Exhibit 99.1

Investor Presentation As of March 27, 2020

This Presentation has been designed to provide general information about Emergent Capital, Inc . (“Emergent” or Emergent Capital” or “EMGC”) and its subsidiaries (collectively the “Companies”) . Any information contained or referenced herein is suitable only as an introduction to the Companies . The recipient is strongly encouraged to refer to and supplement this Presentation with the more comprehensive information Emergent has filed with the Securities and Exchange Commission . This Presentation contains confidential information regarding the Companies . By accepting this Presentation, the recipient agrees that it will cause its directors, officers, employees, and representatives to use the Presentation and such information only to evaluate its interest in continuing an investigation of a specific transaction with Emergent and for no other purpose, will not divulge any such information to any other person or entity and shall return or destroy this Presentation together with any copies thereof and any other information furnished by any of the Companies or its representatives upon request and shall otherwise abide by any confidentiality agreement between it and any of the Companies in all respects None of the Companies makes any representation or warranty, expressed or implied, as to the accuracy or completeness of the information contained in this Presentation, and nothing contained herein is, or shall be relied upon as, a promise or representation, whether as to the past or to the future . Only those representations and warranties that are made in a definitive written agreement relating to a transaction, when and if executed, and subject to any limitations or restrictions as may be specified in such definitive agreement, shall have any legal effect . This Presentation does not purport to include all of the information that may be required to evaluate such a transaction and any recipient hereof should conduct its own independent analysis of the Companies and the data contained or referred to herein . None of the Companies expects to update or otherwise revise the Presentation or other materials supplied herewith . This Presentation contains certain forward - looking statements, estimates and projections with respect to the businesses and anticipated future performances of the Companies . Such statements, estimates and projections have been prepared by the respective managements of the Companies and involve significant elements of subjective judgment and analysis, which may or may not be correct . Such statements, estimates, and projections reflect various assumptions by the Companies concerning anticipated results and are subject to significant business, economic, and competitive risks, uncertainties and contingencies, many of which are beyond the control of the Companies . Accordingly, there can be no assurance that such statements, estimates or projections will be realized, and the actual results and performance of the Companies could differ materially . Thus, the recipient of this Presentation should not place undue reliance on the forward - looking statements, estimates or projections contained in this Presentation . None of the Companies makes any representations as to the accuracy or completeness of such statements, estimates and projections or that any forecasts will be achieved . SPECIAL NOTICE REGARDING MATERIAL NON - PUBLIC INFORMATION THIS PRESENTATION MAY CONTAIN MATERIAL NON - PUBLIC INFORMATION CONCERNING THE COMPANIES OR THEIR RESPECTIVE SECURITIES. BY ACCEPTING THIS PRESENTATION, THE RECIPIENT AGREES TO USE AND MAINTAIN ANY SUCH INFORMATION IN ACCORDANCE WITH ITS COMPLIAN CE POLICIES, CONTRACTUAL OBLIGATIONS AND APPLICABLE LAW, INCLUDING FEDERAL AND STATE SECURITIES LAWS. Disclaimer 2

