Exhibit 99.2 KNX 1Q20 Earnings Presentation

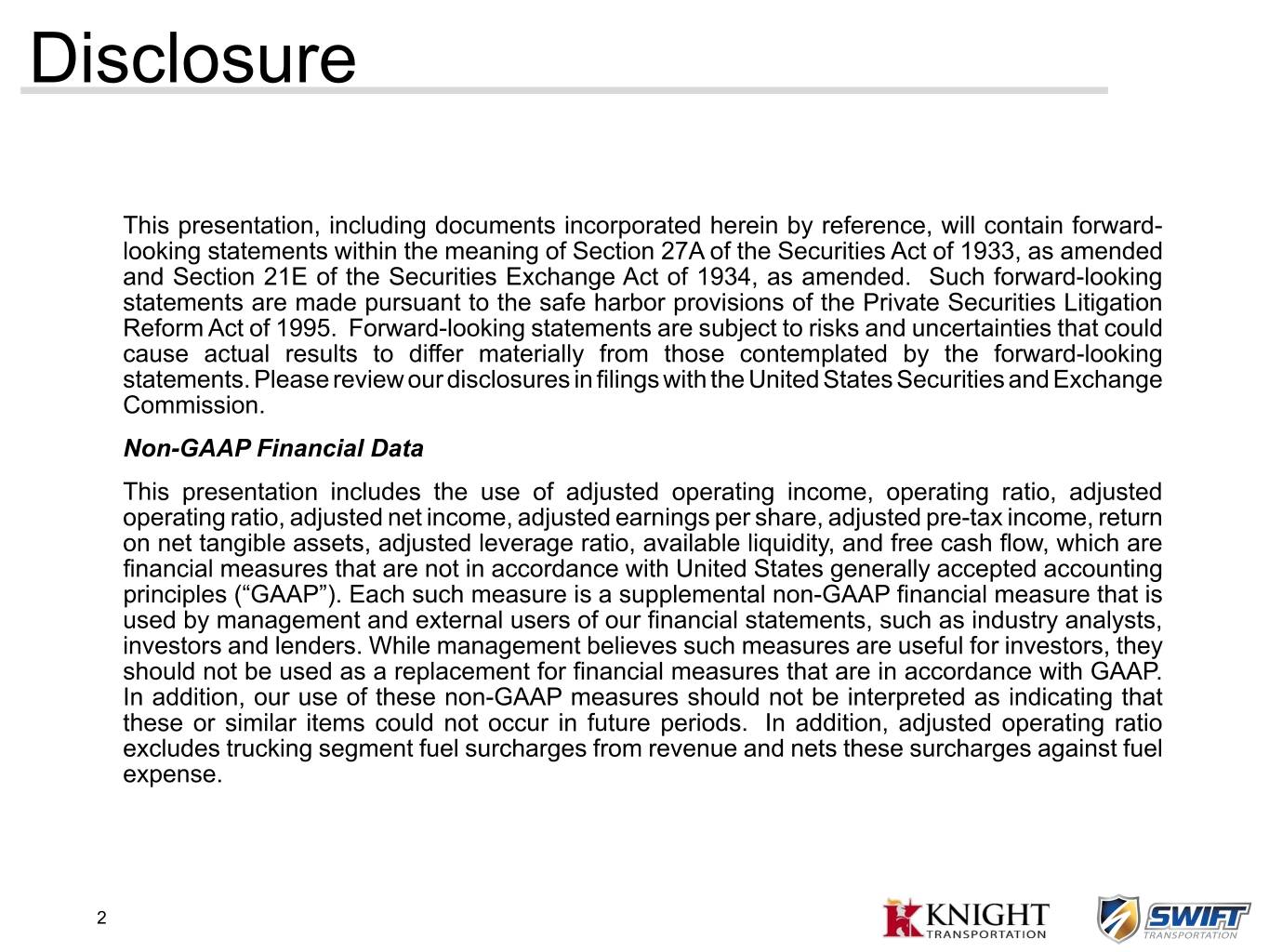

Disclosure This presentation, including documents incorporated herein by reference, will contain forward- looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Please review our disclosures in filings with the United States Securities and Exchange Commission. Non-GAAP Financial Data This presentation includes the use of adjusted operating income, operating ratio, adjusted operating ratio, adjusted net income, adjusted earnings per share, adjusted pre-tax income, return on net tangible assets, adjusted leverage ratio, available liquidity, and free cash flow, which are financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures should not be interpreted as indicating that these or similar items could not occur in future periods. In addition, adjusted operating ratio excludes trucking segment fuel surcharges from revenue and nets these surcharges against fuel expense. 2

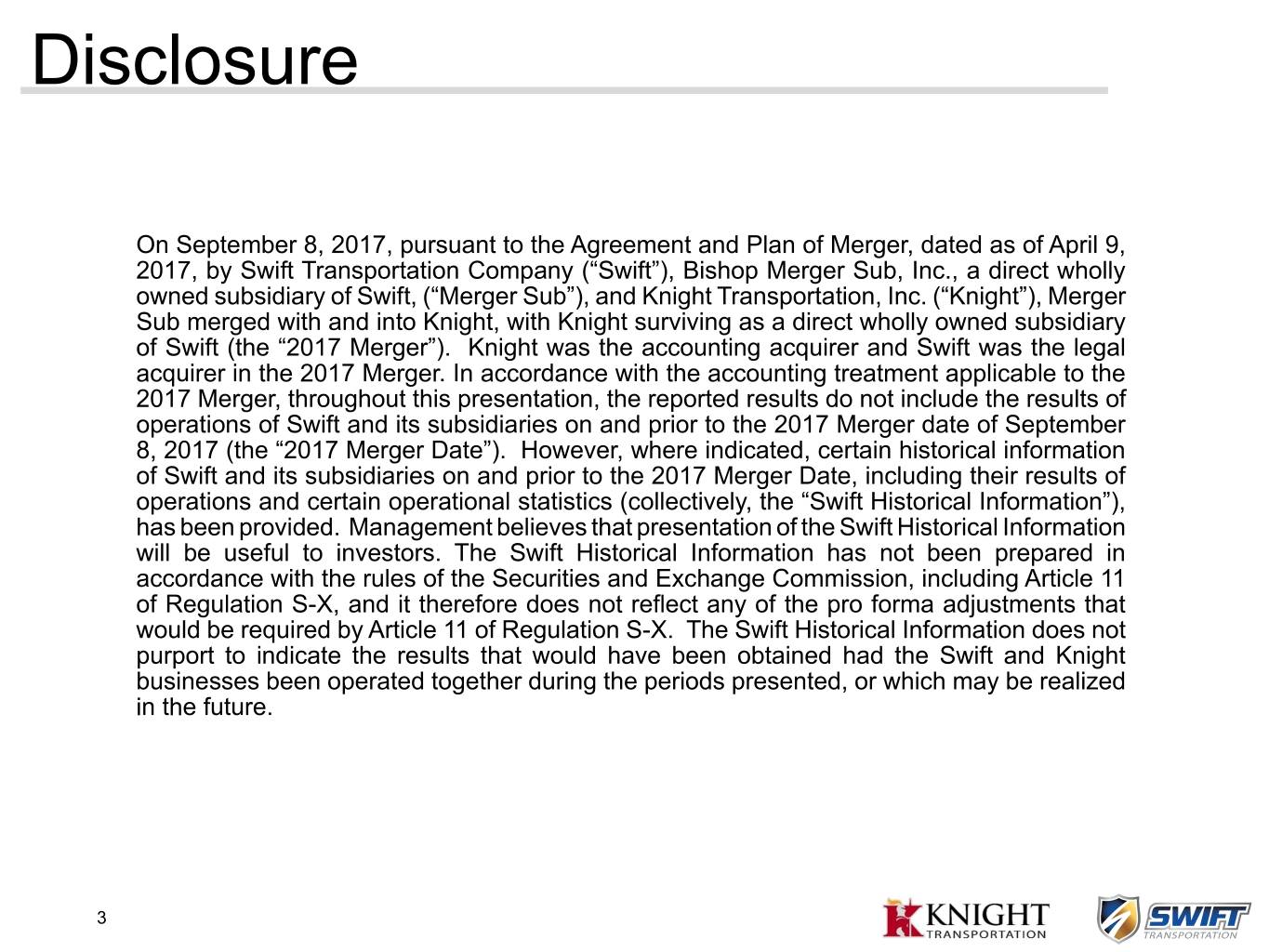

Disclosure On September 8, 2017, pursuant to the Agreement and Plan of Merger, dated as of April 9, 2017, by Swift Transportation Company (“Swift”), Bishop Merger Sub, Inc., a direct wholly owned subsidiary of Swift, (“Merger Sub”), and Knight Transportation, Inc. (“Knight”), Merger Sub merged with and into Knight, with Knight surviving as a direct wholly owned subsidiary of Swift (the “2017 Merger”). Knight was the accounting acquirer and Swift was the legal acquirer in the 2017 Merger. In accordance with the accounting treatment applicable to the 2017 Merger, throughout this presentation, the reported results do not include the results of operations of Swift and its subsidiaries on and prior to the 2017 Merger date of September 8, 2017 (the “2017 Merger Date”). However, where indicated, certain historical information of Swift and its subsidiaries on and prior to the 2017 Merger Date, including their results of operations and certain operational statistics (collectively, the “Swift Historical Information”), has been provided. Management believes that presentation of the Swift Historical Information will be useful to investors. The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the periods presented, or which may be realized in the future. 3

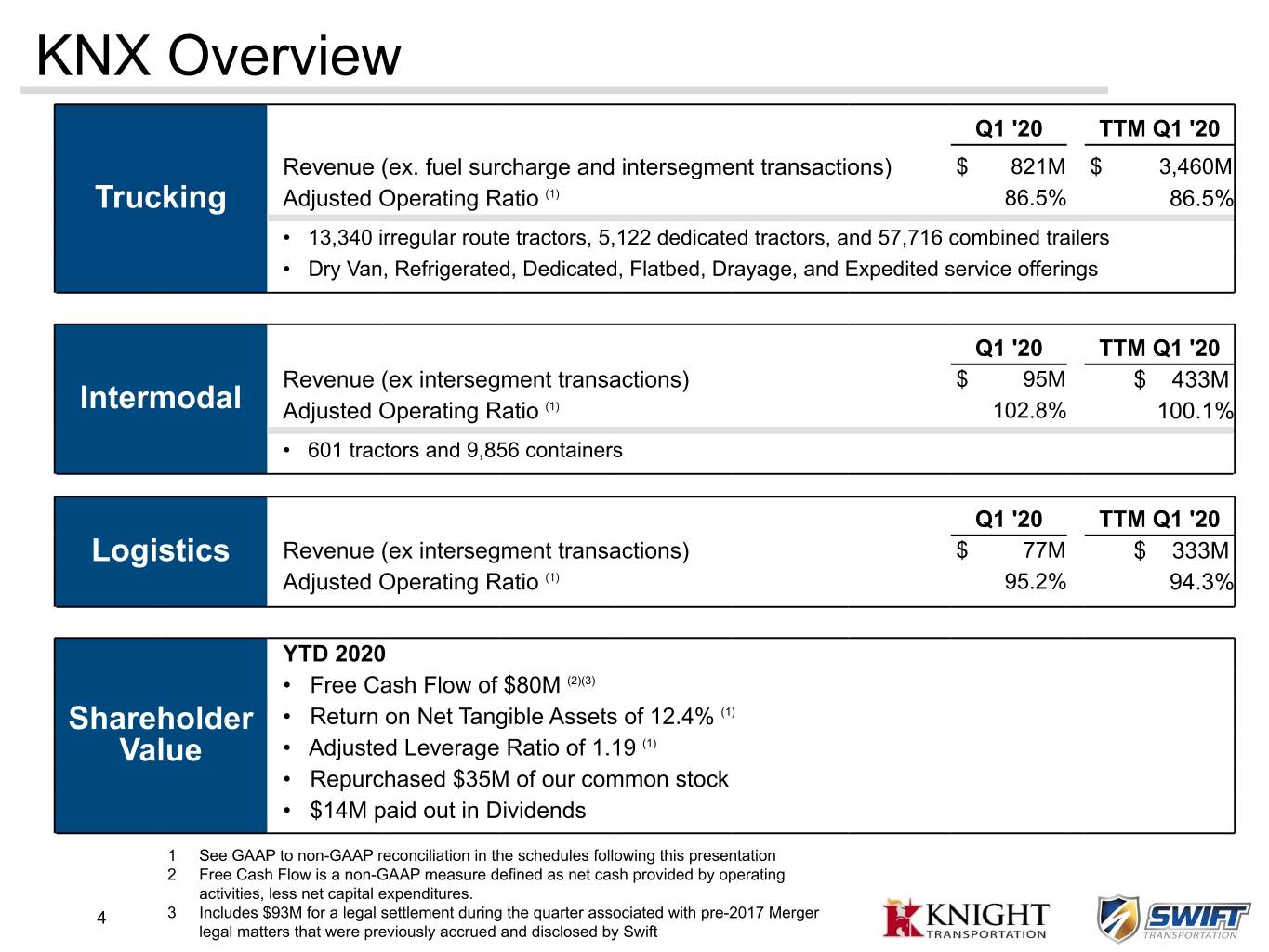

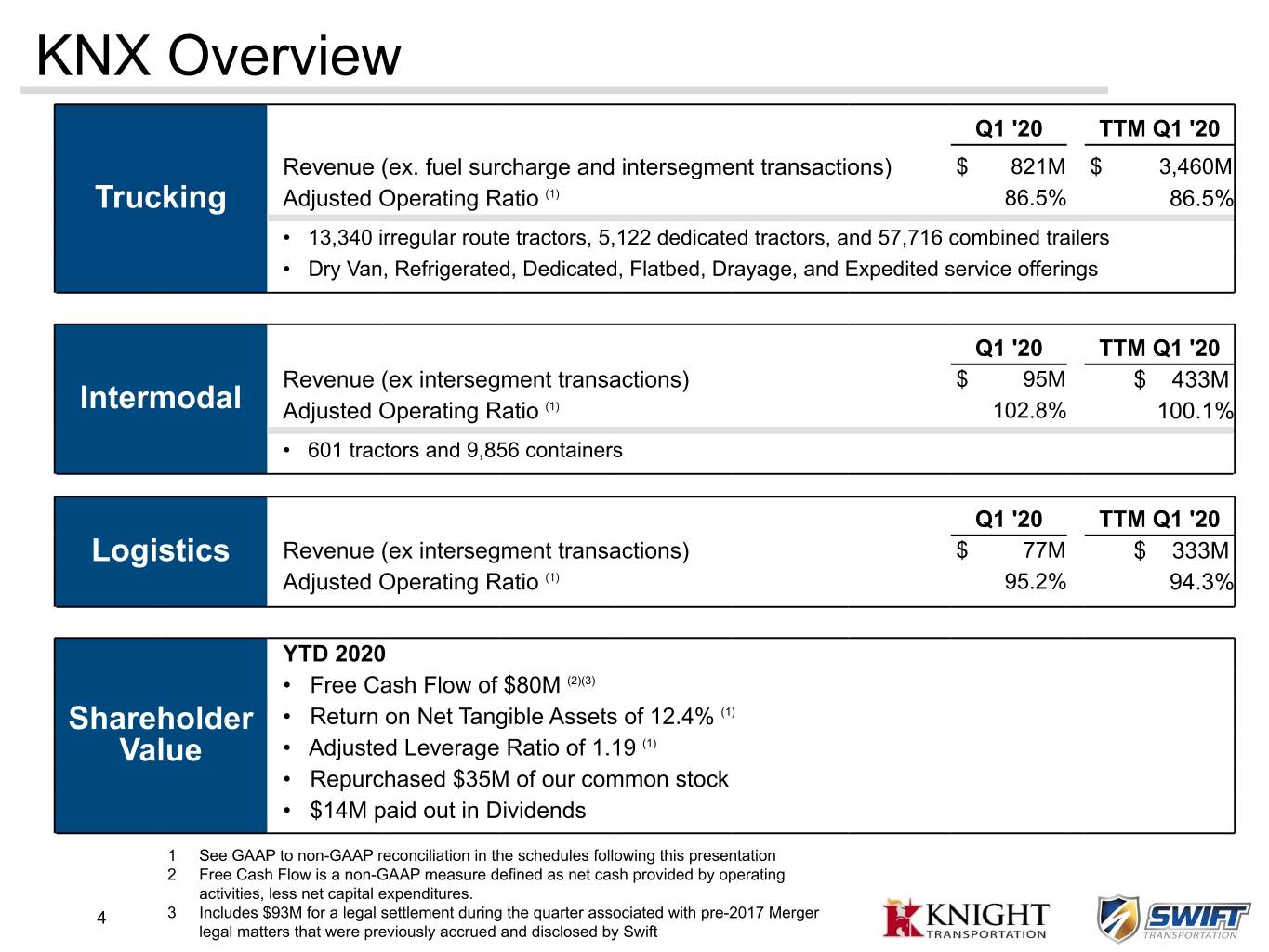

KNX Overview Q1 '20 TTM Q1 '20 Revenue (ex. fuel surcharge and intersegment transactions) $ 821M $ 3,460M Trucking Adjusted Operating Ratio (1) 86.5% 86.5% • 13,340 irregular route tractors, 5,122 dedicated tractors, and 57,716 combined trailers • Dry Van, Refrigerated, Dedicated, Flatbed, Drayage, and Expedited service offerings Q1 '20 TTM Q1 '20 Revenue (ex intersegment transactions) $ 95M $ 433M Intermodal Adjusted Operating Ratio (1) 102.8% 100.1% • 601 tractors and 9,856 containers Q1 '20 TTM Q1 '20 Logistics Revenue (ex intersegment transactions) $ 77M $ 333M Adjusted Operating Ratio (1) 95.2% 94.3% YTD 2020 • Free Cash Flow of $80M (2)(3) Shareholder • Return on Net Tangible Assets of 12.4% (1) Value • Adjusted Leverage Ratio of 1.19 (1) • Repurchased $35M of our common stock • $14M paid out in Dividends 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation 2 Free Cash Flow is a non-GAAP measure defined as net cash provided by operating activities, less net capital expenditures. 4 3 Includes $93M for a legal settlement during the quarter associated with pre-2017 Merger legal matters that were previously accrued and disclosed by Swift

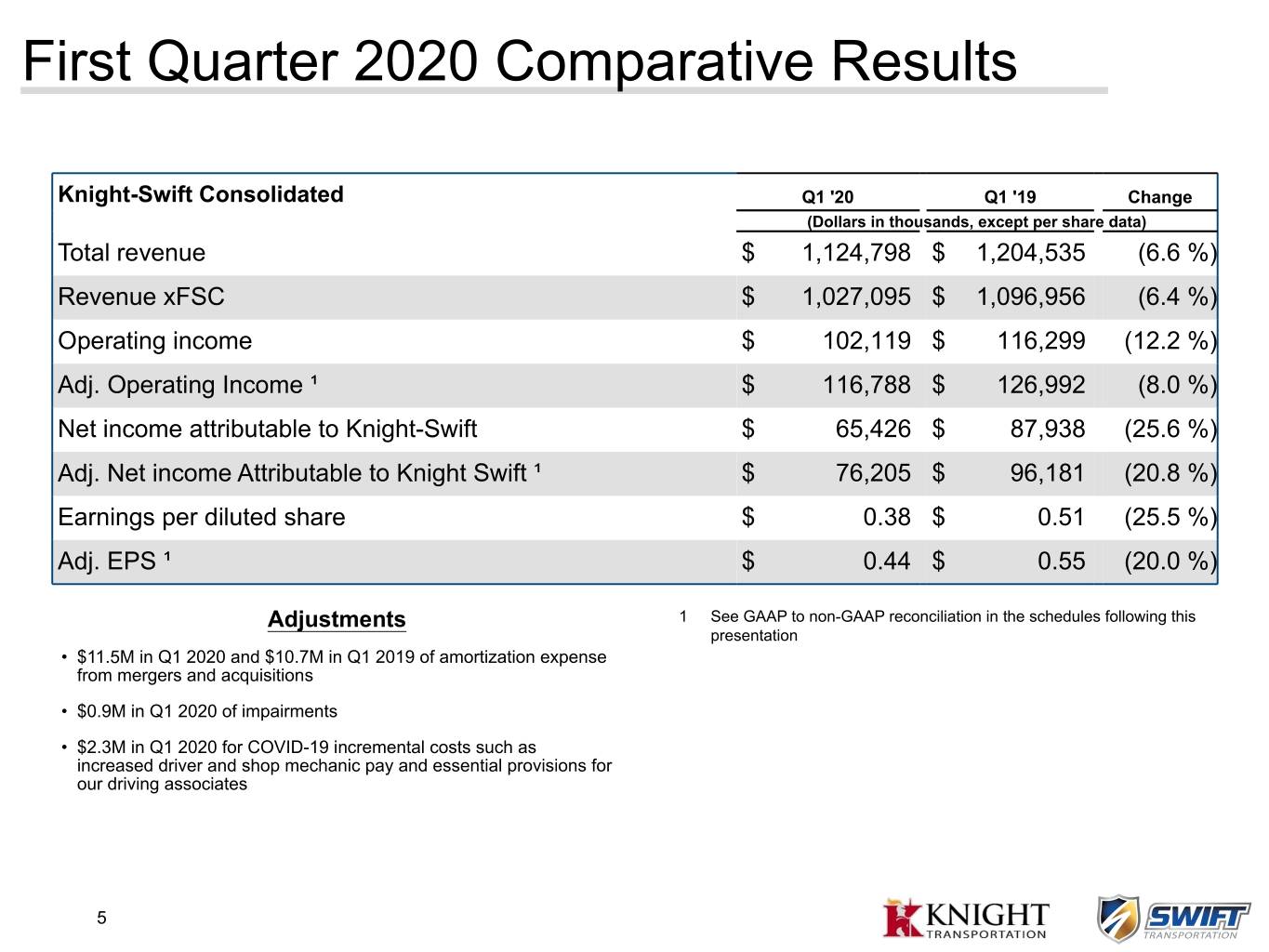

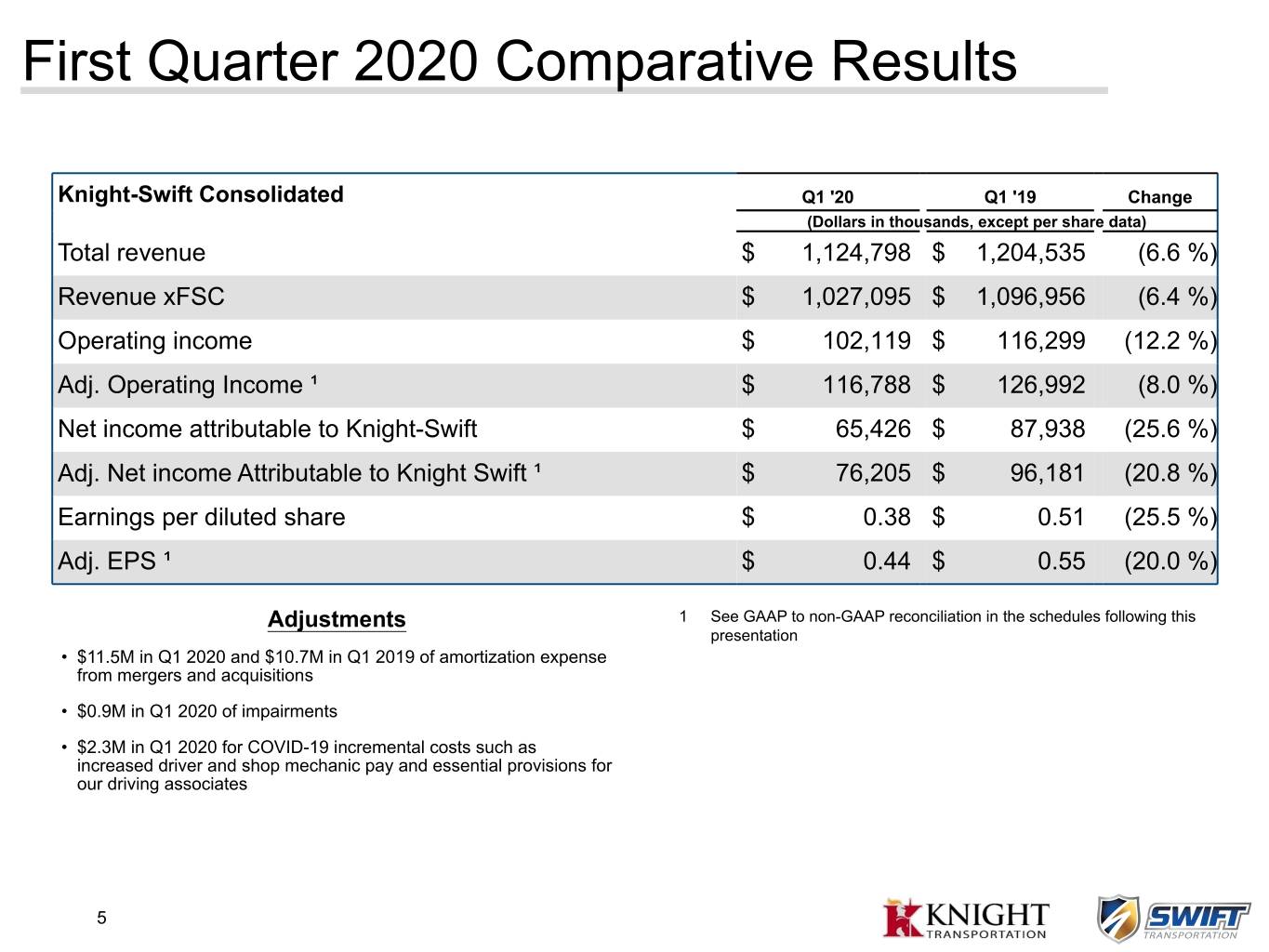

First Quarter 2020 Comparative Results Knight-Swift Consolidated Q1 '20 Q1 '19 Change (Dollars in thousands, except per share data) Total revenue $ 1,124,798 $ 1,204,535 (6.6 %) Revenue xFSC $ 1,027,095 $ 1,096,956 (6.4 %) Operating income $ 102,119 $ 116,299 (12.2 %) Adj. Operating Income ¹ $ 116,788 $ 126,992 (8.0 %) Net income attributable to Knight-Swift $ 65,426 $ 87,938 (25.6 %) Adj. Net income Attributable to Knight Swift ¹ $ 76,205 $ 96,181 (20.8 %) Earnings per diluted share $ 0.38 $ 0.51 (25.5 %) Adj. EPS ¹ $ 0.44 $ 0.55 (20.0 %) Adjustments 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation • $11.5M in Q1 2020 and $10.7M in Q1 2019 of amortization expense from mergers and acquisitions • $0.9M in Q1 2020 of impairments • $2.3M in Q1 2020 for COVID-19 incremental costs such as increased driver and shop mechanic pay and essential provisions for our driving associates 5

