Life is Complex

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

or

www.nuveen.com/accountaccess

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

| Table of Contents | |

| Chairman’s Letter to Shareholders | 4 |

| Portfolio Manager’s Comments | 5 |

| Fund Leverage | 9 |

| Common Share Information | 10 |

| Risk Considerations | 12 |

| Performance Overview and Holding Summaries | 13 |

| Report of Independent Registered Public Accounting Firm | 17 |

| Portfolios of Investments | 18 |

| Statement of Assets and Liabilities | 31 |

| Statement of Operations | 32 |

| Statement of Changes in Net Assets | 33 |

| Statement of Cash Flows | 34 |

| Financial Highlights | 36 |

| Notes to Financial Statements | 38 |

| Additional Fund Information | 49 |

| Glossary of Terms Used in this Report | 50 |

| Reinvest Automatically, Easily and Conveniently | 52 |

| Board Members & Officers | 53 |

NUVEEN 3

Chairman’s Letter to Shareholders

Dear Shareholders,

Whether politics or the economy will prevail over the financial markets this year has been a much-analyzed question. After the U.S. presidential election, stocks rallied to new all-time highs, bonds tumbled, and business and consumer sentiment grew pointedly optimistic. But, to what extent the White House can translate rhetoric into stronger economic and corporate earnings growth remains to be seen. Stock prices have experienced upward momentum driven by positive economic news, interest rates are higher amid the Federal Reserve (Fed) rate hikes and inflation is ticking higher.

The Trump administration's early policy decisions have caused the markets to reassess their outlooks, cooling the stock market rally and stabilizing bond prices. The White House's pro-growth agenda of tax reform, infrastructure spending and deregulation remains on the table, but there is growing recognition that it may look different than Wall Street had initially expected.

Nevertheless, there is a case for optimism. The jobs recovery, firming wages, the housing market and confidence measures are supportive of continued expansion in the economy. The Fed enacted its second and third interest rate hikes in December 2016 and March 2017, respectively, a vote of confidence that its employment and inflation targets are on track. Economies outside the U.S. have strengthened in recent months, possibly heralding the beginnings of a global synchronized recovery. Furthermore, the populist/nationalist undercurrent that helped deliver President Trump’s win and the U.K.’s decision to leave the European Union (or “Brexit”) remained in the minority in the Dutch general election in March and France’s presidential election in May, easing the political uncertainty surrounding Germany’s elections later this year.

In the meantime, the markets will be focused on economic sentiment surveys along with “hard” data such as consumer and business spending to gauge the economy’s progress. With the Fed now firmly in tightening mode, rate moves that are more aggressive than expected could spook the markets and potentially stifle economic growth. On the political economic front, President Trump’s other signature platform plank, protectionism, is arguably anti-growth. We expect some churning in the markets as these issues sort themselves out.

Market volatility readings have been remarkably low of late, but conditions can change quickly. As market conditions evolve, Nuveen remains committed to rigorously assessing opportunities and risks. If you’re concerned about how resilient your investment portfolio might be, we encourage you to talk to your financial advisor. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

William J. Schneider

Chairman of the Board

May 22, 2017

4 NUVEEN

Portfolio Manager’s Comments

Nuveen Build America Bond Fund (NBB)

Nuveen Build America Bond Opportunity Fund (NBD)

These Funds feature portfolio management by Nuveen Asset Management, LLC, an affiliate of Nuveen, LLC. Portfolio manager Daniel J. Close, CFA, reviews U.S. economic and municipal market conditions, key investment strategies and the twelve-month performance of the Nuveen Build America Bond Fund (NBB) and the Nuveen Build America Bond Opportunity Fund (NBD). Dan has managed NBB and NBD since their inceptions in April 2010 and November 2010, respectively.

What factors affected the U.S. economy and the national municipal market during the twelve-month reporting period ended March 31, 2017?

The U.S. economy continued to expand at its below-trend rate but showed some signs of strengthening in the latter months of the reporting period. For 2016 as a whole, the Bureau of Economic Analysis reported that the economy grew at an annual rate of 1.6%, as measured by real gross domestic product (GDP), which is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. Despite a boost in third-quarter GDP from a short-term jump in exports, economic activity in the other three calendar quarters of 2016 stayed near or below the 2% growth mark.

In the first quarter of 2017, growth slackened to an annual rate of 0.7%, tempered by a slowdown in consumer and government spending, according to the government’s “advance” estimate. The deceleration in first-quarter GDP growth, followed by a reaccel-eration in the spring and summer, has been a trend over the past few years. Moreover, other signs of positive momentum remain. The labor market continued to tighten, inflation ticked higher, and consumer and business confidence surveys reflected optimism about the economy’s prospects. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 4.5% in March 2017 from 5.0% in March 2016 and job gains averaged around 200,000 per month for the past twelve months. Higher oil prices helped drive a steady increase in inflation over this reporting period. The twelve-month change in the Consumer Price Index (CPI) rose from the low of 0.8% in July 2016 to 2.4% over the twelve-month reporting period ended March 2017 on a seasonally adjusted basis, as reported by the U.S. Bureau of Labor Statistics. The core CPI (which excludes food and energy) increased 2.0% during the same period, equal to the Federal Reserve’s (Fed) unofficial longer term inflation objective of 2.0%. The housing market also continued to improve, with historically low mortgage rates and low inventory driving home prices higher. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 5.8% annual gain in February 2017 (most recent data available at the time this report was prepared) (effective July 26, 2016, the S&P/Case-Shiller U.S. National Home Price Index was renamed the S&P CoreLogic Case-Shiller U.S. National Home Price Index). The 10-City and 20-City Composites reported year-over-year increases of 5.2% and 5.9%, respectively.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Certain bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

NUVEEN 5

Portfolio Manager’s Comments (continued)

The U.S. economic outlook struck a more optimistic tone, prompting the Fed’s policy making committee to raise its main benchmark interest rate in December 2016 and again in March 2017. These moves were widely expected by the markets and additional increases are anticipated in 2017 as the Fed seeks to gradually “normalize” interest rates.

The political environment was another major influence on the markets over the reporting period. In the U.S., the surprising election of Donald Trump boosted consumer, business and market sentiment, on hopes that President Trump’s policy agenda of tax reform, infrastructure spending and reduced regulation would reignite the economy. While U.S. stocks rallied particularly strongly in the months following the election, the advance slowed as concerns about the new administration’s immigration policy and the Republican’s health care bill began to weigh on the markets. Prior to the U.S. presidential election, Britain’s vote to leave the European Union, known as Brexit, roiled the markets in late June and July 2016. Although world stock markets largely recovered, sterling dropped to a 31-year low and remained volatile as the U.K. prepared for exit negotiations. Investors also worried whether the undercurrent of populism and nationalism supporting President Trump and Brexit victories could spread across Europe, where several countries have key elections in 2017.

The municipal bond market encountered elevated volatility over the twelve-month reporting period, driven by a sell-off and widening credit spreads following the surprise election results. Prior to the election, municipal bond mutual funds had been drawing steady inflows from September 2015 to October 2016, which kept demand outpacing supply and supported prices. However, beginning in mid-October, demand began to soften in anticipation of a Fed rate hike. Municipal bond prices continued to fall in November after President Trump’s win triggered rising inflation and interest rate expectations as well as speculation on tax code changes, and in December 2016 due to tax-loss selling. A sharp rise in interest rates after the election fueled a reversal in municipal bond fund flow. Municipal bond funds experienced large outflows in the fourth quarter of 2016, especially in the high yield municipal segment, which drove mutual fund managers to sell positions to help meet investor redemptions. At the same time, new issuance spiked in October 2016, further contributing to excess supply and exacerbating falling prices and credit spread widening. However, stabilizing market conditions in December gave way to a rally in the first quarter of 2017. Concerns that the new administration’s fiscal, tax and health care policy agenda could have a potentially negative impact on municipal bonds eased somewhat. By the end of the reporting period, interest rates stayed at a higher level than where they began.

In the reporting period overall, municipal bond issuance nationwide totaled $432.7 billion, an 11.2% gain from the issuance for the twelve-month period ended March 31, 2016. Gross issuance remains robust as issuers continue to actively and aggressively refund their outstanding debt given the low interest rate environment. In these transactions the issuers are issuing new bonds and taking the bond proceeds and redeeming (calling) old bonds. These refunding transactions have ranged from 40%-60% of total issuance over the past few years. Thus, the net issuance (all bonds issued less bonds redeemed) is actually much lower than the gross issuance. In fact, the total municipal bonds outstanding has actually declined in each of the past four calendar years. So, the gross is surging, but the net is not and this was an overall positive technical factor on municipal bond investment performance in recent years. However, as interest rates moved higher, the pace of refunding deals began to moderate.

Although the municipal bond market experienced widening credit spreads over a short period after the election, the trend was more attributable to technical conditions than a change in the fundamental backdrop. Despite the U.S. economy’s rather sluggish recovery, improving state and local balance sheets have contributed to generally good credit fundamentals. Higher tax revenue growth, better expense management and a more cautious approach to new debt issuance have led to credit upgrades and stable credit outlooks for many state and local issuers. While some pockets of weakness continued to grab headlines, including Illinois, New Jersey and Puerto Rico, their problems were largely contained, with minimal spillover into the broader municipal market.

