Second Quarter 2019 Performance August 5, 2019

Forward-Looking Statements This presentation includes certain statements relating to future events and our intentions, beliefs, expectations, and predictions for the future, including the expected benefits of the Nexeo acquisition, which are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control, including the risks and uncertainties described under the caption "Risk Factors" in the Company's most recent annual report on Form 10-K. We caution you that the forward- looking information presented in this presentation is not a guarantee of future events or results, and that actual events or results may differ materially from those made in or suggested by the forward-looking information contained in this presentation. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "outlook," "guidance," “may,” “plan,” “seek,” “comfortable with,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” "to achieve," "targets" or “continue” or the negatives or variations of these terms. Forward-looking information contained in this presentation is made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, or otherwise. Regulation G: Non-GAAP Measures The information presented herein regarding certain unaudited non-GAAP measures does not conform to generally accepted accounting principles in the United States (U.S. GAAP) and should not be construed as an alternative to the reported results determined in accordance with U.S. GAAP. The Company has included this non-GAAP information to assist in understanding the operating performance of the company and its operating segments. These non- GAAP financial measures include gross profit, gross margin, delivered gross profit and delivered gross margin (all exclusive of depreciation), Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, Adjusted earnings per share and Free Cash Flow. The non-GAAP information provided may not be consistent with the methodologies used by other companies. All non-GAAP information related to previous Company filings with the SEC has been reconciled with reported U.S. GAAP results. The Company evaluates its results of operations on both an as reported and a constant currency basis. The constant currency presentation is a non-GAAP financial measure, which excludes the impact of fluctuations in foreign currency exchange rates. The Company believes providing constant currency information provides valuable supplemental information regarding its results of operations, consistent with how the Company evaluates its performance. The Company calculates constant currency percentages by converting its financial results in local currency for a period using the average exchange rate for the prior period to which it is comparing. This calculation may differ from similarly-titled measures used by other companies. 2 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Second Quarter 2019 Summary Ÿ Solid second quarter results ◦ Executed with discipline in weakening macroeconomic environment ◦ Legacy Nexeo integration cost capture and solid cost control ◦ Full quarter contribution from legacy Nexeo Chemicals Ÿ USA transformation working ◦ Sales force execution improvement ◦ Focused margin management ◦ Favorable product mix ◦ Marked conversion ratio increase Ÿ Integration plan progressing well ◦ Supplier partners recognize the positive change 3 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Q2-2019 Financial Highlights* Ÿ GAAP EPS: $0.10, compared to $0.40 in the prior year second quarter ◦ Q2-2019 includes $49.1 million of integration and transaction related costs and higher share count from Nexeo acquisition Ÿ Adjusted EPS: $0.42 vs. $0.47 prior year Ÿ Gross Profit: $577.3M vs $500.5M prior year ◦ Nexeo acquisition contribution; improving sales force execution and favorable mix ◦ Estimated pro-forma 5% decline; attributed approximately 2% to FX, 1% due to expected supplier dis-synergies, and 1% from adverse conditions in the Canadian agriculture market Ÿ Adjusted EBITDA: $201.1M vs. $173.1M prior year ◦ Nexeo acquisition contribution; higher gross margin, prudent cost management and synergy capture ◦ FX headwind ◦ Estimated pro-forma performance about flat, currency neutral Ÿ Free Cash Flow year-to-date of ($101.5M): ahead of prior year (excludes one-time legal payment) ◦ Lower than expected Net Working Capital Ÿ Return on Invested Capital (ROIC) of 9.9% • Leverage ratio of 4.1x: essentially equal to Q2-2018 * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 4 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Q2-2019 – Consolidated Highlights ($ in millions) KEY METRICS Solid performance despite lower Three months ended June 2019 2018 Y/Y demand and FX headwinds 30, • Gross margin expansion driven by sales External Net Sales $2,584.6 $2,372.6 8.9% force execution and favorable mix Currency Neutral -- -- 11.0% • Focused on prudent cost management Gross Profit (1) $577.3 $500.5 15.3% and synergy capture Gross Margin (2) 22.3% 21.1% +120 bps Outbound freight and $95.4 $86.5 10.3% handling Del. Gross Profit (3)* $481.9 $414.0 16.4% Adjusted EBITDA * $201.1 $173.1 16.2% Currency Neutral -- -- 18.7% Adjusted EBITDA Margin * 7.8% 7.3% +50 bps Conversion Ratio (4) * 34.8% 34.6% +20 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. (4) Conversion Ratio defined as Adjusted EBITDA / Gross Profit. 5 * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 5 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

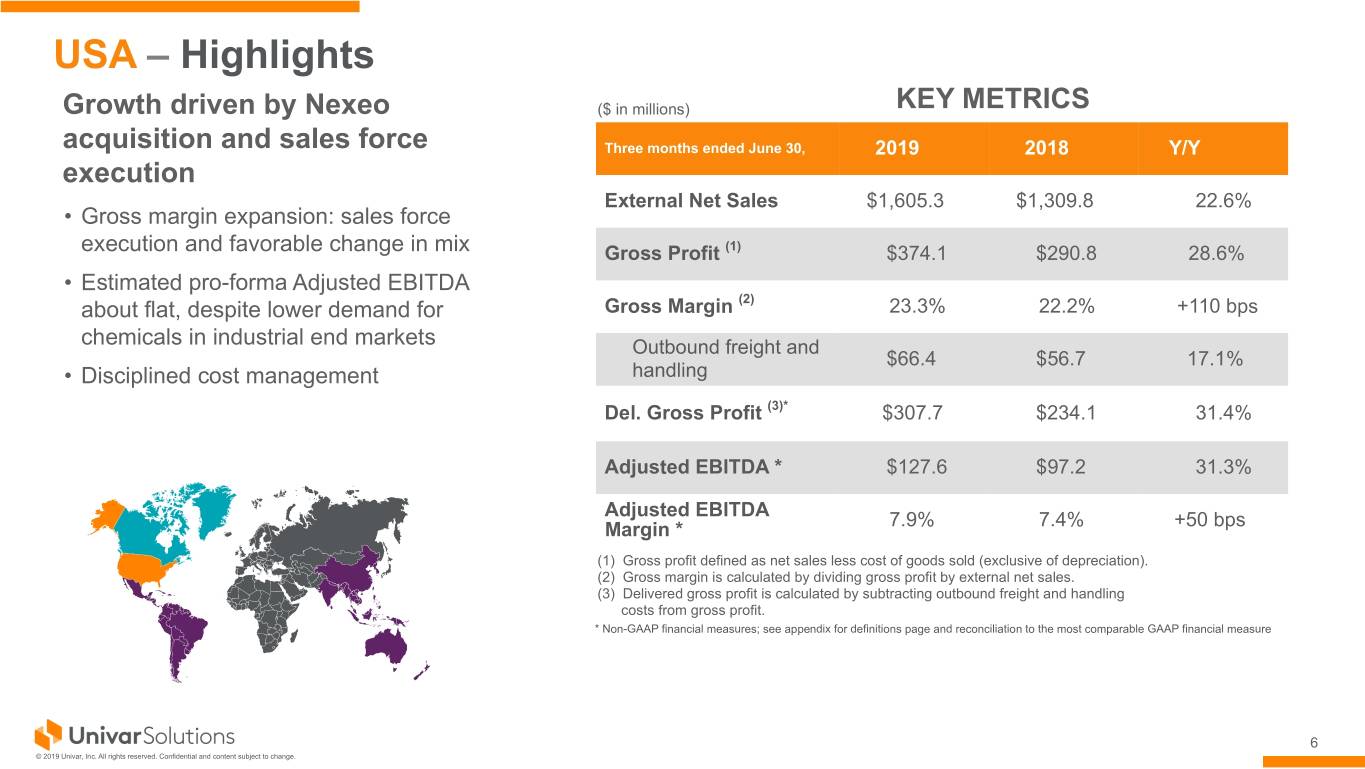

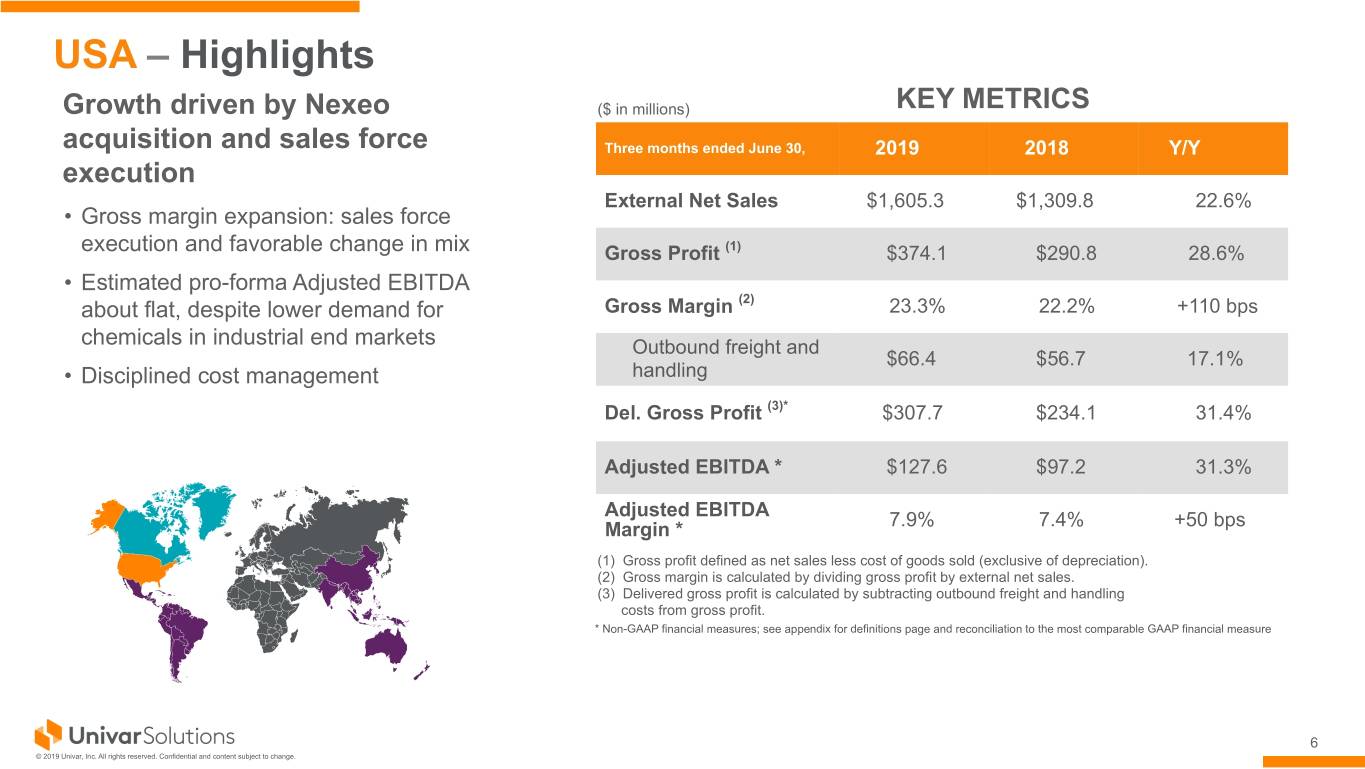

USA – Highlights Growth driven by Nexeo ($ in millions) KEY METRICS acquisition and sales force Three months ended June 30, 2019 2018 Y/Y execution External Net Sales $1,605.3 $1,309.8 22.6% • Gross margin expansion: sales force execution and favorable change in mix Gross Profit (1) $374.1 $290.8 28.6% • Estimated pro-forma Adjusted EBITDA about flat, despite lower demand for Gross Margin (2) 23.3% 22.2% +110 bps chemicals in industrial end markets Outbound freight and $66.4 $56.7 17.1% • Disciplined cost management handling Del. Gross Profit (3)* $307.7 $234.1 31.4% Adjusted EBITDA * $127.6 $97.2 31.3% Adjusted EBITDA Margin * 7.9% 7.4% +50 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 6 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

