Exhibit 99.2

Supplemental Information

December 31, 2012

(Unaudited)

Disclaimer

Certain statements in this supplement contain “forward-looking” information as that term is defined by the Private Securities Litigation Reform Act of 1995 and the federal securities laws. Any statements that do not relate to historical or current facts or matters are forward-looking statements. Examples of forward-looking statements include all statements regarding our expected future financial position, results of operations, cash flows, liquidity, business strategy, growth opportunities, potential acquisitions, and plans and objectives for future operations. You can identify some of the forward-looking statements by the use of forward-looking words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “should,” “may” and other similar expressions, although not all forward-looking statements contain these identifying words.

Our actual results may differ materially from those projected or contemplated by our forward-looking statements as a result of various factors, including, among others, the following: our dependence on Genesis HealthCare LLC (“Genesis”), the parent company of Sun Healthcare Group, Inc., until we are able to further diversify our portfolio; our dependence on the operating success of our tenants; changes in general economic conditions and volatility in financial and credit markets; the dependence of our tenants on reimbursement from governmental and other third-party payors; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to make acquisitions, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; our ability to raise capital through equity financings; the relatively illiquid nature of real estate investments; competitive conditions in our industry; the loss of key management personnel or other employees; the impact of litigation and rising insurance costs on the business of our tenants; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance costs and liabilities; our ability to maintain our status as a REIT; compliance with REIT requirements and certain tax matters related to our status as a REIT; and other factors discussed from time to time in our news releases, public statements and/or filings with the Securities and Exchange Commission (the “SEC”), especially the “Risk Factors” sections of our Annual and Quarterly Reports on Forms 10-K and 10-Q. We do not intend, and we undertake no obligation, to update any forward-looking information to reflect events or circumstances after the date of this supplement or to reflect the occurrence of unanticipated events, unless required by law to do so.

Note Regarding Non-GAAP Financial Measures

This supplement includes the following financial measures defined as non-GAAP financial measures by the SEC: EBITDA, funds from operations (“FFO”), Adjusted FFO (“AFFO”), Normalized AFFO, FFO per diluted share, AFFO per diluted share and Normalized AFFO per diluted share. These measures may be different than non-GAAP financial measures used by other companies, and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. An explanation of these non-GAAP financial measures is included under “Reporting Definitions” in this supplement and reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included under “Reconciliations of Net Income to EBITDA, Funds from Operations (FFO), Adjusted Funds from Operations (AFFO) and Normalized AFFO” in this supplement.

Tenant Information

This supplement includes information regarding each of our tenants that lease properties from us. The information related to these tenants that is provided in this supplement has been provided by the tenants. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only.

Table of Contents

|

| |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| Portfolio Geographic Concentrations | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| Recent Acquisition Activity | |

| | |

| |

| | |

| |

| | |

| |

Company Information

Board of Directors

|

| | |

| | | |

Richard K. Matros Chairman of the Board, President and Chief Executive Officer Sabra Health Care REIT, Inc. | | Michael J. Foster Managing Director RFE Management Corp. |

| | |

Milton J. Walters President Tri-River Capital | | Robert A. Ettl Chief Operating Officer Harvard Management Company |

| | |

Craig A. Barbarosh Partner Katten Muchin Rosenman LLP | | |

Senior Management

|

| | |

| | | |

Richard K. Matros Chairman of the Board, President and Chief Executive Officer | | Harold W. Andrews, Jr. Executive Vice President, Chief Financial Officer and Secretary |

| | |

Talya Nevo-Hacohen Executive Vice President, Chief Investment Officer and Treasurer | | |

Other Information

|

| | |

| | | |

Corporate Headquarters 18500 Von Karman Avenue, Suite 550 Irvine, CA 92612 | | Transfer Agent American Stock Transfer and Trust Company 6201 15th Avenue Brooklyn, NY 11219 |

www.sabrahealth.com

The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the SEC. The Reporting Definitions and Reconciliations of Non-GAAP Measures are an integral part of the information presented herein.

On Sabra's website, www.sabrahealth.com, you can access, free of charge, Sabra’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material is filed with, or furnished to, the SEC. The information contained on Sabra’s website is not incorporated by reference into, and should not be considered a part of, this supplemental information package. All material filed with the SEC can also be accessed through their website, www.sec.gov.

For more information, contact Harold W. Andrews, Jr., Executive Vice President, Chief Financial Officer and Secretary at

(949) 679-0243.

SABRA HEALTH CARE REIT, INC.

COMPANY FACT SHEET

Company Profile

Sabra Health Care REIT, Inc., a Maryland corporation (“Sabra,” the “Company” or “we”), operates as a self-administered, self-managed real estate investment trust (“REIT”) that, through its subsidiaries, owns and invests in real estate serving the healthcare industry. Sabra primarily generates revenues by leasing properties to tenants and operators throughout the United States.

As of December 31, 2012, Sabra's portfolio included 119 real estate properties held for investment and leased to operators/tenants under triple-net lease agreements (consisting of (i) 96 skilled nursing/post-acute facilities, (ii) 22 senior housing facilities, and (iii) one acute care hospital), one asset held for sale and two mortgage loans. As of December 31, 2012, Sabra's real estate properties held for investment had a total of 12,382 licensed beds, or units, spread across 27 states.

Objectives and Strategies

Sabra expects to continue to grow its portfolio primarily through the acquisition of senior housing and memory care facilities and with a secondary focus on acquiring skilled nursing facilities. Sabra also expects to continue to originate financing secured directly or indirectly by healthcare facilities. As Sabra acquires additional properties and expands its portfolio, Sabra expects to further diversify by tenant, asset class and geography within the healthcare sector. Sabra employs a disciplined, opportunistic approach in its healthcare real estate investment strategy by investing in assets that provide attractive opportunities for dividend growth and appreciation of asset values, while maintaining balance sheet strength and liquidity, thereby creating long-term stockholder value.

|

| | | | |

| Market Facts (as of December 31, 2012) | Portfolio Information (as of December 31, 2012) |

| Stock Information | | Investments | |

| Closing Price: | $21.72 | Equity Investments | |

| 52-week range: | $11.91 - $22.86 | Skilled Nursing/Post-Acute | 96 |

|

| Market Capitalization: | $805.8 million | Senior Housing | 22 |

|

| Enterprise Value: | $1.4 billion | Acute Care Hospital | 1 |

|

| Outstanding Shares: | 37.1 million | | 119 |

|

| Ticker symbol: | SBRA | Debt Investments | 2 |

|

| Stock Exchange: | NASDAQ | Assets Held for Sale | 1 |

|

| | | Total Investments | 122 |

|

| | | | |

| Credit Ratings | | Bed/Unit Count (Held for Investment) | |

| Moody's: | B1 (stable) | Skilled Nursing/Post-Acute | 10,826 |

|

| S&P: | | Senior Housing | 1,486 |

|

| Corporate Rating | B+ (stable) | Acute Care Hospital | 70 |

|

| Senior Notes Rating | BB- | Total Beds/Units | 12,382 |

|

|

| | |

| See reporting definitions. | 2 |

SABRA HEALTH CARE REIT, INC.

FINANCIAL HIGHLIGHTS

(dollars in thousands, except per share amounts) |

| | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2012 | | 2011 | | 2012 | | 2011 |

| Revenues | $ | 28,288 |

| | $ | 26,349 |

| | $ | 103,170 |

| | $ | 84,225 |

|

| EBITDA | $ | 23,487 |

| | $ | 22,120 |

| | $ | 86,781 |

| | $ | 69,752 |

|

| Net income | $ | 3,959 |

| | $ | 7,163 |

| | $ | 19,513 |

| | $ | 12,842 |

|

| FFO | $ | 14,347 |

| | $ | 14,528 |

| | $ | 52,257 |

| | $ | 39,433 |

|

| AFFO | $ | 15,759 |

| | $ | 15,259 |

| | $ | 60,287 |

| | $ | 47,142 |

|

| Normalized AFFO | $ | 15,606 |

| | $ | 13,665 |

| | $ | 60,134 |

| | $ | 45,858 |

|

| Per share data: | | | | | | | |

| Diluted EPS | $ | 0.11 |

| | $ | 0.19 |

| | $ | 0.52 |

| | $ | 0.43 |

|

| Diluted FFO | $ | 0.38 |

| | $ | 0.39 |

| | $ | 1.40 |

| | $ | 1.31 |

|

| Diluted AFFO | $ | 0.42 |

| | $ | 0.41 |

| | $ | 1.59 |

| | $ | 1.55 |

|

| Diluted Normalized AFFO | $ | 0.41 |

| | $ | 0.37 |

| | $ | 1.59 |

| | $ | 1.51 |

|

| Weighted-average number of common shares outstanding, diluted: | | | | | | | |

| EPS & FFO | 37,594,583 |

| | 37,052,574 |

| | 37,321,517 |

| | 30,171,225 |

|

| AFFO & Normalized AFFO | 37,917,964 |

| | 37,248,402 |

| | 37,829,421 |

| | 30,399,132 |

|

| | | | | | | | |

| Net cash flow from operations | $ | 8,350 |

| | $ | 10,196 |

| | $ | 56,252 |

| | $ | 44,705 |

|

| | | | | | |

| | December 31, 2012 | | December 31, 2011 | | | | |

| Real Estate Portfolio | | | | | | | |

| Total Equity Investments (#) | 119 |

| | 96 |

| | | | |

| Total Equity Investments, gross ($) | $ | 956,360 |

| | $ | 760,469 |

| | | | |

| Total Licensed Beds/Units | 12,382 |

| | 10,701 |

| | | | |

| Weighted Average Remaining Lease Term (in months) | 132 |

| | 144 |

| | | | |

| Total Assets Held for Sale (#) | 1 |

| | 1 |

| | | | |

| Total Assets Held for Sale, gross ($) | $ | 2,208 |

| | $ | 6,585 |

| | | | |

| Total Debt Investments (#) | 2 |

| | — |

| | | | |

Total Debt Investments, gross ($) (1) | $ | 12,022 |

| | $ | — |

| | | | |

| | | | | | |

| | Three Months Ended December 31, 2012 | | Twelve Months Ended December 31, 2012 | | | | |