What key strategies were used to manage these Funds during the twelve-month reporting period ended March 31, 2017?

Build America Bonds (BAB) posted a small gain for the twelve-month reporting period. A sell-off across fixed income assets after the surprise election results dampened BAB performance as well, but market conditions stabilized and bond markets rallied as 2017 began.

6 NUVEEN

NBB and NBD are designed to invest primarily in BABs and other taxable municipal bonds. The primary investment objective of these two Funds is to provide current income through investments in taxable municipal securities. Their secondary objective is to seek enhanced portfolio value and total return. The Funds offer strategic portfolio diversification opportunities for traditional municipal bond investors, while providing investment options to investors that have not traditionally purchased municipal bonds, including public and corporate retirement plans, endowments, life insurance companies and sovereign wealth funds. For these investors, the Funds can offer investment grade municipal credit, current income and some security issuers typically offer call protection. With the end of the BAB new issuance program in 2010, our focus continued to be on taking advantage of opportunities to add value and improve the liquidity profiles of both NBB and NBD by purchasing additional benchmark BAB issues in the secondary market. Benchmark BAB issues, which typically offer more liquidity than their non-benchmark counterparts, are defined as BABs over $300 million and greater in size and therefore eligible for inclusion in the Bloomberg Barclays Aggregate-Eligible Build America Bond Index. Their greater liquidity makes them potentially easier to sell at Fund termination. In contrast, non-benchmark BABs generally are smaller issues that may offer the same credit quality as benchmark BABs, but sometimes require more detailed credit reviews before purchase and consequently may be less liquid.

Overall, our strategy during this reporting period was to continue to add value by pursuing active management. In the first half of the reporting period, we bought a mix of benchmark and non-benchmark BABs but later focused on adding to existing positions in benchmark BABs. We also favored bonds with higher coupon, shorter call structures, which we believe offered an optimal balance of yield for the level of interest rate risk taken. Cash for purchases came from the proceeds generated by the Funds’ hedging strategy (described in the performance discussion) and from selling longer duration bonds, including a Chicago Board of Education local general obligation bond.

Shareholders should note that, because there was no new issuance of BABs or similar U.S. Treasury-subsidized taxable municipal bonds for the 24-month period ended December 31, 2012, the Funds’ contingent term provisions went into effect on January 1, 2013. During the reporting period ended March 31, 2017, NBB and NBD were managed in line with termination dates on or around June 30, 2020, and December 31, 2020, respectively, with the distribution of the Funds’ assets to shareholders planned for those times. We continued our efforts to maximize the Funds’ liquidity and better position NBB and NBD for termination. Even though the Funds are scheduled to terminate, we believe the opportunity still exists to add value for the shareholders of these Funds through active management and strong credit research.

How did these Funds perform over the twelve-month reporting period ended March 31, 2017?

The tables in each Fund's Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the one-year, five-year and since-inception periods ended March 31, 2017. Each Fund's total returns are compared with the performance of a corresponding market index.

For the twelve-month reporting period ended March 31, 2017, the total returns on common share net asset value (NAV) for NBB and NBD outperformed the return for the Bloomberg Barclays Aggregate-Eligible Build America Bond Index.

Key management factors that influenced the returns of NBB and NBD during this reporting period included duration and yield curve positioning, credit exposure, sector allocation and the use of derivatives. Duration and yield curve positioning contributed positively to the two Funds’ relative performance. NBB was helped by its overweight allocation to two- to four-year duration bonds and NBD benefited from an overweight allocation to 10- to 12-year duration bonds, as these two segments were the top performing duration buckets in the index. The Funds’ credit ratings allocations were also favorable to performance in this reporting period, with exposures to AA rated and unrated credits boosting relative results. Sector allocations remained well diversified but underperformed during this reporting period.

As part of their approach to investing, NBB and NBD use an integrated leverage and hedging strategy in their efforts to enhance current income and total return, while working to maintain a level of interest rate risk similar to that of the Bloomberg Barclays Aggregate Eligible Build America Bond Index. As part of this integrated strategy, both NBB and NBD used inverse floating rate securities and bank borrowings as leverage to potentially magnify performance. At the same time, the Funds used interest rate swaps to

NUVEEN 7

Portfolio Manager’s Comments (continued)

reduce their leverage-adjusted durations to a level close to that of the Bloomberg Barclays Aggregate-Eligible Build America Bond Index. In addition, the Funds entered into staggered interest rate swaps to partially fix the interest cost of leverage. During this reporting period, the inverse floaters and interest rate swaps performed as expected. Due to the path of interest rates over this reporting period, the use of inverse floaters and the use of swaps to shorten long-term interest rates helped the Funds’ total return performance for the reporting period. Leverage is discussed in more detail later in this report.

Given the continued news about economic problems in Puerto Rico, we should note that neither NBB nor NBD has any exposure to Puerto Rico BABs.

A Note About Investment Valuations

The municipal securities held by the Funds are valued by the Funds’ pricing service using a range of market-based inputs and assumptions. A different municipal pricing service might incorporate different assumptions and inputs into its valuation methodology, potentially resulting in different values for the same securities. These differences could be significant, both as to such individual securities, and as to the value of a given Fund’s portfolio in its entirety. Thus, the current net asset value of a Fund’s shares may be impacted, higher or lower, if the Fund were to change its pricing service, or if its pricing service were to materially change its valuation methodology. On October 4, 2016, the Funds’ current municipal bond pricing service was acquired by the parent company of another pricing service. The two services have not yet combined their valuation organizations and process, but they announced in March 2017, that they anticipate doing so sometime in the ensuing several months. Such changes could have an impact on the net asset value of the Fund’s shares.

8 NUVEEN

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the returns of the Funds relative to their comparative benchmark was the Funds’ use of leverage through bank borrowings and investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments have been much lower than the interest the Fund has been earning on its portfolio of long-term bonds that it has bought with the proceeds of that leverage. However, use of leverage also can expose the Fund to additional price volatility. When a Fund uses leverage, the Fund will experience a greater increase in its net asset value if the municipal bonds acquired through the use of leverage increase in value, but it will also experience a correspondingly larger decline in its net asset value if the bonds acquired through leverage decline in value, which will make the Fund’s net asset value more volatile, and its total return performance more variable over time. In addition, income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. As mentioned previously, inverse floaters contributed positively to the performance of the Funds over this reporting period. The Funds’ borrowings also contributed positively to performance over this reporting period.

| As of March 31, 2017, the Funds’ percentages of leverage are as shown in the accompanying table. | ||

| NBB | NBD | |

| Effective Leverage* | 28.74% | 29.35% |

| Regulatory Leverage* | 13.73% | 7.02% |

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

Bank Borrowings

The Funds employ regulatory leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown int he accompanying table.

| Subsequent to the Close | ||||||||||||||||||||||||||||||||

| Current Reporting Period | of the Reporting Period | |||||||||||||||||||||||||||||||

| Average Balance | ||||||||||||||||||||||||||||||||

| Fund | April 1, 2016 | Draws | Paydowns | March 31, 2017 | Outstanding | Draws | Paydowns | May 25, 2017 | ||||||||||||||||||||||||

| NBB | $ | 89,500,000 | $ | 675,000 | $ | — | $ | 90,175,000 | $ | 90,064,041 | $ | — | $ | — | $ | 90,175,000 | ||||||||||||||||

| NBD | $ | 11,800,000 | $ | 200,000 | $ | — | $ | 12,000,000 | $ | 11,967,123 | $ | — | $ | — | $ | 12,000,000 | ||||||||||||||||

| Refer to Notes to Financial Statements, Note 8 - Borrowing Arrangements for further details. |

NUVEEN 9

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of March 31, 2017. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| Per Common | ||||||||

| Share Amounts | ||||||||

| Monthly Distributions (Ex-Dividend Date) | NBB | NBD | ||||||

| April 2016 | $ | 0.1120 | $ | 0.1085 | ||||

| May | 0.1120 | 0.1085 | ||||||

| June | 0.1080 | 0.1035 | ||||||

| July | 0.1080 | 0.1035 | ||||||

| August | 0.1080 | 0.1035 | ||||||

| September | 0.1080 | 0.1035 | ||||||

| October | 0.1080 | 0.1035 | ||||||

| November | 0.1080 | 0.1035 | ||||||

| December | 0.1030 | 0.0955 | ||||||

| January | 0.1030 | 0.0955 | ||||||

| Febuary | 0.1030 | 0.0955 | ||||||

| March 2017 | 0.1030 | 0.0955 | ||||||

| Total Distributions from Net Investment Income | $ | 1.2840 | $ | 1.2200 | ||||

| Yields | ||||||||

| Market Yield* | 5.91 | % | 5.30 | % | ||||

| * Market Yield is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price as of the end of the reporting period. | ||||||||

Each Fund in this report seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. If a Fund has cumulatively earned more than it has paid in dividends, it will hold the excess in reserve as undistributed net investment income (UNII) as part of the Fund’s net asset value. Conversely, if a Fund has cumulatively paid in dividends more than it has earned, the excess will constitute a negative UNII that will likewise be reflected in the Fund’s net asset value. Each Fund will, over time, pay all its net investment income as dividends to shareholders.