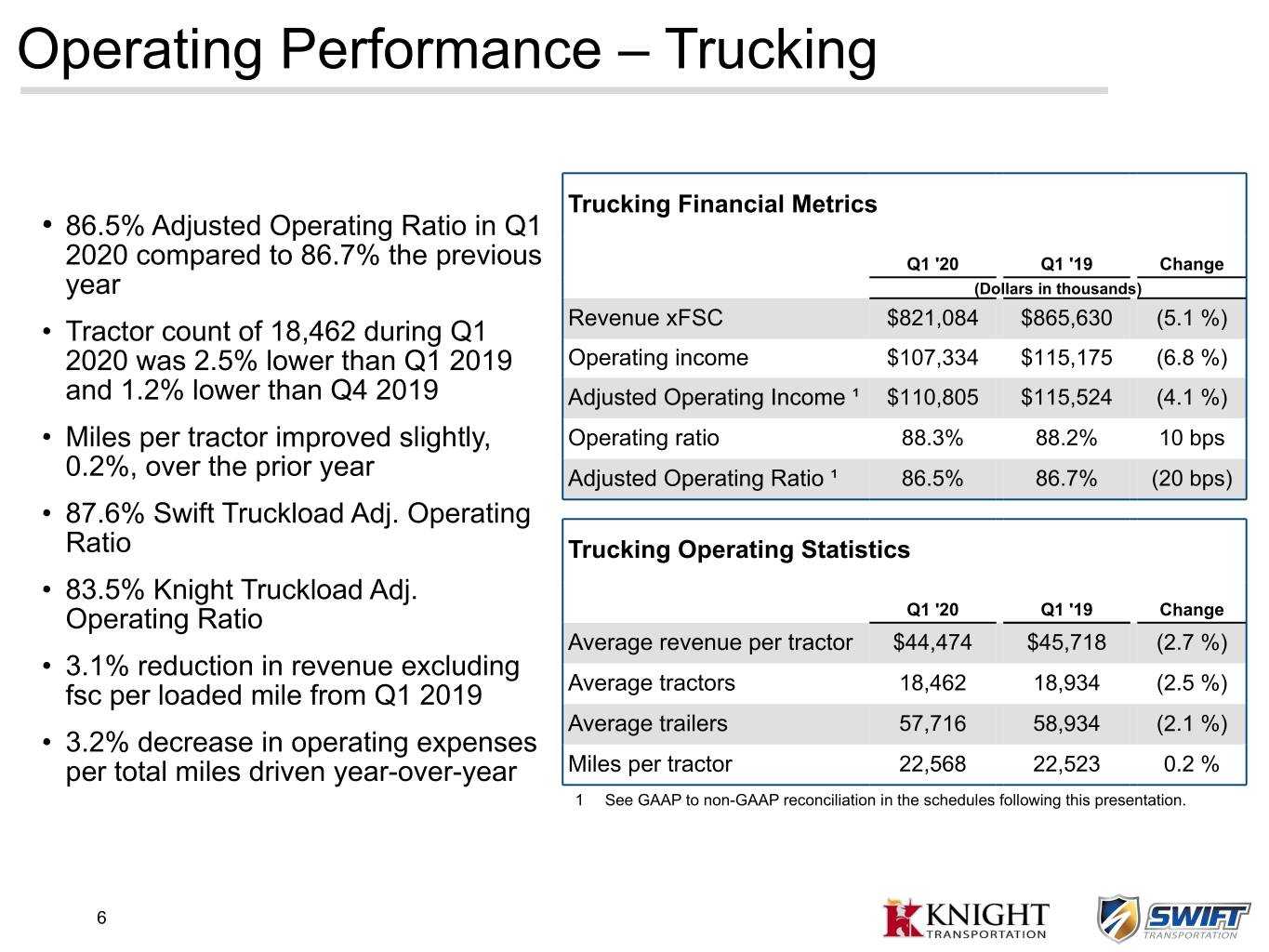

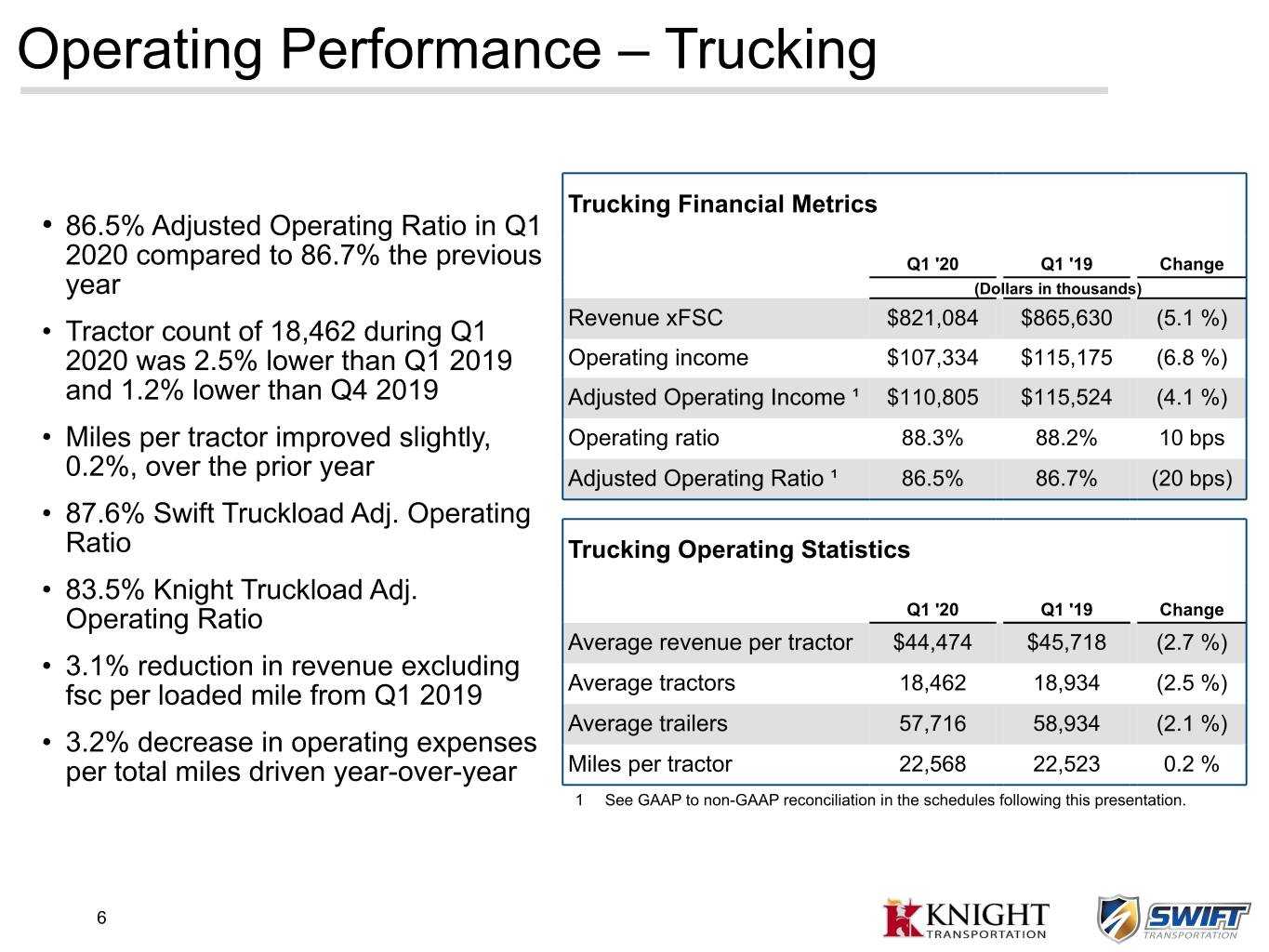

Operating Performance – Trucking Trucking Financial Metrics • 86.5% Adjusted Operating Ratio in Q1 2020 compared to 86.7% the previous Q1 '20 Q1 '19 Change year (Dollars in thousands) • Tractor count of 18,462 during Q1 Revenue xFSC $821,084 $865,630 (5.1 %) 2020 was 2.5% lower than Q1 2019 Operating income $107,334 $115,175 (6.8 %) and 1.2% lower than Q4 2019 Adjusted Operating Income ¹ $110,805 $115,524 (4.1 %) • Miles per tractor improved slightly, Operating ratio 88.3% 88.2% 10 bps 0.2%, over the prior year Adjusted Operating Ratio ¹ 86.5% 86.7% (20 bps) • 87.6% Swift Truckload Adj. Operating Ratio Trucking Operating Statistics • 83.5% Knight Truckload Adj. Operating Ratio Q1 '20 Q1 '19 Change Average revenue per tractor $44,474 $45,718 (2.7 %) • 3.1% reduction in revenue excluding fsc per loaded mile from Q1 2019 Average tractors 18,462 18,934 (2.5 %) Average trailers 57,716 58,934 (2.1 %) • 3.2% decrease in operating expenses per total miles driven year-over-year Miles per tractor 22,568 22,523 0.2 % 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 6

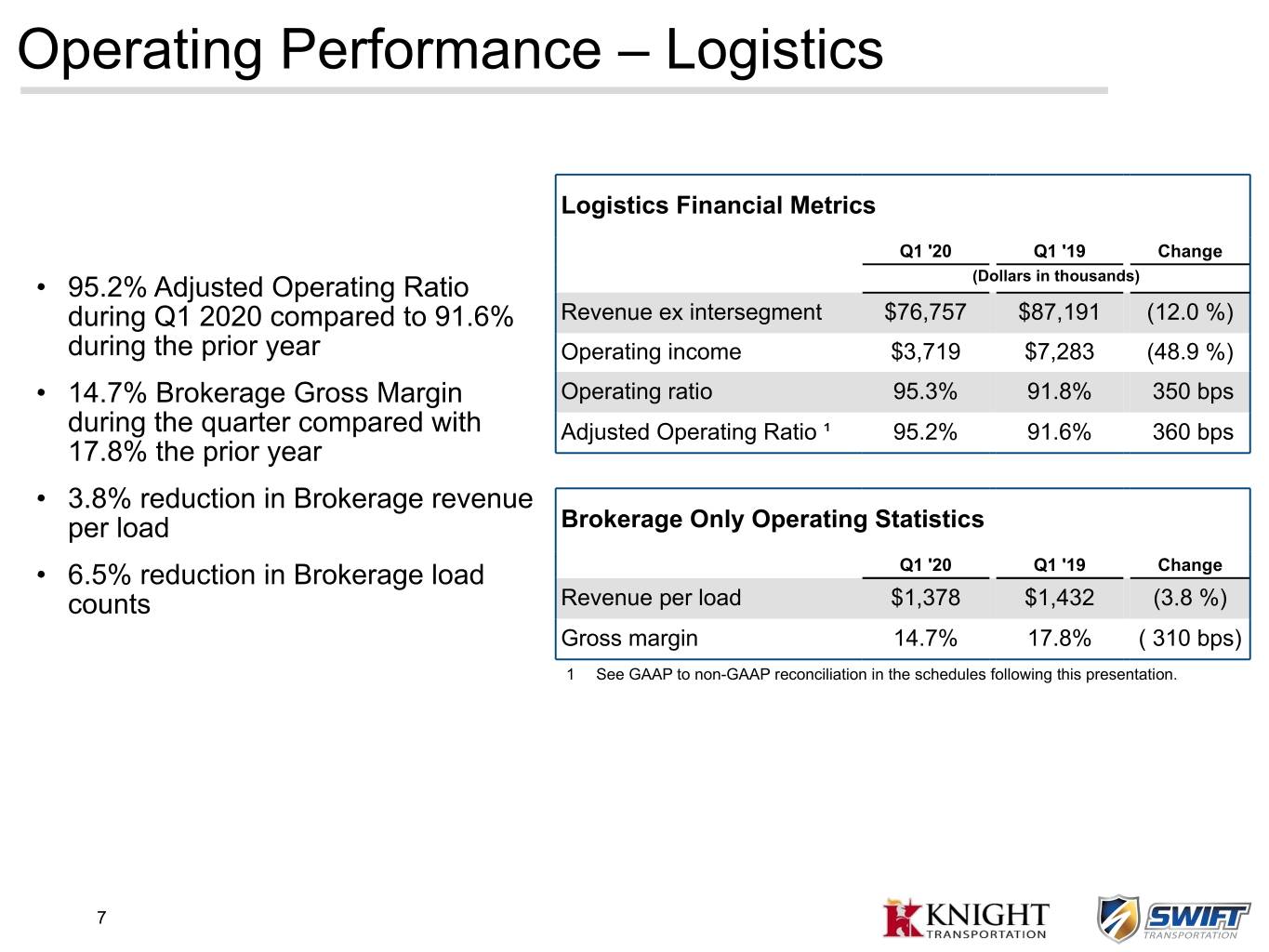

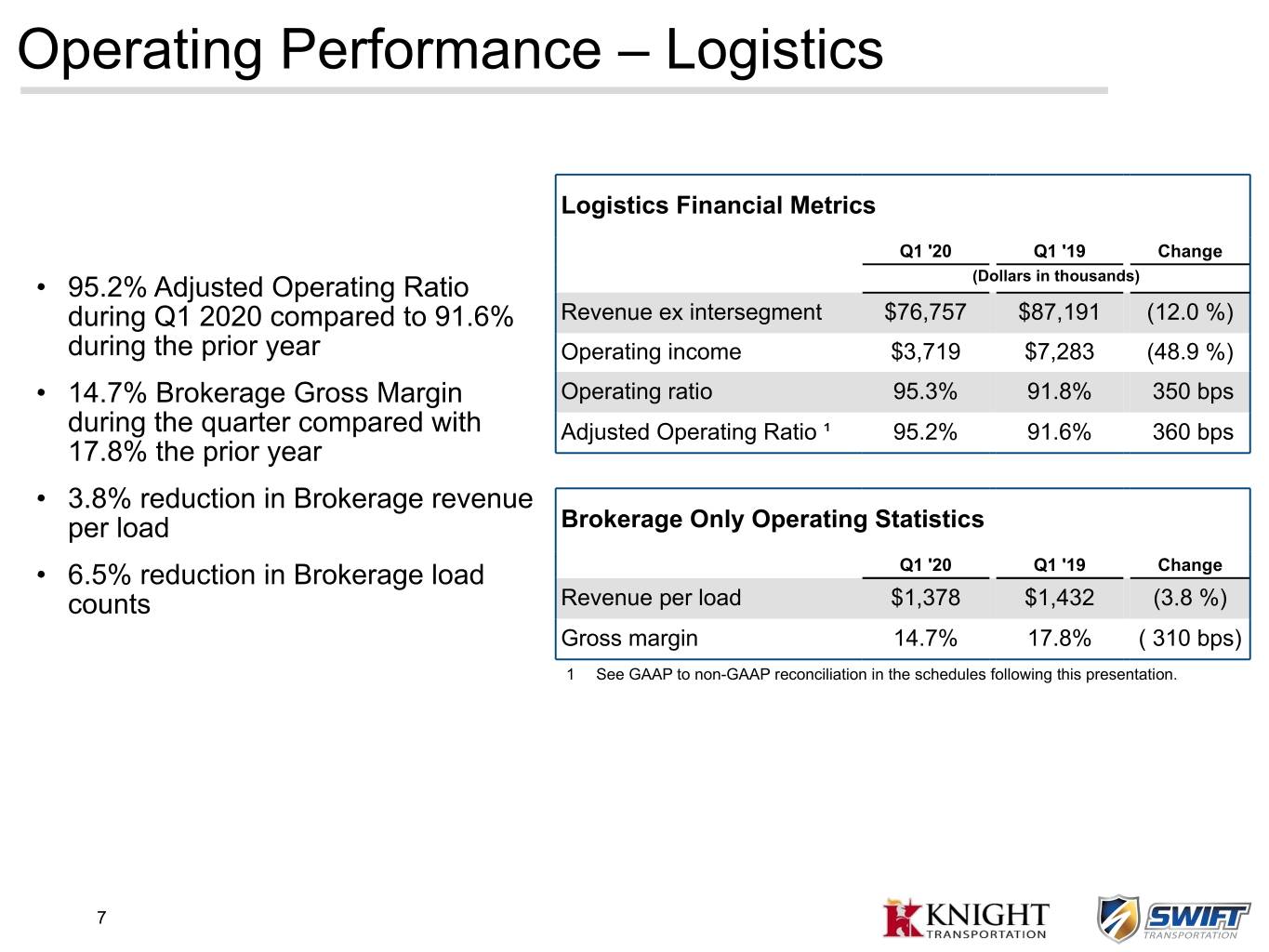

Operating Performance – Logistics Logistics Financial Metrics Q1 '20 Q1 '19 Change • 95.2% Adjusted Operating Ratio (Dollars in thousands) during Q1 2020 compared to 91.6% Revenue ex intersegment $76,757 $87,191 (12.0 %) during the prior year Operating income $3,719 $7,283 (48.9 %) • 14.7% Brokerage Gross Margin Operating ratio 95.3% 91.8% 350 bps during the quarter compared with Adjusted Operating Ratio ¹ 95.2% 91.6% 360 bps 17.8% the prior year • 3.8% reduction in Brokerage revenue per load Brokerage Only Operating Statistics • 6.5% reduction in Brokerage load Q1 '20 Q1 '19 Change counts Revenue per load $1,378 $1,432 (3.8 %) Gross margin 14.7% 17.8% ( 310 bps) 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 7

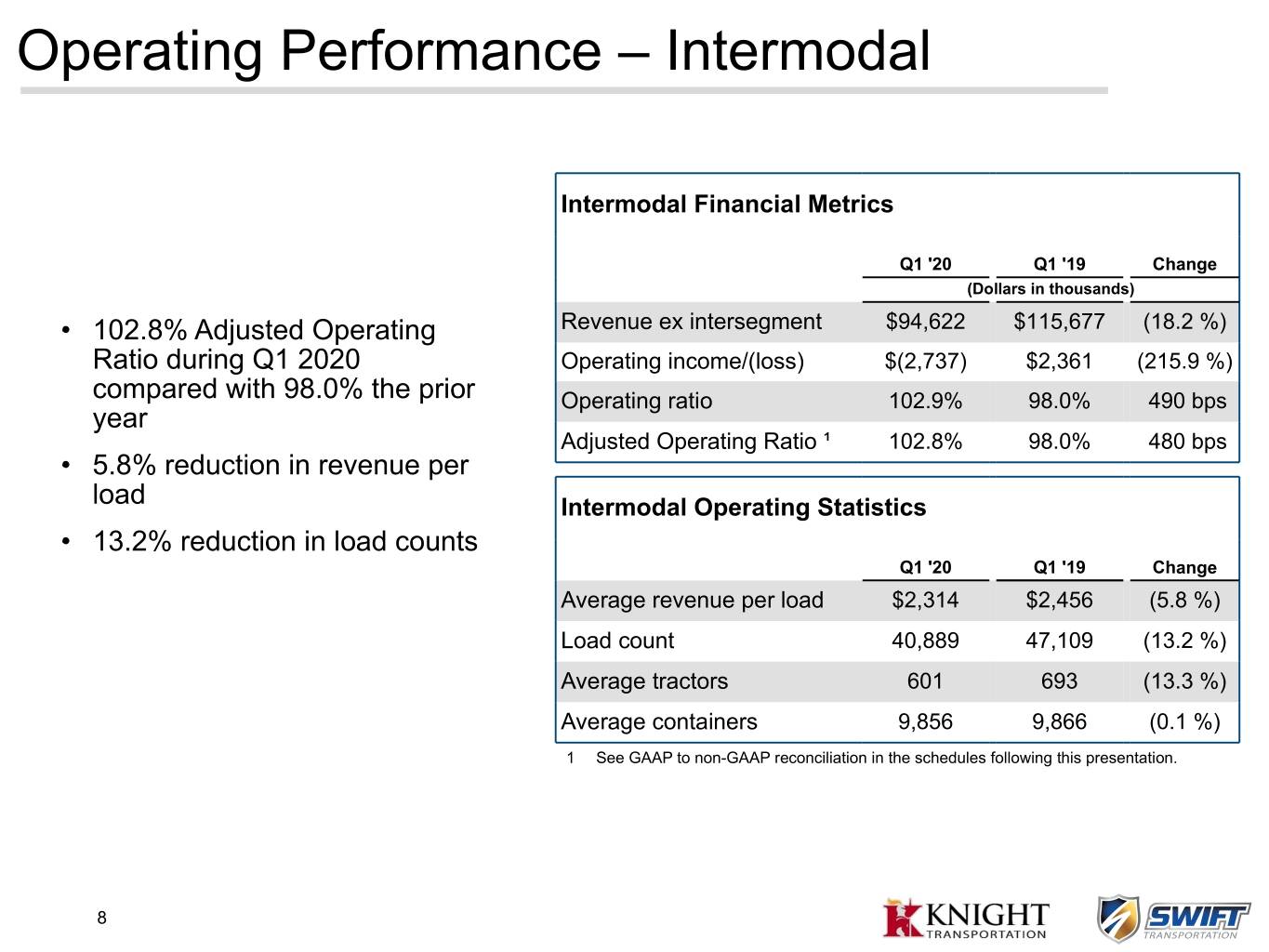

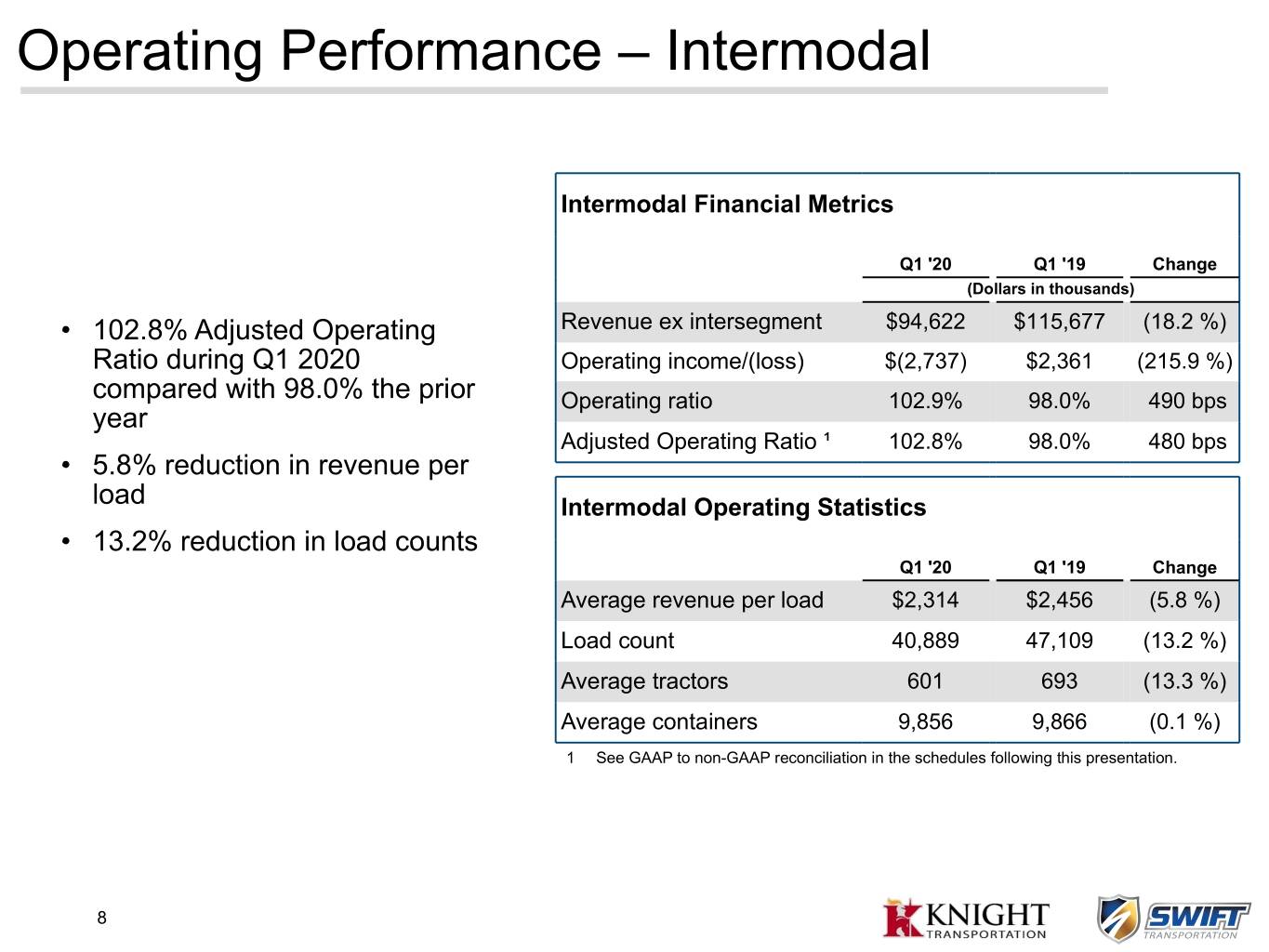

Operating Performance – Intermodal Intermodal Financial Metrics Q1 '20 Q1 '19 Change (Dollars in thousands) • 102.8% Adjusted Operating Revenue ex intersegment $94,622 $115,677 (18.2 %) Ratio during Q1 2020 Operating income/(loss) $(2,737) $2,361 (215.9 %) compared with 98.0% the prior Operating ratio 102.9% 98.0% 490 bps year Adjusted Operating Ratio ¹ 102.8% 98.0% 480 bps • 5.8% reduction in revenue per load Intermodal Operating Statistics • 13.2% reduction in load counts Q1 '20 Q1 '19 Change Average revenue per load $2,314 $2,456 (5.8 %) Load count 40,889 47,109 (13.2 %) Average tractors 601 693 (13.3 %) Average containers 9,856 9,866 (0.1 %) 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 8