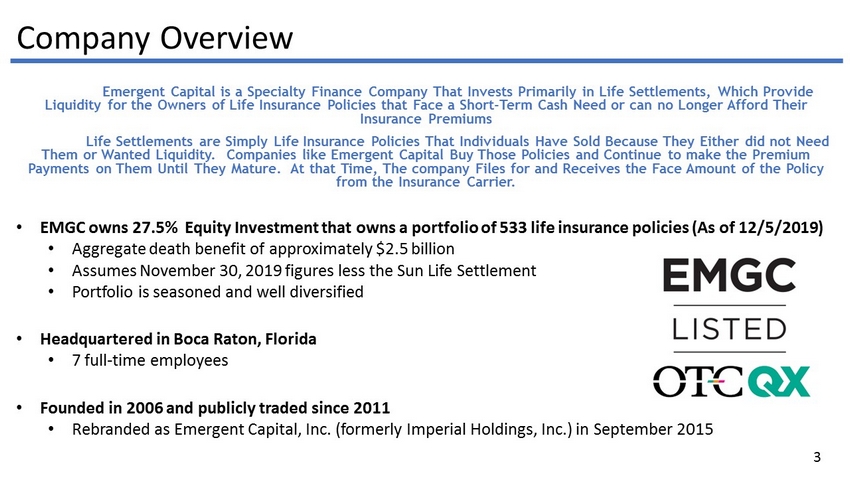

Company Overview Emergent Capital is a Specialty Finance Company That Invests Primarily in Life Settlements, Which Provide Liquidity for the Owners of Life Insurance Policies that Face a Short - Term Cash Need or can no Longer Afford Their Insurance Premiums Life Settlements are Simply Life Insurance Policies That Individuals Have Sold Because They Either did not Need Them or Wanted Liquidity. Companies like Emergent Capital Buy Those Policies and Continue to make the Premium Payments on Them Until They Mature. At that Time, The company Files for and Receives the Face Amount of the Policy from the Insurance Carrier. • EMGC owns 27.5% Equity Investment that owns a portfolio of 533 life insurance policies (As of 12/5/2019) • Aggregate death benefit of approximately $2.5 billion • Assumes November 30, 2019 figures less the Sun Life Settlement • Portfolio is seasoned and well diversified • Headquartered in Boca Raton, Florida • 7 full - time employees • Founded in 2006 and publicly traded since 2011 • Rebranded as Emergent Capital, Inc. (formerly Imperial Holdings, Inc.) in September 2015 3

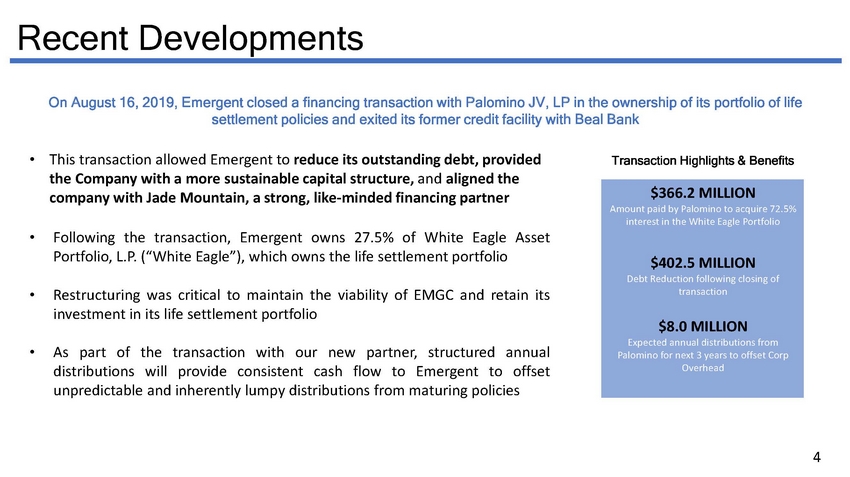

Recent Developments • This transaction allowed Emergent to reduce its outstanding debt, provided the Company with a more sustainable capital structure, and aligned the company with Jade Mountain, a strong, like - minded financing partner • Following the transaction, Emergent owns 27 . 5 % of White Eagle Asset Portfolio, L . P . (“White Eagle”), which owns the life settlement portfolio • Restructuring was critical to maintain the viability of EMGC and retain its investment in its life settlement portfolio • As part of the transaction with our new partner, structured annual distributions will provide consistent cash flow to Emergent to offset unpredictable and inherently lumpy distributions from maturing policies On August 16, 2019, Emergent closed a financing transaction with Palomino JV, LP in the ownership of its portfolio of life settlement policies and exited its former credit facility with Beal Bank $366.2 MILLION Amount paid by Palomino to acquire 72.5% interest in the White Eagle Portfolio $402.5 MILLION Debt Reduction following closing of transaction $8.0 MILLION Expected annual distributions from Palomino for next 3 years to offset Corp Overhead Transaction Highlights & Benefits 4

Life Settlement Asset Portfolio With a continuing ownership interest (27.5%) in a diverse and well - seasoned portfolio of life settlement assets, we see a significant opportunity to generate long - term value for shareholders 533 Life Insurance Policies in Diverse Portfolio $2.5B Approximate Face Value of Life Settlements 85.3 yrs old Average Age of Insured Party 6.9 years Average Life Expectancy of Insured Party Portfolio Overview & Highlights (as of Dec. 5, 2019) 5