As of March 31, 2017, the Funds had positive UNII balances for tax purposes and negative UNII balances for financial reporting purposes.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions was sourced from or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders would have received a notice to that effect. For financial reporting purposes, the composition and per share amounts of each Fund’s dividends for the reporting period are presented in this report’s Statement of

10 NUVEEN

Changes in Net Assets and Financial Highlights, respectively. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 — Income Tax Information within the Notes to Financial Statements of this report.

COMMON SHARE REPURCHASES

During August 2016, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of March 31, 2017, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| NBB | NBD | |||||||

| Common shares cumulatively repurchased and retired | 0 | 0 | ||||||

| Common shares authorized for repurchase | 2,645,000 | 720,000 | ||||||

OTHER COMMON SHARE INFORMATION

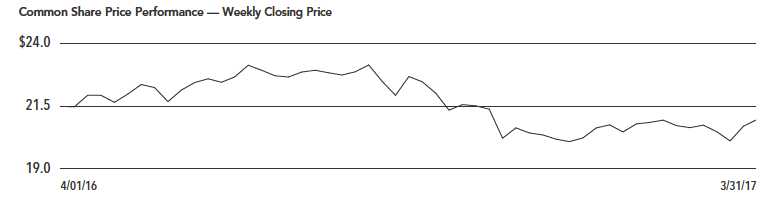

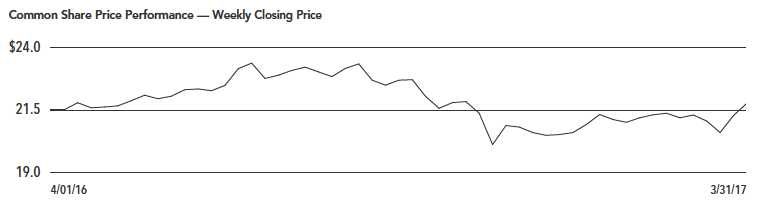

As of March 31, 2017, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| NBB | NBD | |||||||

| Common share NAV | $ | 21.41 | $ | 22.05 | ||||

| Common share price | $ | 20.90 | $ | 21.63 | ||||

| Premium/(Discount) to NAV | (2.38 | )% | (1.90 | )% | ||||

| 12-month average premium/(discount) to NAV | (3.09 | )% | (4.76 | )% | ||||

NUVEEN 11

| Average Annual | |||

| Since | |||

| 1-Year | 5-Year | Inception | |

| NBB at Common Share NAV | 2.66% | 6.33% | 8.23% |

| NBB at Common Share Price | 2.70% | 7.52% | 7.54% |

| Bloomberg Barclays Aggregate – Eligible Build America Bond Index | 1.30% | 5.74% | 8.23% |

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 120.5% |

| Corporate Bonds | 0.5% |

| Other Assets Less Liabilities | 3.3% |

| Net Assets Plus Borrowings | |

| & Floating Rate Obligations | 124.3% |

| Borrowings | (15.9)% |

| Floating Rate Obligations | (8.4)% |

| Net Assets | 100% |

| Portfolio Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 12.9% |

| AA | 55.6% |

| A | 19.8% |

| BBB | 6.1% |

| BB or Lower | 3.3% |

| N/R (not rated) | 2.3% |

| Total | 100% |

| Portfolio Composition | |

| (% of total investments) | |

| Tax Obligation/Limited | 30.0% |

| Transportation | 20.9% |

| Tax Obligation/General | 15.4% |

| Utilities | 13.4% |

| Water and Sewer | 12.6% |

| Other | 7.7% |

| Total | 100% |

| States and Territories | ||

| (% of total municipal bonds) | ||

| California | 22.7% | |

| New York | 14.5% | |

| Texas | 9.1% | |

| Illinois | 7.7% | |

| Ohio | 6.5% | |

| Nevada | 4.6% | |

| Georgia | 4.4% | |

| Virginia | 3.7% | |

| New Jersey | 3.5% | |

| Louisiana | 3.3% | |

| Other | 20.0% | |

| Total | 100% | |

| Average Annual | |||

| Since | |||

| 1-Year | 5-Year | Inception | |

| NBD at Common Share NAV | 3.39% | 5.38% | 8.47% |

| NBD at Common Share Price | 6.25% | 7.05% | 7.85% |

| Bloomberg Barclays Aggregate – Eligible Build America Bond Index | 1.30% | 5.74% | 9.00% |

| Fund Allocation | |

| (% of net assets) | |

| Long-Term Municipal Bonds | 104.7% |

| Corporate Bonds | 0.8% |

| Other Assets Less Liabilities | 5.4% |

| Net Assets Plus Borrowings | |

| & Floating Rate Obligations | 110.9% |

| Borrowings | (7.5)% |

| Floating Rate Obligations | (3.4)% |

| Net Assets | 100% |

| Portfolio Credit Quality | |

| (% of total investment exposure) | |

| AAA/U.S. Guaranteed | 14.4% |

| AA | 62.7% |

| A | 11.5% |

| BBB | 3.5% |

| BB or Lower | 5.2% |

| N/R (not rated) | 2.7% |

| Total | 100% |

| Portfolio Composition | |

| (% of total investments) | |

| Tax Obligation/Limited | 36.0% |

| Transportation | 17.5% |

| Water and Sewer | 13.2% |

| Tax Obligation/General | 12.7% |

| Utilities | 10.0% |

| Consumer Staples | 4.5% |

| Other | 6.1% |

| Total | 100% |

| States and Territories | |

| (% of total municipal bonds) | |

| California | 22.2% |

| New York | 12.2% |

| Illinois | 10.3% |

| Ohio | 6.9% |

| Texas | 6.6% |

| Colorado | 5.0% |

| New Jersey | 4.7% |

| South Carolina | 4.6% |

| Tennessee | 3.2% |

| Virginia | 3.0% |

| Massachusetts | 2.8% |

| Other | 18.5% |

| Total | 100% |

Nuveen Build America Bond Fund

Nuveen Build America Bond Opportunity Fund:

Chicago, Illinois

May 25, 2017

| NBB | |

| Nuveen Build America Bond Fund | |

| Portfolio of Investments | March 31, 2017 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| LONG-TERM INVESTMENTS – 121.0% (100.0% of Total Investments) | |||||

| MUNICIPAL BONDS – 120.5% (99.6% of Total Investments) | |||||

| Arizona – 1.0% (0.8% of Total Investments) | |||||

| $ 5,000 | Mesa, Arizona, Utility System Revenue Bonds, Series 2010, 6.100%, 7/01/34 | 7/20 at 100.00 | Aa2 | $ 5,594,500 | |

| California – 27.4% (22.6% of Total Investments) | |||||

| 2,520 | Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding Taxable | No Opt. Call | BBB+ | 1,218,445 | |

| Subordinate Lien Series 2004B, 0.000%, 10/01/31 – AMBAC Insured | |||||

| 1,995 | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, Build | No Opt. Call | AA | 2,731,135 | |

| America Federally Taxable Bond Series 2009F-2, 6.263%, 4/01/49 | |||||

| Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, | |||||

| Subordinate Lien, Build America Federally Taxable Bond Series 2010S-1: | |||||

| 75 | 6.793%, 4/01/30 | No Opt. Call | AA– | 91,709 | |

| 100 | 6.918%, 4/01/40 | No Opt. Call | AA– | 135,691 | |

| 500 | California Infrastructure and Economic Development Bank, Revenue Bonds, University of | No Opt. Call | AA– | 630,005 | |

| California San Francisco Neurosciences Building, Build America Taxable Bond Series 2010B, | |||||

| 6.486%, 5/15/49 | |||||

| 260 | California Municipal Finance Authority Charter School Revenue Bonds, Albert Einstein Academies | No Opt. Call | B+ | 258,375 | |

| Project, Taxable Series 2013B, 7.000%, 8/01/18 | |||||

| 395 | California School Finance Authority, Charter School Revenue Bonds, City Charter School | No Opt. Call | N/R | 390,939 | |

| Obligated Group, Taxable Series 2016B, 3.750%, 6/01/20 | |||||

| 3,030 | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | No Opt. Call | A+ | 4,376,381 | |

| America Taxable Bond Series 2009G-2, 8.361%, 10/01/34 | |||||

| 2,050 | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | 3/20 at 100.00 | A+ | 2,284,889 | |

| America Taxable Bond Series 2010A-2, 8.000%, 3/01/35 | |||||

| 7,000 | California State University, Systemwide Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | Aa2 | 8,836,170 | |

| 2010B, 6.484%, 11/01/41 | |||||

| 7,115 | California State, General Obligation Bonds, Various Purpose Build America Taxable Bond Series | 3/20 at 100.00 | AA– | 8,210,781 | |

