- Company Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Wright Medical PRE 14APreliminary proxy

Filed: 1 May 19, 5:10pm

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

| Sincerely, | |

| David D. Stevens | Robert J. Palmisano |

| Chairman | President and Chief Executive Officer |

| We intend to make this proxy statement and our 2018 Annual Report to Shareholders available on the Internet and to commence mailing of the notice to all shareholders entitled to vote at the Annual General Meeting beginning on or about May 17, 2019. We will mail paper copies of these materials, together with a proxy card, within three business days of a request properly made by a shareholder entitled to vote at the Annual General Meeting. |

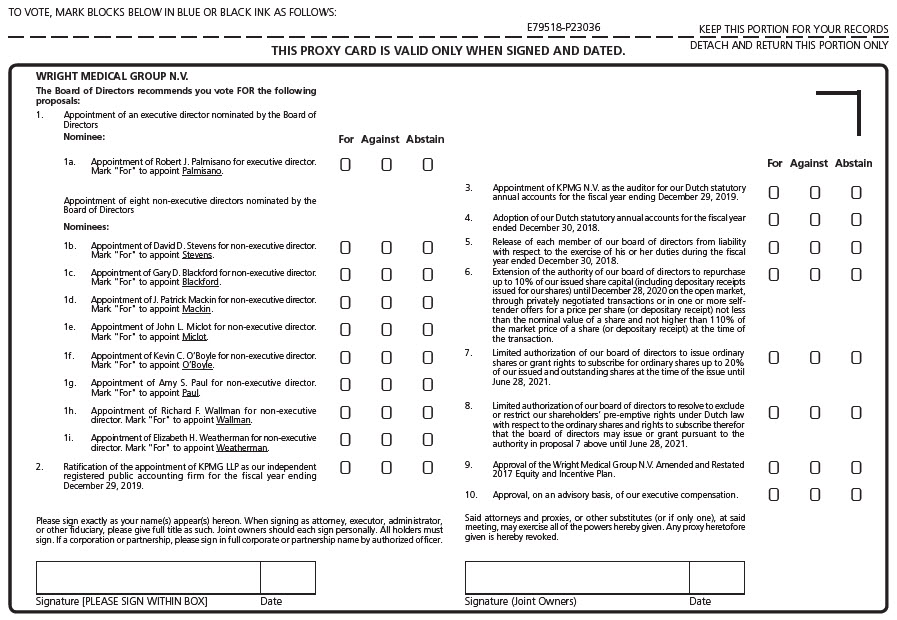

| 1. | Opening. |

| 2. | Report of our board of directors on the fiscal year ended December 30, 2018 (for discussion only). |

| 3. | Appointment of one executive director and eight non-executive directors and notification to the shareholders of the contemplated appointment of Robert J. Palmisano as executive director and David D. Stevens, Gary D. Blackford, J. Patrick Mackin, John L. Miclot, Kevin C. O’Boyle, Amy S. Paul, Richard F. Wallman and Elizabeth H. Weatherman as non-executive directors to serve until the 2020 Annual General Meeting or until his or her earlier death, resignation or removal (Voting Proposal No. 1). |

| 4. | Directors’ remuneration for the fiscal year ended December 30, 2018 (for discussion only). |

| 5. | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2019 (Voting Proposal No. 2). |

| 6. | Appointment of KPMG N.V. as the auditor for our Dutch statutory annual accounts for the fiscal year ending December 29, 2019 (Voting Proposal No. 3). |

| 7. | Adoption of our Dutch statutory annual accounts for the fiscal year ended December 30, 2018 (Voting Proposal No. 4). |

| 8. | Release of each member of our board of directors from liability with respect to the exercise of his or her duties during the fiscal year ended December 30, 2018 (Voting Proposal No. 5). |

| 9. | Extension of the authority of our board of directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until December 28, 2020 on the open market, through privately negotiated transactions or in one or more self-tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the market price of a share (or depositary receipt) at the time of the transaction (Voting Proposal No. 6). |

| 10. | Limited authorization of our board of directors to issue ordinary shares or grant rights to subscribe for ordinary shares up to 20% of our issued and outstanding shares at the time of the issue until June 28, 2021 (Voting Proposal No. 7). |

| 11. | Limited authorization of our board of directors to resolve to exclude or restrict our shareholders’ pre-emptive rights under Dutch law with respect to the ordinary shares and rights to subscribe therefor that the board of directors may issue or grant pursuant to the authority in agenda item 10 above until June 28, 2021 (Voting Proposal No. 8). |

| 12. | Approval of the Wright Medical Group N.V. Amended and Restated 2017 Equity and Incentive Plan (Voting Proposal No. 9). |

| 13. | Approval, on an advisory basis, of our executive compensation (Voting Proposal No. 10). |

| 14. | Closing. |

| By Order of the Board of Directors, | |

| James A. Lightman | |

| Senior Vice President, General Counsel and Secretary | |

| Amsterdam, The Netherlands | |

| May 17, 2019 |

Page | |

| 1 | |

| 12 | |

| 17 | |

| 30 | |

| 34 | |

| 40 | |

| 43 | |

| 44 | |

| 45 | |

| 46 | |

| 47 | |

| 49 | |

| 51 | |

| 67 | |

| 70 | |

| 91 | |

| 108 | |

| 112 | |

| 113 | |

| 116 | |

| 118 |

| • | “Wright,” “company,” “we,” “our” or “us” refer to Wright Medical Group N.V. and our subsidiaries; |

| • | “Wright ordinary shares,” “ordinary shares” or “shares” in this proxy statement refer to our ordinary shares, par value €0.03 per share; |

| • | “Annual General Meeting” or “AGM” refer to the 2019 Annual General Meeting of Shareholders, unless another year is specified; |

| • | a particular year refer to the applicable fiscal year, unless we indicate otherwise; |

| • | “Wright/Tornier merger” or the “merger” in this proxy statement refer to the merger between Wright Medical Group, Inc. and Tornier N.V. completed on October 1, 2015; and |

| • | “legacy Wright” and “legacy Tornier” refer to Wright Medical Group, Inc. and Tornier N.V., respectively, before completion of the Wright/Tornier merger. |

| Voting proposal | Board’s vote recommendation | Page |

| No. 1 – Appointment of directors | FOR | 34 |

| No. 2 – Ratification of appointment of independent registered public accounting firm | FOR | 40 |

| No. 3 – Appointment of auditor for Dutch statutory annual accounts | FOR | 43 |

| No. 4 – Adoption of Dutch statutory annual accounts | FOR | 44 |

| No. 5 – Release of certain liabilities | FOR | 45 |

| No. 6 – Extension of authority of Board to repurchase shares | FOR | 46 |

| No. 7 – Limited authorization to issue ordinary shares | FOR | 47 |

| No. 8 – Limited authorization to exclude or restrict shareholders’ pre-emptive rights until June 28, 2021 | FOR | 49 |

| No. 9 – Approval of Wright Medical Group N.V. Amended and Restated 2017 Equity and Incentive Plan | FOR | 51 |

| No. 10 – Advisory approval of executive compensation | FOR | 67 |

| FINANCIAL | |

$836 million | Net Sales Achieved $836 million in net sales, a 12% é over 2017, propelled by major new product launches – including our PERFORM™ Reversed Glenoid, BLUEPRINT™ adoption, AUGMENT® Injectable and our PROstep™ Minimally Invasive Surgery (MIS) system, as well as improved execution in our U.S. lower extremities sales force |

