Exhibit 99.1 Building a Leading ENT / Allergy Specialty Company Corporate Presentation November 5, 2020

Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: impact of, our plans regarding and the uncertainties caused by, the COVID-19 pandemic; potential for continued XHANCE growth, potential growth drivers and market opportunity; prescription, refill, prescribing frequency and market share trends; potential effects of INS market seasonality on XHANCE prescriptions; projected operating expenses and stock-based compensation for 2020; the Company's plans to seek, and the potential benefits of, a follow-on indication for XHANCE for chronic sinusitis (CS); the expectation of top line results from both CS trials in second half 2021; the expectation to draw additional $20M from debt facility by early 2021; the potential benefits of promotional activities by kaléo; the Company’s development plans and objectives for OPN-019, the potential benefits of OPN-019 and the Company’s intention to fund initial development of OPN-019 within its current operating expense plan and to seek grants, partnerships and/or other sources of capital to fund future development; and other statements regarding the Company’s future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: the extent and duration of the impact of the COVID-19 pandemic on the Company’s business, results of operations and financial condition; physician and patient acceptance of XHANCE; the Company’s ability to maintain adequate third party reimbursement for XHANCE (market access); the Company’s ability to grow XHANCE prescriptions, net revenues, market share and prescriber breadth and depth; market opportunities for XHANCE may be smaller than expected; the effectiveness of kaléo’s sales representatives in promoting XHANCE; uncertainties and delays relating to product development, the initiation, enrollment, completion and results of clinical trials and regulatory approval process; unexpected costs and expenses; the ability to satisfy the conditions for additional funds under the Pharmakon note purchase agreement and ability to comply with the covenants and other terms of the agreement; risks and uncertainties relating to intellectual property; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward- looking statements, whether as a result of new information, future developments or otherwise. 2

