UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Emergent Capital, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

| |

| ¨ | Check box if only part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee Was previously paid. Identify the previous filing by registration number, or the Form on Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

EMERGENT CAPITAL, INC.

5355 Town Center Road, Suite 701

Boca Raton, Florida 33486

(561) 995-4200

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 2, 2016

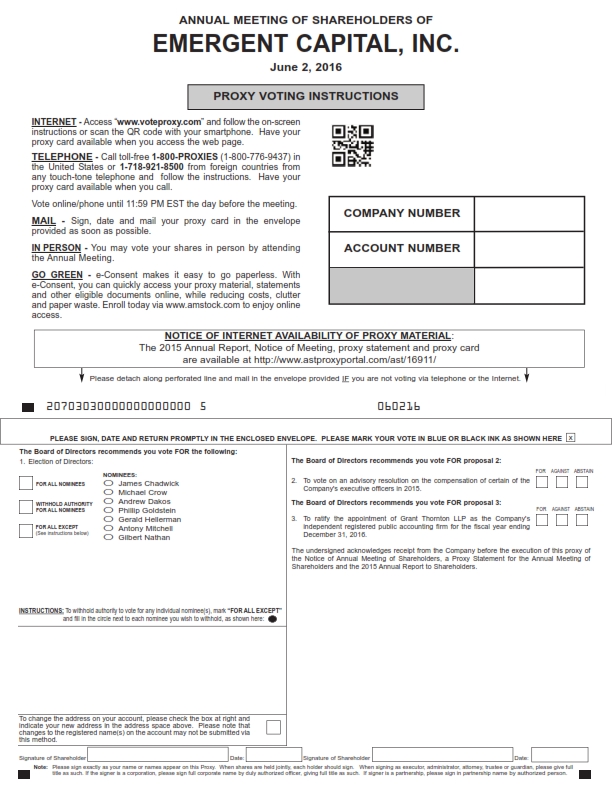

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Emergent Capital, Inc., a Florida corporation (the “Company”), will be held at 10:00 a.m. (ET) on Thursday, June 2, 2016 at the offices of Holland & Knight LLP located at 31 West 52nd Street, 12th Floor, New York, New York 10019, for the following purposes:

|

| |

| 1. | To elect James Chadwick, Michael Crow, Andrew Dakos, Phillip Goldstein, Gerald Hellerman, Antony Mitchell and Gilbert Nathan to our Board of Directors until the next annual meeting of shareholders and their successors have been elected and qualified; |

|

| |

| 2. | To vote on an advisory resolution on the compensation of certain of the Company’s executive officers in 2015; |

|

| |

| 3. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

|

| |

| 4. | To transact such other business as may properly come before the Annual Meeting or any postponement, continuation or adjournment thereof. |

Only shareholders of record as of the close of business on April 1, 2016 will be entitled to attend and vote at the Annual Meeting and at any postponement, continuation or adjournment thereof. It is important that your shares be represented at the Annual Meeting regardless of the size of your holdings. Whether or not you plan to attend the Annual Meeting in person, please authorize your proxy by internet, telephone, or, if you utilize the paper copy of the proxy card, by marking, signing, dating and returning your proxy card as promptly as possible, so that your shares will be represented at the Annual Meeting. If you utilize the enclosed proxy card, no postage is required if mailed in the United States. You may revoke your proxy at any time before it has been voted. This Notice, the Proxy Statement, the proxy card and the Company’s 2015 Annual Report are first being sent on or about April 15, 2016 to the holders of the Company’s common stock as of the close of business on April 1, 2016.

|

| |

| | By Order of the Board of Directors, |

| | |

| | Michael Altschuler |

| | General Counsel and Secretary |

Dated: April 15, 2016

EMERGENT CAPITAL, INC.

5355 Town Center Road, Suite 701

Boca Raton, Florida 33486

(561) 995-4200

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JUNE 2, 2016

The Company will hold its 2016 Annual Meeting of Shareholders (the “Annual Meeting”) at 10:00 a.m. (ET) on Thursday, June 2, 2016 at the offices of Holland & Knight LLP located at 31 West 52nd Street, 12th Floor, New York, New York 10019. This Proxy Statement and the enclosed proxy card are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of the Company for use at the meeting, and at any continuation, postponement or adjournment of the Annual Meeting. The Notice of Meeting, this Proxy Statement, the proxy card and a copy of the Company’s 2015 Annual Report are first being sent on or about April 15, 2016 to the holders of the Company’s common stock as of the close of business on the record date, April 1, 2016.

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON June 2, 2016 The Company’s Proxy Statement and 2015 Annual Report are available at www.astproxyportal.com/ast/16911/ Shareholders may receive directions to attend the meeting in person by calling Mr. David Sasso at 561-995-4300 or by emailing ir@emergentcapital.com.

|

ABOUT THE ANNUAL MEETING

What are the matters to be voted on at the Annual Meeting?

At the meeting, you will be entitled to vote on the following proposals:

| |

| 1. | To elect James Chadwick, Michael Crow, Andrew Dakos, Phillip Goldstein, Gerald Hellerman, Antony Mitchell and Gilbert Nathan to our Board of Directors until the next annual meeting of shareholders and their successors have been elected and qualified; |

| |

| 2. | To vote on an advisory resolution on the compensation of certain of the Company’s executive officers in 2015; |

| |

| 3. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

| |

| 4. | To transact such other business as may properly come before the Annual Meeting or any postponement, continuation or adjournment thereof. |

We are not aware of any other business to be brought before the meeting. If any additional business is properly brought before the meeting, the designated officers serving as proxies will vote in accordance with their best judgment.

How does the Board recommend that I vote?

The Board recommends that you vote your shares as follows:

| |

| • | “FOR” the election of each of the nominees for director named in this Proxy Statement; |

| |

| • | “FOR” the advisory resolution on the compensation of certain of the Company’s executive officers in 2015; and |

| |

| • | “FOR” the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016. |

Who is entitled to vote?

Shareholders as of the close of business on April 1, 2016 (the “Record Date”) may vote at the Annual Meeting. You have one vote for each director nominee and for each other proposal to be voted on at the Annual Meeting with respect to each share of common stock held by you as of the Record Date, including shares:

| |

| • | Held directly in your name as “shareholder of record” (also referred to as “registered shareholder”); and |

| |

| • | Held for you in an account with a broker, bank or other nominee (shares held in “street name”)—street name holders generally cannot vote their shares directly and instead must instruct the broker, bank or other nominee how to vote their shares. |

At the close of business on the Record Date, 27,522,508 shares of our outstanding common stock were entitled to vote at the Annual Meeting.

What is a “broker non-vote”?

If your bank, broker or other nominee does not receive instructions from you on how to vote your shares and does not have discretion to vote on a proposal because it is a non-routine item, the broker may return the proxy without voting on that proposal. This is known as a “broker non-vote.” Brokers generally have discretionary authority to vote on the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm. Brokers, however, do not have discretionary authority to vote on the other matters scheduled to be voted upon at the Annual Meeting.

What constitutes a quorum?

In order to conduct business and have a valid vote at the Annual Meeting a quorum must be present in person or represented by proxy. A majority of the votes entitled to be cast on the business properly brought before the Annual Meeting must be represented in person or by proxy to constitute a quorum for the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum.

How many votes are required to approve each proposal?