| 2010, 7.950%, 3/01/36 | |||||

| 6,610 | California State, General Obligation Bonds, Various Purpose, Build America Taxable Bond Series | No Opt. Call | AA– | 9,887,304 | |

| 2010, 7.600%, 11/01/40 | |||||

| 3,000 | California State, Various Purpose General Obligation Bonds, Build America Federally Taxable | No Opt. Call | AA– | 4,405,920 | |

| Bonds, Series 2009, 7.550%, 4/01/39 | |||||

| 9,185 | California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda | No Opt. Call | BB+ | 9,703,401 | |

| University Medical Center, Series 2014B, 6.000%, 12/01/24 | |||||

| 7,500 | Los Angeles Community College District, California, General Obligation Bonds, Build America | No Opt. Call | AA+ | 10,413,450 | |

| Taxable Bonds, Series 2010, 6.600%, 8/01/42 | |||||

| 10,000 | Los Angeles Community College District, Los Angeles County, California, General Obligation | No Opt. Call | AA+ | 13,884,600 | |

| Bonds, Series 2010, 6.600%, 8/01/42 (UB) (4) | |||||

| 6,000 | Los Angeles County Metropolitan Transportation Authority, California, Measure R Sales Tax | No Opt. Call | AAA | 7,402,620 | |

| Revenue Bonds, Build America Taxable Bond Series 2010A, 5.735%, 6/01/39 | |||||

| Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds, Multiple | |||||

| Capital Projects I, Build America Taxable Bond Series 2010B: | |||||

| 2,050 | 7.488%, 8/01/33 | No Opt. Call | AA | 2,746,057 | |

| 11,270 | 7.618%, 8/01/40 | No Opt. Call | AA | 16,352,094 | |

| 9,740 | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International | No Opt. Call | AA– | 12,474,408 | |

| Airport, Build America Taxable Bonds, Series 2009C, 6.582%, 5/15/39 | |||||

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

California (continued) | |||||

| Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Federally | |||||

| Taxable – Direct Payment – Build America Bonds, Series 2010A: | |||||

| $ 80 | 5.716%, 7/01/39 | No Opt. Call | Aa2 | $ 98,316 | |

| 2,840 | 6.166%, 7/01/40 | 7/20 at 100.00 | Aa2 | 3,176,796 | |

| 1,685 | Los Angeles Department of Water and Power, California, Power System Revenue Bonds, Federally | No Opt. Call | Aa2 | 2,332,023 | |

| Taxable – Direct Payment – Build America Bonds, Series 2010D, 6.574%, 7/01/45 | |||||

| 2,000 | Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Tender | No Opt. Call | AA+ | 6,037,800 | |

| Option Bond Trust 2016-XFT906, 26.890%, 7/01/50 (IF) (4) | |||||

| 1,500 | Metropolitan Water District of Southern California, Water Revenue Bonds, Build America Taxable | 7/19 at 100.00 | AAA | 1,642,710 | |

| Bond Series 2009D, 6.538%, 7/01/39 | |||||

| 1,000 | Metropolitan Water District of Southern California, Water Revenue Bonds, Build America Taxable | 7/20 at 100.00 | AAA | 1,137,260 | |

| Series 2010A, 6.947%, 7/01/40 | |||||

| 2,330 | Oakland Redevelopment Agency, California, Subordinated Housing Set Aside Revenue Bonds, | No Opt. Call | A+ | 2,457,940 | |

| Federally Taxable Series 2011A-T, 7.500%, 9/01/19 | |||||

| 4,250 | Sacramento Public Financing Authority, California, Lease Revenue Bonds, Golden 1 Center, | No Opt. Call | A+ | 4,627,698 | |

| Series 2015, 5.637%, 4/01/50 | |||||

| 2,390 | San Francisco City and County Public Utilities Commission, California, Water Revenue Bonds, | No Opt. Call | AA– | 2,923,615 | |

| Build America Taxable Bonds, Series 2010B, 6.000%, 11/01/40 | |||||

| 4,000 | San Francisco City and County, California, Certificates of Participation, 525 Golden Gate | No Opt. Call | AA | 8,995,600 | |

| Avenue, San Francisco Public Utilities Commission Office Project, Tender Option Bond | |||||

| 2016-XFT901, 25.439%, 11/01/41 (IF) (4) | |||||

| Stanton Redevelopment Agency, California, Tax Allocation Bonds, Stanton Consolidated | |||||

| Redevelopment Project Series 2011A: | |||||

| 275 | 6.500%, 12/01/17 (ETM) | No Opt. Call | A (5) | 284,804 | |

| 295 | 6.750%, 12/01/18 (ETM) | No Opt. Call | A (5) | 321,391 | |

| 1,500 | University of California, General Revenue Bonds, Build America Taxable Bonds, Series 2009R, | 5/19 at 100.00 | AA | 1,630,035 | |

| 6.270%, 5/15/31 | |||||

| 2,505 | University of California, General Revenue Bonds, Limited Project, Build America Taxable Bond | No Opt. Call | AA– | 3,096,506 | |

| Series 2010F, 5.946%, 5/15/45 | |||||

| 117,045 | Total California | 155,196,868 | |||

| Colorado – 0.7% (0.6% of Total Investments) | |||||

| 3,100 | Denver School District 1, Colorado, General Obligation Bonds, Build America Taxable Bonds, | No Opt. Call | AA+ | 3,763,338 | |

| Series 2009C, 5.664%, 12/01/33 | |||||

| Connecticut – 1.3% (1.1% of Total Investments) | |||||

| 6,300 | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation Revenue | 4/20 at 100.00 | N/R | 7,289,352 | |

| Bonds, Harbor Point Project, Federally Taxable – Issuer Subsidy – Recovery Zone Economic | |||||

| Development Bond Series 2010B, 12.500%, 4/01/39 | |||||

| District of Columbia – 0.2% (0.2% of Total Investments) | |||||

| 1,000 | District of Columbia Water and Sewer Authority, Public Utility Revenue Bonds, Subordinate | No Opt. Call | AA+ | 1,206,280 | |

| Lien, Build America Taxable Bond Series 2010A, 5.522%, 10/01/44 | |||||

| Florida – 0.9% (0.8% of Total Investments) | |||||

| 5,000 | Florida State Board of Education, Public Education Capital Outlay Bonds, Build America Taxable | 6/19 at 100.00 | AAA | 5,363,500 | |

| Bonds, Series 2010G, 5.750%, 6/01/35 |

| NBB | Nuveen Build America Bond Fund | |

Portfolio of Investments (continued) | March 31, 2017 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| Georgia – 5.3% (4.4% of Total Investments) | |||||

| $ 2,500 | Cobb-Marietta Coliseum and Exhibit Hall Authority, Georgia, Revenue Bonds, Cobb County | 1/26 at 100.00 | AAA | $ 2,603,575 | |

| Coliseum Project, Taxable Series 2015, 4.500%, 1/01/47 | |||||

| 9,000 | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project J Bonds, Taxable Build | No Opt. Call | A+ | 10,265,400 | |

| America Bonds Series 2010A, 6.637%, 4/01/57 | |||||

| 1,120 | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project M Bonds, Taxable Build | No Opt. Call | A+ | 1,263,259 | |

| America Bonds Series 2010A, 6.655%, 4/01/57 | |||||

| 15,000 | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project P Bonds, Refunding | No Opt. Call | A– | 15,829,050 | |

| Taxable Build America Bonds Series 2010A, 7.055%, 4/01/57 | |||||

| 27,620 | Total Georgia | 29,961,284 | |||

| Illinois – 9.3% (7.7% of Total Investments) | |||||

| 865 | Chicago Transit Authority, Illinois, Sales and Transfer Tax Receipts Revenue Bonds, Pension | No Opt. Call | AA | 1,081,068 | |

| Funding Taxable Series 2008A, 6.899%, 12/01/40 | |||||

| 7,735 | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Federally Taxable Build | No Opt. Call | AA | 9,100,537 | |

| America Bonds, Series 2010B, 6.200%, 12/01/40 | |||||

| Chicago, Illinois, General Airport Revenue Bonds, O’Hare International Airport, Third Lien, | |||||

| Build America Taxable Bond Series 2010B: | |||||

| 10,925 | 6.845%, 1/01/38 | 1/20 at 100.00 | A | 12,196,998 | |

| 355 | 6.395%, 1/01/40 | No Opt. Call | A | 467,471 | |

| 135 | Chicago, Illinois, Wastewater Transmission Revenue Bonds, Build America Taxable Bond Series | No Opt. Call | AA | 167,453 | |

| 2010B, 6.900%, 1/01/40 | |||||

| 14,000 | Illinois State, General Obligation Bonds, Taxable Build America Bonds, Series 2010-3, | No Opt. Call | BBB | 14,387,940 | |

| 6.725%, 4/01/35 | |||||

| 8,090 | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Build America Taxable Bonds, | No Opt. Call | AA– | 10,232,717 | |

| Senior Lien Series 2009A, 6.184%, 1/01/34 | |||||

| 1,595 | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Build America Taxable Bonds, | No Opt. Call | AA– | 1,982,537 | |

