CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Consolidated Financial Statements December 31, 2022 and 2021, and Years ended December 31, 2022, 2021, and 2020 (With Independent Auditors’ Report Thereon)

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Table of Contents Page Independent Auditors’ Report 1 Consolidated Statements of Financial Position 3 Consolidated Statements of Operations 4 Consolidated Statements of Members’ Deficit 5 Consolidated Statements of Cash Flows 6 Notes to Consolidated Financial Statements 7

Phone: 610.862.2200 Fax: 610.862.2500 mhmcpa.com Mayer Hoffman McCann P.C. An Independent CPA Firm 401 Plymouth Road, Suite 200 Plymouth Meeting, PA 19462 A member of Kreston Global – a global network of accounting firms 1 INDEPENDENT AUDITORS’ REPORT To the Board of Directors of Chief1 Holdings, LLC Opinion We have audited the consolidated financial statements of Chief1 Holdings, LLC and Subsidiaries (the “Company”), which comprise the consolidated statements of financial position as of December 31, 2022 and 2021, and the related consolidated statements of operations and comprehensive loss, members’ deficit, and cash flows for the years then ended, and the related notes to the consolidated financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021 and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditors’ Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of Chief1 Holdings, LLC and Subsidiaries and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Substantial Doubt About the Entity’s Ability to Continue as a Going Concern The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, as the result of the COVID-19 pandemic, the Company has seen a significant increase in costs and lost revenue resulting in declining income and cash flow and is in default of its credit facility and mortgage notes debt agreements. As a result, substantial doubt exists about the Company’s ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

2 Auditors’ Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control related matters that we identified during the audit. Comparative Information The comparative information, presented in the accompanying consolidated financial statements, as of and for the year ended December 31, 2020, has not been audited, reviewed, or compiled, and, accordingly, we express no opinion on it. Plymouth Meeting, Pennsylvania March 20, 2023

2022 2021 (audited) (audited) Investment properties: Land $ 59,371 61,079 Building, furniture, equipment and other improvements 465,045 460,975 524,416 522,054 Less accumulated depreciation (162,646) (142,794) Net investment properties 361,770 379,260 Cash and cash equivalents 3,694 4,136 Restricted cash 19,853 12,414 Due from affiliate 3,473 4,343 1,790 1,591 Prepaid expenses 2,419 1,463 Deferred tax asset, net — 57,496 Other assets, net 16,085 7,059 Assets held for sale 4,338 — Total assets $ 413,422 467,762 Mortgages and notes payable, net $ 762,497 757,101 Accounts payable and accrued expenses 18,977 12,056 Accrued payroll expenses 10,052 12,267 Accrual for self-insured liabilities 3,039 3,584 Accrued real estate and property taxes 5,224 5,165 Deferred revenue 6,977 8,642 Deferred tax liabilities — 22,368 Other liabilities 433 979 Total liabilities 807,199 822,162 Members’ deficit (393,777) (354,400) Total liabilities and members’ deficit $ 413,422 467,762 See accompanying notes to consolidated financial statements. Liabilities and Members’ Deficit Assets Accounts receivable, net of allowance of $1,013 and $1,111, respectively CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Consolidated Statements of Financial Position December 31, 2022 and 2021 (In thousands) 3

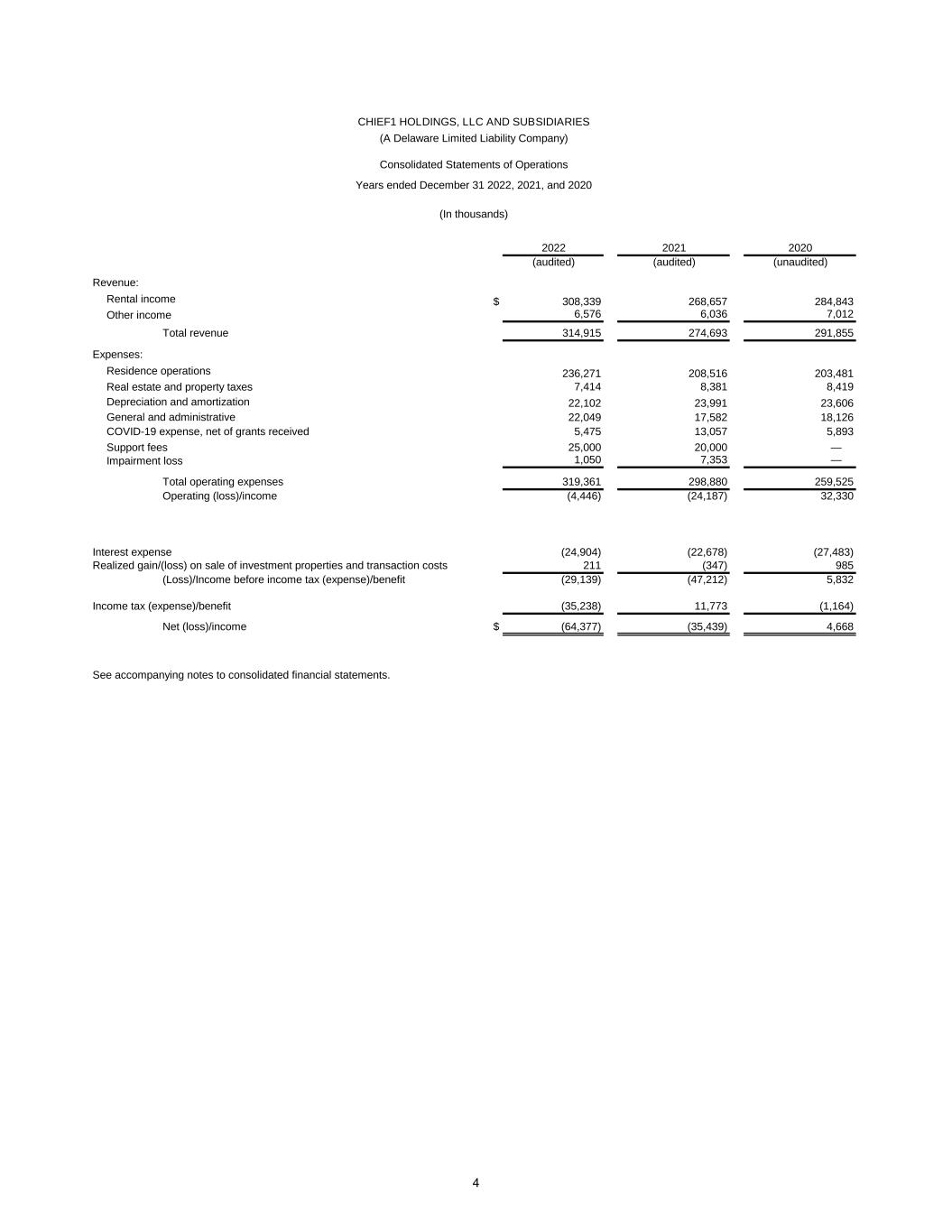

2022 2021 2020 (audited) (audited) (unaudited) Revenue: Rental income $ 308,339 268,657 284,843 Other income 6,576 6,036 7,012 Total revenue 314,915 274,693 291,855 Expenses: Residence operations 236,271 208,516 203,481 Real estate and property taxes 7,414 8,381 8,419 Depreciation and amortization 22,102 23,991 23,606 General and administrative 22,049 17,582 18,126 COVID-19 expense, net of grants received 5,475 13,057 5,893 Support fees 25,000 20,000 — Impairment loss 1,050 7,353 — Total operating expenses 319,361 298,880 259,525 Operating (loss)/income (4,446) (24,187) 32,330 Interest expense (24,904) (22,678) (27,483) Realized gain/(loss) on sale of investment properties and transaction costs 211 (347) 985 (Loss)/Income before income tax (expense)/benefit (29,139) (47,212) 5,832 Income tax (expense)/benefit (35,238) 11,773 (1,164) Net (loss)/income $ (64,377) (35,439) 4,668 See accompanying notes to consolidated financial statements. Years ended December 31 2022, 2021, and 2020 (In thousands) CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Consolidated Statements of Operations 4

