Fourth Quarter, Full Year 2018 Performance & Nexeo Closing March 4, 2019

Forward-Looking Statements This presentation includes certain statements relating to future events and our intentions, beliefs, expectations, and predictions for the future which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that the forward-looking information presented in this presentation is not a guarantee of future events or results, and that actual events or results may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "outlook," "guidance," “may,” “plan,” “seek,” “comfortable with,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe” or “continue” or the negatives or variations of these terms. There can be no assurance regarding the estimates and projections regarding the sale of our plastics business, which remains subject to customary closing conditions and adjustments. Forward-looking information contained in this presentation is made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Regulation G: Non-GAAP Measures The information presented herein regarding certain unaudited non-GAAP measures does not conform to generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. Univar has included this non-GAAP information to assist in understanding the operating performance of the company and its operating segments. These non-GAAP financial measures include gross profit, gross margin and delivered gross profit (all exclusive of depreciation), Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, and Adjusted earnings per share. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information related to previous Univar filings with the SEC has been reconciled with reported U.S. GAAP results. We evaluate our results of operations on both an as reported and a constant currency basis. The constant currency presentation is a non-GAAP financial measure, which excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency information provides valuable supplemental information regarding our results of operations, consistent with how we evaluate our performance. We calculate constant currency percentages by converting our financial results in local currency for a period using the average exchange rate for the prior period to which we are comparing. This calculation may differ from similarly-titled measures used by other companies. 2 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

