UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23477

BNY Mellon ETF Trust

(Exact name of registrant as specified in charter)

240 Greenwich Street

New York, New York 10286

(Address of principal executive offices) (Zip code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and address of agent for service)

Registrant's telephone number, including area code: (212) 922-6400

Date of fiscal year end: June 30

Date of reporting period: December 31, 2024

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Ultra Short Income ETF

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

BNY Mellon Ultra Short Income ETF

Semi-Annual Shareholder Report

Ticker - BKUI (NYSE Arca, Inc.)

This semi-annual shareholder report contains important information about BNY Mellon Ultra Short Income ETF (the “Fund”) for the period of July 1, 2024 to December 31, 2024. You can find additional information about the Fund at bny.com/investments/etfliterature. You can also request this information by calling us at 1-833-383-2696 or calling your financial adviser.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| BNY Mellon Ultra Short Income ETF | $6 | 0.12%Footnote Reference* |

|---|

| Footnote | Description |

Footnote* | Annualized |

KEY FUND STATISTICS (AS OF 12/31/24)

| Fund size (Millions) | Number of Holdings | Portfolio Turnover |

|---|

| $196 | 117 | 9.06% |

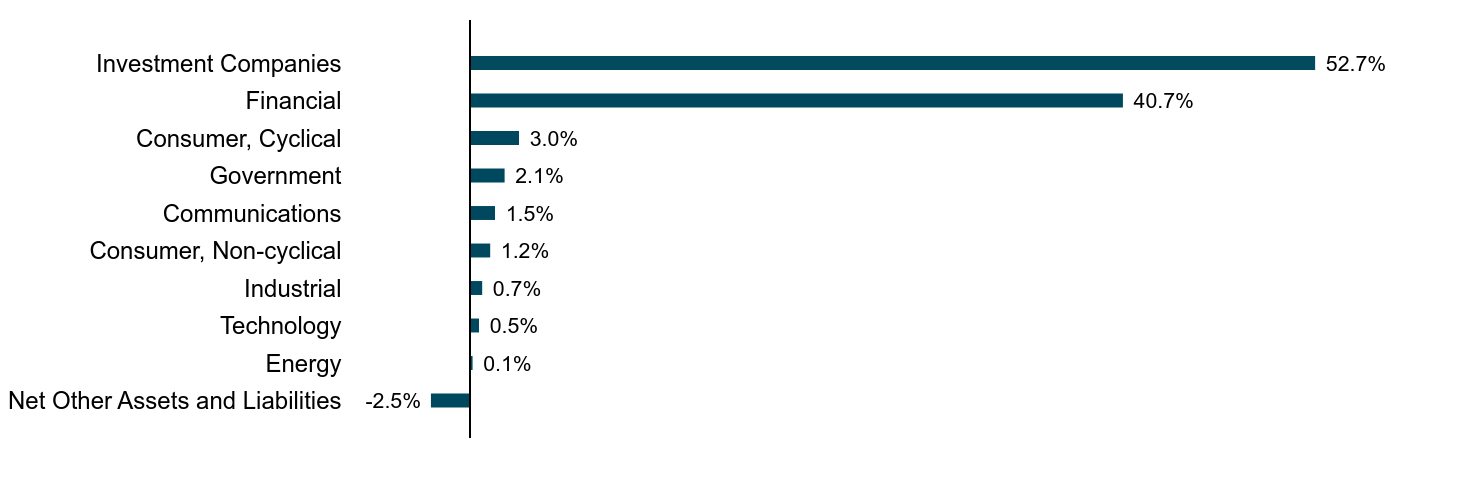

Portfolio Holdings (as of 12/31/24)

Sector Allocation

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | -2.5% |

| Energy | 0.1% |

| Technology | 0.5% |

| Industrial | 0.7% |

| Consumer, Non-cyclical | 1.2% |

| Communications | 1.5% |

| Government | 2.1% |

| Consumer, Cyclical | 3.0% |

| Financial | 40.7% |

| Investment Companies | 52.7% |

Not FDIC-Insured. Not Bank-Guaranteed. May Lose Value.

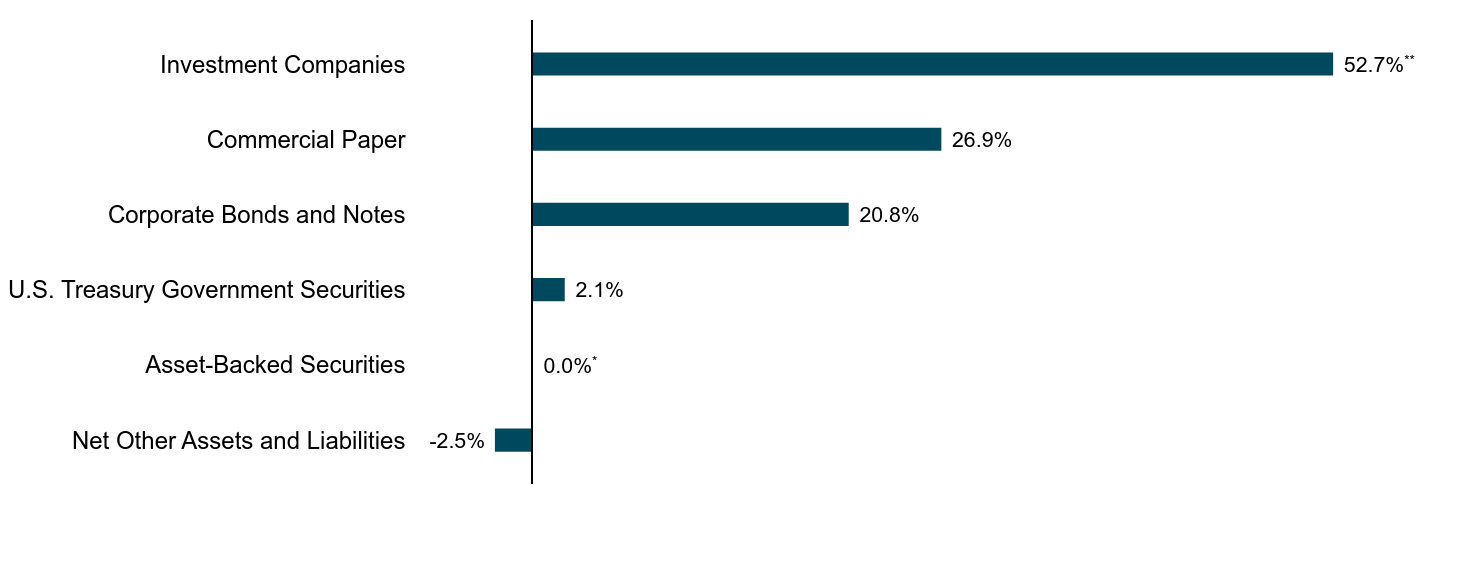

Allocation of Holdings

(Based on Net Assets)

| Value | Value |

|---|

| Net Other Assets and Liabilities | -2.5% |

| Asset-Backed Securities | 0.0%Footnote Reference* |

| U.S. Treasury Government Securities | 2.1% |

| Corporate Bonds and Notes | 20.8% |

| Commercial Paper | 26.9% |

| Investment Companies | 52.7%Footnote Reference** |

| Footnote | Description |

Footnote* | Amount represents less than 0.1%. |

Footnote** | A large creation unit order for shares of the Fund was placed on December 30, 2024 and temporarily invested by the Fund into the Dreyfus Institutional Preferred Government Money Market Fund, temporarily causing the Fund’s investments in investment companies on and around December 31, 2024 to be higher than usual. |

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit bny.com/investments/etfliterature.