| Senior Lien Series 2009B, 5.851%, 12/01/34 | |||||

| 2,000 | Lake County, Illinois, General Obligation Bonds, Series 2010A, 5.125%, 11/30/27 | 11/19 at 100.00 | AAA | 2,154,960 | |

| 685 | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, | No Opt. Call | A2 | 871,628 | |

| Build America Taxable Bond Series 2010A, 7.820%, 1/01/40 | |||||

| 46,385 | Total Illinois | 52,643,309 | |||

| Indiana – 2.6% (2.1% of Total Investments) | |||||

| 5,000 | Indiana University, Consolidated Revenue Bonds, Build America Taxable Bonds, Series 2010B, | 6/20 at 100.00 | AAA | 5,397,800 | |

| 5.636%, 6/01/35 | |||||

| 5,000 | Indianapolis Local Public Improvement Bond Bank, Indiana, Build America Bonds, Series 2010A-2, | No Opt. Call | Aa1 | 6,218,050 | |

| 6.004%, 1/15/40 | |||||

| 2,390 | Indianapolis Local Public Improvement Bond Bank, Indiana, Build America Taxable Bonds, Series | No Opt. Call | AA | 3,008,413 | |

| 2010B-2, 6.116%, 1/15/40 | |||||

| 12,390 | Total Indiana | 14,624,263 | |||

| Kentucky – 1.7% (1.4% of Total Investments) | |||||

| 5,000 | Kentucky Municipal Power Agency, Power System Revenue Bonds, Prairie State Project, Tender | 9/20 at 100.00 | AA | 7,185,000 | |

| Option Bond Trust 2016-XFT902, 25.129%, 9/01/37 – AGC Insured (IF) (4) | |||||

| 1,950 | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage | No Opt. Call | AA | 2,519,829 | |

| System Revenue Bonds, Build America Taxable Bonds Series 2010A, 6.250%, 5/15/43 | |||||

| 6,950 | Total Kentucky | 9,704,829 | |||

| Louisiana – 3.9% (3.3% of Total Investments) | |||||

| 20,350 | East Baton Rouge Sewerage Commission, Louisiana, Revenue Bonds, Series 2010B, | 2/20 at 100.00 | AA | 22,277,349 | |

| 6.087%, 2/01/45 (UB) (4) |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| Massachusetts – 0.8% (0.7% of Total Investments) | |||||

| $ 2,000 | Massachusetts, Transportation Fund Revenue Bonds, Accelerated Bridge Program, Tender Option | No Opt. Call | AAA | $ 4,610,500 | |

| Bond Trust 2016-XFT907, 22.356%, 6/01/40 (IF) (4) | |||||

| Michigan – 1.1% (0.9% of Total Investments) | |||||

| 6,190 | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, | No Opt. Call | B– | 6,066,076 | |

| Taxable Turbo Series 2006A, 7.309%, 6/01/34 | |||||

| Missouri – 0.3% (0.2% of Total Investments) | |||||

| 1,290 | Curators of the University of Missouri, System Facilities Revenue Bonds, Build America Taxable | No Opt. Call | AA+ | 1,590,712 | |

| Bonds, Series 2009A, 5.960%, 11/01/39 | |||||

| Nevada – 5.5% (4.5% of Total Investments) | |||||

| 13,890 | Clark County, Nevada, Airport Revenue Bonds, Senior Lien Series 2009B, 6.881%, 7/01/42 | 7/19 at 100.00 | Aa2 | 15,397,760 | |

| 10,150 | Clark County, Nevada, Airport Revenue Bonds, Taxable Direct Payment Build America Bond Series | No Opt. Call | Aa2 | 14,274,656 | |

| 2010C, 6.820%, 7/01/45 | |||||

| 1,315 | Las Vegas, Nevada, Certificates of Participation, City Hall Project, Build America Federally | 9/19 at 100.00 | AA– (5) | 1,494,616 | |

| Taxable Bonds, Series 2009B, 7.800%, 9/01/39 (Pre-refunded 9/01/19) | |||||

| 25,355 | Total Nevada | 31,167,032 | |||

| New Jersey – 4.2% (3.5% of Total Investments) | |||||

| 2,500 | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Build America | 6/19 at 100.00 | A– | 2,638,725 | |

| Bonds Issuer Subsidy Program, Series 2009B, 6.875%, 12/15/39 | |||||

| 130 | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Build America | 12/20 at 100.00 | A– | 135,056 | |

| Bonds Issuer Subsidy Program, Series 2010C, 6.104%, 12/15/28 | |||||

| 4,190 | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2009F, | No Opt. Call | A+ | 6,044,578 | |

| 7.414%, 1/01/40 | |||||

| 10,910 | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2010A, | No Opt. Call | A+ | 15,267,563 | |

| 7.102%, 1/01/41 | |||||

| 17,730 | Total New Jersey | 24,085,922 | |||

| New York – 17.5% (14.4% of Total Investments) | |||||

| 25,000 | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Series | No Opt. Call | AAA | 30,575,750 | |

| 2010D, 5.600%, 3/15/40 (UB) (4) | |||||

| 5,100 | Long Island Power Authority, New York, Electric System Revenue Bonds, Build America Taxable | No Opt. Call | A– | 6,050,436 | |

| Bond Series 2010B, 5.850%, 5/01/41 | |||||

| 7,965 | Metropolitan Transportation Authority, New York, Dedicated Tax Fund Bonds, Build America | No Opt. Call | AA | 11,620,696 | |

| Taxable Bonds, Series 2010C, 7.336%, 11/15/39 | |||||

| 14,000 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | 12/20 at 100.00 | AA+ | 15,931,300 | |

| Bonds, Second Generation Resolution, Build America Taxable Bonds, Fiscal 2011 Series 2010CC, | |||||

| 6.282%, 6/15/42 | |||||

| 1,000 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | 6/20 at 100.00 | AA+ | 1,103,850 | |

| Bonds, Second Generation Resolution, Build America Taxable Bonds, Fiscal 2011 Series AA, | |||||

| 5.790%, 6/15/41 | |||||

| 2,595 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 3,363,380 | |

| Bonds, Second Generation Resolution, Build America Taxable Bonds, Series 2010DD, | |||||

| 5.952%, 6/15/42 | |||||

| 2,025 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 2,624,603 | |

| Bonds, Second Generation Resolution, Series 2010DD, 5.952%, 6/15/42 (UB) | |||||

| 1,595 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 3,937,656 | |

| Bonds, Second Generation Resolution, Taxable Tender Option Bond Trust 2016-XFT908, | |||||

| 23.519%, 6/15/44 (IF) |

| NBB | Nuveen Build America Bond Fund | |

Portfolio of Investments (continued) | March 31, 2017 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

New York (continued) | |||||

| $ 6,690 | New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Build | No Opt. Call | AA | $ 8,699,542 | |

| America Taxable Bond Fiscal 2011 Series 2010S-1B, 6.828%, 7/15/40 | |||||

| 10,000 | New York City Transitional Finance Authority, New York, Future Tax Secured Bonds, Build | No Opt. Call | AAA | 12,113,500 | |

| America Taxable Bonds, Series 2010G-1, 5.467%, 5/01/40 (4) | |||||

| 3,000 | New York Transportation Development Corporation, Special Facilities Bonds, LaGuardia Airport | No Opt. Call | BBB | 2,878,560 | |

| Terminal B Redevelopment Project, Taxable Series 2016B, 3.673%, 7/01/30 | |||||

| 78,970 | Total New York | 98,899,273 | |||

| North Carolina – 1.9% (1.6% of Total Investments) | |||||

| 10,100 | North Carolina Turnpike Authority, Triangle Expressway System State Annual Appropriation | 1/19 at 100.00 | AA | 10,877,498 | |

| Revenue Bonds, Federally Taxable Issuer Subsidy Build America Bonds, Series 2009B, | |||||

| 6.700%, 1/01/39 | |||||

| Ohio – 7.9% (6.5% of Total Investments) | |||||

| 10,700 | American Municipal Power Inc., Ohio, Combined Hydroelectric Projects Revenue Bonds, Build | No Opt. Call | A | 15,246,109 | |

| America Bond Series 2010B, 7.834%, 2/15/41 | |||||

| 4,000 | American Municipal Power Ohio Inc., Prairie State Energy Campus Project Revenue Bonds, Build | No Opt. Call | A1 | 4,736,560 | |

| America Bond Series 2009C, 6.053%, 2/15/43 | |||||

| 25 | JobsOhio Beverage System, Ohio, Statewide Liquor Profits Revenue Bonds, Senior Lien Taxable | No Opt. Call | AA | 27,015 | |

| Series 2013B, 4.532%, 1/01/35 | |||||

| 15,500 | Northeast Ohio Regional Sewer District, Wastewater Improvement Revenue Bonds, Build America | 11/20 at 100.00 | AA+ | 17,412,389 | |

| Taxable Bonds, Series 2010, 6.038%, 11/15/40 | |||||

| 7,500 | Port of Greater Cincinnati Development Authority, Ohio, Special Obligation TIF Revenue Bonds, | 1/26 at 100.00 | N/R | 7,239,225 | |