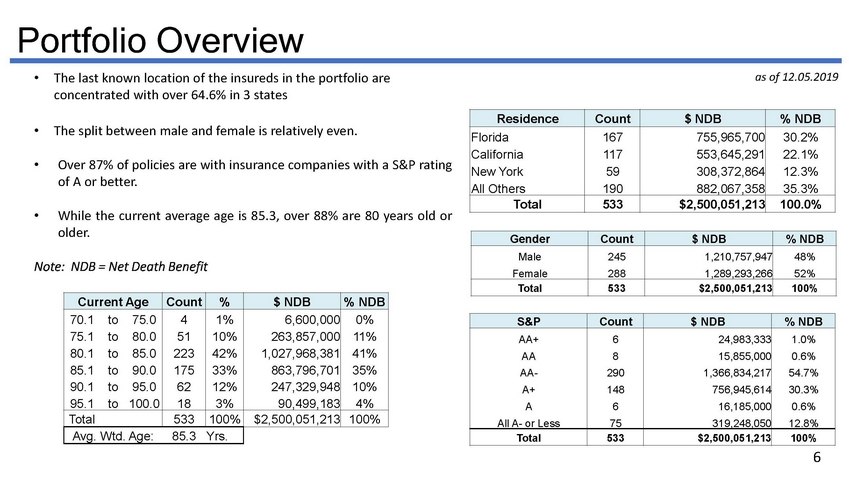

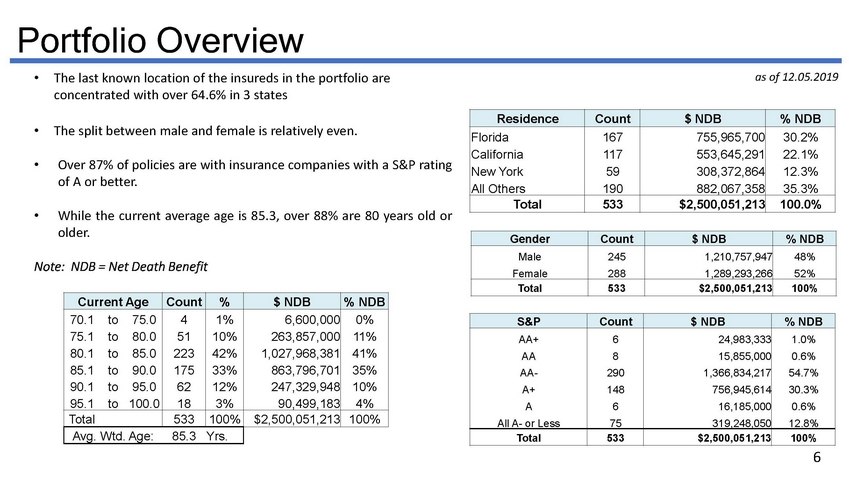

as of 12.05.2019 Gender Count $ NDB % NDB Male 245 1,210,757,947 48% Female 288 1,289,293,266 52% Total 533 $2,500,051,213 100% S&P Count $ NDB % NDB AA+ 6 24,983,333 1.0% AA 8 15,855,000 0.6% AA - 290 1,366,834,217 54.7% A+ 148 756,945,614 30.3% A 6 16,185,000 0.6% All A - or Less 75 319,248,050 12.8% Total 533 $2,500,051,213 100% Residence Count $ NDB % NDB Florida 167 755,965,700 30.2% California 117 553,645,291 22.1% New York 59 308,372,864 12.3% All Others 190 882,067,358 35.3% Total 533 $2,500,051,213 100.0% • The last known location of the insureds in the portfolio are concentrated with over 64.6% in 3 states • The split between male and female is relatively even . • Over 87 % of policies are with insurance companies with a S&P rating of A or better . • While the current average age is 85 . 3 , over 88 % are 80 years old or older . Note : NDB = Net Death Benefit Current Age Count % $ NDB % NDB 70.1 to 75.0 4 1% 6,600,000 0% 75.1 to 80.0 51 10% 263,857,000 11% 80.1 to 85.0 223 42% 1,027,968,381 41% 85.1 to 90.0 175 33% 863,796,701 35% 90.1 to 95.0 62 12% 247,329,948 10% 95.1 to 100.0 18 3% 90,499,183 4% Total 533 100% $2,500,051,213 100% Avg. Wtd. Age: 85.3 Yrs. Portfolio Overview 6