Proposal 1: Directors will be elected by a plurality of the votes cast at the Annual Meeting. Only votes cast “FOR” a nominee will be counted in the election of directors. There is no cumulative voting. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Broker non-votes will have no effect on the election of directors. Our Board has adopted a “majority vote policy.” Under this policy, any nominee for director in an uncontested election who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance and Nominating Committee will promptly consider the tendered resignation and make a recommendation to the Board whether to accept or reject the resignation.

Proposal 2: The advisory vote on executive compensation will be approved if the votes cast favoring the action exceed the votes cast opposing the action. Abstentions and broker non-votes are not considered a vote cast and therefore will have no effect on the outcome of this matter. Because your vote on this matter is advisory, it will not be binding on the Company or the Board. However, the Compensation Committee will review the voting results and take them into consideration when making future decisions regarding executive compensation.

Proposal 3: The ratification of the selection of Grant Thornton LLP will be approved if the votes cast favoring the action exceed the votes cast opposing the action. Abstentions are not considered a vote cast and therefore will have no effect on the outcome of the ratification. Because brokers have discretionary authority to vote on the ratification, we do not expect any broker non-votes in connection with the ratification.

How are proxies being solicited?

Proxies may be solicited on behalf of our Board by mail, personally, by telephone, by facsimile or by email or other electronic transmission by directors, officers or other employees of the Company. The Company will pay the cost of soliciting proxies on its behalf. The Company may also pay brokers or nominees holding common stock of the Company in their names or in the names of their principals for their reasonable expenses in sending solicitation material to their principals.

How do I vote my shares without attending the Annual Meeting?

If you are a registered shareholder you may vote by granting a proxy using any of the following methods:

| |

| • | By Internet —If you have internet access, by submitting your proxy by following the instructions included on the enclosed proxy card. |

| |

| • | By Telephone —By submitting your proxy by following the telephone voting instructions included on the enclosed proxy card. |

| |

| • | By Mail —By completing, signing and dating the enclosed proxy card where indicated and by mailing or otherwise returning the proxy card in the envelope provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

Internet and telephone voting facilities will close at 11:59 p.m. (Eastern Time) on June 1, 2016 for the voting of shares held by shareholders of record. Mailed proxy cards should be returned in the envelope provided to you with your proxy card, and must be received by June 1, 2016.

Your vote is important and we strongly encourage you to vote your shares by following the instructions provided on the enclosed proxy card. Please vote promptly.

If your shares are held in street name, your bank, broker or other nominee should give you instructions for voting your shares. In these cases, you may be able to vote via the internet or by telephone, or by mail by submitting a voting instruction form by the indicated deadline.

Our Board of Directors has designated our Chief Executive Officer, Antony Mitchell, and our General Counsel and Secretary, Michael Altschuler, and each or any of them, as proxies to vote the shares of common stock solicited on its behalf.

How do I vote my shares in person at the Annual Meeting?

First, you must satisfy the requirements for admission to the Annual Meeting (see below). Then, if you are a shareholder of record you may vote by ballot at the Annual Meeting. You may vote shares held in street name at the Annual Meeting only if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares, which must be submitted with your ballot at the meeting.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance so that your vote will be counted in case you later decide not to attend the Annual Meeting as well as to speed the tabulation of votes.

What does it mean if I receive more than one proxy card on or about the same time?

It generally means you hold shares registered in more than one account. In order to vote all of your shares, please sign and return each proxy card or, if you vote via the internet or telephone, vote once for each proxy card you receive.

May I change my vote or revoke my proxy?

Yes. Whether you have voted via the internet, telephone or mail, if you are a shareholder of record, you may change your vote and revoke your proxy by:

| |

| • | Sending a written statement to that effect to our Secretary, provided such statement is received at or prior to the Annual Meeting; |

| |

| • | Submitting a vote at a later time via the internet or telephone before the closing of those voting facilities; |

| |

| • | Submitting a properly signed proxy card with a later date that is received at or prior to the Annual Meeting; or |

| |

| • | Attending the Annual Meeting and voting in person. |

If you hold shares in street name, you may submit new voting instructions or revoke your voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (bank, broker or other nominee) giving you the right to vote the shares, which must be submitted with your ballot at the meeting. Only the latest validly executed proxy that you submit will be counted.

How do I gain admittance to the Annual Meeting?

Only our shareholders on the Record Date and invited guests of the Company will be permitted to attend the Annual Meeting. To gain admission, you must present a government-issued form of identification. If you are a shareholder of record, your name will be checked against our list of shareholders of record on the Record Date. If you hold shares in street name, you must present proof of your ownership of the Company’s shares on the Record Date in order to be admitted to the Annual Meeting.

Will any other matters be decided at the Annual Meeting?

We are currently unaware of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration, the proxyholders will have the discretion to vote on those matters for you should you submit a proxy.

Where can I find the voting results of the Annual Meeting?

The Company intends to announce the preliminary voting results at the Annual Meeting and publish the final results in a Form 8-K within four business days following the Annual Meeting.

What should I do if I have other questions?

If you have any questions or require any assistance with voting your shares, please contact our General Counsel and Secretary, Michael Altschuler, toll free at 1-888-364-6775.

ITEM 1—ELECTION OF DIRECTORS

Our Articles of Incorporation provide that our Board is to be comprised of a minimum of three (3) and a maximum of fifteen (15) directors, as determined from time to time in accordance with our Bylaws. Currently, our Board consists of eight (8) directors. Richard Dayan, who has served as a director since being elected on June 6, 2013, informed the Board on March 9, 2016 that he would not stand for election at the Annual Meeting. The Board, upon recommendation of the Corporate Governance and Nominating Committee of the Board, unanimously nominated the seven director nominees listed below for election to the Board at the Annual Meeting. All nominees currently serve as members of the Board. Following the Annual Meeting, assuming all of the director nominees are re-elected, our Board will consist of seven (7) directors.

Directors elected at the Annual Meeting will be elected to hold office until the next Annual Meeting of Shareholders and until their successors are duly elected and qualified.

Director Nominees

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” ALL OF THE NOMINEES NAMED BELOW.

|

| | | | | |

| Name | | Age | | Position |

| James Chadwick | | 42 |

| | Director |

| Michael Crow | | 53 |

| | Director |

| Andrew Dakos | | 50 |

| | Director |

| Phillip Goldstein | | 71 |

| | Chairman of the Board |

| Gerald Hellerman | | 78 |

| | Director |

| Antony Mitchell | | 51 |

| | Director & Chief Executive Officer |

| Gilbert Nathan | | 36 |

| | Director |

Set forth below is a brief description of the business experience of each of our director nominees, as well as certain specific experiences, qualifications and skills that led to the Board’s conclusion that each of the directors set forth below is qualified to serve as a director.

James Chadwick

Mr. Chadwick became a member of our Board of Directors in June 2013. Mr. Chadwick is a portfolio manager and Director of Research at Ancora Advisors LLC and is also a Managing Director of the private equity firm Main Street Investment Partners, LLC. From June 2010 to April 2011, Mr. Chadwick served as a Managing Director of the private equity firm Opus Partners, LLC. From March 2009 to June 2010, Mr. Chadwick served as a Managing Director of the private equity firm Harlingwood Equity Partners LP. From January 2006 to December 2008, Mr. Chadwick was the Managing Partner of Chadwick Capital Management. Mr. Chadwick serves on the board of directors of Stewart Information Services Corp and Riverview Bancorp, Inc. We believe that Mr. Chadwick is qualified to serve on our Board of Directors because of his financial expertise and varied experience in strategic investments.

