Investor Presentation Horizon Therapeutics plc August 2023 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements, including, but not limited to, statements related to the pending transaction with Amgen Inc., development, manufacturing and commercialization plans; expected timing of clinical trials and commercial launches; expected future milestones, pipeline expansions and regulatory approvals; potential market opportunities for, and benefits of, Horizon’s medicines and medicine candidates; expected impact of commercial strategies, clinical trial results and product label updates; and business and other statements that are not historical facts. These forward-looking statements are based on Horizon’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, whether the pending transaction with Amgen Inc. will be completed in a timely manner or at all, including whether the district court grants or denies the FTC’s request for a preliminary injunction; the parties’ ability to satisfy (or willingness to waive) the conditions to the consummation of the pending transaction with Amgen Inc., including with respect to the absence of orders preventing the consummation of the transaction; the effect of the pending transaction with Amgen Inc. on Horizon’s business relationships, operating results and business generally; risks that Horizon’s actual future financial and operating results may differ from its expectations or goals; Horizon’s ability to grow net sales from existing medicines; impacts of the on-going war between Russia and Ukraine; changes in inflation, interest rates and general economic conditions; the availability of coverage and adequate reimbursement and pricing from government and third-party payers; Horizon’s ability to successfully implement its business strategies, including the risks that its medicine growth and global expansion initiatives and strategies may not be successful and that new challenges to growth may arise in the future; risks inherent in developing novel medicine candidates and existing medicines for new indications; whether additional clinical trial results or data analyses will be consistent with preliminary results, results from other trials or Horizon’s expectations; risks associated with regulatory approvals; risks in the ability to recruit, train and retain qualified personnel; competition, including generic competition; the ability to protect intellectual property and defend patents; regulatory obligations and oversight, including any changes in the legal and regulatory environment in which Horizon operates and those risks detailed from time-to-time under the caption "Risk Factors" and elsewhere in Horizon’s filings and reports with the SEC. Horizon undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information. In light of the announced agreement to be acquired by Amgen Inc. and applicable securities laws, Horizon is not providing forward-looking financial guidance in this presentation.

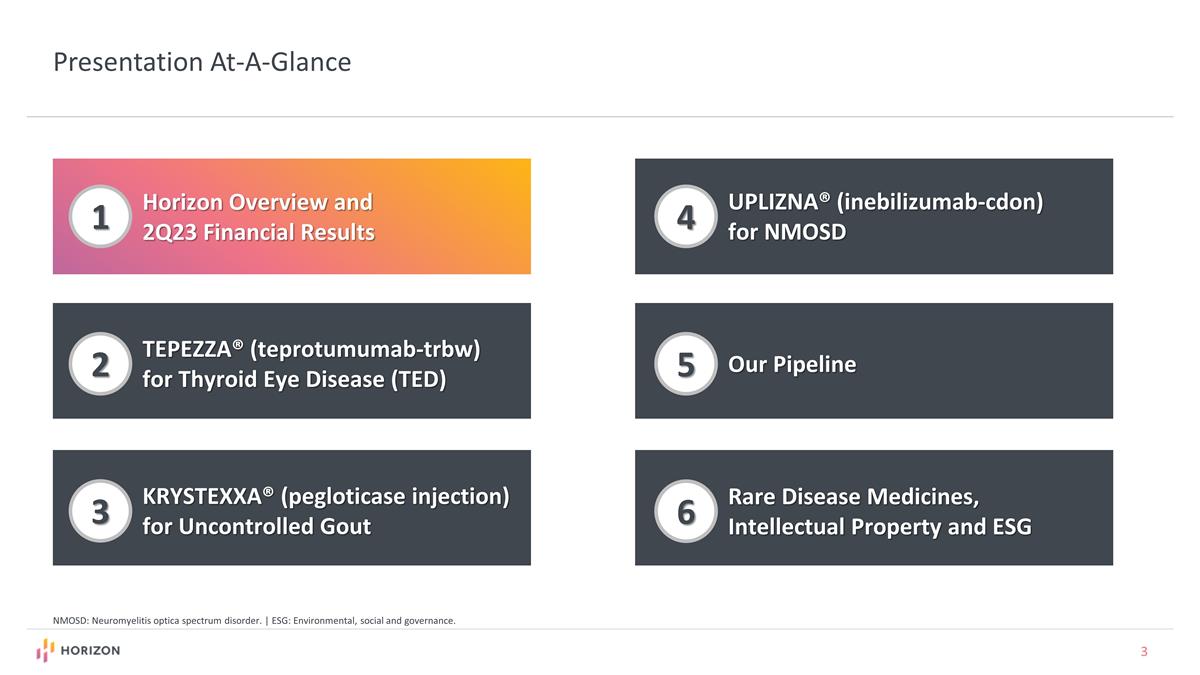

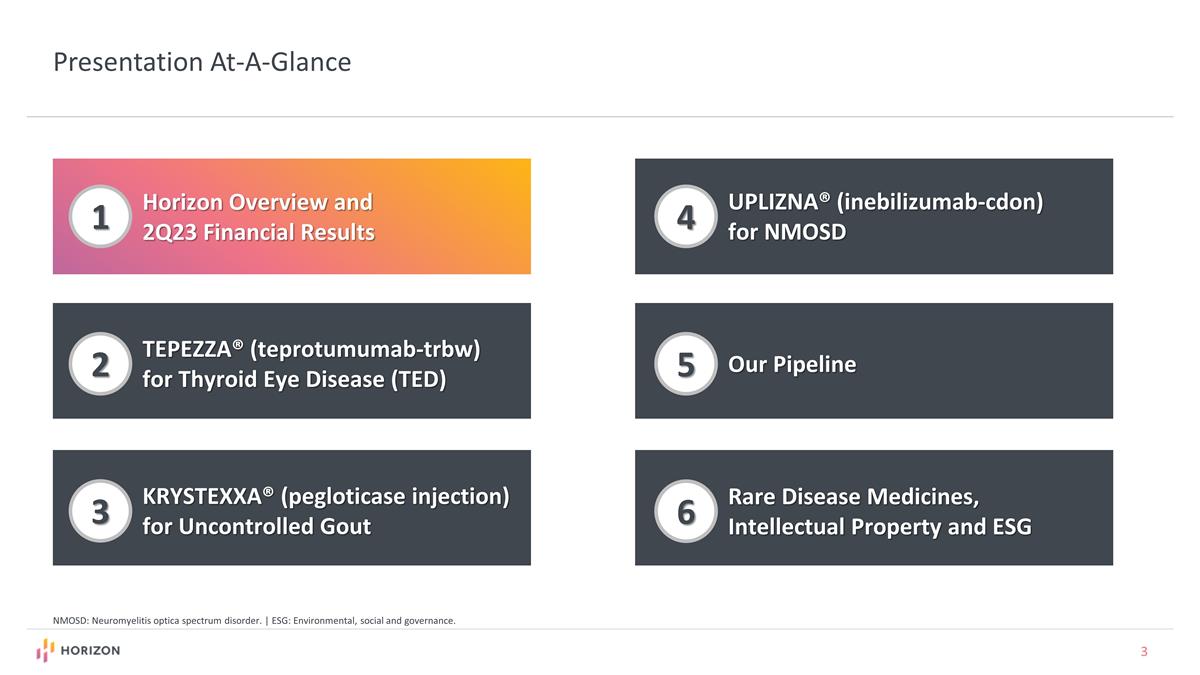

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA® (teprotumumab-trbw) for Thyroid Eye Disease (TED) KRYSTEXXA® (pegloticase injection) for Uncontrolled Gout UPLIZNA® (inebilizumab-cdon) for NMOSD Our Pipeline Rare Disease Medicines, Intellectual Property and ESG NMOSD: Neuromyelitis optica spectrum disorder. | ESG: Environmental, social and governance.

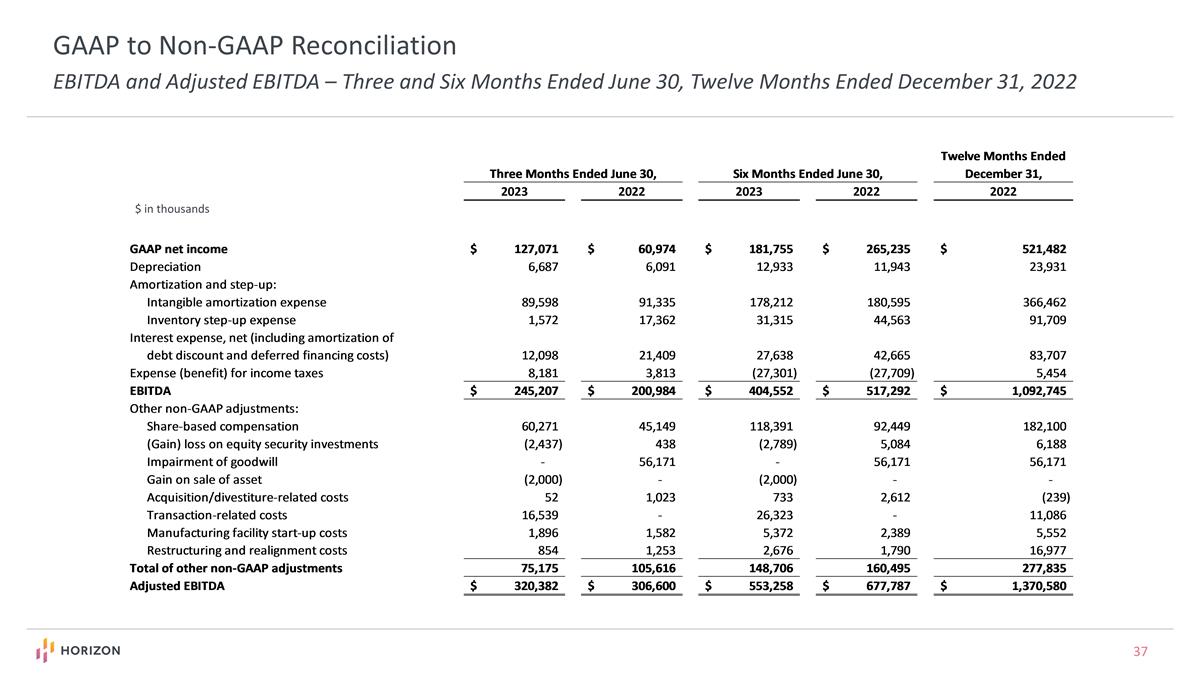

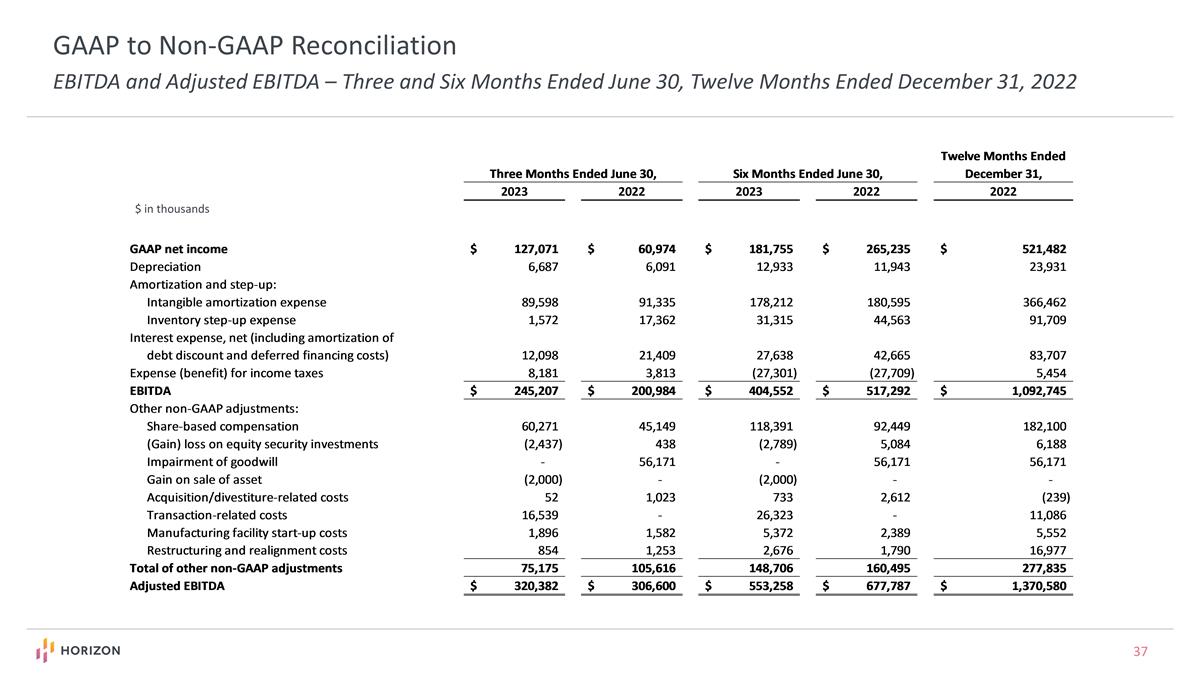

Horizon is a Leading High-Growth, Innovation-Driven, Profitable, Global Biotech Portfolio of Key Rare, Autoimmune and Severe Inflammatory Medicines About Horizon 2022 Net Sales: $3.63 Billion 2022 Adj. EBITDA: $1.37 Billion Cash Position: $2.5 Billion as of June 30, 2023 Employees: >2,000 Global HQ: Dublin, Ireland; U.S. HQ: Deerfield, IL >20 pipeline programs across all stages of clinical development EBITDA: Earnings before interest, taxes, depreciation, and amortization. Adjusted EBITDA is a non-GAAP measure; see reconciliations at the end of the presentation for a reconciliation of GAAP to non-GAAP measures.

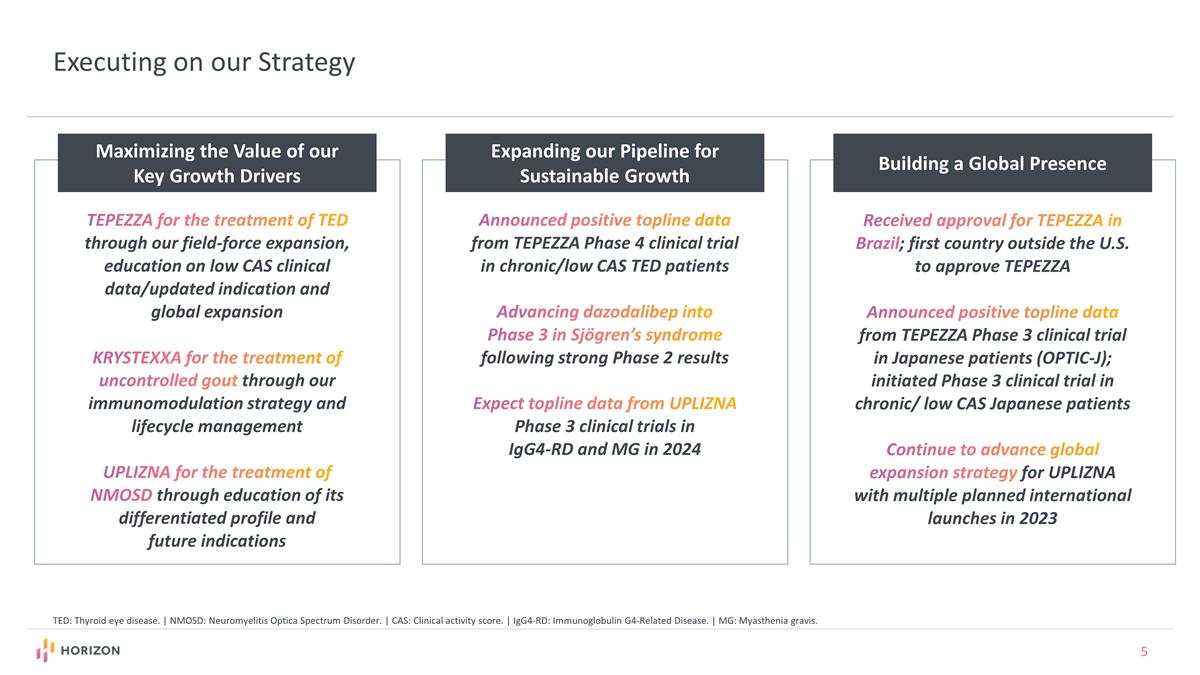

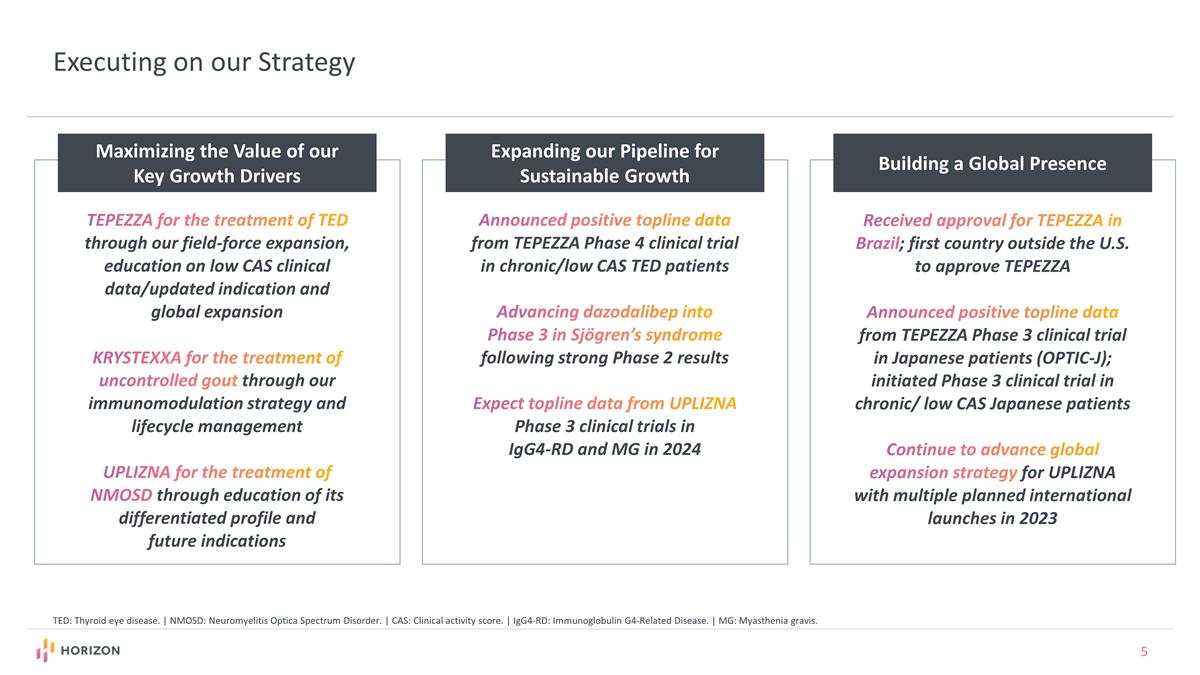

Executing on our Strategy TEPEZZA for the treatment of TED through our field-force expansion, education on low CAS clinical data/updated indication and global expansion KRYSTEXXA for the treatment of uncontrolled gout through our immunomodulation strategy and lifecycle management UPLIZNA for the treatment of NMOSD through education of its differentiated profile and future indications Maximizing the Value of our Key Growth Drivers Expanding our Pipeline for Sustainable Growth Building a Global Presence Announced positive topline data from TEPEZZA Phase 4 clinical trial in chronic/low CAS TED patients Advancing dazodalibep into Phase 3 in Sjögren’s syndrome following strong Phase 2 results Expect topline data from UPLIZNA Phase 3 clinical trials in IgG4-RD and MG in 2024 Received approval for TEPEZZA in Brazil; first country outside the U.S. to approve TEPEZZA Announced positive topline data from TEPEZZA Phase 3 clinical trial in Japanese patients (OPTIC-J); initiated Phase 3 clinical trial in chronic/ low CAS Japanese patients Continue to advance global expansion strategy for UPLIZNA with multiple planned international launches in 2023 TED: Thyroid eye disease. | NMOSD: Neuromyelitis Optica Spectrum Disorder. | CAS: Clinical activity score. | IgG4-RD: Immunoglobulin G4-Related Disease. | MG: Myasthenia gravis.