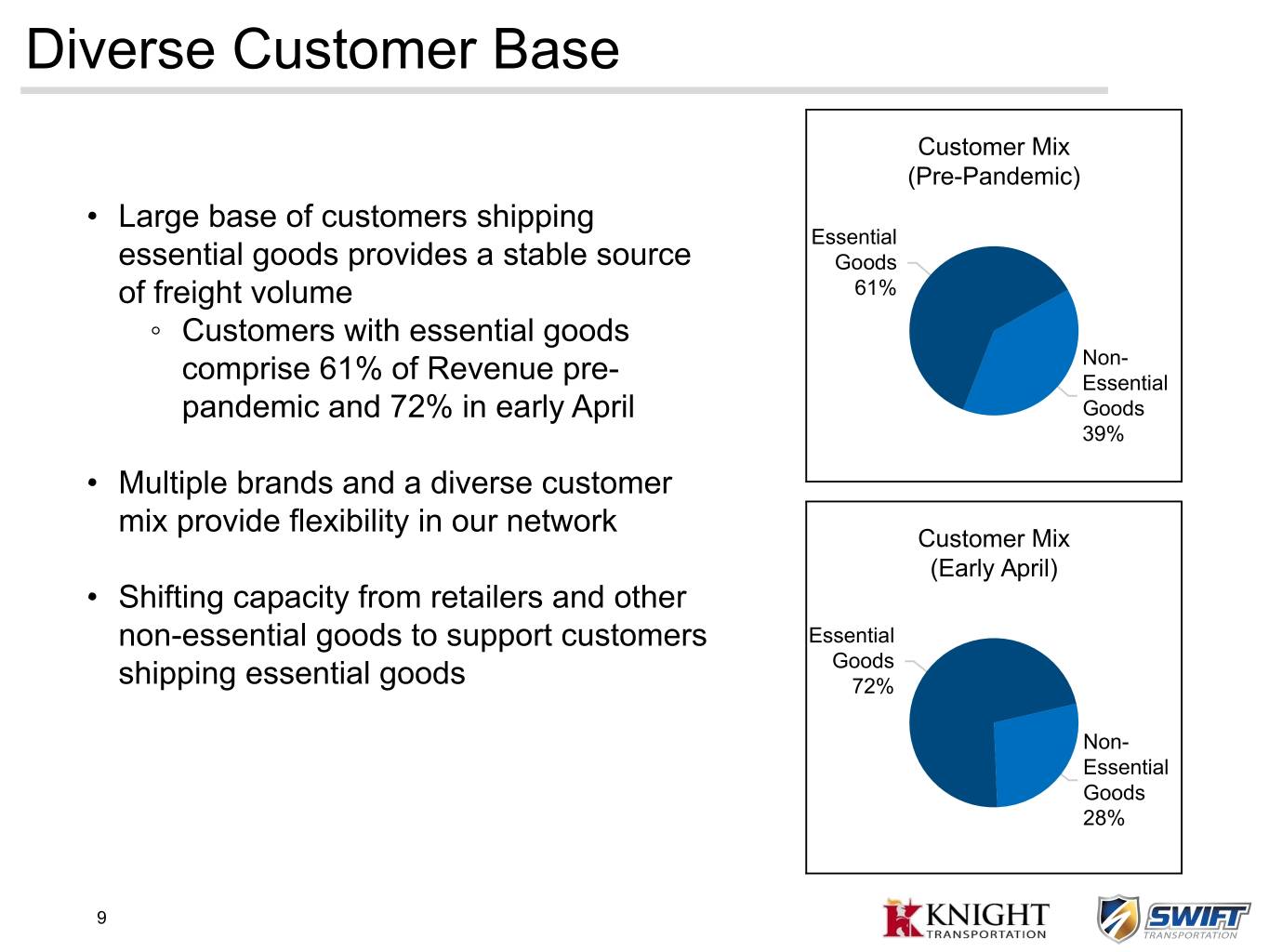

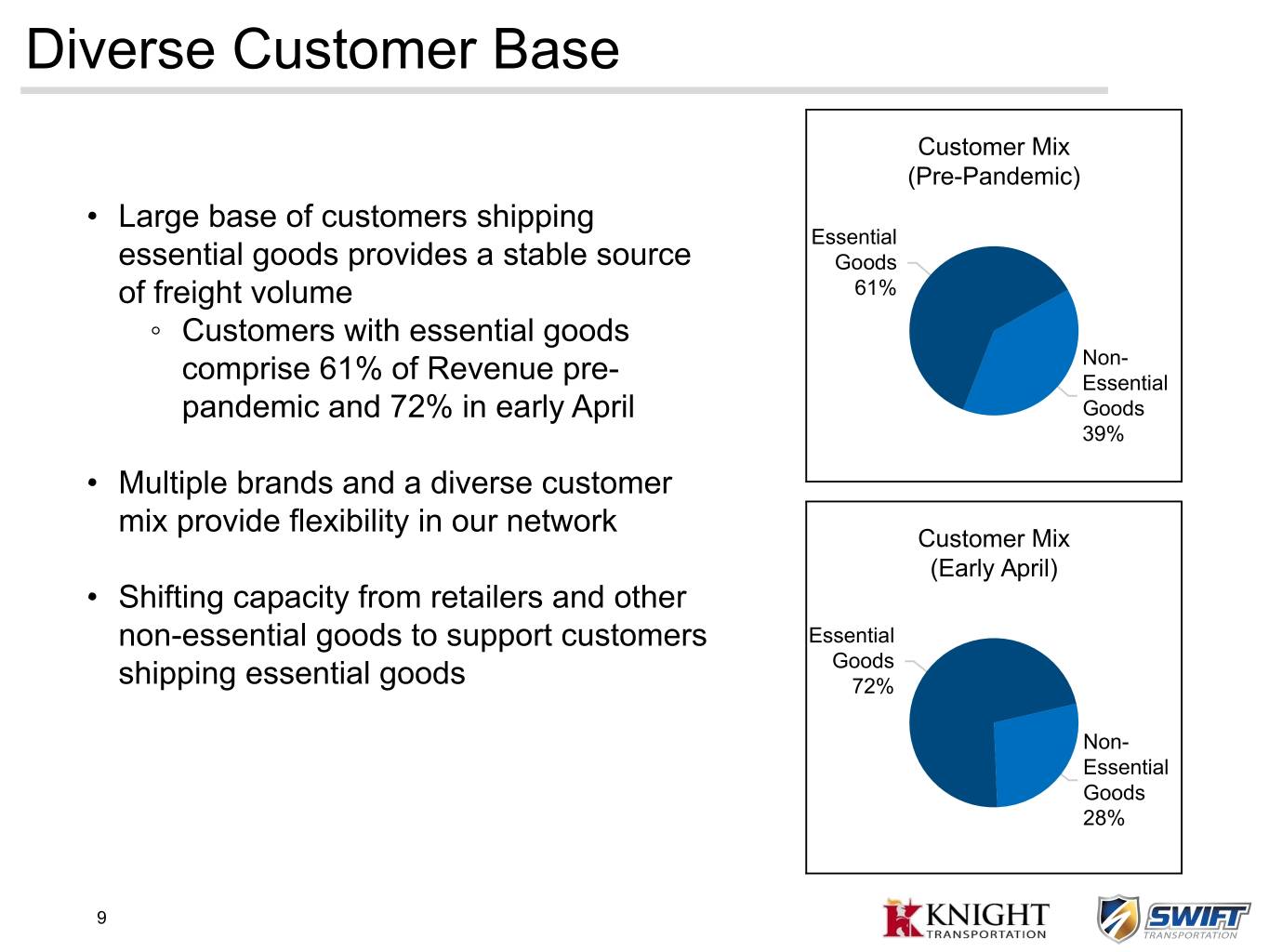

Diverse Customer Base Customer Mix (Pre-Pandemic) • Large base of customers shipping Essential essential goods provides a stable source Goods of freight volume 61% ◦ Customers with essential goods Non- comprise 61% of Revenue pre- Essential pandemic and 72% in early April Goods 39% • Multiple brands and a diverse customer mix provide flexibility in our network Customer Mix (Early April) • Shifting capacity from retailers and other non-essential goods to support customers Essential Goods shipping essential goods 72% Non- Essential Goods 28% 9

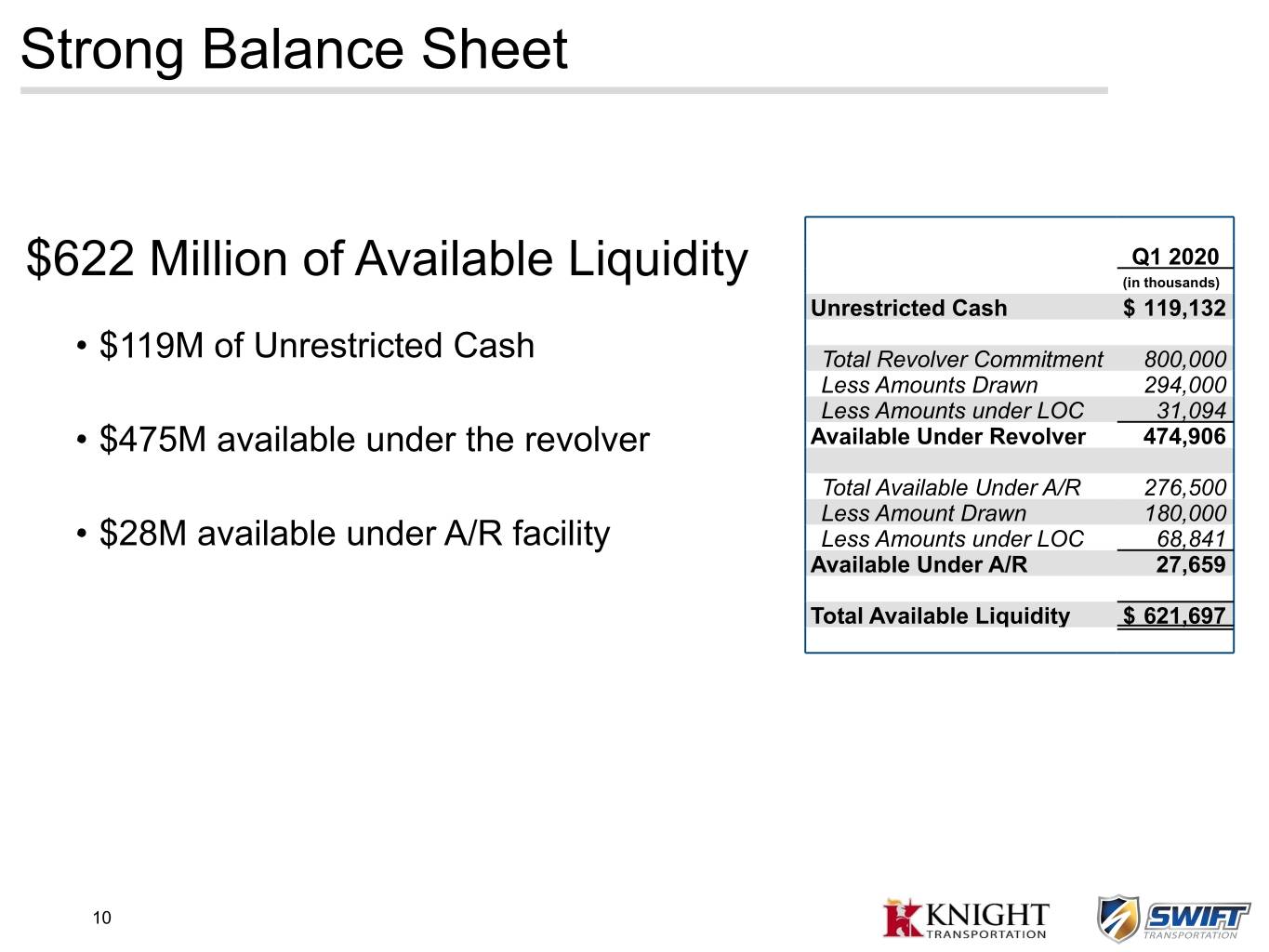

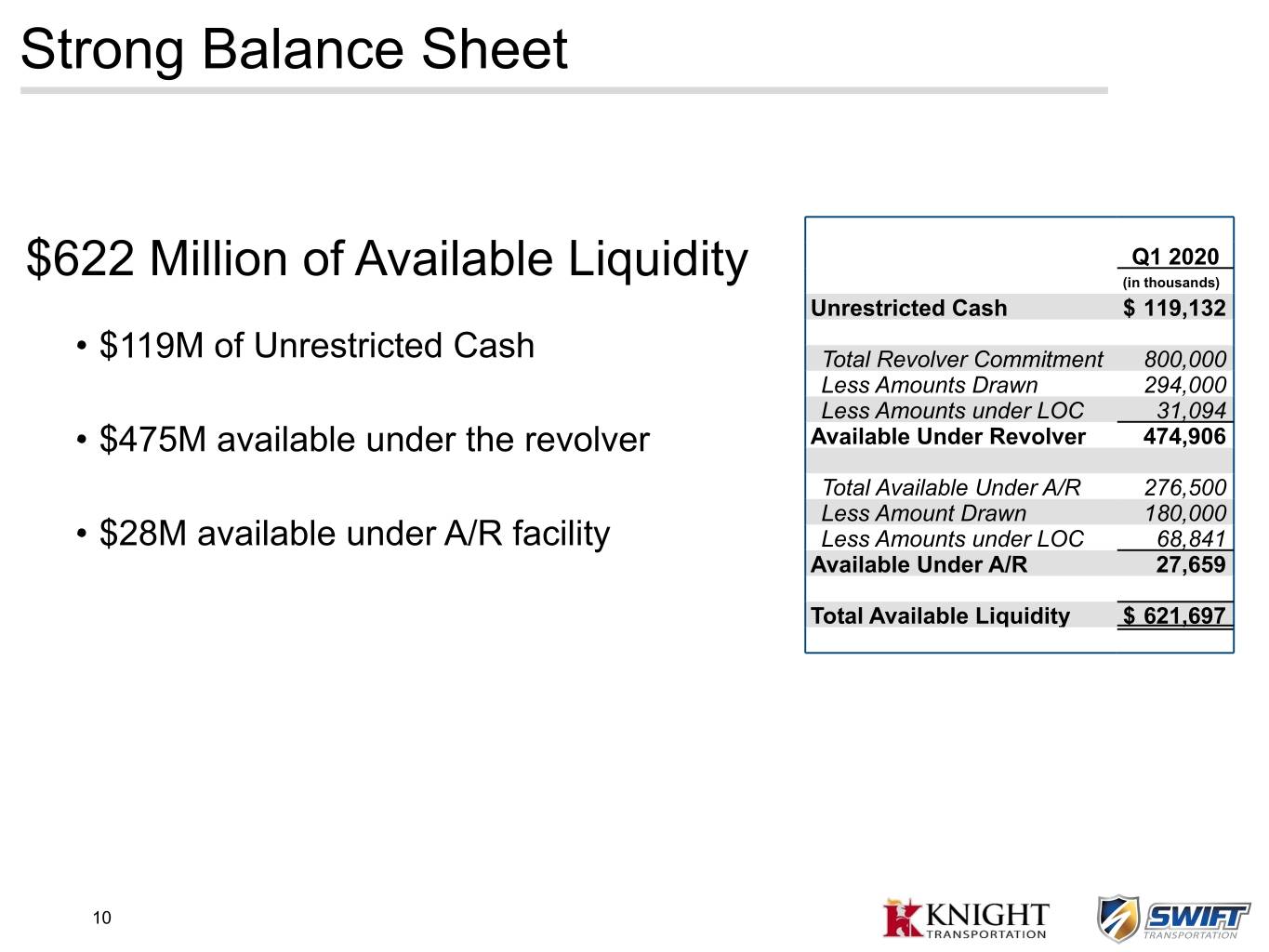

Strong Balance Sheet $622 Million of Available Liquidity Q1 2020 (in thousands) Unrestricted Cash $ 119,132 • $119M of Unrestricted Cash Total Revolver Commitment 800,000 Less Amounts Drawn 294,000 Less Amounts under LOC 31,094 • $475M available under the revolver Available Under Revolver 474,906 Total Available Under A/R 276,500 Less Amount Drawn 180,000 • $28M available under A/R facility Less Amounts under LOC 68,841 Available Under A/R 27,659 Total Available Liquidity $ 621,697 10

