Non-Deal Roadshow Presentation July 10-11, 2013 New York, NY

FORWARD LOOKING STATEMENTS 2 This presentation contains “forward-looking” statements that may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. Forward-looking statements in this presentation also include all statements regarding expected future financial position, results of operations, cash flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends, projected expenses and capital expenditures, competitive position, growth opportunities and potential acquisitions, plans and objectives for future operations and compliance with and changes in governmental regulations. These statements are made as of the date hereof and are subject to known and unknown risks, uncertainties, assumptions and other factors—many of which are out of the Company’s control and difficult to forecast—that could cause actual results to differ materially from those set forth in or implied by our forward-looking statements. These risks and uncertainties include but are not limited to: our dependence on Genesis HealthCare LLC (“Genesis”), the parent company of Sun Healthcare Group, Inc. (“Sun”), until we are able to further diversify our portfolio; our dependence on the operating success of our tenants; changes in general economic conditions and volatility in financial and credit markets; the dependence of our tenants on reimbursement from governmental and other third-party payors; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to make acquisitions, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; our ability to raise capital through equity and debt financings; the relatively illiquid nature of real estate investments; competitive conditions in our industry; the loss of key management personnel or other employees; the impact of litigation and rising insurance costs on the business of our tenants; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance costs and liabilities; our ability to maintain our status as a REIT; compliance with REIT requirements and certain tax matters related to our status as a REIT; and other factors discussed from time to time in our news releases, public statements and/or filings with the Securities and Exchange Commission (the “SEC”), especially the “Risk Factors” sections of our Annual and Quarterly Reports on Forms 10-K and 10-Q. The Company assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise required by law. TENANT INFORMATION This presentation includes information regarding Genesis and Sun, a subsidiary of Genesis effective December 1, 2012. Prior to December 1, 2012, Sun was subject to the reporting requirements of the SEC and was required to file with the SEC annual reports containing audited financial information and quarterly reports containing unaudited financial information. Genesis is not subject to SEC reporting requirements. Sun’s historical filings with the SEC can be found at www.sec.gov. This presentation also includes information regarding each of our other tenants that lease properties from us. The information related to Sun and our other tenants that is provided in this presentation has been provided by the tenants or, in the case of Sun, derived from Sun’s public filings or provided by Sun. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only.

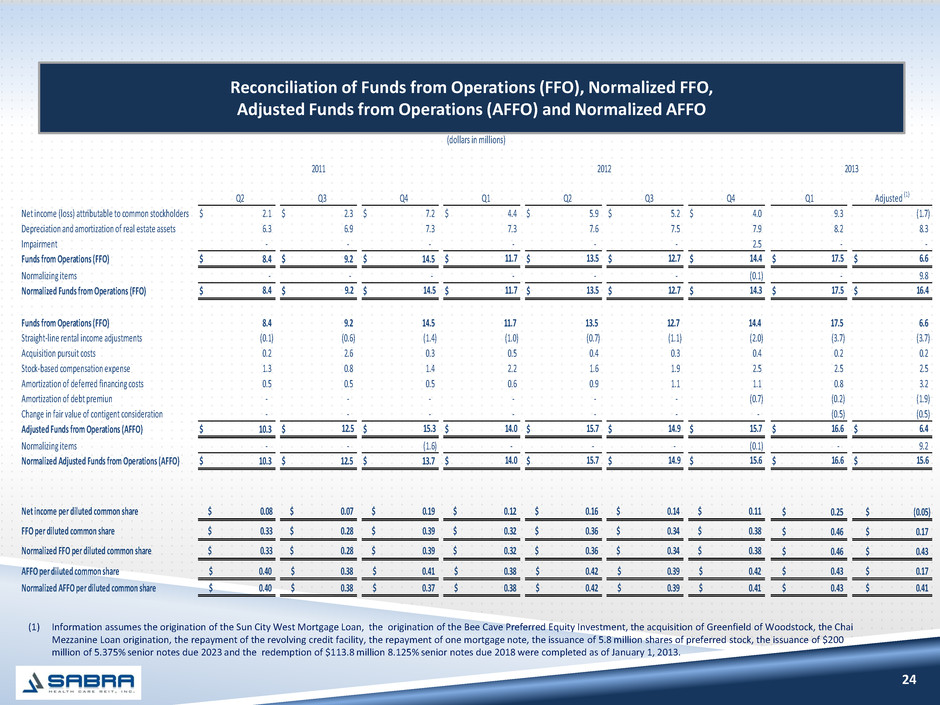

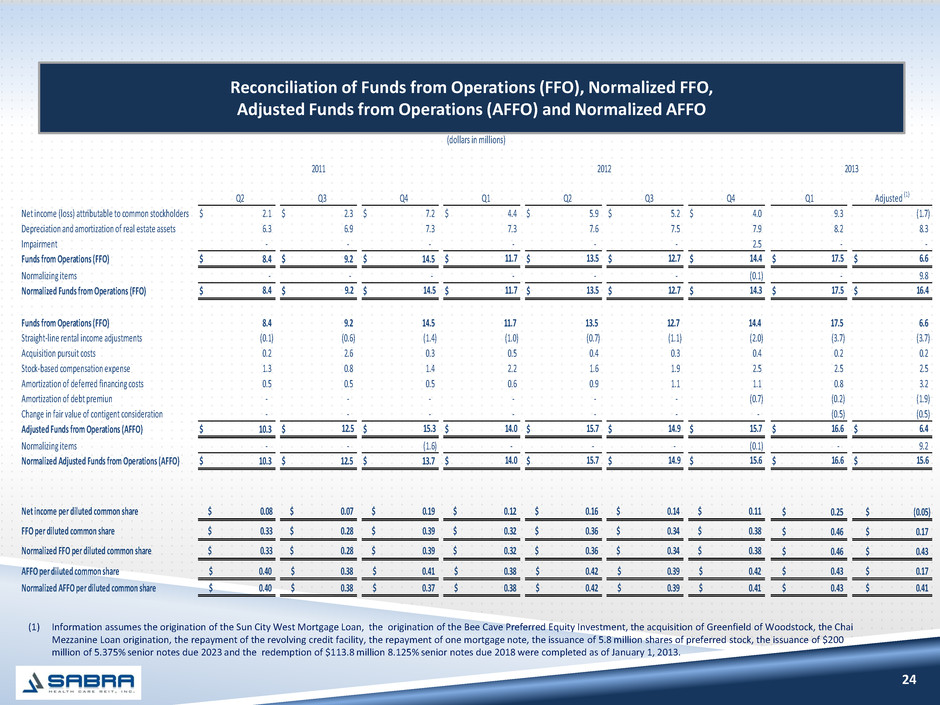

NON-GAAP FINANCIAL MEASURES 3 This presentation includes the following financial measures defined as non-GAAP financial measures by the SEC: EBITDAR, EBITDARM, funds from operations (“FFO”), Normalized FFO, adjusted FFO (“AFFO”), and Normalized AFFO. These measures may be different than non-GAAP financial measures used by other companies and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. EBITDAR is defined as earnings before interest, taxes, depreciation, amortization and rent for a particular facility accruing to the operator/tenant of the property (not the Company) for the period presented. EBITDARM is defined as EBITDAR before management fees for a particular facility accruing to the operator/tenant of the property (not the Company) for the period presented. EBITDAR(M) has limitations as an analytical tool. EBITDAR(M) does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDAR(M) does not represent a property's net income or cash flow from operations and should not be considered an alternative to those indicators. The Company receives EBITDAR(M) and other information from its operators/tenants and relevant guarantors and utilizes EBITDAR(M) as a supplemental measure of the ability of its tenants and the relevant guarantors to generate sufficient liquidity to meet related obligations to the Company. All facility and tenant financial performance data is derived solely from information provided by operators/tenants and guarantors without independent verification by the Company. All such data is presented one quarter in arrears. The Company includes EBITDAR(M) with respect to a property if the property was operated at any time during the period presented subject to a lease with the Company. EBITDAR(M) for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities. EBITDAR(M) excludes the impact of strategic disposition candidates. FFO is calculated in accordance with The National Association of Real Estate Investment Trusts’ definition of “funds from operations,” and is defined as net income attributable to common stockholders (computed in accordance with GAAP), excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization and impairment charges. Normalized FFO represents FFO adjusted for non- recurring income and expenses. AFFO is defined as FFO excluding non-cash revenues (including, but not limited to, straight-line rental income adjustments and non-cash interest income adjustments), non-cash expenses (including, but not limited to, stock-based compensation expense, amortization of deferred financing costs and amortization of debt discounts and premiums), and acquisition pursuit costs. Normalized AFFO represents AFFO adjusted for one-time start-up costs and non-recurring income and expenses. Reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included under “Reconciliation of Funds from Operations (FFO), Normalized FFO, Adjusted Funds from Operations (AFFO) and Normalized AFFO” in this presentation.

