Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2010 |

|

OR |

|

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

OR |

|

o | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-34790

HiSoft Technology International Limited |

(Exact name of Registrant as specified in its charter) |

|

N/A |

(Translation of Registrant’s name into English) |

|

Cayman Islands |

(Jurisdiction of incorporation or organization) |

|

33 Lixian Street Qixianling Industrial Base Hi-Tech Zone, Dalian 116023 People’s Republic of China |

(Address of principal executive offices) |

|

Christine Lu-Wong 33 Lixian Street Qixianling Industrial Base Hi-Tech Zone, Dalian 116023 People’s Republic of China Tel: (86) 411-84556655 Fax: (86) 411-84791350 E-mail: investor_relations@hisoft.com |

(Name, telephone, e-mail and/or facsimile number and address of company contact person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Securities | | Name of Each Exchange on Which Registered |

American Depositary Shares, each representing 19 common shares | | The Nasdaq Stock Market LLC (The Nasdaq Global Select Market) |

Common shares, par value $0.0001 per share* | | The Nasdaq Stock Market LLC (The Nasdaq Global Select Market) |

* Not for trading, but only in connection with the registration of American Depositary Shares representing such common shares pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Table of Contents

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

579,358,183 common shares, par value $0.0001 per share, were outstanding as of December 31, 2010

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP x | | International Financial Reporting Standards as issued

by the International Accounting Standards Board o | | Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o No o

Table of Contents

INTRODUCTION

Unless otherwise indicated, references in this annual report on Form 20-F to:

· “$” and “U.S. dollars” refer to the legal currency of the United States;

· “ADRs” refer to the American depositary receipts, which, if issued, evidence our ADSs;

· “ADSs” refer to our American depositary shares, each of which represents 19 common shares;

· “China” and the “PRC” refer to the People’s Republic of China, excluding, for the purpose of this annual report on Form 20-F only, Taiwan and the special administrative regions of Hong Kong and Macau;

· “common shares” refer to our common shares, par value $0.0001 per share;

· “RMB” and “Renminbi” refer to the legal currency of China; and

· “we,” “us,” “our company” and “our” refer to HiSoft Technology International Limited, its predecessor entities and its consolidated subsidiaries.

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2008, 2009 and 2010.

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. Selected Financial Data

The selected consolidated statements of operations data (other than ADS data) for the years ended December 31, 2008, 2009 and 2010, and the selected consolidated balance sheet data as of December 31, 2009 and 2010 have been derived from our audited consolidated financial statements included elsewhere in this annual report on Form 20-F. The selected consolidated statements of operations data (other than ADS data) for the years ended December 31, 2006 and 2007 and the selected consolidated balance sheet data as of 2006, 2007 and 2008 have been derived from our audited consolidated financial statements not included in this report on Form 20-F.

You should read the selected consolidated financial data in conjunction with those financial statements and related notes and information under “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report on Form 20-F. Our consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Our historical results do not necessarily indicate our results expected for any future period.

Table of Contents

| | Year Ended December 31, | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |

| | (dollars in thousands, except share, per share and per ADS data) | |

Selected Consolidated Statements of Operations Data | | | | | | | | | | | |

Net revenues | | $ | 33,669 | | $ | 63,051 | | $ | 100,720 | | $ | 91,456 | | $ | 146,579 | |

Cost of revenues (1)(2) | | 25,334 | | 47,435 | | 70,295 | | 58,759 | | 92,718 | |

Gross profit | | 8,335 | | 15,616 | | 30,425 | | 32,697 | | 53,861 | |

Operating expenses: | | | | | | | | | | | |

General and administrative (2) | | 12,454 | | 12,617 | | 19,010 | | 18,981 | | 30,509 | |

Selling and marketing (1)(2) | | 4,176 | | 5,599 | | 8,345 | | 5,968 | | 9,310 | |

Offering expenses | | — | | — | | 3,782 | | — | | — | |

Impairment of intangible assets | | 2,480 | | — | | 5,760 | | — | | — | |

Impairment of goodwill | | — | | — | | 4,784 | | — | | — | |

Change in fair value of contingent consideration | | — | | — | | — | | — | | 1,194 | |

Total operating expenses | | 19,110 | | 18,216 | | 41,681 | | 24,949 | | 41,013 | |

(Loss) income from operations | | (10,775 | ) | (2,600 | ) | (11,256 | ) | 7,748 | | 12,848 | |

Other (expenses) income (3) | | (592 | ) | 2,488 | | 411 | | 676 | | 1,143 | |

Income tax (expense) benefit | | 760 | | (770 | ) | 703 | | (1,061 | ) | (1,934 | ) |

Net (loss) income on discontinued operation | | 31 | | (38 | ) | (569 | ) | — | | — | |

Net (loss) income | | (10,576 | ) | (920 | ) | (10,711 | ) | 7,363 | | 12,057 | |

Noncontrolling interest | | 654 | | — | | — | | — | | — | |

Net (loss) income attributable to HiSoft Technology International Limited | | $ | (9,922 | ) | $ | (920 | ) | $ | (10,711 | ) | $ | 7,363 | | $ | 12,057 | |

Deemed dividend on Series A, A-1, B and C convertible redeemable preferred shares | | (1,120 | ) | (5,762 | ) | — | | — | | — | |

Net income attributable to Series A, A-1, B and C convertible redeemable preferred shares | | — | | — | | — | | (5,690 | ) | (3,942 | ) |

Net (loss) income attributable to holders of common shares | | $ | (11,042 | ) | (6,682 | ) | $ | (10,711 | ) | $ | 1,673 | | $ | 8,115 | |

Net (loss) income per common share: | | | | | | | | | | | |

Basic | | $ | (0.13 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | 0.02 | | $ | 0.03 | |

Diluted | | $ | (0.13 | ) | $ | (0.07 | ) | $ | (0.13 | ) | $ | 0.02 | | $ | 0.02 | |

Net (loss) income per ADS: | | | | | | | | | | | |

Basic | | $ | (2.47 | ) | $ | (1.35 | ) | $ | (2.47 | ) | $ | 0.37 | | $ | 0.49 | |

Diluted | | $ | (2.47 | ) | $ | (1.35 | ) | $ | (2.47 | ) | $ | 0.36 | | $ | 0.45 | |

Weighted average common shares used in calculating (loss) income per common share: | | | | | | | | | | | |

Basic | | 82,176,358 | | 94,237,854 | | 82,279,610 | | 86,148,324 | | 315,964,432 | |

Diluted | | 82,176,358 | | 94,237,854 | | 82,279,610 | | 388,372,705 | | 507,037,891 | |

Weighted average ADSs used in calculating net (loss) income per ADS: | | | | | | | | | | | |

Basic | | 4,325,071 | | 4,959,887 | | 4,330,506 | | 4,534,122 | | 16,629,707 | |

Diluted | | 4,325,071 | | 4,959,887 | | 4,330,506 | | 20,440,699 | | 26,686,205 | |

