UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23477

BNY Mellon ETF Trust

(Exact name of registrant as specified in charter)

240 Greenwich Street

New York, New York 10286

(Address of principal executive offices) (Zip code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 922-6400

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Ultra Short Income ETF

BNY Mellon Responsible Horizons Corporate Bond ETF

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

BNY Mellon Ultra Short Income ETF

Annual Shareholder Report

Ticker - BKUI (NYSE Arca, Inc.)

This annual shareholder report contains important information about BNY Mellon Ultra Short Income ETF (the “Fund”) for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at im.bnymellon.com/etfliterature. You can also request this information by calling us at 1-833-383-2696 or calling your financial adviser.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| BNY Mellon Ultra Short Income ETF | $12 | 0.12% |

How did the Fund perform last year?

For the 12 month period ended June 30, 2024, the Fund’s shares returned 5.76% on a net asset value basis and 5.77% on a market price basis.

In comparison, ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”) returned 5.40% for the same period.

What affected the Fund's performance?

U.S. Treasury yields fell in the second half of 2023, then rose by a similar amount in 2024, with bonds maturing in two-to-three years ending the reporting period little changed.

The Fund’s performance relative to the Index benefited from significant exposure to credit assets as credit spreads continued to move tighter over the 12-month period.

The Fund’s exposure to commercial paper during the first half of 2024 provided a yield pick-up versus shorter U.S. government securities.

In the first half of 2024, the Fund’s positions in fixed-rate securities detracted from relative performance as yields rose across the curve on expectations of higher-for-longer interest rates.

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

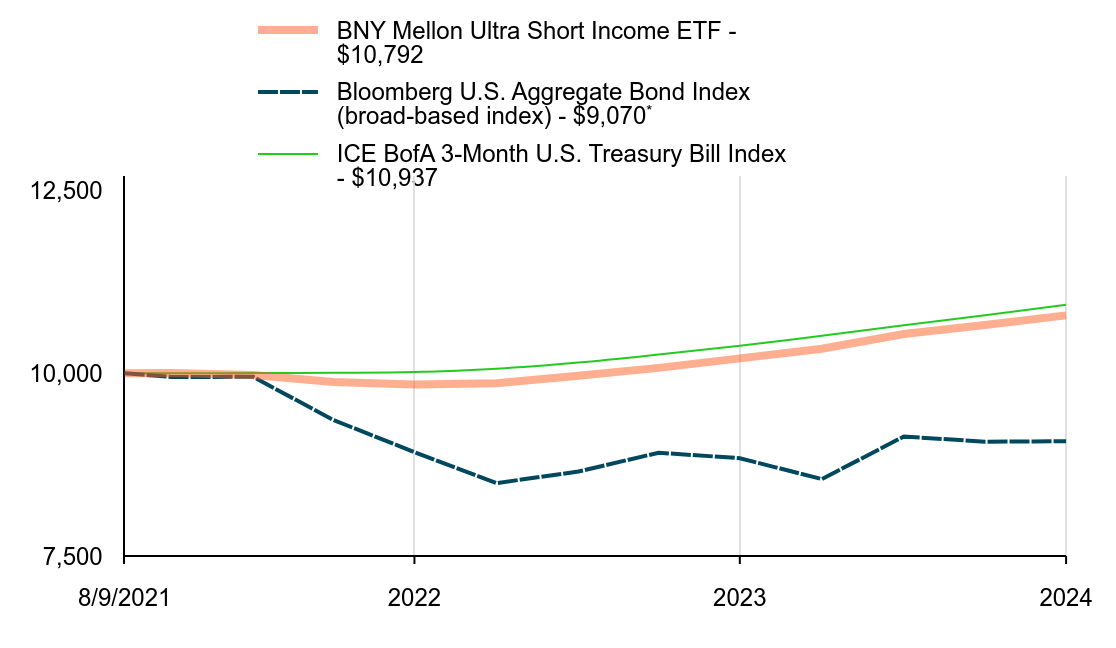

How did the fund perform since its inception?

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

CUMULATIVE PERFORMANCE FROM AUGUST 9, 2021 THROUGH JUNE 30, 2024

INITIAL INVESTMENT OF $10,000

| BNY Mellon Ultra Short Income ETF - $10,792 | Bloomberg U.S. Aggregate Bond Index (broad-based index) - $9,070Footnote Reference* | ICE BofA 3-Month U.S. Treasury Bill Index - $10,937 |

|---|

| 8/9/2021 | 10,000 | 10,000 | 10,000 |

| 9/30/2021 | 10,004 | 9,950 | 10,001 |

| 12/31/2021 | 9,976 | 9,951 | 10,002 |

| 3/31/2022 | 9,880 | 9,361 | 10,006 |

| 6/30/2022 | 9,846 | 8,921 | 10,016 |

| 9/30/2022 | 9,863 | 8,497 | 10,062 |

| 12/31/2022 | 9,966 | 8,656 | 10,147 |

| 3/31/2023 | 10,074 | 8,913 | 10,256 |

| 6/30/2023 | 10,204 | 8,838 | 10,376 |

| 9/30/2023 | 10,336 | 8,552 | 10,512 |

| 12/31/2023 | 10,538 | 9,135 | 10,656 |

| 3/31/2024 | 10,660 | 9,064 | 10,794 |

| 6/30/2024 | 10,792 | 9,070 | 10,937 |

The above graph compares a hypothetical $10,000 investment in the Fund’s shares to a hypothetical investment of $10,000 made in each index on August 9, 2021, the Fund’s inception. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, an index is not subject to fees and other expenses. Investors cannot invest directly in any index.

AVERAGE ANNUAL TOTAL RETURNS (AS OF 6/30/24)

| Fund | 1 YR | Since Inception (August 9, 2021) |

|---|

| BNY Mellon Ultra Short Income ETF - NAV Return | 5.76% | 2.68% |

| BNY Mellon Ultra Short Income ETF - Market Price Return | 5.77% | 2.67% |

Bloomberg U.S. Aggregate Bond Index (broad-based index)Footnote Reference* | 2.63% | |

| ICE BofA 3-Month U.S. Treasury Bill Index | 5.40% | 3.15% |

| Footnote | Description |

Footnote* | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective as of June 30, 2024. |

The performance data quoted represent past performance, which is no guarantee of future results. For more current performance information, visit im.bnymellon.com/etfliterature.

KEY FUND STATISTICS (AS OF 6/30/24)

| Fund size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period ($) | Annual Portfolio Turnover |

|---|

| $74 | 113 | 63,419 | 42.44% |

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

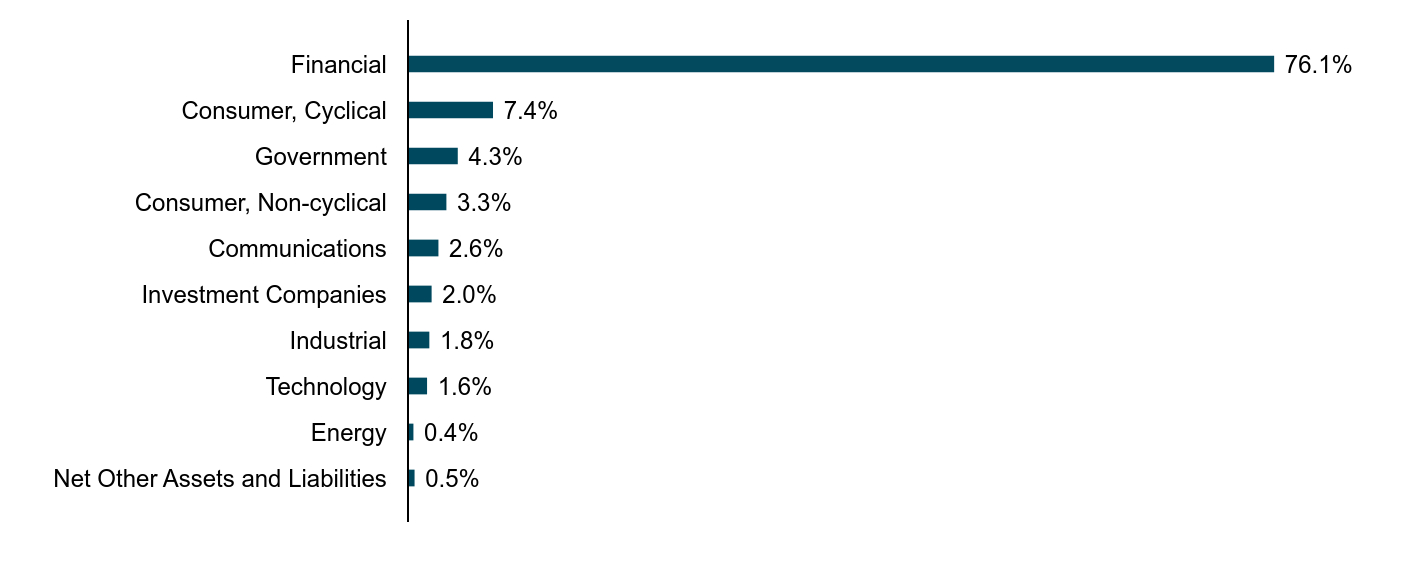

Portfolio Holdings (as of 6/30/24)