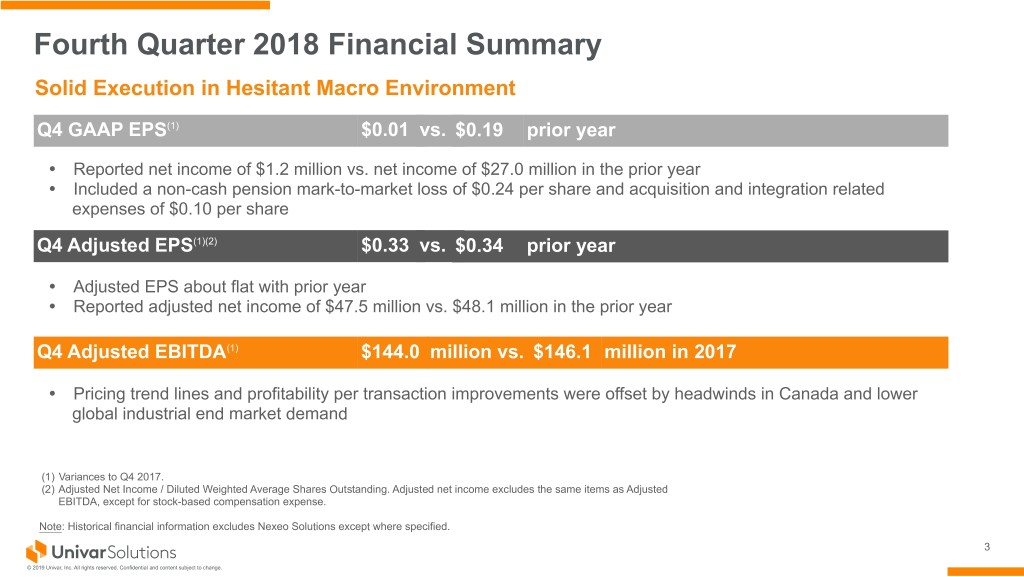

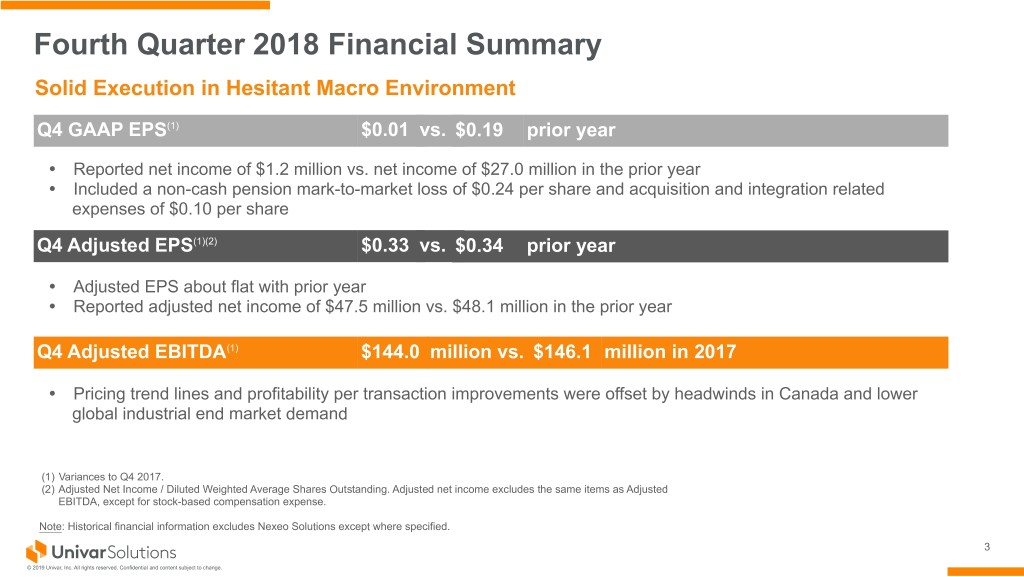

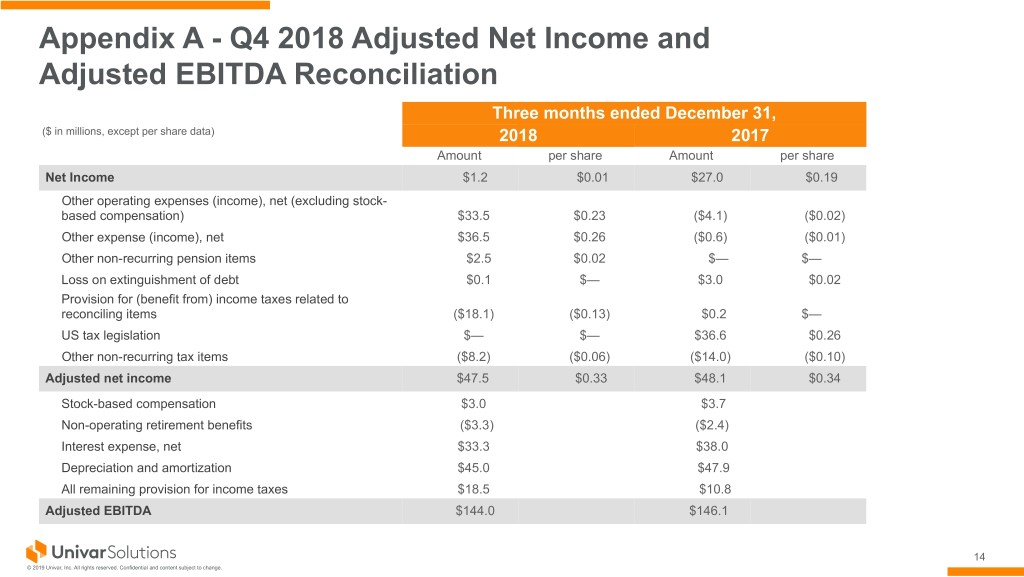

Fourth Quarter 2018 Financial Summary Solid Execution in Hesitant Macro Environment Q4 GAAP EPS(1) $0.01 vs. $0.19 prior year Ÿ Reported net income of $1.2 million vs. net income of $27.0 million in the prior year Ÿ Included a non-cash pension mark-to-market loss of $0.24 per share and acquisition and integration related expenses of $0.10 per share Q4 Adjusted EPS(1)(2) $0.33 vs. $0.34 prior year Ÿ Adjusted EPS about flat with prior year Ÿ Reported adjusted net income of $47.5 million vs. $48.1 million in the prior year Q4 Adjusted EBITDA(1) $144.0 million vs. $146.1 million in 2017 Ÿ Pricing trend lines and profitability per transaction improvements were offset by headwinds in Canada and lower global industrial end market demand (1) Variances to Q4 2017. (2) Adjusted Net Income / Diluted Weighted Average Shares Outstanding. Adjusted net income excludes the same items as Adjusted EBITDA, except for stock-based compensation expense. Note: Historical financial information excludes Nexeo Solutions except where specified. 3 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

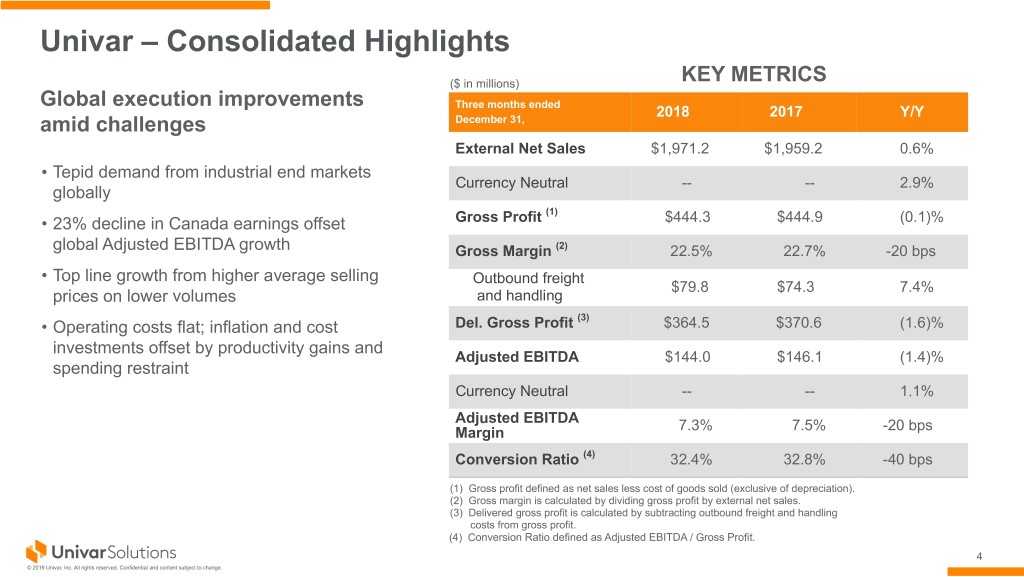

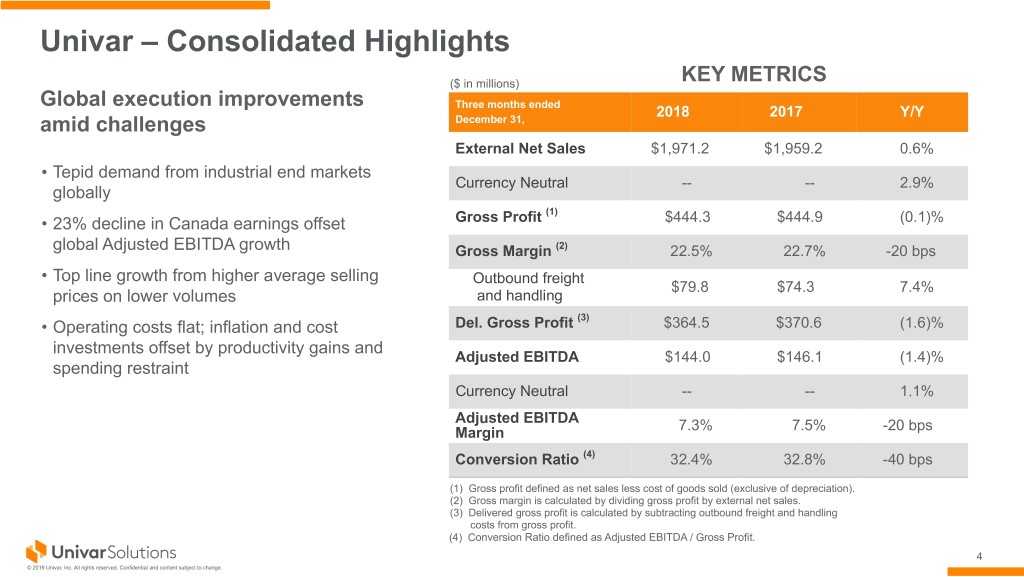

Univar – Consolidated Highlights ($ in millions) KEY METRICS Global execution improvements Three months ended 2018 2017 Y/Y amid challenges December 31, External Net Sales $1,971.2 $1,959.2 0.6% • Tepid demand from industrial end markets Currency Neutral -- -- 2.9% globally (1) • 23% decline in Canada earnings offset Gross Profit $444.3 $444.9 (0.1)% global Adjusted EBITDA growth Gross Margin (2) 22.5% 22.7% -20 bps • Top line growth from higher average selling Outbound freight $79.8 $74.3 7.4% prices on lower volumes and handling (3) • Operating costs flat; inflation and cost Del. Gross Profit $364.5 $370.6 (1.6)% investments offset by productivity gains and Adjusted EBITDA $144.0 $146.1 (1.4)% spending restraint Currency Neutral -- -- 1.1% Adjusted EBITDA 7.3% 7.5% -20 bps Margin Conversion Ratio (4) 32.4% 32.8% -40 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. (4) Conversion Ratio defined as Adjusted EBITDA / Gross Profit. 4 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