CANADA – Highlights ($ in millions) KEY METRICS Legacy Nexeo contribution and Three months ended June 30, 2019 2018 Y/Y industrial chemicals performance External Net Sales $404.8 $450.9 (10.2)% offset by lower agriculture Currency Neutral -- -- (6.7)% • Lower demand from agricultural markets given weather conditions Gross Profit (1) $68.5 $68.9 (0.6)% • Focused on prudent cost and working Currency Neutral -- -- 3.2% capital management Gross Margin (2) 16.9% 15.3% +160 bps Outbound freight and $11.6 $12.0 (3.3)% handling Del. Gross Profit (3)* $56.9 $56.9 —% Adjusted EBITDA * $33.8 $34.6 (2.3)% Currency Neutral -- -- 1.4% Adjusted EBITDA Margin * 8.3% 7.7% +60 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 7 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

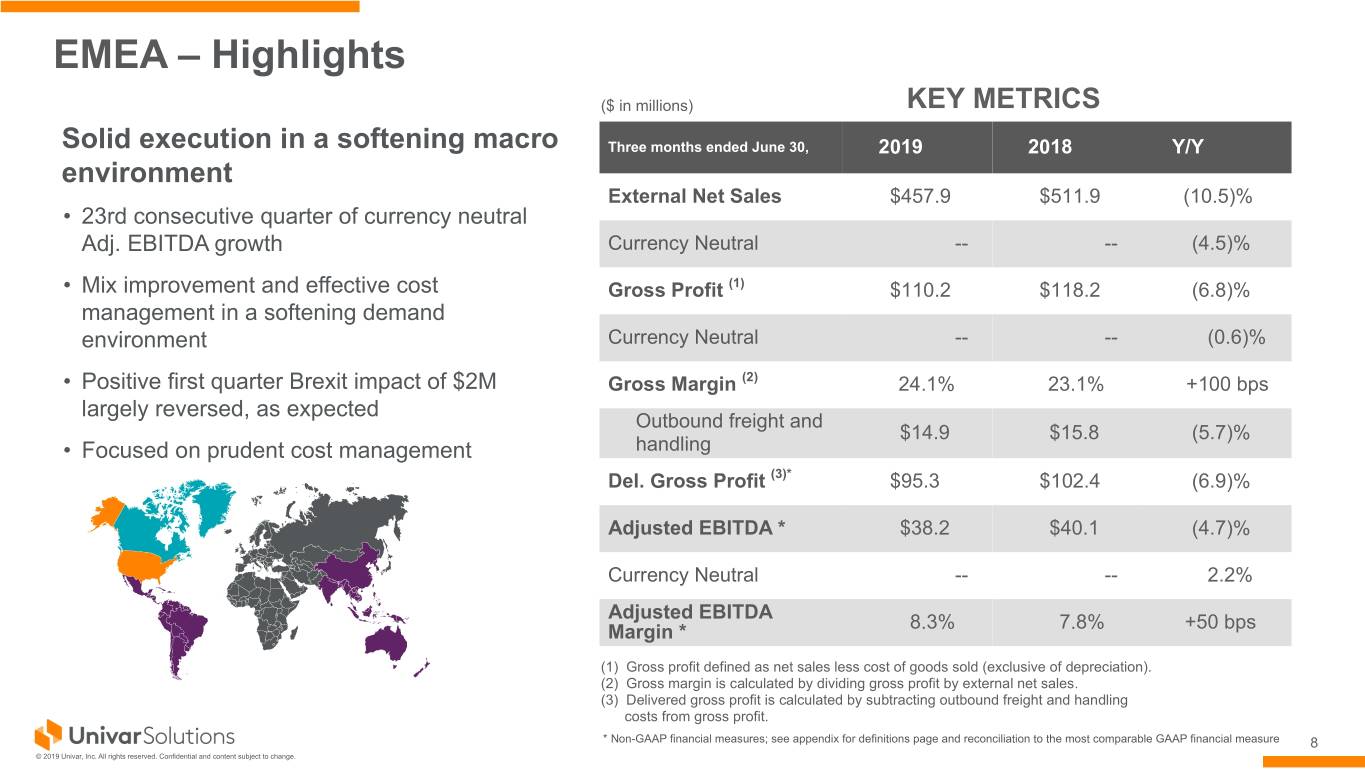

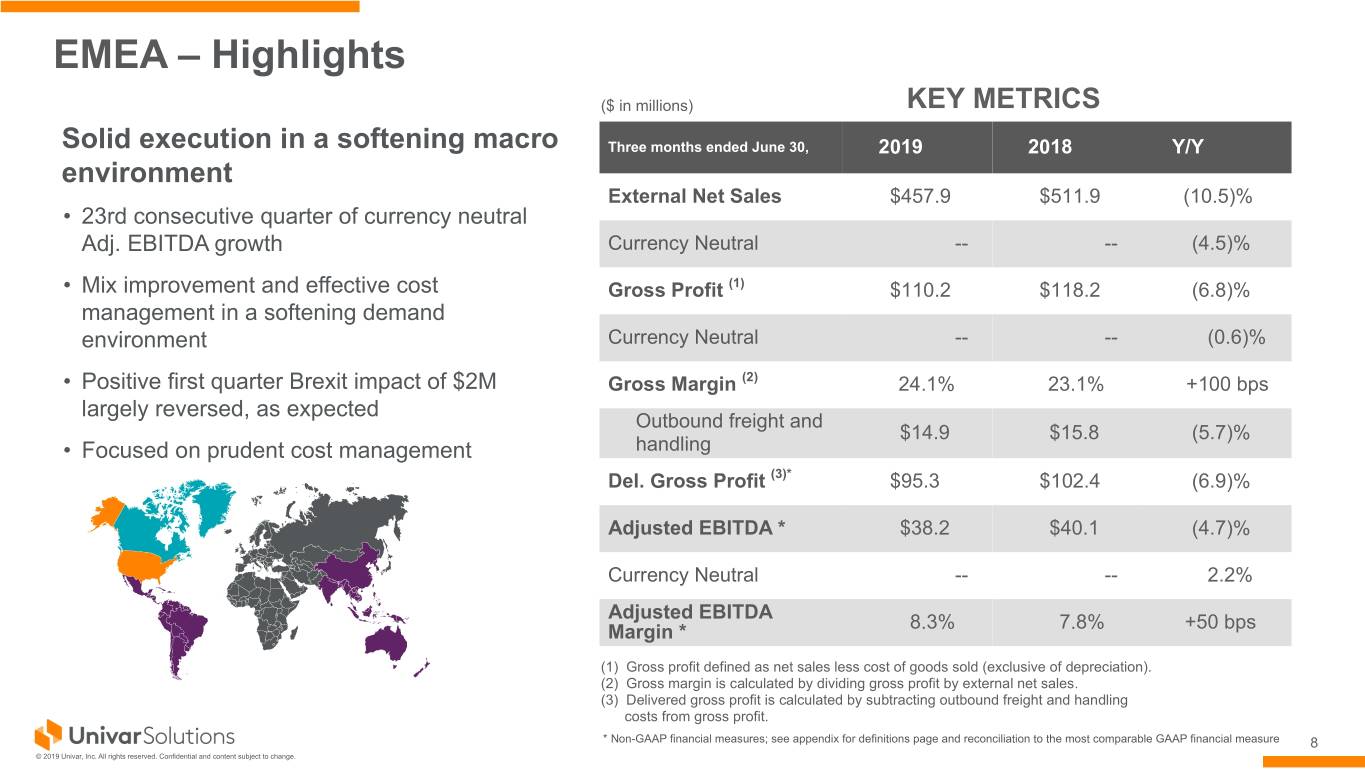

EMEA – Highlights ($ in millions) KEY METRICS Solid execution in a softening macro Three months ended June 30, 2019 2018 Y/Y environment External Net Sales $457.9 $511.9 (10.5)% • 23rd consecutive quarter of currency neutral Adj. EBITDA growth Currency Neutral -- -- (4.5)% • Mix improvement and effective cost Gross Profit (1) $110.2 $118.2 (6.8)% management in a softening demand environment Currency Neutral -- -- (0.6)% • Positive first quarter Brexit impact of $2M Gross Margin (2) 24.1% 23.1% +100 bps largely reversed, as expected Outbound freight and $14.9 $15.8 (5.7)% • Focused on prudent cost management handling Del. Gross Profit (3)* $95.3 $102.4 (6.9)% Adjusted EBITDA * $38.2 $40.1 (4.7)% Currency Neutral -- -- 2.2% Adjusted EBITDA Margin * 8.3% 7.8% +50 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 8 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

