Exhibit 99.2

2 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 03 COMPANY INFORMATION 04 OVERVIEW 05 PORTFOLIO Triple-Net Portfolio Senior Housing - Managed Portfolio Loans and Other Investments NOI Concentrations Geographic Concentrations - Consolidated Portfolio Triple-Net Lease Expirations 12 INVESTMENTS Summary 13 CAPITALIZATION Overview Indebtedness Debt Maturity Credit Metrics and Ratings 17 FINANCIAL INFORMATION 2024 Outlook Consolidated Financial Statements - Statements of Income (Loss) Consolidated Financial Statements - Balance Sheets Consolidated Financial Statements - Statements of Cash Flows FFO, Normalized FFO, AFFO and Normalized AFFO Components of Net Asset Value (NAV) 24 APPENDIX Disclaimer Reporting Definitions Discussion and Reconciliation of Certain Non-GAAP Financial Measures: CONTENT https://ir.sabrahealth.com/investors/financials/quarterly-results

3 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 SENIOR MANAGEMENT Rick Matros Michael Costa Talya Nevo-Hacohen Chief Executive Officer, President Chief Financial Officer, Secretary Chief Investment Officer, Treasurer and Chair and Executive Vice President and Executive Vice President Jessica Flores Chief Accounting Officer and Executive Vice President BOARD OF DIRECTORS Rick Matros Michael Foster Jeffrey Malehorn Chief Executive Officer, President Lead Independent Director Director and Chair Craig Barbarosh Lynne Katzmann Clifton Porter II Director Director Director Katie Cusack Ann Kono Director Director CONTACT INFORMATION Sabra Health Care REIT, Inc. Transfer Agent 1781 Flight Way Equiniti Trust Company, LLC Tustin, CA 92782 P.O. Box 500 888.393.8248 Newark, NJ 07101 sabrahealth.com 800.937.5449 equiniti.com COMPANY INFORMATION

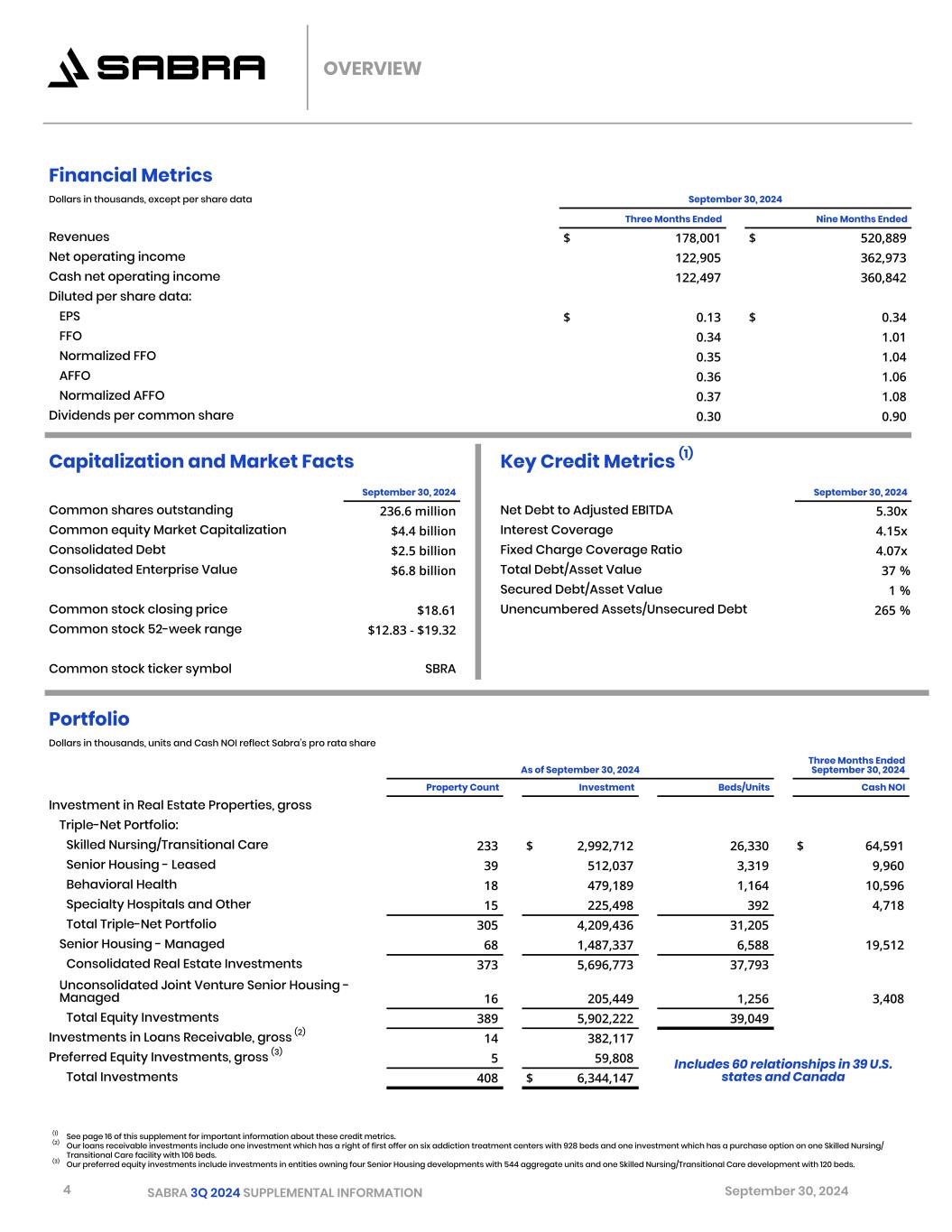

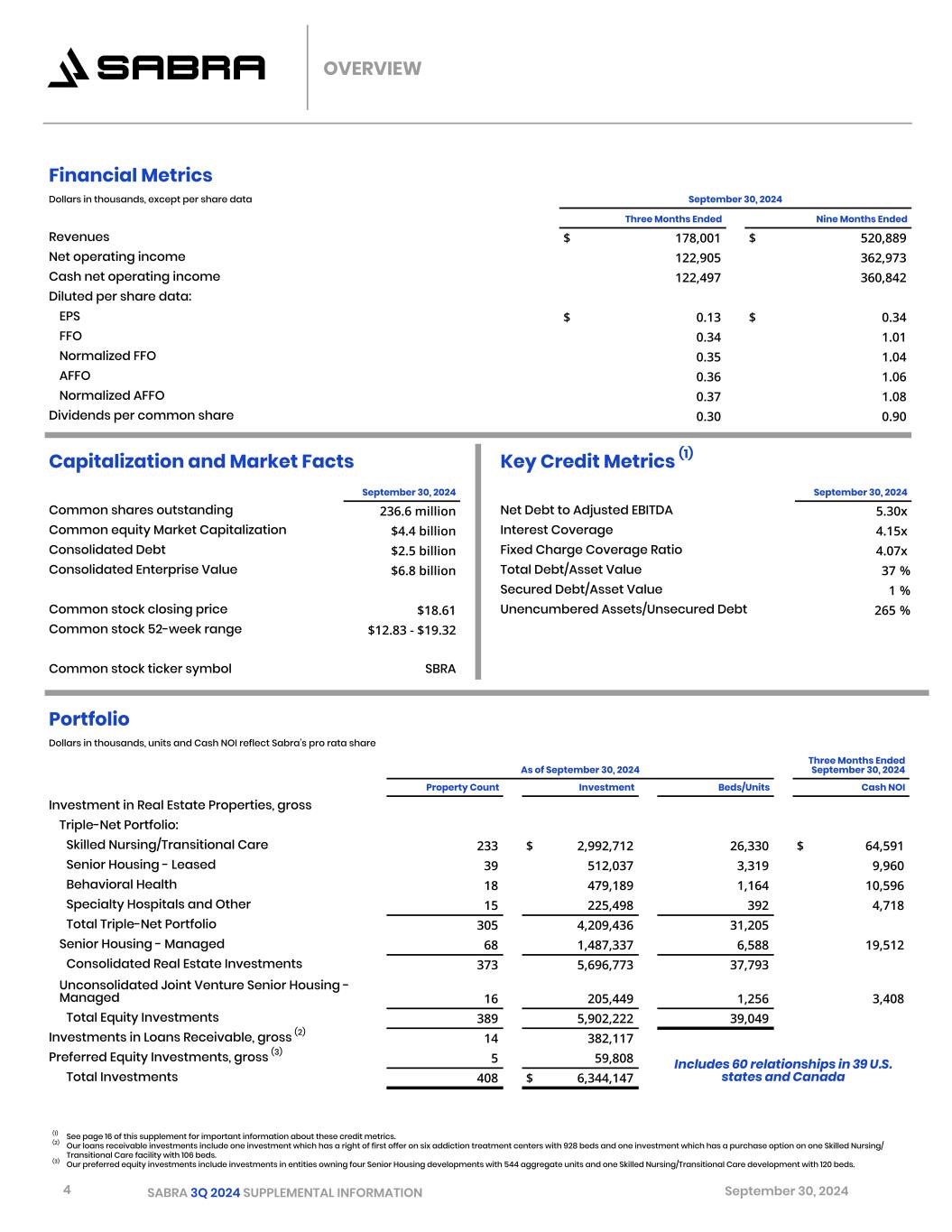

4 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 Financial Metrics Dollars in thousands, except per share data September 30, 2024 Three Months Ended Nine Months Ended Revenues $ 178,001 $ 520,889 Net operating income 122,905 362,973 Cash net operating income 122,497 360,842 Diluted per share data: EPS $ 0.13 $ 0.34 FFO 0.34 1.01 Normalized FFO 0.35 1.04 AFFO 0.36 1.06 Normalized AFFO 0.37 1.08 Dividends per common share 0.30 0.90 Capitalization and Market Facts Key Credit Metrics (1) September 30, 2024 September 30, 2024 Common shares outstanding 236.6 million Net Debt to Adjusted EBITDA 5.30x Common equity Market Capitalization $4.4 billion Interest Coverage 4.15x Consolidated Debt $2.5 billion Fixed Charge Coverage Ratio 4.07x Consolidated Enterprise Value $6.8 billion Total Debt/Asset Value 37 % Secured Debt/Asset Value 1 % Common stock closing price $18.61 Unencumbered Assets/Unsecured Debt 265 % Common stock 52-week range $12.83 - $19.32 Common stock ticker symbol SBRA Portfolio Dollars in thousands, units and Cash NOI reflect Sabra’s pro rata share Three Months Ended September 30, 2024As of September 30, 2024 Property Count Investment Beds/Units Cash NOI Investment in Real Estate Properties, gross Triple-Net Portfolio: Skilled Nursing/Transitional Care 233 $ 2,992,712 26,330 $ 64,591 Senior Housing - Leased 39 512,037 3,319 9,960 Behavioral Health 18 479,189 1,164 10,596 Specialty Hospitals and Other 15 225,498 392 4,718 Total Triple-Net Portfolio 305 4,209,436 31,205 Senior Housing - Managed 68 1,487,337 6,588 19,512 Consolidated Real Estate Investments 373 5,696,773 37,793 Unconsolidated Joint Venture Senior Housing - Managed 16 205,449 1,256 3,408 Total Equity Investments 389 5,902,222 39,049 Investments in Loans Receivable, gross (2) 14 382,117 Preferred Equity Investments, gross (3) 5 59,808 Includes 60 relationships in 39 U.S. states and CanadaTotal Investments 408 $ 6,344,147 (1) See page 16 of this supplement for important information about these credit metrics. (2) Our loans receivable investments include one investment which has a right of first offer on six addiction treatment centers with 928 beds and one investment which has a purchase option on one Skilled Nursing/ Transitional Care facility with 106 beds. (3) Our preferred equity investments include investments in entities owning four Senior Housing developments with 544 aggregate units and one Skilled Nursing/Transitional Care development with 120 beds. OVERVIEW