$117 million | Adjusted EBITDA Achieved $117 million in non-GAAP adjusted EBITDA, a 32% é over 2017 |

| 14% | Adjusted EBITDA Margin Expanded adjusted EBITDA margin by 210 basis points to 14% |

| 79% | Adjusted Gross Margin Expanded non-GAAP adjusted gross margin to 79% |

Twice market rate | U.S. Upper Extremities Business Our U.S. upper extremities business grew more than twice the market rate, fueled by our PERFORM™ Reversed Glenoid, SIMPLICITI™ and other shoulder products |

| 10% | U.S. Lower Extremities Business Our U.S. lower extremities business grew 10% due to the improvement in our lower extremities sales force, the success of our new products like PROstep™ MIS and good progress in further building our Ambulatory Surgery Center (ASC) business |

| ✔ | Received Premarket Approval from FDA for AUGMENT® Injectable AUGMENT® Injectable Bone Graft provides a clinically proven and safe and effective alternative to autograft for use in hindfoot and ankle fusion in an easy to use flowable formulation |

| ✔ | Completed Acquisition of Cartiva, Inc. This acquisition added to our lower extremities portfolio Cartiva’s Synthetic Cartilage Implant, the first and only PMA product for the treatment of great toe osteoarthritis, which is supported by compelling clinical performance and backed by Level I clinical evidence |

| 40% | Accelerated Adoption of BLUEPRINT™ Enabling Technology We achieved an approximate 40% case penetration with our BLUEPRINT™ enabling technology by the end of 2018, up from 20% in the second quarter of 2018 |

| Please see Annex I for a reconciliation of non-GAAP financial measures to most comparable measures under U.S. generally accepted accounting principles. |

| ✔ | One tier of directors – one executive director and eight non-executive directors | ✔ | Internal board rules similar to U.S. corporate bylaws or corporate governance guidelines |

| ✔ | Annual election of directors | ✔ | Nearly 100% meeting attendance by directors |

| ✔ | Majority independent directors | ✔ | Robust stock ownership guidelines and retention requirements |

| ✔ | Independent board chairman | ✔ | Extensive executive succession planning efforts |

| ✔ | Four standing board committees: audit, compensation, nominating, corporate governance and compliance and strategic transactions | ✔ | Annual review of corporate governance documents |

| ✔ | Fully independent board committees | ✔ | Annual and thorough board and board committee evaluations |

| ✔ | Recent board refreshment efforts | ✔ | No poison pill or the Dutch equivalent |

| ✔ | Added performance-based awards to our annual executive officer long-term incentive award program; |

| ✔ | Adopted a clawback policy; |

| ✔ | Adopted a double-trigger change-in-control vesting provision in our 2017 equity and incentive plan; |

| ✔ | Designed our 2017 equity and incentive plan to reflect evolving shareholder preferences; and |

| ✔ | Require pre-approval of additional directorships by our board members. |

| WRITE | CALL | ATTEND | |

Corporate Secretary Wright Medical Group N.V. Prins Bernhardplein 200 1097 JB Amsterdam The Netherlands | Investor Relations (901) 290-5817 | julie.dewey@wright.com | Annual General Meeting Friday, June 28, 2019 Wright Medical Group N.V. |

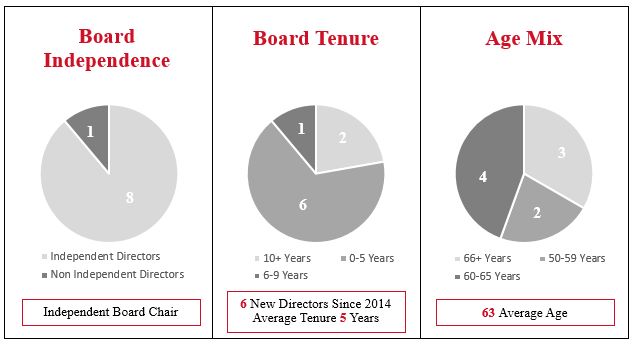

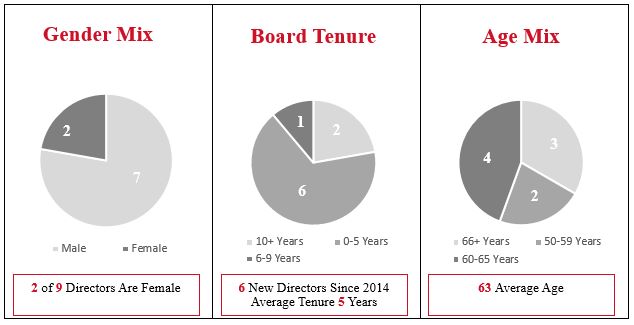

| Gender Diversity | |

| Female Representation | 22% (Two of Nine) |

| Senior Leadership/ Management | Financial Expertise | Industry Expertise | Sales and Marketing Expertise |

| Strategic Planning/M&A | Investor Relations | International Experience | Regulatory/ Clinical/ Quality/ Compliance Experience |

| Public Company Board Experience | Experience in High-Growth Businesses | Technology/Cybersecurity Experience | Reimbursement |

| Director | Board | Audit | Compensation | Nominating, corporate governance and compliance | Strategic transactions | Attendance rate |

| Robert J. Palmisano | ● | 100% | ||||

| David D. Stevens | Chair | ● | ● | 100% | ||

| Gary D. Blackford | ● | Chair | 100% | |||

| J. Patrick Mackin | ● | ● | 80% | |||

| John L. Miclot | ● | Chair | ● | 100% | ||

| Kevin C. O’Boyle | ● | Chair | ● | 100% | ||

| Amy S. Paul | ● | ● | ● | 100% | ||

| Richard F. Wallman | ● | ● | 100% | |||

| Elizabeth H. Weatherman | ● | ● | Chair | 100% |

| Director | Age | Serving since | Independent | Current board committees |

| Robert J. Palmisano | 74 | 2015 | No(1) | N/A |

| David D. Stevens | 65 | 2015 | Yes | Nominating, Corporate Governance and Compliance and Strategic Transactions |

| Gary D. Blackford | 62 | 2015 | Yes | Nominating, Corporate Governance and Compliance |

| J. Patrick Mackin | 52 | 2018 | Yes | Compensation |

| John L. Miclot | 60 | 2015 | Yes | Compensation and Strategic Transactions |

| Kevin C. O’Boyle | 63 | 2010 | Yes | Audit and Strategic Transactions |

| Amy S. Paul | 67 | 2015 | Yes | Compensation and Nominating, Corporate Governance and Compliance |

| Richard F. Wallman | 68 | 2008 | Yes | Audit |

| Elizabeth H. Weatherman | 59 | 2006 | Yes | Audit and Strategic Transactions |

| (1) | Robert J. Palmisano serves as executive director, a role that is inherently not independent. In addition to serving as executive director, Mr. Palmisano serves as President and Chief Executive Officer. |

| ✔ | Reinforce our corporate mission, vision and values; |

| ✔ | Attract and retain executives important to the success of our Company; |

| ✔ | Align the interests of our executives with the interests of our shareholders; and |

| ✔ | Reward executives for the achievement of Company performance objectives, the creation of shareholder value in the short- and long-term, and their contributions to the success of our Company. |

| What we do | What we don’t do | ||

| ✔ | Structure our executive officer compensation so that a significant portion of pay is at risk |  | No automatic salary increases |

| ✔ | Emphasize long-term performance in our equity-based incentive awards |  | No repricing of stock options unless approved by shareholders |

| ✔ | Use a mix of performance measures and caps on payouts |  | No excessive perquisites |

| ✔ | Require minimum vesting periods on equity awards |  | No new single-trigger change in control arrangements |

| ✔ | Require double-trigger for equity acceleration upon a change in control |  | No tax gross-ups, other than limited CEO and relocation tax gross-ups |

| ✔ | Maintain a competitive compensation package |  | No change in control excise tax gross-ups |

| ✔ | Have robust stock ownership guidelines and stock retention requirements for executive officers |  | No pledging or hedging of Wright securities |

| ✔ | Maintain a robust clawback policy |  | No short sales or derivative transactions in Wright shares, including hedges |

| ✔ | Hold an annual say-on-pay vote |  | No current payment of dividends on unvested awards |