© 2025 BNY Mellon Securities Corporation,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-4862SA1224

Item 1. Reports to Stockholders (cont.).

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included in the financial statements filed under Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The following is a copy of the Registrant’s most recent financial statements and financial highlights.

SEMI-ANNUAL

FINANCIALS

AND

OTHER

INFORMATION

December

31,

2024

BNY

Mellon

Ultra

Short

Income

ETF:

BKUI

Principal

U.S.

Listing

Exchange:

NYSE

Arca,

Inc.

Please

note

the

Semi-Annual

Financials

and

Other

Information

only

contains

Items

7-11

required

in

Form

N-CSR.

All

other

required

items

will

be

filed

with

the

SEC.

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

3

Statement

of

Investments

3

Statement

of

Assets

and

Liabilities

7

Statement

of

Operations

8

Statement

of

Changes

in

Net

Assets

9

Financial

Highlights

10

Notes

to

Financial

Statements

11

Item

8.

Changes

in

and

Disagreements

with

Accountants

for

Open-End

Management

Investment

Companies

16

Item

9.

Proxy

Disclosures

for

Open-End

Management

Investment

Companies

17

Item

10.

Remuneration

Paid

to

Directors,

Officers,

and

Others

of

Open-End

Investment

Companies

18

Item

11.

Statement

Regarding

Basis

for

Approval

of

Investment

Advisory

Contracts

19

Save

time.

Save

paper.

View

your

next

shareholder

report

online

as

soon

as

it’s

available.

Log

into

www.bny.com/investments

and

sign

up

for

eCommunications.

It’s

simple

and

only

takes

a

few

minutes.

The

views

expressed

herein

are

current

to

the

date

of

this

report.

These

views

and

the

composition

of

the

fund’s

portfolio

is

subject

to

change

at

any

time

based

on

market

and

other

conditions.

Not

FDIC-Insured

•

Not

Bank-Guaranteed

•

May

Lose

Value

BNY

Mellon

Ultra

Short

Income

ETF

Statement

of

Investments

December

31,

2024

(Unaudited)

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-End

Management

Investment

Companies

Description

Principal

Amount

($)

Value

($)

Asset-Backed

Securities

–

0.0%

Honda

Auto

Receivables

Owner

Trust

,

Series

2021-3,

Class

A3,

0.41%,

11/18/2025

(a)

10,041

10,020

Total

Asset-Backed

Securities

(cost

$10,041)

10,020

Commercial

Paper

–

26.9%

Atlantic

Asset

Securitization

LLC

5.04%,

2/19/2025

(a)(b)

1,000,000

993,738

4.52%,

5/06/2025

(a)(b)

1,000,000

984,351

Banco

Santander

S.A.

,

4.55%,

3/21/2025

(a)(b)

2,500,000

2,475,100

Canadian

Imperial

Bank

5.28%,

4/03/2025

(a)(b)

1,500,000

1,483,200

4.64%

(1

Month

SOFR

+

0.34%),

9/08/2025

(b)(c)

750,000

750,479

Chariot

Funding

LLC

,

4.70%

(1

Month

SOFR

+

0.30%),

5/09/2025

(b)(c)

2,600,000

2,600,147

Cooperatieve

Rabobank

UA

,

4.61%

(1

Month

SOFR

+

0.21%),

8/04/2025

(c)

2,500,000

2,500,015

Credit

Industriel

et

Commercial

5.29%,

2/06/2025

(a)

1,300,000

1,294,163

4.65%

(1

Month

SOFR

+

0.25%),

7/07/2025

(b)(c)

2,500,000

2,500,744

DNB

ASA

,

5.40%,

4/11/2025

(a)(b)

2,000,000

1,975,712

HSBC

Bank

PLC

,

4.76%

(1

Month

SOFR

+

0.36%),

6/05/2025

(b)(c)

1,500,000

1,501,137

LMA

SA/LMA-Americas

LLC

,

5.56%,

1/28/2025

(a)(b)

1,200,000

1,195,840

Manhattan

Asset

Funding

Co.

LLC

,

4.45%,

3/25/2025

(a)(b)

5,000,000

4,947,465

National

Australia

Bank

Ltd.

,

4.60%

(1

Month

SOFR

+

0.20%),

5/05/2025

(b)(c)

2,000,000

2,000,233

National

Bank

of

Canada

,

5.33%,

4/01/2025

(a)(b)

1,500,000

1,483,033

Natixis

SA

,

4.42%,

7/18/2025

(a)

2,750,000

2,683,334

Old

Line

Funding

LLC

,

4.70%

(1

Month

SOFR

+

0.30%),

6/23/2025

(b)(c)

1,200,000

1,200,095

Oversea-Chinese

Banking

Corp.

Ltd.

,

4.60%

(1

Month

SOFR

+

0.20%),

5/20/2025

(b)(c)

2,500,000

2,499,793

Sheffield

Receivables

Co.

LLC

,

4.66%,

3/05/2025

(a)(b)

2,300,000

2,281,655

Societe

Generale

SA

,

5.52%,

4/11/2025

(a)(b)

1,000,000

987,626

Starbird

Funding

Corp.

,

4.45%,

4/01/2025

(a)(b)

3,000,000

2,965,992

Svenska

Handelsbanken AB

,

4.34%,

7/21/2025

(a)(b)

2,750,000

2,682,966

Swedbank

AB

,

5.26%,

3/13/2025

(a)(b)

750,000

743,340

Thunder

Bay

Funding

LLC

,

4.56%

(1

Month

SOFR

+

0.12%),

6/06/2025

(b)(c)

5,000,000

4,905,063

Toronto-Dominion

Bank

(The)

,

5.32%,

4/03/2025

(a)(b)

1,500,000

1,482,745

Westpac

Banking

Corp.

,

5.27%,

3/31/2025

(a)(b)

1,500,000

1,483,223

Total

Commercial

Paper

(cost

$52,574,956)

52,601,189

Corporate

Bonds

and

Notes

–

20.8%

Auto

Manufacturers

–

1.8%

American

Honda

Finance

Corp.

,

1.30%

,

9/09/2026

300,000

283,791

BMW

US

Capital

LLC

,

4.90%

,

4/02/2027

(b)

600,000

601,842

General

Motors

Financial

Co.,

Inc.