Sector Allocation

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | 0.5% |

| Energy | 0.4% |

| Technology | 1.6% |

| Industrial | 1.8% |

| Investment Companies | 2.0% |

| Communications | 2.6% |

| Consumer, Non-cyclical | 3.3% |

| Government | 4.3% |

| Consumer, Cyclical | 7.4% |

| Financial | 76.1% |

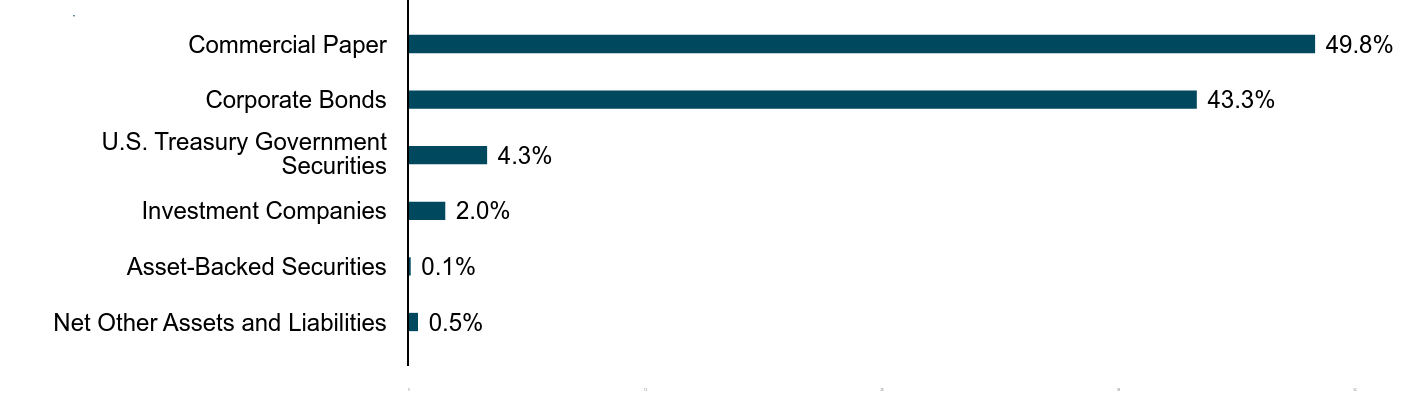

Allocation of Holdings

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | 0.5% |

| Asset-Backed Securities | 0.1% |

| Investment Companies | 2.0% |

| U.S. Treasury Government Securities | 4.3% |

| Corporate Bonds | 43.3% |

| Commercial Paper | 49.8% |

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/etfliterature.

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

© 2024 BNY Mellon Securities Corporation,

240 Greenwich Street, 9th Floor, New York, NY 10281

Code-4862AR0624

BNY Mellon Responsible Horizons Corporate Bond ETF

Annual Shareholder Report

Ticker - RHCB (NYSE Arca, Inc.)

This annual shareholder report contains important information about BNY Mellon Responsible Horizons Corporate Bond ETF (the “Fund”) for the period of July 1, 2023 to June 30, 2024.You can find additional information about the Fund at im.bnymellon.com/etfliterature. You can also request this information by calling us at 1-833-383-2696 or calling your financial adviser.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| BNY Mellon Responsible Horizons Corporate Bond ETF | $36 | 0.35% |

How did the Fund perform last year?

For the 12 month period ended June 30, 2024, the Fund’s shares returned 5.12% on a net asset value basis and 5.07% on a market price basis.

In comparison, ICE BofA U.S. Corporate Index (the “Index”) returned 5.04% for the same period.

What affected the Fund's performance?

Economic growth propelled credit markets to gains, narrowing credit spreads as the Federal Reserve (“Fed”) ended its tightening cycle in September 2023.

The Fund was positioned slightly long duration in anticipation of upcoming Fed rate cuts as inflation normalizes. However, this led to a slight drag on performance as the rate cuts were delayed. In addition, our overweight to the 7 year and 30 year was a slight drag on performance as the very short end of the curve outperformed and the curve steepened.

Security selection and a large allocation to credit risk drove the Fund’s performance. As spreads tightened, the Fund’s overweight to lower-rated investment-grade bonds and a small allocation to high-yield bonds proved beneficial and upwards rating trends in securities held, providing performance tailwinds.

Sector allocation effects were mixed as the Fund’s overweight to banks contributed to performance but its underweight to energy detracted.

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

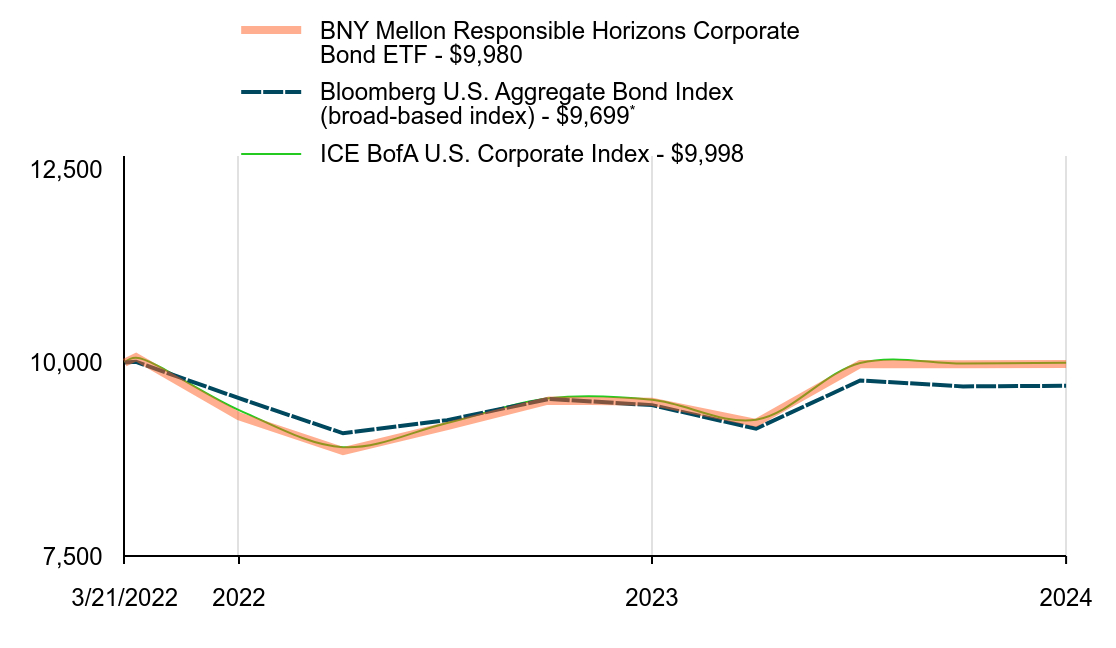

How did the fund perform since its inception?