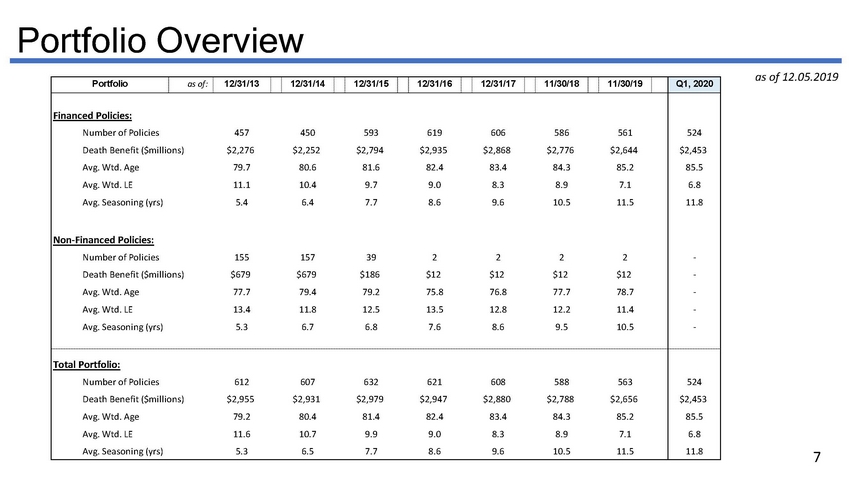

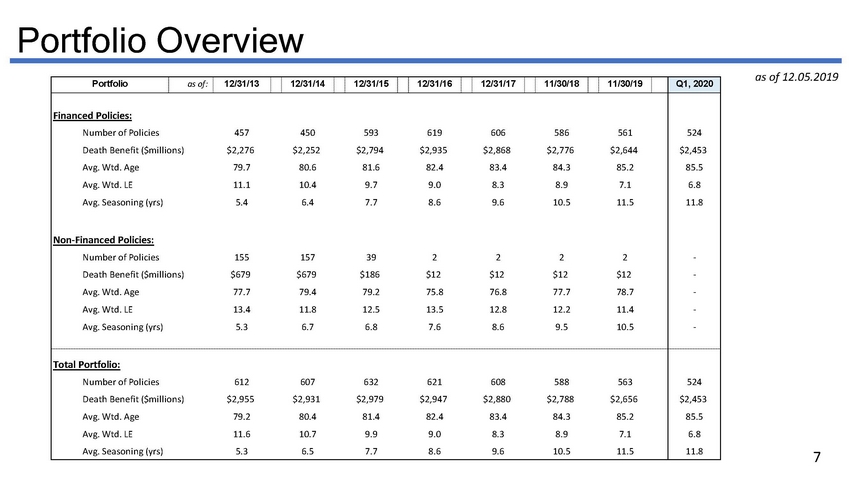

as of 12.05.2019 Portfolio Overview 7 Portfolio as of: 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 11/30/18 11/30/19 Q1, 2020 Financed Policies: Number of Policies 457 450 593 619 606 586 561 524 Death Benefit ($millions) $2,276 $2,252 $2,794 $2,935 $2,868 $2,776 $2,644 $2,453 Avg. Wtd. Age 79.7 80.6 81.6 82.4 83.4 84.3 85.2 85.5 Avg. Wtd. LE 11.1 10.4 9.7 9.0 8.3 8.9 7.1 6.8 Avg. Seasoning (yrs) 5.4 6.4 7.7 8.6 9.6 10.5 11.5 11.8 Non-Financed Policies: Number of Policies 155 157 39 2 2 2 2 - Death Benefit ($millions) $679 $679 $186 $12 $12 $12 $12 - Avg. Wtd. Age 77.7 79.4 79.2 75.8 76.8 77.7 78.7 - Avg. Wtd. LE 13.4 11.8 12.5 13.5 12.8 12.2 11.4 - Avg. Seasoning (yrs) 5.3 6.7 6.8 7.6 8.6 9.5 10.5 - Total Portfolio: Number of Policies 612 607 632 621 608 588 563 524 Death Benefit ($millions) $2,955 $2,931 $2,979 $2,947 $2,880 $2,788 $2,656 $2,453 Avg. Wtd. Age 79.2 80.4 81.4 82.4 83.4 84.3 85.2 85.5 Avg. Wtd. LE 11.6 10.7 9.9 9.0 8.3 8.9 7.1 6.8 Avg. Seasoning (yrs) 5.3 6.5 7.7 8.6 9.6 10.5 11.5 11.8

