4th Quarter 2021 Earnings February 28th, 2022 | 8:00 am ET NYSE: NLSN EXHIBIT 99.2

These materials include information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These statements include those relating to “2022 Full Year Guidance” as well as those that may be identified by words such as “will,” “intend,” “expect,” “anticipate,” “should,” “could” and similar expressions. These statements are subject to risks and uncertainties, and actual results and events could differ materially from what presently is expected. Factors leading thereto may include, without limitation, the risks related to the COVID-19 pandemic on the global economy and financial markets, the uncertainties relating to the impact of the COVID-19 pandemic on Nielsen’s business, the failure of our new business strategy in accomplishing our objectives, economic conditions in the markets Nielsen is engaged in, impacts of actions and behaviors of customers, suppliers and competitors, technological developments, as well as legal and regulatory rules and processes affecting Nielsen’s business and other specific risk factors that are outlined in our disclosure filings and materials, which you can find on http://www.nielsen.com/investors, such as our 10-K, 10-Q and 8-K reports that have been filed with the Securities and Exchange Commission. Please consult these documents for a more complete understanding of these risks and uncertainties. This list of factors is not intended to be exhaustive. Such forward-looking statements only speak as of the date of these materials, and we assume no obligation to update any written or oral forward-looking statement made by us or on our behalf as a result of new information, future events or other factors, except as required by law. Non-GAAP information The following presentation includes certain "non-GAAP financial measures" as defined in Regulation G under the Securities Exchange Act of 1934. Please refer to the Appendix to find a reconciliation of any non-GAAP financial measures and definitions of non-GAAP financial measures. Forward-looking statements

Providing 2022 guidance Today’s discussion Strong 2021 financial performance Advancing our Nielsen ONE product roadmap Why we are & will be the currency of choice Board approves $1B share repurchase authorization

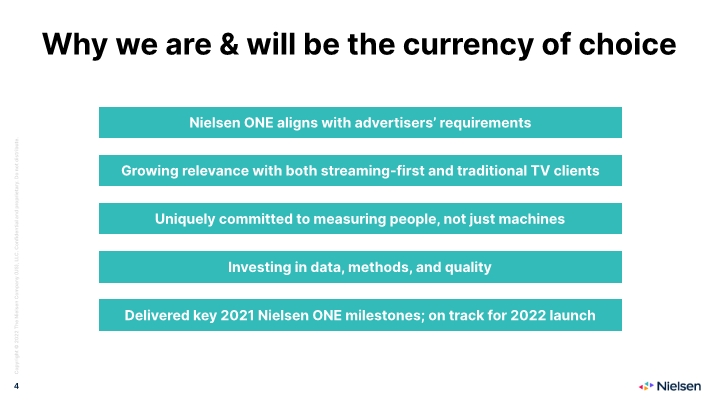

Why we are & will be the currency of choice Investing in data, methods, and quality Growing relevance with both streaming-first and traditional TV clients Uniquely committed to measuring people, not just machines Nielsen ONE aligns with advertisers’ requirements Delivered key 2021 Nielsen ONE milestones; on track for 2022 launch

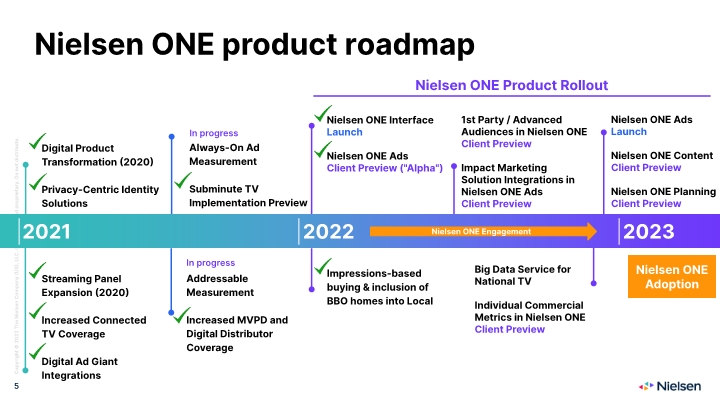

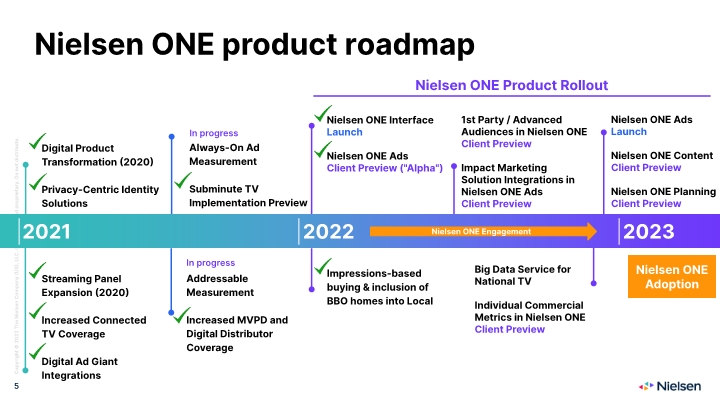

Nielsen ONE product roadmap 2021 2022 Big Data Service for National TV Individual Commercial Metrics in Nielsen ONE Client Preview 1st Party / Advanced Audiences in Nielsen ONE Client Preview Impact Marketing Solution Integrations in Nielsen ONE Ads Client Preview Nielsen ONE Product Rollout Impressions-based buying & inclusion of BBO homes into Local 2023 Nielsen ONE Interface Launch Nielsen ONE Ads Client Preview ("Alpha") Nielsen ONE Ads Launch Nielsen ONE Content Client Preview Nielsen ONE Planning Client Preview Nielsen ONE Adoption Addressable Measurement Increased MVPD and Digital Distributor Coverage Streaming Panel Expansion (2020) Increased Connected TV Coverage Digital Ad Giant Integrations Digital Product Transformation (2020) Privacy-Centric Identity Solutions Always-On Ad Measurement Subminute TV Implementation Preview In progress In progress Nielsen ONE Engagement

