UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________

FORM 20-F

_____________________________

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended ______________

| OR¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ORx | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: December 28, 2012

Commission file number: 000-54022

EASY HEALTH TECHNOLOGIES LTD.

(Exact name of Registrant as Specified in its Charter)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

No. 16, 219th Street, Tiedong District

Anshan, Liaoning Province 200120

People’s Republic of China

(Address of principal executive offices)

Wei Dong

No. 16, 219th Street, Tiedong District

Anshan, Liaoning Province 200120

People’s Republic of China

86-412-223-8188

easyhealth2012@163.com

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered |

| None | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, par value $.01 per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 28, 2012 was 20,000,000 ordinary shares par value $0.01 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨ Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨ No¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer¨ Accelerated filer¨ Non-accelerated filerx

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

xU.S. GAAP¨ International Financial Reporting Standards as issued by the International Accounting

Standards Board¨ Other¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17¨ Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ No¨

EASY HEALTH TECHNOLOGIES LTD.

(formerly Glorious Pioneer Investments, Ltd.)

FORM 20-F SHELL COMPANY REPORT

TABLE OF CONTENTS

| | | Page |

| | | |

| PART I | | |

| Item 1. | Identity of Directors, Senior Management and Advisors | 2 |

| Item 2. | Offer Statistics and Expected Timetable | 2 |

| Item 3. | Key Information | 2 |

| Item 4. | Information on the Company | 11 |

| Item 4A. | Unresolved Staff Comments | 19 |

| Item 5. | Operating and Financial Review and Prospects | 20 |

| Item 6. | Directors, Senior Management, and Employees | 22 |

| Item 7. | Major Shareholders and Related Party Transactions | 25 |

| Item 8. | Financial Information | 26 |

| Item 9. | The Offer and Listing | 26 |

| Item 10. | Additional Information | 27 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 33 |

| Item 12. | Description of Securities Other Than Equity Securities | 33 |

| | | |

| PART II | | |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 33 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 33 |

| Item 15. | Controls and Procedures | 33 |

| Item 16. | Reserved | 33 |

| Item 16A. | Audit Committee Financial Expert | 33 |

| Item 16B. | Code of Ethics | 33 |

| Item 16C. | Principal Accountiing Fees and Services | 33 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 33 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 34 |

| Item 16F. | Change in Registrant's Certifying Accountant | 34 |

| Item 16G. | Corporate Governance | 34 |

| tem 16G. | Corporate Governance | 34 |

| | | |

| PART III | | |

| Item 17. | Financial Statements | 34 |

| Item 18. | Financial Statements | 35 |

| Item 19. | Exhibits | 35 |

CERTAIN INFORMATION

In this shell company report on Form 20-F, unless otherwise indicated, “we,” “us,” “our,” the “Company” and “Easy Health” refer to Easy Health Technologies Ltd., formerly known as Glorious Pioneer Investments Ltd., a company organized in the British Virgin Islands, and its subsidiaries, subsequent to the reverse acquisition referred to below. The “reverse acquisition” refers to the share exchange between Easy Health and its sole shareholder and the shareholders of Oriental Honour International Group Limited, a Hong Kong company (“Oriental Honour”), which resulted in the acquisition of all of the outstanding securities of Oriental Honour by Easy Health, which was consummated on December 28, 2012.

Unless the context indicates otherwise, all references to “China” or “PRC” refer to the People’s Republic of China. All references to “Renminbi” or “RMB” are to the legal currency of the PRC, and all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. This report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On July 31, 2012, the cash buying rate announced by the People’s Bank of China was RMB 6.33 to $1.00. On January 4, 2013, the cash buying rate announced by the People’s Bank of China was RMB 6.23 to $1.00.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and elsewhere in this report.

PART I

| ITEM 1. | Identity of Directors, Senior Management and Advisors |

1.A. Directors and Senior Management

The following table lists the members of the Company’s board of directors:

| Name | | Age | | Position(s) |

| Wei Dong | | 48 | | Chairman of the Board |

| Song Gu | | 30 | | Director |

The business address for each of our directors is:c/o Anshan Easy Health Technology Development Co,. Ltd., 16 219 Street, Anshan City, Liaoning, 114002, People’s Republic of China.

The following table lists the senior management of the Company:

| Name | | Age | | Position(s) |

| Wei Dong | | 48 | | Chairman of the Board |

| Song Gu | | 30 | | Vice General Manager |

The business address for each of the members of senior management is:c/o Anshan Easy Health Technology Development Co,. Ltd., 16 219 Street, Anshan City, Liaoning, 114002, People’s Republic of China.

SeeItem 6.A. –Directors and Senior Management below for more information about our directors and executive officers.

1.B. Advisors

The Company’s legal advisor in the United States is Robert Brantl, Esq., 52 Mulligan Lane, Irvington, NY 10533-1106.

1.C. Auditors

The Company’s auditors are: Goldman Kurland and Mohidin, LLP, 16133 Ventura Blvd., Suite 880, Encino, CA 91436. See Item 16.F – Change in Registrant’s Certifying Accountant below for information about the change in our auditor following the reverse acquisition.

Goldman Kurland and Mohidin, LLP has confirmed it is independent with respect to the Company under the guidelines of the SEC and the Independence Standards Board.

| ITEM 2. | Offer Statistics and Expected Timetable |

Not Applicable.

3.A. Selected Financial Data

The following selected financial information should be read in connection with, and is qualified by reference to, our consolidated financial statements and their related notes and the section entitled “Operating and Financial Review and Prospects,” each of which is included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the period from August 1, 2011 (inception) to July 31, 2012 and the balance sheet data as of July 31, 2012 are derived from the audited consolidated financial statements of Oriental Honour International Group Limited included elsewhere in this report. Our historical results for any of these periods are not necessarily indicative of results to be expected in any future period.

Statement of Operations and Comprehensive Loss:

| | | Period from August 1, 2011

(Inception) through July 31, 2012 | |

| Revenue | | $ | 0 | |

| Operating Expenses | | | 7,817 | |

| Loss from Operations | | | (7,817 | ) |

| Net Loss | | | (7,925 | ) |

| Net Comprehensive Loss | | | (8,233 | ) |

Balance Sheet:

| | | As at July 31, 2012 | |

| Cash | | $ | 1,701,659 | |

| Total Current Assets | | | 1,848,121 | |

| Total Assets | | | 1,854,508 | |

| Total Liabilities | | | 291,566 | |

| Total Shareholders’ Equity | | | 1,562,942 | |

Dividends Declared:

The Company has never declared a dividend payable to shareholders.