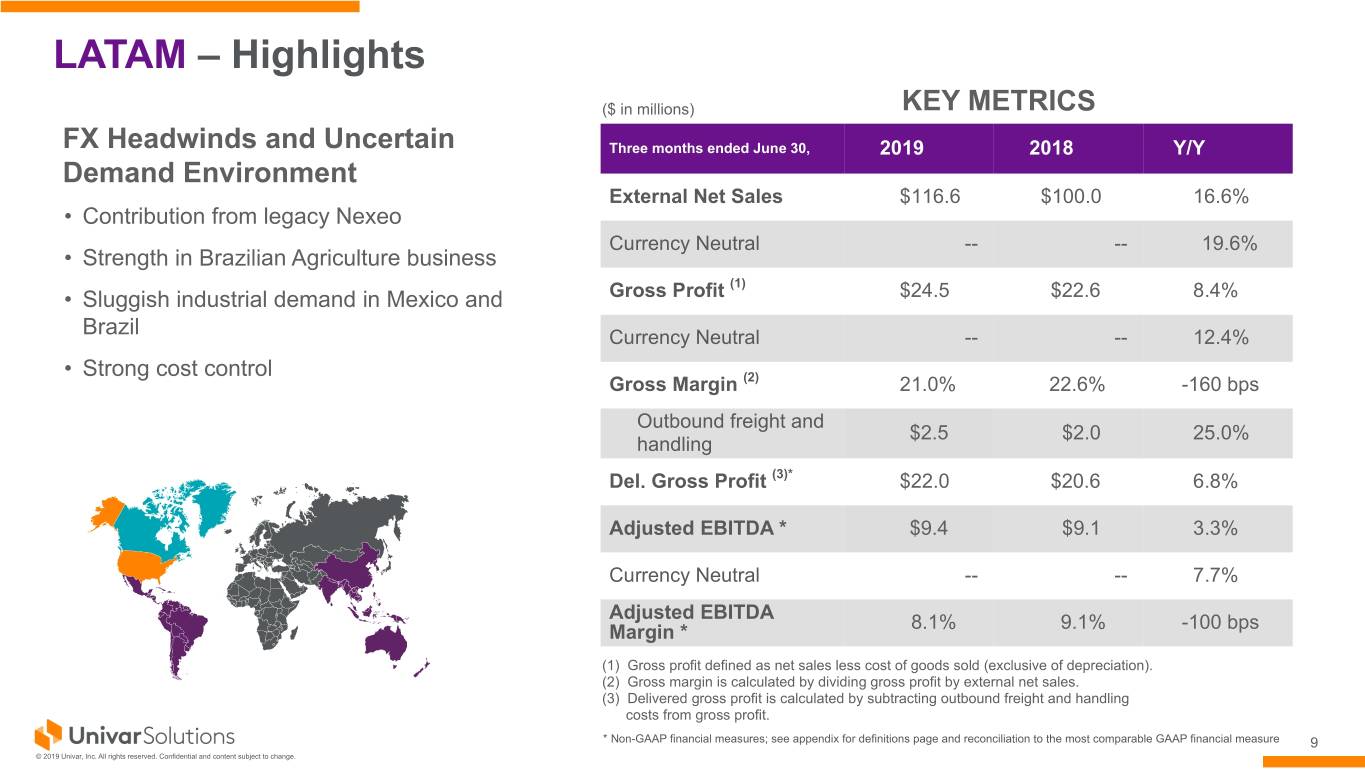

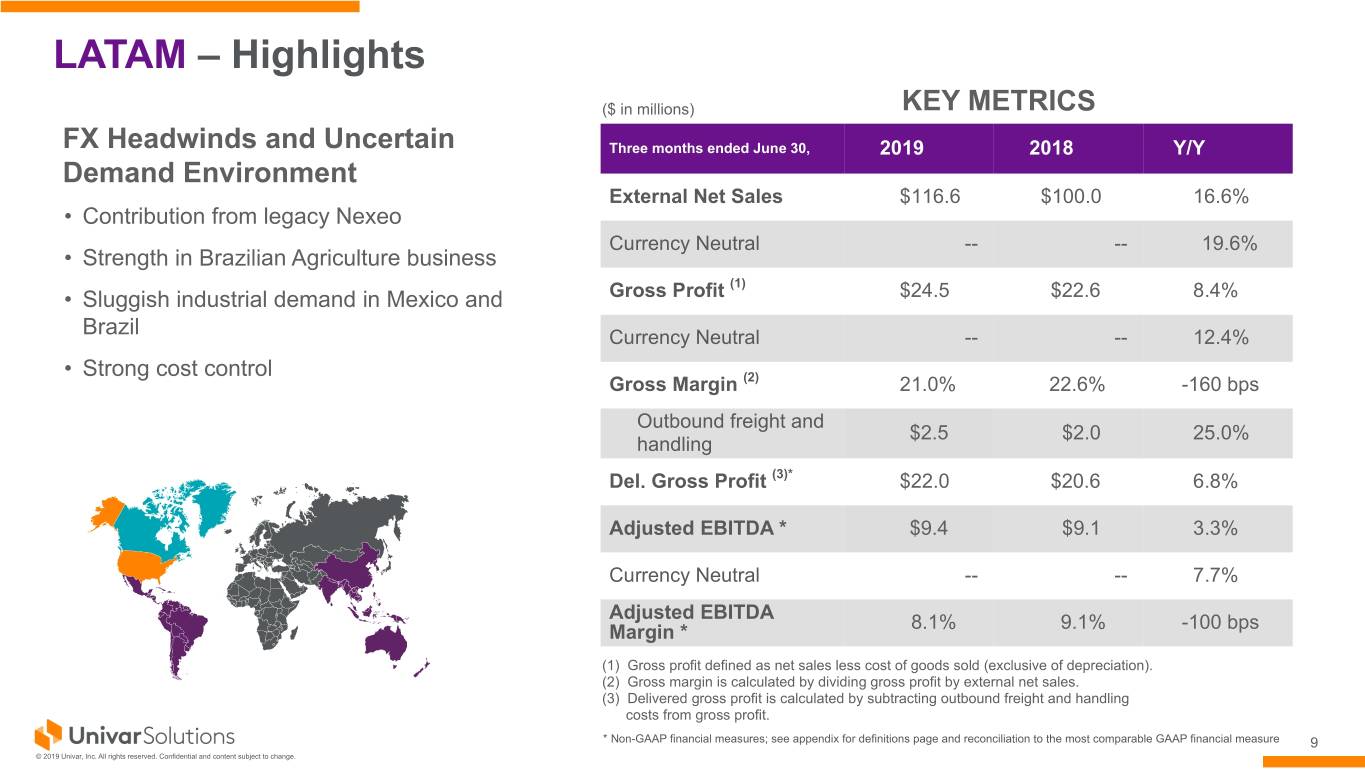

LATAM – Highlights ($ in millions) KEY METRICS FX Headwinds and Uncertain Three months ended June 30, 2019 2018 Y/Y Demand Environment External Net Sales $116.6 $100.0 16.6% • Contribution from legacy Nexeo Currency Neutral -- -- 19.6% • Strength in Brazilian Agriculture business (1) • Sluggish industrial demand in Mexico and Gross Profit $24.5 $22.6 8.4% Brazil Currency Neutral -- -- 12.4% • Strong cost control Gross Margin (2) 21.0% 22.6% -160 bps Outbound freight and $2.5 $2.0 25.0% handling Del. Gross Profit (3)* $22.0 $20.6 6.8% Adjusted EBITDA * $9.4 $9.1 3.3% Currency Neutral -- -- 7.7% Adjusted EBITDA Margin * 8.1% 9.1% -100 bps (1) Gross profit defined as net sales less cost of goods sold (exclusive of depreciation). (2) Gross margin is calculated by dividing gross profit by external net sales. (3) Delivered gross profit is calculated by subtracting outbound freight and handling costs from gross profit. * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 9 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

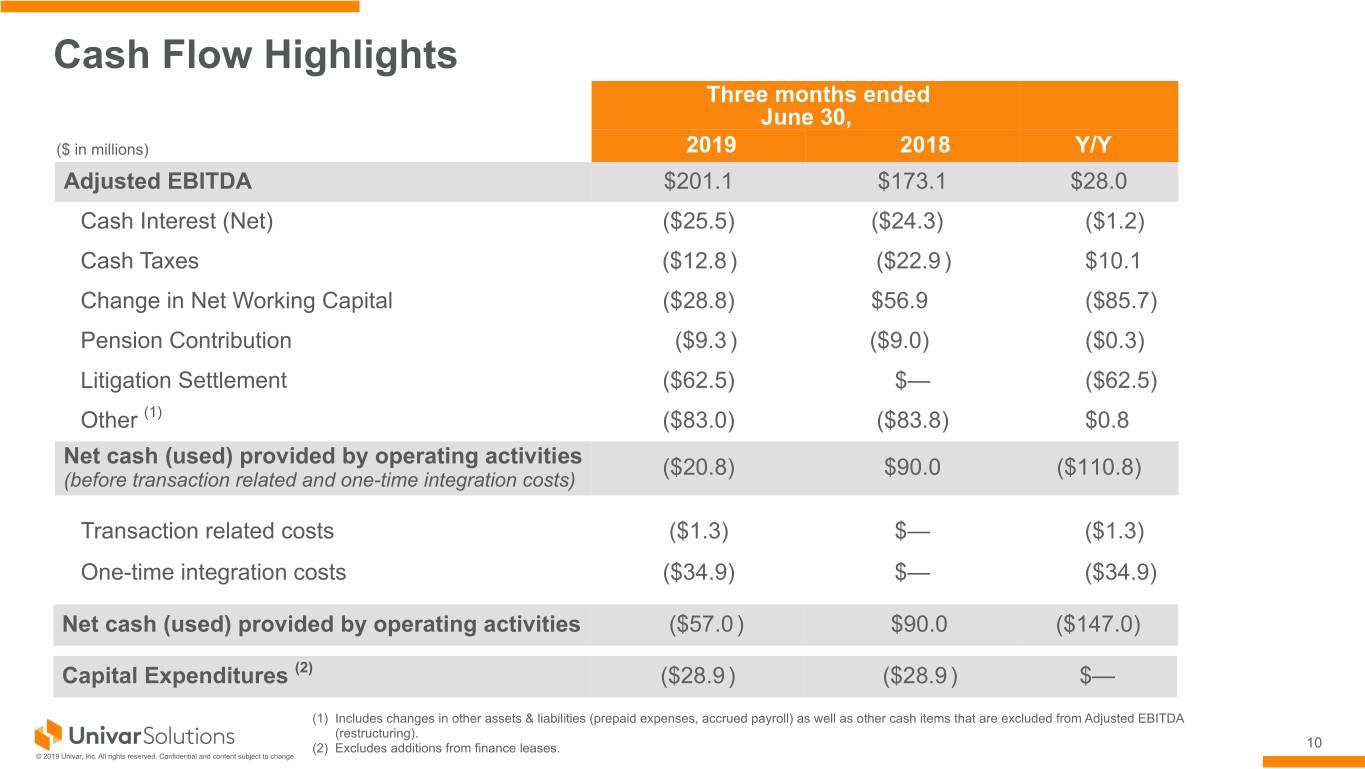

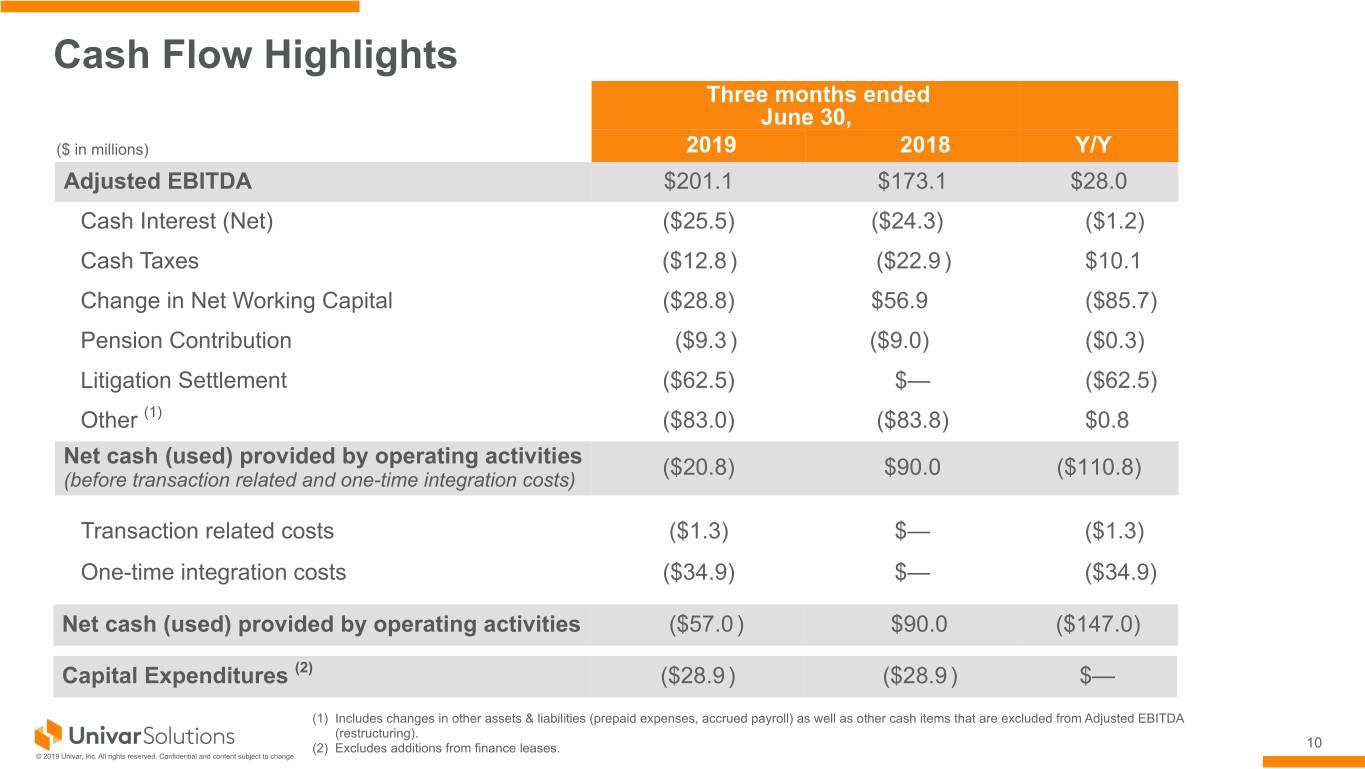

Cash Flow Highlights Three months ended June 30, ($ in millions) 2019 2018 Y/Y Adjusted EBITDA $201.1 $173.1 $28.0 Cash Interest (Net) ($25.5) ($24.3) ($1.2) Cash Taxes ($12.8) ($22.9) $10.1 Change in Net Working Capital ($28.8) $56.9 ($85.7) Pension Contribution ($9.3) ($9.0) ($0.3) Litigation Settlement ($62.5) $— ($62.5) Other (1) ($83.0) ($83.8) $0.8 Net cash (used) provided by operating activities ($20.8) $90.0 ($110.8) (before transaction related and one-time integration costs) Transaction related costs ($1.3) $— ($1.3) One-time integration costs ($34.9) $— ($34.9) Net cash (used) provided by operating activities ($57.0) $90.0 ($147.0) Capital Expenditures (2) ($28.9) ($28.9) $— (1) Includes changes in other assets & liabilities (prepaid expenses, accrued payroll) as well as other cash items that are excluded from Adjusted EBITDA (restructuring). (2) Excludes additions from finance leases. 10 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