Balance at December 31, 2020 (unaudited) $ (333,973) Preferred stock purchases 15,000 Unit-based compensation plans 12 Net (loss)/Income (35,439) Balance at December 31, 2021 (audited) $ (354,400) Preferred stock purchases 25,000 Net (loss)/Income (64,377) Balance at December 31, 2022 (audited) $ (393,777) See accompanying notes to consolidated financial statements. CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Consolidated Statement of Changes in Members' Deficit Years ended December 31, 2022 and 2021 (In thousands) 5

2022 2021 2020 (audited) (audited) (unaudited) Cash flows from operating activities: Net (loss)/income $ (64,377) (35,439) 4,668 Adjustments to reconcile net (loss)/income to net cash provided by operating activities: Depreciation and amortization 22,102 23,991 23,606 Impairment loss 1,050 7,353 — Gain on sale of investment properties and transaction costs (211) — (985) Unrealized loss (Gain) on derivatives (8,178) 117 283 Amortization and expense of deferred financing costs 1,712 1,781 1,889 Amortization of deferred new resident fees (5,891) (5,307) (5,923) Amortization of referral fees and promotional discounts 3,321 3,129 2,924 Provision for bad debt 1,981 1,634 1,766 Change in deferred taxes 35,128 (11,973) 1,813 Unit-based compensation plans — 12 231 Changes in assets and liabilities: Accounts receivable (2,180) (1,953) (2,117) Prepaid expenses (956) 571 (1,858) Other assets (3,654) 3,181 (8,903) Accounts payable and accrued expenses 6,921 5,146 (409) Provision for self-insured liabilities (545) 1,497 323 Deferred revenue 4,226 6,393 3,966 Accrued payroll expenses (2,215) (695) 6,198 Accrued real estate and property taxes 59 440 (756) Other liabilities (547) (333) (534) Net cash(used in) provided by operating activities (12,252) (454) 26,182 Cash flows from investing activities: Payments for net investment property purchases (11,320) (10,787) (11,928) Proceeds from sale of investment properties 1,533 — 16,938 Payments due from affiliate 870 (450) — Net cash (used in) provided by investing activities (8,918) (11,237) 5,010 Cash flows from financing activities: Payments of financing costs (775) (189) (693) Repayments of mortgages and notes payable (14,558) (13,690) (10,654) Proceeds from of mortgages and notes payable 18,500 — 14,468 Purchase of interest rate caps — (358) (34) Distributions of members' equity — — (28,493) Issuance of senior preferred interests 25,000 15,000 — Net cash provided by (used in) financing activities 28,167 763 (25,406) Increase (decrease) in cash, cash equivalents, and restricted cash 6,997 (10,928) 5,786 Cash and cash equivalents, and restricted cash, beginning of year 16,550 27,478 21,692 Cash, cash equivalents, and restricted cash end of year $ 23,547 16,550 27,478 Supplemental schedule of cash flow information: Cash paid during the year for: Interest $ 29,586 18,791 24,635 Change in accrued capital expenditures 343 136 (289) The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the consolidated statements of financial position and consolidated statements of cash flows Cash and cash equivalents $ 3,694 4,136 12,142 Restricted Cash 19,853 12,414 15,335 Total cash, cash equivalents, and restricted cash 23,547 16,550 27,478 See accompanying notes to consolidated financial statements. CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Consolidated Statements of Cash Flows Years ended December 31, 2022, 2021, and 2020 (In thousands) 6

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 7 Organization CHIEF1 Holdings, LLC (“CHIEF”) is a Delaware limited liability company that is the ultimate sole member of AID Holdings, LLC, and its wholly owned subsidiaries (collectively, “the Company”). On January 2, 2018, CHIEF completed its transaction with Sabra Health Care REIT, Inc. (“Sabra”), whereby a 49% equity interest in the Company was sold to Sabra. The Company owns and operates 157 assisted living residences in 18 states in the United States as of December 31, 2022. The residences average 40 to 60 units and offer a supportive, home-like setting. Residents may receive daily living activities assistance either directly from CHIEF’s employees or indirectly through CHIEF’s wholly owned healthcare subsidiaries and the related party management company, AID Holdings II Management Services, LLC (“Manager”). Business Conditions Basis of Presentation The consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP) assuming the Company will continue as a going concern. This assumption regards the realization of assets and satisfaction of liabilities in the normal course of business. However, substantial doubt exists about the Company’s ability to continue as a going concern. Effects of the COVID-19 Pandemic on Our Business In March 2020, the World Health Organization declared COVID-19 a global pandemic and the virus has continued to spread throughout the United States and the world. As a result of the pandemic, the Company experienced a significant reduction in community occupancy and revenue. Additionally, the Company experienced incremental costs associated with preventing the spread of the virus, primarily related to labor and personal protective equipment. During the years ended December 31, 2022, 2021 and 2020, the Company incurred COVID-19 related costs, prior to government assistance, of $12,723, $13,364 and $13,078, respectively. The macroeconomic environment has also changed with rising interest rates negatively impacting the Company’s debt service costs. The interest expense increased from $1,719 per month in Q4 2021 to $3,591 per month in Q4 2022. See Note 9 for further details. Going Concern As the result of the COVID-19 pandemic the Company has seen a significant increase in costs and lost revenue associated with operating the business resulting in declining income and cash flow. For the year ended December 31, 2022, the Company recorded a net loss of $64,377 (inclusive of a $41,553 deferred tax valuation allowance adjustment) and net cash outflows from operations of $12,252. As of December 31, 2022, the Company had cash and cash equivalents of $3,694. Market conditions are rebounding as the Company has seen an occupancy increase from the low point of March 2021 of 67.6% to 73.4% in December 2022. The Company implemented an average 9% price increase in October 2022, compared to ~5% in the prior year. Additionally, contract labor costs have trended down from $1,861 in December 2021 to $687 in December 2022 and $390 in January 2023. In addition, the Company is driving improved liquidity by disposing three negative cash flow communities and executing strategies to further reduce temporary 3rd party labor costs. Despite these improvements, due to the increases in financing costs, the Company will need additional liquidity to continue its operations over the next 12 months.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 8 As of December 31, 2022, the Company failed to meet financial covenants on the Keybank NA credit facility, and as of February 11, 2023, the Company was no longer current with principal and interest payments on its Fannie Mae and Freddie Mac loans. On March 1, 2023, the Company did not make its scheduled payments under the KeyBank NA credit facility. On March 15, 2023, the Company received a Notice of Default and Reservation of Rights letter from Keybank NA. On March 3, 2023, the Company received Notice of Acceleration Letters on its Fannie Mae notes. The notices are a demand for immediate payment in full of the entire unpaid principal balances of the loan, accrued and unpaid interest, and the costs and attorneys’ fees of Fannie Mae. The Company has not received such notices from Freddie Mac or KeyBank NA. On March 3, 2023, the special servicer for the Freddie Mac loan portfolio provided notice of termination for its management agreements with Manager. The company has not received such notices from Fannie Mae or KeyBank NA. On March 8, 2023, the Company entered into an Access and Cooperation agreement with an agent of Freddie Mac. The company has not entered into such agreements with Fannie Mae or KeyBank NA. See Note 5. The Company is currently in the process of negotiating with each of its lenders to restructure its financing arrangements. Such restructuring efforts may include obtaining forbearance agreements, modifying financial covenants and reducing rate cap escrow requirements. The Company cannot provide assurance that it will be able to restructure its financing arrangements on acceptable terms or at all. If the Company fails to reach an agreement with its lenders, Freddie Mac and Keybank NA could require immediate repayment of all outstanding balances and the lenders could place all, or a portion of, assets in receivership, or institute foreclosure proceedings. See Note 5 for further details. U.S. GAAP requires management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt regarding the Company's ability to continue as a going concern after one year from the date the financial statements are issued. Due to the circumstances described above, the Company determined there is substantial doubt of its ability to continue as a going concern. The consolidated financial statements do not include any adjustments to the carrying amounts and classification of assets, liabilities, and reported expenses that may be required if the Company were unable to continue as a going concern. Reclassifications There were reclassifications made in the Consolidated Statements of Financial Position and Consolidated Statements of Operations. Cash held in escrow and cash held as collateral were reclassified as restricted cash. Insurance receivable, net of allowance of doubtful collections, was reclassified from prepaid expenses to other assets. Capital leases were reclassified to other assets. Unrealized losses on derivatives were reclassified from other comprehensive loss to interest expense. Reclassifications have been made within the consolidated financial statements to conform prior periods with current period presentation. These reclassifications had no effect on the reported results of operations.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 9 Summary of Significant Accounting Policies (a) Principles of Presentation and Consolidation The accompanying consolidated financial statements include the accounts of CHIEF, AID Holdings, LLC, Assisted Living Concepts, LLC, Intermediate Aid Co, LLC, UPREIT Aid Co, LLC and its subsidiaries including single member LLCs for each of its facilities. All significant intercompany balances and transactions have been eliminated in consolidation. The Company has no involvement with variable interest entities. (b) Going Concern Assessment On an annual basis, Management assesses whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year of the date that the consolidated financial statements are to be issued. This assessment is based on any relevant conditions or events that are known at this date. Management has performed this assessment through March 20, 2023. (c) Use of Estimates The Company’s consolidated financial statements have been prepared in accordance with U.S. GAAP. The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change relate to the determination of depreciation and amortization, impairment of long-lived assets, valuation of interest rate caps, and deferred tax valuation allowance. The determination of depreciation and amortization is subject to the estimated useful lives of the associated assets. However, the actual remaining life may change or differ. Impairment of long-lived assets is subject to management estimates related to undiscounted cash flows and current market valuations based on prior asset sales. Interest rate caps are valued using an independent third-party valuation analysis. In assessing deferred tax realizability, management considers whether it is more likely than not that some portion or all of the deferred taxes will not be realized. The ultimate realization of deferred taxes is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considers the scheduled reversal of deferred tax liabilities (including the impact of available carryback and carryforward periods), projected future taxable income, and tax planning strategies in making this assessment. The valuation of the Company’s net investment properties as well as its ability to generate income are heavily dependent on the economic conditions both locally and within the industry which are currently dealing with the COVID-19 pandemic (see Note 9). As such, the ultimate carrying value of net investment properties and deferred tax assets are subject to changes in general economic conditions. While management uses the best information available to apply estimates in calculating depreciation and amortization, impairment of long-lived assets, and deferred tax assets, changes in general