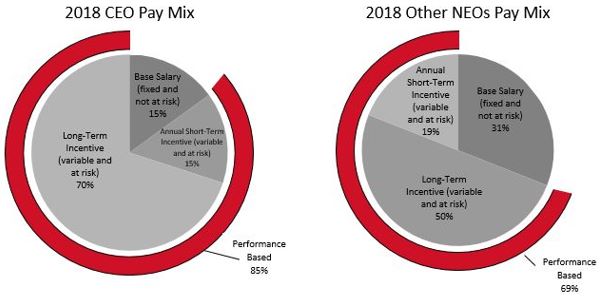

| ✔ | Base salary; |

| ✔ | Short-term annual incentive compensation; and |

| ✔ | Long-term incentive compensation. |

| Pay element | 2018 actions |

| Base Salary | • Our CEO received no base salary increase. • Our NEOs received base salary increases between zero and 4.0%. |

| Short-Term Annual Incentive | • Target bonus percentage for our CEO remained the same at 100% and remained the same for our other NEOs, ranging from 50% to 65% of base salary. • Our CEO’s and CFO’s short-term incentive is based 100% on corporate performance goals. • Other NEOs’ short-term incentives are based on corporate performance goals, and in some cases, divisional and individual performance goals. • Corporate performance payouts were 111.1% of target, based on fiscal 2018 performance. (see page [80] for additional details) • U.S. and international divisional performance payouts were 117.2% and 98.0% of target, respectively, based on fiscal 2018 performance. |

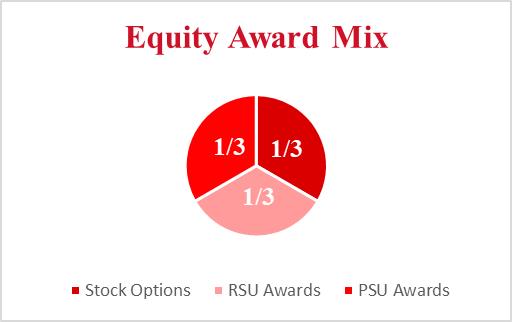

| Long-Term Incentives | • The target long-term incentive (LTI) grant guideline for our CEO increased from 400% to 450% of base salary to align closer with targeted competitive levels and remained the same for other NEOs, ranging from 100% to 175%, except in the case of one NEO whose LTI increased to 225%. • LTI is delivered 1/3 in stock options, 1/3 in time-vested restricted stock unit (RSU) awards, and 1/3 in performance share unit (PSU) awards. • Stock options and RSU awards vest over four years. • PSU awards vest and are paid out in Wright ordinary shares upon the achievement of a threshold net sales growth goal over a three-year period. • Since PSU awards were first granted in 2017, there were no payouts of prior PSU awards during 2018. |

| Other | • We paid Mr. Morton a $200,000 signing bonus upon his hiring, 100% of which he would have had to repay if he had voluntarily left Wright within one year of his start date and 50% of which he must repay if he voluntarily leaves within two years of his start date. • In June 2016, we agreed to pay Mr. Cooke a $1.2 million retention payment to relocate his family to the United Kingdom. This payment, made in June 2018, is in lieu of any future change in control or severance payment under his separation pay agreement. • In December 2018, we approved new compensation packages for Messrs. Berry and Cordell in connection with their promotions effective January 2019. |

| • | “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2019; |

| • | “FOR” the appointment of KPMG N.V. as the auditor for our Dutch statutory annual accounts for the fiscal year ending December 29, 2019; |

| • | “FOR” the adoption of our Dutch statutory annual accounts for the fiscal year ended December 30, 2018; |

| • | “FOR” the release of each member of our board of directors from liability with respect to the exercise of his or her duties during the fiscal year ended December 30, 2018; and |

| • | “FOR” the approval of the extension of the authority of our board of directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until December 28, 2020 on the open market, through privately negotiated transactions or in one or more self-tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the market price of a share (or depositary receipt) at the time of the transaction. |

| • | sustainability efforts (e.g., incorporate sustainability concepts into the design of our products and their packaging to reduce the environmental footprint of our products); |

| • | humanitarianism (e.g., product donations and volunteering during work hours through our Wright Cares programs); |

| • | education (e.g., scholarships and tuition reimbursement programs); |

| • | health and wellness (e.g., days devoted to healthcare awareness and fitness challenges); and |

| • | access to healthcare and products (e.g., patient information programs and donations of implants, products, and supplies related to medical missions and care for the indigent). |

| Shareholder action | Submission deadline |

| Proposal Pursuant to Rule 14a-8 of the United States Securities Exchange Act of 1934, as amended | No later than January 15, 2020 |

| Nomination of a Candidate Pursuant to our Articles of Association | No later than April 28, 2020 |

| Proposal of Other Business for Consideration Pursuant to our Articles of Association | No later than April 28, 2020 |

| Voting proposal | Item of business |

| Voting Proposal No. 1 | Appointment of Directors |

| Voting Proposal No. 2 | Ratification of the Appointment of KPMG LLP as Independent Registered Public Accounting Firm for Fiscal Year 2019 |

| Voting Proposal No. 3 | Appointment of KPMG N.V. as Auditor for Dutch Statutory Annual Accounts for Fiscal Year 2019 |

| Voting Proposal No. 4 | Adoption of Dutch Statutory Annual Accounts |

| Voting Proposal No. 5 | Release of Certain Liabilities |

| Voting Proposal No. 6 | Extension of Authority of the Board of Directors to Repurchase up to 10% of our Issued Share Capital Until December 28, 2020 |

| Voting Proposal No. 7 | Limited Authorization to Issue Ordinary Shares Until June 28, 2021 |

| Voting Proposal No. 8 | Limited Authorization to Exclude or Restrict Shareholders’ Pre-Emptive Rights Until June 28, 2021 |

| Voting Proposal No. 9 | Approval of the Wright Medical Group N.V. Amended and Restated 2017 Equity and Incentive Plan |

| Voting Proposal No. 10 | Advisory Approval of our Executive Compensation |

| If you are a shareholder of record and are voting by proxy, your vote must be received by 11:59 p.m. (Eastern Time) on June 26, 2019 to be counted. |

| • | By Internet – You can vote by Internet by going to the website www.proxyvote.com and following the instructions for Internet voting shown on your Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, your proxy card. |

| • | By Telephone – You can vote by telephone by calling toll-free 1-800-690-6903 in the United States, Canada and Puerto Rico and following the instructions. |

| • | By Mail – You can vote by mail by completing, signing, dating and mailing your proxy card in the envelope provided if you received a paper copy of these proxy materials. If you vote by Internet or telephone, please do not mail your proxy card. |

| • | “FOR” the appointment of Robert J. Palmisano as executive director and David D. Stevens, Gary D. Blackford, J. Patrick Mackin, John L. Miclot, Kevin C. O’Boyle, Amy S. Paul, Richard F. Wallman and Elizabeth H. Weatherman as non-executive directors, as recommended by our board of directors, in Voting Proposal No. 1; and |

| • | “FOR” each of the other voting proposals in this proxy statement, as recommended by our board of directors. |

| • | giving to our Senior Vice President, General Counsel and Secretary a written notice of revocation of the proxy’s authority; |

| • | submitting a duly executed proxy card bearing a later date; |

| • | voting again by Internet, telephone or mail at a later time before the closing of these voting facilities at 11:59 p.m. (Eastern Time) on June 26, 2019; or |

| • | attending the Annual General Meeting and voting in person. |

| • | “FOR” the appointment of Robert J. Palmisano as executive director and David D. Stevens, Gary D. Blackford, J. Patrick Mackin, John L. Miclot, Kevin C. O’Boyle, Amy S. Paul, Richard F. Wallman and Elizabeth H. Weatherman as non-executive directors, in each case to serve until the 2020 Annual General Meeting or until his or her earlier death, resignation or removal (Voting Proposal No. 1); |

| • | “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 29, 2019 (Voting Proposal No. 2); |

| • | “FOR” the appointment of KPMG N.V. as the auditor for our Dutch statutory annual accounts for the fiscal year ending December 29, 2019 (Voting Proposal No. 3); |

| • | “FOR” the adoption of our Dutch statutory annual accounts for the fiscal year ended December 30, 2018 (Voting Proposal No. 4); |

| • | “FOR” the release of each member of our board of directors from liability with respect to the exercise of his or her duties during the fiscal year ended December 30, 2018 (Voting Proposal No. 5); |

| • | “FOR” the approval of the extension of the authority of our board of directors to repurchase up to 10% of our issued share capital (including depositary receipts issued for our shares) until December 28, 2020 on the open market, through privately negotiated transactions or in one or more self-tender offers for a price per share (or depositary receipt) not less than the nominal value of a share and not higher than 110% of the market price of a share (or depositary receipt) at the time of the transaction (Voting Proposal No. 6); |

| • | “FOR” the limited authorization to issue ordinary shares until June 28, 2021 (Voting Proposal No. 7); |

| • | “FOR” the limited authorization to exclude or restrict shareholders’ pre-emptive rights until June 28, 2021 (Voting Proposal No. 8); |

| • | “FOR” the approval of the Wright Medical Group N.V. Amended and Restated 2017 Equity and Incentive Plan (Voting Proposal No. 9); and |

| • | “FOR” the approval, on an advisory basis, of our executive compensation (Voting Proposal No. 10). |