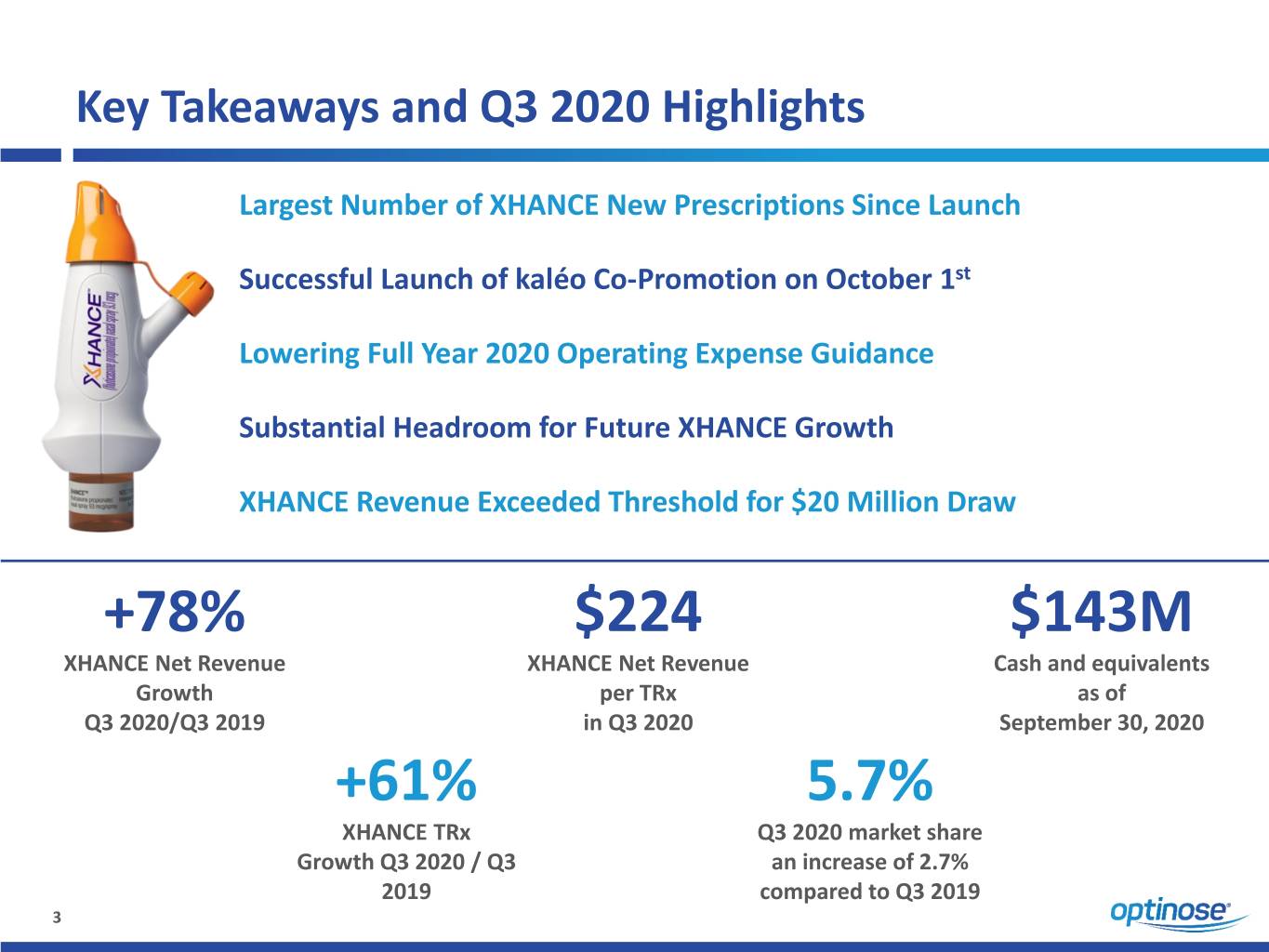

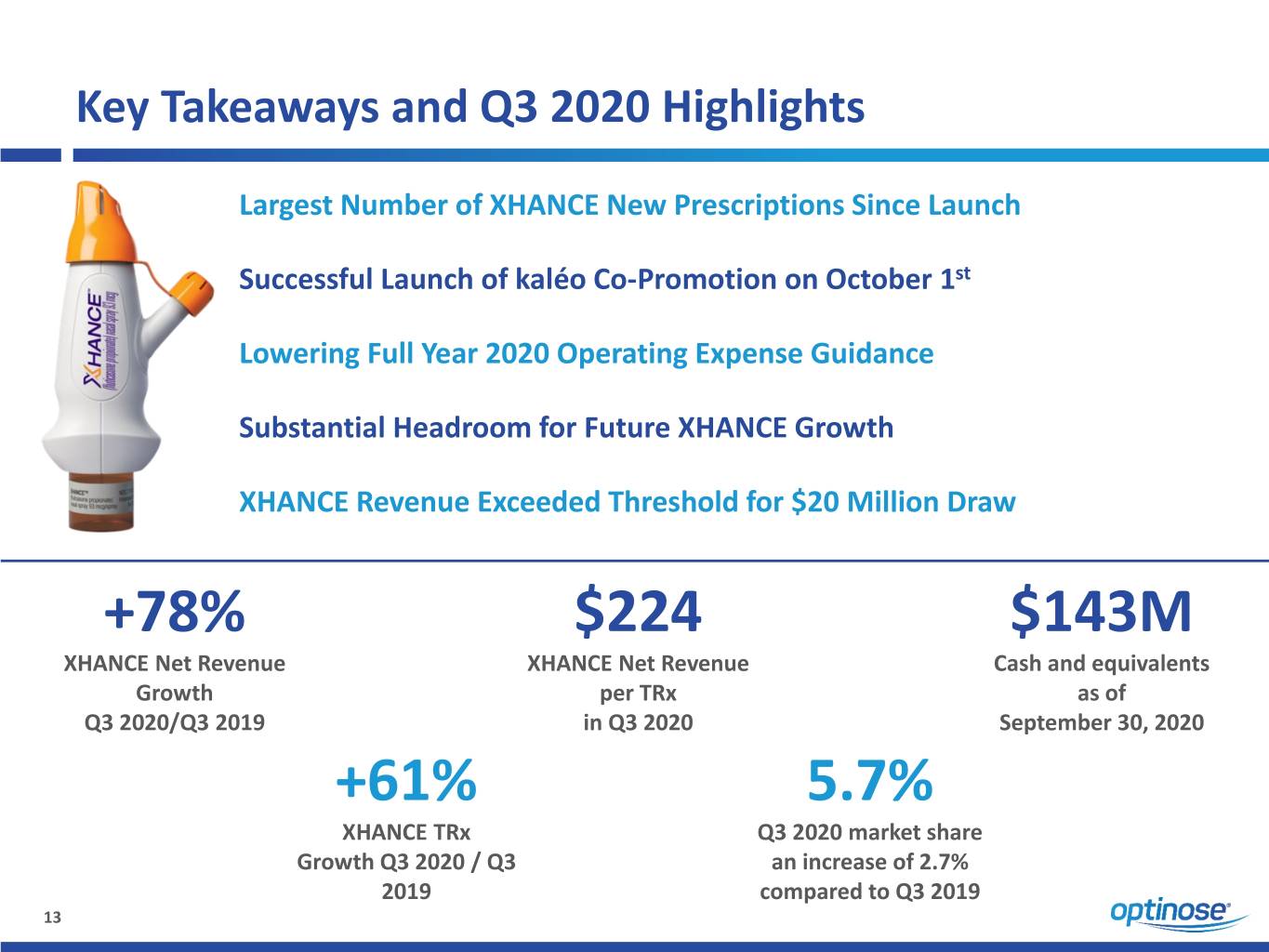

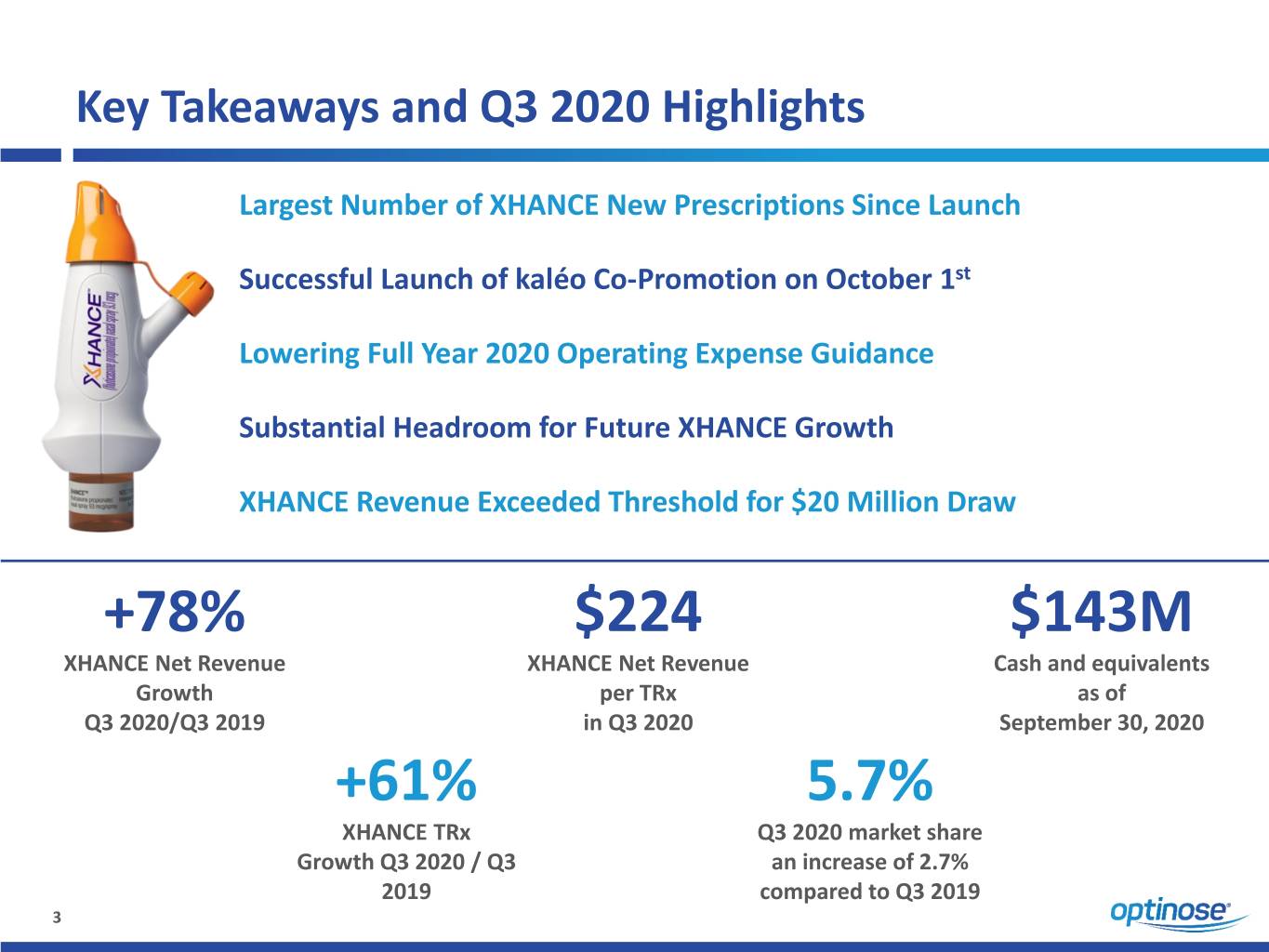

Key Takeaways and Q3 2020 Highlights Largest Number of XHANCE New Prescriptions Since Launch Successful Launch of kaléo Co-Promotion on October 1st Lowering Full Year 2020 Operating Expense Guidance Substantial Headroom for Future XHANCE Growth XHANCE Revenue Exceeded Threshold for $20 Million Draw +78% $224 $143M XHANCE Net Revenue XHANCE Net Revenue Cash and equivalents Growth per TRx as of Q3 2020/Q3 2019 in Q3 2020 September 30, 2020 +61% 5.7% XHANCE TRx Q3 2020 market share Growth Q3 2020 / Q3 an increase of 2.7% 2019 compared to Q3 2019 3