5.40%,

4/06/2026

250,000

251,544

5.91%

(3

Month

SOFRIX

+

1.35%),

5/08/2027

(c)

350,000

353,234

Mercedes-Benz

Finance

North

America

LLC

5.20%,

8/03/2026

(b)

325,000

327,562

3.45%,

1/06/2027

(b)

325,000

317,061

PACCAR

Financial

Corp.

,

3.55%

,

8/11/2025

300,000

298,303

Toyota

Motor

Credit

Corp.

4.98%

(3

Month

SOFR

+

0.32%),

1/13/2025

(c)

300,000

300,016

5.15%

(3

Month

SOFR

+

0.65%),

3/19/2027

(c)

750,000

752,655

3,486,008

Statement

of

Investments

(continued)

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

and

Notes

–

20.8%

(continued)

Banks

–

12.6%

ANZ

New

Zealand

Int'l

Ltd.

,

5.14%

(

3

Month

SOFR

+

0.60%

)

,

2/18/2025

(b)(c)

300,000

300,142

Australia

&

New

Zealand

Banking

Group

Ltd.

,

5.16%

(

3

Month

SOFR

+

0.65%

)

,

9/30/2027

(b)(c)

1,000,000

1,002,464

Bank

of

America

NA

,

5.53%

,

8/18/2026

300,000

304,157

Bank

of

Montreal

5.58%

(3

Month

SOFRIX

+

1.06%),

6/07/2025

(c)

350,000

351,131

5.27%,

12/11/2026

325,000

328,885

Bank

of

Nova

Scotia

(The)

5.12%

(3

Month

SOFR

+

0.46%),

1/10/2025

(c)

300,000

300,015

5.35%,

12/07/2026

750,000

759,867

Barclays

PLC

,

6.39%

(

3

Month

SOFR

+

1.88%

)

,

9/13/2027

(c)

750,000

761,313

Canadian

Imperial

Bank

of

Commerce

3.95%,

8/04/2025

275,000

273,988

5.73%

(3

Month

SOFR

+

1.22%),

10/02/2026

(c)

375,000

378,569

Citigroup,

Inc.

6.03%

(3

Month

SOFR

+

1.53%),

3/17/2026

(c)

300,000

300,793

5.29%

(3

Month

SOFR

+

0.77%),

6/09/2027

(c)

700,000

701,610

Commonwealth

Bank

of

Australia

,

5.26%

(

3

Month

SOFR

+

0.75%

)

,

3/13/2026

(b)(c)

350,000

351,500

Goldman

Sachs

Group,

Inc.

(The)

,

5.31%

(

3

Month

SOFR

+

0.79%

)

,

12/09/2026

(c)

725,000

726,790

ING

Groep

NV

,

3.95%

,

3/29/2027

600,000

589,774

JPMorgan

Chase

&

Co.

,

5.93%

(

3

Month

SOFR

+

1.32%

)

,

4/26/2026

(c)

300,000

301,136

JPMorgan

Chase

Bank

NA

,

5.11%

,

12/08/2026

325,000

328,508

KeyBank

NA

4.70%,

1/26/2026

300,000

299,599

5.85%,

11/15/2027

750,000

768,787

Lloyds

Banking

Group

PLC

,

6.29%

(

3

Month

SOFRIX

+

1.58%

)

,

1/05/2028

(c)

850,000

862,341

Macquarie

Bank

Ltd.

,

5.43%

(

3

Month

SOFRIX

+

0.92%

)

,

7/02/2027

(b)(c)

750,000

754,953

Manufacturers

&

Traders

Trust

Co.

,

4.65%

,

1/27/2026

300,000

299,323

Morgan

Stanley

Bank

NA

,

5.76%

(

3

Month

SOFR

+

1.17%

)

,

10/30/2026

(c)

500,000

505,880

National

Australia

Bank

Ltd.

5.04%

(3

Month

SOFR

+

0.38%),

1/12/2025

(b)(c)

300,000

300,019

1.89%,

1/12/2027

(b)

375,000

355,736

National

Bank

of

Canada

5.25%,

1/17/2025

300,000

300,072

5.54%

(3

Month

SOFRIX

+

1.03%),

7/02/2027

(c)

750,000

752,887

NatWest

Markets

PLC

1.60%,

9/29/2026

(b)

225,000

213,607

5.44%

(3

Month

SOFR

+

0.90%),

5/17/2027

(b)(c)

500,000

501,886

PNC

Financial

Services

Group,

Inc.

(The)

,

2.60%

,

7/23/2026

325,000

315,028

Royal

Bank

of

Canada

Series

G,

5.07%

(3

Month

SOFRIX

+

0.44%),

1/21/2025

(c)

300,000

300,035

Series

G,

5.58%

(3

Month

SOFRIX

+

0.95%),

1/19/2027

(c)

650,000

655,305

Standard

Chartered

PLC

6.25%

(3

Month

SOFR

+

1.74%),

3/30/2026

(b)(c)

350,000

350,940

6.62%

(3

Month

SOFR

+

1.93%),

7/06/2027

(b)(c)

400,000

406,829

State

Street

Corp.

3.55%,

8/18/2025

98,000

97,434

5.27%,

8/03/2026

225,000

227,370

5.42%

(3

Month

SOFRIX

+

0.85%),

8/03/2026

(c)

600,000

604,493

Sumitomo

Mitsui

Financial

Group,

Inc.

,

1.40%

,

9/17/2026

300,000

283,884

Sumitomo

Mitsui

Trust

Bank

Ltd.

5.64%

(3

Month

SOFR

+

1.12%),

3/09/2026

(b)(c)

300,000

302,263

5.65%,

9/14/2026

(b)

325,000

329,956

Toronto-Dominion

Bank

(The)

5.53%,

7/17/2026

200,000

202,456

Series

G,

5.42%

(3

Month

SOFR

+

0.73%),

4/05/2027

(c)

850,000

851,594

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

and

Notes

–

20.8%

(continued)

Banks

–

12.6%

(continued)

Truist

Financial

Corp.

,

1.13%

,

8/03/2027

750,000

683,327

US

Bancorp

1.45%,

5/12/2025

1,600,000

1,581,946

Series

V,

2.38%,

7/22/2026

325,000

314,376

US

Bank

NA

,

5.32%

(

3

Month

SOFR

+

0.69%

)

,

10/22/2027

(c)

600,000

599,991

Wells

Fargo

&

Co.

,

3.00%

,

2/19/2025

300,000

299,183

Wells

Fargo

Bank

NA

5.55%,

8/01/2025

750,000

753,484

5.58%

(3

Month

SOFR

+

1.07%),

12/11/2026

(c)

900,000

910,220

Westpac

Banking

Corp.

,

5.05%

(

3

Month

SOFR

+

0.52%

)

,

6/03/2026

(c)

700,000

700,883

24,746,729

Computers

–

0.2%

International

Business

Machines

Corp.

