|

| | |

| | |

| | P.O. Box 29243 - Phoenix, Arizona 85038-9243 |

| | 2200 S. 75th Avenue - Phoenix, Arizona 85043 |

| | (602) 269-9700 |

| | |

October 26, 2015

Dear Fellow Stockholders of Swift Transportation Company (NYSE: SWFT),

A summary of our key results for the three and nine months ended September 30th is shown below:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | Unaudited |

| | ($ in millions, except per share data) |

| Operating Revenue | $ | 1,065.0 |

| | $ | 1,074.9 |

| | $ | 1,032.1 |

| | $ | 3,139.5 |

| | $ | 3,159.2 |

| | $ | 3,042.8 |

|

Revenue xFSR(1) | $ | 955.0 |

| | $ | 881.8 |

| | $ | 833.4 |

| | $ | 2,785.7 |

| | $ | 2,575.2 |

| | $ | 2,448.1 |

|

| | | | | | | | | | | | |

| Operating Ratio | 93.0 | % | | 90.9 | % | | 91.8 | % | | 92.1 | % | | 92.5 | % | | 91.6 | % |

Adjusted Operating Ratio(2) | 91.7 | % | | 88.2 | % | | 89.3 | % | | 90.7 | % | | 90.2 | % | | 89.1 | % |

| | | | | | | | | | | | |

EBITDA(2) | $ | 137.2 |

| | $ | 154.0 |

| | $ | 144.0 |

| | $ | 430.5 |

| | $ | 405.2 |

| | $ | 437.1 |

|

Adjusted EBITDA(2) | $ | 148.5 |

| | $ | 160.7 |

| | $ | 150.8 |

| | $ | 446.2 |

| | $ | 424.2 |

| | $ | 450.4 |

|

| | | | | | | | | | | | |

| Diluted EPS | $ | 0.25 |

| | $ | 0.35 |

| | $ | 0.21 |

| | $ | 0.87 |

| | $ | 0.72 |

| | $ | 0.78 |

|

Adjusted EPS(2) | $ | 0.31 |

| | $ | 0.39 |

| | $ | 0.29 |

| | $ | 0.96 |

| | $ | 0.84 |

| | $ | 0.87 |

|

| | | | | | | | | | | | |

1Revenue xFSR is operating revenue, excluding fuel surcharge revenue |

2 See GAAP to Non-GAAP reconciliation in the schedules following this letter |

Key Highlights for the Third Quarter 2015 as compared to the Third Quarter 2014:

(discussed in more detail below, including GAAP to non-GAAP reconciliations)

Consolidated

| |

• | Consolidated Revenue xFSR increased 8.3% |

| |

| • | Adjusted EPS was $0.31, consistent with the estimated range of $0.30-$0.33 previously disclosed, and was negatively impacted by $0.07 after-tax due to the adverse current-year development of prior-year insurance and workers' compensation claims and corresponding increase in reserves, $0.02 after-tax due to the settlement of a class action lawsuit and related items, and increased maintenance and depreciation expense associated with the large volume of new tractors received late in the second quarter of 2015 and throughout the third quarter resulting in a significant backlog of tractors being processed for trade and sale |

| |

| • | Consolidated Average Operational Truck Count increased 831 trucks, or 4.8%, year over year in the third quarter, including a 517 increase from the beginning of 2015 through September 30, 2015 |

| |

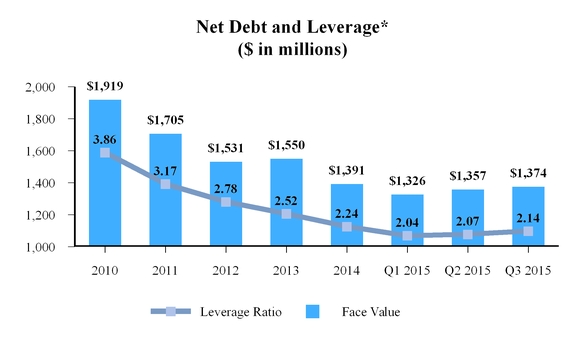

| • | Net Debt and Net Leverage Ratio were $1,374.1 million and 2.14, respectively, as of September 30, 2015 |

| |

| • | On July 27, 2015, the Company entered into a new amended and restated credit agreement, which replaced the previous credit agreement, and is expected to result in an estimated $7 million annualized reduction in interest expense based on current borrowing levels. The new credit agreement includes a $680 million Term Loan A and a $600 million revolving credit facility. |

| |

| • | On September 24, 2015 Swift's Board of Directors approved the repurchase of up to $100 million of our outstanding Class A common stock |

Truckload

| |

| • | Truckload Revenue xFSR increased 6.4% driven by a 3.6% increase in Revenue xFSR per loaded mile and a 2.8% increase in total loaded miles driven within the period |

| |

| • | Adjusted Operating Ratio increased to 88.4% primarily due to increased driver wages, equipment costs and insurance and workers' compensation claims expense |

Dedicated

| |

| • | Dedicated Revenue xFSR grew 8.9% |

| |

| • | Weekly Revenue xFSR per Tractor improved 5.7% year over year, due to improved customer pricing |

| |

| • | Total loaded miles driven within the period increased 3.0% |

| |

| • | Adjusted Operating Ratio increased to 91.8% due to higher insurance and workers' compensation claims expense |

Swift Refrigerated

| |

| • | Central Refrigerated Service ("CRS") segment officially changed its name to Swift Refrigerated during the quarter |

| |

| • | Swift Refrigerated Revenue xFSR was relatively consistent at $81 million |

| |

| • | Adjusted Operating Ratio for the third quarter of 2015 was 96.8%, compared to 96.0% during the third quarter of 2014. The increase was primarily driven by the driver wage and owner-operator pay increases combined with increased insurance and claims expense. |

Intermodal

| |

| • | Intermodal Revenue xFSR grew 9.9%; fueled by Container on Flat Car (COFC) growth of 11.3%, partially offset by a continued reduction in Trailer on Flat Car (TOFC) volumes |

| |

| • | Container turns improved 6.7% year over year |

| |

| • | Adjusted Operating Ratio for the third quarter of 2015 was 99.2%, the increase was primarily due to driver wage increases |

We are encouraged by the operational improvements we were able to achieve in the third quarter of 2015. Revenue excluding Fuel Surcharge Revenue grew 8.3% year over year, and we were able to achieve year over year pricing increases in nearly all of our operating segments. We continue to see benefits from our driver-oriented initiatives as our internal driver retention and satisfaction metrics continue to trend favorably, and have improved year over year. The direct feedback we receive through our weekly driver surveys validates the importance and our continued focus on these driver-orientated initiatives, and reiterates our belief that Swift is increasingly becoming the employer of choice among driving professionals within the industry. Our Consolidated Average Operational Truck Count increased 831 trucks year over year during the third quarter, bringing our year to date Average Operational Truck Count growth to 517 when comparing our December 2014 average to our September 2015 average. On a full-year basis we expect Average Operational Truck Count growth of roughly 500-600 for the year, which is below the low end of the 700-1,100 growth previously disclosed. We have pulled back on our initial growth targets given that the freight environment is softer than we originally expected, and peak volumes have not yet materialized as in years past. As we move into the fourth quarter and into 2016 our focus will be to drive improved utilization on our fleet.

In the third quarter of 2015, we experienced continued reductions in accident frequency and severity. This quarter's improvement marks the third consecutive quarter for such improvements. We expect the organization-wide emphasis and focus on safety to translate into reduced insurance and claims expense in the future, but due to the nature of actuarial models and the long-life of insurance claims, these improvements will take time to manifest themselves in our financial results. Our third quarter's Adjusted EPS was negatively impacted by $0.07, or $15.2 million, due to developments of prior year accident and workers' compensation claims and corresponding reserves. The improved safety trends mentioned above, particularly related to severe accidents, are being augmented by the enhanced safety features incorporated into our new equipment. Although we incurred additional maintenance and depreciation expense associated with the large volume of new tractors received late in the second quarter due to delivery delays and the catch up throughout the third quarter that resulted in a significant backlog of tractors being processed for trade or sale, we remain confident in our strategic decision to accelerate our equipment trade cycle to fully realize the many benefits available from this newer equipment. These expected benefits include: improved safety, increased fuel economy, and increased driver satisfaction resulting in improved driver retention and recruiting. We are actively working through the current backlog and have canceled the purchase and related trade of approximately 450 tractors originally planned for 2015. We believe this will enable us to work through the backlog by early first quarter 2016. We are also working with our suppliers to avoid these delivery issues in the future.

In light of the items discussed in our press release and Form 8-K filed on September 25, 2015, combined with a softening used truck market, we now expect Adjusted EPS to be $0.47-$0.51 for the fourth quarter of 2015 which equates to a range of $1.43-$1.47 for the full year 2015. In addition, our Board of Directors approved the repurchase of up to $100 million of our outstanding Class A common stock. The repurchase is expected to be funded through free cash flow, the reduction in planned capital expenditures explained above, and borrowings on the Company's existing credit facilities.