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 10 economic conditions may result in necessary and potentially material changes to the carrying amounts of investment property assets and deferred tax assets in the near term. (d) Cash and Cash Equivalents The Company considers highly liquid investments with a maturity of 90 days or less to be cash equivalents, unless restricted. The Company has a centralized cash management approach. From time to time, the Company may have bank deposits exceeding Federal Deposit Insurance Corporation limits. Management believes the credit risk related to these deposits is minimal. (e) Restricted Cash The Company defines restricted cash to be funds set aside for a specific purpose that are not readily available for immediate use. Pursuant to various lender requirements, funds are deposited monthly into escrow accounts for real estate taxes, insurance, and capital improvements. Additionally, escrow balances include interest rate cap deposits for the Fannie Mae and Freddie Mac mortgage notes. The Company also has a money market account held via Pearson Insurance Company, a subsidiary of CHIEF and incorporated in Bermuda, that is subject to liquidity ratio minimums as part of the Bermuda Insurance Act of 1978. (f) Accounts Receivable, Net Accounts receivable are recorded at the invoiced amount and do not bear interest. Amounts collected on trade accounts receivable are included in net cash provided by operating activities in the consolidated statements of cash flows. Accounts receivable are reported net of an allowance for doubtful accounts to represent the Company’s estimate of the amount that ultimately will be realized in cash. The allowance for doubtful accounts was $1,013 and $1,111 as of December 31, 2022, and 2021, respectively. The adequacy of the Company’s allowance for doubtful accounts is reviewed on an ongoing basis under multiple assessments including, aging of receivables, trends in reserve balances by type (current resident versus move out reserves), historical collections, as well as a discretionary review of individual tenant accounts. Amounts to be written off are determined by management based on specific resident account activity. For the years ended December 31, 2022, 2021, and 2020, bad debt expense, net of recoveries, is $1,981, $1,633, and $1,766, respectively, and is included in residence operations expense in the consolidated statements of operations.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 11 (g) Net Investment Properties Maintenance and repairs are charged to expense as incurred. Net investment properties are stated at cost less accumulated depreciation. Provisions for depreciation are computed using the straight-line method for financial reporting purposes at rates based upon the following estimated useful lives: Buildings 40 years Building improvements, furniture, and equipment 2 to 15 years Leasehold improvements The shorter of the useful life of the assets or a term that includes required lease periods and renewals that are deemed to be reasonably assured at the date the leasehold improvements are purchased. (h) Long-Lived Assets The Company assesses annually the recoverability of long-lived assets, including net investment properties. U.S. GAAP requires that all long-lived assets be reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by comparison of the carrying value of an asset to the undiscounted future cash flows expected to be generated by the asset, including the eventual liquidation of the asset. If the carrying value of an asset exceeds its estimated undiscounted future cash flows, an impairment provision is recognized to the extent the carrying value of the asset exceeds estimated fair value. For the years ended December 31, 2022, 2021, and 2020, the Company had impairment of $1,050, $7,353, and $0 on its investment properties. Assets to be disposed of are reported at the lower of the carrying amount or the fair value of the asset, less all associated costs of disposition. U.S. GAAP requires reporting of discontinued operations only if the disposal represents a strategic shift that has (or will have) a major effect on the entity’s operations and financial results. Sales and the results of operations of individual properties being sold will be presented in the operations section of the consolidated statements of operations. Net investment properties are classified as held-for-sale when a significant nonrefundable down payment has been received. As of December 31, 2022, the Company had three assets that meet the criteria for held for sale with a combined carrying value amount of $4,338. (i) Self-Insured Liabilities The Company maintains business insurance programs with significant self-insured retentions that cover workers’ compensation and general and professional liability claims. The Company accrues