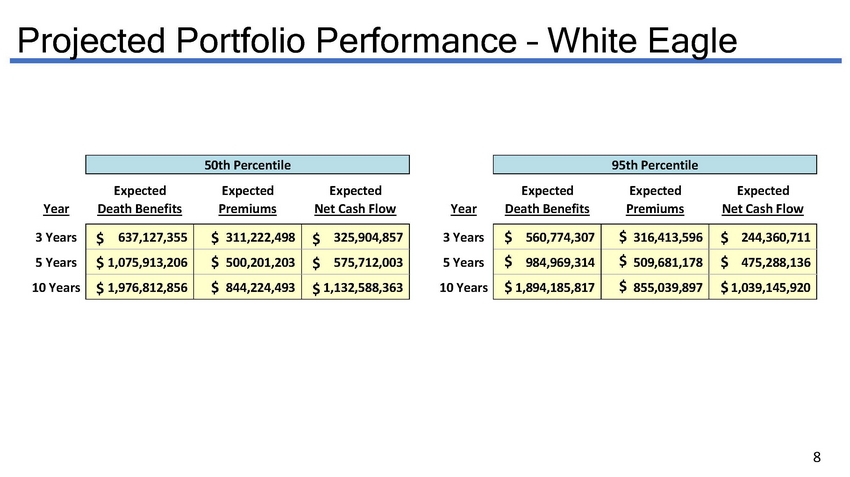

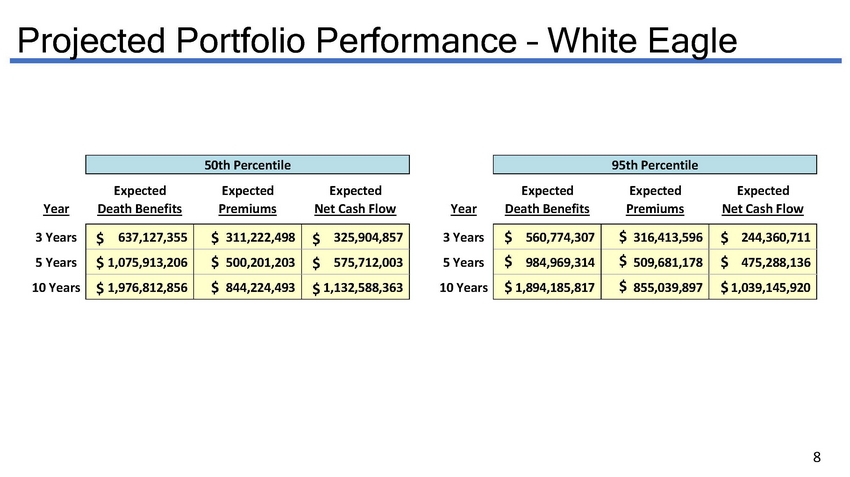

Projected Portfolio Performance – White Eagle Expected Expected Expected Year Death Benefits Premiums Net Cash Flow 3 Years 637,127,355 311,222,498 325,904,857 5 Years 1,075,913,206 500,201,203 575,712,003 10 Years 1,976,812,856 844,224,493 1,132,588,363 50th Percentile Expected Expected Expected Year Death Benefits Premiums Net Cash Flow 3 Years 560,774,307 316,413,596 244,360,711 5 Years 984,969,314 509,681,178 475,288,136 10 Years 1,894,185,817 855,039,897 1,039,145,920 95th Percentile 8 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