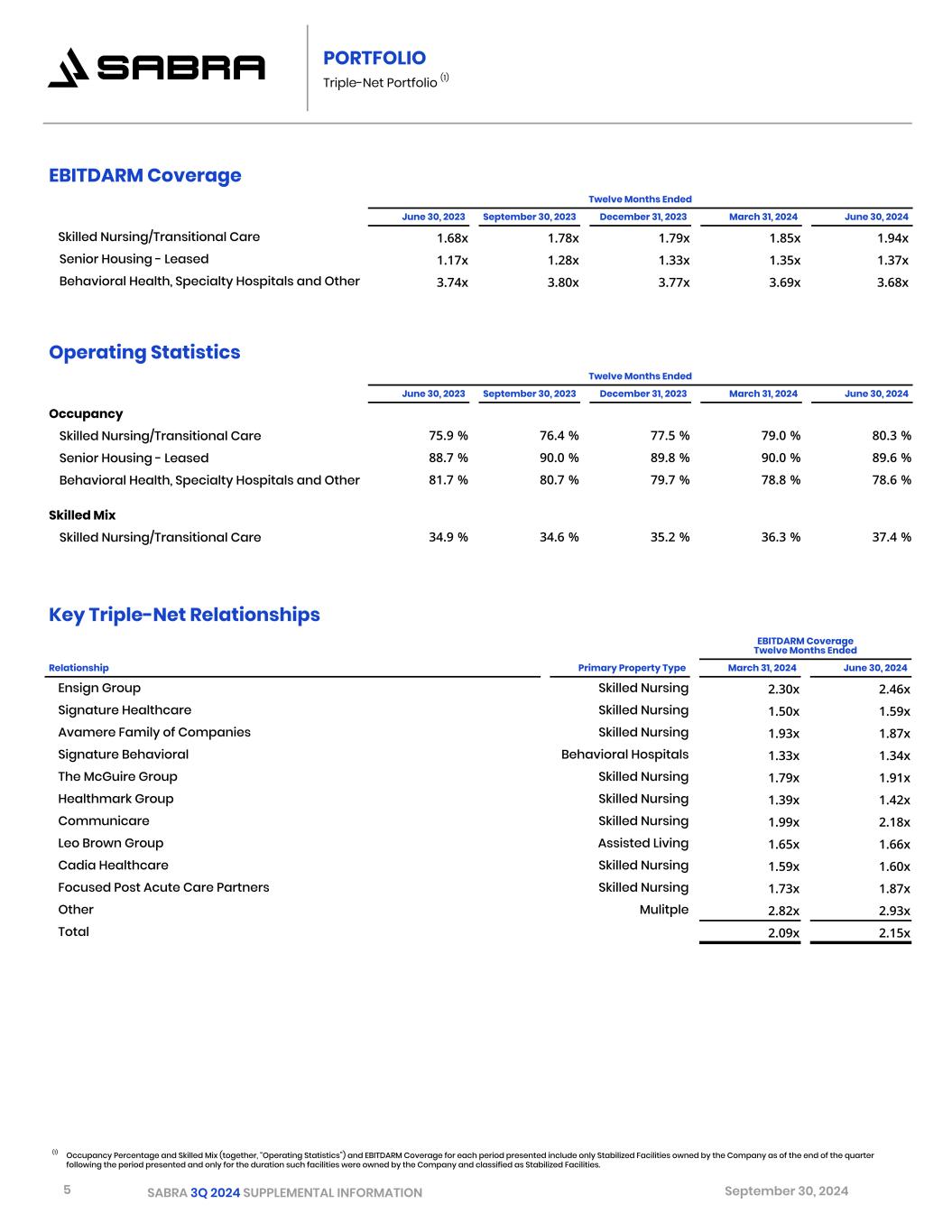

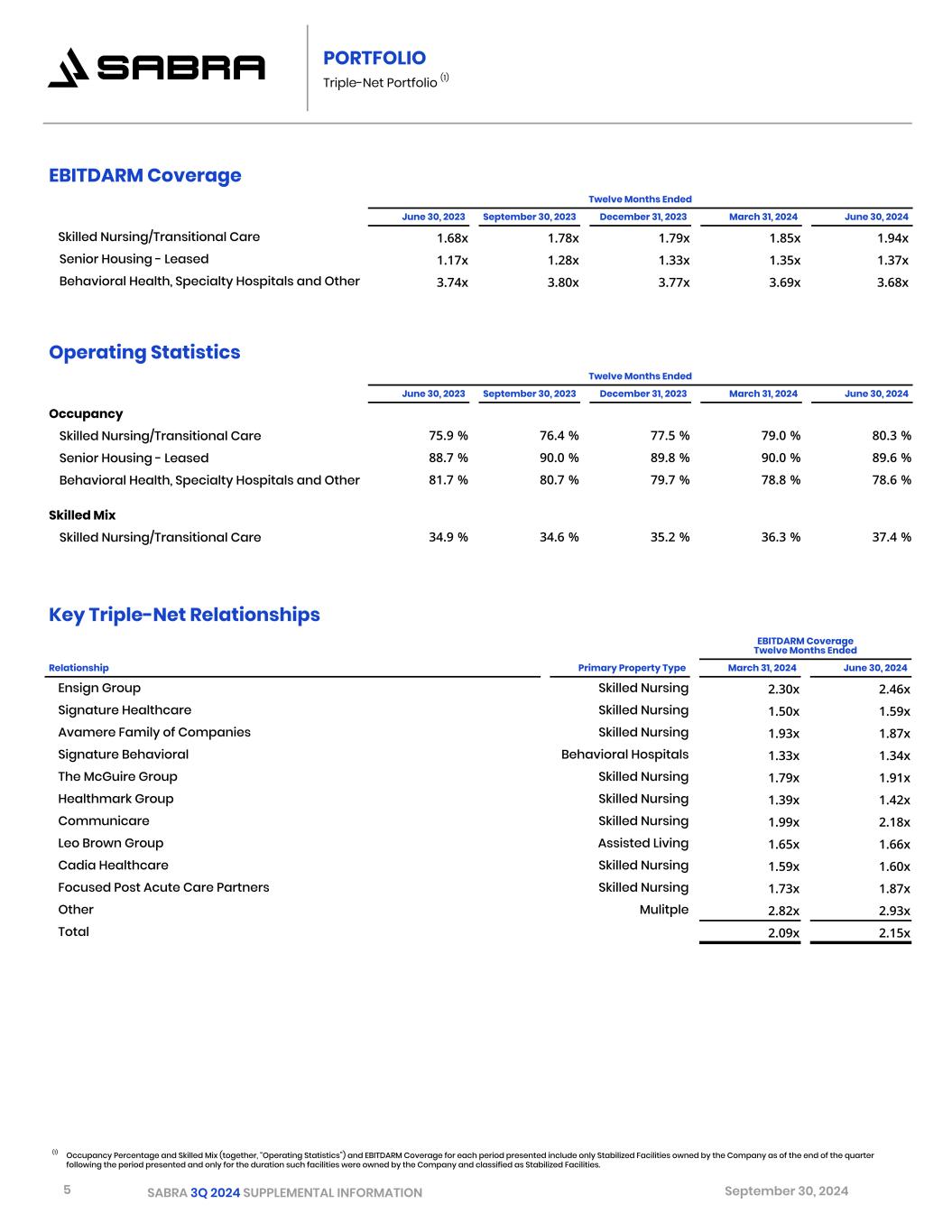

5 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 Operating Statistics Twelve Months Ended June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 Occupancy Skilled Nursing/Transitional Care 75.9 % 76.4 % 77.5 % 79.0 % 80.3 % Senior Housing - Leased 88.7 % 90.0 % 89.8 % 90.0 % 89.6 % Behavioral Health, Specialty Hospitals and Other 81.7 % 80.7 % 79.7 % 78.8 % 78.6 % Skilled Mix Skilled Nursing/Transitional Care 34.9 % 34.6 % 35.2 % 36.3 % 37.4 % PORTFOLIO Triple-Net Portfolio (1) (1) Occupancy Percentage and Skilled Mix (together, “Operating Statistics”) and EBITDARM Coverage for each period presented include only Stabilized Facilities owned by the Company as of the end of the quarter following the period presented and only for the duration such facilities were owned by the Company and classified as Stabilized Facilities. EBITDARM Coverage Twelve Months Ended June 30, 2023 September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 Skilled Nursing/Transitional Care 1.68x 1.78x 1.79x 1.85x 1.94x Senior Housing - Leased 1.17x 1.28x 1.33x 1.35x 1.37x Behavioral Health, Specialty Hospitals and Other 3.74x 3.80x 3.77x 3.69x 3.68x Key Triple-Net Relationships EBITDARM Coverage Twelve Months Ended Relationship Primary Property Type March 31, 2024 June 30, 2024 Ensign Group Skilled Nursing 2.30x 2.46x Signature Healthcare Skilled Nursing 1.50x 1.59x Avamere Family of Companies Skilled Nursing 1.93x 1.87x Signature Behavioral Behavioral Hospitals 1.33x 1.34x The McGuire Group Skilled Nursing 1.79x 1.91x Healthmark Group Skilled Nursing 1.39x 1.42x Communicare Skilled Nursing 1.99x 2.18x Leo Brown Group Assisted Living 1.65x 1.66x Cadia Healthcare Skilled Nursing 1.59x 1.60x Focused Post Acute Care Partners Skilled Nursing 1.73x 1.87x Other Mulitple 2.82x 2.93x Total 2.09x 2.15x

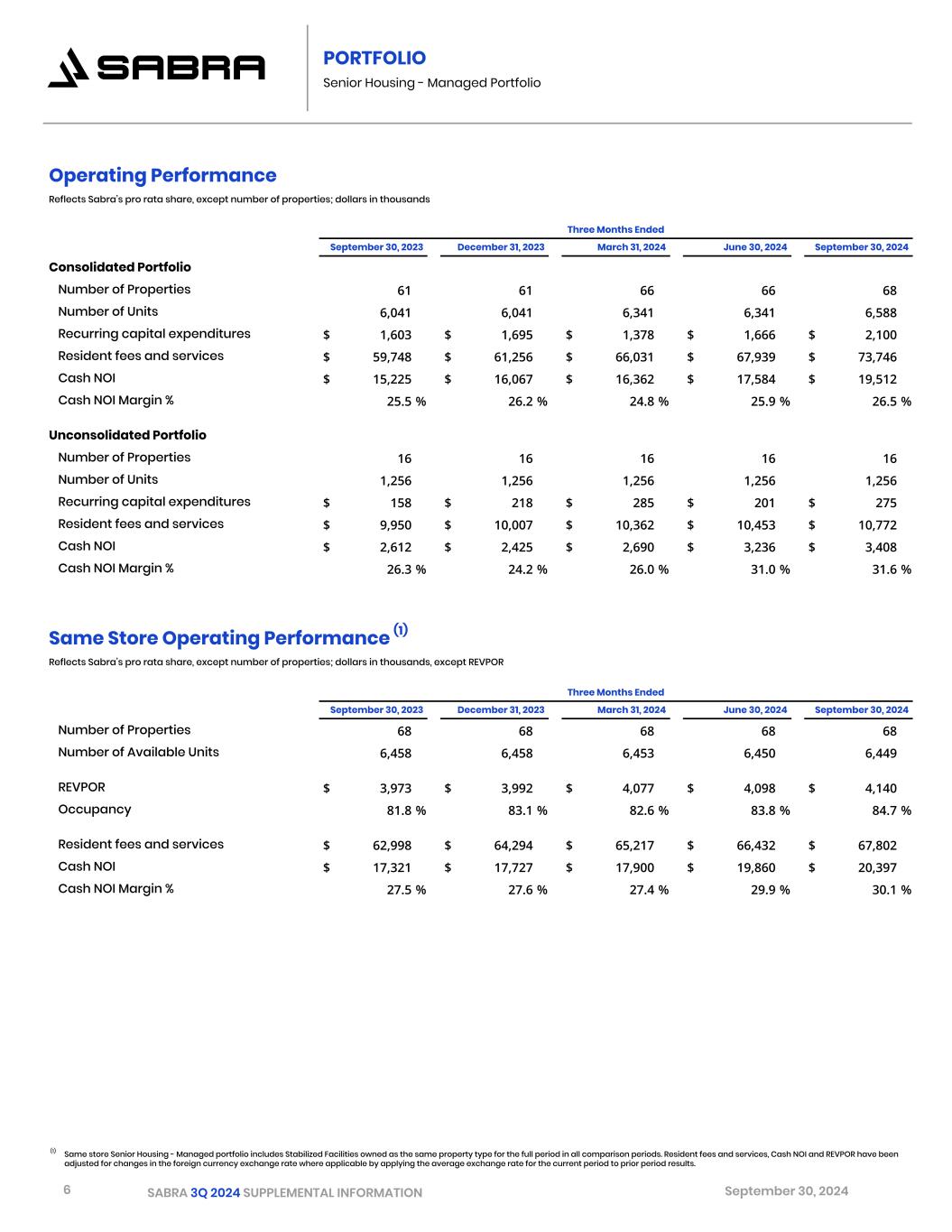

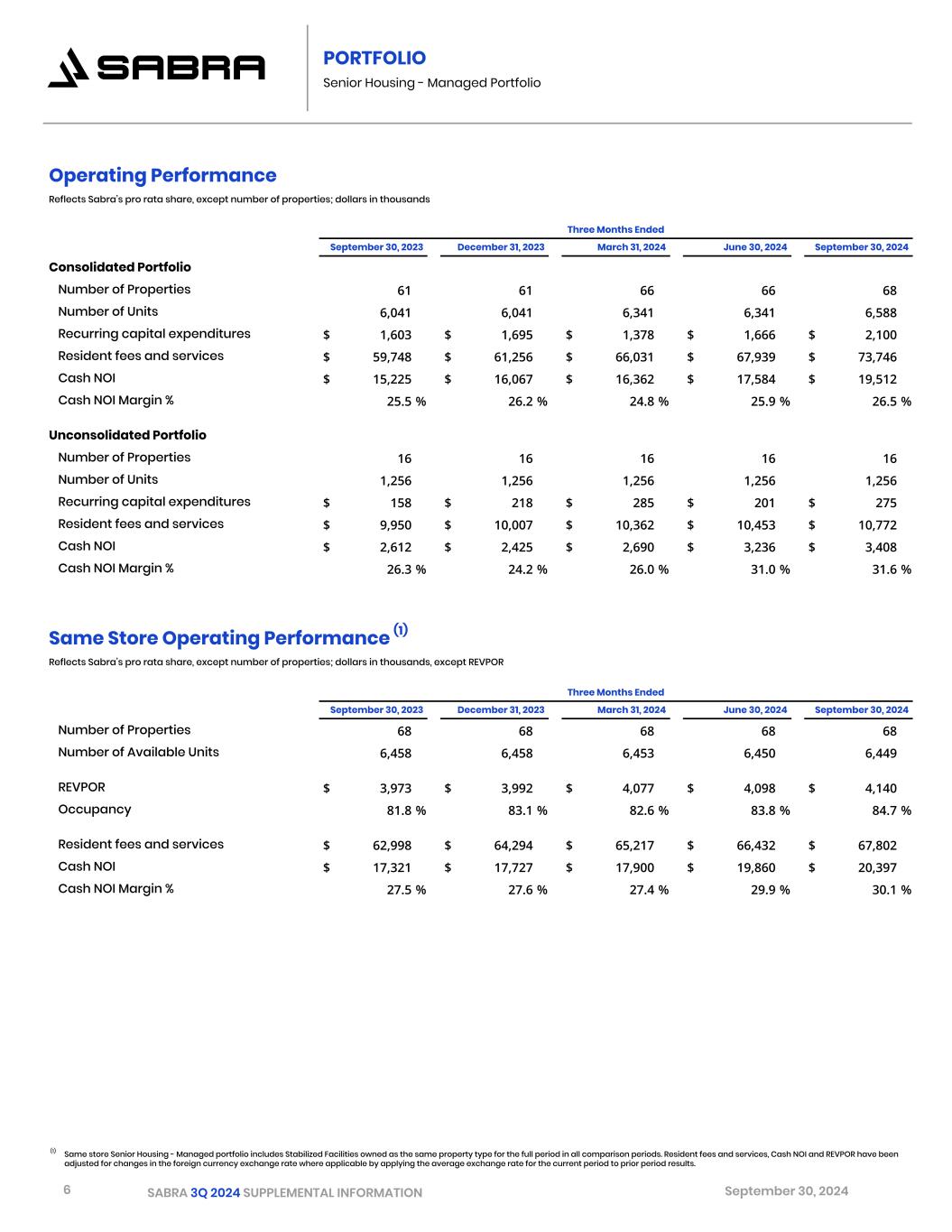

6 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 PORTFOLIO Senior Housing - Managed Portfolio (1) Same store Senior Housing - Managed portfolio includes Stabilized Facilities owned as the same property type for the full period in all comparison periods. Resident fees and services, Cash NOI and REVPOR have been adjusted for changes in the foreign currency exchange rate where applicable by applying the average exchange rate for the current period to prior period results. Operating Performance Reflects Sabra’s pro rata share, except number of properties; dollars in thousands Three Months Ended September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 Consolidated Portfolio Number of Properties 61 61 66 66 68 Number of Units 6,041 6,041 6,341 6,341 6,588 Recurring capital expenditures $ 1,603 $ 1,695 $ 1,378 $ 1,666 $ 2,100 Resident fees and services $ 59,748 $ 61,256 $ 66,031 $ 67,939 $ 73,746 Cash NOI $ 15,225 $ 16,067 $ 16,362 $ 17,584 $ 19,512 Cash NOI Margin % 25.5 % 26.2 % 24.8 % 25.9 % 26.5 % Unconsolidated Portfolio Number of Properties 16 16 16 16 16 Number of Units 1,256 1,256 1,256 1,256 1,256 Recurring capital expenditures $ 158 $ 218 $ 285 $ 201 $ 275 Resident fees and services $ 9,950 $ 10,007 $ 10,362 $ 10,453 $ 10,772 Cash NOI $ 2,612 $ 2,425 $ 2,690 $ 3,236 $ 3,408 Cash NOI Margin % 26.3 % 24.2 % 26.0 % 31.0 % 31.6 % Same Store Operating Performance (1) Reflects Sabra’s pro rata share, except number of properties; dollars in thousands, except REVPOR Three Months Ended September 30, 2023 December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 Number of Properties 68 68 68 68 68 Number of Available Units 6,458 6,458 6,453 6,450 6,449 REVPOR $ 3,973 $ 3,992 $ 4,077 $ 4,098 $ 4,140 Occupancy 81.8 % 83.1 % 82.6 % 83.8 % 84.7 % Resident fees and services $ 62,998 $ 64,294 $ 65,217 $ 66,432 $ 67,802 Cash NOI $ 17,321 $ 17,727 $ 17,900 $ 19,860 $ 20,397 Cash NOI Margin % 27.5 % 27.6 % 27.4 % 29.9 % 30.1 %

7 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 PORTFOLIO Loans and Other Investments Loans Receivable and Other Investments Dollars in thousands As of September 30, 2024 Loan Type Number of Loans Property Type Principal Balance Book Value Weighted Average Contractual Interest Rate Weighted Average Annualized Effective Interest Rate Interest Income Three Months Ended September 30, 2024 (1) Maturity Date Mortgage 3 Behavioral Health / Skilled Nursing $ 335,600 $ 335,600 7.7 % 7.7 % $ 6,514 11/01/26 - 06/01/29 Other 11 Multiple 56,085 52,636 7.9 % 7.6 % 993 12/31/23 - 08/31/33 14 391,685 388,236 7.8 % 7.7 % $ 7,507 Allowance for loan losses — (6,219) $ 391,685 $ 382,017 Other Investment Type Number of Investments Property Type Total Funding Commitments Total Amount Funded Book Value Rate of Return Other Income Three Months Ended September 30, 2024 (1) Preferred Equity 5 Skilled Nursing / Senior Housing $ 52,434 $ 52,434 $ 59,808 10.9 % $ 1,565 (1) Includes income related to loans receivable and other investments held as of September 30, 2024.

8 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 The Ensign Group: 8.3% Avamere Family of Companies: 8.0% Signature Behavioral: 6.7% Recovery Centers of America: 5.6% The McGuire Group: 3.6% Managed (No Operator Credit Exposure): 18.7% Other: 40.4% Signature Healthcare: 8.7% RELATIONSHIP CONCENTRATION PROPERTY TYPE CONCENTRATION PAYOR SOURCE CONCENTRATION (2) PORTFOLIO NOI Concentrations (1) As of September 30, 2024 (1) Relationship and asset class concentrations include real estate investments and investments in loans receivable and other investments. Relationship concentrations use Annualized Cash NOI, and asset class concentrations use Annualized Cash NOI, as adjusted to reflect Annualized Cash NOI from our mortgage and construction loans receivable and preferred equity investments in the related asset class of the underlying real estate. Payor source concentration excludes Annualized Cash NOI from investments in loans receivable and other investments. (2) Tenant payor source allocation presented one quarter in arrears. Behavioral Health: 13.9% Senior Housing - Leased: 10.7% Specialty Hospital and Other: 3.9% Other: 0.8% Skilled Nursing/Transitional Care: 52.0% Senior Housing - Managed: 18.7% Private Pay: 45.4% Non-Private: 54.6%

9 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 PORTFOLIO Geographic Concentrations - Consolidated Portfolio Property Type As of September 30, 2024 Location Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 33 3 7 — 13 56 15.0 % Kentucky 24 2 — 2 1 29 7.8 California 23 — 2 3 1 29 7.8 Indiana 14 4 2 2 — 22 5.9 Oregon 15 1 3 — — 19 5.1 North Carolina 13 — 2 — — 15 4.0 Missouri 10 — 1 1 — 12 3.2 Washington 10 — 2 — — 12 3.2 Massachusetts 11 — — — — 11 2.9 New York 9 — 1 — — 10 2.7 Other (29 states & Canada) 71 29 48 10 — 158 42.4 Total 233 39 68 18 15 373 100.0 % % of Total 62.5 % 10.5 % 18.2 % 4.8 % 4.0 % 100.0 % Distribution of Beds/Units As of September 30, 2024 Property Type Location Total Number of Properties Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 56 4,211 350 856 — 325 5,742 15.2 % Kentucky 29 2,598 270 — 60 40 2,968 7.9 Indiana 22 1,651 563 299 138 — 2,651 7.0 California 29 1,924 — 160 313 27 2,424 6.4 Oregon 19 1,520 215 162 — — 1,897 5.0 North Carolina 15 1,454 — 237 — — 1,691 4.5 New York 10 1,566 — 107 — — 1,673 4.4 Massachusetts 11 1,469 — — — — 1,469 3.9 Washington 12 1,123 — 165 — — 1,288 3.4 Virginia 10 894 — 246 — — 1,140 3.0 Other (29 states & Canada) 160 7,920 1,921 4,356 653 — 14,850 39.3 Total 373 26,330 3,319 6,588 1,164 392 37,793 100.0 % % of Total 69.7 % 8.8 % 17.4 % 3.1 % 1.0 % 100.0 %

10 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 PORTFOLIO Geographic Concentrations - Consolidated Portfolio Continued Investment Dollars in thousands As of September 30, 2024 Property Type Location Total Number of Properties Skilled Nursing/ Transitional Care Senior Housing - Leased Senior Housing - Managed Consolidated Behavioral Health Specialty Hospitals and Other Total % of Total Texas 56 $ 341,228 $ 27,335 $ 207,236 $ — $ 187,387 $ 763,186 13.4 % California 29 411,326 — 59,976 217,764 7,798 696,864 12.2 Indiana 22 196,244 120,197 87,211 12,156 — 415,808 7.3 Oregon 19 261,316 33,002 56,264 — — 350,582 6.2 Kentucky 29 244,481 58,983 — 10,179 30,313 343,956 6.0 New York 10 298,639 — 22,929 — — 321,568 5.6 North Carolina 15 125,549 — 76,992 — — 202,541 3.6 Washington 12 137,014 — 42,273 — — 179,287 3.2 Arizona 5 — 10,348 40,323 121,757 — 172,428 3.0 Ohio 9 32,247 33,394 103,844 — — 169,485 3.0 Other (29 states & Canada) (1) 167 944,668 228,778 790,289 117,333 — 2,081,068 36.5 Total 373 $ 2,992,712 $ 512,037 $ 1,487,337 $ 479,189 $ 225,498 $ 5,696,773 100.0 % % of Total 52.5 % 9.0 % 26.1 % 8.4 % 4.0 % 100.0 % (1) Investment balance in Canada is based on the exchange rate as of September 30, 2024 of $0.7399 per 1 CAD.