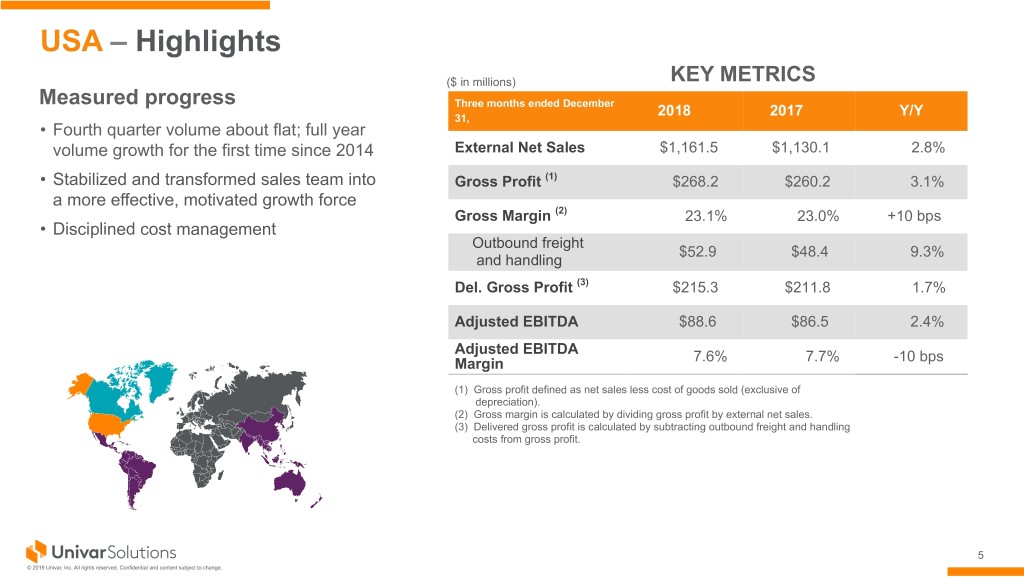

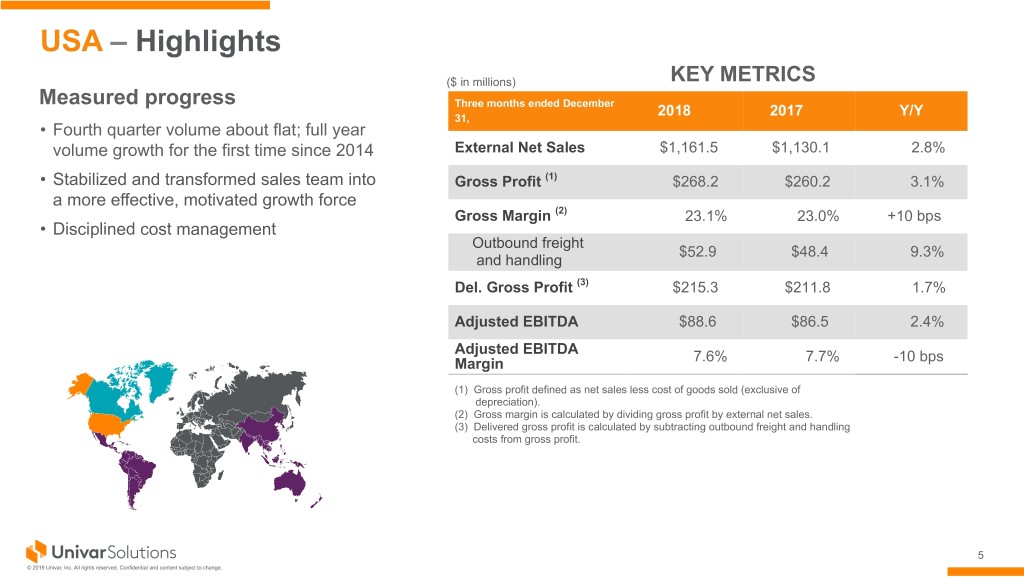

USA – Highlights ($ in millions) KEY METRICS Measured progress Three months ended December 2018 2017 Y/Y 31, • Fourth quarter volume about flat; full year volume growth for the first time since 2014 External Net Sales $1,161.5 $1,130.1 2.8% • Stabilized and transformed sales team into Gross Profit (1) $268.2 $260.2 3.1% a more effective, motivated growth force Gross Margin (2) 23.1% 23.0% +10 bps • Disciplined cost management Outbound freight $52.9 $48.4 9.3% and handling Del. Gross Profit (3) $215.3 $211.8 1.7% Adjusted EBITDA $88.6 $86.5 2.4% Adjusted EBITDA Margin 7.6% 7.7% -10 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. 5 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