Amgen to Acquire Horizon Announced on December 12, 2022 Together, the two companies can serve many more patients impacted by rare, autoimmune and severe inflammatory diseases Amgen brings scale, experience and resources to maximize the value of Horizon’s current portfolio and pipeline and accelerates the ability to reach more patients globally The transaction has been approved by regulators around the world, apart from the U.S. Federal Trade Commission (FTC) The companies continue to expect the transaction to close by mid-December, assuming the FTC’s request for a preliminary injunction is denied The two companies continue to work closely on integration plans

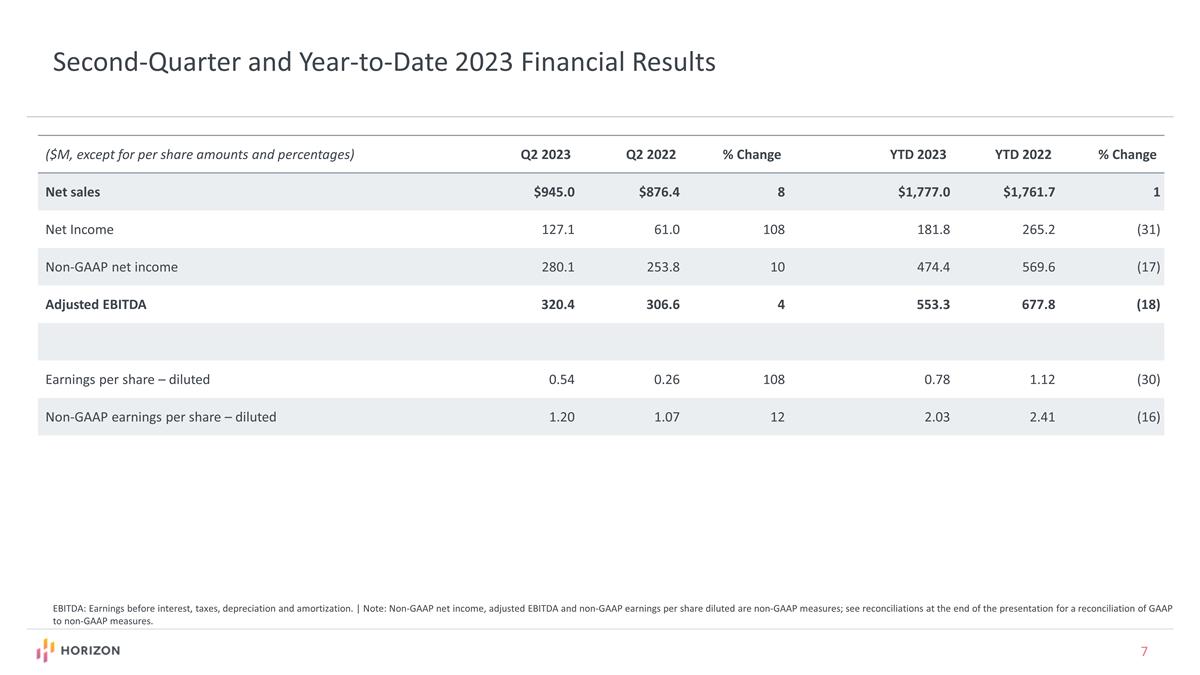

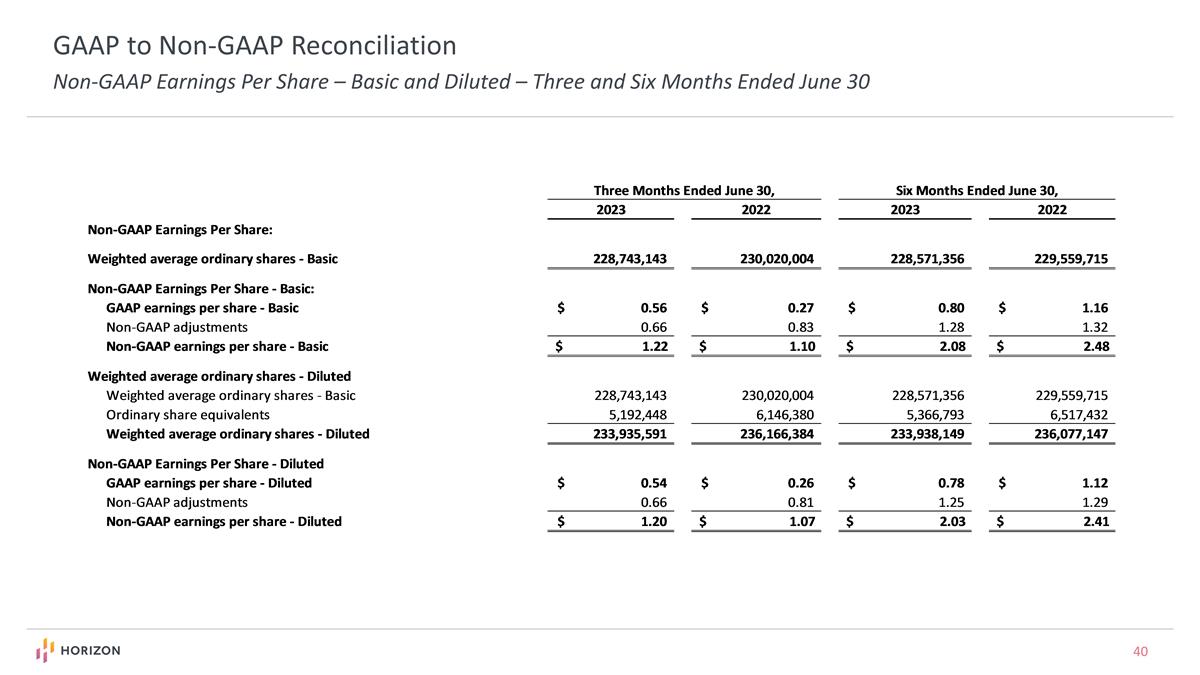

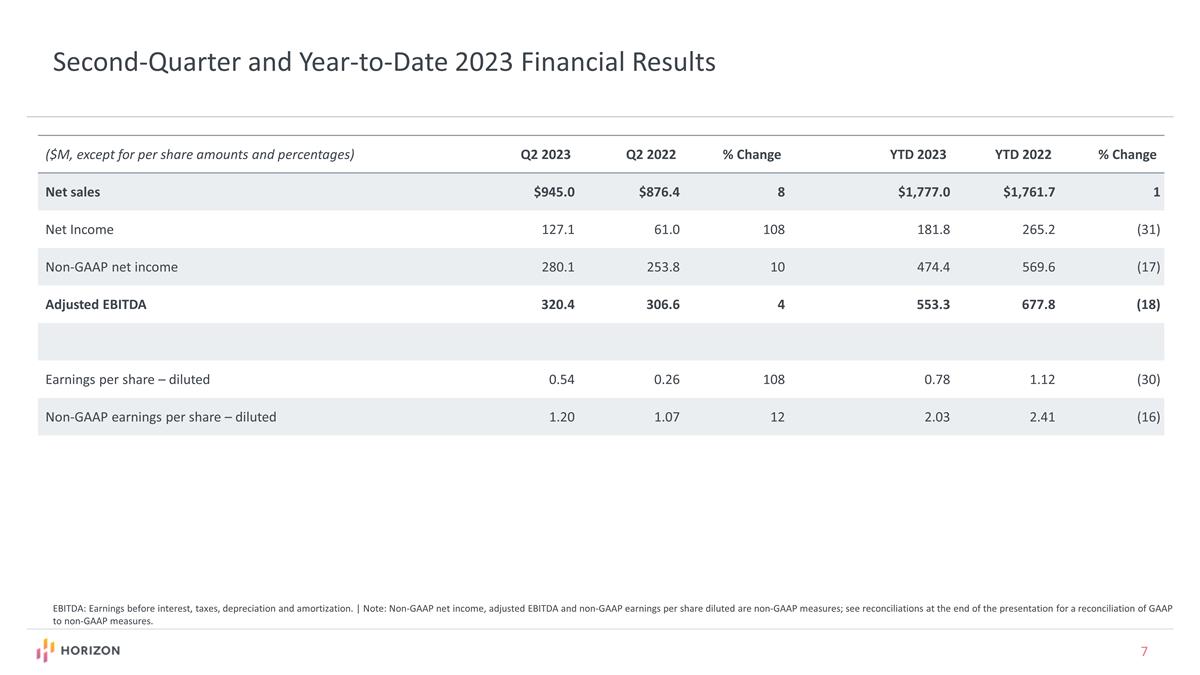

Second-Quarter and Year-to-Date 2023 Financial Results ($M, except for per share amounts and percentages) Q2 2023 Q2 2022 % Change YTD 2023 YTD 2022 % Change Net sales $945.0 $876.4 8 $1,777.0 $1,761.7 1 Net Income 127.1 61.0 108 181.8 265.2 (31) Non-GAAP net income 280.1 253.8 10 474.4 569.6 (17) Adjusted EBITDA 320.4 306.6 4 553.3 677.8 (18) Earnings per share – diluted 0.54 0.26 108 0.78 1.12 (30) Non-GAAP earnings per share – diluted 1.20 1.07 12 2.03 2.41 (16) EBITDA: Earnings before interest, taxes, depreciation and amortization. | Note: Non-GAAP net income, adjusted EBITDA and non-GAAP earnings per share diluted are non-GAAP measures; see reconciliations at the end of the presentation for a reconciliation of GAAP to non-GAAP measures.

Second-Quarter and Year-to-Date 2023 Net Sales Results ($M) Q2 2023 Q2 2022 % Change YTD 2023 YTD 2022 % Change TEPEZZA® $445.5 $479.8 (7) $850.8 $981.3 (13) KRYSTEXXA® 244.3 167.8 46 431.3 308.5 40 RAVICTI® 88.4 75.7 17 178.7 154.1 16 UPLIZNA®(1) 68.1 38.6 76 121.9 69.1 76 PROCYSBI® 53.1 47.7 11 103.6 97.3 7 ACTIMMUNE® 29.0 30.0 (3) 58.2 61.3 (5) PENNSAID 2%®(2) 7.0 23.6 (70) 16.1 59.0 (72) RAYOS® 8.0 11.1 (28) 13.0 24.6 (47) BUPHENYL® 1.3 1.4 (10) 2.6 3.5 (25) QUINSAIRTM 0.3 0.3 3 0.6 0.6 1 DUEXIS® - 0.1 (100) 0.1 1.2 (91) VIMOVO® - 0.3 (100) 0.1 1.2 (91) Total Net Sales(3) $945.0 $876.4 8 $1,777.0 $1,761.7 1 (1) Second-quarter and year-to-date 2023 UPLIZNA net sales included $15.4 million and $22.0 million, respectively, in international net sales. Second-quarter and year-to-date 2022 UPLIZNA net sales included $8.6 million and $13.8 million, respectively, in international net sales. (2) On May 6, 2022, Apotex Inc. initiated an at-risk launch of generic PENNSAID 2% in the United States. (3) Excluding the Company’s inflammation business unit (RAYOS, PENNSAID 2%, DUEXIS and VIMOVO), which was wound down at the end of 2022 due to generic competition, second-quarter year-over-year net sales growth was 11%.

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA KRYSTEXXA UPLIZNA Our Pipeline Rare Disease Medicines, Intellectual Property and ESG ESG: Environmental, social and governance.

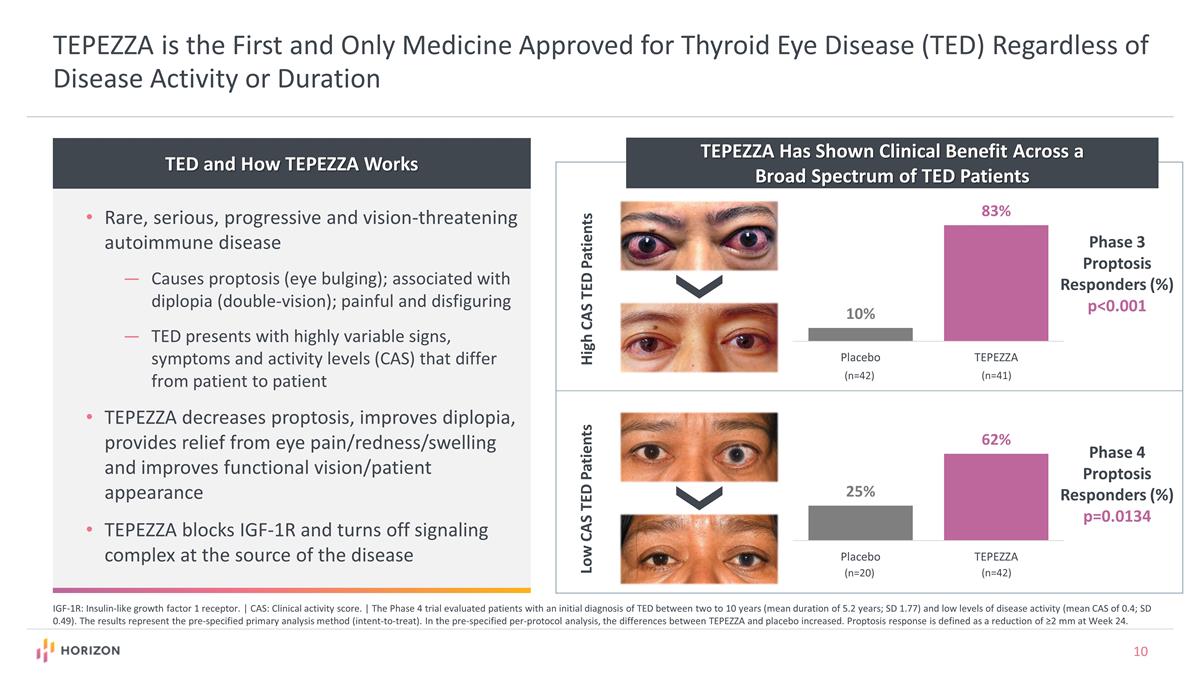

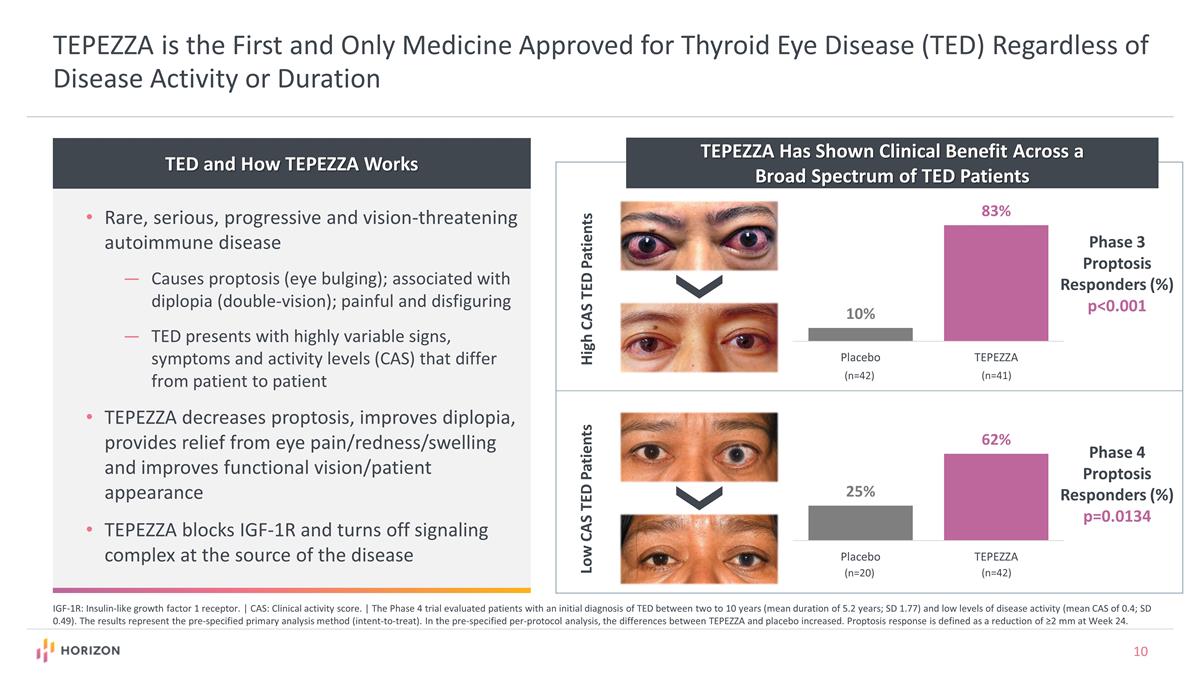

TED and How TEPEZZA Works TEPEZZA is the First and Only Medicine Approved for Thyroid Eye Disease (TED) Regardless of Disease Activity or Duration Rare, serious, progressive and vision-threatening autoimmune disease Causes proptosis (eye bulging); associated with diplopia (double-vision); painful and disfiguring TED presents with highly variable signs, symptoms and activity levels (CAS) that differ from patient to patient TEPEZZA decreases proptosis, improves diplopia, provides relief from eye pain/redness/swelling and improves functional vision/patient appearance TEPEZZA blocks IGF-1R and turns off signaling complex at the source of the disease IGF-1R: Insulin-like growth factor 1 receptor. | CAS: Clinical activity score. | The Phase 4 trial evaluated patients with an initial diagnosis of TED between two to 10 years (mean duration of 5.2 years; SD 1.77) and low levels of disease activity (mean CAS of 0.4; SD 0.49). The results represent the pre-specified primary analysis method (intent-to-treat). In the pre-specified per-protocol analysis, the differences between TEPEZZA and placebo increased. Proptosis response is defined as a reduction of ≥2 mm at Week 24. TEPEZZA Has Shown Clinical Benefit Across a Broad Spectrum of TED Patients High CAS TED Patients Low CAS TED Patients Phase 3 Proptosis Responders (%) p<0.001 (n=42) (n=41) (n=20) (n=42) Phase 4 Proptosis Responders (%) p=0.0134

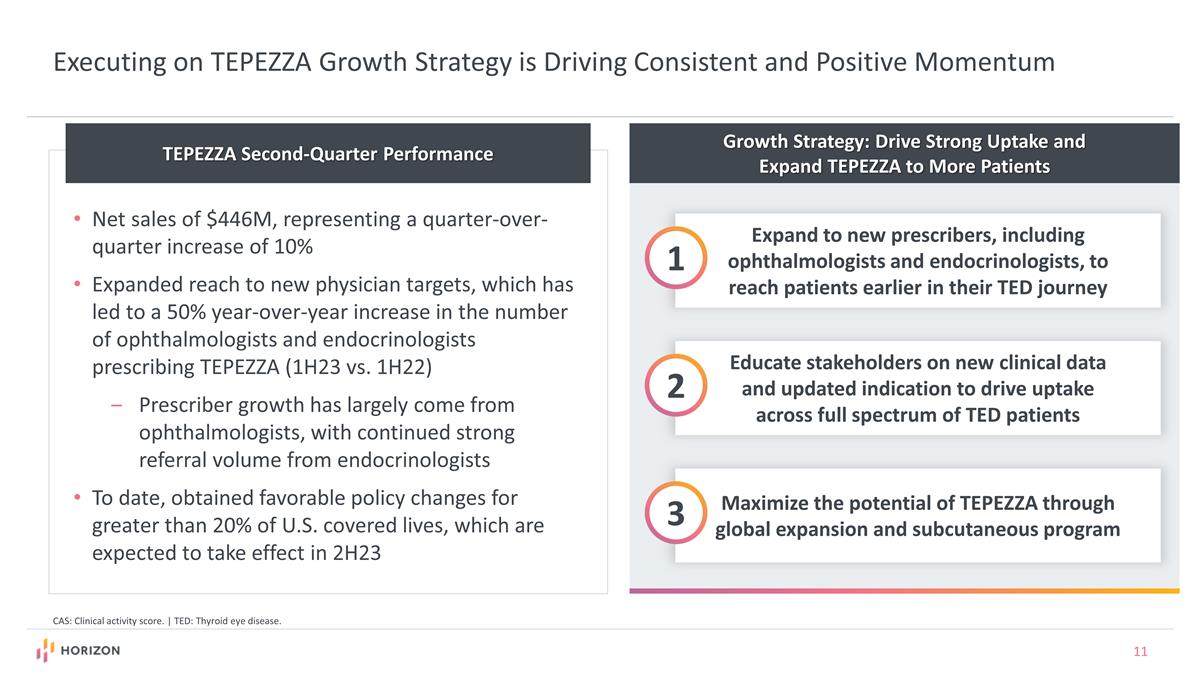

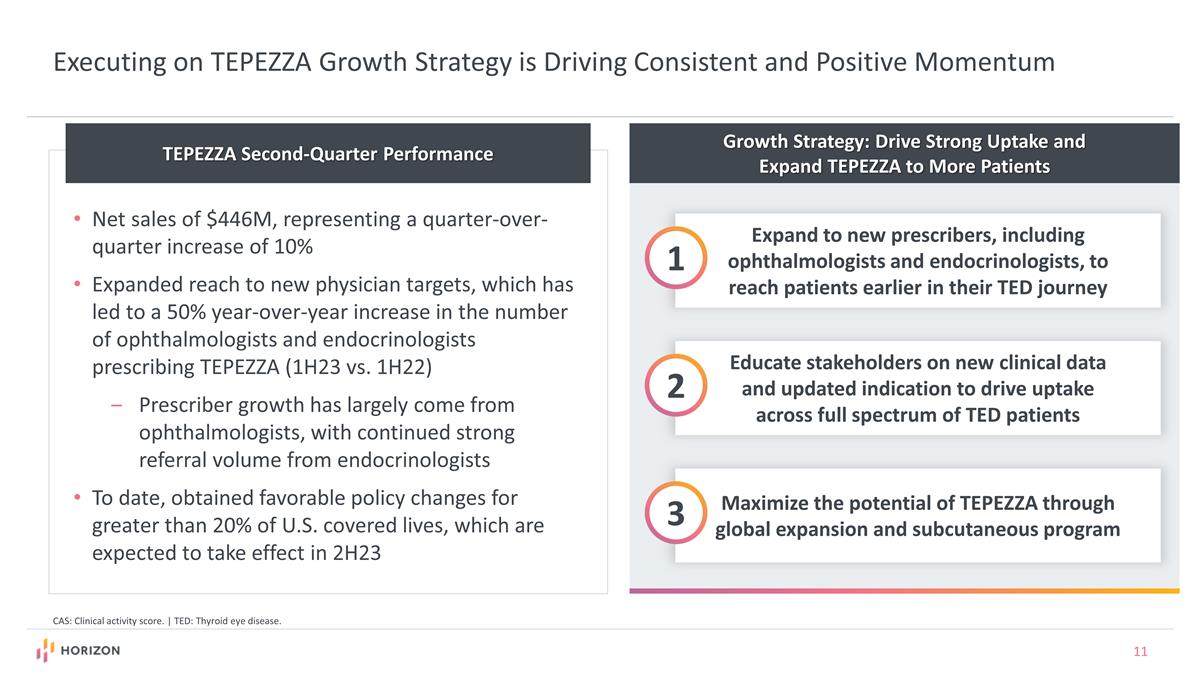

Growth Strategy: Drive Strong Uptake and Expand TEPEZZA to More Patients Expand to new prescribers, including ophthalmologists and endocrinologists, to reach patients earlier in their TED journey 1 Educate stakeholders on new clinical data and updated indication to drive uptake across full spectrum of TED patients 2 Maximize the potential of TEPEZZA through global expansion and subcutaneous program 3 Executing on TEPEZZA Growth Strategy is Driving Consistent and Positive Momentum TEPEZZA Second-Quarter Performance Net sales of $446M, representing a quarter-over-quarter increase of 10% Expanded reach to new physician targets, which has led to a 50% year-over-year increase in the number of ophthalmologists and endocrinologists prescribing TEPEZZA (1H23 vs. 1H22) Prescriber growth has largely come from ophthalmologists, with continued strong referral volume from endocrinologists To date, obtained favorable policy changes for greater than 20% of U.S. covered lives, which are expected to take effect in 2H23 CAS: Clinical activity score. | TED: Thyroid eye disease.