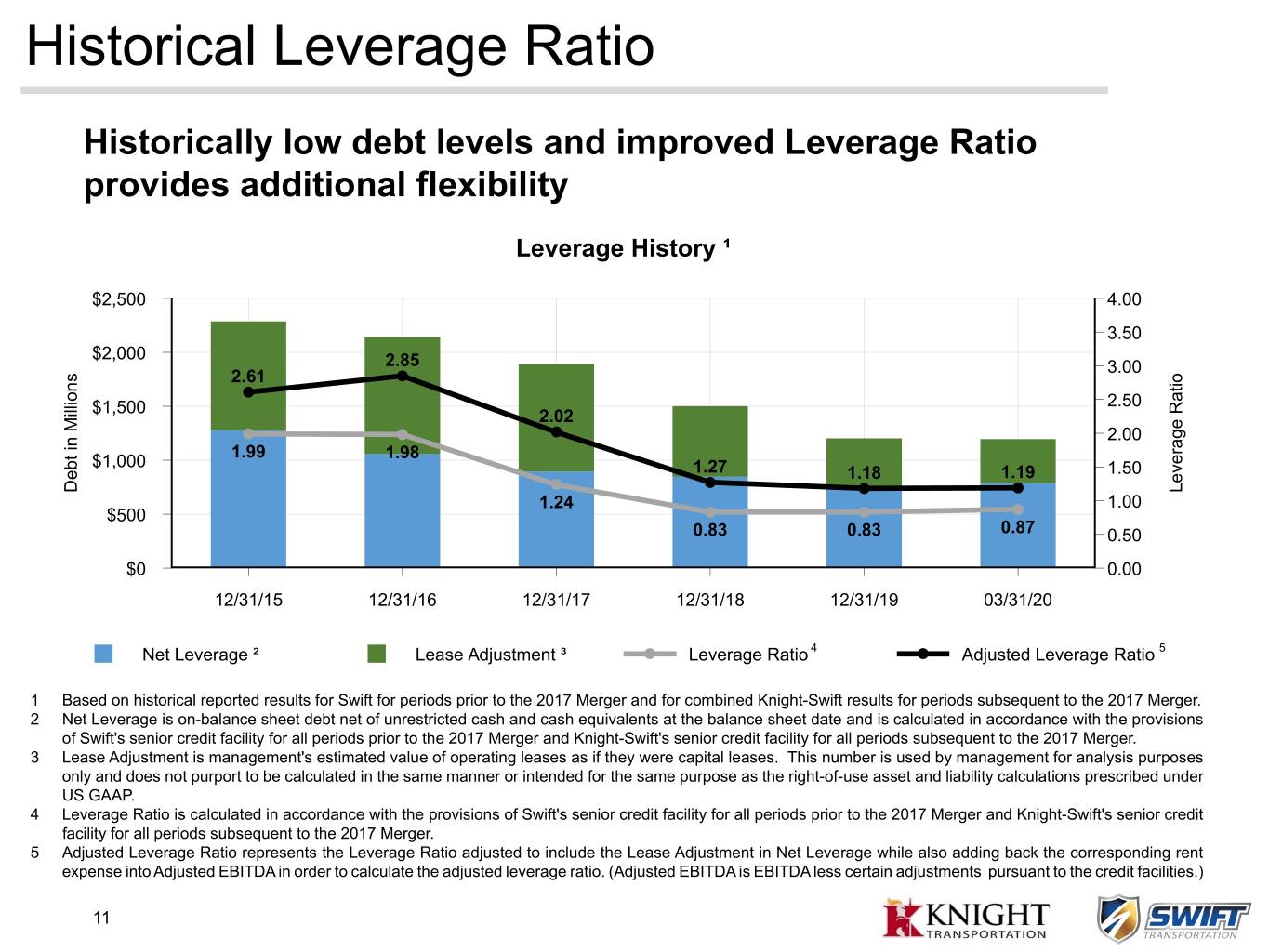

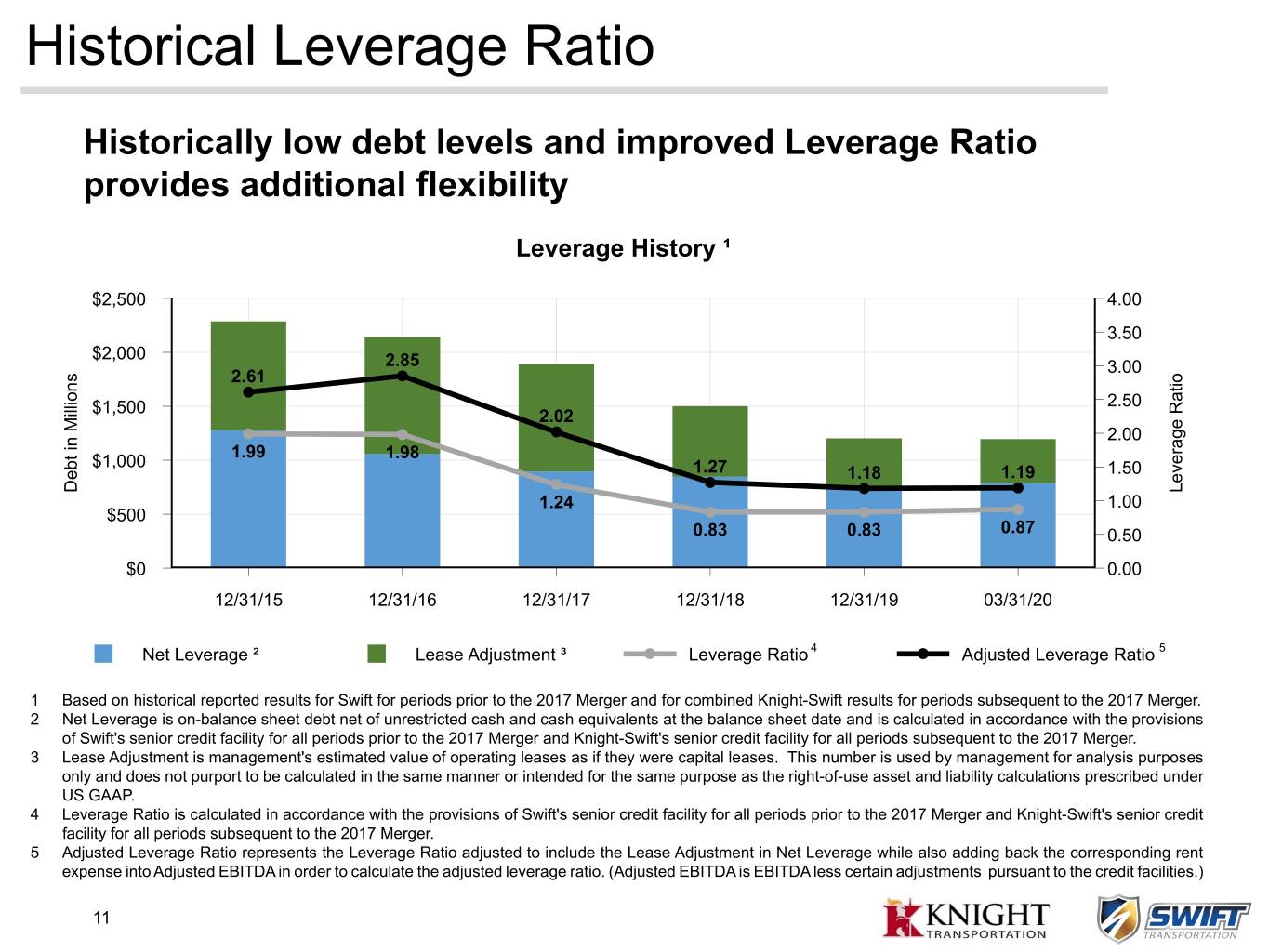

Historical Leverage Ratio Historically low debt levels and improved Leverage Ratio provides additional flexibility Leverage History ¹ $2,500 4.00 3.50 $2,000 2.85 3.00 s 2.61 o i t n a o i l 2.50 l $1,500 R i 2.02 e M 2.00 g n a i r t 1.99 1.98 e b $1,000 1.27 1.50 v e 1.18 1.19 e D L 1.24 1.00 $500 0.83 0.83 0.87 0.50 $0 0.00 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 03/31/20 Net Leverage ² Lease Adjustment ³ Leverage Ratio 4 Adjusted Leverage Ratio 5 1 Based on historical reported results for Swift for periods prior to the 2017 Merger and for combined Knight-Swift results for periods subsequent to the 2017 Merger. 2 Net Leverage is on-balance sheet debt net of unrestricted cash and cash equivalents at the balance sheet date and is calculated in accordance with the provisions of Swift's senior credit facility for all periods prior to the 2017 Merger and Knight-Swift's senior credit facility for all periods subsequent to the 2017 Merger. 3 Lease Adjustment is management's estimated value of operating leases as if they were capital leases. This number is used by management for analysis purposes only and does not purport to be calculated in the same manner or intended for the same purpose as the right-of-use asset and liability calculations prescribed under US GAAP. 4 Leverage Ratio is calculated in accordance with the provisions of Swift's senior credit facility for all periods prior to the 2017 Merger and Knight-Swift's senior credit facility for all periods subsequent to the 2017 Merger. 5 Adjusted Leverage Ratio represents the Leverage Ratio adjusted to include the Lease Adjustment in Net Leverage while also adding back the corresponding rent expense into Adjusted EBITDA in order to calculate the adjusted leverage ratio. (Adjusted EBITDA is EBITDA less certain adjustments pursuant to the credit facilities.) 11

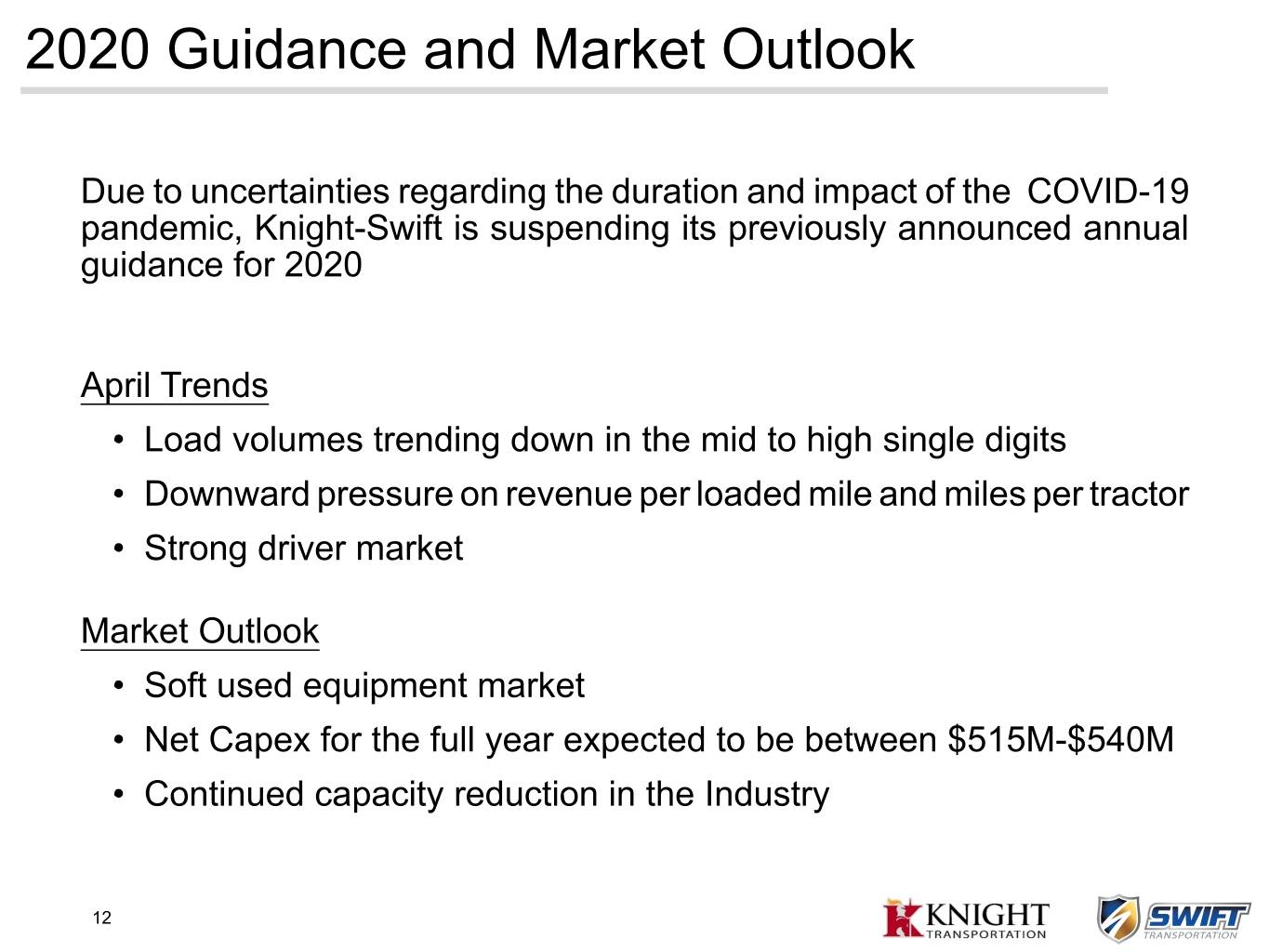

2020 Guidance and Market Outlook Due to uncertainties regarding the duration and impact of the COVID-19 pandemic, Knight-Swift is suspending its previously announced annual guidance for 2020 April Trends • Load volumes trending down in the mid to high single digits • Downward pressure on revenue per loaded mile and miles per tractor • Strong driver market Market Outlook • Soft used equipment market • Net Capex for the full year expected to be between $515M-$540M • Continued capacity reduction in the Industry 12

Appendix 13

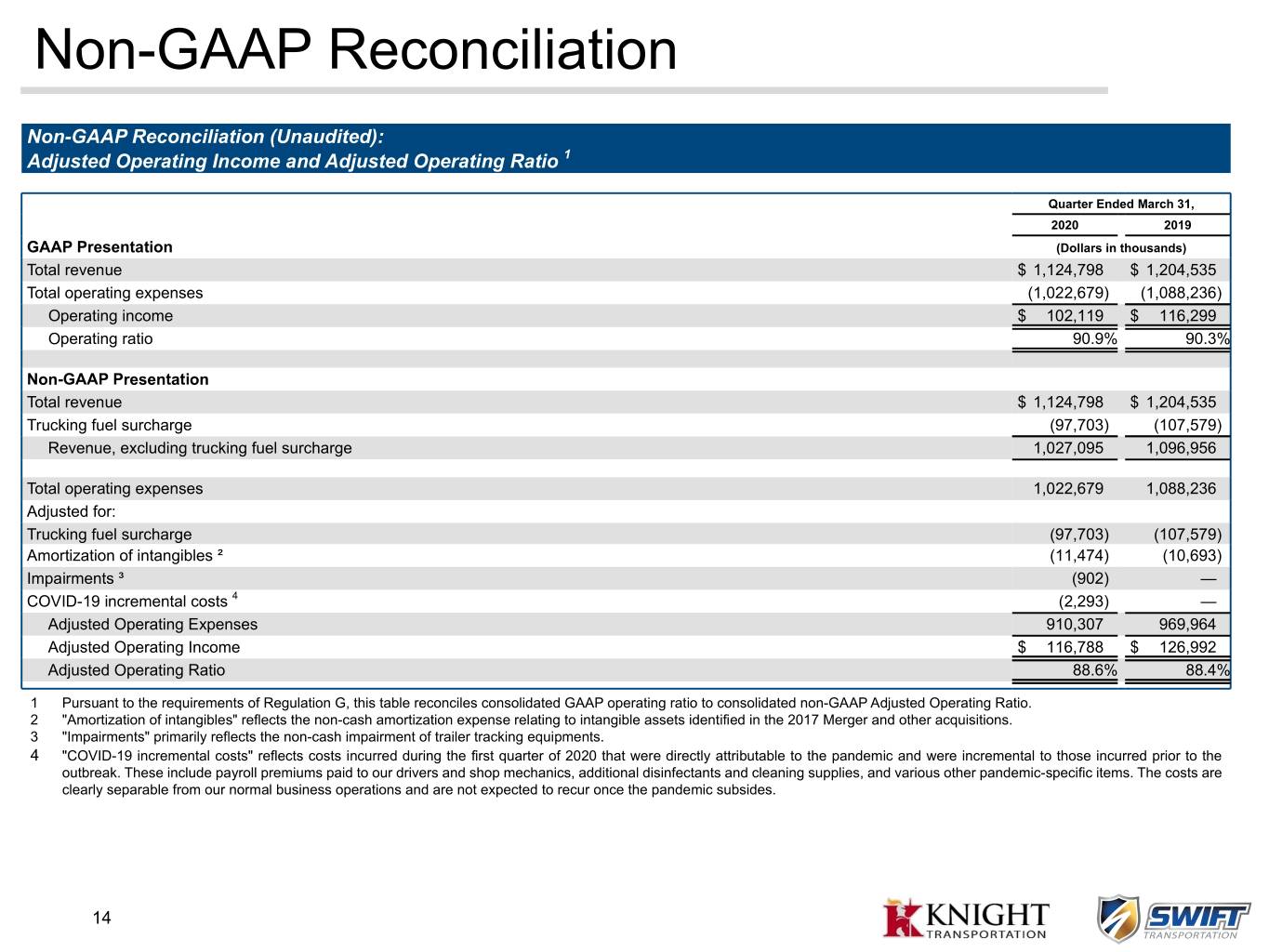

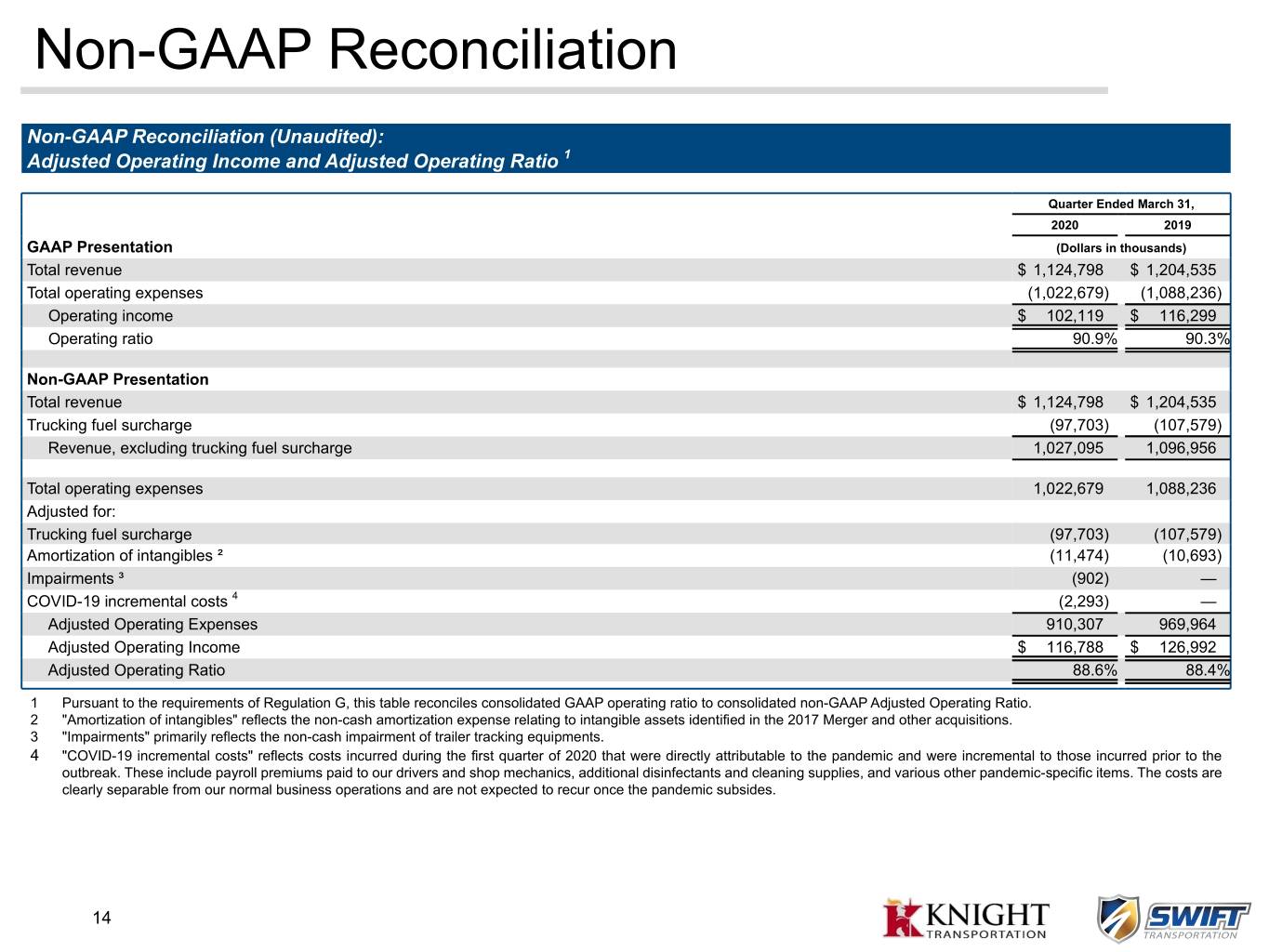

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio 1 Quarter Ended March 31, 2020 2019 GAAP Presentation (Dollars in thousands) Total revenue $ 1,124,798 $ 1,204,535 Total operating expenses (1,022,679) (1,088,236) Operating income $ 102,119 $ 116,299 Operating ratio 90.9% 90.3% Non-GAAP Presentation Total revenue $ 1,124,798 $ 1,204,535 Trucking fuel surcharge (97,703) (107,579) Revenue, excluding trucking fuel surcharge 1,027,095 1,096,956 Total operating expenses 1,022,679 1,088,236 Adjusted for: Trucking fuel surcharge (97,703) (107,579) Amortization of intangibles ² (11,474) (10,693) Impairments ³ (902) — COVID-19 incremental costs 4 (2,293) — Adjusted Operating Expenses 910,307 969,964 Adjusted Operating Income $ 116,788 $ 126,992 Adjusted Operating Ratio 88.6% 88.4% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger and other acquisitions. 3 "Impairments" primarily reflects the non-cash impairment of trailer tracking equipments. 4 "COVID-19 incremental costs" reflects costs incurred during the first quarter of 2020 that were directly attributable to the pandemic and were incremental to those incurred prior to the outbreak. These include payroll premiums paid to our drivers and shop mechanics, additional disinfectants and cleaning supplies, and various other pandemic-specific items. The costs are clearly separable from our normal business operations and are not expected to recur once the pandemic subsides. 14

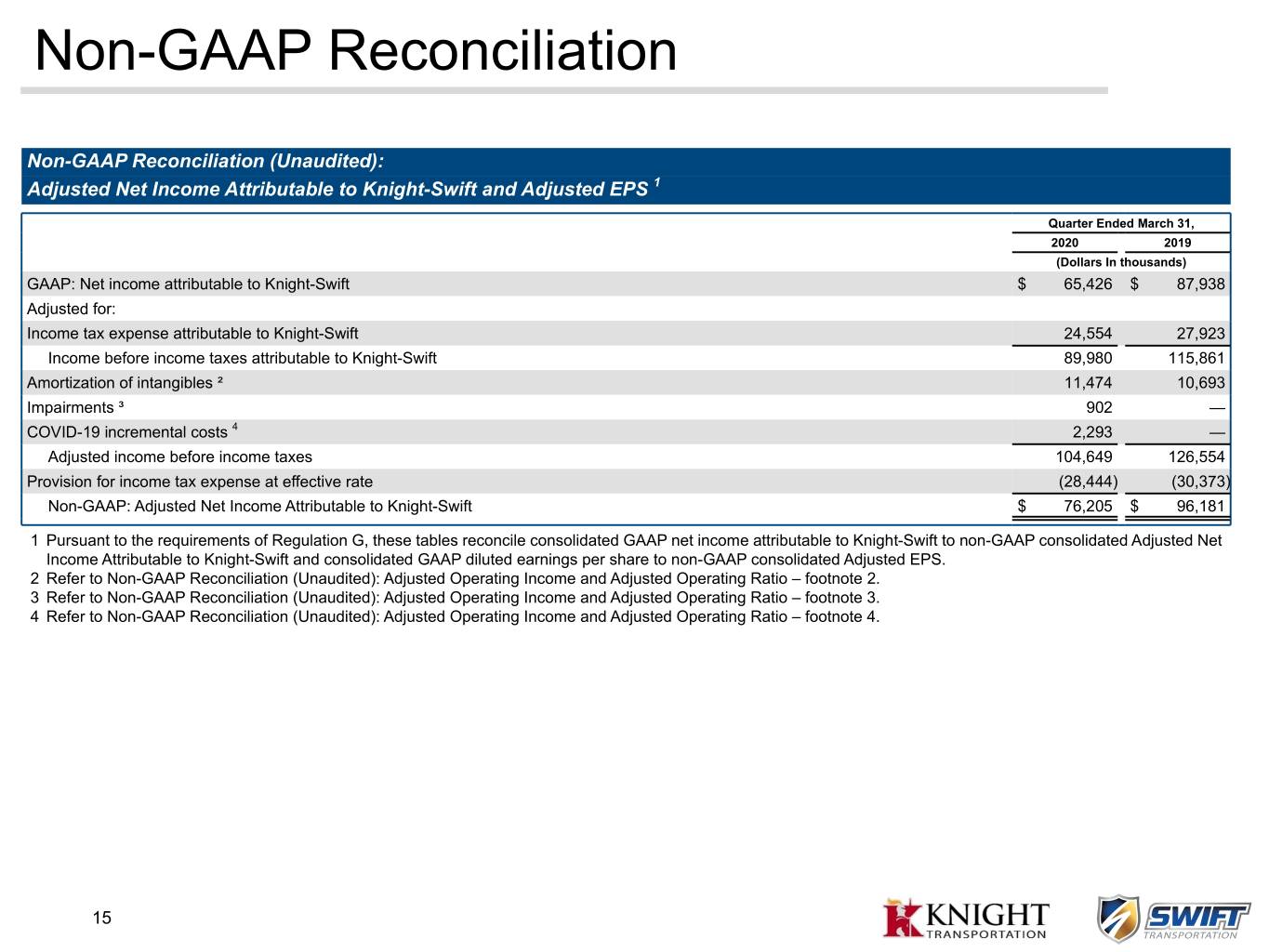

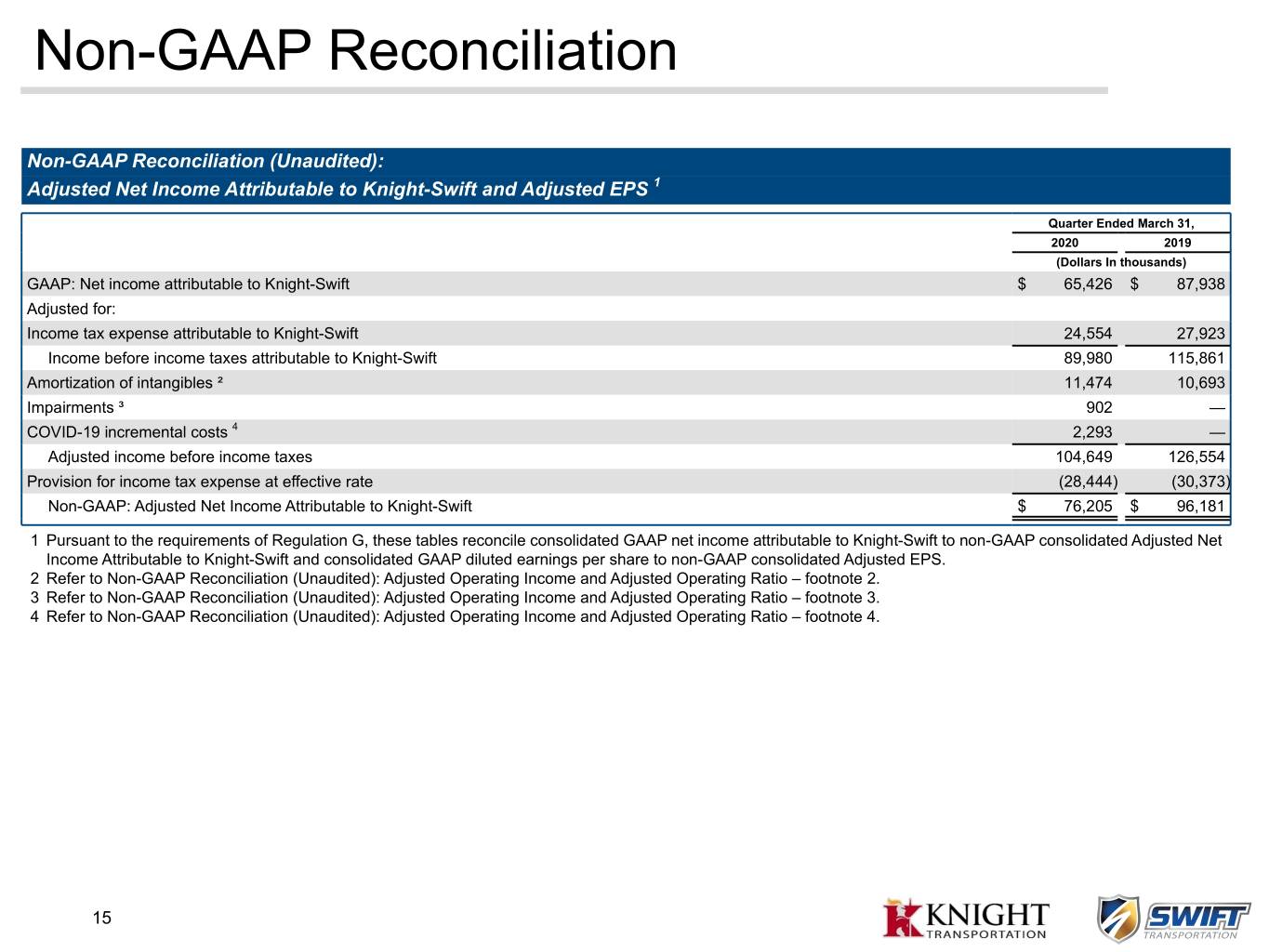

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 Quarter Ended March 31, 2020 2019 (Dollars In thousands) GAAP: Net income attributable to Knight-Swift $ 65,426 $ 87,938 Adjusted for: Income tax expense attributable to Knight-Swift 24,554 27,923 Income before income taxes attributable to Knight-Swift 89,980 115,861 Amortization of intangibles ² 11,474 10,693 Impairments ³ 902 — COVID-19 incremental costs 4 2,293 — Adjusted income before income taxes 104,649 126,554 Provision for income tax expense at effective rate (28,444) (30,373) Non-GAAP: Adjusted Net Income Attributable to Knight-Swift $ 76,205 $ 96,181 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift and consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 15