,

4.00%

,

7/27/2025

300,000

298,848

298,848

Diversified

Financial

Services

–

0.8%

American

Express

Co.

5.31%

(3

Month

SOFR

+

0.76%),

2/13/2026

(c)

250,000

250,875

2.55%,

3/04/2027

750,000

718,114

Charles

Schwab

Corp.

(The)

5.07%

(3

Month

SOFRIX

+

0.52%),

5/13/2026

(c)

300,000

299,928

5.88%,

8/24/2026

350,000

356,197

1,625,114

Healthcare-Services

–

0.7%

Cigna

Group

(The)

,

5.69%

,

3/15/2026

650,000

650,210

Roche

Holdings,

Inc.

,

5.28%

(

3

Month

SOFR

+

0.74%

)

,

11/13/2026

(b)(c)

650,000

655,355

1,305,565

Insurance

–

0.1%

Prudential

Financial,

Inc.

,

1.50%

,

3/10/2026

300,000

289,567

289,567

Internet

–

0.4%

Amazon.com,

Inc.

,

3.15%

,

8/22/2027

750,000

724,377

724,377

Machinery-Construction

&

Mining

–

0.4%

Caterpillar

Financial

Services

Corp.

,

5.06%

(

3

Month

SOFR

+

0.52%

)

,

5/14/2027

(c)

750,000

750,781

750,781

Machinery-Diversified

–

0.3%

John

Deere

Capital

Corp.

4.80%,

1/09/2026

300,000

300,991

1.70%,

1/11/2027

350,000

331,053

632,044

Media

–

0.4%

Comcast

Corp.

,

2.35%

,

1/15/2027

750,000

717,130

717,130

Oil

&

Gas

–

0.1%

BP

Capital

Markets

America,

Inc.

,

3.41%

,

2/11/2026

300,000

296,458

296,458

Pharmaceuticals

–

0.5%

AbbVie,

Inc.

,

2.95%

,

11/21/2026

350,000

340,165

CVS

Health

Corp.

,

3.00%

,

8/15/2026

300,000

290,853

Pfizer

Investment

Enterprises

Pte

Ltd.

,

4.45%

,

5/19/2026

250,000

249,768

Shire

Acquisitions

Investments

Ireland

DAC

,

3.20%

,

9/23/2026

7,000

6,845

887,631

Statement

of

Investments

(continued)

See

Notes

to

Financial

Statements

Description

Principal

Amount

($)

Value

($)

Corporate

Bonds

and

Notes

–

20.8%

(continued)

Real

Estate

–

0.3%

Simon

Property

Group

LP

,

1.38%

,

1/15/2027

725,000

680,021

680,021

Retail

–

1.2%

Home

Depot,

Inc.

(The)

,

4.00%

,

9/15/2025

750,000

747,706

Starbucks

Corp.

,

2.00%

,

3/12/2027

750,000

708,798

Target

Corp.

,

1.95%

,

1/15/2027

700,000

666,074

Walmart,

Inc.

,

3.90%

,

9/09/2025

300,000

299,025

2,421,603

Semiconductors

–

0.2%

Intel

Corp.

,

3.70%

,

7/29/2025

300,000

298,070

298,070

Software

–

0.1%

Oracle

Corp.

,

2.65%

,

7/15/2026

300,000

291,054

291,054

Telecommunications

–

0.7%

AT&T,

Inc.

,

4.25%

,

3/01/2027

700,000

693,744

T-Mobile

USA,

Inc.

,

3.75%

,

4/15/2027

600,000

586,347

1,280,091

Total

Corporate

Bonds

and

Notes

(cost

$40,611,909)

40,731,091

U.S.

Treasury

Government

Securities

–

2.1%

U.S.

Treasury

Notes

3.13%,

8/15/2025

600,000

595,873

4.88%,

11/30/2025

1,500,000

1,508,270

4.13%,

11/15/2027

2,000,000

1,991,487

Total

U.S.

Treasury

Government

Securities

(cost

$4,095,627)

4,095,630

Shares

Investment

Companies

–

52.7%

Registered

Investment

Companies

–

52.7%

Dreyfus

Institutional

Preferred

Government

Money

Market

Fund,

Institutional

Shares,

4.42%

(d)(e)

(cost

$103,146,676)

103,146,676

103,146,676

Total

Investments

(cost

$200,439,209)

102.5%

200,584,606

Liabilities,

Less

Cash

and

Receivables

(2.5)%

(4,819,331)

Net

Assets

100.0%

195,765,275

SOFR—Secured

Overnight

Financing

Rate

SOFRIX—Secured

Overnight

Financing

Rate

Index

(a)

Security

is

a

discount

security.

Income

is

recognized

through

the

accretion

of

discount.

(b)

Security

exempt

from

registration

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933.

These

securities

may

be

resold

in

transactions

exempt

from

registration,

normally

to

qualified

institutional

buyers.

At

December

31,

2024,

these

securities

were

valued

at

$53,195,792

or

27.17%

of

net

assets.

(c)

Variable

rate

security

-

rate

shown

is

the

interest

rate

in

effect

at

period

end.

Security

description

also

includes

the

reference

rate

and

spread

if

published

and

available.

(d)

Investment

in

affiliated

issuer.

The

investment

objective

of

this

investment

company

is

publicly

available

and

can

be

found

within

the

investment

company’s

prospectus.

(e)

The

rate

shown

is

the

1-day

yield

as

of

December

31,

2024.

Holdings

and

transactions

in

these

affiliated

companies

during

the

period

ended

December

31,

2024

are

as

follows:

Description

Value

($)

6/30/24

Purchases

($)

1

Sales

($)

Value

($)

12/31/24

Dividends/

Distributions

($)

Investment

Companies

–

52.7%

Dreyfus

Institutional

Preferred

Government

Money

Market

Fund,

Institutional

Shares

1,494,113

143,200,444

(41,547,881)

103,146,676

92,806

Total

–

52.7%

1,494,113

143,200,444

(41,547,881)

103,146,676

92,806

1

Includes

reinvested

dividends/distributions.