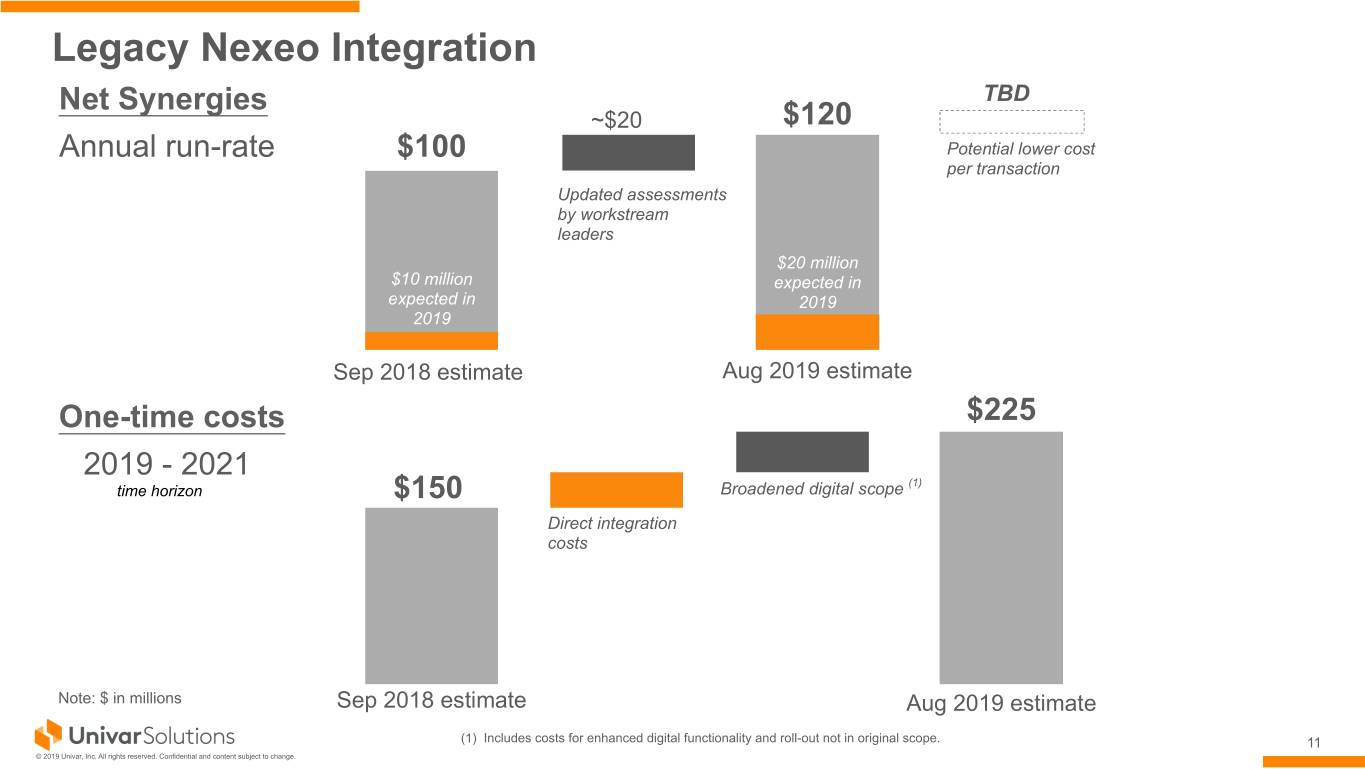

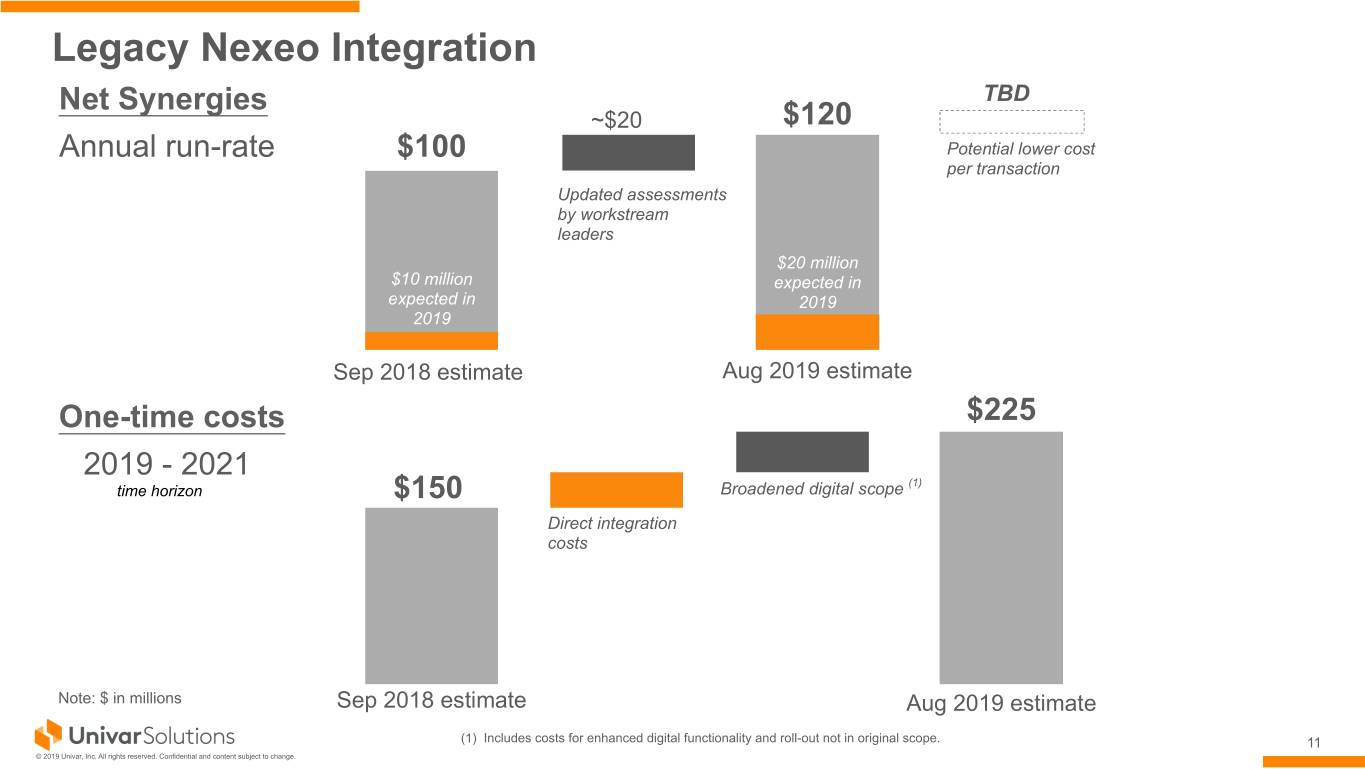

Legacy Nexeo Integration Net Synergies TBD ~$20 $120 Annual run-rate $100 Potential lower cost per transaction Updated assessments by workstream leaders $20 million $10 million expected in expected in 2019 2019 Sep 2018 estimate Aug 2019 estimate One-time costs $225 2019 - 2021 (1) time horizon $150 Broadened digital scope Direct integration costs Note: $ in millions Sep 2018 estimate Aug 2019 estimate (1) Includes costs for enhanced digital functionality and roll-out not in original scope. 11 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