XHANCE Launch Update

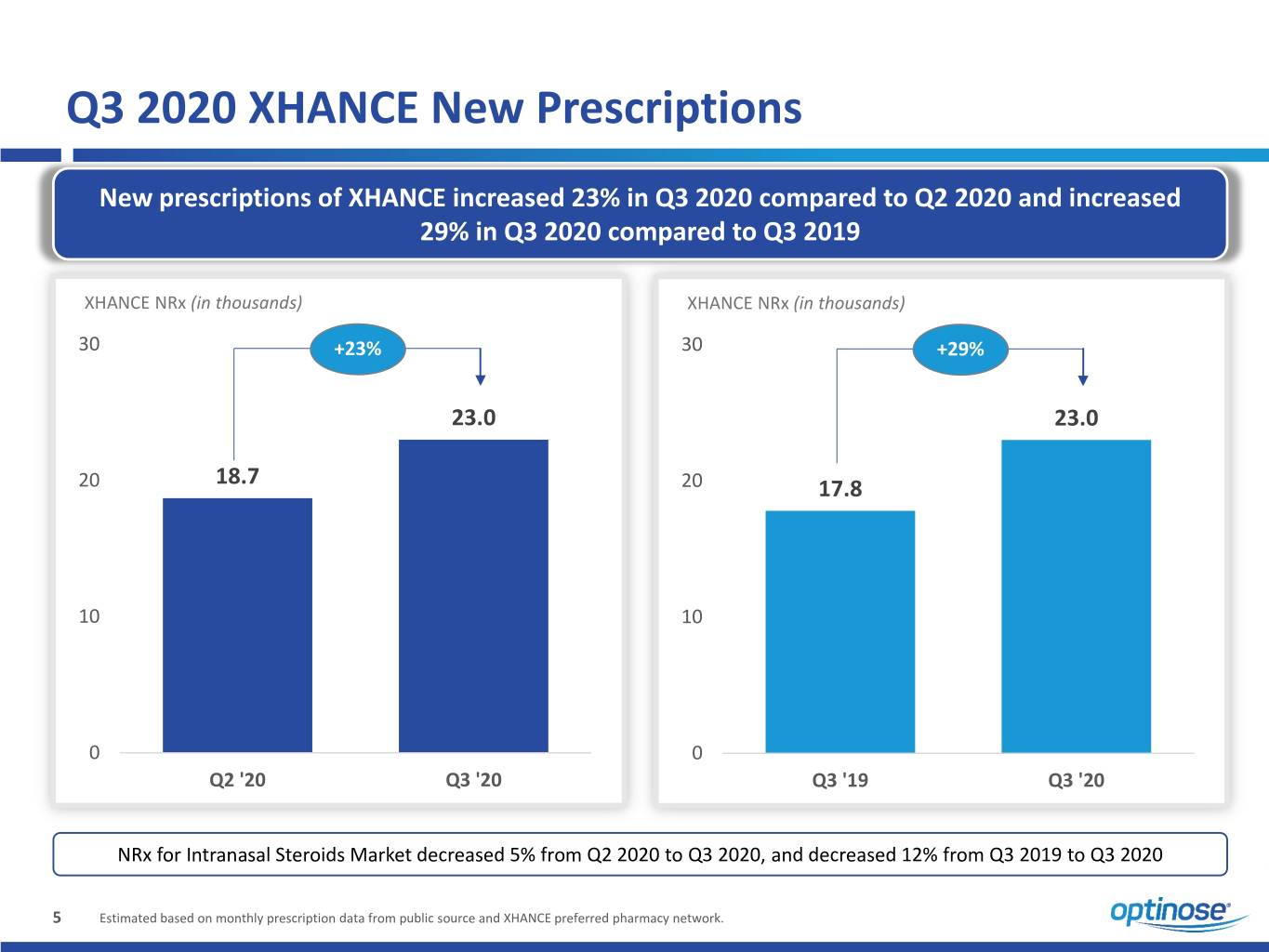

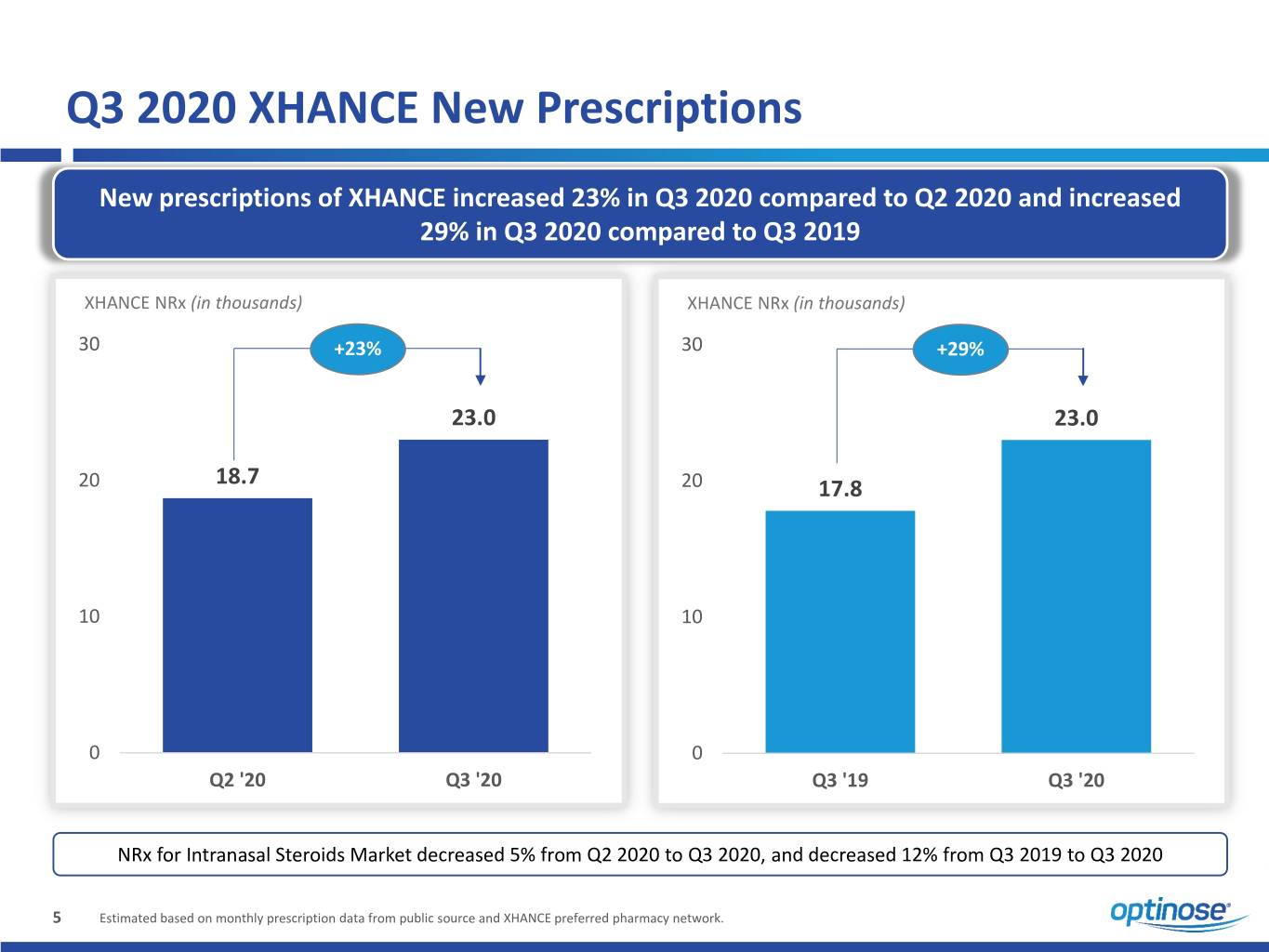

Q3 2020 XHANCE New Prescriptions New prescriptions of XHANCE increased 23% in Q3 2020 compared to Q2 2020 and increased 29% in Q3 2020 compared to Q3 2019 XHANCE NRx (in thousands) XHANCE NRx (in thousands) 30 +23% 30 +29% 23.0 23.0 18.7 20 20 17.8 10 10 0 0 Q2 '20 Q3 '20 Q3 '19 Q3 '20 NRx for Intranasal Steroids Market decreased 5% from Q2 2020 to Q3 2020, and decreased 12% from Q3 2019 to Q3 2020 5 Estimated based on monthly prescription data from public source and XHANCE preferred pharmacy network.