Unmatched position across media ecosystem ONE MEASUREMENT SOLUTIONS IMPACT MARKETING SOLUTIONS GRACENOTE CONTENT SERVICES One Measurement Solutions ~73% of 2021 revenue; Impact Marketing Solutions ~20% of 2021 revenue; Gracenote Content Services ~7% of 2021 revenue Nielsen is and will be the currency of choice as the industry moves to cross-media measurement Digital-first strategy aligns with industry growth Delivered on 2021 Nielsen ONE milestones, on track for 2022 launch Unmatched position, uniquely committed to representative, persons-level measurement Significant steps to improve quality controls to meet MRC accreditation standards Driving growth through new geographies, verticals, and products, linking measurement of audiences to impact Launched campaign measurement in 40 new markets; global expansions with leading digital publishers Strengthened capabilities in verticals such as auto; broadened advertiser intelligence to cover social media 2022 focused on further unlocking value between Nielsen ONE and Impact Marketing Solutions New products address evolving market needs as content & streaming platform growth creates competition for audiences Deploying Gracenote IDs to enable cross-platform linking and universal search Building on leadership position with key wins, strength in international markets Leveraging measurement data and content metadata; launched Audience Predict 2022 focused on growing geographic footprint, expanding use of Gracenote ID, new products

Q4 & FY 2021 results

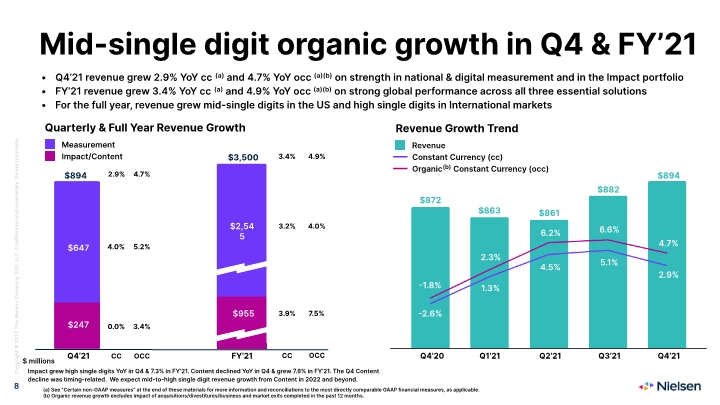

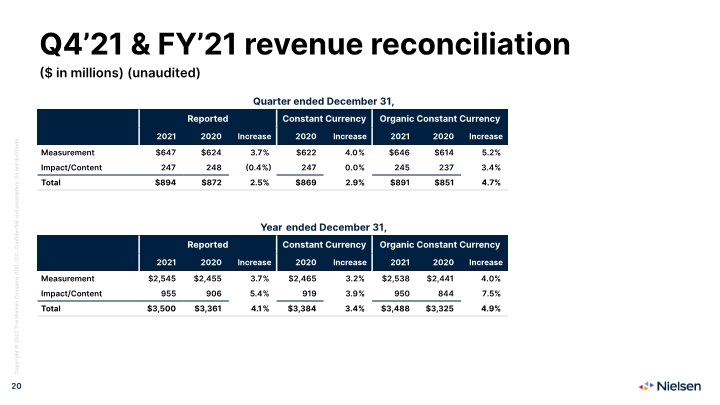

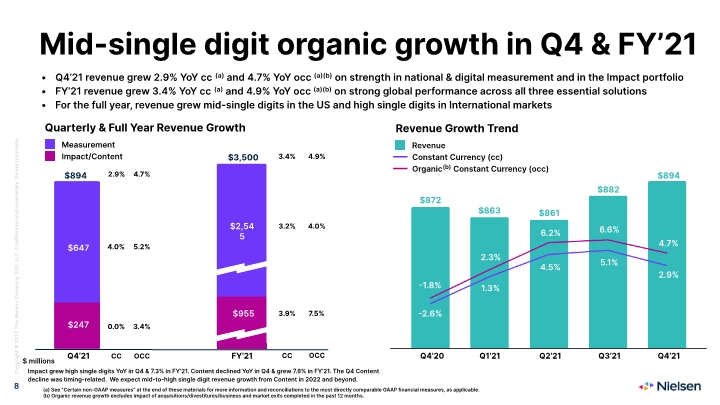

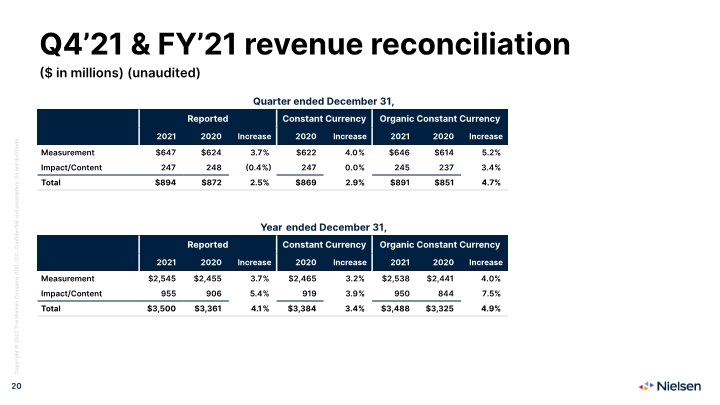

Q4’21 revenue grew 2.9% YoY cc(a) and 4.7% YoY occ(a)(b) on strength in national & digital measurement and in the Impact portfolio FY’21 revenue grew 3.4% YoY cc(a) and 4.9% YoY occ(a)(b) on strong global performance across all three essential solutions For the full year, revenue grew mid-single digits in the US and high single digits in International markets CC Quarterly & Full Year Revenue Growth $894 OCC 5.2% 4.0% 3.4% 0.0% $647 $247 $872 $863 $861 Revenue Growth Trend 4.7% 2.9% $ millions Measurement Mid-single digit organic growth in Q4 & FY’21 $882 2.3% -1.8% 1.3% -2.6% 6.2% 4.5% 6.6% 5.1% Q4’21 Impact/Content Revenue Constant Currency (cc) Organic(b) Constant Currency (occ) (a) See “Certain non-GAAP measures” at the end of these materials for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. (b) Organic revenue growth excludes impact of acquisitions/divestitures/business and market exits completed in the past 12 months. Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 $894 4.7% 2.9% CC $3,500 OCC 4.0% 3.2% 7.5% 3.9% $2,545 $955 4.9% 3.4% FY’21 Impact grew high single digits YoY in Q4 & 7.3% in FY’21. Content declined YoY in Q4 & grew 7.8% in FY’21. The Q4 Content decline was timing-related. We expect mid-to-high single digit revenue growth from Content in 2022 and beyond.