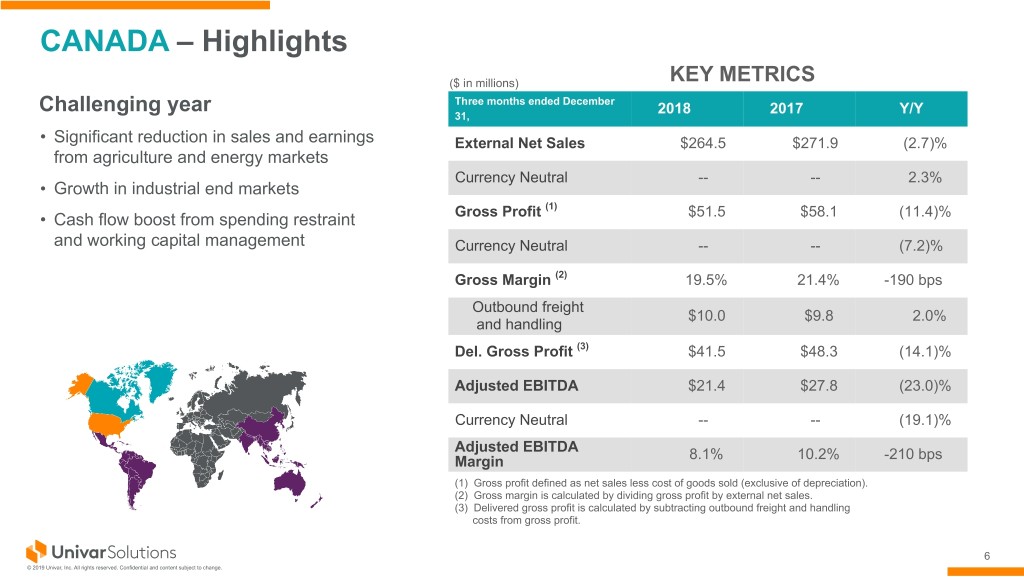

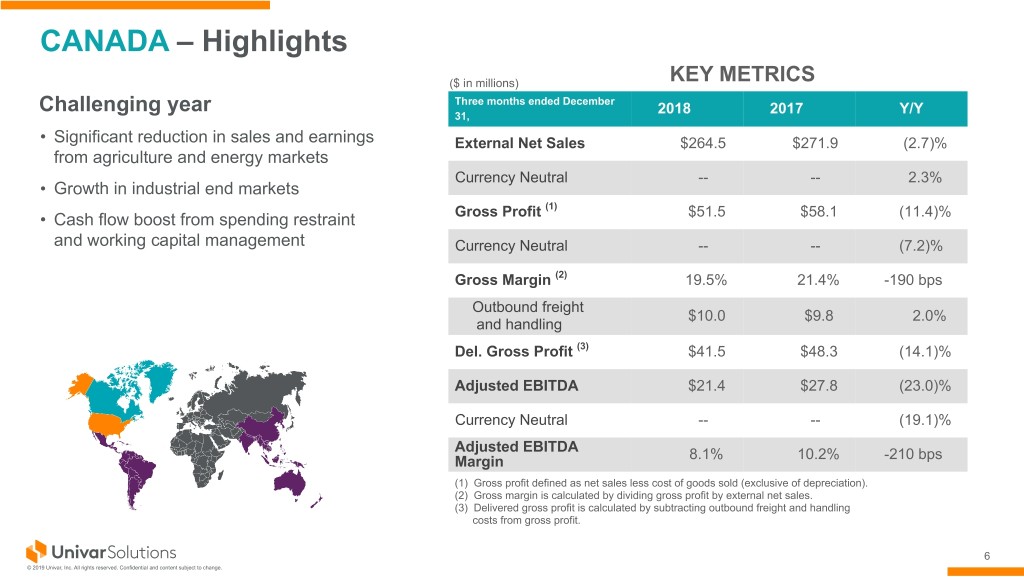

CANADA – Highlights ($ in millions) KEY METRICS Challenging year Three months ended December 2018 2017 Y/Y 31, • Significant reduction in sales and earnings External Net Sales $264.5 $271.9 (2.7)% from agriculture and energy markets Currency Neutral -- -- 2.3% • Growth in industrial end markets (1) • Cash flow boost from spending restraint Gross Profit $51.5 $58.1 (11.4)% and working capital management Currency Neutral -- -- (7.2)% Gross Margin (2) 19.5% 21.4% -190 bps Outbound freight $10.0 $9.8 2.0% and handling Del. Gross Profit (3) $41.5 $48.3 (14.1)% Adjusted EBITDA $21.4 $27.8 (23.0)% Currency Neutral -- -- (19.1)% Adjusted EBITDA 8.1% 10.2% -210 bps Margin (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. 6 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

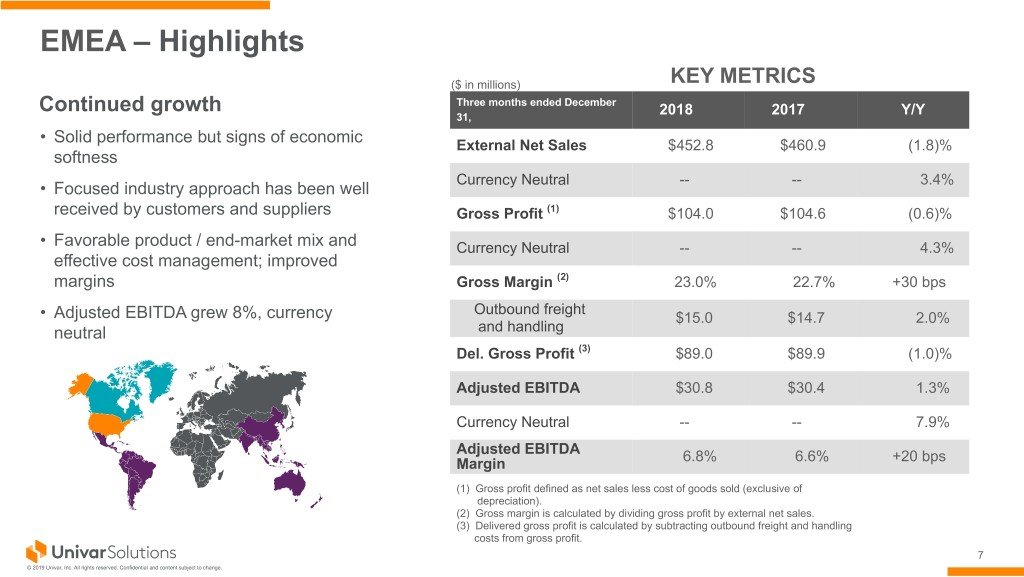

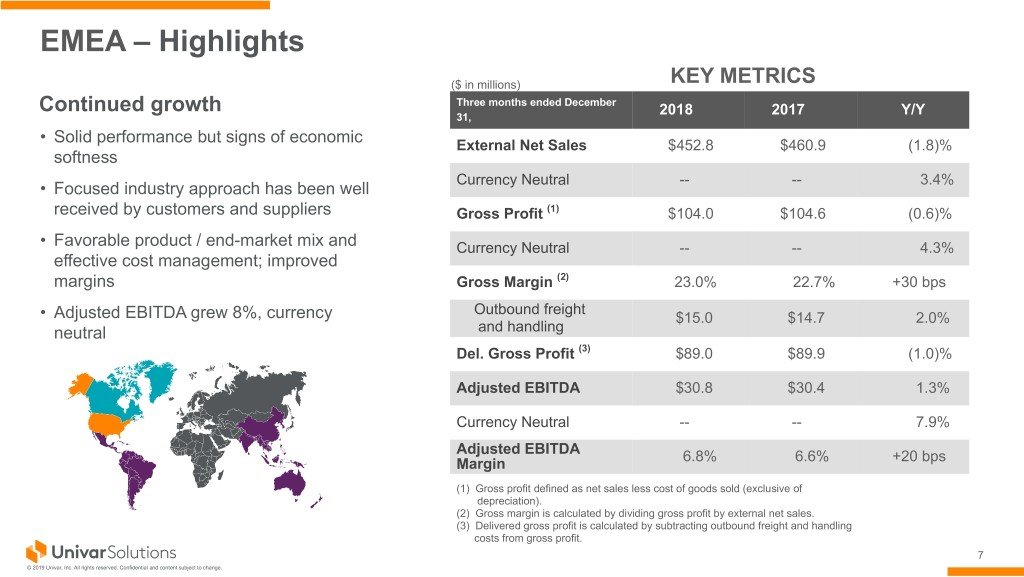

EMEA – Highlights ($ in millions) KEY METRICS Continued growth Three months ended December 2018 2017 Y/Y 31, • Solid performance but signs of economic External Net Sales $452.8 $460.9 (1.8)% softness Currency Neutral -- -- 3.4% • Focused industry approach has been well received by customers and suppliers Gross Profit (1) $104.0 $104.6 (0.6)% • Favorable product / end-market mix and Currency Neutral -- -- 4.3% effective cost management; improved margins Gross Margin (2) 23.0% 22.7% +30 bps Outbound freight • Adjusted EBITDA grew 8%, currency $15.0 $14.7 2.0% neutral and handling Del. Gross Profit (3) $89.0 $89.9 (1.0)% Adjusted EBITDA $30.8 $30.4 1.3% Currency Neutral -- -- 7.9% Adjusted EBITDA 6.8% 6.6% +20 bps Margin (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. 7 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

