Corporate Capital Trust, Inc. 8-K

Exhibit 99.2

FS INVESTMENTS & KKR FORM STRATEGIC PARTNERSHIP Combining FSIC & CCT platforms to create stockholder value

FS INVESTMENTS AND KKR TO ESTABLISH INDUSTRY - LEADING PARTNERSHIP FS Investments (“FS”) and KKR Credit Advisors (“KKR”) have announced an agreement to form a strategic partnership, creating a premier ~$18B 1 alternative lending platform 2 1 Assumes stockholder approval for all funds 2 As of September 30, 2017 3 $18B of total BDC AUM as of September 30, 2017 comprised of $13.7B across FSIC, FSIC II, FSIC III and FSIC IV and $4B in FS En ergy & Power Fund KKR • Leading provider and manager of alternative investment solutions with $20.5B in AUM 2 • Largest manager of credit - focused business development companies with $13.7B in BDC AUM 3 • History of combining differentiated strategies, top institutional managers and innovative structures to provide investors with alternative sources of income and growth • Best - in - class capital raising capabilities with 300,000 investors represented by over 18,000 financial advisors • KKR & Co. L.P. is a leading global investment firm managing $153B 2 in AUM across multiple alternative asset classes • 41 - year history of investment excellence • $15B 2 internal balance sheet largely invested alongside clients • Manages $41.3B in Credit AUM, including $4.6B in BDC AUM 2 • Global industry coverage in Credit strategies complemented by a significant sourcing, underwriting and capital markets platform FS INVESTMENTS

TRANSACTION SUMMARY 1 KEY HIGHLIGHTS PARTNERSHIP CREATES LARGEST BDC PLATFORM 3 COMBINED PLATFORM • FSIC I, II, III & IV comprising $13.7B in gross assets • CCT I & II comprising $4.6B in gross assets • 150 sponsors, 325 borrowers INVESTMENT ADVISORS • FS & KKR to seek stockholder approval for joint venture as sole investment advisor (co - advisors on an interim basis) CO - INVESTMENT • Each FSIC fund expects that it will have the ability to co - invest pro rata alongside KKR’s other client accounts upon receiving shareholder approval for new advisory agreements FEES • Management fee for FSIC funds & CCT II to be reduced to 1.50% annually (CCT was reduced to 1.50% at listing) • Enhancing FSIC incentive - fee lookback calculation to remove add - back of management fee 2 3 1 Metrics assume stockholder approval for all funds 2 Look - back provision change becomes effective for quarters ending after January 1, 2018 3 As of September 30, 2017 per Wall Street research and company filings. BDC Platform data representative of reported gross a sse ts. $12.0 $6.0 $4.1 $3.3 $2.2 $2.1 $2.0 $2.0 $1.6 $1.6 FSIC + CCT BDCs Ares Capital Prospect Capital Apollo Invest. Golub Capital Goldman Sachs Solar Capital TCG New Mountain Finance TCP TPG Specialty Lending $18.2 CCT Assets FSIC Assets FSIC I FSIC II FSIC III FSIC IV CCT I CCT II Peer average: $3.7 • 52% larger than closest competitor • 5x larger than peer average

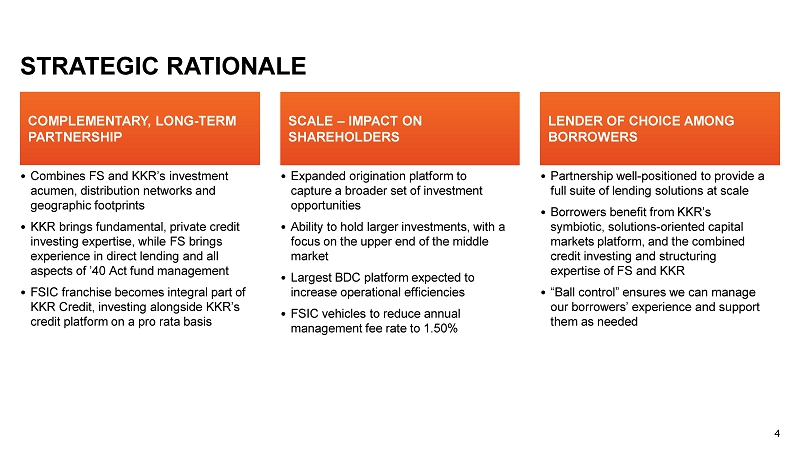

STRATEGIC RATIONALE 4 • Combines FS and KKR’s investment acumen, distribution networks and geographic footprints • KKR brings fundamental, private credit investing expertise, while FS brings experience in direct lending and all aspects of ’40 Act fund management • FSIC franchise becomes integral part of KKR Credit, investing alongside KKR’s credit platform on a pro rata basis • Expanded origination platform to capture a broader set of investment opportunities • Ability to hold larger investments, with a focus on the upper end of the middle market • Largest BDC platform expected to increase operational efficiencies • FSIC vehicles to reduce annual management fee rate to 1.50% • Partnership well - positioned to provide a full suite of lending solutions at scale • Borrowers benefit from KKR’s symbiotic, solutions - oriented capital markets platform, and the combined credit investing and structuring expertise of FS and KKR • “Ball control” ensures we can manage our borrowers’ experience and support them as needed COMPLEMENTARY, LONG - TERM PARTNERSHIP SCALE – IMPACT ON SHAREHOLDERS LENDER OF CHOICE AMONG BORROWERS