4 Strategic Overview

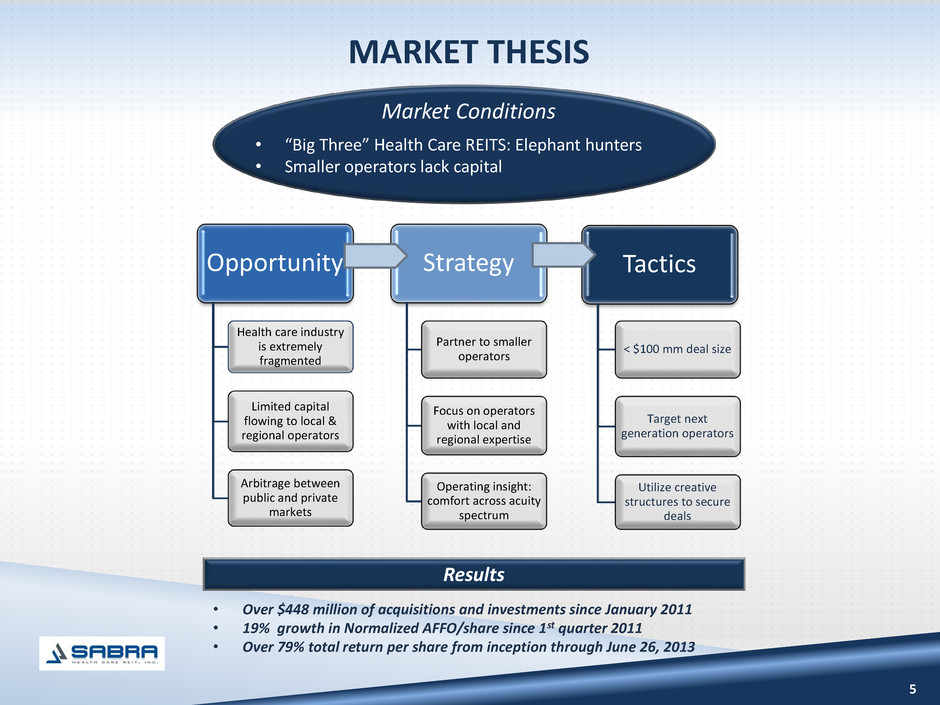

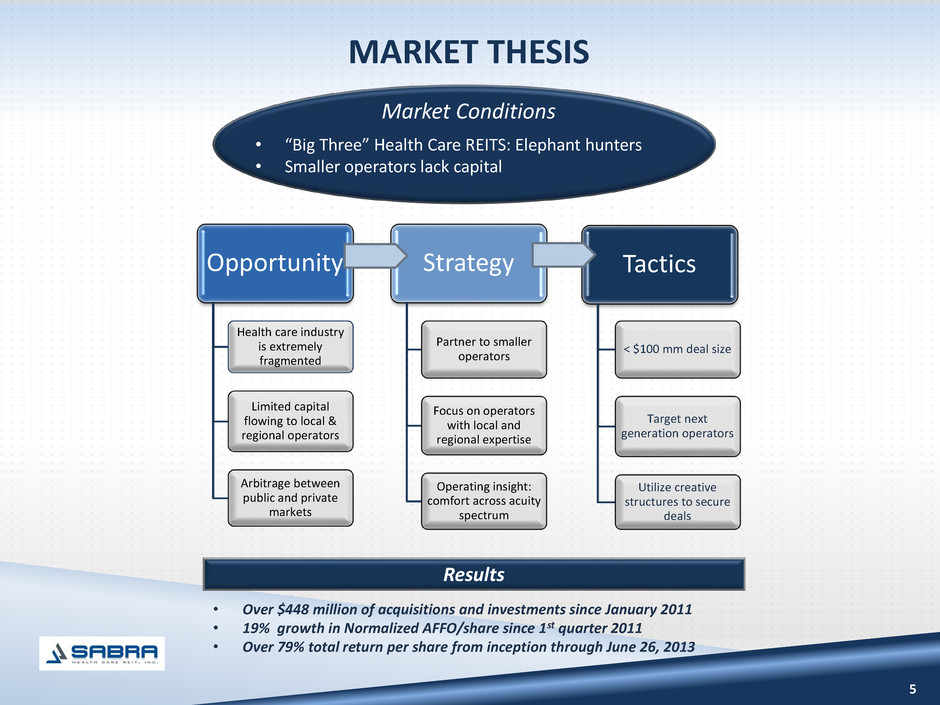

5 MARKET THESIS • “Big Three” Health Care REITS: Elephant hunters • Smaller operators lack capital Market Conditions Opportunity Health care industry is extremely fragmented Limited capital flowing to local & regional operators Arbitrage between public and private markets Strategy Partner to smaller operators Focus on operators with local and regional expertise Operating insight: comfort across acuity spectrum Tactics < $100 mm deal size Target next generation operators Utilize creative structures to secure deals Results • Over $448 million of acquisitions and investments since January 2011 • 19% growth in Normalized AFFO/share since 1st quarter 2011 • Over 79% total return per share from inception through June 26, 2013

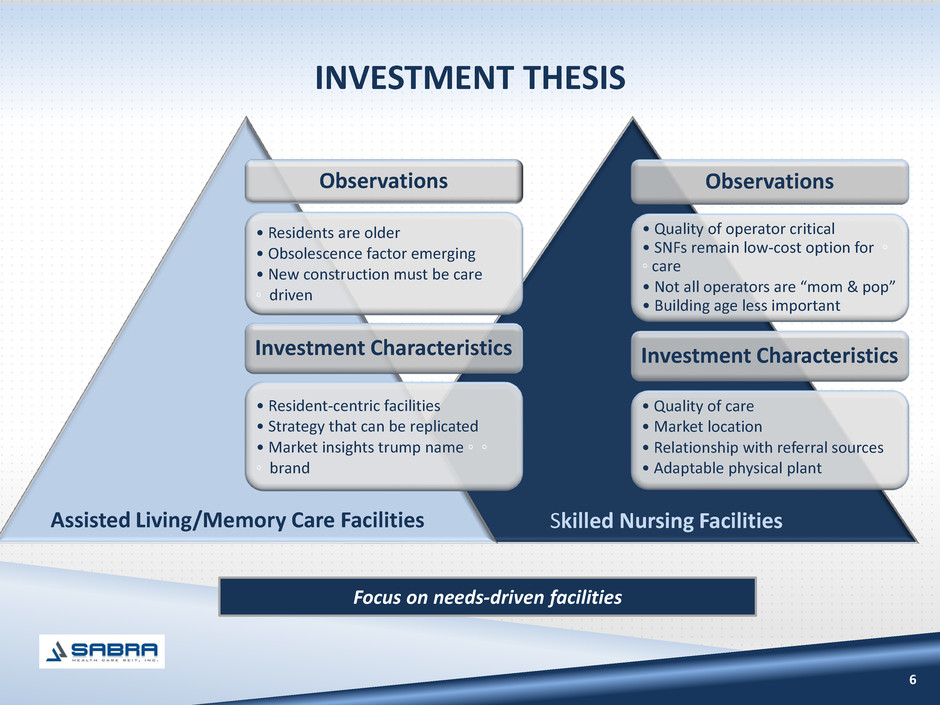

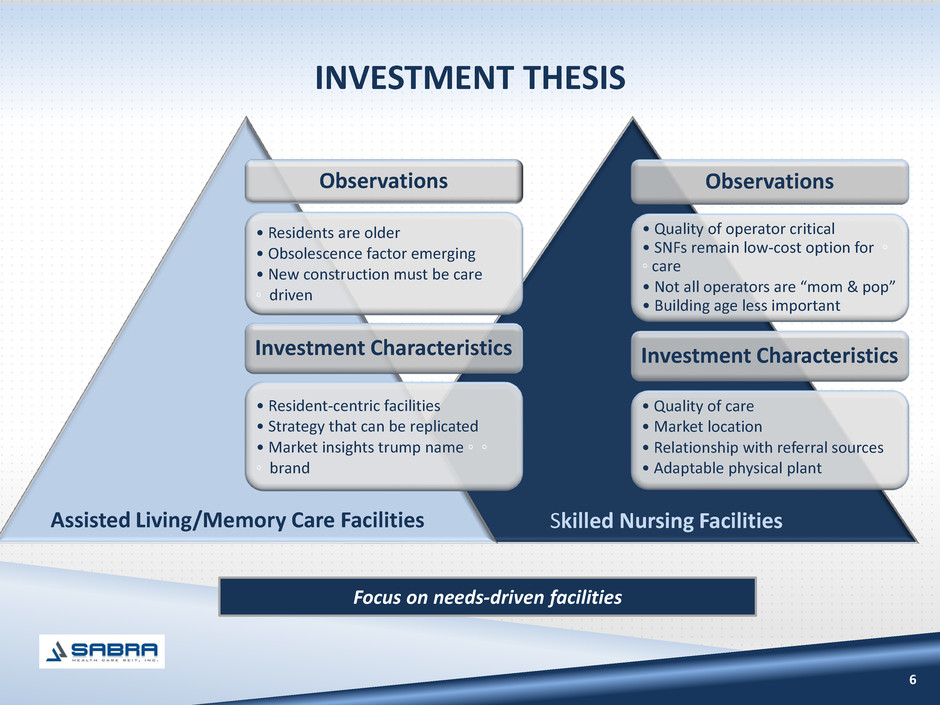

INVESTMENT THESIS 6 Focus on needs-driven facilities Observations • Quality of operator critical • SNFs remain low-cost option for ◦ ◦ care • Not all operators are “mom & pop” • Building age less important Investment Characteristics • Quality of care • Market location • Relationship with referral sources • Adaptable physical plant Observations • Residents are older • Obsolescence factor emerging • New construction must be care ◦ driven Investment Characteristics • Resident-centric facilities • Strategy that can be replicated • Market insights trump name ◦ ◦ ◦ brand Assisted Living/Memory Care Facilities Skilled Nursing Facilities

OPPORTUNISTIC INVESTING 7 SNF AL / MC IL Acute Care Hospital Equity Mezzanine Debt Mortgage Debt RIDEA Development Creative approaches to meet operators’ needs

8 As of December 31, 2010 Pro forma as of March 31, 2013, 37.3% of total annualized revenue derived from acquisitions Sabra’s Annualized Revenue: By Tenant IMPACT OF ACQUISITIONS $70.2 million $94.6 million As of December 31, 2011 Pro forma (1) As of March 31, 2013 $131.1 million (1) Assumes the acquisition of Greenfield of Woodstock and origination of the Chai Mezzanine Loan were completed as of January 1, 2013.

