITDAR and Tenant EBITDAR coverages for facilities with new tenants/ operators (Aurora, Encore, and Creekside) are only included in the periods subsequent to our acquisition of the facilities. (4) Skilled nursing and health care facilities consists of skilled nursing, multi-license designation and mental health facilities, which total 88 properties. (5) Senior housing facilities consists of independent living, assisted living and CCRC facilities, which total 8 properties. Three Months Ended December 31, 2011(1) Year Ended December 31, 2011(1) Facility Type Facility EBITDARM Coverage Facility EBITDAR Coverage Tenant EBITDAR Coverage(2) Facility EBITDARM Coverage Facility EBITDAR Coverage Tenant EBITDAR Coverage(2) Skilled Nursing/ Health Care Facilities (3)(4) 1.76x 1.27x 1.53x 1.96x 1.45x 1.70x Senior Housing (3)(5) 1.85x 1.53x 1.51x 1.83x 1.50x 1.69x Acute Care Hospital 2.99x 2.92x 2.92x 3.10x 2.99x 2.99x Total 1.85x 1.39x 1.62x 2.03x 1.56x 1.78x

PRIMARY TENANT OVERVIEW (as of December 31, 2011) States with facilities Number of facilities per state Key Sun portfolio information Number of Centers: 199 Property Type: Skilled Nursing Multi-License Designation Assisted Living Mental Health Independent Living 165 (83%) 14 (7%) 10 (5%) 8 (4%) 2 (1%) Beds: Licensed Available 22,860 22,045 States: 25 Year ended 12/31/2011: Adjusted EBITDAR (mm)(1) Margin SNF Skilled Mix %(2) Occupancy % $243.4 12.6% 39.8% 86.5% Facilities with Specialty Units: RRS Beds (3) 2308 11 15 9 9 5 7 9 9 8 8 20 7 2 17 15 18 2 10 Sun operates 199 inpatient centers in 25 states (1) Sun defines Adjusted EBITDAR as earnings before loss on discontinued operations, income taxes, interest, net, depreciation and amortization and center rent expense (“EBITDAR”) before loss on extinguishment of debt, loss on sale of assets, restructuring costs and loss on asset impairment. (2) Skilled mix is defined as the total Medicare and non-Medicaid managed care patient revenues divided by the total skilled nursing revenues for any given period. (3) As of December 31, 2011. 5 1 1 1 7 2 1 18

SUN PROFILE AND STATISTICS 19 $117.9 million of liquidity as of December 31, 2011(4) 0.34x Net Debt-to-Adjusted EBITDA ratio(5) Amended Term Loan covenants to ease interest coverage and leverage covenants (1) For the quarter ended December 31, 2011. (2) Sun defines Adjusted EBITDAR as earnings before loss on discontinued operations, income taxes, interest, net, depreciation and amortization and center rent expense (“EBITDAR”) before loss on sale of assets, restructuring costs and loss on asset impairment. (3) Net free cash flow for Sun is defined as net operating cash flow less capital expenditures. (4) Includes $60.0 million available under Sun’s revolving credit facility. (5) Based on net debt as of December 31, 2011 and annualized adjusted EBITDA for the year ended December 31, 2011. Strong Operating Performance $472.9 million in Revenue(1) $48.2 million in Adjusted EBITDAR(1)(2) $33.7 million net operating cash flow(1) $21.9 million net free cash flow (1)(3) Corporate guarantee across diverse health care services Sun Healthcare Group, SunBridge Healthcare, CareerStaff, SolAmor Hospice, SunDance Rehabilitation Attractive business profile Operating statistics Transparency and visibility Balance sheet statistics Public entity Sabra management team has substantial experience with Sun’s operations

20 Financial Overview

FINANCIAL POLICIES $0.32 per share paid Q2, Q3 and Q4 of 2011 $0.33 per share announced Q1 2012 Target of 80% AFFO (dividends for Q1, Q2 and Q3 higher due to acquisition timing and increase in shares from equity offering) 21 Dividend Acquisitions and Investments Continued focus on triple-net lease structure in near term Strategic development programs and mezzanine debt considered in near term Consideration of other investment structures over long term (JV and TRS) Liquidity Liquidity as of December 31, 2011 of $142.3 million (1) Capital Structure Balanced financing of growth primarily through equity and unsecured debt On February 10, 2012 increased revolver to $200 million with $150 million accordion feature and reduced pricing by as much as 225 bps compared to old revolver Opportunistically seek access to US government agency debt Target leverage: 4.5x-5.5x to fund continue growth strategy (1) Pro Forma liquidity as of December 31, 2011 would be $242.3 million. Pro Forma liquidity consists of unrestricted cash and cash equivalents as of December 31, 2011 of $42.3 million and available borrowings (as of February 10, 2012) of $200.0 million under our amended secured revolving credit facility.