(1) Includes acquisition-related amortization of intangible assets totaling $1.7 million, $1.9 million, $1.6 million, $0.1 million and $0.9 million in 2006, 2007, 2008, 2009 and 2010, respectively, allocated as follows:

| | Year Ended December 31, | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |

| | (dollars in thousands) | |

Cost of revenues | | $ | 222 | | $ | 152 | | $ | 50 | | $ | 16 | | $ | 188 | |

Operating expenses: | | | | | | | | | | | |

Selling and marketing | | 1,507 | | 1,716 | | 1,565 | | 60 | | 687 | |

| | | | | | | | | | | | | | | | |

(2) Includes share-based compensation charges totaling $1.4 million, $1.5 million, $1.8 million, $1.1 million and $4.0 million in 2006, 2007, 2008, 2009 and 2010, respectively, allocated as follows:

| | Year Ended December 31, | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |

| | (dollars in thousands) | |

Cost of revenues | | $ | 74 | | $ | 268 | | $ | 362 | | $ | 321 | | $ | 606 | |

Operating expenses: | | | | | | | | | | | |

General and administrative | | 1,339 | | 1,214 | | 1,405 | | 720 | | 3,136 | |

Selling and marketing | | 5 | | 8 | | 35 | | 56 | | 259 | |

| | | | | | | | | | | | | | | | |

(3) Includes change in fair value of warrants of $2.4 million in the year ended 2007 resulting from our issuance in 2004 of warrants allowing the holders to acquire 2,000,000 shares of our series A convertible redeemable preferred shares and 36,000,000 shares of our series A-1 convertible redeemable preferred shares. The warrants were exercised in full in 2007 and no future charge will apply.

2

Table of Contents

| | Year Ended December 31, | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |

Other Consolidated Financial Data | | | | | | | | | | | |

| | | | | | | | | | | |

Gross margin (1) | | 24.8 | % | 24.8 | % | 30.2 | % | 35.8 | % | 36.7 | % |

Operating margin (2) | | (32.0 | )% | (4.1 | )% | (11.2 | )% | 8.5 | % | 8.8 | % |

Net margin (3) | | (31.4 | )% | (1.5 | )% | (10.6 | )% | 8.1 | % | 8.2 | % |

(1) Gross margin represents gross profit as a percentage of net revenues.

(2) Operating margin represents income (loss) from operations as a percentage of net revenues.

(3) Net margin represents net income (loss) before noncontrolling interest as a percentage of net revenues.

| | As of December 31, | |

| | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | |

| | (dollars in thousands) | |

Consolidated Balance Sheet Data | | | | | | | | | | | |

Cash and cash equivalents | | $ | 10,889 | | $ | 39,229 | | $ | 46,881 | | $ | 54,842 | | $ | 169,893 | |

Total assets | | 40,774 | | 96,668 | | 86,100 | | 104,242 | | 255,092 | |

Total liabilities | | 20,217 | | 22,246 | | 16,699 | | 26,151 | | 80,140 | |

Noncontrolling interest | | 181 | | — | | — | | — | | — | |

Series A convertible redeemable preferred shares | | 12,100 | | 12,581 | | 12,581 | | 12,581 | | — | |

Series A-1 convertible redeemable preferred shares | | — | | 9,900 | | 9,900 | | 9,900 | | — | |

Series B convertible redeemable preferred shares | | 12,320 | | 30,800 | | 30,800 | | 30,800 | | — | |

Series C convertible redeemable preferred shares | | — | | 35,750 | | 35,750 | | 35,750 | | — | |

Total equity (deficit) | | $ | (4,044 | ) | $ | (14,609 | ) | $ | (19,630 | ) | $ | (10,940 | ) | $ | 174,952 | |

Exchange Rate Information

This annual report on Form 20-F contains translations of certain RMB amounts into U.S. dollar amounts at specified rates. Unless otherwise stated, the translations of RMB into U.S. dollars have been made at the noon buying rate in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York, or the noon buying rate, on Thursday, December 30, 2010 (the last day of 2010 for which exchange rate data was available), which was RMB6.600 to $1.00. We make no representation that the RMB or U.S. dollar amounts referred to in this annual report on Form 20-F could have been, or could be, converted into U.S. dollars or RMB, as the case may be, at any particular rate or at all. See “Item 3. Key Information. —D. Risk Factors—Risks Related to Our Business— Fluctuations in exchange rates could impact our competitiveness and results of operations.” for discussions of the effects of fluctuating exchange rates and currency control on the value of our ADSs. On April 29, 2011, the exchange rate, as set forth in the H.10 statistical release of the Federal Reserve Board, was RMB6.4900 to $1.00.

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report or will use in the preparation of our periodic reports or any other information to be provided to you. For all periods prior to January 1, 2009, the exchange rate refers to the noon buying rate as reported by the Federal Reserve Bank of New York. For periods beginning on or after January 1, 2009, the exchange rate refers to the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board.

3

Table of Contents

| | RMB per U.S. Dollar Exchange Rate | |

| | Period

End | | Average(1) | | Low | | High | |

| | (RMB per $1.00) | |

2006 | | 7.8041 | | 7.9579 | | 8.0702 | | 7.8041 | |

2007 | | 7.2946 | | 7.5806 | | 7.8127 | | 7.2946 | |

2008 | | 6.8225 | | 6.9193 | | 7.2946 | | 6.7800 | |

2009 | | 6.8259 | | 6.8295 | | 6.8470 | | 6.8176 | |

2010 | | 6.6000 | | 6.7603 | | 6.8305 | | 6.6000 | |

2010 | | | | | | | | | |

October | | 6.6707 | | 6.6678 | | 6.6912 | | 6.6397 | |

November | | 6.6670 | | 6.6538 | | 6.6892 | | 6.6330 | |

December | | 6.6000 | | 6.6497 | | 6.6745 | | 6.6000 | |

2011 | | | | | | | | | |

January | | 6.6017 | | 6.5964 | | 6.6364 | | 6.5809 | |

February | | 6.5713 | | 6.5761 | | 6.5965 | | 6.5520 | |

March | | 6.5483 | | 6.5645 | | 6.5483 | | 6.5743 | |

April (through April 29) | | 6.4900 | | 6.5267 | | 6.5477 | | 6.4900 | |

(1) Annual averages are calculated from month-end rates. Monthly averages are calculated using the average of the daily rates during the relevant period |

| |

B. | Capitalization and Indebtedness |

| |

| Not Applicable. |

| |

C. | Reasons for the Offer and Use of Proceeds |

| |

| Not Applicable. |

| |

D. | Risk Factors |

Risks Related to Our Business

Our operations and those of our customers are vulnerable to natural disasters and other events beyond our control, the occurrence of which may have an adverse effect on our facilities, personnel and results of operations.

Our operations and those of our customers are vulnerable to fires, earthquakes, typhoons, droughts, floods, power losses, and similar events. We cannot guarantee that such future events will not cause material damage to our and our customers’ facilities or property or cause significant business interruptions.