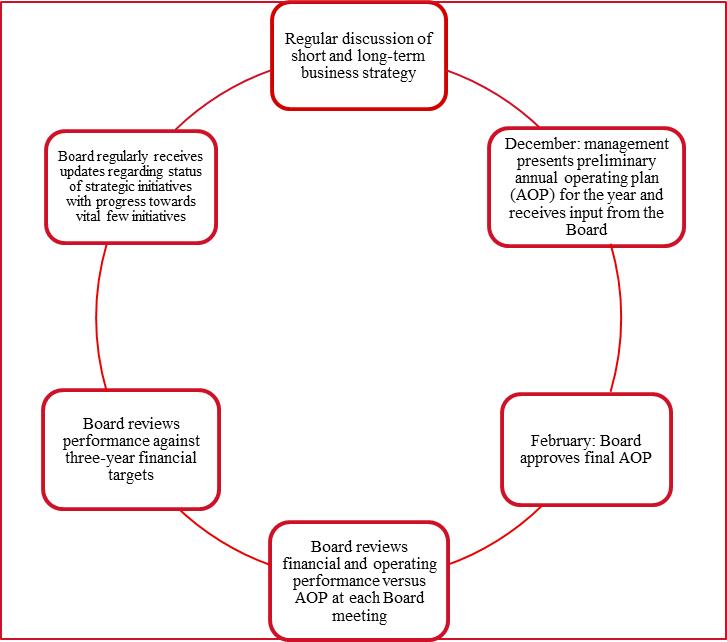

| ✔ | One tier of directors – one executive director and eight non-executive directors | ✔ | Internal board rules similar to U.S. corporate bylaws or corporate governance guidelines |

| ✔ | Annual election of directors | ✔ | Nearly 100% meeting attendance by directors |

| ✔ | Majority independent directors | ✔ | Robust stock ownership guidelines and retention requirements |

| ✔ | Independent board chairman | ✔ | Extensive executive succession planning efforts |

| ✔ | Four standing board committees: audit, compensation, nominating, corporate governance and compliance and strategic transactions | ✔ | Annual review of corporate governance documents |

| ✔ | Fully independent board committees | ✔ | Annual and thorough board and board committee evaluations |

| ✔ | Recent board refreshment efforts | ✔ | No poison pill or the Dutch equivalent |

| Board responsibility | Board meetings |

| Board composition | Board resolutions |

| Chairman responsibilities | Conflicts of interest |

| Executive director responsibilities | Board committees |

| Non-executive director responsibilities | Disclosure of information |

| Ownership of securities | Confidentiality |

| Director | Board | Audit | Compensation | Nominating, corporate governance and compliance | Strategic transactions | Attendance rate |

| Robert J. Palmisano | ● | 100% | ||||

| David D. Stevens | Chair | ● | ● | 100% | ||

| Gary D. Blackford | ● | Chair | 100% | |||

| J. Patrick Mackin | ● | ● | 80% | |||

| John L. Miclot | ● | Chair | ● | 100% | ||

| Kevin C. O’Boyle | ● | Chair | ● | 100% | ||

| Amy S. Paul | ● | ● | ● | 100% | ||

| Richard F. Wallman | ● | ● | 100% | |||

| Elizabeth H. Weatherman | ● | ● | Chair | 100% |

| • | assisting our board of directors in monitoring the integrity of our consolidated financial statements, our compliance with legal and regulatory requirements insofar as they relate to our consolidated financial statements and financial reporting obligations and any accounting, internal accounting controls or auditing matters, our independent registered public accounting firm's qualifications and independence, and the performance of our internal audit function and independent registered public accounting firm; |

| • | appointing, compensating, retaining, and overseeing the work of any independent registered public accounting firm engaged for the purpose of performing any audit, review, or attest services and dealing directly with any such auditing firm; provided, that such appointment will be subject to shareholder ratification or decision in the case of the auditor for our Dutch statutory annual accounts; |

| • | providing a medium for consideration of matters relating to any audit issues; |

| • | establishing procedures for the receipt, retention, and treatment of complaints received by us regarding accounting, internal accounting controls, or auditing matters, and for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; and |

| • | reviewing and approving all related party transactions required to be disclosed under the U.S. federal securities laws. |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluating the performance of these officers in light of those goals and objectives, and setting compensation of these officers based on such evaluations; |

| • | making recommendations to our board of directors with respect to incentive compensation and equity-based plans that are subject to board and shareholder approval, administering or overseeing all of our incentive compensation and equity-based plans, and discharging any responsibilities imposed on the committee by any of these plans; |

| • | reviewing and recommending to our board of directors any severance or similar termination payments proposed to be made to our Chief Executive Officer and reviewing and approving any severance or similar termination payments proposed to be made to any other executive officer; |

| • | reviewing and discussing with our Chief Executive Officer and reporting periodically to our board of directors plans for development and corporate succession plans for our executive officers and other key employees, which include transitional leadership in the event of an unplanned vacancy; |

| • | reviewing and discussing with management the “Compensation Discussion and Analysis” section of this proxy statement, and, based on such discussions, recommending to our board of directors whether the “Compensation Discussion and Analysis” section should be included in this proxy statement; and |

| • | approving, or recommending to our board of directors for approval, the compensation programs, and the payouts for all programs, applying to our non-executive directors, including reviewing the competitiveness of our non-executive director compensation programs and reviewing the terms to make sure they are consistent with our board of directors compensation policy adopted by the general meeting of our shareholders. |

| • | reviewing and making recommendations to our board of directors regarding the size and composition of our board of directors; |

| • | identifying, reviewing, and recommending nominees for election as directors; |

| • | making recommendations to our board of directors regarding corporate governance matters and practices, including any revisions to our internal rules for our board of directors; and |

| • | overseeing our compliance efforts with respect to our legal, regulatory, and quality systems requirements and ethical programs, including our code of business conduct, other than with respect to matters relating to our financial statements and financial reporting obligations and any accounting, internal accounting controls or auditing matters, which are within the purview of the audit committee. |

| • | reviewing and evaluating potential opportunities for strategic business combinations, acquisitions, mergers, dispositions, divestitures, investments, and similar strategic transactions involving our company or any one or more of our subsidiaries outside the ordinary course of our business that may arise from time to time; |

| • | approving on behalf of our board of directors any strategic transaction that may arise from time to time and is deemed appropriate by the strategic transactions committee and involves total cash consideration of less than $5.0 million; provided, however, that the strategic transactions committee is not authorized to approve any strategic transaction involving the issuance of capital stock or in which any director, officer, or affiliate of our company has a material interest; |

| • | making recommendations to our board of directors concerning approval of any strategic transactions that may arise from time to time and are deemed appropriate by the strategic transactions committee and are beyond the authority of the strategic transactions committee to approve; |

| • | reviewing integration efforts with respect to completed strategic transactions from time to time and making recommendations to management and our board of directors, as appropriate; |

| • | assisting management in developing, implementing, and adhering to a strategic plan and direction for its activities with respect to strategic transactions and making recommendations to management and our board of directors, as appropriate; |

| • | reviewing and approving the settlement or compromise of any material litigation or claim against us; and |

| • | reviewing and evaluating potential opportunities for restructuring our business in response to completed strategic transactions or otherwise in an effort to realize anticipated cost and expense savings for, and other benefits to, our company and making recommendations to management and our board of directors, as appropriate. |

| ✔ | Added performance-based awards to our annual executive officer long-term incentive award program; |

| ✔ | Adopted a clawback policy; |

| ✔ | Adopted a double-trigger change-in-control vesting provision in our 2017 equity and incentive plan; |

| ✔ | Designed our 2017 equity and incentive plan to reflect evolving shareholder preferences; and |