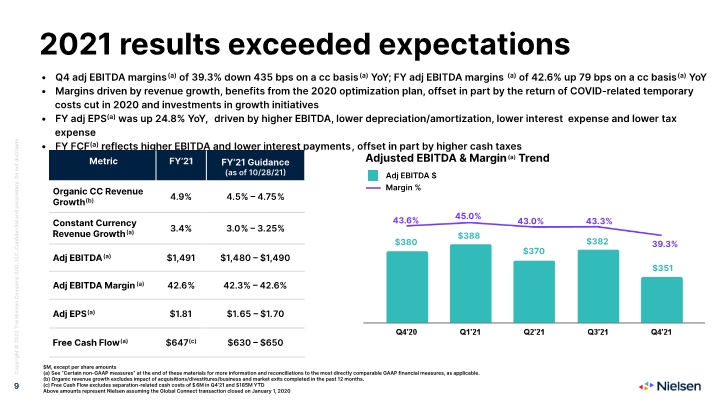

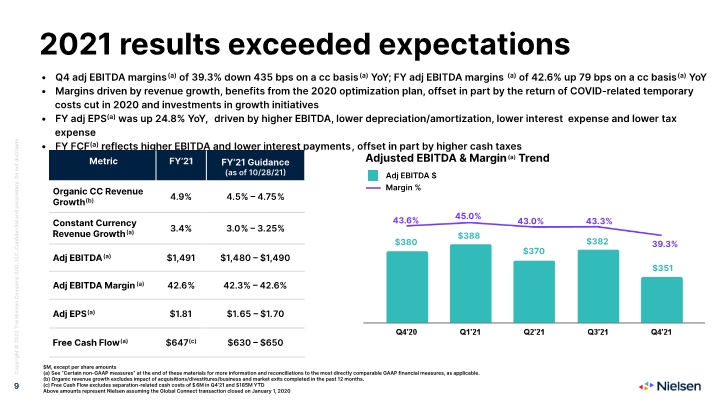

2021 results exceeded expectations Q4 adj EBITDA margins(a) of 39.3% down 435 bps on a cc basis(a) YoY; FY adj EBITDA margins(a) of 42.6% up 79 bps on a cc basis(a) YoY Margins driven by revenue growth, benefits from the 2020 optimization plan, offset in part by the return of COVID-related temporary costs cut in 2020 and investments in growth initiatives FY adj EPS(a) was up 24.8% YoY, driven by higher EBITDA, lower depreciation/amortization, lower interest expense and lower tax expense FY FCF(a) reflects higher EBITDA and lower interest payments, offset in part by higher cash taxes $M, except per share amounts (a) See “Certain non-GAAP measures” at the end of these materials for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. (b) Organic revenue growth excludes impact of acquisitions/divestitures/business and market exits completed in the past 12 months. (c) Free Cash Flow excludes separation-related cash costs of $6M in Q4’21 and $185M YTD Above amounts represent Nielsen assuming the Global Connect transaction closed on January 1, 2020 Adjusted EBITDA & Margin(a) Trend Adj EBITDA $ Margin %

2022 full year guidance

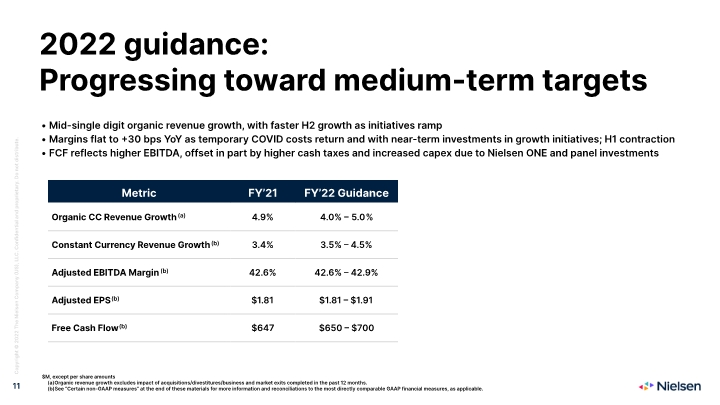

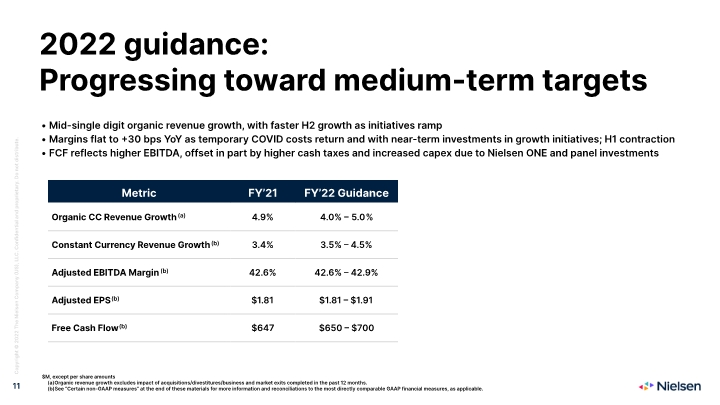

Mid-single digit organic revenue growth, with faster H2 growth as initiatives ramp Margins flat to +30 bps YoY as temporary COVID costs return and with near-term investments in growth initiatives; H1 contraction FCF reflects higher EBITDA, offset in part by higher cash taxes and increased capex due to Nielsen ONE and panel investments $M, except per share amounts Organic revenue growth excludes impact of acquisitions/divestitures/business and market exits completed in the past 12 months. See “Certain non-GAAP measures” at the end of these materials for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. 2022 guidance: Progressing toward medium-term targets

Q&A

Overview of Non-GAAP Presentations We use the non-GAAP financial measures discussed below to evaluate our results of operations, financial condition, liquidity and indebtedness. We believe that the presentation of these non-GAAP measures provides useful information to investors regarding financial and business trends related to our results of operations, cash flows and indebtedness and that, when this non-GAAP financial information is viewed with our GAAP financial information, investors are provided with valuable supplemental information regarding our results of operations, thereby facilitating period-to-period comparisons of our business performance. These non-GAAP measures are also consistent with how management evaluates the company’s operating performance and liquidity. In addition, these non-GAAP measures address questions the Company routinely receives from analysts and investors, and in order to assure that all investors have access to similar data, we have determined that it is appropriate to make this data available to all investors. None of the non-GAAP measures presented should be considered as an alternative to net income or loss, operating income or loss, cash flows from operating activities, total indebtedness or any other measures of operating performance and financial condition, liquidity or indebtedness derived in accordance with GAAP. These non-GAAP measures have important limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under GAAP. Our use of these terms may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Constant Currency Presentation We evaluate our results of operations on both an as reported and a constant currency basis. The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency information provides valuable supplemental information regarding our results of operations, thereby facilitating period-to-period comparisons of our business performance and is consistent with how management evaluates the Company’s performance. We calculate constant currency percentages by converting our prior-period local currency financial results using the current period exchange rates and comparing these adjusted amounts to our current period reported results. No adjustment has been made to foreign currency exchange transaction gains or losses in the calculation of constant currency net income. Certain non-GAAP measures

