Table of Contents

Filed pursuant to Rule 424(b)(3)

Commission File No. 333-167420

FundCore Institutional Income Trust Inc.

Maximum Offering of 75,000,000 Shares of Common Stock

Minimum Offering of 1,000,000 Shares of Common Stock

FundCore Institutional Income Trust Inc. is a newly organized Maryland corporation focused on originating and investing in high-quality commercial real estate loans and other debt investments secured primarily by cash-flowing properties located in the U.S. We will be externally managed and advised by FundCore Advisor LLC, or our advisor. Beginning with our first year of operations, the year ending December 31, 2010, we will elect to be taxed as a Real Estate Investment Trust (“REIT”). We intend to return capital to investors in this offering during a one-year period that commences approximately five years following the end of the offering period, which one-year period shall be referred to herein as the “capital return period.” We may also return capital earlier as some investments amortize, prepay and mature.

We are offering up to 50,000,000 shares of common stock in our primary offering and up to 25,000,000 shares of common stock pursuant to our distribution reinvestment plan at an initial price of $10.00 per share, which price was arbitrarily determined by our board of directors. We reserve the right to reallocate the shares of common stock we are offering between the primary offering and our distribution reinvestment plan. An initial purchase of our shares must generally be at least $1,000,000 per investor, unless we waive such minimum. We will take purchase orders, and investors’ funds will be held in an interest-bearing escrow account with Wells Fargo Bank, N.A., an independent third-party escrow agent, until we (i) receive purchase orders for at least 1,000,000 shares of our common stock and (ii) authorize the release to us of funds in the escrow account, at which time we will commence our operations. We refer to the period prior to the release of offering proceeds from escrow as the “escrow period.” If we do not sell a minimum of 1,000,000 shares of common stock in our primary offering within one year of the commencement of this offering, or October 20, 2011, we will terminate this offering and funds will promptly be returned to all subscribing investors with interest, except for de minimis interest (as defined below). Our primary offering will extend for a period of one year following the end of the escrow period. We refer to such one-year period, together with the escrow period, as the “offering period”.

See “Risk Factors” beginning on page 18 to read about risks you should consider before buying shares of our common stock. These risks include the following:

| • | We have no prior operating history and there is no assurance that we will be able to successfully achieve our investment objectives; |

| • | There is no public trading market for our shares; therefore, it will be difficult for you to sell your shares, and if you are able to sell your shares, you may have to sell them at a substantial loss; |

| • | This is a “blind pool” offering, and you will not have the opportunity to evaluate our investments prior to purchasing shares of our common stock; |

| • | This is a “best efforts” offering, and if we are unable to raise substantial funds, we will be limited in the number and type of investments we may make, which could negatively impact your investment; |

| • | We may be unable to pay or maintain cash distributions or increase distributions over time, and we may have difficulty funding our distributions solely from cash flow from operations and may fund such distributions from offering proceeds, borrowings or the sale of assets, which could reduce the funds we have available for investment and reduce your overall return; |

| • | Our charter does not require that we liquidate during the capital return period; |

| • | Our advisor and its affiliates, including our executive officers and one of our directors, will face conflicts of interest with us and other ventures sponsored by affiliates of our advisor and/or the sponsor, which could result in actions that are not in the long-term best interest of our stockholders; |

| • | If we incorrectly value an impaired asset, the asset management fee payable to our advisor could be in excess of 1.0% of the market value of our assets; and |

| • | If we do not qualify as a REIT or fail to remain qualified as a REIT, we will be subject to tax as a regular corporation and could face a substantial tax liability, which would reduce the amount of cash available for distribution to our stockholders. |

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of our common stock, determined if this prospectus is truthful or complete or passed on or endorsed the merits of this offering. Any representation to the contrary is a criminal offense.

This investment involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. The use of projections or forecasts in this offering is prohibited.

| Price to Public(1) | Proceeds | |||||||

Primary Offering | ||||||||

Per Share of our Common Stock | $ | 10.00 | $ | 10.00 | ||||

Total Minimum | $ | 10,000,000 | $ | 10,000,000 | ||||

Total Maximum | $ | 500,000,000 | $ | 500,000,000 | ||||

Distribution Reinvestment Plan | ||||||||

Per Share of our Common Stock | $ | 10.00 | $ | 10.00 | ||||

Total Maximum(2) | $ | 250,000,000 | $ | 250,000,000 | ||||

| (1) | We will not pay any sales commissions in connection with the sale of shares of our common stock; our advisor will pay deferred sales commissions to the primary dealer out of its asset management fees. |

| (2) | During the offering period, the initial purchase price for shares purchased under the distribution reinvestment plan will be $10.00 per share and following the end of the offering period, we will offer shares under the plan at a per-share purchase price equal to our net asset value, or NAV, divided by the number of shares of our common stock outstanding as of the last business day of the applicable month. We refer to this price as our “NAV per share.” For purposes of this table, we have assumed that all shares sold under the plan are sold at $10.00 per share. |

The primary dealer for this offering, Integrity Investments, Inc., is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered.

October 20, 2010

Table of Contents

Our shares are suitable only as a long-term investment. Because there is no public market for our shares, they will be difficult to sell. In consideration of these factors, we are offering shares to institutions (such as banks, savings institutions, credit unions, trust companies, insurance companies, investment companies registered under the Investment Company Act of 1940, as amended (the “1940 Act”), pension trusts and other similar entities) and purchasers that are exempt under blue sky regulations, whether investing for their own account or in a fiduciary capacity.

The specific types of institutions to whom offers and sales of our shares are permitted varies by jurisdiction. Please see the section titled “Plan of Distribution—Offers and Sales by Broker-Dealers to Institutions,” which describes the suitable offerees in each jurisdiction where our shares may be offered and sold. To ensure compliance with these standards, we require each purchaser to make various representations set forth in a subscription agreement, a form of which is included as Appendix A to this prospectus. We may also ask for supporting documentation to confirm the accuracy of those representations.

Table of Contents

i

Table of Contents

| 29 | ||||

| 33 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 60 | ||||

| 61 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 62 | |||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

| 68 | ||||

Limited Liability and Indemnification of Directors, Officers and Others | 69 | |||

| 70 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| 74 | ||||

| 79 | ||||

| 79 | ||||

| 79 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 84 | ||||

| 84 | ||||

| 84 | ||||

| 85 | ||||

| 85 | ||||

Fees and Other Compensation to the Advisor and its Affiliates | 86 |

ii

Table of Contents

| 86 | ||||

| 86 | ||||

| 88 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| 89 | ||||

Restriction on Ownership and Transfer of Shares of Our Stock | 89 | |||

| 90 | ||||

| 91 | ||||

| 91 | ||||

| 92 | ||||

| 94 | ||||

| 95 | ||||

| 96 | ||||

| 96 | ||||

| 97 | ||||

| 98 | ||||

| 98 | ||||

| 99 | ||||

| 100 | ||||

| 112 | ||||

| 113 | ||||

| 114 | ||||

| 115 | ||||

| 128 | ||||

| 129 | ||||

| 134 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 137 | ||||

| 137 | ||||

| 139 | ||||

| 139 | ||||

| 139 | ||||

| 139 |

iii

Table of Contents

This prospectus summary highlights material information contained elsewhere in this prospectus. To understand this offering fully, you should read the entire prospectus carefully, including the “Risk Factors” section, before making a decision to invest in our common stock. References in this prospectus to “us,” “we,” “our” or “the company” refer to FundCore Institutional Income Trust Inc. and its consolidated subsidiaries.