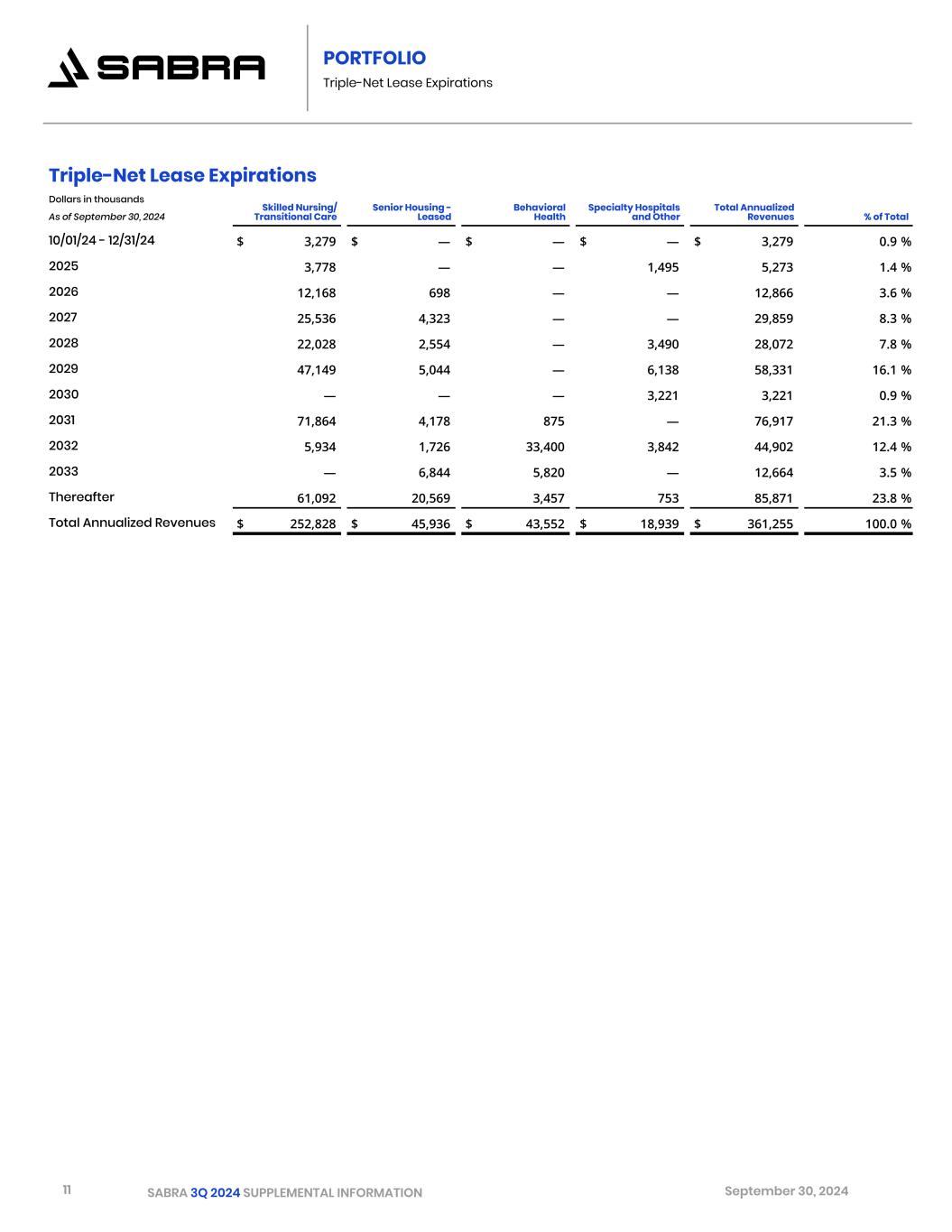

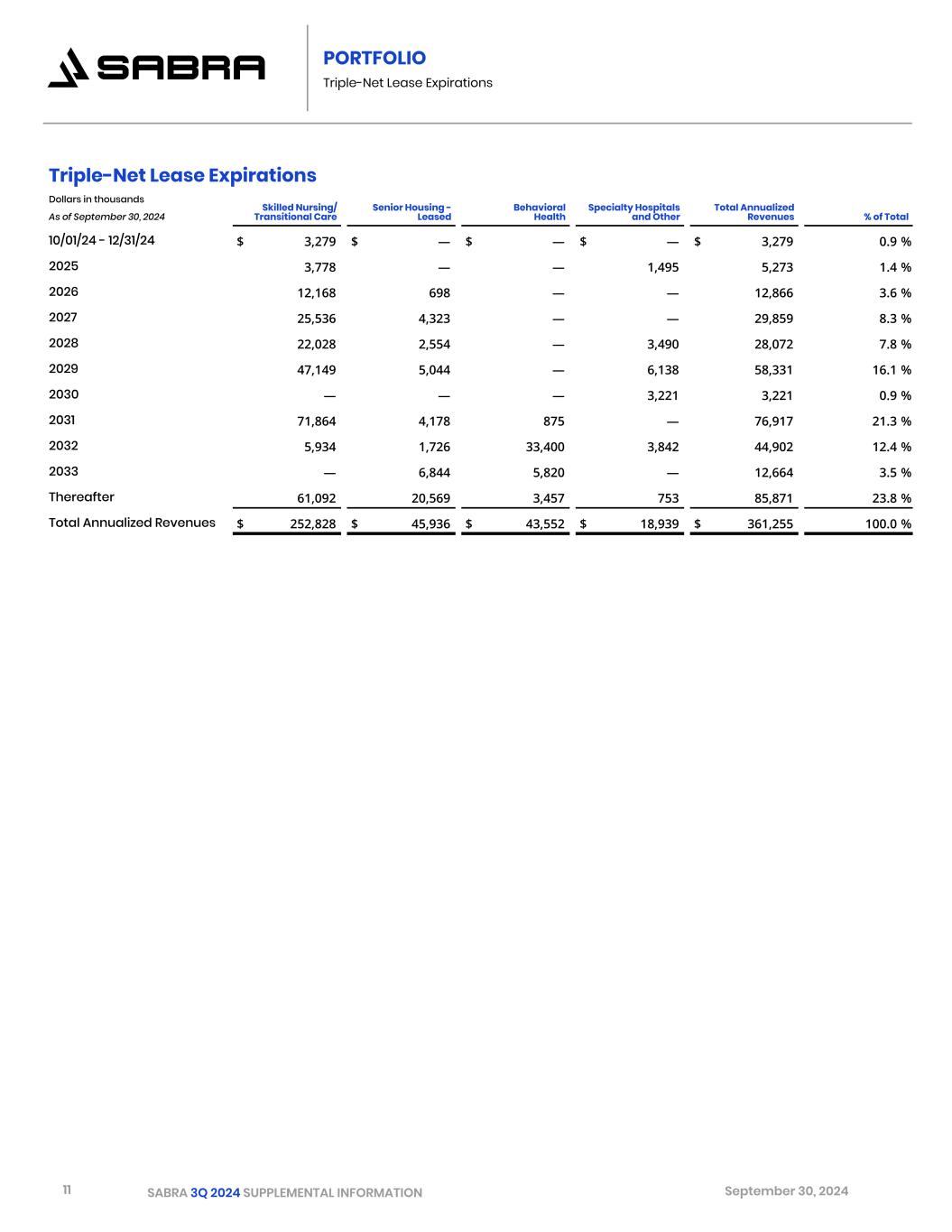

11 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 PORTFOLIO Triple-Net Lease Expirations Triple-Net Lease Expirations Dollars in thousands Skilled Nursing/ Transitional Care Senior Housing - Leased Behavioral Health Specialty Hospitals and Other Total Annualized RevenuesAs of September 30, 2024 % of Total 10/01/24 - 12/31/24 $ 3,279 $ — $ — $ — $ 3,279 0.9 % 2025 3,778 — — 1,495 5,273 1.4 % 2026 12,168 698 — — 12,866 3.6 % 2027 25,536 4,323 — — 29,859 8.3 % 2028 22,028 2,554 — 3,490 28,072 7.8 % 2029 47,149 5,044 — 6,138 58,331 16.1 % 2030 — — — 3,221 3,221 0.9 % 2031 71,864 4,178 875 — 76,917 21.3 % 2032 5,934 1,726 33,400 3,842 44,902 12.4 % 2033 — 6,844 5,820 — 12,664 3.5 % Thereafter 61,092 20,569 3,457 753 85,871 23.8 % Total Annualized Revenues $ 252,828 $ 45,936 $ 43,552 $ 18,939 $ 361,255 100.0 %

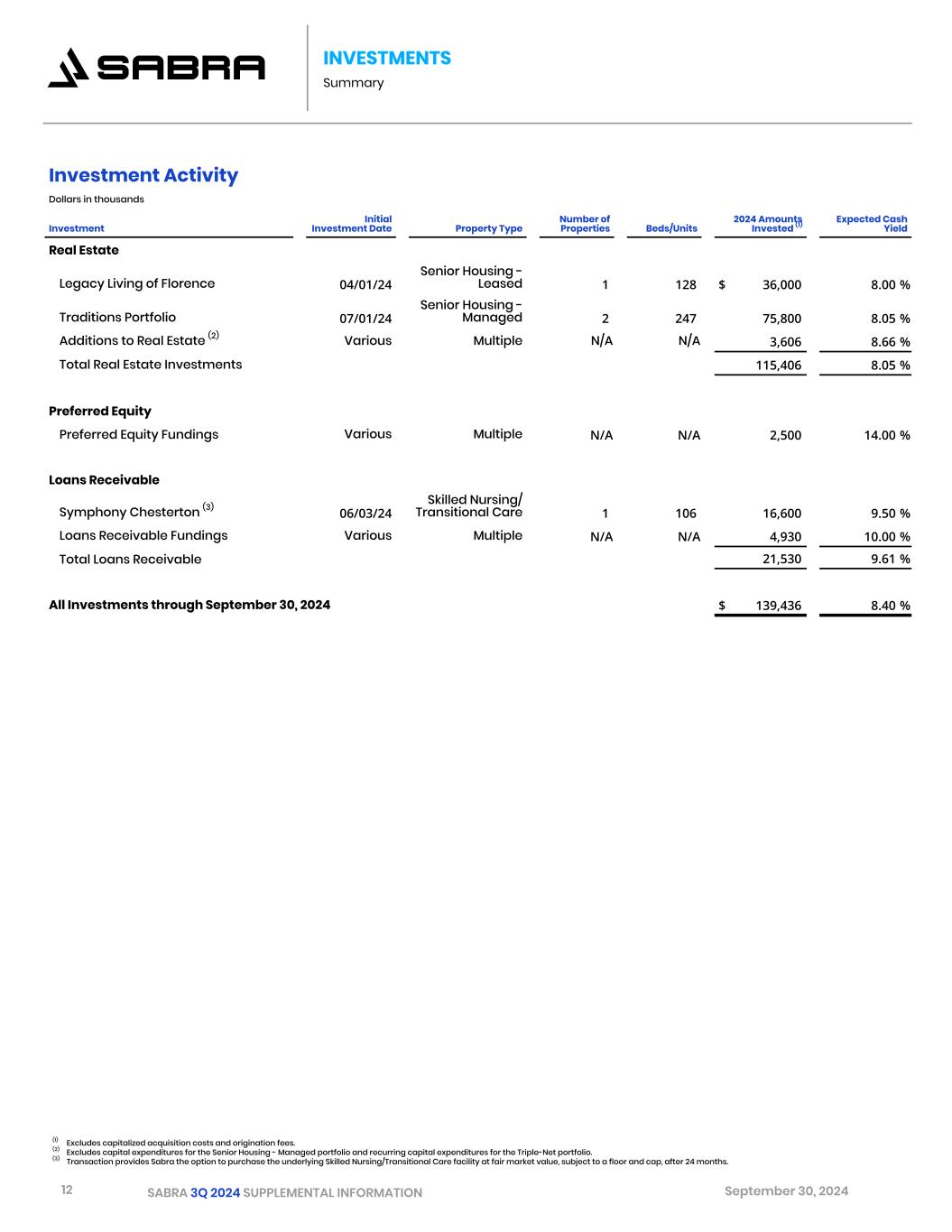

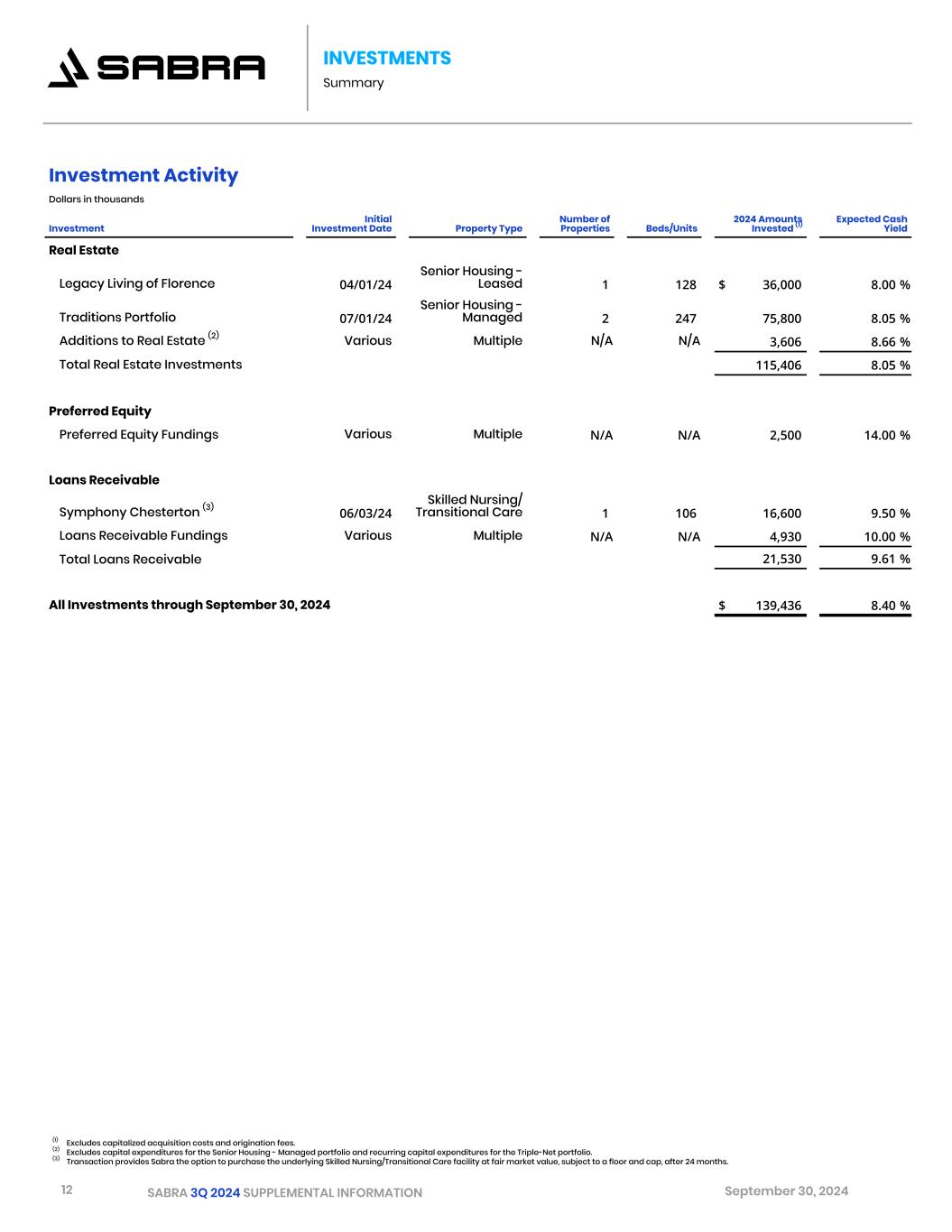

12 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 INVESTMENTS Summary Investment Activity Dollars in thousands Investment Initial Investment Date Property Type Number of Properties Beds/Units 2024 Amounts Invested (1) Expected Cash Yield Real Estate Legacy Living of Florence 04/01/24 Senior Housing - Leased 1 128 $ 36,000 8.00 % Traditions Portfolio 07/01/24 Senior Housing - Managed 2 247 75,800 8.05 % Additions to Real Estate (2) Various Multiple N/A N/A 3,606 8.66 % Total Real Estate Investments 115,406 8.05 % Preferred Equity Preferred Equity Fundings Various Multiple N/A N/A 2,500 14.00 % Loans Receivable Symphony Chesterton (3) 06/03/24 Skilled Nursing/ Transitional Care 1 106 16,600 9.50 % Loans Receivable Fundings Various Multiple N/A N/A 4,930 10.00 % Total Loans Receivable 21,530 9.61 % All Investments through September 30, 2024 $ 139,436 8.40 % (1) Excludes capitalized acquisition costs and origination fees. (2) Excludes capital expenditures for the Senior Housing - Managed portfolio and recurring capital expenditures for the Triple-Net portfolio. (3) Transaction provides Sabra the option to purchase the underlying Skilled Nursing/Transitional Care facility at fair market value, subject to a floor and cap, after 24 months.