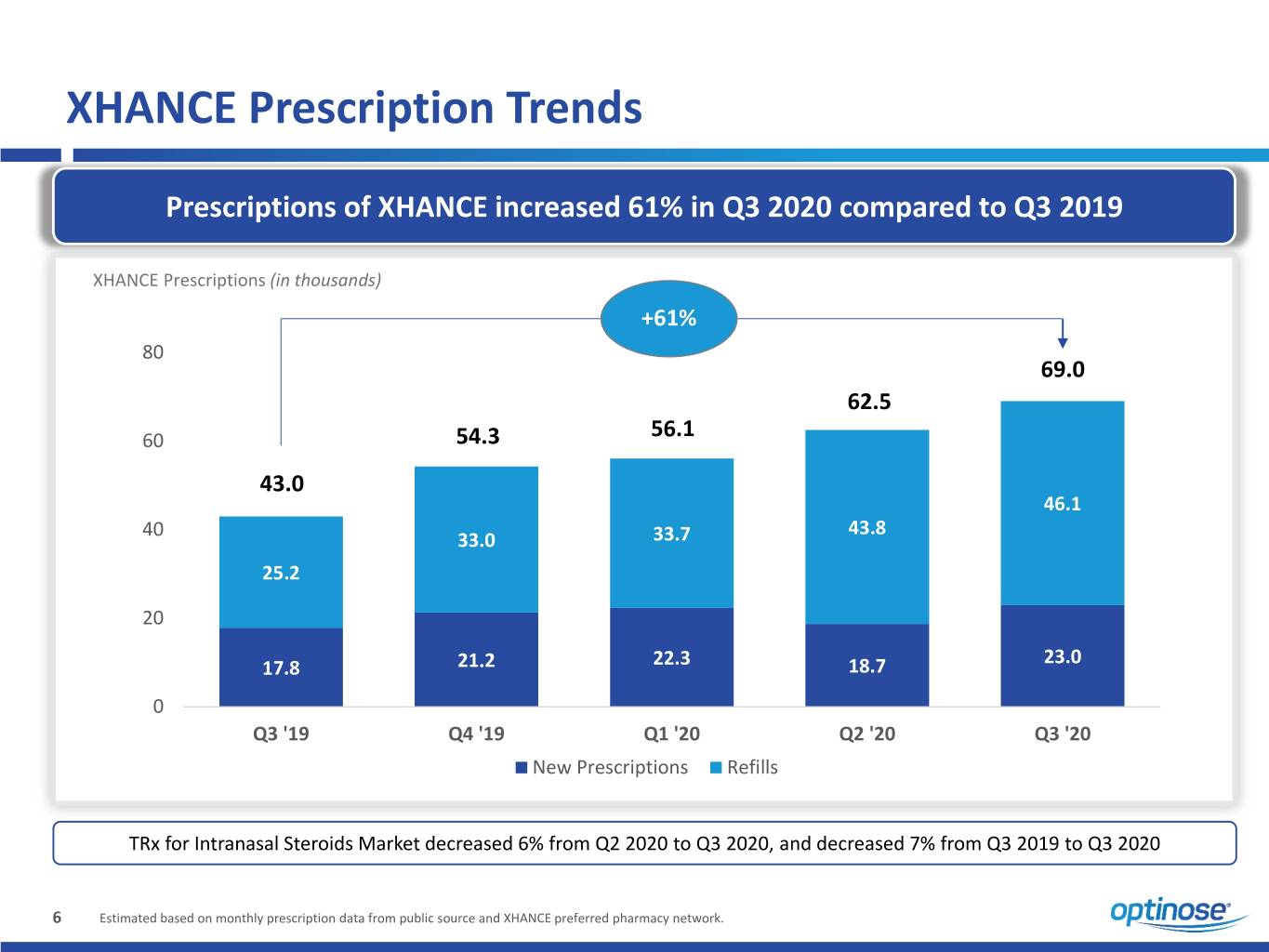

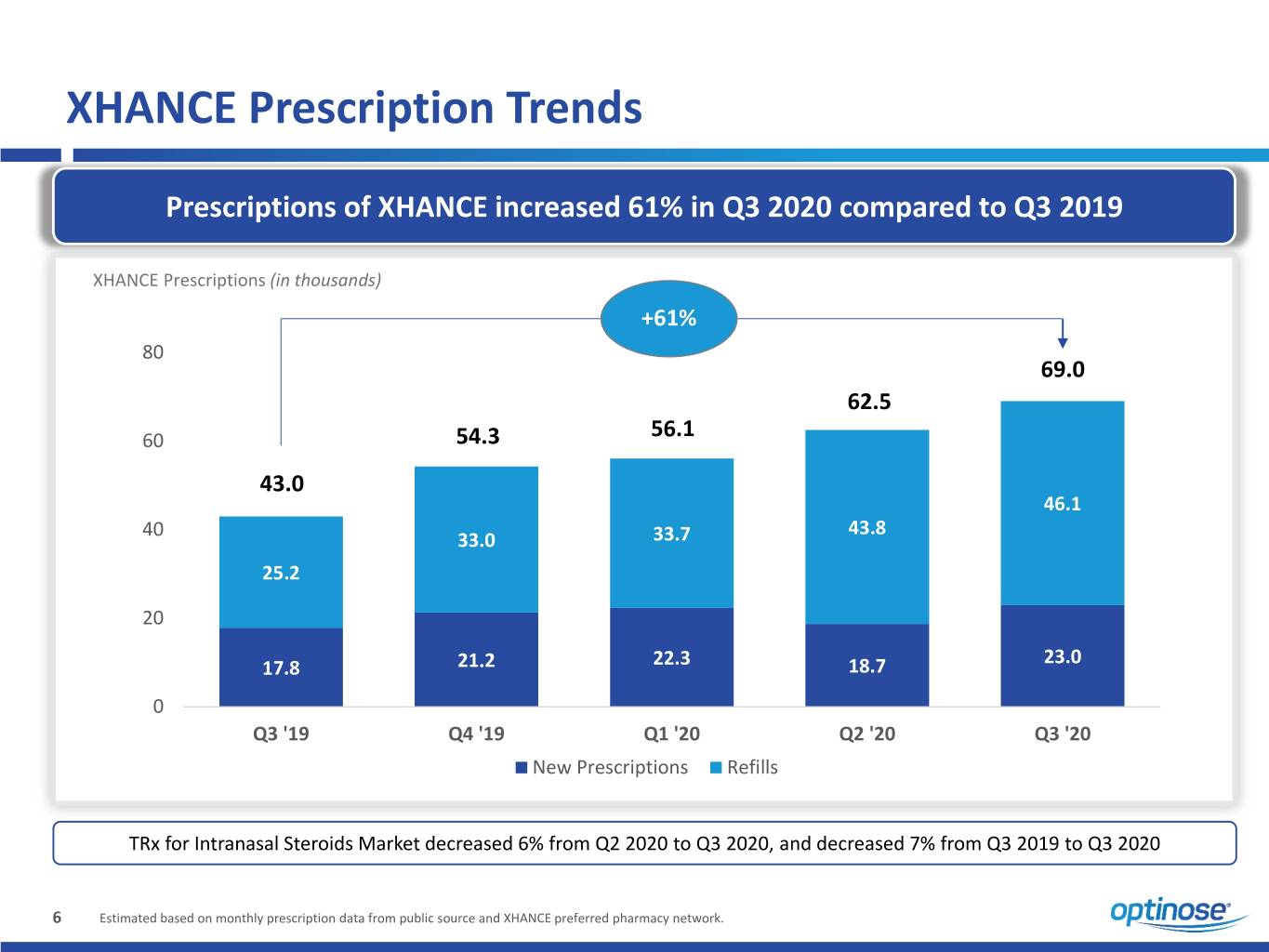

XHANCE Prescription Trends Prescriptions of XHANCE increased 61% in Q3 2020 compared to Q3 2019 XHANCE Prescriptions (in thousands) +61% 80 69.0 62.5 60 54.3 56.1 43.0 46.1 40 43.8 33.0 33.7 25.2 20 23.0 17.8 21.2 22.3 18.7 0 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 New Prescriptions Refills TRx for Intranasal Steroids Market decreased 6% from Q2 2020 to Q3 2020, and decreased 7% from Q3 2019 to Q3 2020 6 Estimated based on monthly prescription data from public source and XHANCE preferred pharmacy network.