The Fund's past performance is not a good predictor of the Fund's future performance.The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

CUMULATIVE PERFORMANCE FROM MARCH 21, 2022 THROUGH JUNE 30, 2024

INITIAL INVESTMENT OF $10,000

| BNY Mellon Responsible Horizons Corporate Bond ETF - $9,980 | Bloomberg U.S. Aggregate Bond Index (broad-based index) - $9,699Footnote Reference* | ICE BofA U.S. Corporate Index - $9,998 |

|---|

| 3/21/2022 | 10,000 | 10,000 | 10,000 |

| 3/31/2022 | 10,071 | 10,009 | 10,061 |

| 6/30/2022 | 9,306 | 9,539 | 9,386 |

| 9/30/2022 | 8,856 | 9,086 | 8,906 |

| 12/31/2022 | 9,180 | 9,256 | 9,220 |

| 3/31/2023 | 9,510 | 9,530 | 9,538 |

| 6/30/2023 | 9,494 | 9,450 | 9,518 |

| 9/30/2023 | 9,221 | 9,145 | 9,262 |

| 12/31/2023 | 9,981 | 9,768 | 9,995 |

| 3/31/2024 | 9,977 | 9,692 | 9,987 |

| 6/30/2024 | 9,980 | 9,699 | 9,998 |

The above graph compares a hypothetical $10,000 investment in the Fund’s shares to a hypothetical investment of $10,000 made in each index on March 21, 2022, the Fund’s inception. The performance shown takes into account applicable fees and expenses of the Fund, including management fees and other expenses. The Fund’s performance also assumes the reinvestment of dividends and capital gains. Unlike the Fund, an index is not subject to fees and other expenses. Investors cannot invest directly in any index.

AVERAGE ANNUAL TOTAL RETURNS (AS OF 6/30/24)

| Fund | 1 YR | Since Inception (March 21, 2022) |

|---|

| BNY Mellon Responsible Horizons Corporate Bond ETF - NAV Return | 5.12% | |

| BNY Mellon Responsible Horizons Corporate Bond ETF - Market Price Return | 5.07% | |

Bloomberg U.S. Aggregate Bond Index (broad-based index)Footnote Reference* | 2.63% | |

| ICE BofA U.S. Corporate Index | 5.04% | |

| Footnote | Description |

Footnote* | In accordance with regulatory changes requiring the Fund’s primary benchmark to represent the overall applicable market, the Fund’s primary prospectus benchmark changed to the indicated benchmark effective as of June 30, 2024. |

The performance data quoted represent past performance, which is no guarantee of future results. For more current performance information, visit im.bnymellon.com/etfliterature.

KEY FUND STATISTICS (AS OF 6/30/24)

| Fund size (Millions) | Number of Holdings | Total Advisory Fee Paid During Period ($) | Annual Portfolio Turnover |

|---|

| $23 | 276 | 78,566 | 56.72% |

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

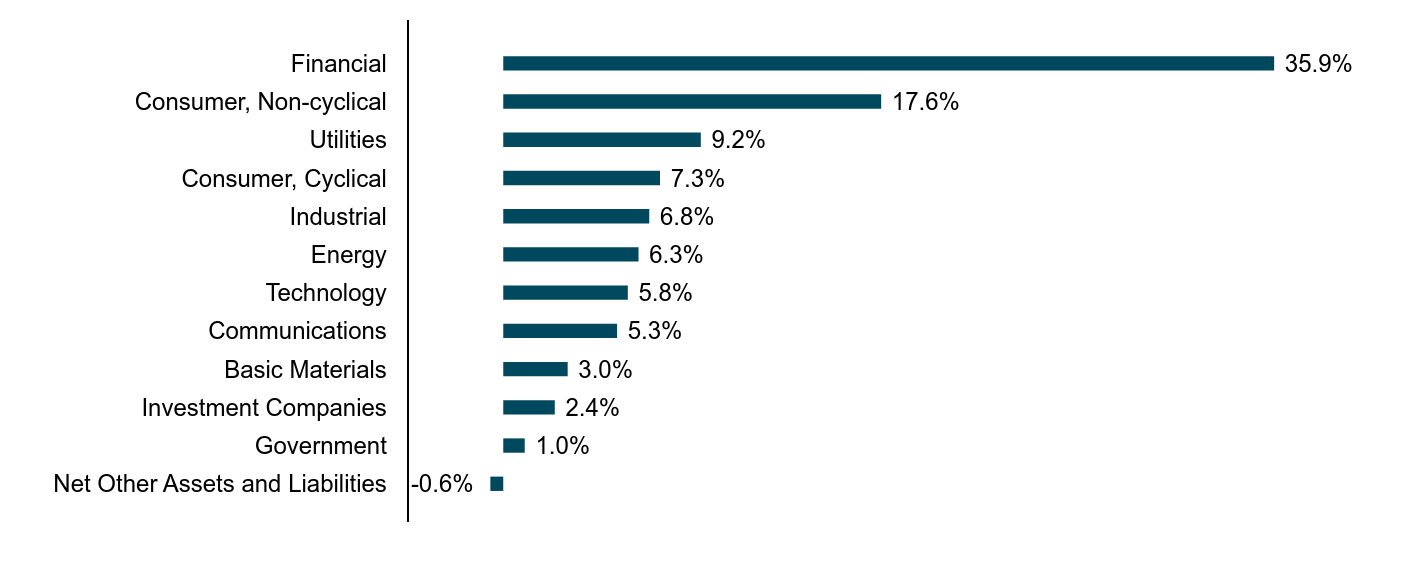

Portfolio Holdings (as of 6/30/24)

Sector Allocation

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | -0.6% |

| Government | 1.0% |

| Investment Companies | 2.4% |

| Basic Materials | 3.0% |

| Communications | 5.3% |

| Technology | 5.8% |

| Energy | 6.3% |

| Industrial | 6.8% |

| Consumer, Cyclical | 7.3% |

| Utilities | 9.2% |

| Consumer, Non-cyclical | 17.6% |

| Financial | 35.9% |

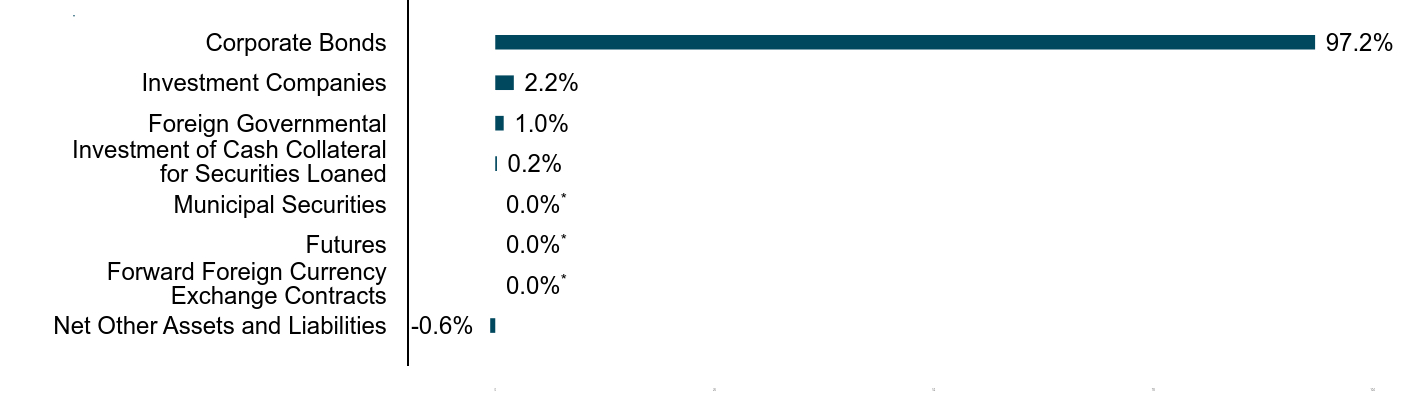

Allocation of Holdings

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | -0.6% |

| Forward Foreign Currency Exchange Contracts | 0.0%Footnote Reference* |

| Futures | 0.0%Footnote Reference* |

| Municipal Securities | 0.0%Footnote Reference* |

| Investment of Cash Collateral for Securities Loaned | 0.2% |

| Foreign Governmental | 1.0% |

| Investment Companies | 2.2% |

| Corporate Bonds | 97.2% |

| Footnote | Description |

Footnote* | Less than 0.1%. |

How has the Fund changed?