3.A.3. Exchange Rates

Not Applicable.

3.B. Capitalization and Indebtedness

The following table sets forth our capitalization and indebtedness as of July 31, 2012. This information should be read in conjunction with our consolidated financial statements and the notes relating to such statements appearing elsewhere in this report.

| | | As at July 31, 2012 | |

| Indebtedness | | $ | 98,698 | |

| Total Shareholders’ Equity | | | 1,562,942 | |

3.C. Reasons for the Offer and Use of Proceeds

Not Applicable.

3.D. Risk Factors

You should carefully consider the risks described below in evaluating our business before investing in our ordinary shares. If any of the following risks were to occur, our business, results of operations and financial condition could be harmed. In that case, the trading price of our ordinary shares could decline and you might lose all or part of your investment in our ordinary shares. You should also refer to the other information set forth in this report, including our consolidated financial statements and the related notes and the section captioned “Operating and Financial Review and Prospects” before deciding whether to invest in our ordinary shares.

Risks Related to Our Business

Our business and operations are newly established. Unless we manage our growth effectively, our business will fail.

Anshan Easy Health was incorporated in March 2012. The two members of our management had prior experience in the health care industry. But the extrapolation of that experience into a marketing business on the magnitude contemplated by Anshan Easy Health will place significant demands on our management, and on our operational and financial infrastructure. If we do not effectively manage our operations, the quality of our marketing program will suffer, which would negatively affect our operating results. The complexity of this undertaking means that we are likely to face many challenges, some of which are not yet foreseeable. Problems may occur with our technology development, our development of a marketing network, and with our ability to sell our services to our customers. If we are not able to overcome these obstacles and operate efficiently, our business plan may fall short of its goals, and our ability to manage our growth could be hurt.

Our ability to maintain or increase our revenue could be harmed if we are unable to sign more Regional Agent Agreements.

Our business plan contemplates that we will engage regional sales agents as the sole conduit for distribution of our services. To date, we have engaged five regional agents, whose exclusive regions represent only a very small portion of China. The success of our business plan requires that we find a large number of other entities that are willing to devote a large portion of their business attention to the distribution of our diagnostic services and whose personnel have the skill and experience necessary to be successful in effecting that distribution. If we are unable to engage a sufficient number of such agents, our business plan will fail.

We may have difficulty defending our intellectual property rights from infringement, which may undermine our competitive position.

Our ability to compete effectively with the hospital industry and other entities providing medical diagnostic services will depend on our ability to distinguish our services from those of our competitors. The primary distinction on which we intend to rely will be the quality of our diagnoses, particularly relative to the cost. To preserve that claim, it is essential that we preserve the confidentiality of our software design and database. We will rely on trade secret laws and restrictions on disclosure to protect our intellectual property rights. Unauthorized use of our database could damage our ability to compete effectively.

If litigation becomes necessary to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others, such litigation may be costly and may divert management attention away from our business. An adverse determination in any such litigation would impair our intellectual property rights and could harm our business, prospects and reputation. Enforcement of judgments in China is uncertain and even if we are successful in litigation it may not provide us with an effective remedy. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, financial condition and results of operations.

Competition in the health service industry could cause us to lose market share, thereby materially and adversely affecting our business, results of operations and financial condition.

To develop a market for our diagnostic services, we will have to persuade potential clients to prefer our diagnostic services over those offered by more traditional health care providers, such as hospitals. Since we have only this year initiated our marketing operations, we do not have adequate experience to determine whether we will be successful in competing with the medical industry.

In addition, our success, if it occurs, is likely to draw other diagnostic services into the market. Because our technology does not involve any patent and because the cost of our equipment is low, there are relatively low barriers to entry into the medical diagnostic field. A well-financed effort by a competitor to capture market share could have a seriously adverse affect on our business, results of operations and financial condition.

Our success depends in large part upon our senior management and key personnel and our inability to attract or retain these individuals could materially and adversely affect our business, results of operations and financial condition.

We are highly dependent on our senior management, including our Chairman of the Board, Wei Dong and our Vice General Manager, Song Gu. Our future performance will be dependent upon the continued service of members of our senior management. Competition for senior management in our industry is intense, and we may not be able to retain our senior management and key personnel or attract and retain new senior management and key personnel in the future, which could materially and adversely affect our business, results of operations and financial condition.

Product liability claims could materially impact operating results and profitability.

Like any medical diagnostic device, our diagnostic equipment is not completely accurate. Our diagnoses include some false positives and, more significantly, can at times fail to detect and identify a disease or other medical condition. The result of our failure to provide a client an accurate diagnosis could be that the patient incurs unnecessary medical expenses. But it could also be that the patient suffers from a disease or other condition that could have been avoided had the diagnosis been accurate. If a client suffers such a result, she or he may initiate legal action against us. Existing laws and regulations in China do not require us to maintain third party liability insurance to cover product liability claims. However, if a product liability claim is brought against us, it may, regardless of merit or eventual outcome, result in damage to our reputation, breach of contract with our customers, decreased demand for our services, costly litigation, loss of revenue, and our inability to expand our operations to a profitable level.

The staff of our accounting department lack training and experience in U.S. Generally Accepted Accounting Principles “U.S. GAAP”), which may result in accounting errors in the financial statements that we file with the Securities and Exchange Commission.

Our executive offices are located in Anshan in the PRC. Our entire bookkeeping and accounting staff is located there. Our books and records are maintained in Chinese, using Chinese accounting principles. Chinese accounting principles vary in many important respects from U.S. accounting principles. To file our Company’s financial statements with the Securities and Exchange Commission, our accounting staff must convert the financial statements from Chinese GAAP to U.S. GAAP. However, none of the members of our accounting staff has extensive experience or training in the preparation of financial statements under U.S. GAAP. Neither do we have any employee who has previous experience in accounting for a U.S. public company. This situation creates a risk that the financial statements we file with the SEC will fail to present our financial condition and/or results of operations as required by SEC rules and the principles of accounting generally applied in the United States.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We expect the rules and regulations to which public companies are subject, including Sarbanes-Oxley, to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements.

Risks Related to the VIE Agreements

The PRC government may determine that our corporate structure is not in compliance with applicable PRC laws, rules and regulations.