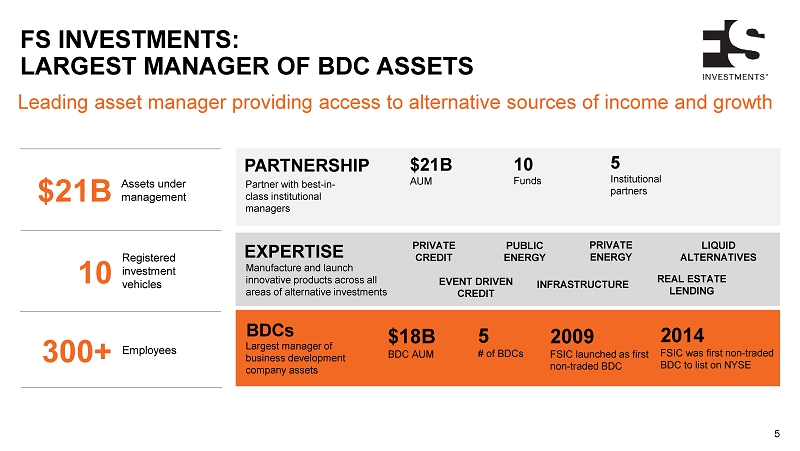

Leading asset manager providing access to alternative sources of income and growth FS INVESTMENTS: LARGEST MANAGER OF BDC ASSETS 5 $21B Assets under management 10 Registered investment vehicles 300+ Employees Partner with best - in - class institutional managers PARTNERSHIP EXPERTISE Manufacture and launch innovative products across all areas of alternative investments Largest manager of business development company assets BDCs $21B AUM 5 # of BDCs 2009 FSIC launched as first non - traded BDC 2014 FSIC was first non - traded BDC to list on NYSE EVENT DRIVEN CREDIT REAL ESTATE LENDING PUBLIC ENERGY PRIVATE ENERGY LIQUID ALTERNATIVES PRIVATE CREDIT INFRASTRUCTURE $18B BDC AUM 10 Funds 5 Institutional partners

KKR – A LEADING ASSET MANAGEMENT PLATFORM 6 Note: AUM and headcount as of September 30, 2017. 1) KKR Capstone is not a subsidiary or affiliate of KKR. Please see Important Information for additional disclosure regarding KK R Capstone, which can be found on slide 12. Founded 1976 $153bn Assets Under Management Stakeholder Management (14 people) Client and Partner Group (~75 people) Global Macro and Asset Allocation (7 people) KKR Global Institute (3 people) KKR Capstone (1) (~50 people) $15bn Internal Balance Sheet Largely Invested Alongside Clients ~360 Investment Professionals 20 Offices Globally Private Equity & Real Assets ~260 investment professionals ($88bn AUM) KKR Credit ~100 investment professionals ($41bn AUM) Capital Markets ~40 capital markets professionals (~$315bn in global refinancings ITD) Hedge Fund Partnerships ($24bn AUM) “One - Firm” Culture – KKR will deliver the resources of the full firm to support the FSIC vehicles

$10bn $24bn 1 Private Credit • Direct Lending • Asset - based Finance • Subordinated Debt $0 $10 $20 $30 $40 $50 $60 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 (Sept 30) 2017 Pro Forma Leveraged Credit Special Situations Private Credit $41bn $55bn 1 KKR Credit Assets Under Management $22bn Leveraged Credit • Leveraged Loans • High Yield Bonds • Opportunistic Credit • CLOs • Revolving Credit $9bn Special Situations • Deep Value • Distressed • Event - Driven KKR CREDIT AUM GROWTH ($BN) 2 CURRENT KKR CREDIT AUM 2 1 Presentation of pro forma AUM as of September 30, 2017 is for illustrative purpose only and assumes that all of FS Investment s’ AUM is in Private Credit. 2 AUM as of September 30, 2017 KKR CREDIT OVERVIEW 7 • Global sourcing platform with investment expertise across the capital structure, covering 150 sponsors • ~100 investment professionals within KKR Credit • Aligned in outcomes – KKR’s Balance Sheet and employees have $2.7 billion committed across KKR Credit • BDCs will allow KKR to continue to invest in and expand its direct origination capabilities IMPACT ON BDCs