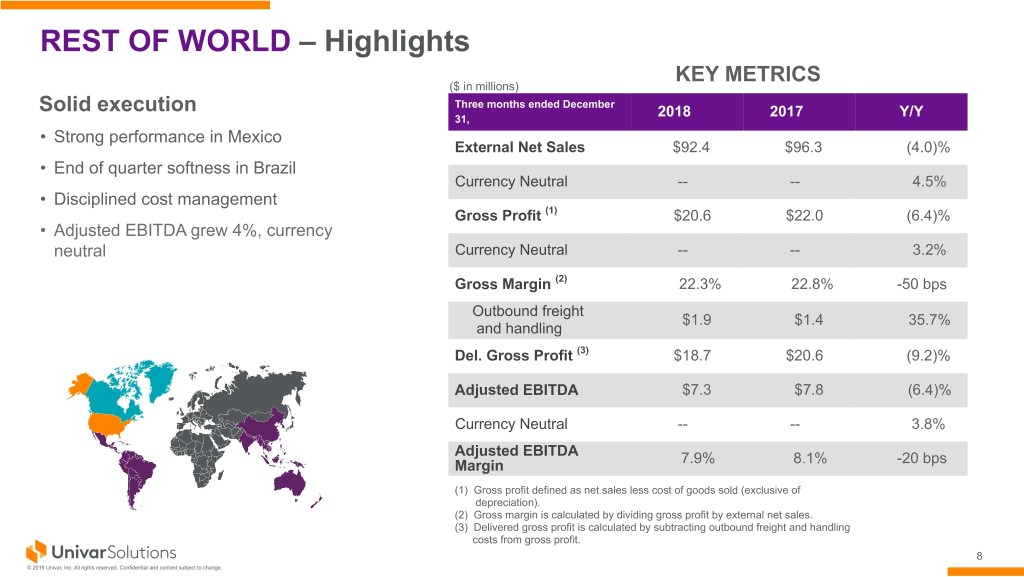

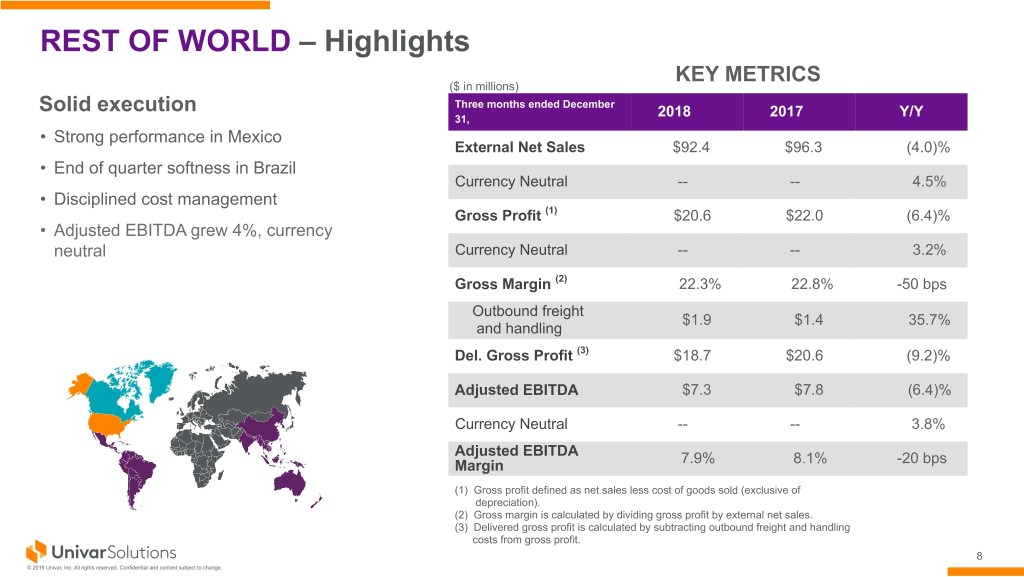

REST OF WORLD – Highlights KEY METRICS ($ in millions) Solid execution Three months ended December 2018 2017 Y/Y 31, • Strong performance in Mexico External Net Sales $92.4 $96.3 (4.0)% • End of quarter softness in Brazil Currency Neutral -- -- 4.5% • Disciplined cost management Gross Profit (1) $20.6 $22.0 (6.4)% • Adjusted EBITDA grew 4%, currency neutral Currency Neutral -- -- 3.2% Gross Margin (2) 22.3% 22.8% -50 bps Outbound freight $1.9 $1.4 35.7% and handling Del. Gross Profit (3) $18.7 $20.6 (9.2)% Adjusted EBITDA $7.3 $7.8 (6.4)% Currency Neutral -- -- 3.8% Adjusted EBITDA 7.9% 8.1% -20 bps Margin (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. 8 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Cash Flow Highlights Solid cash flow generation driven by seasonal inflow of cash from working capital Three months ended December 31, ($ in millions) 2018 2017 Y/Y Net cash provided by operating $292.5 $246.8 18.5% activities Capital Expenditures (1) ($34.7) ($24.7) 40.5% Cash Interest (net) ($25.5) ($25.8) (1.2)% Cash Taxes ($16.0) ($4.2) 281.0% Change in Net Working Capital $197.1 $86.1 128.9% Pension Contribution ($14.3) ($9.3) 53.8% (1) Excludes additions from capital leases. 9 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