Michael Crow

Mr. Crow became a member of our Board of Directors upon the consummation of our initial public offering in February of 2011. Mr. Crow was President and Chief Executive Officer of Ability Reinsurance Holdings Limited, a holding company that, through its subsidiaries, provided reinsurance, administrative and risk management solutions to health and life insurance companies and reinsurance companies, from September 2007 to August 2015. From September 2007 to November 2014, Mr. Crow also served as President and Chief Executive Officer of Ability Reinsurance (Bermuda) Limited, a life reinsurance company he founded in 2007 concentrating on long-term care and disability reinsurance, which was acquired by Front Street Re (Cayman) Ltd in November 2014. From June 2008 to September 2011, Mr. Crow also served as Vice President of Proverian Capital, an underwriter of life settlements. From June 1998 to March 2003, Mr. Crow served as Vice President and Senior Vice President at Centre Group in Hamilton, Bermuda, with respect to its life reinsurance and life settlement business and continued until May 2005 as an actuarial consultant advising Centre Group. Mr. Crow was selected to serve on our Board of Directors because of his experience in the life insurance and life settlement industry as well as his prior work as an actuarial consultant.

Andrew Dakos

Mr. Dakos became a member of our Board of Directors in August 2012. In 2001, Mr. Dakos joined what is now Bulldog Investors, a value oriented group of private investment funds that invest primarily in closed-end funds, small cap operating companies, special purpose acquisition companies, and special situations. In 2009, Mr. Dakos and his business partners formed Brooklyn Capital Management, LLC (N/K/A Bulldog Investors, LLC), an SEC-registered investment adviser that serves as the investment adviser to: the Bulldog Investors group of private investment funds; Special Opportunities Fund, Inc., a registered closed-end investment company; and certain other private investment funds and managed accounts. Mr. Dakos is currently the President and a director of Special Opportunities Fund and serves as a director of Crossroads Capital, Inc. Mr. Dakos graduated from the University of Delaware in 1988 with a BS in Business Administration, Finance concentration. We believe that Mr. Dakos is qualified to serve on our Board of Directors because of his broad business experience.

Phillip Goldstein

Mr. Goldstein became a member of our Board of Directors and its Chairman in August 2012. In December 1992, he co-founded what is now Bulldog Investors, a value oriented group of private investment funds that invest primarily in closed-end funds, small cap operating companies, special purpose acquisition companies, and special situations. In 2009, Mr. Goldstein and his business partners formed Brooklyn Capital Management, LLC (N/K/A Bulldog Investors, LLC), an SEC-registered investment adviser that serves as the investment adviser to: the Bulldog Investors group of private investment funds; Special Opportunities Fund, Inc., a registered closed-end investment company; and certain other private investment funds and managed accounts. Mr. Goldstein has served as a director of a number of closed-end funds and is currently a director of the Mexico Equity & Income Fund, Special Opportunities Fund and MVC Capital. Mr. Goldstein has a Bachelor of Engineering degree from the University of Southern California and a Master of Engineering degree from C.C.N.Y. We believe that Mr. Goldstein is qualified to serve on our Board of Directors because of his long and varied experience in strategic investments.

Gerald Hellerman

Mr. Hellerman became a member of our Board of Directors in August 2012. Mr. Hellerman owned and served as Managing Director of Hellerman Associates, a financial and corporate consulting firm, since the firm’s inception in 1993 until year-end 2013. Mr. Hellerman currently serves as a director and chairman of the Audit Committee for MVC Capital, Inc., as a director and chairman of the Audit Committee for Crossroads Capital, Inc., as director and chief compliance officer for The Mexico Equity and Income Fund, Inc., as director and chief compliance officer for Special Opportunities Fund, Inc. and as director for Ironsides Partners Opportunity Offshore Fund Ltd. Mr. Hellerman also served as a financial analyst and later as a branch chief with the U.S. Securities & Exchange Commission over a ten-year period, as Special Financial Advisor to the U.S. Senate Subcommittee on Antitrust and Monopoly for four years, and as the Chief Financial Analyst of the Antitrust Division of the U.S. Department of Justice for 17 years. Mr. Hellerman has a Bachelor of Arts, Economics, and an MBA, Finance concentration, from the University of Massachusetts. We believe that Mr. Hellerman is qualified to serve on our Board of Directors because of his financial expertise, broad business experience and his experience as a director of numerous other companies.

Antony Mitchell

Mr. Mitchell has served as our Chief Executive Officer since February of 2007 and prior to August 14, 2012, also served as our chairman. From 2001 to January 2007, Mr. Mitchell was Chief Operating Officer and Executive Director of Peach Holdings, Inc., a holding company which, through its subsidiaries, was a provider of specialty factoring services. Mr. Mitchell was also a co-founder of Singer Asset Finance Company, LLC (a subsidiary of Enhance Financial Services Group Inc.) in 1993, which was involved in acquiring insurance policies, structured settlements and other types of receivables. From June 2009 to November 2009, Mr. Mitchell was the Chair of the Board of Polaris Geothermal, Inc., which focuses on the generation of renewable energy projects. Since 2007, Mr. Mitchell has served as a director (being appointed Chair of the Board of Directors in 2015 and formerly the Executive Chair of the Board from 2010 to 2015) of Polaris Infrastructure. Inc., a renewable energy company listed on the Toronto Stock Exchange. From October 2013 through 2015, Mr. Mitchell also served as interim chief executive officer of DRB Capital, the purchaser of our structured settlement business, pursuant to a transition services arrangement. Mr. Mitchell’s qualifications to serve on our Board include his knowledge of our company and the specialty finance industry and his years of leadership at our company.

Gilbert Nathan

Mr. Nathan joined our Board of Directors in October 2015. He currently serves as the managing member at Jackson Square Advisors. Previously, Mr. Nathan was a Senior Analyst with Candlewood Investment Group from July 2013 to August 2015 and, prior to that, he was a principal with Restoration Capital Management from May 2002 to May 2012. Mr. Nathan currently serves as a director of Perle Bioscience, Inc. and liquidating trustee for BPZ Resources. We believe that Mr. Nathan is qualified to serve on our Board of Directors because of his financial expertise and varied experience in strategic investments.

EXECUTIVE OFFICERS

Set forth below is information regarding the Company’s current executive officers who are not also directors. There are no family relationships among any of our current directors or executive officers.

|

| | |

| Richard O’Connell, Jr. | | Chief Financial Officer and Chief Credit Officer |

| Age: 58 | | Executive Officer Since: 2010 |

Mr. O’Connell has served as our Chief Financial Officer since April 2010 and Chief Credit Officer since January 2010. From January 2006 through December 2009, Mr. O’Connell was Chief Financial Officer of RapidAdvance, LLC, a specialty finance company. From January 2002 through September 2005 he served as Chief Operating Officer of Insurent Agency Corporation, a provider of tenant rent guaranties to apartment REITs. From March 2000 to December 2001, Mr. O’Connell acted as Securitization Consultant to the Industrial Bank of Japan. From January 1999 to January 2000, Mr. O’Connell served as president of Telomere Capital, LLC, a life settlement company. From December 1988 through 1998 he served in various senior capacities for Enhance Financial Services Group Inc., including as President and Chief Operating Officer of Singer Asset Finance Company from 1995 to 1998 and Senior Vice President and Treasurer of Enhance Financial Services Group Inc. from 1989 through 1996. Mr. O'Connell also serves on the board of directors for SITO Mobile, Ltd. Mr. O'Connell has a Bachelor of Arts degree in French from Franklin and Marshall College and an MBA from Rutgers University Graduate School of Management.