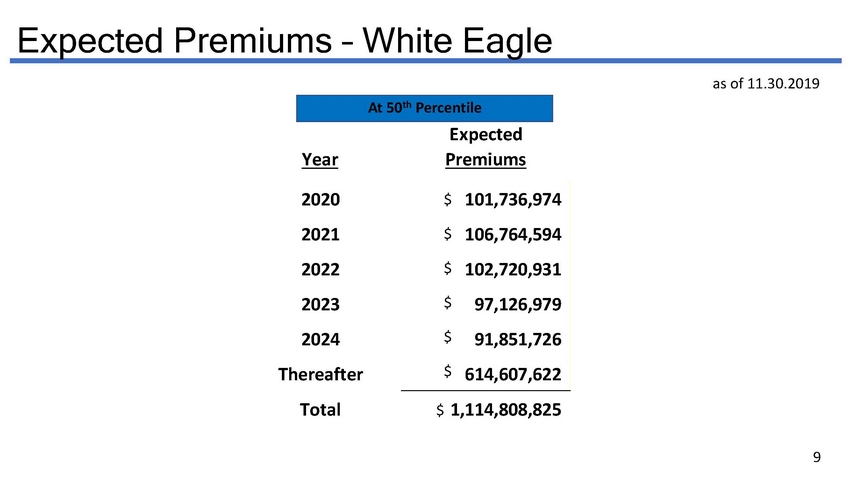

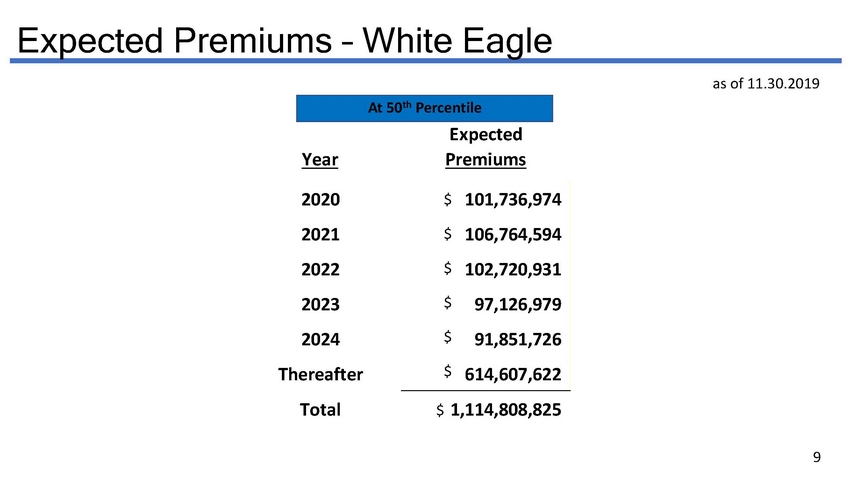

Expected Premiums – White Eagle Expected Year Premiums 2020 101,736,974 2021 106,764,594 2022 102,720,931 2023 97,126,979 2024 91,851,726 Thereafter 614,607,622 Total 1,114,808,825 as of 11.30.2019 $ $ $ $ $ $ $ At 50 th Percentile 9