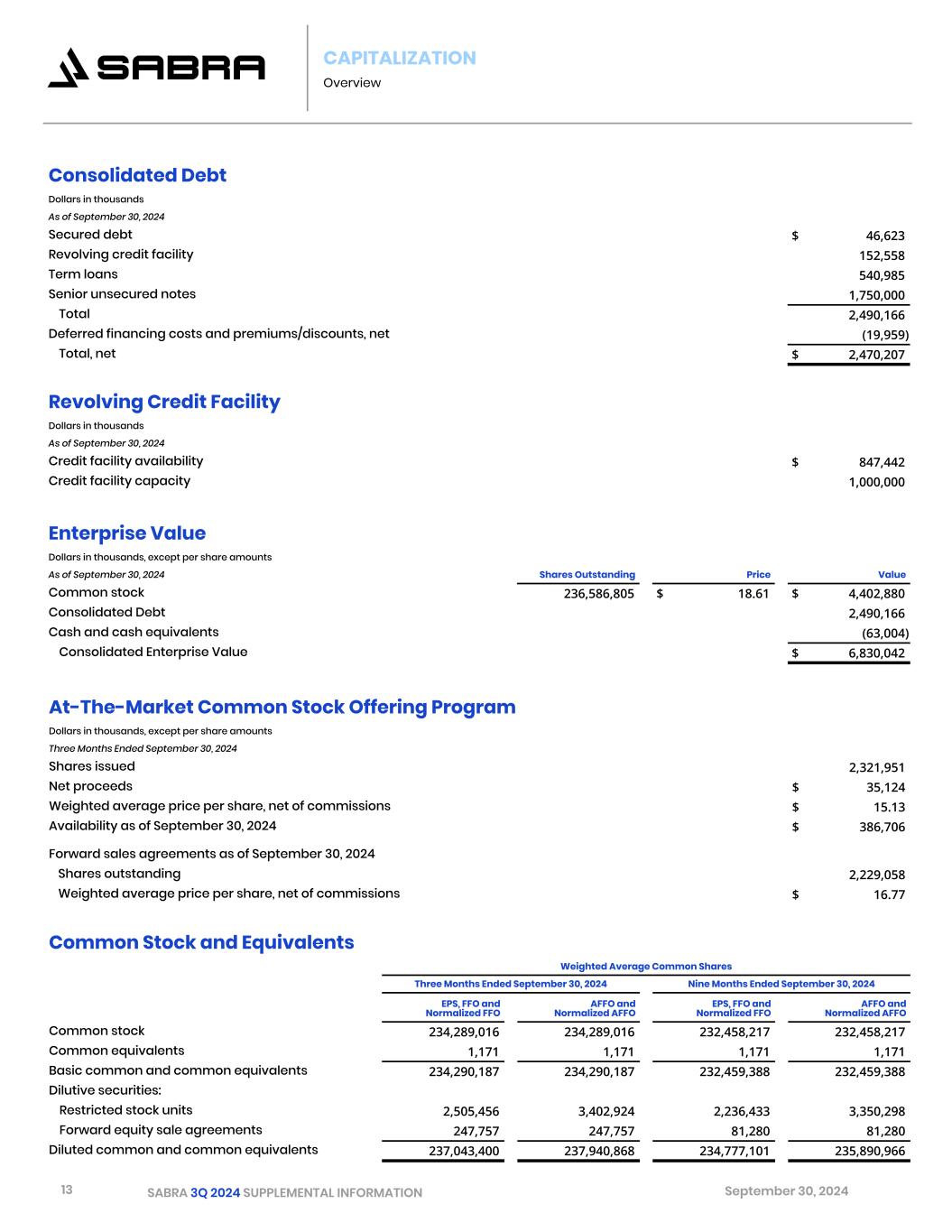

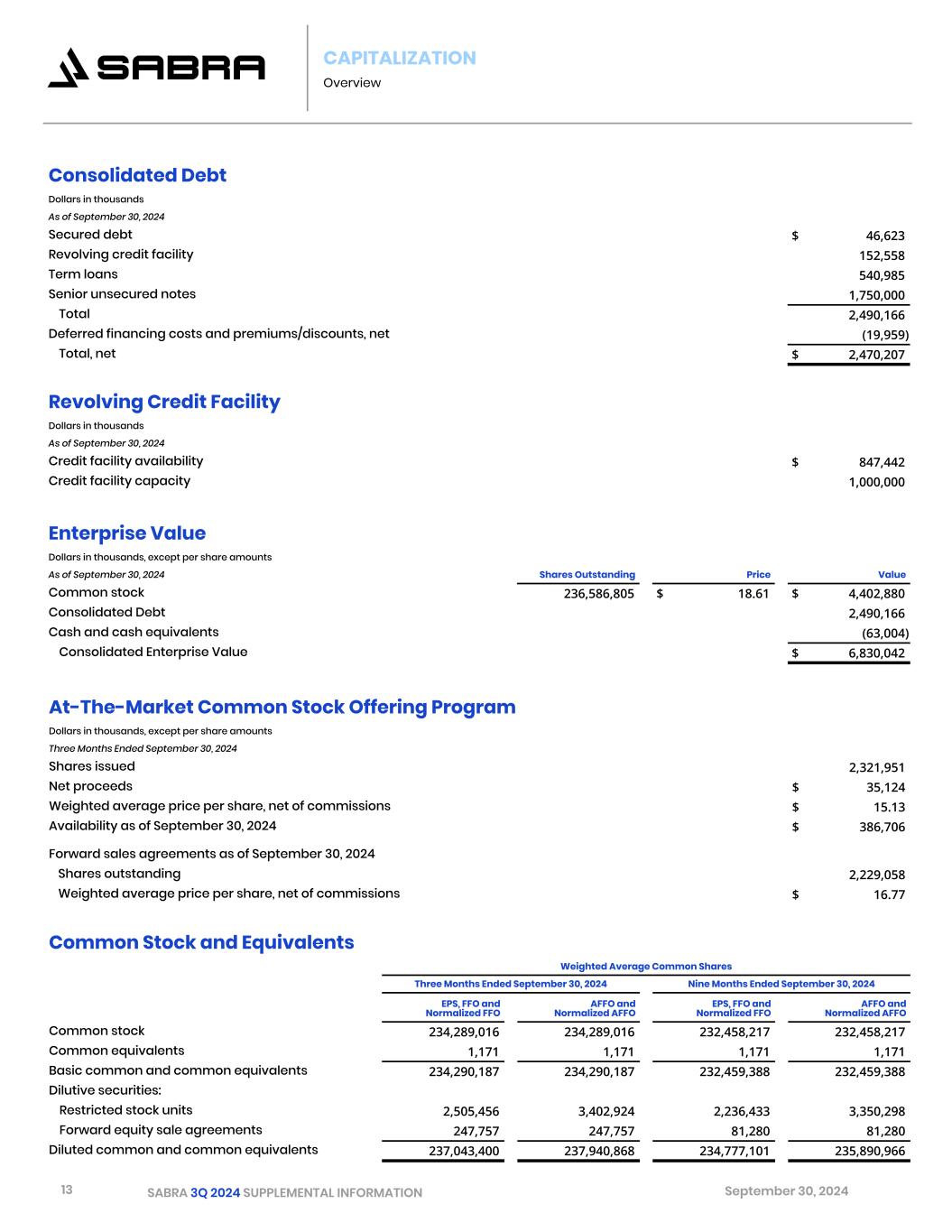

13 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 CAPITALIZATION Overview Consolidated Debt Dollars in thousands As of September 30, 2024 Secured debt $ 46,623 Revolving credit facility 152,558 Term loans 540,985 Senior unsecured notes 1,750,000 Total 2,490,166 Deferred financing costs and premiums/discounts, net (19,959) Total, net $ 2,470,207 Revolving Credit Facility Dollars in thousands As of September 30, 2024 Credit facility availability $ 847,442 Credit facility capacity 1,000,000 Enterprise Value Dollars in thousands, except per share amounts As of September 30, 2024 Shares Outstanding Price Value Common stock 236,586,805 $ 18.61 $ 4,402,880 Consolidated Debt 2,490,166 Cash and cash equivalents (63,004) Consolidated Enterprise Value $ 6,830,042 Common Stock and Equivalents Weighted Average Common Shares Three Months Ended September 30, 2024 Nine Months Ended September 30, 2024 EPS, FFO and Normalized FFO AFFO and Normalized AFFO EPS, FFO and Normalized FFO AFFO and Normalized AFFO Common stock 234,289,016 234,289,016 232,458,217 232,458,217 Common equivalents 1,171 1,171 1,171 1,171 Basic common and common equivalents 234,290,187 234,290,187 232,459,388 232,459,388 Dilutive securities: Restricted stock units 2,505,456 3,402,924 2,236,433 3,350,298 Forward equity sale agreements 247,757 247,757 81,280 81,280 Diluted common and common equivalents 237,043,400 237,940,868 234,777,101 235,890,966 At-The-Market Common Stock Offering Program Dollars in thousands, except per share amounts Three Months Ended September 30, 2024 Shares issued 2,321,951 Net proceeds $ 35,124 Weighted average price per share, net of commissions $ 15.13 Availability as of September 30, 2024 $ 386,706 Forward sales agreements as of September 30, 2024 Shares outstanding 2,229,058 Weighted average price per share, net of commissions $ 16.77