|

| | |

| Miriam Martinez | | Senior Vice President of Finance and Operations |

| Age: 59 | | Executive Officer Since: 2012 |

Ms. Martinez has served as our Senior Vice President of Finance and Operations since September 2010. She primarily oversees the day to day financial, accounting and human resource activities of the Company. Ms. Martinez joined the Company in September 2010 prior to our initial public offering. From the period of 2006 to February 2010, Ms. Martinez served as Regional President and Chief Financial Officer of Qimonda N.A. a U.S. subsidiary of a German memory chip manufacturer. From 2000 to 2006, Ms. Martinez was Chief Financial Officer of Infineon N.A., a U.S. subsidiary of a German-based global semiconductor company. Ms. Martinez has also held executive positions at Siemens and White Oak Semiconductor, a joint venture between Siemens and Motorola. Ms. Martinez has a Bachelor of Accounting degree from Pace University and an MBA from Nova University. She has also completed the Siemens Executive MBA Program with Duke University.

|

| | |

| Michael Altschuler | | General Counsel and Secretary |

| Age: 38 | | Executive Officer Since: 2012 |

Mr. Altschuler joined the Company in December of 2010 and has been General Counsel since April 2011. From 2007 to 2010, Mr. Altschuler was Director & Counsel at UBS Investment Bank where he had legal responsibility for high-yield originations and bridge lending. Prior to UBS, Mr. Altschuler was associated with the law firm of Latham & Watkins LLP. Mr. Altschuler has a Bachelor of Arts degree in History from the University of Michigan, an MBA from the Kellogg School of Management at Northwestern University and earned his JD from Columbia Law School, where he was a Harlan Fiske Stone Scholar.

|

| | |

| David Sasso | | Senior Vice President of Corporate Development and Investor Relations |

| Age: 42 | | Executive Officer Since: 2015 |

Mr. Sasso joined the Company in 2011 and has been the Senior Vice President of Corporate Development and Investor Relations since 2015. Previously, Mr. Sasso served as senior consultant at American Capital Ventures, where he worked with several small cap growth companies and also served as vice president of investor relations and corporate communications at Transax International, a network solutions provider for the healthcare sector, where he oversaw all public and investor relations efforts. Earlier in his career, Mr. Sasso was director of investor relations at MKTG services and vice president at the Abernathy MacGregor group, a financial communications agency. Mr. Sasso has a Bachelor of Arts degree in English and Italian from the State University of New York at Albany.

CORPORATE GOVERNANCE

The Board of Directors

The Board is presently comprised of eight directors, seven of whom have been affirmatively determined by the Board to be independent under the rules of the NYSE. The independent directors are James Chadwick, Michael Crow, Andrew Dakos, Richard Dayan, Phillip Goldstein, Gerald Hellerman and Gilbert Nathan. Mr. Dayan, who has served as a director since being elected on June 6, 2013, informed the Board on March 9, 2016 that he would not stand for election at the Annual Meeting. Accordingly, the Board has set the number of directors at seven (7) effective as of the date of the Annual Meeting.

Board Leadership Structure and Role in Risk Oversight

The Board is responsible for the overall stewardship of the Company. The Board discharges this responsibility directly and indirectly through delegation of specific responsibilities to its committees, the Chairman of the Board and officers of the Company. The Board has established four standing committees to assist with its responsibilities: the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee and the Strategic Risk Oversight Committee. The Strategic Risk Oversight Committee was formed to oversee developments related to certain litigation and investigations as well as certain matters that were previously overseen by a special committee of the Board.

The Company’s Bylaws require the Board to elect a Chair, who presides at the meetings of the Board. If the Chair is an employee of the Company, the Company’s Bylaws require the Board to elect a Lead Director as well, who presides at executive sessions of our independent directors. The Board currently believes that the Company and its shareholders are best served by having a non-employee director, Mr. Goldstein, as its Chair of the Board. As a result, the Board does not currently have a Lead Director. We believe our current leadership structure is the optimal structure for us at this time and recognize that different board leadership structures may be appropriate in different situations.

The Board recognizes the importance of appropriate oversight of potential business risks in running a successful operation and meeting its fiduciary obligations to our business and our shareholders. While our senior executives, including the Chief Executive Officer and Chief Financial Officer, are responsible for the day-to-day assessment and management of business risks, the Board maintains responsibility for creating an appropriate culture of risk management and setting a proper “tone at the top.” In this role, the Board, directly and through its committees, takes an active role in overseeing our aggregate risk potential and in assisting our executives with addressing specific risks, including competitive, legal, regulatory, operational and financial risks. The Board does not believe that its role in the oversight of the Company’s risks affects the Board’s leadership structure.

Majority Voting Policy

Directors are elected by a plurality of votes cast by shares entitled to vote at each Annual Meeting. However, our Board has adopted a “majority voting policy.” Under this policy, any nominee for director in an uncontested election who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance and Nominating Committee will promptly consider the tendered resignation and make a recommendation to the Board whether to accept or reject the resignation.

Factors that the committee and Board will consider under this policy may include:

| |

| • | the stated reasons why votes were withheld from the director and whether those reasons can be cured; |

| |

| • | the director’s length of service, qualifications and contributions as a director; |

| |

| • | NYSE listing requirements; and |

| |

| • | our Corporate Governance Guidelines. |

Any director who tenders his or her resignation under this policy will not participate in the committee recommendation or Board action regarding whether to accept the resignation offer. If all of the members of the Corporate Governance and Nominating Committee receive a majority withheld vote at the same election, then the independent directors who do not receive a majority withheld vote will appoint a committee from among themselves to consider the resignation offers and recommend to the Board whether to accept such resignations.

Resignation Tendered In Advance

Our Bylaws provide that, as a condition to being nominated to the Board or re-nominated for continued service on the Board, the director or director nominee must sign and deliver to the Board an irrevocable letter of resignation. The letter will be

deemed tendered upon its acceptance by a majority of the disinterested members of the Board after a finding that, in connection with the performance of the director’s duties to the Company, the director either substantially participated in a breach of fiduciary duty arising from a material violation of a United States federal or state law or a regulation, or recklessly disregarded his or her duty to exercise reasonable oversight.

Board Committee Composition

Each of the standing committees maintains a written charter detailing its authority and responsibilities. These charters are reviewed and updated periodically as legislative and regulatory developments and business circumstances warrant. These committee charters are available on our website at www.emergentcapital.com in the Investors Relations section, under the Corporate Governance tab.

The following table sets forth the membership of the Board’s committees at April 15, 2016:

|

| | | | | | | | |

| Name | | Audit Committee | | Compensation Committee | | Corporate Governance and Nominating Committee | | Strategic Risk Oversight Committee |

| James Chadwick | | X | | | | | | |

| Michael A. Crow | | X | | X | | X | | |

| Andrew Dakos | | | | CHAIR | | X | | X |

| Richard Dayan | | X | | | | | | |

| Phillip Goldstein | | | | X | | CHAIR | | CHAIR |

| Gerald Hellerman | | CHAIR | | X | | X | | X |

| Gilbert Nathan | | | | | | | | |

Meetings

The Board and the standing committees met as follows during the year ended December 31, 2015:

|

| | |

| Name | Number of Meetings |

|

| Board of Directors | 12 |

|

| Audit Committee | 4 |

|

| Compensation Committee | 3 |

|

| Corporate Governance and Nominating Committee | 4 |

|

| Strategic Risk Oversight Committee | 16 |

|

The non-management directors also meet routinely in executive session in connection with regular meetings of the Board.