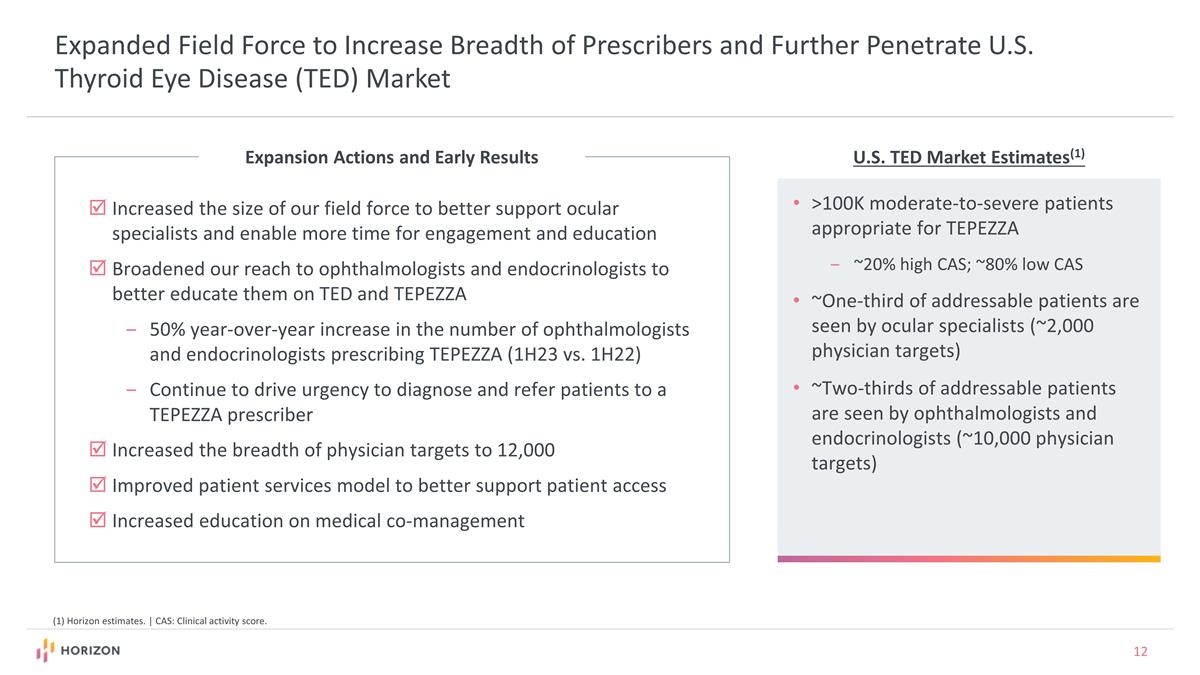

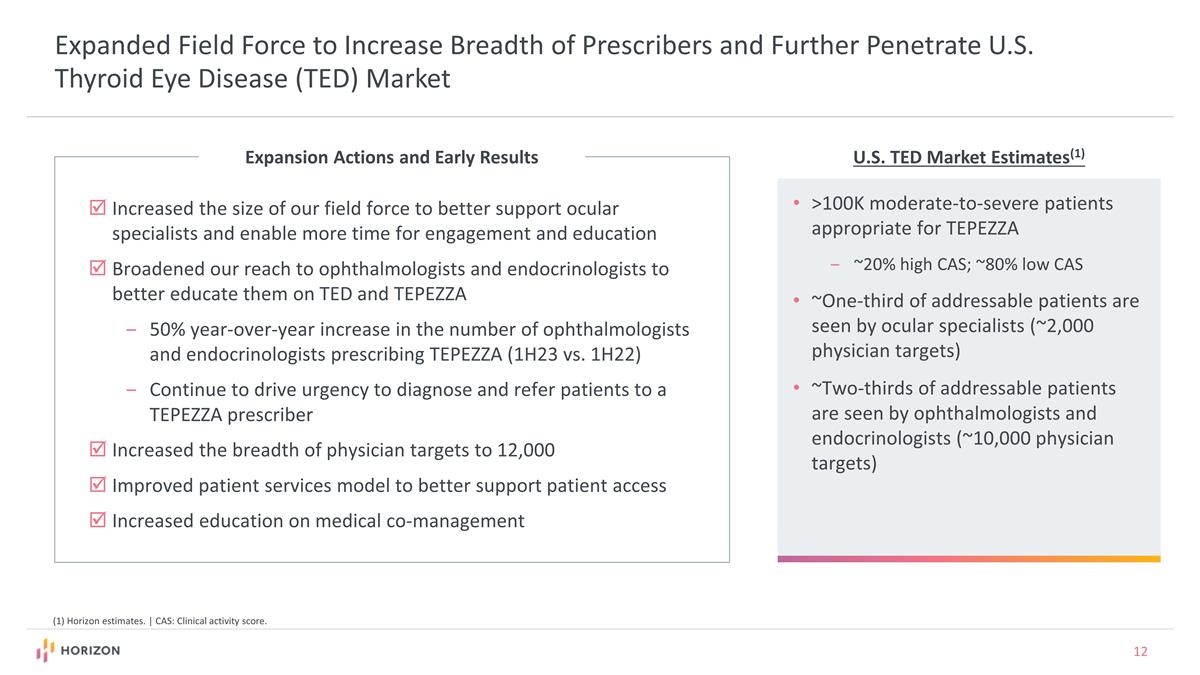

U.S. TED Market Estimates(1) (1) Horizon estimates. | CAS: Clinical activity score. Expanded Field Force to Increase Breadth of Prescribers and Further Penetrate U.S. Thyroid Eye Disease (TED) Market Expansion Actions and Early Results >100K moderate-to-severe patients appropriate for TEPEZZA ~20% high CAS; ~80% low CAS ~One-third of addressable patients are seen by ocular specialists (~2,000 physician targets) ~Two-thirds of addressable patients are seen by ophthalmologists and endocrinologists (~10,000 physician targets) Increased the size of our field force to better support ocular specialists and enable more time for engagement and education Broadened our reach to ophthalmologists and endocrinologists to better educate them on TED and TEPEZZA 50% year-over-year increase in the number of ophthalmologists and endocrinologists prescribing TEPEZZA (1H23 vs. 1H22) Continue to drive urgency to diagnose and refer patients to a TEPEZZA prescriber Increased the breadth of physician targets to 12,000 Improved patient services model to better support patient access Increased education on medical co-management

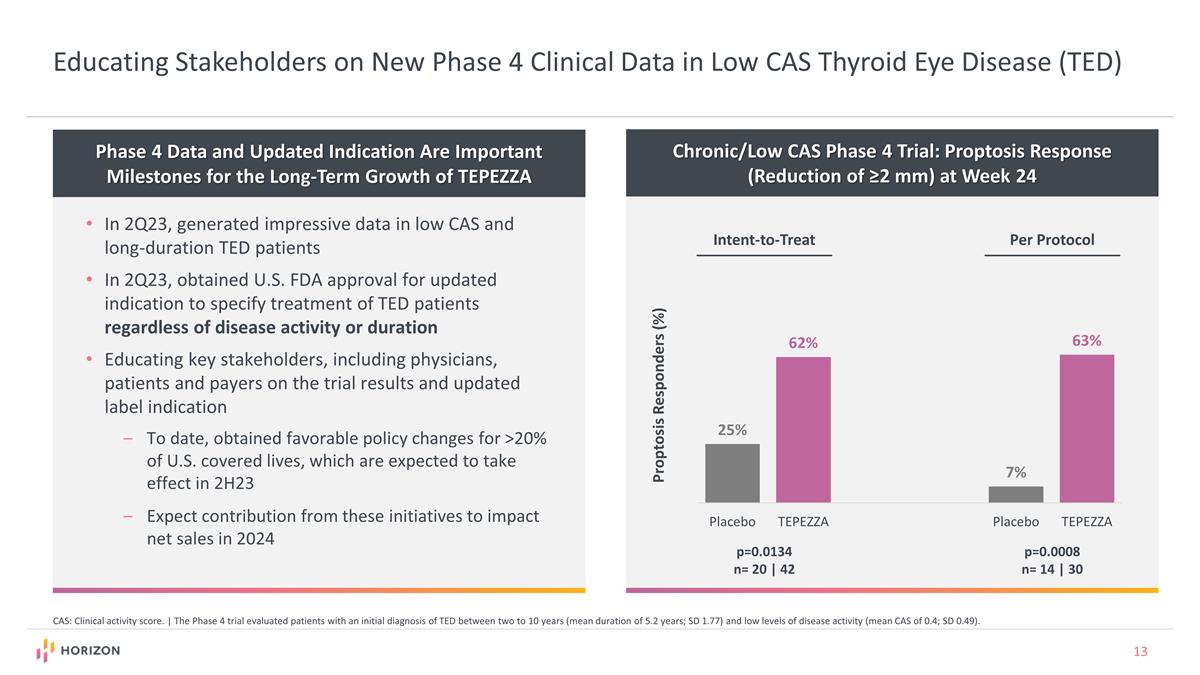

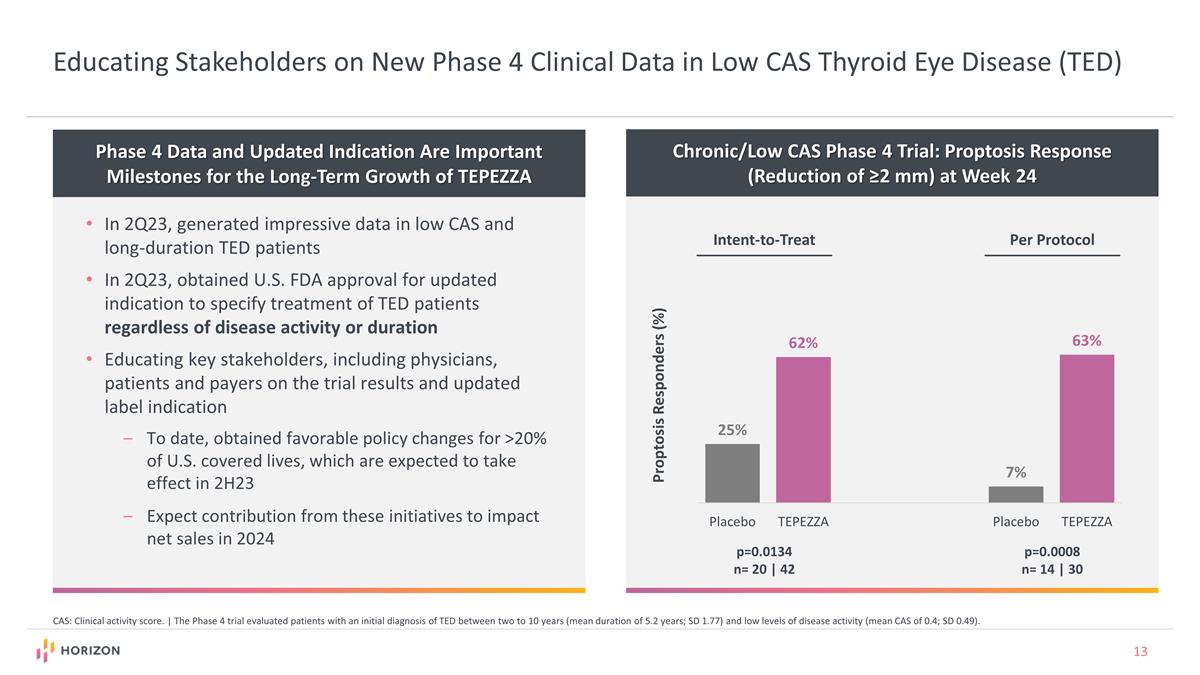

Educating Stakeholders on New Phase 4 Clinical Data in Low CAS Thyroid Eye Disease (TED) Phase 4 Data and Updated Indication Are Important Milestones for the Long-Term Growth of TEPEZZA In 2Q23, generated impressive data in low CAS and long-duration TED patients In 2Q23, obtained U.S. FDA approval for updated indication to specify treatment of TED patients regardless of disease activity or duration Educating key stakeholders, including physicians, patients and payers on the trial results and updated label indication To date, obtained favorable policy changes for >20% of U.S. covered lives, which are expected to take effect in 2H23 Expect contribution from these initiatives to impact net sales in 2024 CAS: Clinical activity score. | The Phase 4 trial evaluated patients with an initial diagnosis of TED between two to 10 years (mean duration of 5.2 years; SD 1.77) and low levels of disease activity (mean CAS of 0.4; SD 0.49). Chronic/Low CAS Phase 4 Trial: Proptosis Response (Reduction of ≥2 mm) at Week 24 Per Protocol Intent-to-Treat p=0.0134 n= 20 | 42 p=0.0008 n= 14 | 30 Proptosis Responders (%)

TEPEZZA Clinical Data Provides an Opportunity to Address the Significant Unmet Need in Targeted International Markets Global Expansion of TEPEZZA Can Provide Long Runway for Growth OPTIC-J Phase 3 Trial: Proptosis Response (Reduction of ≥2 mm) at Week 24 TEPEZZA n=27 n=27 Placebo p<0.0001 89% 11% Proptosis Responders (%) Announced positive topline data from TEPEZZA Phase 3 clinical trial (OPTIC-J) in Japanese patients Initiated Phase 3 clinical trial for chronic/low CAS TED patients in Japan Received approval for TEPEZZA in Brazil for the treatment of TED; first country outside the U.S. to approve TEPEZZA Expect contribution from our global expansion to impact net sales beginning in 2025 CAS: Clinical activity score. | TED: Thyroid eye disease.

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA KRYSTEXXA UPLIZNA Our Pipeline Rare Disease Medicines, Intellectual Property and ESG ESG: Environmental, social and governance.

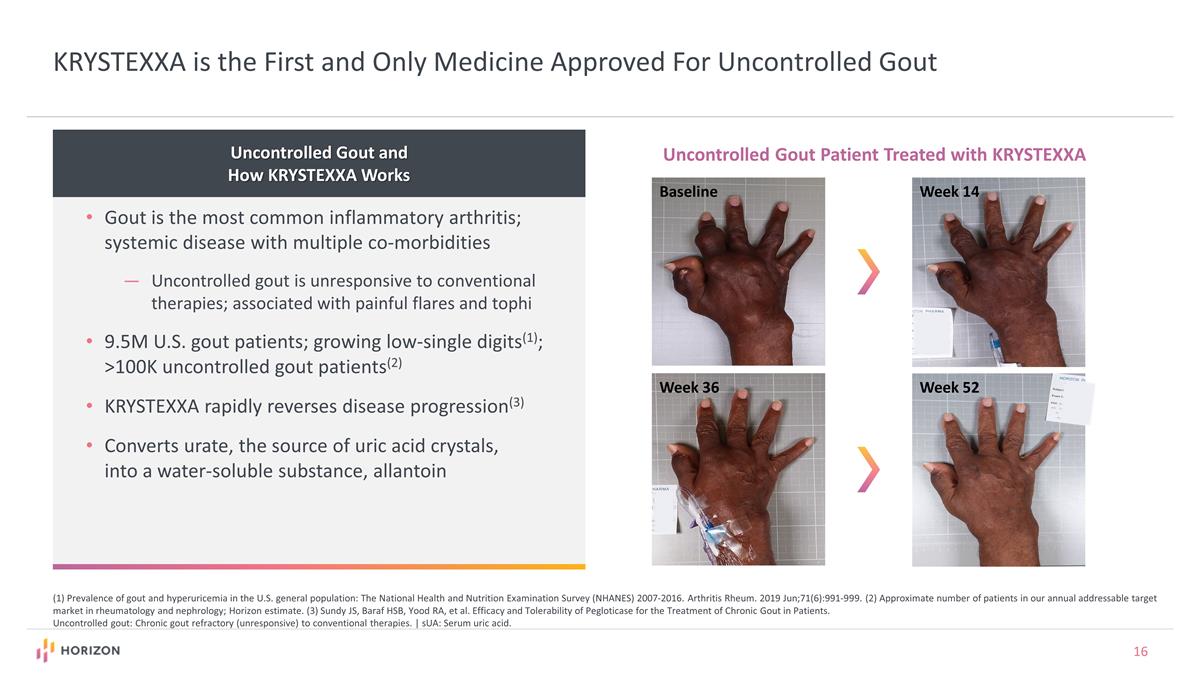

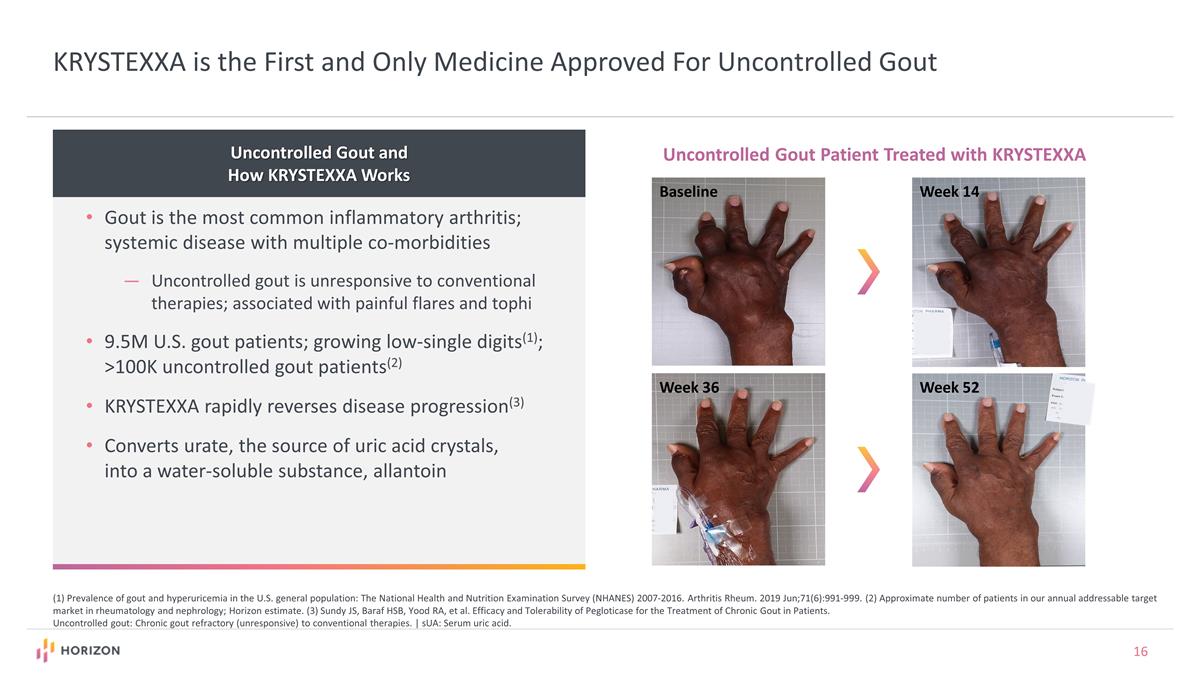

KRYSTEXXA is the First and Only Medicine Approved For Uncontrolled Gout Uncontrolled Gout and How KRYSTEXXA Works Gout is the most common inflammatory arthritis; systemic disease with multiple co-morbidities Uncontrolled gout is unresponsive to conventional therapies; associated with painful flares and tophi 9.5M U.S. gout patients; growing low-single digits(1); >100K uncontrolled gout patients(2) KRYSTEXXA rapidly reverses disease progression(3) Converts urate, the source of uric acid crystals, into a water-soluble substance, allantoin (1) Prevalence of gout and hyperuricemia in the U.S. general population: The National Health and Nutrition Examination Survey (NHANES) 2007-2016. Arthritis Rheum. 2019 Jun;71(6):991-999. (2) Approximate number of patients in our annual addressable target market in rheumatology and nephrology; Horizon estimate. (3) Sundy JS, Baraf HSB, Yood RA, et al. Efficacy and Tolerability of Pegloticase for the Treatment of Chronic Gout in Patients. Uncontrolled gout: Chronic gout refractory (unresponsive) to conventional therapies. | sUA: Serum uric acid. Baseline Week 14 Week 36 Week 52 Uncontrolled Gout Patient Treated with KRYSTEXXA