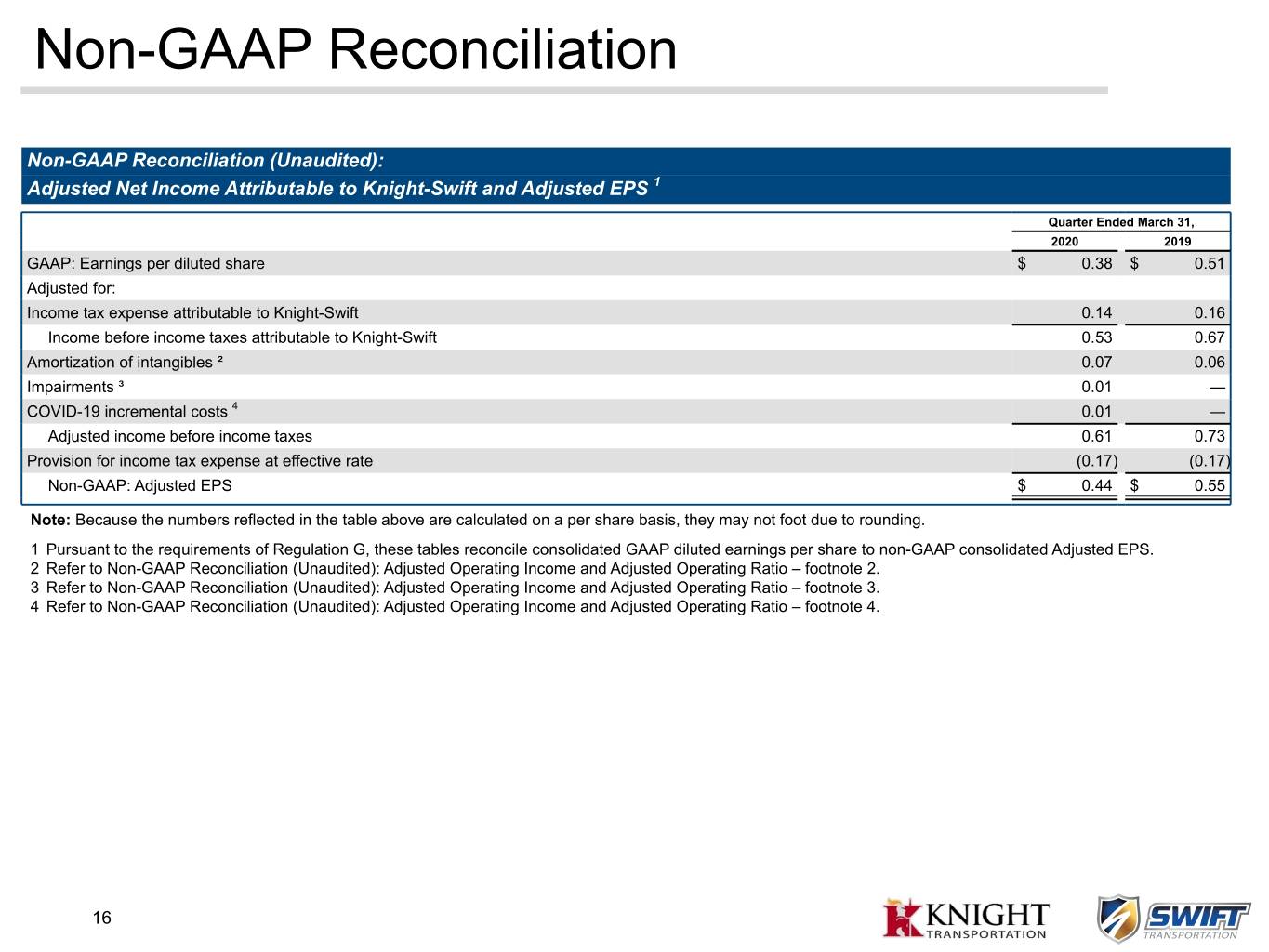

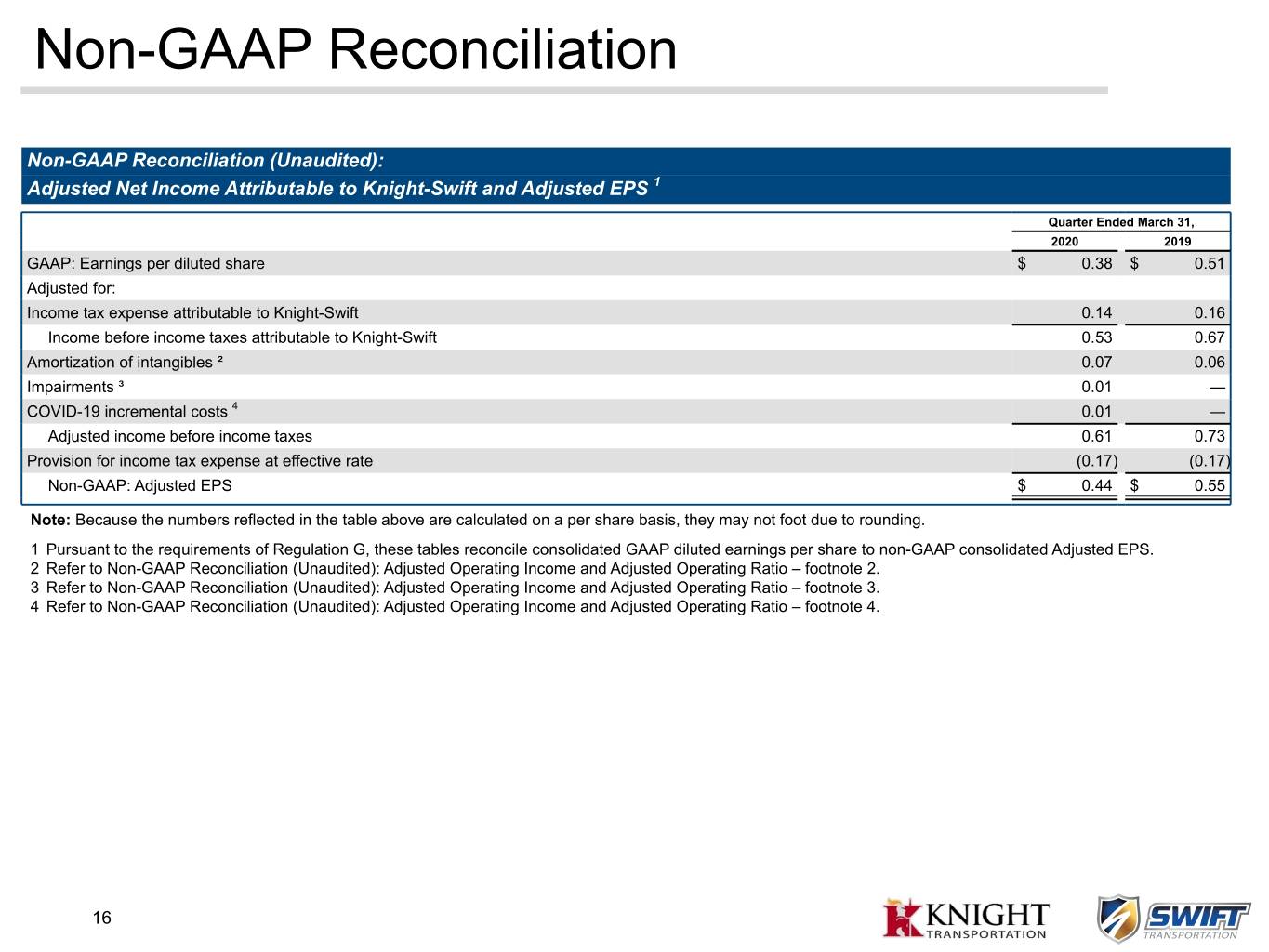

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 Quarter Ended March 31, 2020 2019 GAAP: Earnings per diluted share $ 0.38 $ 0.51 Adjusted for: Income tax expense attributable to Knight-Swift 0.14 0.16 Income before income taxes attributable to Knight-Swift 0.53 0.67 Amortization of intangibles ² 0.07 0.06 Impairments ³ 0.01 — COVID-19 incremental costs 4 0.01 — Adjusted income before income taxes 0.61 0.73 Provision for income tax expense at effective rate (0.17) (0.17) Non-GAAP: Adjusted EPS $ 0.44 $ 0.55 Note: Because the numbers reflected in the table above are calculated on a per share basis, they may not foot due to rounding. 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 16

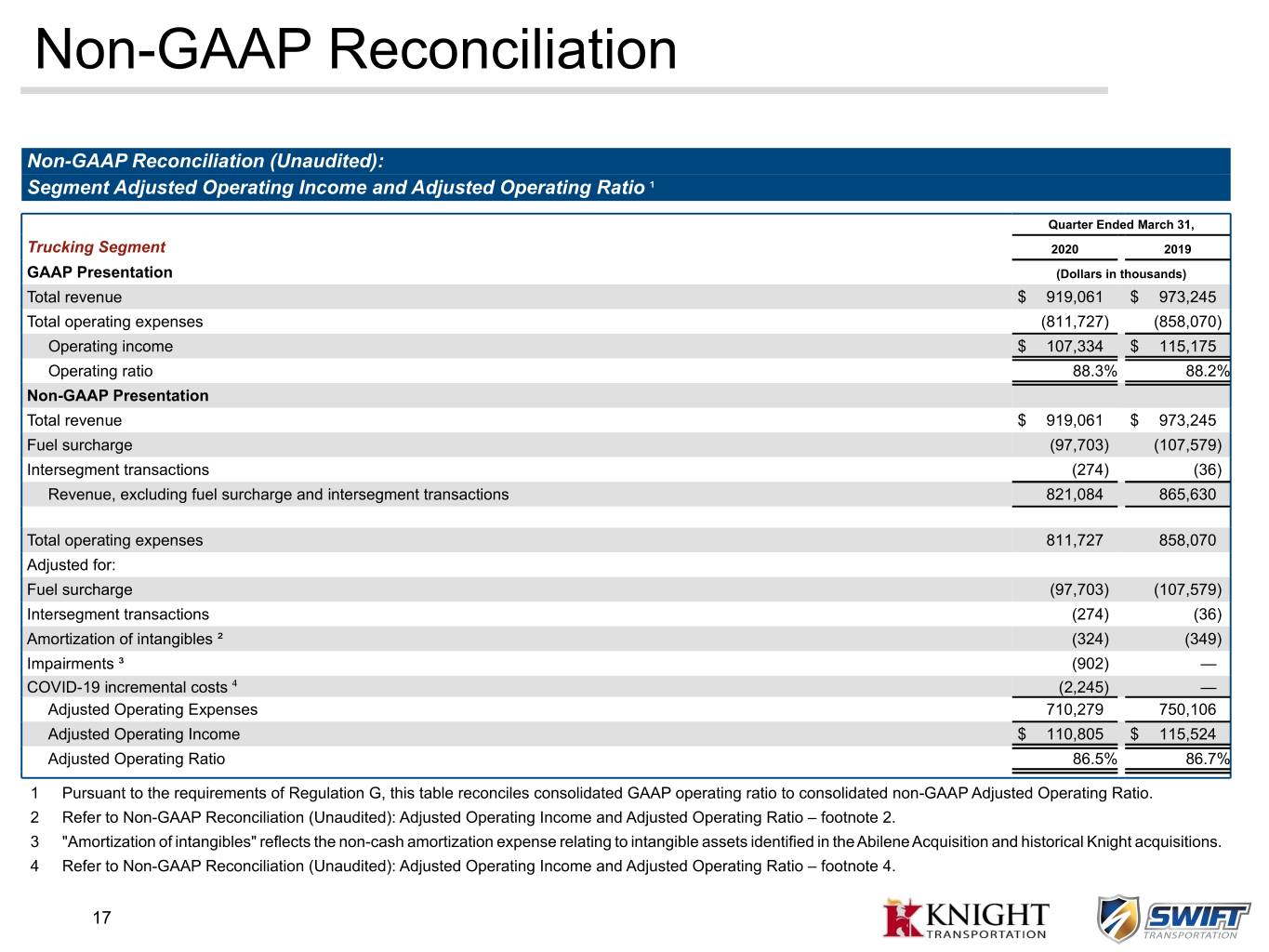

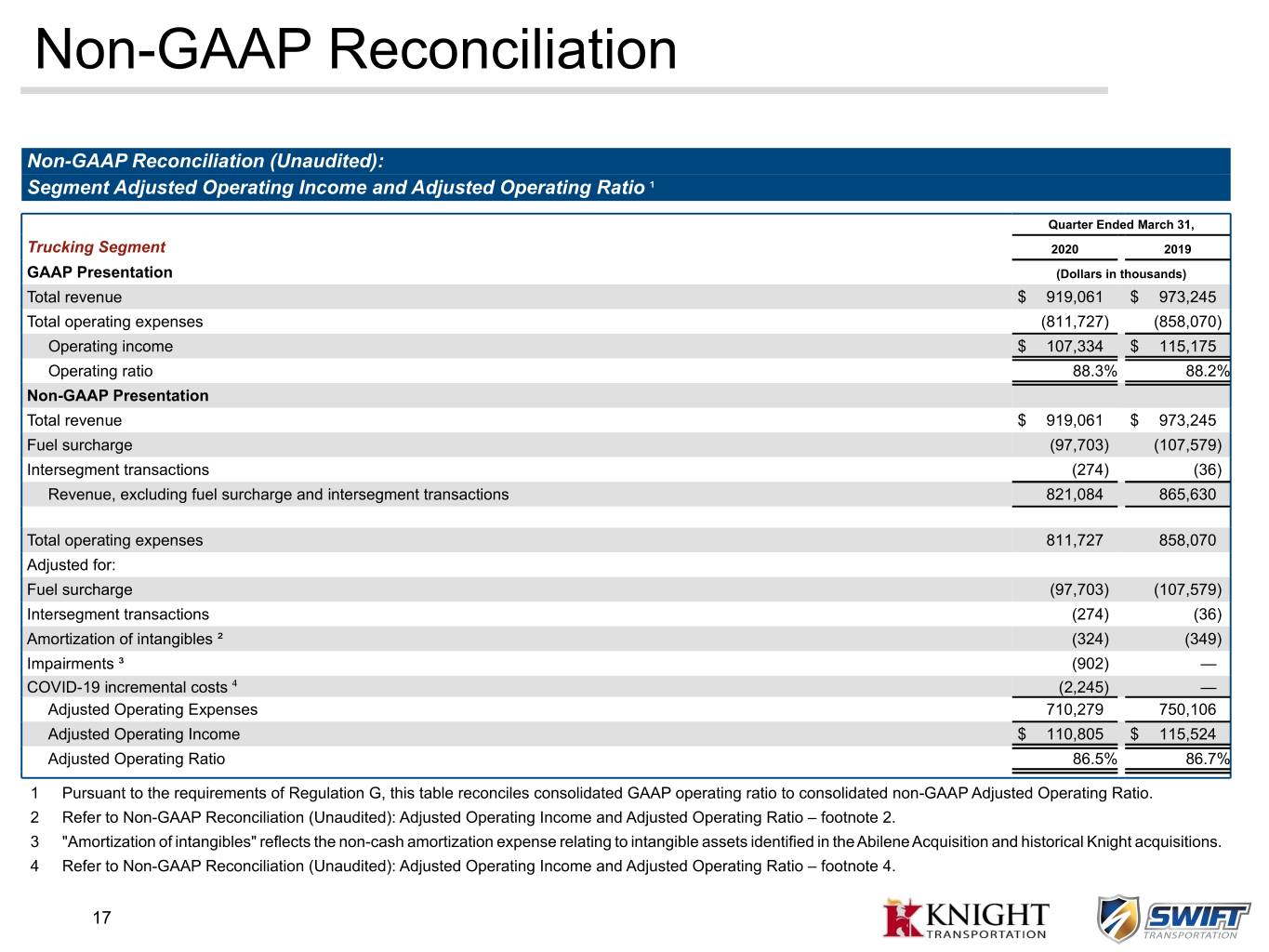

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ Quarter Ended March 31, Trucking Segment 2020 2019 GAAP Presentation (Dollars in thousands) Total revenue $ 919,061 $ 973,245 Total operating expenses (811,727) (858,070) Operating income $ 107,334 $ 115,175 Operating ratio 88.3% 88.2% Non-GAAP Presentation Total revenue $ 919,061 $ 973,245 Fuel surcharge (97,703) (107,579) Intersegment transactions (274) (36) Revenue, excluding fuel surcharge and intersegment transactions 821,084 865,630 Total operating expenses 811,727 858,070 Adjusted for: Fuel surcharge (97,703) (107,579) Intersegment transactions (274) (36) Amortization of intangibles ² (324) (349) Impairments ³ (902) — COVID-19 incremental costs ⁴ (2,245) — Adjusted Operating Expenses 710,279 750,106 Adjusted Operating Income $ 110,805 $ 115,524 Adjusted Operating Ratio 86.5% 86.7% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the Abilene Acquisition and historical Knight acquisitions. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 17

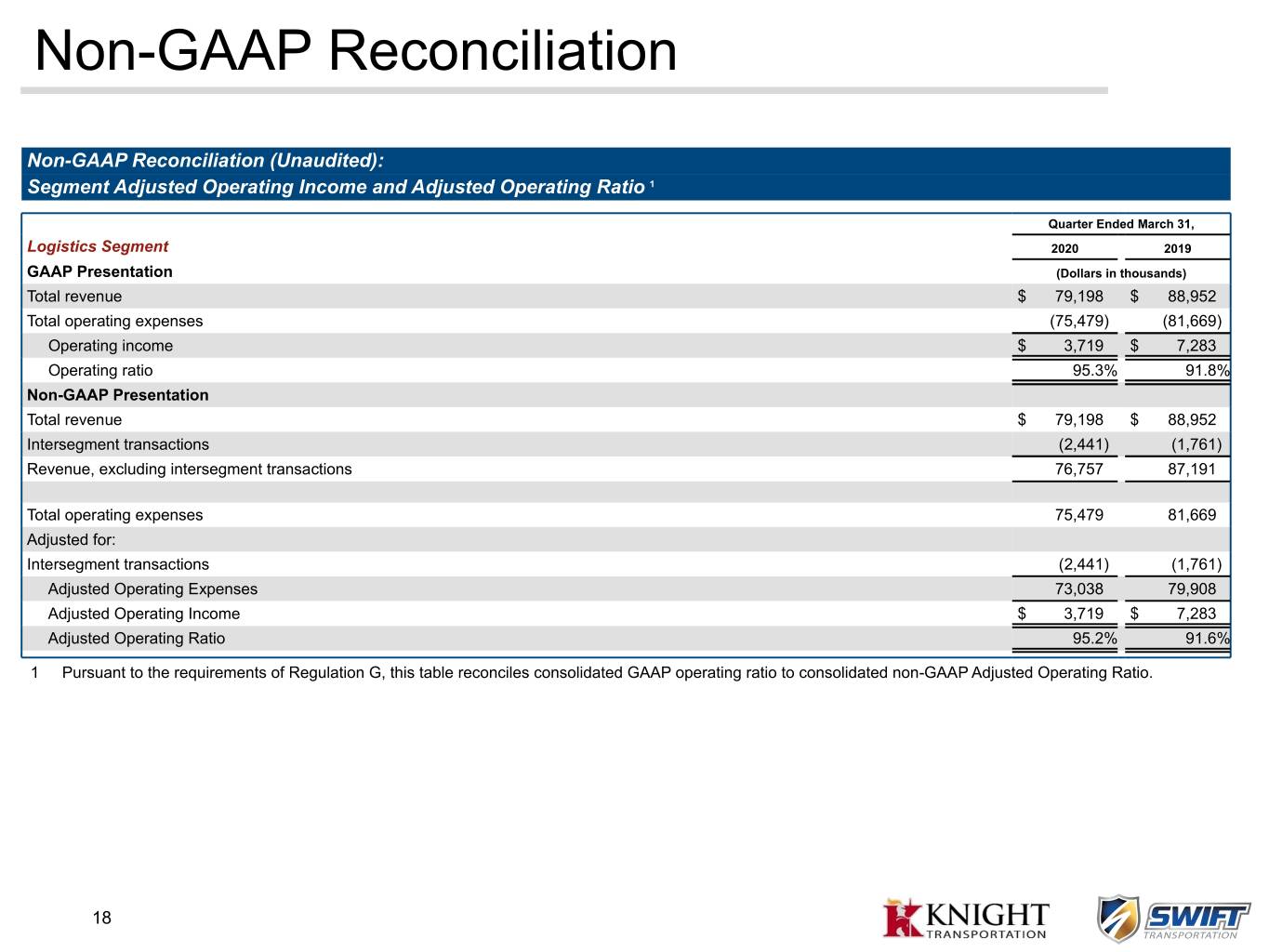

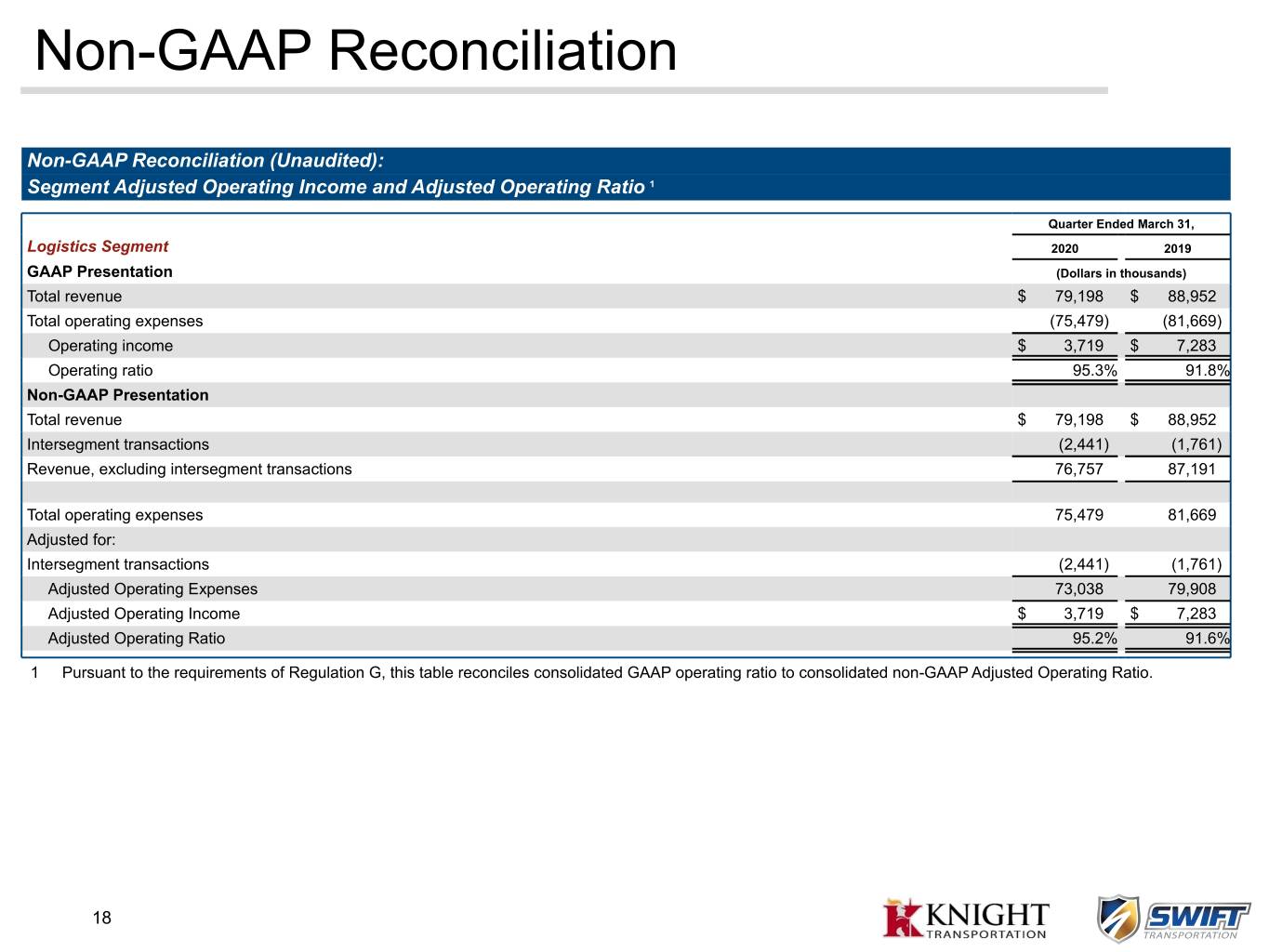

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ Quarter Ended March 31, Logistics Segment 2020 2019 GAAP Presentation (Dollars in thousands) Total revenue $ 79,198 $ 88,952 Total operating expenses (75,479) (81,669) Operating income $ 3,719 $ 7,283 Operating ratio 95.3% 91.8% Non-GAAP Presentation Total revenue $ 79,198 $ 88,952 Intersegment transactions (2,441) (1,761) Revenue, excluding intersegment transactions 76,757 87,191 Total operating expenses 75,479 81,669 Adjusted for: Intersegment transactions (2,441) (1,761) Adjusted Operating Expenses 73,038 79,908 Adjusted Operating Income $ 3,719 $ 7,283 Adjusted Operating Ratio 95.2% 91.6% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 18