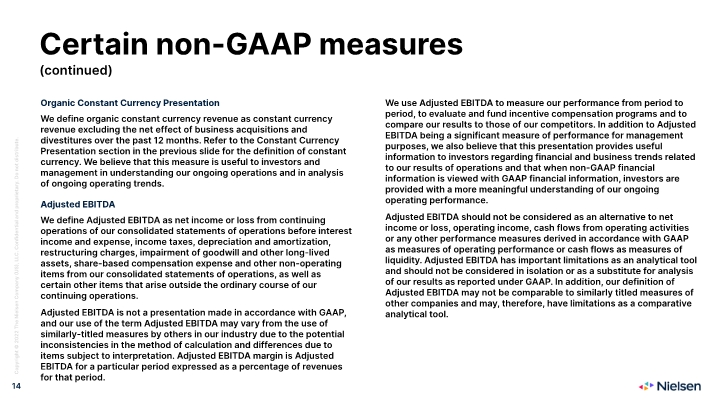

Organic Constant Currency Presentation We define organic constant currency revenue as constant currency revenue excluding the net effect of business acquisitions and divestitures over the past 12 months. Refer to the Constant Currency Presentation section in the previous slide for the definition of constant currency. We believe that this measure is useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends. Adjusted EBITDA We define Adjusted EBITDA as net income or loss from continuing operations of our consolidated statements of operations before interest income and expense, income taxes, depreciation and amortization, restructuring charges, impairment of goodwill and other long-lived assets, share-based compensation expense and other non-operating items from our consolidated statements of operations, as well as certain other items that arise outside the ordinary course of our continuing operations. Adjusted EBITDA is not a presentation made in accordance with GAAP, and our use of the term Adjusted EBITDA may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Adjusted EBITDA margin is Adjusted EBITDA for a particular period expressed as a percentage of revenues for that period. (continued) We use Adjusted EBITDA to measure our performance from period to period, to evaluate and fund incentive compensation programs and to compare our results to those of our competitors. In addition to Adjusted EBITDA being a significant measure of performance for management purposes, we also believe that this presentation provides useful information to investors regarding financial and business trends related to our results of operations and that when non-GAAP financial information is viewed with GAAP financial information, investors are provided with a more meaningful understanding of our ongoing operating performance. Adjusted EBITDA should not be considered as an alternative to net income or loss, operating income, cash flows from operating activities or any other performance measures derived in accordance with GAAP as measures of operating performance or cash flows as measures of liquidity. Adjusted EBITDA has important limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. In addition, our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies and may, therefore, have limitations as a comparative analytical tool. Certain non-GAAP measures

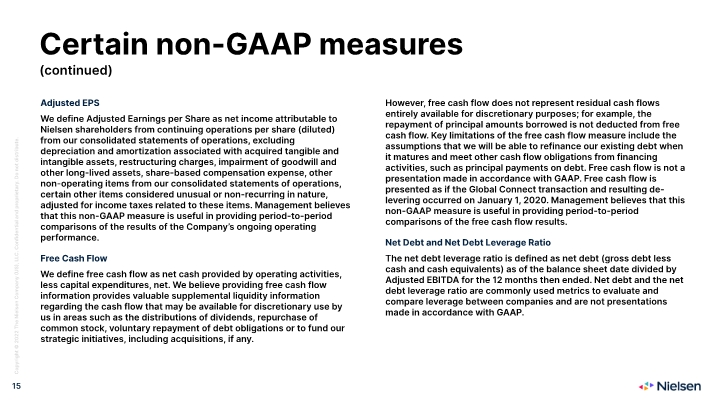

Certain non-GAAP measures Adjusted EPS We define Adjusted Earnings per Share as net income attributable to Nielsen shareholders from continuing operations per share (diluted) from our consolidated statements of operations, excluding depreciation and amortization associated with acquired tangible and intangible assets, restructuring charges, impairment of goodwill and other long-lived assets, share-based compensation expense, other non-operating items from our consolidated statements of operations, certain other items considered unusual or non-recurring in nature, adjusted for income taxes related to these items. Management believes that this non-GAAP measure is useful in providing period-to-period comparisons of the results of the Company’s ongoing operating performance. Free Cash Flow We define free cash flow as net cash provided by operating activities, less capital expenditures, net. We believe providing free cash flow information provides valuable supplemental liquidity information regarding the cash flow that may be available for discretionary use by us in areas such as the distributions of dividends, repurchase of common stock, voluntary repayment of debt obligations or to fund our strategic initiatives, including acquisitions, if any. However, free cash flow does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from free cash flow. Key limitations of the free cash flow measure include the assumptions that we will be able to refinance our existing debt when it matures and meet other cash flow obligations from financing activities, such as principal payments on debt. Free cash flow is not a presentation made in accordance with GAAP. Free cash flow is presented as if the Global Connect transaction and resulting de-levering occurred on January 1, 2020. Management believes that this non-GAAP measure is useful in providing period-to-period comparisons of the free cash flow results. Net Debt and Net Debt Leverage Ratio The net debt leverage ratio is defined as net debt (gross debt less cash and cash equivalents) as of the balance sheet date divided by Adjusted EBITDA for the 12 months then ended. Net debt and the net debt leverage ratio are commonly used metrics to evaluate and compare leverage between companies and are not presentations made in accordance with GAAP. (continued)