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 12 estimated losses using actuarial calculations, models, and assumptions based on historical loss experience. The Company uses an independent actuarial firm to assist in determining the adequacy of general and professional liability reserves. (j) Revenue Recognition Approximately 100% of revenues are derived from private payers. Revenue is recorded in the period in which services and products are provided at established rates. Under the Company’s senior living residency agreements, residents pay monthly rent that covers occupancy of their unit and basic services, including utilities, meals, and some housekeeping services. Rent terms are short term in nature (month-to-month). The Company also provides senior care services for a stated daily fee. The Company has determined that the senior care services included under the daily fee have the same timing and pattern of transfer and are considered one performance obligation. Fees for ancillary services are recorded in the period in which the services are performed. Revenues collected in advance are recorded as deferred revenue upon receipt and recorded to revenue in the period earned. In the years ended December 31, 2022 and 2021, the company recorded deferred revenue from prior periods of $7,574 and $6,743, respectively. The Company recognizes revenue under ASC Topic 606, Revenue Recognition from Contracts with Customers ("ASC 606") for its assisted living and memory care residency agreements for which it has estimated the non-lease components of such residency agreements are the predominant component of the contract. See note (t), Recent Accounting Pronouncements, for additional details. From time to time, the Company collects new residency fees from private pay residents. These fees are nonrefundable and are used to prepare a resident’s room for occupancy. The Company defers this revenue and amortizes it over the average private pay resident stay, approximately 21 months. (k) Deferred Financing Costs, Net Costs associated with obtaining financing are shown as a direct deduction from the carrying amount of the associated debt liability or within other assets in the consolidated statements of financial position. These amounts are capitalized and amortized as interest expense over the term of the related debt, which approximates the effective yield method. As of December 31, 2022, and 2021, the Company recorded $17,789 and $17,530 of deferred financing costs and $13,454 and $11,742 of accumulated amortization, respectively, within mortgage and notes payable in the consolidated statements of financial position. As of December 31, 2022, and 2021, the Company recorded $1,043 and $528 of deferred financing costs within other assets, net in the consolidated statements of financial position. (l) Income Taxes Income taxes are accounted for under the asset-and-liability method. Deferred tax assets and liabilities are recognized for the expected future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 13 income taxes also reflect the impact of operating loss and tax credit carryforwards. A valuation allowance is provided if the Company believes it is more likely than not that all or some portion of the deferred tax asset will not be realized. Management assesses the available positive and negative evidence to estimate whether sufficient future taxable income will be generated to permit use of existing deferred tax assets. Any increase or decrease in the valuation allowance that results from a change in circumstances, and that causes a change in our judgement about the realizability of the related deferred tax asset, is included in the tax provision when such changes occur. The Company accrues interest and penalties related to unrecognized tax benefits in the provision for income taxes if applicable. CARES Act and CAA On March 27, 2020 and December 27, 2020, the President of the United States signed and enacted into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and the Consolidated Appropriations Act, 2021 (CAA). Among other provisions, the CARES Act and the CAA provide relief to U.S. federal corporate taxpayers through temporary adjustments to net operating loss rules, changes to limitations on interest expense deductibility, and the acceleration of available refunds for minimum tax credit carryforwards. The CARES Act and the CAA did not have a material effect on the Company’s consolidated financial statements. (m) Derivative Financial Instruments The Company recognizes all derivatives as either an asset or liability in the consolidated statements of financial position. Derivative instruments are measured at fair value based on a discounted cash flow analysis. This analysis reflects the derivative instruments contractual terms, including the period to maturity, and uses of observable market-based inputs, including interest rate curves and implied volatilities. The accounting for changes in the derivative instruments fair value is dependent upon whether the applicable instrument has been formally designated and qualifies as a hedging instrument. The instrument must be designated, based upon the exposure being hedged, as a fair value hedge, cash flow hedge, or a hedge of a net investment in a foreign operation. As of December 31, 2022, and 2021, the Company’s derivatives were measured at fair value and were derived using primarily Level 2 inputs. For the years ended December 31, 2022 and 2021, the Company’s derivative instruments were not designated for hedge accounting. (n) Purchase Accounting In order to allocate the purchase price of a company or facility acquisition the Company assesses the fair value of acquired assets and liabilities, which can include land, building, and other improvements, resident relationships, and acquired leases and liabilities. In respect to the valuation of the real estate acquired, the Company calculates the fair value of net investment properties using an “as if vacant” approach or obtains independent appraisals. The value of resident relationships is determined based upon the valuation methodology outlined below. The Company allocates the purchase price of the acquisition based upon these assessments. These estimates were based upon historical, financial, and market information. Acquisition costs associated with real estate acquisitions deemed asset acquisitions are capitalized, and costs associated with real estate acquisitions deemed business

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 14 combinations are expensed as incurred. Current assets and current liabilities assumed are valued at carryover basis, which approximates fair value. Net investment properties are valued utilizing discounted cash flow projections of future revenue and costs, and capitalization and discount rates using current market conditions, replacement cost, or economic obsolescence methodologies. Resident relationships intangible assets are valued upon acquisition using discounted cash flow projections and are stated at the calculated amount, net of accumulated amortization. Resident relationships intangible assets are amortized on a straight-line basis, based upon a review of the time period of the life of existing leases. Amortization of the resident relationships intangible asset is included within depreciation and amortization expense in the consolidated statements of operations. (o) Fair Value Measurements The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs where possible. The Company determines fair value based on assumptions that market participants would use in pricing an asset or liability in the principal or most advantageous market. When considering market participant assumptions in fair value measurements, the following fair value hierarchy distinguishes between observable and unobservable inputs, which are categorized in one of the following levels: Level 1 inputs: Unadjusted quoted prices in active markets for identical assets or liabilities accessible to the reporting entity at the measurement date Level 2 inputs: Other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the asset or liability Level 3 inputs: Unobservable inputs for the asset or liability used to measure fair value to the extent that observable inputs are not available, thereby allowing for situations in which there is little, if any, market activity for the asset or liability at measurement date (p) Members’ Deficit The Company shall operate perpetually, unless dissolved earlier as provided in the respective operating agreement. Except as provided in the Company’s Limited Liability Company Agreement, no member shall be personally liable for any debt, obligations, or liability of the Company solely by reason of being a member of a Limited Liability Company. On November 19, 2021, the Company created a class of senior preferred interests (“Senior Preferred Interests”). In the event of a declared dividend or liquidation event, the Senior Preferred Interests would be considered senior to both common interests and all other existing or future class of interests in the Company that are not parity or senior securities. Senior Preferred Interests accrue preferential cumulative distributions on a daily basis at a rate of 8% to be paid at each quarter end (“Preference Accrual”). Any unpaid Preference Accrual compounds on the applicable distribution payment date. Pursuant to the terms of the Limited Liability Company Agreement, profits and losses are allocated to common interests in accordance with the ownership percentages. Contributions and distributions are recorded as they occur.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 15 In 2021, the Company issued 15,000 of Senior Preferred Interests at a par value of $1. During 2022, the Company issued an additional 25,000 of Senior Preferred Interests at a par value of $1. As of December 31, 2022, the total Senior Preferred Interests were $40,000 which were funded to the Company by Enlivant Holdings, L.P, the TPG owned entity holding 51% of CHIEF. At December 31, 2022, there was an undeclared dividend related to the Preference Accrual of $2,053. (q) Unit-Based Compensation Plans The cost of unit-based compensation is measured at the grant date, based on the calculated fair value of the awards, and is recognized over the vesting period of the grant. Fair value is determined using the Black-Scholes model and assessing inputs, such as volatility and valuations and probability. As of December 31, 2022 and 2021, the Company has not recorded a liability in accordance with ASC Topic 718. (r) Government Grants The Company recognizes income for government grants on a systematic and rational basis over the periods in which the Company recognizes the related expenses for which the grants are intended to compensate when there is reasonable assurance that the Company will comply with the applicable terms and conditions of the grant and there is reasonable assurance that the grant will be received. The amounts are presented net of COVID-19 expenses on the consolidated statements of operations. See Note 9 for the accounting treatment of government grants for 2022 and for additional information related to grants received from the CARES Act and other state funded programs. (s) COVID-19 Expenses The Company segregates incremental costs associated with the COVID-19 pandemic and includes them in the COVID-19 expense line within total operating expenses in the consolidated statements of operations, net of any grant income intended to compensate for the expense. (t) Recent Accounting Pronouncements In February 2016, the FASB issued ASC Topic 842 Leases (“ASC 842”) which is an update that sets out the principles for the recognition, measurement, presentation, and disclosure of leases for both lessees and lessors. This revised guidance supersedes previous leasing standards and is effective for reporting periods beginning after December 15, 2021, for private entities. The Company adopted ASC 842 effective January 1, 2022. The company has reviewed the pronouncement and has elected the lessor practical expedient within ASC 842, and recognizes, measures, presents, and discloses the revenue for services under the Company's senior living residency agreements based upon the predominant component, either the lease or non-lease component, of the contracts. The Company has determined that the services included under the Company's assisted living and memory care residency agreements have the same timing and pattern of transfer and are performance obligations that are satisfied over time. The Company recognizes revenue under ASC 606 for its assisted living and memory care residency agreements for which it has estimated the non-lease components of such residency agreements are the predominant component of the contract. In June 2016, the FASB issued ASU 2016-13 Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments, which replaces the current incurred loss impairment