| ✔ | Require pre-approval of additional directorships by our board members. |

| WRITE | CALL | ATTEND | |

Corporate Secretary Wright Medical Group N.V. Prins Bernhardplein 200 1097 JB Amsterdam The Netherlands | Investor Relations (901) 290-5817 | julie.dewey@wright.com | Annual General Meeting Friday, June 28, 2019 Wright Medical Group N.V. |

| Name | Age | Position |

| Robert J. Palmisano | 74 | President and Chief Executive Officer and Executive Director |

| Lance A. Berry | 46 | Executive Vice President, Chief Financial and Operations Officer |

| Kevin D. Cordell | 53 | Executive Vice President, Chief Global Commercial Officer |

| Jason D. Asper | 44 | Senior Vice President, Strategy, Corporate Development and Technology |

| Julie D. Dewey | 57 | Senior Vice President, Chief Communications Officer |

| James A. Lightman | 61 | Senior Vice President, General Counsel and Secretary |

| Andrew C. Morton | 54 | Senior Vice President and Chief Human Resources Officer |

| J. Wesley Porter | 49 | Senior Vice President, Chief Compliance Officer |

| Barry J. Regan | 47 | Senior Vice President, Operations |

| Kevin C. Smith | 59 | Senior Vice President, Quality and Regulatory |

| Jennifer S. Walker | 51 | Senior Vice President, Process Improvement |

| Peter S. Cooke | 54 | President, Emerging Markets, Australia and Japan |

| Patrick Fisher | 45 | President, Lower Extremities |

| Timothy L. Lanier | 57 | President, Upper Extremities |

| Steven P. Wallace | 39 | President, International |

| Julie B. Andrews | 48 | Vice President of Finance, Chief Accounting Officer |

| Robert J. Palmisano, Executive Director |

| Gary D. Blackford, Non-Executive Director |

| J. Patrick Mackin, Non-Executive Director |

| John L. Miclot, Non-Executive Director |

| Kevin C. O’Boyle, Non-Executive Director |

| Amy S. Paul, Non-Executive Director |

| David D. Stevens, Non-Executive Director |

| Richard F. Wallman, Non-Executive Director |

| Elizabeth H. Weatherman, Non-Executive Director |

| Name | Age | Position |

| Robert J. Palmisano | 74 | President and Chief Executive Officer and Executive Director |

| David D. Stevens | 65 | Chairman and Non-Executive Director |

| Gary D. Blackford | 62 | Non-Executive Director |

| J. Patrick Mackin | 52 | Non-Executive Director |

| John L. Miclot | 60 | Non-Executive Director |

| Kevin C. O’Boyle | 63 | Non-Executive Director |

| Amy S. Paul | 67 | Non-Executive Director |

| Richard F. Wallman | 68 | Non-Executive Director |

| Elizabeth H. Weatherman | 59 | Non-Executive Director |

| 1. | For the only open executive director position, our board of directors has nominated Robert J. Palmisano to serve as executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Palmisano for this position. |

| 2. | For the first open non-executive director position, our board of directors has nominated David D. Stevens to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Stevens for this position. |

| 3. | For the second open non-executive director position, our board of directors has nominated Gary D. Blackford to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Blackford for this position. |

| 4. | For the third open non-executive director position, our board of directors has nominated J. Patrick Mackin to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Mackin for this position. |

| 5. | For the fourth open non-executive director position, our board of directors has nominated John L. Miclot to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Miclot for this position. |

| 6. | For the fifth open non-executive director position, our board of directors has nominated Kevin C. O’Boyle to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. O’Boyle for this position. |

| 7. | For the sixth open non-executive director position, our board of directors has nominated Amy S. Paul to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until her earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Ms. Paul for this position. |

| 8. | For the seventh open non-executive director position, our board of directors has nominated Richard F. Wallman to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until his earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Mr. Wallman for this position. |

| 9. | For the eighth open non-executive director position, our board of directors has nominated Elizabeth H. Weatherman to serve as a non-executive director for a term ending on the 2020 Annual General Meeting or until her earlier death, resignation or removal. Our board of directors recommends that shareholders vote for the appointment of Ms. Weatherman for this position. |

The Board of Directors Recommends a Vote FOR each Director Nominee in Voting Proposal No. 1 | ☑ |

| Fees | 2018 | 2017 | ||||||

| Audit fees | $ | 2,398,575 | $ | 2,050,153 | ||||

| Audit-related fees | 50,125 | 72,550 | ||||||

| Tax fees | 65,000 | — | ||||||

| All other fees | 15,625 | 3,000 | ||||||

| Total | $ | 2,529,325 | $ | 2,125,703 | ||||

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 2 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 3 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 4 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 5 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 6 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 7 | ☑ |

| The Board of Directors Recommends a Vote FOR Voting Proposal No. 8 | ☑ |

| • | Attracts and retains talent. Talented, motivated and effective employees, non-employee directors and consultants are essential to executing our business strategies. Stock-based and cash-based incentive compensation have been important components of total compensation for our executive officers and key employees for many years because such compensation enables us to effectively recruit and retain qualified individuals while encouraging them to think and act like owners of our company. If our shareholders approve the amended plan, we believe we will maintain our ability to offer competitive compensation packages to both attract new talent and retain our best performers. |

| • | Consistent with our pay-for-performance compensation philosophy. We believe that stock-based compensation, by its very nature, is performance-based compensation. Over time, the most significant component of total compensation for our executives is incentive compensation in the form of both stock-based and cash-based incentives that are tied to the achievement of business results. We use incentive compensation both to reinforce desired business results for our key employees and to motivate them to achieve those results. |

| • | Aligns director, employee and shareholder interests. We currently provide long-term incentives primarily in the form of option and RSU awards to our non-employee directors, executives and certain key employees and PSU awards to our executives. We believe our stock-based compensation programs, along with our stock ownership guidelines for our non-employee directors and executives, and our annual cash incentive programs for employees, help align the interests of our non-employee directors and employees with those of our shareholders. We believe our long-term stock-based incentives help promote long-term retention of our employees and encourage significant ownership of our ordinary shares. We believe our annual cash incentives reinforce achievement of our business performance goals by linking a significant portion of executives’ compensation to the achievement of these performance goals. If the amended plan is approved, we will be able to maintain these important means of aligning the interests of our non-employee directors and employees with those of our shareholders. |

| • | Protects shareholder interests and embraces sound equity-based compensation practices. As described in more detail below under “—Summary of Sound Governance Features of the Amended Plan,” the amended plan includes a number of features that are consistent with protecting the interests of our shareholders and sound corporate governance practices. |

| ✔ | No evergreen provision | ✔ | No discounted or reload stock options or SARs |

| ✔ | Not excessively dilutive | ✔ | No liberal change in control definition |

| ✔ | Minimum vesting and performance period requirements | ✔ | “Double-trigger” acceleration of vesting upon a change in control |

| ✔ | No dividend payments on unvested awards | ✔ | No tax gross-ups |

| ✔ | Limits on non-employee director awards and overall compensation | ✔ | Awards subject to forfeiture or “clawback” and our clawback policy |

| ✔ | No re-pricing of “underwater” stock options or SARs without shareholder approval | ✔ | No liberal share counting or “recycling” of shares from exercised stock options, SARs or other stock-based awards |

| ✔ | Members of the committee administering the plan are non-employee and independent directors |

| • | Ordinary shares available under the 2017 plan and total outstanding equity-based awards and how long the ordinary shares available are expected to last; |

| • | Historical equity award granting practices, including our three-year average ordinary share usage rate (commonly referred to as burn rate); and |

| • | Potential dilution and overhang. |

| • | [3,062,149] ordinary shares remained available for issuance under the 2017 plan, assuming target performance under our PSU awards and [2,828,125] ordinary shares remained available for issuance under the 2017 plan, assuming maximum performance under our PSU awards; and |

| • | [9,341,907] stock options and [1,547,058] ordinary shares underlying full value awards (such as RSU and PSU awards, assuming target performance) were outstanding under the 2017 plan and our predecessor plans. |

