2Q 2018 Earnings Call Presentation 1

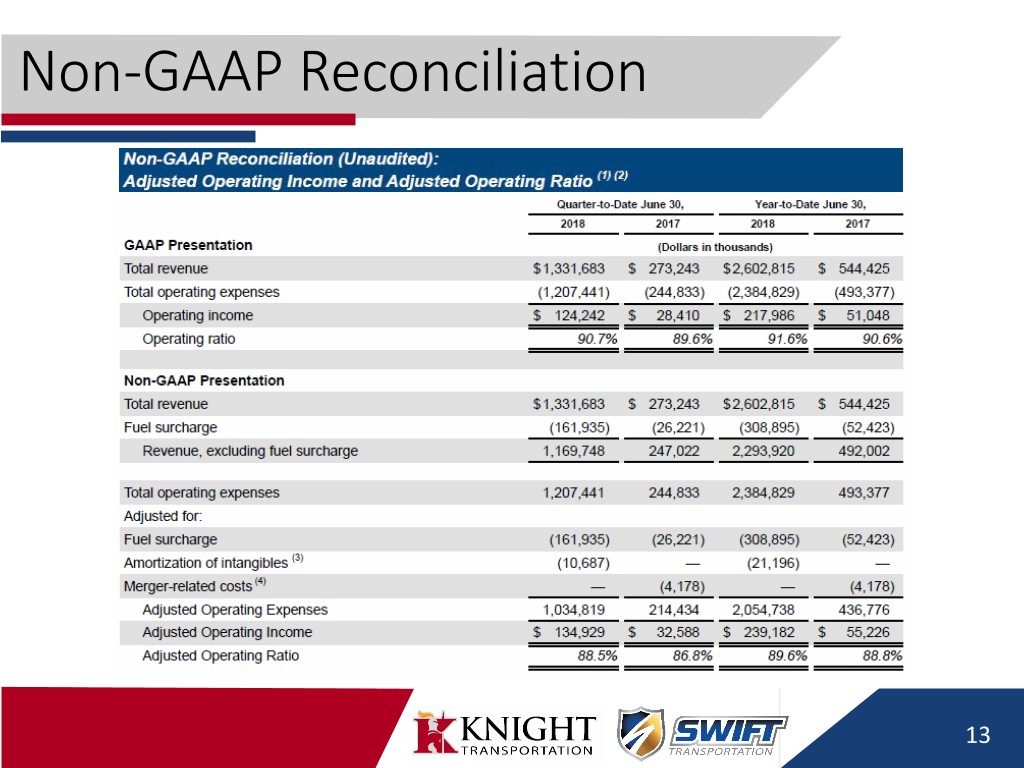

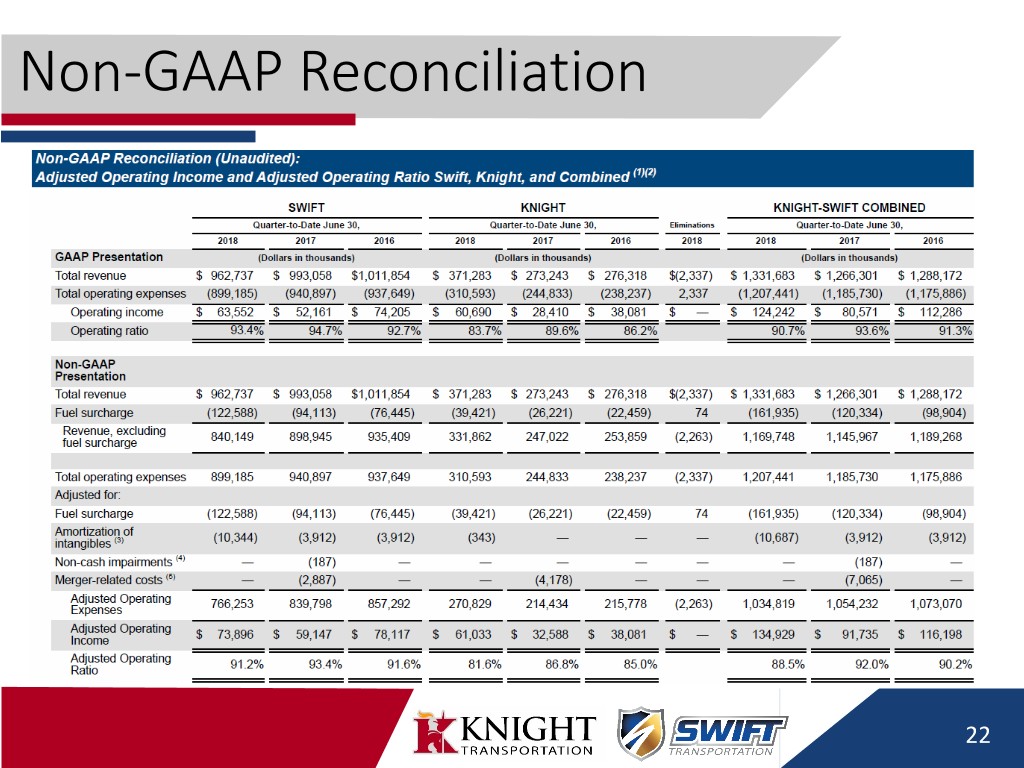

Disclosure This presentation, including documents incorporated herein by reference, will contain forward- looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Please review our disclosures in filings with the Securities Exchange Commission. Non-GAAP Financial Data This presentation includes the use of adjusted operating income, operating ratio, adjusted operating ratio, adjusted net income, adjusted earnings per share, and free cash flow, which are financial measures that are not in accordance with generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures should not be interpreted as indicating that these or similar items could not occur in future periods. In addition, adjusted operating ratio excludes trucking segment fuel surcharges from revenue and nets these surcharges against fuel expense. 2