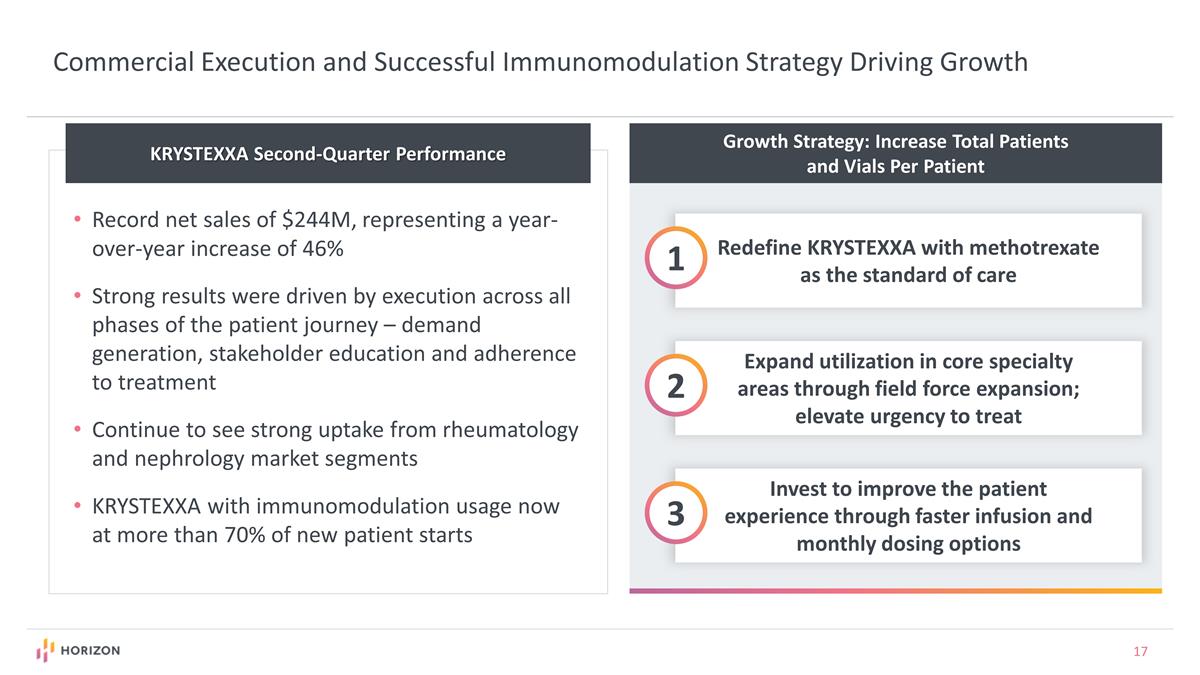

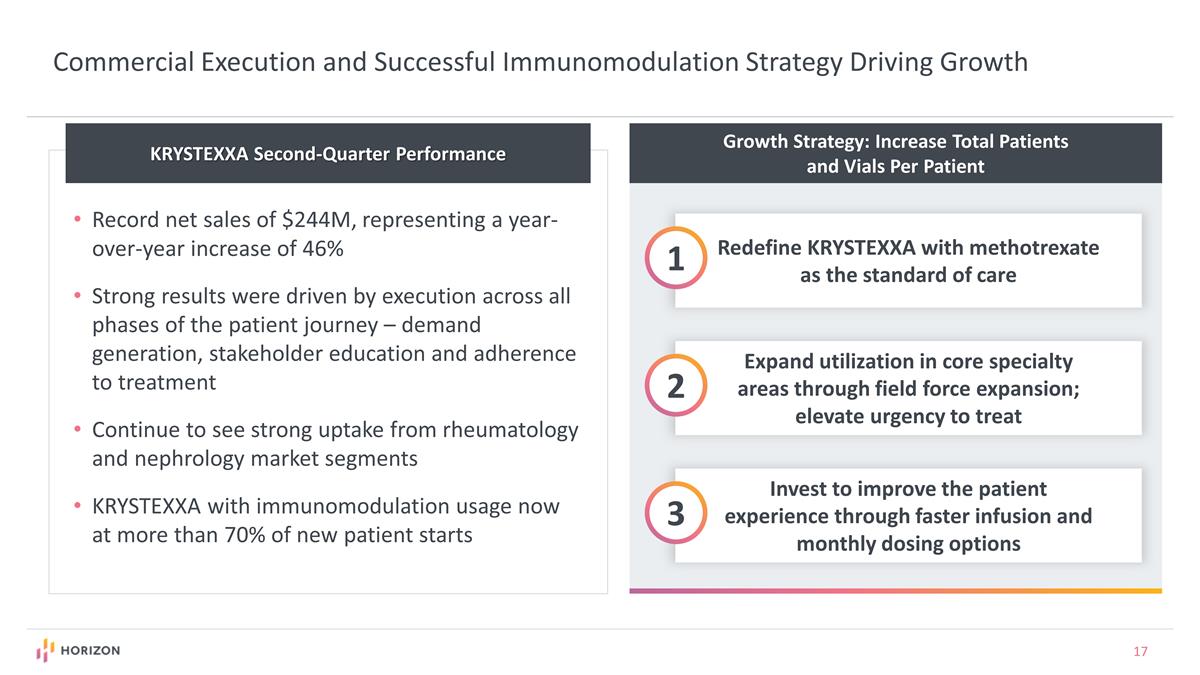

Growth Strategy: Increase Total Patients and Vials Per Patient Redefine KRYSTEXXA with methotrexate as the standard of care 1 Expand utilization in core specialty areas through field force expansion; elevate urgency to treat 2 Invest to improve the patient experience through faster infusion and monthly dosing options 3 Commercial Execution and Successful Immunomodulation Strategy Driving Growth KRYSTEXXA Second-Quarter Performance Record net sales of $244M, representing a year-over-year increase of 46% Strong results were driven by execution across all phases of the patient journey – demand generation, stakeholder education and adherence to treatment Continue to see strong uptake from rheumatology and nephrology market segments KRYSTEXXA with immunomodulation usage now at more than 70% of new patient starts

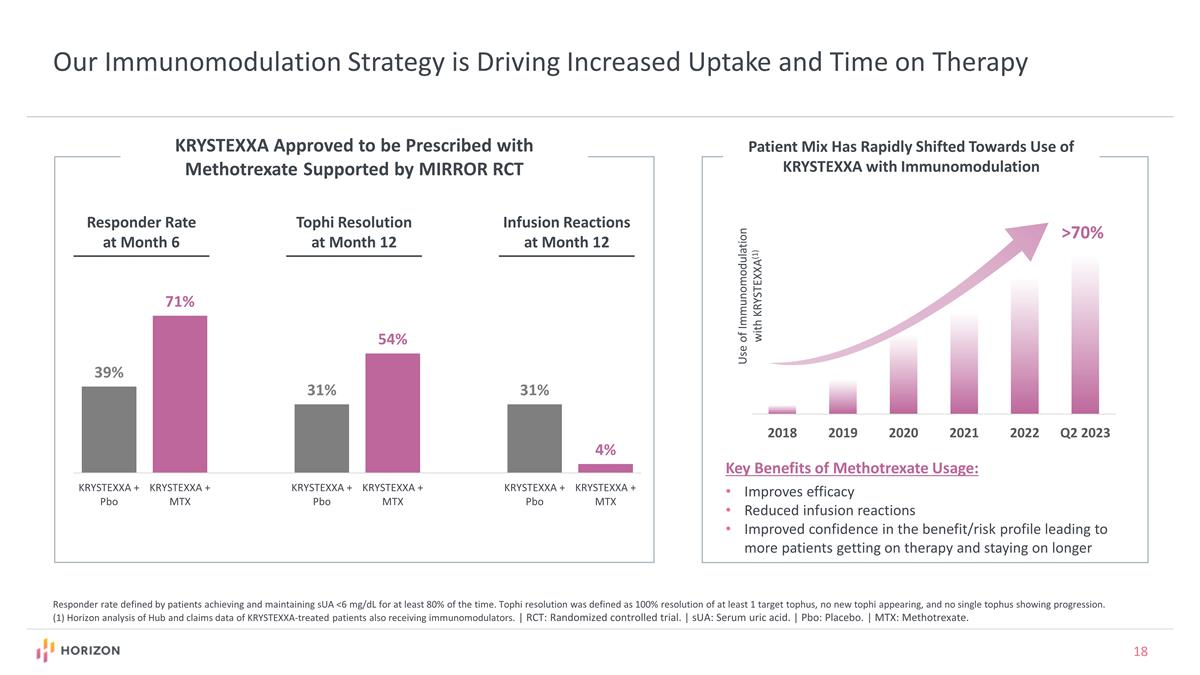

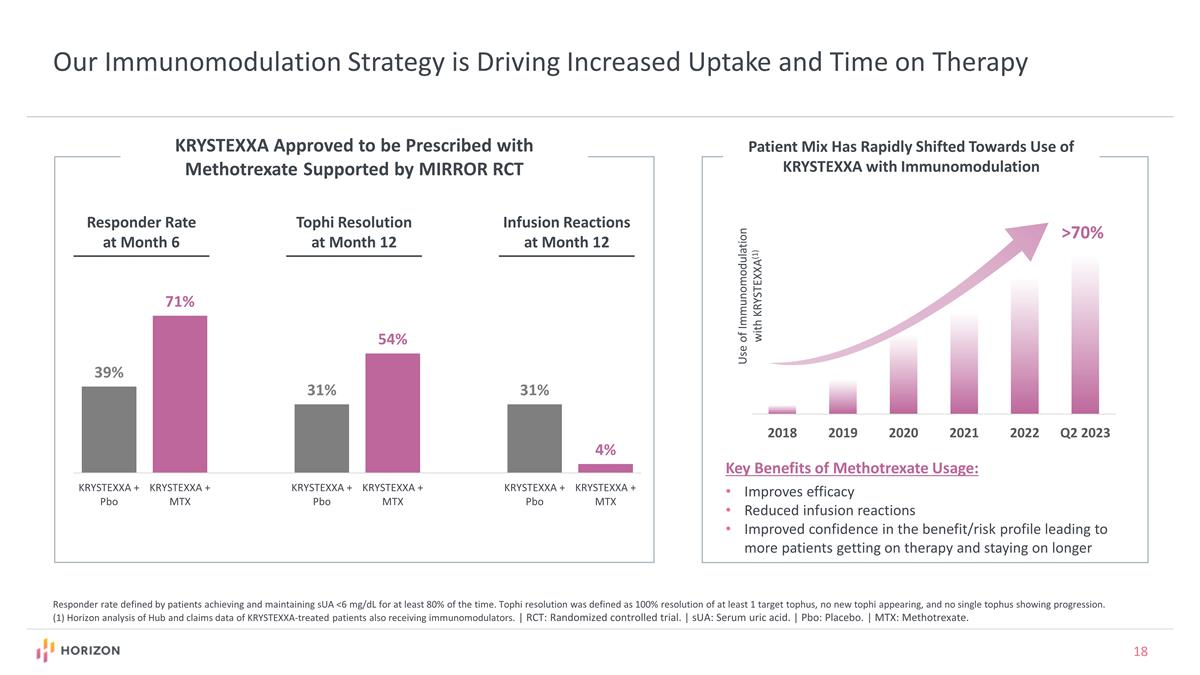

Our Immunomodulation Strategy is Driving Increased Uptake and Time on Therapy Responder rate defined by patients achieving and maintaining sUA <6 mg/dL for at least 80% of the time. Tophi resolution was defined as 100% resolution of at least 1 target tophus, no new tophi appearing, and no single tophus showing progression. (1) Horizon analysis of Hub and claims data of KRYSTEXXA-treated patients also receiving immunomodulators. | RCT: Randomized controlled trial. | sUA: Serum uric acid. | Pbo: Placebo. | MTX: Methotrexate. >70% Use of Immunomodulation with KRYSTEXXA(1) Patient Mix Has Rapidly Shifted Towards Use of KRYSTEXXA with Immunomodulation Key Benefits of Methotrexate Usage: Improves efficacy Reduced infusion reactions Improved confidence in the benefit/risk profile leading to more patients getting on therapy and staying on longer KRYSTEXXA Approved to be Prescribed with Methotrexate Supported by MIRROR RCT Responder Rate at Month 6 Tophi Resolution at Month 12 Infusion Reactions at Month 12

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA KRYSTEXXA UPLIZNA Our Pipeline Rare Disease Medicines, Intellectual Property and ESG ESG: Environmental, social and governance.

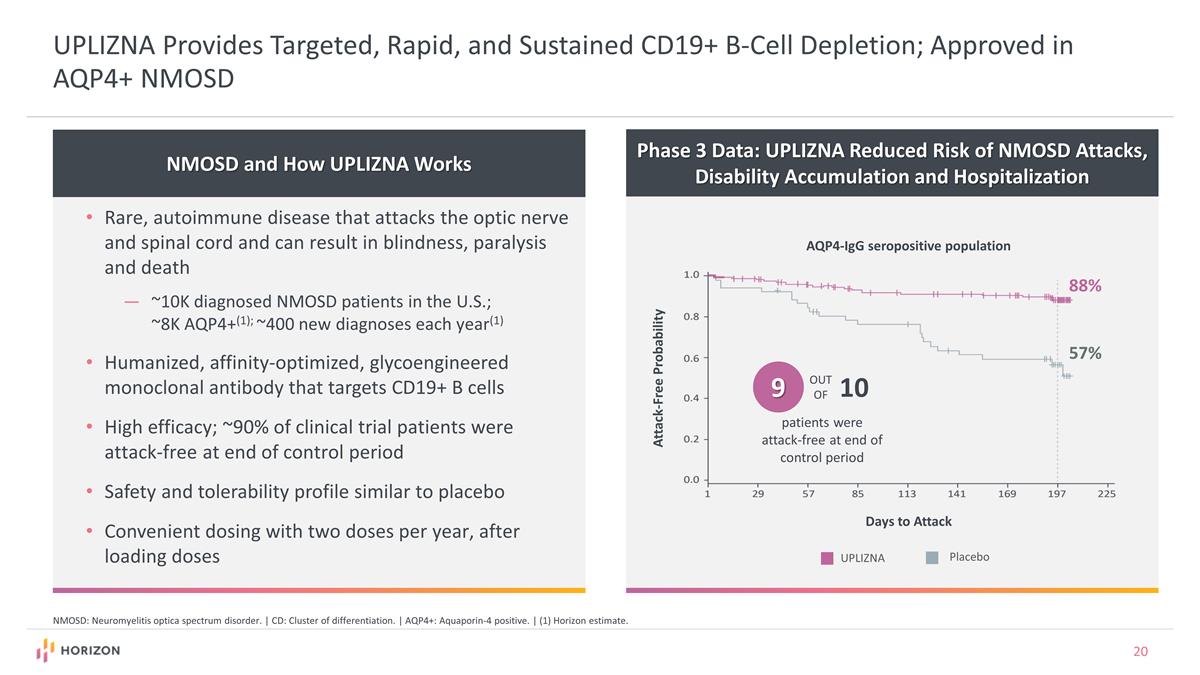

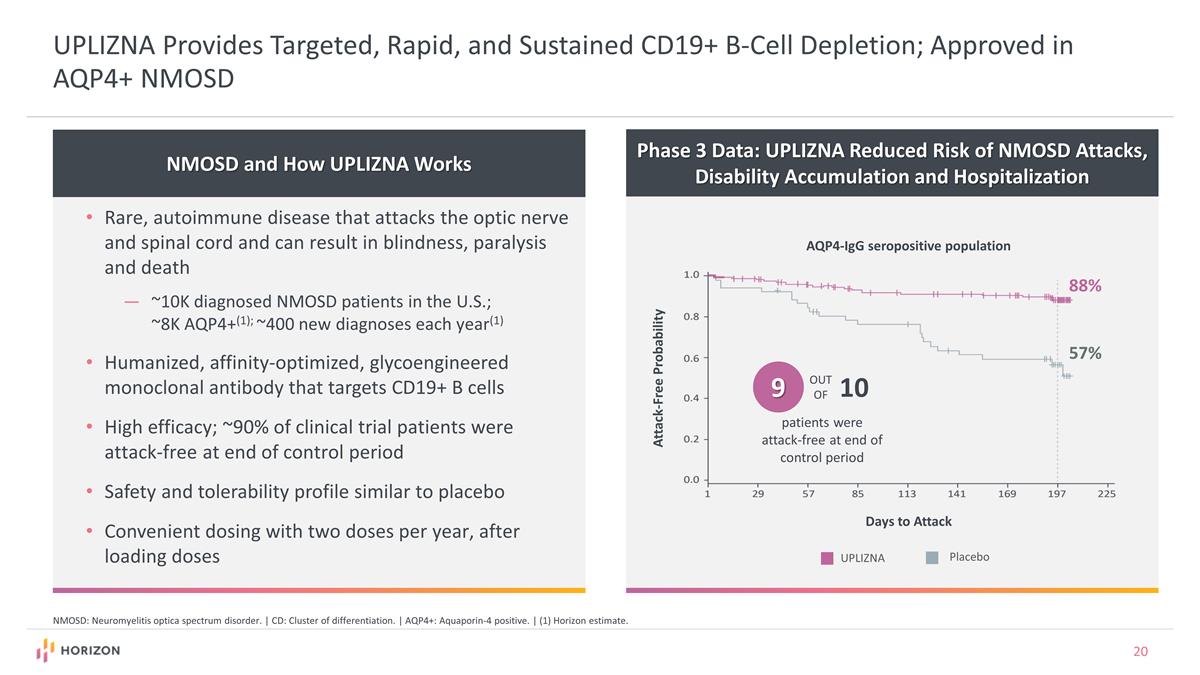

UPLIZNA Provides Targeted, Rapid, and Sustained CD19+ B-Cell Depletion; Approved in AQP4+ NMOSD NMOSD and How UPLIZNA Works Rare, autoimmune disease that attacks the optic nerve and spinal cord and can result in blindness, paralysis and death ~10K diagnosed NMOSD patients in the U.S.; ~8K AQP4+(1); ~400 new diagnoses each year(1) Humanized, affinity-optimized, glycoengineered monoclonal antibody that targets CD19+ B cells High efficacy; ~90% of clinical trial patients were attack-free at end of control period Safety and tolerability profile similar to placebo Convenient dosing with two doses per year, after loading doses NMOSD: Neuromyelitis optica spectrum disorder. | CD: Cluster of differentiation. | AQP4+: Aquaporin-4 positive. | (1) Horizon estimate. Phase 3 Data: UPLIZNA Reduced Risk of NMOSD Attacks, Disability Accumulation and Hospitalization 88% 57% Attack-Free Probability AQP4-IgG seropositive population Days to Attack Placebo UPLIZNA 9 OUT OF 10 patients were attack-free at end of control period

