Exhibit 99.2 Building a Leading ENT / Allergy Specialty Company Corporate Presentation M a r c h 6 , 2 0 1 9

Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: potential benefits of XHANCE® and our EDS technology; potential drivers of XHANCE growth; the timing of XHANCE sales force expansion, the availability of 7-day samples and the initiation of a DTC pilot; market access objectives; potential effects of INS market seasonality on XHANCE prescriptions; the initiation and timing of clinical trials for chronic sinusitis; projected 2019 operating expenses and stock-based compensation; expectations regarding average revenue per prescription in 2019; and other statements regarding our future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: physician and patient acceptance of XHANCE; our ability to obtain, maintain and increase insurance coverage for XHANCE (market access); our ability to grow XHANCE prescriptions and become profitable; uncertainties and delays relating to the initiation, enrollment, completion and results of clinical trials; market opportunities for XHANCE may be smaller than we believe; unexpected costs and expenses; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise. 2

Optinose Key Priorities Continue to drive XHANCE® prescription growth Advance our XHANCE clinical program for a follow-on indication for the treatment of Chronic Sinusitis Support our commercial and development objectives through efficient use of capital ■ $201 Million of cash as of December 31, 2018 3

XHANCE Launch Update

Key Levers to Continue to Drive XHANCE Growth Continued Execution of Strategy (Defined Appropriate Patient Type, Enhanced Efficacy Message & Affordability Program) Sales Force Expansion 7-Day Samples Increase Payer Coverage Direct to Consumer Pilot 5