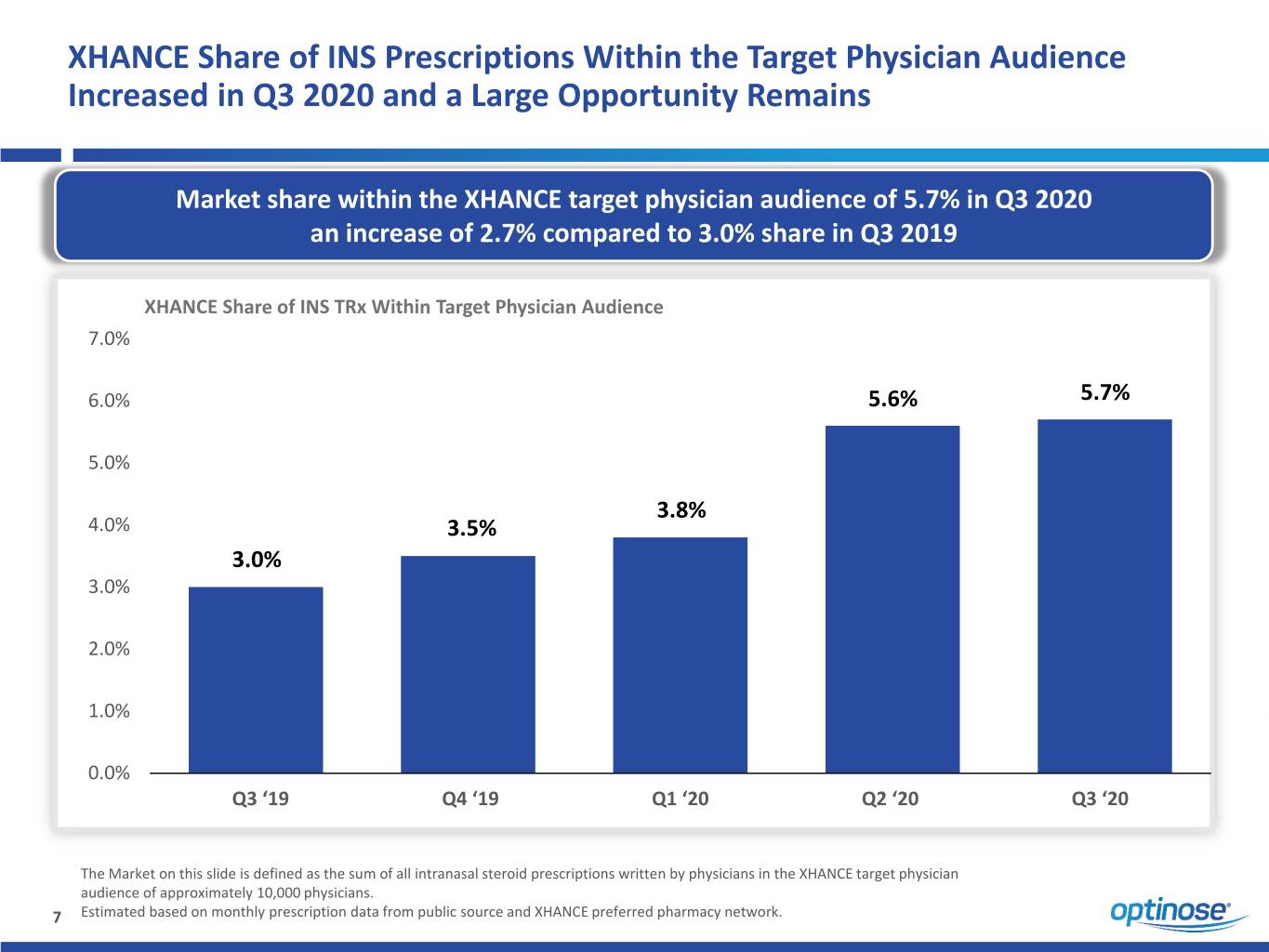

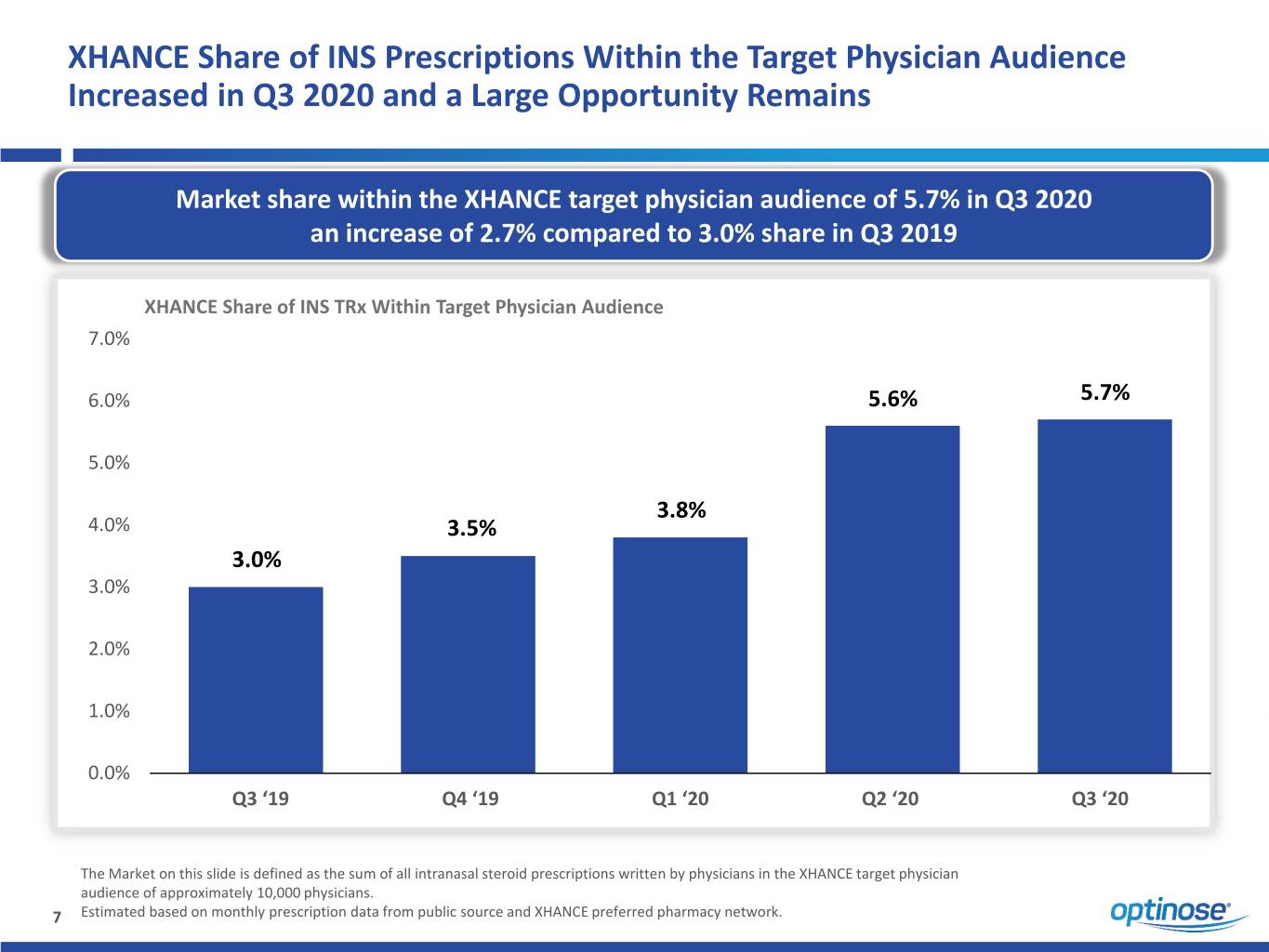

XHANCE Share of INS Prescriptions Within the Target Physician Audience Increased in Q3 2020 and a Large Opportunity Remains Market share within the XHANCE target physician audience of 5.7% in Q3 2020 an increase of 2.7% compared to 3.0% share in Q3 2019 XHANCE Share of INS TRx Within Target Physician Audience 7.0% 6.0% 5.6% 5.7% 5.0% 3.8% 4.0% 3.5% 3.0% 3.0% 2.0% 1.0% 0.0% Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 The Market on this slide is defined as the sum of all intranasal steroid prescriptions written by physicians in the XHANCE target physician audience of approximately 10,000 physicians. 7 Estimated based on monthly prescription data from public source and XHANCE preferred pharmacy network.