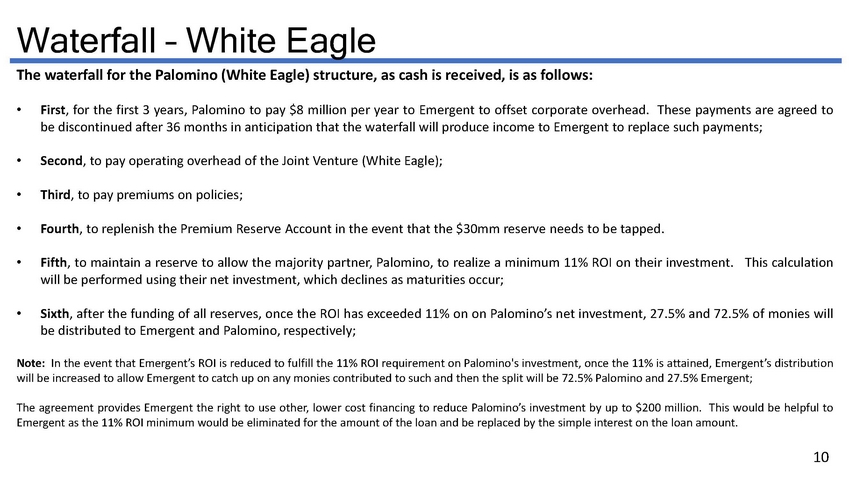

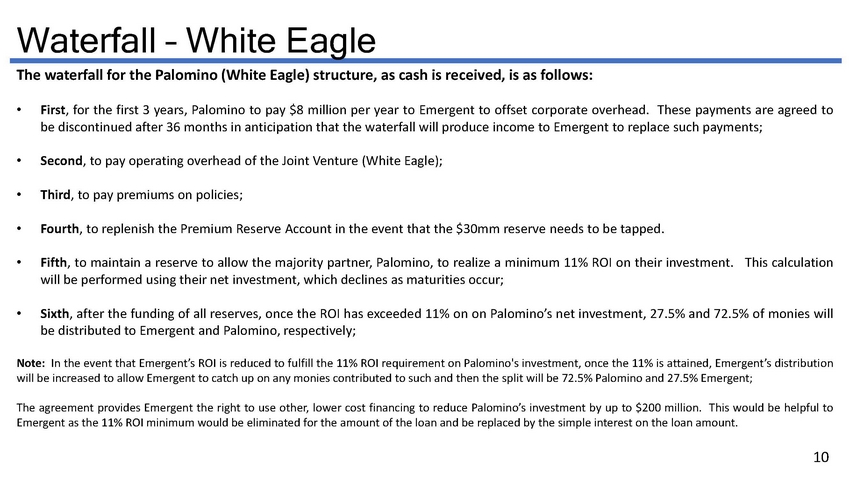

Waterfall – White Eagle The waterfall for the Palomino (White Eagle) structure, as cash is received, is as follows : • First , for the first 3 years, Palomino to pay $ 8 million per year to Emergent to offset corporate overhead . These payments are agreed to be discontinued after 36 months in anticipation that the waterfall will produce income to Emergent to replace such payments ; • Second , to pay operating overhead of the Joint Venture (White Eagle) ; • Third , to pay premiums on policies ; • Fourth , to replenish the Premium Reserve Account in the event that the $ 30 mm reserve needs to be tapped . • Fifth , to maintain a reserve to allow the majority partner, Palomino, to realize a minimum 11 % ROI on their investment . This calculation will be performed using their net investment, which declines as maturities occur ; • Sixth , after the funding of all reserves, once the ROI has exceeded 11 % on on Palomino’s net investment, 27 . 5 % and 72 . 5 % of monies will be distributed to Emergent and Palomino, respectively ; Note : In the event that Emergent’s ROI is reduced to fulfill the 11 % ROI requirement on Palomino's investment, once the 11 % is attained, Emergent’s distribution will be increased to allow Emergent to catch up on any monies contributed to such and then the split will be 72 . 5 % Palomino and 27 . 5 % Emergent ; The agreement provides Emergent the right to use other, lower cost financing to reduce Palomino’s investment by up to $ 200 million . This would be helpful to Emergent as the 11 % ROI minimum would be eliminated for the amount of the loan and be replaced by the simple interest on the loan amount . 10