This is a summary of certain changes to the Fund since July 1, 2023. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by November 1, 2024 at im.bnymellon.com/etfliterature or upon request at 1-833-383-2696 or by calling your financial adviser.

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/etfliterature.

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

© 2024 BNY Mellon Securities Corporation,

240 Greenwich Street, 9th Floor, New York, NY 10281

Code-4863AR0624

Item 1. Reports to Stockholders (cont.).

(b) Not applicable.

Item 2. Code of Ethics.

(a) As of the period ended June 30, 2024 (the “Reporting Period”), the Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party.

(c) During the Reporting Period, there have been no amendments to a provision of the code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, and that relates to any element of the code of ethics description.

(d) During the Reporting Period, the Registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that Mr. Kevin W. Quinn is qualified to serve as an audit committee financial expert serving on the Registrant’s audit committee and that he is “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years were $43,299 in 2023 and $44,165 in 2024.

(b) Audit-Related Fees

The aggregate fees billed for each of the last two fiscal years for assurance and related services rendered to the Registrant by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $12,240 in 2023 and $12,484 in 2024. These services consisted of security counts required by Rule 17f-2 under the Investment Company Act of 1940, as amended.

(c) Tax Fees

The aggregate fees billed for each of the last two fiscal years for professional services rendered to the Registrant by the principal accountant for tax compliance, tax advice and tax planning were $7,752 in 2023 and $7,908 in 2024. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local entity tax planning, advice and assistance regarding statutory, regulatory or administrative developments, and (iii) tax advice regarding tax qualification.

(d) All Other Fees

The aggregate fees billed for each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item were $0 in 2023 and $0 in 2024.

(e)(1) Pursuant to the Registrant’s Audit Committee Charter that has been adopted by the audit committee, the audit committee shall approve all audit and permissible non-audit services to be provided to the Registrant and all permissible non-audit services to be provided to its investment adviser or any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant if the engagement relates directly to the operations and financial reporting of the Registrant.

(e)(2) The percentage of services described in paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, with respect to: Audit-Related Fees was 100%; Tax Fees was 100%; and All Other Fees was 0%.

(f) The percentage of hours expended on the principal accountant’s engagement to audit the Registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was less than fifty percent.

(g) The aggregate non-audit fees billed by the Registrant’s accountant for services rendered to the Registrant, and rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant for each of the last two fiscal years of the Registrant were $269,097 in 2023 and $282,787 in 2024.

(h) The Registrant’s audit committee has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

(a) The Registrant has a separately designated audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, which consists of independent trustees of the Registrant. The audit committee members are J. Charles Cardona, Kristen M. Dickey, F. Jack Liebau, Jr., Jill I. Mavro, Kevin W. Quinn, and Stacy L. Schaus.

(b) Not applicable.

Item 6. Investments.

(a) The Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included in the financial statements filed under Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The following is a copy of the Registrant’s most recent financial statements and financial highlights.

ANNUAL

FINANCIALS

AND

OTHER

INFORMATION

June

30,

2024

BNY

Mellon

Ultra

Short

Income

ETF:

BKUI

Principal

U.S.

Listing

Exchange:

NYSE

Arca,

Inc.

IMPORTANT

NOTICE

–

CHANGES

TO

ANNUAL

AND

SEMI-ANNUAL

REPORTS

The

Securities

and

Exchange

Commission

(the

“SEC”)

has

adopted

rule

and

form

amendments

which

have

resulted

in

changes

to

the

design

and

delivery

of

annual

and

semi-annual

fund

reports

(“Reports”).

Reports

are

now

streamlined

to

highlight

key

information.

Certain

information

previously

included

in

Reports,

including

financial

statements,

no

longer

appear

in

the

Reports

but

will

be

available

online

within

the

Semi-Annual

and

Annual

Financials

and

Other

Information,

delivered

free

of

charge

to

shareholders

upon

request,

and

filed

with

the

SEC.

Please

note

the

Annual

Financials

and

Other

Information

only

contains

Items

7-11

required

in

Form

N-CSR.

All

other

required

items

will

be

filed

with

the

SEC.

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

3

Statement

of

Investments

3

Statement

of

Assets

and

Liabilities

7

Statement

of

Operations

8

Statement

of

Changes

in

Net

Assets

9

Financial

Highlights

10

Notes

to

Financial

Statements

11

Report

of

Independent

Registered

Public

Accounting

Firm

16

Important

Tax

Information

17

Board

Members

Information

18

Officers

of

the

Trust

19

Item

8.

Changes

in

and

Disagreements

with

Accountants

for

Open-End

Management

Investment

Companies

21

Item

9.

Proxy

Disclosures

for

Open-End

Management

Investment

Companies

22

Item

10.

Remuneration

Paid

to

Directors,

Officers,

and

Others

of

Open-End

Investment

Companies

23

Item

11.

Statement

Regarding

Basis

for

Approval

of

Investment

Advisory

Contracts

24

Save

time.

Save

paper.

View

your

next

shareholder

report

online

as

soon

as

it’s

available.

Log

into

www.

im.bnymellon.com

and

sign

up

for

eCommunications.

It’s

simple

and

only

takes

a

few

minutes.

The

views

expressed

herein

are

current

to

the

date

of

this

report.

These

views

and

the

composition

of

the

fund’s

portfolio

is

subject

to

change

at

any

time

based

on

market

and

other

conditions.

Not

FDIC-Insured

•

Not

Bank-Guaranteed

•

May

Lose

Value

BNY

Mellon

Ultra

Short

Income

ETF

Statement

of

Investments

June

30,

2024

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

Description

Principal

Amount

($)

Value

($)

Asset-Backed

Securities

–

0.1%

Honda

Auto

Receivables

Owner

Trust,

Series

2021-3,

Class

A3,

0.41%,

11/18/2025

86,676

85,396

Total

Asset-Backed

Securities

(cost

$86,675)

85,396

Commercial

Paper

–

49.8%

Atlantic

Asset

Securitization

LLC,

5.41%,

7/10/2024

(a)(b)

1,000,000

998,219

Bank

of

Montreal,

5.48%,

9/04/2024

(a)(b)

1,400,000

1,385,979

Canadian

Imperial

Bank,

5.43%,

4/03/2025

(b)

1,500,000

1,440,051

Chariot

Funding

LLC,

5.51%

(1

Month

SOFR

+

0.17%),

10/02/2024

(a)(c)

750,000

750,014

Commonwealth

Bank

of

Australia,

5.22%,

10/16/2024

(a)(b)

1,600,000

1,574,016

Credit

Industriel

et

Commercial

5.28%,

1/09/2024

(a)(b)

1,000,000

984,518

5.35%,

2/06/2025

(a)(b)

1,300,000

1,256,282

DNB

ASA,

5.56%,

4/11/2025

(a)(b)

2,000,000

1,917,874

Fairway

Finance

Co.

LLC,

5.66%

(1

Month

SOFR

+

0.12%),

11/14/2024

(a)(c)

1,000,000

1,000,038

HSBC

Bank

PLC,

6.01%

(1

Month

SOFR

+

0.67%),

6/05/2025

(a)(c)

1,500,000

1,500,223

ING

(U.S.)

Funding

LLC,

5.40%,

9/05/2024

(b)

500,000

494,840

Liberty

Street

Funding

Corp.,

5.53%,

9/23/2024

(a)(b)

1,000,000

986,967

LMA

SA/LMA-Americas

LLC,

5.61%,

1/28/2025

(a)(b)

1,200,000

1,162,210

Macqurie

Bank

Ltd.,

5.29%,

9/16/2024

(a)(b)

2,000,000

1,975,615

Manhattan

Asset

Funding

Co.