EBITDARM Coverage (2) | 1.83x |

| | 1.77x |

| | | | |

EBITDAR Coverage (2) | 1.60x |

| | 1.50x |

| | | | |

| | | | | | | | |

| | December 31, 2012 | | December 31, 2011 | | | | |

| Debt | | | | | | | |

| Book Value | | | | | | | |

| Fixed Rate Debt | $ | 425,039 |

| | $ | 319,783 |

| | | | |

| Variable Rate Debt | 150,449 |

| | 59,159 |

| | | | |

| Total Debt | $ | 575,488 |

| | $ | 378,942 |

| | | | |

| Weighted Average Effective Rate | | | | | | | |

| Fixed Rate Debt | 7.01 | % | | 7.55 | % | | | | |

| Variable Rate Debt | 4.21 | % | | 5.50 | % | | | | |

| Total Debt | 6.28 | % | | 7.24 | % | | | | |

| | | | | | | | |

| % of Total | | | | | | | |

| Fixed Rate Debt | 73.9 | % | | 84.6 | % | | | | |

| Variable Rate Debt | 26.1 | % | | 15.4 | % | | | | |

| Total Debt | 100.0 | % | | 100.0 | % | | | | |

| | | | | | | | |

| Availability Under Credit Facility: | $ | 109,130 |

| | $ | 100,000 |

| | | | |

| Available Liquidity (Unrestricted Cash and Availability Under Credit Facility) | $ | 126,231 |

| | $ | 142,250 |

| | | | |

(1) Total Debt Investments, gross consists of principal of $12.0 million plus capitalized origination fees of $0.1 million.

(2) EBITDARM and EBITDAR and related coverages for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities and exclude the impact of strategic disposition candidates and facilities held for sale. All facility financial performance data are presented one month in arrears.

|

| | |

| See reporting definitions. | 3 |

SABRA HEALTH CARE REIT, INC.

2013 OUTLOOK

|

| | | | | | | |

| | | Low | High |

| Net income | | $ | 1.03 |

| $ | 1.07 |

|

| Add: | | | |

| Depreciation and amortization of real estate assets | | 0.82 |

| 0.82 |

|

| | | | |

| Funds from Operations (FFO) | | $ | 1.85 |

| $ | 1.89 |

|

| | | | |

| Acquisition pursuit costs | | 0.04 |

| 0.04 |

|

| Stock-based compensation expense | | 0.11 |

| 0.11 |

|

| Straight-line rental income adjustments | | (0.32 | ) | (0.32 | ) |

| Amortization of deferred financing costs | | 0.08 |

| 0.08 |

|

| Amortization of debt premium | | (0.02 | ) | (0.02 | ) |

| | | | |

| Adjusted Funds from Operations (AFFO) | | $ | 1.74 |

| $ | 1.78 |

|

| | | | |

The Company's guidance excludes the impact of investments that may be made during 2013. The Company does, however, expect to make investments of between $150.0 million and $200.0 million during 2013, with a significant portion closing in the latter part of the year and with a continued focus on senior housing and memory care facilities. Investments in 2013 are expected to be funded with existing cash, borrowings available under the secured revolving credit facility or the proceeds from additional issuances of common stock (through an At-the-Market common equity offering program or through other equity issuances), debt or other securities.

Except as otherwise noted above, the foregoing projections reflect management's view of current and future market conditions. There can be no assurance that the Company's actual results will not differ materially from the estimates set forth above. Except as otherwise required by law, the Company assumes no, and hereby disclaims any, obligation to update any of the foregoing projections as a result of new information or new or future developments.

|

| | |

| See reporting definitions. | 4 |

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| Revenues: | | | | | | | | |

| Rental income | | $ | 27,838 |

| | $ | 23,195 |

| | $ | 101,742 |

| | $ | 80,678 |

|

| Interest income | | 450 |

| | 3,154 |

| | 1,428 |

| | 3,547 |

|

| | | | | | | | | |

| Total revenues | | 28,288 |

| | 26,349 |

| | 103,170 |

| | 84,225 |

|

| | | | | | | | | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Depreciation and amortization | | 7,907 |

| | 7,365 |

| | 30,263 |

| | 26,591 |

|

| Interest | | 11,621 |

| | 7,592 |

| | 37,005 |

| | 30,319 |

|

| General and administrative | | 4,516 |

| | 4,229 |

| | 16,104 |

| | 14,473 |

|

| Impairment | | 2,481 |

| | — |

| | 2,481 |

| | — |

|

| | | | | | | | | |

| Total expenses | | 26,525 |

| | 19,186 |

| | 85,853 |

| | 71,383 |

|

| | | | | | | | | |

| Other income | | 2,196 |

| | — |

| | 2,196 |

| | — |

|

| | | | | | | | | |

| Net income | | $ | 3,959 |

| | $ | 7,163 |

| | $ | 19,513 |

| | $ | 12,842 |

|

| | | | | | | | | |

| Net income per common share, basic | | $ | 0.11 |

| | $ | 0.19 |

| | $ | 0.53 |

| | $ | 0.43 |

|

| | | | | | | | | |

| Net income per common share, diluted | | $ | 0.11 |

| | $ | 0.19 |

| | $ | 0.52 |

| | $ | 0.43 |

|

| | | | | | | | | |

| Weighted-average number of common shares outstanding, basic | | 37,106,473 |

| | 36,965,431 |

| | 37,061,111 |

| | 30,109,417 |

|

| | | | | | | | | |

| Weighted-average number of common shares outstanding, diluted | | 37,594,583 |

| | 37,052,574 |

| | 37,321,517 |

| | 30,171,225 |

|

| | | | | | | | | |

|

| | |

| See reporting definitions. | 5 |

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share amounts)

|

| | | | | | | |

| | December 31, |

| | 2012 | | 2011 |

| | | | |

| Assets | | | |

| Real estate investments, net of accumulated depreciation of $129,479 and $107,331 as of December 31, 2012 and 2011, respectively | $ | 827,135 |

| | $ | 653,377 |

|

| Loans receivable, net | 12,017 |

| | — |

|

| Cash and cash equivalents | 17,101 |

| | 42,250 |

|

| Restricted cash | 4,589 |

| | 6,093 |

|

| Deferred tax assets | 24,212 |

| | 25,540 |

|

| Assets held for sale, net | 2,215 |

| | 5,243 |

|

| Prepaid expenses, deferred financing costs and other assets | 29,613 |

| | 17,147 |

|

| Total assets | $ | 916,882 |

| | $ | 749,650 |

|

| Liabilities and stockholders’ equity | | | |

| Mortgage notes payable | $ | 152,322 |

| | $ | 153,942 |

|

| Secured revolving credit facility | 92,500 |

| | — |

|

| Senior unsecured notes payable | 330,666 |

| | 225,000 |

|

| Liabilities related to assets held for sale | — |

| | 4,485 |

|

| Accounts payable and accrued liabilities | 11,694 |

| | 14,110 |

|

| Tax liability | 24,212 |

| | 25,540 |

|

| Total liabilities | 611,394 |

| | 423,077 |

|

| |

| |

|

| Stockholders’ equity | | | |

| Preferred stock, $.01 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of December 31, 2012 and 2011 | — |

| | — |

|

Common stock, $.01 par value; 125,000,000 shares authorized, 37,099,209 and 36,891,712 shares issued and outstanding as of

December 31, 2012 and 2011, respectively | 371 |

| | 369 |

|

| Additional paid-in capital | 353,861 |

| | 344,995 |

|

| Cumulative distributions in excess of net income | (48,744 | ) | | (18,791 | ) |

| Total stockholders’ equity | 305,488 |

| | 326,573 |

|

| Total liabilities and stockholders’ equity | $ | 916,882 |

| | $ | 749,650 |

|

|

| | |

| See reporting definitions. | 6 |

SABRA HEALTH CARE REIT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands) |