STATEMENT

OF

ASSETS

AND

LIABILITIES

December

31,

2024

(Unaudited)

See

Notes

to

Financial

Statements

Cost

Value

Assets

($):

Investments

in

securities—See

Statement

of

Investments:

–

Unaffiliated

issuers

97,292,533

97,437,930

Affiliated

issuers

103,146,676

103,146,676

Interest

receivable

475,181

Dividends

receivable

13,674

201,073,461

Liabilities

($):

Due

to

BNY

Mellon

ETF

Investment

Adviser,

LLC—Note

3(b)

9,193

Cash

overdraft

due

to

Custodian

393,930

Payable

for

investment

securities

purchased

4,905,063

5,308,186

Net

Assets

($)

195,765,275

Composition

of

Net

Assets

($):

Paid-in

capital

195,957,238

Total

distributable

earnings

(loss)

(191,963)

Net

Assets

($)

195,765,275

Shares

outstanding

no

par

value

(unlimited

shares

authorized):

3,950,001

Net

asset

value

per

share

49.56

Market

price

per

share

49.58

STATEMENT

OF

OPERATIONS

Six

Months

Ended

December

31,

2024

(Unaudited)

See

Notes

to

Financial

Statements

Investment

Income

($):

Income:

Cash

dividends:

Affiliated

issuers

92,806

Interest

2,033,145

Total

Income

2,125,951

Expenses:

Management

fee—Note

3(a)

49,132

Total

Expenses

49,132

Net

Investment

Income

2,076,819

Realized

and

Unrealized

Gain

(Loss)

on

Investments—Note

4

($):

Net

realized

gain

(loss)

on

investments

4,364

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

230,797

Net

Realized

and

Unrealized

Gain

(Loss)

on

Investments

235,161

Net

Increase

(Decrease)

in

Net

Assets

Resulting

from

Operations

2,311,980

STATEMENT

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements

Six

Months

Ended

December

31,

2024

(Unaudited)

Year

Ended

June

30,

2024

Operations

($):

Net

investment

income

2,076,819

2,587,443

Net

realized

gain

(loss)

on

investments

4,364

(16,315)

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

230,797

241,251

Net

Increase

(Decrease)

in

Net

Assets

Resulting

from

Operations

2,311,980

2,812,379

Distributions

($):

Distributions

to

shareholders

(2,393,435)

(2,459,830)

Beneficial

Interest

Transactions

($):

Proceeds

from

shares

sold

128,906,022

47,001,580

Cost

of

shares

redeemed

(7,456,631)

(2,473,521)

Transaction

fees—Note

5

13,636

4,948

Increase

(Decrease)

in

Net

Assets

from

Beneficial

Interest

Transactions

121,463,027

44,533,007

Total

Increase

(Decrease)

in

Net

Assets

121,381,572

44,885,556

Net

Assets

($):

Beginning

of

Period

74,383,703

29,498,147

End

of

Period

195,765,275

74,383,703

Changes

in

Shares

Outstanding:

Shares

sold

2,600,000

950,000

Shares

redeemed

(150,000)

(50,000)

Net

Increase

(Decrease)

in

Shares

Outstanding

2,450,000

900,000

The

following

table

describes

the

performance

for

the

fiscal

periods

indicated.

See

Notes

to

Financial

Statements

Six

Months

Ended

December

31,

2024

(Unaudited)

Year

Ended

June

30,

For

the

Period

from

August

11,

2021

(a)

to

June

30,

2022

2024

2023

Per

Share

Data

($):

Net

asset

value,

beginning

of

period

49.59

49.16

48.97

50.00

Investment

Operations:

Net

investment

income

(b)

1.26

2.41

1.56

0.17

Net

realized

and

unrealized

gain

(loss)

on

investments

0.19

0.36

0.18

(0.94)

Total

from

Investment

Operations

1.45

2.77

1.74

(0.77)

Distributions:

–

–

–

–

Dividends

from

net

investment

income

(1.49)

(2.34)

(1.55)

(0.27)

Transaction

fees

(b)

0.01

0.00

(c)

0.00

(c)

0.01

Net

asset

value,

end

of

period

49.56

49.59

49.16

48.97

Market

price,

end

of

period

49.58

49.58

49.15

48.96

Net

Asset

Value

Total

Return

(%)

(d)

2.99

5.76

3.64

(1.54)

(e)

Market

Price

Total

Return

(%)

(d)

3.04

5.77

3.62

(1.55)

(e)

Ratios/Supplemental

Data

(%):

Ratio

of

total

expenses

to

average

net

assets

0.12

(f)

0.12

0.12

0.12

(f)

Ratio

of

net

investment

income

to

average

net

assets

5.07

(f)

4.88

3.19

0.39

(f)

Portfolio

Turnover

Rate

(g)

9.06

42.44

20.55

43.10

Net

Assets,

end

of

period

($

x

1,000)

195,765

74,384

29,498

26,931

(a)

Commencement

of

operations.

(b)

Based

on

average

shares

outstanding.

(c)

Amount

represents

less

than

$0.01

per

share.

(d)

Net

asset

value

total

return

is

calculated

assuming

an

initial

investment

made

at

the

net

asset

value

at

the

beginning

of

the

period,

reinvestment

of

all

dividends

and

distributions

at

net

asset

value

during

the

period,

and

redemption

at

net

asset

value

on

the

last

day

of

the

period.

Net

asset

value

total

return

includes

adjustments

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

and

as

such,

the

net

asset

value

for

financial

reporting

purposes

and

the

returns

based

upon

those

net

asset

values

may

differ

from

the

net

asset

value

and

returns

for

shareholder

transactions.

Market

price

total

return

is

calculated

assuming

an

initial

investment

made

at

the

market

price

at

the

beginning

of

the

period,

reinvestment

of

all

dividends

and

distributions

at

market

price

during

the

period,

and

sale

at

the

market

price

on

the

last

day

of

the

period.

Total

investment

returns

calculated

for

a

period

of

less

than

one

year

are

not

annualized.

(e)

The

net

asset

value

total

return

and

the

market

price

total

return

is

calculated

from

fund

inception.

The

inception

date

is

the

first

date

the

fund

was

available

on

NYSE

Arca,

Inc.

(f)

Annualized.

(g)

Portfolio

turnover

rate

is

not

annualized

for

periods

less

than

one

year,

if

applicable,

and

does

not

include

securities

received

or

delivered

from

processing

creations

or

redemptions.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)

NOTE

1—Organization:

BNY

Mellon

Ultra

Short

Income

ETF (the “fund”) is a

separate

diversified series

of

BNY

Mellon

ETF

Trust

(the

“Trust”),

which is

registered as

a

Massachusetts

business

trust

under

the

Investment

Company

Act

of

1940,

as

amended

(the

“Act”),

as

an

open-ended

management

investment

company.

The

Trust

operates

as

a

series

company

currently

consisting

of

twelve

series,

including

the

fund.

The

investment

objective

of

the

fund

is

to

seek

high

current

income

consistent

with

the

maintenance

of

liquidity

and

low

volatility

of

principal.

BNY

Mellon

ETF

Investment

Adviser,

LLC

(the

“Adviser”),

a

wholly-owned

subsidiary

of

The

Bank

of

New

York

Mellon

Corporation

(“BNY”),

serves

as

the

fund’s

investment

adviser. Dreyfus,

a

division

of

Mellon

Investments

Corporation (the

“Sub-Adviser”),

an

indirect wholly-owned

subsidiary

of

BNY

and

an

affiliate

of

the

Adviser,

serves

as

the

fund’s

sub-adviser.

The

Bank

of

New

York

Mellon,

a

subsidiary

of

BNY

and

an

affiliate

of

the

Adviser,

serves

as

administrator,

custodian

and

transfer

agent

with

the

Trust.