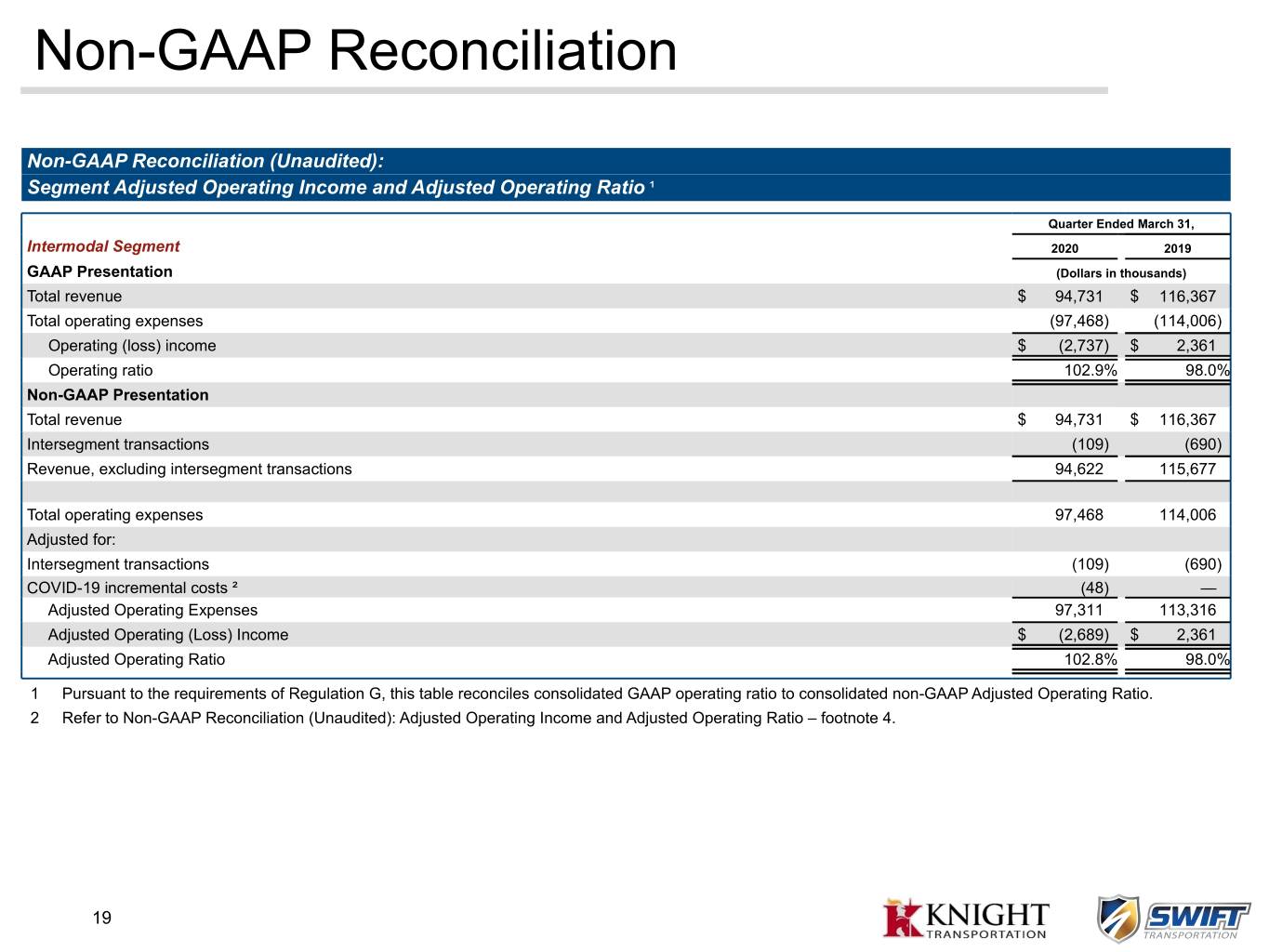

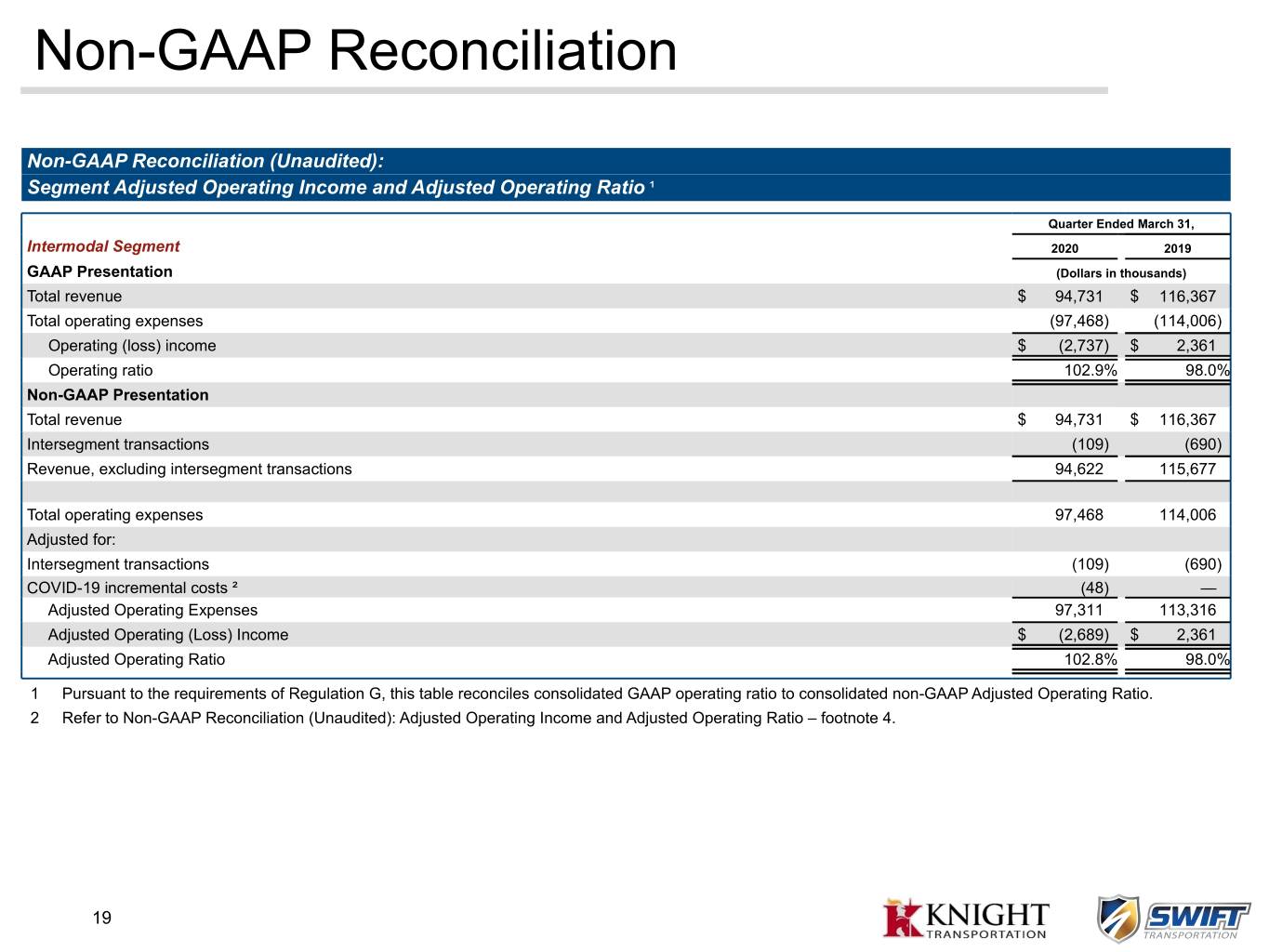

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ Quarter Ended March 31, Intermodal Segment 2020 2019 GAAP Presentation (Dollars in thousands) Total revenue $ 94,731 $ 116,367 Total operating expenses (97,468) (114,006) Operating (loss) income $ (2,737) $ 2,361 Operating ratio 102.9% 98.0% Non-GAAP Presentation Total revenue $ 94,731 $ 116,367 Intersegment transactions (109) (690) Revenue, excluding intersegment transactions 94,622 115,677 Total operating expenses 97,468 114,006 Adjusted for: Intersegment transactions (109) (690) COVID-19 incremental costs ² (48) — Adjusted Operating Expenses 97,311 113,316 Adjusted Operating (Loss) Income $ (2,689) $ 2,361 Adjusted Operating Ratio 102.8% 98.0% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 19

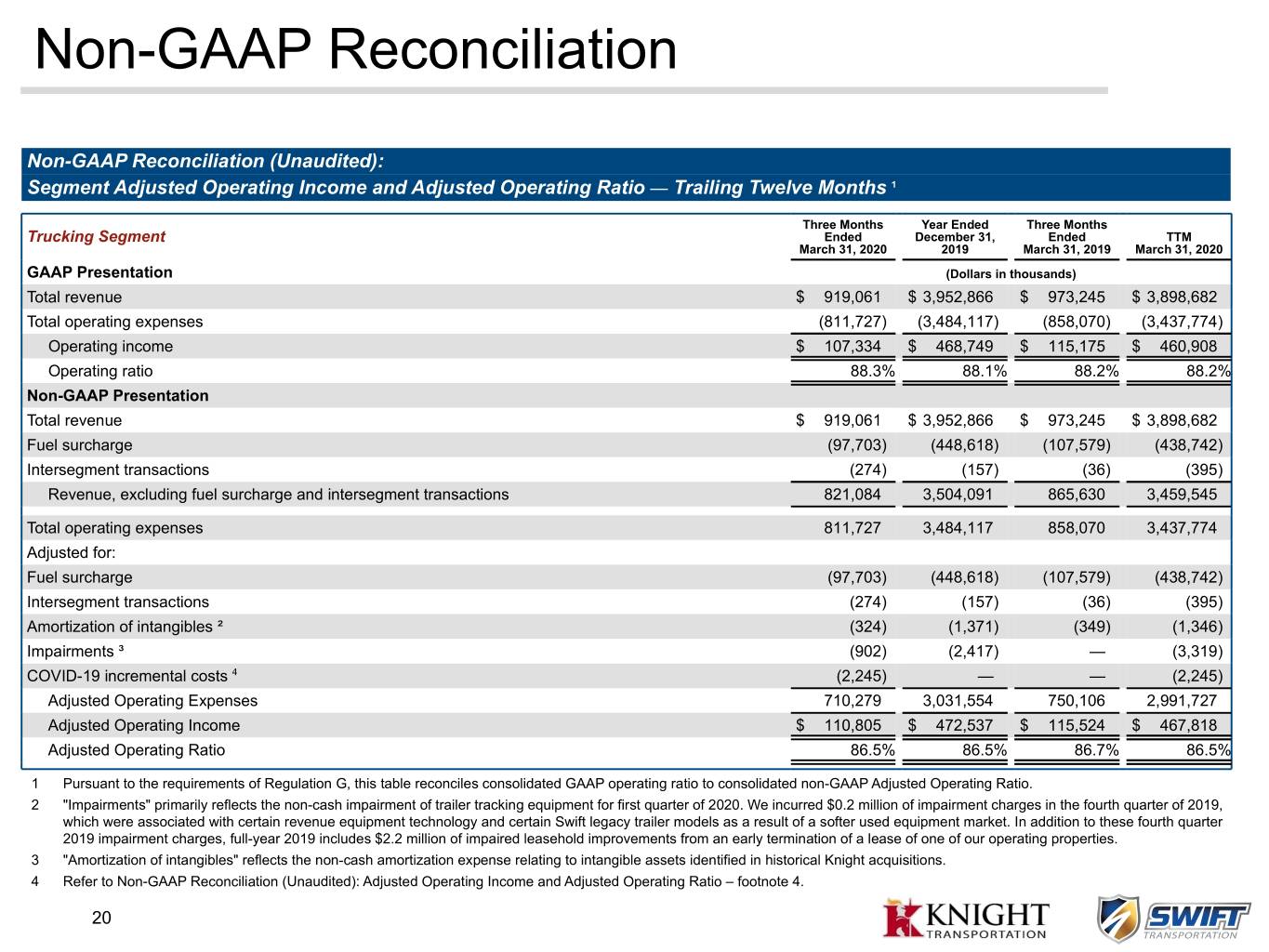

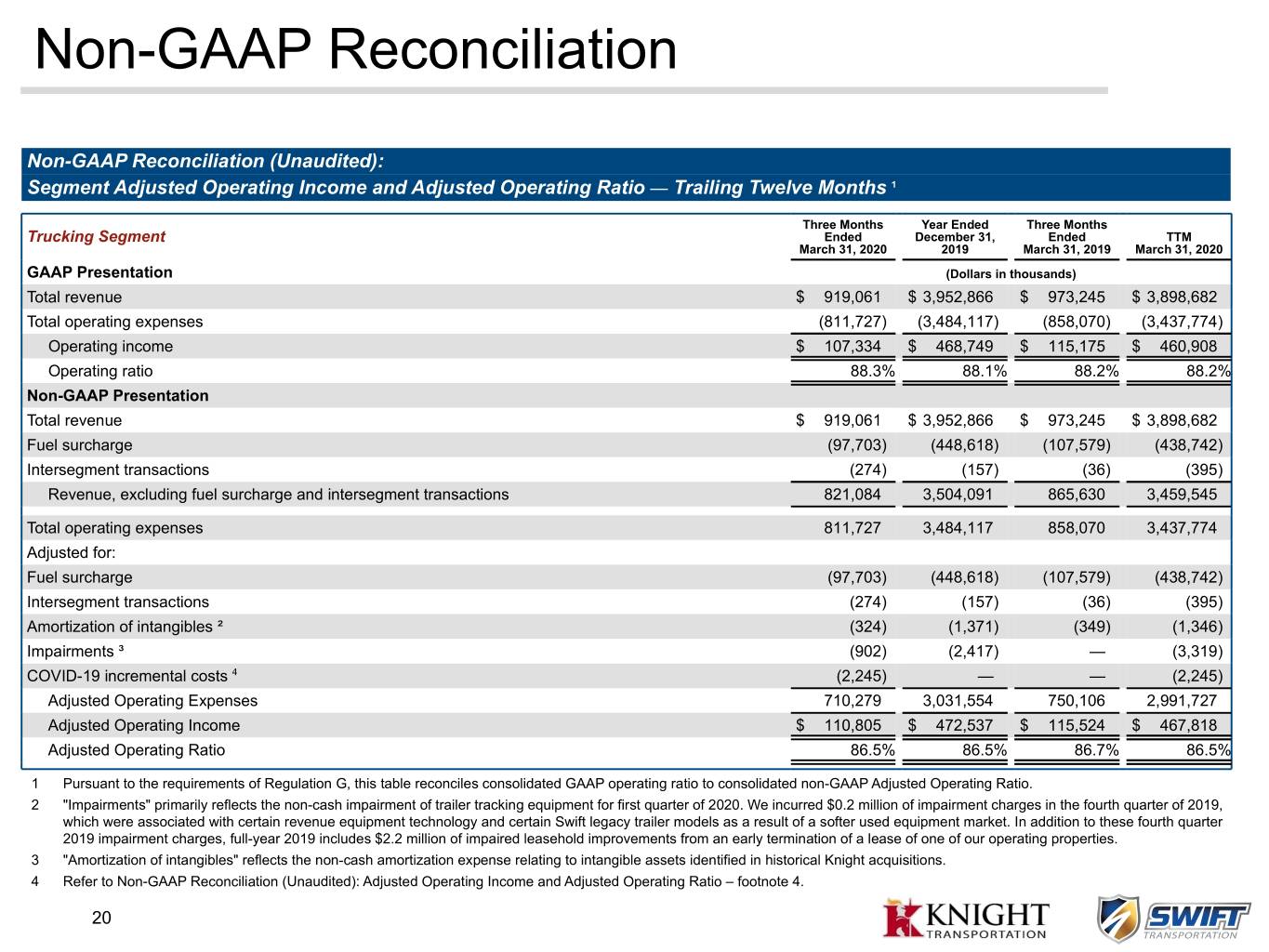

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio — Trailing Twelve Months ¹ Three Months Year Ended Three Months Trucking Segment Ended December 31, Ended TTM March 31, 2020 2019 March 31, 2019 March 31, 2020 GAAP Presentation (Dollars in thousands) Total revenue $ 919,061 $ 3,952,866 $ 973,245 $ 3,898,682 Total operating expenses (811,727) (3,484,117) (858,070) (3,437,774) Operating income $ 107,334 $ 468,749 $ 115,175 $ 460,908 Operating ratio 88.3% 88.1% 88.2% 88.2% Non-GAAP Presentation Total revenue $ 919,061 $ 3,952,866 $ 973,245 $ 3,898,682 Fuel surcharge (97,703) (448,618) (107,579) (438,742) Intersegment transactions (274) (157) (36) (395) Revenue, excluding fuel surcharge and intersegment transactions 821,084 3,504,091 865,630 3,459,545 Total operating expenses 811,727 3,484,117 858,070 3,437,774 Adjusted for: Fuel surcharge (97,703) (448,618) (107,579) (438,742) Intersegment transactions (274) (157) (36) (395) Amortization of intangibles ² (324) (1,371) (349) (1,346) Impairments ³ (902) (2,417) — (3,319) COVID-19 incremental costs ⁴ (2,245) — — (2,245) Adjusted Operating Expenses 710,279 3,031,554 750,106 2,991,727 Adjusted Operating Income $ 110,805 $ 472,537 $ 115,524 $ 467,818 Adjusted Operating Ratio 86.5% 86.5% 86.7% 86.5% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 "Impairments" primarily reflects the non-cash impairment of trailer tracking equipment for first quarter of 2020. We incurred $0.2 million of impairment charges in the fourth quarter of 2019, which were associated with certain revenue equipment technology and certain Swift legacy trailer models as a result of a softer used equipment market. In addition to these fourth quarter 2019 impairment charges, full-year 2019 includes $2.2 million of impaired leasehold improvements from an early termination of a lease of one of our operating properties. 3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in historical Knight acquisitions. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 20