In March 2011, Japan was struck by a 9.0-magnitude earthquake. The earthquake resulted in a tsunami and radiation leak at the Fukushima nuclear facility. In response to unfolding safety concerns at the damaged nuclear facility at Fukushima, we incurred relocation expenses associated with relocating our nearly 200 Japan-based employees and their families. Those employees and their families were given the option of being relocated to Osaka, Japan or to China to work out of these alternative locations, after consultation with the Company’s clients. As a result, in the first quarter of 2011, we experienced additional operating expenses of approximately $0.7 million. We cannot assure you that these events will not have any further subsequent adverse effect on our facilities and operations or those of our customers. In particular, the extent of existing and potential future radiation release from the Fukushima nuclear facility is still in flux and coupled with potential aftershocks from the earthquake, may result in future additional adverse effects on our facilities and operations and those of our customers and suppliers.

Furthermore, in 2009 and 2010, 25.3% and 23.0% of our net revenues were derived from clients headquartered in Japan, respectively. Our customers with facilities and operations in Japan or who have business dealings with Japan that have been affected by these events may suffer from a slowdown resulting in reduced demand for our services and we can make no assurances that our results of operation will not be adversely affected. In the first quarter of 2011, we experienced loss of revenue from work interruptions of approximately $0.6 million.

4

Table of Contents

We cannot assure you that there will be no further adverse impact on our future revenue as a result of potential interruption or slowdown of operations of our customers.

Our net revenues declined from 2008 to 2009 due in part to the recent global economic crisis. Although our net revenues increased in 2010, continuing economic difficulties due to the global economic downturn or any future economic downturn, particularly in our key client geographies of the United States or Japan, could adversely affect our business.

As a result of the recent global economic crisis and downturn in business activities in Japan, the United States and other countries where our clients are located, we experienced a decrease in demand for outsourced technology services that led to a decrease in our net revenues from 2008 to 2009. In 2009 and 2010, respectively, 59.6% and 54.1% of our net revenues were derived from clients headquartered in the U.S. and 25.3% and 23.0% of our net revenues were derived from clients headquartered in Japan; we expect that a significant majority of our net revenues will continue to be derived from clients in these two geographic areas in the future. If the economies of the United States or Japan or other countries where our clients are located experience continuing difficulties in recovering from the global economic downturn, or if there is another general economic downturn or a recession in these countries, our clients and potential clients in these countries may substantially reduce their budgets for outsourced technology services and modify, delay or cancel plans to purchase our services. Additionally, if our clients’ operating and financial performance deteriorates, they may not be able to pay, or may delay payment of, amounts owed to us. Any or all of these events could cause a decline in our net revenues and materially and adversely affect our business and results of operations.

If we do not succeed in attracting new clients for our technology services and/or growing revenues from existing clients, we may not achieve our revenue growth goals.

We plan to significantly expand the number of clients we serve to diversify our client base and grow our revenues. Revenues from a new client often rise quickly over the first several years following our initial engagement as we expand the services that we provide to that client. Therefore, obtaining new clients is important for us to achieve rapid revenue growth. Our ability to attract new clients, as well as our ability to grow revenues from our existing clients, depends on a number of factors, including our ability to offer high quality technology services at competitive prices, the strength of our competitors and the capabilities of our marketing and sales teams to attract new clients and to sell additional services to existing clients. If we fail to attract new clients or to grow our revenues from existing clients in the future, we may not be able to grow our revenues as quickly as we anticipate or at all.

If we are not successful in expanding our service offerings and managing increasingly large and complex projects, we may not achieve our financial goals and our results of operations may be adversely affected.

We have been expanding, and plan to continue to expand, the nature and scope of our service offerings. As part of this expansion, we plan to add new capabilities within our existing service lines, such as embedded systems testing. The success of our expanded service offerings is dependent, in part, upon demand for such services by new and existing clients and our ability to meet this demand in a cost-competitive and effective manner. To successfully market our expanded service offerings and obtain larger and more complex projects, we need to establish closer relationships with our clients and develop a thorough understanding of their operations. In addition, we may face a number of challenges managing larger and more complex projects, including:

· maintaining high quality control and process execution standards;

· maintaining high resource utilization rates on a consistent basis;

· maintaining productivity levels and implementing necessary process improvements;

· controlling costs; and

5

Table of Contents

· maintaining close client contact and high levels of client satisfaction, while at the same time preserving continuity in personnel engaged in a particular project while also rotating personnel to ensure that periodic wage adjustments do not adversely impact our margins on a particular project.

Our ability to successfully manage large and complex projects depends significantly on the skills of our management personnel and professionals, some of whom do not have experience managing large-scale or complex projects. In addition, large and complex projects may involve multiple engagements or stages, and there is a risk that a client may choose not to retain us for additional stages or may cancel or delay additional planned engagements. Such cancellations or delays may make it difficult to plan our project resource requirements.

If we fail to successfully market our expanded service offerings or obtain engagements for large and complex projects, we may not achieve our revenue growth and other financial goals. Even if we are successful in obtaining such engagements, a failure by us to effectively manage these large and complex projects could damage our reputation, cause us to lose business, impact our net margins and adversely affect our results of operations.

If we are not successful in integrating and managing our past and future strategic acquisitions, our business and results of operations may suffer and we may incur exceptional expenses or write-offs.

We have completed several acquisitions in recent years, including our recent acquisitions of substantially all the business and assets of Besure Technology Co., Ltd., or Besure, a IT services company specializing in SAP consulting and implementation services based in China; substantially all of the business and assets of Beans Group PTE LTD, a Singapore-based research and development service provider; a business team from certain China-based IT services firms providing IT services to banking and financial clients; substantially all of the business and assets of iConnect, Inc., a US-based development and testing services provider; and substantially all of the business and assets of Shanghai Yuetong Software Technology Co., a China-based development and testing services provider. We may in the future continue to pursue strategic acquisitions. See “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Acquisitions.” While we identified and may identify expected synergies and growth opportunities in connection with these acquisitions prior to their completion, we may not achieve, and have not always achieved, the expected benefits. For example, in 2008, we recorded an impairment of intangible assets of $5.8 million and impairment of goodwill of $4.8 million due to lower than expected sales and profits in 2008 from several businesses we had acquired.

For companies we have acquired or may acquire in the future, we could have difficulty assimilating the target company’s personnel, operations, products, services and technology into our operations. The primary value of many potential targets in the outsourcing industry lies in their skilled professionals and established client relationships. Transitioning these types of assets to our business can be particularly difficult due to different corporate cultures and values, geographic distance and other intangible factors. Some newly acquired employees may decide not to work with us or to leave shortly after their move to our company and some acquired clients may decide to discontinue their commercial relationships with us. Also, although we believe such risks are remote based on our due diligence performed prior to completing our acquisitions, we may be unsuccessful in obtaining qualifications or consents necessary for the operation of all or part of the acquired businesses. For example, in connection with our acquisition of substantially all of the businesses of Besure Technology Co., Ltd., or Besure, a China based IT services firm specializing in SAP consulting and implementation services, we may have to reapply for certain SAP certifications in order to provide certain services. These difficulties could disrupt our ongoing business, distract our management and current employees and increase our expenses, including causing us to incur significant one-time expenses, impairment charges and write-offs. Furthermore, any acquisition or investment that we attempt, whether or not completed, or any media reports or rumors with respect to any such transactions, may adversely affect the value of our ADSs.