LLC,

5.57%,

12/06/2024

(a)(b)

2,000,000

1,952,258

MetLife,

5.46%

(1

Month

SOFR

+

0.12%),

8/16/2024

(a)(c)

1,500,000

1,500,047

National

Bank,

5.47%,

4/01/2025

(b)

1,500,000

1,439,789

Natixis

SA,

5.45%,

8/05/2024

(b)

2,000,000

1,988,776

Old

Line

Funding

LLC

5.58%,

10/21/2024

(a)(b)

250,000

245,688

5.74%

(1

Month

SOFR

+

0.40%),

1/27/2025

(a)(c)

1,200,000

1,200,060

Societe

Generale

SA,

5.59%,

4/11/2025

(b)

1,000,000

959,031

Standard

Chartered

Bank,

5.26%,

10/01/2024

(b)

1,500,000

1,478,694

Svenska

Handelsbanken

AB,

6.02%,

9/18/2024

(b)

425,000

419,851

Swedbank

AB

5.40%,

7/17/2024

(a)(b)

2,000,000

1,994,431

5.37%,

3/13/2025

(a)(b)

750,000

722,012

Toronto-Dominion

Bank

5.90%

(1

Month

SOFR

+

0.56%),

10/28/2024

(a)(c)

350,000

350,438

5.46%,

4/03/2025

(a)(b)

1,500,000

1,439,859

United

Overseas

Bank

Ltd.,

5.48%

(1

Month

SOFR

+

0.15%),

9/30/2024

(a)(c)

2,000,000

2,000,392

Westpac

Banking

Corp.

5.79%,

11/14/2024

(a)(b)

500,000

489,842

5.41%,

3/31/2025

(a)(b)

1,500,000

1,440,984

Total

Commercial

Paper

(cost

$37,063,915)

37,048,998

Corporate

Bonds

–

43.3%

Auto

Manufacturers

–

5.1%

American

Honda

Finance

Corp.

,

1.30%

,

9/09/2026

300,000

276,551

BMW

US

Capital

LLC

5.74%

(3

Month

SOFRIX

+

0.38%),

8/12/2024

(a)(c)

300,000

300,072

4.90%,

4/02/2027

(a)

600,000

598,064

General

Motors

Financial

Co.,

Inc.

5.40%,

4/06/2026

250,000

249,564

6.71%

(3

Month

SOFRIX

+

1.35%),

5/08/2027

(c)

350,000

352,893

Mercedes-Benz

Finance

North

America

LLC

5.20%,

8/03/2026

(a)

325,000

325,241

3.45%,

1/06/2027

(a)

325,000

312,766

PACCAR

Financial

Corp.

,

3.55%

,

8/11/2025

300,000

294,650

Toyota

Motor

Credit

Corp.

5.67%

(3

Month

SOFR

+

0.32%),

1/13/2025

(c)

300,000

300,081

6.01%

(3

Month

SOFR

+

0.65%),

3/19/2027

(c)

750,000

753,281

3,763,163

Statement

of

Investments

(continued)

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

–

43.3%

(continued)

Banks

–

22.7%

ANZ

New

Zealand

Int'l

Ltd.

,

5.96%

(

3

Month

SOFR

+

0.60%

)

,

2/18/2025

(a)(c)

300,000

300,466

Bank

of

America

NA

,

5.53%

,

8/18/2026

300,000

302,188

Bank

of

Montreal

6.42%

(3

Month

SOFRIX

+

1.06%),

6/07/2025

(c)

350,000

351,852

5.27%,

12/11/2026

325,000

324,597

Bank

of

Nova

Scotia

(The)

5.81%

(3

Month

SOFR

+

0.46%),

1/10/2025

(c)

300,000

300,271

5.35%,

12/07/2026

750,000

751,144

Canadian

Imperial

Bank

of

Commerce

3.95%,

8/04/2025

275,000

270,403

6.59%

(3

Month

SOFR

+

1.22%),

10/02/2026

(c)

375,000

379,333

Citigroup,

Inc.

6.89%

(3

Month

SOFR

+

1.53%),

3/17/2026

(c)

300,000

302,422

6.13%

(3

Month

SOFR

+

0.77%),

6/09/2027

(c)

700,000

700,422

Commonwealth

Bank

of

Australia

,

6.11%

(

3

Month

SOFR

+

0.75%

)

,

3/13/2026

(a)(c)

350,000

351,821

Goldman

Sachs

Group,

Inc.

(The)

,

6.15%

(

3

Month

SOFR

+

0.79%

)

,

12/09/2026

(c)

725,000

725,940

ING

Groep

NV

,

3.95%

,

3/29/2027

600,000

579,403

JPMorgan

Chase

&

Co.

,

6.68%

(

3

Month

SOFR

+

1.32%

)

,

4/26/2026

(c)

300,000

302,555

JPMorgan

Chase

Bank

NA

,

5.11%

,

12/08/2026

325,000

325,006

KeyBank

NA

,

4.70%

,

1/26/2026

300,000

294,144

Manufacturers

&

Traders

Trust

Co.

,

4.65%

,

1/27/2026

300,000

294,641

Mitsubishi

UFJ

Financial

Group,

Inc.

,

6.75%

(

3

Month

SOFR

+

1.39%

)

,

9/12/2025

(c)

350,000

350,791

Morgan

Stanley

Bank

NA

,

6.52%

(

3

Month

SOFR

+

1.17%

)

,

10/30/2026

(c)

500,000

506,897

National

Australia

Bank

Ltd.

5.73%

(3

Month

SOFR

+

0.38%),

1/12/2025

(a)(c)

300,000

300,199

1.89%,

1/12/2027

(a)

375,000

347,450

National

Bank

of

Canada

,

5.25%

,

1/17/2025

300,000

299,234

Natwest

Markets

PLC

,

6.26%

(

3

Month

SOFR

+

0.90%

)

,

5/17/2027

(a)(c)

500,000

500,469

NatWest

Markets

PLC

5.89%

(3

Month

SOFR

+

0.53%),

8/12/2024

(a)(c)

350,000

350,115

1.60%,

9/29/2026

(a)

225,000

206,688

PNC

Financial

Services

Group,

Inc.

(The)

,

2.60%

,

7/23/2026

325,000

307,785

Royal

Bank

of

Canada

Series

G,

5.80%

(3

Month

SOFRIX

+

0.44%),

1/21/2025

(c)

300,000

299,878

Series

G,

6.31%

(3

Month

SOFRIX

+

0.95%),

1/19/2027

(c)

650,000

655,338

Standard

Chartered

PLC

,

7.11%

(

3

Month

SOFR

+

1.74%

)

,

3/30/2026

(a)(c)

350,000

352,316

State

Street

Corp.

3.55%,

8/18/2025

98,000

96,150

5.27%,

8/03/2026

225,000

225,474

6.20%

(3

Month

SOFRIX

+

0.85%),

8/03/2026

(c)

350,000

351,503

Sumitomo

Mitsui

Financial

Group,

Inc.

,

1.40%

,

9/17/2026

300,000

275,445

Sumitomo

Mitsui

Trust

Bank

Ltd.

5.80%

(3

Month

SOFR

+

0.44%),

9/16/2024

(a)(c)

300,000

300,159

6.48%

(3

Month

SOFR

+

1.12%),

3/09/2026

(a)(c)

300,000

303,106

5.65%,

9/14/2026

(a)

325,000

327,055

Toronto-Dominion

Bank

(The)

5.71%

(3

Month

SOFR

+

0.35%),

9/10/2024

(c)

300,000

300,099

5.53%,

7/17/2026

200,000

200,749

US

Bancorp

1.45%,

5/12/2025

1,600,000

1,545,619

Series

V,

2.38%,

7/22/2026

325,000

306,766

Wells

Fargo

&

Co.

,

3.00%

,

2/19/2025

300,000

295,194

Wells

Fargo

Bank

NA

,

5.55%

,

8/01/2025

750,000

751,220

Westpac

Banking

Corp.

,

5.66%

(

3

Month

SOFR

+

0.30%

)

,

11/18/2024

(c)

300,000

300,106

16,912,413

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

–

43.3%

(continued)

Computers

–

0.4%

International

Business

Machines

Corp.

,

4.00%

,

7/27/2025

300,000

295,799

295,799

Diversified

Financial

Services

–

2.2%

American

Express

Co.