Third Quarter Results by Reportable Segment

Truckload Segment

Our Truckload segment consists of one-way movements over irregular routes throughout the United States, Mexico and Canada. This service uses both company and owner-operator tractors with dry van, flatbed and other specialized trailing equipment.

Our Truckload Revenue xFSR for the third quarter of 2015 increased $29.4 million, or 6.4%, over the same quarter in 2014. This revenue growth was the result of a 3.6% year over year increase in Revenue xFSR per loaded mile and a 2.8% increase in total loaded miles driven within the period. Weekly Revenue xFSR per Tractor increased 1.3% year over year to $3,493 driven by the 3.6% increase in Revenue xFSR per loaded mile, partially offset by a 2.3% decrease in loaded miles per tractor per week caused by the significant in-servicing of new tractors mentioned above. Our Average Operational Truck Count increased 515 trucks, or 5.1%, in the third quarter of 2015 over the same quarter in 2014.

Our Adjusted Operating Ratio increased 390 basis points to 88.4% compared to 84.5% from the prior year. The increase in Adjusted Operating Ratio was primarily driven by increased maintenance and depreciation expense caused by the equipment backlog mentioned above, developments of prior year accident and workers' compensation claims and corresponding reserves, and increases in driver wage and owner-operator pay packages, partially offset by the increase in pricing and a reduction in fuel expense reflecting a combination of declining diesel prices and better fuel efficiency.

|

| | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2015 | | 2014 | | 2013 |

| | Unaudited |

Operating Revenue (1) | $ | 552.8 |

| | $ | 570.9 |

| | $ | 579.5 |

|

Revenue xFSR(1)(2)(3) | $ | 489.5 |

| | $ | 460.0 |

| | $ | 460.4 |

|

| | | | | | |

| Operating Ratio | 89.7 | % | | 87.5 | % | | 90.0 | % |

Adjusted Operating Ratio(3) | 88.4 | % | | 84.5 | % | | 87.4 | % |

| | | | | | |

| Weekly Revenue xFSR per Tractor | $ | 3,493 |

| | $ | 3,449 |

| | $ | 3,212 |

|

Total Loaded Miles(4) | 261,339 |

| | 254,320 |

| | 267,607 |

|

| | | | | | |

| Average Operational Truck Count | 10,662 |

| | 10,147 |

| | 10,907 |

|

| Deadhead Percentage | 12.2 | % | | 11.7 | % | | 11.5 | % |

| | | | | | |

1 In millions |

2 Revenue xFSR is operating revenue, excluding fuel surcharge revenue |

3 See GAAP to Non-GAAP reconciliation in the schedules following this letter |

4 Total Loaded Miles presented in thousands |

Dedicated Segment

Through our Dedicated segment, we devote equipment and offer tailored solutions under long-term contracts with customers. This dedicated business utilizes refrigerated, dry van, flatbed and other specialized trailing equipment.

|

| | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2015 | | 2014 | | 2013 |

| | Unaudited |

Operating Revenue (1) | $ | 234.5 |

| | $ | 238.0 |

| | $ | 184.6 |

|

Revenue xFSR(1)(2)(3) | $ | 215.2 |

| | $ | 197.7 |

| | $ | 150.1 |

|

| | | | | | |

| Operating Ratio | 92.5 | % | | 90.0 | % | | 88.9 | % |

Adjusted Operating Ratio(3) | 91.8 | % | | 88.0 | % | | 86.3 | % |

| | | | | | |

| Weekly Revenue xFSR per Tractor | $ | 3,333 |

| | $ | 3,154 |

| | $ | 3,326 |

|

| Average Operational Truck Count | 4,913 |

| | 4,769 |

| | 3,434 |

|

| | | | | | |

1 In millions |

2 Revenue xFSR is operating revenue, excluding fuel surcharge revenue |

3 See GAAP to Non-GAAP reconciliation in the schedules following this letter |

Dedicated Revenue xFSR grew 8.9% to $215.2 million in the third quarter of 2015 compared to the third quarter of 2014. This growth was driven by the various new contracts awarded over the last twelve months, which resulted in a 3.0% increase in our Average Operational Truck Count year over year. Weekly Revenue xFSR per Tractor increased 5.7% to $3,333 primarily due to improved pricing and mix.

For the third quarter of 2015 the Adjusted Operating Ratio in our Dedicated segment increased 380 basis points year over year primarily driven by developments of prior year accident and workers' compensation claims and corresponding reserves, resulting in a 370 basis point increase in insurance and workers' compensation claims expense as a percentage of Revenue xFSR.

Swift Refrigerated Segment

Our Swift Refrigerated segment, formally known as Central Refrigerated Service or "CRS", represents shipments for customers that require temperature-controlled trailers. These shipments include one-way movements over irregular routes and dedicated truck operations.

|

| | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2015 | | 2014 | | 2013 |

| | Unaudited |

Operating Revenue (1) | $ | 93.0 |

| | $ | 100.4 |

| | $ | 115.3 |

|

Revenue xFSR(1)(2)(3) | $ | 81.0 |

| | $ | 80.6 |

| | $ | 92.0 |

|

| | | | | | |

| Operating Ratio | 97.2 | % | | 96.8 | % | | 97.0 | % |

Adjusted Operating Ratio(3) | 96.8 | % | | 96.0 | % | | 96.3 | % |

| | | | | | |

| Weekly Revenue xFSR per Tractor | $ | 3,466 |

| | $ | 3,510 |

| | $ | 3,544 |

|

| Average Operational Truck Count | 1,778 |

| | 1,747 |

| | 1,976 |

|

| Deadhead Percentage | 14.4 | % | | 15.9 | % | | 13.4 | % |

| | | | | | |

1 In millions |

2 Revenue xFSR is operating revenue, excluding fuel surcharge revenue |

3 See GAAP to Non-GAAP reconciliation in the schedules following this letter |

Revenue xFSR for the third quarter of 2015 increased slightly to $81.0 million compared to the third quarter of 2014, primarily driven by a 5.8% increase in total loaded miles driven within the period, partially offset by a 5.0% reduction in Revenue xFSR per loaded mile. The year over year reduction in Revenue xFSR per loaded mile is largely driven by the discontinued servicing of a large specialty dedicated account from the first quarter of 2015. This dedicated account, which had a much lower average length of haul, higher deadhead, and a much higher Revenue xFSR per loaded mile, was not profitable, and artificially skewed some of our operating metrics.

The Adjusted Operating Ratio increased 80 basis points to 96.8% in the third quarter of 2015 from 96.0% in the third quarter of 2014. This increase was primarily driven by driver wage and owner-operator pay increases, and the development of prior year accident and workers' compensation claims and corresponding reserves, partially offset by lower deadhead, improved asset utilization, and improved driver retention. We believe the initiatives we have implemented in this segment are starting to drive improvements in many key operating metrics and expect these trends to continue as we move forward.

Intermodal Segment

Our Intermodal segment includes revenue generated by freight moving over the rail in our containers and other trailing equipment, combined with revenue for drayage to transport loads between the railheads and customer locations.

|

| | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2015 | | 2014 | | 2013 |

| | Unaudited |

Operating Revenue (1) | $ | 101.0 |

| | $ | 100.0 |

| | $ | 96.5 |

|

Revenue xFSR(1)(2)(3) | $ | 88.1 |

| | $ | 80.1 |

| | $ | 76.7 |

|

| | | | | | |

| Operating Ratio | 99.3 | % | | 98.1 | % | | 98.4 | % |

Adjusted Operating Ratio(3) | 99.2 | % | | 97.6 | % | | 98.0 | % |

| | | | | | |

| Load Counts | 47,107 | | 44,275 | | 41,747 |

| Average Container Counts | 9,150 | | 8,778 | | 8,717 |

| | | | | | |

1 In millions |

2 Revenue xFSR is operating revenue, excluding fuel surcharge revenue |

3 See GAAP to Non-GAAP reconciliation in the schedules following this letter |

Intermodal Revenue xFSR grew by 9.9% in the third quarter of 2015 compared to the third quarter of 2014, driven by a 6.4% increase in Load Counts. COFC loads increased 11.3%, while TOFC loads decreased 51.6% primarily due to the elimination of the refrigerated TOFC business as discussed in 2014. Revenue xFSR per load increased 3.5% in the third quarter of 2015 from the same period of 2014, primarily due to increased pricing and improved freight selection.

Intermodal Adjusted Operating Ratio increased 160 basis points to 99.2% in the third quarter of 2015 compared to 97.6% during the same period last year. This increase was primarily driven by investments in our internal dray network that include driver wage increases and the relocation of several operating locations in key markets which we believe will improve operational efficiencies once complete. These factors were partially offset by a 6.7% increase in container turns.

Other Non-Reportable Segments

Our other non-reportable segments include our logistics and brokerage services, and our subsidiaries offering support services to customers and owner-operators, including shop maintenance, equipment leasing and insurance. Also captured here is the intangible asset amortization related to the 2007 going-private transaction.