We may not succeed in identifying suitable acquisition targets, which could adversely affect our ability to expand our operations and service offerings and enhance our competitiveness.

We have pursued and may continue to pursue strategic acquisition opportunities to increase our scale and geographic presence, expand our service offerings and capabilities and enhance our industry and technical expertise. However, it is possible that we may not identify suitable acquisition or investment candidates, or, if we do identify suitable candidates, we may not complete those transactions on terms commercially favorable to us or at all. Any inability by us to identify suitable acquisition targets or investments or to complete such transactions could adversely affect our competitiveness and our growth prospects.

6

Table of Contents

We face challenges hiring and retaining highly skilled professionals, especially senior engineers, project managers and mid-level technology professionals. Our results of operations and ability to effectively serve our clients may be negatively affected if we cannot attract and retain highly skilled professionals.

The success of our business is dependent to a significant degree on our ability to attract and retain highly skilled professionals. In China there is currently a shortage of, and significant competition for, professionals who possess the technical skills and experience necessary to act as senior engineers, project managers and middle managers for IT and research and development outsourcing projects, and we believe that such professionals are likely to remain a limited resource for the foreseeable future. Moreover, similar to India, the outsourced technology industry in China has experienced significant levels of employee attrition. The attrition rate among our employees who have worked for us for at least six months were 18.8%, 13.8% and 14.6% for 2008, 2009 and 2010, respectively. Due to the cost of hiring and training new professionals, high attrition rates can negatively affect our cost of revenues and net income. In addition, we may face increasing difficulties recruiting the talent we need to staff our outsourcing facilities in less developed cities in China with lower average wages and living standards. If we are unable to hire and retain highly skilled professionals, our ability to bid on, obtain and effectively execute new projects may be impaired, which would adversely affect our results of operations.

Any inability to manage the growth of our operations could disrupt our business and reduce our profitability.

We have experienced significant growth in recent years. Our net revenues have grown from $63.1 million in 2007 to $100.7 million in 2008, decreased slightly to $91.5 million in 2009 and grown to $146.6 million in 2010. The total number of our employees grew from 2,781 as of December 31, 2008, 3,819 as of December 31, 2009 to 5,521 as of December 31, 2010. Our operations have also expanded in recent years through increases in our service delivery capabilities and acquisitions of complementary businesses. We expect our operations to continue to grow in terms of both headcount and geographic locations. Our rapid growth has placed and will continue to place significant demands on our management and our administrative, operational and financial infrastructure. Continued expansion increases the challenges we face in:

· recruiting, training and retaining a sufficient number of skilled technical, sales and management personnel;

· creating and capitalizing upon economies of scale;

· managing a larger number of clients in a greater number of industry sectors;

· managing our days of sales outstanding;

· maintaining effective oversight over personnel and offices;

· coordinating work among onshore and offshore sites and project teams and maintaining high resource utilization rates;

· integrating new management personnel and expanded operations while preserving our culture, values and entrepreneurial environment; and

· developing and improving our internal systems and infrastructure, particularly our financial, operational and communications systems.

7

Table of Contents

We operate in an intensely competitive environment, which may lead to declining revenue growth or other circumstances that would negatively affect our results of operations.

The markets in which we compete are changing rapidly and we face intense competition from both global providers of outsourced technology services as well as those based in China. There are relatively low barriers to entry into our markets and we have faced, and expect to continue to face, additional competition from new market entrants. We believe that the principal competitive factors in our markets are breadth and depth of service offerings, reputation and track record, ability to tailor service offerings to client needs, industry expertise, ability to leverage offshore delivery platforms, service quality, price, scalability of infrastructure, financial stability, and sales and marketing skills. We face competition or competitive pressure primarily from:

· global offshore outsourced technology services companies such as Cognizant Technology Solutions, HCL Technologies, Infosys Technologies, Patni Computer Systems, Tata Consultancy Services and Wipro Technologies;

· China-based technology outsourcing service providers such as Beyondsoft, Chinasoft, Dalian Hi-think Computer (DHC), iSoftStone, Neusoft, SinoCom and VanceInfo;

· certain divisions of large multinational technology firms; and

· in-house IT departments of our clients and potential clients.

China-based outsourced technology services companies compete with us primarily in the Japan and China markets, while global offshore outsourced technology services companies compete with us primarily in the U.S. market. Many of our international competitors have significantly greater financial, human and marketing resources, a broader range of service offerings, greater technological expertise, more experienced personnel, longer track records, more recognizable brand names and more established relationships in industries that we serve or may serve in the future. Moreover, a number of our international competitors have established operations in China.

To compete successfully in our markets, we will need to develop new service offerings and enhance our existing service offerings while maintaining price competitiveness. If and to the extent we fail to develop value-adding service offerings that differentiate us from our competitors, we may need to compete largely on price, which may cause our operating margins to decline. Our ability to compete also depends in part on a number of factors beyond our control, including the ability of our competitors to attract, train, motivate and retain highly skilled professionals, the price at which our competitors offer comparable services and our competitors’ responsiveness to client needs. In particular, outsourcing of technology services by domestic Chinese companies is a relatively recent development and it is not yet clear how this industry may develop. Our inability to compete successfully against competitors and pricing pressures could result in lost clients, loss of market share and reduced operating margins, which would adversely impact our results of operations.

Our competitiveness depends significantly on our ability to keep pace with the rapid changes in information technology. Failure by us to anticipate and meet our clients’ technological needs could adversely affect our competitiveness and growth prospects.

The technology services market is characterized by rapid technological changes, evolving industry standards, changing client preferences and new product and service introductions. Our future success will depend on our ability to anticipate these advances and develop new service offerings to meet client needs. We may fail to anticipate or respond to these advances in a timely or cost-effective manner or, if we do respond, the services or technologies we develop may fail in the marketplace. Furthermore, services or technologies that are developed by our competitors may render our services less competitive or obsolete. In addition, new technologies may be developed that allow our clients to more cost-effectively perform the services that we provide, thereby reducing demand for our outsourced technology services. Our failure to address these developments could have a material adverse effect on our competitiveness and our ability to meet our growth targets.

8

Table of Contents

Our revenues are highly dependent on a limited number of clients, and the loss of, or any significant decrease in business from, any one or more of our major clients could adversely affect our financial condition and results of operations.

We have in the past derived, and believe that we will continue to derive, a significant portion of our revenues from a limited number of clients. Microsoft and UBS accounted for 10.3% and 13.5%, respectively, of our net revenues in 2008. In 2009, Microsoft accounted for 13.7% of our net revenues and our ten largest clients accounted for a combined 61.4% of our net revenues. In 2010, a U.S.-based multinational IT company and Microsoft each accounted for 10% or more of our net revenues and in aggregate accounted for 23.1% of our net revenues. Our ten largest clients accounted for a combined 56.8% of our net revenues.