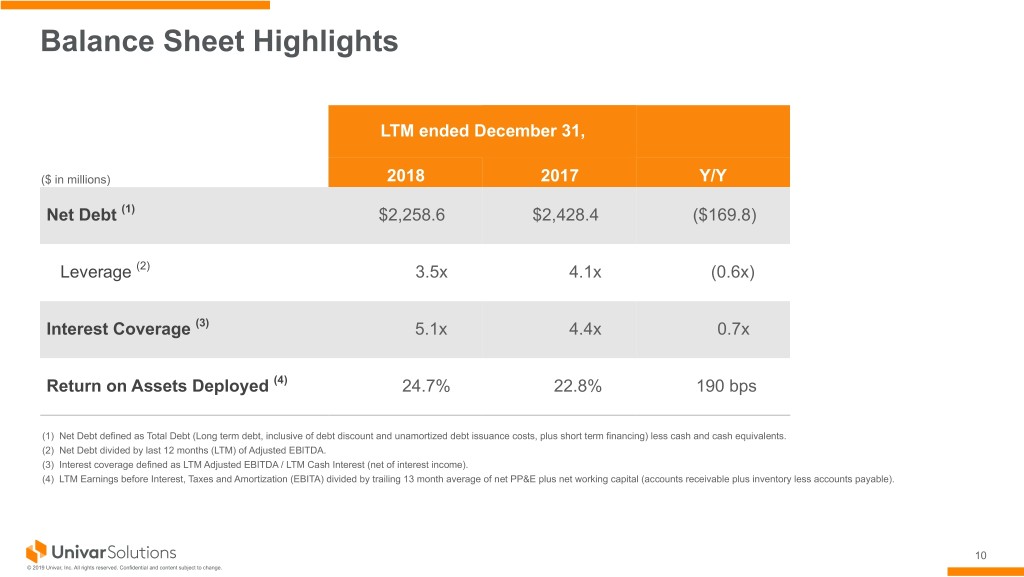

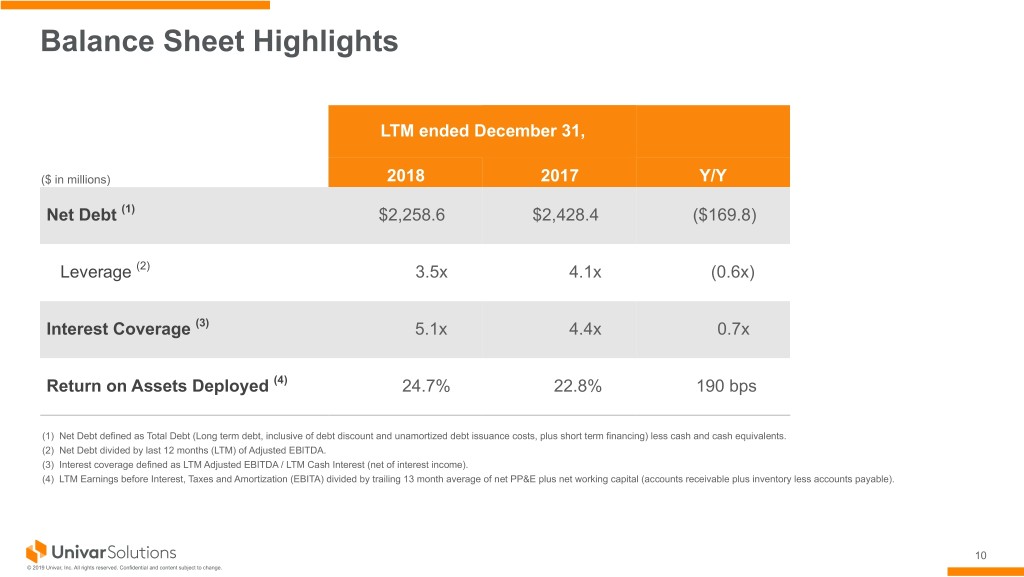

Balance Sheet Highlights LTM ended December 31, ($ in millions) 2018 2017 Y/Y Net Debt (1) $2,258.6 $2,428.4 ($169.8) Leverage (2) 3.5x 4.1x (0.6x) Interest Coverage (3) 5.1x 4.4x 0.7x Return on Assets Deployed (4) 24.7% 22.8% 190 bps (1) Net Debt defined as Total Debt (Long term debt, inclusive of debt discount and unamortized debt issuance costs, plus short term financing) less cash and cash equivalents. (2) Net Debt divided by last 12 months (LTM) of Adjusted EBITDA. (3) Interest coverage defined as LTM Adjusted EBITDA / LTM Cash Interest (net of interest income). (4) LTM Earnings before Interest, Taxes and Amortization (EBITA) divided by trailing 13 month average of net PP&E plus net working capital (accounts receivable plus inventory less accounts payable). 10 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Debt Structure Structure at Adj. for Nexeo Adj. for Nexeo Pro-Forma Structure ($ in millions) December 31, 2018 WholeCo Transaction Plastics Sale N. American ABL $135 $486 $621 Euro ABL $59 $59 Existing USD Term Loan B $1,748 $1,748 Incr. USD Term Loan B $300 $300 Incr. EUR Term Loan B $482 $482 Capital Lease Obligations $55 $55 Est. Proceeds from Plastics Sale (1) ($615) ($615) Total Secured Debt $1,997 $1,268 ($615) $2,650 Senior Notes due 2023 $400 $400 Other Debt $8 $8 Total Debt (before discount)(2) $2,405 $1,268 ($615) $3,058 less: unamortized debt issuance costs & debt discount ($23) ($23) Total Debt $2,382 $1,268 ($615) $3,035 Cash & Cash Equivalents $122 $122 Net Debt $2,260 $1,268 ($615) $2,913 (1) Estimate of net proceeds of the transaction. There can be no assurance as to the actual amount of cash to be received, which is subject to customary adjustments. The transaction remains subject to the satisfaction of customary closing conditions, including certain regulatory approvals. (2) Excludes current maturities. 11 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