| Cooperative Township Public Parking, Kenwood Collection Redevelopment, Senior Lien Series | |||||

| 2016A, 6.600%, 1/01/39 | |||||

| 37,725 | Total Ohio | 44,661,298 | |||

| Oregon – 2.6% (2.1% of Total Investments) | |||||

| 4,000 | Oregon Department of Administrative Services, Certificates of Participation, Federally Taxable | 5/20 at 100.00 | AA | 6,066,800 | |

| Build America Bonds, Tender Option Bond Trust 2016-TXG001, 23.753%, 5/01/35 (IF) (4) | |||||

| 8,030 | Warm Springs Reservation Confederated Tribes, Oregon, Tribal Economic Development Bonds, | No Opt. Call | A3 | 8,636,537 | |

| Hydroelectric Revenue Bonds, Pelton Round Butte Project, Refunding Series 2009A, 8.250%, 11/01/19 | |||||

| 12,030 | Total Oregon | 14,703,337 | |||

| Pennsylvania – 1.4% (1.1% of Total Investments) | |||||

| Commonwealth Financing Authority, Pennsylvania, State Appropriation Lease Bonds, Build America | |||||

| Taxable Bonds, Series 2009D: | |||||

| 1,225 | 5.653%, 6/01/24 | No Opt. Call | A+ | 1,357,655 | |

| 1,915 | 6.218%, 6/01/39 | No Opt. Call | A+ | 2,309,413 | |

| 2,000 | Pennsylvania State, General Obligation Bonds, Build America Taxable Bonds, Third Series 2010B, | 7/20 at 100.00 | Aa3 | 2,219,500 | |

| 5.850%, 7/15/30 | |||||

| 1,535 | Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Build America Taxable Bonds, Series | No Opt. Call | A1 | 1,948,391 | |

| 2009A, 6.105%, 12/01/39 | |||||

| 6,675 | Total Pennsylvania | 7,834,959 | |||

| South Carolina – 0.5% (0.4% of Total Investments) | |||||

| 55 | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, | No Opt. Call | AA– | 85,236 | |

| Federally Taxable Build America Tender Option Bond Trust 2016-XFT909, 26.230%, 1/01/50 (IF) | |||||

| 2,245 | South Carolina Public Service Authority, Electric System Revenue Bonds, Santee Cooper, | No Opt. Call | AA– | 2,491,838 | |

| Federally Taxable Build America Series 2010C, 6.454%, 1/01/50 (UB) | |||||

| 2,300 | Total South Carolina | 2,577,074 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| Tennessee – 1.9% (1.6% of Total Investments) | |||||

| $ 5,000 | Metropolitan Government Nashville & Davidson County Convention Center Authority, Tennessee, | No Opt. Call | A1 | $ 6,603,950 | |

| Tourism Tax Revenue Bonds, Build America Taxable Bonds, Series 2010A-2, 7.431%, 7/01/43 | |||||

| 3,290 | Metropolitan Government Nashville & Davidson County Convention Center Authority, Tennessee, | No Opt. Call | Aa3 | 4,313,387 | |

| Tourism Tax Revenue Bonds, Build America Taxable Bonds, Subordinate Lien Series 2010B, | |||||

| 6.731%, 7/01/43 | |||||

| 8,290 | Total Tennessee | 10,917,337 | |||

| Texas – 10.9% (9.0% of Total Investments) | |||||

| 1,000 | Bexar County Hospital District, Texas, Certificates of Obligation, Taxable Build America Bond | 2/19 at 100.00 | AA+ | 1,085,210 | |

| Series 2009B, 6.904%, 2/15/39 | |||||

| 9,280 | Dallas Convention Center Hotel Development Corporation, Texas, Hotel Revenue Bonds, Build | No Opt. Call | A– | 12,051,565 | |

| America Taxable Bonds, Series 09B, 7.088%, 1/01/42 | |||||

| 2,200 | Dallas Independent School District, Dallas County, Texas, General Obligation Bonds, School | 2/21 at 100.00 | AAA | 2,525,600 | |

| Building, Build America Taxable Bond Series 2010C, 6.450%, 2/15/35 | |||||

| 3,250 | Houston, Texas, General Obligation Bonds, Public Improvement, Build America Bond Series 2010B, | 3/20 at 100.00 | AA | 3,581,533 | |

| 6.319%, 3/01/30 | |||||

| 10,785 | North Texas Tollway Authority, System Revenue Bonds, Taxable Build America Bond Series 2009B, | No Opt. Call | A1 | 15,078,723 | |

| 6.718%, 1/01/49 | |||||

| 10,220 | North Texas Tollway Authority, System Revenue Bonds, Taxable Build America Bonds, Series | 2/20 at 100.00 | Baa2 | 11,828,117 | |

| 2010-B2, 8.910%, 2/01/30 | |||||

| 1,000 | San Antonio, Texas, Electric and Gas System Revenue Bonds, Junior Lien, Build America Taxable | No Opt. Call | AA+ | 1,257,200 | |

| Bond Series 2010A, 5.808%, 2/01/41 | |||||

| 10 | San Antonio, Texas, Electric and Gas System Revenue Bonds, Series 2012, 4.427%, 2/01/42 | No Opt. Call | Aa1 | 10,715 | |

| 5,000 | San Antonio, Texas, General Obligation Bonds, Build America Taxable Bonds, Series 2010B, | 8/20 at 100.00 | AAA | 5,575,800 | |

| 6.038%, 8/01/40 | |||||

| 7,015 | Texas State, General Obligation Bonds, Transportation Commission, Build America Taxable Bonds, | No Opt. Call | AAA | 8,803,825 | |

| Series 2009A, 5.517%, 4/01/39 | |||||

| 49,760 | Total Texas | 61,798,288 | |||

| Utah – 1.0% (0.8% of Total Investments) | |||||

| 4,000 | Central Utah Water Conservancy District, Utah, Revenue Bonds, Federally Taxable Build America | 4/20 at 100.00 | AA+ | 4,297,880 | |

| Bonds, Series 2010A, 5.700%, 10/01/40 | |||||

| 1,000 | Tooele County Municipal Building Authority, Utah, Lease Revenue Bonds, Build America Bond | 12/20 at 100.00 | A+ | 1,104,840 | |

| Series 2010A-2, 8.000%, 12/15/32 | |||||

| 5,000 | Total Utah | 5,402,720 | |||

| Virginia – 4.4% (3.7% of Total Investments) | |||||

| Metropolitan Washington Airports Authority, Virginia, Dulles Toll Road Second Senior Lien | |||||

| Revenue Bonds, Build America Bonds, Series 2009D: | |||||

| 1,500 | 7.462%, 10/01/46 – AGM Insured | No Opt. Call | AA | 2,204,850 | |

| Metropolitan Washington Airports Authority, Virginia, Dulles Toll Road Second Senior Lien | |||||

| Revenue Bonds, Build America Bonds, Series 2009D: | |||||

| 11,930 | 7.462%, 10/01/46 – AGC Insured | No Opt. Call | BBB+ | 16,916,024 | |

| 7,125 | Tobacco Settlement Financing Corporation of Virginia, Tobacco Settlement Asset Backed Bonds, | 6/17 at 100.00 | B– | 5,972,745 | |

| Refunding Senior Lien Series 2007A, 6.706%, 6/01/46 | |||||

| 20,555 | Total Virginia | 25,093,619 |

| NBB | Nuveen Build America Bond Fund | |

Portfolio of Investments (continued) | March 31, 2017 |

| Principal | Optional Call | |||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | ||

| Washington – 3.7% (3.1% of Total Investments) | ||||||

| $ 4,000 | Seattle, Washington, Municipal Light and Power Revenue Bonds, Federally Taxable Build America | No Opt. Call | AA | $ 7,075,400 | ||

| Bonds, Tender Option Bond Trust 2016-XFT905, 21.484%, 2/01/40 (IF) (4) | ||||||

| 11,090 | Washington State Convention Center Public Facilities District, Lodging Tax Revenue Bonds, | No Opt. Call | Aa3 | 14,087,849 | ||

| Build America Taxable Bond Series 2010B, 6.790%, 7/01/40 | ||||||

| 15,090 | Total Washington | 21,163,249 | ||||

| West Virginia – 0.6% (0.5% of Total Investments) | ||||||

| 3,800 | Tobacco Settlement Finance Authority, West Virginia, Tobacco Settlement Asset-Backed Bonds, | 6/25 at 100.00 | B2 | 3,642,262 | ||

| Taxable Turbo Series 2007A, 7.467%, 6/01/47 | ||||||

| $ 554,000 | Total Municipal Bonds (cost $606,560,483) | 682,716,028 | ||||

| Principal | ||||||

| Amount (000) | Description (1) | Coupon | Maturity | Ratings (3) | Value | |

| CORPORATE BONDS – 0.5% (0.4% of Total Investments) | ||||||

| Diversified Consumer Services – 0.5% (0.4% of Total Investments) | ||||||

| $ 3,015 | BCOM Investment Partners LLC, Taxable Notes, Burrell College of Osteopathic | 7.500% | 9/01/45 | N/R | $ 3,043,109 | |