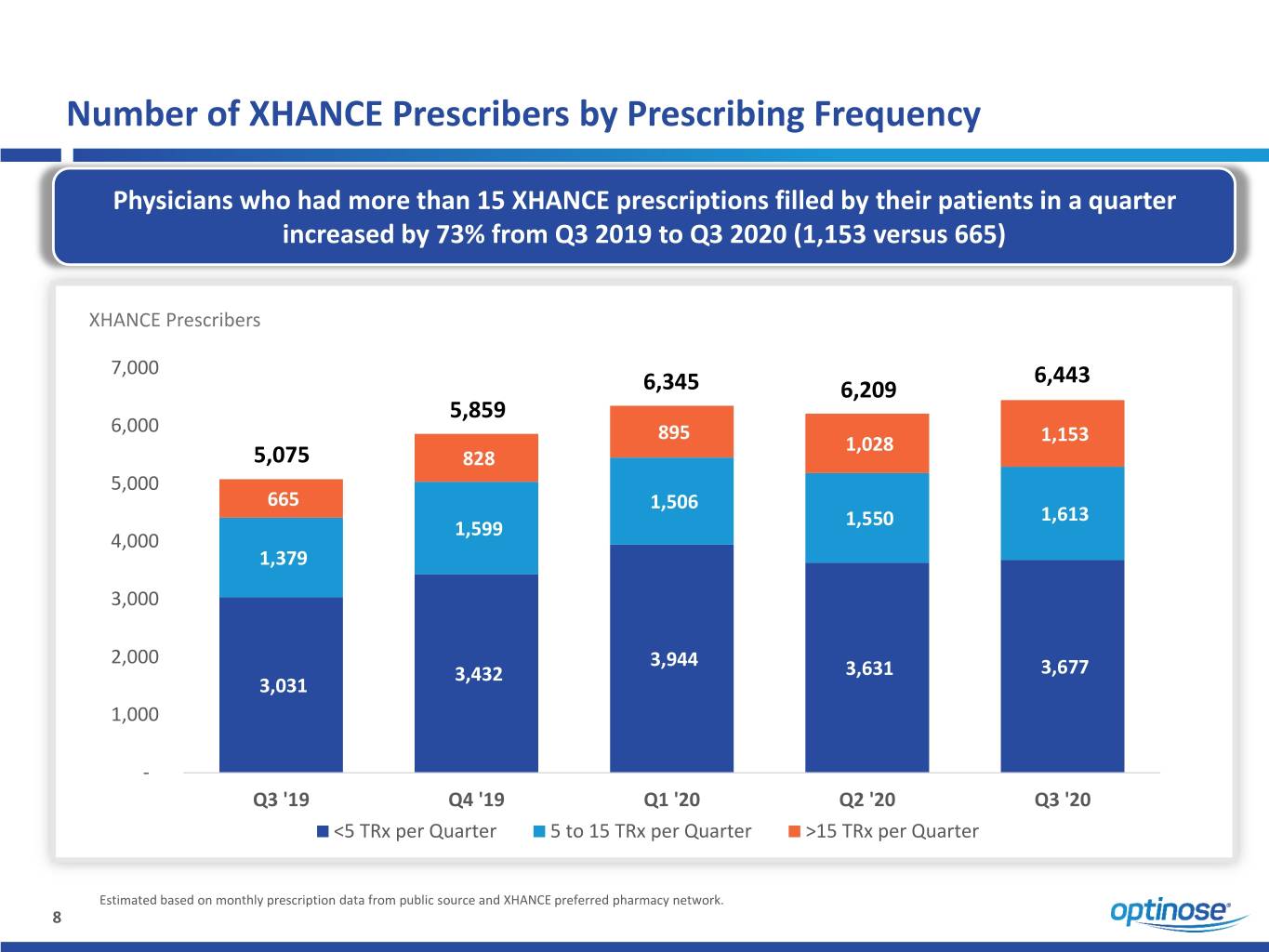

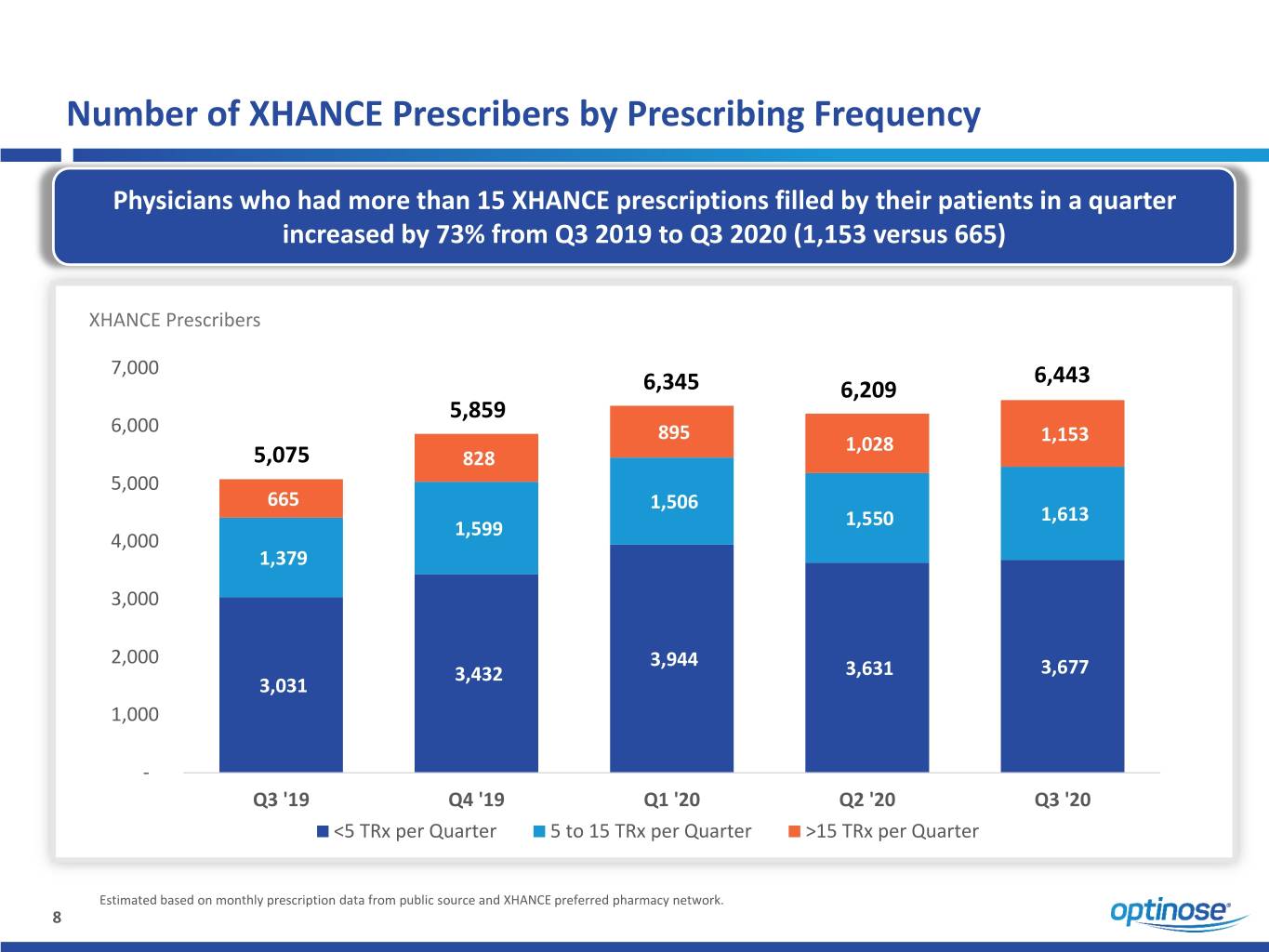

Number of XHANCE Prescribers by Prescribing Frequency Physicians who had more than 15 XHANCE prescriptions filled by their patients in a quarter increased by 73% from Q3 2019 to Q3 2020 (1,153 versus 665) XHANCE Prescribers 7,000 6,443 6,345 6,209 5,859 6,000 895 1,028 1,153 5,075 828 5,000 665 1,506 1,613 1,599 1,550 4,000 1,379 3,000 2,000 3,944 3,432 3,631 3,677 3,031 1,000 - Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 <5 TRx per Quarter 5 to 15 TRx per Quarter >15 TRx per Quarter Estimated based on monthly prescription data from public source and XHANCE preferred pharmacy network. 8

Q3 2020 Financial Update

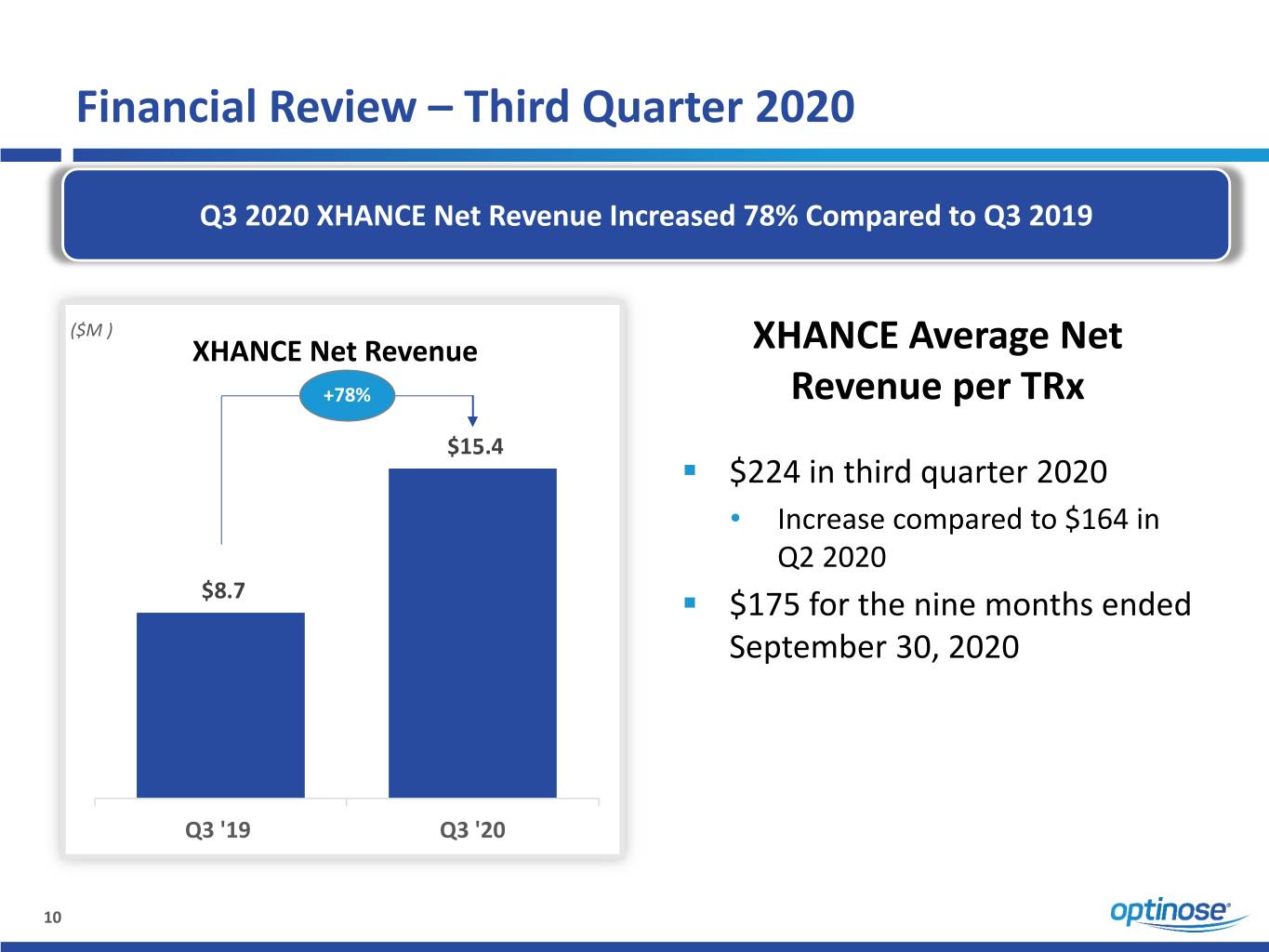

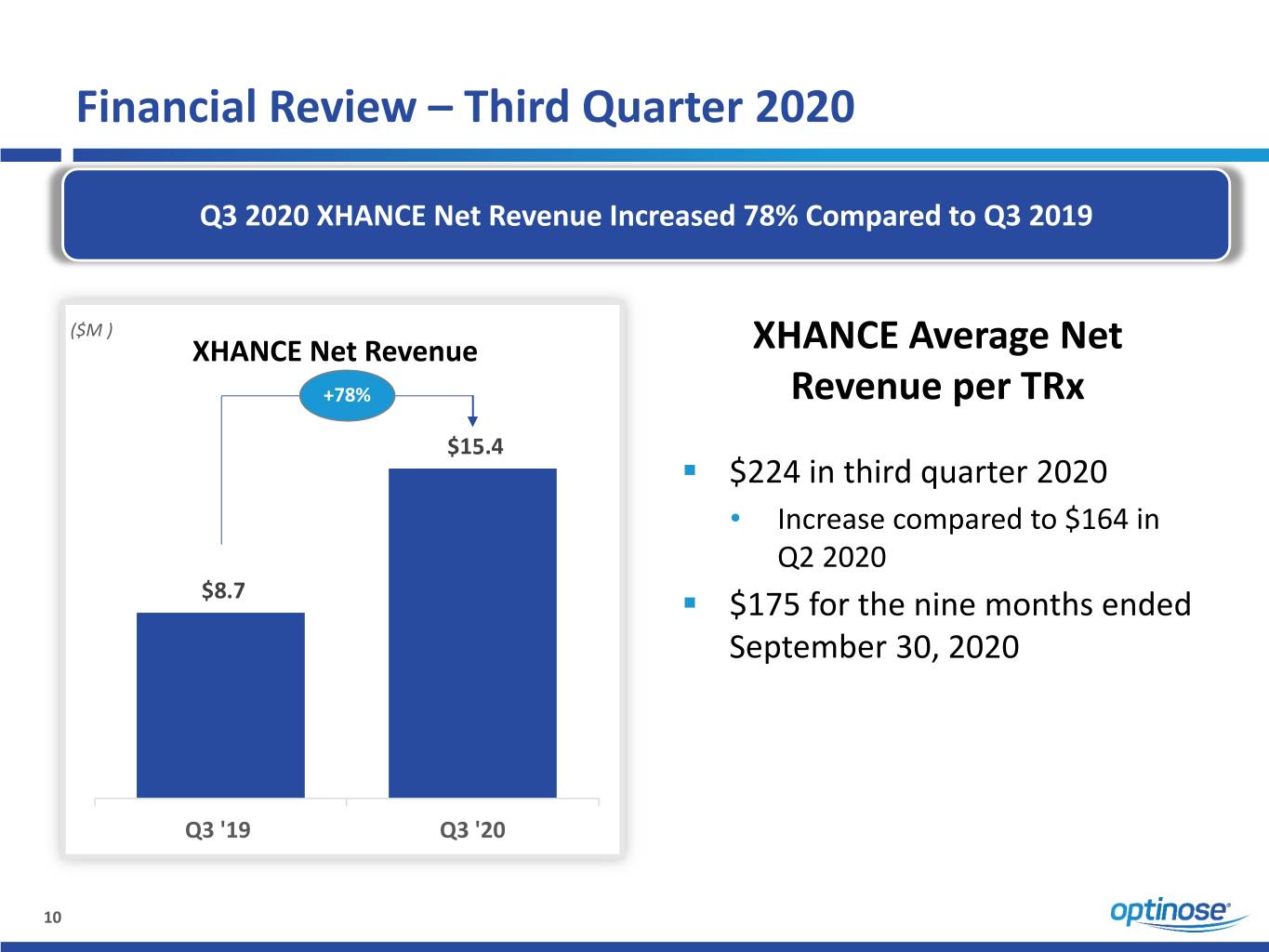

Financial Review – Third Quarter 2020 Q3 2020 XHANCE Net Revenue Increased 78% Compared to Q3 2019 ($M ) XHANCE Net Revenue XHANCE Average Net +78% Revenue per TRx $15.4 . $224 in third quarter 2020 • Increase compared to $164 in Q2 2020 $8.7 . $175 for the nine months ended September 30, 2020 Q3 '19 Q3 '20 10

Updated Corporate Guidance . Operating Expense (GAAP) . Expected to be between $127 – $132 million; approximately $10 million of which represents stock-based compensation . Prior guidance range of $131 - $136 million; approximately $11 million of which was stock-based compensation . Chronic Sinusitis Clinical Trials . Expect top-line results from both trials evaluating XHANCE as a potential treatment for Chronic Sinusitis in the second half of 2021 . Cash and Cash Equivalents . Company qualified to draw $20 million of cash from debt facility as a result of Q3 2020 XHANCE net revenues > $14.5M . Company expects to draw the $20 million by early 2021 (subject to meeting continued eligibility requirements) . A final $20 million from the debt facility is available subject to achieving XHANCE net revenues of at least $26.0 million in Q2 2021 11

Closing Remarks

Key Takeaways and Q3 2020 Highlights Largest Number of XHANCE New Prescriptions Since Launch Successful Launch of kaléo Co-Promotion on October 1st Lowering Full Year 2020 Operating Expense Guidance Substantial Headroom for Future XHANCE Growth XHANCE Revenue Exceeded Threshold for $20 Million Draw +78% $224 $143M XHANCE Net Revenue XHANCE Net Revenue Cash and equivalents Growth per TRx as of Q3 2020/Q3 2019 in Q3 2020 September 30, 2020 +61% 5.7% XHANCE TRx Q3 2020 market share Growth Q3 2020 / Q3 an increase of 2.7% 2019 compared to Q3 2019 13

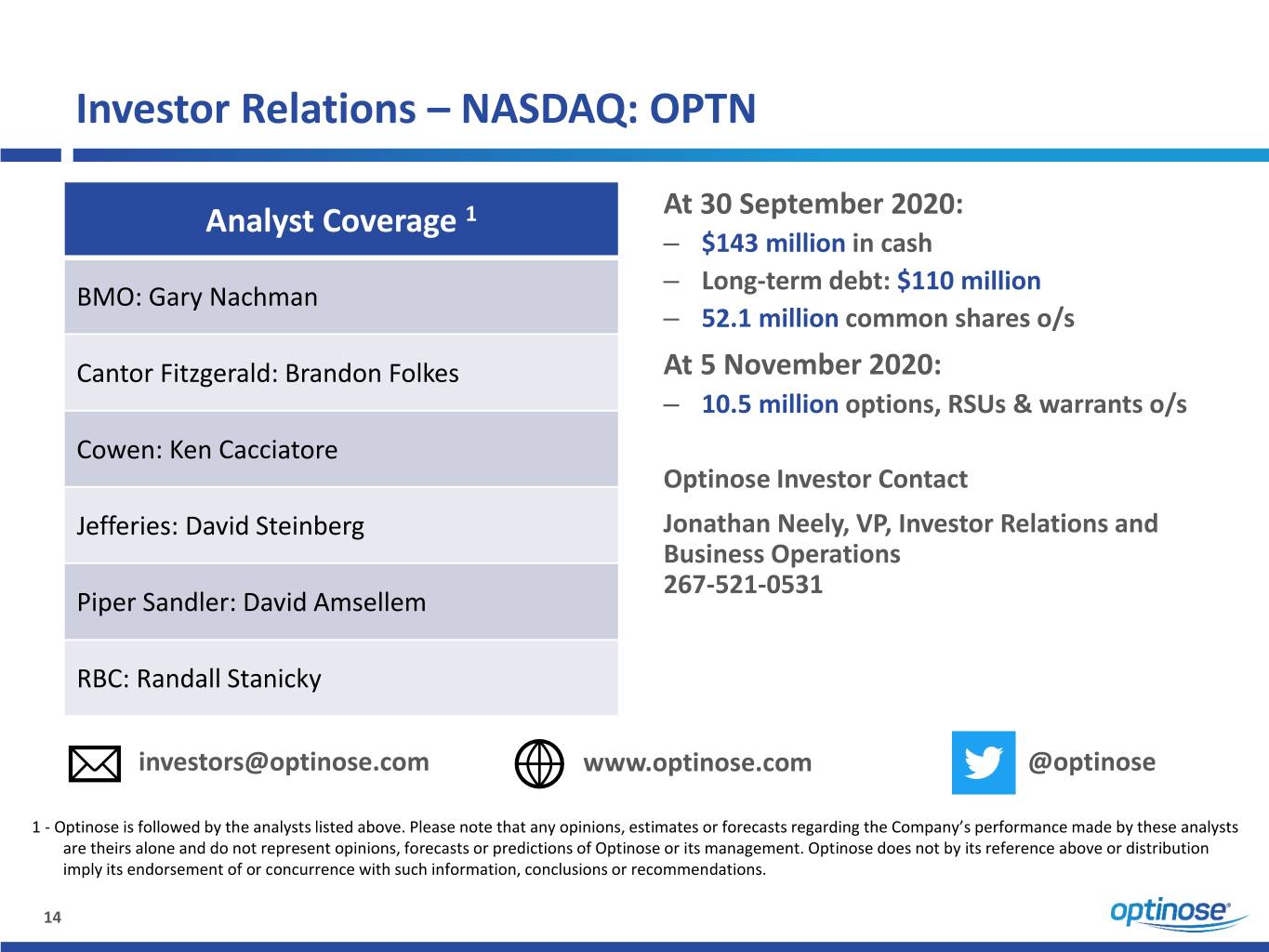

Investor Relations – NASDAQ: OPTN At 30 September 2020: Analyst Coverage 1 – $143 million in cash – Long-term debt: $110 million BMO: Gary Nachman – 52.1 million common shares o/s Cantor Fitzgerald: Brandon Folkes At 5 November 2020: – 10.5 million options, RSUs & warrants o/s Cowen: Ken Cacciatore Optinose Investor Contact Jefferies: David Steinberg Jonathan Neely, VP, Investor Relations and Business Operations 267-521-0531 Piper Sandler: David Amsellem RBC: Randall Stanicky investors@optinose.com www.optinose.com @optinose 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. 14

Building a Leading ENT / Allergy Specialty Company Corporate Presentation November 5, 2020