Currently, we do not maintain a formal policy regarding director attendance at the Annual Meeting of Shareholders; however, it is expected that absent compelling circumstances directors will attend. During 2015, each director attended at least 75% of the board meetings and meetings of committees on which the director served.

The Audit Committee

The Audit Committee consists of Messrs. Hellerman, Chadwick, Crow and Dayan, with Mr. Hellerman serving as chair. Our Board has determined that Messrs. Hellerman and Chadwick are audit committee financial experts as defined under the rules of the SEC, and all Audit Committee members are independent under the applicable listing standards of the NYSE and applicable rules of the SEC. The Audit Committee oversees our accounting and financial reporting processes and the audits of our financial statements.

The Audit Committee has sole authority for the appointment, compensation and oversight of the work of our independent registered public accounting firm, and responsibility for reviewing and discussing with management and our independent registered public accounting firm our audited consolidated financial statements included in our Annual Report on Form 10-K, our interim financial statements and our earnings press releases. The Audit Committee also reviews the independence and quality control procedures of our independent registered public accounting firm, reviews management’s assessment of the

effectiveness of internal controls, discusses with management the Company’s policies with respect to risk assessment and risk management and reviews the adequacy of its charter on an annual basis.

The Compensation Committee

The Compensation Committee consists of Messrs. Dakos, Crow, Goldstein and Hellerman, with Mr. Dakos serving as chair. Our Board has determined that all Compensation Committee members are independent under the applicable listing standards of the NYSE and applicable rules of the SEC. The Compensation Committee establishes, administers and reviews our policies, programs and procedures for compensating our executive officers and directors.

The Compensation Committee is generally responsible for: (a) assisting our Board in fulfilling its fiduciary duties with respect to the oversight of the Company’s compensation plans, policies and programs, including assessing our overall compensation structure, reviewing all executive compensation programs, incentive compensation plans and equity-based plans, and determining executive compensation; (b) reviewing the adequacy of the Compensation Committee Charter on an annual basis; (c) evaluating the Chief Executive Officer’s performance in light of corporate goals and objectives relevant to compensation; (d) reviewing the performance of the Company’s executive officers and determining and approving such executive officers’ compensation; (e) making recommendations to the Board with respect to incentive-compensation plans and equity-based plans; (f) administering the Company’s equity compensation plans, and granting awards under such plans; (g) overseeing the administration of the Company’s employee benefit plans; (h) overseeing regulatory compliance with respect to compensation matters; and (i) reviewing and approving employment or severance arrangements with senior management.

The Compensation Committee maintains a subcommittee consisting of Messrs. Crow and Hellerman to consider the potential effects of Section 162(m) of the Internal Revenue Code (the “Code”) on compensation matters. For a discussion of the Compensation Committee’s processes and procedures for considering and determining compensation for our executive officers, please see the “Compensation Discussion and Analysis” section below.

The Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee (the “CGN Committee”) consists of Messrs. Goldstein, Crow, Dakos and Hellerman, with Mr. Goldstein serving as chair.

The CGN Committee is responsible for: (a) developing and recommending corporate governance principles and procedures applicable to our board and employees; (b) recommending committee composition and assignments; (c) overseeing periodic self-evaluations by the board, its committees, individual directors and management with respect to their respective performance; (d) identifying individuals qualified to become directors; (e) recommending director nominees; (f) assisting in board succession planning; (g) recommending whether incumbent directors should be nominated for re-election to our board; and (h) reviewing the adequacy of its charter on an annual basis.

The CGN Committee considered whether to engage a third party to assist in the oversight of the evaluations under the CGN Committee’s purview and, based on the Company’s present circumstances, believes that the Company and its shareholders are currently best served without engaging a third party.

The Strategic Risk Oversight Committee

The Strategic Risk Oversight Committee (the “Risk Committee”) consists of Messrs. Goldstein, Dakos and Hellerman, with Mr. Goldstein serving as chair.

The Risk Committee is responsible for: (a) reviewing actions proposed and taken by management in any areas of strategic risk as deemed appropriate by the Risk Committee; and (b) reviewing other areas of material risk, including litigation, as appropriate or as requested by the Board.

Selection and Evaluation of Director Candidates

In searching for qualified director candidates for election to the Board and to fill vacancies on the Board, the CGN Committee may solicit current directors for the names of potentially qualified candidates and may ask directors to pursue their own business contacts for the names of potentially qualified candidates. The CGN Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates and will consider suggestions from shareholders for nominees for election as directors and evaluate such suggested nominees on the same terms as candidates identified by directors, outside advisors or search firms selected by the CGN Committee. The CGN Committee and the Board have not established a formal policy with regard to the consideration of director candidates recommended by shareholders. This is due to the following factors: (i) the limited number of such recommendations, (ii) the need to evaluate such recommendations on a

case-by-case basis, and (iii) the expectation that recommendations from shareholders would be considered in the same manner as recommendations by a director or an officer of the Company.

Any shareholder who wishes to recommend a candidate to the CGN Committee for consideration as a director nominee should provide the Company with the following information: (a) the suggested candidate’s biographical data (including business experience, service on other boards, and academic credentials), (b) all transactions and relationships, if any, between the recommending shareholder or such candidate, on the one hand, and the Company or its management, on the other hand, as well as any relationships or arrangements, if any, between the recommending shareholder and the candidate and any other transactions or relationships of which the Board should be aware in order to evaluate such candidate’s potential independence as a director, (c) details of whether the candidate or the recommending shareholder is involved in any on-going litigation adverse to the Company or is associated with an entity which is engaged in such litigation and (d) whether the candidate or any company for which the candidate serves or has served as an officer or director is, or has been, the subject of any bankruptcy, SEC or criminal proceedings or investigations, any civil proceedings or investigations related to fraud, accounting or financial misconduct, or any other material civil proceedings or investigations. The notice must also contain a written consent confirming the candidate’s (a) consent to be nominated and named in the Company’s proxy statement and, if elected, to serve as a director of the Company and (b) agreement to be interviewed by the CGN Committee and submit additional information if requested to do so. This information should be delivered to the Company sufficiently in advance of the Company’s annual meeting to permit the CGN Committee to complete its review in a timely fashion.

The Board and the CGN Committee have not established a formal policy on the consideration of diversity in director candidates. The CGN Committee selects nominees on the basis of their character, expertise, sound judgment, ability to make independent analytical inquiries, business experience, understanding of the Company’s business environment, ability to make time commitments to the Company, demonstrated teamwork and the ability to bring unique and diverse perspectives and understandings to the Board. These criteria center on finding candidates who have the highest level of integrity, are financially literate, have motivation and sufficient time to devote themselves to Company matters and who have skills that complement the skills and knowledge of the current directors. In connection with the foregoing, the Board and the CGN Committee are aware and have considered that (i) on October 17, 2007, the Secretary of the Commonwealth of Massachusetts concluded an enforcement action by issuing a permanent “obey the law” injunction and fining Messrs. Dakos and Goldstein and certain related parties $25,000 for operating a non-password protected open website containing information about certain unregistered investments and sending an e-mail about such investments to a Massachusetts resident who requested information, (ii) in light of the passage of the JOBS Act in April 2012, which permits the conduct giving rise to the enforcement action, Messrs. Dakos and Goldstein and the other parties submitted a motion to the Secretary of the Commonwealth of Massachusetts to vacate this order, and (iii) on January 29, 2014, the injunction and fine were removed as they were found to no longer be in the public interest.