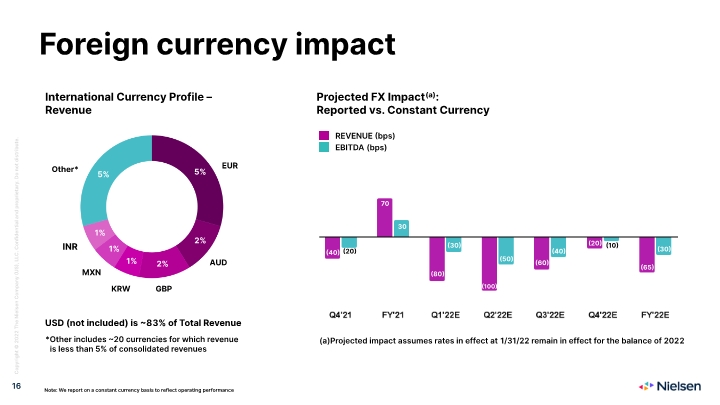

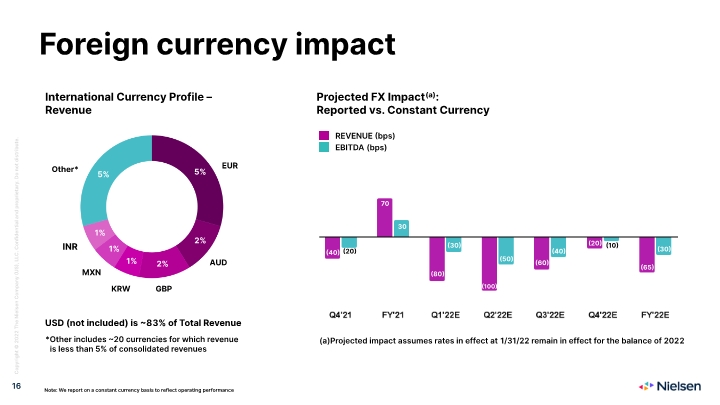

Foreign currency impact Projected FX Impact(a): Reported vs. Constant Currency International Currency Profile – Revenue Note: We report on a constant currency basis to reflect operating performance Projected impact assumes rates in effect at 1/31/22 remain in effect for the balance of 2022 USD (not included) is ~83% of Total Revenue REVENUE (bps) EBITDA (bps) INR 1% *Other includes ~20 currencies for which revenue is less than 5% of consolidated revenues (40) (20) (80) (30) (100) (50) (60) (40) (20) (10) (65) (30) 70 30

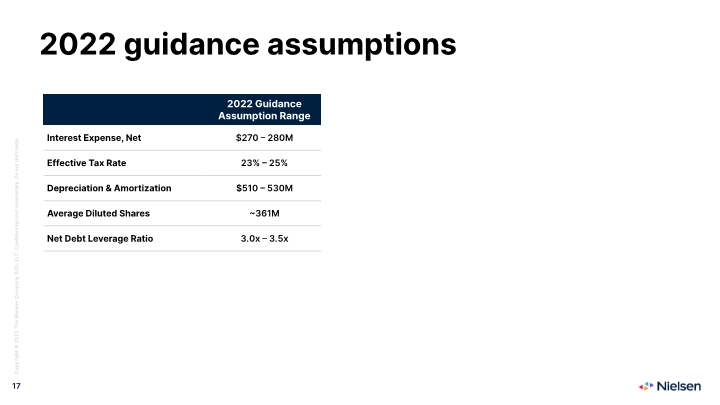

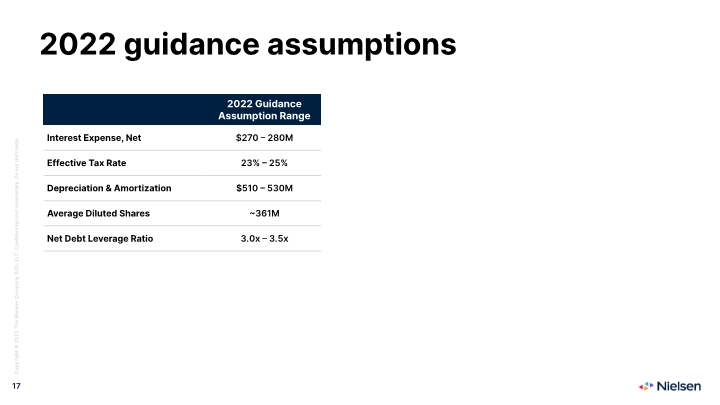

2022 guidance assumptions

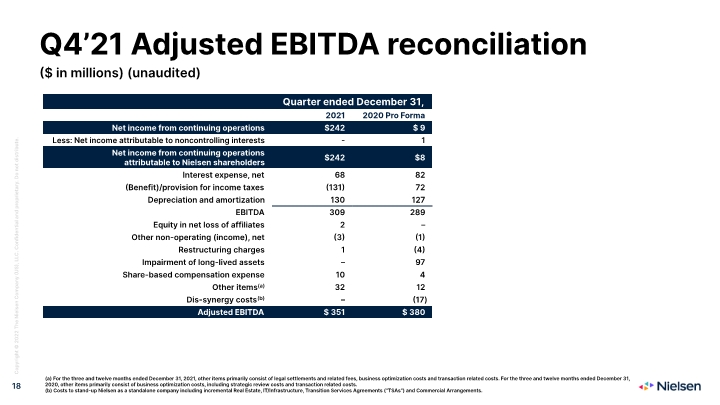

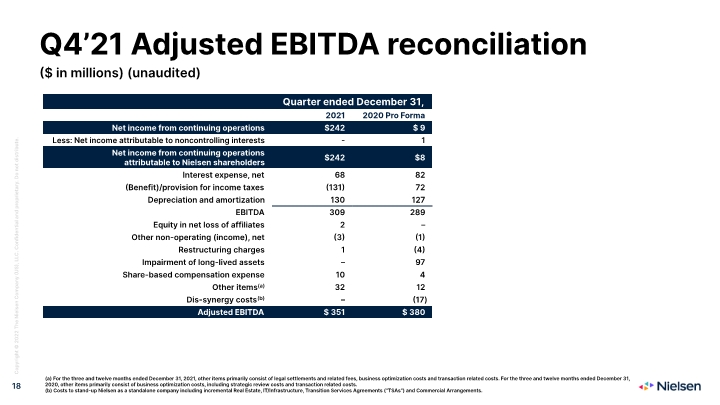

($ in millions) (unaudited) Q4’21 Adjusted EBITDA reconciliation (a) For the three and twelve months ended December 31, 2021, other items primarily consist of legal settlements and related fees, business optimization costs and transaction related costs. For the three and twelve months ended December 31, 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. (b) Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, Transition Services Agreements (“TSAs”) and Commercial Arrangements.