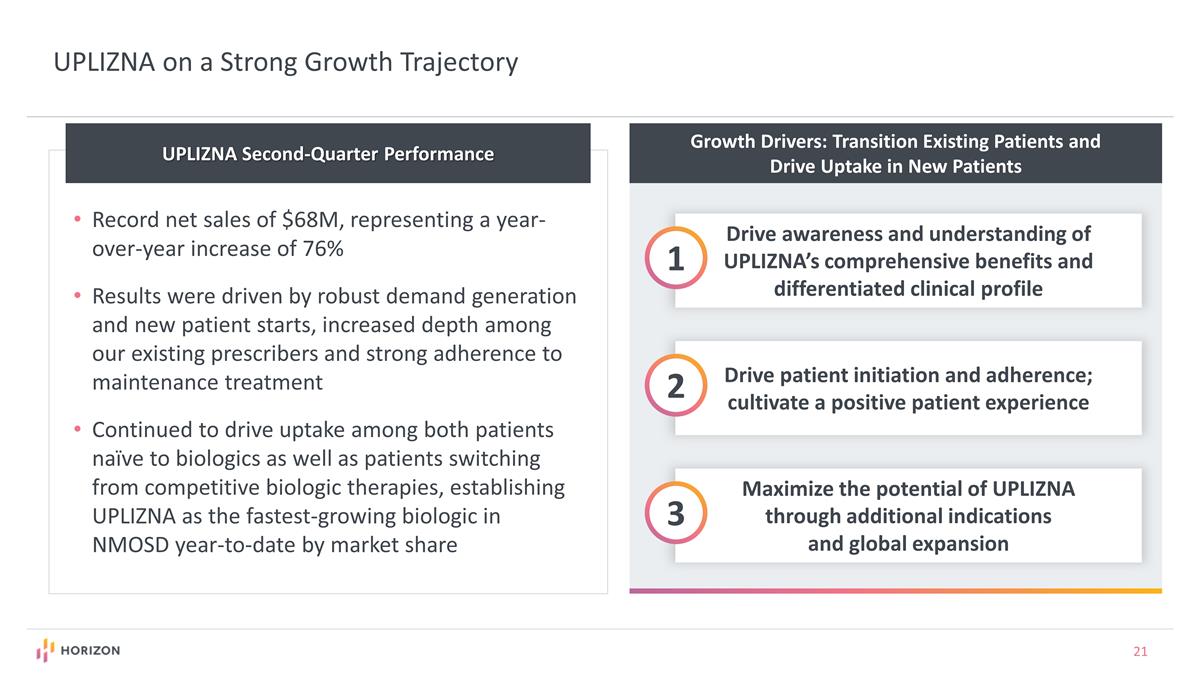

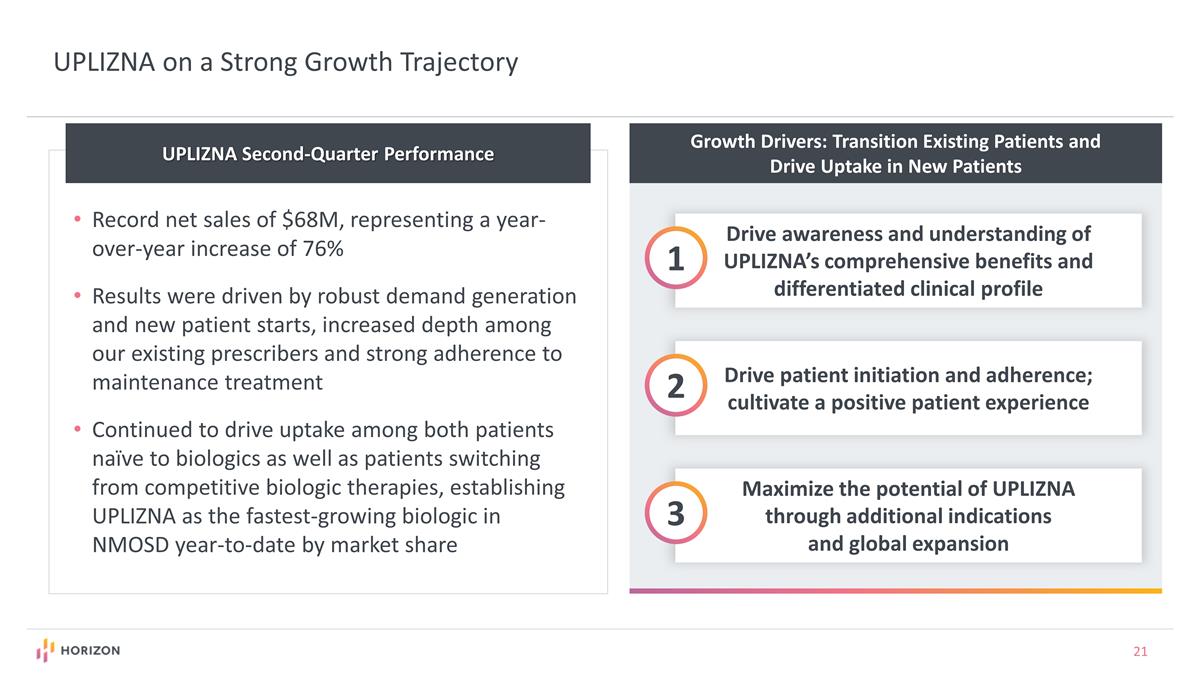

Growth Drivers: Transition Existing Patients and Drive Uptake in New Patients Drive awareness and understanding of UPLIZNA’s comprehensive benefits and differentiated clinical profile 1 Drive patient initiation and adherence; cultivate a positive patient experience 2 Maximize the potential of UPLIZNA through additional indications and global expansion 3 UPLIZNA on a Strong Growth Trajectory UPLIZNA Second-Quarter Performance Record net sales of $68M, representing a year-over-year increase of 76% Results were driven by robust demand generation and new patient starts, increased depth among our existing prescribers and strong adherence to maintenance treatment Continued to drive uptake among both patients naïve to biologics as well as patients switching from competitive biologic therapies, establishing UPLIZNA as the fastest-growing biologic in NMOSD year-to-date by market share

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA KRYSTEXXA UPLIZNA Our Pipeline Rare Disease Medicines, Intellectual Property and ESG ESG: Environmental, social and governance.

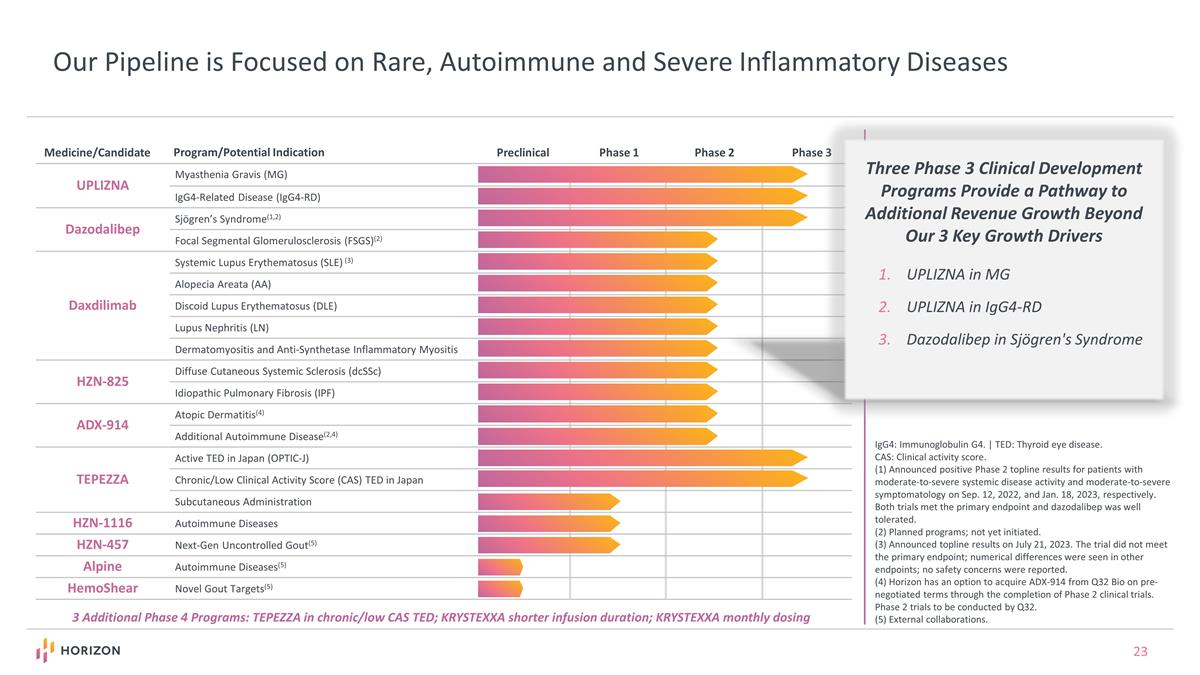

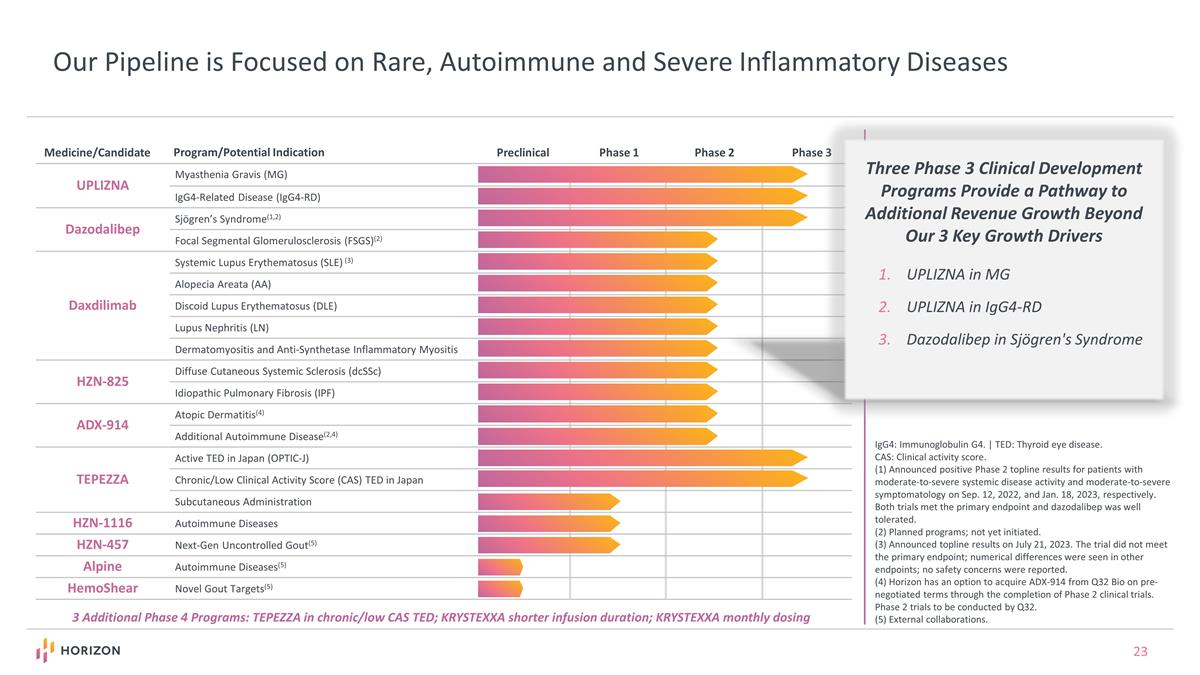

IgG4: Immunoglobulin G4. | TED: Thyroid eye disease. CAS: Clinical activity score. (1) Announced positive Phase 2 topline results for patients with moderate-to-severe systemic disease activity and moderate-to-severe symptomatology on Sep. 12, 2022, and Jan. 18, 2023, respectively. Both trials met the primary endpoint and dazodalibep was well tolerated. (2) Planned programs; not yet initiated. (3) Announced topline results on July 21, 2023. The trial did not meet the primary endpoint; numerical differences were seen in other endpoints; no safety concerns were reported. (4) Horizon has an option to acquire ADX-914 from Q32 Bio on pre-negotiated terms through the completion of Phase 2 clinical trials. Phase 2 trials to be conducted by Q32. (5) External collaborations. Our Pipeline is Focused on Rare, Autoimmune and Severe Inflammatory Diseases UPLIZNA Myasthenia Gravis (MG) IgG4-Related Disease (IgG4-RD) Dazodalibep Sjögren’s Syndrome(1,2) Focal Segmental Glomerulosclerosis (FSGS)(2) Daxdilimab Systemic Lupus Erythematosus (SLE) (3) Alopecia Areata (AA) Discoid Lupus Erythematosus (DLE) Lupus Nephritis (LN) Dermatomyositis and Anti-Synthetase Inflammatory Myositis HZN-825 Diffuse Cutaneous Systemic Sclerosis (dcSSc) Idiopathic Pulmonary Fibrosis (IPF) ADX-914 Atopic Dermatitis(4) Additional Autoimmune Disease(2,4) TEPEZZA Active TED in Japan (OPTIC-J) Chronic/Low Clinical Activity Score (CAS) TED in Japan Subcutaneous Administration HZN-1116 Autoimmune Diseases HZN-457 Next-Gen Uncontrolled Gout(5) Alpine Autoimmune Diseases(5) HemoShear Novel Gout Targets(5) Medicine/Candidate Program/Potential Indication Preclinical Phase 1 Phase 2 Phase 3 Three Phase 3 Clinical Development Programs Provide a Pathway to Additional Revenue Growth Beyond Our 3 Key Growth Drivers UPLIZNA in MG UPLIZNA in IgG4-RD Dazodalibep in Sjögren's Syndrome 3 Additional Phase 4 Programs: TEPEZZA in chronic/low CAS TED; KRYSTEXXA shorter infusion duration; KRYSTEXXA monthly dosing

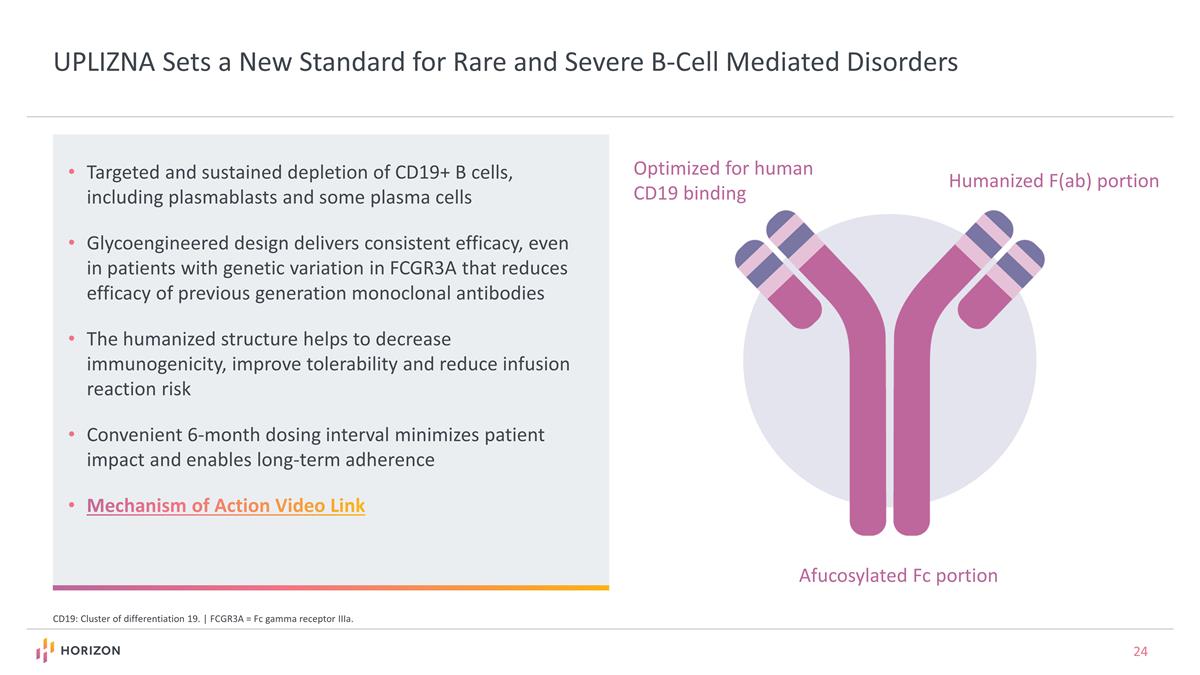

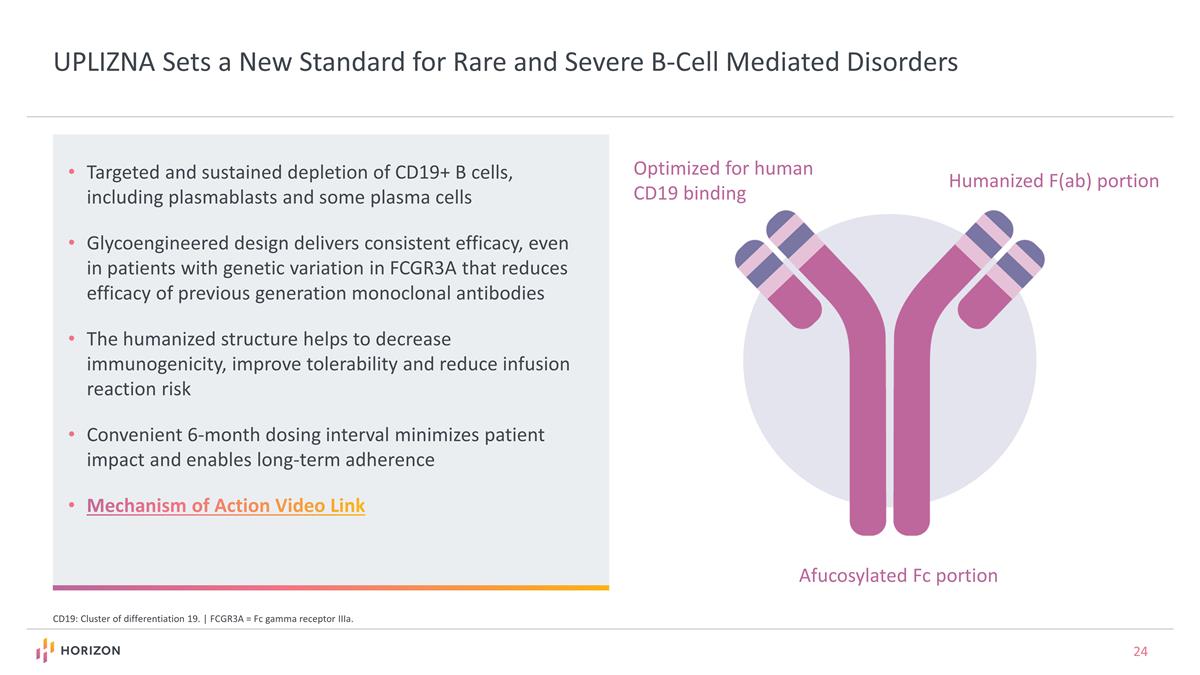

UPLIZNA Sets a New Standard for Rare and Severe B-Cell Mediated Disorders CD19: Cluster of differentiation 19. | FCGR3A = Fc gamma receptor IIIa. Targeted and sustained depletion of CD19+ B cells, including plasmablasts and some plasma cells Glycoengineered design delivers consistent efficacy, even in patients with genetic variation in FCGR3A that reduces efficacy of previous generation monoclonal antibodies The humanized structure helps to decrease immunogenicity, improve tolerability and reduce infusion reaction risk Convenient 6-month dosing interval minimizes patient impact and enables long-term adherence Mechanism of Action Video Link Humanized F(ab) portion Optimized for human CD19 binding Afucosylated Fc portion

UPLIZNA is in Phase 3 Development for Two Additional Immune-Mediated Diseases Where B-Cell Dysregulation Plays an Important Role IgG4-Related Disease (IgG4-RD) Chronic, serious autoimmune fibro-inflammatory disease often affecting multiple organs, such as pancreas, salivary glands, kidneys Symptoms depend on which organs are affected, and can result in permanent organ damage Prevalence: ~20-40K in the U.S.(1) Significant unmet need; potential to be first FDA-approved therapy Phase 3 topline data expected in 2024 Myasthenia Gravis (MG) A chronic, rare autoimmune neuromuscular disorder Symptoms include weakness in voluntary muscles, especially those that control the eyes, mouth, throat and limbs Prevalence: ~55K in the U.S.(1) Potential for differentiation based on unique MOA and convenient, predictable 6-month dosing Phase 3 topline data expected in 2024 IgG4: Immunoglobulin G4. | MOA: Mechanism of action. (1) Horizon estimate.

