Exhibit 99.1

Exhibit 99.1

NIELSEN CAPITAL

STRUCTURE DISCUSSION

NYSE: NLSN

SAFE HARBOR FOR FORWARD-LOOKING

STATEMENTS

The following discussion contains forward-looking statements, including those about Nielsen’s outlook and prospects and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those which are not historical facts including those relating to the future financial targets, dividends and share repurchases. These and other statements that relate to future results and events are based on Nielsen’s current expectations as of March 26, 2014

These statements are subject to risks and uncertainties, and actual results and events may differ materially from what presently is expected. The risks and uncertainties that we believe are material are outlined in our disclosure filings and materials, which you can find on http://ir.nielsen.com. Please consult these documents for a more complete understanding of these risks and uncertainties. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

2

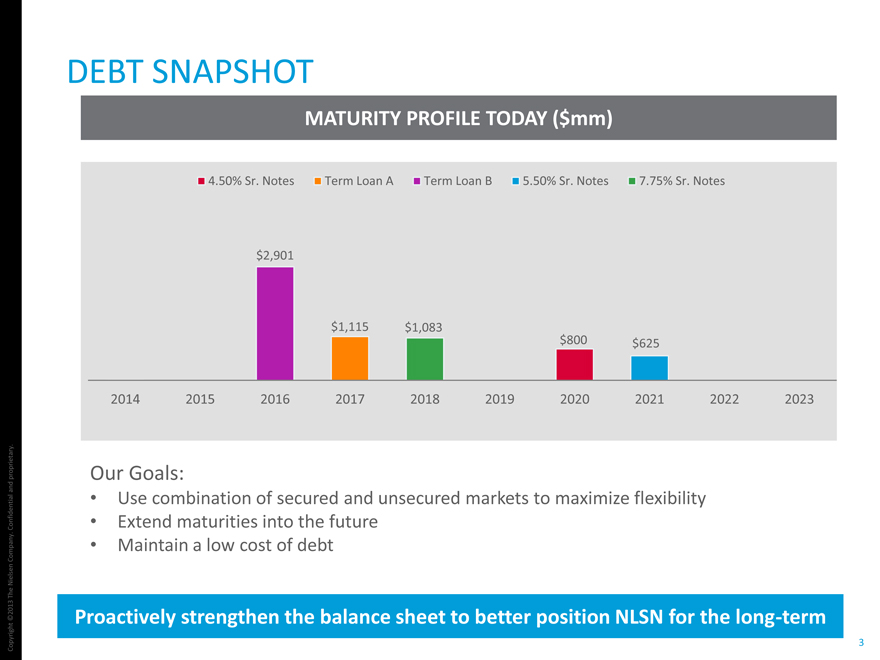

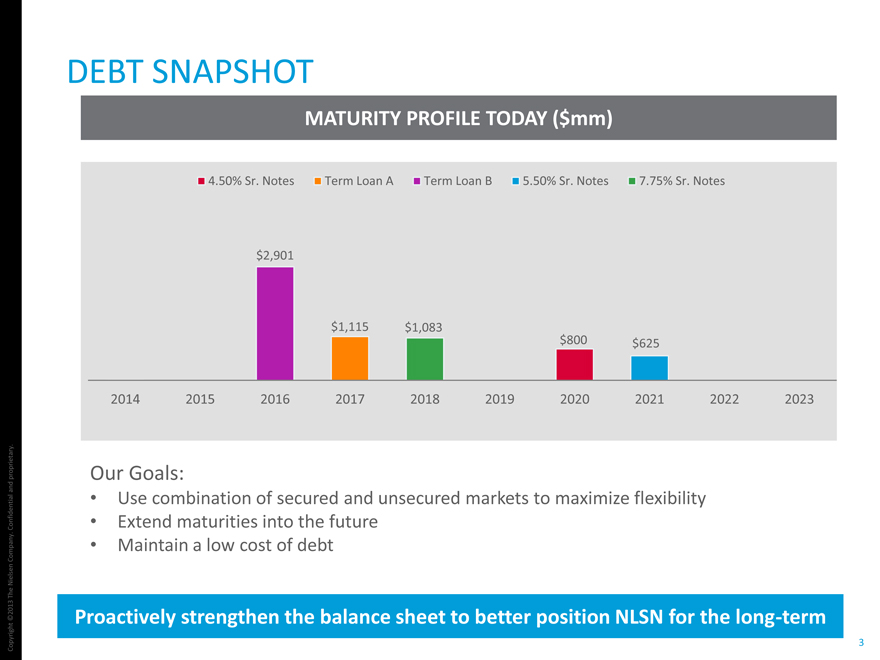

DEBT SNAPSHOT

MATURITY PROFILE TODAY ($mm)

4.50% Sr. Notes Term Loan A Term Loan B 5.50% Sr. Notes 7.75% Sr. Notes

$2,901

$1,115 $1,083

$800 $625

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Our Goals:

Use combination of secured and unsecured markets to maximize flexibility

Extend maturities into the future

Maintain a low cost of debt

Proactively strengthen the balance sheet to better position NLSN for the long-term