Our wholly owned subsidiary, Jinwo Shanghai, manages and operates our business through Anshan Easy Health, a PRC company owned by Ms. Lingxiang Zhang and Mr. Song Gu. Jinwo Shanghai operates Anshan Easy Health’ business pursuant to contractual arrangements with Anshan Easy Health and Ms. Zhang and Mr.Gu, which arrangements we refer to throughout this report as the VIE Agreements. Almost all economic benefits and risks arising from Anshan Easy Health’ operations have been transferred to Jinwo Shanghai under these agreements. Details of the VIE Agreements are set out below in Item 4A – “History and Development of the Company – Our Subsidiaries - VIE Agreements.”

There are risks involved in the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. If the VIE Agreements were determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

| · | imposing economic penalties; |

| · | discontinuing or restricting the operations of Jinwo Shanghai or Anshan Easy Health; |

| · | imposing conditions or requirements in respect of the VIE Agreements with which Jinwo Shanghai may not be able to comply; |

| · | requiring our company to restructure the relevant ownership structure or operations; |

| · | taking other regulatory or enforcement actions that could adversely affect our company’s business; and |

| · | revoking the business licenses and/or the licenses or certificates of Jinwo Shanghai or Anshan Easy Health, and voiding the VIE Agreements. |

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Anshan Easy Health, which would have a material adverse impact on our business, financial condition and results of operations.

If we were unable to enforce the terms of the entrusted management agreements between Jinwo Shanghai and Anshan Easy Health, we would have no business operations.

All of our business activities are carried out by Anshan Easy Health. Substantially all of the assets shown on our balance sheet are owned by Anshan Easy Health. However, Easy Health Technologies Ltd., the public company owned by our shareholders, does not own any equity in Anshan Easy Health. Instead, we consolidate the assets and results of operations of Anshan Easy Health with the financial statements of Easy Health Technologies Ltd. by reason of a set of five contracts. Those contracts transfer 100% of the benefits of and responsibilities for the operations of Anshan Easy Health to a wholly-owned subsidiary of Easy Health Technologies. As a result, under U.S. GAAP, Anshan Easy Health is deemed to be a variable interest entity with respect to that subsidiary, and so is a consolidated entity within the Company. Our entitlement to those benefits, however, depends on our ability to enforce the agreements between our subsidiary, Jinwo Shanghai, and Anshan Easy Health. If a dispute arose between those entities that could not be resolved amicably, we would have to resort to a court or arbitration tribunal in the PRC to secure our rights with respect to Anshan Easy Health. We are not aware, however, of a body of reported decisions regarding the enforceability of agreements of this sort under the laws of the PRC. It is possible, therefore, that the Chinese tribunal would decide that the agreements were not enforceable, either as a matter of national policy or for some other reason. If that were to occur, Easy Health Technologies Ltd. would have no business operations or assets, and its outstanding common stock would be essentially worthless.

The shareholders of Anshan Easy Health may breach, or cause Anshan Easy Health to breach, the VIE Agreements.

Lingxiang Zhang, the primary shareholder of Anshan Easy Health, may breach, or cause Anshan Easy Health to breach, the VIE Agreements because her equity interests in Anshan Easy Health is much greater than her equity interests in our company. As a result, Ms. Zhang may breach a contract with us if she believes that such breach will lead to greater economic benefit for her. If the shareholders of Anshan Easy Health were to breach, or cause Anshan Easy Health to breach, the VIE Agreements for this reason or any other reason, we may have to rely on legal or arbitral proceedings to enforce our contractual rights, including specific performance, injunctive relief or claiming damages. Such arbitral and legal proceedings may cost us substantial financial and other resources, and result in disruption of our business, and we cannot assure you that the outcome will be in our favor.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through payments that we receive from Anshan Easy Health pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability.

Risks Related to Doing Business in China

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have a negative effect are:

| · | level of government involvement in the economy; |

| · | control of foreign exchange; |

| · | methods of allocating resources; |

| · | balance of payments position; |

| · | international trade restrictions; and |

The Chinese economy differs from the economies of most countries in Europe and the Americas in a number of ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of European or American countries.

Increased government regulation of our marketing operations could diminish our profits.

At present, there is no significant government regulation of the business of providing electromagnetic medical diagnosis. Other developed countries, in particular members of the European Community, have far more extensive regulation of the commercial use of medical devices, including strict limitations on the health-related claims that can be made without scientifically-tested evidence. It is not unlikely, therefore, that China will increase its regulation of our activities in the future. To the extent that new regulations required us to conduct scientific tests of the efficacy of our TDS device, the expense of such testing would reduce our profitability. In addition, to the extent that the accuracy of the TDS in diagnosis could not be fully supported by scientific evidence, our sales might be reduced.

Most of our revenues are denominated in Renminbi, which is not freely convertible for capital account transactions and may be subject to exchange rate volatility.

We are exposed to the risks associated with foreign exchange controls and restrictions in China, as our revenues are primarily denominated in Renminbi, which is currently not freely exchangeable. The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by, or registered with, the PRC State Administration of Foreign Exchange, or SAFE. Further, capital contribution by an offshore shareholder to its PRC subsidiaries may require approval by the Ministry of Commerce in China or its local counterparts. We cannot assure you that we will be able to meet all of our foreign currency obligations to remit profits out of China or to fund operations in China.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or Circular 142, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may be used only for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Compliance with Circular 142 may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business.

Fluctuation in the value of the Renminbi and of the U.S. dollar may have a material adverse effect on investments in our ordinary shares.

Any significant revaluation of the Renminbi may have a material adverse effect on the U.S. dollar equivalent amount of our revenues and financial condition as well as on the value of, and any dividends payable on, our ordinary shares in foreign currency terms. For instance, a decrease in the value of Renminbi against the U.S. dollar could reduce the U.S. dollar equivalent amounts of our financial results, the value of your investment in our ordinary shares and the dividends we may pay in the future, if any, all of which may have a material adverse effect on the prices of our common shares. All of our revenues are denominated in Renminbi. Any further appreciation of the Renminbi against the U.S. dollar may result in significant exchange losses.