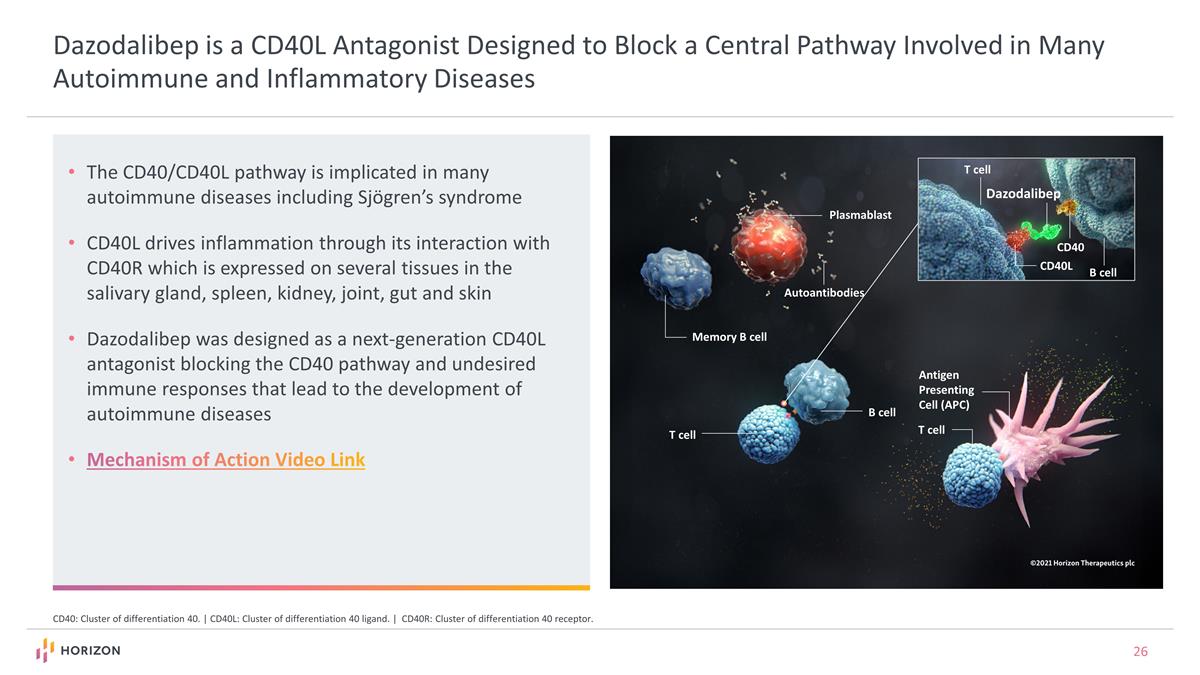

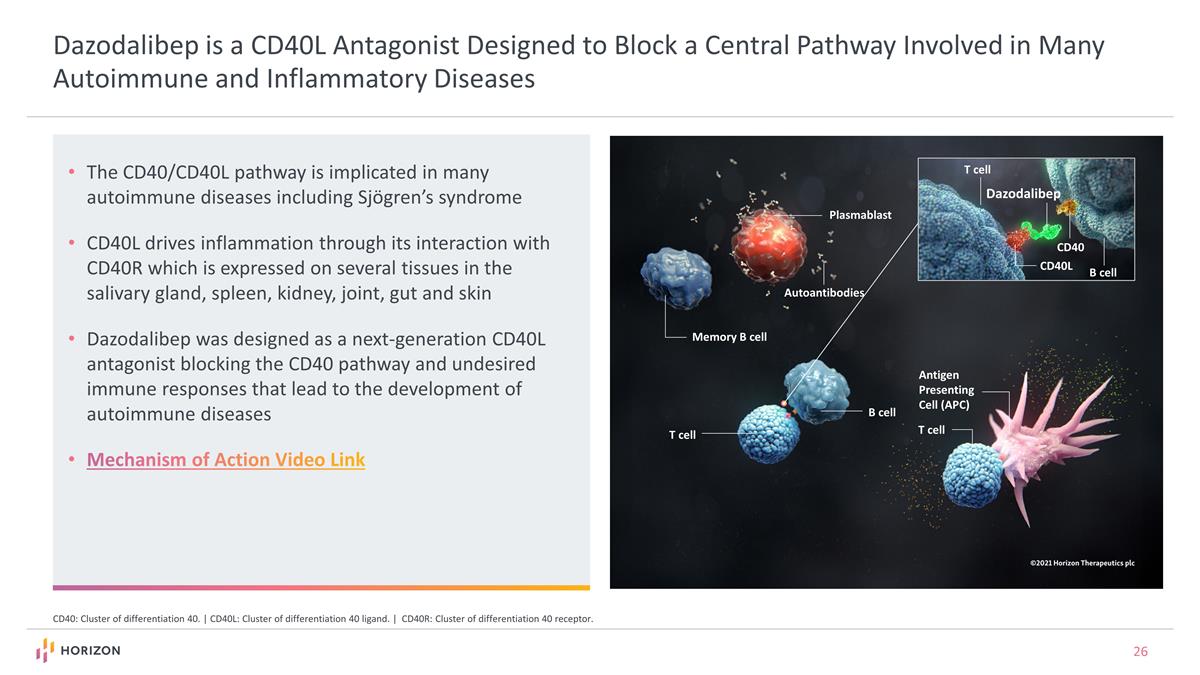

The CD40/CD40L pathway is implicated in many autoimmune diseases including Sjögren’s syndrome CD40L drives inflammation through its interaction with CD40R which is expressed on several tissues in the salivary gland, spleen, kidney, joint, gut and skin Dazodalibep was designed as a next-generation CD40L antagonist blocking the CD40 pathway and undesired immune responses that lead to the development of autoimmune diseases Mechanism of Action Video Link CD40: Cluster of differentiation 40. | CD40L: Cluster of differentiation 40 ligand. | CD40R: Cluster of differentiation 40 receptor. Plasmablast Autoantibodies T cell Antigen Presenting Cell (APC) T cell T cell B cell Memory B cell B cell CD40L CD40 Dazodalibep Dazodalibep is a CD40L Antagonist Designed to Block a Central Pathway Involved in Many Autoimmune and Inflammatory Diseases

Chronic, systemic autoimmune disease attacking the salivary and tear (exocrine) glands, with severe cases also involving multiple organ systems Disease manifestations include dry eyes, dry mouth, arthritis and kidney or lung dysfunction Prevalence: ~250K-350K patients with Sjögren’s syndrome in the U.S.; OUS prevalence similar in size as U.S. Significant unmet need: No FDA-approved disease modifying treatments Current treatments: palliative care (artificial tears, medicines for dry mouth); topical cyclosporine; steroids/immunosuppressants used off-label as needed to manage systemic symptoms Sjögren’s Syndrome Dazodalibep is in Phase 3 Development for Sjögren’s Syndrome Following Strong Phase 2 Results Moderate-to-Severe Systemic Disease Activity (Pop. 1): ESSDAI score of ≥ 5, representing extraglandular organ involvement Systemic clinical manifestations in one or more organ systems in addition to the traditional Sjogren’s manifestations Two Distinct Patient Populations Moderate-to-Severe Symptomatology (Pop. 2): ESSPRI score of ≥ 5, indicative of significant symptomatic burden, and an ESSDAI score of < 5, representing limited extraglandular organ involvement Three domains of ESSPRI measure dryness, fatigue and pain OUS: Outside the United States, defined as prevalence for France, Germany, Italy, Spain, United Kingdom and Japan. | EULAR: European League Against Rheumatism | ESSDAI: EULAR Sjögren’s Syndrome Disease Activity Index: A Sjögren’s specific disease activity index composed of 12 system domains. | ESSPRI: EULAR Sjögren’s Syndrome Patient Reported Index: Patient reported index composed of three questions assessing dryness, fatigue and pain.

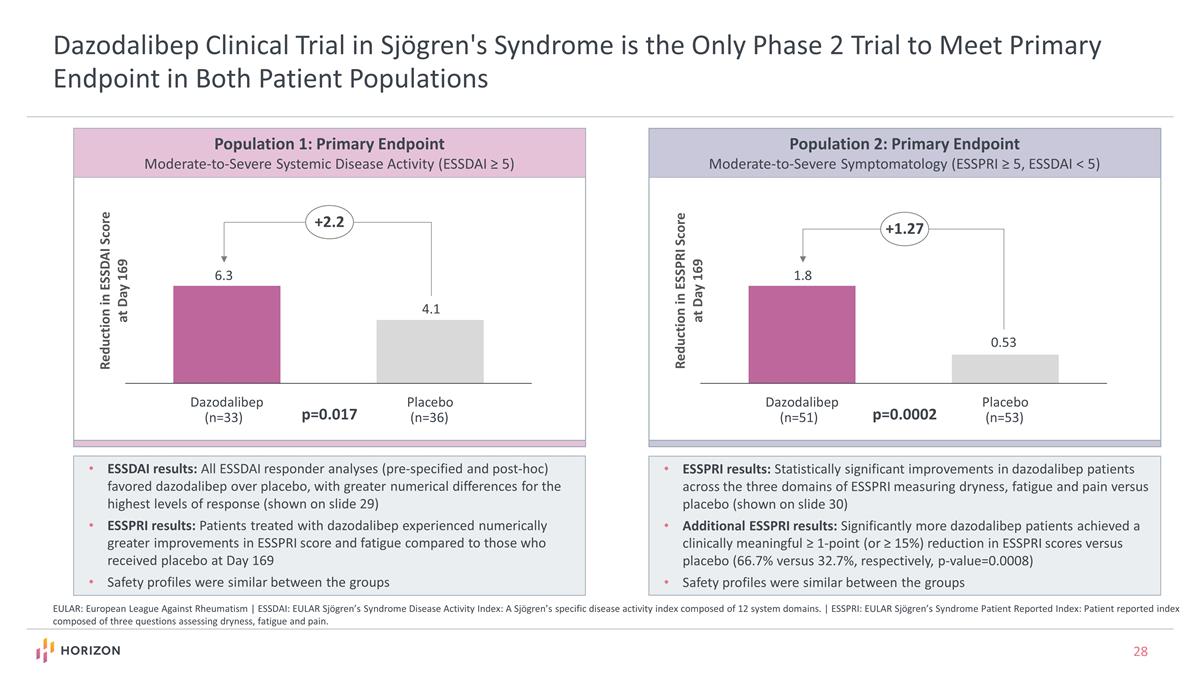

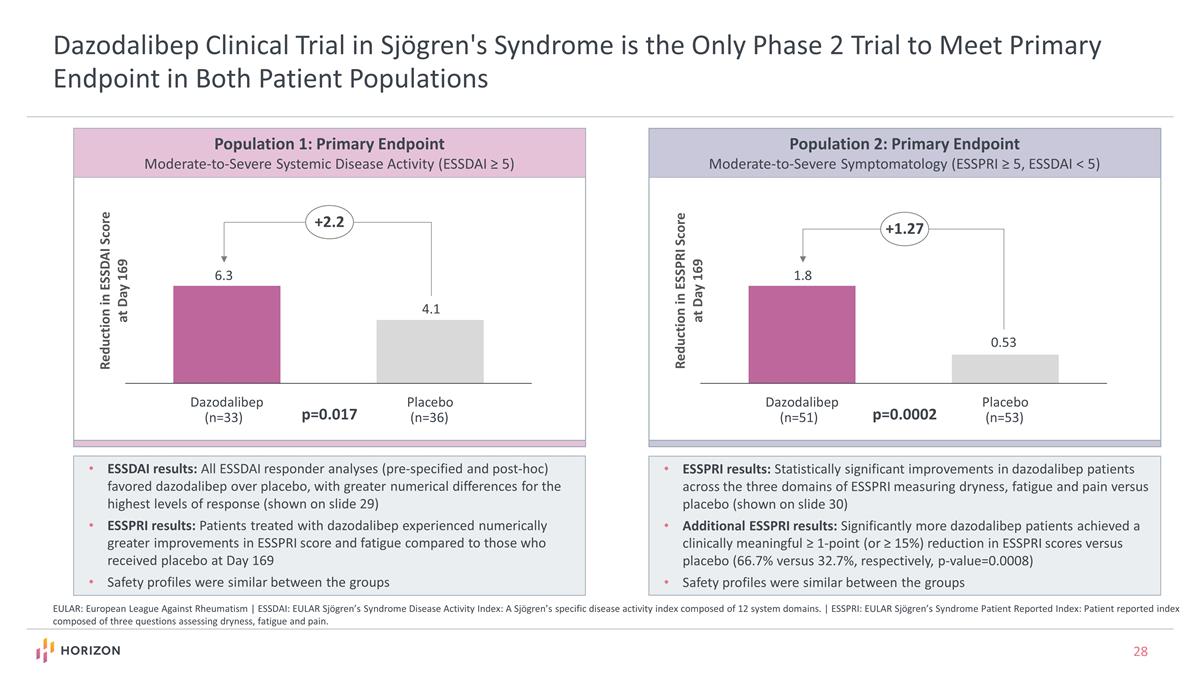

Reduction in ESSDAI Score at Day 169 Dazodalibep Clinical Trial in Sjögren's Syndrome is the Only Phase 2 Trial to Meet Primary Endpoint in Both Patient Populations EULAR: European League Against Rheumatism | ESSDAI: EULAR Sjögren’s Syndrome Disease Activity Index: A Sjögren’s specific disease activity index composed of 12 system domains. | ESSPRI: EULAR Sjögren’s Syndrome Patient Reported Index: Patient reported index composed of three questions assessing dryness, fatigue and pain. 4.1 +2.2 6.3 p=0.017 Population 1: Primary Endpoint Moderate-to-Severe Systemic Disease Activity (ESSDAI ≥ 5) Population 2: Primary Endpoint Moderate-to-Severe Symptomatology (ESSPRI ≥ 5, ESSDAI < 5) Reduction in ESSPRI Score at Day 169 0.53 +1.27 1.8 p=0.0002 ESSDAI results: All ESSDAI responder analyses (pre-specified and post-hoc) favored dazodalibep over placebo, with greater numerical differences for the highest levels of response (shown on slide 29) ESSPRI results: Patients treated with dazodalibep experienced numerically greater improvements in ESSPRI score and fatigue compared to those who received placebo at Day 169 Safety profiles were similar between the groups ESSPRI results: Statistically significant improvements in dazodalibep patients across the three domains of ESSPRI measuring dryness, fatigue and pain versus placebo (shown on slide 30) Additional ESSPRI results: Significantly more dazodalibep patients achieved a clinically meaningful ≥ 1-point (or ≥ 15%) reduction in ESSPRI scores versus placebo (66.7% versus 32.7%, respectively, p-value=0.0008) Safety profiles were similar between the groups

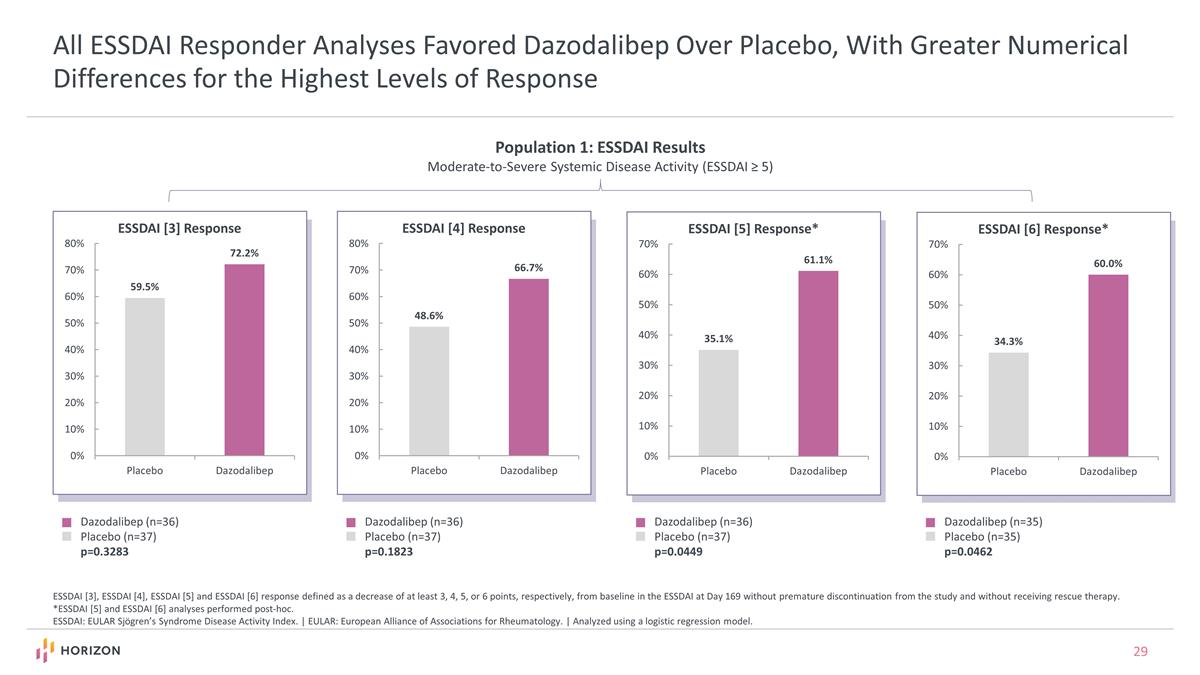

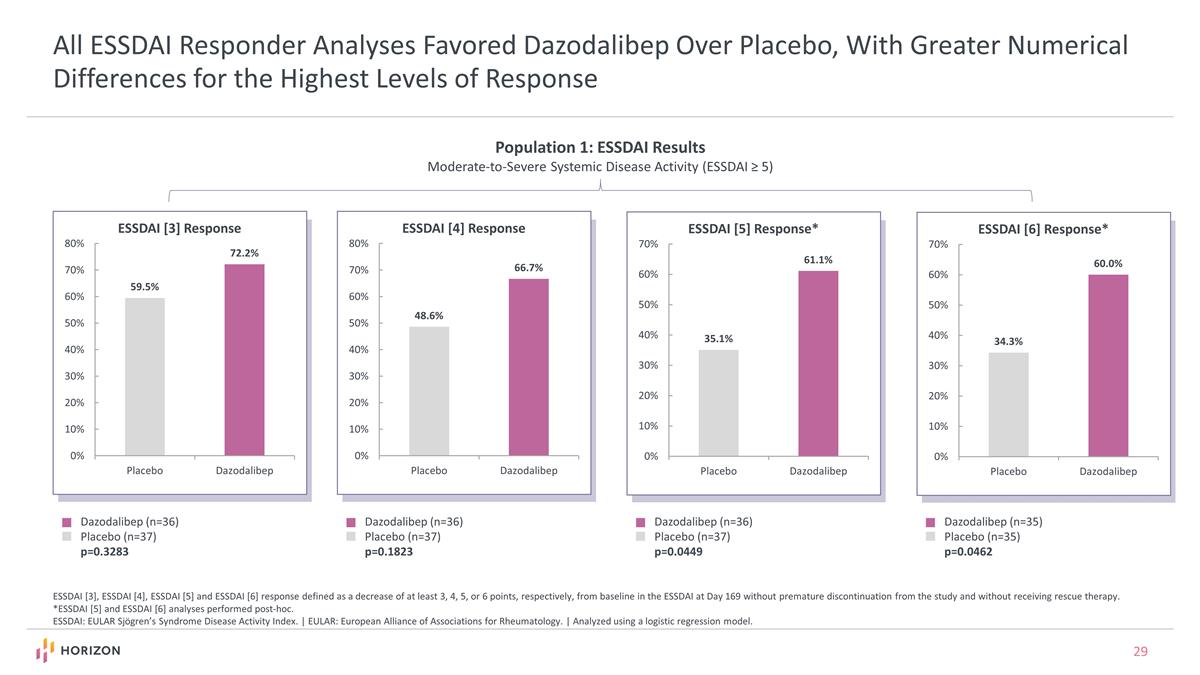

All ESSDAI Responder Analyses Favored Dazodalibep Over Placebo, With Greater Numerical Differences for the Highest Levels of Response ESSDAI [3], ESSDAI [4], ESSDAI [5] and ESSDAI [6] response defined as a decrease of at least 3, 4, 5, or 6 points, respectively, from baseline in the ESSDAI at Day 169 without premature discontinuation from the study and without receiving rescue therapy. *ESSDAI [5] and ESSDAI [6] analyses performed post-hoc. ESSDAI: EULAR Sjögren’s Syndrome Disease Activity Index. | EULAR: European Alliance of Associations for Rheumatology. | Analyzed using a logistic regression model. Dazodalibep (n=36) Placebo (n=37) p=0.3283 Dazodalibep (n=36) Placebo (n=37) p=0.1823 Dazodalibep (n=36) Placebo (n=37) p=0.0449 Dazodalibep (n=35) Placebo (n=35) p=0.0462 Population 1: ESSDAI Results Moderate-to-Severe Systemic Disease Activity (ESSDAI ≥ 5)