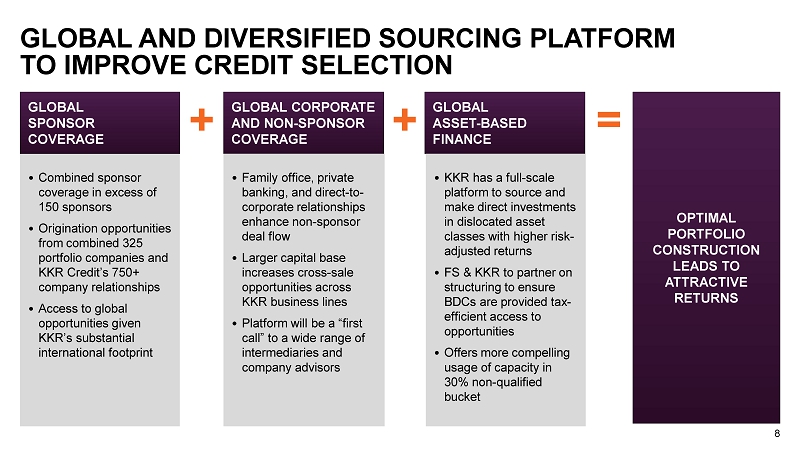

GLOBAL AND DIVERSIFIED SOURCING PLATFORM TO IMPROVE CREDIT SELECTION 8 GLOBAL CORPORATE AND NON - SPONSOR COVERAGE GLOBAL ASSET - BASED FINANCE • Combined sponsor coverage in excess of 150 sponsors • Origination opportunities from combined 325 portfolio companies and KKR Credit’s 750+ company relationships • Access to global opportunities given KKR’s substantial international footprint • KKR has a full - scale platform to source and make direct investments in dislocated asset classes with higher risk - adjusted returns • FS & KKR to partner on structuring to ensure BDCs are provided tax - efficient access to opportunities • Offers more compelling usage of capacity in 30% non - qualified bucket • Family office, private banking, and direct - to - corporate relationships enhance non - sponsor deal flow • Larger capital base increases cross - sale opportunities across KKR business lines • Platform will be a “first call” to a wide range of intermediaries and company advisors GLOBAL SPONSOR COVERAGE OPTIMAL PORTFOLIO CONSTRUCTION LEADS TO ATTRACTIVE RETURNS = + +

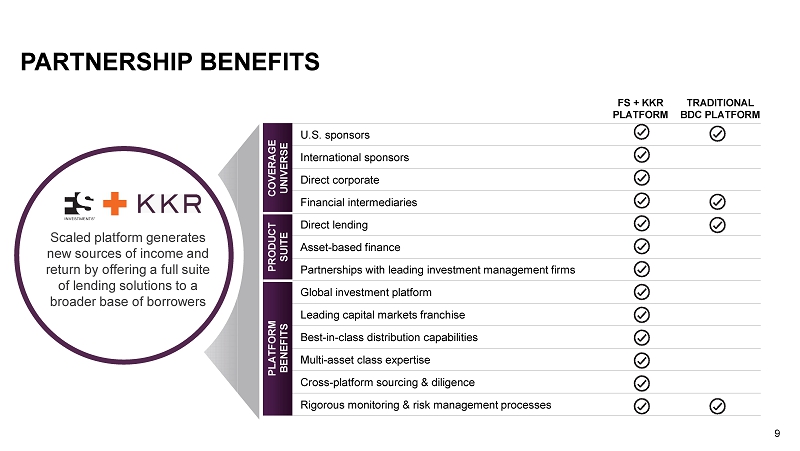

9 PARTNERSHIP BENEFITS Scaled platform generates new sources of income and return by offering a full suite of lending solutions FS + KKR PLATFORM TRADITIONAL BDC PLATFORM COVERAGE UNIVERSE U.S. sponsors International sponsors Direct corporate Financial intermediaries PRODUCT SUITE Direct lending Asset - based finance Partnerships with leading investment management firms PLATFORM BENEFITS Global investment platform Leading capital market s franchise Best - in - class distribution capabilities Multi - asset class expertise Cross - platform sourcing & diligence Rigorous monitoring & risk management processes Scaled platform generates new sources of income and return by offering a full suite of lending solutions to a broader base of borrowers

THE PATH FORWARD COMMITTED TO A SEAMLESS TRANSITION FOR INVESTORS 10 TRANSITION PERIOD STRATEGIC PARTNERSHIP CURRENT • FS will serve as adviser • GSO serves as sub - adviser up until April 2018 • KKR (or its affiliates) will provide sourcing and administrative services to FS • Enhanced joint platform • FS & KKR will serve as co - advisers • FSIC & CCT BDCs will co - invest pro rata alongside KKR’s other client accounts in private credit opportunities • FS served as adviser • GSO served as sub - adviser FSIC CCT • FS & KKR will turn attention toward deriving the full benefits of platform including through the evaluation of mergers and liquidity events for non - traded vehicles