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 16 methodology for credit losses with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The Company will be required to use a forward-looking expected credit loss model for accounts receivable and other financial instruments. ASU 2016-13 is effective for the Company beginning January 1, 2023. The Company is currently evaluating the impact the adoption will have on its consolidated financial statements and disclosures. In March 2020, the FASB issued ASU 2020-04, Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional guidance for a limited period of time to ease the potential burden in accounting for (or recognizing the effects of) reference rate reform on contracts, hedging relationships, and other transactions that reference the London Inter-Bank Offered Rate ("LIBOR"). ASU 2020-04 is effective for the Company beginning January 1, 2022 and adoption of this standard did not have a material impact on the consolidated financial statements. In November 2021, the FASB issued ASU 2021-10 (“ASC 832”), Disclosures by Business Entities about Government Assistance, which requires expanded disclosure for transactions involving the receipt of government assistance. Required disclosures include a description of the nature of the transactions with the government entities, the Company’s accounting policies for such transactions, and their impact to the Company’s consolidated financial statements. ASC 832 is effective for the Company beginning January 1, 2022 and adoption of this standard did not have a significant impact on the consolidated financial statements. Net Investment Properties Net investment properties and related accumulated depreciation and amortization consisted of the following at December 31, 2022 and 2021: 2022 2021 Land $ 59,371 61,079 Buildings, furniture, equipment and other improvements 465,045 460,975 524,416 522,054 Less accumulated depreciation (162,646) (142,794) Net investment properties $ 361,770 379,260 During the year ended December 31, 2022, the Company completed the sale of Grand Emerald Place for cash proceeds of $1,533, net of transaction costs, and realized a gain on sale of investment properties of $211. For the year ended December 31, 2021, the Company completed no sales, however, did incur $347 of additional costs from prior dispositions. For the year ended December 31, 2020, the Company completed the sale of twelve communities for proceeds of $16,938, net of transaction costs, and realized a gain on sale of investment properties of $985.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 17 For the years ended December 31, 2022, and December 31, 2021, the Company evaluated its long-lived assets for impairment. For the year ended December 31, 2022, it was determined the carrying values of one asset was greater than the estimated fair value, and therefore, the Company recognized an impairment charge of $1,050. For the year ended December 31, 2021, it was determined that the carrying values of four assets were greater than the estimated fair values, and therefore, the Company recognized an impairment charge of $7,353. For the year ended December 31, 2020, the Company did not recognize any impairment loss. Mortgages and Notes Payable Mortgages and notes payable are collateralized and secured by certain net investment properties, as defined per the loan agreements. On May 22, 2022, the Company completed a refinancing transaction to add 8 communities to the KeyBank NA credit facility and remove one community. The KeyBank NA credit facility capacity increased from $25,000 to $30,000 as part of this transaction. The KeyBank NA credit facility agreement contains debt service coverage ratio, loan to value, and fixed charge coverage ratio restrictions. As of December 31, 2021, the Company was in compliance with the outstanding debt’s financial covenants. Under the current parameters of the KeyBank NA credit facility agreement the Company did not meet the covenants for the year ending December 31, 2022. The Company is currently engaged in negotiations with KeyBank NA to update the parameters of the financial covenants. On February 9, 2023, the Board of Directors voted to defer the Company’s principal and interest payments on its Fannie Mae and Freddie Mac loans. As of February 11, 2023, the Company was no longer current with principal and interest payments on its Fannie Mae and Freddie Mac notes and the loans are in default. On March 1, 2023, the Company did not make its scheduled payments under the KeyBank NA credit facility. On March 15, 2023, the Company received a Notice of Default and Reservation of Rights letter from Keybank NA. On March 3, 2023, the Company received Notice of Acceleration Letters for its Fannie Mae notes. The letters are a demand for immediate payment in full of the entire unpaid principal balances of the loan, accrued and unpaid interest, and the costs and attorneys’ fees of Fannie Mae. The Company has not received such notices from Freddie Mac or KeyBank NA. The Company is currently in the process of negotiating with each of its lenders to restructure its financing agreements. In the absence of a forbearance agreement, the debt is now classified as a current liability. As of December 31, 2022 and 2021, mortgages and notes payable consisted of the following:

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 18 Interest Balance Balance rate at Current December 31, December 31, Stated December 31, Payment maturity 2022 2021 interest rate 2022 terms date Fannie Mae 317,561$ 323,332$ SOFR + 221bps 6.273 % Interest only through 1/1/2025 1/31/20, Beginning Fannie Mae borrow -up 76,204 77,586 SOFR + 291bps 6.973 2/1/20 Principal & 1/1/2025 Interest through maturity, Monthly Fannie Mae 11 69,559 70,564 SOFR + 245bps 6.513 Interest only through 1/1/2027 1/31/22, Beginning 2/1/22 Principal & Interest through maturity, Monthly Fannie Mae 25 84,023 84,570 SOFR + 242bps 6.483 Interest only through 7/1/2027 6/30/22, Beginning 7/1/22 Principal & Interest through maturity, Monthly FHLMC 177,163 180,178 SOFR + 297bps 7.033 Interest only through 6/1/2026 5/31/21, Beginning 6/1/21 Principal & Interest through maturity, Monthly Fannie Mae 5 13,821 14,159 SOFR + 235bps 6.413 Beginning 1/1/21 1/1/2031 Principal & Interest through maturity, Monthly KeyBank NA (Revolver) 28,501 12,501 SOFR + 300bps 7.063 Interest only, Monthly 12/31/2023 Total 766,832 762,890 Deferred financing costs, net of amortization of $13,454 and 4,335 5,789 $11,742, respectively. Total mortgage and notes payable, net 762,497$ 757,101$