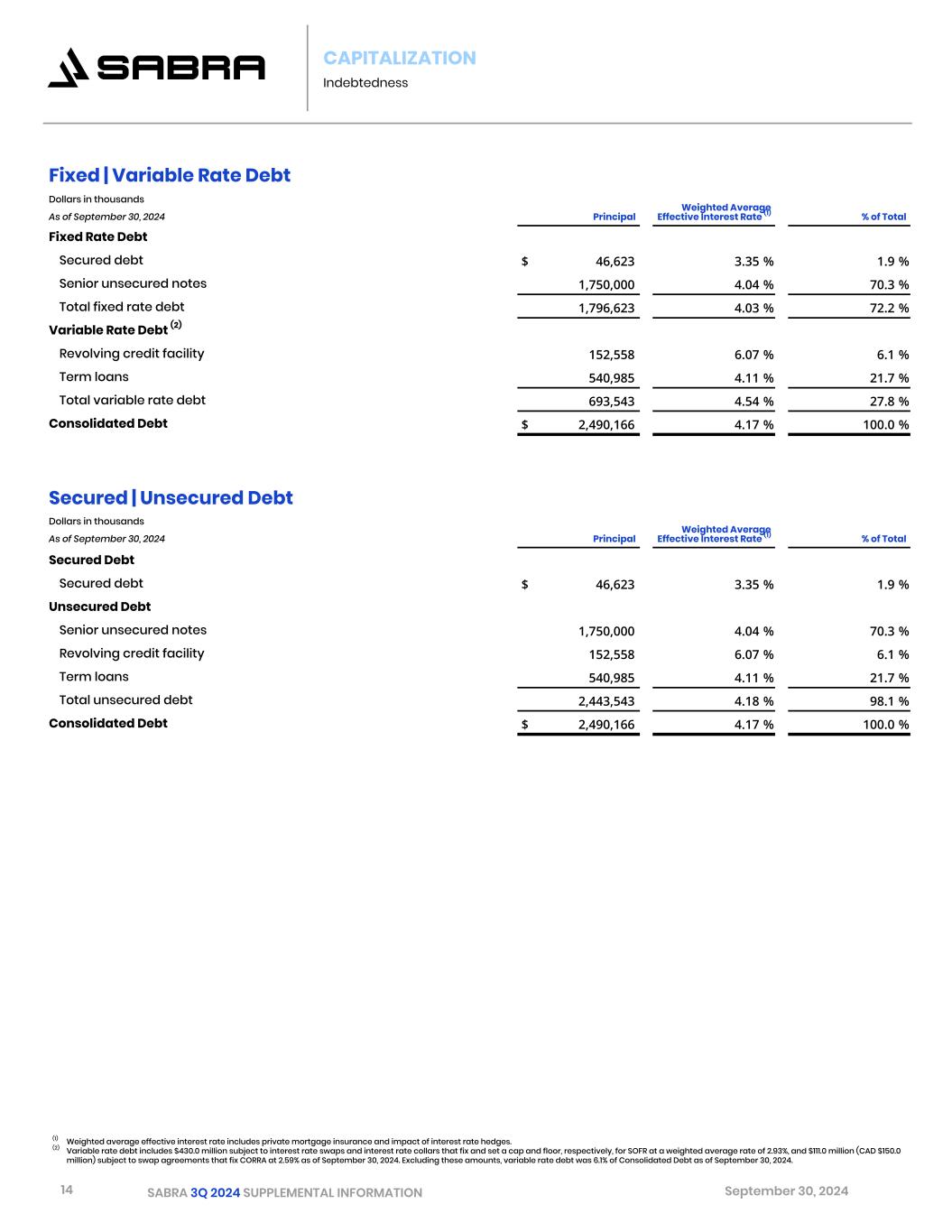

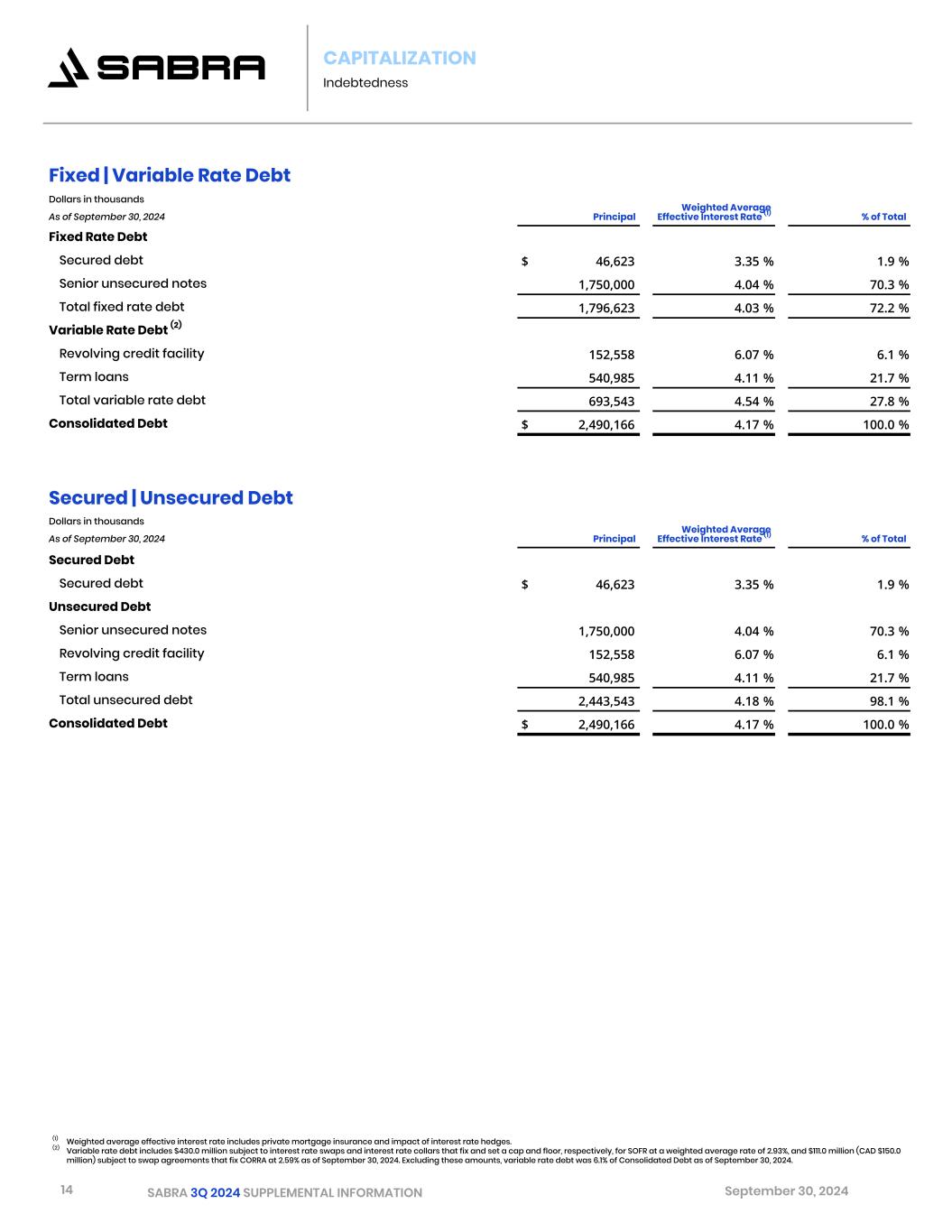

14 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 CAPITALIZATION Indebtedness Fixed | Variable Rate Debt Dollars in thousands Weighted Average Effective Interest Rate (1)As of September 30, 2024 Principal % of Total Fixed Rate Debt Secured debt $ 46,623 3.35 % 1.9 % Senior unsecured notes 1,750,000 4.04 % 70.3 % Total fixed rate debt 1,796,623 4.03 % 72.2 % Variable Rate Debt (2) Revolving credit facility 152,558 6.07 % 6.1 % Term loans 540,985 4.11 % 21.7 % Total variable rate debt 693,543 4.54 % 27.8 % Consolidated Debt $ 2,490,166 4.17 % 100.0 % Secured | Unsecured Debt Dollars in thousands Weighted Average Effective Interest Rate (1)As of September 30, 2024 Principal % of Total Secured Debt Secured debt $ 46,623 3.35 % 1.9 % Unsecured Debt Senior unsecured notes 1,750,000 4.04 % 70.3 % Revolving credit facility 152,558 6.07 % 6.1 % Term loans 540,985 4.11 % 21.7 % Total unsecured debt 2,443,543 4.18 % 98.1 % Consolidated Debt $ 2,490,166 4.17 % 100.0 % (1) Weighted average effective interest rate includes private mortgage insurance and impact of interest rate hedges. (2) Variable rate debt includes $430.0 million subject to interest rate swaps and interest rate collars that fix and set a cap and floor, respectively, for SOFR at a weighted average rate of 2.93%, and $111.0 million (CAD $150.0 million) subject to swap agreements that fix CORRA at 2.59% as of September 30, 2024. Excluding these amounts, variable rate debt was 6.1% of Consolidated Debt as of September 30, 2024.

15 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 CAPITALIZATION Debt Maturity Debt Maturity Schedule Dollars in thousands Secured Debt Senior Unsecured Notes Term Loans Revolving Credit Facility (1) Consolidated Debt As of September 30, 2024 Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) Principal Rate (2) 10/01/24 - 12/31/24 $ 513 2.85 % $ — — $ — — $ — — $ 513 2.85 % 2025 2,089 2.86 % — — — — — — 2,089 2.86 % 2026 2,147 2.86 % 500,000 5.13 % — — — — 502,147 5.12 % 2027 2,206 2.87 % 100,000 5.88 % — — 152,558 6.07 % 254,764 5.97 % 2028 2,266 2.88 % — — 540,985 6.21 % — — 543,251 6.20 % 2029 2,328 2.89 % 350,000 3.90 % — — — — 352,328 3.89 % 2030 2,392 2.90 % — — — — — — 2,392 2.90 % 2031 2,093 2.92 % 800,000 3.20 % — — — — 802,093 3.20 % 2032 1,887 2.92 % — — — — — — 1,887 2.92 % 2033 1,940 2.93 % — — — — — — 1,940 2.93 % Thereafter 26,762 3.10 % — — — — — — 26,762 3.10 % Total 46,623 1,750,000 540,985 152,558 2,490,166 Discount, net — (4,826) — — (4,826) Deferred financing costs, net (806) (9,326) (5,001) — (15,133) Total, net $ 45,817 $ 1,735,848 $ 535,984 $ 152,558 $ 2,470,207 Wtd. avg. maturity/years 20.4 5.0 3.3 2.3 4.7 Wtd. avg. interest rate (3) 3.35 % 4.04 % 4.11 % 6.07 % 4.17 % (1) Revolving Credit Facility is subject to two six-month extension options. (2) Represents actual contractual interest rates excluding private mortgage insurance and impact of interest rate hedges. (3) Weighted average interest rate includes private mortgage insurance and impact of interest rate hedges.

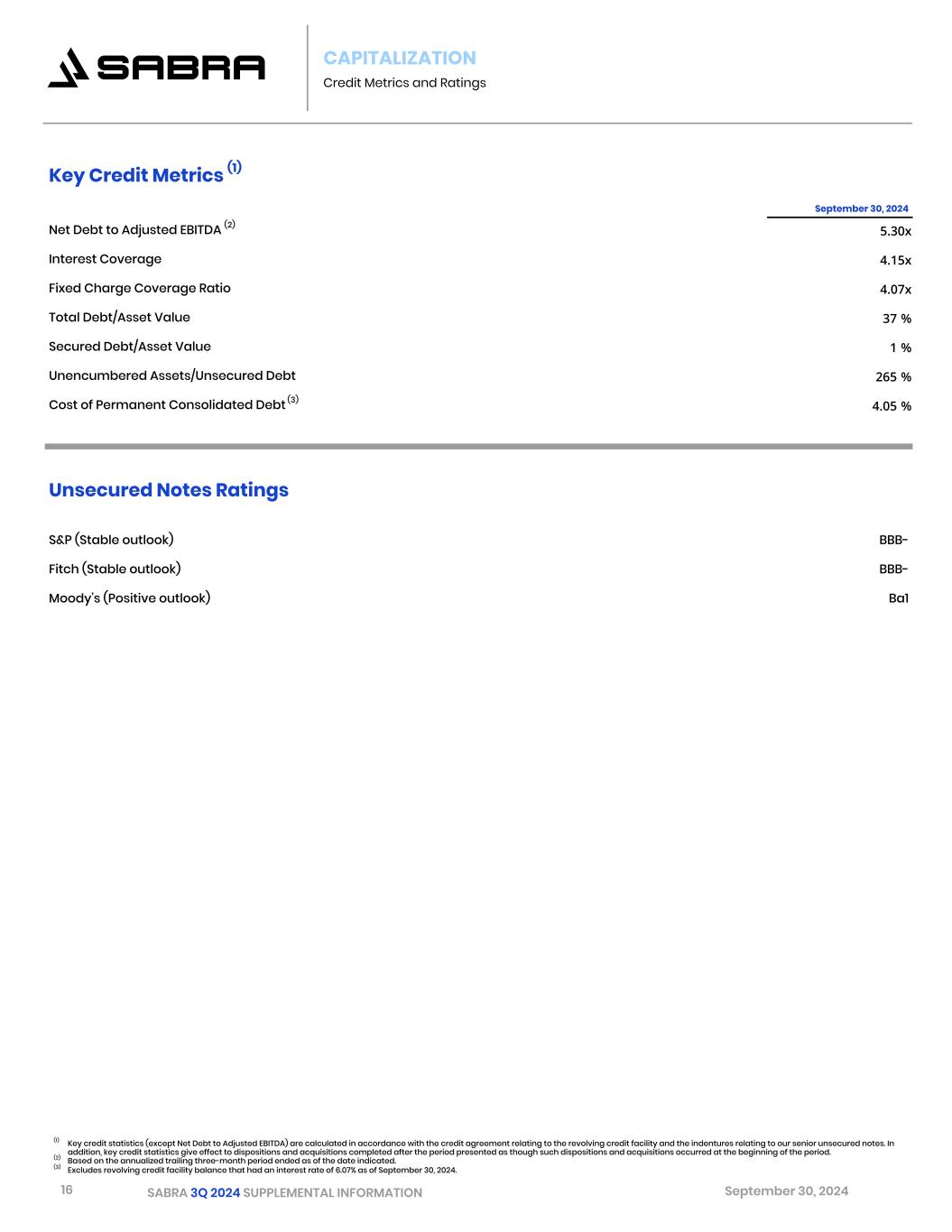

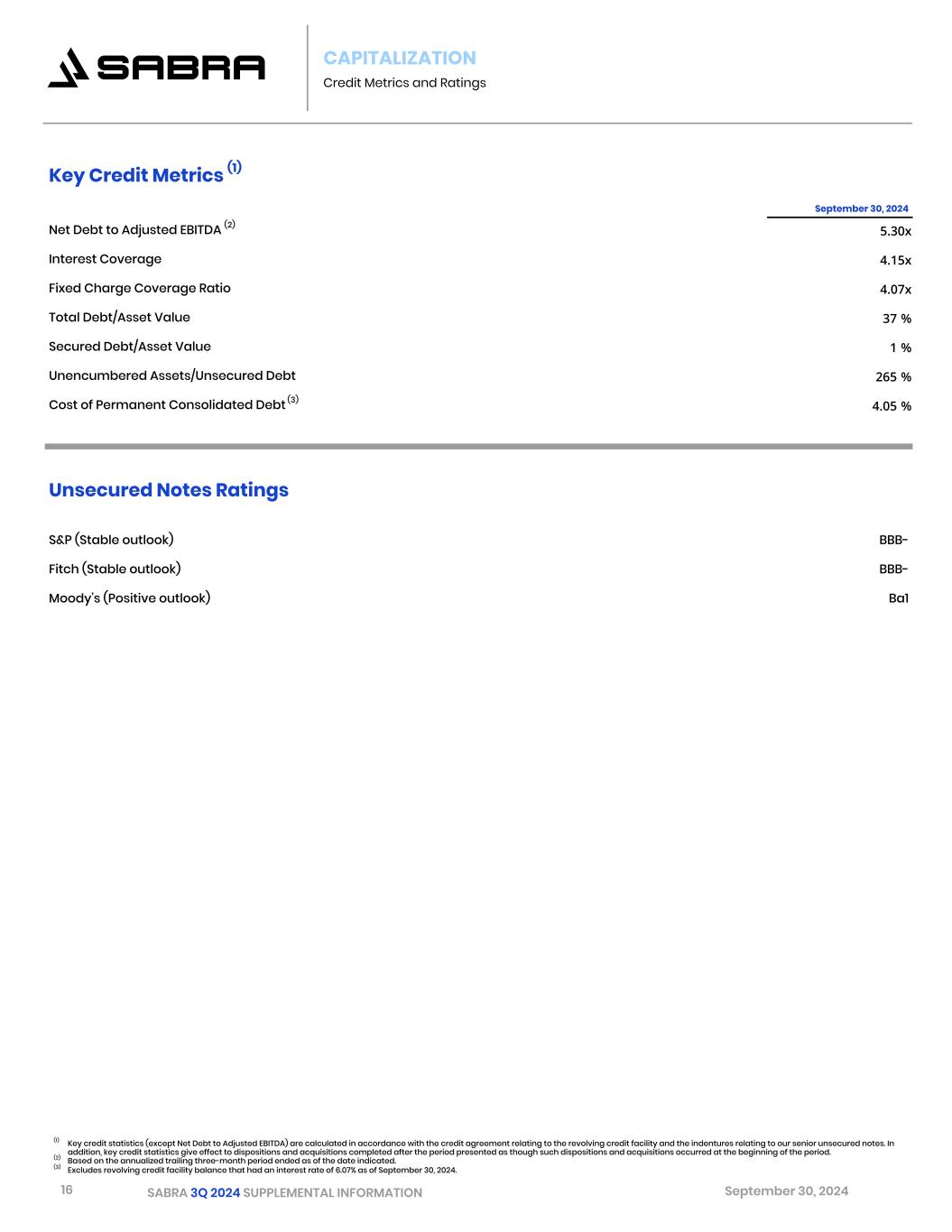

16 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 Key Credit Metrics (1) September 30, 2024 Net Debt to Adjusted EBITDA (2) 5.30x Interest Coverage 4.15x Fixed Charge Coverage Ratio 4.07x Total Debt/Asset Value 37 % Secured Debt/Asset Value 1 % Unencumbered Assets/Unsecured Debt 265 % Cost of Permanent Consolidated Debt (3) 4.05 % Unsecured Notes Ratings S&P (Stable outlook) BBB- Fitch (Stable outlook) BBB- Moody’s (Positive outlook) Ba1 CAPITALIZATION Credit Metrics and Ratings (1) Key credit statistics (except Net Debt to Adjusted EBITDA) are calculated in accordance with the credit agreement relating to the revolving credit facility and the indentures relating to our senior unsecured notes. In addition, key credit statistics give effect to dispositions and acquisitions completed after the period presented as though such dispositions and acquisitions occurred at the beginning of the period. (2) Based on the annualized trailing three-month period ended as of the date indicated. (3) Excludes revolving credit facility balance that had an interest rate of 6.07% as of September 30, 2024.