FINANCIAL HIGHLIGHTS 22 Income statement and other data Revenues $ 26.3 $ 26.5 $ 84.2 $ 96.5 G&A costs 4.2 4.2 14.5 14.5 EBITDA 22.1 22.3 69.8 82.2 Net income 7.2 7.3 12.8 21.9 FFO 14.5 14.7 39.4 51.8 AFFO 15.3 15.8 47.2 57.7 Normalized AFFO 13.7 14.2 45.9 56.4 Per share data: Diluted EPS $ 0.19 $ 0.20 $ 0.43 $ 0.59 Diluted FFO 0.39 0.40 1.31 1.40 Diluted AFFO 0.41 0.43 1.55 1.55 Diluted Normalized AFFO 0.37 0.38 1.51 1.52 (1) Pro forma assumes the acquisitions of Texas Regional Medical Center at Sunnyvale, Oak Brook Health Care Center, the Cadia Portfolio, the Aurora Portfolio, the Encore Portfolio and Creekside Senior Living, as well as the offering of 11.7 million shares of common stock that closed in August 2011, were completed as of January 1, 2011. Pro Forma (1) (dol lars in mi l l ions , except per share data) Actual Pro Forma (1) Actual For Three Months Ended December 31, 2011 Year Ended December 31, 2011

FINANCIAL HIGHLIGHTS 23 Balance sheet and other data (as of December 31, 2011) Cash $ 42.3 Real Estate, Gross Book Value 767.1 Real Estate, Asset Value (2) 926.8 Total Debt 383.4 Total Equity 326.6 Capitalization 446.0 Liquidity 142.3 Debt Covenants (3) MAX Actual Incurrence: Total Debt/ Asset Value 60% 39% 39% Secured Debt/ Asset Value 40% 16% 16% Minimum Interest Coverage 2.00x 3.17x 3.17x Maintenance: Consolidated Leverage Ratio 5.75x 4.26x 4.26x Consolidated Fixed Charge Coverage Ratio 1.75x 2.87x 2.87x Consolidated Tangible Net Worth $ 300.2 $ 425.9 $ 425.9 Unencumbered Assets/ Unsecured Debt 150% 227% 175% (dollars in millions) Pro Forma (1) (1) The Pro Forma debt covenants are based on the covenants under the amended secured revolving credit facility. (2) Real Estate Asset Value for Sun properties based on a cap rate of 9.75%. (3) All covenants are based on terms defined in the amended credit agreement and unsecured senior notes indenture. Asset Value and Unencumbered Assets used for debt covenant calculation purposes include a value for the initial real estate portfolio obtained in the separation from Sun, which is calculated by dividing the total initial annual rental revenue from this portfolio by an assumed 9.75% capitalization rate. This results in an assumed total portfolio value for the initial real estate portfolio of $720 million. Actual MIN