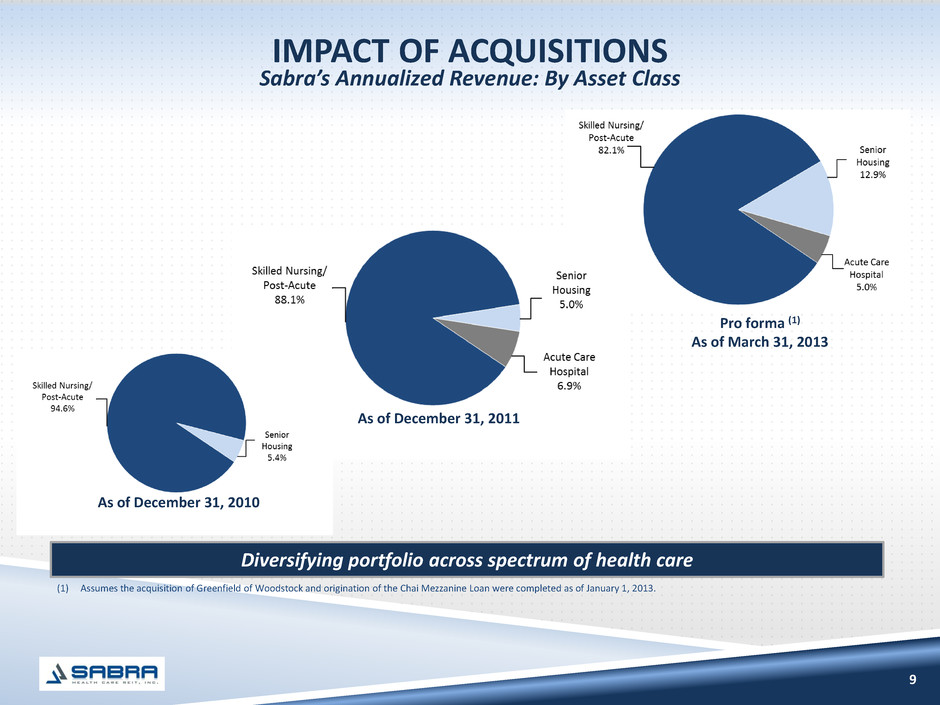

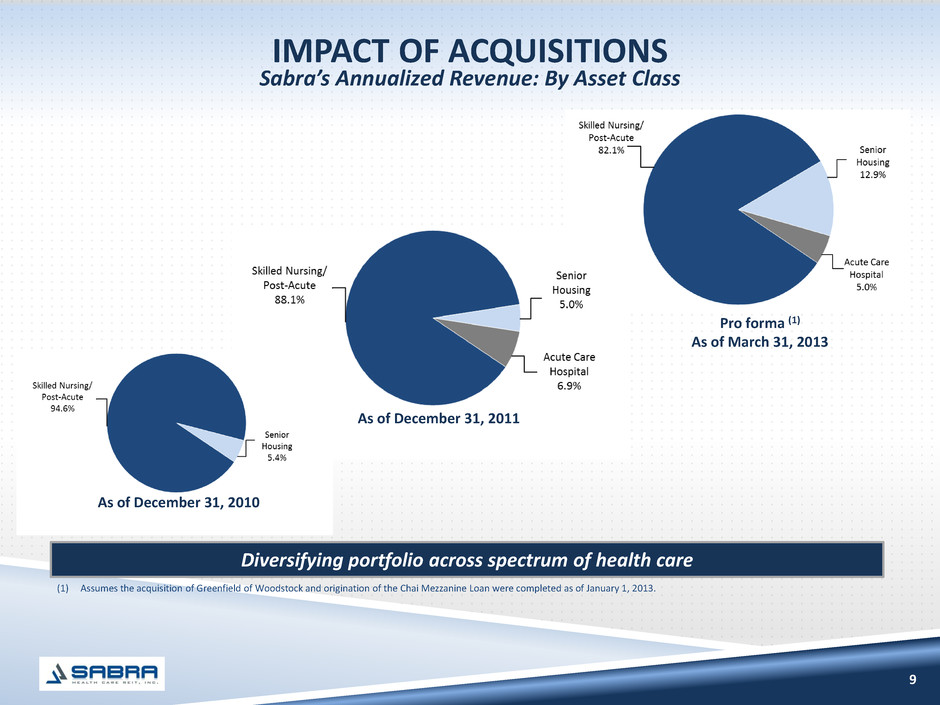

9 Diversifying portfolio across spectrum of health care Sabra’s Annualized Revenue: By Asset Class IMPACT OF ACQUISITIONS As of December 31, 2011 Pro forma (1) As of March 31, 2013 As of December 31, 2010 (1) Assumes the acquisition of Greenfield of Woodstock and origination of the Chai Mezzanine Loan were completed as of January 1, 2013.

Chai Portfolio Mezzanine Loan (Closed June 2013) Greenfield of Woodstock (Closed June 2013) 10 Property Type: Assisted Living Location: Virginia Investment Type: Equity Purchase Price: $6.2 mm Number of Properties: 1 Units: 32 Initial Cash Yield: 7.75% * Recent Acquisition and Investment Activity Property Type: Skilled Nursing Location: Seven states throughout U.S. Investment Type: Mezzanine Loan Investment: $12.4 mm Interest Rate: 12.0% Option to Purchase: Purchase up to $50.0 million of properties within the Chai Portfolio * * * * RECENT DEVELOPMENTS * * * *

11 * * * * * RECENT DEVELOPMENTS * * * * * Experienced SNF developers transforming from merchant builder to sustainable business model Dec. 2010: Introduced to Meridian as potential JV partner in SNF development program Mar. 2012: Sabra closes on $10 mm mezzanine loan with purchase option on Meridian portfolio 2010 2011 2012 2013 Aug. 2011: Meridian seeking refinancing on Onion Creek SNF Oct. 2011: Meridian seeks mezzanine loan on four properties Jun. 2012: Sabra completes $11 mm mortgage with purchase option on Onion Creek SNF Nov. 2012: Sabra closes on acquisition of four properties in Meridian portfolio 2013: Exploring development opportunities Mar. 2013: Sabra closes on $7.2 mm preferred equity investments for construction of 141 bed SNF and 52 unit memory care facility in Austin, TX Recent Acquisition and Investment Activity (Continued) Property Type: Skilled Nursing and Memory Care Location: Texas Investment Type: Preferred Equity Investment: $7.2 mm Investment Return: 15.0% Available Units: 141 SNF, 52 Memory Care Option to Purchase: Option to purchase skilled nursing facility upon completion of construction and stabilization Bee Cave (Closed March 2013)

RECENT DEVELOPMENTS New Dawn 12 Recent Acquisition and Investment Activity (Continued) New Dawn Sun City West (Closed January 2013) Property Type: Memory Care Location: Arizona Investment Type: Mortgage Loan Investment: $12.8 mm Rate of Return: 9.0% Option to Purchase: Beginning April 2014 Sabra has option to purchase facility securing loan Jul. 2012: Sabra introduced to New Dawn through its financial advisor Oct. 2012: Explored partial recapitalization of Sun City West facility 2012 2013 2013: Exploring participating in New Dawn developments Jan. 2013: Completed total recapitalization of Sun City West facility with option to purchase Sep. 2012: Closed sale/leaseback on Aurora, Colorado facility

13 Financial Overview

14 FINANCIAL STRENGTH (dollars in millions) $461 $225 $161 As of December 31, 2010 $1,083 $415 $144 $144 Pro forma as of March 31, 2013 Common Equity Market Value Senior Notes Mortgage Debt Preferred Equity Capitalization $847 million $1.79 billion Track record of access to capital markets (1) Assumes the payoff of a $7.3 million mortgage loan, the issuance of $200 million of 5.375% senior notes due 2023 and the redemption of $113.8 million of 8.125% senior notes due 2018 were completed as of January 1, 2013. (1)