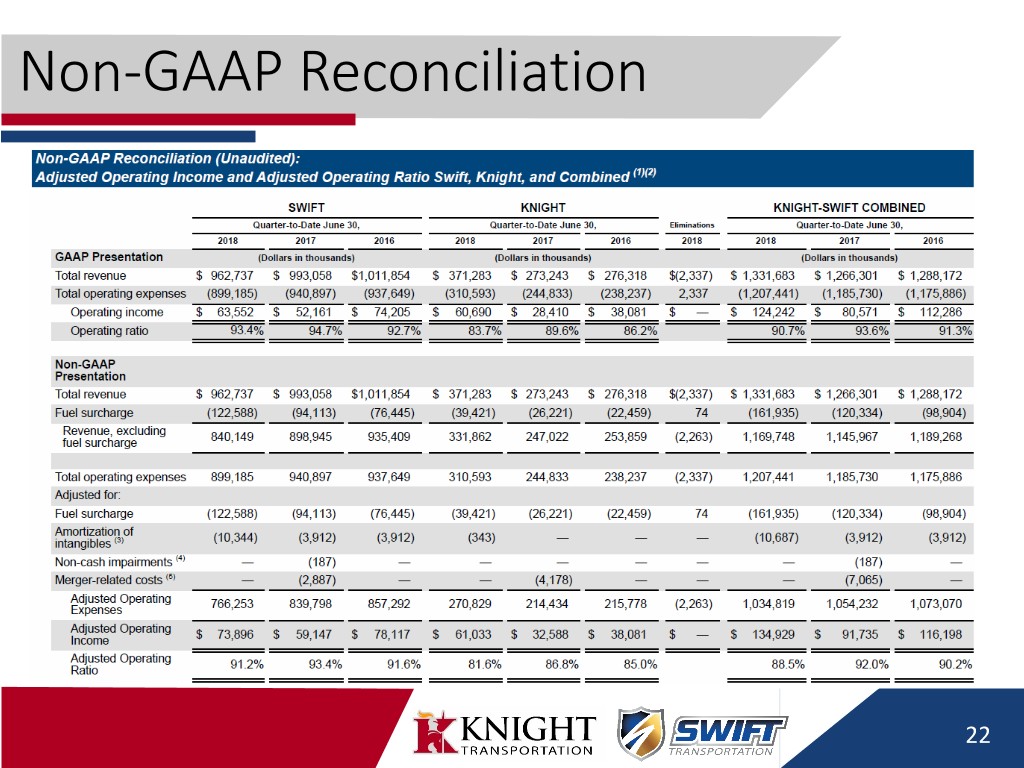

Disclosure On September 8, 2017, pursuant to the Agreement and Plan of Merger, dated as of April 9, 2017, by Swift Transportation Company (“Swift”), Bishop Merger Sub, Inc., a direct wholly owned subsidiary of Swift, (“Merger Sub”), and Knight Transportation, Inc. (“Knight”), Merger Sub merged with and into Knight, with Knight surviving as a direct wholly owned subsidiary of Swift (the “2017 Merger”). Knight was the accounting acquirer and Swift was the legal acquirer in the 2017 Merger. In accordance with the accounting treatment applicable to the 2017 Merger, throughout this presentation, the reported results do not include the results of operations of Swift and its subsidiaries on and prior to the 2017 Merger date of September 8, 2017 (the “2017 Merger Date”). However, where indicated, certain historical information of Swift and its subsidiaries on and prior to the 2017 Merger Date, including their results of operations and certain operational statistics (collectively, the “Swift Historical Information”), has been provided. Management believes that presentation of the Swift Historical Information will be useful to investors. The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the periods presented, or which may be realized in the future. 3

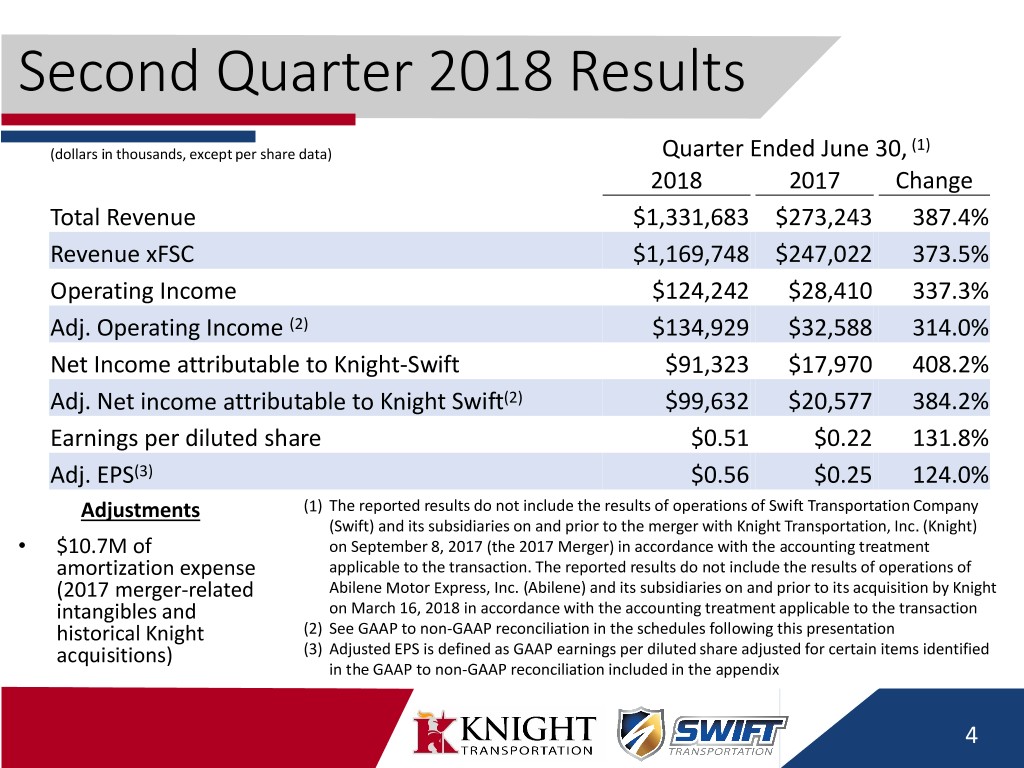

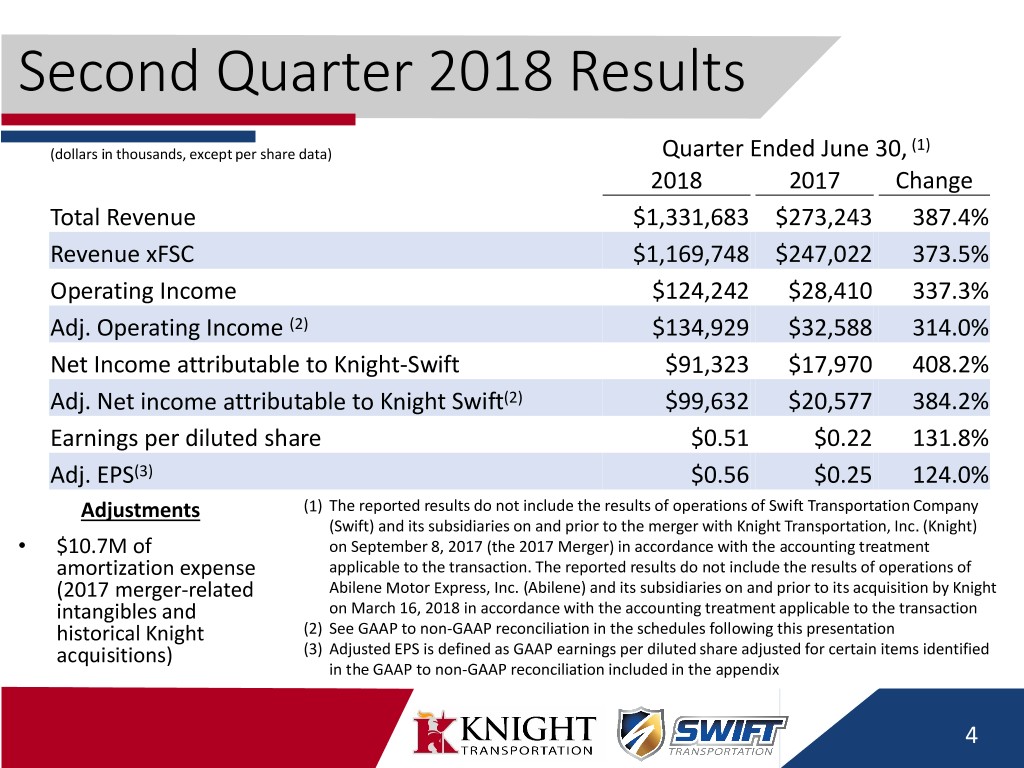

Second Quarter 2018 Results (1) (dollars in thousands, except per share data) Quarter Ended June 30, 2018 2017 Change Total Revenue $1,331,683 $273,243 387.4% Revenue xFSC $1,169,748 $247,022 373.5% Operating Income $124,242 $28,410 337.3% Adj. Operating Income (2) $134,929 $32,588 314.0% Net Income attributable to Knight-Swift $91,323 $17,970 408.2% Adj. Net income attributable to Knight Swift(2) $99,632 $20,577 384.2% Earnings per diluted share $0.51 $0.22 131.8% Adj. EPS(3) $0.56 $0.25 124.0% Adjustments (1) The reported results do not include the results of operations of Swift Transportation Company (Swift) and its subsidiaries on and prior to the merger with Knight Transportation, Inc. (Knight) • $10.7M of on September 8, 2017 (the 2017 Merger) in accordance with the accounting treatment amortization expense applicable to the transaction. The reported results do not include the results of operations of (2017 merger-related Abilene Motor Express, Inc. (Abilene) and its subsidiaries on and prior to its acquisition by Knight intangibles and on March 16, 2018 in accordance with the accounting treatment applicable to the transaction historical Knight (2) See GAAP to non-GAAP reconciliation in the schedules following this presentation acquisitions) (3) Adjusted EPS is defined as GAAP earnings per diluted share adjusted for certain items identified in the GAAP to non-GAAP reconciliation included in the appendix 4