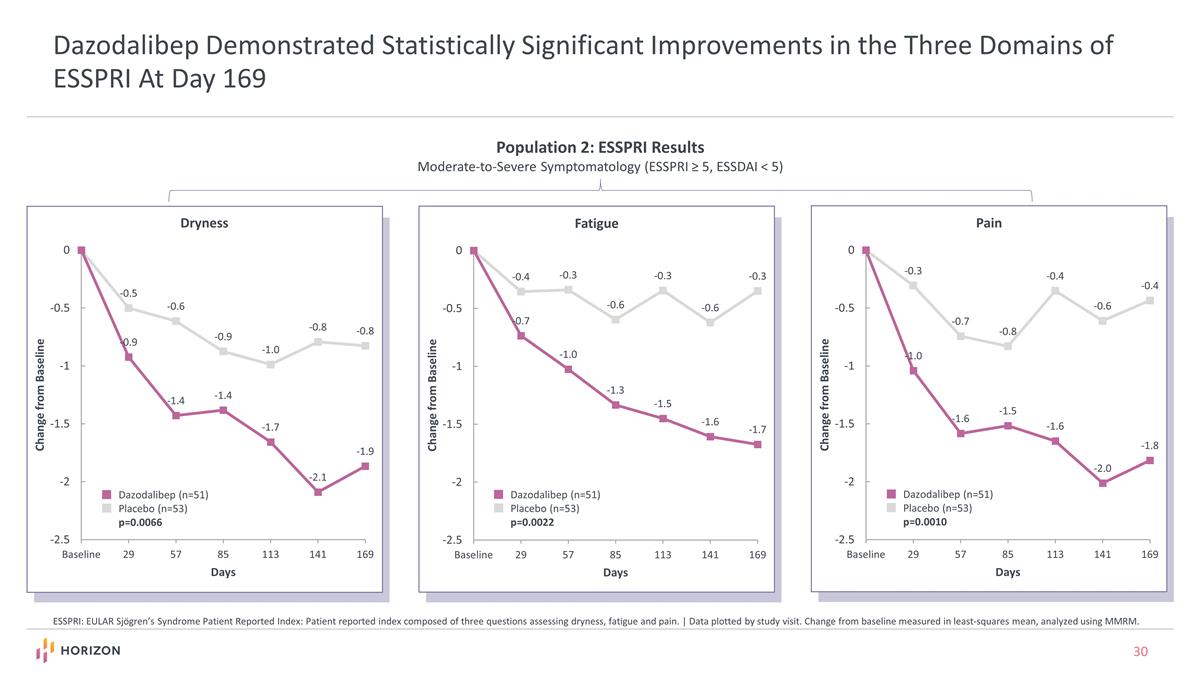

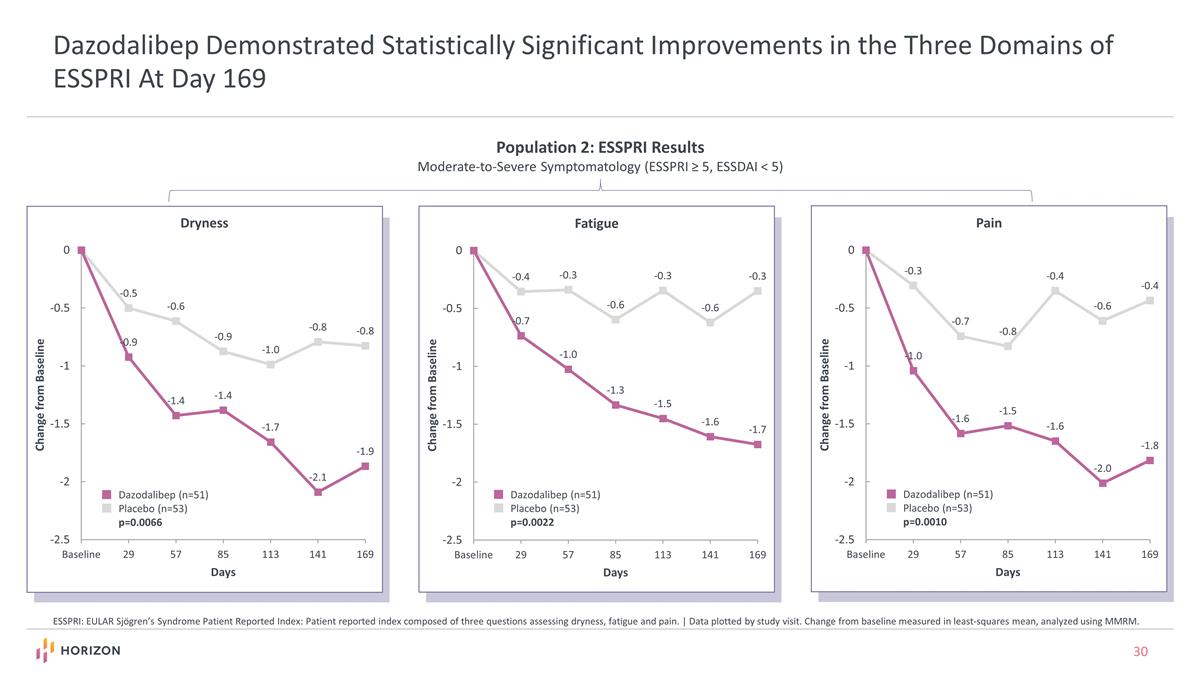

Dazodalibep Demonstrated Statistically Significant Improvements in the Three Domains of ESSPRI At Day 169 ESSPRI: EULAR Sjögren’s Syndrome Patient Reported Index: Patient reported index composed of three questions assessing dryness, fatigue and pain. | Data plotted by study visit. Change from baseline measured in least-squares mean, analyzed using MMRM. Dazodalibep (n=51) Placebo (n=53) p=0.0066 Dazodalibep (n=51) Placebo (n=53) p=0.0022 Dazodalibep (n=51) Placebo (n=53) p=0.0010 Population 2: ESSPRI Results Moderate-to-Severe Symptomatology (ESSPRI ≥ 5, ESSDAI < 5)

Presentation At-A-Glance 1 2 3 4 5 6 Horizon Overview and 2Q23 Financial Results TEPEZZA KRYSTEXXA UPLIZNA Our Pipeline Rare Disease Medicines, Intellectual Property and ESG ESG: Environmental, social and governance.

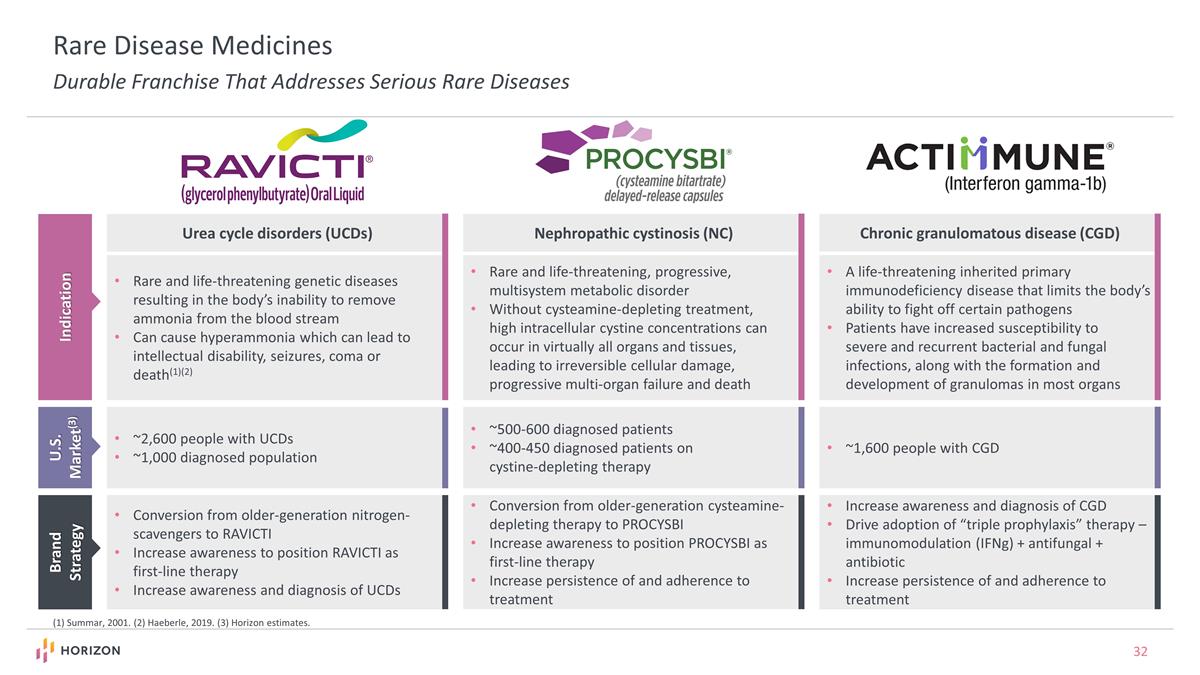

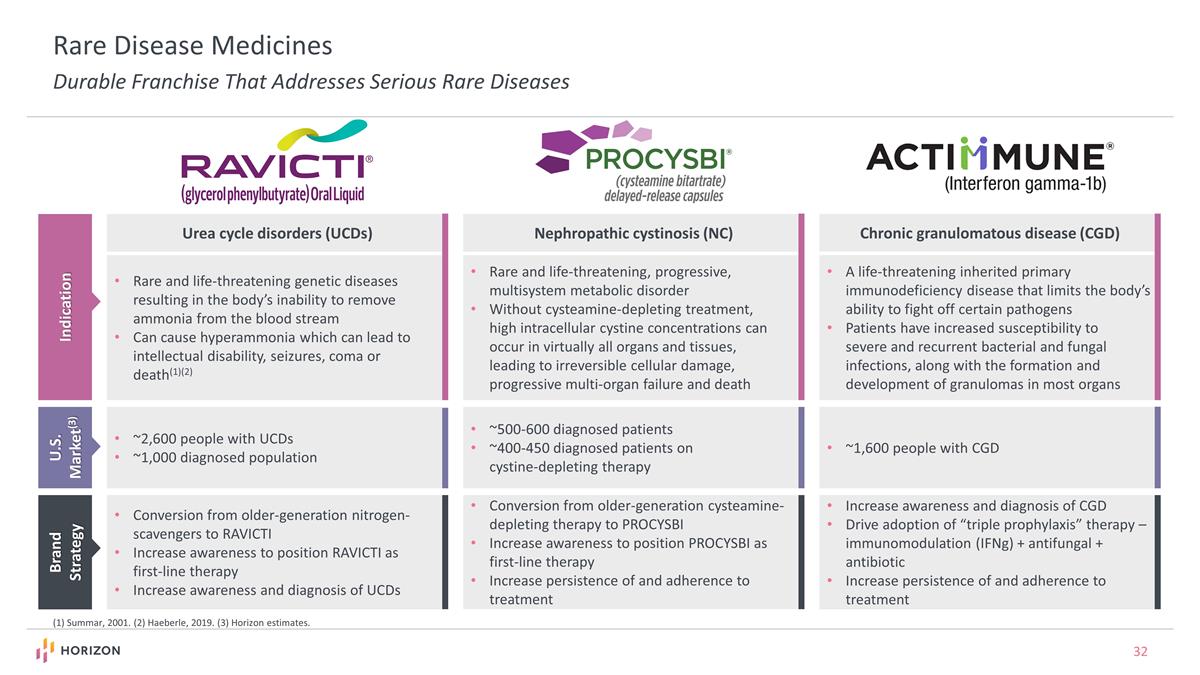

Urea cycle disorders (UCDs) Nephropathic cystinosis (NC) Chronic granulomatous disease (CGD) Indication U.S. Market(3) ~2,600 people with UCDs ~1,000 diagnosed population ~500-600 diagnosed patients ~400-450 diagnosed patients on cystine-depleting therapy ~1,600 people with CGD Rare and life-threatening genetic diseases resulting in the body’s inability to remove ammonia from the blood stream Can cause hyperammonia which can lead to intellectual disability, seizures, coma or death(1)(2) Rare and life-threatening, progressive, multisystem metabolic disorder Without cysteamine-depleting treatment, high intracellular cystine concentrations can occur in virtually all organs and tissues, leading to irreversible cellular damage, progressive multi-organ failure and death A life-threatening inherited primary immunodeficiency disease that limits the body’s ability to fight off certain pathogens Patients have increased susceptibility to severe and recurrent bacterial and fungal infections, along with the formation and development of granulomas in most organs Brand Strategy Conversion from older-generation nitrogen-scavengers to RAVICTI Increase awareness to position RAVICTI as first-line therapy Increase awareness and diagnosis of UCDs Conversion from older-generation cysteamine-depleting therapy to PROCYSBI Increase awareness to position PROCYSBI as first-line therapy Increase persistence of and adherence to treatment Increase awareness and diagnosis of CGD Drive adoption of “triple prophylaxis” therapy – immunomodulation (IFNg) + antifungal + antibiotic Increase persistence of and adherence to treatment (1) Summar, 2001. (2) Haeberle, 2019. (3) Horizon estimates. Rare Disease Medicines Durable Franchise That Addresses Serious Rare Diseases

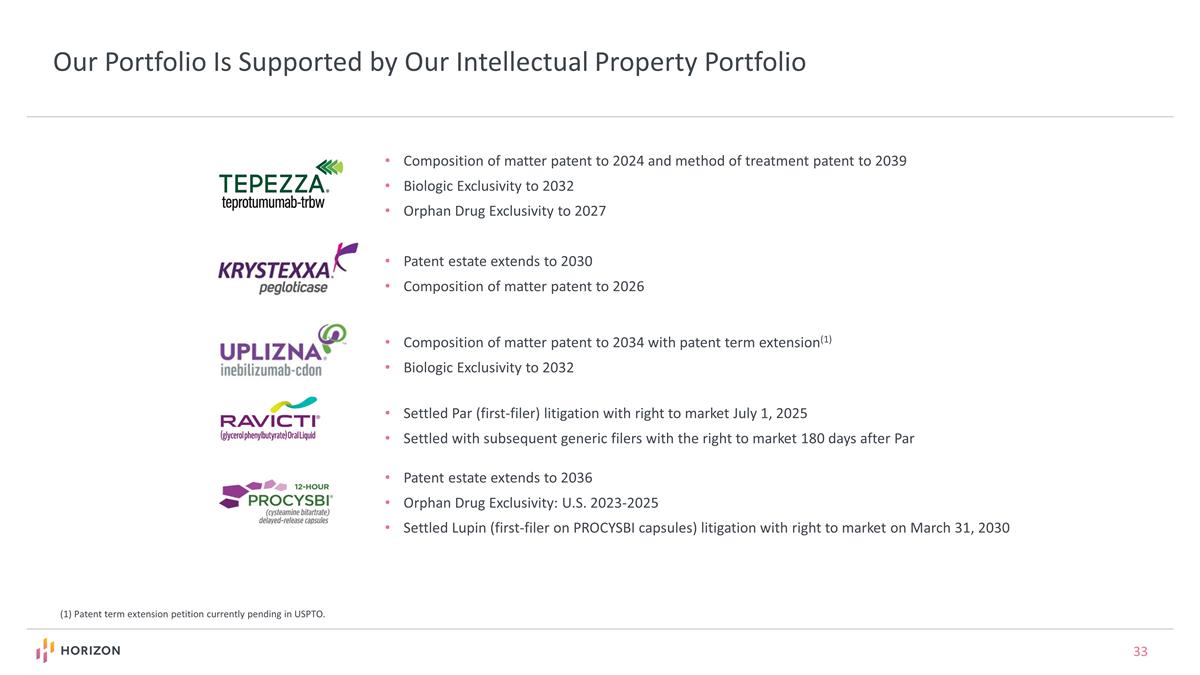

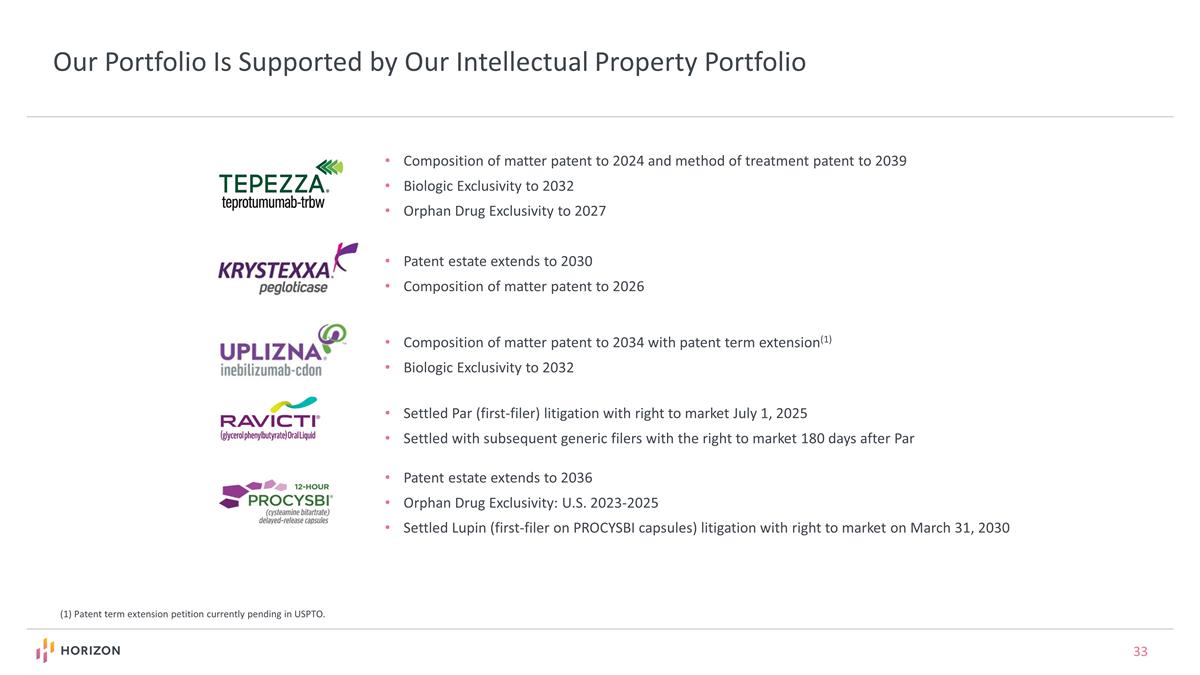

Composition of matter patent to 2024 and method of treatment patent to 2039 Biologic Exclusivity to 2032 Orphan Drug Exclusivity to 2027 Patent estate extends to 2030 Composition of matter patent to 2026 Composition of matter patent to 2034 with patent term extension(1) Biologic Exclusivity to 2032 Settled Par (first-filer) litigation with right to market July 1, 2025 Settled with subsequent generic filers with the right to market 180 days after Par Patent estate extends to 2036 Orphan Drug Exclusivity: U.S. 2023-2025 Settled Lupin (first-filer on PROCYSBI capsules) litigation with right to market on March 31, 2030 (1) Patent term extension petition currently pending in USPTO. Our Portfolio Is Supported by Our Intellectual Property Portfolio