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 19 (a) Key Bank Facility As of December 31, 2022, and 2021, the Company had $1,499 and $1,749, respectively, in outstanding letters of credit, all of which were collateralized under the KeyBank NA credit facility. The outstanding letters of credit were not reflected as liabilities within the consolidated financial statements. As of December 31, 2022, and 2021, the total KeyBank NA credit facility included the following: December 31 2022 2021 Credit facility capacity $ 30,000 25,000 KeyBank revolver (28,501) (12,501) Letters of credit (1,499) (1,749) Unused credit facility $ — 10,750 (b) Interest Rate Cap The Company uses interest rate related derivative instruments solely to manage its exposure related to changes in interest rates on its variable rate debt instruments. In 2021, the Company purchased additional interest rate caps from SMBC Capital Markets, Inc for a total consideration $358. The Company did not purchase any interest rate caps in 2022. The origination costs are included in other assets on the consolidated statements of financial position as follows:

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 20 December 31, 2022 Current Notional Origination Interest maturity Fair Effective date amount costs cap date value January 1, 2020 334,394 287 3.00 1/1/2023 329 January 1, 2020 80,236 69 3.00 1/1/2023 79 January 1, 2020 70,564 60 3.00 1/1/2023 69 July 1, 2020 84,570 72 3.00 7/1/2023 848 December 16, 2020 14,468 34 2.50 1/1/2024 336 June 1, 2021 182,000 100 2.50 6/1/2023 1,973 January 1, 2023 334,394 137 3.00 7/1/2023 3,023 January 1, 2023 80,236 33 3.00 7/1/2023 725 January 1, 2023 70,564 28 3.00 7/1/2023 638 June 1, 2023 182,000 60 2.50 7/1/2023 380 Total $ 8,400 The interest rate cap’s remaining fair value is recorded in Other assets, net in the consolidated statements of financial position and had a net balance of $8,400 and $287 as of December 31, 2022 and 2021, respectively. Unrealized gains and losses on interest rate caps are included within interest expense on the consolidated statements of operations. December 31, 2021 Current Notional Origination Interest maturity Fair Effective date amount costs cap date value January 1, 2020 334,394 287 3.00 1/1/2023 19 January 1, 2020 80,236 69 3.00 1/1/2023 5 January 1, 2020 70,564 60 3.00 1/1/2023 4 July 1, 2020 84,570 72 3.00 7/1/2023 28 December 16, 2020 14,468 34 2.50 1/1/2024 13 June 1, 2021 182,000 100 2.50 6/1/2023 69 January 1, 2023 334,394 137 3.00 7/1/2023 92 January 1, 2023 80,236 33 3.00 7/1/2023 22 January 1, 2023 70,564 28 3.00 7/1/2023 20 June 1, 2023 182,000 60 2.50 7/1/2023 15 Total $ 287

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 21 Disclosures about Fair Values The following tables present information about the Company’s assets, liabilities, and equity measured at fair value on a recurring basis as of December 31, 2022, and 2021. No transfers occurred between Level 2 and Level 3 investments during 2022 or 2021: December 31, 2022 Quoted prices in active Significant markets for other Significant identical observable unobservable assets inputs inputs (Level 1) (Level 2) (Level 3) Assets: Trading securities $ 75 — — Interest rate cap — 8,400 — Total assets $ 75 8,400 — December 31, 2021 Quoted prices in active Significant markets for other Significant identical observable unobservable assets inputs inputs (Level 1) (Level 2) (Level 3) Assets: Trading securities $ 75 — — Interest rate cap — 287 — Total assets $ 75 287 —

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 22 Commitments and Contingencies (a) Self-insured Liabilities Pearson Insurance Company, LTD (Pearson), a wholly owned, consolidated, Bermuda based captive insurance company, was formed on June 19, 2006, to self-insure general and professional liability risks. The Company insures through Pearson on a claims-made basis above specified self-insured retention levels. Pearson insures above the Company’s self-insured retention levels and reinsures for significant or catastrophic risks up to a specified level through third-party insurers. The insurance policies cover comprehensive general and professional liability and employers’ liability in such amounts and with such deductibles as determined to be prudent and reasonable, based on the nature and risk of the business, historical experiences, availability of coverage, and industry standards. Self-insured liabilities with respect to general and professional liability claims are included within the accrual for self- insured liabilities. The Company regularly evaluates levels of the self-insured liability through an independent actuarial review. The methods for pricing and evaluating the Pearson insurance coverage are reasonable and the historical cost of similar coverage would not have been materially different if the Company had obtained such coverage from third parties. General and professional liability claims are the most volatile and significant of the risks for which the Company is self-insured. The estimate of the accrual for general and professional liability costs is significantly influenced by assumptions, which are limited by the uncertainty of predicting future events, and assessments regarding expectations of several factors. Such factors include, but are not limited to, the frequency and severity of claims, which can differ materially by jurisdiction; coverage limits of third-party reinsurance; the effectiveness of the claims management process; and the outcome of litigation. Following is a summary of activity in the accrual for self-insured general and professional liabilities: 2022 2021 Balance at beginning of year $ 3,584 2,087 Cash payments (1,871) (933) Provisions for self-insured liabilities 1,326 2,430 Balance at end of year $ 3,039 3,584 As of December 31, 2022 and 2021, the Company had an accrual for workers’ compensation claims of $1,924 and $1,765 respectively, included in accrued payroll expenses on the consolidated statements of financial position. For the years ended December 31, 2022, 2021, and 2020, $3,156, $2,772, and $3,109, respectively, of expense was included in residence operations expense on the consolidated statements of operations, of which, $1,867, $1,683, and $2,929 was paid during the periods, respectively. Payment timing is not directly within management’s control, and therefore, estimates are subject to change.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 23 (b) Litigation The nature of the Company’s operations exposes it to the risk of claims and litigation in the normal course of its business. The Company is involved in various unresolved legal matters that arise in the normal course of operations, the most prevalent of which relate to commercial contracts and premises and professional liability matters. Although the outcome of these matters cannot be predicted with certainty and favorable or unfavorable resolutions may affect the results of operations on a period-to- period basis, the Company believes the outcome of such legal and other matters will not have a material adverse effect on its consolidated financial position, results of operations, or liquidity. Income Taxes Deferred taxes are provided on temporary differences and on any carryforwards that can be claimed on the Company’s hypothetical return. The Company assesses the need for a valuation allowance on the basis of projected separate return results. Total income taxes for the years ended December 31, 2022, and 2021 were based on the loss before income tax of $29,139 and $47,212, respectively. Income taxes for the year ended December 31, 2020, was based on the income before tax of $5,832. In 2022, a valuation allowance was booked for the total net deferred tax asset and liability (See 8c for additional details). Income tax (expense) benefit, net of valuation allowance, consists of the following: 2022 Current Deferred Total U.S. federal $ — (30,030) (30,030) State and local (27) (5,181) (5,208) Total $ (27) (35,211) (35,238) 2021 Current Deferred Total U.S. federal $ — 10,053 10,053 State and local (200) 1,920 1,720 Total $ (200) 11,973 11,773

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 24 2020 Current Deferred Total U.S. federal $ — (1,427) (1,427) State and local (36) 299 263 Total $ (36) (1,128) (1,164) (a) Tax Rate Reconciliation For the year ended December 31, 2022, and 2021 income tax benefit attributable to loss from operations was $6,315 and $11,579, respectively. Income tax expense attributable to income from operations was $917 for the year ending December 31, 2020 and differed from the amounts computed by applying the U.S. federal income tax rate of 21% to pretax income from operations as a result of the following: 2022 Tax rate Provision $ (6,119) 21% Increase (reduction) in income taxes resulting from: Change in tax rate (13) — State and local income taxes, net of federal income tax benefit (1,105) 4 Permanent differences 15 — Noncontrolling interest — — Other, net 907 (3) Total (6,315) 22 Valuation allowance 41,553 (143) Total $ 35,238 -121% (See note C for additional 2022 valuation impact)