The volume of work performed for specific clients is likely to vary from year to year, especially since we are generally not our client’s exclusive technology outsourcing service provider. A significant client in one year may not provide the same level of revenues for us in any subsequent year. The technology outsourcing services we provide to our clients, and the revenues and income from those services, may decline or vary as the type and quantity of technology outsourcing and other services we provide change over time. In addition, our reliance on any individual client for a significant portion of our revenues may give that client a certain degree of pricing leverage against us when negotiating contracts and terms of services with us.

There are a number of factors that could cause us to lose major clients. Because many of our engagements involve functions that are critical to the operations of our clients’ businesses, any failure by us to meet a client’s expectations could result in cancellation or non-renewal of the engagement. In addition, our clients may decide to reduce spending on technology services from us due to a challenging economic environment or other factors, both internal and external, relating to their business such as corporate restructuring or changing their outsourcing strategy by moving more work in-house or to other providers. Furthermore, our clients, some of whom have experienced rapid changes in their business, substantial price competition and pressures on their profitability, may demand price reductions, automate some or all of their processes or reduce the services to be provided by us, any of which could reduce our profitability.

The loss of any of our major clients, or a significant decrease in the volume of work they outsource to us or the price at which we sell our services to them, could adversely affect our financial condition and results of operations.

The non-competition clauses contained in some of our business contracts with our existing clients may affect our ability to explore new business relationships and to procure new clients.

Some of our business contracts contain non-competition clauses which restrict our ability to provide services to competitors of our existing clients. Such clauses provide that, during the term of the contract or for a certain period of time after the completion of the service (typically 12 months), we or our employees who worked for a client may not provide similar services to such client’s competitors. In addition, some contracts restrict us from competing with the client in quoting, tendering or offering services or solutions, whether by ourselves or with others, directly or indirectly, to such client’s customers.

Our clients operate in a limited number of industries. Factors that adversely affect these industries or IT or research and development spending by companies within these industries may adversely affect our business.

We derive a large proportion of our revenues from clients which operate in a limited number of industries, including technology and banking, financial services and insurance, or BFSI. In 2010, we derived 63.0% and 24.1% of our revenues, respectively, from clients operating in these two industries. Our business and growth largely depend on continued demand for our services from clients and potential clients in these industries and those industries where we are focusing expansion efforts, such as manufacturing, telecommunications, Internet and life sciences. Demand for our services, and technology services in general, in any particular industry could be affected by multiple factors outside of our control, including a decrease in growth or growth prospects of the industry, a slowdown or reversal of the trend to outsource technological applications, or consolidation in the industry. In addition, serving a major client within a particular industry may effectively preclude us from seeking or obtaining engagements with direct competitors of that client if there is a perceived conflict of interest. Any significant decrease in demand for our services by clients in these industries, or other industries from which we derive significant revenues in the future, may reduce the demand for our services.

9

Table of Contents

The inability of our clients to pay the receivable balance on their accounts with us may expose us to the credit risks of such clients and may adversely affect our results of operations and liquidity.

We maintain allowances for doubtful accounts based upon information available to us to make estimates, considering historical experience and other factors surrounding the credit risk of specific clients. However, if we additionally identify that collection from certain other significant accounts is in doubt, we may be exposed to the credit risk of such clients and may have to provide for the provision of those doubtful accounts. For example, in the financial year ended December 31, 2010, we recorded a bad debt provision of US$3.5 million in the fourth quarter resulting from our identification of the credit risk and liquidity issue associated with a client. The inability of our clients to pay the receivable balance on their accounts may require us to make bad debt provisions and may adversely affect our results of operations and liquidity.

We enter into fixed-price contracts with some of our clients, and our failure to accurately estimate the resources and time required for these contracts could negatively affect our results of operations.

Some of our outsourced technology services are provided on a fixed-price basis that requires us to undertake significant projections and planning related to resource utilization and costs. Net revenues from fixed-price contracts accounted for 13.6% and 17.4% of our total net revenues in 2009 and 2010, respectively. Although our past project experience helps to reduce the risks associated with estimating, planning and performing fixed-price contracts, we bear the risk of cost overruns and completion delays in connection with these projects. Any failure to accurately estimate the resources and time required for a project, wage inflation or any other factors that may impact our costs to complete the project, could adversely affect our profitability and results of operations.

Many of our client contracts typically can be terminated by our clients without cause and with little or no notice or penalty. Any termination of our significant contracts could negatively impact our revenues and profitability.

Our clients typically retain us on a non-exclusive, project-by-project basis. Many of our client contracts can be terminated by our clients with or without cause, with less than three months’ notice and without penalty. Failure to meet contractual requirements could result in cancellation or non-renewal of a contract. There are a number of factors relating to our clients that are outside of our control which might lead them to terminate a contract or project with us, including:

· client financial difficulties;

· a change in strategic priorities resulting in elimination of the impetus for the project or a reduced level of technology spending;

· a change in outsourcing strategy resulting in moving more work to the client’s in-house technology departments or to our competitors;

· the replacement by our clients of existing software with other software packages supported by licensors; and

· mergers and acquisitions or significant corporate restructurings.

Any termination of significant contracts, especially if unanticipated, could have a negative impact on our future revenues and profitability.

10

Table of Contents

Most of our engagements with clients are for a specific project only and do not necessarily provide for subsequent engagements. If we are unable to generate a substantial number of new engagements for projects on a continual basis, our business and results of operations will be adversely affected.

Our clients generally retain us on an engagement-by-engagement basis in connection with specific projects rather than on a recurring basis under long-term contracts. Although a substantial majority of our revenues are generated from repeat business, which we define as revenues from a client who also contributed to our revenues during the prior fiscal year, our engagements with our clients are typically for projects that are singular and often short-term in nature. Therefore, we must seek out new engagements when our current engagements are successfully completed or are terminated, and we are constantly seeking to expand our business with existing clients and secure new clients for our services. If we are unable to generate a substantial number of new engagements on a continual basis, our business and results of operations will be adversely affected.

Some of our client contracts contain provisions which, if triggered, could adversely affect our future profitability.

Our contracts with certain of our clients contain provisions that provide for downward revision of our prices under certain circumstances. For example, certain client contracts provide that if during the term of the contract we were to offer similar services to any other client on terms and conditions more favorable than those provided in the contract, we would be obliged to offer equally favorable terms and conditions to the client prospectively for future work performed. This may result in lower revenue and profits in future periods. Certain other contracts allow a client to request a benchmark study comparing our pricing and performance with that of other service providers for comparable services. Based on the results of the study and depending on the reasons for any unfavorable variance, we may be required to make improvements in the service we provide for the remaining term of the contract. While this has not happened in the past, the triggering of any of the provisions described above could adversely affect our future profitability.