| Medicine, Series 2015, 144A | ||||||

| $ 3,015 | Total Corporate Bonds (cost $3,015,000) | 3,043,109 | ||||

| Total Long-Term Investments (cost $609,575,483) | 685,759,137 | |||||

| Borrowings – (15.9)% (6), (7) | (90,175,000) | |||||

| Floating Rate Obligations – (8.4)% | (47,700,000) | |||||

| Other Assets Less Liabilities – 3.3% (8) | 18,547,438 | |||||

| Net Assets Applicable to Common Shares – 100% | $ 566,431,575 | |||||

| Investments in Derivatives as of March 31, 2017 | ||||||||||

| Interest Rate Swaps (OTC Uncleared) | ||||||||||

| Fund | Fixed Rate | Optional | Unrealized | |||||||||||||||||||

| Notional | Pay/Receive | Floating Rate | Fixed Rate | Payment | Effective | Termination | Termination | Appreciation | ||||||||||||||

| Counterparty | Amount | Floating Rate | Index | (Annualized) | Frequency | Date (9) | Date | Date | Value | (Depreciation) | ||||||||||||

| Morgan Stanley | $ | 121,000,000 | Receive | 1-Month USD- | 1.500 | % | Monthly | 7/03/17 | 12/01/17 | 12/01/19 | $ | (273,646 | ) | $ | (1,993,646 | ) | ||||||

| Capital | LIBOR-ICE | |||||||||||||||||||||

| Services LLC | ||||||||||||||||||||||

| Interest Rate Swaps (OTC Cleared) | |||||||||||||||||||||||||

| Variation | |||||||||||||||||||||||||

| Fund | Fixed Rate | Optional | Margin | Unrealized | |||||||||||||||||||||

| Notional | Pay/Receive | Floating Rate | Fixed Rate | Payment | Effective | Termination | Termination | Receivable/ | Appreciation | ||||||||||||||||

| Clearing Broker | Amount | Floating Rate | Index | (Annualized) | Frequency | Date (9) | Date | Date | (Payable) | (Depreciation) | |||||||||||||||

| Citigroup Global | $ | 47,500,000 | Receive | 3-Month USD- | 2.769 | % | Semi-Annually | 1/10/18 | N/A | 1/10/40 | $ | (72,946 | ) | $ | (561,705 | ) | |||||||||

| Markets Inc.* | LIBOR-ICE | ||||||||||||||||||||||||

| Citigroup Global | 19,100,000 | Receive | 3-Month USD- | 1.731 | Semi-Annually | 8/11/17 | N/A | 8/11/46 | (14,948 | ) | 3,834,684 | ||||||||||||||

| Markets Inc.* | LIBOR-ICE | ||||||||||||||||||||||||

| Citigroup Global | 15,500,000 | Receive | 3-Month USD- | 1.775 | Semi-Annually | 8/25/17 | 7/06/26 (10) | 8/25/46 | (12,375 | ) | 2,973,194 | ||||||||||||||

| Markets Inc.* | LIBOR-ICE | ||||||||||||||||||||||||

| $ | 82,100,000 | $ | (100,269 | ) | $ | 6,246,173 | |||||||||||||||||||

| * | LCH.Clearnet Ltd is the clearing house for this transaction. |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. |

| Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public | |

| accounting firm. | |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or |

| Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB | |

| by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national | |

| rating agencies. Ratings are not covered by the report of independent registered public accounting firm. | |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in derivatives and/or inverse floating rate transactions. |

| (5) | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. Certain |

| bonds backed by U.S. Government or agency securities are regarded as having an implied rating equal to the rating of such securities. | |

| (6) | Borrowings as a percentage of Total Investments is 13.1%. |

| (7) | The Fund may pledge up to 100% of its eligible investments (excluding any investments separately pledged as collateral for specific investments in derivatives, when |

| applicable) as collateral for borrowings. | |

| (8) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and |

| Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers | |

| and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. | |

| (9) | Effective date represents the date on which both the Fund and counterparty commence interest payment accruals on each contract. |

| (10) | This interest rate swap has an optional early termination date beginning on July 6, 2026 and every five years thereafter through the termination date as specified in the |

| swap contract. | |

| (ETM) | Escrowed to maturity. |

| (IF) | Inverse floating rate investment. |

| (UB) | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Note 3 – Portfolio Securities and Investments in |

| Derivatives, Inverse Floating Rate Securities for more information. | |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from |

| registration, which are normally those transactions with qualified institutional buyers. | |

| N/A | Not applicable. |

| USD-LIBOR-ICE | United States Dollar-London Inter-Bank Offered Rate-Intercontinental Exchange |

| NBD | |

| Nuveen Build America Bond Opportunity Fund | |

| Portfolio of Investments | March 31, 2017 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| LONG-TERM INVESTMENTS – 105.5% (100.0% of Total Investments) | |||||

| MUNICIPAL BONDS – 104.7% (99.2% of Total Investments) | |||||

| California – 23.2% (22.0% of Total Investments) | |||||

| $ 1,500 | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Build | No Opt. Call | A+ | $ 2,166,525 | |

| America Taxable Bond Series 2009G-2, 8.361%, 10/01/34 | |||||

| 2,000 | California State, Various Purpose General Obligation Bonds, Build America Federally Taxable | No Opt. Call | AA– | 2,835,820 | |

| Bonds, Series 2009, 7.500%, 4/01/34 | |||||

| 3,500 | California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda | No Opt. Call | BB+ | 3,697,540 | |

| University Medical Center, Series 2014B, 6.000%, 12/01/24 | |||||

| 2,000 | Los Angeles Community College District, Los Angeles County, California, General Obligation | No Opt. Call | AA+ | 6,563,000 | |

| Bonds, Tender Option Bond Trust 2016-XG002, 27.019%, 8/01/49 (IF) (4) | |||||

| 1,150 | Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International | No Opt. Call | AA– | 1,472,851 | |

| Airport, Build America Taxable Bonds, Series 2009C, 6.582%, 5/15/39 | |||||

| 2,000 | Los Angeles Department of Water and Power, California, Water System Revenue Bonds, Tender | No Opt. Call | AA+ | 6,037,800 | |

| Option Bond Trust 2016-XFT906, 26.890%, 7/01/50 (IF) (4) | |||||

| 775 | Oakland Redevelopment Agency, California, Subordinated Housing Set Aside Revenue Bonds, | No Opt. Call | A+ | 817,555 | |

| Federally Taxable Series 2011A-T, 7.500%, 9/01/19 | |||||

| 2,200 | San Diego County Regional Transportation Commission, California, Sales Tax Revenue Bonds, | No Opt. Call | AAA | 2,805,528 | |

| Build America Taxable Bonds Series 2010A, 5.911%, 4/01/48 | |||||

| 1,500 | San Francisco City and County Public Utilities Commission, California, Water Revenue Bonds, | No Opt. Call | AA– | 2,121,045 | |

| Build America Taxable Bonds, Series 2010G, 6.950%, 11/01/50 | |||||

| 675 | San Francisco City and County Redevelopment Financing Authority, California, Tax Allocation | No Opt. Call | AA– | 910,697 | |

| Revenue Bonds, San Francisco Redevelopment Projects, Taxable Series 2009E, 8.406%, 8/01/39 | |||||

| 2,000 | San Francisco City and County, California, Certificates of Participation, 525 Golden Gate | No Opt. Call | AA | 4,497,800 | |

| Avenue, San Francisco Public Utilities Commission Office Project, Tender Option Bond | |||||

| 2016-XFT901, 25.439%, 11/01/41 (IF) (4) | |||||

| 315 | Stanton Redevelopment Agency, California, Tax Allocation Bonds, Stanton Consolidated | No Opt. Call | A (5) | 359,015 | |

| Redevelopment Project Series 2011A, 7.000%, 12/01/19 (ETM) | |||||

| 2,000 | The Regents of the University of California, Medical Center Pooled Revenue Bonds, Build | No Opt. Call | AA– | 2,599,380 | |

| America Taxable Bonds, Series 2010H, 6.548%, 5/15/48 | |||||

| 21,615 | Total California | 36,884,556 | |||

| Colorado – 5.3% (5.0% of Total Investments) | |||||

| 4,000 | Colorado State Bridge Enterprise Revenue Bonds, Federally Taxable Build America Series 2010A, | No Opt. Call | AA | 5,016,200 | |

| 6.078%, 12/01/40 | |||||

| 2,585 | Regional Transportation District, Colorado, Sales Tax Revenue Bonds, Fastracks Project, Build | No Opt. Call | AA+ | 3,367,583 | |

| America Series 2010B, 5.844%, 11/01/50 | |||||

| 6,585 | Total Colorado | 8,383,783 | |||

| Connecticut – 1.0% (0.9% of Total Investments) | |||||

| 1,355 | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation Revenue | 4/20 at 100.00 | N/R | 1,567,789 | |