| | | | | | | |

| | Year Ended December 31, 2012 | | Year Ended December 31, 2011 |

| Cash flows from operating activities: | | |

|

| Net income | $ | 19,513 |

| | $ | 12,842 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

|

| Depreciation and amortization | 30,263 |

| | 26,591 |

|

| Non-cash interest income adjustments | 24 |

| | — |

|

| Amortization of deferred financing costs | 3,800 |

| | 1,998 |

|

| Stock-based compensation expense | 8,279 |

| | 4,600 |

|

| Amortization of premium on notes payable | (500 | ) | | (15 | ) |

| Amortization of premium on senior unsecured notes | (334 | ) | | — |

|

| Straight-line rental income adjustments | (4,893 | ) | | (2,092 | ) |

| Impairment charge | 2,481 |

| | — |

|

| Changes in operating assets and liabilities: | | |

|

|

| Prepaid expenses and other assets | (82 | ) | | (1,035 | ) |

| Accounts payable and accrued liabilities | 1,321 |

| | 5,695 |

|

| Restricted cash | (3,620 | ) | | (3,879 | ) |

| | | |

| Net cash provided by operating activities | 56,252 |

| | 44,705 |

|

| Cash flows from investing activities: | | |

|

| Acquisitions of real estate | (205,424 | ) | | (204,500 | ) |

| Origination of loans receivable | (22,180 | ) | | — |

|

| Acquisition of note receivable | — |

| | (5,348 | ) |

| Additions to real estate | (1,046 | ) | | (86 | ) |

| Repayment of note receivable | 10,000 |

| | 5,348 |

|

| | | |

| Net cash used in investing activities | (218,650 | ) | | (204,586 | ) |

| Cash flows from financing activities: | | |

|

| Proceeds from secured revolving credit facility | 135,000 |

| | — |

|

| Proceeds from mortgage notes payable | 56,651 |

| | — |

|

| Proceeds from issuance of senior unsecured notes | 106,000 |

| | — |

|

| Payments on secured revolving credit facility | (42,500 | ) | | — |

|

| Principal payments on mortgage notes payable | (62,226 | ) | | (3,027 | ) |

| Payments of deferred financing costs | (6,800 | ) | | (677 | ) |

| Issuance of common stock | 53 |

| | 163,242 |

|

| Dividends paid | (48,929 | ) | | (31,640 | ) |

| | | |

| Net cash provided by financing activities | 137,249 |

| | 127,898 |

|

| | | |

| Net decrease in cash and cash equivalents | (25,149 | ) | | (31,983 | ) |

| Cash and cash equivalents, beginning of period | 42,250 |

| | 74,233 |

|

| | | |

| Cash and cash equivalents, end of period | $ | 17,101 |

| | $ | 42,250 |

|

| Supplemental disclosure of cash flow information: | | |

|

| Interest paid | $ | 32,613 |

| | $ | 28,557 |

|

| | | |

|

| | |

| See reporting definitions. | 7 |

SABRA HEALTH CARE REIT, INC.

RECONCILIATIONS OF NET INCOME TO EBITDA, FUNDS FROM OPERATIONS (FFO),

ADJUSTED FUNDS FROM OPERATIONS (AFFO) AND NORMALIZED AFFO

(in thousands, except share and per share amounts)

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| Net income | | $ | 3,959 |

| | $ | 7,163 |

| | $ | 19,513 |

| | $ | 12,842 |

|

| Interest expense | | 11,621 |

| | 7,592 |

| | 37,005 |

| | 30,319 |

|

| Depreciation and amortization | | 7,907 |

| | 7,365 |

| | 30,263 |

| | 26,591 |

|

| | | | | | | | | |

| EBITDA | | $ | 23,487 |

| | $ | 22,120 |

| | $ | 86,781 |

| | $ | 69,752 |

|

| | | | | | | | | |

| Net income | | $ | 3,959 |

| | $ | 7,163 |

| | $ | 19,513 |

| | $ | 12,842 |

|

| Add: | | | | | | | | |

| Depreciation of real estate assets | | 7,907 |

| | 7,365 |

| | 30,263 |

| | 26,591 |

|

| Impairment | | 2,481 |

| | — |

| | 2,481 |

| | — |

|

| | | | | | | | | |

| Funds from Operations (FFO) | | $ | 14,347 |

| | $ | 14,528 |

| | $ | 52,257 |

| | $ | 39,433 |

|

| | | | | | | | | |

| Acquisition pursuit costs | | 415 |

| | 264 |

| | 1,654 |

| | 3,218 |

|

| Stock-based compensation expense | | 2,530 |

| | 1,351 |

| | 8,279 |

| | 4,600 |

|

| Straight-line rental income adjustments | | (2,036 | ) | | (1,372 | ) | | (4,893 | ) | | (2,092 | ) |

| Amortization of deferred financing costs | | 1,180 |

| | 491 |

| | 3,800 |

| | 1,998 |

|

| Amortization of debt premium | | (683 | ) | | (3 | ) | | (834 | ) | | (15 | ) |

| Non-cash interest income adjustments | | 6 |

| | — |

| | 24 |

| | — |

|

| | | | | | | | | |

| Adjusted Funds from Operations (AFFO) | | $ | 15,759 |

| | $ | 15,259 |

| | $ | 60,287 |

| | $ | 47,142 |

|

| | | | | | | | | |

| Consent fee | | (2,196 | ) | | — |

| | (2,196 | ) | | — |

|

| Prepayment penalty fees | | 2,043 |

| | — |

| | 2,043 |

| | — |

|

| Start-up costs | | — |

| | — |

| | — |

| | 310 |

|

| Hillside Terrace interest income, net of expense | | — |

| | (1,594 | ) | | — |

| | (1,594 | ) |

| | | | | | | | | |

| Normalized AFFO | | $ | 15,606 |

| | $ | 13,665 |

| | $ | 60,134 |

| | $ | 45,858 |

|

| | | | | | | | | |

| Net income per diluted common share | | $ | 0.11 |

| | $ | 0.19 |

| | $ | 0.52 |

| | $ | 0.43 |

|

| | | | | | | | | |

| FFO per diluted common share | | $ | 0.38 |

| | $ | 0.39 |

| | $ | 1.40 |

| | $ | 1.31 |

|

| | | | | | | | | |

| AFFO per diluted common share | | $ | 0.42 |

| | $ | 0.41 |

| | $ | 1.59 |

| | $ | 1.55 |

|

| | | | | | | | | |

| Normalized AFFO per diluted common share | | $ | 0.41 |

| | $ | 0.37 |

| | $ | 1.59 |

| | $ | 1.51 |

|

| | | | | | | | | |

| Weighted average number of common shares outstanding, diluted | | | | | | | | |

| Net income and FFO | | 37,594,583 |

| | 37,052,574 |

| | 37,321,517 |

| | 30,171,225 |

|

| AFFO and Normalized AFFO | | 37,917,964 |

| | 37,248,402 |

| | 37,829,421 |

| | 30,399,132 |

|

| | | | | | | | | |

|

| | |

| See reporting definitions. | 8 |

SABRA HEALTH CARE REIT, INC.

CAPITALIZATION

(in thousands, except share and per share amounts) |

| | | | | | | |

| Debt | December 31, |

| | 2012 | | 2011 |

| Secured mortgage debt | $ | 152,322 |

| | $ | 153,942 |

|

| Senior unsecured notes | 330,666 |

| | 225,000 |

|

| Revolving credit facility | 92,500 |

| | — |

|

| Debt related to assets held for sale | — |

| | 4,456 |

|

| | | | |

| Total debt | $ | 575,488 |

| | $ | 383,398 |

|

|

| | | | | | | | | | |

| Enterprise Value | | | | | |

| As of December 31, 2012 | Shares Outstanding | | Price | | Value |

| Common stock | 37,099,209 |

| | $ | 21.72 |

| | $ | 805,795 |

|

| Total debt | | | | | 575,488 |

|

| Cash and cash equivalents | | | | | (17,101 | ) |

| | | | | | |

| Total enterprise value | | | | | $ | 1,364,182 |

|

| | | | | | |

| As of December 31, 2011 | Shares

Outstanding | | Price | | Value |

| Common stock | 36,891,712 |

| | $ | 12.09 |

| | $ | 446,021 |

|

| Total debt | | | | | 383,398 |

|

| Cash and cash equivalents | | | | | (42,250 | ) |

| | | | | | |

| Total enterprise value | | | | | $ | 787,169 |

|

| | | | | | |

|

| | | | | | | | | | | | |

| Common Stock and Equivalents | | | | | | | | |

| | | Weighted Avg. Common Shares |

| | | Three Months Ended December 31, 2012 | | Year Ended December 31, 2012 |

| | | EPS & FFO | | AFFO & Normalized AFFO | | EPS & FFO | | AFFO & Normalized AFFO |

| Common stock | | 37,070,152 |

| | 37,070,152 |

| | 37,023,114 |

| | 37,023,114 |

|

| Common equivalents | | 36,321 |

| | 36,321 |

| | 37,997 |

| | 37,997 |

|

| | | | | | | | | |

| Basic common and common equivalents | | 37,106,473 |

| | 37,106,473 |

| | 37,061,111 |

| | 37,061,111 |

|

| Dilutive securities: | | | | | | | | |

| Restricted stock and units | | 456,703 |

| | 767,058 |

| | 250,156 |

| | 753,579 |

|

| Options | | 31,407 |

| | 44,433 |

| | 10,250 |

| | 14,731 |

|

| | | | | | | | | |

| Diluted common and common equivalents | | 37,594,583 |

| | 37,917,964 |

| | 37,321,517 |

| | 37,829,421 |

|

| | | | | | | | | |

|

| | |

| See reporting definitions. | 9 |

SABRA HEALTH CARE REIT, INC.

INDEBTEDNESS

December 31, 2012

(dollars in thousands)

|

| | | | | | | | | |

| | Principal | | Weighted Average Effective Rate | | % of Total |

| Fixed rate debt | | | | | |

Secured mortgage debt (1) | $ | 94,373 |

| | 4.43 | % | | 16.4 | % |

Unsecured senior notes (2) | 330,666 |

| | 7.75 | % | | 57.5 | % |

| | | | | | |

| Total fixed rate debt | 425,039 |

| | 7.01 | % | | 73.9 | % |

| | | | | | |

| Variable rate debt | | | | | |

Secured mortgage debt(3) | 57,949 |

| | 5.00 | % | | 10.1 | % |

Revolving credit facility (4) | 92,500 |

| | 3.71 | % | | 16.0 | % |

| | | | | | |

| Total variable rate debt | 150,449 |

| | 4.21 | % | | 26.1 | % |

| | | | | | |

| Total debt | $ | 575,488 |

| | 6.28 | % | | 100.0 | % |

| | | | | | |

| | | | | |

| Secured debt | | | | | |

| Secured mortgage debt | $ | 152,322 |

| | 4.65 | % | | 26.5 | % |

Revolving credit facility (4) | 92,500 |

| | 3.71 | % | | 16.0 | % |

| | | | | | |

| Total secured debt | 244,822 |

| | 4.29 | % | | 42.5 | % |

| | | | | | |

| | | | | | |

| Unsecured debt | | | | | |

Unsecured senior notes (2) | 330,666 |

| | 7.75 | % | | 57.5 | % |

| | | | | | |

| Total unsecured debt | 330,666 |

| | 7.75 | % | | 57.5 | % |

| | | | | | |

| Total debt | $ | 575,488 |

| | 6.28 | % | | 100.0 | % |

(1)Fixed rate secured mortgage debt includes $30.7 million which converts to a variable interest rate based on 90-day LIBOR plus 4.0% (1.00% floor) effective January 2014. This debt matures in August 2015.