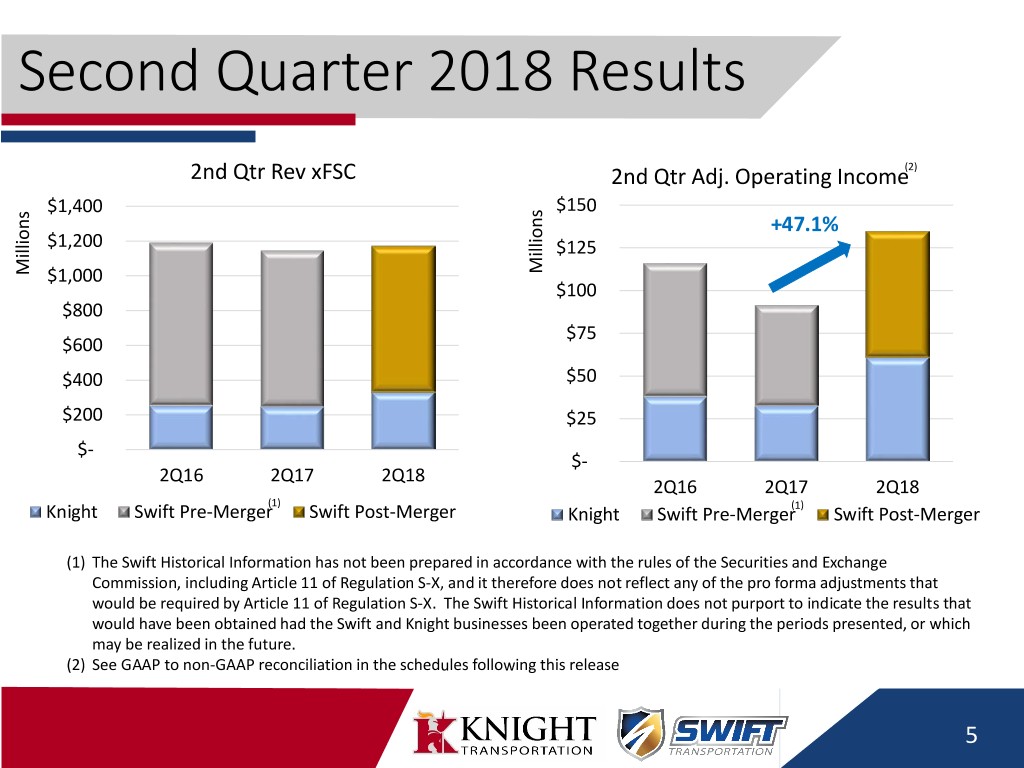

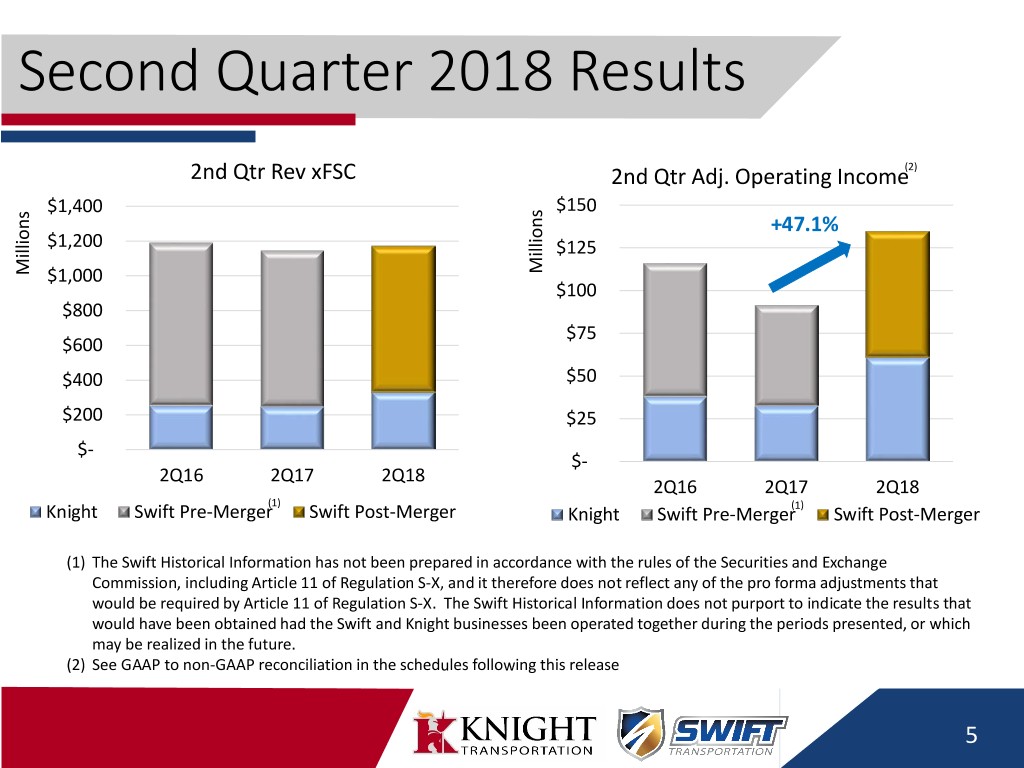

Second Quarter 2018 Results 2nd Qtr Rev xFSC 2nd Qtr Adj. Operating Income(2) $1,400 $150 +47.1% $1,200 $125 Millions Millions $1,000 $100 $800 $75 $600 $400 $50 $200 $25 $- $- 2Q16 2Q17 2Q18 2Q16 2Q17 2Q18 (1) (1) Knight Swift Pre-Merger Swift Post-Merger Knight Swift Pre-Merger Swift Post-Merger (1) The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the periods presented, or which may be realized in the future. (2) See GAAP to non-GAAP reconciliation in the schedules following this release 5