Once potential candidates are identified, the CGN Committee reviews the backgrounds of those candidates, conducts interviews of candidates and establishes a list of final candidates. To the extent practical, final candidates are then to be interviewed by each member of the CGN Committee, the Chair of the Board and the Chief Executive Officer. Reasonable efforts are made to have all remaining directors interview final candidates.

Under the Company’s Bylaws, a shareholder may propose a director candidate for nomination at the 2017 annual meeting if the shareholder delivers the proposal to the Company on or before December 16, 2016. Please see “Other Matters—Shareholder Proposals for the 2016 Annual Meeting.”

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee will be, or will have been, employed by us. None of our executive officers currently serves, or in the past three years has served, as a member of the board of directors, compensation committee or other board committee performing equivalent functions of another entity that has one or more executive officers serving on our Board or Compensation Committee.

Report of the Audit Committee

The primary purpose of the Audit Committee is to assist the Board of Directors’ oversight of the integrity of the Company’s financial statements, the qualifications, independence and performance of the Company’s independent registered public accounting firm and the performance of the Company’s internal controls and procedures.

In addition to fulfilling its responsibilities as set forth in its charter and further described above in “Corporate Governance—Board Committees and Meetings—The Audit Committee,” the Audit Committee has reviewed the Company’s audited financial statements for fiscal year 2015. Discussions about the Company’s audited financial statements included its independent registered public accounting firm’s judgments about the quality, not just the acceptability, of the Company’s accounting principles and underlying estimates used in its financial statements, as well as other matters, as required by audit standards and by our Audit Committee Charter. In conjunction with the specific activities performed by the Audit Committee in its oversight role, it issued the following report:

| |

| 1. | The Audit Committee has reviewed and discussed the audited financial statements as of and for the year ended December 31, 2015 with the Company’s management. |

| |

| 2. | The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed pursuant to Public Company Accounting Oversight Board Auditing Standard No. 16 (Communications with Audit Committees), including the quality of the Company's accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. |

| |

| 3. | The Audit Committee has received from the independent registered public accounting firm the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accounting firm’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with the independent registered public accounting firm their independence from the Company. |

Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 for filing with the SEC.

Gerald Hellerman (Chairperson)

James Chadwick

Michael Crow

Richard Dayan

Communications with the Board

Any interested party wishing to communicate with the Board, the non-management directors or a specific Board member, may do so by writing to the Board, the non-management directors or the particular Board member, and delivering the communication in person or mailing it to: Emergent Capital, Inc., 5355 Town Center Road, Suite 701, Boca Raton, Florida 33486, Attention: Secretary. Communications will be distributed to specific Board members as requested by the shareholder in the communication. If addressed generally to the Board, communications may be distributed to specific members of the Board as appropriate, depending on the material outlined in the communication. For example, if a communication relates to accounting, internal accounting controls or auditing matters, the communication will be forwarded to the Chair of the Audit Committee unless otherwise specified. The Company will forward all such communications, unless the communication is clearly of a marketing nature or is unduly hostile, threatening, illegal or similarly inappropriate.

Code of Ethics

Our Board has adopted Corporate Governance Guidelines, including a Code of Ethics for our directors, officers and employees. Copies of the Corporate Governance Guidelines and Code of Ethics are available on the Company’s website at www.emergentcapital.com in the “Investor Relations” section, under the Corporate Governance tab.

DIRECTOR COMPENSATION

Directors who are employees of the Company or its subsidiaries receive no compensation for their service on our Board of Directors. Effective as of the date of the 2015 Annual Meeting, our outside directors were compensated as follows:

| |

| • | Cash Compensation —(a) Except as noted below, directors were paid $35,000 in an annual cash retainer; (b) the Chairman of the Board received an additional $30,000 annual retainer; (c) committee chairs were paid an additional retainer of $30,000 for the Audit Committee, $15,000 for the Risk Committee, $10,000 for the Compensation Committee and $5,000 for the CGN Committee; (d) with the exception of the Risk Committee, all members of each committee (including the committee chair) received an additional annual member retainer of $5,000 for their committee membership and the members of the Risk Committee received annual retainers of $10,000 each; (e) following their fourth meeting, regular members of the Risk Committee were paid $2,500 per meeting and the chair of the Risk Committee was paid $3,000 per meeting. |

| |

| • | Equity Compensation —Except as noted below, directors were paid $45,000 through the issuance of 7,281 shares of one year vesting restricted stock. The number of shares granted to each director was determined based on the fair market value of the Company’s closing stock price on the day prior to the 2015 Annual Meeting, and was granted in full on the date of the 2015 Annual Meeting. Directors owning at least $200,000 in market value of the Company’s common stock have an option to elect all or a portion of the equity payment in cash in lieu of restricted stock at the end of the restricted period. Mr. Hellerman elected to receive 4,854 shares of one year vesting restricted stock with the remainder paid in cash. Additionally, at our 2015 Annual Meeting held on May 28, 2015, shareholders ratified the award of 5,000 performance shares to each of our outside directors; these performance shares were awarded in 2014, but were contingent on shareholder ratification. |

With the exception of Risk Committee meetings, directors do not receive meeting fees or fees for executing written consents in lieu of meetings of the board of directors or its committees. All retainers are paid in quarterly installments. The Company reimburses directors for their travel and lodging expenses if they do not live in the area where a meeting is held. Directors receive no other compensation, perquisite or benefit from the Company.

The table below summarizes the compensation earned by non-employee directors for the fiscal year ended December 31, 2015.

2015 DIRECTOR COMPENSATION

|

| | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | Restricted Stock Awards (1) | | | Total |

| James Chadwick | | $ | 40,000 |

| | $ | 44,997 |

| | | $ | 84,997 |

|

| Michael Crow | | $ | 53,750 |

| | $ | 44,997 |

| | | $ | 98,747 |

|

| Andrew Dakos | | $ | 102,500 |

| | $ | 44,997 |

| | | $ | 147,497 |

|

| Richard Dayan | | $ | 40,000 |

| | $ | 44,997 |

| | | $ | 84,997 |

|

| Phillip Goldstein | | $ | 140,000 |

| | $ | 44,997 |

| | | $ | 184,997 |

|

| Gerald Hellerman (2) | | $ | 145,006 |

| | $ | 29,998 |

| | | $ | 175,004 |

|

| Gilbert Nathan (3) | | $ | 11,818 |

| | $ | — |

| | | $ | 11,818 |

|

| |

| (1) | Aggregate grant date fair values reflect director annual retainer grants and were computed in accordance with ASC 718. The director stock awards were determined on May 27, 2015, the day before the 2015 Annual Meeting, at $6.18 per share. |

| |

| (2) | Directors owning at least $200,000 in market value of the Company’s common stock have an option to elect all or a portion of the equity payment in cash in lieu of restricted stock at the end of the restricted period. Mr. Hellerman elected to receive 4,854 shares of one year vesting restricted stock with the remainder paid in cash in the amount of $15,000 payable after the restricted stock vests. |

| |

| (3) | Mr. Nathan joined the Board on October 30, 2015 and received $11,818 in cash compensation, representing the pro rata portion of the annual retainer for his service. |

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This section describes the objectives and components of our 2015 executive compensation program for named executive officers. Our named executive officers, or NEOs, for 2015 were:

| |

| • | Antony Mitchell, our chief executive officer; |

| |

| • | Richard O’Connell, our chief financial officer; |

| |

| • | Michael Altschuler, our general counsel and secretary; |

| |

| • | Miriam Martinez, our senior vice president of finance and operations; and |

| |

| • | David Sasso, our senior vice president of corporate development and investor relations |

Executive Summary

Beginning in late 2011 after notification of an investigation of the Company related to its legacy premium finance program by the United States Attorney for the District of New Hampshire (the “USAO Investigation”), the Compensation Committee, which we refer to in this section as the “Committee,” sought to preserve the talent necessary for protecting the Company’s assets and its business operations for the term of what became a very disruptive USAO Investigation. In early 2012, the Committee’s efforts culminated with the signing of retention agreements by certain key individuals the Company believed were critical to preserving the existing value and assets of the Company through the USAO Investigation, providing potential severance as well as a minimum annual cash bonus award to our NEOs, other than our chief executive officer. The retention arrangements expired in 2013 and in 2014 the Committee established a pay-for-performance program for Company executives.