(2)Unsecured senior notes includes $5.7 million of notes premium.

(3)Variable rate secured mortgage debt interest is based on 90-day LIBOR plus 4.0% (1.00% floor).

(4)Borrowings under the revolving credit facility bear interest on the outstanding principal amount at a rate equal to, at our option, LIBOR plus 3.00% to 4.00% or a Base Rate plus 2.00% to 3.00%. The actual interest rate within the applicable range is determined based on our then applicable Consolidated Leverage Ratio.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Maturities |

| | Secured Mortgage Debt | | Unsecured Senior Notes | | Revolving Credit Facility | | Total |

| | Principal | | Rate (5) | | Principal | | Rate (5) | | Principal | | Rate (5) | | Principal | | Rate |

| 2013 | $ | 3,946 |

| | 4.70 | % | | $ | — |

| | — |

| | $ | — |

| | — |

| | $ | 3,946 |

| | 4.70 | % |

| 2014 | 4,146 |

| | 4.69 | % | | — |

| | — |

| | — |

| | — |

| | 4,146 |

| | 4.69 | % |

| 2015 | 86,522 |

| | 4.20 | % | | — |

| | — |

| | 92,500 |

| | 3.71 | % | | 179,022 |

| | 3.95 | % |

| 2016 | 2,138 |

| | 3.22 | % | | — |

| | — |

| | — |

| | — |

| | 2,138 |

| | 3.22 | % |

| 2017 | 2,230 |

| | 3.18 | % | | — |

| | — |

| | — |

| | — |

| | 2,230 |

| | 3.18 | % |

| 2018 | 2,326 |

| | 3.13 | % | | 325,000 |

| | 8.13 | % | | — |

| | — |

| | 327,326 |

| | 8.09 | % |

| 2019 | 2,429 |

| | 3.07 | % | | — |

| | — |

| | — |

| | — |

| | 2,429 |

| | 3.07 | % |

| 2020 | 2,538 |

| | 3.00 | % | | — |

| | — |

| | — |

| | — |

| | 2,538 |

| | 3.00 | % |

| 2021 | 2,656 |

| | 2.91 | % | | — |

| | — |

| | — |

| | — |

| | 2,656 |

| | 2.91 | % |

| 2022 | 2,781 |

| | 2.80 | % | | — |

| | — |

| | — |

| | — |

| | 2,781 |

| | 2.80 | % |

| Thereafter | 40,610 |

| | 2.46 | % | | — |

| | — |

| | — |

| | — |

| | 40,610 |

| | 2.46 | % |

| | 152,322 |

| | | | 325,000 |

| | | | 92,500 |

| | | �� | 569,822 |

| | |

| Mortgage premium | — |

| | | | 5,666 |

| | | | — |

| | | | 5,666 |

| | |

| Total debt | $ | 152,322 |

| | | | $ | 330,666 |

| | | | $ | 92,500 |

| | | | $ | 575,488 |

| | |

| Weighted average maturity in years | 12.3 |

| | | | 5.8 |

| | | | 2.1 |

| | | | 7.0 |

| | |

| Weighted average effective interest rate | 4.65 | % | | | | 7.75 | % | | | | 3.71 | % | | | | 6.28 | % | | |

(5) Represents actual contractual interest rates.

|

| | |

| See reporting definitions. | 10 |

SABRA HEALTH CARE REIT, INC.

DEBT COVENANTS

(dollars in millions)

|

| | | | | | | | | | | | | | |

| | | | | | December 31, 2012 | | December 31, 2011 |

| | Minimum | | Maximum | | Actual | | Actual |

| Credit Facility: | | | | | | | |

| Consolidated Leverage Ratio | | | 5.75x |

| | 4.71x |

| | 4.26x |

|

| Consolidated Fixed Charge Coverage Ratio | 1.75x |

| | | | 2.92x |

| | 2.87x |

|

| Consolidated Tangible Net Worth | $ | 342.0 |

| | | | $ | 422.4 |

| | $ | 425.9 |

|

| | | | | | | | |

| Unsecured Senior Notes: | | | | | | | |

| Total Debt/ Asset Value | | | 60 | % | | 48 | % | | 39 | % |

| Secured Debt/ Asset Value | | | 40 | % | | 21 | % | | 16 | % |

| Unencumbered Assets/ Unsecured Debt | 150 | % | | | | 183 | % | | 227 | % |

| Minimum Interest Coverage | 2.00x |

| | | | 3.22x |

| | 3.17x |

|

Note: All covenants are based on terms defined in the related credit agreement and unsecured senior notes indenture. Asset Value and Unencumbered Assets used for debt covenant calculation purposes include a value for the initial real estate portfolio obtained in the separation from Sun, which is calculated by dividing the total initial annual rental revenue from this portfolio by an assumed 9.75% capitalization rate. This results in an assumed total portfolio value for the initial real estate portfolio of $720 million.

|

| | |

| See reporting definitions. | 11 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO SUMMARY — ALL INVESTMENTS

December 31, 2012

(dollars in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Rental Income | | Number of Licensed Beds/Units | | Occupancy Percentage |

| | | Number of Properties | | | | Three Months Ended December 31, | | | Three Months Ended December 31, |

| Facility Type | | | Investment | | 2012 | | 2011 | | | 2012 | | 2011 |

| Skilled Nursing/Post-Acute | | 96 |

| | $ | 746,510 |

| | $ | 23,712 |

| | $ | 20,438 |

| | 10,826 |

| | 88.9 | % | | 88.9 | % |

| Senior Housing | | 22 |

| | 148,210 |

| | 2,478 |

| | 1,109 |

| | 1,486 |

| | 85.0 | % | | 83.6 | % |

| Acute Care Hospital | | 1 |

| | 61,640 |

| | 1,648 |

| | 1,648 |

| | 70 |

| | 62.9 | % | | 66.2 | % |

Total (1) | | 119 |

| | $ | 956,360 |

| | $ | 27,838 |

| | $ | 23,195 |

| | 12,382 |

| | 88.2 | % | | 88.4 | % |

| | | | |

|

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Loan Type | Number of Loans | | Facility Type | | Principal Balance as of December 31, 2012 | | Book Value as of December 31, 2012 | | Contractual Interest Rate | | Annualized Effective Interest Rate | | Interest Income Three Months Ended December 31, 2012 | | Maturity Date |

| Mortgage | 2 | | Skilled Nursing / Assisted Living | | $ | 11,965 |

| | $ | 12,017 |

| | 8.5 | % | | 8.4 | % | | $ | 261 |

| | Various |

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Year Ended December 31, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| Facility Type | | EBITDARM Coverage | | EBITDAR Coverage | | EBITDARM Coverage | | EBITDAR Coverage | | EBITDARM Coverage | | EBITDAR Coverage | | EBITDARM Coverage | | EBITDAR Coverage |

| Skilled Nursing/Post-Acute | | 1.83x | | 1.59x | | 1.91x | | 1.59x | | 1.75x | | 1.45x | | 2.09x | | 1.74x |

Senior Housing (2) (3) | | 1.55x | | 1.36x | | 1.69x | | 1.55x | | 1.40x | | 1.21x | | 1.63x | | 1.73x |

| Acute Care Hospital | | 2.46x | | 2.39x | | 2.36x | | 2.29x | | 3.03x | | 2.93x | | 2.06x | | 1.96x |

| | | | | | | | | | | | | | | | | |

Total (1) | | 1.83x | | 1.60x | | 1.93x | | 1.63x | | 1.77x | | 1.50x | | 2.06x | | 1.76x |

| | | | | | | | | | | | | | | | | |

|

| | | | | | |

| | | Year Ended December 31, |

| Total Revenue | | 2012 | | 2011 |

| Genesis | | 70.6 | % | | 76.4 | % |

| Cadia Portfolio | | 10.3 |

| | 11.4 |

|

| Texas Regional Medical Center | | 6.4 |

| | 7.1 |

|

| Aurora Portfolio | | 3.5 |

| | 2.4 |

|

| Pennsylvania Subacute Portfolio | | 2.5 |

| | — |

|

| Encore Portfolio | | 1.6 |

| | — |

|

| Oakbrook | | 1.2 |

| | — |

|

| Other | | 3.9 |

| | 2.7 |

|

| Total | | 100.0 | % | | 100.0 | % |

(1) Occupancy percentage, EBITDARM, EBITDAR and related coverages are only included in periods subsequent to our acquisition of the facilities for facilities with new tenants/operators and excludes the impact of strategic disposition candidates and facilities held for sale. All facility financial performance data are presented one month in arrears.