BNY

Mellon

Securities

Corporation

(the

“Distributor”),

a wholly-owned

subsidiary

of

the

Adviser,

is

the

distributor

of

the

fund’s

shares.

The

shares

of

the

fund

are

referred

to

herein

as

“Shares”

or

“Fund

Shares.”

Fund

Shares

are

listed

and

traded

on

NYSE

Arca,

Inc..

The

market

price

of

each

Share

may

differ

to

some

degree

from

the

fund’s

net

asset

value

(“NAV”).

Unlike

conventional

mutual

funds,

the

fund

issues

and

redeems

Shares

on

a

continuous

basis,

at

NAV,

only

in

a

large

specified

number

of

Shares,

each

called

a

“Creation

Unit”.

Creation

Units

are

issued

and

redeemed

principally

in

exchange

for

the

deposit

or

delivery

of

a

basket

of

securities.

Except

when

aggregated

in

Creation

Units

by

Authorized

Participants,

the

Shares

are

not

individually

redeemable

securities

of

the

fund.

Individual

Fund

Shares

may

only

be

purchased

and

sold

on

the

NYSE

Arca,

Inc.,

other

national

securities

exchanges,

electronic

crossing

networks

and

other

alternative

trading

systems

through

your

broker-dealer

at

market

prices.

Because

Fund

Shares

trade

at

market

prices

rather

than

at

NAV,

Fund

Shares

may

trade

at

a

price

greater

than

NAV

(premium)

or

less

than

NAV

(discount).

When

buying

or

selling

Shares

in

the

secondary

market,

you

may

incur

costs

attributable

to

the

difference

between

the

highest

price

a

buyer

is

willing

to

pay

to

purchase

Shares

of

the

fund

(bid)

and

the

lowest

price

a

seller

is

willing

to

accept

for

Shares

of

the

fund

(ask).

NOTE

2—Significant

Accounting

Policies:

The

Financial

Accounting

Standards

Board

(“FASB”)

Accounting

Standards

Codification

(“ASC”)

is

the

exclusive

reference

of

authoritative

U.S.

generally

accepted

accounting

principles

(“GAAP”)

recognized

by

the

FASB

to

be

applied

by

nongovernmental

entities.

Rules

and

interpretive

releases

of

the

SEC

under

authority

of

federal

laws

are

also

sources

of

authoritative

GAAP

for

SEC

registrants. The

fund

is an

investment

company

and

applies

the

accounting

and

reporting

guidance

of

the

FASB

ASC

Topic

946

Financial

Services-Investment

Companies. The

fund’s

financial

statements

are

prepared

in

accordance

with

GAAP,

which

may

require

the

use

of

management

estimates

and

assumptions.

Actual

results

could

differ

from

those

estimates.

The

Trust

enters

into

contracts

that

contain

a

variety

of

indemnifications.

The

fund’s

maximum

exposure

under

these

arrangements

is

unknown.

The

fund

does

not

anticipate

recognizing

any

loss

related

to

these

arrangements.

(a)

Portfolio

valuation:

The

fair

value

of

a

financial

instrument

is

the

amount

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date

(i.e.,

the

exit

price).

GAAP

establishes

a

fair

value

hierarchy

that

prioritizes

the

inputs

of

valuation

techniques

used

to

measure

fair

value.

This

hierarchy

gives

the

highest

priority

to

unadjusted

quoted

prices

in

active

markets

for

identical

assets

or

liabilities

(Level

1

measurements)

and

the

lowest

priority

to

unobservable

inputs

(Level

3

measurements).

Additionally,

GAAP

provides

guidance

on

determining

whether

the

volume

and

activity

in

a

market

has

decreased

significantly

and

whether

such

a

decrease

in

activity

results

in

transactions

that

are

not

orderly.

GAAP

requires

enhanced

disclosures

around

valuation

inputs

and

techniques

used

during

annual

and

interim

periods.

Various

inputs

are

used

in

determining

the

value

of

the

fund’s

investments

relating

to

fair

value

measurements.

These

inputs

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

—

unadjusted

quoted

prices

in

active

markets

for

identical

investments.

Level

2

—

other

significant

observable

inputs

(including

quoted

prices

for

similar investments,

interest

rates,

prepayment

speeds,

credit

risk,

etc.).

Level

3

—

significant

unobservable

inputs

(including

the

fund’s

own

assumptions

in

determining

the

fair

value

of

investments).

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risk

associated

with

investing

in

those

securities.

Changes

in

valuation

techniques

may

result

in

transfers

in

or

out

of

an

assigned

level

within

the

disclosure

hierarchy.

Valuation

techniques

used

to

value

the

fund’s

investments

are

as

follows:

Registered

investment

companies

that

are

not

traded

on

an

exchange

are

valued

at

their

net

asset

value

and

are

generally

categorized

within

Level 1

of

the

fair

value

hierarchy.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)

(continued)

The

Trust’s Board

of

Trustees

(the

“Board”)

has

designated

the

Adviser

as

the

fund’s

valuation

designee

to

make

all

fair

value

determinations

with

respect

to

the

fund’s

portfolio

of

investments,

subject

to

the

Board’s

oversight

and

pursuant

to

Rule

2a-5

under

the

Act.

Investments

in

debt

securities

excluding

short-term

investments

(other

than

U.S.

Treasury

Bills)

are

valued

each

business

day

by

one

or

more

independent

pricing

services

(each,

a

“Service”)

approved

by the Board.

Investments

for

which

quoted

bid

prices

are

readily

available

and

are

representative

of

the

bid

side

of

the

market

in

the

judgment

of

a

Service

are

valued

at

the

mean

between

the

quoted

bid

prices

(as

obtained

by

a

Service

from

dealers

in

such

securities)

and

asked

prices

(as

calculated

by

a

Service

based

upon

its

evaluation

of

the

market

for

such

securities).

Securities

are

valued

as

determined

by

a

Service,

based

on

methods

which

include

consideration

of

the

following:

yields

or

prices

of

securities

of

comparable

quality,

coupon,

maturity

and

type;

indications

as

to

values

from

dealers;

and

general

market

conditions.

Each

Service

and

independent

valuation

firm

is

engaged

under

the

general

oversight

of

the

Board.

Overnight

and

certain

other

short-term

debt

instruments

(excluding

U.S.

Treasury

Bills)

will

be

valued

by

the

amortized

cost

method,

which

approximates

value,

unless

a

Service

provides

a

valuation

for

such

security

or,

in

the

opinion

of

the

Board

or

a

committee

or

other

persons

designated

by

the

Board,

the

amortized

cost

method

would

not

represent

fair

value. These

securities

are

generally

categorized

within

Level

2

of

the

fair

value

hierarchy.

When

market

quotations

or

official

closing

prices

are

not

readily

available,

or

are

determined

not

to

reflect

fair

value

accurately,

they are

valued

at

fair

value

as

determined

in

good

faith

based

on

procedures

approved

by

the

Board.