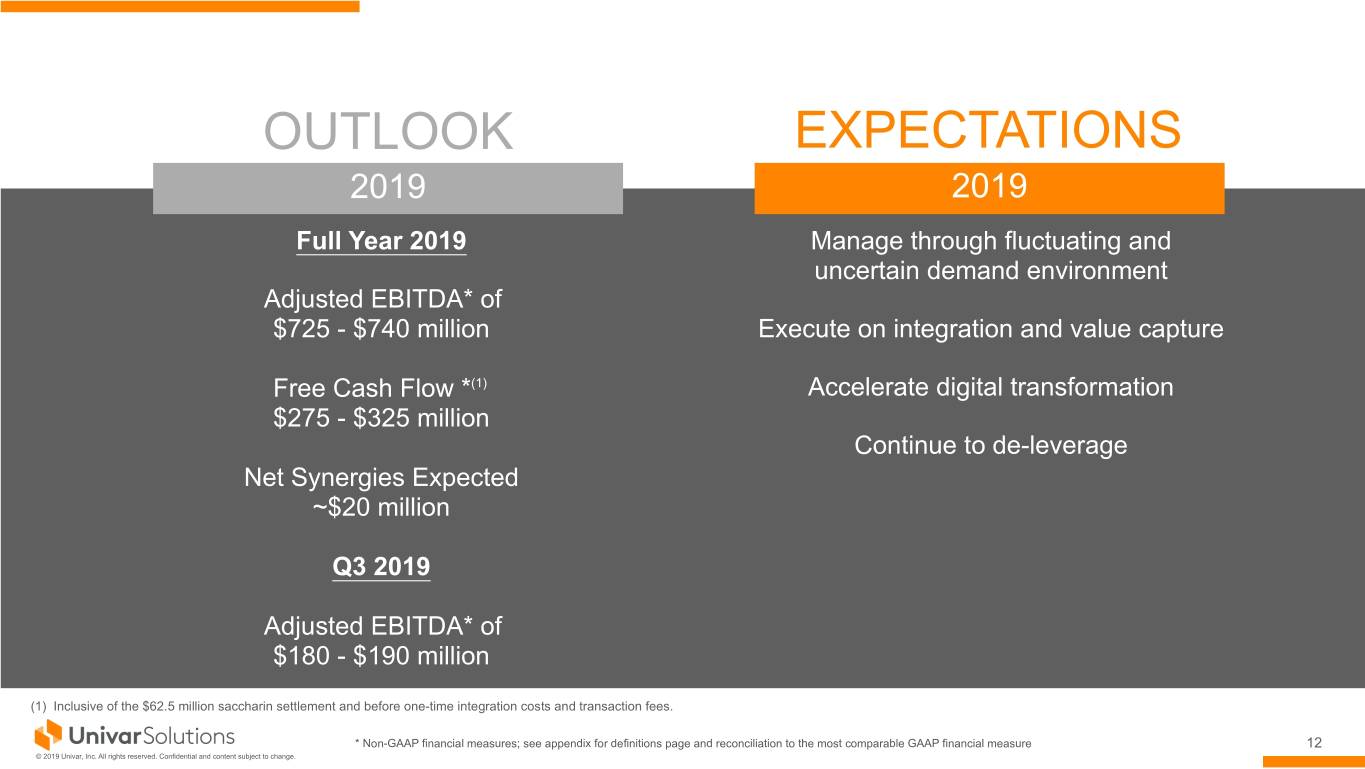

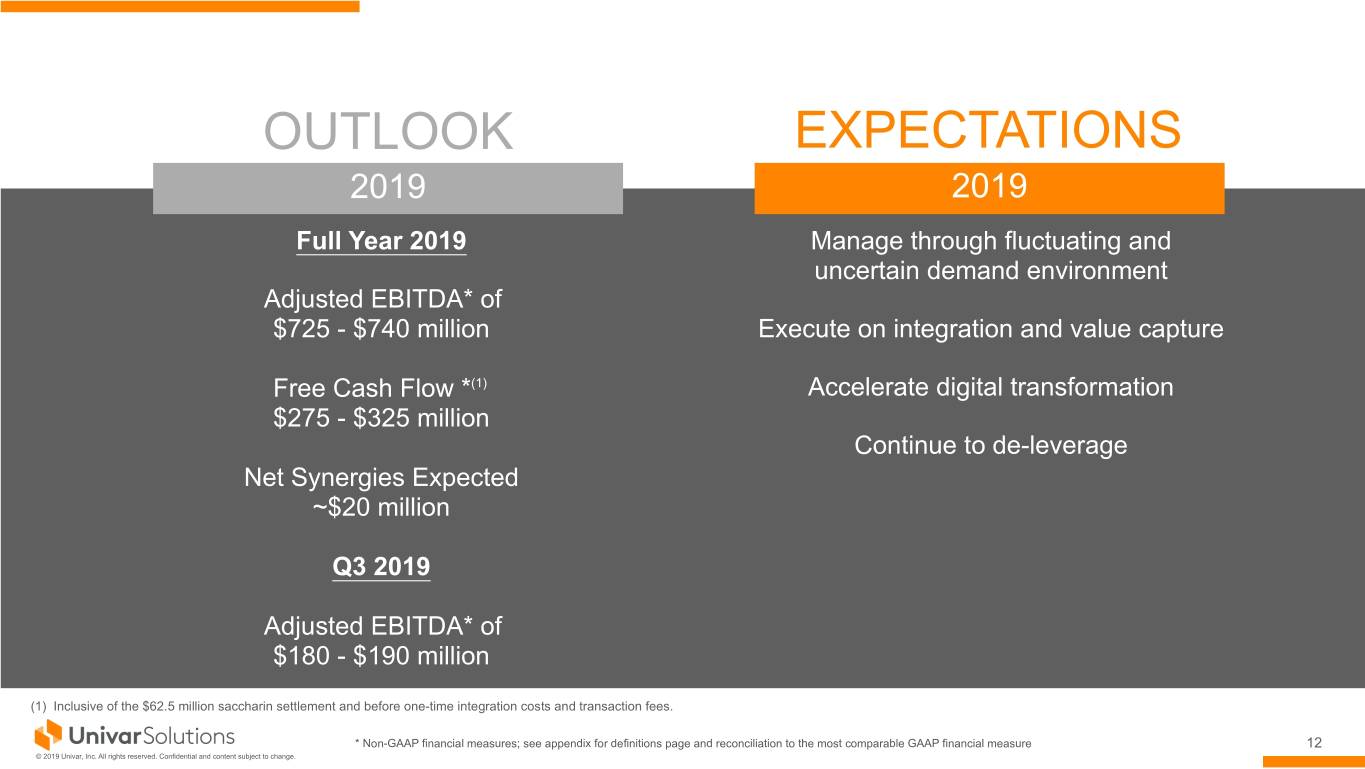

OUTLOOK EXPECTATIONS 2019 2019 Full Year 2019 Manage through fluctuating and uncertain demand environment Adjusted EBITDA* of $725 - $740 million Execute on integration and value capture Free Cash Flow *(1) Accelerate digital transformation $275 - $325 million Continue to de-leverage Net Synergies Expected ~$20 million Q3 2019 Adjusted EBITDA* of $180 - $190 million (1) Inclusive of the $62.5 million saccharin settlement and before one-time integration costs and transaction fees. * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 12 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

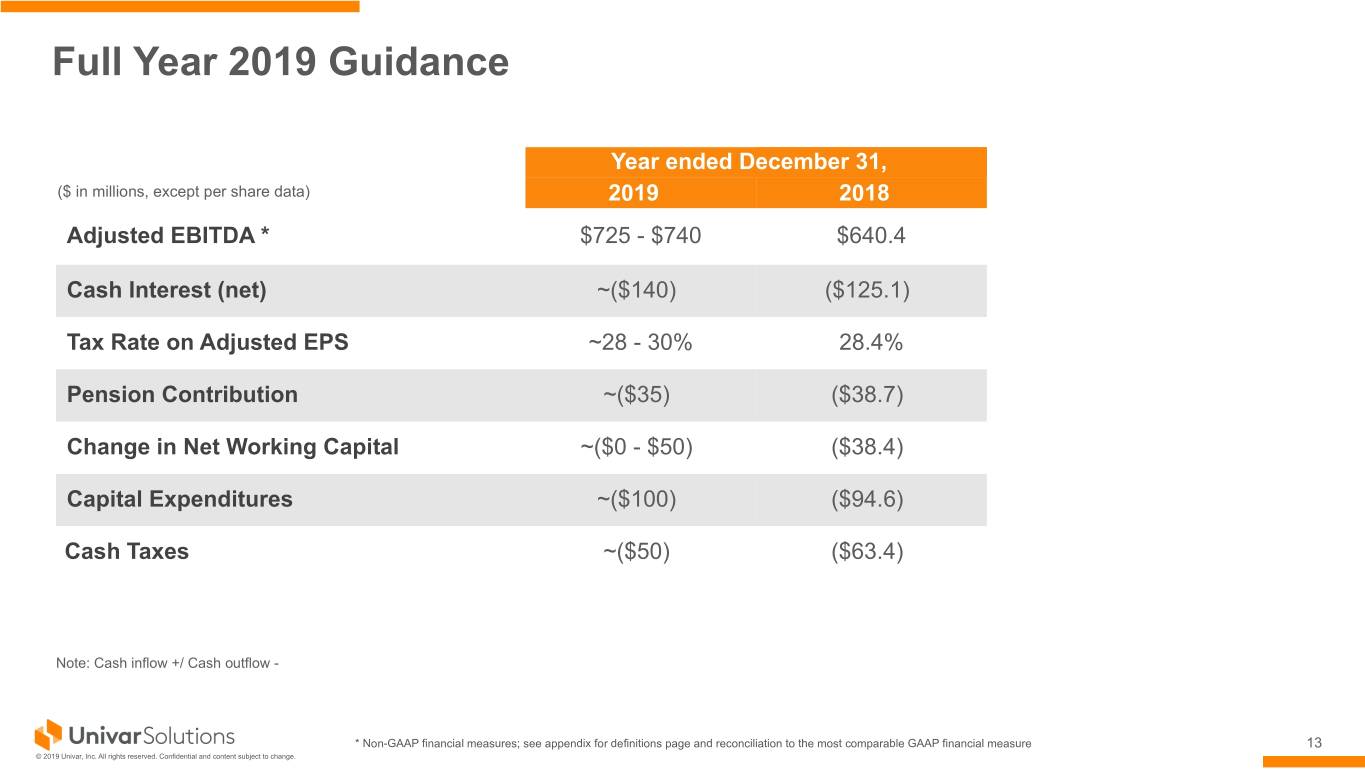

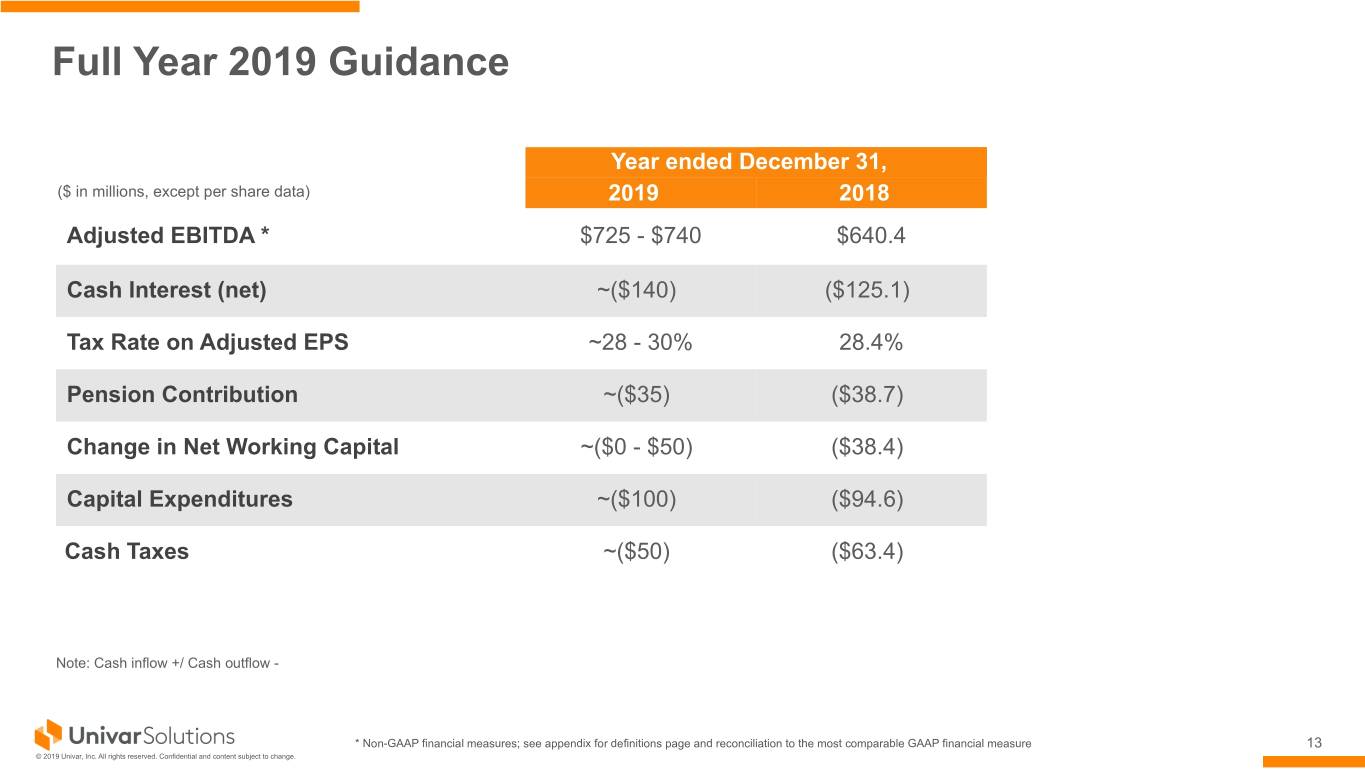

Full Year 2019 Guidance Year ended December 31, ($ in millions, except per share data) 2019 2018 Adjusted EBITDA * $725 - $740 $640.4 Cash Interest (net) ~($140) ($125.1) Tax Rate on Adjusted EPS ~28 - 30% 28.4% Pension Contribution ~($35) ($38.7) Change in Net Working Capital ~($0 - $50) ($38.4) Capital Expenditures ~($100) ($94.6) Cash Taxes ~($50) ($63.4) Note: Cash inflow +/ Cash outflow - * Non-GAAP financial measures; see appendix for definitions page and reconciliation to the most comparable GAAP financial measure 13 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