(2) Excluding the impact of Age Well (formerly known as Creekside), which was not stabilized as of December 31, 2012, the three months ended December 31, 2012, EBITDARM Coverage and EBITDAR Coverage for Senior Housing facilities would have been 1.62x and 1.42x, respectively; and for the year ended December 31, 2012, EBITDARM Coverage and EBITDAR Coverage for Senior Housing facilities would have been 1.47x and 1.27x, respectively. See reporting definition for definitions of EBITDARM Coverage and EBITDAR Coverage.

(3) During the three months and year ended December 31, 2011, 8 of the Company's 9 Senior Housing Facilities were leased to subsidiaries of Sun and therefore subject to the guarantee from Sun. As a result, the EBITDAR coverage reflects the impact of the Sun guarantee and the EBITDAR generated by all other Sun operations. Excluding the impact of the Sun guarantee, EBITDAR coverage for the three months and year ended December 31, 2011 would have been 1.39x and 1.33x, respectively.

|

| | |

| See reporting definitions. | 12 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO SUMMARY - SAME STORE (1)

December 31, 2012

(dollars in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended December 31, |

| | | | | Rental Income | | Occupancy Percentage | | Skilled Mix |

| Facility Type | | Number of

Properties | | 2012 | | 2011 | | 2012 | | 2011 | | 2012 | | 2011 |

| Skilled Nursing/Post-Acute | | 84 |

| | $ | 21,150 |

| | $ | 20,163 |

| | 88.7 | % | | 88.9 | % | | 37.1 | % | | 40.1 | % |

| Senior Housing | | 8 |

| | 1,153 |

| | 1,081 |

| | 85.8 | % | | 83.7 | % | | N/A |

| | N/A |

|

| Acute Care Hospital | | 1 |

| | 1,648 |

| | 1,648 |

| | 62.9 | % | | 66.2 | % | | N/A |

| | N/A |

|

| Total | | 93 |

| | $ | 23,951 |

| | $ | 22,892 |

| | 88.3 | % | | 88.4 | % | | 37.1 | % | | 40.1 | % |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2012 | | 2011 | | 2012 | | 2011 |

| Facility Type | | EBITDARM

Coverage | | EBITDAR

Coverage | | EBITDARM

Coverage | | EBITDAR

Coverage | | EBITDARM

Coverage | | EBITDAR

Coverage | | EBITDARM

Coverage | | EBITDAR

Coverage |

| Skilled Nursing/Post-Acute | | 1.83x | | 1.62x | | 1.91x | | 1.59x | | 1.75x | | 1.47x | | 2.09x | | 1.75x |

Senior Housing (2) | | 1.77x | | 1.57x | | 1.69x | | 1.55x | | 1.64x | | 1.47x | | 1.63x | | 1.73x |

| Acute Care Hospital | | 2.46x | | 2.39x | | 2.36x | | 2.29x | | 3.03x | | 2.93x | | 2.06x | | 1.96x |

| Total | | 1.87x | | 1.67x | | 1.93x | | 1.63x | | 1.83x | | 1.57x | | 2.06x | | 1.76x |

| | | | | | | | | | | | | | | | | |

(1) Same Store statistics consist of facilities held or acquired before October 1, 2011 and exclude the impact of strategic disposition candidates and facilities held for sale.

(2) During the three months and year ended December 31, 2011, the Senior Housing Facilities included above were all leased to subsidiaries of Sun and therefore subject to the guarantee from Sun. As a result, the EBITDAR coverage reflects the impact of the Sun guarantee and the EBITDAR generated by all other Sun operations. Excluding the impact of the Sun guarantee, EBITDAR coverage for the three months and year ended December 31, 2011 would have been 1.39x and 1.33x, respectively.

|

| | |

| See reporting definitions. | 13 |

SABRA HEALTH CARE REIT, INC.

INVESTMENT ACTIVITY

For the Twelve Months Ended December 31, 2012

(dollars in millions) |

| | | | | | | | | | | | | |

| | Acquisition Date | | Facility Type | | Beds | | Investment Amount | | Initial Cash Yield |

| Real Estate Investments | | | | | | | | | |

| Pennsylvania Subacute Portfolio | 03/30/12 | | Skilled Nursing | | 120 |

| | $ | 29.9 |

| | 9.50 | % |

| Ridgecrest Manor | 05/01/12 | | Skilled Nursing | | 120 |

| | 5.7 |

| | 11.00 |

|

Aurora II Portfolio (1) | 06/01/12 | | Skilled Nursing | | 327 |

| | 20.0 |

| | 10.18 |

|

| New Dawn Memory Care | 09/20/12 | | Senior Housing | | 48 |

| | 16.0 |

| | 8.00 |

|

| Independence Village at Frankenmuth | 09/21/12 | | Senior Housing | | 249 |

| | 26.5 |

| | 8.00 |

|

Meridian Portfolio (2) | 11/30/12 | | Senior Housing/Skilled Nursing | | 394 |

| | 33.0 |

| | 9.00 |

|

| Camden Care Center | 11/30/12 | | Skilled Nursing | | 87 |

| | 7.2 |

| | 10.00 |

|

| Retirement Living | 12/14/12 | | Senior Housing | | 322 |

| | 49.0 |

| | 8.00 |

|

Stoney River Marshfield (3) | 12/18/12 | | Senior Housing | | 60 |

| | 8.2 |

| | 8.00 |

|

| Total real estate investments | | | | | 1,727 |

| | $ | 195.5 |

| | 8.78 | % |

| Debt Investments | | | | | | |

| | |

Meridian Mezzanine Loan (2) | 03/15/12 | | Senior Housing/Skilled Nursing | | | | $ | 10.0 |

| | 11.00 | % |

Onion Creek Mortgage Loan (4) | 06/22/12 | | Skilled Nursing | | | | 11.0 |

| | 8.50 |

|

First Phoenix Mortgage Loan (5) | 08/16/12 | | Senior Housing | | | | 1.0 |

| | 9.00 |

|

| Total debt investments | | | | | | | $ | 22.0 |

| | 9.66 | % |

| | | | | | | | | | |

| Total Investments | | | | | | | $ | 217.5 |

| | 8.78 | % |

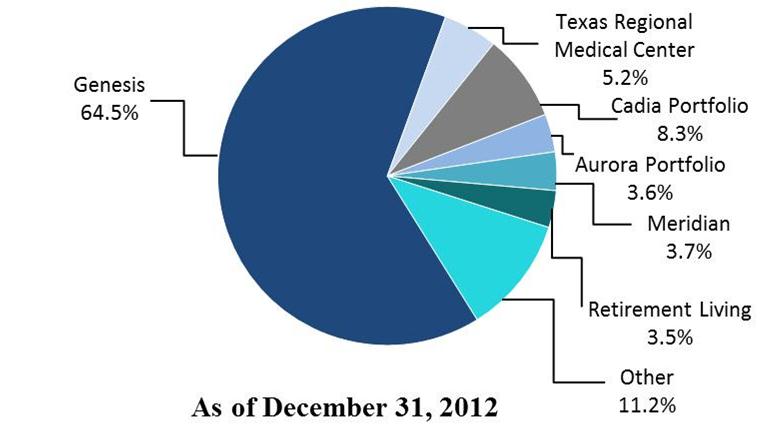

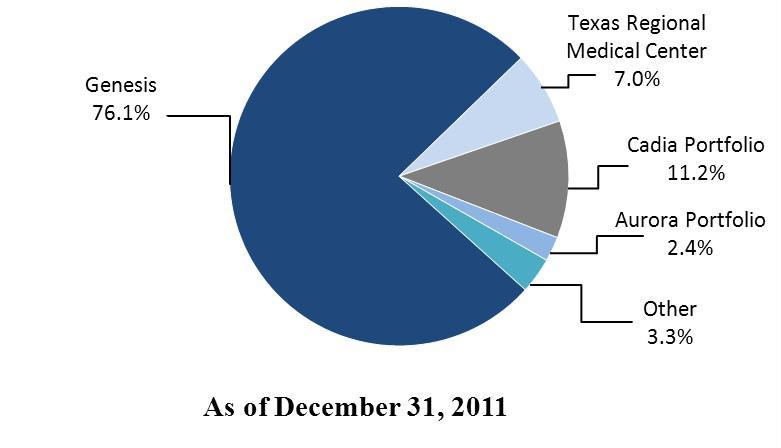

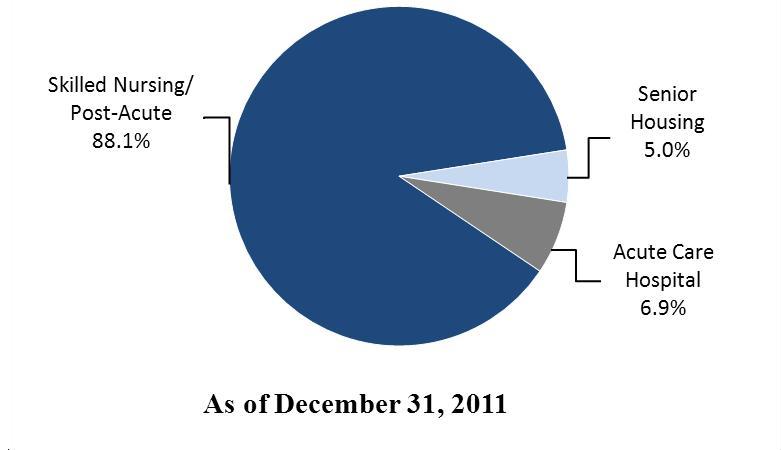

Annualized Revenue Concentration (6)

Annualized Revenue by Asset Class (6)

(1) The total funds paid at closing was $21.8 million, which included $1.8 million in deferred purchase price related to the original Aurora acquisition.

(2) Included an option to purchase three skilled nursing facilities and one assisted living facility located in Texas, which was exercised on November 30, 2012. The total funds paid on November 30, 2012 was $33.0 million, which was net of the $10.0 million Meridian Mezzanine loan.