Prior to 1994, the Renminbi experienced a significant net devaluation against most major currencies, and there was significant volatility in the exchange rate during certain periods. Upon the execution of the unitary managed floating rate system in 1994, the Renminbi was devalued by 50% against the U.S. dollar. Since 1994, the Renminbi to U.S. dollar exchange rate has largely stabilized. On July 21, 2005, the People’s Bank of China announced that the exchange rate of U.S. dollar to Renminbi would be adjusted from $1 to RMB8.27 to $1 to RMB8.11, and it ceased to peg the Renminbi to the U.S. dollar. Instead, the Renminbi would be pegged to a basket of currencies, whose components would be adjusted based on changes in market supply and demand under a set of systematic principles. On September 23, 2005, the PRC government widened the daily trading band for Renminbi against non-U.S. dollar currencies from 1.5% to 3.0% to improve the flexibility of the new foreign exchange system. Since the adoption of these measures, the value of Renminbi against the U.S. dollar has fluctuated on a daily basis within narrow ranges, but overall has further strengthened against the U.S. dollar. In June 2010, the Chinese government announced its intention to allow the Renminbi to fluctuate within the June 2005 parameters. There remains international pressure on the PRC government to further liberalize its currency policy, which could result in a further and more significant appreciation in the value of the Renminbi against the U.S. dollar. The Renminbi may be revalued further against the U.S. dollar or other currencies, or may be permitted to enter into a full or limited free float, which may result in an appreciation or depreciation in the value of the Renminbi against the U.S. dollar or other currencies.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification would likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC tax authorities.

Although all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. If the PRC tax authorities determine that we are a resident enterprise for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as tax-exempt income, we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new resident enterprise classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC shareholders and with respect to gains derived by our non-PRC shareholders from transferring our shares.

Restrictions under PRC law on Jinwo Shanghai’s ability to pay dividends and make other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

PRC regulations restrict the ability of PRC subsidiaries to pay dividends and make other payments to their offshore parent company. PRC legal restrictions permit payments of dividends by PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of their registered capital. Allocations to these statutory reserve funds can be used only for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of Jinwo Shanghai to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

If the China Securities Regulatory Commission, or CSRC, or another Chinese regulatory agency, determines that CSRC approval is required in connection with our reverse acquisition or our contractual arrangement with Jinwo Shanghai and its shareholders, we may become subject to penalties.

On August 8, 2006, six Chinese regulatory agencies, including the Chinese Securities Regulatory Commission, or CSRC, promulgated the M&A Regulation, which became effective on September 8, 2006 and was subsequently revised on June 22, 2009. This regulation, among other things, has provisions that require offshore special purpose vehicles formed for the purpose of acquiring Chinese domestic companies and directly or indirectly established or controlled by Chinese entities or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock market. On September 21, 2006, the CSRC published on its official website a notice specifying the documents and materials that are required to be submitted for obtaining CSRC approval. It is not clear how the provisions in the regulation regarding the offshore listing and trading of the securities of a special purpose vehicle apply to us. We believe, based on the interpretation of the regulation and the practice experience of our Chinese legal counsel that CSRC approval is not required for the reverse acquisition between Oriental Honour and Jinwo Shanghai or our contractual arrangement with Jinwo Shanghai and its shareholders. There remains some uncertainty as to how this regulation will be interpreted or implemented. If the CSRC or another Chinese regulatory agency subsequently determines that the CSRC’s approval is required for this reverse acquisition or our contractual arrangement with Jinwo Shanghai and its shareholders, we may face sanctions by the CSRC or another Chinese regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in China, limit our operating privileges in China, restrict or prohibit payment or remittance of dividends to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary or affiliate, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75, which required PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Internal implementing guidelines issued by SAFE, which became public in June 2007 (known as Notice 106), expanded the reach of Circular 75 by (1) purporting to cover the establishment or acquisition of control by PRC residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; (2) adding requirements relating to the source of the PRC resident’s funds used to establish or acquire the offshore entity; covering the use of existing offshore entities for offshore financings; (3) purporting to cover situations in which an offshore SPV establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; and (4) making the domestic affiliate of the SPV responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds. Amendments to registrations made under Circular 75 are required in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations, and Notice 106 makes the offshore SPV jointly responsible for these filings. Failure to comply with the requirements of Circular 75, as applied by SAFE in accordance with Notice 106, may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We have advised our shareholders who are PRC residents, as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary and affiliate. However, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiary’s and affiliate’s ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiary’s and affiliate’s ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

Because our funds are held in banks that do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue our business operations.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to access our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue our business operations.

Risks Related to Our Ordinary Shares.

We may not be able to pay any dividends on our ordinary shares.

Under British Virgin Islands law, we may pay dividends if we are able to satisfy the solvency test laid out in the BVI Business Companies Act, 2004, or the BVI Act, which provides that directors must declare that immediately following the payment of a dividend or distribution the Company would be solvent on both a cash flow and balance sheet basis. Our ability to pay dividends will therefore depend on our ability to generate sufficient profits. We cannot give any assurance that we will declare dividends of any amounts, at any rate or at all in the future. Future dividends, if any, will be at the discretion of our board of directors and will depend upon our results of operations, our cash flows, our financial condition, the payment of our subsidiaries of cash dividends to us, our capital needs, future prospects and other factors that our directors may deem appropriate. We have never declared or paid any dividend on our ordinary shares and we do not anticipate paying any dividends on our ordinary shares in the future.

There is no public market for our ordinary shares, and you may not be able to resell our ordinary shares at or above the price you paid, or at all.

There is no public market for our ordinary shares. If an active trading market for our ordinary shares does not develop, the market price and liquidity of our ordinary shares will be materially and adversely affected and you may not be able to resell our ordinary shares at or above the price you paid, or at all. An active trading market for our ordinary shares may not develop in a timely manner or at all.

ITEM 4. INFORMATION ON THE COMPANY

| 4A. | History and Development of the Company |

We are a limited liability company organized on January 5, 2010 under the BVI Business Companies Act, 2004 of the British Virgin Islands. We were organized under the name Glorious Pioneer Investments Ltd., as a blank check company for the purpose of acquiring, through a share exchange, asset acquisition or other similar reverse acquisition, an operating business. On December 28, 2012 we completed such an acquisition.