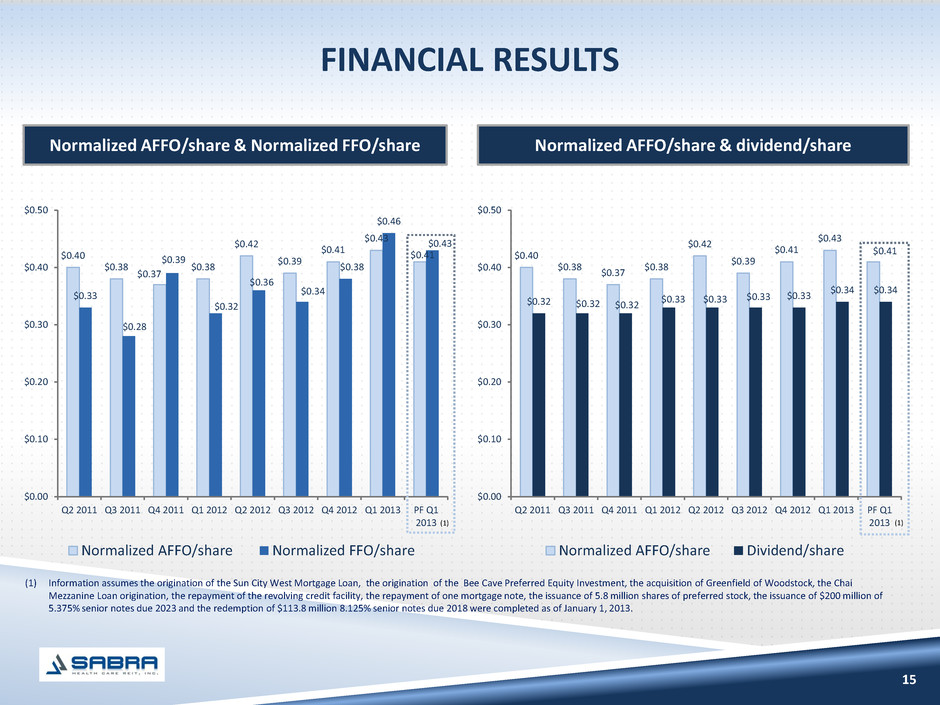

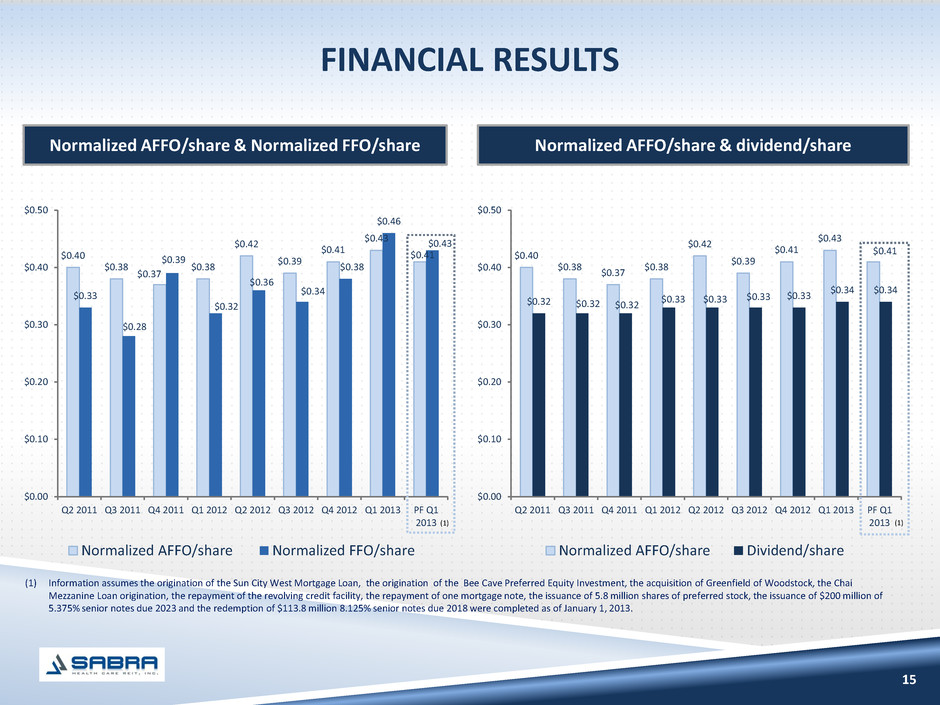

FINANCIAL RESULTS 15 Normalized AFFO/share & Normalized FFO/share Normalized AFFO/share & dividend/share $0.40 $0.38 $0.37 $0.38 $0.42 $0.39 $0.41 $0.43 $0.41 $0.32 $0.32 $0.32 $0.33 $0.33 $0.33 $0.33 $0.34 $0.34 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 PF Q1 2013 Normalized AFFO/share Dividend/share $0.40 $0.38 $0.37 $0.38 $0.42 $0.39 $0.41 $0.43 $0.41 $0.33 $0.28 $0.39 $0.32 $0.36 $0.34 $0.38 $0.46 $0.43 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 PF Q1 2013 Normalized AFFO/share Normalized FFO/share (1) (1) (1) Information assumes the origination of the Sun City West Mortgage Loan, the origination of the Bee Cave Preferred Equity Investment, the acquisition of Greenfield of Woodstock, the Chai Mezzanine Loan origination, the repayment of the revolving credit facility, the repayment of one mortgage note, the issuance of 5.8 million shares of preferred stock, the issuance of $200 million of 5.375% senior notes due 2023 and the redemption of $113.8 million 8.125% senior notes due 2018 were completed as of January 1, 2013.

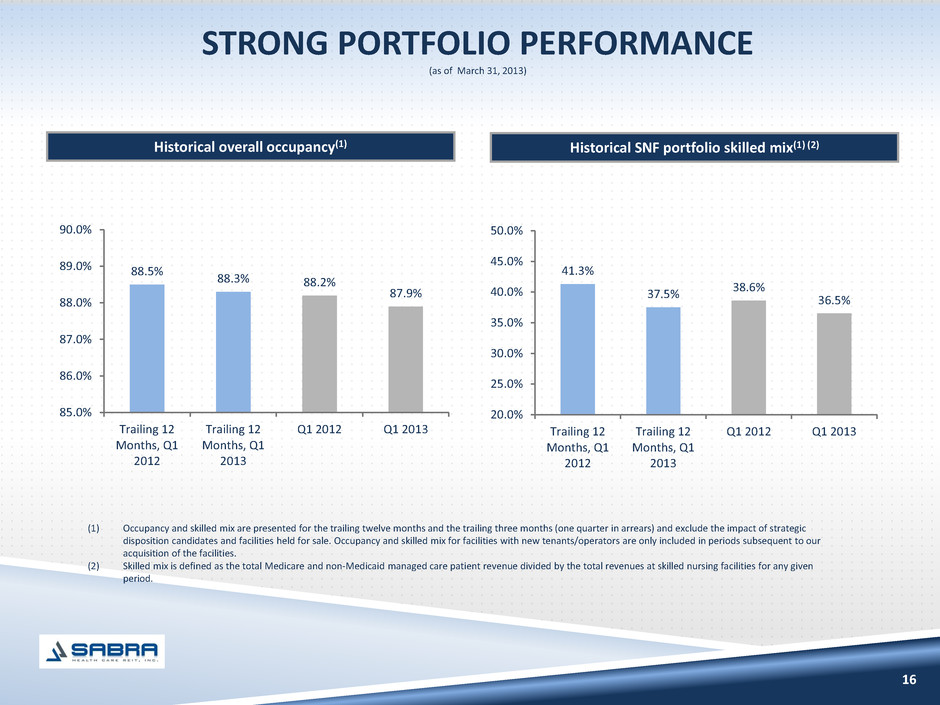

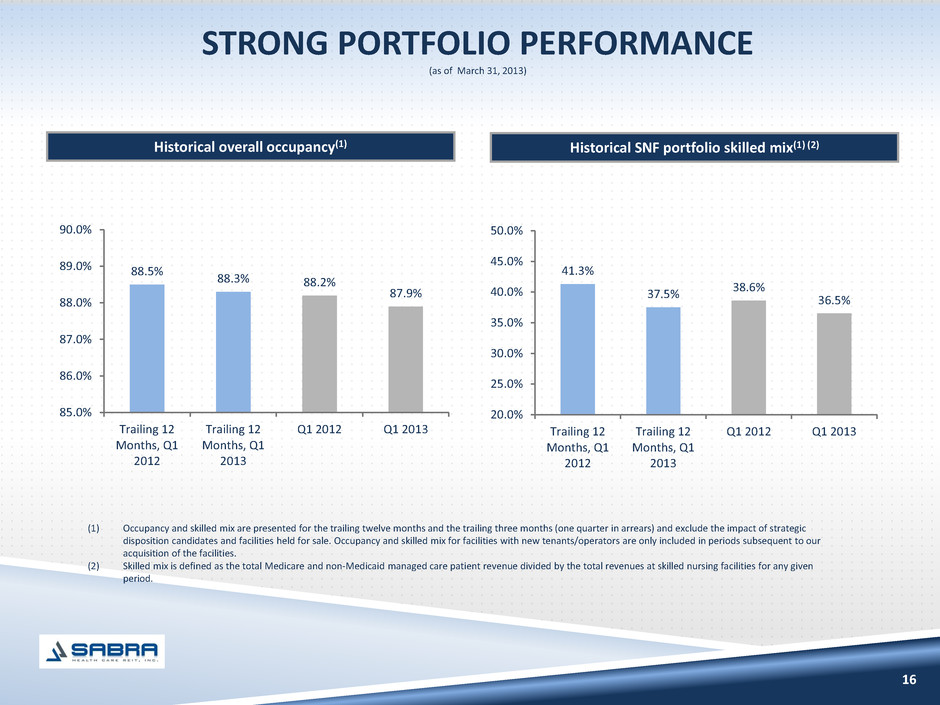

16 Historical overall occupancy(1) Historical SNF portfolio skilled mix(1) (2) STRONG PORTFOLIO PERFORMANCE (as of March 31, 2013) 41.3% 37.5% 38.6% 36.5% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% Trailing 12 Months, Q1 2012 Trailing 12 Months, Q1 2013 Q1 2012 Q1 2013 88.5% 88.3% 88.2% 87.9% 85.0% 86.0% 87.0% 88.0% 89.0% 90.0% Trailing 12 Months, Q1 2012 Trailing 12 Months, Q1 2013 Q1 2012 Q1 2013 (1) Occupancy and skilled mix are presented for the trailing twelve months and the trailing three months (one quarter in arrears) and exclude the impact of strategic disposition candidates and facilities held for sale. Occupancy and skilled mix for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities. (2) Skilled mix is defined as the total Medicare and non-Medicaid managed care patient revenue divided by the total revenues at skilled nursing facilities for any given period.