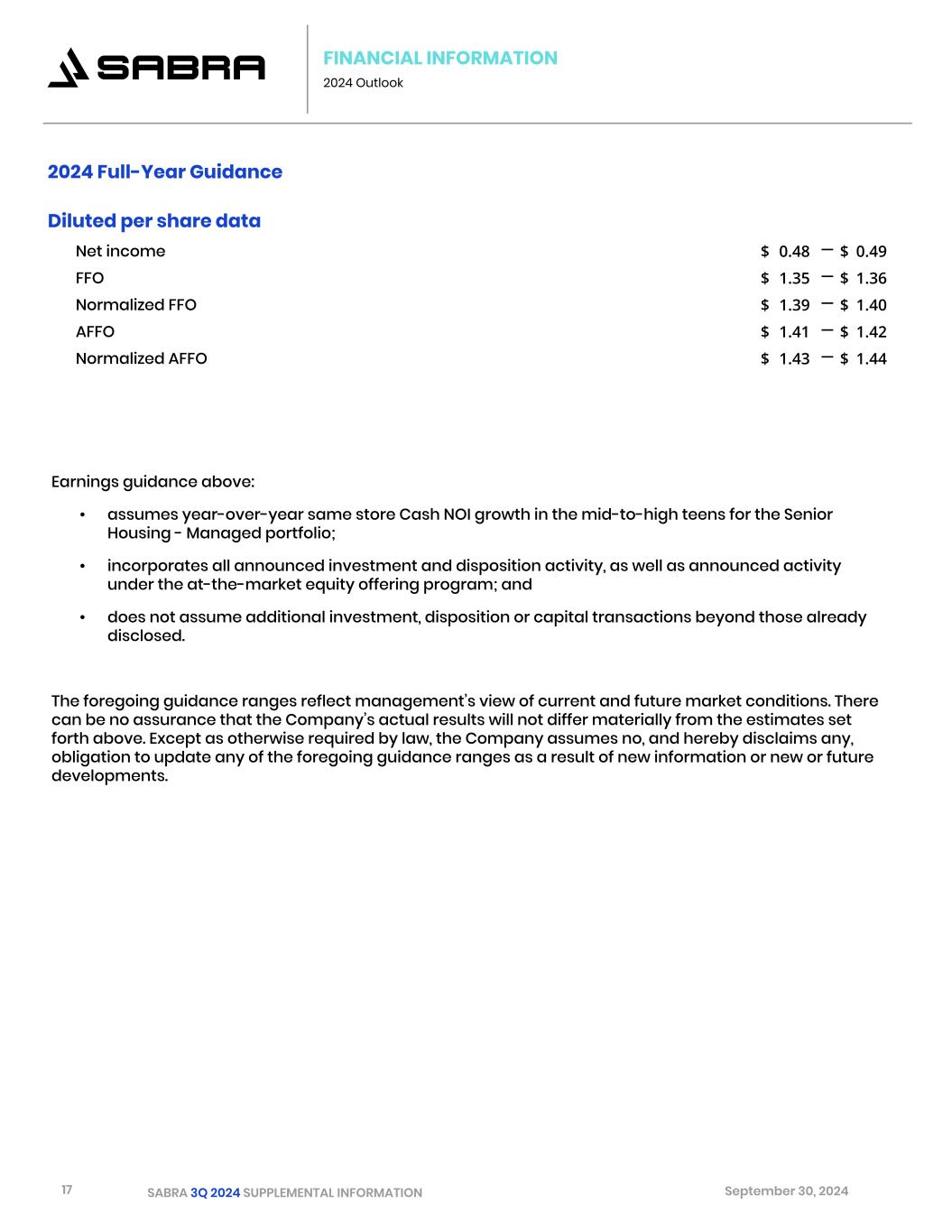

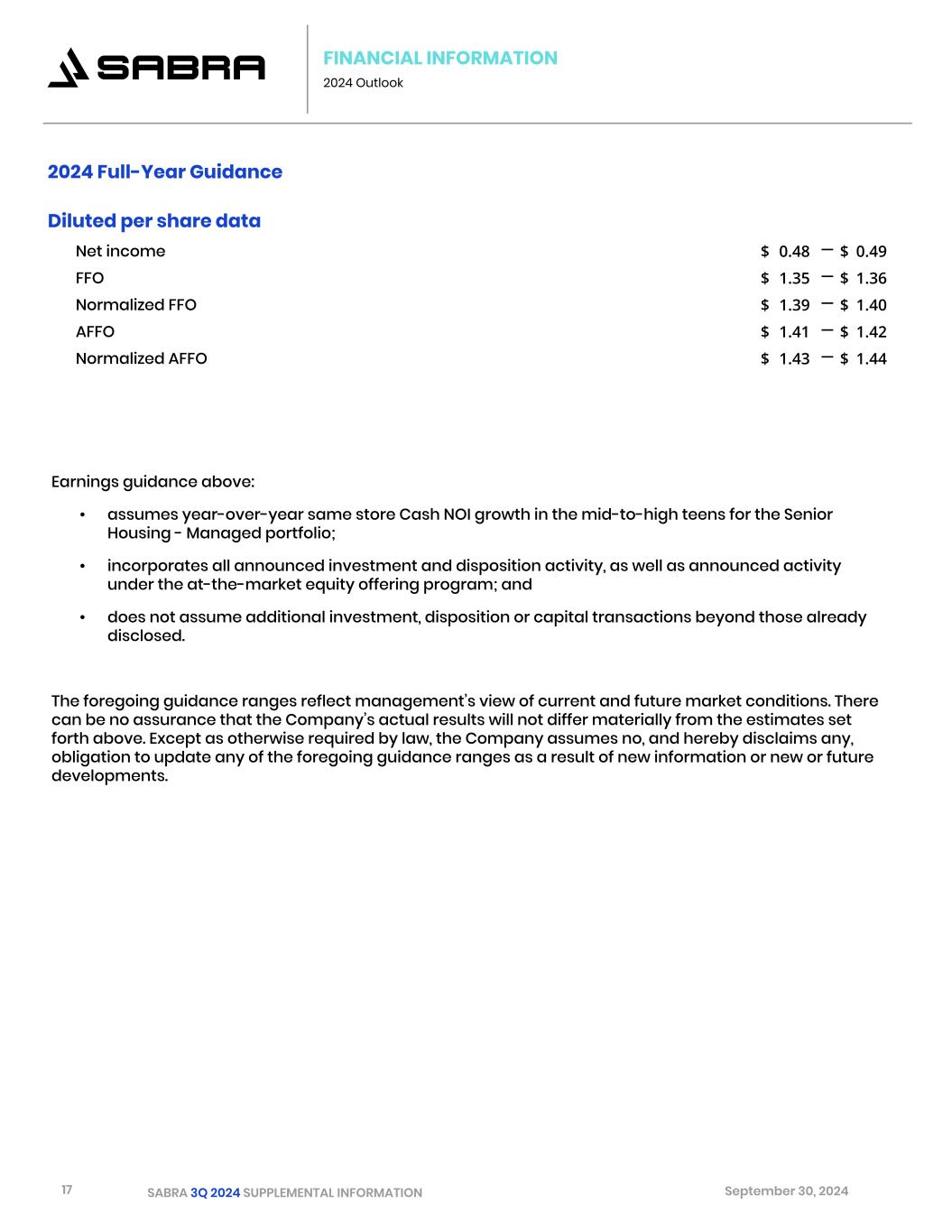

17 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 2024 Full-Year Guidance Diluted per share data Net income $ 0.48 — $ 0.49 FFO $ 1.35 — $ 1.36 Normalized FFO $ 1.39 — $ 1.40 AFFO $ 1.41 — $ 1.42 Normalized AFFO $ 1.43 — $ 1.44 FINANCIAL INFORMATION 2024 Outlook Earnings guidance above: • assumes year-over-year same store Cash NOI growth in the mid-to-high teens for the Senior Housing - Managed portfolio; • incorporates all announced investment and disposition activity, as well as announced activity under the at-the-market equity offering program; and • does not assume additional investment, disposition or capital transactions beyond those already disclosed. The foregoing guidance ranges reflect management’s view of current and future market conditions. There can be no assurance that the Company’s actual results will not differ materially from the estimates set forth above. Except as otherwise required by law, the Company assumes no, and hereby disclaims any, obligation to update any of the foregoing guidance ranges as a result of new information or new or future developments.

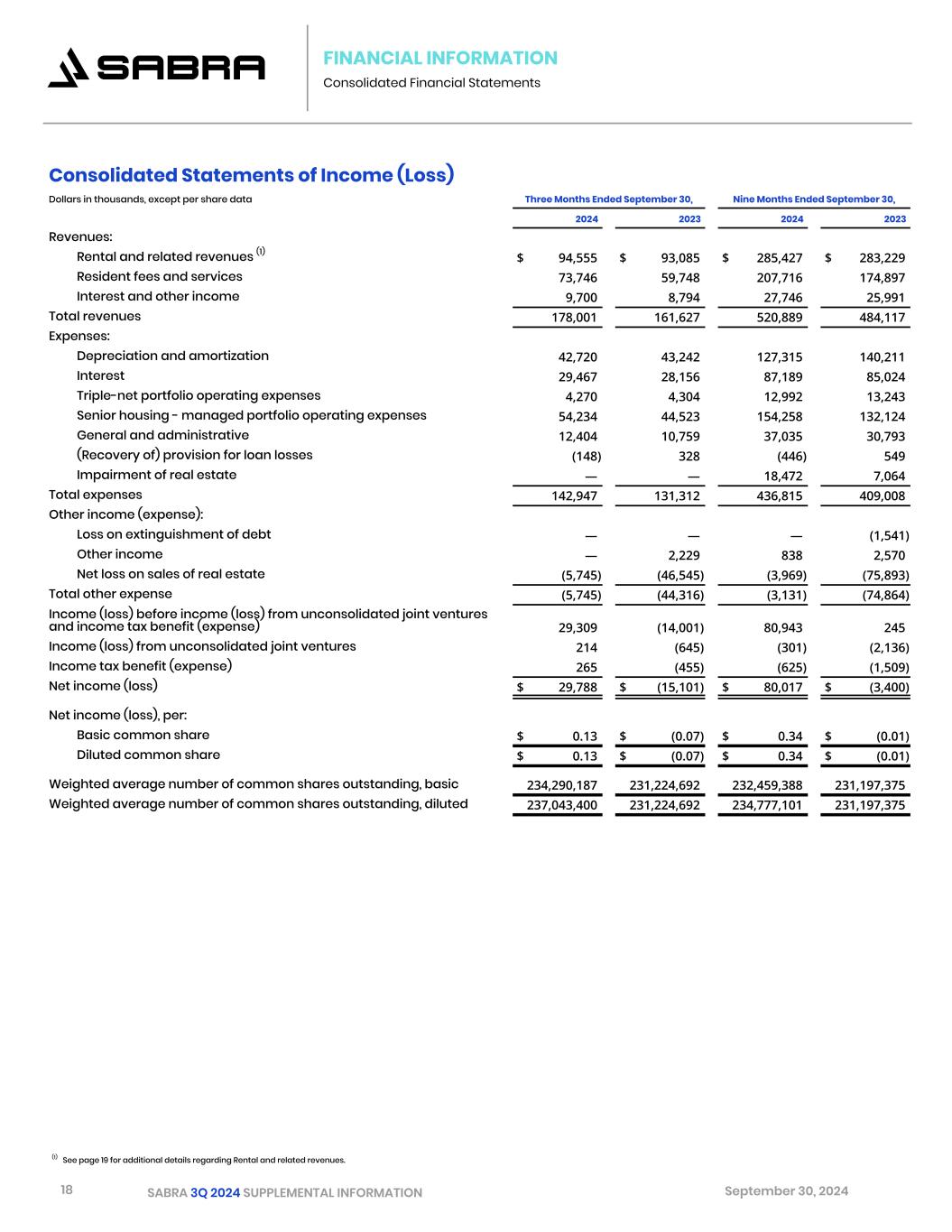

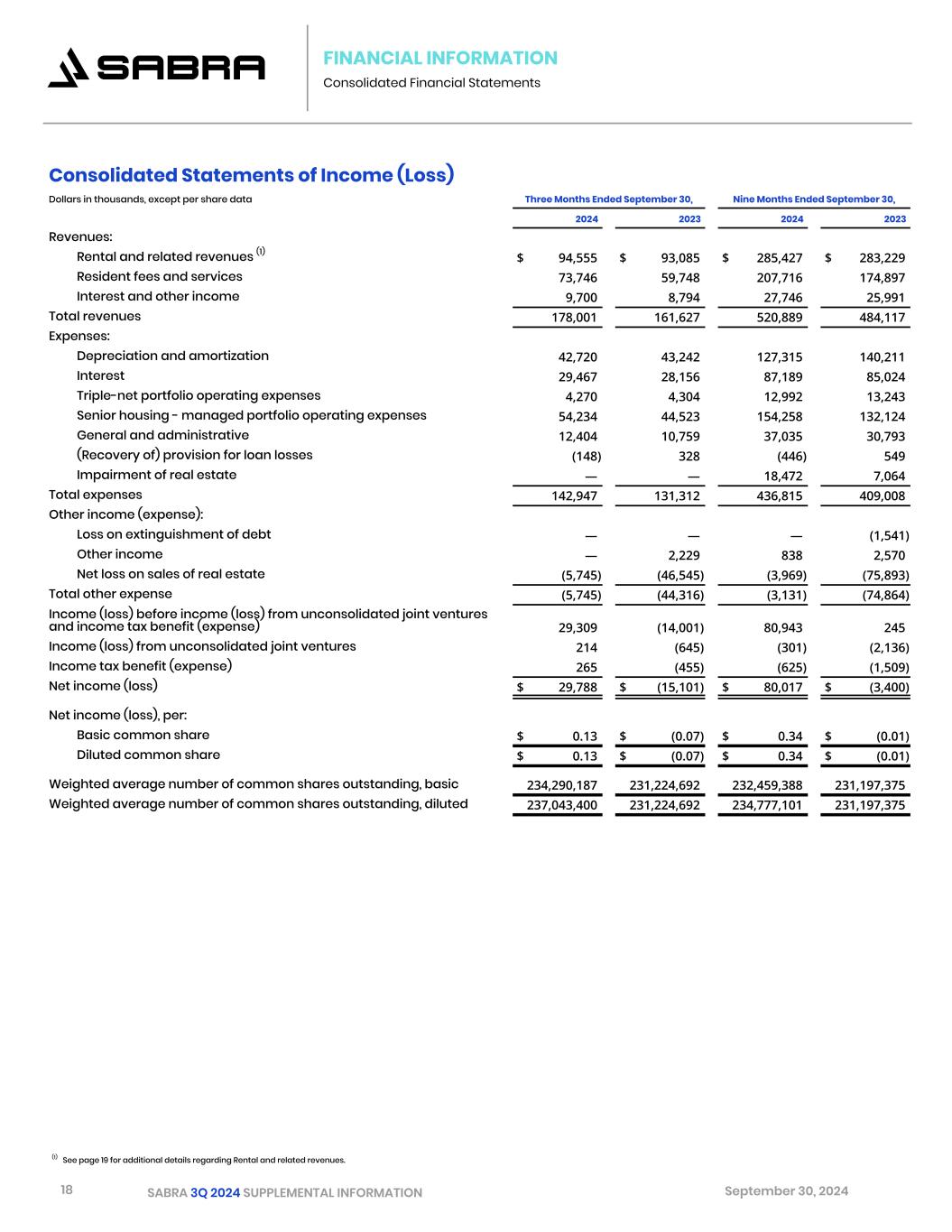

18 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Income (Loss) Dollars in thousands, except per share data Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenues: Rental and related revenues (1) $ 94,555 $ 93,085 $ 285,427 $ 283,229 Resident fees and services 73,746 59,748 207,716 174,897 Interest and other income 9,700 8,794 27,746 25,991 Total revenues 178,001 161,627 520,889 484,117 Expenses: Depreciation and amortization 42,720 43,242 127,315 140,211 Interest 29,467 28,156 87,189 85,024 Triple-net portfolio operating expenses 4,270 4,304 12,992 13,243 Senior housing - managed portfolio operating expenses 54,234 44,523 154,258 132,124 General and administrative 12,404 10,759 37,035 30,793 (Recovery of) provision for loan losses (148) 328 (446) 549 Impairment of real estate — — 18,472 7,064 Total expenses 142,947 131,312 436,815 409,008 Other income (expense): Loss on extinguishment of debt — — — (1,541) Other income — 2,229 838 2,570 Net loss on sales of real estate (5,745) (46,545) (3,969) (75,893) Total other expense (5,745) (44,316) (3,131) (74,864) Income (loss) before income (loss) from unconsolidated joint ventures and income tax benefit (expense) 29,309 (14,001) 80,943 245 Income (loss) from unconsolidated joint ventures 214 (645) (301) (2,136) Income tax benefit (expense) 265 (455) (625) (1,509) Net income (loss) $ 29,788 $ (15,101) $ 80,017 $ (3,400) Net income (loss), per: Basic common share $ 0.13 $ (0.07) $ 0.34 $ (0.01) Diluted common share $ 0.13 $ (0.07) $ 0.34 $ (0.01) Weighted average number of common shares outstanding, basic 234,290,187 231,224,692 232,459,388 231,197,375 Weighted average number of common shares outstanding, diluted 237,043,400 231,224,692 234,777,101 231,197,375 (1) See page 19 for additional details regarding Rental and related revenues.

19 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Income (Loss) - Supplemental Information Dollars in thousands Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Cash rental income $ 91,829 $ 88,006 $ 273,955 $ 265,044 Straight-line rental income 1,119 796 3,383 3,561 Write-offs of cash and straight-line rental income receivable and lease intangibles (3,086) (939) (5,539) (1,372) Above/below market lease amortization 1,212 1,456 3,634 4,592 Operating expense recoveries 3,481 3,766 9,994 11,404 Rental and related revenues $ 94,555 $ 93,085 $ 285,427 $ 283,229

20 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Balance Sheets Dollars in thousands, except per share data September 30, 2024 December 31, 2023 Assets Real estate investments, net of accumulated depreciation of $1,125,470 and $1,021,086 as of September 30, 2024 and December 31, 2023, respectively $ 4,574,268 $ 4,617,261 Loans receivable and other investments, net 441,825 420,624 Investment in unconsolidated joint ventures 130,811 136,843 Cash and cash equivalents 63,004 41,285 Restricted cash 5,972 5,434 Lease intangible assets, net 28,790 30,897 Accounts receivable, prepaid expenses and other assets, net 121,456 133,806 Total assets $ 5,366,126 $ 5,386,150 Liabilities Secured debt, net $ 45,817 $ 47,301 Revolving credit facility 152,558 94,429 Term loans, net 535,984 537,120 Senior unsecured notes, net 1,735,848 1,735,253 Accounts payable and accrued liabilities 122,805 136,981 Lease intangible liabilities, net 28,270 32,532 Total liabilities 2,621,282 2,583,616 Equity Preferred stock, $0.01 par value; 10,000,000 shares authorized, zero shares issued and outstanding as of September 30, 2024 and December 31, 2023 — — Common stock, $0.01 par value; 500,000,000 shares authorized, 236,586,805 and 231,266,020 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively 2,366 2,313 Additional paid-in capital 4,574,707 4,494,755 Cumulative distributions in excess of net income (1,849,168) (1,718,279) Accumulated other comprehensive income 16,939 23,745 Total equity 2,744,844 2,802,534 Total liabilities and equity $ 5,366,126 $ 5,386,150