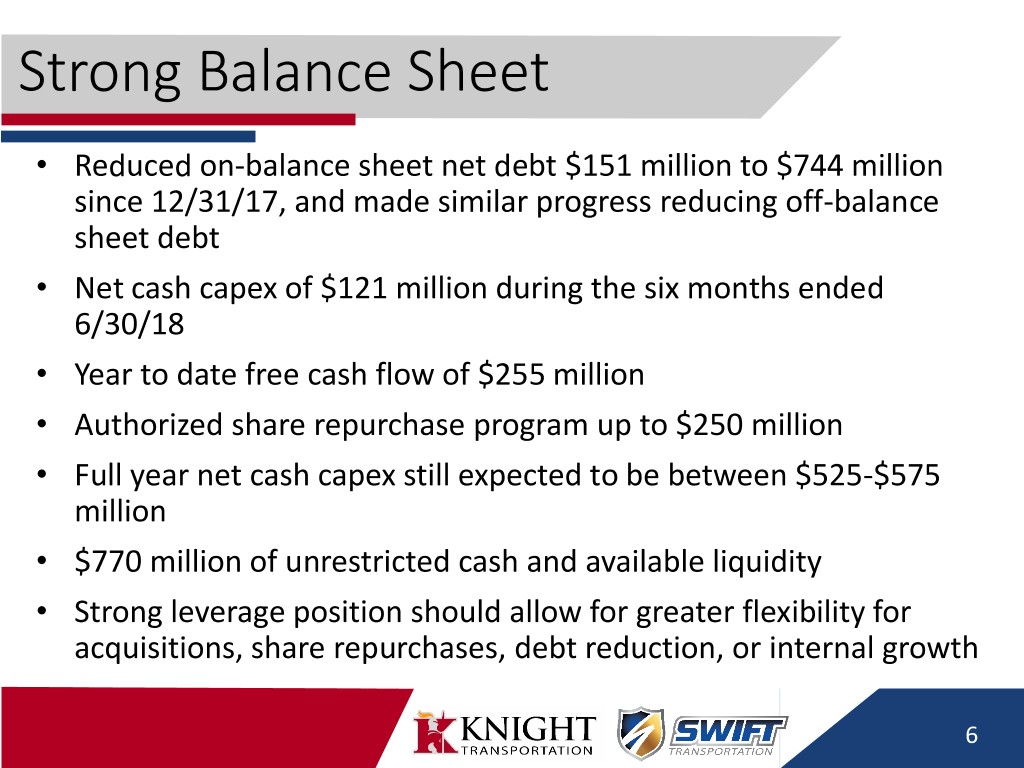

Strong Balance Sheet • Reduced on-balance sheet net debt $151 million to $744 million since 12/31/17, and made similar progress reducing off-balance sheet debt • Net cash capex of $121 million during the six months ended 6/30/18 • Year to date free cash flow of $255 million • Authorized share repurchase program up to $250 million • Full year net cash capex still expected to be between $525-$575 million • $770 million of unrestricted cash and available liquidity • Strong leverage position should allow for greater flexibility for acquisitions, share repurchases, debt reduction, or internal growth 6

The Leading Truckload Franchise Knight-Swift Transportation Holdings, Inc. • Proven track record as the most profitable truckload carrier Industry leading OR at Knight over two decades. • Largest decentralized truckload carrier network 50+ years in the making. • Largest irregular-route truckload fleet (nearly 14k) Most difficult truckload service and most in demand. • Extensive customizable dedicated capabilities $1 billion in annual dedicated revenues • Positioned for additional M&A growth Success in improving margins in each M&A deal (6 by KNX so far) 7

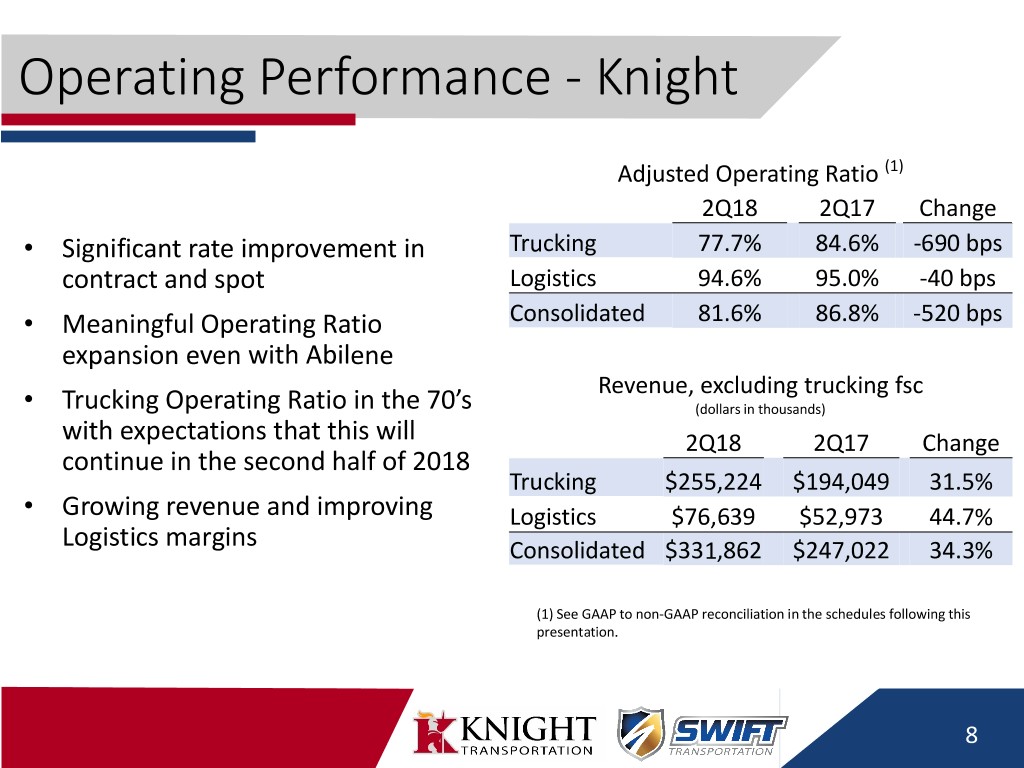

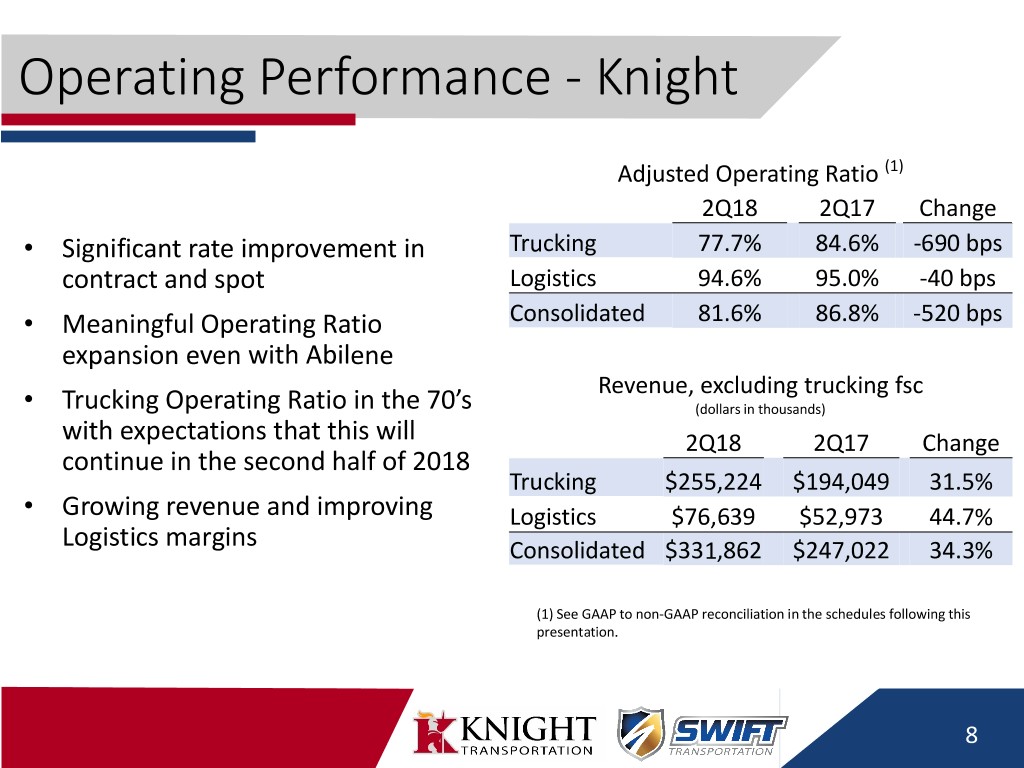

Operating Performance - Knight Adjusted Operating Ratio (1) 2Q18 2Q17 Change • Significant rate improvement in Trucking 77.7% 84.6% -690 bps contract and spot Logistics 94.6% 95.0% -40 bps • Meaningful Operating Ratio Consolidated 81.6% 86.8% -520 bps expansion even with Abilene Revenue, excluding trucking fsc • Trucking Operating Ratio in the 70’s (dollars in thousands) with expectations that this will 2Q18 2Q17 Change continue in the second half of 2018 Trucking $255,224 $194,049 31.5% • Growing revenue and improving Logistics $76,639 $52,973 44.7% Logistics margins Consolidated $331,862 $247,022 34.3% (1) See GAAP to non-GAAP reconciliation in the schedules following this presentation. 8