Fair

value

of

investments

may

be

determined

by

valuation

designee

using

such

information

as

it

deems

appropriate

under

the

circumstances.

Certain

factors

may

be

considered

when

fair

valuing

investments

such

as:

fundamental

analytical

data,

the

nature

and

duration

of

restrictions

on

disposition,

an

evaluation

of

the

forces

that

influence

the

market

in

which

the

securities

are

purchased

and

sold,

and

public

trading

in

similar

securities

of

the

issuer

or

comparable

issuers.

These

securities

are

either

categorized

within

Level

2

or

3

of

the

fair

value

hierarchy

depending

on

the

relevant

inputs

used.

For

securities

where

observable

inputs

are

limited,

assumptions

about

market

activity

and

risk

are

used

and

are

generally

categorized

within

Level

3

of

the

fair

value

hierarchy.

The

table

below

summarizes

the

inputs

used

as

of December

31,

2024

in

valuing

the

fund’s

investments:

Fair

Value

Measurements

(b) Securities

transactions

and

investment

income:

Securities

transactions

are

recorded

on

a

trade

date

basis.

Realized

gains

and

losses

from

securities

transactions

are

recorded

on

the

identified

cost

basis.

Dividend

income

is

recognized

on

the

ex-dividend

date

and

interest

income,

including,

where

applicable,

accretion

of

discount

and

amortization

of

premium

on

investments,

is

recognized

on

the

accrual

basis.

(c)

Affiliated

issuers:

Investments

in

other

investment

companies

advised

by

the

Adviser

or

its

affiliates are

defined

as

“affiliated”

under

the

Act.

(d)

Market

Risk:

The

value

of

the

securities

in

which

the

fund

invests

may

be

affected

by

political,

regulatory,

economic

and

social

developments,

and

developments

that

impact

specific

economic

sectors,

industries

or

segments

of

the

market.

In

addition,

turbulence

in

financial

markets

and

reduced

liquidity

in

equity,

credit

and/or

fixed

income

markets

may

negatively

affect

many

issuers,

which

could

adversely

affect

the

fund.

Global

economies

and

financial

markets

are

becoming

increasingly

interconnected,

and

conditions

and

events

in

one

country,

region

or

financial

market

may

adversely

impact

issuers

in

a

different

country,

region

or

financial

market.

These

risks

may

be

magnified

if

certain

events

or

developments

adversely

interrupt

the

global

supply

chain;

in

these

and

other

circumstances,

such

risks

might

affect

companies

world-wide.

Level

1

-

Unadjusted

Quoted

Prices

Level

2

-

Other

Significant

Observable

Inputs

Level

3

-

Significant

Unobservable

Inputs

Total

Assets

($)

Investments

In

Securities:

†

Asset-Backed

Securities

—

10,020

—

10,020

Commercial

Paper

—

52,601,189

—

52,601,189

Corporate

Bonds

—

40,731,091

—

40,731,091

U.S.

Treasury

Government

Securities

—

4,095,630

—

4,095,630

Investment

Companies

103,146,676

—

—

103,146,676

†

See

Statement

of

Investments

for

additional

detailed

categorizations,

if

any.

Fixed-Income

Market

Risk:

The

market

value

of

a

fixed-income

security

may

decline

due

to

general

market

conditions

that

are

not

specifically

related

to

a

particular

company,

such

as

real

or

perceived

adverse

economic

conditions,

changes

in

the

outlook

for

corporate

earnings,

changes

in

interest

or

currency

rates

or

adverse

investor

sentiment

generally.

The

fixed-income

securities

market

can

be

susceptible

to

increases

in

volatility

and

decreases

in

liquidity.

Liquidity

can

decline

unpredictably

in

response

to

overall

economic

conditions

or

credit

tightening.

Increases

in

volatility

and

decreases

in

liquidity

may

be

caused

by

a

rise

in

interest

rates

(or

the

expectation

of

a

rise

in

interest

rates).

An

unexpected

increase

in

redemption

requests,

including

requests

from

Authorized

Participants

who

may

own

a

significant

percentage

of

the

fund’s

shares,

which

may

be

triggered

by

market

turmoil

or

an

increase

in

interest

rates,

could

cause

the

fund

to

sell

its

holdings

at

a

loss

or

at

undesirable

prices

and

adversely

affect

the

fund’s

share

price

and

increase

the

fund’s

liquidity

risk,

fund

expenses

and/or

taxable

distributions.

Federal

Reserve

policy

in

response

to

market

conditions,

including

with

respect

to

interest

rates,

may

adversely

affect

the

value,

volatility

and

liquidity

of

dividend

and

interest

paying

securities.

Policy

and

legislative

changes

worldwide

are

affecting

many

aspects

of

financial

regulation.

The

impact

of

these

changes

on

the

markets

and

the

practical

implications

for

market

participants

may

not

be

fully

known

for

some

time.

Commercial

Paper

Risk:

Commercial

paper

is

a

short-term

obligation

with

a

maturity

generally

ranging

from one

to

270

days

and

is

issued

by

U.S.

or

foreign

companies

or

other

entities

in

order

to

finance

their

current

operations.

Such

investments

are

unsecured

and

usually

discounted

from

their

value

at

maturity.

The

value

of

commercial

paper

may

be

affected

by

changes

in

the

credit

rating

or

financial

condition

of

the

issuing

entities

and

will

tend

to

fall

when

interest

rates

rise

and

rise

when

interest

rates

fall.

Authorized

Participants,

Market

Makers

and

Liquidity

Providers

Risk:

The

fund

has

a

limited

number

of

financial

institutions

that

may

act

as

Authorized

Participants,

which

are

responsible

for

the

creation

and

redemption

activity

for

the

fund.

In

addition,

there

may

be

a

limited

number

of

market

makers

and/or

liquidity

providers

in

the

marketplace.

To

the

extent

either

of

the

following

events

occur,

fund

shares

may

trade

at

a

material

discount

to

net

asset

value

and

possibly

face

delisting:

(

i

)

Authorized

Participants

exit

the

business

or

otherwise

become

unable

to

process

creation

and/or

redemption

orders

and

no

other

Authorized

Participants

step

forward

to

perform

these

services,

or

(ii)

market

makers

and/or

liquidity

providers

exit

the

business

or

significantly

reduce

their

business

activities

and

no

other

entities

step

forward

to

perform

their

functions.

(e)

Dividends

and

distributions

to

shareholders:

Dividends

and

distributions

are

recorded

on

the

ex-dividend

date.

Dividends

from

net

investment

income

are

normally

declared

and

paid

on

a

monthly

basis.

Dividends

from

net

realized

capital

gains,

if

any,

are

normally

declared

and

paid

annually,

but

the

fund

may

make

distributions

on

a

more

frequent

basis

to

comply

with

the

distribution

requirements

of

the

Internal

Revenue

Code

of

1986,

as

amended

(the

“Code”).