3

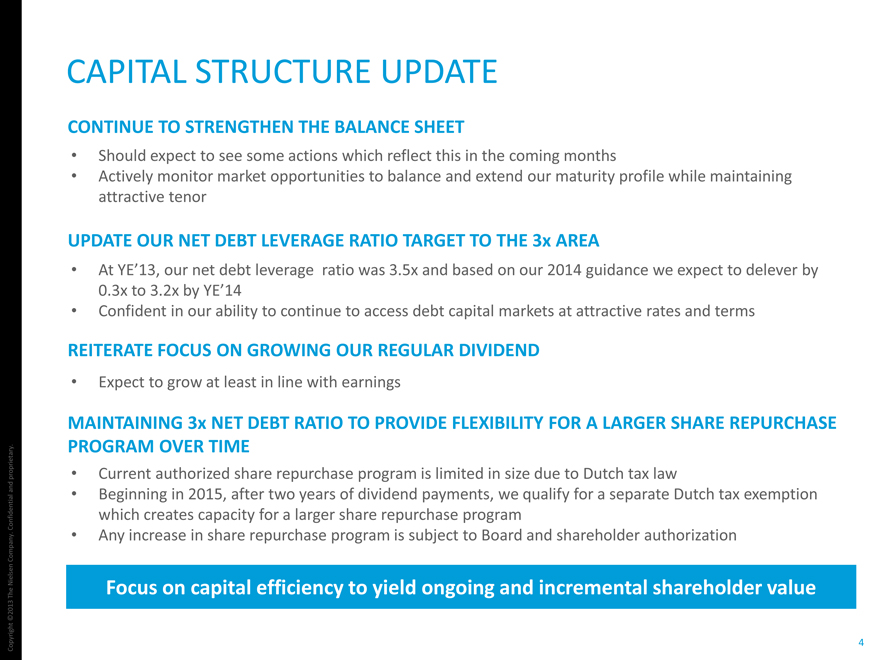

CAPITAL STRUCTURE UPDATE

CONTINUE TO STRENGTHEN THE BALANCE SHEET

Should expect to see some actions which reflect this in the coming months

Actively monitor market opportunities to balance and extend our maturity profile while maintaining attractive tenor

UPDATE OUR NET DEBT LEVERAGE RATIO TARGET TO THE 3x AREA

At YE’13, our net debt leverage ratio was 3.5x and based on our 2014 guidance we expect to delever by 0.3x to 3.2x by YE’14

Confident in our ability to continue to access debt capital markets at attractive rates and terms

REITERATE FOCUS ON GROWING OUR REGULAR DIVIDEND

Expect to grow at least in line with earnings

MAINTAINING 3x NET DEBT RATIO TO PROVIDE FLEXIBILITY FOR A LARGER SHARE REPURCHASE PROGRAM OVER TIME

Current authorized share repurchase program is limited in size due to Dutch tax law

Beginning in 2015, after two years of dividend payments, we qualify for a separate Dutch tax exemption which creates capacity for a larger share repurchase program

Any increase in share repurchase program is subject to Board and shareholder authorization

Focus on capital efficiency to yield ongoing and incremental shareholder value

4

Q&A

APPENDIX

CERTAIN NON-GAAP MEASURES

Overview of Non-GAAP Presentations

We consistently use the below non-GAAP financial measures to evaluate the results of our operations. We believe that the

presentation of these non-GAAP measures provides useful information to investors regarding financial and business trends

related to our results of operations, cash flows and indebtedness and that when this non-GAAP financial information is viewed

with our GAAP financial information, investors are provided with a more meaningful understanding of our ongoing operating

performance. None of the non-GAAP measures presented should be considered as an alternative to net income or loss,

operating income or loss, cash flows from operating activities or any other performance measures of operating performance or

liquidity derived in accordance with GAAP. These non-GAAP measures have important limitations as analytical tools and should

not be considered in isolation or as substitutes for an analysis of our results as reported under GAAP.

Net Debt and Net Debt Leverage Ratio

The net debt leverage ratio is defined as net debt (total indebtedness less cash and cash equivalents) as of the balance sheet

date divided by Adjusted EBITDA for the twelve months then ended. Net debt and the net debt leverage ratio are not

presentations made in accordance with GAAP, and our use of these terms may vary from the use of similarly-titled measures by

others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to

interpretation.

7

CERTAIN NON-GAAP MEASURES

(continued)

Adjusted EBITDA

We define Adjusted EBITDA as net income or loss from our consolidated statements of operations before interest income and

expense, income taxes, depreciation and amortization, restructuring charges, goodwill and intangible asset impairment charges,

stock-based compensation expense and other non-operating items from our consolidated statements of operations as well as

certain other items considered unusual or non-recurring in nature. Adjusted EBITDA is not a presentation made in accordance

with GAAP, and our use of the term Adjusted EBITDA may vary from the use of similarly-titled measures by others in our industry

due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. We use

Adjusted EBITDA to consistently measure our performance from period to period both at the consolidated level as well as within

our operating segments, to evaluate and fund incentive compensation programs and to compare our results to those of our

competitors.

Free Cash Flow

We define free cash flow as net cash provided by operating activities, normalized for non-recurring Arbitron transaction costs,

less capital expenditures. We believe providing free cash flow information provides valuable supplemental information regarding

the cash flow that may be available for discretionary use by us. Free cash flow is not a presentation made in accordance with

GAAP.

8

NIELSEN INVESTOR RELATIONS

ir@nielsen.com

+1.646.654.4602

http://ir.nielsen.com

Download the Nielsen IR iPad app