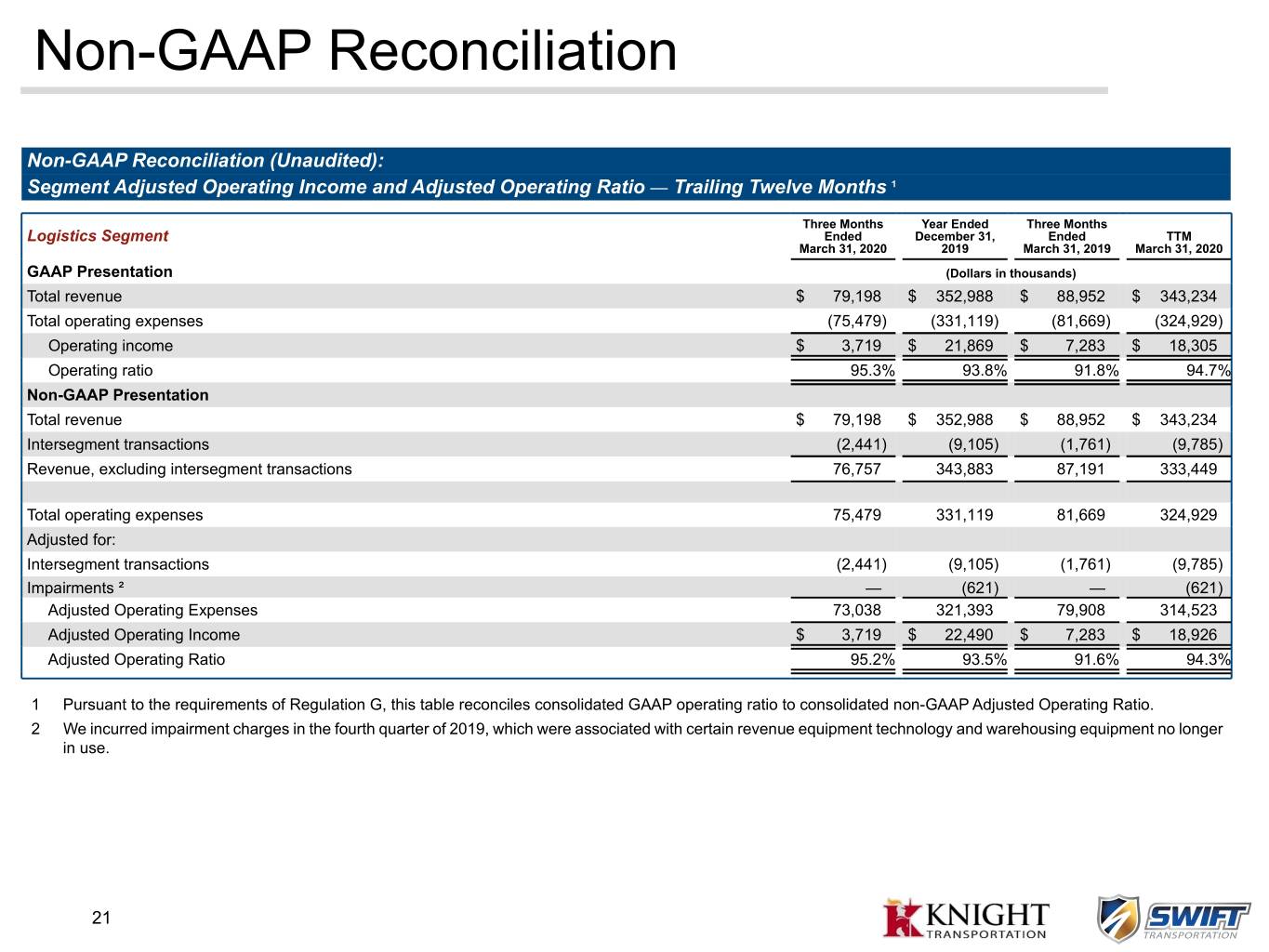

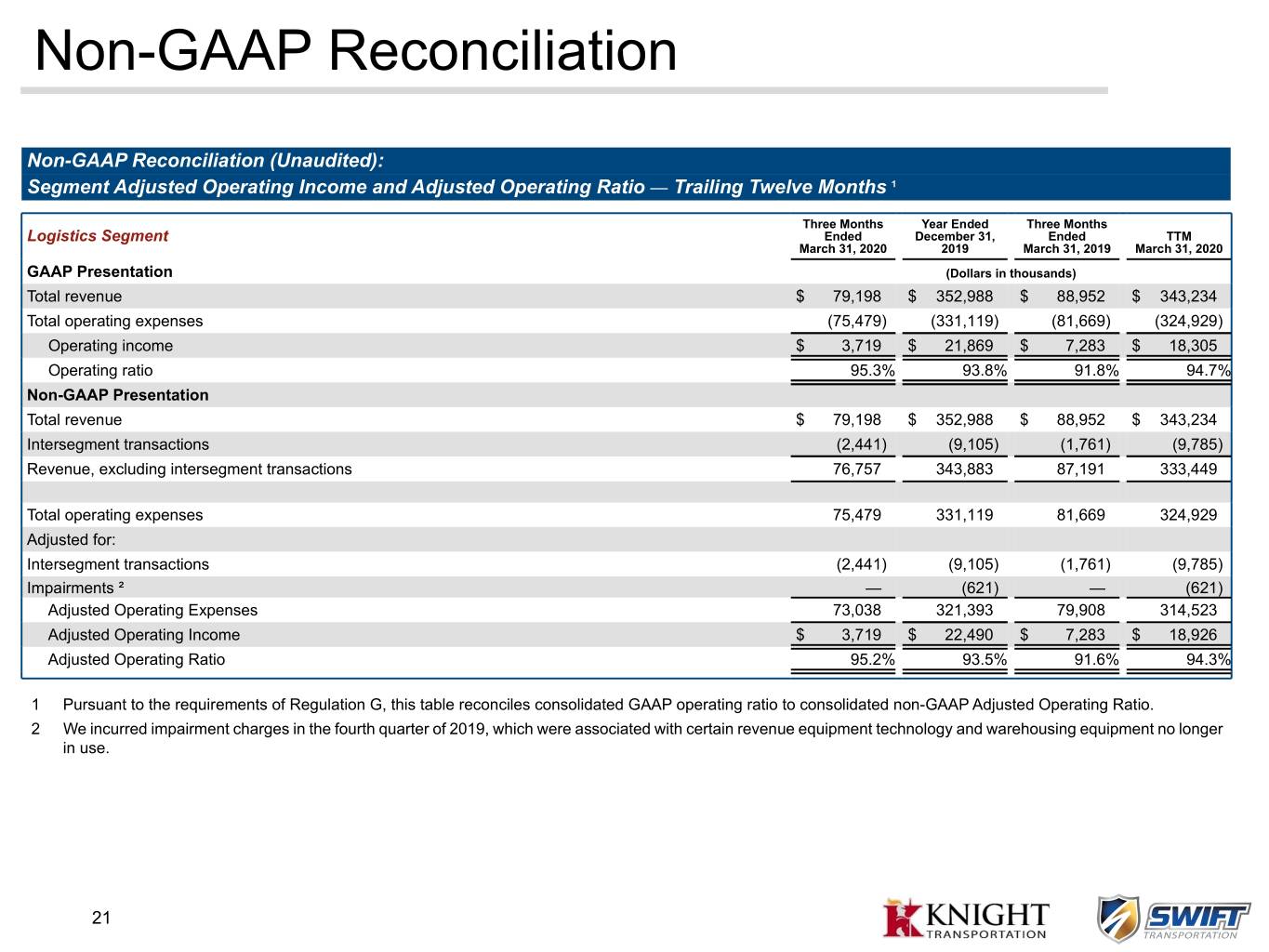

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio — Trailing Twelve Months ¹ Three Months Year Ended Three Months Logistics Segment Ended December 31, Ended TTM March 31, 2020 2019 March 31, 2019 March 31, 2020 GAAP Presentation (Dollars in thousands) Total revenue $ 79,198 $ 352,988 $ 88,952 $ 343,234 Total operating expenses (75,479) (331,119) (81,669) (324,929) Operating income $ 3,719 $ 21,869 $ 7,283 $ 18,305 Operating ratio 95.3% 93.8% 91.8% 94.7% Non-GAAP Presentation Total revenue $ 79,198 $ 352,988 $ 88,952 $ 343,234 Intersegment transactions (2,441) (9,105) (1,761) (9,785) Revenue, excluding intersegment transactions 76,757 343,883 87,191 333,449 Total operating expenses 75,479 331,119 81,669 324,929 Adjusted for: Intersegment transactions (2,441) (9,105) (1,761) (9,785) Impairments ² — (621) — (621) Adjusted Operating Expenses 73,038 321,393 79,908 314,523 Adjusted Operating Income $ 3,719 $ 22,490 $ 7,283 $ 18,926 Adjusted Operating Ratio 95.2% 93.5% 91.6% 94.3% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 We incurred impairment charges in the fourth quarter of 2019, which were associated with certain revenue equipment technology and warehousing equipment no longer in use. 21

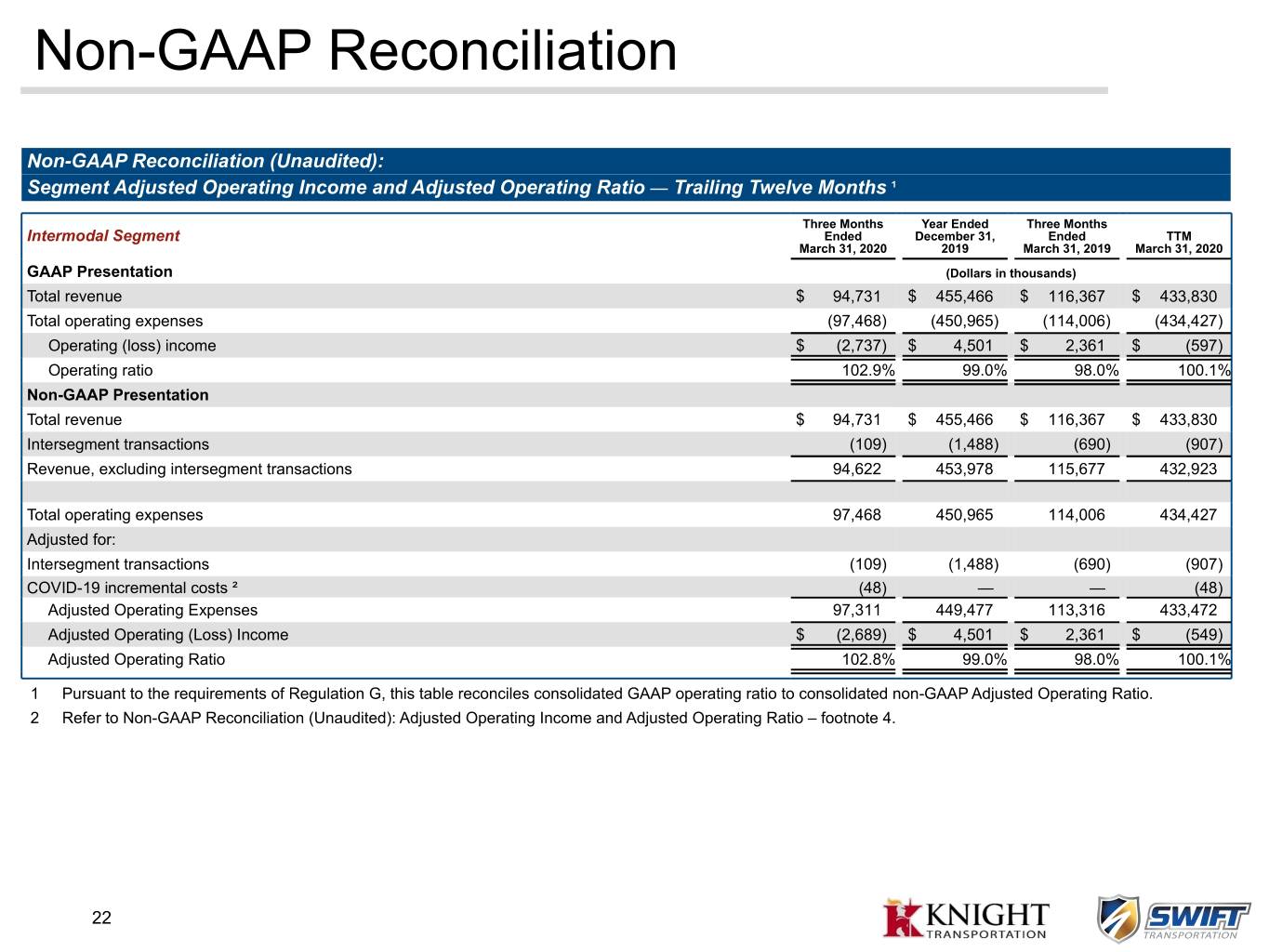

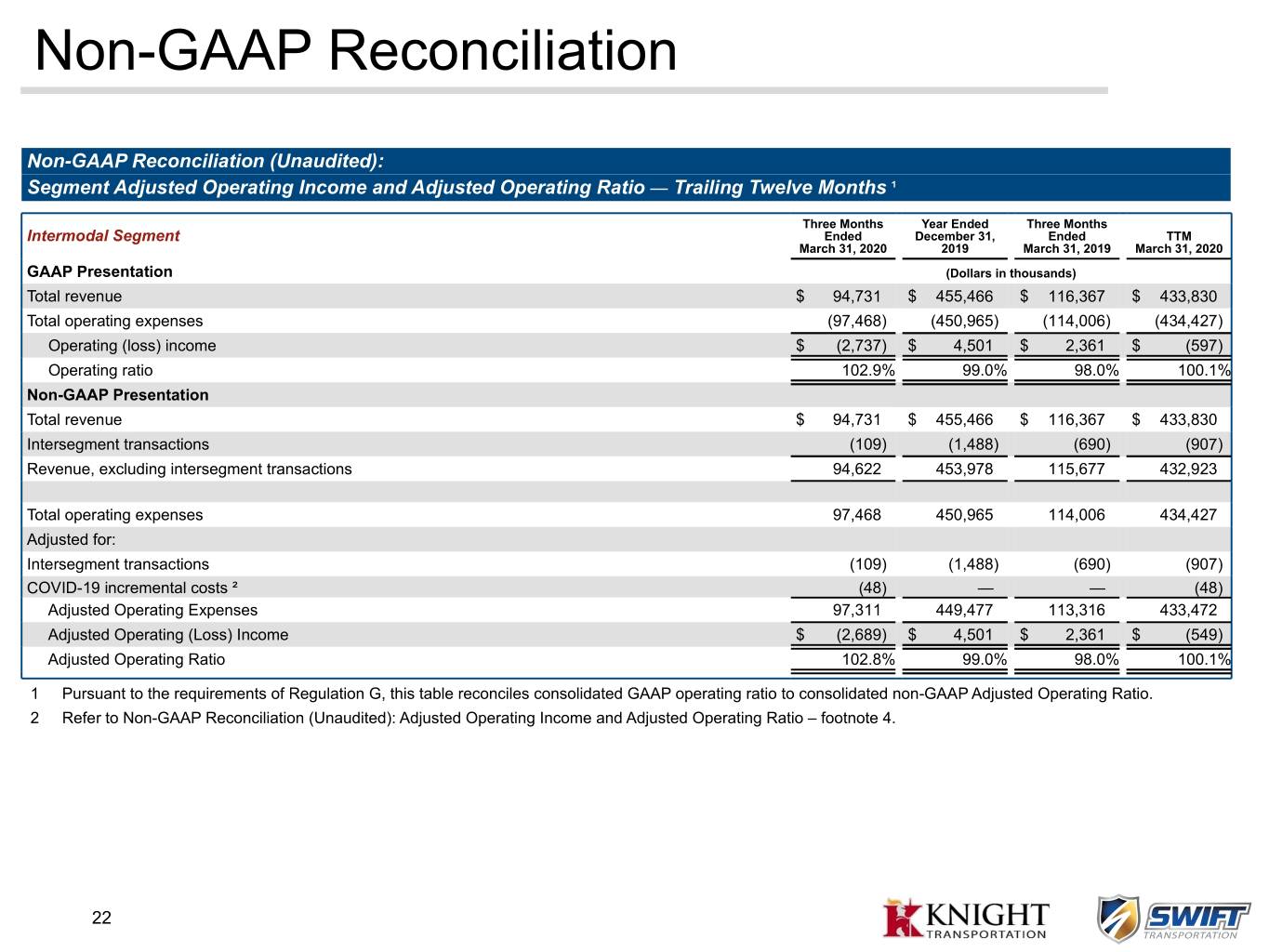

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio — Trailing Twelve Months ¹ Three Months Year Ended Three Months Intermodal Segment Ended December 31, Ended TTM March 31, 2020 2019 March 31, 2019 March 31, 2020 GAAP Presentation (Dollars in thousands) Total revenue $ 94,731 $ 455,466 $ 116,367 $ 433,830 Total operating expenses (97,468) (450,965) (114,006) (434,427) Operating (loss) income $ (2,737) $ 4,501 $ 2,361 $ (597) Operating ratio 102.9% 99.0% 98.0% 100.1% Non-GAAP Presentation Total revenue $ 94,731 $ 455,466 $ 116,367 $ 433,830 Intersegment transactions (109) (1,488) (690) (907) Revenue, excluding intersegment transactions 94,622 453,978 115,677 432,923 Total operating expenses 97,468 450,965 114,006 434,427 Adjusted for: Intersegment transactions (109) (1,488) (690) (907) COVID-19 incremental costs ² (48) — — (48) Adjusted Operating Expenses 97,311 449,477 113,316 433,472 Adjusted Operating (Loss) Income $ (2,689) $ 4,501 $ 2,361 $ (549) Adjusted Operating Ratio 102.8% 99.0% 98.0% 100.1% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 22

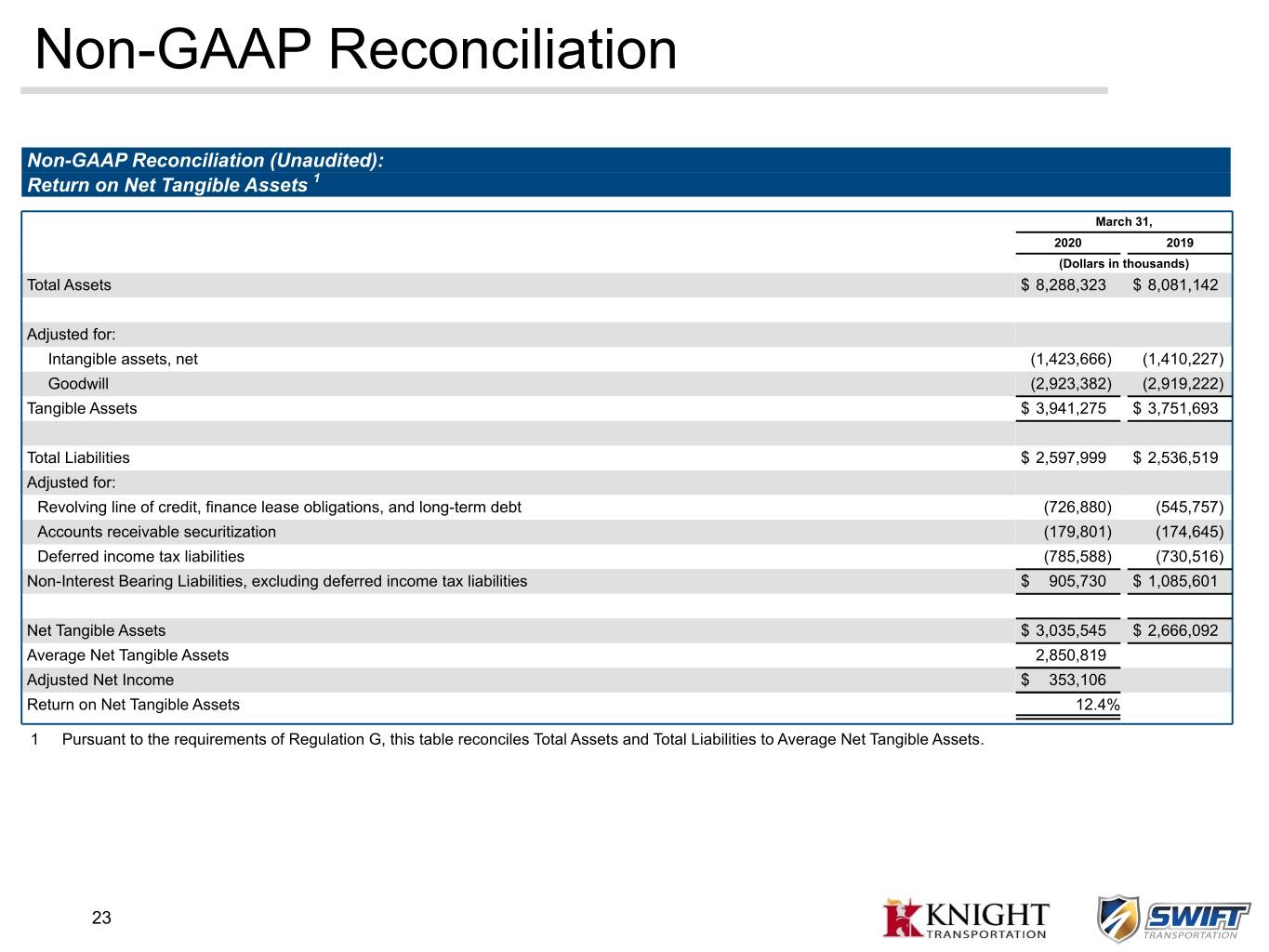

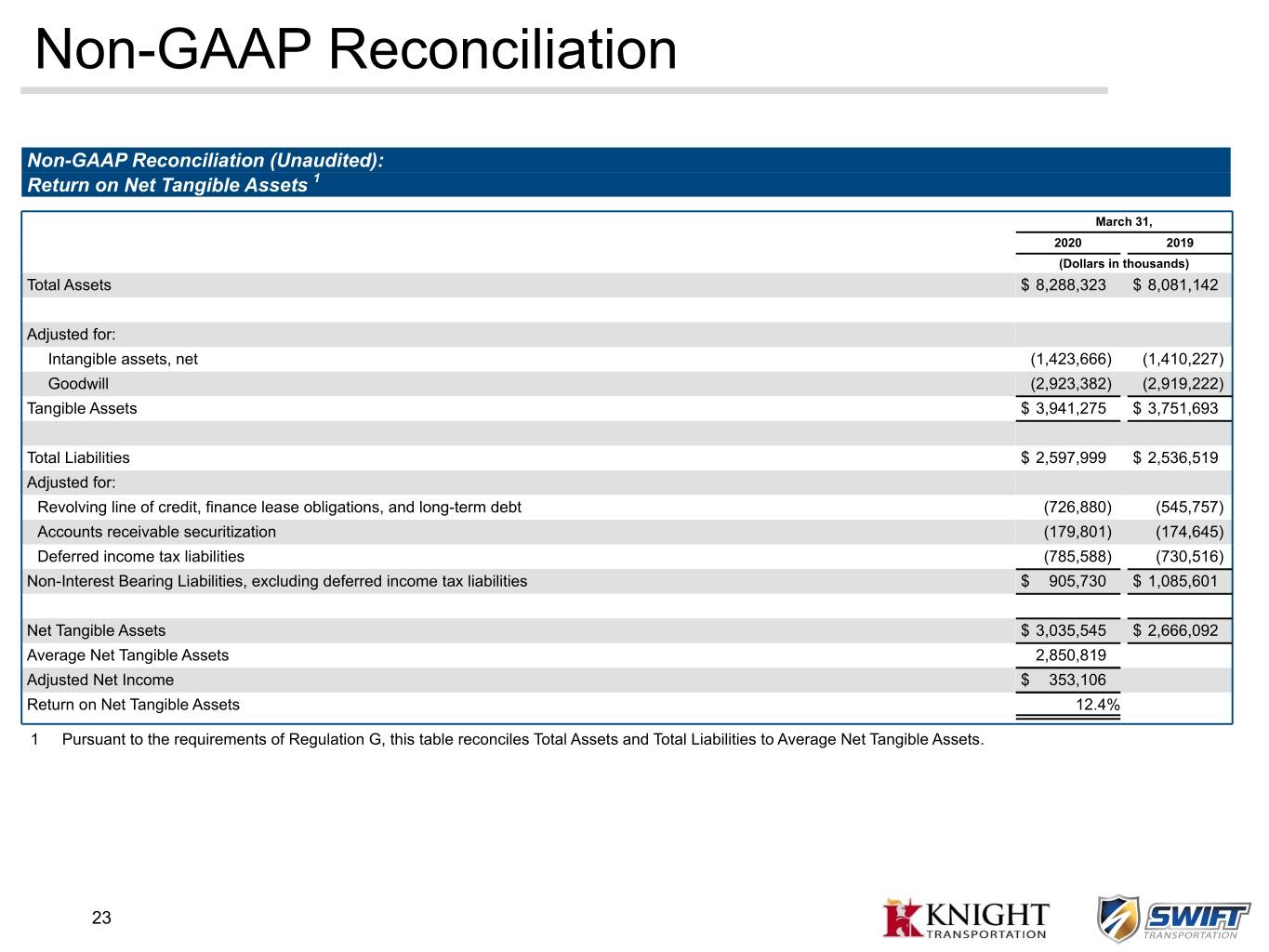

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Return on Net Tangible Assets 1 March 31, 2020 2019 (Dollars in thousands) Total Assets $ 8,288,323 $ 8,081,142 Adjusted for: Intangible assets, net (1,423,666) (1,410,227) Goodwill (2,923,382) (2,919,222) Tangible Assets $ 3,941,275 $ 3,751,693 Total Liabilities $ 2,597,999 $ 2,536,519 Adjusted for: Revolving line of credit, finance lease obligations, and long-term debt (726,880) (545,757) Accounts receivable securitization (179,801) (174,645) Deferred income tax liabilities (785,588) (730,516) Non-Interest Bearing Liabilities, excluding deferred income tax liabilities $ 905,730 $ 1,085,601 Net Tangible Assets $ 3,035,545 $ 2,666,092 Average Net Tangible Assets 2,850,819 Adjusted Net Income $ 353,106 Return on Net Tangible Assets 12.4% 1 Pursuant to the requirements of Regulation G, this table reconciles Total Assets and Total Liabilities to Average Net Tangible Assets. 23