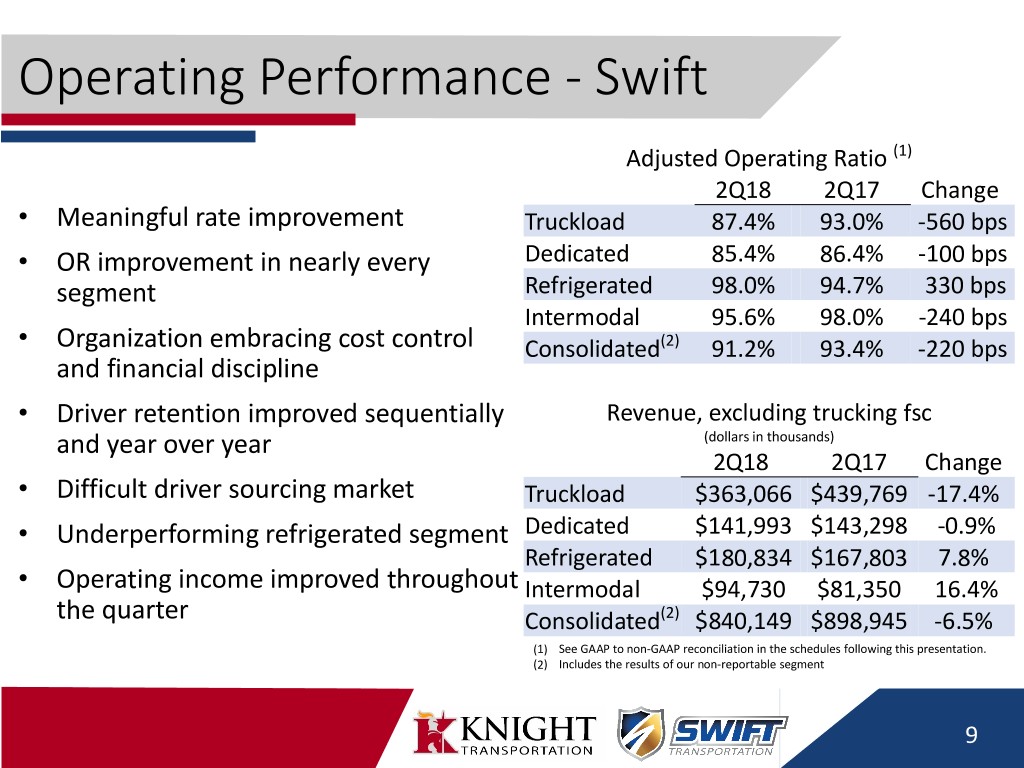

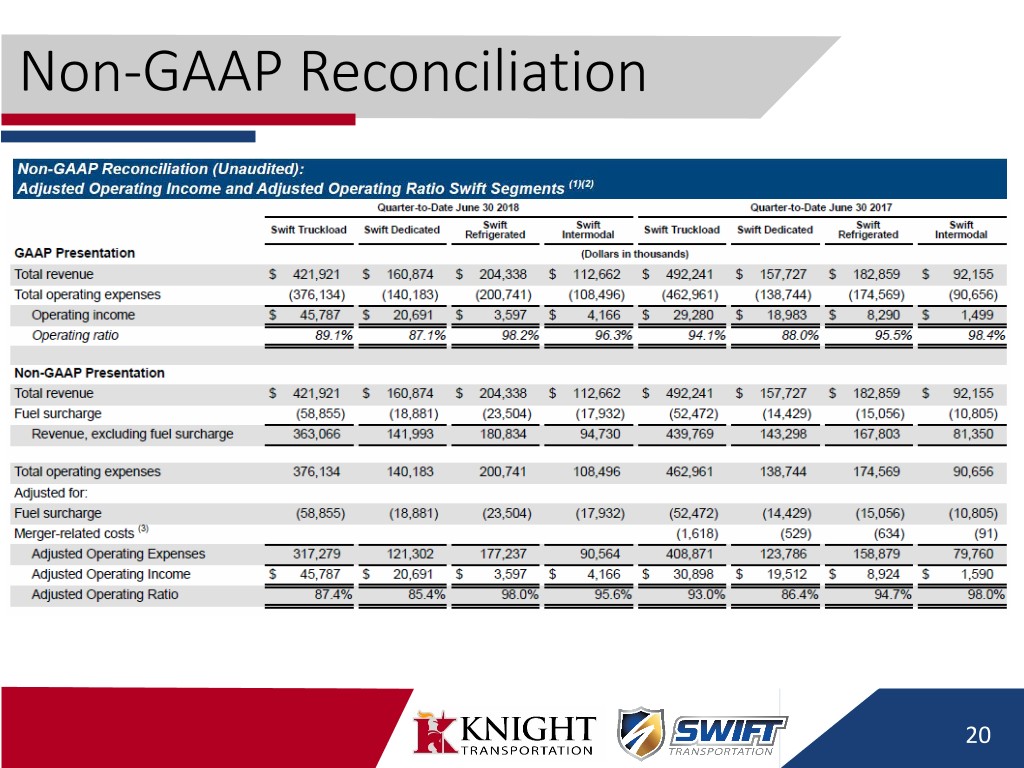

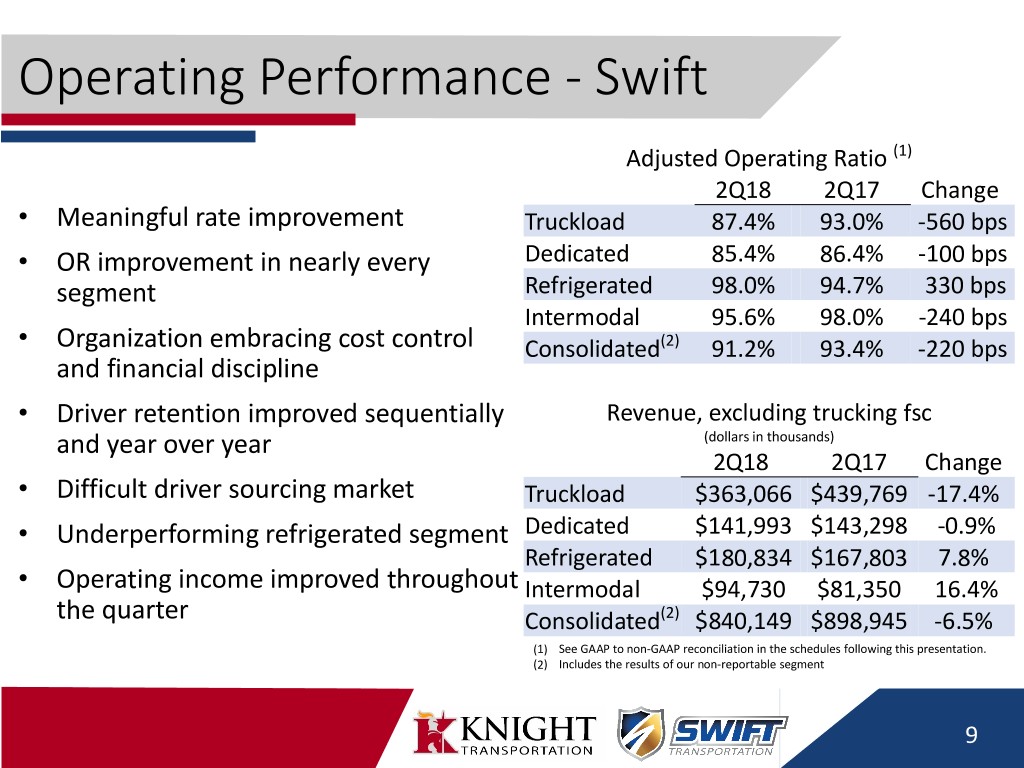

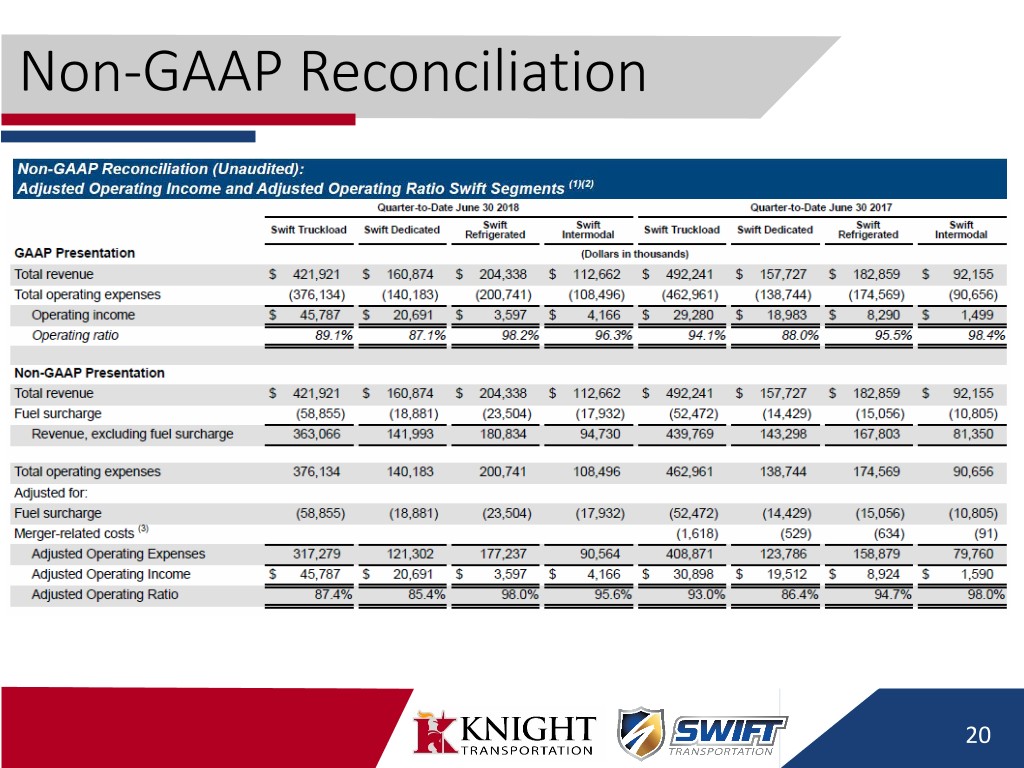

Operating Performance - Swift Adjusted Operating Ratio (1) 2Q18 2Q17 Change • Meaningful rate improvement Truckload 87.4% 93.0% -560 bps • OR improvement in nearly every Dedicated 85.4% 86.4% -100 bps segment Refrigerated 98.0% 94.7% 330 bps Intermodal 95.6% 98.0% -240 bps • Organization embracing cost control Consolidated(2) 91.2% 93.4% -220 bps and financial discipline • Driver retention improved sequentially Revenue, excluding trucking fsc and year over year (dollars in thousands) 2Q18 2Q17 Change • Difficult driver sourcing market Truckload $363,066 $439,769 -17.4% • Underperforming refrigerated segment Dedicated $141,993 $143,298 -0.9% Refrigerated $180,834 $167,803 7.8% • Operating income improved throughout Intermodal $94,730 $81,350 16.4% the quarter Consolidated(2) $840,149 $898,945 -6.5% (1) See GAAP to non-GAAP reconciliation in the schedules following this presentation. (2) Includes the results of our non-reportable segment 9

Merger Update • Creating a stronger foundation at Swift • 80% of the trucking business (15,300 trucks) is performing well demonstrated by a combined adjusted operating ratio of 83.8% • Refrigerated business is behind expectations, but is being addressed • Intermodal continues to be profitable and making meaningful improvement on a year over year basis • Logistics is growing revenue while maintaining healthy margins that are converting to operating income growth 10

Q3 & Q4 Guidance • Expected Adjusted EPS for the third quarter 2018 of $0.56 - $0.60 • Expected Adjusted EPS for the fourth quarter 2018 of $0.68 - $0.72 11