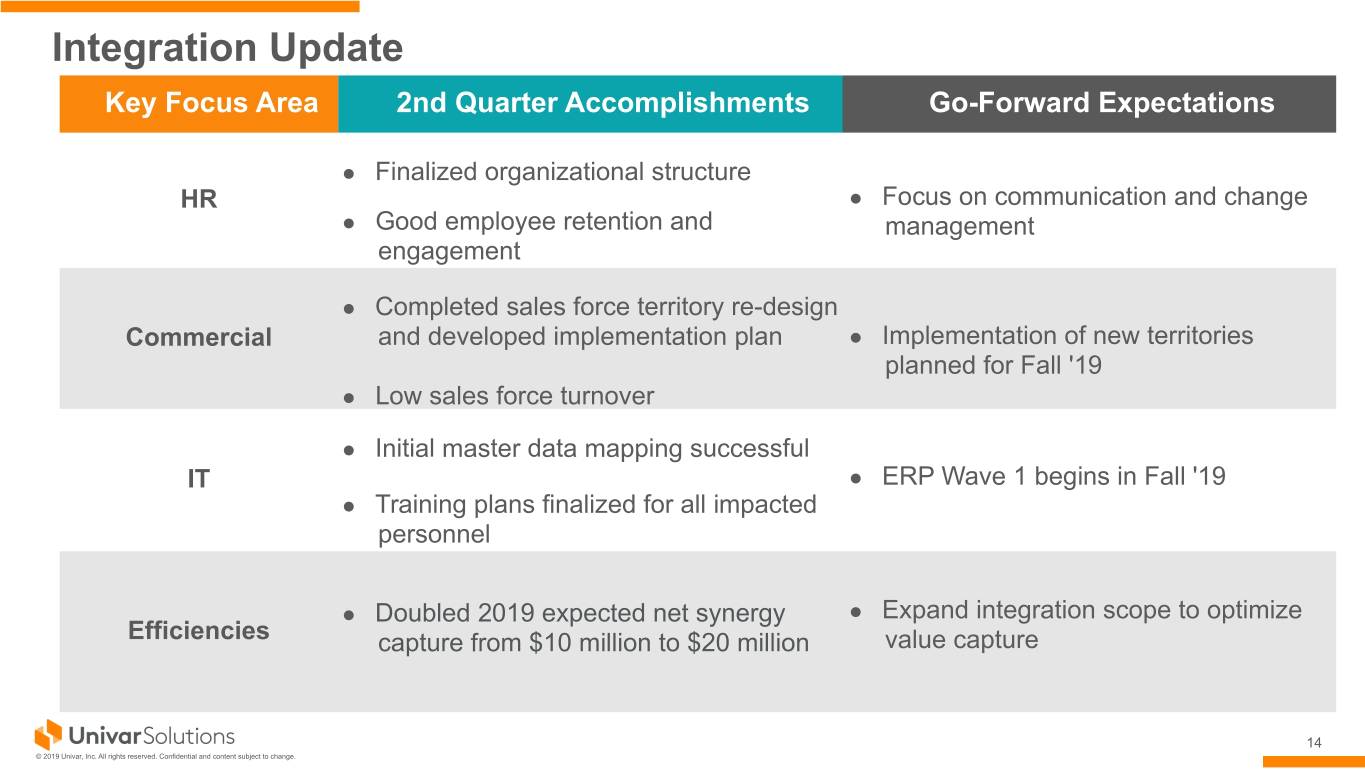

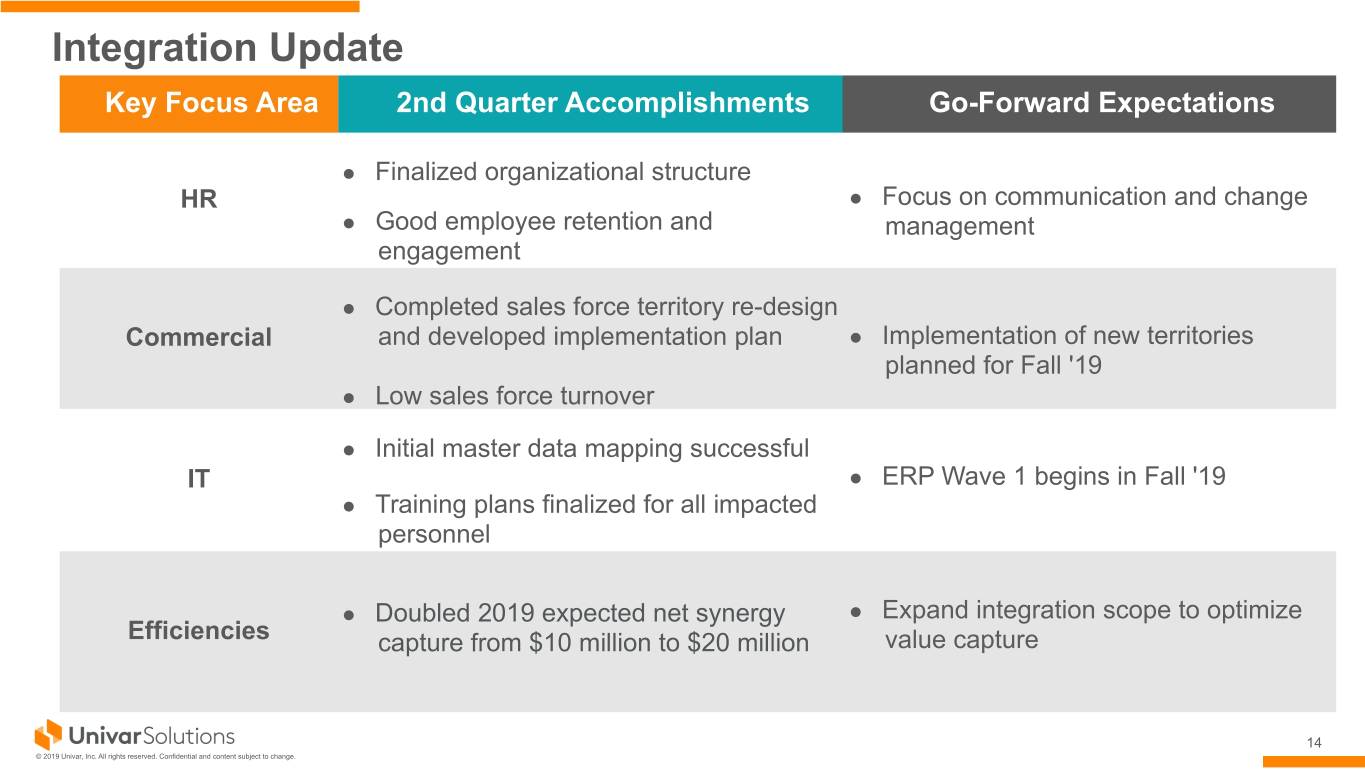

Integration Update Key Focus Area 2nd Quarter Accomplishments Go-Forward Expectations l Finalized organizational structure HR l Focus on communication and change l Good employee retention and management engagement l Completed sales force territory re-design Commercial and developed implementation plan l Implementation of new territories planned for Fall '19 l Low sales force turnover l Initial master data mapping successful IT l ERP Wave 1 begins in Fall '19 l Training plans finalized for all impacted personnel l Doubled 2019 expected net synergy l Expand integration scope to optimize Efficiencies capture from $10 million to $20 million value capture 14 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

Creating Sustainable Competitive Advantage • Eliminate bottlenecks • Enhanced customer & • Leading portfolio of supplier experience products • Remove redundancies through digitization • Leverage scale • Structurally reduce cost • Market intelligence and base analytics • Energized sales force • Insights into supply chain and trends 15 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