In 2014 the Committee established a pay-for-performance program emphasizing executive share ownership that provides competitive rewards for executives based on:

| |

| • | effective deployment of capital and further refinement of the Company’s business model; |

| |

| • | continued improvement in expense and cash management; and |

| |

| • | resolution of certain legal and regulatory issues. |

The pay-for-performance program is reflected in the following substantive changes to our executive compensation program adopted in 2014.

| |

| • | New Employment Agreements. Each of our NEOs whose prior retention agreements were expiring, were provided employment agreements that established new terms of employment to replace the retention-based programs that expired in 2013. All retention-based programs were allowed to expire and were replaced by performance-based compensation arrangements and market-competitive post-employment protections. |

| |

| • | New Discretionary Annual Cash Bonus Plan. The Company established a performance-based annual cash bonus plan providing NEOs and other participants with the ability to earn a payout based on performance compared to specific financial and non-financial goals approved by the Committee at the beginning of the year. |

| |

| • | A One-Time, Special Cash Bonus. As a result of the transformative changes initiated in 2013, the Committee awarded special cash bonus payments on a one-time basis to executives and employees of the Company in June 2014. |

| |

| • | Performance Share Program. The Company established a performance share program in 2014 that is designed to reward key employees with Company shares when certain multi-year financial and market goals are realized. |

In 2015, the Company achieved a number of key accomplishments that provide a foundation for future value creation, which were considered by the Committee. Key 2015 achievements include:

| |

| • | Formally concluding the USAO Investigation; |

| |

| • | Increasing the fair value of the Company’s life settlement portfolio by approximately 19% to $462 million; |

| |

| • | Amending the White Eagle credit facility to allow for earlier access to the portfolio cash flows; |

| |

| • | Refinancing all outstanding 12.875% Senior Secured Notes with longer-term capital that provides financing for premiums on 159 policies; |

| |

| • | Investing in new policies to better shape the timing of expected cash flows from Emergent's portfolio; and |

| |

| • | Defending against private litigation challenging certain life insurance policies. |

Compensation Philosophy

The primary objective of our compensation programs and policies is to attract, retain and motivate employees whose knowledge, skills and performance are critical to our success. We believe that compensation is unique to each individual, and it should be determined based on objective performance results as well as discretionary and subjective factors relevant to the particular named executive officer. To attain our compensation objectives, we also believe it is critical to provide executives and key employees with the opportunity to share in the ownership of the Company as a means of providing appropriate and balanced incentives for achievement.

Determination of Compensation Awards

The Committee has the primary authority to determine and approve the compensation awards available for the Company’s executive officers. The Committee is charged with reviewing executive officer compensation policies and practices and making recommendations to the full Board of Directors to ensure adherence to our compensation philosophies and to ensure that the total compensation paid to our NEOs is fair, reasonable and competitive, taking into account our performance as well as the individual performance, level of expertise and experience of our NEOs, as determined by the Committee based upon the judgment of its members. The Committee also determines salary increases for each of the five NEOs, reflecting their relative skills and responsibilities, individual performance, and leadership roles within the Company.

In making compensation determinations, the Committee considers recommendations from its independent compensation consultant, Board Advisory LLC (“Board Advisory”). The Committee also considers the chief executive officer’s assessment of the performance of executive officers other than himself as well as recommendations of the chief executive officer regarding base salaries, annual bonus awards, equity-based incentive awards and other employment terms for executive officers. The Committee evaluates the performance of our executive officers annually, including the chief executive officer, based on enterprise-wide financial and non-financial results, individual achievements, leadership and other factors the Committee’s members determine to be appropriate. The chief executive officer generally attends Committee meetings, but is not present during executive sessions of the Committee at which his performance and compensation are discussed. Other members of senior management may also attend meetings at the Committee’s request, for example, to provide reports and information on agenda topics. The Committee has not established a peer group for compensation purposes.

Stock Ownership Guidelines

In 2014, the Company adopted a policy whereby each non-employee director is required to own common stock or common stock equivalents, including restricted stock, at least equal in acquisition basis to, or a fair market value of, $100,000 within five years of the later of when the director joined the Board or January 16, 2014. For purposes of the ownership guidelines, unexercised stock options are not counted towards the ownership guidelines. In the first quarter of 2015, the Company adopted similar ownership guidelines for NEOs. Within the next four years, each executive is expected to own shares with a market value equal to a multiple of their annual salary, as presented below.

|

| | |

| Role | Ownership Value as Multiple of Salary |

|

| CEO | 5 |

|

| Other NEOs | 3 |

|

| Other Key Executives | 2 |

|

Under the guidelines, executives are expected to hold all shares earned through Company incentive arrangements, net of taxes and exercise price, if applicable, until the ownership guidelines are met.

The Company has an insider trading policy that includes anti-hedging provisions. Consequently, no employee, executive officer or director may enter into a hedge of the Company’s common stock, including by use of derivatives such as puts and calls, short sales or similar transactions.

Use of Compensation Consultants

Since 2011, the Committee has retained Board Advisory as its compensation consultant to provide advice and resources to help refine and execute the overall compensation strategy. Board Advisory reports directly to the Committee. The Committee has the sole power to terminate or replace any compensation consultant and authorize payment of fees to any compensation consultant. The Committee also directed Board Advisory to work with members of our management to obtain information necessary for it to form its recommendations and evaluate management’s recommendations. Board Advisory also met with the

Committee during the Committee’s regular meetings, in executive sessions (where no members of management were present), and with the Committee chair and other members of the Committee outside of the regular meetings.

Board Advisory provides no services to and earns no fees from the Company outside of its engagement with the Committee. The Committee has determined that Board Advisory is independent from management based upon the consideration of relevant factors, including:

| |

| • | that Board Advisory does not provide any services to the Company except advisory services to the Committee; |

| |

| • | that the amount of fees received from the Company by Board Advisory is not material as a percentage of Board Advisory’s total revenue; |

| |

| • | that Board Advisory has policies and procedures that are designed to prevent conflicts of interest; |

| |

| • | that Board Advisory and its employees who provide services to the Committee do not have any business or personal relationship with any member of the Committee or any executive officer of the Company; and |

| |

| • | that Board Advisory and its employees who provide services to the Committee do not own any stock of the Company. |

Compensation Elements and Committee Actions

We compensated our NEOs for 2015 through base salary, cash awards in the form of an annual cash bonus, and various broad-based benefits provided to employees generally.