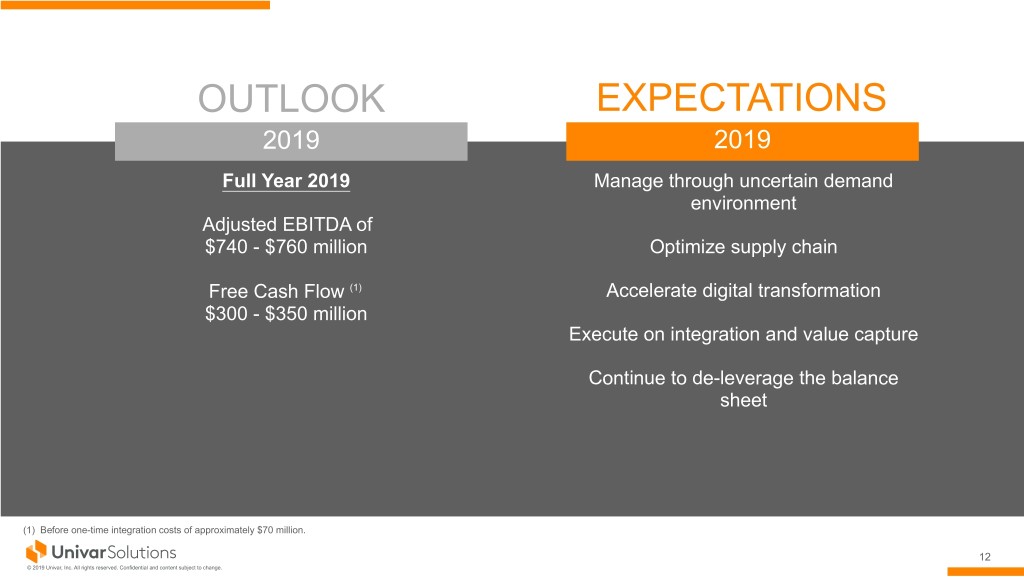

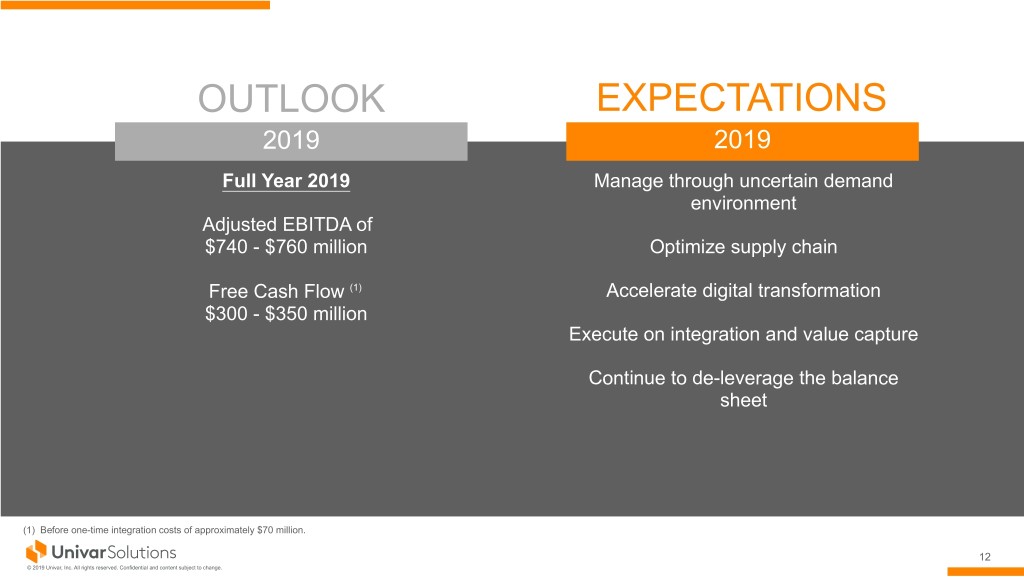

OUTLOOK EXPECTATIONS 2019 2019 Full Year 2019 Manage through uncertain demand environment Adjusted EBITDA of $740 - $760 million Optimize supply chain Free Cash Flow (1) Accelerate digital transformation $300 - $350 million Execute on integration and value capture Continue to de-leverage the balance sheet (1) Before one-time integration costs of approximately $70 million. 12 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

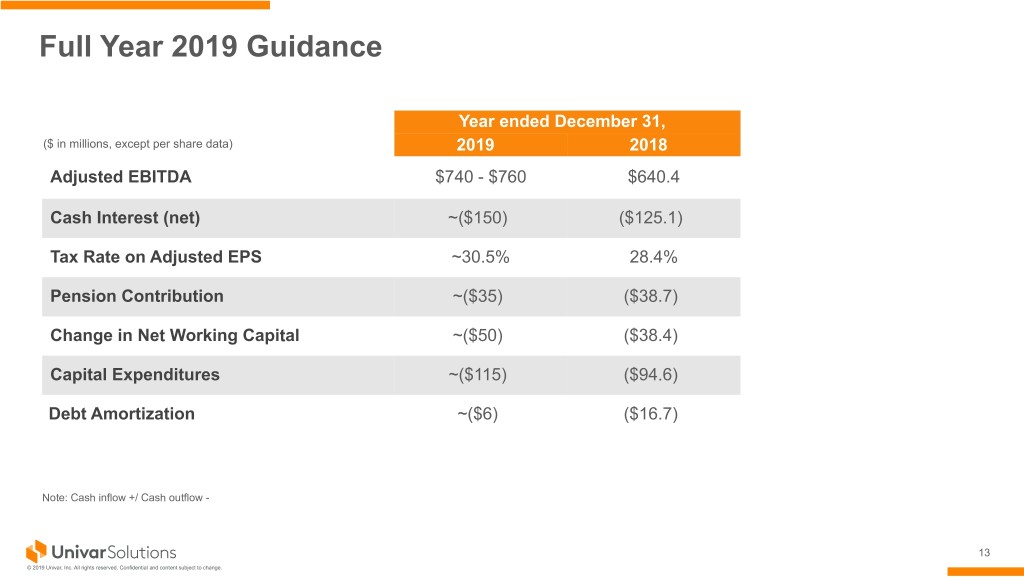

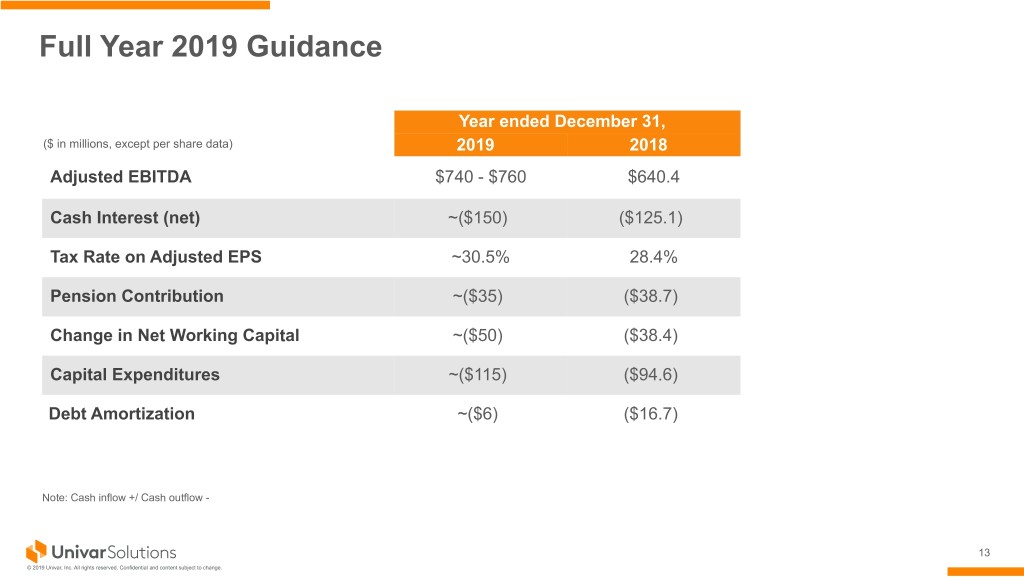

Full Year 2019 Guidance Year ended December 31, ($ in millions, except per share data) 2019 2018 Adjusted EBITDA $740 - $760 $640.4 Cash Interest (net) ~($150) ($125.1) Tax Rate on Adjusted EPS ~30.5% 28.4% Pension Contribution ~($35) ($38.7) Change in Net Working Capital ~($50) ($38.4) Capital Expenditures ~($115) ($94.6) Debt Amortization ~($6) ($16.7) Note: Cash inflow +/ Cash outflow - 13 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