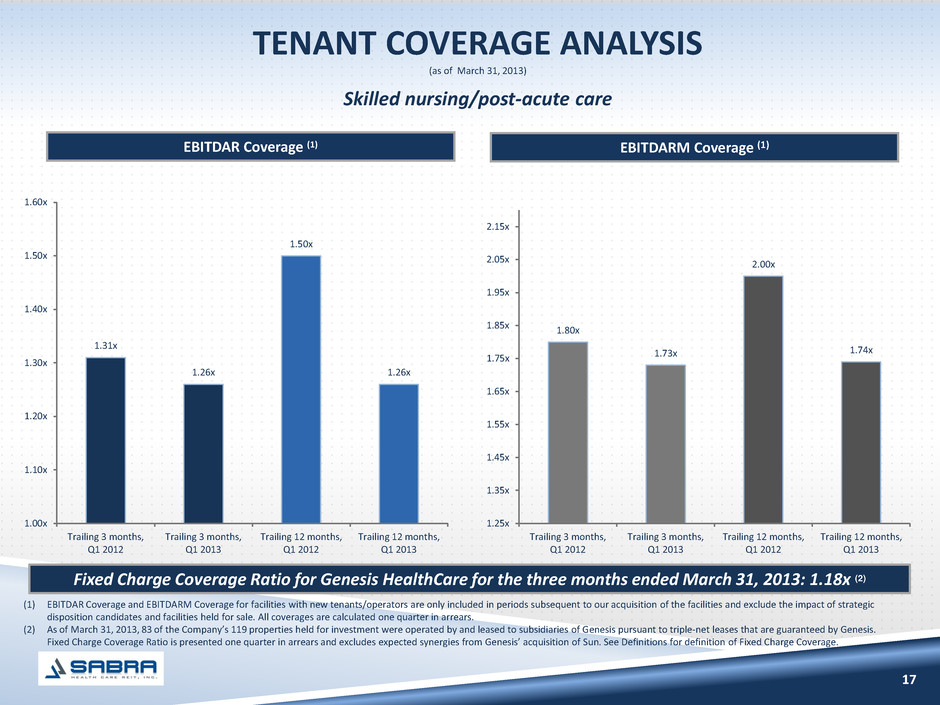

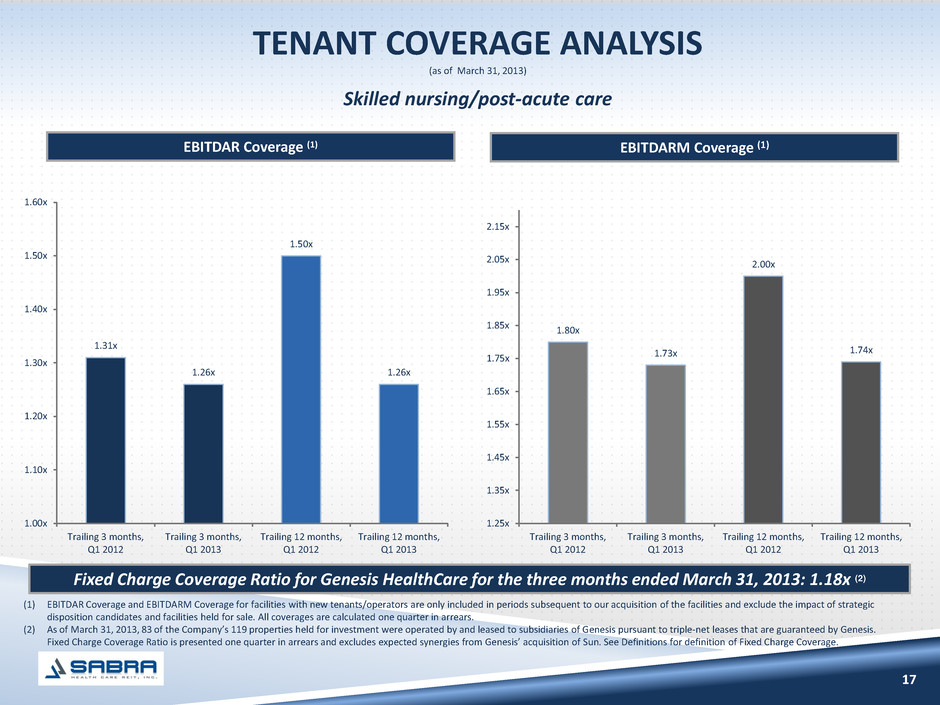

17 EBITDAR Coverage (1) EBITDARM Coverage (1) TENANT COVERAGE ANALYSIS (as of March 31, 2013) 1.31x 1.26x 1.50x 1.26x 1.00x 1.10x 1.20x 1.30x 1.40x 1.50x 1.60x Trailing 3 months, Q1 2012 Trailing 3 months, Q1 2013 Trailing 12 months, Q1 2012 Trailing 12 months, Q1 2013 (1) EBITDAR Coverage and EBITDARM Coverage for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities and exclude the impact of strategic disposition candidates and facilities held for sale. All coverages are calculated one quarter in arrears. (2) As of March 31, 2013, 83 of the Company’s 119 properties held for investment were operated by and leased to subsidiaries of Genesis pursuant to triple-net leases that are guaranteed by Genesis. Fixed Charge Coverage Ratio is presented one quarter in arrears and excludes expected synergies from Genesis’ acquisition of Sun. See Definitions for definition of Fixed Charge Coverage. 1.80x 1.73x 2.00x 1.74x 1.25x 1.35x 1.45x 1.55x 1.65x 1.75x 1.85x 1.95x 2.05x 2.15x Trailing 3 months, Q1 2012 Trailing 3 months, Q1 2013 Trailing 12 months, Q1 2012 Trailing 12 months, Q1 2013 Skilled nursing/post-acute care Fixed Charge Coverage Ratio for Genesis HealthCare for the three months ended March 31, 2013: 1.18x (2)