What is FundCore Institutional Income Trust Inc.?

FundCore Institutional Income Trust Inc. is a newly organized Maryland corporation that intends to qualify as a REIT beginning with the tax year ending December 31, 2010. Once we elect REIT status, we intend to operate in such a manner so that we may continue to qualify for taxation as a REIT. We expect to originate and invest in high-quality commercial real estate loans and other debt investments secured primarily by cash-flowing properties located in the U.S. We collectively refer to such assets as our “target assets.”

We were incorporated in the State of Maryland on May 18, 2010. Because we have not yet identified, originated or acquired any target assets, we will be considered a “blind pool.” We have no paid employees and are externally advised by FundCore Advisor LLC, or our “advisor.” FundCore Real Estate LLC, or the “sponsor,” is the parent of the advisor and the sponsor of this offering. Steven A. Ball, Kevin M. Davis, Robert S. Kukulka and John M. Mulligan presently own, directly or indirectly, 100% of the voting interests and 51% of the economic interests in the sponsor, which owns the advisor, and the sponsor and the advisor are jointly controlled by Messrs. Ball, Davis, Kukulka and Mulligan. Messrs. Ball, Davis, Kukulka and Mulligan are part of the advisor’s management team and investment committee. Other key members of the advisor’s investment committee include John A. Blumberg, James R. Mulvihill and Evan H. Zucker, each of whom, directly or indirectly, holds a minority non-voting economic interest in the sponsor.

We intend to return capital to investors in this offering during the capital return period, which we anticipate funding as the loans we originate are paid off at maturity or sold. We may also return capital earlier as some investments amortize, prepay and mature. However, there can be no assurance that we will not return all or a portion of your capital prior to the start of the capital return period or after the capital return period. Furthermore, there can be no assurance that we will be able to return your capital in full or at all. Our charter does not require us to liquidate during the capital return period.

Our office is located at One World Financial Center, 30th Floor, New York, NY 10281. Our telephone number is (212) 909-5897 and our fax number is (646) 374-4715.

One of our affiliates maintains a website for us at www.fundcoreinvestments.com where you may find additional information about us. The contents of this site are not incorporated by reference in, or otherwise a part of, this prospectus.

What are your investment objectives?

Our primary investment objectives include the following:

| • | Preserving and protecting our stockholders’ capital; |

| • | Providing current income to our stockholders in the form of monthly cash distributions; and |

| • | Returning capital to investors in this offering during the capital return period, and earlier, as some investments amortize, prepay and mature. |

See “Business, Investment Objectives and Policies—Investment Objectives” for a more complete description of our investment policies and investment restrictions.

What is the market opportunity?

We believe the current opportunity in the U.S. commercial real estate debt markets is driven by a contraction in credit that started in the sub-prime residential mortgage market in early 2007 and which ultimately triggered a deep global recession in 2008. Since late 2008, a number of large financial institutions have filed for bankruptcy, were forced to merge or otherwise sought significant equity injections from the U.S. government to remain solvent. As a result of these events, the multi-trillion dollar commercial real estate mortgage market has experienced significant dislocation.

1

Table of Contents

Commercial banks, which historically represented the largest source of commercial real estate mortgage capital, have sharply reduced new loan origination as they focus on repairing their balance sheets and working out troubled loans. Moreover, recent regulatory changes have facilitated banks’ keeping impaired real estate loans on their balance sheets, likely limiting banks’ new loan origination volumes for the foreseeable future.

The commercial mortgage backed securities (“CMBS”) market, which was the second largest source of mortgage capital and which provided $230 billion of liquidity to commercial real estate in 2007, has contracted meaningfully, with approximately $15 billion of issuance between the beginning of 2008 and July 9, 2010.

This decrease in the supply of mortgage capital is occurring as the industry is facing a significant wave of commercial real estate loan maturities over the next several years. We believe the mismatch between the supply and demand for commercial real estate debt has created a significant opportunity to originate high-quality mortgage loans at attractive coupons. We also believe the lack of mortgage capital gives rise to potential opportunities to provide subordinated debt and preferred equity.

See “Market Opportunity” for a detailed description of the opportunities in the U.S. commercial real estate debt market.

2

Table of Contents

How do you intend to take advantage of this opportunity?

We will seek to take advantage of this opportunity through the origination or acquisition of target assets, which may include, but are not limited to, the following:

Mortgage Loans Secured by Commercial Real Properties

We may invest in commercial mortgages and other commercial real estate interests consistent with the requirements for qualification as a REIT. We may acquire or originate interests in mortgage loans, which may pay fixed or variable interest rates or have “participating” features. Our loans may include first mortgage loans, second mortgage loans and leasehold mortgage loans. Loans will usually not be insured or guaranteed by the U.S. government, its agencies or anyone else. They will usually be nonrecourse, which means they will not be the borrower’s personal obligations.

We will generally require a security interest in the underlying properties or leases. The advisor generally will rely on its own analysis in determining whether to make or acquire a particular loan and may obtain independent appraisals for underlying real property.

B-notes

We may purchase from third parties, and may retain from mortgage loans we originate and securitize or sell, subordinated interests referred to as “B-notes.” B-notes are loans secured by a first mortgage and subordinated to a senior interest, referred to as an “A-note.” The subordination of a B-note is generally evidenced by a co-lender or participation agreement between the holders of the related A-note and the B-note. In some instances, the B-note lender may require a security interest in the stock or partnership interests of the borrower as part of the transaction. A B-note lender has the same obligations, collateral and borrower as the corresponding A-note lender, but is typically subordinated in recovery upon a default. B-notes share certain credit characteristics with second mortgages, in that both are subject to greater credit risk with respect to the underlying mortgage collateral than the corresponding first mortgage or A-note, and as a result generally carry a higher rate of interest. When we acquire or originate B-notes, we may earn income on the investment, in addition to interest payable on the B-note, in the form of fees charged to the borrower under that note. If we originate first mortgage loans, we may divide the loans, securitizing or selling the A-note and keeping the B-note for investment.

Mezzanine Loans

We may invest in mezzanine loans that are senior to the borrower’s common and preferred equity in, and subordinated to a first mortgage loan as well as B-notes and C-notes, if any, on a property. These loans are typically secured by pledges of ownership interests, in whole or in part, in entities that directly or indirectly own the real property.

Mezzanine loans may have elements of both debt and equity instruments, offering the fixed returns in the form of interest payments and principal payments associated with senior debt, while providing lenders an opportunity to participate in the capital appreciation of a borrower, if any, through an equity interest. Due to their higher risk profile and often less-restrictive covenants, as compared to senior loans, mezzanine loans are generally structured to earn a higher return than senior secured loans. Mezzanine loans also may include a “put” feature, which permits the holder to sell its equity interest back to the borrower at a price determined through an agreed-upon formula.

3

Table of Contents

CMBS Bonds

We may invest in fixed- and floating-rate bonds that are collateralized by one or more loans secured by one or more commercial properties. The CMBS that we expect to acquire as target assets will generally have a duration of three years or greater. However, prior to identifying investments in target assets or as part of an overall cash management strategy, we may acquire short-duration CMBS, generally having durations of less than three years, which should not be considered target assets.

Other Investments:

We may invest in certain “Other Investments” which may include, but are not limited to, preferred equity and bridge loans.