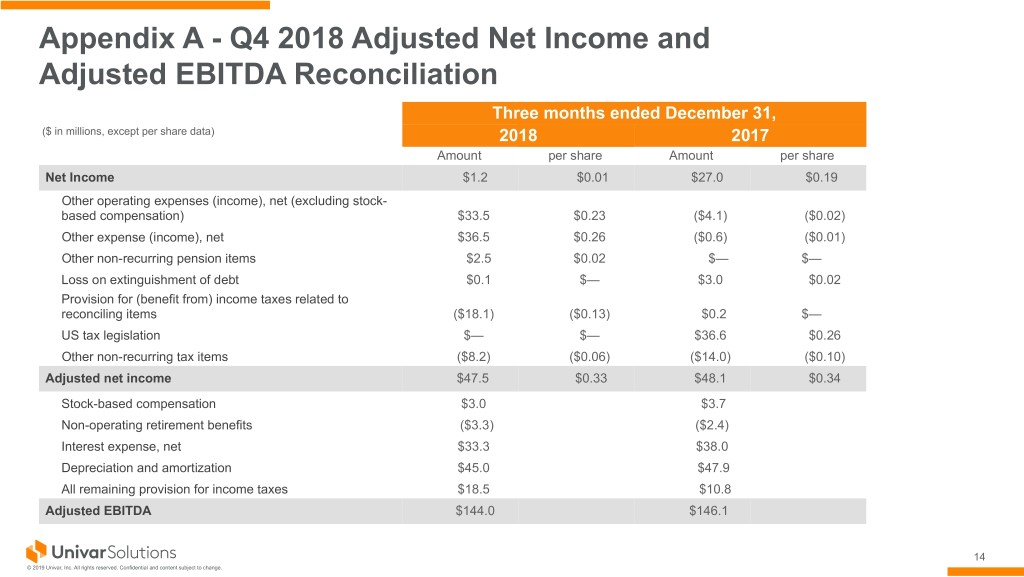

Appendix A - Q4 2018 Adjusted Net Income and Adjusted EBITDA Reconciliation Three months ended December 31, ($ in millions, except per share data) 2018 2017 Amount per share Amount per share Net Income $1.2 $0.01 $27.0 $0.19 Other operating expenses (income), net (excluding stock- based compensation) $33.5 $0.23 ($4.1) ($0.02) Other expense (income), net $36.5 $0.26 ($0.6) ($0.01) Other non-recurring pension items $2.5 $0.02 $— $— Loss on extinguishment of debt $0.1 $— $3.0 $0.02 Provision for (benefit from) income taxes related to reconciling items ($18.1) ($0.13) $0.2 $— US tax legislation $— $— $36.6 $0.26 Other non-recurring tax items ($8.2) ($0.06) ($14.0) ($0.10) Adjusted net income $47.5 $0.33 $48.1 $0.34 Stock-based compensation $3.0 $3.7 Non-operating retirement benefits ($3.3) ($2.4) Interest expense, net $33.3 $38.0 Depreciation and amortization $45.0 $47.9 All remaining provision for income taxes $18.5 $10.8 Adjusted EBITDA $144.0 $146.1 14 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

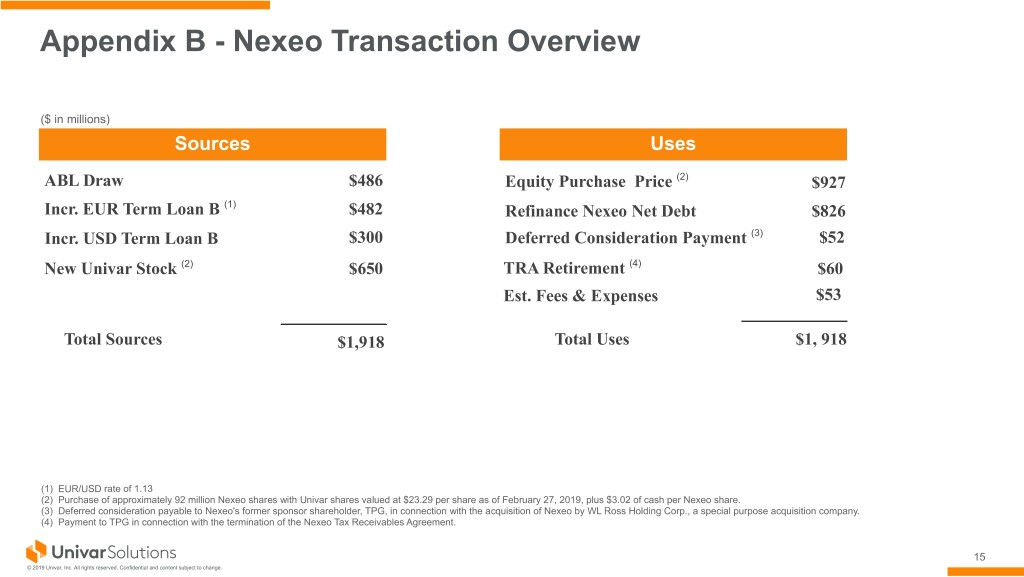

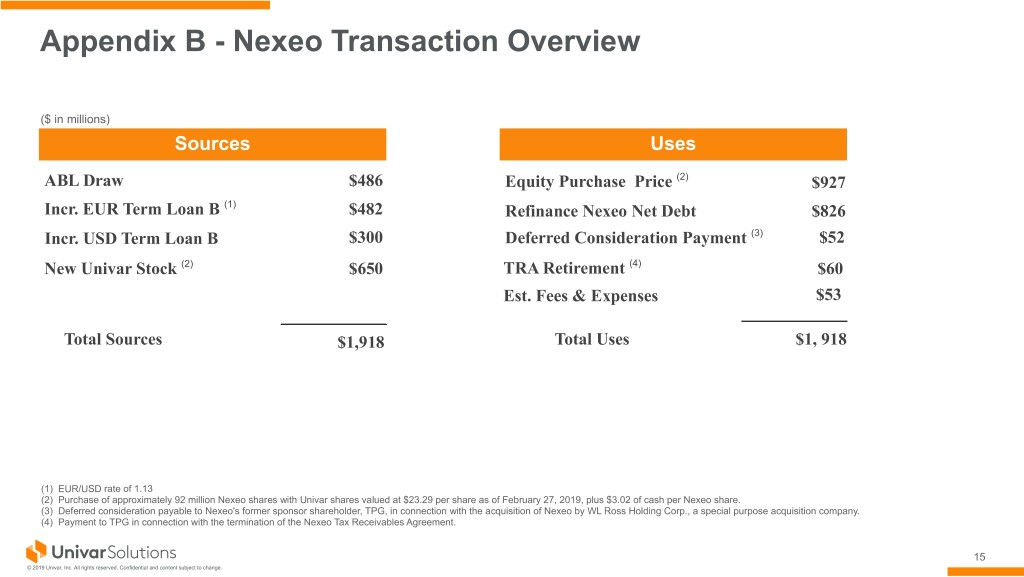

Appendix B - Nexeo Transaction Overview ($ in millions) Sources Uses ABL Draw $486 Equity Purchase Price (2) $927 Incr. EUR Term Loan B (1) $482 Refinance Nexeo Net Debt $826 Incr. USD Term Loan B $300 Deferred Consideration Payment (3) $52 New Univar Stock (2) $650 TRA Retirement (4) $60 Est. Fees & Expenses $53 Total Sources $1,918 Total Uses $1, 918 (1) EUR/USD rate of 1.13 (2) Purchase of approximately 92 million Nexeo shares with Univar shares valued at $23.29 per share as of February 27, 2019, plus $3.02 of cash per Nexeo share. (3) Deferred consideration payable to Nexeo's former sponsor shareholder, TPG, in connection with the acquisition of Nexeo by WL Ross Holding Corp., a special purpose acquisition company. (4) Payment to TPG in connection with the termination of the Nexeo Tax Receivables Agreement. 15 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.