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 25 2021 Tax rate Provision $ (9,914) 21% Increase (reduction) in income taxes resulting from: State and local income taxes, net of federal income tax benefit (1,666) 4 Permanent differences 14 — Noncontrolling interest 3 — Other, net (16) — Total (11,579) 25 Valuation allowance (194) — Total $ (11,773) 25% 2020 Tax rate Provision $ 1,225 21% Increase (reduction) in income taxes resulting from: Change in tax rate 71 1 State and local income taxes, net of federal income tax benefit 266 5 Permanent differences 13 — Noncontrolling interest 58 1 Other, net (716) (12) Total 917 16 Valuation allowance 247 4 Total $ 1,164 20% (b) Significant Components of Current and Deferred Taxes The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities at December 31, 2022 and 2021 are as follows:

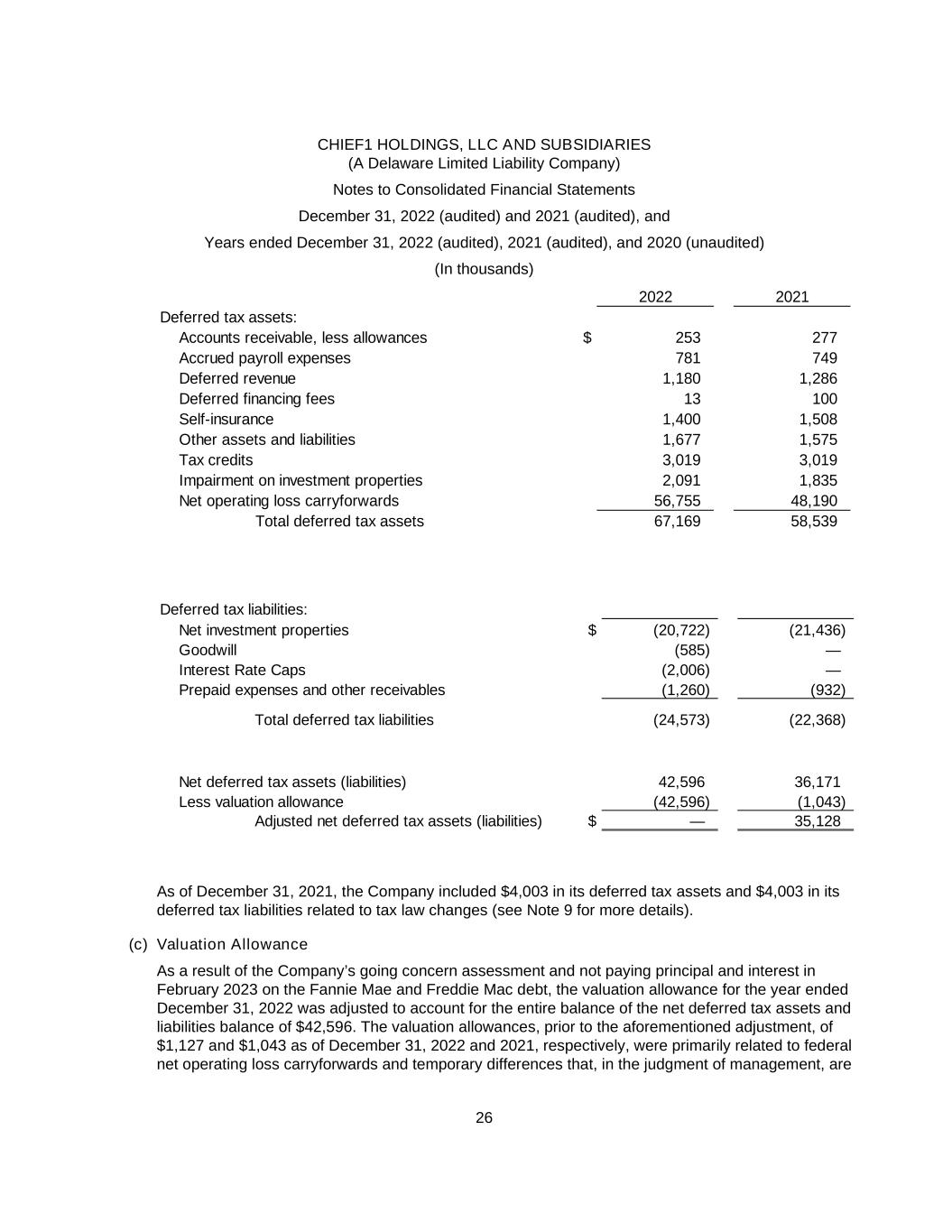

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 26 2022 2021 Deferred tax assets: Accounts receivable, less allowances $ 253 277 Accrued payroll expenses 781 749 Deferred revenue 1,180 1,286 Deferred financing fees 13 100 Self-insurance 1,400 1,508 Other assets and liabilities 1,677 1,575 Tax credits 3,019 3,019 Impairment on investment properties 2,091 1,835 Net operating loss carryforwards 56,755 48,190 Total deferred tax assets 67,169 58,539 Deferred tax liabilities: Net investment properties $ (20,722) (21,436) Goodwill (585) — Interest Rate Caps (2,006) — Prepaid expenses and other receivables (1,260) (932) Total deferred tax liabilities (24,573) (22,368) Net deferred tax assets (liabilities) 42,596 36,171 Less valuation allowance (42,596) (1,043) Adjusted net deferred tax assets (liabilities) $ — 35,128 As of December 31, 2021, the Company included $4,003 in its deferred tax assets and $4,003 in its deferred tax liabilities related to tax law changes (see Note 9 for more details). (c) Valuation Allowance As a result of the Company’s going concern assessment and not paying principal and interest in February 2023 on the Fannie Mae and Freddie Mac debt, the valuation allowance for the year ended December 31, 2022 was adjusted to account for the entire balance of the net deferred tax assets and liabilities balance of $42,596. The valuation allowances, prior to the aforementioned adjustment, of $1,127 and $1,043 as of December 31, 2022 and 2021, respectively, were primarily related to federal net operating loss carryforwards and temporary differences that, in the judgment of management, are