Base Salaries. Annual base salaries compensate our NEOs for performing their functional duties with us. We believe base salaries should be competitive based upon an NEO’s scope of responsibilities, the market compensation of similarly situated executives, and the relative talent of the individual officer. When establishing base salary for an executive, we also consider other factors such as internal consistency and, for new hires, salary paid by a former employer. In 2015, the Committee approved the following limited salary increases based on the criteria presented above. Mr. O’Connell, Ms. Martinez and Mr. Altschuler received a 2% salary increase effective January 2015. Mr. Sasso received a 2% salary increase plus a promotional increase of an additional 16.4% effective July 2015.

Discretionary Annual Cash Bonus. Beginning in 2014 the Committee established a pay-for-performance program that includes an annual cash bonus for NEOs and other key management based on company and individual performance during the fiscal year performance period. The bonus is based on Committee-approved target award levels for each of the NEOs except the chief executive officer, expressed as a percent of salary.

In 2015, our shareholders approved amendments to our 2010 Omnibus Incentive Plan (the “Plan”) that allowed our Discretionary Annual Cash Bonus to meet the “qualified performance-based compensation” definition described in Internal Revenue Code Section 162(m). For 2015, the Committee established a “plan-within-a-plan” design for the bonus whereby the bonus is fully funded (maximum payout) when specific annual goals are achieved and certified by the Committee. The Committee may then reduce the awards based on its discretion to reflect individual and/or Company progress compared to additional financial and non-financial goals pre-approved by the Committee for the annual performance period.

For 2015, the annual cash bonus would be fully funded upon achieving both book value per share and weighted average cost of capital (WACC) goals. While the WACC goal was achieved, the book value per share goal was not achieved. As a result, the CEO did not request and the Committee did not approve any bonus awards for our NEOs.

Equity-Based Awards. In 2014 the Company established a performance share award program for key management, including our NEOs. The program is intended to be an important part of providing an attractive and competitive total pay opportunity for our NEOs, and also to provide an ownership interest in the Company that is earned through delivering short-term results and long-term value creation. Our performance shares are notional shares that are earned over a performance period based on the degree to which specific book value per share and market-to-book-value targets are met or exceeded. Depending on performance, participants may earn between 0% and 150% of their performance share award in the form of shares of common stock that are restricted and subject to forfeiture for one additional year. We believe our performance shares, which are earned through a combination of improving the book value per share of our stock and improving our market-to-book-value share price, are directly related to advancing our investor interests.

The performance period for the 2014 award is 24 months, with shares earned subject to an additional 12-month restriction period. This performance period represents the expected cycle necessary for full investment of the Company’s investable capital. The Committee did not award a new cycle of performance shares during 2015.

Retirement Benefits. We provide retirement benefits to our employees through the opportunity to participate in our 401(k) savings plan. We believe the 401(k) savings plan provides an important benefit to assist our employees and executives in long-term personal financial planning, improving their personal financial security and their relationship with the Company. We believe a 401(k) plan is necessary in constructing an overall compensation program that is competitive with other employers and helps us attract prospective employees. We have historically not made any contributions or otherwise matched any employee contributions to the 401(k) plan. We do not provide any supplemental executive retirement benefits or other non-qualified deferred compensation arrangements for our executives.

Other Benefits and Executive Perquisites. We also provide certain other customary benefits to our employees, including the NEOs, which are intended to be part of a competitive compensation program. These benefits, which are offered to all full-time employees, include medical, dental, life and disability insurance as well as paid leave during the year.

Employment Agreements and Retention Arrangements

We believe that employment agreements with executives are appropriate in many instances to ensure clarity and improve trust in the employment relationship, and to provide the Company with non-compete/non-solicitation protective covenants on the part of its executive officers. We do not have any general policies regarding the use of employment agreements. The Company expects that from time to time it may enter into employment agreements with employees, including NEOs, whether at the time of hire or thereafter. Since the formation of the Committee, the Committee has reviewed and approved all NEO employment agreements and severance agreements prior to execution. In 2014, as a result of expiration of prior retention arrangements, the Committee approved and the Company executed new employment agreements with four of our five NEOs. Our chief executive officer remains under an employment agreement established prior to the IPO in 2011.

The employment agreements with our NEOs are discussed in more detail under “Executive Compensation—Employment Agreements.”

Accounting and Tax Implications

The accounting and tax treatment of particular forms of compensation has not, historically, materially affected our compensation decisions. We have established a subcommittee and have reviewed the potential effect of Section 162(m) of the Code periodically and use our judgment to authorize compensation payments that may be subject to the Section 162(m) deductibility limit when we believe such payments are appropriate and in our best interests after taking into consideration changing business conditions and the performance of our executive officers.

Risk Management Implications of Executive Compensation

In connection with its oversight of compensation related risks, the Committee and management annually evaluate whether our Company’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on our Company. We believe the structure of our current bonus program mitigates risks by avoiding employees placing undue emphasis on any particular performance metric at the expense of other aspects of our business. Further, a substantial portion of our executive incentives are in the form of equity and, coupled with ownership and share retention guidelines, provides further incentive for long-term value creation and prudent risk-taking. We believe our employee and executive assessment process is well aligned with creating long-term value and does not create an incentive for excessive risk taking or unusual pressure on any single operating measure. For 2015, the Committee determined that our compensation programs do not encourage risk taking that is reasonably likely to have a material adverse effect on the Company.

COMPENSATION COMMITTEE REPORT

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis set forth in this proxy statement, and based on such review and discussions, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Andrew Dakos (Chairperson)

Michael Crow

Phillip Goldstein

Gerald Hellerman

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE FOR 2015

The following table summarizes the compensation earned by our NEOs for the years ending December 31, 2013, 2014 and 2015.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Year | | Salary | | Bonus (1) | | Option Awards (2) | | Performance Share Awards (3) | | Total |

| Antony Mitchell, | | 2015 | | $ | 649,038 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 649,038 |

|

| Chief Executive | | 2014 | | $ | 620,385 |

| | $ | — |

| | $ | — |

| | $ | 782,400 |

| | $ | 1,402,785 |

|

| Officer | | 2013 | | $ | 525,000 |

| | $ | — |

| | $ | 424,284 |

| | $ | — |

| | $ | 949,284 |

|

| Richard O’Connell | | 2015 | | $ | 365,431 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 365,431 |

|

| Chief Financial | | 2014 | | $ | 339,868 |

| | $ | 524,316 |

| | $ | — |

| | $ | 260,800 |

| | $ | 1,124,984 |

|

| Officer | | 2013 | | $ | 334,852 |

| | $ | 250,000 |

| | $ | 159,107 |

| | $ | — |

| | $ | 743,959 |

|

| Miriam Martinez | | 2015 | | $ | 324,173 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 324,173 |

|

| SVP, Finance | | 2014 | | $ | 301,531 |

| | $ | 210,281 |

| | $ | — |

| | $ | 234,720 |

| | $ | 746,532 |

|

| | | 2013 | | $ | 297,047 |

| | $ | 200,000 |

| | $ | 159,107 |

| | $ | — |

| | $ | 656,154 |

|

| Michael Altschuler | | 2015 | | $ | 318,451 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 318,451 |

|

| General Counsel | | 2014 | | $ | 293,156 |

| | $ | 188,334 |

| | $ | — |

| | $ | 169,520 |

| | $ | 651,010 |

|

| | | 2013 | | $ | 286,245 |

| | $ | 106,000 |

| | $ | 159,107 |

| | $ | — |

| | $ | 551,352 |

|

| David Sasso (4) | | 2015 | | $ | 211,375 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 211,375 |

|