Our success depends to a substantial degree upon our senior management and key personnel, and our business operations may be negatively affected if we fail to attract and retain highly competent senior management.

We depend to a significant degree on our senior management and key personnel such as project managers and other middle management. However, competition for senior management and key personnel in our industry is intense, and we may be unable to retain our senior management or key personnel or attract and retain new senior management or other key personnel in the future. If one or more members of our senior management team or key personnel resigns, it could disrupt our business operations and create uncertainty as we search for and integrate a replacement. If any member of our senior management leaves us to join a competitor or to form a competing company, any resulting loss of existing or potential clients to any such competitor could have a material adverse effect on our business, financial condition and results of operations. Additionally, there could be unauthorized disclosure or use of our technical knowledge, practices or procedures by such personnel. We have entered into employment agreements with our senior management and key personnel which contain non-competition, non-solicitation and nondisclosure covenants that survive for up to one year following termination of employment. We may not, however, be able to enforce the non-competition, non-solicitation and nondisclosure provisions of these agreements, and such agreements do not ensure the continued service of these senior management and key personnel. In addition, we do not maintain key man life insurance for any of the senior members of our management team or our key personnel.

We may be liable to our clients for damages caused by system failures or breaches of security obligations.

Many of our contracts involve projects that are critical to the operations of our clients’ businesses. Certain of our client contracts require us to comply with security obligations including maintaining network security and back-up data, ensuring our network is virus-free, maintaining business continuity planning procedures, and verifying the integrity of employees that work with the clients by conducting background checks. Any failure in a client’s system or breach of security relating to the services we provide to the client could damage our reputation or result in a claim for substantial damages against us. In some of our client contracts we limit our liability for damages arising from negligent acts in rendering our technology services. However, these contractual limitations of liability may be unenforceable or may fail to protect us from liability for damages in the event of a claim for breach of our obligations. In addition, our liability insurance is limited and may be insufficient to cover liabilities that we incur.

11

Table of Contents

Assertions of system failures or breaches of security obligations against us, if successful, could have a material adverse effect on our business, reputation, financial condition and results of operations. Even if such assertions against us are unsuccessful, we may incur reputational harm and substantial legal fees.

If our clients’ proprietary intellectual property or confidential information is misappropriated by us or our employees in violation of applicable laws and contractual agreements, we could be exposed to protracted and costly legal proceedings and lose clients.

We and our employees are frequently provided with access to our clients’ proprietary intellectual property and confidential information, including source codes, software products, business policies and plans, trade secrets and personal data. We use network security technologies and other methods to prevent employees from making unauthorized copies, or engaging in unauthorized use, of such intellectual property and confidential information. We also require our employees to enter into non-disclosure arrangements to limit access to and distribution of our clients’ intellectual property and other confidential information as well as our own. However, the steps taken by us in this regard may not be adequate to safeguard our clients’ intellectual property and confidential information. Moreover, most of our client contracts do not include any limitation on our liability to them with respect to breaches of our obligation to keep the information we receive from them confidential. In addition, we may not always be aware of intellectual property registrations or applications relating to source codes, software products or other intellectual property belonging to our clients. As a result, if our clients’ proprietary rights are misappropriated by us or our employees, our clients may consider us liable for that act and seek damages and compensation from us. Assertions of infringement of intellectual property or misappropriation of confidential information against us, if successful, could have a material adverse effect on our business, financial condition and results of operations. Any such acts could also cause us to lose existing and future business and damage our reputation in the market. Even if such assertions against us are unsuccessful, they may cause us to incur reputational harm and substantial legal fees.

We face risks associated with having a long selling and implementation cycle for our services that requires us to make significant resource commitments prior to realizing revenues for those services.

We have a long selling cycle for our outsourced technology services, which requires significant investment of capital, human resources and time by both our clients and us. Before committing to use our services, potential clients often require us to expend substantial time and resources educating them as to the value of our services and our ability to meet their requirements. Therefore, our selling cycle, which frequently exceeds six months for new clients and three months for existing clients, is subject to many risks and delays over which we have little or no control, including our clients’ decision to choose alternatives to our services (such as other providers or in-house resources) and the timing of our clients’ budget cycles and approval processes. For certain engagements we may begin work and incur substantial costs prior to concluding the contract.

Implementing our services also involves a significant commitment of resources over an extended period of time from both our clients and us. Our clients may experience delays in obtaining internal approvals or delays associated with technology or system implementations, thereby further delaying the implementation process. Our current and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to obtain contracts with potential clients to which we have devoted significant time and resources, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our profitability will suffer if we are not able to maintain our resource utilization levels and continue to improve our productivity levels.

Our gross margin and profitability are significantly impacted by our utilization levels of fixed-cost resources, including human resources as well as other resources such as computers and office space, and our ability to increase our productivity levels. We have expanded our operations significantly in recent years through organic growth and external acquisitions, which has resulted in a significant increase in our headcount and fixed overhead costs. We may face difficulties in maintaining high levels of utilization for our newly established or newly acquired businesses and resources. In addition, some of our professionals are specially trained to work for specific clients or on specific projects and some of our delivery center facilities are dedicated to specific clients or specific projects. Our ability to manage our utilization levels depends significantly on our ability to hire and train high-performing professionals and to staff projects appropriately, and on the mix of our onshore versus offshore services provided on a given project.

12

Table of Contents

If we experience a slowdown or stoppage of work for any client or on any project for which we have dedicated professionals or facilities, we may not be able to efficiently reallocate these professionals and facilities to other clients and projects to keep their utilization and productivity levels high. If we are not able to maintain high resource utilization levels without corresponding cost reductions or price increases, our profitability will suffer.

Wage increases in China may prevent us from sustaining our competitive advantage and may reduce our profitability.

Compensation expenses for our professionals and other employees form a significant part of our costs. Wage costs in China have historically been significantly lower than wage costs in Japan, the United States and other developed countries for comparably skilled professionals. However, because of rapid economic growth and increased competition for skilled employees in China, wages for highly skilled employees in China, in particular middle- and senior-level managers, are increasing at a higher rate than in Japan, the United States, Singapore and Europe. We may need to increase our levels of employee compensation more rapidly than in the past to remain competitive in attracting and retaining the quality and number of employees that our business requires. Increases in the wages and other compensation we pay our employees in China could reduce the competitive advantage we have enjoyed against onshore service providers in Japan, the United States and other countries.

If we fail to comply with the regulations of the various industries and the different jurisdictions in which our clients conduct their business or fail to adhere to the regulations that govern our business, our ability to perform services may be affected and may result in breach of obligation with our clients.

We serve clients across the United States, Japan, China, Singapore and other countries and our clients are subject to various regulations that apply to specific industries. Therefore, we need to perform our services to satisfy the requirements for our clients to comply with applicable regulations. We are also required under PRC laws and regulations to obtain and maintain licenses and permits to conduct our business. If we fail to perform our services in such a manner that enables any client to comply with applicable regulations, we may be in breach of our obligations with such client and as a result, we may be required to pay the client penalties under the terms of the relevant contract with such client. In addition, if we cannot maintain the licenses or approval necessary for our business, there may be a material adverse effect on our business and results of operations.