What will be the characteristics of your target assets?

We generally will seek to invest in or originate high-quality commercial real estate loans and other debt investments secured primarily by cash-flowing properties located in the U.S. We generally will focus on the major property types within commercial real estate – multifamily, industrial, office, retail and hospitality – but we may also seek to lend on certain other property types with strong credit characteristics. We intend to focus on lending to commercial real estate owners with significant experience in the respective asset class being financed and with the financial wherewithal to support an asset in periods of distress. With respect to CMBS bonds, we intend to focus on acquiring bonds that are secured by an underlying pool of assets that we believe can sustain a significant decline in cash flows and expansion in interest rate, with less likelihood of adversely affecting the principal repayment of the class of bonds acquired.

We will seek to construct a portfolio that is ultimately made up of not less than 75% first mortgage loans, with the balance of the portfolio containing subordinated debt (B-notes and mezzanine loans), CMBS, preferred equity, bridge loans and other investments. We may, however, in our sole discretion, determine a different mix of target assets.

With respect to first mortgage loans and CMBS, we generally will seek to originate or acquire loans of up to 75% loan-to-value (“LTV”), with a ratio of cash flow to debt service in excess of 115%, but we do have the ability to originate or acquire first mortgage loans and CMBS that do not adhere to these parameters. Further, our investments in subordinated debt, preferred equity, bridge loans and other investments will likely not adhere to these parameters.

4

Table of Contents

What are your leverage policies?

We intend to employ prudent leverage, to the extent available, to fund the acquisition of our target assets and to increase potential returns to our stockholders. We intend to utilize portfolio leverage of approximately 50% of the cost of our gross assets; however, pursuant to our charter, portfolio leverage shall not exceed 75% of the cost of our gross assets.

Are there any risks involved in an investment in your shares?

An investment in our shares involves significant risk. You should read the “Risk Factors” section of this prospectus beginning on page 18. That section contains a detailed discussion of material risks that you should consider before you invest in the common stock we are offering with this prospectus. Some of the more significant risks relating to an investment in our shares include the following:

| • | We have no prior operating history and there is no assurance that we will be able to successfully achieve our investment objectives; |

| • | There is no public trading market for our shares; therefore, it will be difficult for you to sell your shares; |

| • | This is a “blind pool” offering, and you will not have the opportunity to evaluate our investments prior to purchasing shares of our common stock; |

| • | This is a “best efforts” offering, and if we are unable to raise substantial funds, we will be limited in the number and type of investments we may make, which could negatively impact your investment; |

| • | If we raise substantial offering proceeds in a short period of time, we may not be able to invest all of the offering proceeds promptly, which may cause our distributions and your investment returns to be lower than they otherwise would be; |

| • | The initial offering price for shares of our common stock was arbitrarily determined by our board of directors. The subsequent NAV-per-share price at which you purchase our shares of common stock pursuant to our dividend reinvestment plan or we repurchase our shares of common stock pursuant to our share repurchase program may not accurately represent the current value of our assets at any particular time, and may not reflect changes in our NAV that are not immediately quantifiable. The $10.00 per share price during the offering period may not necessarily reflect our NAV at any particular time; |

| • | We may be unable to pay or maintain cash distributions or increase distributions over time, and we may have difficulty funding our distributions solely from cash flow from operations and may fund such distributions from offering proceeds, borrowings or the sale of assets, which could reduce the funds we have available for investment and reduce your overall return; |

| • | We may be unable to return capital to investors in this offering by the conclusion of the capital return period; |

| • | Our charter does not require that we liquidate during the capital return period; |

| • | Our advisor and its affiliates, including our executive officers and one of our directors, will face conflicts of interest with us and other ventures sponsored by affiliates of our advisor and/or the sponsor, which could result in actions that are not in the long-term best interest of our stockholders; |

| • | If we incorrectly value an impaired asset, the asset management fee payable to our advisor could be in excess of 1.0% of the market value of our assets; |

| • | The advisory agreement with our advisor was not negotiated on an arm’s-length basis and may not be as favorable to us as if it had been negotiated with an unaffiliated third party and may be costly and difficult to terminate; |

| • | Our charter limits the number of shares a person may own, which may discourage a takeover that could otherwise result in a premium price to our stockholders; |

5

Table of Contents

| • | We may return significant amounts of capital to investors in this offering prior to the conclusion of the capital return period, and, as a result, our stockholders could be subject to reinvestment risk; |

| • | A significant increase in liquidity for commercial real estate loans and other debt investments could substantially reduce opportunities for us to invest in target assets and may negatively impact our results of operations; |

| • | Inflation may inhibit our ability to conduct our business and acquire or dispose of target assets or debt financing at attractive prices, and your overall return may be reduced; |

| • | We are likely to incur indebtedness, which may increase our business risks and adversely affect the return on our target assets; |

| • | Increases in interest rates could increase the amount of our debt payments, thereby negatively impacting our operating results and decreasing the market value of our assets; |

| • | Hedging against interest rate exposure may adversely affect our earnings, which could reduce our cash available for distribution to our stockholders; and |

| • | If we do not qualify as a REIT or fail to remain qualified as a REIT, we will be subject to tax as a regular corporation and could face a substantial tax liability, which would reduce the amount of cash available for distribution to our stockholders. |

Who is your advisor and what will the advisor do?

FundCore Advisor LLC is our advisor. Our advisor was formed as a Delaware limited liability company on May 19, 2010. We will contract with the advisor to manage our day-to-day activities and to implement our investment strategy. Under the advisory agreement, the advisor must use commercially reasonable efforts, subject to the oversight of our board of directors, to, among other things, research, identify, review and make investments in and dispositions of investments on our behalf consistent with our investment policies and objectives. The advisor performs its duties and responsibilities under the advisory agreement. The initial term of the advisory agreement expires on the fifth anniversary of the date on which the escrow period ends and will be automatically renewed for a one-year term each anniversary date thereafter unless previously terminated. The advisory agreement was not negotiated at arm’s length, and we may pay more for advisory services than we otherwise would have if we had negotiated the advisory agreement at arm’s length. Our officers and our affiliated directors are all officers of the advisor.

What is our advisor’s competitive advantage?

The advisor’s management team and investment committee have substantial experience in many aspects of commercial real estate debt, equity and capital markets over multiple cycles, and we will benefit significantly from this expertise:

| • | Significant Lending Experience: Certain members of our advisor’s management team and investment committee previously ran a commercial real estate lending platform at Merrill Lynch for the U.S., Canada and Japan from 2001-2009, during which period they participated in the origination of a significant volume of first mortgage loans, B-notes and mezzanine loans. Further, certain members of our advisor’s management team have been involved in commercial real estate lending and capital markets during several periods of dislocation, including the commercial real estate recession of 1988 to 1992, the 1998 credit crisis/Long Term Capital Management debacle and the 2008-2009 credit crisis. We believe this experience will enable us to successfully originate and structure loans in today’s rapidly changing lending environment. |

| • | Strong Loan Sourcing Capabilities: While at Merrill Lynch, certain members of our advisor’s management team and investment committee transacted with a significant number of borrowers and have strong relationships with many of the largest commercial real estate owners and financial intermediaries which control a significant share of commercial real estate loan volume. We believe these relationships will provide us with significant investment opportunities. |