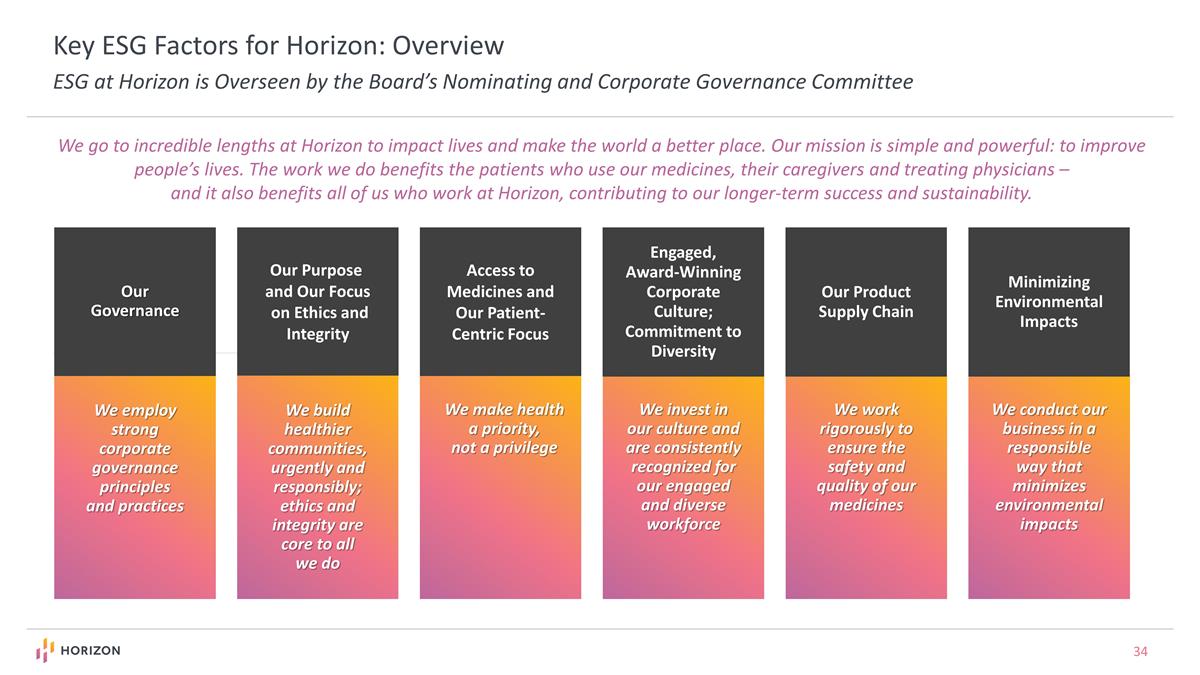

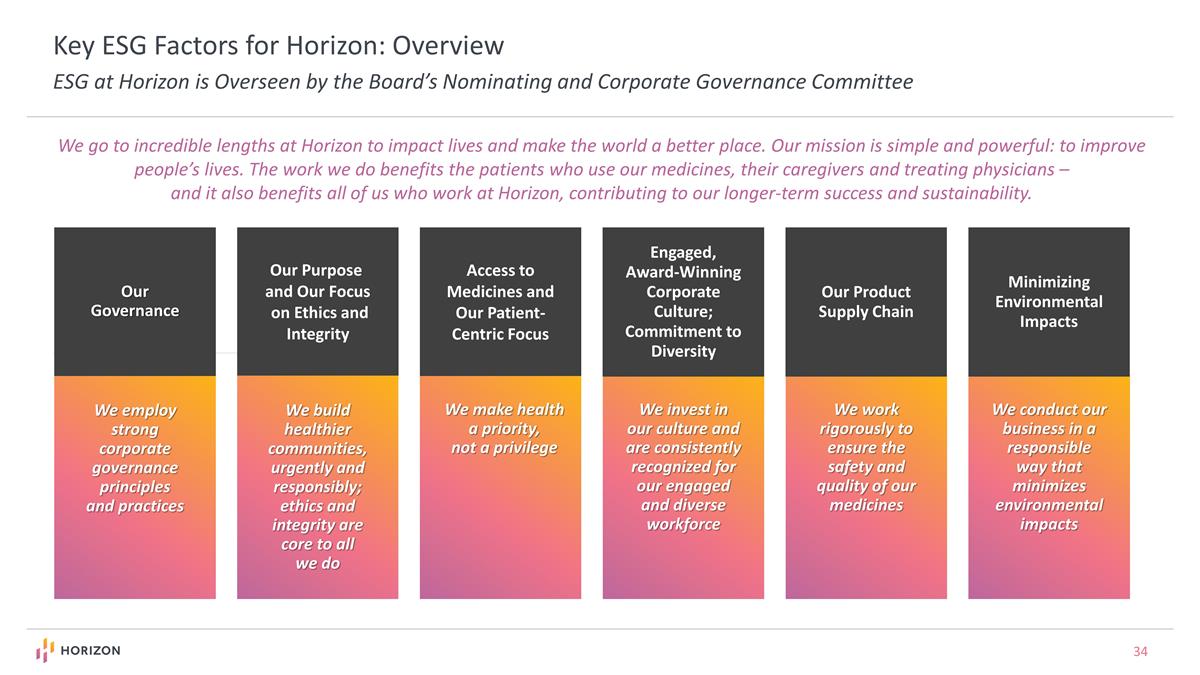

We make health a priority, not a privilege Access to Medicines and Our Patient-Centric Focus Key ESG Factors for Horizon: Overview ESG at Horizon is Overseen by the Board’s Nominating and Corporate Governance Committee We employ strong corporate governance principles and practices Our Governance We build healthier communities, urgently and responsibly; ethics and integrity are core to all we do Our Purpose and Our Focus on Ethics and Integrity We invest in our culture and are consistently recognized for our engaged and diverse workforce Engaged, Award-Winning Corporate Culture; Commitment to Diversity We go to incredible lengths at Horizon to impact lives and make the world a better place. Our mission is simple and powerful: to improve people’s lives. The work we do benefits the patients who use our medicines, their caregivers and treating physicians – and it also benefits all of us who work at Horizon, contributing to our longer-term success and sustainability. We work rigorously to ensure the safety and quality of our medicines Our Product Supply Chain We conduct our business in a responsible way that minimizes environmental impacts Minimizing Environmental Impacts

Reconciliations of GAAP to Non-GAAP Measures

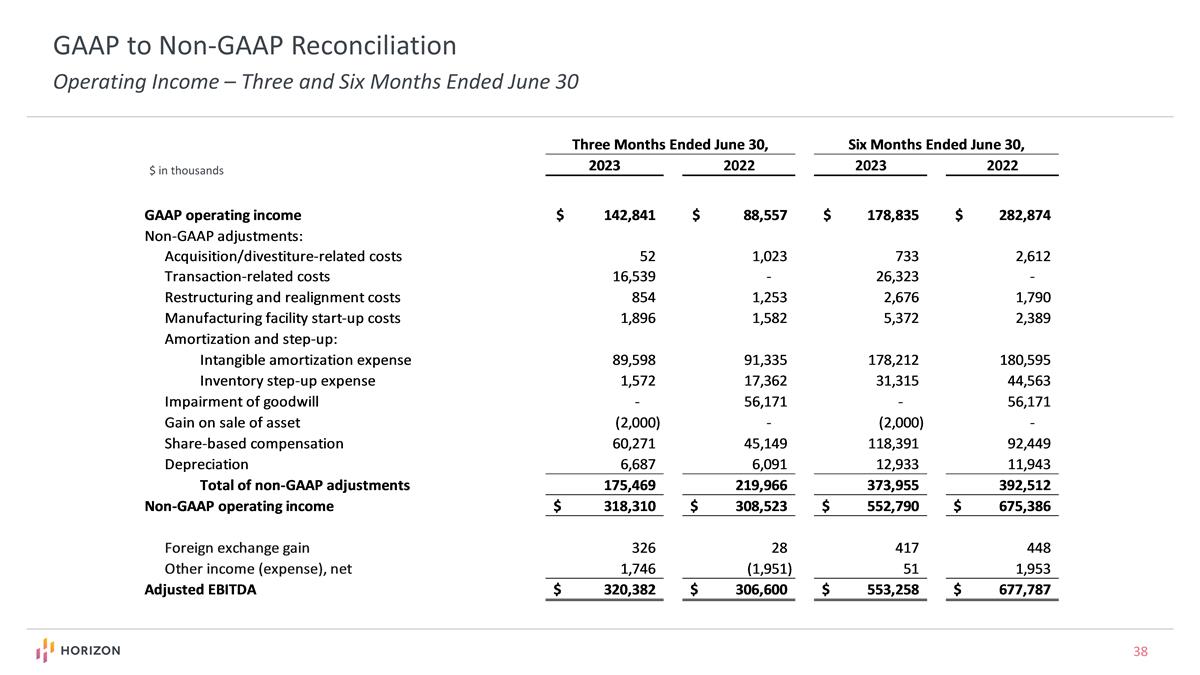

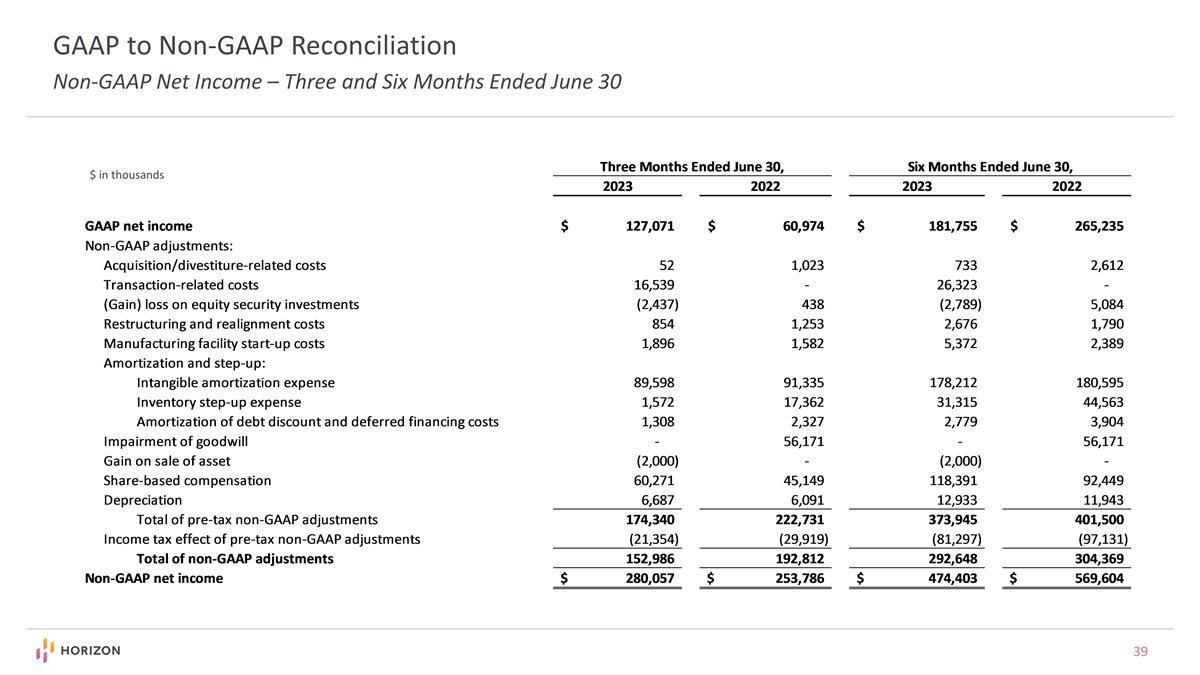

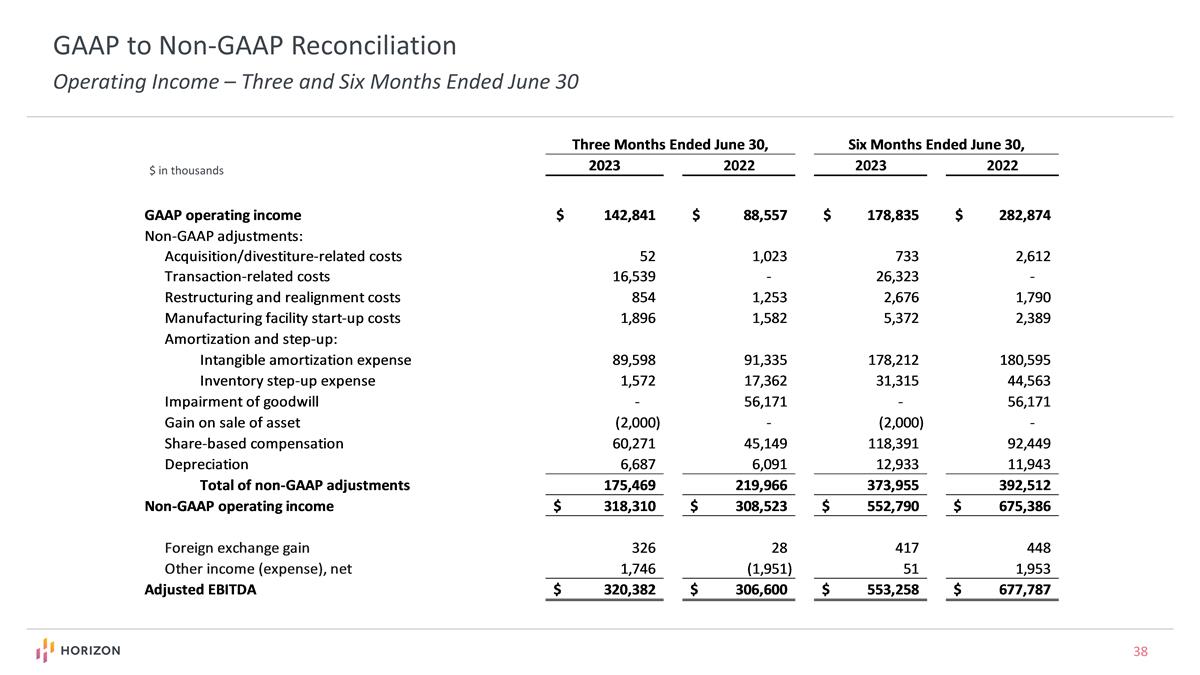

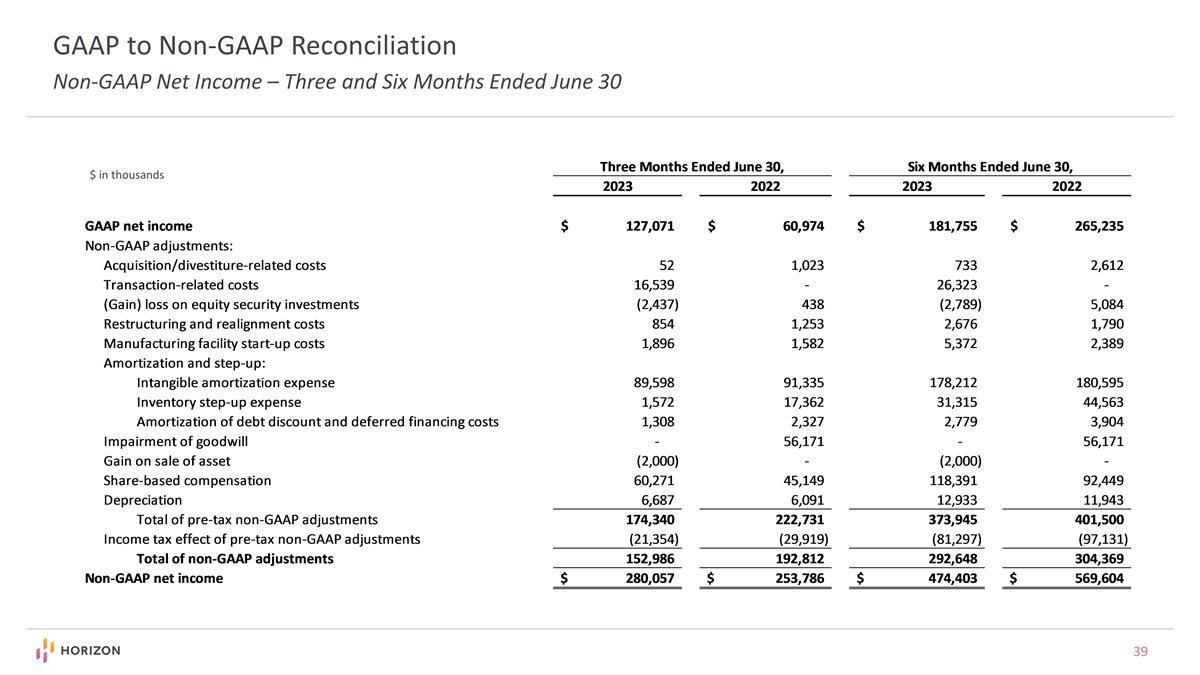

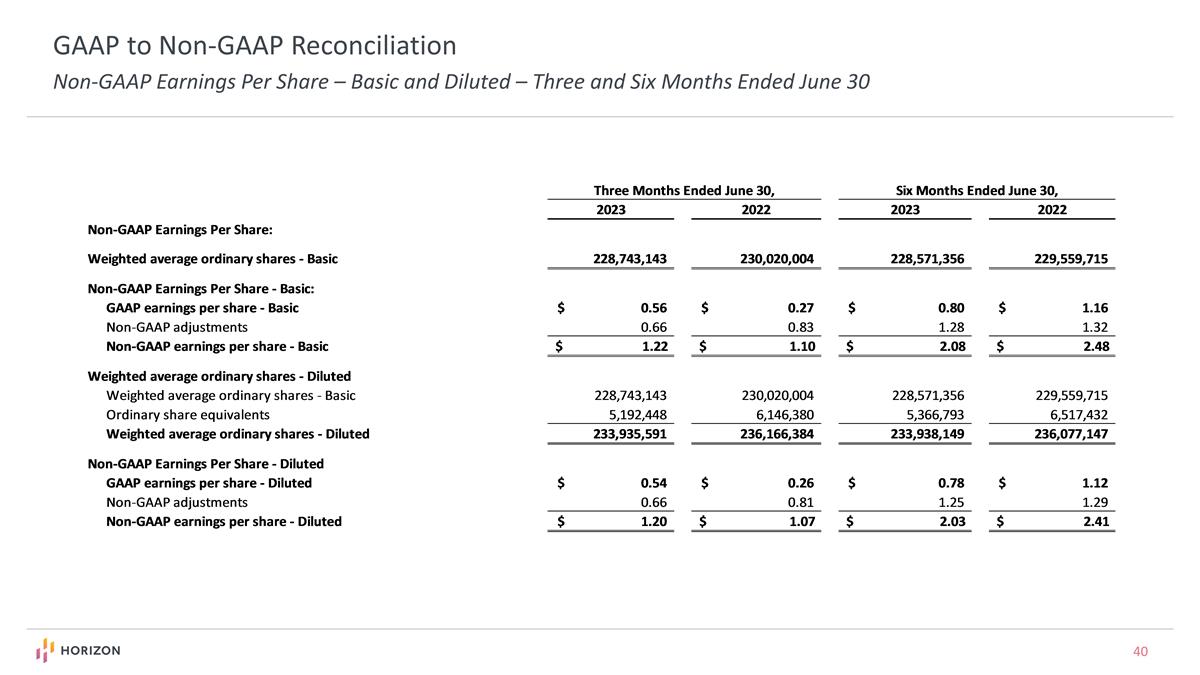

Note Regarding Use of Non-GAAP Financial Measures Horizon provides certain non-GAAP financial measures, including EBITDA, or earnings before interest, taxes, depreciation and amortization, adjusted EBITDA, non-GAAP net income, non-GAAP diluted earnings per share, non-GAAP operating income and certain other non-GAAP income statement line items, each of which include adjustments to GAAP figures. These non-GAAP measures are intended to provide additional information on Horizon’s performance, operations, expenses, profitability and cash flows. Adjustments to Horizon’s GAAP figures exclude, as applicable, acquisition and/or divestiture-related costs, manufacturing facility start-up costs, restructuring and realignment costs, as well as non-cash items such as share-based compensation, inventory step-up expense, depreciation and amortization, non-cash interest expense, goodwill and long-lived assets impairment charges, gain (loss) on equity security investments and sales of assets, and other non-cash adjustments. Certain other special items or substantive events may also be included in the non-GAAP adjustments periodically when their magnitude is significant within the periods incurred. Horizon maintains an established non-GAAP cost policy that guides the determination of what costs will be excluded in non-GAAP measures. Horizon believes that these non-GAAP financial measures, when considered together with the GAAP figures, can enhance an overall understanding of Horizon’s financial and operating performance. The non-GAAP financial measures are included with the intent of providing investors with a more complete understanding of the Company’s historical and expected financial results and trends and to facilitate comparisons between periods and with respect to projected information. In addition, these non-GAAP financial measures are among the indicators Horizon’s management uses for planning and forecasting purposes and measuring the Company's performance. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, non-GAAP financial measures used by other companies.

GAAP to Non-GAAP Reconciliation EBITDA and Adjusted EBITDA – Three and Six Months Ended June 30, Twelve Months Ended December 31, 2022 $ in thousands

GAAP to Non-GAAP Reconciliation Operating Income – Three and Six Months Ended June 30 $ in thousands

GAAP to Non-GAAP Reconciliation Non-GAAP Net Income – Three and Six Months Ended June 30 $ in thousands

GAAP to Non-GAAP Reconciliation Non-GAAP Earnings Per Share – Basic and Diluted – Three and Six Months Ended June 30