Appendix 12

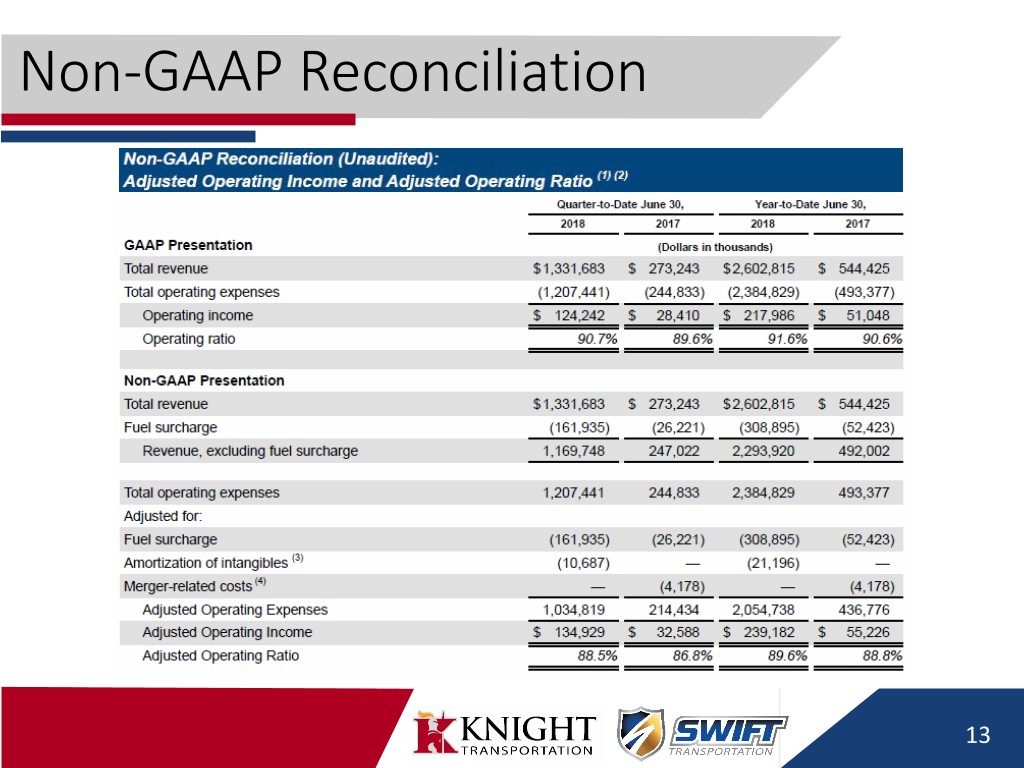

Non-GAAP Reconciliation 13

Non-GAAP Reconciliation 14

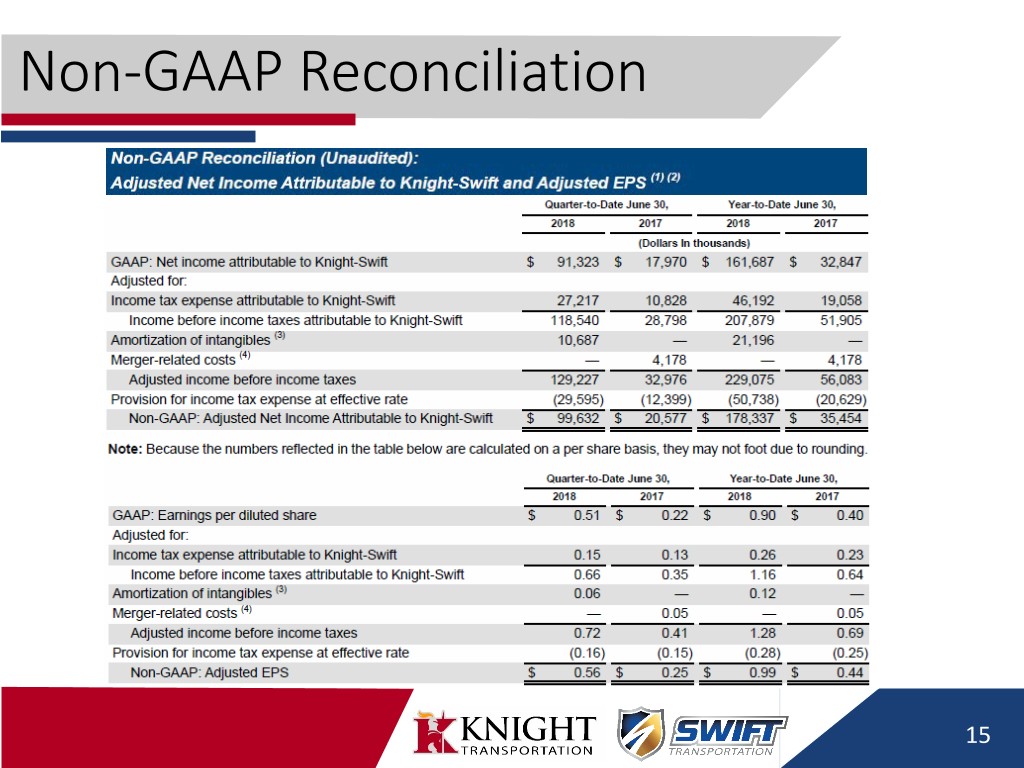

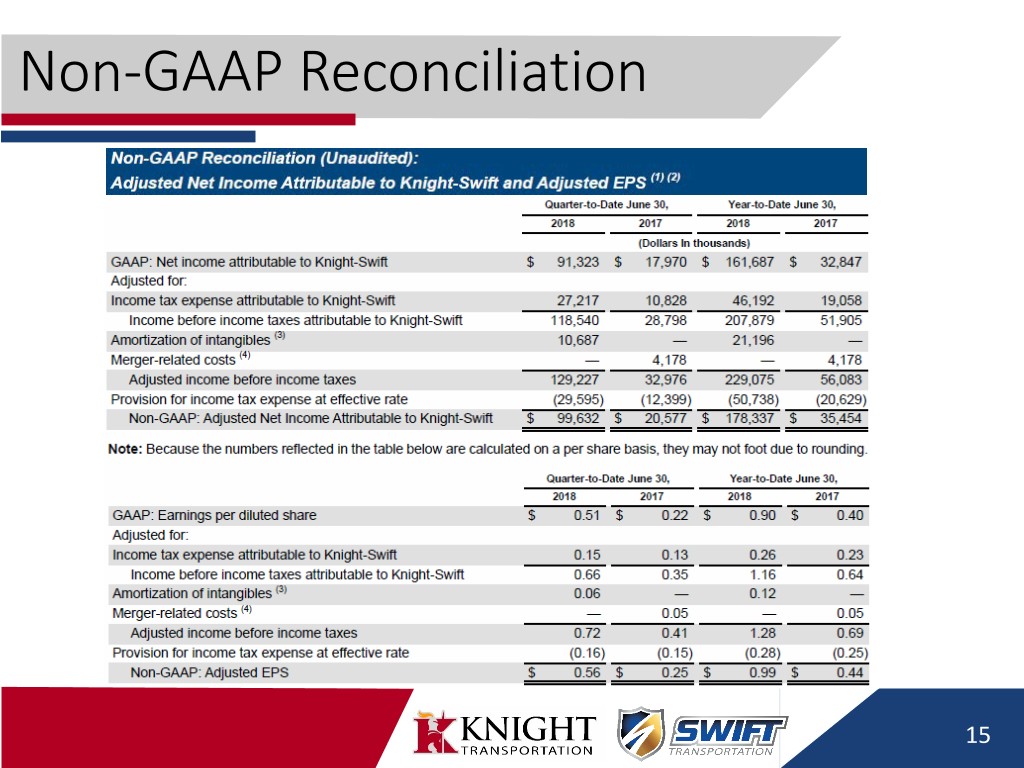

Non-GAAP Reconciliation 15

Non-GAAP Reconciliation 16

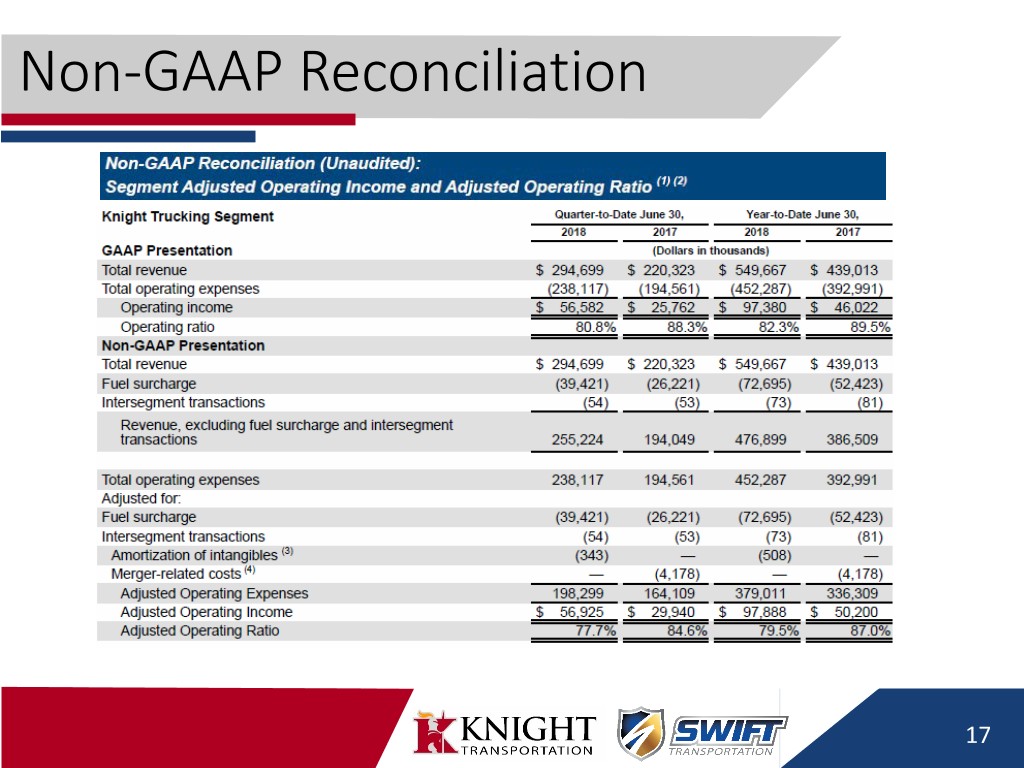