In the third quarter of 2015, combined revenues from the aforementioned services, before eliminations, increased $24.1 million compared to the same period of 2014, primarily due to growth in our logistics business.

Included in Operating Income in the other non-reportable segments in the third quarter of 2015 was a $5.1 million charge associated with the settlement of a class-action lawsuit and related items, partially offset by a $1.9 million year over year increase in the Operating Income produced by our logistics business. The third quarter of 2014 included a charge related to the impairment of certain operations software of $2.3 million.

Third Quarter Consolidated Operating and Other Expenses

The table below highlights some of our cost categories for the third quarter of 2015, compared to the third quarter of 2014 and the second quarter of 2015, showing each as a percent of Revenue xFSR. Fuel surcharge revenue can be volatile and is primarily dependent upon the cost of fuel and not specifically related to our non-fuel operational expenses. Therefore, we believe that Revenue xFSR is a better measure for analyzing our expenses and operating metrics.

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | YOY | | | | | | QOQ |

| Q3'15 | | Q3'14 | | Variance1 | ($ in millions) | Q3'15 | | Q2'15 | | Variance1 |

| Unaudited | | Unaudited |

| $ | 1,065.0 |

| | $ | 1,074.9 |

| | -0.9 | % | Operating Revenue | $ | 1,065.0 |

| | $ | 1,059.4 |

| | 0.5 | % |

| $ | (110.0 | ) | | $ | (193.1 | ) | | -43.0 | % | Less: Fuel Surcharge Revenue | $ | (110.0 | ) | | $ | (123.5 | ) | | -10.9 | % |

| $ | 955.0 |

| | $ | 881.8 |

| | 8.3 | % | Revenue xFSR | $ | 955.0 |

| | $ | 935.9 |

| | 2.0 | % |

| | | | | | | | | | | |

| $ | 283.8 |

| | $ | 240.0 |

| | -18.2 | % | Salaries, Wages & Benefits | $ | 283.8 |

| | $ | 276.3 |

| | -2.7 | % |

| 29.7 | % | | 27.2 | % | | -250bps |

| % of Revenue xFSR | 29.7 | % | | 29.5 | % | | -20bps |

|

| | | | | | | | | | | |

| $ | 102.7 |

| | $ | 88.5 |

| | -16.1 | % | Operating Supplies & Expenses | $ | 102.7 |

| | $ | 91.1 |

| | -12.7 | % |

| 10.8 | % | | 10.0 | % | | -80bps |

| % of Revenue xFSR | 10.8 | % | | 9.7 | % | | -110bps |

|

| | | | | | | | | | | |

| $ | 52.9 |

| | $ | 37.7 |

| | -40.4 | % | Insurance & Claims | $ | 52.9 |

| | $ | 42.2 |

| | -25.3 | % |

| 5.5 | % | | 4.3 | % | | -120bps |

| % of Revenue xFSR | 5.5 | % | | 4.5 | % | | -100bps |

|

| | | | | | | | | | | |

| $ | 8.2 |

| | $ | 7.3 |

| | -12.5 | % | Communication & Utilities | $ | 8.2 |

| | $ | 7.4 |

| | -11.3 | % |

| 0.9 | % | | 0.8 | % | | -10bps |

| % of Revenue xFSR | 0.9 | % | | 0.8 | % | | -10bps |

|

| | | | | | | | | | | |

| $ | 19.2 |

| | $ | 17.9 |

| | -7.6 | % | Operating Taxes & Licenses | $ | 19.2 |

| | $ | 18.3 |

| | -5.3 | % |

| 2.0 | % | | 2.0 | % | | — |

| % of Revenue xFSR | 2.0 | % | | 2.0 | % | | — |

|

| | | | | | | | | | | |

1 Positive numbers represent favorable variances, negative numbers represent unfavorable variances |

Salaries, wages and benefits increased $43.8 million to $283.8 million during the third quarter of 2015, compared to $240.0 million for the third quarter of 2014 due primarily to increases in total miles driven by company drivers within the period, the two previously disclosed targeted driver pay rate increases in August 2014 and May 2015, and adverse current-year development of prior-year claims in workers' compensation expense. Sequentially, salaries, wages and benefits increased $7.4 million during the third quarter of 2015 compared to the second quarter of 2015, but remained relatively consistent as a percentage of Revenue xFSR. The sequential increase is primarily driven by the adverse development of prior year claims in workers' compensation expense, growth in the number of miles driven by company drivers and the driver pay rate increases mentioned above.

Third quarter 2015 operating supplies and expenses increased $14.3 million year over year, which included a $5.1 million legal expense associated with the class action settlement and related items and a year over year increase in equipment maintenance expense caused by growth in the number of miles driven within the period and the large volume of new and used tractors processed for in-service and sale, respectively. Sequentially, these items also caused

the increase in operating supplies and expenses during the third quarter of 2015 compared to the second quarter of 2015.

As a percentage of Revenue xFSR, insurance and claims expense increased by $15.2 million, to 5.5% in the third quarter of 2015 compared to 4.3% in the third quarter of 2014, while also increasing 100 basis points sequentially compared to the second quarter of 2015. This increase was predominantly associated with prior-year claims, and the corresponding development of the current-year actuarial reserves. Although, we continue to experience positive safety trends in 2015, given that actuarially developed claims accruals are largely derived based on historical trends, we expect it to take some time for noticeable benefits to be realized even if the current trends continue. We are particularly encouraged by the results we are seeing on the new technologically advanced equipment we are implementing this year. Specifically, we are experiencing a lower frequency of severe accidents on the newer technology equipment, when compared to our older equipment. We expect further improvement of these safety trends as we continue to focus on a safety culture throughout the organization, as well as expanding the enhanced safety technology throughout the fleet.

Fuel Expense

|

| | | | | | | | | | | | | | |

| Q3'15 | | Q3'14 | ($ in millions) | Q3'15 | | Q2'15 |

| Unaudited | | Unaudited |

| $ | 103.0 |

| | $ | 149.1 |

| Fuel Expense | $ | 103.0 |

| | $ | 116.7 |

|

| 9.7 | % | | 13.9 | % | % of Operating Revenue | 9.7 | % | | 11.0 | % |

Fuel expense for the third quarter of 2015 was $103.0 million, representing a decrease of $46.1 million or 30.9% from the third quarter of 2014. The decrease was a result of lower fuel prices and improved fuel efficiency, partially offset by an increase in the number of miles driven by company drivers. Sequentially, fuel expense decreased $13.6 million in the third quarter of 2015 compared to the second quarter of 2015. This sequential decrease is primarily due to lower fuel prices as evidenced by the corresponding reduction in Fuel Surcharge Revenue, partially offset by an increase in the number of miles driven by company drivers.

Purchased Transportation

Purchased transportation includes payments to owner-operators, railroads and other third parties we use for intermodal drayage and other brokered business.

|

| | | | | | | | | | | | | | |

| Q3'15 | | Q3'14 | ($ in millions) | Q3'15 | | Q2'15 |

| Unaudited | | Unaudited |

| $ | 299.9 |

| | $ | 328.1 |

| Purchased Transportation | $ | 299.9 |

| | $ | 294.7 |

|

| 28.2 | % | | 30.5 | % | % of Operating Revenue | 28.2 | % | | 27.8 | % |

Purchased transportation decreased $28.2 million year over year, primarily due to a reduction in fuel reimbursements to owner-operators and other third parties as a result of declining fuel prices and fewer miles driven by owner-operators. These reductions were partially offset by the owner-operator contracted pay package changes implemented in August 2014 and May 2015.

Sequentially, purchased transportation increased $5.2 million primarily due to growth in our logistics business and the May 2015 owner-operator contracted pay package increase mentioned above, partially offset by a reduction of fuel reimbursed to owner-operators and other third parties.

Rental Expense and Depreciation & Amortization of Property and Equipment

Due to fluctuations in the number of tractors leased versus owned, we combine our rental expense with depreciation and amortization of property and equipment for analytical purposes.

|

| | | | | | | | | | | | | | |

| Q3'15 | | Q3'14 | ($ in millions) | Q3'15 | | Q2'15 |

| Unaudited | | Unaudited |

| $ | 59.1 |

| | $ | 59.7 |

| Rental Expense | $ | 59.1 |

| | $ | 59.8 |

|

| 6.2 | % | | 6.8 | % | % of Revenue xFSR | 6.2 | % | | 6.4 | % |

| | | | | | | |

| $ | 66.9 |

| | $ | 54.4 |

| Depreciation & Amortization of Property and Equipment | $ | 66.9 |

| | $ | 60.4 |

|

| 7.0 | % | | 6.2 | % | % of Revenue xFSR | 7.0 | % | | 6.5 | % |

| | | | | | | |

| $ | 126.0 |

| | $ | 114.0 |

| Combined Rental Expense and Depreciation | $ | 126.0 |

| | $ | 120.2 |

|

| 13.2 | % | | 12.9 | % | % of Revenue xFSR | 13.2 | % | | 12.8 | % |

As noted in the table above, combined rental and depreciation expense in the third quarter of 2015 increased $11.9 million to $126.0 million from the third quarter of 2014. This increase is primarily due to larger tractor and trailer fleets, higher equipment replacement costs, and an increase in the percent of the assets which are leased versus owned. Sequentially, combined rental and depreciation expense increased $5.7 million from the second quarter of 2015.