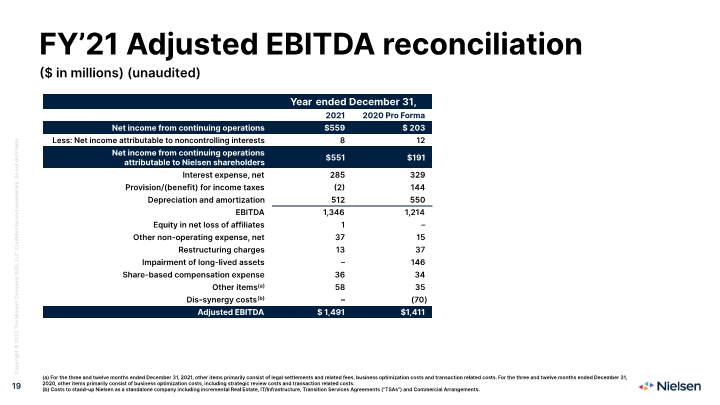

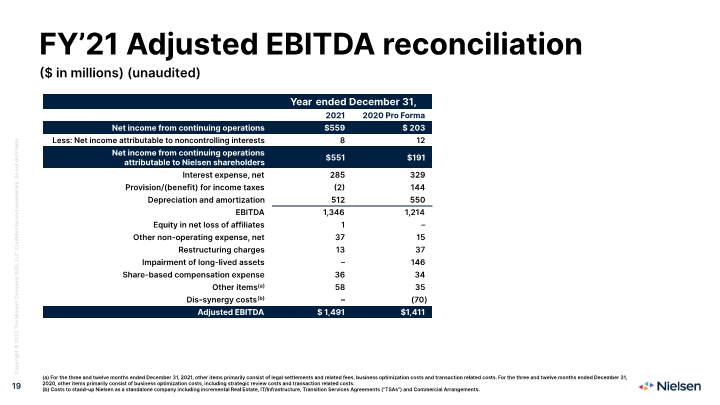

(a) For the three and twelve months ended December 31, 2021, other items primarily consist of legal settlements and related fees, business optimization costs and transaction related costs. For the three and twelve months ended December 31, 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. (b) Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, Transition Services Agreements (“TSAs”) and Commercial Arrangements. ($ in millions) (unaudited) FY’21 Adjusted EBITDA reconciliation

Q4’21 & FY’21 revenue reconciliation Quarter ended December 31, ($ in millions) (unaudited) Year ended December 31,

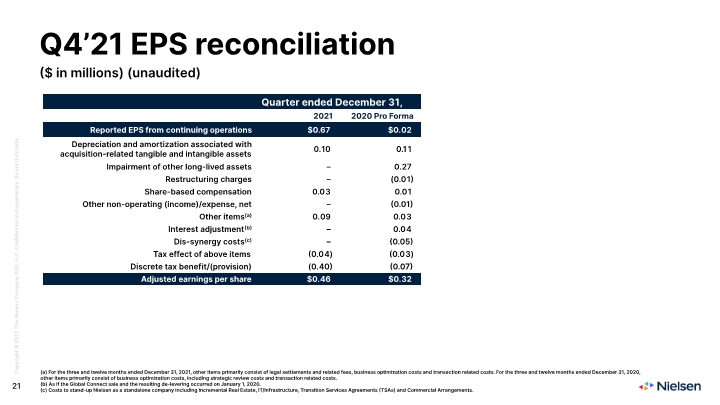

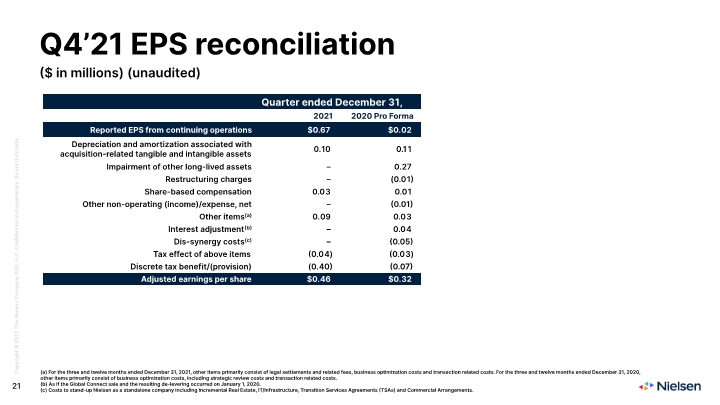

Q4’21 EPS reconciliation ($ in millions) (unaudited) (a) For the three and twelve months ended December 31, 2021, other items primarily consist of legal settlements and related fees, business optimization costs and transaction related costs. For the three and twelve months ended December 31, 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. (b) As if the Global Connect sale and the resulting de-levering occurred on January 1, 2020. (c) Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, Transition Services Agreements (TSAs) and Commercial Arrangements.

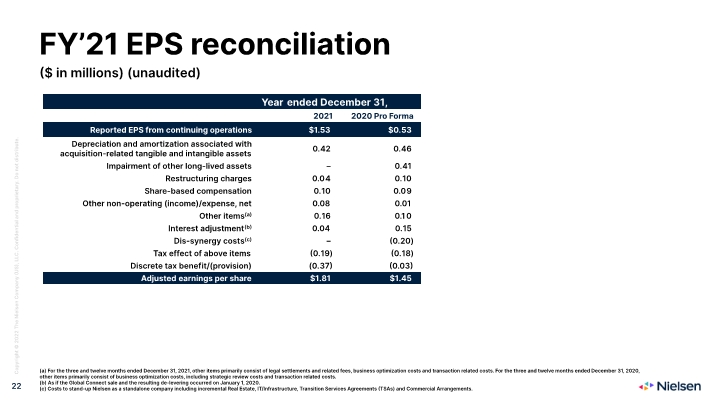

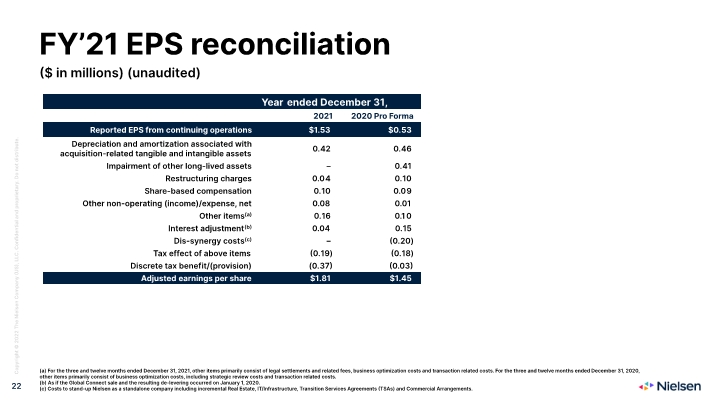

FY’21 EPS reconciliation ($ in millions) (unaudited) (a) For the three and twelve months ended December 31, 2021, other items primarily consist of legal settlements and related fees, business optimization costs and transaction related costs. For the three and twelve months ended December 31, 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. (b) As if the Global Connect sale and the resulting de-levering occurred on January 1, 2020. (c) Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, Transition Services Agreements (TSAs) and Commercial Arrangements.