6

Table of Contents

| • | Capital Markets Expertise: Certain members of our advisor’s management team and investment committee have been active in the capital markets since the late 1980s and the establishment of the CMBS lending market in the early 1990s. Additionally, certain members of our advisor’s management team and investment committee have been active in the loan syndication market and have strong relationships with buyers and sellers of commercial real estate debt. We believe our advisor’s capital markets expertise provides us with sophisticated structuring capabilities and an ability to execute complex capital markets transactions. |

| • | Commercial Real Estate Equity Expertise: As of June 30, 2010, certain members of the advisor’s investment committee, directly or indirectly through affiliated entities, operated and owned a number of retail, office and industrial properties, in markets throughout the U.S. We will rely on the experience of certain members of the advisor’s investment committee to get a real-time view on markets and tenants, which will enhance our underwriting of assets. We believe that our ability to understand assets from both a debt and equity perspective is especially important in the current market, where asset values may continue to remain under pressure. Also, in the unlikely event we need to foreclose on an asset, this equity experience will enable us to operate the property and not be forced into a “fire sale” of the asset, as are many lenders that do not have equity capabilities. |

| • | Experience Establishing and Advising Multiple Commercial Real Estate Platforms: Certain members of the advisor’s investment committee, directly or indirectly through affiliated entities, have established and advised multiple commercial real estate platforms. Specifically, such members, directly or indirectly through affiliated entities, collectively or in various combinations, have sponsored, past and present, four REITs: (i) Keystone Property Trust (formerly known as American Real Estate Investment Corp.) (NYSE: KTR), (ii) DCT Industrial Trust Inc. (formerly known as “Dividend Capital Trust Inc.”) (NYSE: DCT), (iii) Dividend Capital Total Realty Trust Inc. and (iv) Industrial Income Trust Inc. In addition to their participation in the sponsorship of these ventures, these members, directly or indirectly through affiliated entities, have served as sponsors, officers, managers, partners, directors or joint venture partners in a number of private real estate ventures. The advisor anticipates that it will benefit from this experience in its operations. |

What is your stockholder distribution policy and how will you calculate the payment of distributions to stockholders?

We expect to pay a monthly distribution based on realized net income and all or a portion of any loan amortization received, beginning 45 days after the initial closing. To maintain our qualification as a REIT, we are required to make aggregate annual distributions to our stockholders of at least 90% of our REIT taxable income. REIT taxable income is computed without regard to the distributions-paid deduction and excludes net capital gain. Further, REIT taxable income does not necessarily equal net income as calculated in accordance with accounting principles generally accepted in the United States (“GAAP”). Our board of directors may authorize distributions in excess of those required for us to maintain REIT status depending on our financial condition and such other factors as our board of directors deems relevant. We may pay distributions from any source, including proceeds from this offering, borrowings and the sale of assets. Distributions may constitute a return of capital. We have not established a minimum distribution level.

May I reinvest my distributions in shares of FundCore Institutional Income Trust Inc.?

Yes. We have adopted a distribution reinvestment plan. If you are eligible, you may participate in our distribution reinvestment plan by checking the appropriate box on your subscription agreement or by filling out an enrollment form that we will provide to you at your request. During the offering period (including if we extend the offering period), the initial purchase price for shares purchased under this plan will be equal to our $10.00 per share offering price, which was arbitrarily determined by our board of directors. Following the end of the offering period, we will begin calculating our NAV on a monthly basis, and we will offer shares of our common stock pursuant to our distribution reinvestment plan at a per-share purchase price equal to our NAV per share as of the last business day of the applicable month. See “—How long will this offering last?” for a discussion of how we will notify you each month following the end of the offering period of what our NAV and NAV per share is. We may amend, suspend or terminate our distribution reinvestment plan at our discretion at any time provided that any amendment that adversely affects the rights or obligations of participants (as determined by the board) will only take effect on the tenth day following written notice to participants or upon publication of a press release or filing of a current or periodic report with the SEC. For more information regarding the distribution reinvestment plan, see “Description of Capital Stock—Distribution Reinvestment Plan.”

7

Table of Contents

Will the distributions I receive be taxable as ordinary income?

Generally, distributions that you receive, including distributions that are reinvested pursuant to our distribution reinvestment plan, will be taxed as ordinary income (or capital gain, if our distributions are designated as capital gain dividends) to the extent they are from our current or accumulated earnings and profits.

It is possible that some portion of your distributions will not be subject to tax in the year in which they are received because distributions paid by us may exceed our earnings and profits as calculated for tax purposes. The portion of your distribution that is not subject to tax immediately is considered a return of capital for tax purposes and will reduce the tax basis of your investment. Distributions that constitute a return of capital effectively defer a portion of your tax until your investment is sold or FundCore Institutional Income Trust Inc. is liquidated, at which time you will be taxed at capital gains rates. Any such return of capital in excess of the tax basis of your investment will be taxed as gain from the sale of our stock. However, because each investor’s tax considerations are different, we suggest that you consult with your tax advisor. You should also review the section of the prospectus entitled “U.S. Federal Income Tax Considerations.”

How will you use the proceeds raised from this offering?

We intend to use all of the gross proceeds from this offering to invest in target assets. A portion of our gross proceeds may be used to repurchase our common stock pursuant to our proposed share repurchase program.

More specifically, the amounts listed in the table below represent our current estimates concerning the use of the offering proceeds. Since these are estimates, they may not accurately reflect the actual receipt or application of the offering proceeds. The minimum dollar amount columns assume we will sell the minimum of 1,000,000 shares of common stock in this offering and the maximum dollar amount columns assume we will sell our maximum of 50,000,000 primary offering shares at $10.00 per share.

| Minimum Dollar Amount | Percent | Maximum Dollar Amount | Percent | |||||||||

Gross offering proceeds | $ | 10,000,000 | 100% | $ | 500,000,000 | 100% | ||||||

Amount available for investment | $ | 10,000,000 | 100% | $ | 500,000,000 | 100% | ||||||

Proceeds invested | $ | 10,000,000 | 100% | $ | 500,000,000 | 100% | ||||||

Total application of proceeds(1)(2)(3) | $ | 10,000,000 | 100% | $ | 500,000,000 | 100% | ||||||

Estimated organization and offering expenses | $ | 3,300,000 | (3) | $ | 3,300,000 | (3) | ||||||

| (1) | For purposes of this table only, we assume that there will be no repurchases, which would otherwise reduce proceeds available for investment. Because of the limited ability to repurchase and inability to estimate the number of stockholders who will request repurchase, we are unable to estimate the percentage of proceeds from the sale of shares that we expect will be used to repurchase shares of our common stock under the proposed share repurchase program. See “Description of Capital Stock—Share Repurchase Program.” |

| (2) | Our advisor will pay the primary dealer an annual deferred sales commission of up to 1.0% of the gross offering proceeds we raise from the sale of shares in the primary offering, without recourse against or reimbursement by us, provided, however, that the aggregate deferred sales commission paid to the primary dealer shall not exceed 5.0% of the gross offering proceeds we raise from the sale of shares in the primary offering. If a participating broker-dealer effects the sale, the primary dealer will pay the participating broker-dealer a deferred sales commission on the gross proceeds from sales of our shares by such participating broker-dealer. Deferred sales commissions will be paid by the advisor from the advisor’s asset management fees, described under “Compensation Table,” and will not reduce funds available for investment in target assets or stockholder distributions. |

| (3) | Our advisor will be responsible for paying our cumulative organizational and offering expenses. Although we intend to reimburse our advisor for paying such expenses, we will not use proceeds from this offering to do so. |

Until we invest the proceeds of this offering in target assets, we may invest in short-term, highly liquid instruments or other authorized investments. Such short-term investments, which may also include short-duration CMBS, will not earn as high a return as we expect to earn on our investments in target assets, and we may not be able to invest the proceeds in target assets promptly. See “Estimated Use of Proceeds” for a more detailed description of the estimated use of the proceeds of the offering.