Gain on Disposal of Property and Equipment

Gain on disposal of property and equipment in the third quarter of 2015 was $9.8 million, compared to $11.6 million in the third quarter of 2014 and $10.2 million in the second quarter of 2015. We did experience softening in the used truck market toward the end of the third quarter, and thus far in the fourth quarter, and therefore, expect our gain on sale to be much lower in the fourth quarter, in the range of $2.5-$4.5 million.

Income Tax Expense

The income tax provision in accordance with GAAP for the third quarter of 2015 was $21.3 million, resulting in an effective tax rate of 37.0%, which is 150 basis points lower than anticipated primarily due to additional federal employment tax credits realized as discrete items during the quarter. In the third quarter of 2014, our income tax provision was $23.9 million, resulting in an effective tax rate of 32.3%, which was 620 basis points lower than anticipated primarily due to certain prior year federal income tax credits realized during the quarter.

Interest Expense

Interest expense, which includes debt related interest expense, the amortization of deferred financing costs and original issue discount, but excludes derivative interest expense on our interest rate swaps, decreased by $11.2 million in the third quarter of 2015 to $9.1 million, compared with $20.4 million for the third quarter of 2014. The decrease was largely due to our call of our remaining 10.0% Senior Secured 2nd Lien Notes in November 2014, but was also influenced by our lower debt balances, and our July 2015 amended and restated credit facility which contains more favorable interest rates and terms.

Debt Balances

|

| | | | | | | | | | | | | | |

| | June 30, 2015 | Credit Facility Replacement | | Q3 2015 Other Changes | | September 30,

2015 |

| | Unaudited |

| | ($ in millions) |

| Unrestricted Cash | $ | 53.7 |

| $ | (4.9 | ) | | $ | 4.9 |

| | $ | 53.7 |

|

| | | | | | | |

| A/R Securitization ($375 mm) | $ | 264.0 |

| $ | — |

| | $ | (14.0 | ) | | $ | 250.0 |

|

| Revolver ($600 mm) | $ | — |

| $ | 200.0 |

| | $ | — |

| | $ | 200.0 |

|

| Term Loan A | $ | 488.0 |

| $ | 195.0 |

| | $ | (6.6 | ) | | $ | 676.4 |

|

Term Loan B (1) | $ | 395.0 |

| $ | (395.0 | ) | | $ | — |

| | $ | — |

|

| Capital Leases & Other Debt | $ | 263.5 |

| $ | — |

| | $ | 37.9 |

| | $ | 301.4 |

|

| Total Debt | $ | 1,410.5 |

| $ | — |

| | $ | 17.3 |

| | $ | 1,427.8 |

|

| | | | | | | |

| Net Debt | $ | 1,356.8 |

| $ | 4.9 |

| | $ | 12.4 |

| | $ | 1,374.1 |

|

| (1) Amounts presented represent face value |

As shown in the chart below, our leverage ratio as of September 30, 2015 increased slightly to 2.14 compared to 2.07 as of June 30, 2015. As we noted in our first quarter Stockholder letter, this increase was expected and was primarily the result of increased capital expenditures in the second and third quarters and a year over year reduction in Adjusted EBITDA in the third quarter. The increase in capital expenditures led to a $37.9 million increase in capital lease liabilities, while our use of operating cash flows to repay debt partially offset this increase, resulting in a net $17.3 million increase in our Net Debt as of September 30, 2015, compared to June 30, 2015.

* Data prior to Q3 2013 does not include Swift Refrigerated

In addition, on July 27, 2015, we closed on an amended and restated credit facility in which we replaced our previous $450 million revolving credit facility, and outstanding amounts under the Term Loan A of $485 million and Term Loan B of $395 million, with a new facility that includes a $600 million revolving credit facility and a $680 million Term Loan A. The previous Term Loan B was paid off by using the incremental $195 million of proceeds on the new Term Loan A and a $200 million draw on the revolver. We also used $4.9 million of cash from the balance sheet to pay deal costs and expenses. At closing, the pricing of the revolver and Term Loan A are 1.75% over LIBOR, unchanged from the prior facility, and represent a reduction of approximately 180 basis points as compared to the pricing of the Term Loan B for an annualized savings of approximately $7 million based on current borrowing levels. The new revolver and Term Loan A mature in July 2020 and are subject to the same financial covenants and substantially the same terms as those contained in the prior facility. The replacement of the previous facility resulted in a loss on debt extinguishment of $9.6 million in the third quarter of 2015, reflecting the write-off of the unamortized original issue discount and deferred financing fees related to the previous facility.

Cash Flow and Capital Expenditures

We continue to generate positive cash flows from operations. During the nine months ended September 30, 2015, we generated $357.2 million of cash from operations compared with $292.8 million during the same period of 2014. Cash used in investing activities was $204.2 million, of which capital expenditures were $260.9 million, partially offset by proceeds from the sale of property and equipment of $76.5 million. Cash used in financing activities for the nine months ended September 30, 2015 was $204.4 million, compared to $208.3 million for the same period in 2014.

Due to the backlog of tractors we are currently processing, we have decided to cancel the purchase and trade of approximately 450 tractors in 2015 which when combined with other minor changes, will reduce our net cash capital expenditures for 2015 from $350-$375 million to $275-$300 million. This reduction in expected capital expenditures will be used to partially fund the potential $100 million share repurchase plan the Board of Directors authorized on September 24, 2015.

Summary

We remain optimistic regarding the many positive initiatives we have continued to develop and implement this year. At the beginning of the third quarter we renewed our focus on improving asset utilization. We have assigned many of our most experienced and talented leaders from across the entire organization to this priority. The opportunities include: sales team's evaluation of our freight network to ensure the proper freight is getting booked in the right areas at the desired levels, planning and customer service personnel working with both our drivers and customers to ensure we maximize our drivers' on-duty hours while making certain we deliver our customers' freight safely and on-time, shop personnel streamlining the required steps needed for equipment maintenance and trade-prep thus reducing equipment downtime, and our executive team working with our vendors and suppliers to ensure a smoother and improved equipment delivery process in 2016. We are also experiencing positive trends on our organizational safety goals as our 1-on-1 driver conversations have proved to be effective to both our overall safety metrics and driver satisfaction and retention. We expect this safety improvement to continue, especially as a larger percentage of our fleet is able to benefit from the technological equipment advances mentioned above.

We are excited about our future growth prospects on the horizon as recent customer interactions have indicated to us that shippers continue to seek quality carriers offering a wide suite of services. We feel very well-positioned for this migration and are confident in our ability to capitalize.

We believe in our team and our ability to deliver upon these commitments. We would like to thank all of our hard-working employees and our owner-operators, as well as our loyal customers and stockholders, for their continued support of Swift as we strive towards "Delivering a Better LifeSM" to our drivers, customers, and stockholders.

Conference Call Q&A Session

Swift Transportation's management team will host a Q&A session at 11:00 a.m. Eastern Time on Tuesday, October 27th to answer questions about the Company’s third quarter financial results. Please email your questions to Investor_Relations@swifttrans.com prior to 7:00 p.m. Eastern Time on Monday, October 26th.

Participants may access the call using the following dial-in numbers:

U.S./Canada: (877) 897-8479

International/Local: (706) 501-7951

Conference ID: 56603082

The live webcast, letter to stockholders, transcript of the Q&A, and the replay of the earnings Q&A session can be accessed via our investor relations website at investor.swifttrans.com.