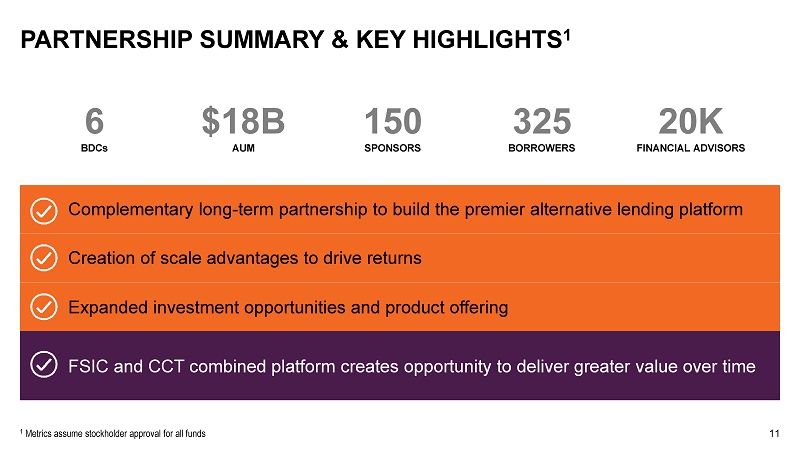

PARTNERSHIP SUMMARY & KEY HIGHLIGHTS 1 11 Complementary long - term partnership to build the premier alternative lending platform Creation of scale advantages to drive returns Expanded investment opportunities and product offering FSIC and CCT combined platform creates opportunity to deliver greater value over time 6 BDCs $18B AUM 150 SPONSORS 325 BORROWERS 20K FINANCIAL ADVISORS 1 Metrics assume stockholder approval for all funds

DISCLOSURES FORWARD - LOOKING STATEMENTS This presentation may contain certain “forward - looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future perf orm ance or operations of FS Investment Corporation (“FSIC”), FS Investment Corporation II, FS Investment Corporation III, FS Investment Corporation IV, Corporate Capital Trust, Inc. (“CCT”) and Corporate Capital Trust I I ( collectively, the “Funds”). Words such as “believes,” “expects,” “projects,” and “future” or similar expressions are intended to identify forward - looking statements. These forward - looking statements are subject to the inh erent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward - looking statements. Factors that could cause actual re sults to differ materially include changes in the economy, risks associated with possible disruption to a Fund’s operations or the economy generally due to terrorism or natural disasters, future changes in laws or r egu lations and conditions in a Fund’s operating area, and the price at which shares of FSIC’s or CCT’s common stock trade on the New York Stock Exchange. Some of these factors are enumerated in the filings the Funds makes wit h the Securities and Exchange Commission (the “SEC”) and will also be contained in the Proxy Statements (as defined below) when such documents become available. The inclusion of forward - looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward - looking statements speak only as of the date of this communication. The Funds undertake no obligation to u pdate or revise any forward - looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward - looking statements. ADDITIONAL INFORMATION AND WHERE TO FIND IT This presentation relates to proposed new investment advisory agreements for certain of the Funds (collectively, the “Proposa ls” ). In connection with the Proposals, certain Funds intend to file relevant materials with the SEC, including a proxy statement on Schedule 14A (each a “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Sec urities Act of 1933, as amended. STOCKHOLDERS OF THE FUNDS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING ANY PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATIO N A BOUT THE PROPOSALS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC's web site, www.sec.gov and from FS Investments’ website at www.fsinvestments.com or CCT’s website at www.corporatecapitaltrust.com . PARTICIPANTS IN THE SOLICITATIONS The Funds and their respective directors, trustees, executive officers and certain other members of management and employees, in cluding employees of FS Investments, KKR & Co. L.P. and their respective affiliates, may be deemed to be participants in the solicitation of proxies from the stockholders of the Funds in connection with the Pro pos als. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Funds’ stockholders in connection with the Proposals will be contained in the Proxy S tat ements when such documents become available. These documents may be obtained free of charge from the sources indicated above. KKR CAPSTONE References to “KKR Capstone” or “Capstone” are to all or any of KKR Capstone Americas LLC, KKR Capstone EMEA LLP, KKR Capston e E MEA (International) LLP, KKR Capstone Asia Limited, and their affiliates, each of which are owned and controlled by their senior management. KKR Capstone is not a subsidiary or affiliate of KKR. KKR Capst one operates under several consulting agreements with KKR and uses the “KKR” name under license from KKR. References to operating executives, operating experts, or operating consultants are to employees of K KR Capstone and not to employees of KKR. 12