8

Table of Contents

What kind of offering is this?

We are offering up to 50,000,000 shares of common stock on a “best efforts” basis. The broker-dealers participating in the offering are only required to use their best efforts to offer and sell up to 50,000,000 shares of our common stock in our primary offering at a price of $10.00 per share, but we must sell a minimum of 1,000,000 shares to achieve the minimum threshold and minimum amount of funds necessary to commence our operations.

We are also offering 25,000,000 shares of common stock under our distribution reinvestment plan at an initial offering price of $10.00 per share during the offering period. We reserve the right to reallocate the shares of common stock we are offering between the primary offering and our distribution reinvestment plan as described below under “Plan of Distribution.” Following the end of the offering period, we will begin calculating our NAV on a monthly basis, and we will offer shares of our common stock pursuant to our distribution reinvestment plan at a per-share purchase price equal to our NAV per share, as calculated on the last business day of the applicable month. See “—How long will this offering last?” for a discussion of how we will notify you each month following the end of the offering period of what our NAV and NAV per share is.

How does a “best efforts” offering work?

When shares are offered on a “best efforts” basis, the broker-dealers participating in the offering are only required to use their best efforts to sell the shares and have no firm commitment or obligation to purchase any of the shares.

How long will this offering last?

We will take purchase orders, and investors’ funds will be held in an interest-bearing escrow account with Wells Fargo Bank, N.A., an independent third-party escrow agent, until we (i) receive purchase orders for at least 1,000,000 shares of our common stock and (ii) authorize the release to us of funds in the escrow account, at which time we will commence our operations. Funds in escrow will be invested in short-term investments that can be readily sold or otherwise disposed of for cash without any significant risk of dissipation of the offering proceeds invested. If we do not sell a minimum of 1,000,000 shares of common stock in our primary offering within one year of the commencement of this offering, or October 20, 2011, we will terminate this offering and funds will promptly be returned to all subscribing investors with interest, except forde minimis interest. Even if we sell the minimum of 1,000,000 shares of common stock in our primary offering within one year of the commencement of this offering, interest will be paid on all escrowed funds unless (i) the minimum offering amount is achieved on the first day we commence the offering or (ii) the total amount of interest payable is lower than the costs and expenses to the company associated with any such payment, which we refer to as “de minimis interest.” Our primary offering will extend for a period of one year following the end of the escrow period. We may extend the offering period, in which case we will supplement or amend this prospectus accordingly. Following the end of the offering period, we will begin calculating our NAV on a monthly basis, and we will offer shares of our common stock pursuant to our distribution reinvestment plan at a per-share purchase price equal to our NAV per share. We anticipate posting our NAV per share on our website prior to the close of business on the first business day of the applicable month as is more fully described below. We may terminate this offering at any time.

Following the end of the offering period, we will file with the SEC after the end of the last business day of each month a prospectus supplement disclosing the monthly determination of our NAV and the calculation of NAV per share for that month, which we refer to as the pricing supplement. Each month, we will also post that pricing supplement on our public website at www.fundcoreinvestments.com. The website will also contain this prospectus, including any supplements and amendments.

Institutions and other purchasers exempt under blue sky regulations may participate in this offering. For more information, please read the more detailed description under “Suitability Standards” immediately following the cover page of this prospectus and below under “Plan of Distribution—Offers and Sales by Broker-Dealers to Institutions.”

Are there any special restrictions on the ownership of shares?

Yes. Our charter prohibits the ownership of more than 9.8% in value or 9.8% in number of shares, whichever is more restrictive, of our outstanding common stock, unless exempted by our board of directors. This prohibition may inhibit large investors from purchasing shares. In order to comply with tax rules applicable to REITs, we will require our record holders to provide us with detailed information regarding the beneficial ownership of our shares on an annual basis.

9

Table of Contents

These restrictions are designed to assist us in complying with the ownership restrictions imposed on REITs by the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), among other purposes. See “Description of Capital Stock—Restriction on Ownership and Transfer of Shares of Our Stock.”

Is there any minimum investment required?

Yes. An initial purchase of our shares must generally be at least $1,000,000 per investor, unless we waive such minimum. Once you have satisfied the applicable minimum purchase requirement, any additional purchases of our shares in this offering must be in amounts of at least $100,000, except for additional purchases pursuant to our distribution reinvestment plan. See “Plan of Distribution—The Offering.”

How does an investor subscribe for shares?

If an investor chooses to acquire shares in this offering, that particular investor will need to fill out a subscription agreement in the form included in this prospectus as Appendix A. The subscription agreement requires that the investor buy a specific number of shares and pay for such shares at the next monthly share purchase date, generally the first business day of each month.

What is the per-share purchase price in the primary offering?

The per-share purchase price for shares of our common stock in the primary offering will be $10.00, which price was arbitrarily determined by our board of directors. During the offering period, we will not be calculating our NAV. The $10.00 per share price does not necessarily reflect our NAV at any particular time. There can be no assurance that when we begin to calculate our NAV following the end of the offering period, or at any time thereafter, our NAV will be $10.00 or greater.

What is the per-share purchase price pursuant to the distribution reinvestment plan?

During the offering period (including if we extend the offering period), the per-share purchase price for shares of our common stock purchased pursuant to our distribution reinvestment plan will initially be $10.00, which price was arbitrarily determined by our board of directors. Following the end of the offering period, we will begin calculating our NAV on a monthly basis, and we will offer shares of our common stock pursuant to our distribution reinvestment plan at a per-share purchase price equal to our NAV per share. See “—How long will this offering last?” for a discussion of how we will notify you each month following the end of the offering period of what our NAV and NAV per share is. During the offering period, we will not be calculating our NAV. The $10.00 per share price does not necessarily reflect our NAV at any particular time. There can be no assurance that when we begin to calculate our NAV following the end of the offering period, or at any time thereafter, our NAV will be $10.00 or greater.

How will NAV per share be calculated?

Beginning on the last business day of the month following the end of the offering period, we, with the assistance of our advisor and a third-party administrator—Cortland Fund Services LLC—will calculate our NAV per share on a monthly basis. Our NAV per share will be calculated by dividing the value of all of our assets (including accrued interest and distributions), less all liabilities (including accrued expenses and distributions declared but unpaid), by the total number of common shares outstanding as of the close of business on the last business day of each month. Our board of directors, including a majority of our independent directors, will adopt valuation guidelines that contain a comprehensive set of methodologies to be used by our advisor and the third-party administrator in connection with the calculation of our NAV. For more information regarding the calculation of NAV per share, see “Business, Investment Objectives and Policies – Calculation of NAV.”

What is the value of the target assets that you currently own?

Currently, we hold no interests in any target assets and have not yet identified any target assets to acquire or originate.

What does it mean that you are considered a “blind pool” offering and how is that significant?