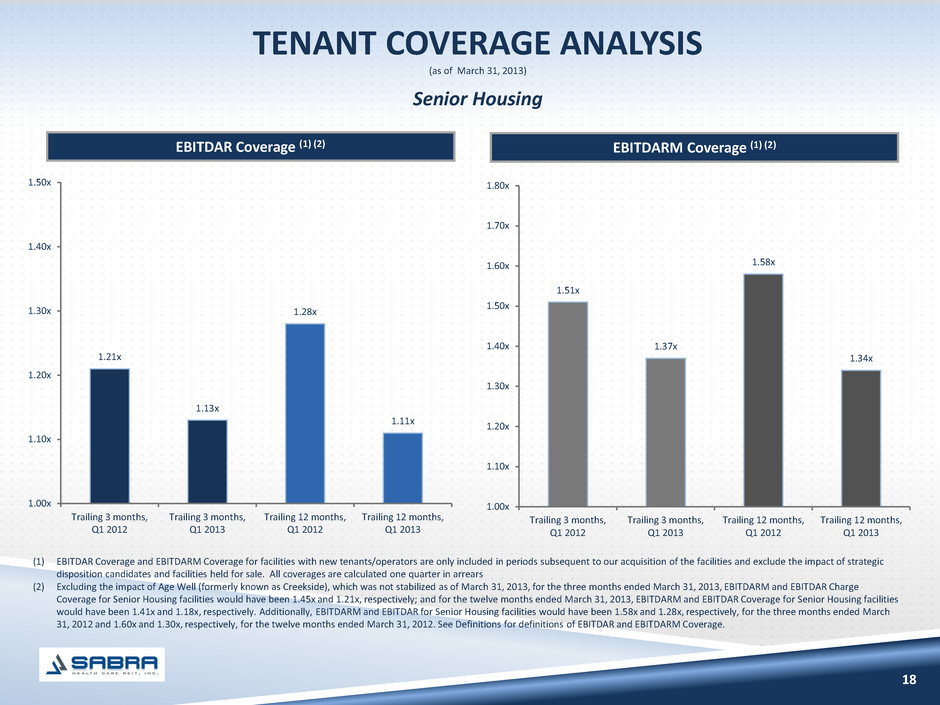

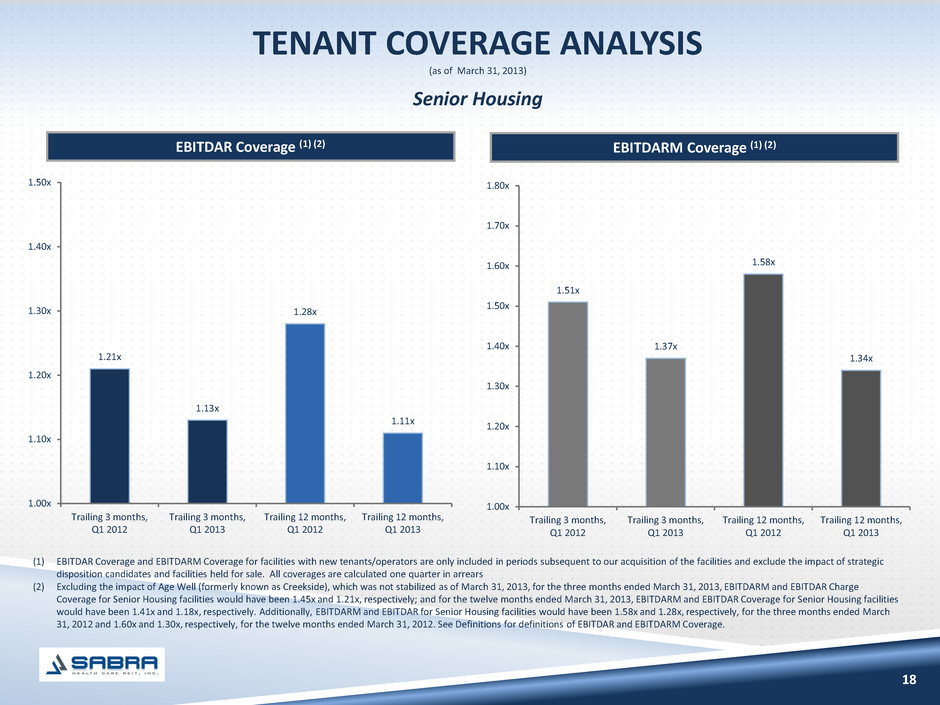

18 EBITDAR Coverage (1) (2) EBITDARM Coverage (1) (2) TENANT COVERAGE ANALYSIS (as of March 31, 2013) 1.21x 1.13x 1.28x 1.11x 1.00x 1.10x 1.20x 1.30x 1.40x 1.50x Trailing 3 months, Q1 2012 Trailing 3 months, Q1 2013 Trailing 12 months, Q1 2012 Trailing 12 months, Q1 2013 (1) EBITDAR Coverage and EBITDARM Coverage for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities and exclude the impact of strategic disposition candidates and facilities held for sale. All coverages are calculated one quarter in arrears (2) Excluding the impact of Age Well (formerly known as Creekside), which was not stabilized as of March 31, 2013, for the three months ended March 31, 2013, EBITDARM and EBITDAR Charge Coverage for Senior Housing facilities would have been 1.45x and 1.21x, respectively; and for the twelve months ended March 31, 2013, EBITDARM and EBITDAR Coverage for Senior Housing facilities would have been 1.41x and 1.18x, respectively. Additionally, EBITDARM and EBITDAR for Senior Housing facilities would have been 1.58x and 1.28x, respectively, for the three months ended March 31, 2012 and 1.60x and 1.30x, respectively, for the twelve months ended March 31, 2012. See Definitions for definitions of EBITDAR and EBITDARM Coverage. 1.51x 1.37x 1.58x 1.34x 1.00x 1.10x 1.20x 1.30x 1.40x 1.50x 1.60x 1.70x 1.80x Trailing 3 months, Q1 2012 Trailing 3 months, Q1 2013 Trailing 12 months, Q1 2012 Trailing 12 months, Q1 2013 Senior Housing

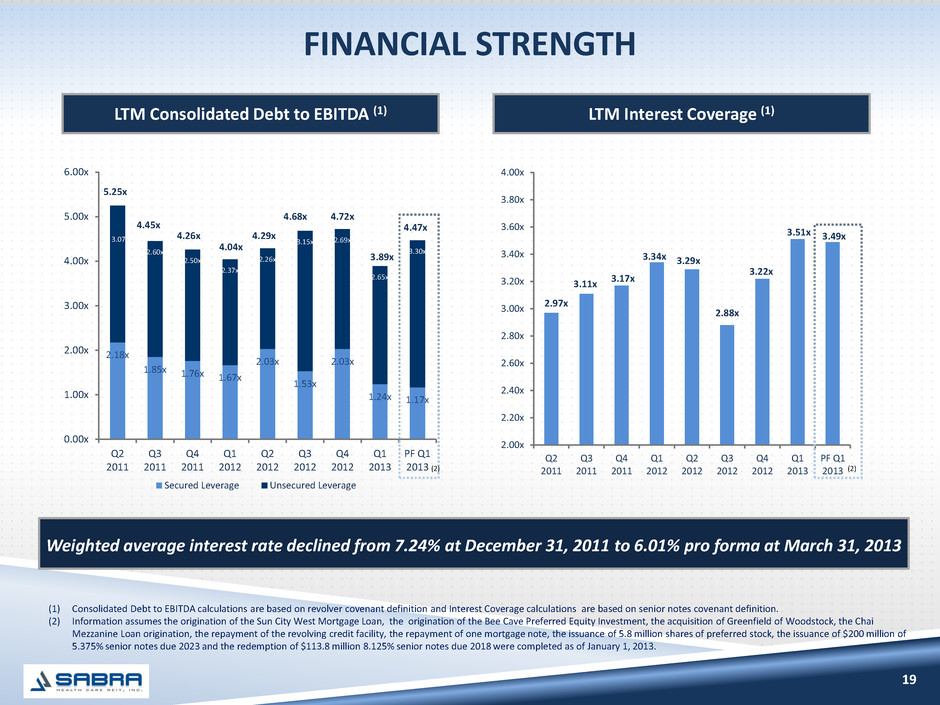

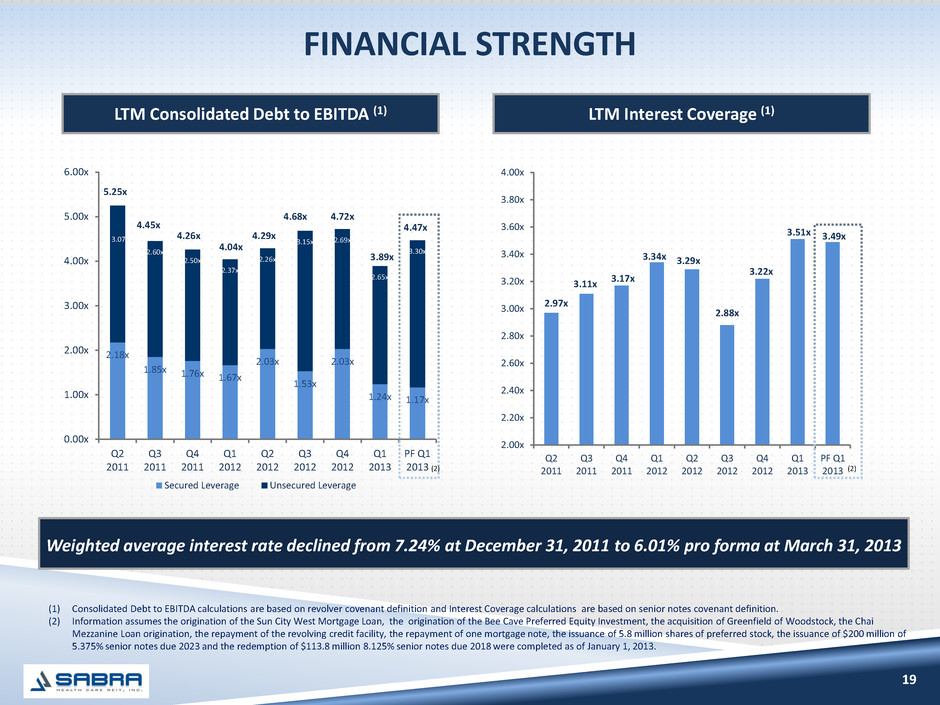

2.18x 1.85x 1.76x 1.67x 2.03x 1.53x 2.03x 1.24x 1.17x 3.07x 2.60x 2.50x 2.37x 2.26x 3.15x 2.69x 2.65x 3.30x 0.00x 1.00x 2.00x 3.00x 4.00x 5.00x 6.00x Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 PF Q1 2013 Secured Leverage Unsecured Leverage 4.04x 4.47x FINANCIAL STRENGTH 19 LTM Consolidated Debt to EBITDA (1) LTM Interest Coverage (1) 2.97x 3.11x 3.17x 3.34x 3.29x 2.88x 3.22x 3.51x 3.49x 2.00x 2.20x 2.40x 2.60x 2.80x 3.00x 3.20x 3.40x 3.60x 3.80x 4.00x Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 PF Q1 2013 (1) Consolidated Debt to EBITDA calculations are based on revolver covenant definition and Interest Coverage calculations are based on senior notes covenant definition. (2) Information assumes the origination of the Sun City West Mortgage Loan, the origination of the Bee Cave Preferred Equity Investment, the acquisition of Greenfield of Woodstock, the Chai Mezzanine Loan origination, the repayment of the revolving credit facility, the repayment of one mortgage note, the issuance of 5.8 million shares of preferred stock, the issuance of $200 million of 5.375% senior notes due 2023 and the redemption of $113.8 million 8.125% senior notes due 2018 were completed as of January 1, 2013. 5.25x 4.45x 4.26x 4.29x 4.68x 4.72x 3.89x Weighted average interest rate declined from 7.24% at December 31, 2011 to 6.01% pro forma at March 31, 2013 (2) (2)