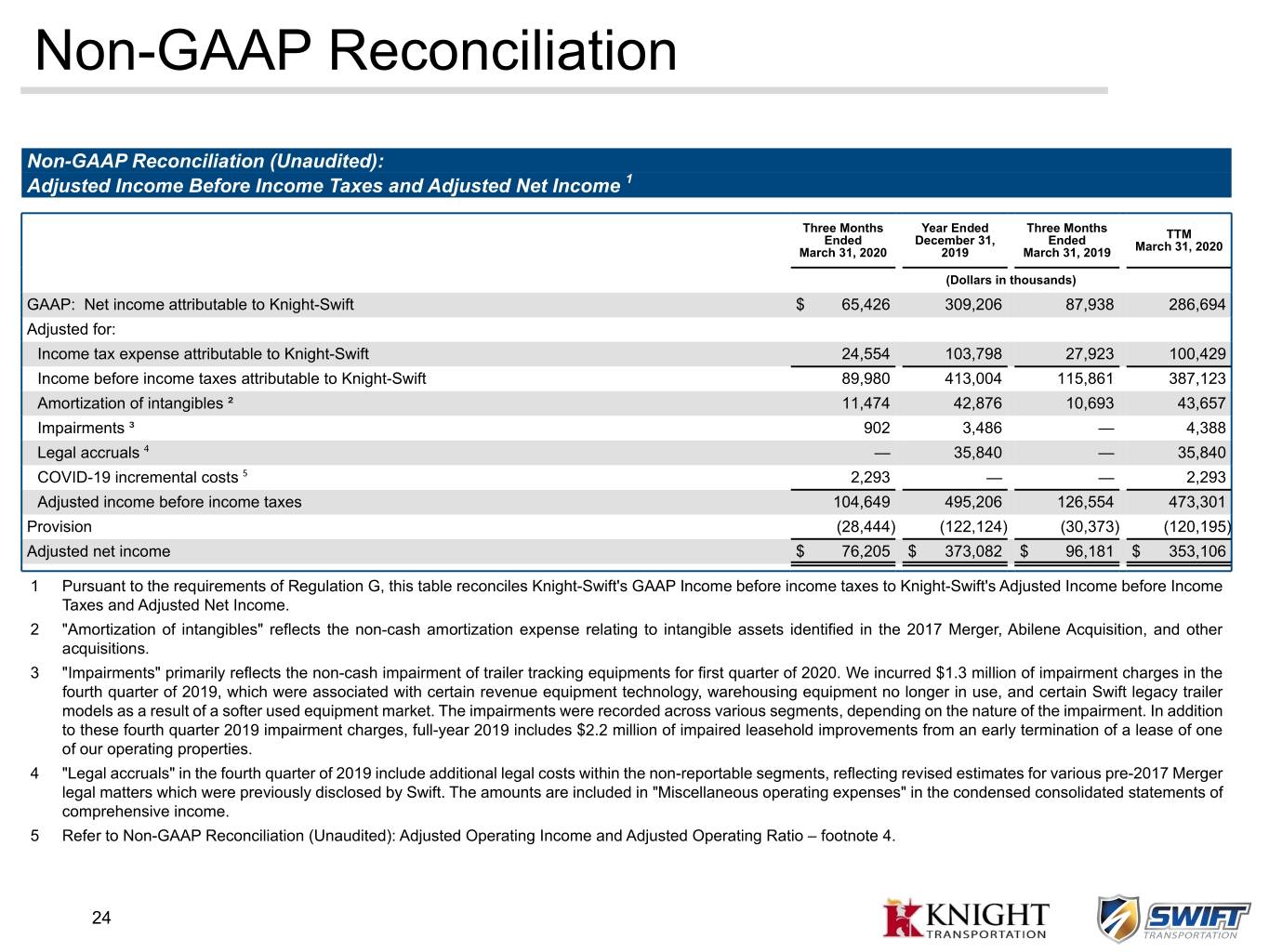

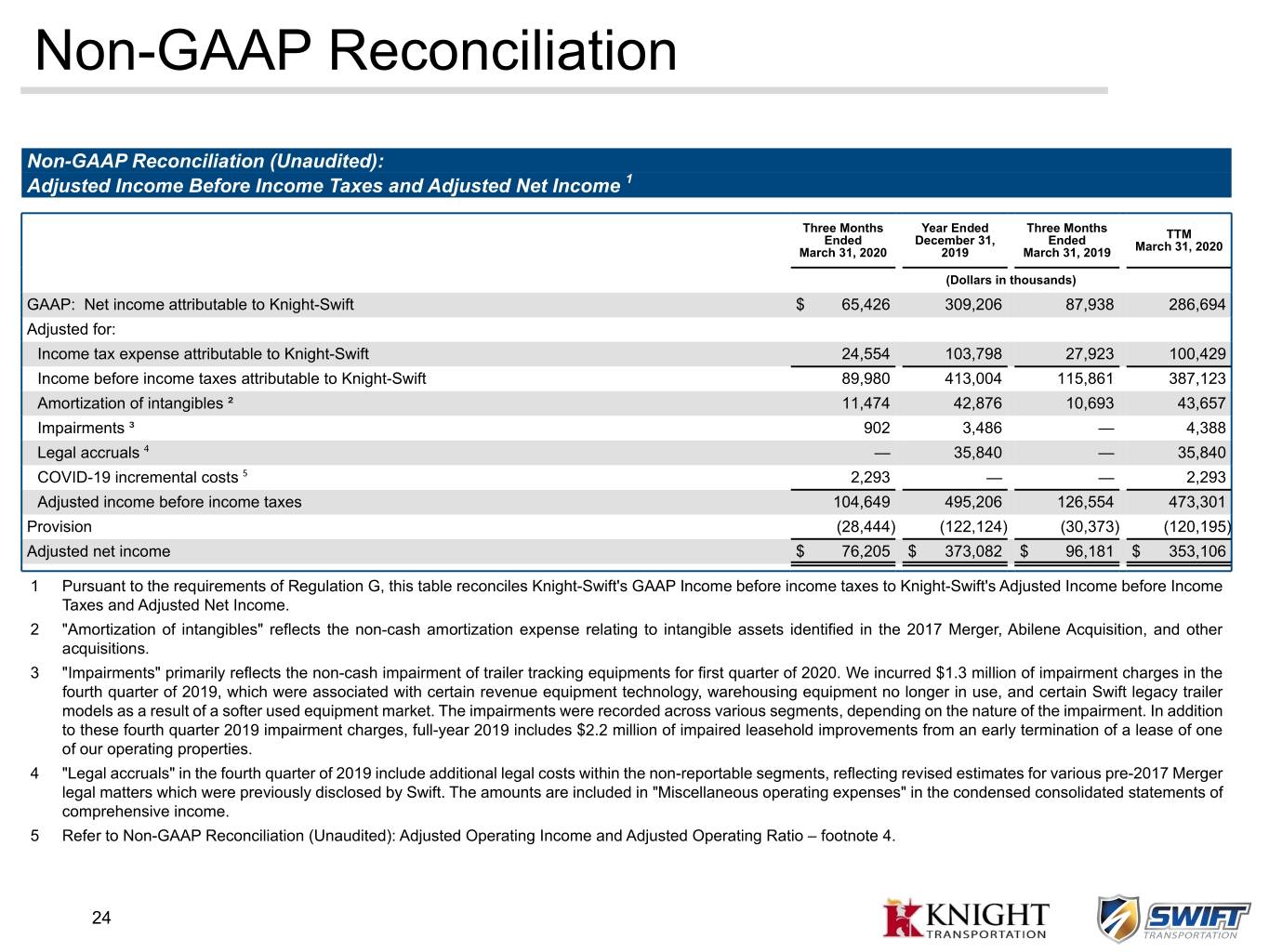

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Income Before Income Taxes and Adjusted Net Income 1 Three Months Year Ended Three Months Ended December 31, Ended TTM March 31, 2020 2019 March 31, 2019 March 31, 2020 (Dollars in thousands) GAAP: Net income attributable to Knight-Swift $ 65,426 309,206 87,938 286,694 Adjusted for: Income tax expense attributable to Knight-Swift 24,554 103,798 27,923 100,429 Income before income taxes attributable to Knight-Swift 89,980 413,004 115,861 387,123 Amortization of intangibles ² 11,474 42,876 10,693 43,657 Impairments ³ 902 3,486 — 4,388 Legal accruals ⁴ — 35,840 — 35,840 COVID-19 incremental costs ⁵ 2,293 — — 2,293 Adjusted income before income taxes 104,649 495,206 126,554 473,301 Provision (28,444) (122,124) (30,373) (120,195) Adjusted net income $ 76,205 $ 373,082 $ 96,181 $ 353,106 1 Pursuant to the requirements of Regulation G, this table reconciles Knight-Swift's GAAP Income before income taxes to Knight-Swift's Adjusted Income before Income Taxes and Adjusted Net Income. 2 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger, Abilene Acquisition, and other acquisitions. 3 "Impairments" primarily reflects the non-cash impairment of trailer tracking equipments for first quarter of 2020. We incurred $1.3 million of impairment charges in the fourth quarter of 2019, which were associated with certain revenue equipment technology, warehousing equipment no longer in use, and certain Swift legacy trailer models as a result of a softer used equipment market. The impairments were recorded across various segments, depending on the nature of the impairment. In addition to these fourth quarter 2019 impairment charges, full-year 2019 includes $2.2 million of impaired leasehold improvements from an early termination of a lease of one of our operating properties. 4 "Legal accruals" in the fourth quarter of 2019 include additional legal costs within the non-reportable segments, reflecting revised estimates for various pre-2017 Merger legal matters which were previously disclosed by Swift. The amounts are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income. 5 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 24

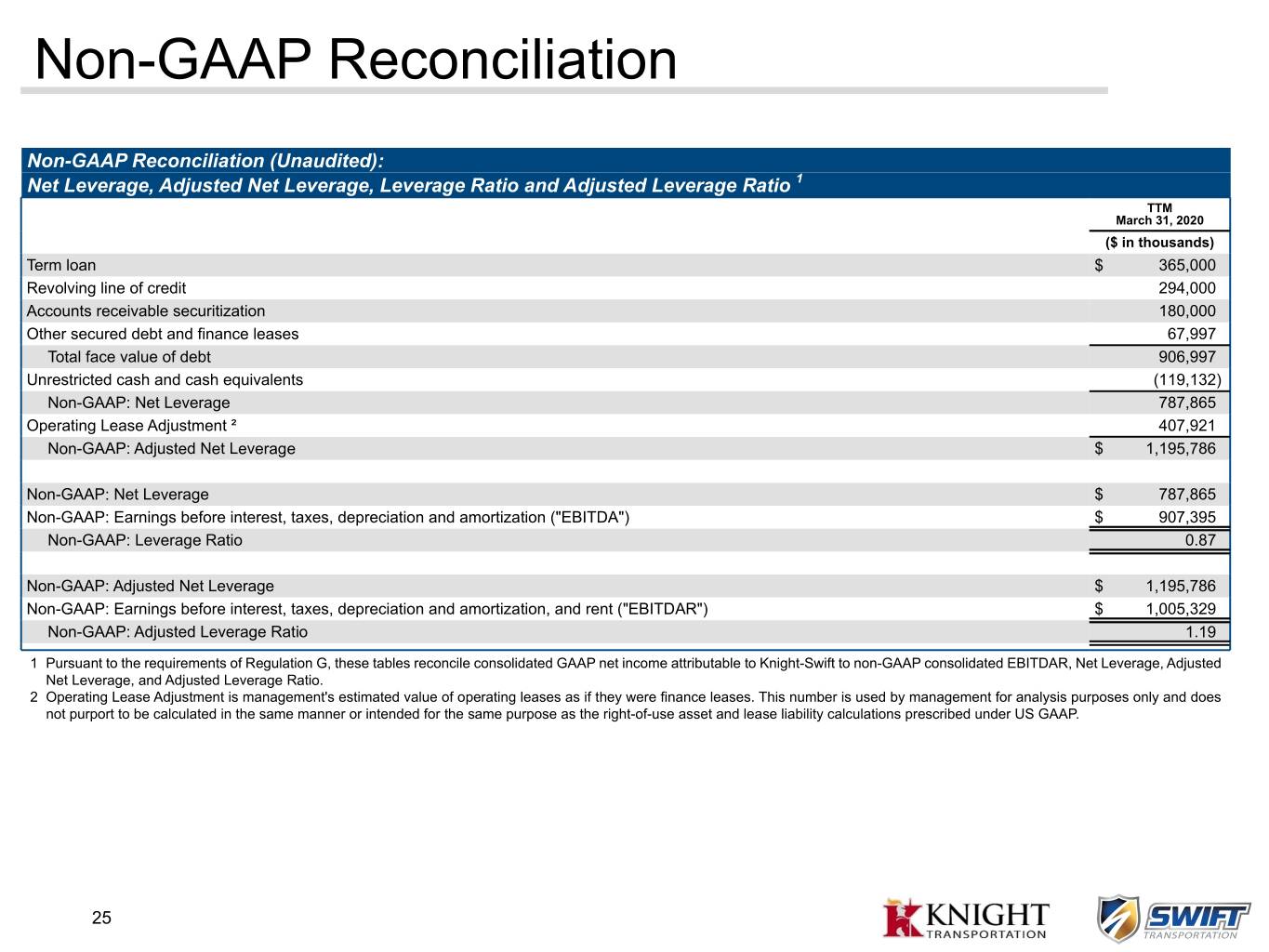

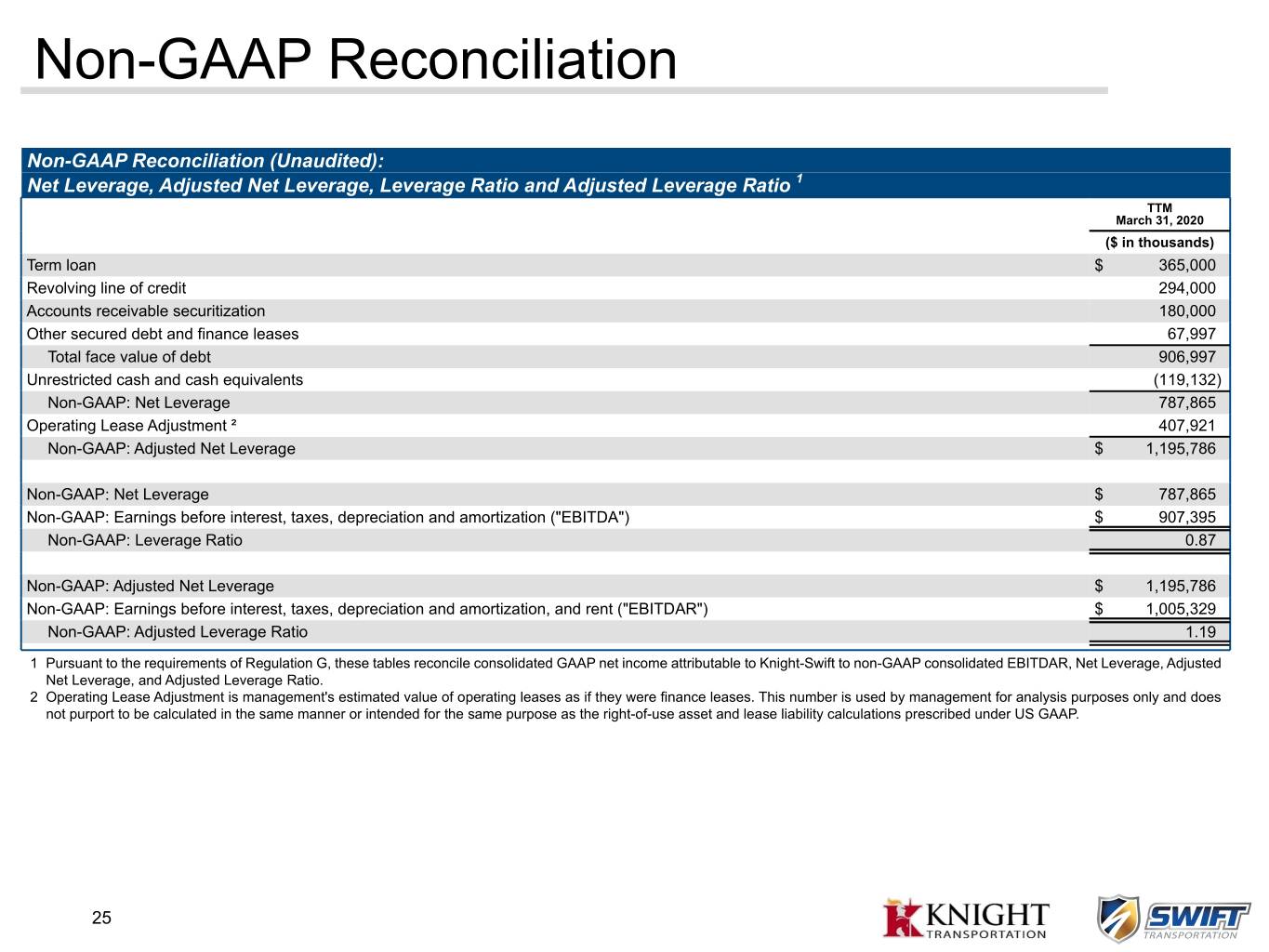

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Net Leverage, Adjusted Net Leverage, Leverage Ratio and Adjusted Leverage Ratio 1 TTM March 31, 2020 ($ in thousands) Term loan $ 365,000 Revolving line of credit 294,000 Accounts receivable securitization 180,000 Other secured debt and finance leases 67,997 Total face value of debt 906,997 Unrestricted cash and cash equivalents (119,132) Non-GAAP: Net Leverage 787,865 Operating Lease Adjustment ² 407,921 Non-GAAP: Adjusted Net Leverage $ 1,195,786 Non-GAAP: Net Leverage $ 787,865 Non-GAAP: Earnings before interest, taxes, depreciation and amortization ("EBITDA") $ 907,395 Non-GAAP: Leverage Ratio 0.87 Non-GAAP: Adjusted Net Leverage $ 1,195,786 Non-GAAP: Earnings before interest, taxes, depreciation and amortization, and rent ("EBITDAR") $ 1,005,329 Non-GAAP: Adjusted Leverage Ratio 1.19 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated EBITDAR, Net Leverage, Adjusted Net Leverage, and Adjusted Leverage Ratio. 2 Operating Lease Adjustment is management's estimated value of operating leases as if they were finance leases. This number is used by management for analysis purposes only and does not purport to be calculated in the same manner or intended for the same purpose as the right-of-use asset and lease liability calculations prescribed under US GAAP. 25

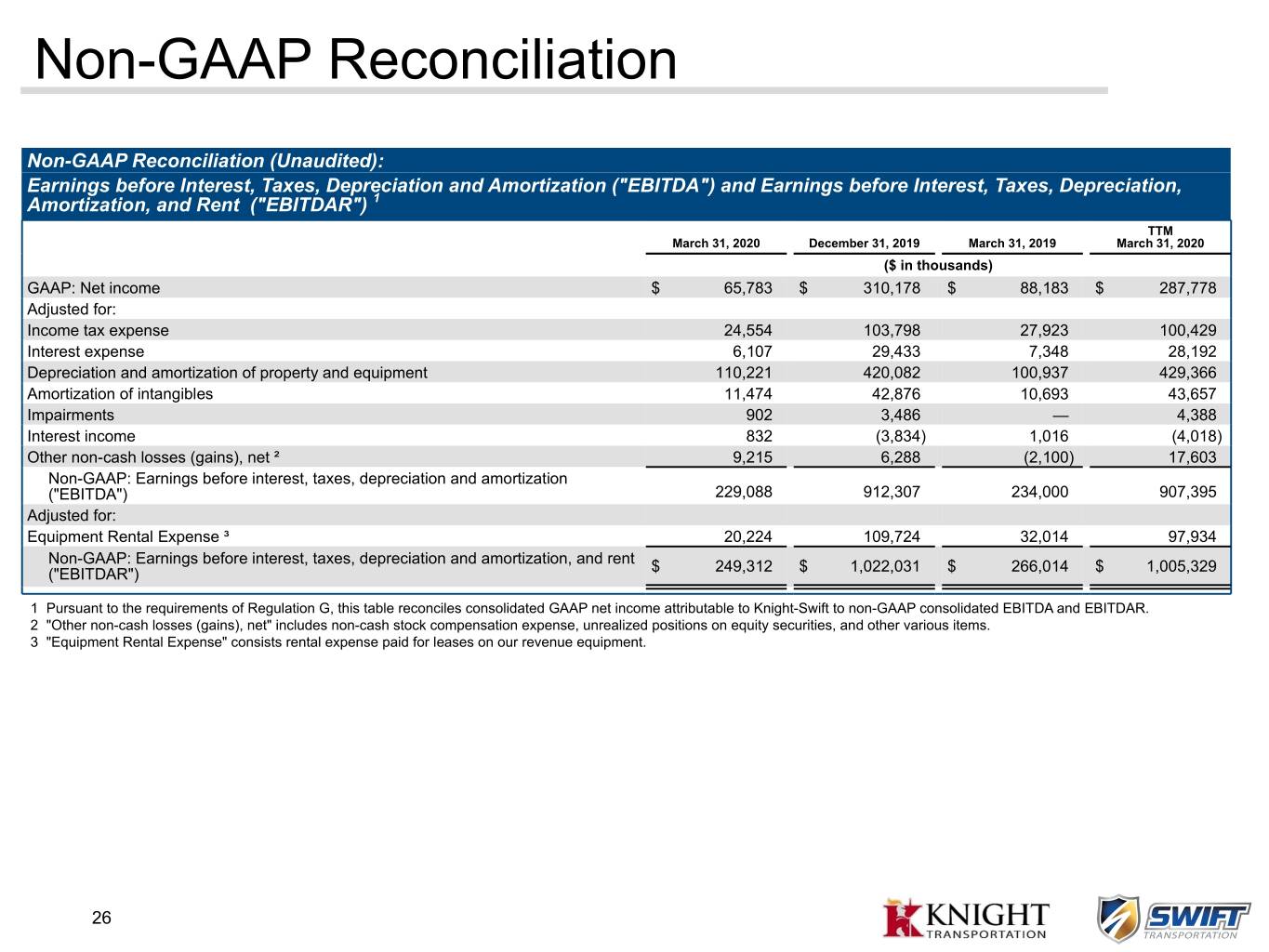

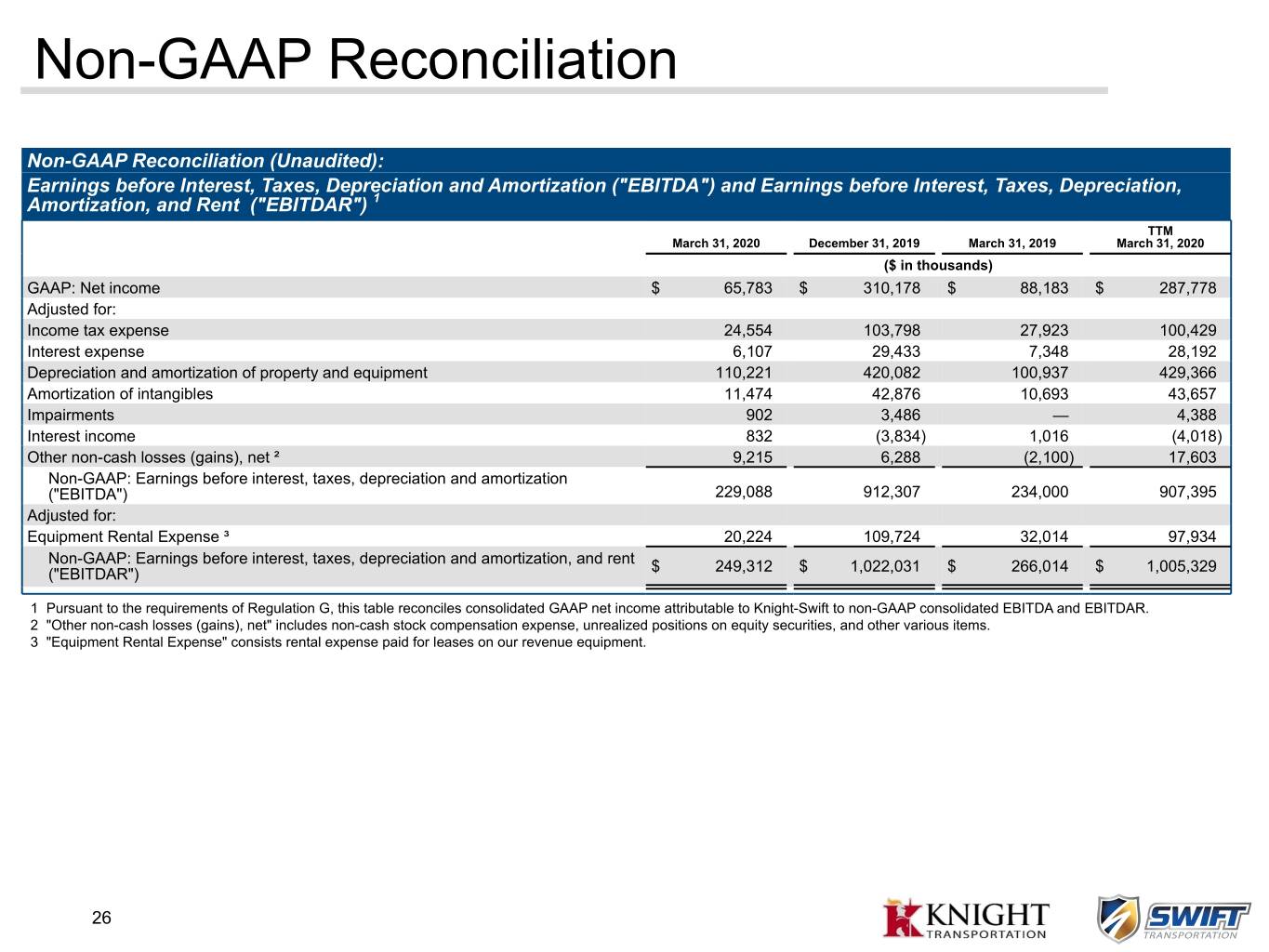

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA") and Earnings before Interest, Taxes, Depreciation, Amortization, and Rent ("EBITDAR") 1 TTM March 31, 2020 December 31, 2019 March 31, 2019 March 31, 2020 ($ in thousands) GAAP: Net income $ 65,783 $ 310,178 $ 88,183 $ 287,778 Adjusted for: Income tax expense 24,554 103,798 27,923 100,429 Interest expense 6,107 29,433 7,348 28,192 Depreciation and amortization of property and equipment 110,221 420,082 100,937 429,366 Amortization of intangibles 11,474 42,876 10,693 43,657 Impairments 902 3,486 — 4,388 Interest income 832 (3,834) 1,016 (4,018) Other non-cash losses (gains), net ² 9,215 6,288 (2,100) 17,603 Non-GAAP: Earnings before interest, taxes, depreciation and amortization ("EBITDA") 229,088 912,307 234,000 907,395 Adjusted for: Equipment Rental Expense ³ 20,224 109,724 32,014 97,934 Non-GAAP: Earnings before interest, taxes, depreciation and amortization, and rent $ $ $ $ ("EBITDAR") 249,312 1,022,031 266,014 1,005,329 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated EBITDA and EBITDAR. 2 "Other non-cash losses (gains), net" includes non-cash stock compensation expense, unrealized positions on equity securities, and other various items. 3 "Equipment Rental Expense" consists rental expense paid for leases on our revenue equipment. 26