Reverse Acquisition

On November 1, 2012, Easy Health and its sole shareholder entered into a share exchange agreement with Oriental Honour and the shareholders of Oriental Honour. Pursuant to the share exchange agreement, on December 28, 2012 Easy Health acquired from the shareholders of Oriental Honour all of the issued and outstanding shares of OrientalHonour, in exchange for 15,000,000 newly issued ordinary shares issued by Easy Health to the shareholders of Oriental Honour. In addition, the sole shareholder of Easy Health sold all of the 5,000,000 ordinary shares of Easy Health that were issued and outstanding prior to the reverse acquisition, to the shareholders of Oriental Honour for $450,000 (which is equal to $0.09 per share) in cash. As a result, the individuals and entities that owned shares of Oriental Honour prior to the reverse acquisition acquired 100% of the equity of Easy Health, and Easy Health acquired 100% of the equity of Oriental Honour. Oriental Honour is now a wholly owned subsidiary of Easy Health. In anticipation of the reverse acquisition, Easy Health filed an amended charter, pursuant to which Easy Health changed its fiscal year end to July 31, changed the par value of its ordinary shares to $0.01 per share and increased its authorized shares to 100,000,000. Upon the consummation of the reverse acquisition, we ceased to be a shell company.

Our Shareholders

The following individuals and entities were shareholders of Oriental Honour prior to the reverse acquisition:

| | | Shares of Easy

Health Acquired | | | Percentage of

Outstanding

Shares | | | Affiliation, other than as

Shareholder |

| Mark Time Development Limited(1) | | | 8,344,000 | | | | 41.7 | % | | None |

| Mascot Fortune International Limited(2) | | | 2,896,000 | | | | 14.5 | % | | See Note 2 below |

| Industrial Express Limited(2) | | | 2,000,000 | | | | 10.0 | % | | See Note 2 below |

| Songlin Su | | | 680,000 | | | | 3.4 | % | | None |

| Guangxing Gao | | | 680,000 | | | | 3.4 | % | | None |

| Other Investors(3) | | | 5,400,000 | | | | 27.0 | % | | None |

| (1) | Wu Sixiang has exclusive authority to vote and dispose of the shares held by Mark Time Development Limited. |

| (2) | Wu Liangbiao has exclusive authority to vote and dispose of the shares held by Mascot Fortune International Limited and the shares held by Industrial Express Limited. Lingxiang Zhang, the owner of 90% of the registered equity of Anshan Easy Health Technology Development Co., Ltd., is the niece of Wu Liangbiao. |

| (3) | The holders of the remaining 27% of our shares are seven investors, each owning less than 5% of our outstanding shares, who are residents of the PRC and are unaffiliated with us. |

Our Subsidiaries

Hong Kong Company

Oriental Honour, our wholly owned subsidiary, was incorporated on July 28, 2011 under the laws of the Hong Kong. We acquired all of the capital stock of Oriental Honour pursuant to the reverse acquisition on December 28, 2012. As a result of the transaction, Oriental Honour is a wholly owned subsidiary of Easy Health. Oriental Honour owns the registered equity of Jinwo (Shanghai) Information Technology Co., Ltd. (“Jinwo Shanghai”).

PRC WFOE

Jinwo Shanghai was organized on May 10, 2012 in the PRC as a wholly foreign-owned entity. As described below, Jinwo Shanghai controls the operations of Anshan Easy Health, our PRC operating company, through a set of agreements known as the “VIE Agreements.”

PRC Operating Company

Anshan Easy Health is was organized in Liaoning Province, PRC on March 9, 2012. Ms. Lingxiang Zhang and Mr. Song Gu together own 100% of the registered equity of Anshan Easy Health, having contributed 1,000,000 RMB ($158,479) to the capital of Anshan Easy Health. Ms. Zhang owns 90% of Anshan Easy Health and Mr. Gu owns 10%. Anshan Easy Health carries on all of our business operations.

VIE Agreements

Ms. Lingxiang Zhang and Mr. Song Gu, along with Anshan Easy Health and Jinwo Shanghai, entered into a set of contracts on July 2, 2012 that provide Jinwo Shanghai with effective control over the operations of Anshan Easy Health and assign the economic benefits and responsibilities of Anshan Easy Health to Jinwo Shanghai in consideration for the services provided by Jinwo Shanghai. Each of the agreements has a term of 30 years. However, we intend to continue this business arrangement upon the expiration of these contractual arrangements by renewing such agreements or entering into new, similar contractual arrangements, unless the then current PRC law allows us to directly operate Anshan Easy Health’s business in China.

Below is a summary of the five agreements that depict the VIE relationship of Anshan Easy Health with Jinwo Shanghai, with the result that their financial condition and results of operations will be consolidated on the financial statements of the Company.

Exclusive Business Cooperation Agreement. Pursuant to the Exclusive Business Cooperation Agreement entered into on July 2, 2012 between Jinwo Shanghai and Anshan Easy Health, Jinwo Shanghai provides technical and consulting services related to the business operations of Anshan Easy Health, including management consultation, staff training, business support, financial consulting and related services. Among other things, Jinwo Shanghai has assumed responsibility for all management functions, all labor matters, all financial controls, all contract matters, and all financing matters. As consideration for such services, Anshan Easy Health agreed to pay an annual service fee to Jinwo Shanghai equal to 100% of its net income for such year. The term of this agreement is 30 years from the date thereof. Anshan Easy Health may terminate the agreement upon Jinwo Shanghai’s gross negligence or commission of a fraudulent act against Anshan Easy Health. Jinwo Shanghai may terminate the agreement at any time upon giving 30 days’ prior written notice to Anshan Easy Health.

Exclusive Option Agreement. Jinwo Shanghai entered into an exclusive option agreement on July 2, 2012 with the shareholders of Anshan Easy Health, Messrs. Zhang and Gu, as well as Anshan Easy Health itself, pursuant to which Jinwo Shanghai has an exclusive option to purchase, or to designate another qualified person to purchase, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Anshan Easy Health owned by Ms. Zhang and Mr. Gu. To the extent permitted by the PRC laws, the purchase price for the entire equity interest shall equal the actual capital contributions paid into the registered capital of Anshan Easy Health by each of the Anshan Easy Health shareholders. The exclusive option agreement has a 30 year term.

Share Pledge Agreement. Pursuant to share pledge agreements dated July 2, 2012, each of Ms. Zhang and Mr. Gu pledged her/his equity interest in Anshan Easy Health to Jinwo Shanghai to secure Anshan Easy Health’s obligations under the exclusive business cooperation agreement described above. In addition, the shareholders of Anshan Easy Health agreed not to transfer, sell, pledge, dispose of or create any encumbrance on any equity interests in Anshan Easy Health that would affect Jinwo Shanghai’s interests. The share pledge agreement will expire when Anshan Easy Healthfully performs its obligations under the exclusive business cooperation agreement. We are in the process of registering the share pledges with the local Administration of Industry and Commerce branch in the PRC.