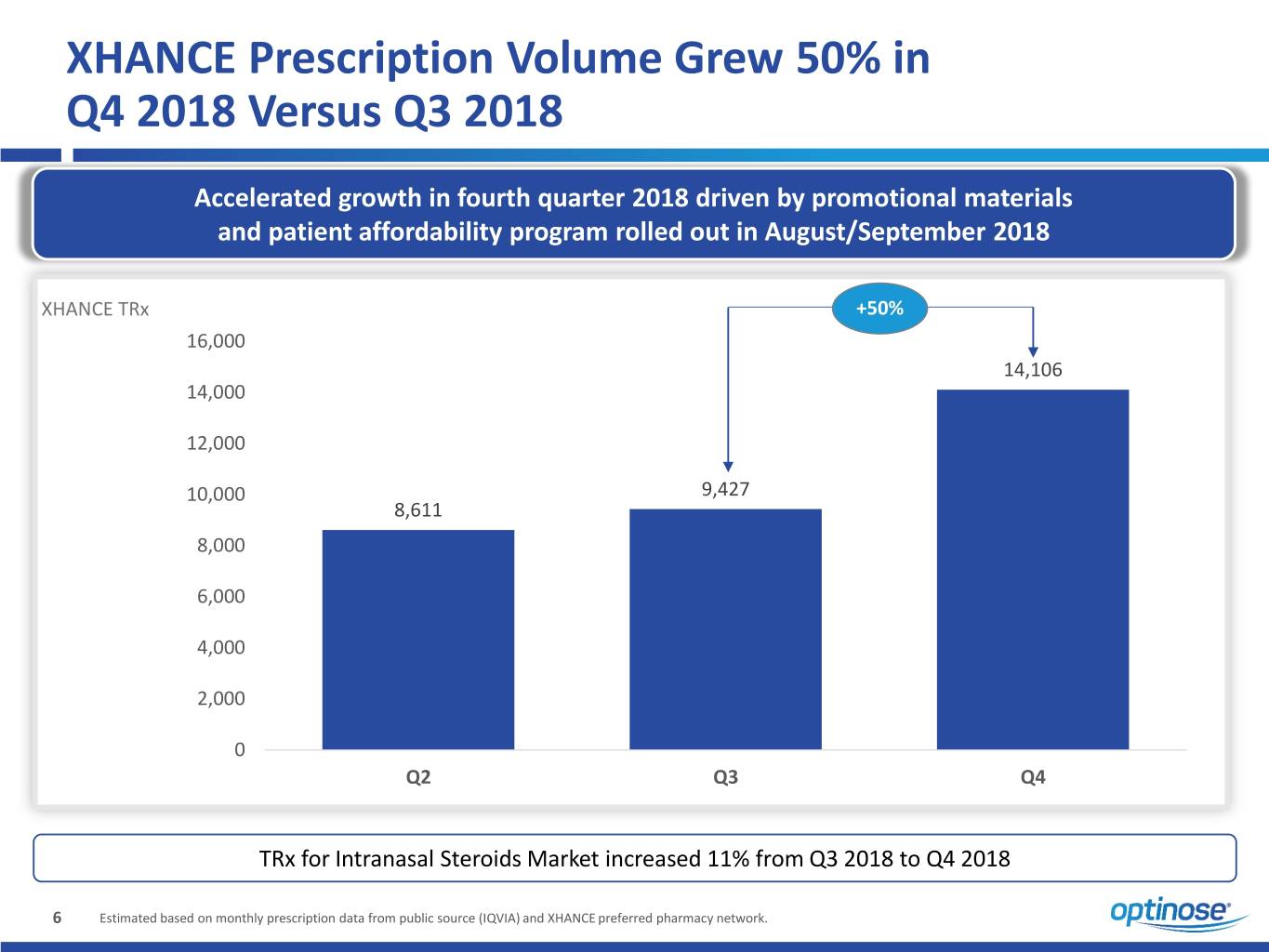

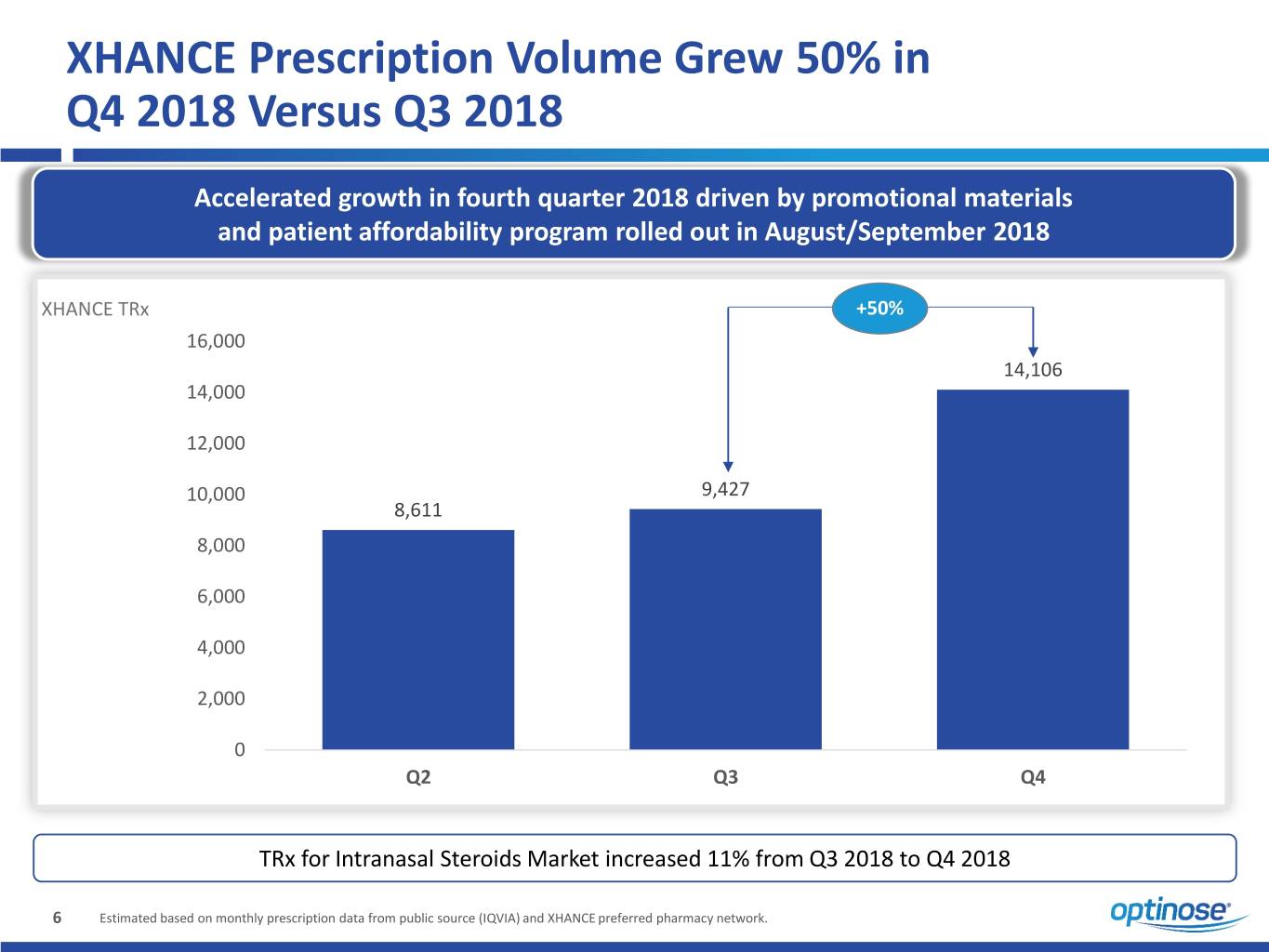

XHANCE Prescription Volume Grew 50% in Q4 2018 Versus Q3 2018 Accelerated growth in fourth quarter 2018 driven by promotional materials and patient affordability program rolled out in August/September 2018 XHANCE TRx +50% 16,000 14,106 14,000 12,000 10,000 9,427 8,611 8,000 6,000 4,000 2,000 0 Q2 Q3 Q4 TRx for Intranasal Steroids Market increased 11% from Q3 2018 to Q4 2018 6 Estimated based on monthly prescription data from public source (IQVIA) and XHANCE preferred pharmacy network.

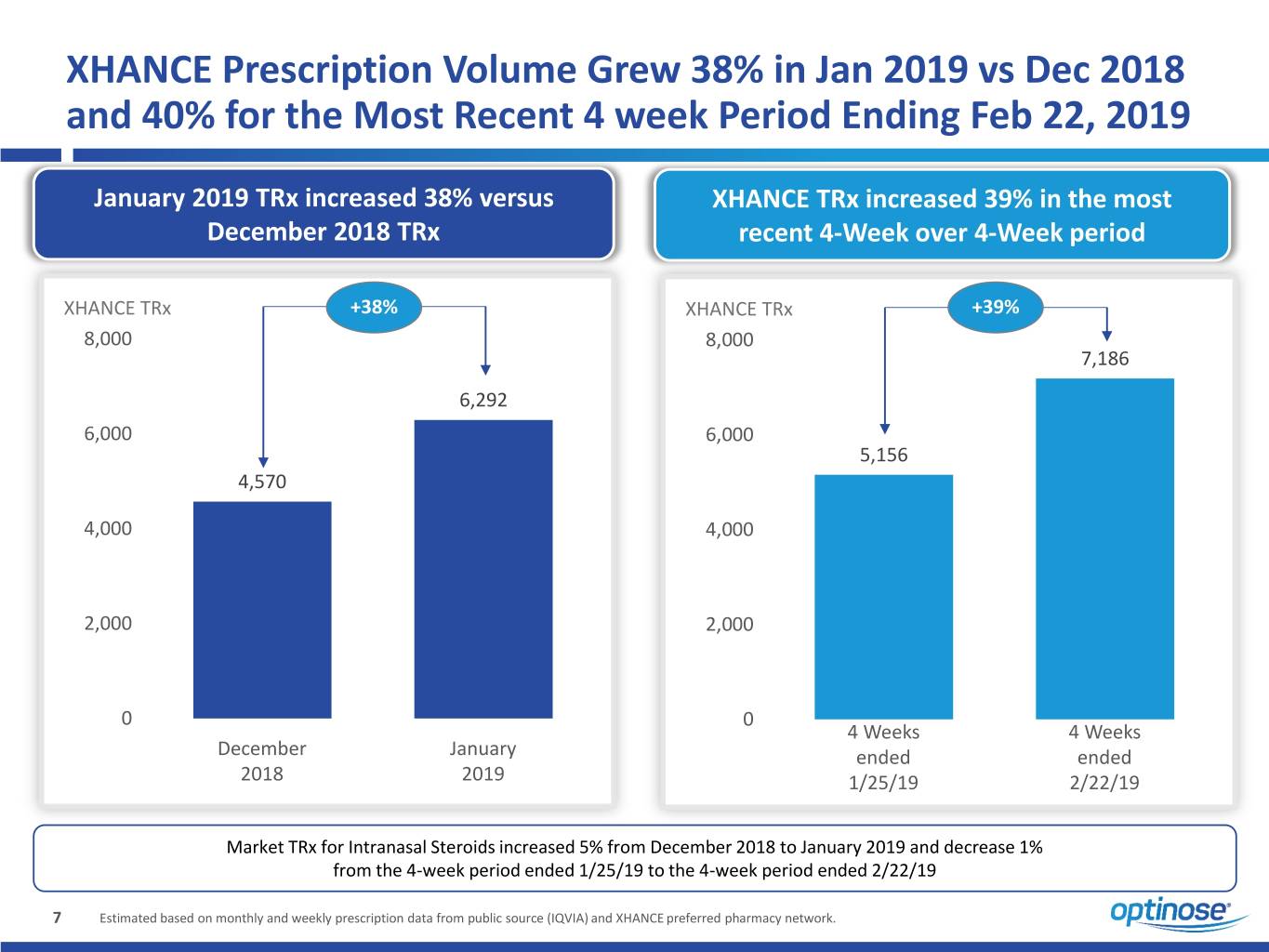

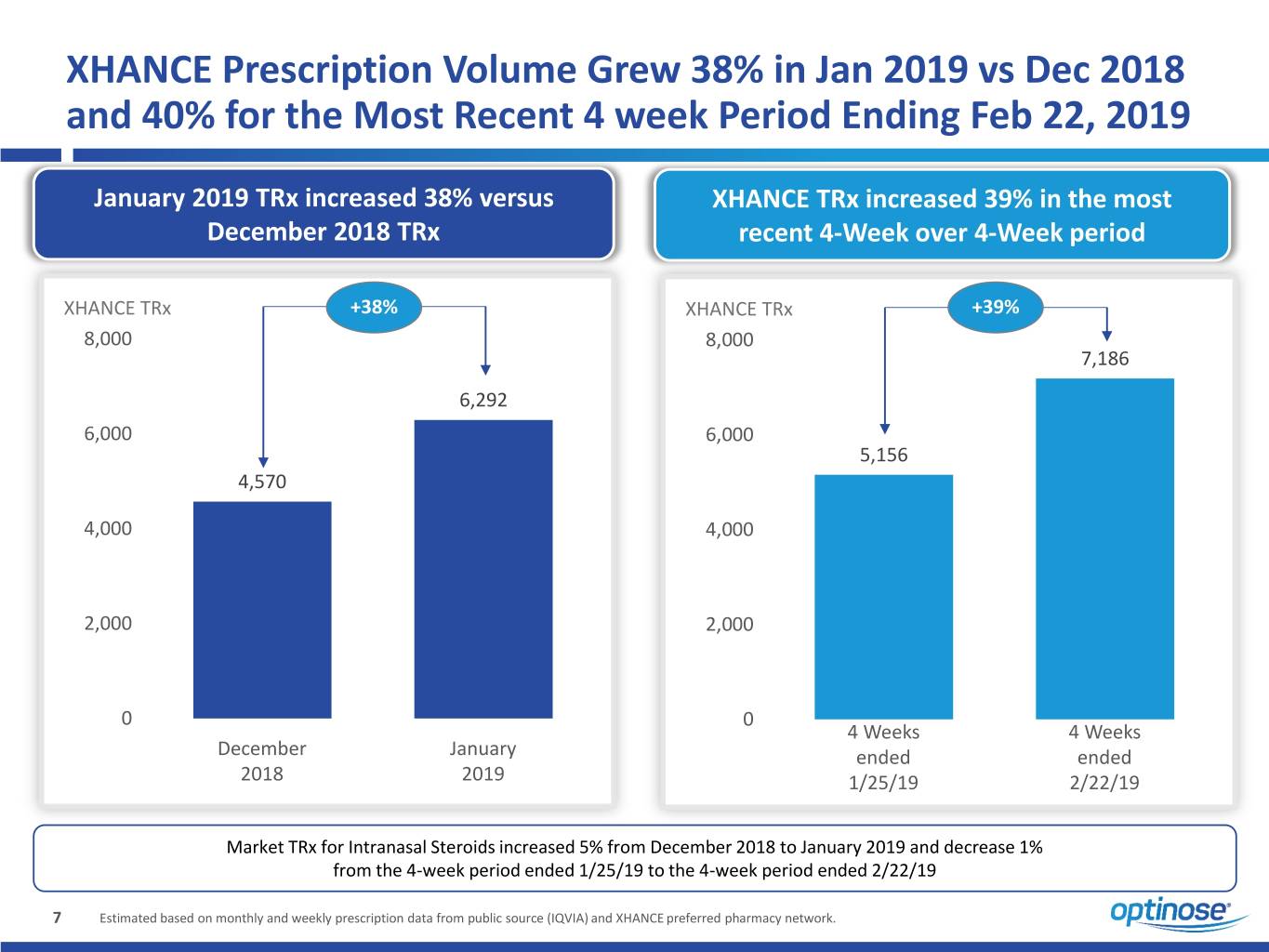

XHANCE Prescription Volume Grew 38% in Jan 2019 vs Dec 2018 and 40% for the Most Recent 4 week Period Ending Feb 22, 2019 January 2019 TRx increased 38% versus XHANCE TRx increased 39% in the most December 2018 TRx recent 4-Week over 4-Week period XHANCE TRx +38% XHANCE TRx +39% 8,000 8,000 7,186 6,292 6,000 6,000 5,156 4,570 4,000 4,000 2,000 2,000 0 0 4 Weeks 4 Weeks December January ended ended 2018 2019 1/25/19 2/22/19 Market TRx for Intranasal Steroids increased 5% from December 2018 to January 2019 and decrease 1% from the 4-week period ended 1/25/19 to the 4-week period ended 2/22/19 7 Estimated based on monthly and weekly prescription data from public source (IQVIA) and XHANCE preferred pharmacy network.

Additional Commercial Updates Market Access Sales Force Expansion ▪ Nationally, we believe more than 75% of ▪ Expect to deploy Territory Managers in commercial lives are in a plan where new territories in April XHANCE is covered in a Tier 3 formulary ▪ Increase of ~25% in deployed territories position* Direct to Consumer 7-Day Sample ▪ Expect to initiate DTC pilot in 2019 ▪ Expected availability of 7-Day XHANCE ▪ Will include broadcast in three cities sample in 2Q 2019 * Estimated based on third party syndicated data and internal analyses as of December 31, 2018. Coverage is subject to change. 8

Q4 2018 Financial Update

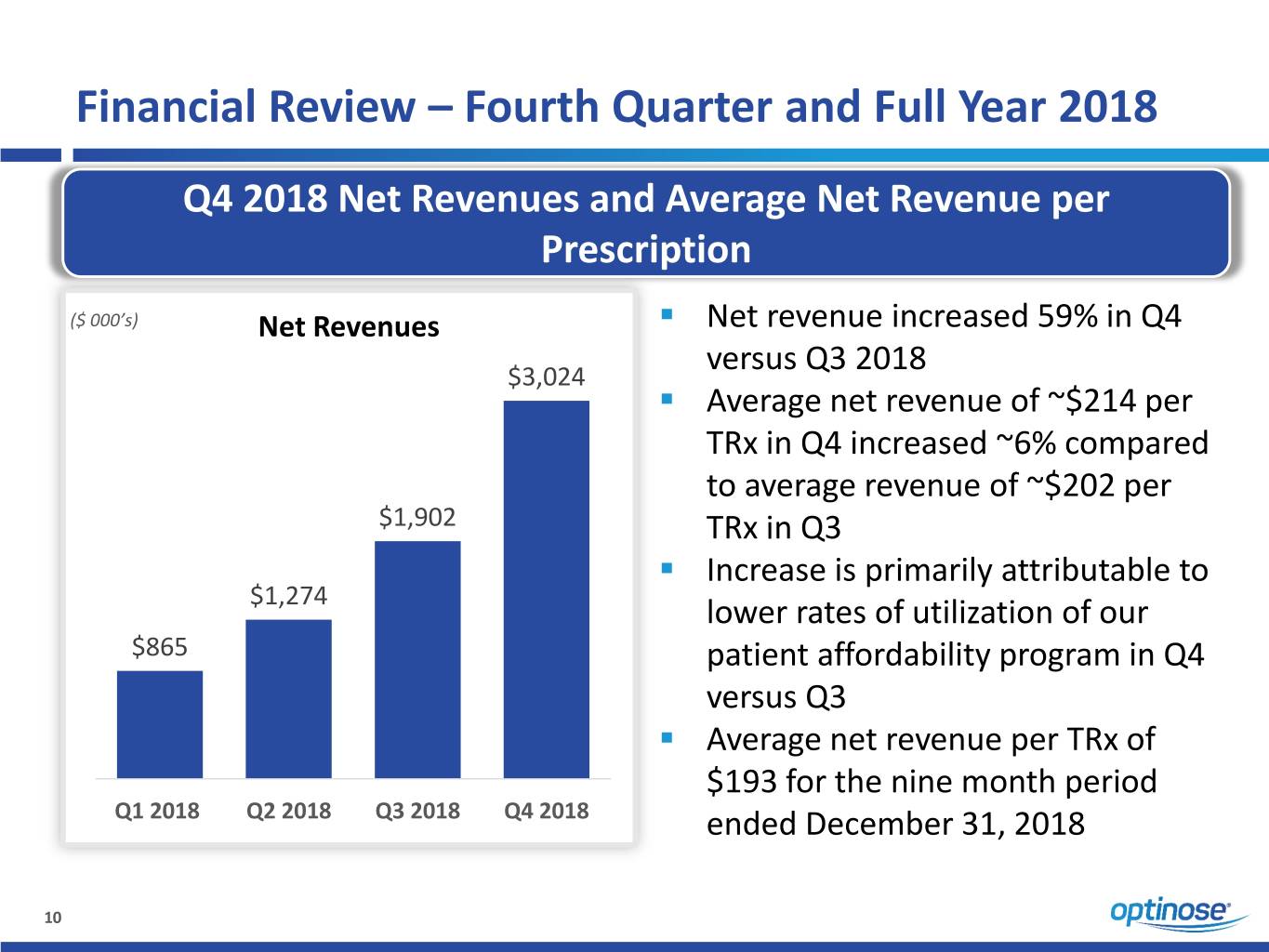

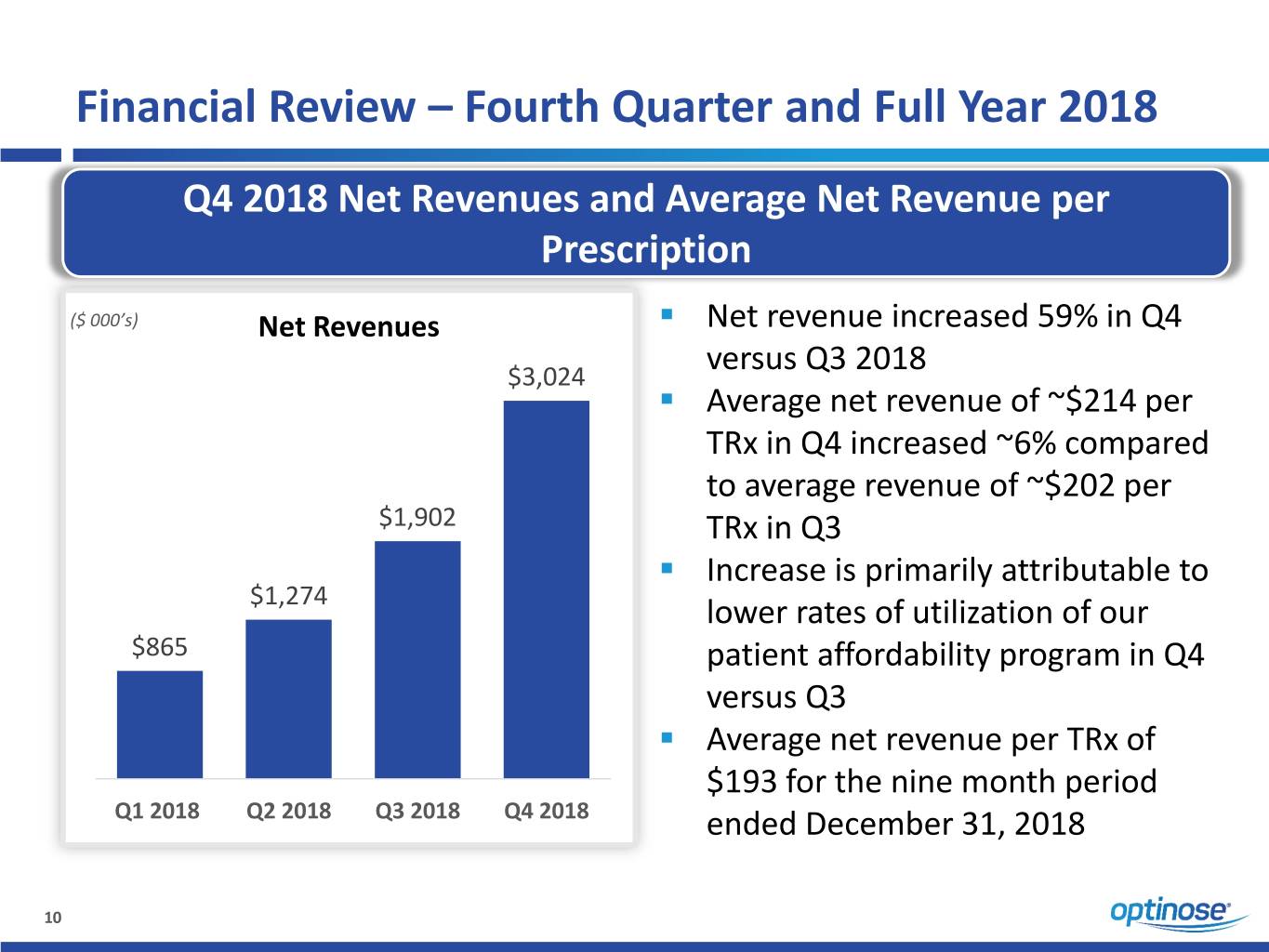

Financial Review – Fourth Quarter and Full Year 2018 Q4 2018 Net Revenues and Average Net Revenue per Prescription ▪ ($ 000’s) Net Revenues Net revenue increased 59% in Q4 versus Q3 2018 $3,024 ▪ Average net revenue of ~$214 per TRx in Q4 increased ~6% compared to average revenue of ~$202 per $1,902 TRx in Q3 ▪ Increase is primarily attributable to $1,274 lower rates of utilization of our $865 patient affordability program in Q4 versus Q3 ▪ Average net revenue per TRx of $193 for the nine month period Q1 2018 Q2 2018 Q3 2018 Q4 2018 ended December 31, 2018 10

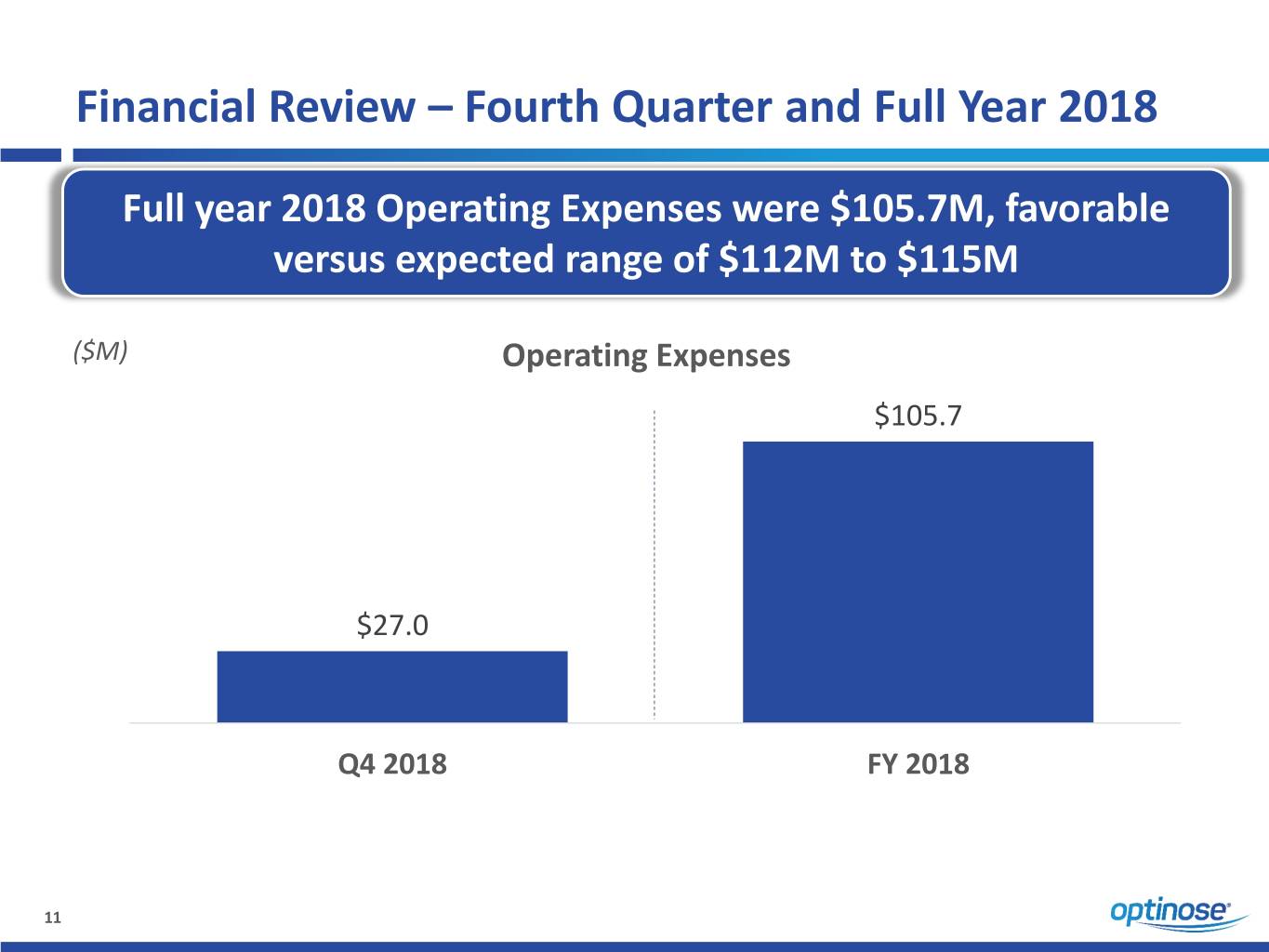

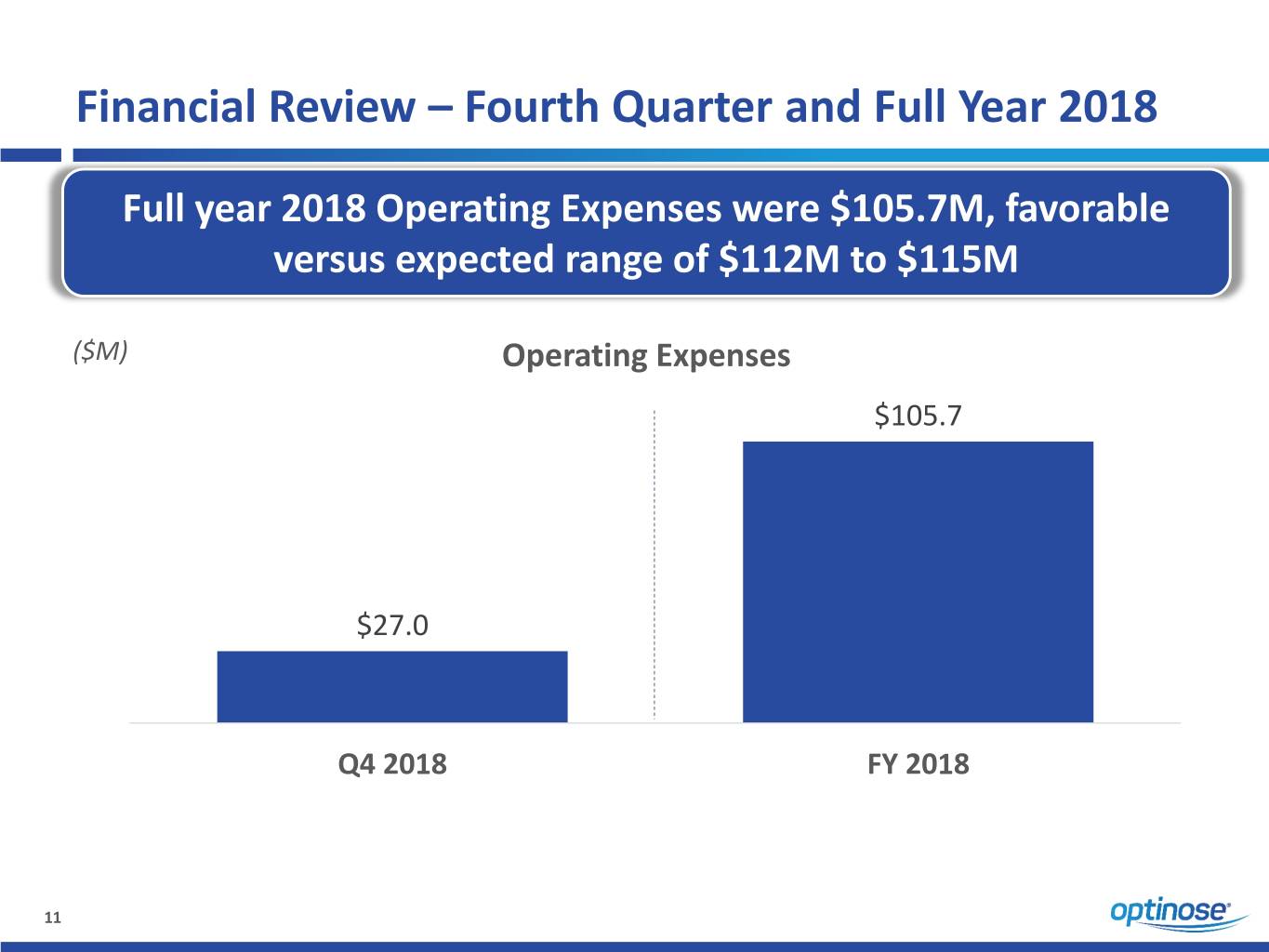

Financial Review – Fourth Quarter and Full Year 2018 Full year 2018 Operating Expenses were $105.7M, favorable versus expected range of $112M to $115M ($M) Operating Expenses $105.7 $27.0 Q4 2018 FY 2018 11

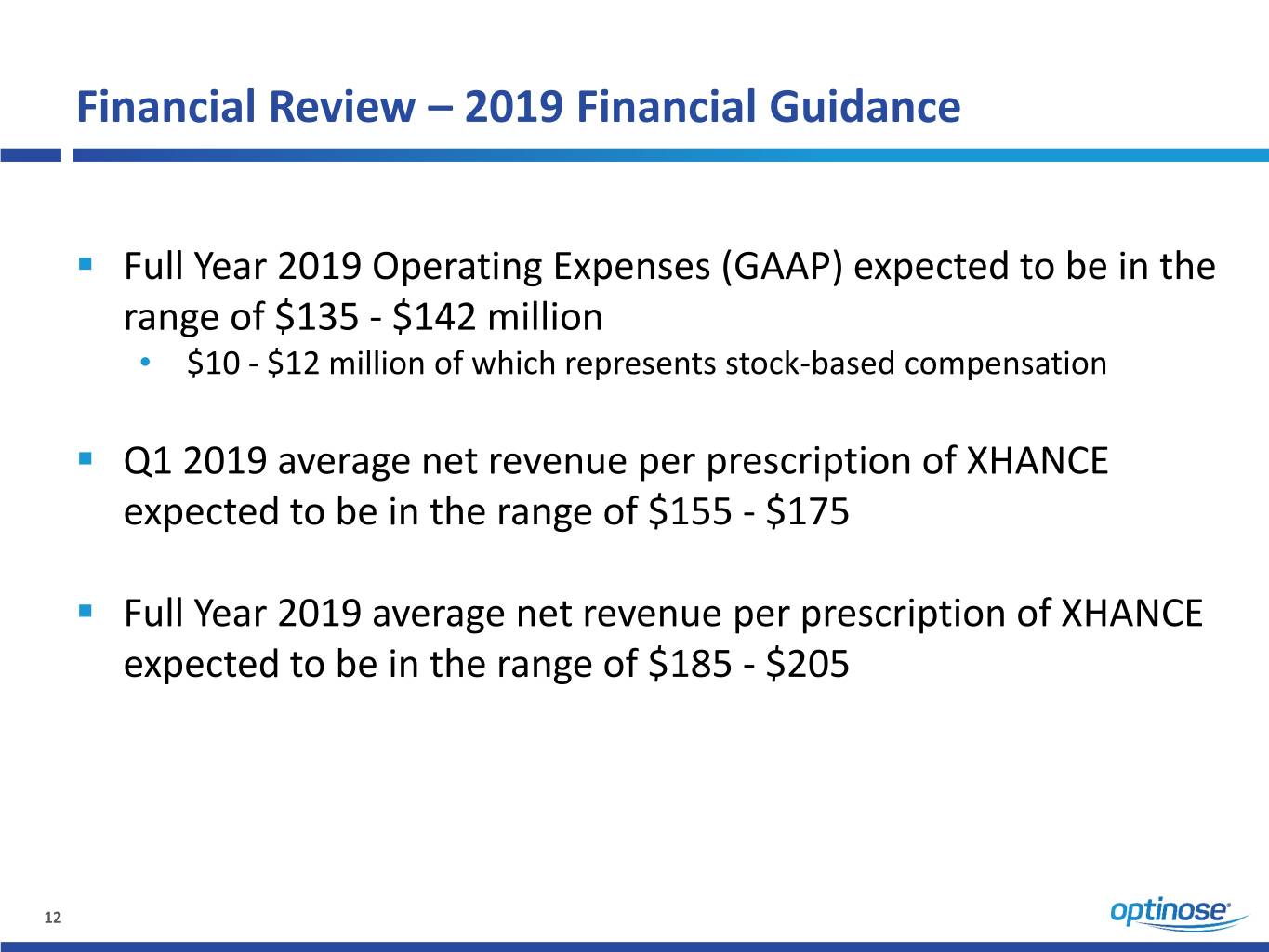

Financial Review – 2019 Financial Guidance ▪ Full Year 2019 Operating Expenses (GAAP) expected to be in the range of $135 - $142 million • $10 - $12 million of which represents stock-based compensation ▪ Q1 2019 average net revenue per prescription of XHANCE expected to be in the range of $155 - $175 ▪ Full Year 2019 average net revenue per prescription of XHANCE expected to be in the range of $185 - $205 12

Pipeline Update

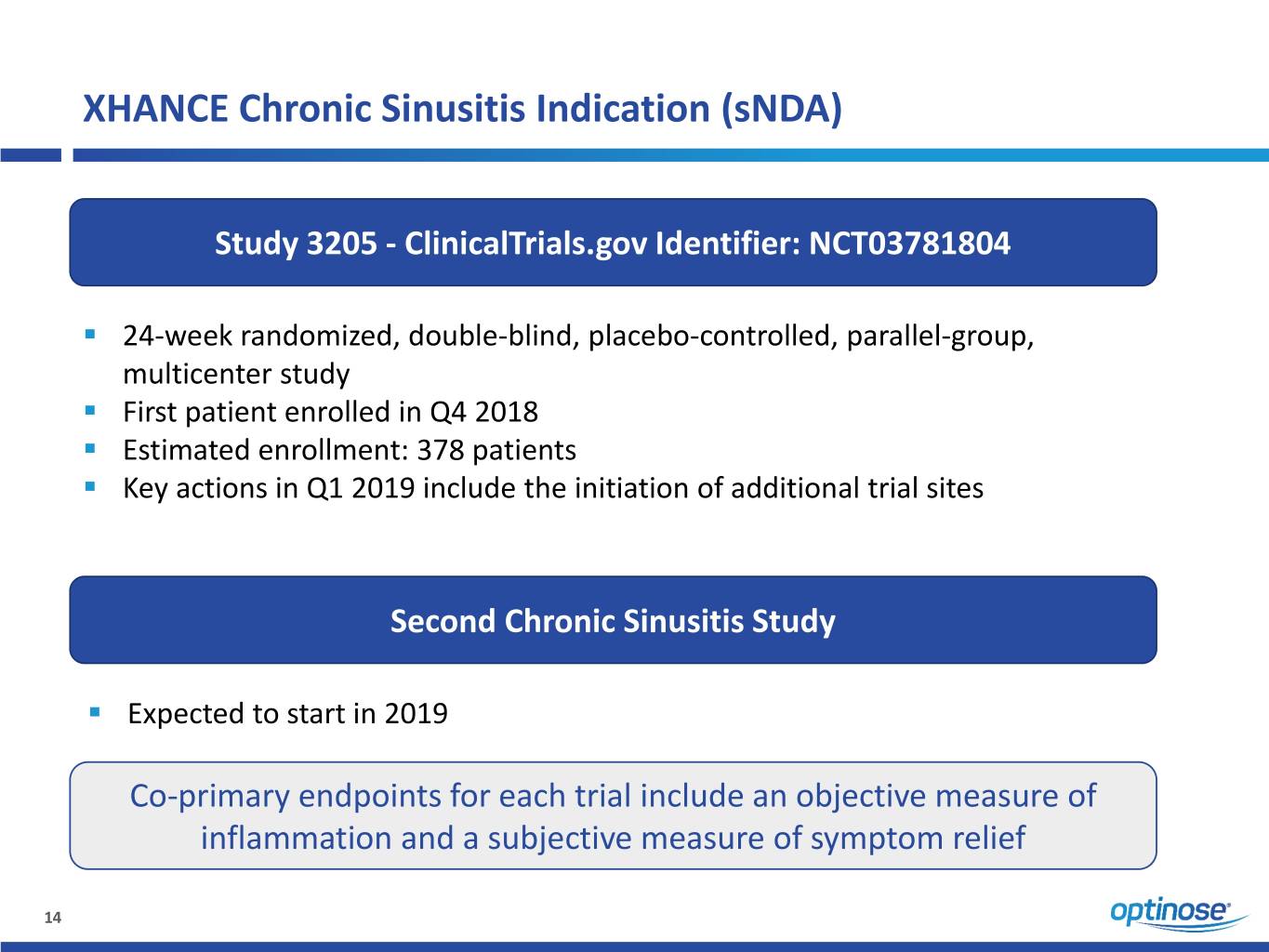

XHANCE Chronic Sinusitis Indication (sNDA) Study 3205 - ClinicalTrials.gov Identifier: NCT03781804 ▪ 24-week randomized, double-blind, placebo-controlled, parallel-group, multicenter study ▪ First patient enrolled in Q4 2018 ▪ Estimated enrollment: 378 patients ▪ Key actions in Q1 2019 include the initiation of additional trial sites Second Chronic Sinusitis Study ▪ Expected to start in 2019 Co-primary endpoints for each trial include an objective measure of inflammation and a subjective measure of symptom relief 14

Closing Remarks

Building a leading ENT/Allergy Specialty Company XHANCE® represents a significant opportunity in the ENT/Allergy market with the current indication Potential for CS indication provides pipeline value Additional business development expected to focus on leveraging ENT/Allergy infrastructure and expertise Recent license with Inexia demonstrates ability to add value from technology applications outside ENT/Allergy $201 million of cash as of December 31, 2018 16

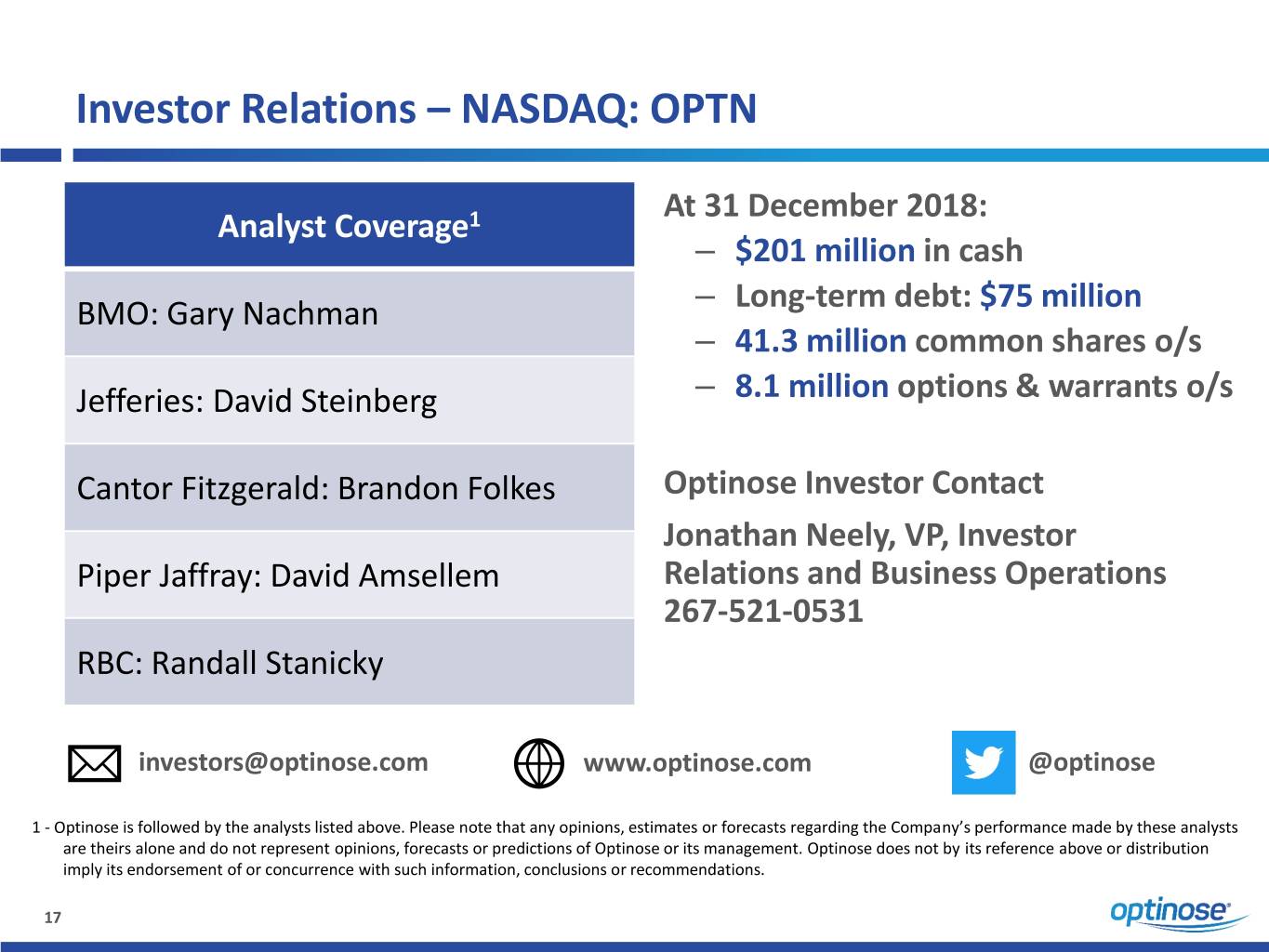

Investor Relations – NASDAQ: OPTN At 31 December 2018: Analyst Coverage1 – $201 million in cash – Long-term debt: $75 million BMO: Gary Nachman – 41.3 million common shares o/s Jefferies: David Steinberg – 8.1 million options & warrants o/s Cantor Fitzgerald: Brandon Folkes Optinose Investor Contact Jonathan Neely, VP, Investor Piper Jaffray: David Amsellem Relations and Business Operations 267-521-0531 RBC: Randall Stanicky investors@optinose.com www.optinose.com @optinose 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. 17

Building a Leading ENT / Allergy Specialty Company Corporate Presentation M a r c h 6 , 2 0 1 9