| Fiscal 2018 | Fiscal 2017 | Fiscal 2016 | ||||||||||

| Stock options granted | 1,464,209 | 1,334,596 | 1,870,214 | |||||||||

| Restricted stock units granted | 607,050 | 493,030 | 706,361 | |||||||||

| Performance share units granted (assuming target) | 128,625 | 114,403 | — | |||||||||

| Weighted average basic ordinary shares outstanding during fiscal year | 112,591,541 | 104,530,708 | 102,967,571 | |||||||||

| Burn rate | 2.0 | % | 1.9 | % | 2.5 | % | ||||||

| Potential dilution is calculated as shown below: | |||

| Potential dilution | = | Total outstanding award shares divided by total number of outstanding ordinary shares + total outstanding award shares | |

| Potential overhang is calculated as shown below: | |||

| Potential overhang | = | Total potential award shares divided by total number of outstanding ordinary shares + total outstanding award shares | |

| Purpose | The purpose of the amended plan is to advance the interests of our company and shareholders by enabling us to attract and retain qualified individuals to perform services, provide incentive compensation for such individuals in a form that is linked to the growth and profitability of our company and increases in shareholder value, and provide opportunities for equity participation that align the interests of recipients with those of our shareholders. | |

| Administration | Our board of directors and compensation committee will administer the amended plan. All members of our compensation committee are “non-employee directors” within the meaning of Rule 16b-3 under the Exchange Act and “independent” under the Listing Rules of the Nasdaq Stock Market. We refer to the board and compensation committee in this summary as the “committee.” |

Shares Authorized | As of May 10, 2019, before giving effect to the amended plan, we had available for issuance under the 2017 plan a total of [2,828,125] ordinary shares. This number could increase to reflect awards that are subsequently forfeited, cancelled or expired. Subject to adjustment as described below, the number of ordinary shares authorized and available for issuance under the amended plan will be increased by 6,200,000 ordinary shares. The amended plan also increases the limits on the number of incentive stock options and full value awards that can be granted under the plan proportionate to the overall increased share limit. | |

Annual Award Limits | The following limits are per participant per fiscal year. • 2,000,000 ordinary shares subject to stock options and stock appreciation rights; • 2,000,000 ordinary shares subject to restricted stock awards, restricted stock units and deferred stock units; • $5,000,000 in performance awards denominated in cash or 2,000,000 ordinary shares for performance awards denominated in shares; • $5,000,000 in annual performance cash awards; • $5,000,000 in other cash-based awards; and • 2,000,000 ordinary shares granted under other stock-based awards. | |

| Adjustments | In the event of any reorganization, merger, consolidation, recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture or extraordinary dividend (including a spin off) or other similar change in our corporate structure or ordinary shares, the committee will make the appropriate adjustment or substitution. These adjustments or substitutions may be to the number and kind of securities and property that may be available for issuance under the amended plan. In order to prevent dilution or enlargement of the rights of participants, the committee may also adjust the number, kind, and exercise price of securities or other property subject to outstanding awards. | |

| No Re-Pricing | The committee may not, except as described above under “Adjustments,” without prior approval of our shareholders, seek to effect any re-pricing of any previously granted “underwater” option or stock appreciation right by: (i) amending or modifying the terms of the option or stock appreciation rights to lower the exercise price or grant price; (ii) canceling the underwater option or stock appreciation right in exchange for (A) cash; (B) replacement options or stock appreciation rights having a lower exercise price or grant price; or (C) other awards; or (iii) repurchasing the underwater options or stock appreciation rights and granting new awards under the amended plan. An option or stock appreciation right will be deemed to be “underwater” at any time when the fair market value of an ordinary share is less than the exercise price of the option or the grant price of the stock appreciation right. |

Minimum Vesting Requirements | The amended plan provides that any full value awards granted to employees will vest no more rapidly than ratably over a three year period after the grant date, no awards will vest prior to the one-year anniversary of the grant date, and any awards that vest upon the attainment of performance goals will have a minimum performance period of at least one year. There is an exception for ordinary shares that do not exceed 5% of the total number of ordinary shares authorized for awards under the amended plan. There are also exceptions provided for substitute awards and ordinary shares delivered in lieu of fully vested cash awards. | |

Eligible Recipients | Awards may be granted to our employees, non-employee directors and consultants. A “consultant” is one who renders services that are not in connection with the offer and sale of our securities in a capital raising transaction and do not directly or indirectly promote or maintain a market for our securities. As of May 10, 2019, approximately [1,420] employees, eight non-employee directors and approximately [40] consultants would have been eligible to participate in the amended plan had it been approved by our shareholders at such time. | |

Types of Awards | The amended plan will permit us to grant non-statutory and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock units, deferred stock units, performance awards, annual performance cash awards, non-employee director awards, other cash-based awards and other stock based awards. Awards may be granted either alone or in addition to or in tandem with any other type of award. | |

| Stock Options | Stock options entitle the holder to purchase a specified number of ordinary shares at a specified price, which is called the exercise price, subject to the terms and conditions of the stock option grant. The amended plan permits the grant of both non-statutory and incentive stock options. Incentive stock options may be granted solely to eligible employees. Each stock option granted under the amended plan must be evidenced by an award agreement that specifies the exercise price, the term, the number of shares underlying the stock option, the vesting schedule and any other conditions. The exercise price of each stock option granted under the amended plan must be at least 100% of the fair market value of an ordinary share as of the date the award is granted to a participant. Fair market value is the closing price of our ordinary shares, as reported on the Nasdaq Global Select Market. The closing price of our ordinary shares, as reported on the Nasdaq Global Select Market, on May 10, 2019, was $[29.33] per ordinary share. The committee will fix the terms and conditions of each stock option, subject to certain restrictions, such as a ten-year maximum term. | |

Stock Appreciation Rights | A stock appreciation right, or SAR, is a right granted to receive payment of cash, shares or a combination of both, equal to the difference between the fair market value of ordinary shares and the grant price of such ordinary shares. Each SAR granted must be evidenced by an award agreement that specifies the grant price, the term, and such other provisions as the committee may determine. The grant price of a SAR must be at least 100% of the fair market value of an ordinary share on the date of grant. The committee will fix the term of each SAR, but SARs granted under the amended plan will not be exercisable more than 10 years after the date the SAR is granted. |

Restricted Stock Awards, Restricted Stock Units and Deferred Stock Units | Restricted stock awards, restricted stock units (RSUs), and/or deferred stock units may be granted under the amended plan. A restricted stock award is an award of ordinary shares that are subject to restrictions on transfer and risk of forfeiture upon certain events, typically including termination of service. RSUs are similar to restricted stock awards except that no ordinary shares are actually awarded to the participant on the grant date. Deferred stock units permit the holder to receive ordinary shares or the equivalent value in cash or other property at a future time as determined by the committee. The committee will determine, and set forth in an award agreement, the period of restriction, the number of ordinary shares of restricted stock awards or the number of RSUs or deferred stock units granted, the time of payment for deferred stock units and other such conditions or restrictions. | |

Performance Awards | Performance awards, in the form of cash, ordinary shares or a combination of both, may be granted under the amended plan in such amounts and upon such terms as the committee may determine. The committee shall determine, and set forth in an award agreement, the amount of cash and/or number of ordinary shares, the performance goals, the performance periods and other terms and conditions. The extent to which the participant achieves his or her performance goals during the applicable performance period will determine the amount of cash and/or number of ordinary shares earned by the participant. At any time during a performance period of more than one fiscal year, the committee may, in its discretion, cancel a portion of, or scale back, unvested performance awards under certain circumstances set forth in the amended plan, including that the performance goals for the performance period cannot be achieved at least at the minimum levels established at the time of grant. | |

Annual Performance Cash Awards | Annual performance cash awards may be granted under the amended plan in such amounts and upon such terms as the committee may determine at the time of grant and set forth in the award agreement, based on the achievement of specified performance goals for annual periods or other time periods as determined by the committee. The committee may determine at the time of grant and set forth in the award agreement the target amount that may be paid with respect to an annual performance award, which will be based on a percentage of a participant’s actual annual base compensation at the time of grant. The committee may establish a maximum potential payout amount with respect to an annual performance award in the event performance goals are exceeded by an amount established by the committee at the time performance goals are established. The committee may establish measurements for prorating the amount of payouts for achievement of performance goals at less than or greater than the target payout but less than the maximum payout. | |