Fluctuations in exchange rates could impact our competitiveness and results of operations.

The majority of our revenues are generated in Renminbi, Japanese yen and U.S. dollars, while the majority of our costs are denominated in Renminbi. Accordingly, changes in exchange rates, especially relative changes in exchange rates among the Renminbi, Japanese yen and U.S. dollar, may have a material adverse effect on our revenues, costs and expenses, gross and operating margins and net income. For example, because substantially all of our employees are based in China and paid in Renminbi, our employee costs as a percentage of revenues may increase or decrease significantly along with fluctuations in the exchange rates between the Renminbi, Japanese yen and U.S. dollar.

The Japanese yen and U.S. dollar are freely floating currencies. However, the conversion of the Renminbi into foreign currencies, including the Japanese yen and the U.S. dollar, has been based on exchange rates set by the People’s Bank of China. On July 21, 2005, the PRC government changed its policy of pegging the value of the Renminbi solely to the U.S. dollar. Under this revised policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the Renminbi appreciated more than 20% against the U.S. dollar over the following three years. Since July 2008, however, the Renminbi has traded within a narrow range against the U.S. dollar. As a consequence, the Renminbi has fluctuated significantly since July 2008 against other freely traded currencies, in tandem with the U.S. dollar. On June 19, 2010, the People’s Bank of China announced that it will allow a more flexible exchange rate for Renminbi without mentioning specific policy changes, although it ruled out any large-scale appreciation. It is difficult to predict how long the current situation may last and when and how Renminbi exchange rates may change going forward.

13

Table of Contents

If the Renminbi appreciates significantly against the U.S. dollar or the Japanese yen and we are unable to correspondingly increase the proportion of our Renminbi-denominated revenues, our margins and profitability could decrease substantially. We have entered into a limited number of Renminbi-Japanese yen forward contracts to partially hedge our exposure to risks relating to fluctuations in the Renminbi-Japanese yen exchange rate, and we periodically review the need to enter into hedging transactions to protect against fluctuations in the Renminbi-Japanese yen and Renminbi-U.S. dollar exchange rates. However, only limited hedging transactions were available as of the date of this annual report on Form 20-F for Renminbi exchange rates, and the effectiveness of these hedging transactions in reducing the adverse effects on us of exchange rate fluctuations may be limited.

We have limited ability to protect our intellectual property rights, and unauthorized parties may infringe upon or misappropriate our intellectual property.

Our success depends in part upon our proprietary intellectual property rights, including certain methodologies, practices, tools and technical expertise we utilize in designing, developing, implementing and maintaining applications and processes used in providing our services. We rely on a combination of copyright, trademark and patent laws, trade secret protections and confidentiality agreements with our employees, clients and others to protect our intellectual property, including our brand identity. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization. The unauthorized use of intellectual property is common and widespread in China and enforcement of intellectual property rights by PRC regulatory agencies is inconsistent. As a result, litigation may be necessary to enforce our intellectual property rights. Litigation could result in substantial costs and diversion of our management’s attention and resources, and could disrupt our business, as well as have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of China’s legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt any unauthorized use of our intellectual property in China through litigation.

We may be subject to third-party claims of intellectual property infringement.

Although there were no material pending or threatened intellectual property claims against us as of the date of this annual report on Form 20-F, and we believe that our intellectual property rights do not infringe on the intellectual property rights of others, infringement claims may be asserted against us in the future. For example, we may be unaware of intellectual property registrations or applications that purport to relate to our services, which could give rise to potential infringement claims against us. Parties making infringement claims may be able to obtain an injunction to prevent us from delivering our services or using technology containing the allegedly infringing intellectual property. In addition, our contracts contain broad indemnity clauses in favor of our clients, and under most of our contracts, we are required to provide specific indemnities relating to third-party intellectual property rights infringement. In some instances, the amount of these indemnities may be greater than the revenues we receive from the client. If we become liable to third parties for infringing their intellectual property rights, we could be required to pay a substantial damage award. Although we carry limited professional liability insurance, such insurance may not cover some claims and may not be sufficient to cover all damages that we may be required to pay. Furthermore, we may be forced to develop non-infringing technologies or obtain a license to provide the services that are deemed infringing. We may be unable to develop non-infringing processes, methods or technologies or to obtain a license on commercially reasonable terms or at all. We may also be required to alter our processes or methodologies so as not to infringe others’ intellectual property, which may not be technically or commercially feasible and may cause us to expend significant resources. Any claims or litigation in this area, whether we ultimately win or lose, could be time-consuming and costly and could damage our reputation.

Our business operations and financial condition could be adversely affected by negative publicity about offshore outsourcing or anti-outsourcing legislation in the United States, Japan or other countries in which our clients are based.

Concerns that offshore outsourcing has resulted in a loss of jobs and sensitive technologies and information to foreign countries have led to negative publicity concerning outsourcing in some countries, including the United States. Current or prospective clients may elect to perform services that we offer themselves or may be discouraged from transferring these services to offshore providers to avoid any negative perception that may be associated with using an offshore provider.

14

Table of Contents

These trends could harm our ability to compete effectively with competitors that operate primarily out of facilities located in these countries.

Offshore outsourcing has also become a politically sensitive topic in many countries, including the United States. A number of U.S. states have passed legislation that restricts state government entities from outsourcing certain work to offshore service providers. Other federal and state legislation has been proposed that, if enacted, would provide tax disincentives for offshore outsourcing or require disclosure of jobs outsourced abroad. Similar legislation could be enacted in Japan and other countries in which we have clients. Any expansion of existing laws or the enactment of new legislation restricting or discouraging offshore outsourcing by companies in the United States, Japan or other countries in which we have clients could adversely impact our business operations and financial results.

We may need additional capital and any failure by us to raise additional capital on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our service offerings to respond to market demand or competitive challenges.

Capital requirements are difficult to plan in our rapidly changing industry. As of the date of this annual report on Form 20-F, we expect that we will need capital to fund:

· acquisitions of assets, technologies or businesses;

· the development and expansion of our technology service offerings;

· the expansion of our operations and geographic presence; and

· our marketing and business development costs.

We may require additional capital resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

· investors’ perception of, and demand for, securities of outsourced technology services companies;

· conditions in the U.S. and other capital markets in which we may seek to raise funds;

· our future results of operations and financial condition;

· PRC government regulation of foreign investment in China;

· economic, political and other conditions in China; and

· PRC government policies relating to the borrowing and remittance outside China of foreign currency.

Financing may not be available in amounts or on terms acceptable to us or at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our product and service offerings to respond to market demand or competitive challenges.

15

Table of Contents

Because there is limited business and litigation insurance coverage available in China, any business disruption or litigation we experience might result in our incurring substantial costs and diverting significant resources to handle such disruption or litigation.