IR Contact:

Jason Bates

Vice President of Finance &

Investor Relations Officer

(623) 907-7335

Forward Looking Statements

This letter contains statements that may constitute forward-looking statements, which are based on information currently available, usually identified by words such as "anticipates," "believes," "estimates", "plans,'' "projects," "expects," "hopes," "intends," "will," "could," "should," "may," or similar expressions which speak only as of the date the statement was made. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning:

| |

| • | trends and expectations relating to our operations, Revenue xFSR, expenses, other revenue, pricing, profitability and related metrics; |

| |

| • | the anticipated benefits of our driver satisfaction and retention initiatives; |

| |

| • | projected Adjusted EPS for full year 2015; |

| |

| • | our efforts and the expected timing to eliminate the backlog of equipment being processed for trade; |

| |

| • | the expected benefits from our relocation of several operating locations in the Intermodal segment; |

| |

| • | the timing and level of fleet size changes and equipment and container count; |

| |

| • | expected trends in insurance claims expense resulting from our safety initiatives including the timing and expected benefits relating there to; and |

| |

| • | estimated capital expenditures for the remainder of 2015 [and full year 2016]. |

Such forward-looking statements are inherently uncertain, and are based upon the current beliefs, assumptions and expectations of Company management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2014. As to the Company’s business and financial performance, the following factors, among others, could cause actual results to differ materially from those in forward-looking statements:

| |

| • | economic conditions, including future recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries in which we have a significant concentration of customers; |

| |

| • | increasing competition from trucking, rail, intermodal, and brokerage competitors; |

| |

| • | our ability to execute or integrate any future acquisitions successfully; |

| |

| • | increases in driver compensation to the extent not offset by increases in freight rates and difficulties in driver recruitment and retention; |

| |

| • | our ability to attract and maintain relationships with owner-operators; |

| |

| • | our ability to retain or replace key personnel; |

| |

| • | our dependence on third parties for intermodal and brokerage business; |

| |

| • | potential failure in computer or communications systems; |

| |

| • | seasonal factors such as harsh weather conditions that increase operating costs; |

| |

| • | the regulatory environment in which we operate, including existing regulations and changes in existing regulations, or violations by us of existing or future regulations; |

| |

| • | the possible re-classification of our owner-operators as employees; |

| |

| • | changes in rules or legislation by the National Labor Relations Board or Congress and/or union organizing efforts; |

| |

| • | our Compliance Safety Accountability safety rating; |

| |

| • | government regulations with respect to our captive insurance companies; |

| |

| • | uncertainties and risks associated with our operations in Mexico; |

| |

| • | a significant reduction in, or termination of, our trucking services by a key customer; |

| |

| • | our significant ongoing capital requirements; |

| |

| • | the amount and velocity of changes in fuel prices and our ability to recover fuel prices through our fuel surcharge program; |

| |

| • | volatility in the price or availability of fuel; |

| |

| • | increases in new equipment prices or replacement costs; |

| |

| • | our level of indebtedness and our ability to service our outstanding indebtedness, including compliance with our indebtedness covenants, and the impact such indebtedness may have on the way we operate our business; |

| |

| • | restrictions contained in our debt agreements; |

| |

| • | adverse impacts of insuring risk through our captive insurance companies, including our need to provide restricted cash and similar collateral for anticipated losses; |

| |

| • | potential volatility or decrease in the amount of earnings as a result of our claims exposure through our captive insurance companies; |

| |

| • | the potential impact of the significant number of shares of our common stock that is outstanding; |

| |

| • | our intention to not pay dividends; |

| |

| • | conflicts of interest or potential litigation that may arise from other businesses owned by Jerry Moyes, including pledges of Swift stock and guarantees related to other businesses by Jerry Moyes; |

| |

| • | the significant amount of our stock and related control over the Company by Jerry Moyes; |

| |

| • | related-party transactions between the Company and Jerry Moyes; and |

| |

| • | that our acquisition of Central may be challenged by our stockholders. |

You should understand that many important factors, in addition to those listed above and in our filings with the SEC, could impact us financially. As a result of these and other factors, actual results may differ from those set forth in the forward-looking statements and the prices of the Company's securities may fluctuate dramatically. The Company makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events, new information or changes in these expectations.

Use of Non-GAAP Measures

In addition to our GAAP results, this Letter to Stockholders also includes certain non-GAAP financial measures, as defined by the SEC. The terms "Adjusted EBITDA," "Adjusted Operating Ratio," and "Adjusted EPS," as we define them, are not presented in accordance with GAAP. These financial measures supplement our GAAP results in evaluating certain aspects of our business. We believe that using these measures improves comparability in analyzing our performance because they remove the impact of items from our operating results that, in our opinion, do not

reflect our core operating performance. Management and the board of directors focus on Adjusted EBITDA, Adjusted Operating Ratio and Adjusted EPS as key measures of our performance, all of which are reconciled to the most comparable GAAP financial measures and further discussed below. We believe our presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance and compliance with debt covenants.

Adjusted EBITDA, Adjusted Operating Ratio and Adjusted EPS are not substitutes for their comparable GAAP financial measures, such as net income, cash flows from operating activities, operating margin, or other measures prescribed by GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

CONSOLIDATED INCOME STATEMENTS (UNAUDITED)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (In thousands, except per share data) |

| Operating revenue: | | | | | | | |

| Revenue, excluding fuel surcharge revenue | $ | 954,974 |

| | $ | 881,829 |

| | $ | 2,785,737 |

| | $ | 2,575,165 |

|

| Fuel surcharge revenue | 109,999 |

| | 193,051 |

| | 353,784 |

| | 584,059 |

|

| Operating revenue | 1,064,973 |

| | 1,074,880 |

| | 3,139,521 |

| | 3,159,224 |

|

| Operating expenses: | | | | | | | |

| Salaries, wages and employee benefits | 283,767 |

| | 240,005 |

| | 821,747 |

| | 707,464 |

|

| Operating supplies and expenses | 102,719 |

| | 88,459 |

| | 288,070 |

| | 253,361 |

|

| Fuel | 103,023 |

| | 149,099 |

| | 326,598 |

| | 458,798 |

|

| Purchased transportation | 299,866 |

| | 328,112 |

| | 883,354 |

| | 987,530 |

|

| Rental expense | 59,088 |

| | 59,655 |

| | 180,909 |

| | 167,509 |

|

| Insurance and claims | 52,877 |

| | 37,673 |

| | 139,390 |

| | 113,442 |

|

| Depreciation and amortization of property and equipment | 66,852 |

| | 54,369 |

| | 184,194 |

| | 165,335 |

|

| Amortization of intangibles | 4,204 |

| | 4,204 |

| | 12,611 |

| | 12,611 |

|

| Impairments | — |

| | 2,308 |

| | — |

| | 2,308 |

|

| Gain on disposal of property and equipment | (9,825 | ) | | (11,628 | ) | | (23,987 | ) | | (23,099 | ) |

| Communication and utilities | 8,236 |

| | 7,321 |

| | 23,134 |

| | 22,207 |

|

| Operating taxes and licenses | 19,245 |

| | 17,892 |

| | 55,104 |

| | 54,155 |

|

| Total operating expenses | 990,052 |

| | 977,469 |

| | 2,891,124 |

| | 2,921,621 |

|

| Operating income | 74,921 |

| | 97,411 |

| | 248,397 |

| | 237,603 |

|

| Other expenses (income): | | | | | | | |

| Interest expense | 9,130 |

| | 20,372 |

| | 29,627 |

| | 65,050 |

|

| Derivative interest expense | 68 |

| | 1,756 |

| | 3,972 |

| | 5,027 |

|

| Interest income | (647 | ) | | (777 | ) | | (1,825 | ) | | (2,235 | ) |

| Loss on debt extinguishment | 9,567 |

| | 2,854 |

| | 9,567 |

| | 12,757 |

|

| Non-cash impairments of non-operating assets | — |

| | — |

| | 1,480 |

| | — |

|

| Legal settlement | — |

| | — |

| | 6,000 |

| | — |

|

| Other | (752 | ) | | (842 | ) | | (2,341 | ) | | (2,416 | ) |

| Total other expenses (income), net | 17,366 |

| | 23,363 |

| | 46,480 |

| | 78,183 |

|

| Income before income taxes | 57,555 |

| | 74,048 |

| | 201,917 |

| | 159,420 |

|

| Income tax expense | 21,274 |

| | 23,890 |

| | 76,842 |

| | 56,759 |

|

| Net income | $ | 36,281 |

| | $ | 50,158 |

| | $ | 125,075 |

| | $ | 102,661 |

|

| Basic earnings per share | $ | 0.25 |

| | $ | 0.35 |

| | $ | 0.88 |

| | $ | 0.73 |

|

| Diluted earnings per share | $ | 0.25 |

| | $ | 0.35 |

| | $ | 0.87 |

| | $ | 0.72 |

|

| Shares used in per share calculations: | | | | | | | |

| Basic | 142,801 |

| | 141,557 |

| | 142,535 |

| | 141,282 |

|

| Diluted | 144,132 |

| | 143,322 |

| | 144,238 |

| | 143,338 |

|

NON-GAAP RECONCILIATION:

ADJUSTED EPS (UNAUDITED) (1)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| Diluted earnings per share | $ | 0.25 |

| | $ | 0.35 |

| | $ | 0.21 |

| | $ | 0.87 |

| | $ | 0.72 |

| | $ | 0.78 |

|

| Adjusted for: | | | | | | | | | | | |

| Income tax expense | 0.15 |

| | 0.17 |

| | 0.18 |

| | 0.53 |

| | 0.40 |

| | 0.48 |

|

| Income before income taxes | 0.40 |

| | 0.52 |

| | 0.39 |

| | 1.40 |

| | 1.11 |

| | 1.25 |

|

Non-cash impairments (2) | — |

| | 0.02 |

| | — |

| | — |

| | 0.02 |

| | — |

|

Non-cash impairments of non-operating assets (3) | — |

| | — |

| | — |

| | 0.01 |

| | — |

| | — |

|

Loss on debt extinguishment (4) | 0.07 |

| | 0.02 |

| | — |

| | 0.07 |

| | 0.09 |

| | 0.04 |

|

Amortization of certain intangibles (5) | 0.03 |

| | 0.03 |

| | 0.03 |

| | 0.08 |

| | 0.08 |

| | 0.08 |

|

Acceleration of non-cash equity compensation (6) | — |

| | — |

| | 0.01 |

| | — |

| | — |

| | 0.01 |

|

Excludable transaction costs (7) | — |

| | — |

| | 0.03 |

| | — |

| | — |

| | 0.03 |

|

| Adjusted income before income taxes | 0.49 |

| | 0.58 |

| | 0.47 |

| | 1.56 |

| | 1.30 |

| | 1.42 |

|

| Provision for income tax expense at effective rate | 0.18 |

| | 0.19 |

| | 0.18 |

| | 0.59 |

| | 0.46 |

| | 0.55 |

|

| Adjusted EPS | $ | 0.31 |

| | $ | 0.39 |

| | $ | 0.29 |

| | $ | 0.96 |

| | $ | 0.84 |

| | $ | 0.87 |

|

(1) Our definition of the non-GAAP measure, Adjusted EPS, starts with (a) income (loss) before income taxes, the most comparable GAAP measure. We add

the following items back to (a) to arrive at (b) adjusted income (loss) before income taxes:

| |

| (i) | amortization of the intangibles from our 2007 going-private transaction, |

| |

| (ii) | non-cash impairments, |

(iii) other special non-cash items,

| |

| (iv) | excludable transaction costs, |

| |

| (v) | mark-to-market adjustments on our interest rate swaps, recognized in the income statement, and |

| |

| (vi) | amortization of previous losses recorded in accumulated other comprehensive income (loss) ("AOCI") related to the interest rate swaps we terminated upon our IPO and refinancing transactions in December 2010. |

We subtract income taxes, at the GAAP effective tax rate (except for 2013, when we used the GAAP expected effective tax rate), from (b) to arrive at (c) adjusted earnings. Adjusted EPS is equal to (c) divided by weighted average diluted shares outstanding. Since the numbers reflected in the above table are calculated on a per share basis, they may not foot due to rounding.

We believe that excluding the impact of derivatives provides for more transparency and comparability since these transactions have historically been volatile. Additionally, we believe that comparability of our performance is improved by excluding impairments that are unrelated to our core operations, as well as intangibles from the 2007 going-private transactions and other special items that are non-comparable in nature.

| |

| (2) | During the three months ended September 30, 2014 certain operations software was replaced and determined to be fully impaired. This resulted in a pre-tax impairment loss of $2.3 million. |

| |

| (3) | During the three months ended March 31, 2015, the Company recorded an impairment loss related to an uncollectible note receivable. In September 2013, the Company agreed to advance up to $2.3 million, pursuant to an unsecured promissory note, to an independent fleet contractor that transported freight on Swift's behalf. In March 2015, management became aware that the independent contractor violated various covenants outlined in the unsecured promissory note, which created an event of default that made the principal and accrued interest immediately due and payable. As a result of this event of default, as well as an overall decline in the independent contractor's financial condition, management re-evaluated the fair value of the unsecured promissory note. As of March 31, 2015, management determined that the remaining balance due from the independent contractor to the Company was not collectible, which resulted in a $1.5 million pre-tax adjustment that was recorded in "Non-cash impairments of non-operating assets" in the Company's consolidated income statements. |

| |

| (4) | In July 2015, the Company entered into a Fourth Amended and Restated Credit Agreement ("2015 Agreement"), which included a $680.0 million first lien Term Loan A tranche and a $600.0 million revolving credit line. The 2015 Agreement replaced the then-existing $450.0 million revolving credit line, as well as the first lien Term Loan A and Term Loan B tranches of the Third Amended and Restated Credit Agreement ("2014 Agreement"), which had outstanding principal balances at closing of $485.0 million and $395.0 million, respectively. The replacement of the 2014 Agreement resulted in a loss on debt extinguishment of $9.6 million, reflecting the write-off of the unamortized original issue discount and deferred financing fees related to the 2014 Agreement. |

During the nine months ended September 30, 2014, the Company used cash on hand to repurchase $71.9 million in principal of its Senior Secured Second Priority Notes. The repurchase occurred in various open market transactions at an average price of 109.05%. Including principal, premium and accrued interest, the Company paid $80.5 million. The repurchase of the Senior Secured Second Priority Notes resulted in a loss on debt extinguishment, representing the write-off of the unamortized original issue discount, of $2.9 million and $7.6 million for the three and nine months ended September 30, 2014, respectively.

NON-GAAP RECONCILIATION:

ADJUSTED EPS (UNAUDITED) — CONTINUED (1)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

In June 2014, the Company entered into the 2014 Agreement, which included a $500.0 million delayed-draw first lien Term Loan A tranche, a $400.0 million first lien Term Loan B tranche, and a $450.0 million revolving credit line. The 2014 Agreement replaced the then-existing $400.0 million revolving credit line, as well as the first lien Term Loan B-1 and B-2 tranches of the Second Amended and Restated Credit Agreement ("2013 Agreement"), which had outstanding principal balances at closing of $229.0 million and $370.9 million, respectively. The replacement of the 2013 Agreement resulted in a loss on debt extinguishment of $5.2 million, reflecting the write-off of the unamortized original issue discount and deferred financing fees related to the 2013 Agreement and the previous revolving credit line.

In March 2013, the Company entered into the 2013 Agreement, which included a first lien Term Loan B-1 tranche and a first lien Term Loan B-2 tranche with face values of $250.0 million and $410.0 million, respectively. The 2013 Agreement replaced the then-existing term loan B-1 and B-2 tranches of the Amended and Restated Credit Agreement ("2012 Agreement"), which had outstanding principal balances at closing of $152.0 million and $508.0 million, respectively. The replacement of the 2012 Agreement resulted in a loss on debt extinguishment of $5.0 million, reflecting the write-off of the unamortized original issue discount and deferred financing fees associated with the original term loan.

In association with the acquisition of Central, on August 6, 2013, certain outstanding Central debt was paid in full and extinguished, resulting in a loss on debt extinguishment of $0.5 million in the third quarter of 2013, representing the write-off of the remaining unamortized deferred financing fees.

| |

| (5) | For each three and nine month periods presented, amortization of certain intangibles reflects the non-cash amortization expense of $3.9 million and $11.7 million, respectively, relating to certain intangible assets identified in the 2007 going-private transaction through which Swift Corporation acquired Swift Transportation Co. |

| |

| (6) | In the three months ended September 30, 2013, Central incurred a $0.9 million one-time non-cash equity compensation expense for certain stock options that accelerated upon the closing of the Central Refrigerated acquisition. |

| |

| (7) | As a result of the acquisition of Central, both Swift and Central incurred certain transactional expenses, including financial advisory and other professional fees related to the acquisition, totaling approximately $4.3 million for the three and nine months ended September 30, 2013. |

NON-GAAP RECONCILIATION:

ADJUSTED OPERATING INCOME AND OPERATING RATIO (UNAUDITED) (1)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | (Dollar amounts in thousands) |

| Operating revenue | $ | 1,064,973 |

| | $ | 1,074,880 |

| | $ | 1,032,127 |

| | $ | 3,139,521 |

| | $ | 3,159,224 |

| | $ | 3,042,806 |

|

| Less: Fuel surcharge revenue | 109,999 |

| | 193,051 |

| | 198,746 |

| | 353,784 |

| | 584,059 |

| | 594,727 |

|

| Revenue, excluding fuel surcharge revenue | 954,974 |

| | 881,829 |

| | 833,381 |

| | 2,785,737 |

| | 2,575,165 |

| | 2,448,079 |

|

| Operating expense | 990,052 |

| | 977,469 |

| | 947,707 |

| | 2,891,124 |

| | 2,921,621 |

| | 2,788,402 |

|

| Adjusted for: | | | | | | | | | | | |

| Fuel surcharge revenue | (109,999 | ) | | (193,051 | ) | | (198,746 | ) | | (353,784 | ) | | (584,059 | ) | | (594,727 | ) |

Amortization of certain intangibles (2) | (3,912 | ) | | (3,912 | ) | | (3,912 | ) | | (11,736 | ) | | (11,736 | ) | | (11,736 | ) |

Non-cash impairments (3) | — |

| | (2,308 | ) | | — |

| | — |

| | (2,308 | ) | | — |

|

Acceleration of non-cash equity compensation (4) | — |

| | — |

| | (887 | ) | | — |

| | — |

| | (887 | ) |

| Adjusted operating expense | 876,141 |

| | 778,198 |

| | 744,162 |

| | 2,525,604 |

| | 2,323,518 |

| | 2,181,052 |

|

| Adjusted operating income | $ | 78,833 |

| | $ | 103,631 |

| | $ | 89,219 |

| | $ | 260,133 |

| | $ | 251,647 |

| | $ | 267,027 |

|

| Operating Ratio | 93.0 | % | | 90.9 | % | | 91.8 | % | | 92.1 | % | | 92.5 | % | | 91.6 | % |

| Adjusted Operating Ratio | 91.7 | % | | 88.2 | % | | 89.3 | % | | 90.7 | % | | 90.2 | % | | 89.1 | % |

| |

| (1) | Our definition of the non-GAAP measure, Adjusted Operating Ratio, starts with (a) operating expense and (b) operating revenue, which are GAAP financial measures. We subtract the following items from (a) to arrive at (c) adjusted operating expense: |

| |

| (i) | fuel surcharge revenue, |

| |

| (ii) | amortization of the intangibles from our 2007 going-private transaction, |

| |

| (iii) | non-cash operating impairment charges, |

| |

| (iv) | other special non-cash items, and |

| |

| (v) | excludable transaction costs. |

We then subtract fuel surcharge revenue from (b) to arrive at (d) Revenue xFSR. Adjusted Operating Ratio is equal to (c) adjusted operating expense as a percentage of (d) Revenue xFSR.