| Bonds, Harbor Point Project, Federally Taxable – Issuer Subsidy – Recovery Zone Economic | |||||

| Development Bond Series 2010B, 12.500%, 4/01/39 |

| Principal | Optional Call | ||||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value | |

| Georgia – 2.7% (2.5% of Total Investments) | |||||

| $ 1,000 | Cobb-Marietta Coliseum and Exhibit Hall Authority, Georgia, Revenue Bonds, Cobb County | 1/26 at 100.00 | AAA | $ 1,041,430 | |

| Coliseum Project, Taxable Series 2015, 4.500%, 1/01/47 | |||||

| 3,000 | Georgia Municipal Electric Authority, Plant Vogtle Units 3 & 4 Project P Bonds, Refunding | No Opt. Call | A– | 3,165,810 | |

| Taxable Build America Bonds Series 2010A, 7.055%, 4/01/57 | |||||

| 4,000 | Total Georgia | 4,207,240 | |||

| Illinois – 10.7% (10.2% of Total Investments) | |||||

| 3,715 | Chicago Transit Authority, Illinois, Sales Tax Receipts Revenue Bonds, Federally Taxable Build | No Opt. Call | AA | 4,370,846 | |

| America Bonds, Series 2010B, 6.200%, 12/01/40 | |||||

| 1,255 | Chicago, Illinois, General Airport Revenue Bonds, O’Hare International Airport, Third Lien, | 1/20 at 100.00 | A | 1,401,120 | |

| Build America Taxable Bond Series 2010B, 6.845%, 1/01/38 | |||||

| 2,000 | Illinois State, General Obligation Bonds, Build America Taxable Bonds, Series 2010-5, | No Opt. Call | BBB | 2,134,400 | |

| 7.350%, 7/01/35 | |||||

| 5,000 | Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Build America Taxable Bonds, | No Opt. Call | AA– | 6,324,300 | |

| Senior Lien Series 2009A, 6.184%, 1/01/34 | |||||

| 2,000 | Lake County, Illinois, General Obligation Bonds, Series 2010A, 5.250%, 11/30/28 | 11/19 at 100.00 | AAA | 2,151,060 | |

| 365 | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, | No Opt. Call | A2 | 426,473 | |

| Build America Bond Series 2009C, 6.859%, 1/01/39 | |||||

| 205 | Northern Illinois Municipal Power Agency, Power Project Revenue Bonds, Prairie State Project, | No Opt. Call | A2 | 260,852 | |

| Build America Taxable Bond Series 2010A, 7.820%, 1/01/40 | |||||

| 14,540 | Total Illinois | 17,069,051 | |||

| Indiana – 0.8% (0.8% of Total Investments) | |||||

| 1,000 | Indianapolis Local Public Improvement Bond Bank, Indiana, Build America Taxable Bonds, Series | No Opt. Call | AA | 1,258,750 | |

| 2010B-2, 6.116%, 1/15/40 | |||||

| Kentucky – 2.4% (2.3% of Total Investments) | |||||

| 3,000 | Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage | No Opt. Call | AA | 3,876,660 | |

| System Revenue Bonds, Build America Taxable Bonds Series 2010A, 6.250%, 5/15/43 | |||||

| Massachusetts – 2.9% (2.7% of Total Investments) | |||||

| 2,000 | Massachusetts, Transportation Fund Revenue Bonds, Accelerated Bridge Program, Tender Option | No Opt. Call | AAA | 4,610,500 | |

| Bond Trust 2016-XFT907, 22.356%, 6/01/40 (IF) (4) | |||||

| Michigan – 1.2% (1.2% of Total Investments) | |||||

| 2,000 | Michigan Tobacco Settlement Finance Authority, Tobacco Settlement Asset-Backed Revenue Bonds, | No Opt. Call | B– | 1,959,960 | |

| Taxable Turbo Series 2006A, 7.309%, 6/01/34 | |||||

| Mississippi – 1.6% (1.5% of Total Investments) | |||||

| 2,085 | Mississippi State, General Obligation Bonds, Build America Taxable Bond Series 2010F, | No Opt. Call | AA | 2,493,639 | |

| 5.245%, 11/01/34 | |||||

| Nevada – 2.7% (2.6% of Total Investments) | |||||

| 1,965 | Clark County, Nevada, Airport Revenue Bonds, Senior Lien Series 2009B, 6.881%, 7/01/42 | 7/19 at 100.00 | Aa2 | 2,178,301 | |

| 1,500 | Clark County, Nevada, Airport Revenue Bonds, Taxable Direct Payment Build America Bond Series | No Opt. Call | Aa2 | 2,109,555 | |

| 2010C, 6.820%, 7/01/45 | |||||

| 3,465 | Total Nevada | 4,287,856 |

| NBD | ||

| Nuveen Build America Bond Opportunity Fund | ||

Portfolio of Investments (continued) | March 31, 2017 |

| Principal | Optional Call | |||

| Amount (000) | Description (1) | Provisions (2) | Ratings (3) | Value |

| New Jersey – 4.9% (4.7% of Total Investments) | ||||

| $ 3,890 | New Jersey Turnpike Authority, Revenue Bonds, Build America Taxable Bonds, Series 2010A, | No Opt. Call | A+ | $ 5,443,705 |

| 7.102%, 1/01/41 | ||||

| 2,000 | Rutgers State University, New Jersey, Revenue Bonds, Build America Taxable Bond Series 2010H, | No Opt. Call | Aa3 | 2,356,660 |

| 5.665%, 5/01/40 | ||||

| 5,890 | Total New Jersey | 7,800,365 | ||

| New York – 12.8% (12.1% of Total Investments) | ||||

| 2,000 | Dormitory Authority of the State of New York, State Personal Income Tax Revenue Bonds, Tender | No Opt. Call | AAA | 4,230,300 |

| Option Bond Trust 2016-XFT903, 20.726%, 3/15/40 (IF) (4) | ||||

| 1,270 | Metropolitan Transportation Authority, New York, Transportation Revenue Bonds, Federally | 11/33 at 100.00 | AA– | 1,690,738 |

| Taxable Issuer Subsidy Build America Bonds, Series 2010A, 6.668%, 11/15/39 | ||||

| 1,500 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 1,873,410 |

| Bonds, Second Generation Resolution, Build America Taxable Bonds, Fiscal 2011 Series AA, | ||||

| 5.440%, 6/15/43 (4) | ||||

| 2,000 | New York City Municipal Water Finance Authority, New York, Water and Sewer System Revenue | No Opt. Call | AA+ | 4,937,500 |

| Bonds, Second Generation Resolution, Taxable Tender Option Bond Trust 2016-XFT908, | ||||

| 23.519%, 6/15/44 (IF) | ||||

| 3,750 | New York City Transitional Finance Authority, New York, Building Aid Revenue Bonds, Build | No Opt. Call | AA | 4,876,425 |

| America Taxable Bond Fiscal 2011 Series 2010S-1B, 6.828%, 7/15/40 | ||||

| 1,500 | New York City, New York, General Obligation Bonds, Federally Taxable Build America Bonds, | 12/20 at 100.00 | AA | 1,714,920 |

| Series 2010-F1, 6.646%, 12/01/31 | ||||

| 1,000 | New York Transportation Development Corporation, Special Facilities Bonds, LaGuardia Airport | No Opt. Call | BBB | 959,520 |

| Terminal B Redevelopment Project, Taxable Series 2016B, 3.673%, 7/01/30 | ||||

| 13,020 | Total New York | 20,282,813 | ||

| North Carolina – 1.3% (1.3% of Total Investments) | ||||

| 1,955 | North Carolina Turnpike Authority, Triangle Expressway System State Annual Appropriation | 1/19 at 100.00 | AA | 2,105,496 |

| Revenue Bonds, Federally Taxable Issuer Subsidy Build America Bonds, Series 2009B, | ||||

| 6.700%, 1/01/39 | ||||

| Ohio – 7.2% (6.8% of Total Investments) | ||||

| 1,500 | American Municipal Power Inc., Ohio, Meldahl Hydroelectric Projects Revenue Bonds, Build | No Opt. Call | A | 2,048,190 |

| America Bond Series 2010B, 7.499%, 2/15/50 | ||||

| 2,690 | American Municipal Power Ohio Inc., Prairie State Energy Campus Project Revenue Bonds, Build | No Opt. Call | A1 | 3,185,337 |

| America Bond Series 2009C, 6.053%, 2/15/43 | ||||

| 2,850 | Northeast Ohio Regional Sewer District, Wastewater Improvement Revenue Bonds, Build America | 11/20 at 100.00 | AA+ | 3,201,633 |

| Taxable Bonds, Series 2010, 6.038%, 11/15/40 | ||||

| 3,075 | Port of Greater Cincinnati Development Authority, Ohio, Special Obligation TIF Revenue Bonds, | 1/26 at 100.00 | N/R | 2,968,082 |

| Cooperative Township Public Parking, Kenwood Collection Redevelopment, Senior Lien Series | ||||

| 2016A, 6.600%, 1/01/39 | ||||

| 10,115 | Total Ohio | 11,403,242 | ||