To

the

extent

that

net

realized

capital

gains

can

be

offset

by

capital

loss

carryovers

of

a

fund,

it

is

the

policy

of

the

fund

not

to

distribute

such

gains.

Income

and

capital

gain

distributions

are

determined

in

accordance

with

income

tax

regulations,

which

may

differ

from

GAAP.

(f)

Federal

income

taxes:

It

is

the

policy

of

the

fund

to

continue to

qualify

as

a

regulated

investment

company,

if

such

qualification

is

in

the

best

interests

of

its

shareholders,

by

complying

with

the

applicable

provisions

of

the

Code,

and

to

make

distributions

of

taxable

income

and

net

realized

capital

gain sufficient

to

relieve

it

from

substantially

all

federal

income

and

excise

taxes.

As

of

and

during

the period

ended December

31,

2024,

the

fund

did

not

have

any

liabilities

for

any

uncertain

tax

positions.

The

fund

recognizes

interest

and

penalties,

if

any,

related

to

uncertain

tax

positions

as

income

tax

expense

in

the

Statement

of

Operations.

During

the period

ended December

31,

2024,

the

fund

did

not

incur

any

interest

or

penalties.

Each

tax

year

in

the

three-year

period

ended June

30,

2024

remains

subject

to

examination

by

the

Internal

Revenue

Service

and

state

taxing

authorities.

The

fund

is

permitted

to

carry

forward

capital

losses

for

an

unlimited

period.

Furthermore,

capital

loss

carryovers

retain

their

character

as

either

short-term

or

long-term

capital

losses.

The

fund

has

an

unused

capital

loss

carryover

of

$324,269

available

for

federal

income

tax

purposes

to

be

applied

against

future

net

realized

capital

gains,

if

any,

realized

subsequent

to

June

30,

2024.

The

fund

had

$119,472

of

short-term

capital

losses

and

$204,797

of

long-term

capital

losses

which

can

be

carried

forward

for

an

unlimited

period.

The

tax

character

of

distributions

paid

to

shareholders

during

the

fiscal

year

ended

June

30,

2024

were

as

follows:

ordinary

income

$2,459,830.

The

tax

character

of

current

year

distributions

will

be

determined

at

the

end

of

the

current

fiscal

year.

NOTE

3—Management

Fee,

Sub-Advisory

Fee

and

Other

Transactions

with

Affiliates:

(a)

Pursuant

to

a

management

agreement

with

the

Adviser,

the

management

fee

is computed

at

an

annual

rate of

0.12%

of

the

value

of

the

fund’s

average

daily

net

assets

and

is

payable

monthly.

The

fund’s

management

agreement

provides

that

the

Adviser

pays

substantially

all

expenses

of

the

fund,

except

for

the

management

fees,

payments

under

the

fund’s

12b-1

plan

(if

any),

interest

expenses,

taxes,

acquired

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)

(continued)

fund

fees

and

expenses,

brokerage

commissions,

costs

of

holding

shareholder

meetings,

fees

and

expenses

associated

with

the

fund’s

securities

lending

program,

and

litigation

and

potential

litigation

and

other

extraordinary

expenses

not

incurred

in

the

ordinary

course

of

the

fund’s

business.

The

Adviser

may

from

time

to

time

voluntarily

waive

and/or

reimburse

fees

or

expenses

in

order

to

limit

total

annual

fund

operating

expenses.

Any

such

voluntary

waiver

or

reimbursement

may

be

eliminated

by

the

Adviser

at

any

time.

During

the

period

ended

December

31,

2024,

there

was

no

reduction

in

expenses

pursuant

to

the

undertaking.

Pursuant

to

a

sub-investment

advisory

agreement

between

the

Adviser

and

the

Sub-Adviser,

the

Sub-Adviser

serves

as

the

fund’s

sub-

adviser

responsible

for

the

day-to-day

management

of

the

fund’s

portfolio.

The

Adviser

pays

the

Sub-Adviser

a

monthly

fee

at

an

annual

percentage

of

the

value

of

the

fund’s

average

daily

net

assets.

The

Adviser

has

obtained

an

exemptive

order

from

the

SEC

(the

“Order”),

upon

which

the

fund

may

rely,

to

use

a

manager

of

managers

approach

that

permits

the

Adviser,

subject

to

certain

conditions

and

approval

by

the

Board,

to

enter

into

and

materially

amend

sub-investment

advisory

agreements

with

one

or

more

sub-advisers

who

are

either

unaffiliated

or

affiliated

with

the

Adviser

without

obtaining

shareholder

approval.

The

Order

also

relieves

the

fund

from

disclosing

the

sub-advisory

fee

paid

by

the

Adviser

to

a

Sub-Adviser

in

documents

filed

with

the

SEC

and

provided

to

shareholders.

In

addition,

pursuant

to

the

Order,

it

is

not

necessary

to

disclose

the

sub-advisory

fee

payable

by

the

Adviser

separately

to

a

Sub-Adviser

that

is

a

wholly-owned

subsidiary

(as

defined

in

the

1940

Act)

of

BNY

in

documents

filed

with

the

SEC

and

provided

to

shareholders;

such

fees

are

to

be

aggregated

with

fees

payable

to

the

Adviser.

The

Adviser

has

ultimate

responsibility

(subject

to

oversight

by

the

Board)

to

supervise

any

Sub-Adviser

and

recommend

the

hiring,

termination,

and

replacement

of

any

Sub-Adviser

to

the

Board.

Pursuant

to

a

sub-investment

advisory

agreement

between

the

Adviser

and

the

Sub-Adviser,

the

Adviser

pays

the

Sub-Adviser

a

monthly

fee

at

an

annual

rate

of

0.06%

of

the

value

of

the

fund’s

average

daily

net

assets.

The

Adviser,

and

not

the

fund,

pays

the

Sub-Adviser

fee

rate.

(b)

The

fund

has

an

arrangement

with

The

Bank

of

New

York

Mellon

(the

“Custodian”),

a

subsidiary

of

BNY

and

an

affiliate

of

the

Adviser, whereby

the

fund

will

receive

interest

income

or

be

charged

overdraft

fees

when

cash

balances

are

maintained.

For

financial

reporting

purposes,

the

fund

includes

this

interest

income

and

overdraft

fees,

if

any,

as

interest

income

in

the

Statement

of

Operations.

The

components

of

“Due

to

BNY

Mellon

ETF Investment

Adviser,

LLC”

in

the

Statement

of

Assets

and

Liabilities

consist

of:

Management

fee

of $9,193.

(c)

Each

Board

member

serves

as

a

Board

member

of

each

fund

within

the

Trust.

The

Board

members

are

not

compensated

directly

by

the

fund.

The

Board

members

are

paid

by

the

Adviser

from

the

unitary

management

fees

paid

to

the

Adviser

by

the

funds

within

the

Trust,

including

the

fund.

NOTE

4—Securities

Transactions:

The