6.12%

(3

Month

SOFR

+

0.76%),

2/13/2026

(c)

250,000

251,251

2.55%,

3/04/2027

750,000

701,162

Charles

Schwab

Corp.

(The)

5.88%

(3

Month

SOFRIX

+

0.52%),

5/13/2026

(c)

300,000

300,084

5.88%,

8/24/2026

350,000

354,125

1,606,622

Healthcare-Services

–

0.9%

Roche

Holdings,

Inc.

,

6.10%

(

3

Month

SOFR

+

0.74%

)

,

11/13/2026

(a)(c)

650,000

654,914

654,914

Insurance

–

0.4%

Prudential

Financial,

Inc.

,

1.50%

,

3/10/2026

300,000

282,262

282,262

Machinery-Construction

&

Mining

–

1.0%

Caterpillar

Financial

Services

Corp.

,

5.88%

(

3

Month

SOFR

+

0.52%

)

,

5/14/2027

(c)

750,000

752,508

752,508

Machinery-Diversified

–

0.8%

John

Deere

Capital

Corp.

4.80%,

1/09/2026

300,000

298,243

1.70%,

1/11/2027

350,000

322,867

621,110

Media

–

0.9%

Comcast

Corp.

,

2.35%

,

1/15/2027

750,000

702,371

702,371

Oil

&

Gas

–

0.4%

BP

Capital

Markets

America,

Inc.

,

3.41%

,

2/11/2026

300,000

291,668

291,668

Pharmaceuticals

–

2.4%

AbbVie,

Inc.

,

2.95%

,

11/21/2026

350,000

333,703

Cigna

Group

(The)

,

5.69%

,

3/15/2026

650,000

650,035

CVS

Health

Corp.

,

3.00%

,

8/15/2026

300,000

285,933

Pfizer

Investment

Enterprises

Pte

Ltd.

,

4.45%

,

5/19/2026

250,000

246,894

Shire

Acquisitions

Investments

Ireland

DAC

,

3.20%

,

9/23/2026

300,000

287,764

1,804,329

Real

Estate

–

0.9%

Simon

Property

Group

LP

,

1.38%

,

1/15/2027

725,000

661,765

661,765

Retail

–

2.3%

Home

Depot,

Inc.

(The)

,

4.00%

,

9/15/2025

750,000

739,340

Target

Corp.

,

1.95%

,

1/15/2027

700,000

651,639

Walmart,

Inc.

,

3.90%

,

9/09/2025

300,000

295,774

1,686,753

Semiconductors

–

0.4%

Intel

Corp.

,

3.70%

,

7/29/2025

300,000

294,941

294,941

Software

–

0.8%

Oracle

Corp.

,

2.65%

,

7/15/2026

300,000

284,387

Salesforce,

Inc.

,

0.63%

,

7/15/2024

300,000

299,427

583,814

Statement

of

Investments

(continued)

See

Notes

to

Fina

ncial

Statements

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

–

43.3%

(continued)

Telecommunications

–

1.7%

AT&T,

Inc.

,

4.25%

,

3/01/2027

700,000

683,846

T-Mobile

USA,

Inc.

,

3.75%

,

4/15/2027

600,000

576,817

1,260,663

Total

Corporate

Bonds

(cost

$32,221,420)

32,175,095

U.S.

Treasury

Government

Securities

–

4.3%

U.S.

Treasury

Notes

3.13%,

8/15/2025

1,750,000

1,713,530

4.88%,

11/30/2025

1,500,000

1,498,506

Total

U.S.

Treasury

Government

Securities

(cost

$3,234,915)

3,212,036

Shares

Investment

Companies

–

2.0%

Registered

Investment

Companies

–

2.0%

Dreyfus

Institutional

Preferred

Government

Money

Market

Fund,

Institutional

Shares,

5.27%

(d)(e)

(cost

$1,494,113)

1,494,113

1,494,113

Total

Investments

(cost

$74,101,038)

99.5%

74,015,638

Cash

and

Receivables

(Net)

0.5%

368,065

Net

Assets

100.0%

74,383,703

SOFR—Secured

Overnight

Financing

Rate

SOFRIX—Secured

Overnight

Financing

Rate

Index

(a)

Security

exempt

from

registration

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

At

June

30,

2024,

these

securities

were

valued

at

$34,658,867

or

46.59%

of

net

assets.

(b)

Security

is

a

discount

security.

Income

is

recognized

through

the

accretion

of

discount.

(c)

Variable

rate

security

-

rate

shown

is

the

interest

rate

in

effect

at

period

end.

Security

description

also

includes

the

reference

rate

and

spread

if

published

and

available.

(d)

Investment

in

affiliated

issuer.

The

investment

objective

of

this

investment

company

is

publicly

available

and

can

be

found

within

the

investment

company’s

prospectus.

(e)

The

rate

shown

is

the

1-day

yield

as

of

June

30,

2024.

Holdings

and

transactions

in

these

affiliated

companies

during

the

period

ended

June

30,

2024

are

as

follows:

Description

Value

($)

6/30/23

Purchases

($)

1

Sales

($)

Value

($)

6/30/24

Dividends/

Distributions

($)

Investment

Companies

–

2.0%

Dreyfus

Institutional

Preferred

Government

Money

Market

Fund,

Institutional

Shares

39,339

75,033,420

(73,578,646)

1,494,113

97,699

Total

–

2.0%

39,339

75,033,420

(73,578,646)

1,494,113

97,699

1

Includes

reinvested

dividends/distributions.

STATEMENT

OF

ASSETS

AND

LIABILITIES

June

30,

2024

See

Notes

to

Financial

Statements

Cost

Value

Assets

($):

Investments

in

securities—See

Statement

of

Investments:

–

Unaffiliated

issuers

72,606,925

72,521,525

Affiliated

issuers

1,494,113

1,494,113

Interest

receivable

371,339

Dividends

receivable

4,031

74,391,008

Liabilities

($):

Due

to

BNY

Mellon

ETF

Investment

Adviser,

LLC—Note

3(b)

7,305

7,305

Net

Assets

($)

74,383,703

Composition

of

Net

Assets

($):

Paid-in

capital

74,494,211

Total

distributable

earnings

(loss)

(110,508)

Net

Assets

($)

74,383,703

Shares

outstanding

no

par

value

(unlimited

shares

authorized):

1,500,001

Net

asset

value

per

share

49.59

Market

price

per

share

49.58

STATEMENT

OF

OPERATIONS

Year

Ended

June

30,

2024

See

Notes

to

Financial

Statements

Investment

Income

($):

Income:

Cash

dividends:

Affiliated

issuers

97,699

Interest

2,553,163

Total

Income

2,650,862

Expenses:

Management

fee—Note

3(a)

63,419

Total

Expenses

63,419

Net

Investment

Income

2,587,443

Realized

and

Unrealized

Gain

(Loss)

on

Investments—Note

4

($):

Net

realized

gain

(loss)

on

investments

(16,315)

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

241,251

Net

Realized

and

Unrealized

Gain

(Loss)

on

Investments

224,936

Net

Increase

(Decrease)

in

Net

Assets

Resulting

from

Operations

2,812,379

STATEMENT

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements

Year

Ended

June

30,

2024

2023

Operations

($):

Net

investment

income

2,587,443

887,148

Net

realized

gain

(loss)

on

investments

(16,315)

(9,700)

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

241,251

117,584

Net

Increase

(Decrease)

in

Net

Assets

Resulting

from

Operations

2,812,379

995,032

Distributions

($):

Distributions

to

shareholders

(2,459,830)

(878,254)

Beneficial

Interest

Transactions

($):

Proceeds

from

shares

sold

47,001,580

4,886,067

Cost

of

shares

redeemed

(2,473,521)

(2,436,261)

Transaction

fees—Note

5

4,948

732

Increase

(Decrease)

in

Net

Assets

from

Beneficial

Interest

Transactions

44,533,007

2,450,538

Total

Increase

(Decrease)

in

Net

Assets

44,885,556

2,567,316

Net

Assets

($):

Beginning

of

Period

29,498,147

26,930,831

End

of

Period

74,383,703

29,498,147

Changes

in

Shares

Outstanding:

Shares

sold

950,000

100,000

Shares

redeemed

(50,000)

(50,000)

Net

Increase

(Decrease)

in

Shares

Outstanding

900,000

50,000

The

following

table

describes

the

performance

for

the

fiscal

periods

indicated.