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 27 not likely to be realized. The net change in the total valuation allowance was an increase of $41,553, a decrease of $194 and increase of $875 in 2022, 2021 and 2020, respectively. The recording of a valuation allowance does not limit the ability to utilize the tax benefit of net operating losses prior to their tax expiration. As of December 31, 2022, the Company has net operating loss carryforwards for Federal income tax purposes of $229,372 which are available to offset future Federal taxable income, if any. In order to fully realize the Federal net operating loss carryforwards that were generated prior to December 31, 2017, the Company will need to generate future taxable income of approximately $136,666 prior to the expiration starting in 2033. The remaining $92,706 of losses were generated after December 31, 2017 and have an unlimited carryforward but are subject to a limitation of 80% of taxable income in a given year. As of December 31, 2022 and 2021, the Company had net operating loss carryforwards for state income tax purposes of $139,213 and $104,924 which are available to offset future state taxable income. The state net operating loss carryforwards begin to expire in 2028. As of December 31, 2022, the Company has no unrecognized tax benefits. As of December 31, 2022, with few exceptions, the calendar year 2019 through 2022 returns remain subject to IRS and various state and local tax jurisdictions examination. For the year ended December 31, 2022, the Company had no uncertain tax positions in the accompanying consolidated financial statements. The Company had one uncertain tax position for the year ended December 31, 2021, that was resolved in 2022 via settlement for $27 in excess of the amount reserved in the year 2021. COVID-19 Pandemic In March 2020, the World Health Organization declared COVID-19 a pandemic, and the United States declared a national emergency with respect to COVID-19. In the intervening months, COVID-19 has spread globally and led governments and other authorities around the world, including federal, state, and local authorities in the United States, to impose measures intended to control its spread, including restrictions on freedom of movement and business operations such as travel bans, border closings, business closures, quarantines, and shelter-in-place orders. Although some of these governmental restrictions have since been lifted or scaled back, a recent surge of COVID-19 infections has resulted in the re-imposition of certain restrictions and may lead to other restrictions being re-implemented in response to efforts to reduce the spread of COVID-19. In December 2020, distribution of the COVID-19 vaccine began to all 50 states, and while states have the authority over who receives the vaccine, the Centers for Disease Control and Prevention recommended that the initial distribution prioritize healthcare workers and residents of long-term care facilities. However, governmental restrictions may remain in place for a significant amount of time. The ongoing COVID-19 pandemic and measures intended to prevent its spread have negatively impacted and are expected to continue to negatively impact the Company and its operations in a number of ways, including but not limited to decreased occupancy and increased operating costs. During the years ended December 31, 2022, 2021, and 2020, the Company incurred $12,723, $13,364, and $13,077, respectively, of incremental costs associated with preventing the spread of the virus respectively. COVID-19 costs largely consist of incremental payroll costs and costs of personal

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 28 protective equipment and are included within COVID-19 expense in the consolidated statements of operations. As of September 1, 2020, eligible assisted living facility operators were able to apply for funding through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and the assistance received partially mitigated the negative impact of COVID-19. In addition, on October 1, 2020, the Department of Health and Human Services announced $20 billion of new funding for assisted living facility operators that have already received funds and to those who were previously ineligible. During the years ended December 31, 2022, 2021 and 2020, the Company recognized government grants under the CARES Act and other state relief programs of $7,248, $307 and $7,184, respectively, and used them to offset COVID-19 expense within its consolidated statements of operations. There were no grant receivables included in the consolidated statements of financial position as of December 31, 2022 and 2021. The grant funds received were in the form of cash and were recognized upon notification from the government confirming issuance of the grants or upon receipt of the funds, whichever came earlier. The Company’s accounting policy is to recognize grants in the period in which the related expenses were incurred or immediately if the grants were related to prior period expenses. All grants received were related to prior period expenses at the time of receipt or government notification of issuance. Under the CARES Act, the Company elected to defer payment of the employer portion of social security payroll taxes incurred from March 27, 2020, through December 31, 2020. One-half of such deferral amount became due of December 31, 2021, and the other half became due on December 31, 2022. As of December 31, 2022 and 2021, the Company had deferred payments of $0 and $2,731, respectively, under the program and presented these amounts in accrued payroll expenses within the Company's consolidated statements of financial position. The Company paid the first half of the deferral on December 23, 2021, and second half on December 31, 2022. Additionally, under the CARES Act, the Company elected to apply a technical correction which allowed them to claim additional depreciation for assets placed in service during 2018, 2019, or 2020. This technical correction sought to amend an error in the Tax Cuts and Jobs Act passed December 22, 2017, which dictated that assets whose tax basis was intended to be depreciated over 37 years were depreciated over 40 years. This correction created a deferred tax asset and deferred tax liability on the consolidated statement of financial position as of December 31, 2021 (see Note 8). Related Party Transactions The Company entered into a Management Agreement (the Agreement) with the Manager to provide property management services effective for a term of 10 years beginning January 1, 2018. The Company pays a monthly management fee of (i) 4.0% of gross revenue (as defined by the Agreement) for the first 24 months and (ii) 4.5% of gross revenue (as defined by the Agreement) for the remainder of the term. Total management fees were $14,095, $12,417, and $13,435 for the years ended December 31, 2022, 2021, and 2020, respectively, and were included in general and administrative expenses in the consolidated statements of operations. As of December 31, 2022 and 2021, accrued management fees were $3,696 and $1,122, respectively, and were included within accounts payable and accrued expenses within the consolidated statements of financial position.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 29 In addition to the management fee stated above, 2022 is the first year under the agreement the Company met the requirements of an additional incentive fee. Following the third anniversary of the Agreement, Manager is entitled to receive an annual incentive fee. The incentive fee is equal to 25% of the year over year improvement of EBITDAR, as defined in the Agreement, and capped at 6% of total revenue. For the year ended December 31, 2022, the total incentive fees of $1,599 were accrued and included within general and administrative expenses in the consolidated statements of operations. For the years ended December 31, 2022 and 2021, the Company liabilities for Manager overhead costs, included in accounts payable and accrued expenses within the consolidated statements of financial position were $4,488 and $1,538, respectively. In 2022 and 2021, the Company, acknowledging the unprecedented challenges and significant economic stress caused by the COVID-19 pandemic, entered into support agreements in which it agreed to make payments to Manager in the amounts of $25,000 and $20,000, respectively. Bi-weekly payroll, including payroll related expenses, for employees of Manager is initially funded by Manager, but promptly reimbursed by the Company for its ratable share based on the salaries and wages of employees that directly serviced the operation of the Company’s assisted living residences. Total payroll was $168,051, $143,321, and $144,276 for the years ended December 31, 2022, 2021, and 2020, respectively, and were included in residence operations in the consolidated statements of operations. As of December 31, 2022 and 2021, accrued payroll expenses were $10,052 and $12,267, respectively, and were included within accrued payroll within the consolidated statements of financial position. The Workers’ Compensation policy utilized by the Company’s employees requires collateral to offset the risk of non-payment. Because the policy holder is an affiliate of CHIEF, the Company records the amount funded as due from affiliate on the consolidated statements of financial position. Subsequent Events The Company has evaluated subsequent events from the consolidated statements of financial position date through March 20, 2023, the date at which the consolidated financial statements were issued and has concluded that there are no material events to disclose other than the following. See note 5 regarding the Board of Directors decision not to pay principal and interest on the Fannie Mae and Freddie Mac loans in February 2023. The planned disposition of three Georgia assets (held for sale) closed on March 2, 2023 with proceeds net of transaction costs of $4,416. On January 27, 2023, the Company received an additional $1,000 of TPG funding from the issuance of 1,000 Class A Senior Preferred Interests. On March 1, 2023, the Company did not make its schedule payments under the KeyBank NA credit facility.

CHIEF1 HOLDINGS, LLC AND SUBSIDIARIES (A Delaware Limited Liability Company) Notes to Consolidated Financial Statements December 31, 2022 (audited) and 2021 (audited), and Years ended December 31, 2022 (audited), 2021 (audited), and 2020 (unaudited) (In thousands) 30 On March 3, 2023, the Company received Notice of Acceleration Letters for its Fannie Mae notes. The letters are a demand for immediate payment in full of the entire unpaid principal balances of the loan, accrued and unpaid interest, and the costs and attorneys’ fees of Fannie Mae. On March 3, 2023, the special servicer for the Freddie Mac loan portfolio provided notice of termination for its management agreements with Manager. The company has not received such notices from Fannie Mae or KeyBank NA. On March 8, 2023, the Company entered into an Access and Cooperation agreement with an agent of Freddie Mac. The company has not entered into such agreements with Fannie Mae or KeyBank NA. On March 15, 2023, the Company received a Notice of Default and Reservation of Rights letter from Keybank NA.