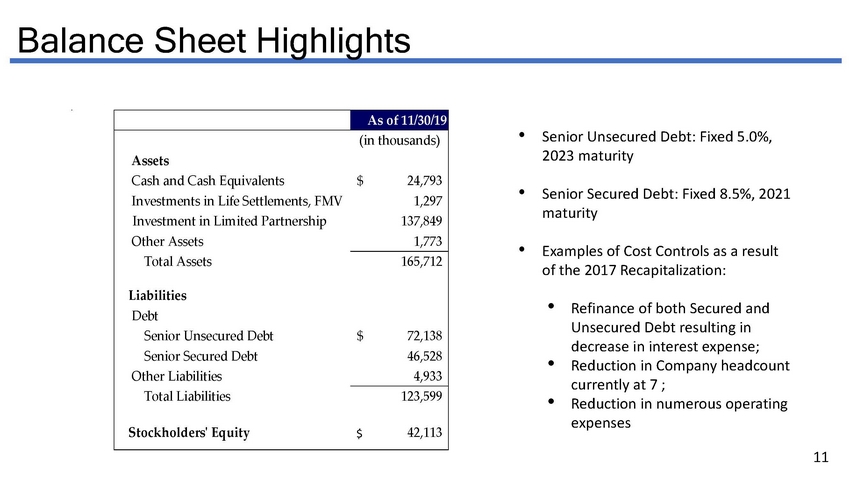

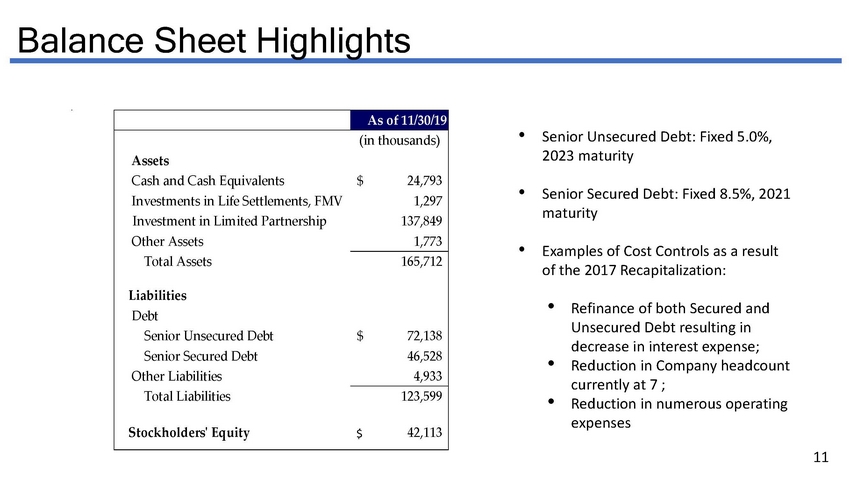

Balance Sheet Highlights As of 11/30/19 (in thousands) Assets Cash and Cash Equivalents 24,793$ Investments in Life Settlements, FMV 1,297 Investment in Limited Partnership 137,849 Other Assets 1,773 Total Assets 165,712 Liabilities Debt Senior Unsecured Debt 72,138$ Senior Secured Debt 46,528 Other Liabilities 4,933 Total Liabilities 123,599 Stockholders' Equity 42,113 • Senior Unsecured Debt: Fixed 5.0%, 2023 maturity • Senior Secured Debt: Fixed 8.5%, 2021 maturity • Examples of Cost Controls as a result of the 2017 Recapitalization: • Refinance of both Secured and Unsecured Debt resulting in decrease in interest expense; • Reduction in Company headcount currently at 7 ; • Reduction in numerous operating expenses $ 11

Income Statement Highlights • Total Stockholder’s Equity currently reflects 15.25% discount rate, significantly more conservative than other industry participants and recent market transactions • Each 50 bps decline in in the discount rate used to determine the FMV of the life settlement portfolio results in a $3.8 million increase in the FMV 12 (in thousands) 2019 2018 2019 2018 Total Income 7,412$ (237,289)$ 41,525$ (196,422)$ Total Expenses 6,874$ (66,119)$ 20,900$ 26,525$ Income (Loss) 538$ (171,170)$ 20,625$ (169,897)$ Income Statement Highlights Ended November 30, For the Three/Two Months For the Twelve/Eleven Months Ended November 30,

EMGC Cap Table (as of 11/30/2019) 13 Current Shares Outstanding Diluted Notes Outstanding Common Stock 59,572,779 59,572,779 21587 - Emergent Capital Common Accredited Outstanding Common Stock 97,851,162 97,851,162 16911 - Emergent Capital Inc Outstanding Restricted Stock 333,334 333,334 Officers and Senior Employees Convertible Note Share Reserve - 37,918,483 Assumes $75,836,966 outstanding converting at $2.00 Omnibus Plan - 8,511,785 Master Transaction Warrants - 17,500,000 Currently exercisable, expires 2025, $0.20 per share Master Transaction Warrants - 25,000,000 Exercise tied to conversion of convertible notes, expires 2025, $0.20 per share Total Shares 157,842,275 246,687,543

Emergent Capital Management Patrick J. Curry – Chairman & CEO Mr. Curry currently serves as the President and Chief Executive Officer of PJC Investments, LLC. Previously, from 1997 to 2003, Mr. Curry served as Executive Vice President and a director of Central Freight Lines, Inc. From 1994 to 1997, Mr. Curry was the President and Chief Executive Officer of Universal Express Limited, LLC. From 1991 to 1993, Mr. Curry served as President and Chief Executive Offer of Lortex, Inc. Prior to these roles, Mr. Curry was also a licensed stock and bond broker for Legg Mason Wood Walker, Inc. and a financial analyst for Hercules Aerospace, Inc. Mr. Curry has previous experience in investing in entities in the life settlement business. Mr. Curry has a Bachelor of Business Administration in Finance from Texas A&M University. Miriam Martinez - Senior Vice President and Chief Financial Officer With more than 30 years in the financial services industry, Ms. Martinez is a highly accomplished business leader. She joined Emergent Capital in 2010 as senior vice president, finance and operations, and has bee. She has been Chief Financial Officer since 2016 and Secretary since 2017. Ms. Martinez manages the company’s financial resources and functions, participates in strategic planning and oversees operational departments I including human resources and servicing. 14

Additional Notes • Note ( 1 ) : To avoid confusion, the December 5 , 2019 policy number and face amounts are shown only to reflect the year ending November 30 , 2019 disclosed figures adjusted for the Sun Life Settlement that occurred on December 5 , 2019 . • Note (2): All figures for the years ending December 31, 2017 and prior reflect each 12 - month period of activity. The fiscal year for Emergent was changed to November during 2018, so the figures reported for November 30, 2018 reflect 11 months of activity. The figures for the fiscal year ending November 30, 2019 reflect a full 12 months of activity for that fiscal year. 15

Company Contact Investor Relations Contact Rob Fink Fink IR phone: 646.809.4048 IR@emergentcapital.com Corporate Information 5355 Town Center Road, Suite 701, Boca Raton, FL 33486 phone: 561 - 995 - 4200 fax: 561 - 995 - 4201 info@emergentcapital.com www.emergentcapital.com