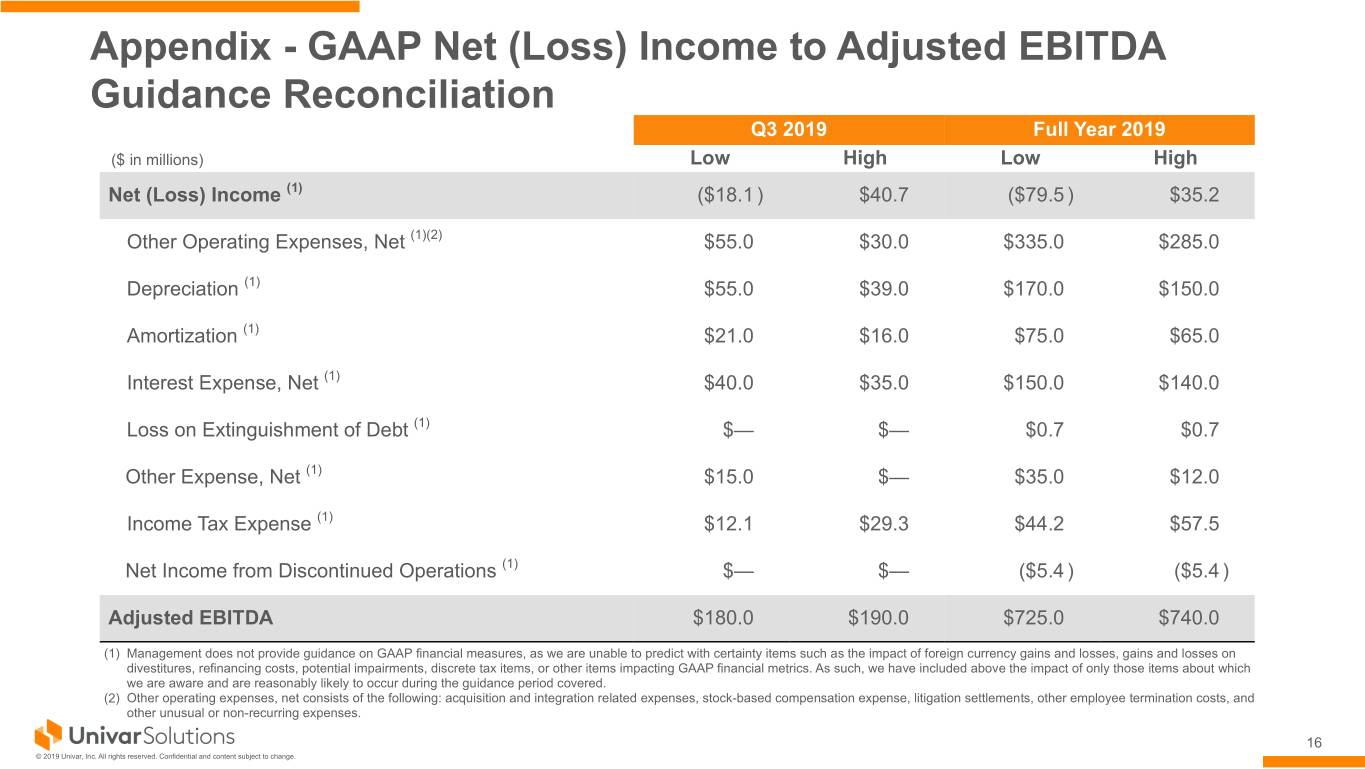

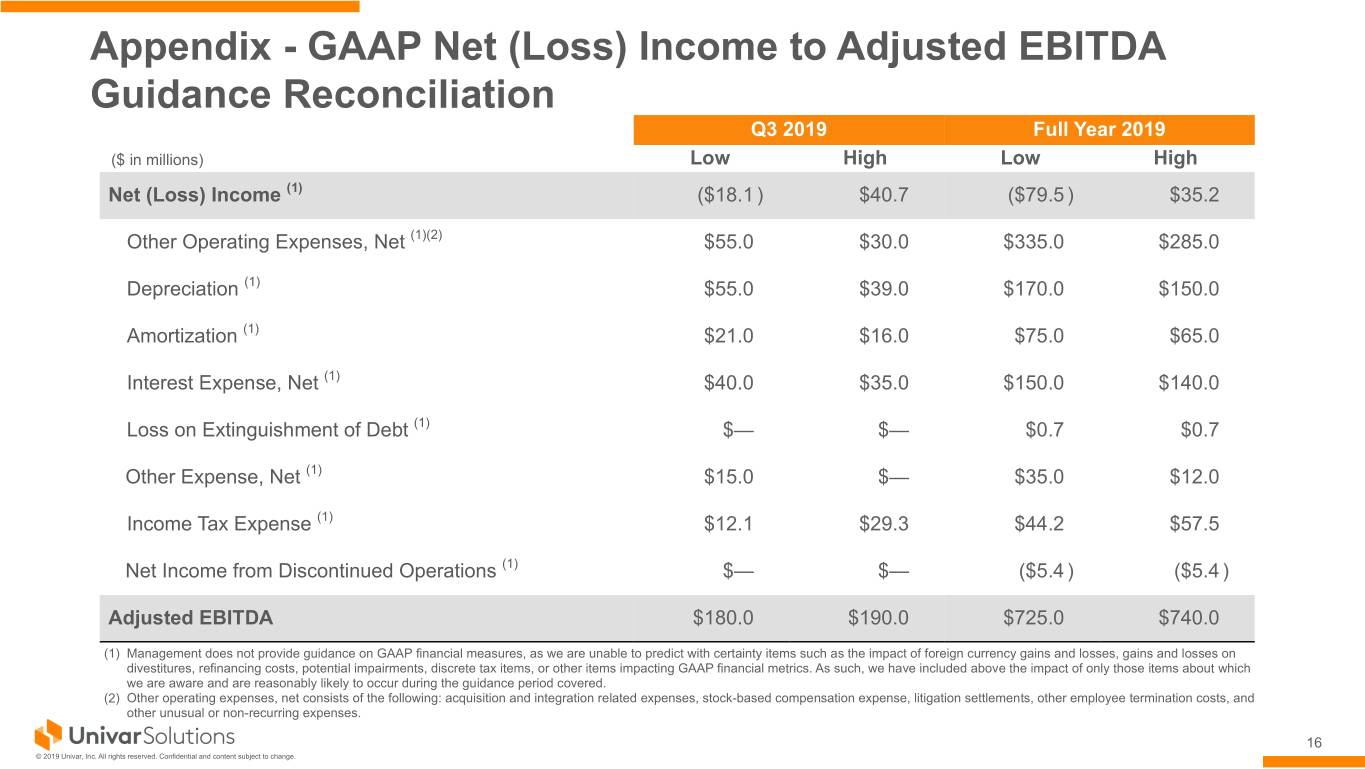

Appendix - GAAP Net (Loss) Income to Adjusted EBITDA Guidance Reconciliation Q3 2019 Full Year 2019 ($ in millions) Low High Low High Net (Loss) Income (1) ($18.1 ) $40.7 ($79.5 ) $35.2 Other Operating Expenses, Net (1)(2) $55.0 $30.0 $335.0 $285.0 Depreciation (1) $55.0 $39.0 $170.0 $150.0 Amortization (1) $21.0 $16.0 $75.0 $65.0 Interest Expense, Net (1) $40.0 $35.0 $150.0 $140.0 Loss on Extinguishment of Debt (1) $— $— $0.7 $0.7 Other Expense, Net (1) $15.0 $— $35.0 $12.0 Income Tax Expense (1) $12.1 $29.3 $44.2 $57.5 Net Income from Discontinued Operations (1) $— $— ($5.4 ) ($5.4 ) Adjusted EBITDA $180.0 $190.0 $725.0 $740.0 (1) Management does not provide guidance on GAAP financial measures, as we are unable to predict with certainty items such as the impact of foreign currency gains and losses, gains and losses on divestitures, refinancing costs, potential impairments, discrete tax items, or other items impacting GAAP financial metrics. As such, we have included above the impact of only those items about which we are aware and are reasonably likely to occur during the guidance period covered. (2) Other operating expenses, net consists of the following: acquisition and integration related expenses, stock-based compensation expense, litigation settlements, other employee termination costs, and other unusual or non-recurring expenses. 16 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

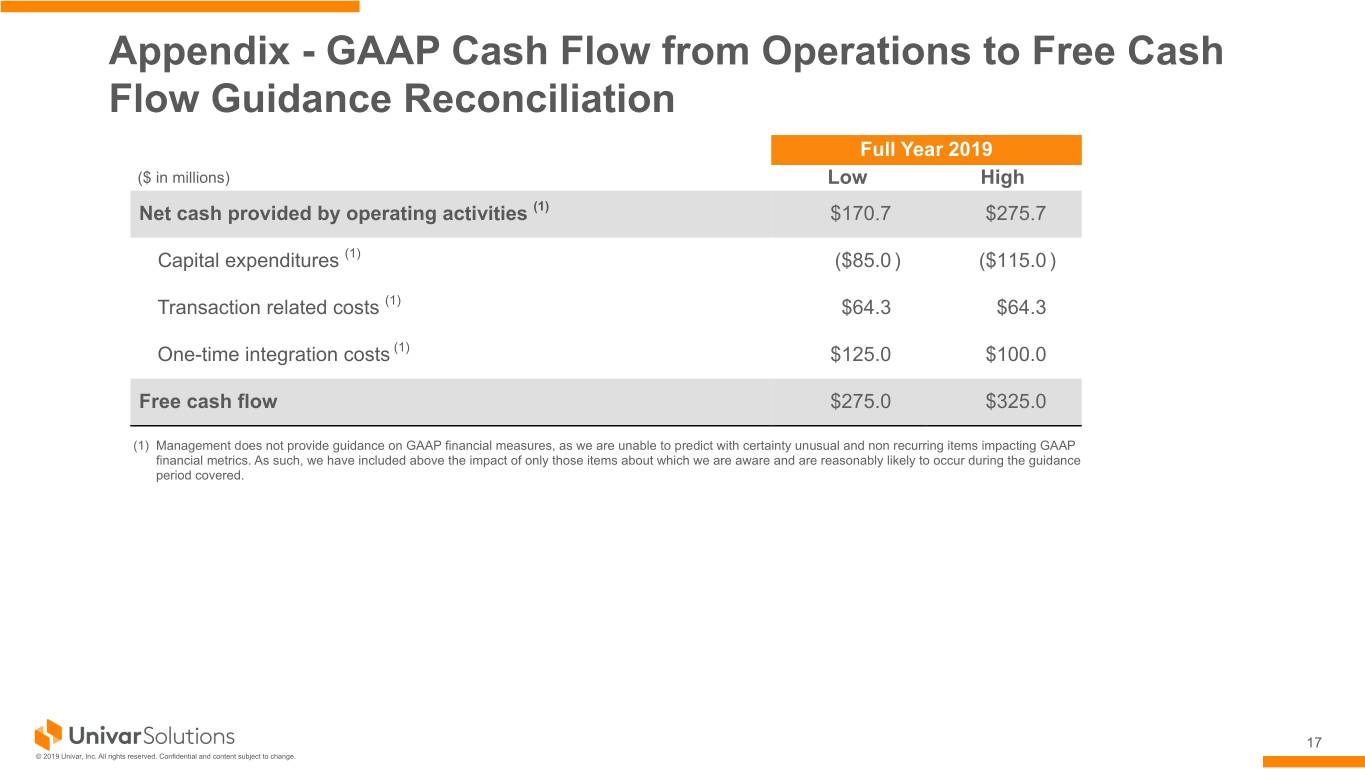

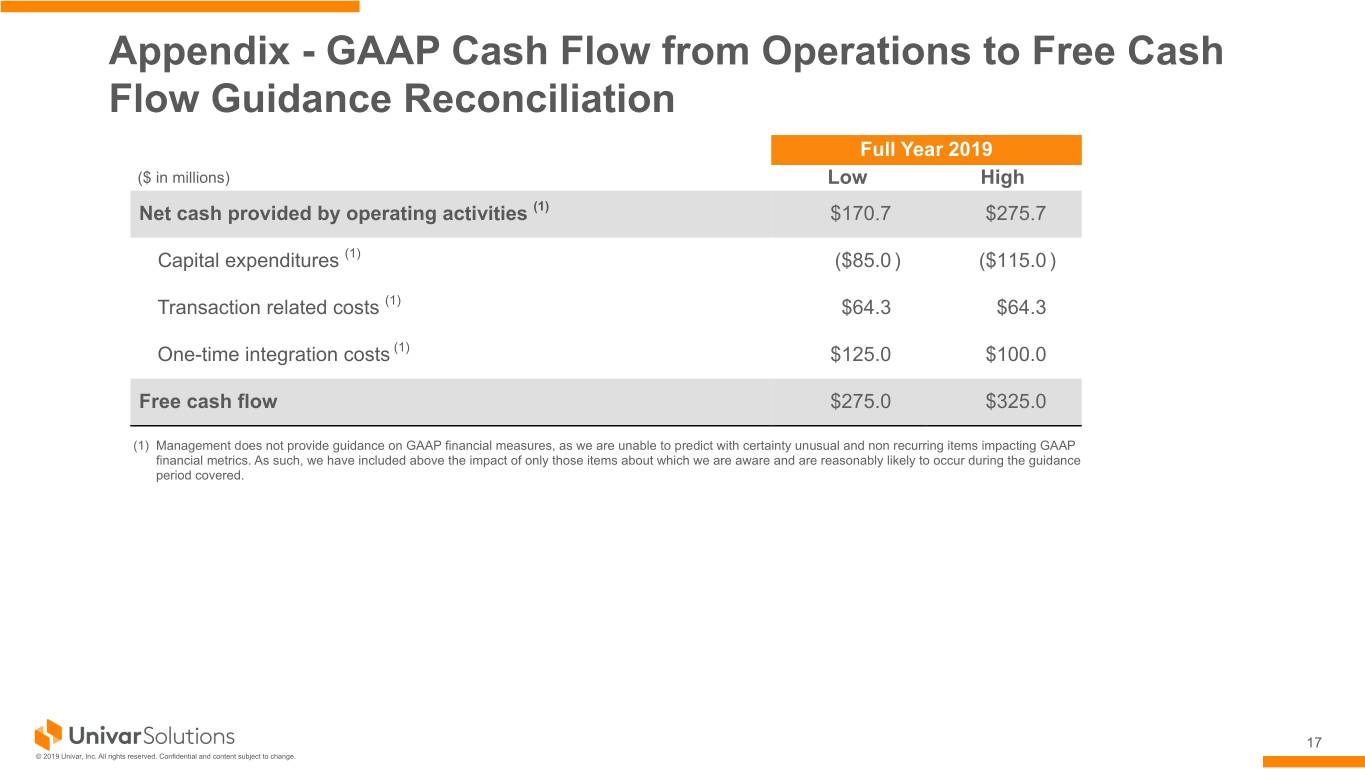

Appendix - GAAP Cash Flow from Operations to Free Cash Flow Guidance Reconciliation Full Year 2019 ($ in millions) Low High Net cash provided by operating activities (1) $170.7 $275.7 Capital expenditures (1) ($85.0 ) ($115.0 ) Transaction related costs (1) $64.3 $64.3 One-time integration costs (1) $125.0 $100.0 Free cash flow $275.0 $325.0 (1) Management does not provide guidance on GAAP financial measures, as we are unable to predict with certainty unusual and non recurring items impacting GAAP financial metrics. As such, we have included above the impact of only those items about which we are aware and are reasonably likely to occur during the guidance period covered. 17 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