Powers of Attorney. Ms. Zhang and Mr. Gu each signed a power of attorney dated July 2, 2012 providing Jinwo Shanghai the power to act as her/his exclusive agent with respect to all matters related to his/her ownership of Anshan Easy Health, including the right to attend shareholders’ meetings of Anshan Easy Health and the right to exercise voting rights to which she/he is entitled under PRC law.

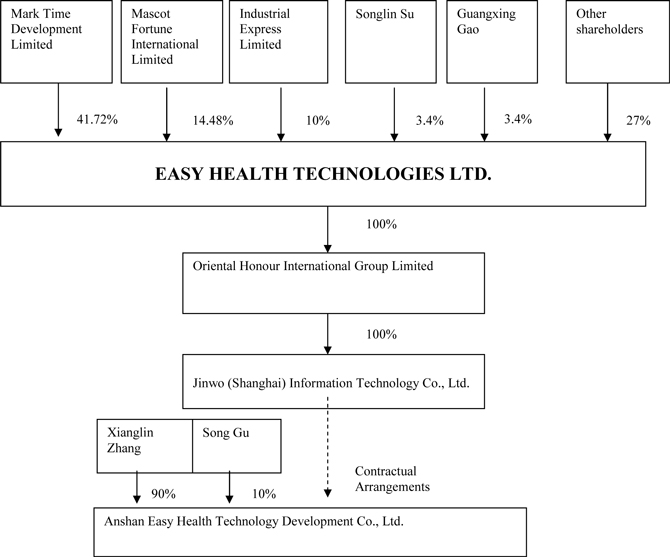

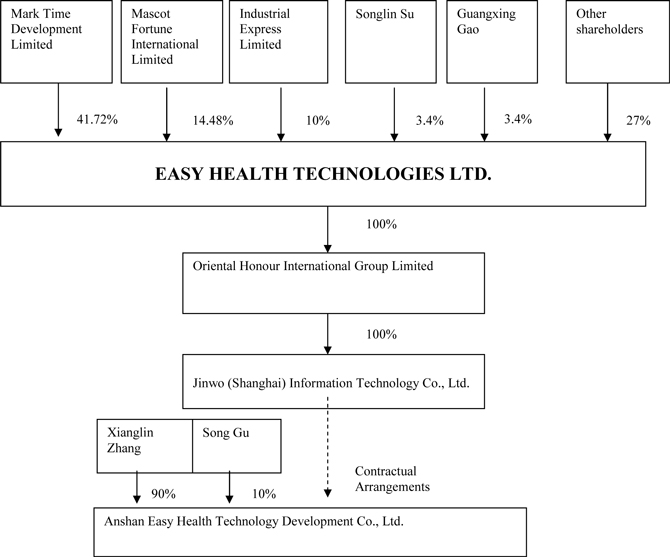

Organizational Structure Chart

The following chart reflects our organizational structure after the reverse acquisition between Oriental Honour and Easy Health:

Registered office - British Virgin Islands

The address of our registered office in the British Virgin Islands is: Akara Building, 24 De Castro Street, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands. The telephone number of the registered office is (284) 494-4840.

4B. Business Overview

Overview

The individuals who organized our company have developed an electrical medical diagnostic device that will enable our customers to obtain low cost, rapid diagnosis of a wide array of adverse health conditions. The device incorporates knowledge from a number of disciplines: Chinese Meridian theory - the measurement of the flow of life energy (“qi”) - as well as 21st Century western medicine, advanced statistical analysis, and electronics. Nevertheless, the device is manufactured for us at a relatively low cost. The low cost of the device, combined with the availability of a portable data collector, provide us a vehicle for rapid distribution of our diagnostic services, for both home and office-based applications, throughout China.

Our business plan contemplates that our company will serve as a relatively small and flexible hub for the network of independent parties that will participate in the distribution of diagnostic services to our clientele. The primary spokes on the network will be:

| · | Manufacturing. We have contracted with a well-established medical equipment manufacturer to produce the devices to our order. |

| · | Marketing.A network of exclusive regional agents will solicit clients for our diagnostic services and perform the diagnostic services utilizing our device. |

| | | |

| · | Health Care Services.A major health care provider has contracted to provide post-diagnosis, health care consultation and medical services to our clientele, and to provide hospital services as needed. |

This combination, in which we outsource all but the central management function, is intended to enable us to achieve wide penetration for our diagnostic services with only modest capital investment. We expect the initial capital contribution of $1.5 million to Anshan Easy Health will be adequate to finance our business operations at the initial stage.

The Tele Diagnostic System

The foundation for our business is a theTeleDiagnosis System (“TDS”), a non-invasive, electronic diagnostic device that can assess a wide range of human health conditions accurately within ten minutes. The technological foundation for the TDS is the theory of biomechanical impulses, first given practical application by Professor William Einthoven, who received the Nobel Prize for his development in 1903 of a practical device to diagnose cardiac issues by analyzing surface bio-electric impulses - i.e. the electrocardiograph. Currently western medical practitioners carry our electrical diagnosis of a range of maladies is carried out through a variety of devices, including ECG diagnosis, EEG diagnosis, EGG diagnosis, ERG diagnosis and so on.

Our device incorporates the principles underlying the electrocardiogram, but combines them with the Meridian theory that is at the root of much traditional Chinese medicine - the theory that life-energy nourishes the body’s organs by travelling through a network of meridians that connect organs and extremities. Combining the principles from these two traditions allows us to offer clients a broader array of targets for diagnosis than is the focus of either tradition individually.

The diagnostic test is performed by a technician trained by Anshan Easy Health to understand and operate the TDS. The places where the tests are performed must be quiet with no electromagnetic interference. The technician initially collects basic medical information from the client: gender, age, height, weight, blood pressure, the current state of health and disease, family history, lifestyle (diet, physical activity, smoking, alcohol consumption, etc.), and hematic laboratory tests (blood lipids, blood sugar, etc.). After the technician inputs the client’s information into the TDS, the acupoints of the examinees on which the tests will be conducted are wiped with a cotton ball with 0.9% sodium chloride. Moving from the client’s right side to the left side, the testing staff collects data on 24 bioelectrical collection points with a non-invasive probe. After the data input is complete, the testing staff logs onto a central database that provides an interpretive data report for the client. The entire process takes 3-5 minutes to complete.