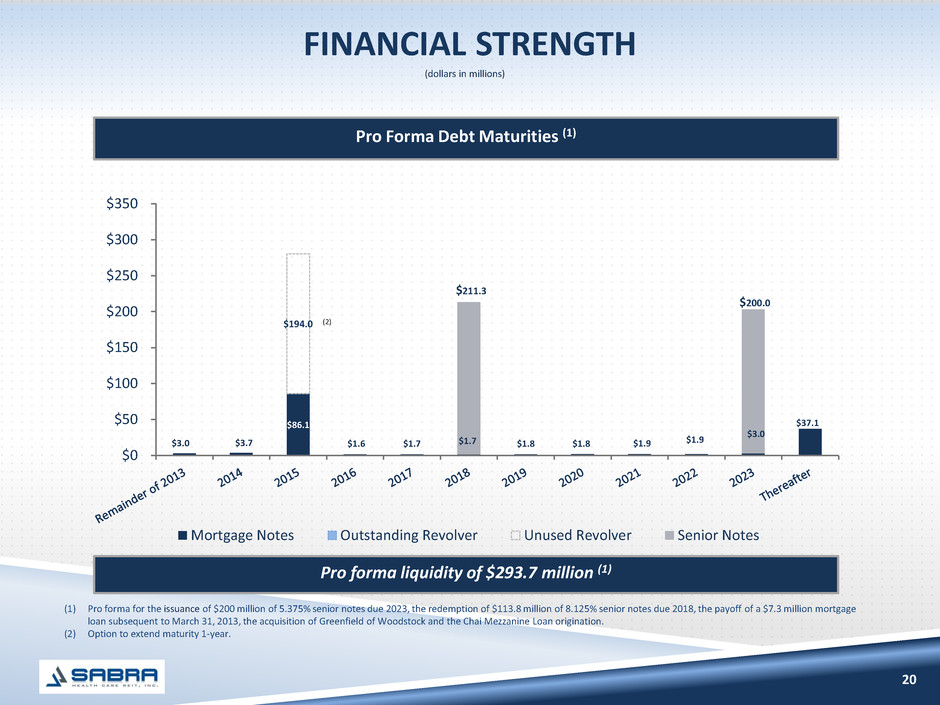

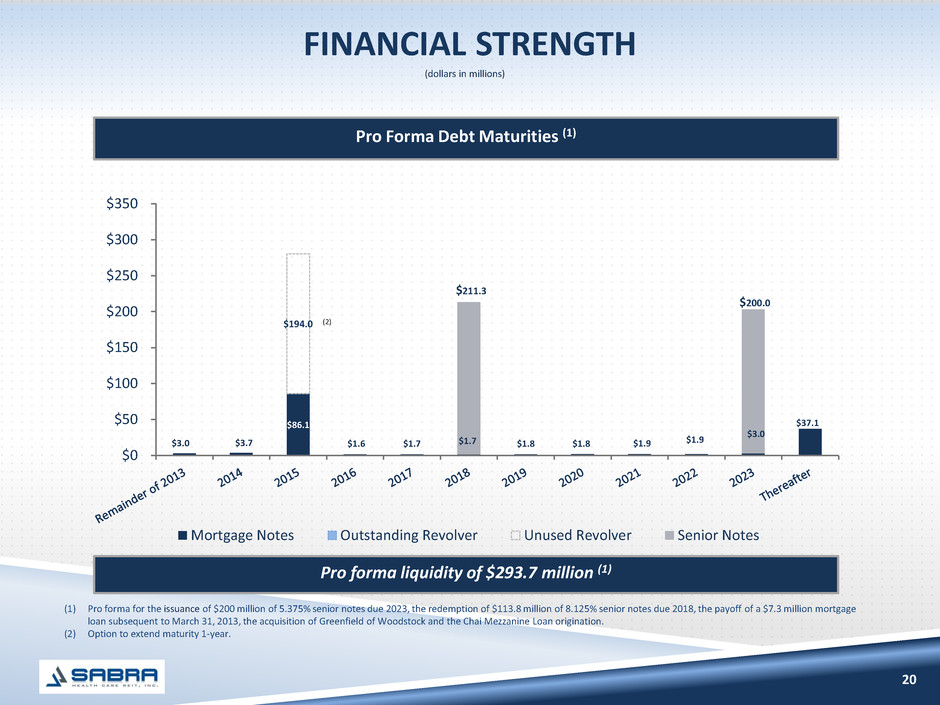

FINANCIAL STRENGTH 20 Pro Forma Debt Maturities (1) (dollars in millions) $3.0 $3.7 $86.1 $1.6 $1.7 $1.7 $1.8 $1.8 $1.9 $1.9 $3.0 $37.1 $194.0 $0 $50 $100 $150 $200 $250 $300 $350 Mortgage Notes Outstanding Revolver Unused Revolver Senior Notes $200.0 $211.3 Pro forma liquidity of $293.7 million (1) (1) Pro forma for the issuance of $200 million of 5.375% senior notes due 2023, the redemption of $113.8 million of 8.125% senior notes due 2018, the payoff of a $7.3 million mortgage loan subsequent to March 31, 2013, the acquisition of Greenfield of Woodstock and the Chai Mezzanine Loan origination. (2) Option to extend maturity 1-year. (2)

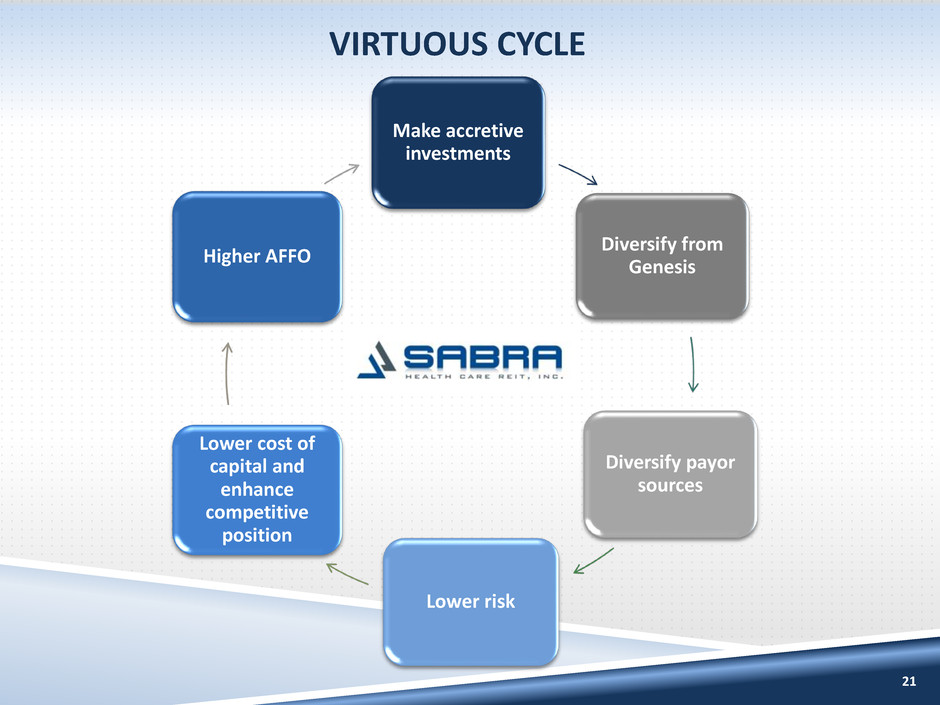

21 Make accretive investments Diversify from Genesis Diversify payor sources Lower risk Lower cost of capital and enhance competitive position Higher AFFO VIRTUOUS CYCLE