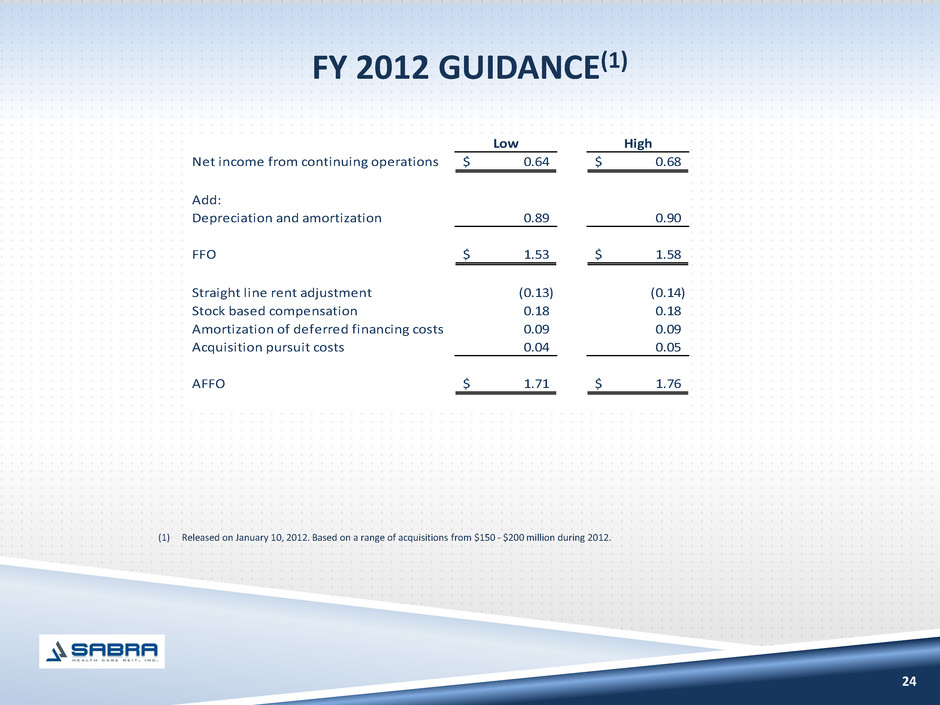

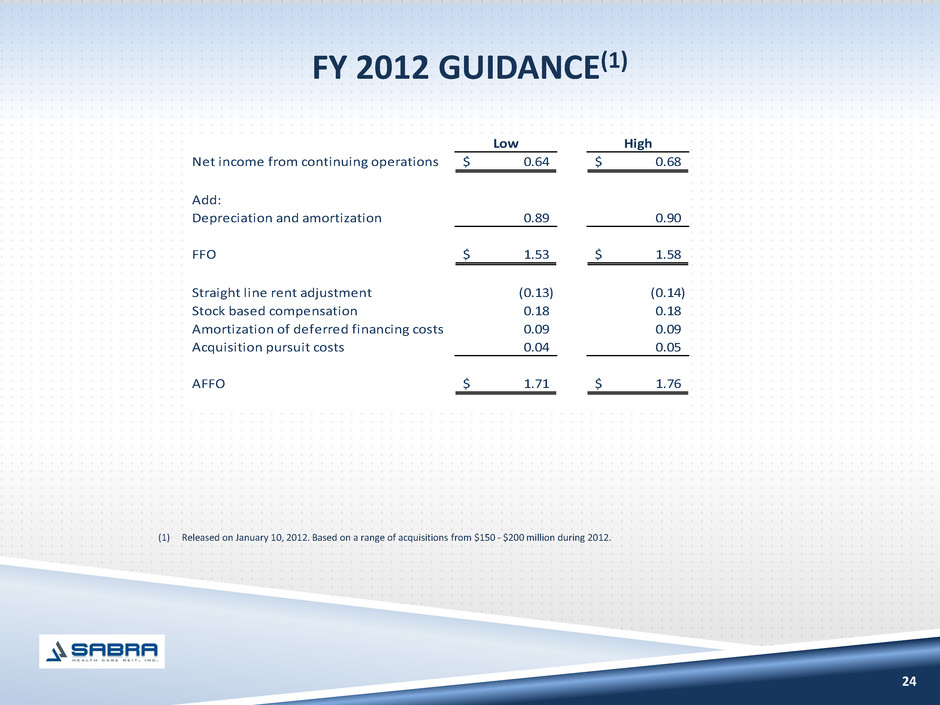

FY 2012 GUIDANCE(1) 24 Low High Net income from continuing operations 0.64$ 0.68$ Add: Depreciation and amortization 0.89 0.90 FFO 1.53$ 1.58$ Straight line rent adjustment (0.13) (0.14) Stock based compensation 0.18 0.18 Amortization of deferred financing costs 0.09 0.09 Acquisition pursuit costs 0.04 0.05 AFFO 1.71$ 1.76$ (1) Released on January 10, 2012. Based on a range of acquisitions from $150 - $200 million during 2012.

25 $3.2 $3.4 $3.6 $86.0 $1.7 $1.8 $1.9 $2.1 $2.2 $2.4 $49.5 $200.0 $0 $50 $100 $150 $200 $250 Mortgage Notes Revolver Senior Unsecured Notes $225.0 Minimal near-term debt maturities PRO FORMA DEBT MATURITY SCHEDULE Weighted Average Cost of Debt(1): 7.25% (before utilization of revolver) (1) 5.99% weighted average interest rate on mortgage debt and 8.13% on Unsecured Senior Notes. (2) $200.0 million available. None outstanding as of March 1, 2012 and assumes exercise of one year extension option. (dollars in millions) (2)

26 Geographically Diverse Portfolio Attractive Industry Fundamentals Favorable Long-Term Lease Structure Strong Lease Coverage Strong Asset Coverage Financially Secure Primary Tenant Growth Opportunities Experienced Management Team

27 Reconciliation of Net Income to EBITDA, Funds from Operations (FFO), Adjusted Funds from Operations (AFFO) and Normalized AFFO Actual Pro Forma (1) Net income $ 7.2 $ 7.3 $ 12.8 $ 21.9 Interest expense 7.6 7.6 30.4 30.4 Depreciation and amortization 7.3 7.4 26.6 29.9 EBITDA $ 22.1 $ 22.3 $ 69.8 $ 82.2 Net income $ 7.2 $ 7.3 $ 12.8 $ 21.9 Depreciation and amortization of real estate assets 7.3 7.4 26.6 29.9 Funds from Operations (FFO) $ 14.5 $ 14.7 $ 39.4 $ 51.8 Straight-line rental income adjustments (1.4) (1.1) (2.1) (4.0) Acquisition pursuit costs 0.3 0.3 3.3 3.3 Stock-based compensation expense 1.4 1.4 4.6 4.6 Amortization of deferred financing costs 0.5 0.5 2.0 2.0 Adjusted Funds from Operations (AFFO) $ 15.3 $ 15.8 $ 47.2 $ 57.7 Start-up costs - - 0.3 0.3 Hillside Terrace interest income, net of expense (1.6) (1.6) (1.6) (1.6) Normalized AFFO $ 13.7 $ 14.2 $ 45.9 $ 56.4 (1) Pro forma assumes the acquis i tions of Texas Regional Medica l Center at Sunnyvale, Oak Brook Health Care Center, the Cadia Portfol io, the Aurora Portfol io, the Encore Portfol io and Creeks ide Senior Living, as wel l as the offering of 11.7 mi l l ion shares of common stock that closed in August 2011, were completed as of January 1, 2011. Pro Forma (1) (dol lars in mi l l ions) Actual Three Months Ended December 31, 2011 Year Ended December 31, 2011