Our proprietary software interprets the client’s data by comparison to data models. The Anshan Easy Health database system consists of three parts: the terminal testing equipment, the central database and the test report. The terminal testing equipment collects bioelectrical values at specific points on the client’s skin and transfers the values into digital signals in TDS measurement units. The signals are uploaded to the central database, where a large number of normal human bioelectrical data models and individual specific-state bioelectrical data models are stored. The models are updated continuously following the principles of evidence-based medicine, providing a frame of reference for detecting a variety of common diseases. When the data submitted by the terminal testing equipment achieves a certain degree of similarity with a pre-existing data model, the system will analyze the disease status, make a preliminary judgment on potential diseases, make a preliminary screening on cancer risk, and make a comprehensive assessment of the overall condition of the client’s body. After the central database completes the assessment of the client’s bioelectric signals, it will send its conclusions and the relevant health warnings to the terminal testing equipment, which will generate a test report for the client.

Included in the comparative analysis performed by the TDS database of the overall health status of the client are the following procedures:

| 1. | an assessment of the nine basic states of the body, including physical, metabolic status, the spirit of the neural activity state, and the state of motion; |

| 2. | a diagnosis or diagnostic warning of nearly 60 types of common diseases/healthy problems, including: gastritis, cervical spondylosis,lumbar vertebrae disease, insufficiency of cardiovascular and cerebrovascular blood supply, bad gallbladder contraction and autonomic dysfunction; |

| 3. | an early warning analysis for coronary heart disease, stroke, liver disease, diabetes, and cancer; |

| 4. | a diagnostic warning on more than 30 types of diseases diagnosable by Chinese traditional medical doctors, such as: liver yang hyperactivity, deficiency of lung qi, stomach hotness, dampness-heat of bladder, and yin deficiency of spleen and kidney. |

| | | |

| 5. | the TDS database can also categorize nine kinds of constitution/physical type, such as qi-insufficiency constitution, damp-heat constitution, blood insufficiency constitution and peace/balance constitution. |

Quality control over the TDS is maintained by an ongoing program of sampling and testing. Anshan Easy Health has engaged a number of hospitals to function as independent third party reviewers of the diagnostic results produced by the TDS. The hospitals examine the client and then review the diagnostic report provided to the client by Anshan Easy Health to determine its accuracy. To date, the rate of consistency between the TDS diagnoses and the clinical diagnoses has exceeded 80%.

The hardware component of the TDS is manufactured for us by Fuzhou Fobes, an experienced fabricator of medical devices. The Cooperation Agreement that we signed with Fuzhou Fobes on May 29, 2012 includes the following terms:

| · | For a term of five years Fuzhou Fobes will manufacture the TDS exclusively for Anshan Easy Health. |

| · | The purchase prices payable by Anshan Easy Health will be 20,000 RMB ($3,170) for a complete office-based system and 2,000 ($317) for a portable data collection unit. |

| · | Anshan Easy Health has committed to the following minimum annual purchases: 2012: 500,000 RMB ($79,239); 2013: 1,000,000 RMB ($158,479); 2014 - 2016: 1,500,000 RMB ($237,718). |

| · | In the event of default, liquidated damages are stipulated, equal to 10% of the prior year’s purchases. |

| · | Fuzhou Fobes provides a five year repair or replace warranty. |

Membership

Our method of recruiting clients for our diagnostic services centers on the sale of membership cards. We are developing a network of regional sales agents, who will be responsible for client solicitation and delivery of the TDS services. Each sales agent commits to purchase membership cards from us, which it then distributes at fixed prices in its region. We sell a standard one year Easy Health membership card to our agent for 600 RMB ($95), and the agent resells it for 800 RMB ($127). We also offer a VIP membership card, purchased by our agent for 2,400 RMB ($380) and resold for 3600 RMB ($571). Both memberships offer the client comprehensive diagnostic services, including:

| · | TDS diagnosis.Based on the collection of personal health information, quantitative assessment of an individual's health state and the risk of future illness or death is conducted in a mathematical model and then the status of the individuals in the "health", "mild sub-health", "severe sub-health" or "disease" is determined; |

| · | Health Management Consulting. After the completion of the physical examination and TDS health assessment, our client may receive different levels of health advisory services. Our client may go to a health management service center to receive counseling, or communicate by telephone with a personal health administrator. The consultation includes explanation of the personal health information, the health assessment results, and the effects to our customers’ health. The consulting professional will also assist the client in making personal health management plans, provide health guidance, and make follow-up plans. |

| · | General Health Service. The follow-up health services vary, depending on the situation of our clients. Our clients have access to personal health information on the internet and receive health guidance. We regularly send our customers communications regarding health management and health tips and provide personalized health improvement plans. |

| · | Specific Health and Disease Management Services.Our customers who have chronic diseases can choose specific services for a specific disease or disease risk factors, such as diabetes management, cardiovascular disease management, stress relief, smoking cessation, exercise, nutrition and dietary counseling. Optional services include personal health education, lifestyle improvement consulting and education. |

Purchase of a standard one year Easy Health membership card entitles the holder to the following:

| · | two TDS diagnostic sessions with the follow-on evaluations and recommendations; |

| · | free online health counseling provided by the China Health Management Center Network (www.12021.cn); |

| · | green channel service and favorable pricing when visiting doctors in the medical institutions that are affiliated with Anshan Easy Health; |

| | | |

| · | life-long health records. |

Purchase of a one year VIP Easy Health membership card entitles the holder to these additional privileges:

| · | four TDS diagnostics sessions. |

| · | free consultation, twice a year, conducted by specialists in a 3 Grade Class A Hospital in a major city in China; |

| · | one annual doctor visit or hospitalization in a 3 Grade Class A Hospital in a major city in China. |