See

Notes

to

Financial

Statements

Year

Ended

June

30,

For

the

Period

from

August

11,

2021

(a)

to

June

30,

2022

2024

2023

Per

Share

Data

($):

Net

asset

value,

beginning

of

period

49.16

48.97

50.00

Investment

Operations:

Net

investment

income

(b)

2.41

1.56

0.17

Net

realized

and

unrealized

gain

(loss)

on

investments

0.36

0.18

(0.94)

Total

from

Investment

Operations

2.77

1.74

(0.77)

Distributions:

–

–

–

Dividends

from

net

investment

income

(2.34)

(1.55)

(0.27)

Transaction

fees

(b)

0.00

(c)

0.00

(c)

0.01

Net

asset

value,

end

of

period

49.59

49.16

48.97

Market

price,

end

of

period

49.58

49.15

48.96

Net

Asset

Value

Total

Return

(%)

(d)

5.76

3.64

(1.54)

(e)

Market

Price

Total

Return

(%)

(d)

5.77

3.62

(1.55)

(e)

Ratios/Supplemental

Data

(%):

Ratio

of

total

expenses

to

average

net

assets

0.12

0.12

0.12

(f)

Ratio

of

net

investment

income

to

average

net

assets

4.90

3.19

0.39

(f)

Portfolio

Turnover

Rate

(g)

42.44

20.55

43.10

Net

Assets,

end

of

period

($

x

1,000)

74,384

29,498

26,931

(a)

Commencement

of

operations.

(b)

Based

on

average

shares

outstanding.

(c)

Amount

represents

less

than

$0.01

per

share.

(d)

Net

asset

value

total

return

is

calculated

assuming

an

initial

investment

made

at

the

net

asset

value

at

the

beginning

of

the

period,

reinvestment

of

all

dividends

and

distributions

at

net

asset

value

during

the

period,

and

redemption

at

net

asset

value

on

the

last

day

of

the

period.

Net

asset

value

total

return

includes

adjustments

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

and

as

such,

the

net

asset

value

for

financial

reporting

purposes

and

the

returns

based

upon

those

net

asset

values

may

differ

from

the

net

asset

value

and

returns

for

shareholder

transactions.

Market

price

total

return

is

calculated

assuming

an

initial

investment

made

at

the

market

price

at

the

beginning

of

the

period,

reinvestment

of

all

dividends

and

distributions

at

market

price

during

the

period,

and

sale

at

the

market

price

on

the

last

day

of

the

period.

Total

investment

returns

calculated

for

a

period

of

less

than

one

year

are

not

annualized.

(e)

The

net

asset

value

total

return

and

the

market

price

total

return

is

calculated

from

fund

inception.

The

inception

date

is

the

first

date

the

fund

was

available

on

NYSE

Arca,

Inc.

(f)

Annualized.

(g)

Portfolio

turnover

rate

is

not

annualized

for

periods

less

than

one

year,

if

applicable,

and

does

not

include

securities

received

or

delivered

from

processing

creations

or

redemptions.

NOTES

TO

FINANCIAL

STATEMENTS

NOTE

1—Organization:

BNY

Mellon

Ultra

Short

Income

ETF (the “fund”) is a

separate

diversified series

of

BNY

Mellon

ETF

Trust

(the

“Trust”),

which is

registered as

a

Massachusetts

business

trust

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”),

as

an

open-ended

management

investment

company.

The

Trust

operates

as

a

series

company

currently

consisting

of

thirteen

series,

including

the

fund.

The

investment

objective

of

the

fund

is

to

seek

high

current

income

consistent

with

the

maintenance

of

liquidity

and

low

volatility

of

principal.

BNY

Mellon

ETF

Investment

Adviser,

LLC

(the

“Adviser”),

a

wholly-owned

subsidiary

of

The

Bank

of

New

York

Mellon

Corporation

(“BNY”),

serves

as

the

fund’s

investment

adviser. Dreyfus,

a

division

of

Mellon

Investments

Corporation (the

“Sub-Adviser”),

an

indirect wholly-owned

subsidiary

of

BNY

and

an

affiliate

of

the

Adviser,

serves

as

the

fund’s

sub-adviser.

The

Bank

of

New

York

Mellon,

a

subsidiary

of

BNY

and

an

affiliate

of

the

Adviser,

serves

as

administrator,

custodian

and

transfer

agent

with

the

Trust.

BNY

Mellon

Securities

Corporation

(the

“Distributor”),

a wholly-owned

subsidiary

of

the

Adviser,

is

the

distributor

of

the

fund’s

shares.

The

shares

of

the

fund

are

referred

to

herein

as

“Shares”

or

“Fund

Shares.”

Fund

Shares

are

listed

and

traded

on

NYSE

Arca,

Inc.

The

market

price

of

each

Share

may

differ

to

some

degree

from

the

fund’s

net

asset

value

(“NAV”).

Unlike

conventional

mutual

funds,

the

fund

issues

and

redeems

Shares

on

a

continuous

basis,

at

NAV,

only

in

a

large

specified

number

of

Shares,

each

called

a

“Creation

Unit”.

Creation

Units

are

issued

and

redeemed

principally

in

exchange

for

the

deposit

or

delivery

of

a

basket

of

securities.

Except

when

aggregated

in

Creation

Units

by

Authorized

Participants,

the

Shares

are

not

individually

redeemable

securities

of

the

fund.

Individual

Fund

Shares

may

only

be

purchased

and

sold

on

the

NYSE

Arca,

Inc.,

other

national

securities

exchanges,

electronic

crossing

networks

and

other

alternative

trading

systems

through

your

broker-dealer

at

market

prices.

Because

Fund

Shares

trade

at

market

prices

rather

than

at

NAV,

Fund

Shares

may

trade

at

a

price

greater

than

NAV

(premium)

or

less

than

NAV

(discount).

When

buying

or

selling

Shares

in

the

secondary

market,

you

may

incur

costs

attributable

to

the

difference

between

the

highest

price

a

buyer

is

willing

to

pay

to

purchase

Shares

of

the

fund

(bid)

and

the

lowest

price

a

seller

is

willing

to

accept

for

Shares

of

the

fund

(ask).

NOTE

2—Significant

Accounting

Policies:

The

Financial

Accounting

Standards

Board

(“FASB”)

Accounting

Standards

Codification

(“ASC”)

is

the

exclusive

reference

of

authoritative

U.S.

generally

accepted

accounting

principles

(“GAAP”)

recognized

by

the

FASB

to

be

applied

by

nongovernmental

entities.

Rules

and

interpretive

releases

of

the

SEC

under

authority

of

federal

laws

are

also

sources

of

authoritative

GAAP

for

SEC

registrants. The

fund

is an

investment

company

and

applies

the

accounting

and

reporting

guidance

of

the

FASB

ASC

Topic

946

Financial

Services-Investment

Companies. The

fund’s

financial

statements

are

prepared

in

accordance

with

GAAP,

which

may

require

the

use

of

management

estimates

and

assumptions.

Actual

results

could

differ

from

those

estimates.

The

Trust

enters

into

contracts

that

contain

a

variety

of

indemnifications.

The

fund’s

maximum

exposure

under

these

arrangements

is

unknown.

The

fund

does

not

anticipate

recognizing

any

loss

related

to

these

arrangements.

(a)

Portfolio

valuation:

The

fair

value

of

a

financial

instrument

is

the

amount

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date

(i.e.,

the

exit

price).

GAAP

establishes

a

fair

value

hierarchy

that

prioritizes

the

inputs

of

valuation

techniques

used

to

measure

fair

value.

This

hierarchy

gives

the

highest

priority

to

unadjusted

quoted

prices

in

active

markets

for

identical

assets

or

liabilities

(Level

1

measurements)

and

the

lowest

priority

to

unobservable

inputs

(Level

3

measurements).