Non-GAAP Reconciliation 17

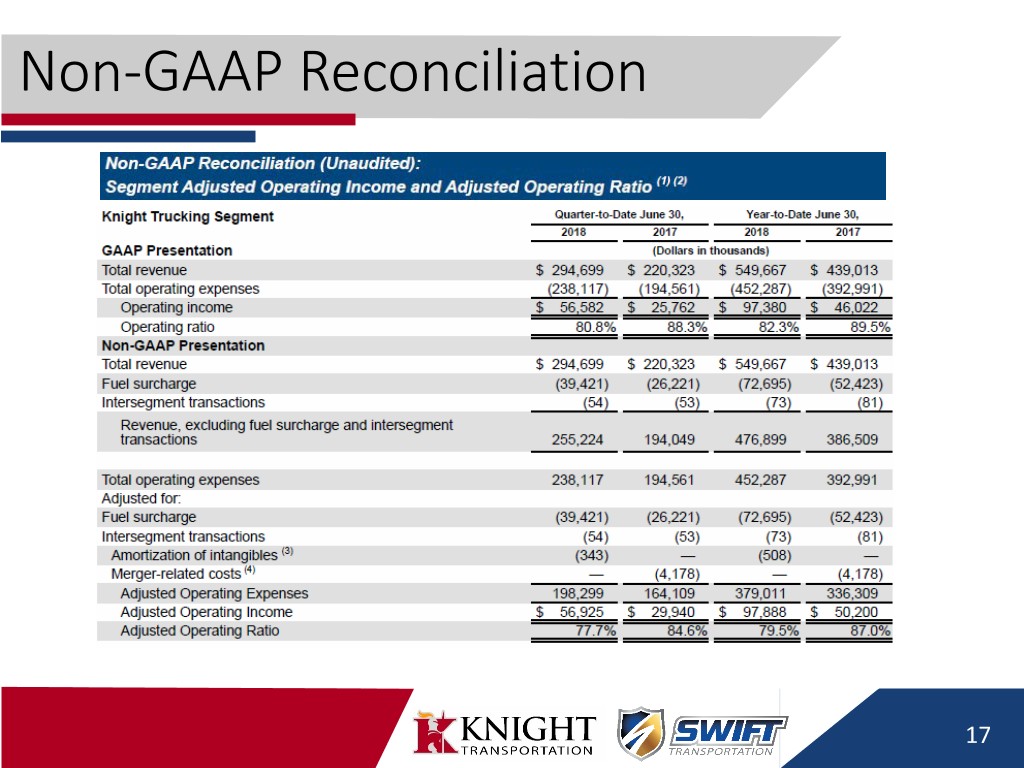

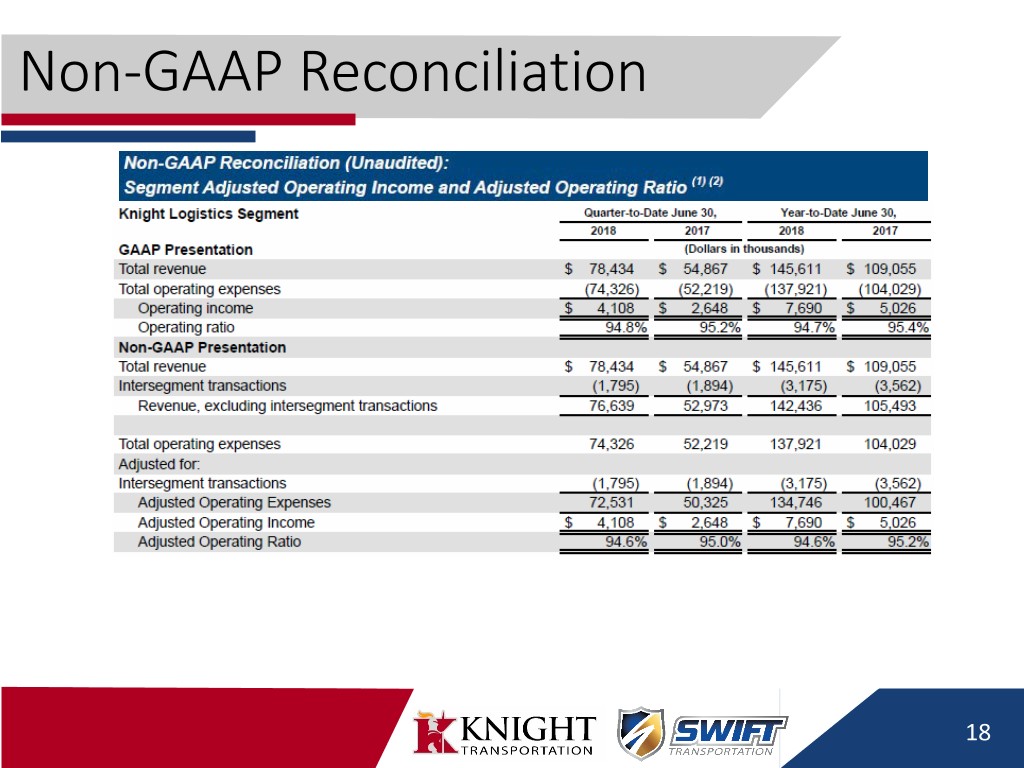

Non-GAAP Reconciliation 18

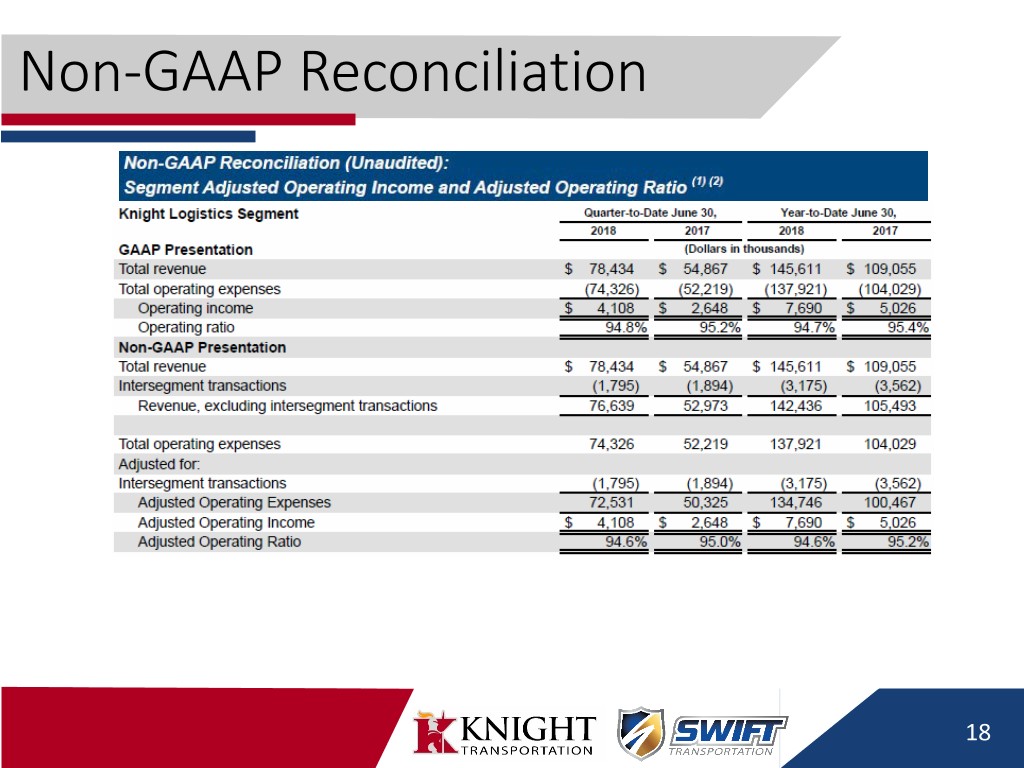

Non-GAAP Reconciliation 19

Non-GAAP Reconciliation 20

Non-GAAP Reconciliation 21

Non-GAAP Reconciliation 22

Non-GAAP Reconciliation 23