While business disruption insurance may be available to a limited extent in China, we have determined that the risks of disruption and the difficulties and costs associated with acquiring such insurance render it commercially impractical for us to have such insurance. As a result, we do not have any business liability or business disruption coverage for our operations in China. Although we carry limited professional liability insurance, such insurance may not cover some claims and may not be sufficient to cover all damages that we may be required to pay due to such claims. As a result, any business disruption or litigation might result in our incurring substantial costs and the diversion of resources.

Natural disasters may lead to damages to our equipment and facilities and may affect our ability to perform services for our clients.

Natural disasters such as earthquakes, floods, fires, heavy rains, sand storms, tsunamis and cyclones could damage certain of our infrastructure or facilities and may disrupt our information systems or telephone service. Such damages and disruptions could affect our ability to perform services for our clients in accordance with the contractual provisions and may cause us to incur additional expenses to repair or to reinvest in equipment or facilities. In addition, the damages and additional expenses caused by natural disasters may not be fully covered by our insurance and our failure to perform services for our clients due to such natural disasters may affect our reputation and may damage our relationships with our clients.

Our net revenues, expenses and profits are subject to fluctuation, which make them difficult to predict and may negatively affect the market price of our ADSs.

Our operating results and growth rate may vary significantly from quarter to quarter. Therefore, we believe that period-to-period comparisons of our results of operations are not necessarily meaningful and should not be relied upon as an indication of our future performance. It is possible that in the future some of our quarterly results of operations may be below the expectations of market analysts and our investors, which could lead to a significant decline in the market value of our ADSs. As a large part of any quarter’s revenues are derived from existing clients, revenue growth can vary due to project starts and stops and client-specific situations.

Additional factors which affect the fluctuation of our net revenues, expenses and profits include:

· variations in the duration, size, timing and scope of our engagements, particularly with our major clients;

· impact of new or terminated client engagements;

· timing and impact of acquisitions, including how quickly and effectively we are able to integrate the acquired business, its service offerings and employees, and retain acquired clients;

· changes in our pricing policies or those of our clients or competitors;

· start-up expenses for new engagements;

· progress on fixed-price engagements, and the accuracy of estimates of resources and time frames required to complete pending assignments;

· the proportion of services that we perform onshore versus offshore;

· the proportion of fixed-price contracts versus time-and-materials contracts;

· unanticipated employee turnover and attrition;

16

Table of Contents

· the size and timing of expansion of our facilities;

· unanticipated cancellations, non-renewal of our contracts by our clients, contract terminations or deferrals of projects;

· changes in our employee utilization rates;

· changes in relevant exchange rates; and

· our ability to implement productivity and process improvements, and maintain appropriate staffing to ensure cost-effectiveness on individual engagements.

A significant portion of our expenses, particularly those related to personnel and facilities, are fixed in advance of any particular quarter. As a result, unanticipated variations in the number and timing of our projects or employee utilization rates may cause significant variations in our operating results in any particular quarter. Fluctuations in our operating results may result in sharp unpredictable fluctuations in the market price of our ADSs. Such sharp fluctuations may be viewed negatively by the market and result in a lower market price than our ADSs would have in the absence of such fluctuations.

Our net revenues and results of operations are affected by seasonal trends.

Our net revenues and results of operations are affected by seasonal trends. In particular, as most of our net revenues are derived from contracts priced on a time-and-materials basis, we typically experience lower total net revenues during holiday periods, particularly during the Chinese New Year holidays in the first quarter of every year and during the week-long National Day holiday in October of every year, when our delivery centers in the PRC operate with reduced staffing. However, during periods of high growth in our net revenues as well as during periods of quarterly fluctuations in net revenues due to other factors, such as the recent economic crisis, any seasonal impact on our quarterly results may not be apparent. We believe that our net revenues and results of operations will continue to be affected in the future by seasonal trends. As a result, you may not be able to rely on period to period comparisons of our net revenues and results of operations as an indication of our future performance.

The international nature of our business exposes us to risks that could adversely affect our financial condition and results of operations.

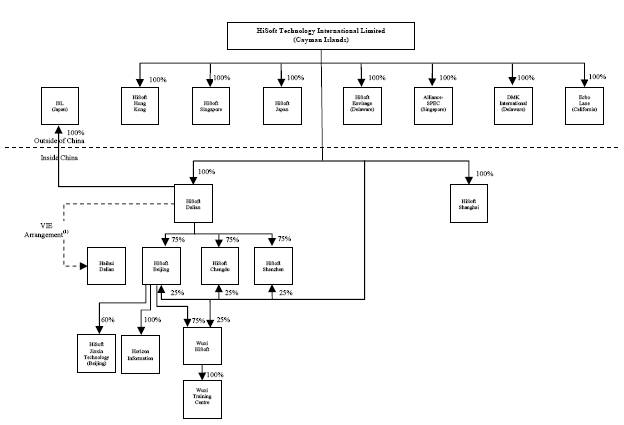

We have operations in China, Japan, the United States and Singapore and we serve clients across North America, Europe and Asia. Our corporate structure also spans multiple jurisdictions, with our parent holding company incorporated in the Cayman Islands and intermediate and operating subsidiaries incorporated in the British Virgin Islands, China, Hong Kong, Japan, Singapore and the United States. As a result, we are exposed to risks typically associated with conducting business internationally, many of which are beyond our control. These risks include:

· significant currency fluctuations among the Renminbi, Japanese yen, U.S. dollar and other currencies in which we transact business;

· legal uncertainty owing to the overlap of different legal regimes, problems in asserting contractual or other rights across international borders, and the burden and expense of complying with the laws and regulations of various jurisdictions;

· potentially adverse tax consequences, such as scrutiny of transfer pricing arrangements by authorities in the countries in which we operate;

· current and future tariffs and other trade barriers, including restrictions on technology and data transfers;

· obtaining visas and other travel documents, especially for our employees who are PRC citizens;

17

Table of Contents

· unexpected changes in regulatory requirements; and

· terrorist attacks and other acts of violence, regional conflicts or war, including any escalation of recent events involving South Korea and North Korea; and

· natural and man-made disasters, including the recent 9.0 magnitude eartherquake in Japan and resulting tsunami and radiation leaks at the Fukushima nuclear power plant.

The occurrence of any of these events could have a material adverse effect on our financial condition and results of operations.

We may cease to enjoy financial incentives and subsidies from certain PRC government agencies.

Certain of our PRC subsidiaries have in the past been granted financial incentives and subsidies from certain local government agencies in support of the continued expansion of our business locally and globally. These government agencies may decide to reduce or eliminate such financial incentives and subsidies at any time. Therefore, we cannot assure you of the continued availability of such financial incentives and subsidies. The discontinuation of these financial incentives and subsidies could potentially increase our operating and other expenses and adversely affect our financial condition and results of operation.

We rely on technological infrastructure and telecommunications systems in providing our services to our clients, and any failures by, or disruptions to, the infrastructure and systems we use could adversely affect our business and results of operations.