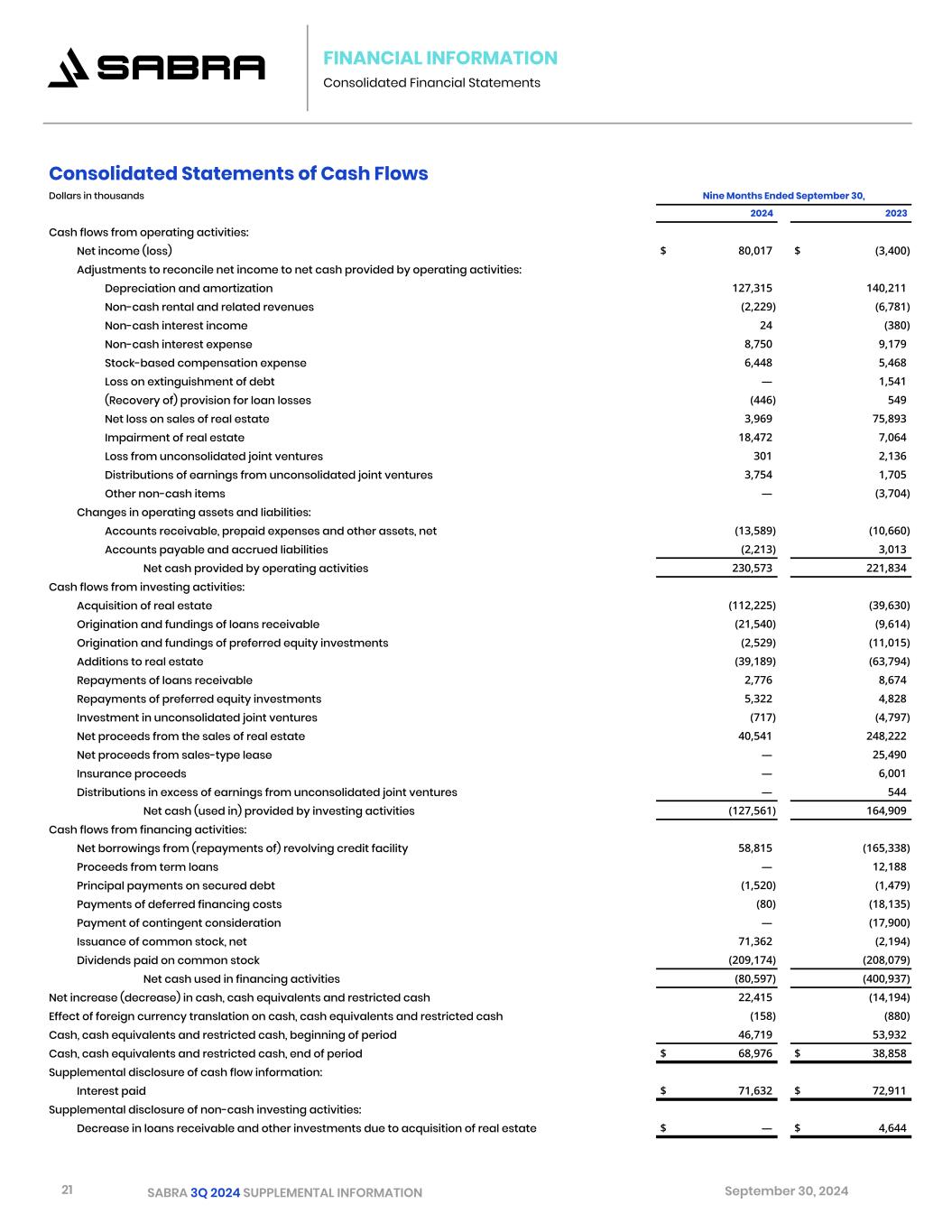

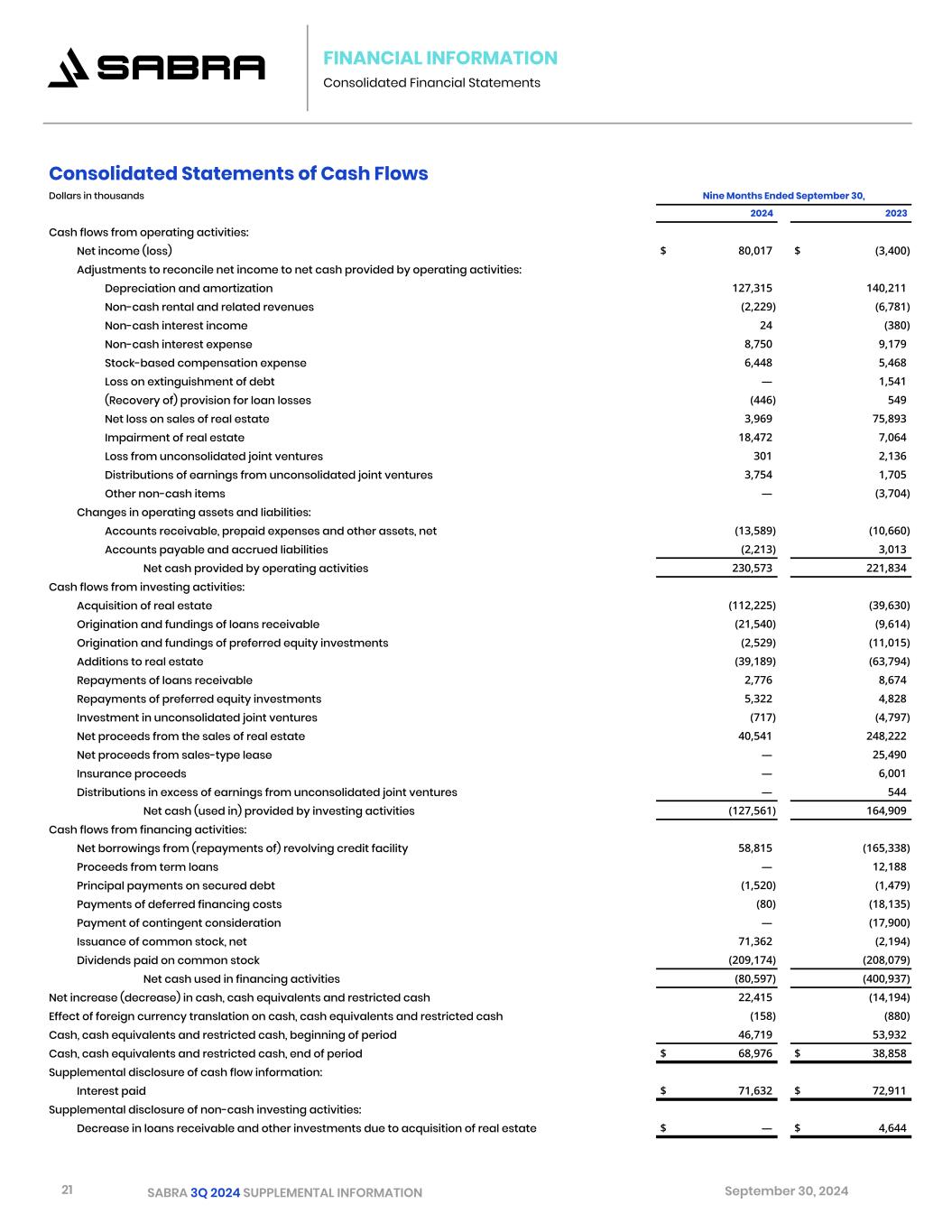

21 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION Consolidated Financial Statements Consolidated Statements of Cash Flows Dollars in thousands Nine Months Ended September 30, 2024 2023 Cash flows from operating activities: Net income (loss) $ 80,017 $ (3,400) Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 127,315 140,211 Non-cash rental and related revenues (2,229) (6,781) Non-cash interest income 24 (380) Non-cash interest expense 8,750 9,179 Stock-based compensation expense 6,448 5,468 Loss on extinguishment of debt — 1,541 (Recovery of) provision for loan losses (446) 549 Net loss on sales of real estate 3,969 75,893 Impairment of real estate 18,472 7,064 Loss from unconsolidated joint ventures 301 2,136 Distributions of earnings from unconsolidated joint ventures 3,754 1,705 Other non-cash items — (3,704) Changes in operating assets and liabilities: Accounts receivable, prepaid expenses and other assets, net (13,589) (10,660) Accounts payable and accrued liabilities (2,213) 3,013 Net cash provided by operating activities 230,573 221,834 Cash flows from investing activities: Acquisition of real estate (112,225) (39,630) Origination and fundings of loans receivable (21,540) (9,614) Origination and fundings of preferred equity investments (2,529) (11,015) Additions to real estate (39,189) (63,794) Repayments of loans receivable 2,776 8,674 Repayments of preferred equity investments 5,322 4,828 Investment in unconsolidated joint ventures (717) (4,797) Net proceeds from the sales of real estate 40,541 248,222 Net proceeds from sales-type lease — 25,490 Insurance proceeds — 6,001 Distributions in excess of earnings from unconsolidated joint ventures — 544 Net cash (used in) provided by investing activities (127,561) 164,909 Cash flows from financing activities: Net borrowings from (repayments of) revolving credit facility 58,815 (165,338) Proceeds from term loans — 12,188 Principal payments on secured debt (1,520) (1,479) Payments of deferred financing costs (80) (18,135) Payment of contingent consideration — (17,900) Issuance of common stock, net 71,362 (2,194) Dividends paid on common stock (209,174) (208,079) Net cash used in financing activities (80,597) (400,937) Net increase (decrease) in cash, cash equivalents and restricted cash 22,415 (14,194) Effect of foreign currency translation on cash, cash equivalents and restricted cash (158) (880) Cash, cash equivalents and restricted cash, beginning of period 46,719 53,932 Cash, cash equivalents and restricted cash, end of period $ 68,976 $ 38,858 Supplemental disclosure of cash flow information: Interest paid $ 71,632 $ 72,911 Supplemental disclosure of non-cash investing activities: Decrease in loans receivable and other investments due to acquisition of real estate $ — $ 4,644

22 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION FFO, Normalized FFO, AFFO and Normalized AFFO (1) Other normalizing items for FFO and AFFO primarily include triple-net operating expenses, net of recoveries. FFO, Normalized FFO, AFFO and Normalized AFFO Dollars in thousands, except per share data Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net income (loss) $ 29,788 $ (15,101) $ 80,017 $ (3,400) Add: Depreciation and amortization of real estate assets 42,720 43,242 127,315 140,211 Depreciation, amortization and impairment of real estate assets related to unconsolidated joint ventures 2,243 2,255 6,680 6,505 Net loss on sales of real estate 5,745 46,545 3,969 75,893 Impairment of real estate — — 18,472 7,064 FFO $ 80,496 $ 76,941 $ 236,453 $ 226,273 Write-offs of cash and straight-line rental income receivable and lease intangibles 3,086 939 5,539 1,371 Loss on extinguishment of debt — — — 1,541 (Recovery of) provision for loan losses (148) 328 (446) 549 Other normalizing items (1) 119 (1,003) 2,718 1,066 Normalized FFO $ 83,553 $ 77,205 $ 244,264 $ 230,800 FFO $ 80,496 $ 76,941 $ 236,453 $ 226,273 Stock-based compensation expense 2,586 2,235 6,448 5,468 Non-cash rental and related revenues (433) (1,312) (2,229) (6,781) Non-cash interest income 12 8 24 (380) Non-cash interest expense 2,611 3,088 8,750 9,179 Non-cash portion of loss on extinguishment of debt — — — 1,541 (Recovery of) provision for loan losses (148) 328 (446) 549 Other adjustments related to unconsolidated joint ventures 113 133 401 371 Other adjustments 353 256 1,192 950 AFFO $ 85,590 $ 81,677 $ 250,593 $ 237,170 Write-off of cash rental income 1,189 — 751 — Other normalizing items (1) 113 (1,017) 2,549 1,021 Normalized AFFO $ 86,892 $ 80,660 $ 253,893 $ 238,191 Amounts per diluted common share: Net income (loss) $ 0.13 $ (0.07) $ 0.34 $ (0.01) FFO $ 0.34 $ 0.33 $ 1.01 $ 0.97 Normalized FFO $ 0.35 $ 0.33 $ 1.04 $ 0.99 AFFO $ 0.36 $ 0.35 $ 1.06 $ 1.01 Normalized AFFO $ 0.37 $ 0.34 $ 1.08 $ 1.02 Weighted average number of common shares outstanding, diluted: Net income (loss) 237,043,400 231,224,692 234,777,101 231,197,375 FFO and Normalized FFO 237,043,400 232,835,849 234,777,101 232,566,392 AFFO and Normalized AFFO 237,940,868 233,988,463 235,890,966 233,878,874