Additionally,

GAAP

provides

guidance

on

determining

whether

the

volume

and

activity

in

a

market

has

decreased

significantly

and

whether

such

a

decrease

in

activity

results

in

transactions

that

are

not

orderly.

GAAP

requires

enhanced

disclosures

around

valuation

inputs

and

techniques

used

during

annual

and

interim

periods.

Various

inputs

are

used

in

determining

the

value

of

the

fund’s

investments

relating

to

fair

value

measurements.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

—

unadjusted

quoted

prices

in

active

markets

for

identical

investments.

Level

2

—

other

significant

observable

inputs

(including

quoted

prices

for

similar investments,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Level

3

—

significant

unobservable

inputs

(including

the

fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risk

associated

with

investing

in

those

securities.

Changes

in

valuation

techniques

may

result

in

transfers

in

or

out

of

an

assigned

level

within

the

disclosure

hierarchy.

Valuation

techniques

used

to

value

the

fund’s

investments

are

as

follows:

Registered

investment

companies

that

are

not

traded

on

an

exchange

are

valued

at

their

net

asset

value

and

are

generally

categorized

within

Level 1

of

the

fair

value

hierarchy.

NOTES

TO

FINANCIAL

STATEMENTS

(continued)

The

Trust’s Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser

as

the

fund’s

valuation

designee

to

make

all

fair

value

determinations

with

respect

to

the

fund’s

portfolio

of

investments,

subject

to

the

Board’s

oversight

and

pursuant

to

Rule

2a-5

under

the

Act.

Investments

in

debt

securities

excluding

short-term

investments

(other

than

U.S.

Treasury

Bills)

are

valued

each

business

day

by

one

or

more

independent

pricing

services

(each,

a

“Service”)

approved

by the Board.

Investments

for

which

quoted

bid

prices

are

readily

available

and

are

representative

of

the

bid

side

of

the

market

in

the

judgment

of

a

Service

are

valued

at

the

mean

between

the

quoted

bid

prices

(as

obtained

by

a

Service

from

dealers

in

such

securities)

and

asked

prices

(as

calculated

by

a

Service

based

upon

its

evaluation

of

the

market

for

such

securities).

Securities

are

valued

as

determined

by

a

Service,

based

on

methods

which

include

consideration

of

the

following:

yields

or

prices

of

securities

of

comparable

quality,

coupon,

maturity

and

type;

indications

as

to

values

from

dealers;

and

general

market

conditions.

Each

Service

and

independent

valuation

firm

is

engaged

under

the

general

oversight

of

the

Board.

Overnight

and

certain

other

short-term

debt

instruments

(excluding

U.S.

Treasury

Bills)

will

be

valued

by

the

amortized

cost

method,

which

approximates

value,

unless

a

Service

provides

a

valuation

for

such

security

or,

in

the

opinion

of

the

Board

or

a

committee

or

other

persons

designated

by

the

Board,

the

amortized

cost

method

would

not

represent

fair

value. These

securities

are

generally

categorized

within

Level

2

of

the

fair

value

hierarchy.

When

market

quotations

or

official

closing

prices

are

not

readily

available,

or

are

determined

not

to

reflect

fair

value

accurately,

they are

valued

at

fair

value

as

determined

in

good

faith

based

on

procedures

approved

by

the

Board.

Fair

value

of

investments

may

be

determined

by

valuation

designee

using

such

information

as

it

deems

appropriate

under

the

circumstances.

Certain

factors

may

be

considered

when

fair

valuing

investments

such

as:

fundamental

analytical

data,

the

nature

and

duration

of

restrictions

on

disposition,

an

evaluation

of

the

forces

that

influence

the

market

in

which

the

securities

are

purchased

and

sold,

and

public

trading

in

similar

securities

of

the

issuer

or

comparable

issuers.

These

securities

are

either

categorized

within

Level

2

or

3

of

the

fair

value

hierarchy

depending

on

the

relevant

inputs

used.

For

securities

where

observable

inputs

are

limited,

assumptions

about

market

activity

and

risk

are

used

and

are

generally

categorized

within

Level

3

of

the

fair

value

hierarchy.

The

table

below

summarizes

the

inputs

used

as

of June

30,

2024

in

valuing

the

fund’s

investments:

Fair

Value

Measurements

(b) Securities

transactions

and

investment

income:

Securities

transactions

are

recorded

on

a

trade

date

basis.

Realized

gains

and

losses

from

securities

transactions

are

recorded

on

the

identified

cost

basis.

Dividend

income

is

recognized

on

the

ex-dividend

date

and

interest

income,

including,

where

applicable,

accretion

of

discount

and

amortization

of

premium

on

investments,

is

recognized

on

the

accrual

basis.

(c)

Affiliated

issuers:

Investments

in

other

investment

companies

advised

by

the

Adviser

or

its

affiliates are

defined

as

“affiliated”

under

the

Act.

(d)

Market

Risk:

The

value

of

the

securities

in

which

the

fund

invests

may

be

affected

by

political,

regulatory,

economic

and

social

developments,

and

developments

that

impact

specific

economic

sectors,

industries

or

segments

of

the

market.

In

addition,

turbulence

in

financial

markets

and

reduced

liquidity

in

equity,

credit

and/or

fixed

income

markets

may

negatively

affect

many

issuers,

which

could

adversely

affect

the

fund.

Global

economies

and

financial

markets

are

becoming

increasingly

interconnected,

and

conditions

and

events

in

one

country,

region

or

financial

market

may

adversely

impact

issuers

in

a

different

country,

region

or

financial

market.

These

risks

may

be

magnified

if

certain

events

or

developments

adversely

interrupt

the

global

supply

chain;

in

these

and

other

circumstances,

such

risks

might

affect

companies

world-wide.

Level

1

-

Unadjusted

Quoted

Prices

Level

2

-

Other

Significant

Observable

Inputs

Level

3

-

Significant

Unobservable

Inputs

Total

Assets

($)

Investments

In

Securities:

†

Asset-Backed

Securities

—

85,396

—

85,396

Commercial

Paper

—

37,048,998

—

37,048,998

Corporate

Bonds

—

32,175,095

—

32,175,095

U.S.

Treasury

Government

Securities

—

3,212,036

—

3,212,036

Investment

Companies

1,494,113

—

—

1,494,113

†

See

Statement

of

Investments

for

additional

detailed

categorizations,

if

any.

Fixed-Income

Market

Risk:

The

market

value

of

a

fixed-income

security

may

decline

due

to

general

market

conditions

that

are

not

specifically

related

to

a

particular

company,

such

as

real

or

perceived

adverse

economic

conditions,

changes

in

the

outlook

for

corporate

earnings,

changes

in

interest

or

currency

rates

or

adverse

investor

sentiment

generally.

The

fixed-income

securities

market

can

be

susceptible

to

increases

in

volatility

and

decreases

in

liquidity.

Liquidity

can

decline

unpredictably

in

response

to

overall

economic

conditions

or

credit

tightening.

Increases

in

volatility

and

decreases

in

liquidity

may

be

caused

by

a

rise

in

interest

rates

(or

the

expectation

of

a

rise

in

interest

rates).

An

unexpected

increase

in

redemption

requests,

including

requests

from

Authorized

Participants

who

may

own

a

significant

percentage

of

the

fund’s

shares,

which

may

be

triggered

by

market

turmoil

or

an

increase

in

interest

rates,

could

cause

the

fund

to

sell

its

holdings

at

a

loss

or

at

undesirable

prices

and

adversely

affect

the

fund’s

share

price

and

increase

the

fund’s

liquidity

risk,

fund

expenses

and/or

taxable

distributions.

Federal

Reserve

policy

in

response

to

market

conditions,

including

with

respect

to

interest

rates,

may

adversely

affect

the

value,

volatility

and

liquidity

of

dividend

and

interest

paying

securities.

Policy

and

legislative

changes

worldwide

are

affecting

many

aspects

of

financial

regulation.

The

impact

of

these

changes

on

the

markets

and

the

practical

implications

for

market

participants

may

not

be

fully

known

for

some

time.

Commercial

Paper

Risk:

Commercial

paper

is

a

short-term

obligation

with

a

maturity

generally

ranging