We net fuel surcharge revenue against fuel expense in the calculation of our Adjusted Operating Ratio, thereby excluding fuel surcharge revenue from operating revenue in the denominator. Because fuel surcharge revenue is so volatile, we believe excluding it provides for more transparency and comparability. Additionally, we believe that comparability of our performance is improved by excluding impairments, non-comparable intangibles from the 2007 Transactions and other special items.

| |

| (2) | Includes the items discussed in note (5) to the Non-GAAP Reconciliation: Adjusted EPS. |

| |

| (3) | Includes the items discussed in note (2) to the Non-GAAP Reconciliation: Adjusted EPS. |

| |

| (4) | Includes the items discussed in note (6) to the Non-GAAP Reconciliation: Adjusted EPS. |

NON-GAAP RECONCILIATION:

ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION

AND AMORTIZATION (UNAUDITED) (1)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | (In thousands) |

| Net income | $ | 36,281 |

| | $ | 50,158 |

| | $ | 29,953 |

| | $ | 125,075 |

| | $ | 102,661 |

| | $ | 110,124 |

|

| Adjusted for: | | | | | | | | | | | |

| Depreciation and amortization of property and equipment | 66,852 |

| | 54,369 |

| | 58,254 |

| | 184,194 |

| | 165,335 |

| | 170,004 |

|

| Amortization of intangibles | 4,204 |

| | 4,204 |

| | 4,204 |

| | 12,611 |

| | 12,611 |

| | 12,611 |

|

| Interest expense | 9,130 |

| | 20,372 |

| | 24,595 |

| | 29,627 |

| | 65,050 |

| | 75,719 |

|

| Derivative interest expense | 68 |

| | 1,756 |

| | 1,465 |

| | 3,972 |

| | 5,027 |

| | 2,559 |

|

| Interest income | (647 | ) | | (777 | ) | | (604 | ) | | (1,825 | ) | | (2,235 | ) | | (1,741 | ) |

| Income tax expense | 21,274 |

| | 23,890 |

| | 26,156 |

| | 76,842 |

| | 56,759 |

| | 67,806 |

|

| Earnings before interest, taxes, depreciation and amortization (EBITDA) | $ | 137,162 |

| | $ | 153,972 |

| | $ | 144,023 |

| | $ | 430,496 |

| | $ | 405,208 |

| | $ | 437,082 |

|

Non-cash impairments (2) | — |

| | 2,308 |

| | — |

| | — |

| | 2,308 |

| | — |

|

Non-cash equity compensation (3) | 1,735 |

| | 1,539 |

| | 1,967 |

| | 4,618 |

| | 3,892 |

| | 3,465 |

|

Loss on debt extinguishment (4) | 9,567 |

| | 2,854 |

| | 496 |

| | 9,567 |

| | 12,757 |

| | 5,540 |

|

Non-cash impairments of non-operating assets (5) | — |

| | — |

| | — |

| | 1,480 |

| | — |

| | — |

|

Excludable transaction costs (6) | — |

| | — |

| | 4,331 |

| | — |

| | — |

| | 4,331 |

|

| Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) | $ | 148,464 |

| | $ | 160,673 |

| | $ | 150,817 |

| | $ | 446,161 |

| | $ | 424,165 |

| | $ | 450,418 |

|

| |

| (1) | Our definition of the non-GAAP measure, Adjusted EBITDA, starts with (a) net income (loss), the most comparable GAAP measure. We add the following items back to (a) to arrive at Adjusted EBITDA: |

| |

| (i) | depreciation and amortization, |

| |

| (ii) | interest and derivative interest expense, including fees and charges associated with indebtedness, net of interest income, |

| |

| (iv) | non-cash equity compensation expense, |

| |

| (vi) | other special non-cash items, and |

| |

| (vii) | excludable transaction costs. |

We believe that Adjusted EBITDA is a relevant measure for estimating the cash generated by our operations that would be available to cover capital expenditures, taxes, interest and other investments and that it enhances an investor’s understanding of our financial performance. We use Adjusted EBITDA for business planning purposes and in measuring our performance relative to that of our competitors. Our method of computing Adjusted EBITDA is consistent with that used in our debt covenants, specifically our leverage ratio, and is also routinely reviewed by management for that purpose.

| |

| (2) | Includes the item discussed in note (2) to the Non-GAAP Reconciliation: Adjusted EPS. |

| |

| (3) | Represents recurring non-cash equity compensation expense, on a pre-tax basis. In accordance with the terms of our senior credit agreement, this expense is added back in the calculation of Adjusted EBITDA for covenant compliance purposes. |

| |

| (4) | Includes the items discussed in note (4) to the Non-GAAP Reconciliation: Adjusted EPS. |

| |

| (5) | Includes the item discussed in note (3) to the Non-GAAP Reconciliation: Adjusted EPS. |

| |

| (6) | Includes the item discussed in note (7) to the Non-GAAP Reconciliation: Adjusted EPS. |

FINANCIAL INFORMATION BY SEGMENT (UNAUDITED)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | (Dollar amounts in thousands) |

| Operating Revenue: | | | | | | | | | | | |

| Truckload | $ | 552,816 |

| | $ | 570,931 |

| | $ | 579,494 |

| | $ | 1,646,872 |

| | $ | 1,699,469 |

| | $ | 1,727,813 |

|

| Dedicated | 234,517 |

| | 238,025 |

| | 184,550 |

| | 686,505 |

| | 654,776 |

| | 546,427 |

|

| Swift Refrigerated | 93,045 |

| | 100,448 |

| | 115,339 |

| | 286,301 |

| | 314,122 |

| | 332,979 |

|

| Intermodal | 100,966 |

| | 99,962 |

| | 96,478 |

| | 289,827 |

| | 292,186 |

| | 270,736 |

|

| Subtotal | 981,344 |

| | 1,009,366 |

| | 975,861 |

| | 2,909,505 |

| | 2,960,553 |

| | 2,877,955 |

|

Non-reportable segment (1) | 104,176 |

| | 80,122 |

| | 63,982 |

| | 289,667 |

| | 239,279 |

| | 207,954 |

|

| Intersegment eliminations | (20,547 | ) | | (14,608 | ) | | (7,716 | ) | | (59,651 | ) | | (40,608 | ) | | (43,103 | ) |

| Operating Revenue | $ | 1,064,973 |

| | $ | 1,074,880 |

| | $ | 1,032,127 |

| | $ | 3,139,521 |

| | $ | 3,159,224 |

| | $ | 3,042,806 |

|

| | | | | | | | | | | | |

| Operating Income (Loss): | | | | | | | | | | | |

| Truckload | $ | 57,012 |

| | $ | 71,186 |

| | $ | 58,053 |

| | $ | 181,810 |

| | $ | 172,689 |

| | $ | 165,070 |

|

| Dedicated | 17,573 |

| | 23,692 |

| | 20,508 |

| | 54,885 |

| | 56,334 |

| | 63,725 |

|

| Swift Refrigerated | 2,622 |

| | 3,238 |

| | 3,422 |

| | 13,538 |

| | 9,320 |

| | 13,803 |

|

| Intermodal | 723 |

| | 1,934 |

| | 1,531 |

| | 1,081 |

| | 513 |

| | 715 |

|

| Subtotal | 77,930 |

| | 100,050 |

| | 83,514 |

| | 251,314 |

| | 238,856 |

| | 243,313 |

|

Non-reportable segment (1) | (3,009 | ) | | (2,639 | ) | | 906 |

| | (2,917 | ) | | (1,253 | ) | | 11,091 |

|

| Consolidated operating income | $ | 74,921 |

| | $ | 97,411 |

| | $ | 84,420 |

| | $ | 248,397 |

| | $ | 237,603 |

| | $ | 254,404 |

|

| | | | | | | | | | | | |

| Operating Ratio: | | | | | | | | | | | |

| Truckload | 89.7 | % | | 87.5 | % | | 90.0 | % | | 89.0 | % | | 89.8 | % | | 90.4 | % |

| Dedicated | 92.5 | % | | 90.0 | % | | 88.9 | % | | 92.0 | % | | 91.4 | % | | 88.3 | % |

| Swift Refrigerated | 97.2 | % | | 96.8 | % | | 97.0 | % | | 95.3 | % | | 97.0 | % | | 95.9 | % |