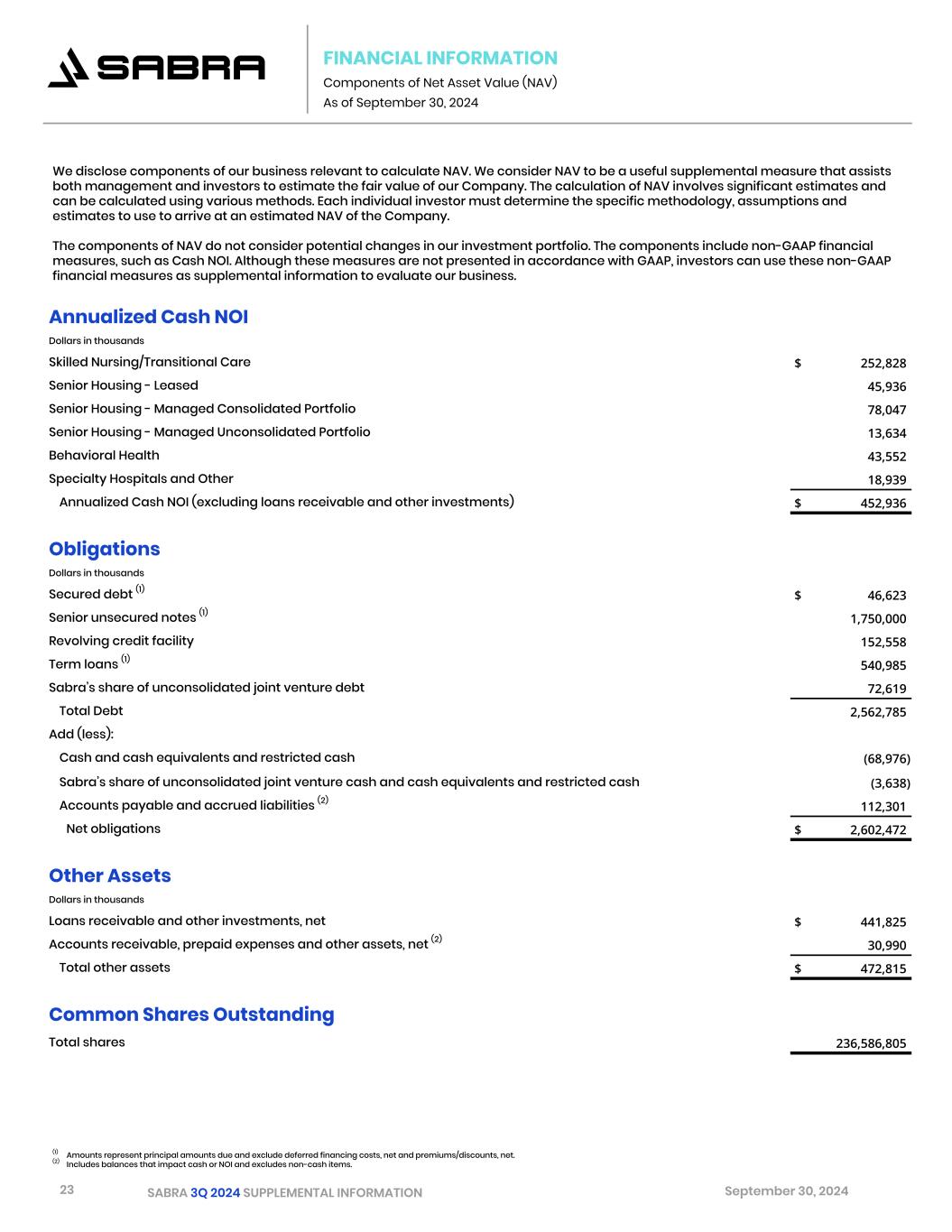

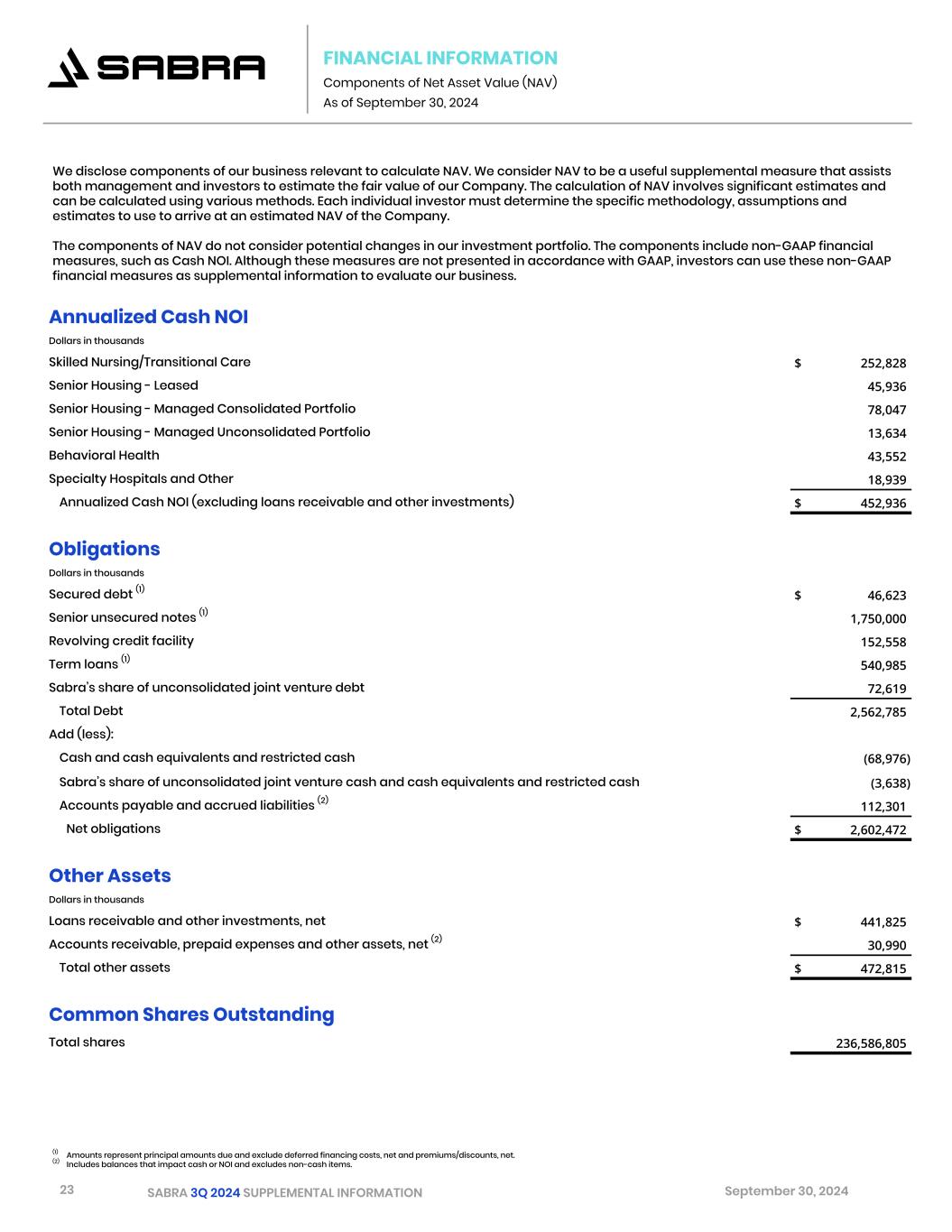

23 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 FINANCIAL INFORMATION Components of Net Asset Value (NAV) As of September 30, 2024 (1) Amounts represent principal amounts due and exclude deferred financing costs, net and premiums/discounts, net. (2) Includes balances that impact cash or NOI and excludes non-cash items. Annualized Cash NOI Dollars in thousands Skilled Nursing/Transitional Care $ 252,828 Senior Housing - Leased 45,936 Senior Housing - Managed Consolidated Portfolio 78,047 Senior Housing - Managed Unconsolidated Portfolio 13,634 Behavioral Health 43,552 Specialty Hospitals and Other 18,939 Annualized Cash NOI (excluding loans receivable and other investments) $ 452,936 Obligations Dollars in thousands Secured debt (1) $ 46,623 Senior unsecured notes (1) 1,750,000 Revolving credit facility 152,558 Term loans (1) 540,985 Sabra’s share of unconsolidated joint venture debt 72,619 Total Debt 2,562,785 Add (less): Cash and cash equivalents and restricted cash (68,976) Sabra’s share of unconsolidated joint venture cash and cash equivalents and restricted cash (3,638) Accounts payable and accrued liabilities (2) 112,301 Net obligations $ 2,602,472 Other Assets Dollars in thousands Loans receivable and other investments, net $ 441,825 Accounts receivable, prepaid expenses and other assets, net (2) 30,990 Total other assets $ 472,815 Common Shares Outstanding Total shares 236,586,805 We disclose components of our business relevant to calculate NAV. We consider NAV to be a useful supplemental measure that assists both management and investors to estimate the fair value of our Company. The calculation of NAV involves significant estimates and can be calculated using various methods. Each individual investor must determine the specific methodology, assumptions and estimates to use to arrive at an estimated NAV of the Company. The components of NAV do not consider potential changes in our investment portfolio. The components include non-GAAP financial measures, such as Cash NOI. Although these measures are not presented in accordance with GAAP, investors can use these non-GAAP financial measures as supplemental information to evaluate our business.

24 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 APPENDIX Disclaimer Disclaimer This supplement contains “forward-looking” information as that term is defined in the Private Securities Litigation Reform Act of 1995. Any statements that do not relate to historical or current facts or matters are forward-looking statements. Examples of forward-looking statements include all statements regarding our expected future financial position (including our earnings guidance for 2024, as well as the assumptions set forth therein), results of operations, cash flows, liquidity, business strategy, growth opportunities, potential investments, and plans and objectives for future operations. You can identify some of the forward-looking statements by the use of forward-looking words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “should,” “may” and other similar expressions, although not all forward-looking statements contain these identifying words. Our actual results may differ materially from those projected or contemplated by our forward-looking statements as a result of various factors, including, among others, the following: increased labor costs and historically low unemployment; increases in market interest rates and inflation; pandemics or epidemics, including COVID-19, and the related impact on our tenants, borrowers and Senior Housing - Managed communities; operational risks with respect to our Senior Housing - Managed communities; competitive conditions in our industry; the loss of key management personnel; uninsured or underinsured losses affecting our properties; potential impairment charges and adjustments related to the accounting of our assets; the potential variability of our reported rental and related revenues as a result of Accounting Standards Update (“ASU”) 2016-02, Leases, as amended by subsequent ASUs; risks associated with our investment in our unconsolidated joint ventures; catastrophic weather and other natural or man-made disasters, the effects of climate change on our properties and a failure to implement sustainable and energy-efficient measures; increased operating costs and competition for our tenants, borrowers and Senior Housing - Managed communities; increased healthcare regulation and enforcement; our tenants’ dependency on reimbursement from governmental and other third-party payor programs; the effect of our tenants, operators or borrowers declaring bankruptcy or becoming insolvent; our ability to find replacement tenants and the impact of unforeseen costs in acquiring new properties; the impact of litigation and rising insurance costs on the business of our tenants; the impact of required regulatory approvals of transfers of healthcare properties; environmental compliance costs and liabilities associated with real estate properties we own; our tenants’, borrowers’ or operators’ failure to adhere to applicable privacy and data security laws, or a material breach of our or our tenants’, borrowers’ or operators’ information technology; our concentration in the healthcare property sector, particularly in skilled nursing/transitional care facilities and senior housing communities, which makes our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to pay dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms; adverse changes in our credit ratings; our ability to make dividend distributions at expected levels; our ability to raise capital through equity and debt financings; changes and uncertainty in macroeconomic conditions and disruptions in the financial markets; risks associated with our ownership of property outside the U.S., including currency fluctuations; the relatively illiquid nature of real estate investments; our ability to maintain our status as a real estate investment trust (“REIT”) under the federal tax laws; compliance with REIT requirements and certain tax and tax regulatory matters related to our status as a REIT; changes in tax laws and regulations affecting REITs; the ownership limits and takeover defenses in our governing documents and under Maryland law, which may restrict change of control or business combination opportunities; and the exclusive forum provisions in our bylaws. Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”), including in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023. We do not intend, and we undertake no obligation, to update any forward-looking information to reflect events or circumstances after the date of this supplement or to reflect the occurrence of unanticipated events, unless required by law to do so. Note Regarding Non-GAAP Financial Measures This supplement includes the following financial measures defined as non-GAAP financial measures by the SEC: net operating income (“NOI”), Cash NOI, funds from operations (“FFO”), Normalized FFO, Adjusted FFO (“AFFO”), Normalized AFFO, FFO per diluted common share, Normalized FFO per diluted common share, AFFO per diluted common share, Normalized AFFO per diluted common share and Adjusted EBITDA (defined below). These measures may be different than non-GAAP financial measures used by other companies, and the presentation of these measures is not intended to be considered in isolation or as a substitute for financial information prepared and presented in accordance with U.S. generally accepted accounting principles. An explanation of these non-GAAP financial measures is included under “Reporting Definitions” in this supplement and reconciliations of these non-GAAP financial measures to the GAAP financial measures we consider most comparable are included on the Investors section of our website at https://ir.sabrahealth.com/investors/ financials/quarterly-results. Tenant and Borrower Information This supplement includes information regarding our tenants that lease properties from us and our borrowers, most of which are not subject to SEC reporting requirements. The information related to our tenants and borrowers that is provided in this supplement has been provided by, or derived from information provided by, such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only. Sabra Information The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10- K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other information filed with the SEC. The Reporting Definitions and Reconciliations of Non-GAAP Measures are an integral part of the information presented herein. On Sabra’s website, www.sabrahealth.com, you can access, free of charge, Sabra’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material is filed with, or furnished to, the SEC. The information contained on Sabra’s website is not incorporated by reference into, and should not be considered a part of, this supplemental information package. All material filed with the SEC can also be accessed through its website, www.sec.gov. For more information, contact Investor Relations at (888) 393-8248 or investorrelations@sabrahealth.com.

25 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 APPENDIX Reporting Definitions Adjusted EBITDA* Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based compensation expense under the Company’s long-term equity award program, and loan loss reserves. Adjusted EBITDA is an important non-GAAP supplemental measure of operating performance. Annualized Cash Net Operating Income (“Annualized Cash NOI”)* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers Annualized Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Annualized Cash NOI as Annualized Revenues less operating expenses and non-cash revenues and expenses. Annualized Cash NOI excludes all other financial statement amounts included in net income. Annualized Revenues The annual contractual rental revenues under leases and interest and other income generated by the Company’s loans receivable and other investments based on amounts invested and applicable terms as of the end of the period presented. Annualized Revenues do not include tenant recoveries or additional rents and are adjusted to reflect actual payments received related to the twelve months ended at the end of the respective period for leases no longer accounted for on an accrual basis. Behavioral Health Includes behavioral hospitals that provide inpatient and outpatient care for patients with mental health conditions, chemical dependence or substance addictions and addiction treatment centers that provide treatment services for chemical dependence and substance addictions, which may include inpatient care, outpatient care, medical detoxification, therapy and counseling. Cash Net Operating Income (“Cash NOI”)* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Cash NOI as total revenues less operating expenses and non-cash revenues and expenses. Cash NOI excludes all other financial statement amounts included in net income. Cash NOI Margin Cash NOI Margin is calculated as Cash NOI divided by resident fees and services. Consolidated Debt The principal balances of the Company’s revolving credit facility, term loans, senior unsecured notes, and secured indebtedness as reported in the Company’s consolidated financial statements. Consolidated Debt, Net The carrying amount of the Company’s revolving credit facility, term loans, senior unsecured notes, and secured indebtedness, as reported in the Company’s consolidated financial statements. Consolidated Enterprise Value The Company believes Consolidated Enterprise Value is an important measurement as it is a measure of a company’s value. The Company calculates Consolidated Enterprise Value as market equity capitalization plus Consolidated Debt. Market equity capitalization is calculated as (i) the number of shares of common stock multiplied by the closing price of the Company’s common stock on the last day of the period presented plus (ii) the number of shares of preferred stock multiplied by the closing price of the Company’s preferred stock on the last day of the period presented. Consolidated Enterprise Value includes the Company’s market equity capitalization and Consolidated Debt, less cash and cash equivalents. EBITDARM Earnings before interest, taxes, depreciation, amortization, rent and management fees (“EBITDARM”) for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. The Company uses EBITDARM in determining EBITDARM Coverage. EBITDARM has limitations as an analytical tool. EBITDARM does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDARM does not represent a property’s net income or cash flows from operations and should not be considered an alternative to those indicators. The Company utilizes EBITDARM to evaluate the core operations of the properties by eliminating management fees, which may vary by operator/tenant and operating structure, and as a supplemental measure of the ability of the Company’s operators/tenants and relevant guarantors to generate sufficient liquidity to meet related obligations to the Company. EBITDARM Coverage Represents the ratio of EBITDARM to cash rent for owned facilities (excluding Senior Housing - Managed communities) for the period presented. EBITDARM Coverage is a supplemental measure of a property’s ability to generate cash flows for the operator/tenant (not the Company) to meet the operator’s/tenant’s related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. EBITDARM Coverage includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful.

26 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 APPENDIX Reporting Definitions Funds From Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”)* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company also believes that funds from operations, or FFO, as defined in accordance with the definition used by the National Association of Real Estate Investment Trusts (“Nareit”), and adjusted funds from operations, or AFFO (and related per share amounts) are important non-GAAP supplemental measures of the Company’s operating performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market and other conditions, presentations of operating results for a real estate investment trust that uses historical cost accounting for depreciation could be less informative. Thus, Nareit created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost depreciation and amortization, among other items, from net income, as defined by GAAP. FFO is defined as net income, computed in accordance with GAAP, excluding gains or losses from real estate dispositions and the Company’s share of gains or losses from real estate dispositions related to its unconsolidated joint ventures, plus real estate depreciation and amortization, net of amounts related to noncontrolling interests, plus the Company’s share of depreciation and amortization related to its unconsolidated joint ventures, and real estate impairment charges of both consolidated and unconsolidated entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. AFFO is defined as FFO excluding stock-based compensation expense, non-cash rental and related revenues, non-cash interest income, non-cash interest expense, non-cash portion of loss on extinguishment of debt, provision for (recovery of) loan losses and other reserves, non-cash lease termination income and deferred income taxes, as well as other non-cash revenue and expense items (including noncapitalizable acquisition costs, transaction costs related to operator transitions and organizational or other restructuring activities, ineffectiveness gain/loss on derivative instruments, and non-cash revenue and expense amounts related to noncontrolling interests) and the Company’s share of non-cash adjustments related to its unconsolidated joint ventures. The Company believes that the use of FFO and AFFO (and the related per share amounts), combined with the required GAAP presentations, improves the understanding of the Company’s operating results among investors and makes comparisons of operating results among real estate investment trusts more meaningful. The Company considers FFO and AFFO to be useful measures for reviewing comparative operating and financial performance because, by excluding the applicable items listed above, FFO and AFFO can help investors compare the operating performance of the Company between periods or as compared to other companies. While FFO and AFFO are relevant and widely used measures of operating performance of real estate investment trusts, they do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. FFO and AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of FFO and AFFO may not be comparable to FFO and AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current Nareit definition or that interpret the current Nareit definition or define AFFO differently than the Company does. Grant Income Grant income consists of funds specifically paid to communities in our Senior Housing - Managed portfolio from state or federal governments related to the pandemic and were incremental to the amounts that would have otherwise been received for providing care to residents. Investment Represents the carrying amount of real estate assets after adding back accumulated depreciation and amortization and excludes net intangible assets and liabilities. Market Capitalization Total common shares of Sabra outstanding multiplied by the closing price per common share as of a given period. Net Debt* The principal balances of the Company’s revolving credit facility, term loans, senior unsecured notes, and secured indebtedness as reported in the Company’s consolidated financial statements, net of cash and cash equivalents as reported in the Company’s consolidated financial statements. Net Debt to Adjusted EBITDA* Net Debt to Adjusted EBITDA is calculated as Net Debt divided by Annualized Adjusted EBITDA, which is Adjusted EBITDA, as adjusted for annualizing adjustments that give effect to the acquisitions and dispositions completed during the respective period as though such acquisitions and dispositions were completed as of the beginning of the period presented. Net Operating Income (“NOI”)* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines NOI as total revenues less operating expenses. NOI excludes all other financial statement amounts included in net income.

27 SABRA 3Q 2024 SUPPLEMENTAL INFORMATION September 30, 2024 APPENDIX Reporting Definitions Normalized FFO and Normalized AFFO* Normalized FFO and Normalized AFFO represent FFO and AFFO, respectively, adjusted for certain income and expense items that the Company does not believe are indicative of its ongoing operating results. The Company considers Normalized FFO and Normalized AFFO to be useful measures to evaluate the Company’s operating results excluding these income and expense items to help investors compare the operating performance of the Company between periods or as compared to other companies. Normalized FFO and Normalized AFFO do not represent cash flows from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. Normalized FFO and Normalized AFFO also do not consider the costs associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of Normalized FFO and Normalized AFFO may not be comparable to Normalized FFO and Normalized AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current Nareit definition or that interpret the current Nareit definition or define FFO and AFFO or Normalized FFO and Normalized AFFO differently than the Company does. Occupancy Percentage Occupancy Percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the period presented by the available beds/units for the same period. Occupancy includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. REVPOR REVPOR represents the average revenues generated per occupied unit per month at Senior Housing - Managed communities for the period indicated. It is calculated as resident fees and services revenues, excluding Grant Income, divided by average monthly occupied unit days. REVPOR includes only Stabilized Facilities. Senior Housing Senior Housing communities include independent living, assisted living, continuing care retirement and memory care communities. Senior Housing - Managed Senior Housing communities operated by third-party property managers pursuant to property management agreements. Skilled Mix Skilled Mix is defined as the total Medicare and non-Medicaid managed care patient revenue at Skilled Nursing/Transitional Care facilities divided by the total revenues at Skilled Nursing/Transitional Care facilities for the period indicated. Skilled Mix includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Skilled Nursing/Transitional Care Skilled Nursing/Transitional Care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities. Specialty Hospitals and Other Includes acute care, long-term acute care and rehabilitation hospitals, facilities that provide residential services, which may include assistance with activities of daily living, and other facilities not classified as Skilled Nursing/Transitional Care, Senior Housing or Behavioral Health. Stabilized Facility At the time of acquisition, the Company classifies each facility as either stabilized or non-stabilized. In addition, the Company may classify a facility as non-stabilized after acquisition. Circumstances that could result in a facility being classified as non-stabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities are typically reclassified to stabilized upon the earlier of maintaining consistent performance or 24 months after the date of classification as non-stabilized. Stabilized Facilities generally exclude (i) facilities held for sale, (ii) strategic disposition candidates, (iii) facilities being transitioned to a new operator, (iv) facilities being transitioned from being leased by the Company to being operated by the Company and (v) leased facilities acquired during the three months preceding the period presented. *Non-GAAP Financial Measures Reconciliations, definitions and important discussions regarding the usefulness and limitations of the Non-GAAP Financial Measures used in this supplement can be found at https://ir.sabrahealth.com/investors/financials/quarterly-results.