Traditionally, public real estate programs acquire interests in one or more properties, mortgage loans or other real estate-related assets. The property or properties, mortgage loans or other real estate-related assets in which such public programs intend to invest are not always known before commencing the offering. When the real estate program has not identified a significant number of the properties, mortgage loans or other real estate-related assets that it intends to acquire, the real estate program is commonly referred to as a “blind pool” program. During such a blind pool offering, we will identify the assets we will acquire or originate during and possibly after our public offering has closed. Pending our investment in target assets, we expect to invest the offering proceeds in short-term government securities or other liquid instruments.

10

Table of Contents

We believe that the blind pool format offers us greater flexibility than a specified-target assets program because we are more likely to have funds in hand before identifying target assets for origination or acquisition. Otherwise, our advisor would need to begin the registration process only after identifying specific assets we may acquire or originate. Under this scenario, we would operate at a significant competitive disadvantage in originating or acquiring these assets as compared to those competitors who may have currently available sources of financing. Since we own no target assets, you cannot currently consider the financial history of any assets we may acquire or originate.

What are the fees that will be paid to the advisor and its affiliates and other participants in connection with this offering?

Our advisor, its affiliates and Integrity will receive compensation and reimbursement for services relating to this offering and the investment and management of our assets. Some of the fees paid to our advisor, such as asset-management fees, will be paid irrespective of the quality of the services provided and will be unrelated to our performance. The most significant items of compensation are set forth in the table below.

Type of Compensation and | Description and Method of | Estimated annual | Estimated annual | |||

| Offering Stage | ||||||

| Selling Commissions -Integrity Investments Inc. | We will not pay any sales commissions in connection with the sale of shares of our common stock; our advisor will pay an annual deferred sales commissions to the primary dealer out of its asset management fees which shall not in the aggregate exceed 5.0% of the gross offering proceeds raised from the sale of primary shares. See “Plan of Distribution” for a description of such deferred sales commissions to be paid by our advisor. | N/A | The Advisor, and not us, will pay the primary dealer up to a minimum of $100,000 and a maximum of $5,000,000. | |||

| Operational Stage | ||||||

Asset Management Fee-FundCore Advisor LLC | We will pay the Advisor a monthly fee equal to one-twelfth of 1.0% of the sum of the aggregate Cost Basis of all investments (including short-term, highly liquid investments) and cash in the Company’s portfolio on the last business day of each month, excluding proceeds from this offering prior to the initial investment (including investment in short-term, highly liquid investments) of such proceeds.

“Cost Basis” means the total amount actually paid or allocated (as of the date of origination or acquisition) with respect to the origination or acquisition of an investment (except in the case of CMBS bonds which will be marked-to-market), including without limitation acquisition expenses the Company capitalizes and any debt attributable to such investment, less any impairments which shall be calculated in accordance with GAAP. (1) | $400,000-$20,000,000 (assuming maximum permissible use of leverage of 75% of cost of our gross assets)

| N/A

| |||

Borrower Paid Origination Fee- FundCore Advisor LLC | Up to 1% of the value of the debt investment amount to be paid by the borrower under the debt investment; the portion of borrower-paid origination fees in excess of 1% shall be paid to us. | N/A | Borrowers may pay one time origination fees of $400,000 to $20,000,000 (assuming maximum permissible use of leverage of 75% of the cost of our gross assets and an origination fee is realized on all investments). | |||

| Other Organization and Offering Expenses-FundCore Advisor LLC andIntegrity Investments LLC | Our advisor will also be responsible for paying our cumulative organization and offering expenses, including legal, accounting, printing and other expenses related to the distribution of this offering, and for reimbursing the primary dealer’s and participating broker-dealers’ out-of-pocket expenses on a non-accountable basis up to $1,000,000, which is deemed to be underwriting compensation under FINRA (as hereinafter defined) rules, as well as reimbursing their bona fide due diligence expenses. We intend to reimburse the advisor, without limitation, for paying such organization and offering expenses and bona fide due diligence expenses amortized over a period of five years, payable monthly, commencing with the completion of the offering period; provided, however, that we shall not use proceeds from this offering to reimburse such expenses. | $3,300,000 | N/A | |||

| Other Operational Expenses-FundCore Advisor LLC andthird party providers | In addition to the fees described above, the Company is responsible for paying its operational costs, including but not limited to fees paid to our third-party administrator, Cortland Fund Services LLC, servicing fees and expenses incurred by the advisor in connection with its provision of services to us other than personnel costs in connection with services for which our advisor receives asset management fees. Such personnel costs for which the advisor will not be reimbursed by us includes salaries and benefits paid to our named executive officers. We are not obligated to pay any fees in connection with the disposition of our assets or in connection with our liquidation as no such fee is required pursuant to our advisory agreement with our advisor. See “The Advisor and the Advisory Agreement,” “Compensation Table” and “Plan of Distribution” for a more detailed description of the fees and expenses payable to our advisor and the primary dealer. | (2) | N/A | |||

| (1) | The Cost Basis of an asset will not increase if the value of an asset increases and consequently, the asset management fee will not increase if the value of an asset increases, except in the case of CMBS bonds, which will be marked-to-market and which cost basis, and thus the asset management fee, could increase. |

| (2) | Our Other Operational Expenses are unable to be estimated at this time. |

11

Table of Contents

Who is Integrity Investments, Inc. and what will it do?

Integrity Investments, Inc. (“Integrity” or the “primary dealer”) is a member firm of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and was organized in Florida in September 1992. Integrity is an independent third party, not affiliated with our advisor. Integrity will serve as the primary participating broker-dealer for our best efforts offering and may also authorize other broker-dealers that are FINRA members to sell our shares.

Who is Cortland Fund Services LLC and what will it do?

Our advisor has contracted with Cortland Fund Services LLC, to provide us and our advisor with assistance in various administrative functions, including the calculation of our NAV per share. We will be responsible for calculating our NAV per share in accordance with procedures approved by our board, however, Cortland will assist our advisor in making such calculation of our NAV per share. Cortland is a provider of fund administration and outsourcing services to hedge funds, asset managers, banks, mortgage companies, and government agencies. In addition to assisting us and our advisor in calculating our NAV per share, Cortland will assist us and our advisor in numerous other functions including the processing of subscriptions and redemptions, the issuance of quarterly and annual shareholder reports, daily cash and account reconciliation, trade settlement and securities/document custody. We will reimburse our advisor for the cost of services provided by Cortland. We will pay Cortland a fee monthly in arrears calculated based on a percentage of our assets and leverage (with such percentage decreasing as our assets and leverage increase). We will also pay additional fees to the extent we or our advisor use certain specified services.

How may investors in this offering sell their shares?

At the time shares are purchased, they will not be listed for trading on any securities exchange or over-the-counter market. In fact, we expect that there will not be any public market for the shares when you purchase them, and we cannot be sure that one will ever develop. In addition, our charter imposes restrictions on the ownership of our common stock, which ownership restrictions will apply to potential purchasers of your stock. Our charter prohibits the ownership of more than 9.8% in value or 9.8% in number of shares, whichever is more restrictive, of our outstanding common stock, unless exempted by our board of directors. See “Description of Capital Stock—Restriction on Ownership of Shares of Capital Stock.”

After you have held shares of our common stock for a minimum of one year, our share repurchase program may provide a limited opportunity for you to have all or a portion of your shares of common stock repurchased, subject to certain restrictions and limitations, at a price equal to the NAV per share; provided, however, that during the offering period (including if we extend the offering period) shares will be repurchased at a price per share equal to $10.00. At that time, we may, subject to the conditions and limitations described below under “Description of Capital Stock—Share Repurchase Program,” repurchase the shares of our common stock presented for repurchase for cash to the extent that we have sufficient funds available to fund such repurchase. There is no fee in connection with a repurchase of shares of our common stock.

When will my capital be returned?

We intend to return capital to investors in this offering during the capital return period, which we anticipate funding as the loans we originate are paid off at maturity or sold. We may also return capital earlier as some investments amortize, prepay and mature. However, there can be no assurance that we will not return all or a portion of your capital prior to the start of the capital return period or after the capital return period. Furthermore, there can be no assurance that we will be able to return your capital in full or at all. Our charter does not require us to liquidate during the capital return period. See “Description of Capital Stock—Liquidity Events.”

12

Table of Contents

Will I be notified of how the company and my investment are performing?

Yes, we will provide your institution or bank trust account contact with periodic updates on the performance of the company and your investment in us, including:

| • | Monthly distribution reports; |

| • | An annual report; and |

| • | An annual IRS Form 1099-DIV, if required. |

We will provide this information to you via U.S. mail or other courier. However, with your permission, we may furnish this information by electronic delivery, including, with respect to our annual report, by notice of the posting of our annual report on our website, which is www.fundcoreinvestments.com. Investors desiring to receive such information by electronic delivery must make an affirmative election on the subscription agreement at the time of purchase. We will also include on this website access to our annual report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statement and other filings we make with the SEC, which filings will provide you with periodic updates on our performance and the performance of your investment.

When will I get my detailed tax information?

We will endeavor to mail your Form 1099-DIV tax information, if required, by January 31 of each year.

Will you or our advisor keep track of the beneficial owners of the stock purchased pursuant to this prospectus?

Our advisor will generally only keep records of the holders of record of our stock, except as otherwise required by REIT qualification rules. As a condition to participating in this offering, institutions that purchase our shares for trusts or other accounts will be responsible as record holders for maintaining records of the underlying beneficial owners and for providing such beneficial ownership information as we may need on an annual basis to comply with the REIT qualification rules, or as we may need for purposes of complying with an exception to the Plan Assets Regulation under ERISA. See “Certain ERISA Considerations.”

What is the role of your board of directors?

We operate under the direction of our board of directors, which is responsible for directing the management of our business and affairs. We currently have three members on our board of directors, two of whom are independent of us. Our directors are elected annually by the stockholders. Our bylaws require that a majority of our directors be independent of our advisor. Our board of directors intends to establish an audit committee. The names and biographical information of our directors and officers are contained under “Management—Directors and Executive Officers.”

What is the experience of your officers and directors?

Our management team has significant experience in commercial real estate debt, capital markets and mortgage products over multiple economic cycles. Our President and Chief Investment Officer, Steven A. Ball, along with certain managers of our advisor, previously ran a commercial real estate lending platform at Merrill Lynch for the U.S., Canada and Japan from 2001-2009, during which period they participated in the origination of a significant volume of commercial real estate loans. Below is a listing of our officers and directors, their ages and their positions. See the “Management—Directors and Executive Officers” section of this prospectus for a detailed description of the experience of each of our officers and directors.

Name | Age | Position | ||||

Steven A. Ball | 51 | President, Chief Investment Officer & Director | ||||

Lee J. Taragin | 44 | Chief Financial Officer & Chief Operating Officer | ||||

Michael C. Vessels | 54 | Executive Vice President & Secretary | ||||

Christopher T. Anderson | 64 | Director* | ||||

Leonard W. Cotton | 61 | Director* | ||||

| * | Denotes director who is not affiliated with our advisor, and is independent under our independence standards. |

13

Table of Contents

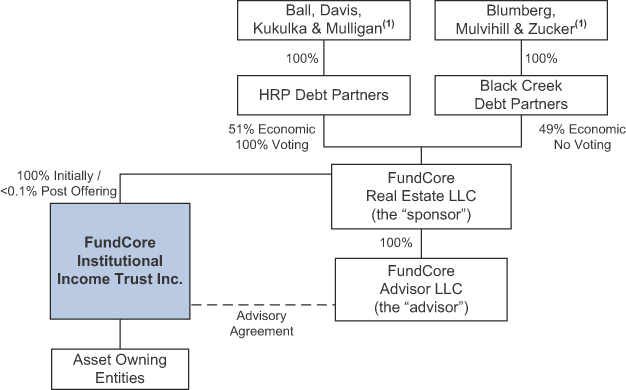

What is the ownership structure of FundCore Institutional Income Trust Inc. and FundCore Advisor LLC?

The chart below shows the ownership structure of FundCore Institutional Income Trust Inc. and the advisor. Our sponsor is a newly-formed entity and has no prior operating history. Steven A. Ball, Kevin M. Davis, Robert S. Kukulka and John M. Mulligan presently own, directly or indirectly, 100% of the voting interests and 51% of the economic interests in the sponsor, which owns the advisor, and the sponsor and the advisor are jointly controlled by Messrs. Ball, Davis, Kukulka and Mulligan. Messrs. Ball, Davis, Kukulka and Mulligan are part of the advisor’s management team and investment committee. Other key members of the advisor’s investment committee include John A. Blumberg, James R. Mulvihill and Evan H. Zucker, each of whom, directly or indirectly, holds a minority non-voting economic interest in the sponsor. FundCore Real Estate LLC has issued and may in the future issue to certain of its officers, affiliated or other unaffiliated individuals, consultants or other parties equity interests or derivatives thereof representing economic, and non voting, interests in FundCore Real Estate LLC.

| (1) | Each of Messrs. Ball, Davis, Kukulka, Mulligan, Blumberg, Mulvihill and Zucker may hold their interests in HRP Debt Partners or Black Creek Debt Partners directly or indirectly. No individual’s ownership in HRP Debt Partners or Black Creek Debt Partners exceeds 33.33%. Messrs. Ball, Davis, Kukulka and Mulligan are the joint managers of and, through HRP Debt Partners, have ultimate voting and dispositive control over, FundCore Real Estate LLC, with a 51% economic and a 100% voting interest. Messrs. Blumberg, Mulvihill and Zucker, through Black Creek Debt Partners, hold a minority non-voting 49% economic interest in FundCore Real Estate LLC. |

What conflicts of interest will your advisor and its affiliates face?

FundCore Advisor LLC, as our advisor, will experience conflicts of interest in connection with the management of our business affairs, including the following:

| • | Our advisor, its affiliates and its management will have to allocate their time between us and other real estate ventures and activities in which they are involved; |

| • | Our advisory agreement provides for our advisor to receive fees in connection with the origination and management of our assets, regardless of the quality of the assets or of the services provided to us; |

| • | If we incorrectly value an impaired asset, the asset management fee payable to our advisor could be in excess of 1.0% of the market value of our assets; and |

14

Table of Contents

| • | Managers of our advisor and members of its investment committee must determine which investment opportunities to recommend to us or other existing or future ventures in which they are involved with similar investment objectives with which we may directly compete for assets. |

Each of our executives will also face these conflicts because of his affiliation with our advisor and by way of his service as an officer or director of FundCore Real Estate LLC. See the “Conflicts of Interest” section of this prospectus for a detailed discussion of the various conflicts of interest relating to your investment, as well as the procedures that we have established to mitigate a number of these potential conflicts.