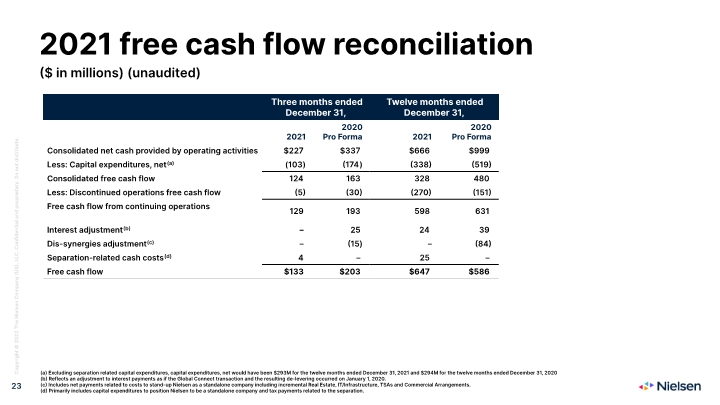

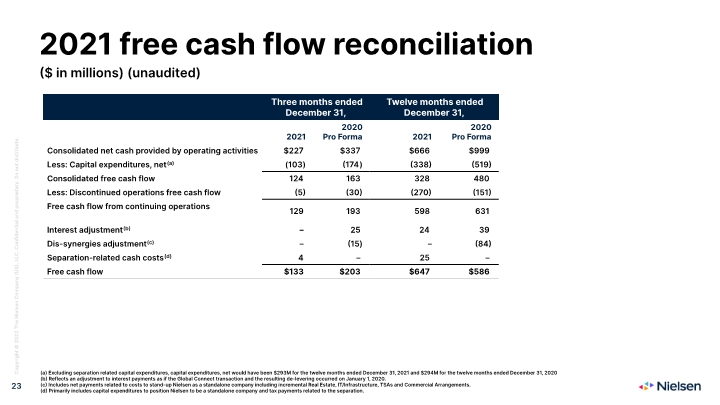

2021 free cash flow reconciliation ($ in millions) (unaudited) (a) Excluding separation related capital expenditures, capital expenditures, net would have been $293M for the twelve months ended December 31, 2021 and $294M for the twelve months ended December 31, 2020 (b) Reflects an adjustment to interest payments as if the Global Connect transaction and the resulting de-levering occurred on January 1, 2020. (c) Includes net payments related to costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, TSAs and Commercial Arrangements. (d) Primarily includes capital expenditures to position Nielsen to be a standalone company and tax payments related to the separation.

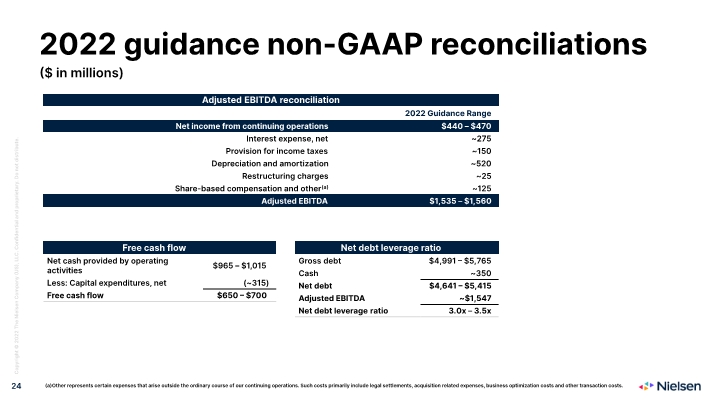

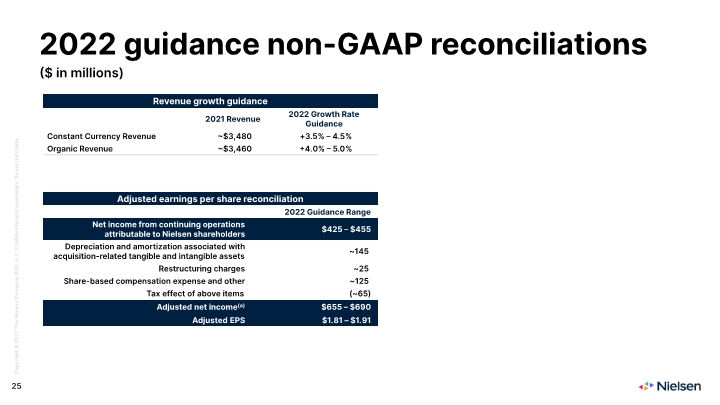

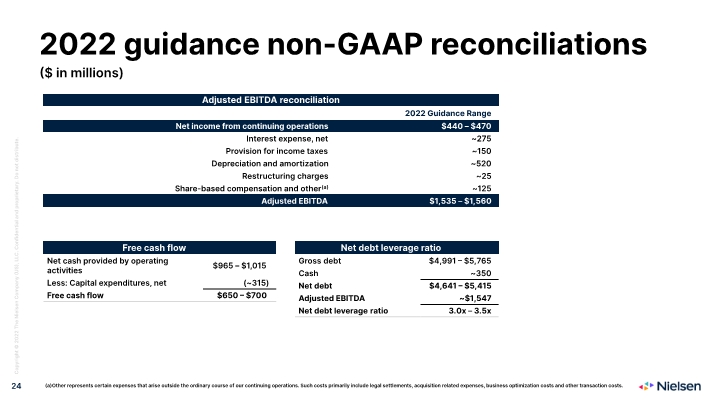

2022 guidance non-GAAP reconciliations ($ in millions) Other represents certain expenses that arise outside the ordinary course of our continuing operations. Such costs primarily include legal settlements, acquisition related expenses, business optimization costs and other transaction costs.