(3) Excludes contingent consideration valued at $1.3 million as of December 31, 2012.

(4) Includes an option to purchase one skilled nursing facility located in Texas.

(5) Pre-development funding for amount included in pipeline agreement.

(6) December 31, 2011 information excludes interest income on the Hillside Terrace Mortgage Note, which we acquired on March 25, 2011 and which was subsequently repaid on December 5, 2011.

|

| | |

| See reporting definitions. | 14 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO GEOGRAPHIC CONCENTRATIONS

December 31, 2012

Property Type

|

| | | | | | | | | | | | | | | |

| | | Skilled Nursing/Post-Acute | | Senior Housing | | Acute Care Hospital | | Total | | % of Total |

| New Hampshire | | 14 |

| | 2 |

| | — |

| | 16 |

| | 13.4 | % |

| Kentucky | | 13 |

| | 2 |

| | — |

| | 15 |

| | 12.6 |

|

| Connecticut | | 12 |

| | 1 |

| | — |

| | 13 |

| | 10.9 |

|

| Michigan | | — |

| | 10 |

| | — |

| | 10 |

| | 8.4 |

|

| Ohio | | 8 |

| | — |

| | — |

| | 8 |

| | 6.7 |

|

| Texas | | 6 |

| | 1 |

| | 1 |

| | 8 |

| | 6.7 |

|

| Florida | | 5 |

| | — |

| | — |

| | 5 |

| | 4.2 |

|

| Oklahoma | | 3 |

| | 1 |

| | — |

| | 4 |

| | 3.4 |

|

| Delaware | | 4 |

| | — |

| | — |

| | 4 |

| | 3.4 |

|

| Montana | | 4 |

| | — |

| | — |

| | 4 |

| | 3.4 |

|

| Other (17 states) | | 27 |

| | 5 |

| | — |

| | 32 |

| | 26.9 |

|

| | | | | | | | | | | |

| Total | | 96 |

| | 22 |

| | 1 |

| | 119 |

| | 100.0 | % |

| | | | | | | | | | | |

Distribution of Licensed Beds/Units

|

| | | | | | | | | | | | | | | | | | |

| | | Total Number of Properties | | Bed Type | | | |

| | | | Skilled Nursing/Post-Acute | | Senior Housing | | Acute Care Hospital | | Total | | % of Total |

| Connecticut | | 13 |

| | 1,770 |

| | 49 |

| | — |

| | 1,819 |

| | 14.7 | % |

| New Hampshire | | 16 |

| | 1,470 |

| | 203 |

| | — |

| | 1,673 |

| | 13.5 |

|

| Kentucky | | 15 |

| | 1,020 |

| | 128 |

| | — |

| | 1,148 |

| | 9.3 |

|

| Ohio | | 8 |

| | 897 |

| | — |

| | — |

| | 897 |

| | 7.2 |

|

| Texas | | 8 |

| | 720 |

| | 34 |

| | 70 |

| | 824 |

| | 6.7 |

|

| Florida | | 5 |

| | 660 |

| | — |

| | — |

| | 660 |

| | 5.3 |

|

| Michigan | | 10 |

| | — |

| | 571 |

| | — |

| | 571 |

| | 4.6 |

|

| Montana | | 4 |

| | 538 |

| | — |

| | — |

| | 538 |

| | 4.3 |

|

| Delaware | | 4 |

| | 500 |

| | — |

| | — |

| | 500 |

| | 4.0 |

|

| Colorado | | 3 |

| | 362 |

| | 48 |

| | — |

| | 410 |

| | 3.3 |

|

| Other (17 states) | | 33 |

| | 2,889 |

| | 453 |

| | — |

| | 3,342 |

| | 27.1 |

|

| | | | | | | | | | | | | |

| Total | | 119 |

| | 10,826 |

| | 1,486 |

| | 70 |

| | 12,382 |

| | 100.0 | % |

| | | | | | | | | | | | | |

| % of Total beds/units | | | | 87.4 | % | | 12.0 | % | | 0.6 | % | | 100.0 | % | | |

| | | | | | | | | | | | | |

|

| | |

| See reporting definitions. | 15 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO GEOGRAPHIC CONCENTRATIONS

December 31, 2012

(dollars in thousands)

Investment

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Total Number of Properties | | Skilled Nursing/Post-Acute | | Senior Housing | | Acute Care Hospital | | Total | | % of Total |

| Connecticut | | 13 |

| | $ | 143,992 |

| | $ | 7,999 |

| | $ | — |

| | $ | 151,991 |

| | 15.9 | % |

| Texas | | 8 |

| | 65,795 |

| | 1,396 |

| | 61,640 |

| | 128,831 |

| | 13.5 |

|

| Delaware | | 4 |

| | 95,780 |

| | — |

| | — |

| | 95,780 |

| | 10.0 |

|

| New Hampshire | | 16 |

| | 76,992 |

| | 12,792 |

| | — |

| | 89,784 |

| | 9.4 |

|

| Michigan | | 10 |

| | — |

| | 73,968 |

| | — |

| | 73,968 |

| | 7.7 |

|

| Kentucky | | 15 |

| | 59,350 |

| | 10,489 |

| | — |

| | 69,839 |

| | 7.3 |

|

| Colorado | | 3 |

| | 28,852 |

| | 15,702 |

| | — |

| | 44,554 |

| | 4.7 |

|

| Montana | | 4 |

| | 42,729 |

| | — |

| | — |

| | 42,729 |

| | 4.5 |

|

| Ohio | | 8 |

| | 42,612 |

| | — |

| | — |

| | 42,612 |

| | 4.5 |

|

| Florida | | 5 |

| | 30,748 |

| | — |

| | — |

| | 30,748 |

| | 3.2 |

|

| Other (17 states) | | 33 |

| | 159,660 |

| | 25,864 |

| | | | 185,524 |

| | 19.3 |

|

| | | | | | | | | | | | | |

| Total | | 119 |

| | $ | 746,510 |

| | $ | 148,210 |

| | $ | 61,640 |

| | $ | 956,360 |

| | 100.0 | % |

| | | | | | | | | | | | | |

| % of Total Properties | | | | 78.1 | % | | 15.5 | % | | 6.4 | % | | 100.0 | % | | |

| | | | | | | | | | | | | |

|

| | |

| See reporting definitions. | 16 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO GEOGRAPHIC CONCENTRATIONS

December 31, 2012

(dollars in thousands)

Rental Income - Three Months Ended December 31, 2012

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Total Number of Properties | | Skilled Nursing/Post-Acute | | Senior Housing | | Acute Care Hospital | | Total | | % of Total |

| Connecticut | | 13 |

| | $ | 3,519 |

| | $ | 77 |

| | $ | — |

| | $ | 3,596 |

| | 12.9 | % |

| New Hampshire | | 16 |

| | 3,172 |

| | 354 |

| | — |

| | 3,526 |

| | 12.7 |

|

| Texas | | 8 |

| | 1,116 |

| | 8 |

| | 1,648 |

| | 2,772 |

| | 10.0 |

|

| Kentucky | | 15 |

| | 2,611 |

| | 132 |

| | — |

| | 2,743 |

| | 9.9 |

|

| Delaware | | 4 |

| | 2,645 |

| | — |

| | — |

| | 2,645 |

| | 9.5 |

|

| Florida | | 5 |

| | 2,046 |

| | — |

| | — |

| | 2,046 |

| | 7.3 |

|

| Montana | | 4 |

| | 1,371 |

| | — |

| | — |

| | 1,371 |

| | 4.9 |

|

| Ohio | | 8 |

| | 1,366 |

| | — |

| | — |

| | 1,366 |

| | 4.9 |

|

| Colorado | | 3 |

| | 866 |

| | 367 |

| | — |

| | 1,233 |

| | 4.4 |

|

| Pennsylvania | | 2 |

| | 847 |

| | — |

| | — |

| | 847 |

| | 3.0 |

|

| Other (17 states) | | 41 |

| | 4,153 |

| | 1,540 |

| | — |

| | 5,693 |

| | 20.5 |

|

| | | | | | | | | | | | | |

| Total | | 119 |

| | $ | 23,712 |

| | $ | 2,478 |

| | $ | 1,648 |

| | $ | 27,838 |

| | 100.0 | % |

| | | | | | | | | | | | | |

| % of Total Properties | | | | 85.2 | % | | 8.9 | % | | 5.9 | % | | 100.0 | % | | |

| | | | | | | | | | | | | |

Rental Income - Twelve Months Ended December 31, 2012

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Total Number of Properties | | Skilled Nursing/Post-Acute | | Senior Housing | | Acute Care Hospital | | Total | | % of Total |

| New Hampshire | | 16 |

| | $ | 12,074 |

| | $ | 1,360 |

| | $ | — |

| | $ | 13,434 |

| | 13.2 | % |

| Connecticut | | 13 |

| | 12,854 |

| | 298 |

| | — |

| | 13,152 |

| | 12.9 |

|

| Kentucky | | 15 |

| | 10,075 |

| | 509 |

| | — |

| | 10,584 |

| | 10.4 |

|

| Delaware | | 4 |

| | 10,578 |

| | — |

| | — |

| | 10,578 |

| | 10.4 |

|

| Texas | | 8 |

| | 3,320 |

| | 8 |

| | 6,593 |

| | 9,921 |

| | 9.8 |

|

| Florida | | 5 |

| | 7,947 |

| | — |

| | — |

| | 7,947 |

| | 7.8 |

|

| Ohio | | 8 |

| | 5,304 |

| | — |

| | — |

| | 5,304 |

| | 5.2 |

|

| Montana | | 4 |

| | 5,283 |

| | — |

| | — |

| | 5,283 |

| | 5.2 |

|

| Colorado | | 3 |

| | 3,353 |

| | 412 |

| | — |

| | 3,765 |

| | 3.7 |

|

| Idaho | | 3 |

| | 2,922 |

| | — |

| | — |

| | 2,922 |

| | 2.9 |

|

| Other (17 states) | | 40 |

| | 15,323 |

| | 3,529 |

| | — |

| | 18,852 |

| | 18.5 |

|

| | | | | | | | | | | | | |

| Total | | 119 |

| | $ | 89,033 |

| | $ | 6,116 |

| | $ | 6,593 |

| | $ | 101,742 |

| | 100.0 | % |

| | | | | | | | | | | | | |

| % of Total Properties | | | | 87.5 | % | | 6.0 | % | | 6.5 | % | | 100.0 | % | | |

| | | | | | | | | | | | | |

|

| | |

| See reporting definitions. | 17 |

SABRA HEALTH CARE REIT, INC.

HISTORICAL SKILLED MIX AND OCCUPANCY PERCENTAGE

|

| | | | | | | | | | | | | | |

| | Skilled Mix Percentage (1) |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2012 | | 2011 | | 2012 | | 2011 | | 2010 |

| Skilled Nursing | 36.4 | % | | 39.9 | % | | 37.7 | % | | 41.8 | % | | 39.5 | % |

| | | | | | | | | | |

| | Occupancy Percentage (1) |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2012 | | 2011 | | 2012 | | 2011 | | 2010 |

| Skilled Nursing/Post-Acute | 88.9 | % | | 88.9 | % | | 89.0 | % | | 89.1 | % | | 89.0 | % |

| Senior Housing | 85.0 |

| | 83.6 |

| | 84.4 |

| | 82.7 |

| | 84.4 |

|

| Acute Care Hospital | 62.9 |

| | 66.2 |

| | 66.5 |

| | 71.8 |

| | N/A |

|

| | | | | | | | | | |

| Weighted Average | 88.2 | % | | 88.4 | % | | 88.3 | % | | 88.5 | % | | 88.6 | % |

| | | | | | | | | | |

(1) Skilled mix and occupancy percentage for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities and exclude the impact of strategic disposition candidates and facilities held for sale. All facility financial performance data are presented one month in arrears.

|

| | |

| See reporting definitions. | 18 |

SABRA HEALTH CARE REIT, INC.

PORTFOLIO LEASE EXPIRATIONS

December 31, 2012

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2013 - 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | 2024 | | 2025 | | Thereafter | | Total |

| Skilled Nursing/Post-Acute | | | | | | | | | | | | | | | | | |

| Properties | — |

| | 29 |

| | 30 |

| | 12 |

| | — |

| | 1 |

| | 5 |

| | 19 |

| | 96 |

|

| Licensed Beds/Units | — |

| | 3,191 |

| | 3,508 |

| | 869 |

| | — |

| | 360 |

| | 734 |

| | 2,164 |

| | 10,826 |

|

| Annualized Revenues | $ | — |

| | $ | 27,575 |

| | $ | 30,831 |

| | $ | 10,072 |

| | $ | — |

| | $ | 2,134 |

| | $ | 6,245 |

| | $ | 27,745 |

| | $ | 104,602 |

|

| Senior Housing | | | | | | | | | | | | | | | | | |

| Properties | — |

| | 2 |

| | 3 |

| | 14 |

| | — |

| | — |

| | 2 |

| | 1 |

| | 22 |

|

| Licensed Beds/Units | — |

| | 251 |

| | 197 |

| | 807 |

| | — |

| | — |

| | 197 |

| | 34 |

| | 1,486 |

|

| Annualized Revenues | — |

| | 1,974 |

| | 1,492 |

| | 9,718 |

| | — |

| | — |

| | 1,465 |

| | 99 |

| | 14,748 |

|

| Acute Care Hospital | | | | | | | | | | | | | | | | | |

| Properties | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1 |

| | 1 |

|

| Licensed Beds/Units | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 70 |

| | 70 |

|

| Annualized Revenues | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 6,593 |

| | 6,593 |

|

| | | | | | | | | | | | | | | | | | |

| Total Properties | — |

| | 31 |

| | 33 |

| | 26 |

| | — |

| | 1 |

| | 7 |

| | 21 |

| | 119 |

|

| | | | | | | | | | | | | | | | | | |

| Total Licensed Beds/Units | — |

| | 3,442 |

| | 3,705 |

| | 1,676 |

| | — |

| | 360 |

| | 931 |

| | 2,268 |

| | 12,382 |

|

| | | | | | | | | | | | | | | | | | |

| Total Annualized Revenues | $ | — |

| | $ | 29,549 |

| | $ | 32,323 |

| | $ | 19,790 |

| | $ | — |

| | $ | 2,134 |

| | $ | 7,710 |

| | $ | 34,437 |

| | $ | 125,943 |

|

| | | | | | | | | | | | | | | | | | |

| % of Revenue | — | % | | 23.5 | % | | 25.7 | % | | 15.7 | % | | — | % | | 1.7 | % | | 6.1 | % | | 27.3 | % | | 100.0 | % |

| | | | | | | | | | | | | | | | | | |

|

| | |

| See reporting definitions. | 19 |

SABRA HEALTH CARE REIT, INC.

RECENT ACQUISITION ACTIVITY

Stoney River Marshfield

|

| | | | | | | |

| • Acquisition Date: | | December 18, 2012 | | | | | |

| | | | | | | | |

| • Purchase Price: | | $8.2 million (1) | | | | | |

| | | | | | | | |

| • Investment Type: | | Equity | | | | | |

| | | | | | | | |

| • Property Type: | | Assisted Living Facility | | | | | |

| | | | | | | | |

| • Location: | | Wisconsin | | | | | |

| | | | | | | | |

| • Available Beds: | | 60 | | | | | |

| | | | | | | | |

| • Annualized GAAP Rental Income: | | $0.8 million | | | | | |

| | | | | | | | |

| • Initial Cash Yield: | | 8.00% | | | | | |

(1) Excludes contingent consideration valued at $1.3 million as of December 31, 2012.

|

| | |

| See reporting definitions. | 20 |

SABRA HEALTH CARE REIT, INC.

RECENT ACQUISITION ACTIVITY

Retirement Living Portfolio

|

| | | | | | | |

| • Acquisition Date: | | December 14, 2012 | | | | | |

| | | | | | | | |

| • Purchase Price: | | $49.0 million | | | | | |

| | | | | | | | |

| • Number of Facilities: | | 9 | | | | | |

| | | | | | | | |

| • Investment Type: | | Equity | | | | | |

| | | | | | | | |

| • Property Type: | | Senior Housing | | | | | |

| | | | | | | | |

| • Location: | | Michigan | | | | | |

| | | | | | | | |

| • Available Beds: | | 322 | | | | | |

| | | | | | | | |

| • Annualized GAAP Rental Income: | | $4.5 million | | | | | |

| | | | | | | | |

| • Initial Cash Yield: | | 8.00% | | | | | |

|

| | |

| See reporting definitions. | 21 |

SABRA HEALTH CARE REIT, INC.

RECENT ACQUISITION ACTIVITY

Meridian Portfolio

|

| | | | | | | |

| • Acquisition Date: | | November 30, 2012 | | | | | |

| | | | | | | | |

| • Purchase Price: | | $43.0 million (1) | | | | | |

| | | | | | | | |

| • Number of Facilities: | | 4 | | | | | |

| | | | | | | | |

| • Investment Type: | | Equity | | | | | |

| | | | | | | | |

| • Property Type: | | Skilled Nursing (3) and Assisted Living (1) | | | | |

| | | | | | | | |

| • Location: | | Texas | | | | | |

| | | | | | | | |

| • Available Beds: | | 394 | | | | | |

| | | | | | | | |

| • Annualized GAAP Rental Income: | | $4.7 million | | | | | |

| | | | | | | | |

| • Initial Cash Yield: | | 9.00% | | | | | |

(1) The total purchase price for these facilities was $43.0 million. At closing, the $10.0 million mezzanine loan Sabra had provided to the sellers was repaid, resulting in Sabra funding a net $33.0 million.

|

| | |

| See reporting definitions. | 22 |

SABRA HEALTH CARE REIT, INC.

RECENT ACQUISITION ACTIVITY

Camden Care Center

|

| | | | | | | |

| • Acquisition Date: | | November 30, 2012 | | | | | |

| | | | | | | | |

| • Purchase Price: | | $7.2 million | | | | | |

| | | | | | | | |

| • Investment Type: | | Equity | | | | | |

| | | | | | | | |

| • Property Type: | | Skilled Nursing Facility | | | | | |

| | | | | | | | |

| • Location: | | Minnesota | | | | | |

| | | | | | | | |

| • Available Beds: | | 87 | | | | | |

| | | | | | | | |

| • Annualized GAAP Rental Income: | | $0.9 million | | | | | |

| | | | | | | | |

| • Initial Cash Yield: | | 10.00% | | | | | |

|

| | |

| See reporting definitions. | 23 |

SABRA HEALTH CARE REIT, INC.

ACQUISITION ACTIVITY AFTER DECEMBER 31, 2012

New Dawn Sun City West Mortgage Loan

|

| | | |

| • Funding Date: | | February 4, 2013 | |

| | | | |

| • Loan Amount: | | $12.8 million | |

| | | | |

| • Investment Type: | | Debt (with purchase option) | |

| | | | |

| • Property Type: | | Memory Care Facility | |

| | | | |

| • Location: | | Arizona | |

| | | | |

| • Available Units: | | 48 | |

| | | | |

| • Annualized GAAP Interest Income: | | $1.2 million | |

| | | | |

| • Initial Cash Yield: | | 9.00% | |

|

| | |

| See reporting definitions. | 24 |

SABRA HEALTH CARE REIT, INC.

RECENT ACQUISITION ACTIVITY — PRO FORMA INFORMATION

(dollars in thousands, except per share amounts)

Note: The following pro forma information assumes all 2012 investments, the refinance of six mortgage notes, pay off of one mortgage note, the amendment to the Sun lease agreements in connection with the acquisition of Sun by Genesis, the additional $100.0 million aggregate principal amount of senior notes issued and the origination of the New Dawn Sun City West Mortgage Loan were completed as of January 1, 2012.

Pro Forma Net Income, FFO, AFFO, and Normalized AFFO

|

| | | | | | | |

| | Three Months Ended December 31, 2012 | | Year Ended December 31, 2012 |

| Net income | $ | 3,959 |

| | $ | 19,513 |

|

| Revenues - real estate and debt investments | 3,743 |

| | 25,025 |

|

| Depreciation and amortization - acquisitions (estimated) | (522 | ) | | (3,963 | ) |

| Interest (estimated) | 1,612 |

| | (3,867 | ) |

| Amortization of deferred financing costs (estimated) | 404 |

| | 818 |

|

| Amortization of debt premium (estimated) | (488 | ) | | (37 | ) |

| Pro forma net income | $ | 8,708 |

| | $ | 37,489 |

|

| | | | |

| Pro forma net income | $ | 8,708 |

| | $ | 37,489 |

|

| Add: | | | |

| Depreciation of real estate assets (estimated) | 8,429 |

| | 34,226 |

|

| Impairment | 2,481 |

| | 2,481 |

|

| Pro forma FFO | $ | 19,618 |

| | $ | 74,196 |

|

| Straight-line rental income adjustments | (3,860 | ) | | (14,917 | ) |

| Acquisition pursuit costs | 415 |

| | 1,654 |

|

| Stock-based compensation expense | 2,530 |

| | 8,279 |

|

| Amortization of deferred financing costs (estimated) | 776 |

| | 2,982 |

|

| Amortization of debt premium (estimated) | (195 | ) | | (797 | ) |

| Non-cash interest income adjustments | 3 |

| | 5 |

|

| Pro forma AFFO | $ | 19,287 |

| | $ | 71,402 |

|

| Consent fee | (2,196 | ) | | (2,196 | ) |

| Normalized AFFO | $ | 17,091 |

| | $ | 69,206 |

|

| | | | |

| Pro forma per diluted common share: | | | |

| | | | |

| Net income | $ | 0.23 |

| | $ | 1.00 |

|

| | | | |

| FFO | $ | 0.52 |

| | $ | 1.99 |

|

| | | | |

| AFFO | $ | 0.51 |

| | $ | 1.89 |

|

| | | | |

| Normalized AFFO | $ | 0.45 |

| | $ | 1.83 |

|

| | | | |

| Weighted average number of common shares outstanding, diluted | | | |

| Pro forma net income and FFO | 37,594,583 |

| | 37,321,517 |

|

| Pro forma AFFO and Normalized AFFO | 37,917,964 |

| | 37,829,421 |

|

SABRA HEALTH CARE REIT, INC.

ACTIVITY AFTER DECEMBER 31, 2012 — PRO FORMA INFORMATION

Pro Forma Debt Covenants

|

| | | | | | | | | | |

| | | | | | |

| | Minimum | | Maximum | | Pro Forma |

| Credit Facility: | | | | | |

| Consolidated Leverage Ratio | | | 5.75x |

| | 4.68x |

|

| Consolidated Fixed Charge Coverage Ratio | 1.75x |

| | | | 2.95x |

|

| Consolidated Tangible Net Worth | $ | 342.0 |

| | | | $ | 422.4 |

|

| | | | | | |

| Unsecured Senior Notes: | | | | | |

| Total Debt/ Asset Value | | | 60 | % | | 48 | % |

| Secured Debt/ Asset Value | | | 40 | % | | 21 | % |

| Unencumbered Assets/ Unsecured Debt | 150 | % | | | | 183 | % |

| Minimum Interest Coverage | 2.00x |

| | | | 3.22x |

|

| | | | | | |

Pro Forma Annualized Revenue Concentration

Pro Forma Annualized Revenue by Asset Class

|

| | |

| See reporting definitions. | 25 |

SABRA HEALTH CARE REIT, INC.

REPORTING DEFINITIONS

Acute Care Hospital. A facility designed to provide extended medical and rehabilitation care for patients who are clinically complex and have multiple acute or chronic conditions.

Annualized Revenues. The annual straight-line rental revenues under leases. Annualized Revenues do not include tenant recoveries or additional rents. The Company uses Annualized Revenues for the purpose of determining tenant concentrations and lease expirations.

EBITDA. The real estate industry uses earnings before interest, taxes, depreciation and amortization (“EBITDA”), a non-GAAP financial measure, as a measure of both operating performance and liquidity. The Company uses EBITDA to measure both its operating performance and liquidity. By excluding interest expense, EBITDA allows investors to measure the Company’s operating performance independent of its capital structure and indebtedness and, therefore, allows for a more meaningful comparison of its operating performance between quarters as well as annual periods and to compare its operating performance to that of other companies, both in the real estate industry and in other industries. As a liquidity measure, the Company believes that EBITDA helps investors analyze the Company’s ability to meet its interest payments on outstanding debt. The Company believes investors should consider EBITDA in conjunction with net income (the primary measure of the Company’s performance) and the other required GAAP measures of its performance and liquidity, to improve their understanding of the Company’s operating results and liquidity, and to make more meaningful comparisons of its performance between periods and against other companies. EBITDA has limitations as an analytical tool and should be used in conjunction with the Company’s required GAAP presentations. EBITDA does not reflect the Company’s historical cash expenditures or future cash requirements for capital expenditures or contractual commitments. While EBITDA is a relevant and widely used measure of operating performance and liquidity, it does not represent net income or cash flow from operations as defined by GAAP and it should not be considered as an alternative to those indicators in evaluating operating performance or liquidity. Further, the Company’s computation of EBITDA may not be comparable to similar measures reported by other companies.

EBITDAR. Earnings before interest, taxes, depreciation, amortization and rent (“EBITDAR”) for a particular facility accruing to the operator/tenant of the property (not the Company) for the period presented plus EBITDAR (excluding one-time adjustments) for the period presented for all other operations of any entities that guarantee the tenants' lease obligations to the Company (if applicable). The Company uses EBITDAR in determining EBITDAR Coverage. EBITDAR has limitations as an analytical tool. EBITDAR does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDAR does not represent a property's net income or cash flow from operations and should not be considered an alternative to those indicators. The Company receives EBITDAR and other information from its operators/tenants and relevant guarantors and utilizes EBITDAR as a supplemental measure of their ability to generate sufficient liquidity to meet related obligations to the Company. All facility and tenant financial performance data is derived solely from information provided by operators/tenants and guarantors without independent verification by the Company and is presented one month in arrears. The Company includes EBITDAR with respect to a property if the property was operated at any time during the period presented subject to a lease with the Company. EBITDAR for facilities with new tenants/operators are only included in periods subsequent to the Company's acquisition of the facilities. EBITDAR excludes the impact of strategic disposition candidates and facilities held for sale.

EBITDAR Coverage. EBITDAR for the trailing 3 and 12 month periods prior to and including the period presented divided by the same period cash rent for all of our facilities plus rent expense for other operations of any entity that guarantees the tenants' lease obligation to the Company. EBITDAR Coverage is a supplemental measure of an operator/tenant's and relevant guarantor's ability to meet their cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR. All facility and tenant data are derived solely from information provided by operators/tenants and guarantors without independent verification by the Company. All such data is presented one month in arrears and excludes the impact of strategic disposition candidates and facilities held for sale.

EBITDARM. Earnings before interest, taxes, depreciation, amortization, rent and management fees ("EBITDARM") for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. The Company uses EBITDARM in determining EBITDARM Coverage. The usefulness of EBITDARM is limited by the same factors that limit the usefulness of EBITDAR. Together with EBITDAR, the Company utilizes EBITDARM to evaluate the core operations of the properties by eliminating management fees, which vary based on operator/tenant and its operating structure. All facility financial performance data is derived solely from information provided by operators/tenants without independent verification by the Company. All such data is presented one month in arrears. The Company includes EBITDARM for a property if it was operated at any time during the period presented subject to a lease with the Company. EBITDARM for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities. EBITDARM excludes the impact of strategic disposition candidates and facilities held for sale.

EBITDARM Coverage. EBITDARM for the trailing 3 and 12 month periods prior to and including the period presented divided by the same period cash rent. EBITDARM coverage is a supplemental measure of a property's ability to generate cash flows for the operator/tenant (not the Company) to meet the operator's/tenant's related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. All facility data is derived solely from information provided by operators/tenants without independent verification by the Company. All such data is presented one month in arrears and excludes the impact of strategic disposition candidates and facilities held for sale.

Enterprise Value. The Company believes Enterprise Value is an important measurement as it is a measure of a company’s value. We calculate Enterprise Value as market equity capitalization plus debt. Market equity capitalization is calculated as the number of shares of

SABRA HEALTH CARE REIT, INC.

REPORTING DEFINITIONS

common stock multiplied by the closing price of our common stock on the last day of the period presented. Total Enterprise Value includes our market equity capitalization and consolidated debt, less cash and cash equivalents.