Marketing Network

We intend to rely on exclusive regional agents to market our services. To date, Anshan Easy Health has entered into regional agency agreements with agents in the TieDong District of Anshan City, the TieXi District of Anshan City, Fujian Province, Fushun (Liaoning Province) and Jinan (Shandong Province). Each regional agent enters into an agency agreement that contains the following basic terms:

| · | The agent will purchase membership cards at set prices and resell them at a 33% markup. |

| · | For every 1000 membership cards purchased, Anshan Easy Health will provide the agent one office-based TDS system and two portable data collection devices. |

| · | Anshan Easy Health will train the agent’s personnel to enable them to administer the TDS test. For each diagnostic test administered by the agent, Anshan Easy Health will pay 40 RMB ($6.35) to Fuzhou Fobes and Fuzhou Fobes in turn will pay 30 RMB ($4.75) to the agent who performed the diagnostic test. Fuzhou Fobees will retain 10RMB as compensation for equipment maintenance and consulting. |

| · | To maintain its agency, the agent must meet set targets for annual sales. Our two initial agents, for example, are required to meet the following sales targets: to sell the membership cards worth no less than 1.0 million RMB ($158,730) in the first year; no less than 2.0 million RMB ($317,460) in 2013; and no less than 3.0 million RMB ($476,190) in each year from 2014 to 2016. If two consecutive quarters of sales amount to less than 300,000 RMB ($47,619), we are entitled to revoke the agency. |

Each of the five regional agents engaged to date has purchased its initial inventory of 1,000 membership cards. In turn, since August Anshan Easy Health has purchased 11 office-based TDS sets and 22 portable TDS data collection units, some for delivery to the initial agents, others to have available as new agents are brought on.

Medical Services

Anshan Easy Health does not employ doctors or directly offer medical care to its clients. To meet the needs of clients whose TDS diagnosis indicates a need for medical care, Anshan Easy Health has associated with the China Primary Health Care Foundation, a non-profit organizationco-founded by the Chinese Peasants and Workers Democratic Party and the PRC Ministry of Health for the purpose of funding and developing the primary health care task in China's poverty-stricken areas. China Primary Health Care Foundation is a supporter of a large-scale public welfare activity, "Chinese Enterprises Health Miles,” and Anshan Easy Health is one of the partners in the abovementioned welfare activity.

The specific medical services provided to Anshan Easy Health’s clients are made available by Dayi Jingcheng (Beijing) Hospital Management Co. (“Dayi”) which is a cooperative partner of the China Primary Health Care Foundation. In June 2012 Anshan Easy Health entered into a Service Agreement with Dayi, which provides that Dayi will arrange consultation conducted by specialists/doctors and hospitalization in a 3 Grade Class-A Hospital for Anshan Easy Health’s members. Dayi also provides Anshan Easy Health with specialists’ service on www.12021.cn. Anshan Easy Health pays Dayi for its services up to the limits afforded to members - i.e. one annual hospital-based doctor visit, one annual hospitalization, and online or telephonic consultation as needed.

Competition

We are not aware of any company currently providing electromagnetic medical diagnostic services on an out-patient basis in China. In China, this type of medical diagnostic equipment is mainly used in hospitals at all levels, such as MRI, CT, ECG, EEG, EGG, ERG map. We expect clients to choose our services as an alternative to hospital-based diagnosis mainly because of the convenience.

We expect that if we are successful in this business, competitors will arise. Our plan for successful competition will be to focus on the technological advantages of our proprietary software system. While our hardware could be readily duplicated, the hardware device is mainly a bio-signal collection tool to obtain the bioelectrical value of the specific surface points of examinees. Our core technology and competitive advantage lie in the central database and the test report. In the future, the Company plans to strengthen our research and development activities so as to enhance the applicability and accuracy of the software. Medical diagnosis is an area in which quality is the primary competitive advantage. So we plan to offer the quality of our TDS as our core competitiveness.

Governmental Regulations

Our business will be subject to government regulation in several aspects:

Business license

Any company that conducts business in the PRC must have a business license that covers a particular type of work. Our business license covers our present business of performing electromagnetic diagnosis. Prior to expanding our business beyond that of our business license, we would be required to apply and receive approval from the PRC government.

Employment laws

We are subject to laws and regulations governing our relationship with our employees, including wage and hour requirements, working and safety conditions, citizenship requirements, work permits and travel restrictions. These include local labor laws and regulations, which may require substantial resources for compliance. China’s National Labor Law, which became effective on January 1, 1995, and China’s National Labor Contract Law, which became effective on January 1, 2008, permit workers in both state and private enterprises in China to bargain collectively. The National Labor Law and the National Labor Contract Law provide for collective contracts to be developed through collaboration between the labor union (or worker representatives in the absence of a union) and management that specify such matters as working conditions, wage scales, and hours of work. The laws also permit workers and employers in all types of enterprises to sign individual contracts, which are to be drawn up in accordance with the collective contract.

Value added tax

Pursuant to the Provisional Regulation of China on Value Added Tax and their implementing rules, all entities and individuals that are engaged in the sale of goods, the provision of repairs and replacement services and the importation of goods in China are generally required to pay VAT at a rate of 17.0% of the gross sales proceeds received, less any deductible VAT already paid or borne by the taxpayer. Furthermore, when exporting goods, the exporter is entitled to a portion, or in some instances all, of the VAT refund that the exporter previously paid.

Mandatory statutory reserve and dividend distributions

Under applicable PRC regulations, foreign-invested enterprises in China may pay dividends out of their accumulated profits only, if any, as determined in accordance with PRC accounting standards and regulations. In addition, a foreign-invested enterprise in China is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year for its general reserve until the cumulative amount of such reserve reaches 50% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a foreign-invested enterprise has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

4C. Organizational Structure

See “—History and Development of the Company” above in subsection A of Item 4 for a description of our organizational structure.

4D. Property, Plants and Equipment

We entered into a lease on March 18, 2012 with Chunyang Xie for office space located in Anshan City, Liaoning Province, with an area of 247 square meters. The lease is for a three year term, which terminates on March 17, 2015. The annually rent is $11,041. We use this space as office space and our headquarters. At the conclusion of the lease we have the option, with one month notice, to negotiate a lease renewal.

ITEM 4A. UNRESOLVED STAFF COMMENTS

Not applicable

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

Accounting for Reverse Acquisition

On December 28, 2012 the Company acquired ownership of the outstanding shares of Oriental Honour International Group Limited (“Oriental Honour”). In connection with the acquisition, control of the Company was transferred to the prior owners of Oriental Honour. In addition, the fundamental nature of the Company’s business was changed, as the Company had been a shell prior to the acquisition and became involved in the business of providing medical diagnostics after the acquisition, utilizing the assets of, and business relationships developed by, an entity controlled by Oriental Honour. For these reasons, for accounting purposes, the acquisition of Oriental Honour has been treated as a recapitalization with no adjustment to the historical basis of its assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations were consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

Accounting for Variable Interest