| Intermodal | 99.3 | % | | 98.1 | % | | 98.4 | % | | 99.6 | % | | 99.8 | % | | 99.7 | % |

| | | | | | | | | | | | |

Adjusted Operating Ratio (2): | | | | | | | | | | | |

| Truckload | 88.4 | % | | 84.5 | % | | 87.4 | % | | 87.4 | % | | 87.3 | % | | 88.0 | % |

| Dedicated | 91.8 | % | | 88.0 | % | | 86.3 | % | | 91.2 | % | | 89.5 | % | | 85.6 | % |

| Swift Refrigerated | 96.8 | % | | 96.0 | % | | 96.3 | % | | 94.5 | % | | 96.3 | % | | 94.7 | % |

| Intermodal | 99.2 | % | | 97.6 | % | | 98.0 | % | | 99.6 | % | | 99.8 | % | | 99.7 | % |

| |

| (1) | The other non-reportable segment includes the Company's logistics and freight brokerage services, as well as support services provided by its subsidiaries to customers and owner-operators, including repair and maintenance shop services, equipment leasing, and insurance. Intangible asset amortization related to the 2007 going-private transactions is also included in this other non-reportable segment. |

| |

| (2) | For more details, refer to the Non-GAAP Reconciliation: Adjusted Operating Income and Operating Ratio by Segment. |

OPERATING STATISTICS BY SEGMENT (UNAUDITED)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| Truckload: | | | | | | | | | | | |

| Weekly revenue xFSR per tractor | $ | 3,493 |

| | $ | 3,449 |

| | $ | 3,212 |

| | $ | 3,508 |

| | $ | 3,376 |

| | $ | 3,222 |

|

Total loaded miles (1) | 261,339 |

| | 254,320 |

| | 267,607 |

| | 777,874 |

| | 768,329 |

| | 804,287 |

|

| Deadhead miles percentage | 12.2 | % | | 11.7 | % | | 11.5 | % | | 11.9 | % | | 11.7 | % | | 11.3 | % |

| Average operational truck count: | | | | | | | | | | | |

| Company | 7,663 |

| | 6,811 |

| | 7,552 |

| | 7,488 |

| | 6,928 |

| | 7,593 |

|

| Owner-Operator | 2,999 |

| | 3,336 |

| | 3,355 |

| | 3,063 |

| | 3,409 |

| | 3,311 |

|

| Total | 10,662 |

| | 10,147 |

| | 10,907 |

| | 10,551 |

| | 10,337 |

| | 10,904 |

|

| | | | | | | | | | | | |

| Dedicated: | | | | | | | | | | | |

| Weekly revenue xFSR per tractor | $ | 3,333 |

| | $ | 3,154 |

| | $ | 3,326 |

| | $ | 3,294 |

| | $ | 3,173 |

| | $ | 3,369 |

|

| Average operational truck count: | | | | | | | | | | | |

| Company | 4,020 |

| | 3,786 |

| | 2,771 |

| | 3,963 |

| | 3,532 |

| | 2,730 |

|

| Owner-Operator | 893 |

| | 983 |

| | 663 |

| | 881 |

| | 815 |

| | 646 |

|

| Total | 4,913 |

| | 4,769 |

| | 3,434 |

| | 4,844 |

| | 4,347 |

| | 3,376 |

|

| | | | | | | | | | | | |

| Swift Refrigerated: | | | | | | | | | | | |

| Weekly revenue xFSR per tractor | $ | 3,466 |

| | $ | 3,510 |

| | $ | 3,544 |

| | $ | 3,429 |

| | $ | 3,429 |

| | $ | 3,416 |

|

Total loaded miles (1) | 42,431 |

| | 40,105 |

| | 48,003 |

| | 127,525 |

| | 125,799 |

| | 144,342 |

|

| Deadhead miles percentage | 14.4 | % | | 15.9 | % | | 13.4 | % | | 14.1 | % | | 15.0 | % | | 12.6 | % |

| Average operational truck count: | | | | | | | | | | | |

| Company | 1,191 |

| | 1,071 |

| | 1,012 |

| | 1,246 |

| | 1,062 |

| | 1,017 |

|

| Owner-Operator | 587 |

| | 676 |

| | 964 |

| | 589 |

| | 814 |

| | 939 |

|

| Total | 1,778 |

| | 1,747 |

| | 1,976 |

| | 1,835 |

| | 1,876 |

| | 1,956 |

|

| | | | | | | | | | | | |

| Intermodal: | | | | | | | | | | | |

| Average operational truck count: | | | | | | | | | | | |

| Company | 546 |

| | 461 |

| | 329 |

| | 516 |

| | 416 |

| | 308 |

|

| Owner-Operator | 111 |

| | 79 |

| | 48 |

| | 98 |

| | 73 |

| | 32 |

|

| Total | 657 |

| | 540 |

| | 377 |

| | 614 |

| | 489 |

| | 340 |

|

| Load Count | 47,107 |

| | 44,275 |

| | 41,747 |

| | 135,564 |

| | 126,282 |

| | 116,510 |

|

| Average Container Count | 9,150 |

| | 8,778 |

| | 8,717 |

| | 9,150 |

| | 8,737 |

| | 8,717 |

|

| |

| (1) | Total loaded miles presented in thousands. |

CONSOLIDATED EQUIPMENT (UNAUDITED)

AS OF SEPTEMBER 30, 2015, DECEMBER 31, 2014 AND SEPTEMBER 30, 2014

AND

AVERAGE OPERATIONAL TRUCK COUNT (UNAUDITED)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | |

| | September 30,

2015 | | December 31, 2014 | | September 30,

2014 |

| Tractors | | | | | |

| Company: | | | | | |

| Owned | 7,334 |

| | 6,083 |

| | 5,452 |

|

| Leased – capital leases | 2,296 |

| | 1,700 |

| | 2,081 |

|

| Leased – operating leases | 6,194 |

| | 6,099 |

| | 6,160 |

|

| Total company tractors | 15,824 |

| | 13,882 |

| | 13,693 |

|

| Owner-operator: | | | | | |

| Financed through the Company | 3,891 |

| | 4,204 |

| | 4,260 |

|

| Other | 1,121 |

| | 750 |

| | 748 |

|

| Total owner-operator tractors | 5,012 |

| | 4,954 |

| | 5,008 |

|

| Total tractors | 20,836 |

| | 18,836 |

| | 18,701 |

|

| Trailers | 64,528 |

| | 61,652 |

| | 60,262 |

|

| Containers | 9,150 |

| | 9,150 |

| | 8,900 |

|

|

| | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

Average operational truck count (1) : | | | | | | | | | | | | |

| Company | | 13,469 |

| | 12,156 |

| | 11,682 |

| | 13,249 |

| | 11,966 |

| | 11,674 |

|

| Owner-operator | | 4,592 |

| | 5,074 |

| | 5,031 |

| | 4,632 |

| | 5,109 |

| | 4,930 |

|

| Total | | 18,061 |

| | 17,230 |

| | 16,713 |

| | 17,881 |

| | 17,075 |

| | 16,604 |

|

| |

| (1) | Includes trucks within our non-reportable segment. |

NON-GAAP RECONCILIATION:

ADJUSTED OPERATING INCOME AND OPERATING RATIO

BY SEGMENT (UNAUDITED)

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2015, 2014 AND 2013

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2013 | | 2015 | | 2014 | | 2013 |

| | (Dollars in thousands) |

| Truckload: | | | | | | | | | | | |

| Operating revenue | $ | 552,816 |

| | $ | 570,931 |

| | $ | 579,494 |

| | $ | 1,646,872 |

| | $ | 1,699,469 |

| | $ | 1,727,813 |

|

| Less: Fuel surcharge revenue | 63,363 |

| | 110,917 |

| | 119,088 |

| | 203,205 |

| | 338,979 |

| | 357,571 |

|

| Revenue xFSR | 489,453 |

| | 460,014 |

| | 460,406 |

| | 1,443,667 |

| | 1,360,490 |

| | 1,370,242 |

|

| | | | | | | | | | | | |

| Operating expense | 495,804 |

| | 499,745 |

| | 521,441 |

| | 1,465,062 |

| | 1,526,780 |

| | 1,562,743 |

|

| Adjusted for: Fuel surcharge revenue | (63,363 | ) | | (110,917 | ) | | (119,088 | ) | | (203,205 | ) | | (338,979 | ) | | (357,571 | ) |

| Adjusted operating expense | 432,441 |

| | 388,828 |

| | 402,353 |

| | 1,261,857 |

| | 1,187,801 |

| | 1,205,172 |

|

| Adjusted operating income | $ | 57,012 |

| | $ | 71,186 |

| | $ | 58,053 |

| | $ | 181,810 |

| | $ | 172,689 |

| | $ | 165,070 |

|

| Operating Ratio | 89.7 | % | | 87.5 | % | | 90.0 | % | | 89.0 | % | | 89.8 | % | | 90.4 | % |