Non-Employee Director Awards | The committee at any time and from time to time may approve resolutions providing for the automatic grant to non-employee directors of non-statutory stock options, SARs or full value awards. The committee may also at any time and from time to time grant on a discretionary basis to non-employee directors non-statutory stock options, SARs or full value awards. In either case, any such awards may be granted singly, in combination, or in tandem, and may be granted pursuant to such terms, conditions and limitations as the committee may establish in its sole discretion consistent with the provisions of the amended plan. The committee may permit non-employee directors to elect to receive all or any portion of their annual retainers, meeting fees or other fees in restricted stock, RSUs, deferred stock units or other stock-based awards in lieu of cash. Any awards granted to non-employee directors under the amended plan must be made by a committee consisting solely of directors who are “independent directors” under the Listing Rules of the Nasdaq Stock Market and will not be subject to management’s discretion. | |

Other Cash- Based and Stock-Based Awards | Consistent with the terms of the amended plan, other cash-based awards that are not annual performance cash awards and other stock-based awards may be granted to participants in such amounts and upon such terms as the committee may determine. |

Performance Measures | The performance goals selected by the committee may be based on any one or more performance measures, including those listed in the amended plan. Any of the performance measure elements can be used in an algebraic formula (e.g., averaged over a period), combined into a ratio, compared to a budget or standard, compared to previous periods or other formulaic combinations based on the performance measure elements to create a performance measure. Any of the performance measures specified in the amended plan may be used to measure the performance of our company or any subsidiary, as a whole, or any division or business unit, product or product group, region or territory, or any combination thereof, as the committee deems appropriate. Performance measures may be compared to the performance of a peer group or a published or special index that the committee deems appropriate or, with respect to share price, various stock market indices. The committee also may provide for accelerated vesting of any award based on the achievement of performance goals. The committee may amend or modify the vesting criteria (including any performance goals, performance measures or performance periods) of any outstanding awards based in whole or in part on our financial performance (or any subsidiary or division, business unit or other sub-unit thereof) in recognition of unusual or nonrecurring events affecting us or our financial statements or of changes in applicable laws, regulations or accounting principles, whenever the committee determines that such adjustments are appropriate in order to prevent unintended dilution or enlargement of the benefits or potential benefits intended to be made available under the amended plan. | |

Dividend Equivalents | With the exception of stock options, SARs and unvested performance-based awards, awards under the amended plan may, in the committee’s discretion, earn dividends or dividend equivalents with respect to the cash or stock dividends or other distributions that would have been paid on the ordinary shares covered by such award had such ordinary shares been issued and outstanding on the dividend payment date. However, no dividends or dividend equivalents may be paid out on unvested awards and participants holding performance-based awards will not receive any cash dividends or dividend equivalents until after such awards are settled. Such dividend equivalents will be accumulated in cash or converted into additional ordinary shares by such formula and at such time and subject to such limitations as determined by the committee. | |

Termination of Employment or Other Service | The amended plan provides for certain default rules in the event of a termination of a participant’s employment or other service. These default rules may be modified in an award agreement, any individual agreement between a participant and us or any plan or policy of our company applicable to the participant. If a participant’s employment or other service with us is terminated for cause, then all outstanding awards held by such participant will be immediately terminated and forfeited. In the event a participant’s employment or other service with us is terminated by reason of death or disability, then: • All outstanding stock options and SARs held by the participant will, to the extent exercisable, remain exercisable for a period of one year after such termination, but not later than the date the stock options or SARs expire and all outstanding stock options and SARs that are not exercisable will be terminated and forfeited; provided, however, that if the exercise of a stock option that is exercisable is prevented by securities laws or other restrictions, the stock option will remain exercisable until 30 days after the date such exercise first would no longer be prevented by such provisions, but in any event no later than the date the stock option expires; • All outstanding unvested restricted stock awards will be terminated and forfeited; and |

• All outstanding but unvested RSUs, performance awards, annual performance cash awards, other cash-based awards and other stock-based awards held by the participant will terminate and be forfeited. However, with respect to any awards that vest based on the achievement of performance goals, if a participant’s employment or other service with us is terminated prior to the end of the performance period of such award, but after the conclusion of a portion of the performance period (but in no event less than one year), the committee may cause shares to be delivered or payment made with respect to the participant’s award, but only if otherwise earned for the entire performance period and only with respect to the portion of the applicable performance period completed at the date of such event, with proration based on the number of months or years that the participant was employed or performed services during the performance period. In the event a participant’s employment or other service with us is terminated by reason other than for cause, death or disability, then: • All outstanding stock options and SARs held by the participant that are then exercisable will remain exercisable for three months after the date of such termination, but will not be exercisable later than the date the stock options or SARs expire and all outstanding stock options and SARs that are not exercisable will be terminated and forfeited; provided, however, that if the exercise of a stock option that is exercisable is prevented by securities laws or other restrictions, the stock option will remain exercisable until 30 days after the date such exercise first would no longer be prevented by such provisions, but in any event no later than the date the stock option expires; • All outstanding unvested restricted stock awards will be terminated and forfeited; and • All outstanding unvested RSUs, performance awards, annual performance cash awards, other cash-based awards and other stock-based awards will be terminated and forfeited. However, with respect to any awards that vest based on the achievement of performance goals, if a participant’s employment or other service with us is terminated prior to the end of the performance period of such award, but after the conclusion of a portion of the performance period (but in no event less than one year), the committee may, in its sole discretion, cause shares to be delivered or payment made with respect to the participant’s award, but only if otherwise earned for the entire performance period and only with respect to the portion of the applicable performance period completed at the date of such event, with proration based on the number of months or years that the participant was employed or performed services during the performance period. | ||

Modification of Rights Upon Termination | Upon a participant’s termination of employment or other service with us, the committee may, in its discretion (which may be exercised at any time on or after the grant date, including following such termination) cause stock options or SARs (or any part thereof) held by such participant as of the effective date of such termination to become or continue to become exercisable or remain exercisable following such termination of employment or service, and restricted stock, RSUs, performance awards, annual performance cash awards, other cash-based awards and other stock-based awards held by such participant as of the effective date of such termination to vest or become free of restrictions and conditions to payment, as the case may be, following such termination of employment or service, in each case in the manner determined by the committee; provided, however, that (a) no stock option or SAR may remain exercisable beyond its expiration date; and (b) any such action by the committee adversely affecting any outstanding award will not be effective without the consent of the affected participant, except to the extent the committee is authorized by the amended plan to take such action. |

Forfeiture and Recoupment | If a participant is determined by the committee to have taken any action while providing services to us, or within one year after termination of such services, that would constitute “cause” or an “adverse action,” as such terms are defined in the amended plan, all rights of the participant under the amended plan and any agreements evidencing an award then held by the participant will terminate and be forfeited. The committee has the authority to rescind the exercise, vesting, issuance or payment in respect of any awards of the participant that were exercised, vested, issued or paid, and require the participant to pay to us, within 10 days of receipt of notice, any amount received or the amount gained as a result of any such rescinded exercise, vesting, issuance or payment. We may defer the exercise of any stock option or SAR for up to six months after receipt of notice of exercise in order for the committee to determine whether “cause” or “adverse action” exists. We are entitled to withhold and deduct future wages to collect any amount due. All awards also are subject to any required automatic clawback, forfeiture or other penalties pursuant to any applicable law, including without limitation under Section 304 of the Sarbanes-Oxley Act of 2002. In addition, all awards are subject to clawback, forfeiture or other penalties pursuant to any policy adopted by us, including the Wright Medical Group N.V. Clawback Policy adopted in 2017, and such clawback, forfeiture and/or penalty conditions or provisions as determined by the committee. | |