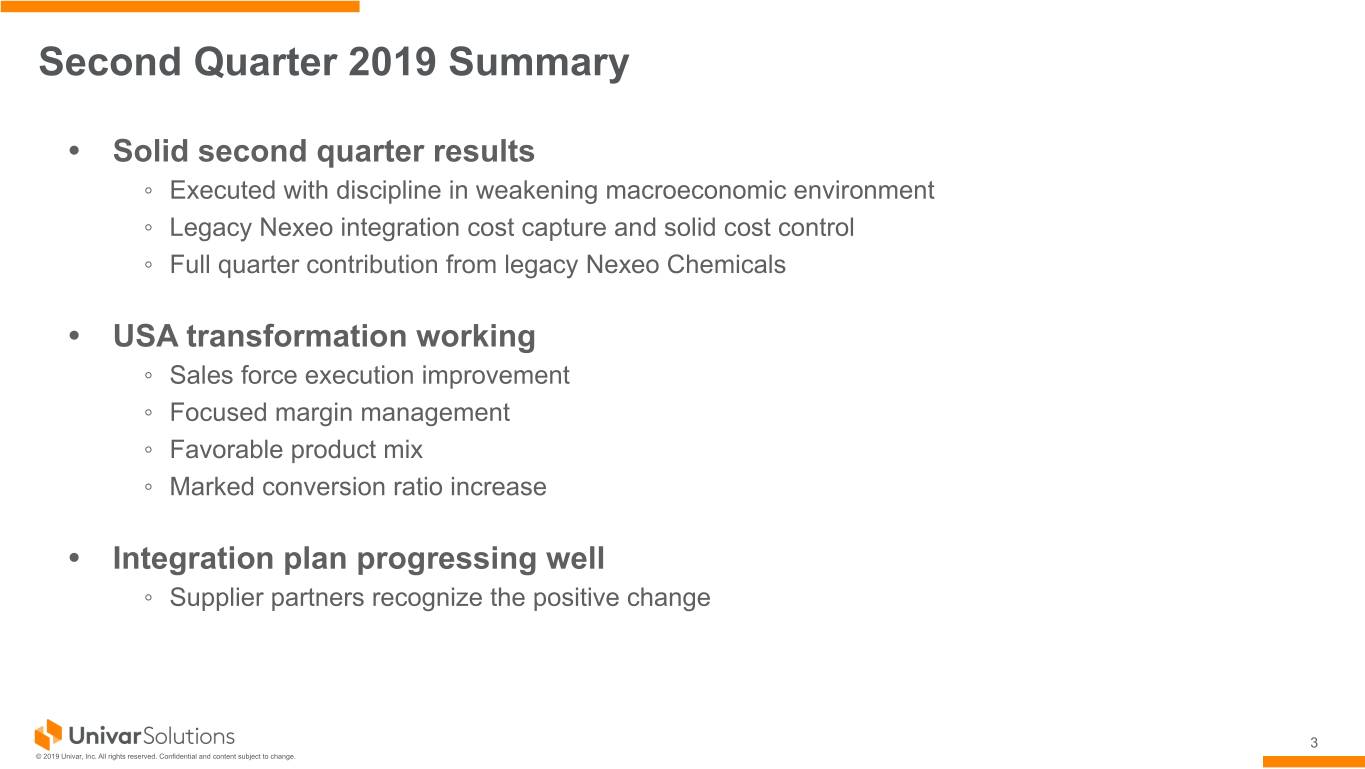

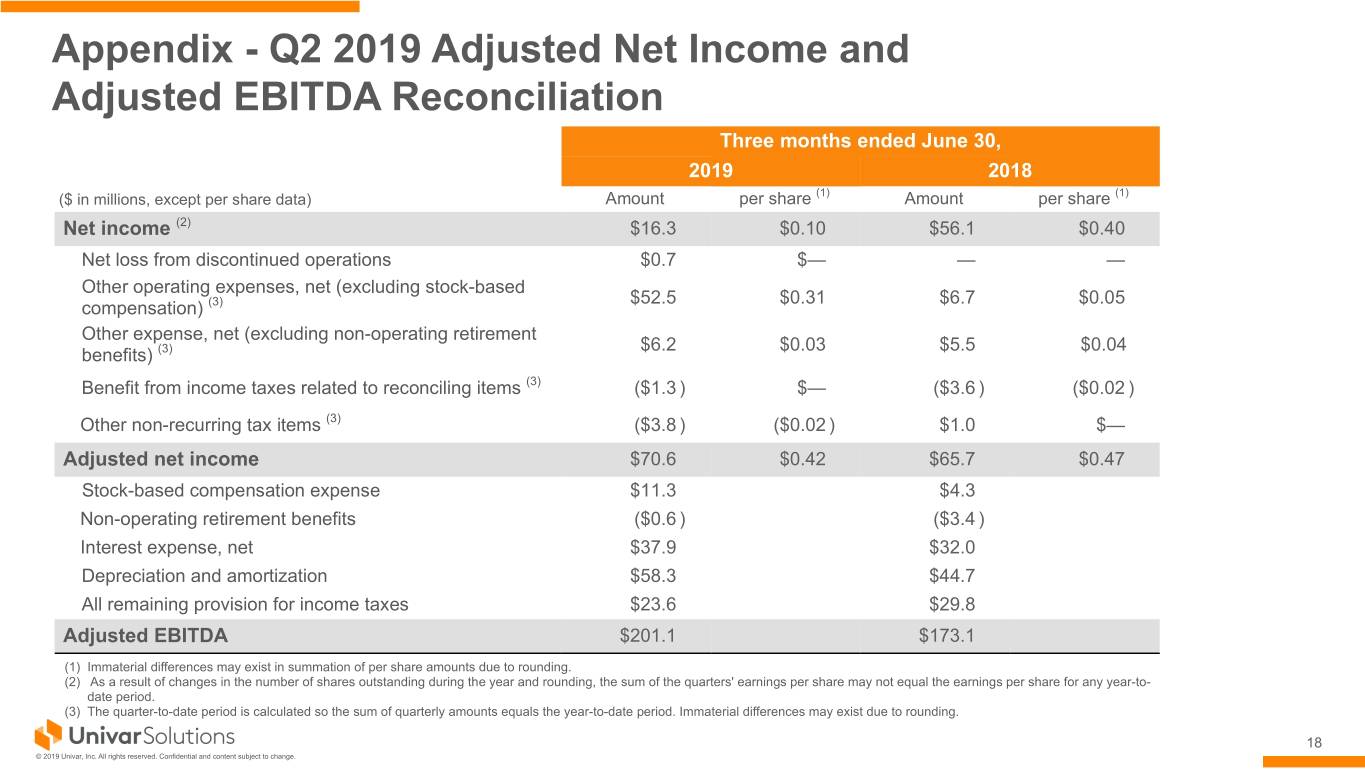

Appendix - Q2 2019 Adjusted Net Income and Adjusted EBITDA Reconciliation Three months ended June 30, 2019 2018 ($ in millions, except per share data) Amount per share (1) Amount per share (1) Net income (2) $16.3 $0.10 $56.1 $0.40 Net loss from discontinued operations $0.7 $— — — Other operating expenses, net (excluding stock-based $52.5 $0.31 $6.7 $0.05 compensation) (3) Other expense, net (excluding non-operating retirement $6.2 $0.03 $5.5 $0.04 benefits) (3) Benefit from income taxes related to reconciling items (3) ($1.3 ) $— ($3.6 ) ($0.02 ) Other non-recurring tax items (3) ($3.8 ) ($0.02 ) $1.0 $— Adjusted net income $70.6 $0.42 $65.7 $0.47 Stock-based compensation expense $11.3 $4.3 Non-operating retirement benefits ($0.6 ) ($3.4 ) Interest expense, net $37.9 $32.0 Depreciation and amortization $58.3 $44.7 All remaining provision for income taxes $23.6 $29.8 Adjusted EBITDA $201.1 $173.1 (1) Immaterial differences may exist in summation of per share amounts due to rounding. (2) As a result of changes in the number of shares outstanding during the year and rounding, the sum of the quarters' earnings per share may not equal the earnings per share for any year-to- date period. (3) The quarter-to-date period is calculated so the sum of quarterly amounts equals the year-to-date period. Immaterial differences may exist due to rounding. 18 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.

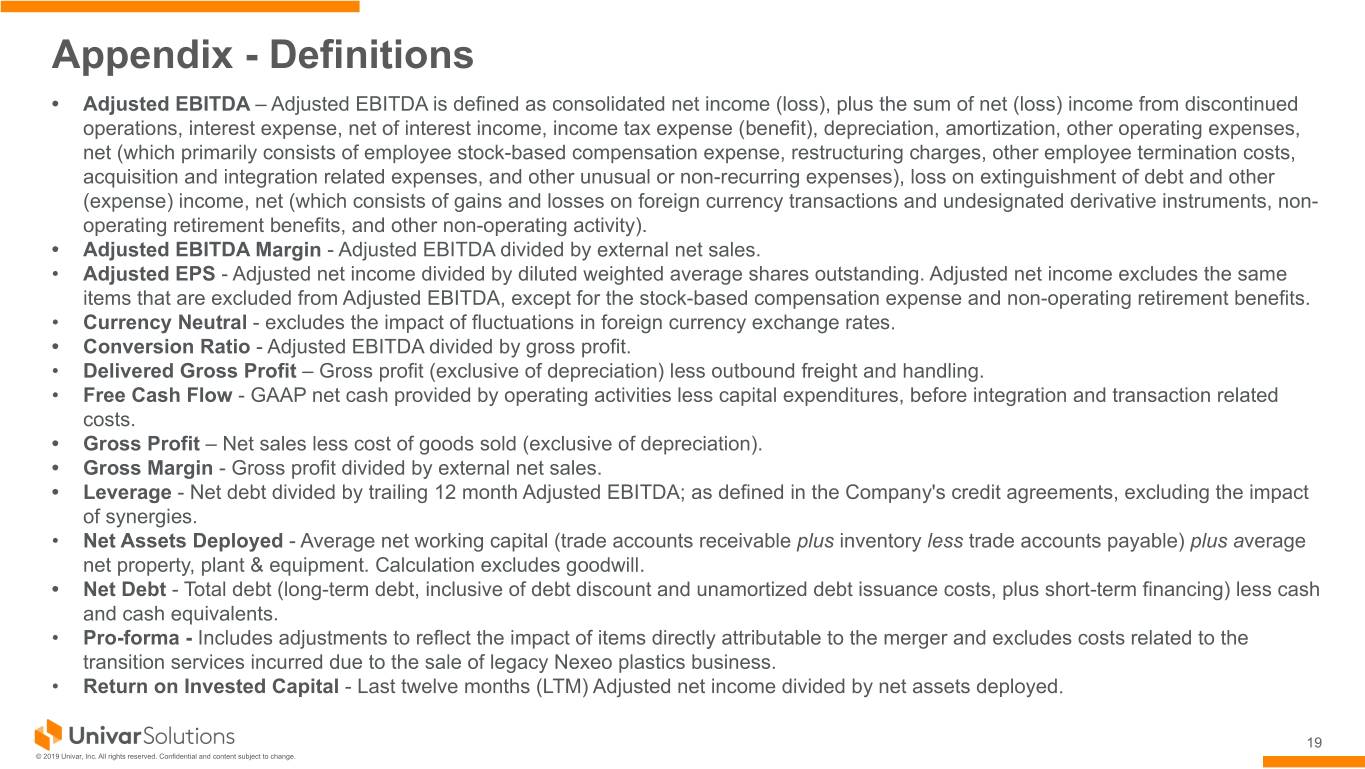

Appendix - Definitions • Adjusted EBITDA – Adjusted EBITDA is defined as consolidated net income (loss), plus the sum of net (loss) income from discontinued operations, interest expense, net of interest income, income tax expense (benefit), depreciation, amortization, other operating expenses, net (which primarily consists of employee stock-based compensation expense, restructuring charges, other employee termination costs, acquisition and integration related expenses, and other unusual or non-recurring expenses), loss on extinguishment of debt and other (expense) income, net (which consists of gains and losses on foreign currency transactions and undesignated derivative instruments, non- operating retirement benefits, and other non-operating activity). • Adjusted EBITDA Margin - Adjusted EBITDA divided by external net sales. • Adjusted EPS - Adjusted net income divided by diluted weighted average shares outstanding. Adjusted net income excludes the same items that are excluded from Adjusted EBITDA, except for the stock-based compensation expense and non-operating retirement benefits. • Currency Neutral - excludes the impact of fluctuations in foreign currency exchange rates. • Conversion Ratio - Adjusted EBITDA divided by gross profit. • Delivered Gross Profit – Gross profit (exclusive of depreciation) less outbound freight and handling. • Free Cash Flow - GAAP net cash provided by operating activities less capital expenditures, before integration and transaction related costs. • Gross Profit – Net sales less cost of goods sold (exclusive of depreciation). • Gross Margin - Gross profit divided by external net sales. • Leverage - Net debt divided by trailing 12 month Adjusted EBITDA; as defined in the Company's credit agreements, excluding the impact of synergies. • Net Assets Deployed - Average net working capital (trade accounts receivable plus inventory less trade accounts payable) plus average net property, plant & equipment. Calculation excludes goodwill. • Net Debt - Total debt (long-term debt, inclusive of debt discount and unamortized debt issuance costs, plus short-term financing) less cash and cash equivalents. • Pro-forma - Includes adjustments to reflect the impact of items directly attributable to the merger and excludes costs related to the transition services incurred due to the sale of legacy Nexeo plastics business. • Return on Invested Capital - Last twelve months (LTM) Adjusted net income divided by net assets deployed. 19 © 2019 Univar, Inc. All rights reserved. Confidential and content subject to change.