22 Appendix

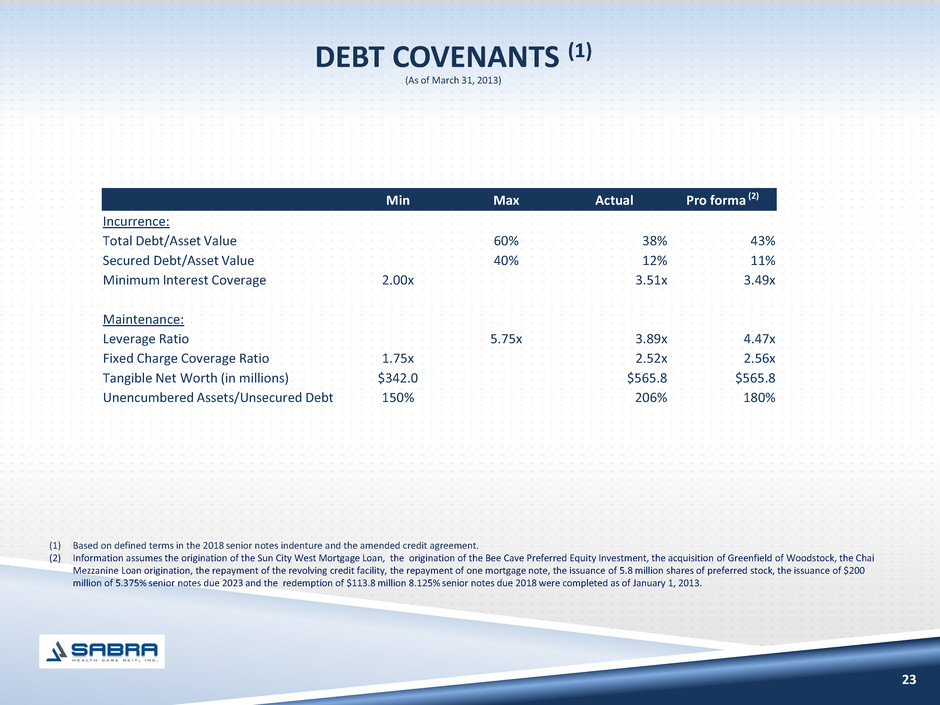

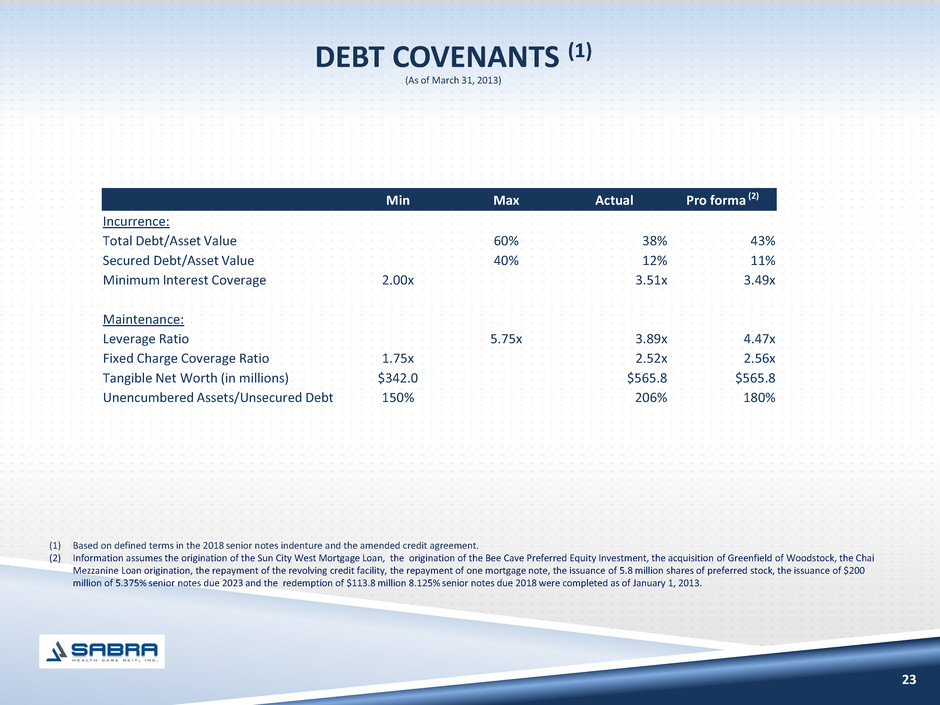

DEBT COVENANTS (1) 23 (1) Based on defined terms in the 2018 senior notes indenture and the amended credit agreement. (2) Information assumes the origination of the Sun City West Mortgage Loan, the origination of the Bee Cave Preferred Equity Investment, the acquisition of Greenfield of Woodstock, the Chai Mezzanine Loan origination, the repayment of the revolving credit facility, the repayment of one mortgage note, the issuance of 5.8 million shares of preferred stock, the issuance of $200 million of 5.375% senior notes due 2023 and the redemption of $113.8 million 8.125% senior notes due 2018 were completed as of January 1, 2013. (As of March 31, 2013) Min Max Actual Pro forma (2) Incurrence: Total Debt/Asset Value 60% 38% 43% Secured Debt/Asset Value 40% 12% 11% Minimum Interest Coverage 2.00x 3.51x 3.49x Maintenance: Leverage Ratio 5.75x 3.89x 4.47x Fixed Charge Coverage Ratio 1.75x 2.52x 2.56x Tangible Net Worth (in millions) $342.0 $565.8 $565.8 Unencumbered Assets/Unsecured Debt 150% 206% 180%

24 Reconciliation of Funds from Operations (FFO), Normalized FFO, Adjusted Funds from Operations (AFFO) and Normalized AFFO (1) Information assumes the origination of the Sun City West Mortgage Loan, the origination of the Bee Cave Preferred Equity Investment, the acquisition of Greenfield of Woodstock, the Chai Mezzanine Loan origination, the repayment of the revolving credit facility, the repayment of one mortgage note, the issuance of 5.8 million shares of preferred stock, the issuance of $200 million of 5.375% senior notes due 2023 and the redemption of $113.8 million 8.125% senior notes due 2018 were completed as of January 1, 2013. Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net income (loss) attributable to common stockholders $ 2.1 $ 2.3 $ 7.2 $ 4.4 $ 5.9 $ 5.2 $ 4.0 9.3 (1.7) Depreciation and amortization of real estate assets 6.3 6.9 7.3 7.3 7.6 7.5 7.9 8.2 8.3 Impairment - - - - - - 2.5 - - Funds from Operations (FFO) $ 8.4 $ 9.2 $ 14.5 $ 11.7 $ 13.5 $ 12.7 $ 14.4 $ 17.5 $ 6.6 Normalizing items - - - - - - (0.1) - 9.8 Normalized Funds from Operations (FFO) $ 8.4 $ 9.2 $ 14.5 $ 11.7 $ 13.5 $ 12.7 $ 14.3 $ 17.5 $ 16.4 Funds from Operations (FFO) 8.4 9.2 14.5 11.7 13.5 12.7 14.4 17.5 6.6 Straight-line rental income adjustments (0.1) (0.6) (1.4) (1.0) (0.7) (1.1) (2.0) (3.7) (3.7) Acquisition pursuit costs 0.2 2.6 0.3 0.5 0.4 0.3 0.4 0.2 0.2 Stock-based compensation expense 1.3 0.8 1.4 2.2 1.6 1.9 2.5 2.5 2.5 Amortization of deferred financing costs 0.5 0.5 0.5 0.6 0.9 1.1 1.1 0.8 3.2 Amortization of debt premiun - - - - - - (0.7) (0.2) (1.9) Change in fair value of contigent consideration - - - - - - - (0.5) (0.5) Adjusted Funds from Operations (AFFO) $ 10.3 $ 12.5 $ 15.3 $ 14.0 $ 15.7 $ 14.9 $ 15.7 $ 16.6 $ 6.4 Normalizing items - - (1.6) - - - (0.1) - 9.2 Normalized Adjusted Funds from Operations (AFFO) $ 10.3 $ 12.5 $ 13.7 $ 14.0 $ 15.7 $ 14.9 $ 15.6 $ 16.6 $ 15.6 Net income per diluted common share $ 0.08 $ 0.07 $ 0.19 $ 0.12 $ 0.16 $ 0.14 $ 0.11 0.25$ (0.05)$ F O per diluted common share $ 0.33 $ 0.28 $ 0.39 $ 0.32 $ 0.36 $ 0.34 $ 0.38 0.46$ 0.17$ Normalized FFO per diluted common share $ 0.33 $ 0.28 $ 0.39 $ 0.32 $ 0.36 $ 0.34 $ 0.38 0.46$ 0.43$ AFFO per diluted common share 0.40$ 0.38$ 0.41$ 0.38$ 0.42$ 0.39$ 0.42$ 0.43$ 0.17$ Normalized AFFO per diluted common share 0.40$ 0.38$ 0.37$ 0.38$ 0.42$ 0.39$ 0.41$ 0.43$ 0.41$ Q1 2013 Adjusted (1) (dollars in millions) 2011 2012

DEFINITIONS 25 Acute Care Hospital. A facility designed to provide extended medical and rehabilitation care for patients who are clinically complex and have multiple acute or chronic conditions. EBITDAR Coverage. EBITDAR for the trailing 3 and 12 month periods prior to and including the period presented divided by the same period cash rent for all of our facilities. EBITDAR Coverage is a supplemental measure of an operator/tenant's ability to meet their cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR. All facility and tenant data are derived solely from information provided by operators/tenants without independent verification by the Company. All such data is presented one quarter in arrears and excludes the impact of strategic disposition candidates and facilities held for sale. EBITDARM Coverage. EBITDARM for the trailing 3 and 12 month periods prior to and including the period presented divided by the same period cash rent. EBITDARM coverage is a supplemental measure of a property's ability to generate cash flows for the operator/tenant (not the Company) to meet the operator's/tenant's related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. All facility data is derived solely from information provided by operators/tenants without independent verification by the Company. All such data is presented one quarter in arrears and excludes the impact of strategic disposition candidates and facilities held for sale. Fixed Charge Coverage. EBITDAR (including adjustments for one-time and pro forma items) for the period indicated (one quarter in arrears) for all operations of any entities that guarantee the tenants' lease obligations to the Company divided by the same period cash rent expense, interest expense and mandatory principal payments for operations of any entity that guarantees the tenants' lease obligation to the Company. Fixed Charge Coverage is a supplemental measure of a guarantor's ability to meet the operator/tenant's cash rent and other obligations to the Company should the operator/tenant be unable to do so itself. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDAR. Fixed Charge Coverage is calculated by the Company as described above based on information provided by guarantors without independent verification by the Company and may differ from similar metrics calculated by the guarantors. Occupancy Percentage. Occupancy Percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the period presented by the available beds/units for the same period. Occupancy for independent living facilities can be greater than 100% for a given period as multiple residents could occupy a single unit. All facility financial performance data were derived solely from information provided by operators/tenants without independent verification by the Company. All facility financial performance data are presented one quarter in arrears. The Company includes the occupancy percentage for a property if it was owned by the Company at any time during the period presented and excludes the impact of strategic disposition candidates and facilities held for sale. Occupancy Percentage for facilities with new tenants/operators are only included in periods subsequent to our acquisition of the facilities. Senior Housing. Senior housing facilities include independent living, assisted living, continuing care retirement community and memory care facilities. Skilled Nursing/Post-Acute. Skilled nursing/post-acute facilities include skilled nursing facilities, multi-license designation, and mental health facilities.