Effect of Change in Control; Double Trigger Acceleration of Vesting | Under the amended plan, a “change in control” means: • The acquisition, other than from us, by any person, entity or group of beneficial ownership of more than 50% of either the then-outstanding ordinary shares or the combined voting power of our then outstanding capital stock entitled to vote generally in the election of directors; • Individuals who, as of the effective date of the amended plan, constitute our incumbent board ceasing for any reason to constitute at least a majority of our board, provided that any person becoming a director subsequent to the effective date of the amended plan whose election, or nomination for election, by our shareholders was approved by a vote of at least a majority of our directors then comprising our incumbent board (other than an election or nomination of an individual whose initial assumption of office is in connection with an actual or threatened election contest relating to the election of our directors) will be, for purposes of amended plan, considered as though such person were a member of the incumbent board; • The consummation of a reorganization, merger or consolidation, in each case, with respect to which persons who were our shareholders immediately prior to such transaction do not, immediately thereafter, own more than 50% of the combined voting power entitled to vote generally in the election of directors of the then-outstanding voting securities of the reorganized, merged, consolidated, or other surviving corporation (or its direct or indirect parent corporation); • The consummation of a liquidation or dissolution of our company; or • The consummation of the sale of all or substantially all of the assets of our company (40% or more of the total gross fair market value of all of our assets) with respect to which persons who were our shareholders immediately prior to such sale do not, immediately thereafter, own more than 50% of the combined voting power entitled to vote generally in the election of directors of the then-outstanding voting securities of the acquiring corporation (or its direct or indirect parent corporation). |

Without limiting the authority of the committee to adjust awards as discussed under “—Plan Administration” and “—Adjustments,” if a change in control of our company occurs, then if an award is continued, assumed or substituted by the successor entity, the award will not vest or lapse solely as a result of the change in control but will instead remain outstanding under the terms pursuant to which it has been continued, assumed or substituted and will continue to vest or lapse pursuant to such terms. If the award is continued, assumed or substituted by the successor entity and within two years following the change in control the participant is either terminated by the successor entity without “cause” or, if the participant is an employee, resigns for “good reason,” each as defined in the amended plan, then: • All outstanding stock options and SARs held by such participant will become immediately vested and exercisable in full and will remain exercisable for the remainder of their respective terms; • All restrictions imposed on restricted stock, RSUs or deferred units that are not performance-based held by such participant will lapse and be of no further force and effect; • All performance-based awards held by such participant for which the performance period has been completed as of the date of such termination or resignation but have not yet been paid will vest and be paid in cash or shares and at such time as provided in the award agreement based on actual attainment of each performance goal; and • All performance-based awards held by such participant for which the performance period has not been completed as of the date of such termination or resignation will with respect to each performance goal vest and be paid out for the entire performance period (and not pro rata) based on actual performance achieved through the date of such termination or resignation with the manner of payment to be made in cash or shares as provided in the award agreement within 30 days following the date of termination or resignation. If a change in control of our company occurs, and if an award participant suffers a “termination of continued employment” in connection with such change in control, or if outstanding awards are not continued, assumed or substituted with equivalent awards by the successor entity, or in the case of a dissolution or liquidation of our company, outstanding awards will be subject to the following rules: • All outstanding stock options and SARs will become fully vested and exercisable and the committee will give such participant a reasonable opportunity to exercise any and all stock options and SARs before but conditioned upon the resulting change in control and if a participant does not exercise all stock options and SARs, the committee will pay such participant the difference between the exercise price for the stock option or grant price for the SAR and the per share consideration provided to other similarly situated shareholders in the change in control, provided, however, that if the exercise price or grant price exceeds the consideration provided, then such exercised stock option or SAR will be canceled and terminated without payment; • All restrictions imposed on restricted stock, RSUs or deferred units that are not performance-based will lapse and be of no further force and effect, and RSUs and deferred units will be settled and paid in cash or shares and at such time as provided in the award agreement, provided, however, that if any such payment is to be made in shares, the committee may provide such holders the consideration provided to other similarly situated shareholders in the change in control; |

• All performance-based awards held by such participant for which the performance period has been completed as of the date of the change in control but have not yet been paid will vest and be paid in cash or shares and at such time as provided in the award agreement based on actual attainment of each performance goal; and • All performance-based awards held by such participant for which the performance period has not been completed as of the date of the change in control will with respect to each performance goal vest and be paid out for the entire performance period (and not pro rata) based on actual performance achieved through the date of the change in control with the manner of payment to be made in cash or shares as provided in the award agreement within 30 days following the change in control. These change in control provisions may not be terminated, amended or modified in any manner that adversely affects any then-outstanding award or award participant without the prior written consent of such participant. | ||

| Transferability | All awards granted under the amended plan are non-transferable, except for certain transfers as described below and transfers pursuant to a will or under the laws of descent and distribution. Non-statutory stock options may be transferred to certain family members of such eligible employee, non-employee director or consultant to a trust exclusively for the benefit of one or more of the family members of such eligible employee, non-employee director or consultant; however, such transfer must be made as a gift without consideration and comply with applicable securities laws. | |

Term, Termination and Amendment | Unless sooner terminated by our board, the amended plan will terminate at midnight on June 22, 2027. No award will be granted after termination of the amended plan, but awards outstanding upon termination of the amended plan will remain outstanding in accordance with their applicable terms and conditions and the terms and conditions of the amended plan. Subject to certain exceptions, our board of directors has the authority to terminate and the committee has the authority to amend the amended plan or any outstanding award agreement at any time and from time to time. No amendments to the amended plan will be effective without approval of our shareholders if: (i) shareholder approval of the amendment is then required pursuant to Code Section 422, the rules of the primary stock exchange on which the ordinary shares are then traded, applicable U.S. state and federal laws or regulations and the applicable laws of any foreign country or jurisdiction where awards are, or will be, granted under the amended plan; or (ii) such amendment would: (a) modify the restrictions on re-pricing; (b) materially increase benefits accruing to participants; (c) increase the aggregate number of ordinary shares issued or issuable under the amended plan; (d) increase any limitation set forth in the amended plan on the number of ordinary shares which may be issued or the aggregate value of awards which may be made, with respect to any type of award to any single participant during any specified period; (e) modify the eligibility requirements for participants in the amended plan; or (f) reduce the minimum exercise price or any option or grant price of any SAR. No termination or amendment of the amended plan or an award agreement shall adversely affect in any material way any award previously granted under the amended plan without the written consent of the participant holding such award. |

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted- average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||||

| Equity compensation plans approved by security holders | 9,136,421 | (1)(2)(3) | $ | 22.62 | (4) | 2,619,972 | (5) | |||||

| Equity compensation plans not approved by security holders | — | — | — | |||||||||

| Total | 9,136,421 | (1)(2)(3) | $ | 22.62 | (4) | 2,619,972 | (5) | |||||

| (1) | Amount includes ordinary shares issuable upon the exercise of stock options granted under the Wright Medical Group N.V. 2017 Equity and Incentive Plan, Wright Medical Group N.V. Amended and Restated 2010 Incentive Plan and Tornier N.V. Amended and Restated Stock Option Plan, ordinary shares issuable upon the vesting of restricted stock unit awards granted under the Wright Medical Group N.V. 2017 Equity and Incentive Plan and Wright Medical Group N.V. Amended and Restated 2010 Incentive Plan and performance share unit awards granted under the Wright Medical Group N.V. 2017 Equity and Incentive Plan, assuming maximum performance share unit award payouts. The actual number of shares that will be issued under the performance share unit awards is determined by the level of achievement of performance goals. |

| (2) | Excludes employee stock purchase rights under the Wright Medical Group N.V. Amended and Restated Employee Stock Purchase Plan, which was approved by our shareholders on June 28, 2016. Under such plan, each eligible employee may purchase ordinary shares at semi-annual intervals on June 30th and December 31st each calendar year at a purchase price per share equal to 85% of the closing sales price per share of our ordinary shares on the first or last trading day of the offering period, whichever is lower. |

| (3) | Excludes an aggregate of 2,547,656 ordinary shares issuable upon the exercise of stock options granted under legacy Wright equity compensation plans and non-plan inducement option agreements assumed by us in connection with the Wright/Tornier merger. The weighted-average per share exercise price of these assumed stock options as of December 30, 2018 was $21.71. No further grants or awards will be made under these assumed legacy Wright equity compensation plans and non-plan inducement option agreements. |

| (4) | Not included in the weighted-average exercise price calculation are 1,322,214 restricted stock unit awards and 465,974 performance share unit awards, assuming maximum performance share unit award payouts. |