Our board of directors has approved a plan with respect to the allocation of investment opportunities among the sponsor, FundCore Finance Group LLC and other affiliated entities. See “Conflicts of Interests—Conflict Resolution Procedures”

What are my voting rights as a stockholder?

We intend to hold annual meetings of our stockholders for the purpose of electing our directors or conducting other business matters that may be properly presented at such meetings. We may also call a special meeting of stockholders from time to time. Each of our stockholders will be entitled to one vote for each share of common stock held of record as of the record date for any of these meetings.

Are there any special considerations that apply to employee benefit plans subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) or other retirement plans that are investing in shares?

Yes. The section of this prospectus entitled “Certain ERISA Considerations” describes the effect the purchase of shares will have on individual retirement accounts and retirement plans subject to ERISA or the Internal Revenue Code. ERISA is a federal law that regulates the operation of certain employee benefit plans. Any plan trustee, fiduciary or individual considering purchasing shares for a plan or an individual retirement account should read this section of the prospectus very carefully.

In general, a REIT is a company that:

| • | combines the capital of many investors to acquire or provide financing for real estate properties or real estate-related assets; |

| • | allows investors to invest in a large-scale diversified real estate-related portfolio through the purchase of interests, typically shares, in the REIT; |

| • | is required to distribute to investors at least 90% of its annual REIT taxable income (computed without regard to the dividends-paid deduction and excluding net capital gain); and |

| • | avoids the “double taxation” treatment of income that would normally result from investments in a corporation because a REIT does not generally pay federal corporate income taxes on its net income, to the extent such income is distributed to stockholders and provided certain income tax requirements are satisfied. |

However, REITs are subject to numerous organizational and operational requirements. If we fail to qualify for taxation as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as a REIT for the four-year period following the year in which we fail to qualify. Even if we qualify as a REIT for federal income tax purposes, we may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed income and on certain other types of income.

15

Table of Contents

How does the 1940 Act impact us?

We intend to conduct our operations so that neither we nor any of our subsidiaries are required to register as an investment company under the 1940 Act. Section 3(a)(1)(A) of the 1940 Act defines an investment company as any issuer that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the 1940 Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. Excluded from the term “investment securities,” among other things, are U.S. government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company for private funds set forth in Section 3(c)(1) or Section 3(c)(7) of the 1940 Act.

We are organized as a holding company that conducts its businesses primarily through wholly-owned subsidiaries. We intend to conduct our operations so that we do not come within the definition of an investment company because less than 40% of the value of our total assets on an unconsolidated basis will consist of “investment securities.” The securities issued by any wholly-owned or majority-owned subsidiaries that we may form in the future that are excepted from the definition of “investment company” based on Section 3(c)(1) or 3(c)(7) of the 1940 Act, together with any other investment securities we may own, may not have a value in excess of 40% of the value of our total assets on an unconsolidated basis. We will monitor our holdings to ensure continuing and ongoing compliance with this test. In addition, we believe we will not be considered an investment company under Section 3(a)(1)(A) of the 1940 Act because we will not engage primarily or hold ourselves out as being engaged primarily in the business of investing, reinvesting or trading in securities. Rather, through our wholly-owned subsidiaries, we will be primarily engaged in the non-investment company businesses of these subsidiaries.

If the value of securities issued by our subsidiaries that are excepted from the definition of “investment company” by Section 3(c)(1) or 3(c)(7) of the 1940 Act, together with any other investment securities we own, exceeds 40% of our total assets on an unconsolidated basis, or if one or more of such subsidiaries fail to maintain an exception or exemption from the 1940 Act, we could, among other things, be required either (a) to substantially change the manner in which we conduct our operations to avoid being required to register as an investment company or (b) to register as an investment company under the 1940 Act, either of which could have an adverse effect on us and the market price of our securities. If we were required to register as an investment company under the 1940 Act, we would become subject to substantial regulation with respect to our capital structure (including our ability to use leverage), management, operations, transactions with affiliated persons (as defined in the 1940 Act), portfolio composition, including restrictions with respect to diversification and industry concentration, and other matters.

We expect certain of our other subsidiaries that we may form in the future to rely upon the exemption from registration as an investment company under the 1940 Act pursuant to Section 3(c)(5)(C) of the 1940 Act, which is available for entities “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” This exemption generally requires that at least 55% of these subsidiaries’ assets must be comprised of qualifying real estate assets and at least 80% of each of their portfolios must be comprised of qualifying real estate assets and real estate-related assets. We expect each of our subsidiaries relying on Section 3(c)(5)(C) to rely on guidance published by the SEC staff or on our analyses of such guidance to determine which assets are qualifying real estate and real estate-related assets. The SEC has not published guidance with respect to the treatment of CMBS for purposes of the Section 3(c)(5)(C) exemption. Based on our analysis of published guidance with respect to other types of assets, we consider the controlling class of CMBS to be a qualifying real estate asset under certain conditions. The SEC may in the future take a view different than or contrary to our analysis with respect to CMBS or any other types of assets we have determined to be qualifying real estate assets. To the extent that the SEC staff publishes new or different guidance with respect to any assets we have determined to be qualifying real estate assets, we may be required to adjust our strategy accordingly. In addition, we may be limited in our ability to make certain investments and these limitations could result in the subsidiary holding assets we might wish to sell or selling assets we might wish to hold.

Certain of our subsidiaries may rely on the exemption provided by Section 3(c)(6) to the extent that they hold mortgage assets through majority-owned subsidiaries that rely on Section 3(c)(5)(C). The SEC staff has issued little interpretive guidance with respect to Section 3(c)(6) and any guidance published by the staff could require us to adjust our strategy accordingly.

To the extent that the SEC staff provides more specific guidance regarding any of the matters bearing upon the exceptions we and our subsidiaries rely on from the 1940 Act, we may be required to adjust our strategy accordingly. Any additional guidance from the SEC staff could provide additional flexibility to us, or it could further inhibit our ability to pursue the strategies we have chosen.

See “Business, Investment Objectives and Policies – 1940 Act Limitations” for a further discussion of the specific exemptions from registration under the 1940 Act that our subsidiaries are expected to rely on and the treatment of certain of our targeted asset classes for purposes of such exemptions.

16

Table of Contents

Qualification for exemption from registration under the 1940 Act will limit our ability to make certain investments. See “Risk Factors—Risks Related to this Offering and Our Corporate Structure—Maintenance of our exemption from registration under the 1940 Act imposes significant limits on our operations.”

Who can help answer my questions?

If you have more questions about the offering, or if you would like additional copies of this prospectus, you should contact the primary dealer at:

Integrity Investments, Inc.

221 Pensacola Road

Venice, Florida 34285

Telephone: (800) 242-9340

Fax: (941) 480-0555

E-mail: info@reitsales.com

Alternatively, you may review the SEC filing of our prospectus on our website at www.fundcoreinvestments.com. The contents of this site are not incorporated by reference in, or otherwise a part of, this prospectus.

17

Table of Contents

An investment in our common stock involves various risks and uncertainties. You should carefully consider the following risk factors in conjunction with the other information contained in this prospectus before purchasing our common stock. The risks discussed in this prospectus can adversely affect our business, operating results, prospects and financial condition. This could cause the value of our common stock to decline and could cause you to lose all or part of your investment. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks Related to an Investment in Us

We have no prior operating history and there is no assurance that we will be able to successfully achieve our investment objectives.