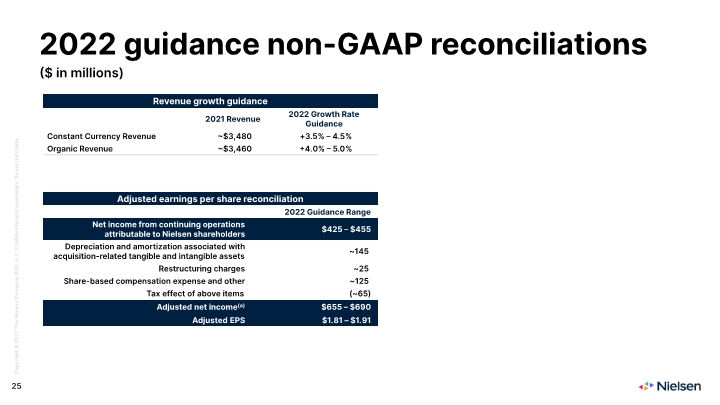

2022 guidance non-GAAP reconciliations ($ in millions)

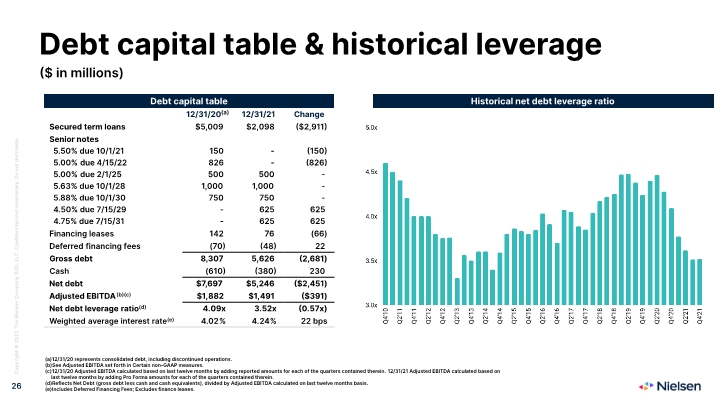

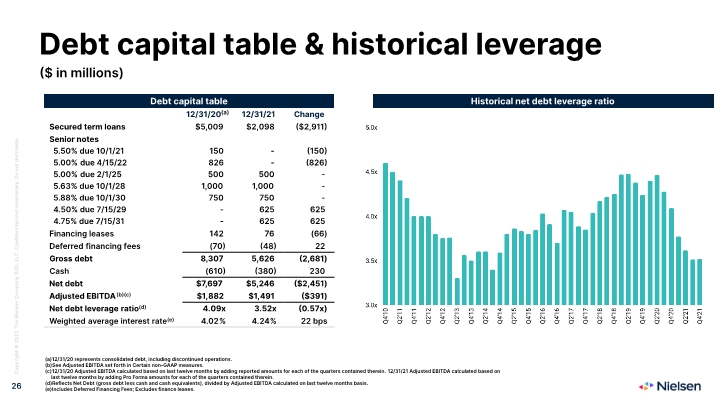

Debt capital table & historical leverage ($ in millions) 12/31/20 represents consolidated debt, including discontinued operations. See Adjusted EBITDA set forth in Certain non-GAAP measures. 12/31/20 Adjusted EBITDA calculated based on last twelve months by adding reported amounts for each of the quarters contained therein. 12/31/21 Adjusted EBITDA calculated based on last twelve months by adding Pro Forma amounts for each of the quarters contained therein. Reflects Net Debt (gross debt less cash and cash equivalents), divided by Adjusted EBITDA calculated on last twelve months basis. Includes Deferred Financing Fees; Excludes finance leases. Historical net debt leverage ratio

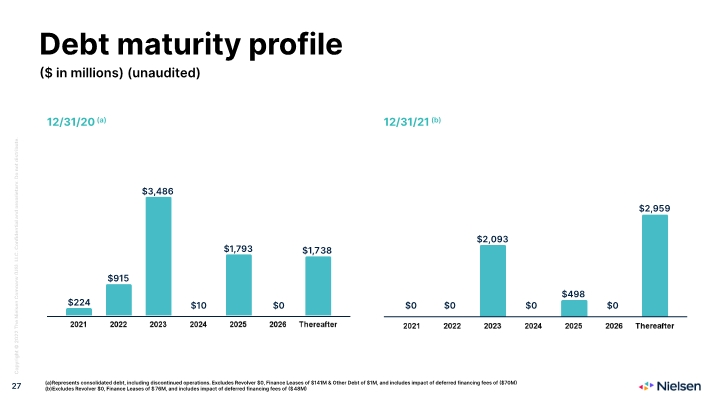

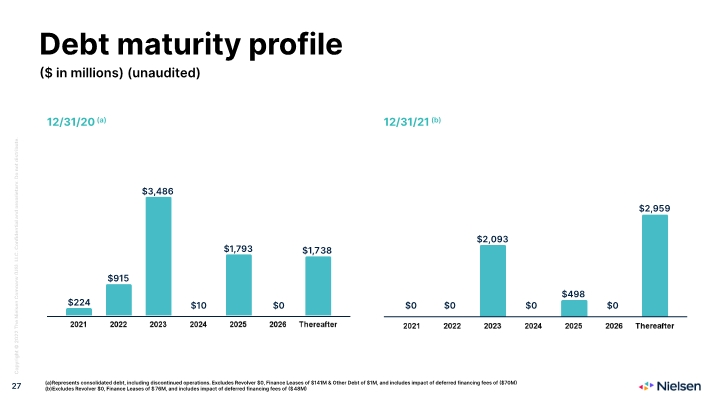

Debt maturity profile 12/31/20 (a) $3,486 $1,793 $1,738 $915 $224 $10 $0 $0 $2,093 $0 $498 $0 $2,959 Represents consolidated debt, including discontinued operations. Excludes Revolver $0, Finance Leases of $141M & Other Debt of $1M, and includes impact of deferred financing fees of ($70M) Excludes Revolver $0, Finance Leases of $76M, and includes impact of deferred financing fees of ($48M) ($ in millions) (unaudited) 12/31/21 (b) $0

28 Nielsen investor relations ir@nielsen.com +1.646.654.8153 nielsen.com/investors 28 Copyright © 2021 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute.