Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n N o v e m b e r 1 0 , 2 0 2 2 Exhibit 99.2

2 Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: potential for XHANCE prescription and net revenue growth and factors supporting such growth; potential to increase insurance coverage for XHANCE in the future; XHANCE prescription, refill and market share trends; potential effects of INS market seasonality on XHANCE prescriptions; the effects of changes made to the XHANCE co-pay assistance program in January 2022 and the potential benefits of such changes; projected Company GAAP operating expenses and stock-based compensation for 2022 and 2023; projected XHANCE net revenues for full year 2022; projected XHANCE average net revenue per prescription for full year 2022; the potential benefits of XHANCE for the treatment of chronic sinusitis; the Company's plans to seek approval for a follow-on indication for XHANCE for the treatment of chronic sinusitis and believe that the clinical safety and efficacy database is sufficient to support filing of the sNDA; the Company's plans to submit an sNDA in early 2023 resulting in an expected target FDA action date in December 2023; the potential for XHANCE to be the first FDA-approved drug treatment for chronic sinusitis and the potential market expansion opportunities and other benefits of obtaining such indication; the Company's plan to secure a partnership to promote XHANCE in primary care and the prospects for, and potential benefits of, such potential partnership; and other statements regarding the Company’s future operations, financial performance, prospects, intentions, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: impact of, and the uncertainties caused by, the COVID-19 pandemic; physician and patient acceptance of XHANCE for its current and any potential future indication; the Company’s ability to maintain adequate third party reimbursement for XHANCE (market access); the Company’s ability to grow XHANCE prescriptions and net revenues; the prevalence of chronic sinusitis and market opportunities for XHANCE may be smaller than expected; unexpected costs and expenses; potential for varying interpretation of the results from the ReOpen program; uncertainties related to the clinical development program and regulatory approval of XHANCE for the treatment of chronic sinusitis; the Company’s ability to comply with the covenants and other terms of the Pharmakon note purchase agreement; the Company's ability to continue as a going concern; risks and uncertainties relating to intellectual property; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise.

Q3 2022 Performance

4 Key Takeaways Met with FDA in Q3 2022 to Discuss CS Data Submission CS is a 10-fold Market Opportunity for XHANCE Focused on Improving Profitability in 2023 While Preparing to Capitalize on a CS launch Expect to Submit sNDA in Early 2023 1 Millionth XHANCE Prescription Filled in Q3 2022

ReOpen Program Update

6 CS Supplemental NDA - Anticipated Next Steps As planned, we met with FDA in September to discuss submission of our upcoming supplemental new drug application (sNDA) in pursuit of a new indication - We believe it was a positive meeting Submission of the sNDA now expected in early 2023 - Previously expected by the end of 2022 - Additional time has enabled us to incorporate the feedback received in September into the preparation of the sNDA submission We believe the clinical safety and efficacy database is sufficient to support the filing of the sNDA

7 ReOpen Program at Conferences American Rhinologic Society (ARS) ‒ Re-Open-1: A randomized double-blind placebo-controlled trial of EDS-FLU for CRSwNP or CRSsNP ‒ Abstract presented at 68th Annual Meeting on September 9th IDWeek 2022 ‒ Pooled Data: Exhalation Delivery System with Fluticasone (EDS- FLU) Significantly Reduces Acute Exacerbations and Associated Antibiotic Use in Chronic Rhinosinusitis ‒ Late Breaking Abstract presented on October 21st American College of Asthma, Allergy and Immunology (ACAAI) ‒ Re-Open-2: A randomized double-blind placebo-controlled trial of EDS-FLU for CRSsNP ‒ Poster presentation on November 12th

Q3 2022 Commercial Update

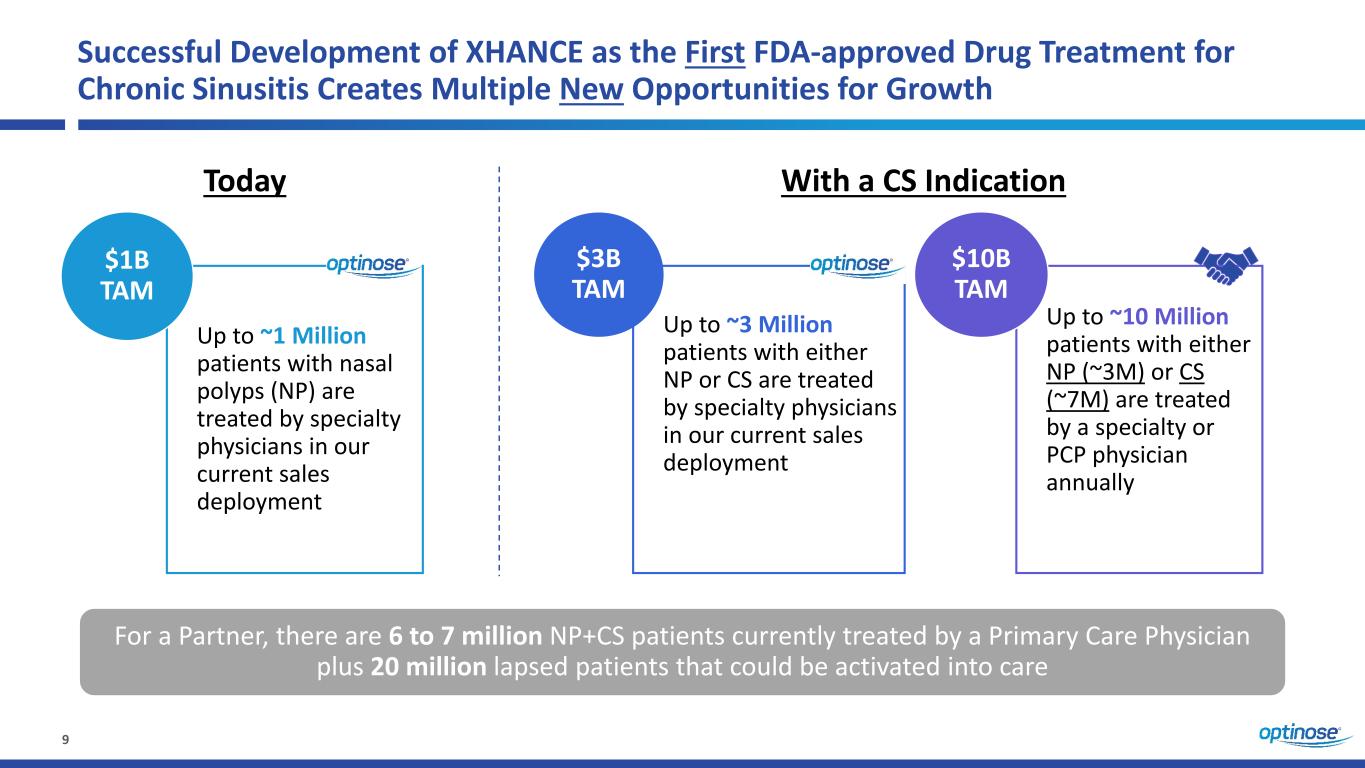

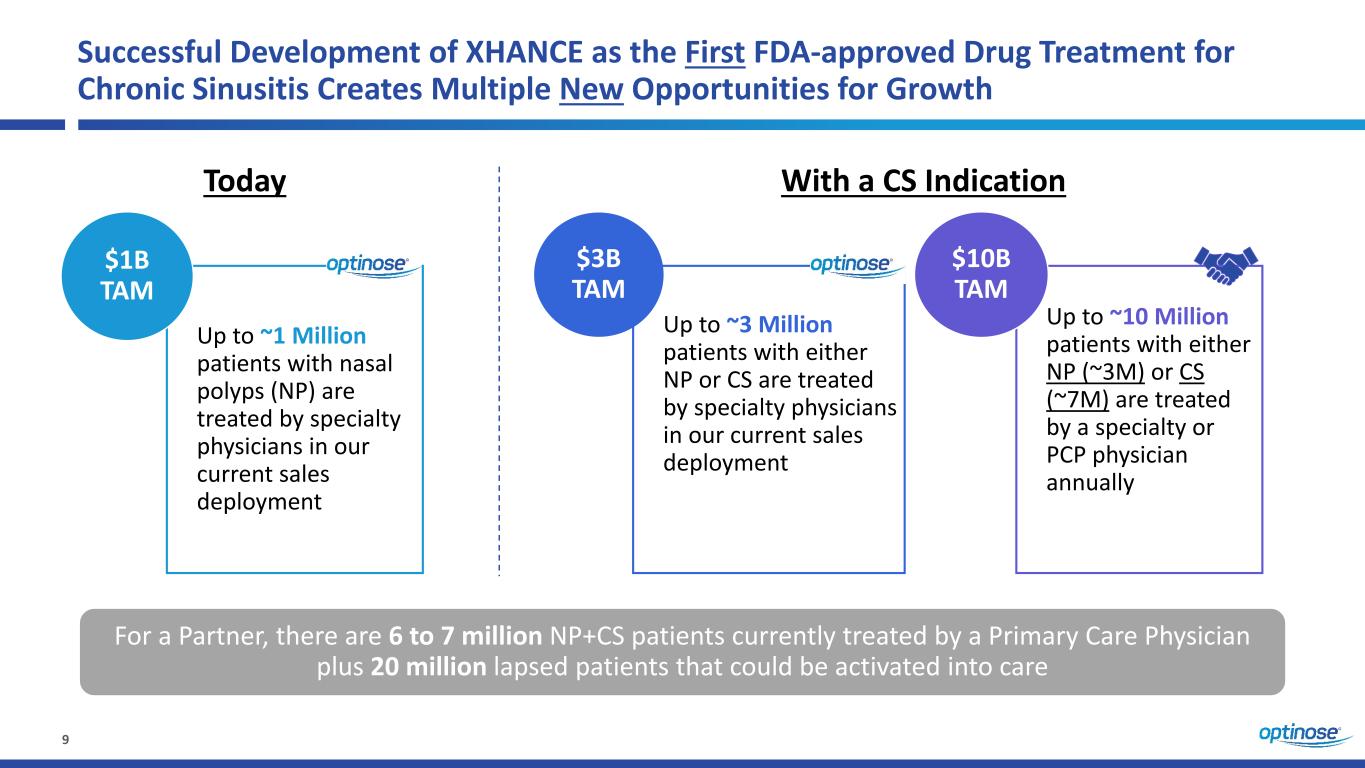

9 Successful Development of XHANCE as the First FDA-approved Drug Treatment for Chronic Sinusitis Creates Multiple New Opportunities for Growth Up to ~1 Million patients with nasal polyps (NP) are treated by specialty physicians in our current sales deployment $1B TAM $3B TAM Up to ~10 Million patients with either NP (~3M) or CS (~7M) are treated by a specialty or PCP physician annually $10B TAM Today With a CS Indication Up to ~3 Million patients with either NP or CS are treated by specialty physicians in our current sales deployment For a Partner, there are 6 to 7 million NP+CS patients currently treated by a Primary Care Physician plus 20 million lapsed patients that could be activated into care

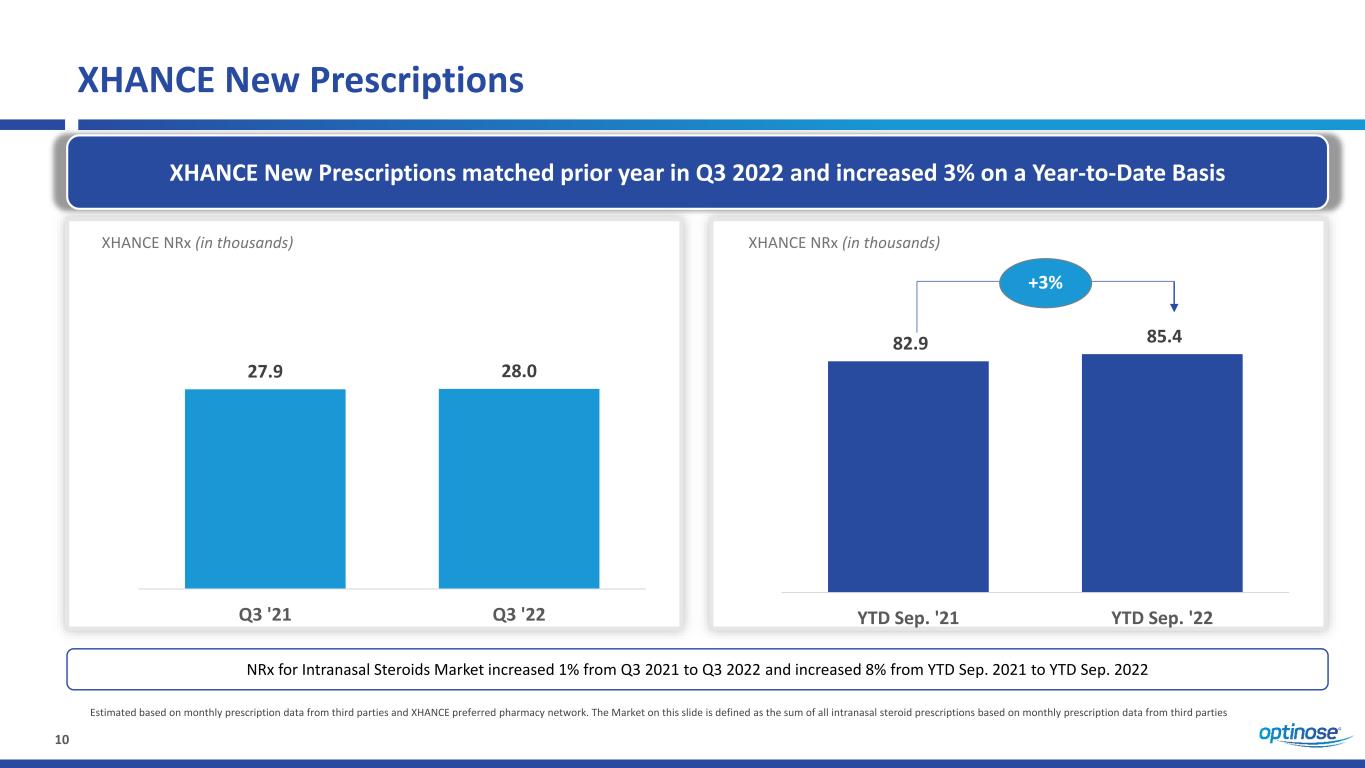

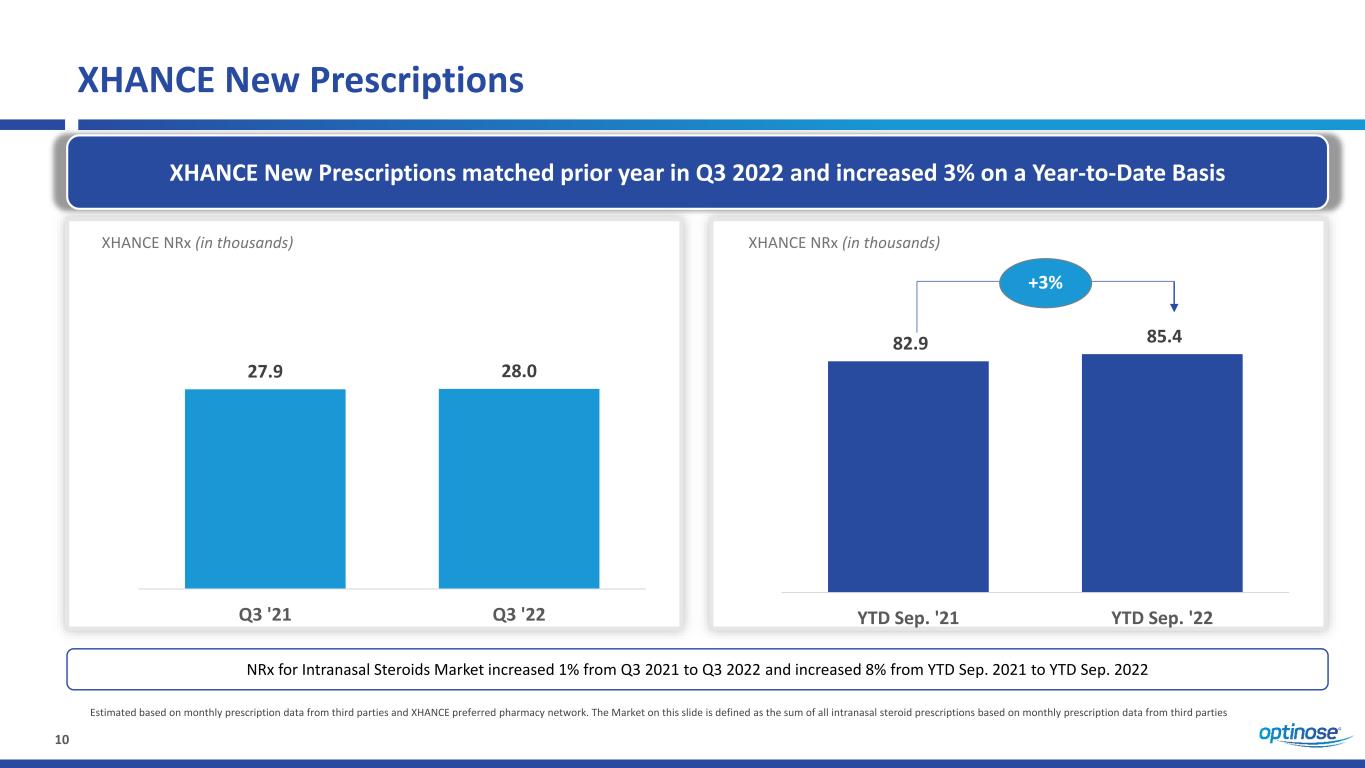

10 XHANCE New Prescriptions XHANCE New Prescriptions matched prior year in Q3 2022 and increased 3% on a Year-to-Date Basis Estimated based on monthly prescription data from third parties and XHANCE preferred pharmacy network. The Market on this slide is defined as the sum of all intranasal steroid prescriptions based on monthly prescription data from third parties 27.9 28.0 Q3 '21 Q3 '22 XHANCE NRx (in thousands) NRx for Intranasal Steroids Market increased 1% from Q3 2021 to Q3 2022 and increased 8% from YTD Sep. 2021 to YTD Sep. 2022 82.9 85.4 YTD Sep. '21 YTD Sep. '22 XHANCE NRx (in thousands) +3%

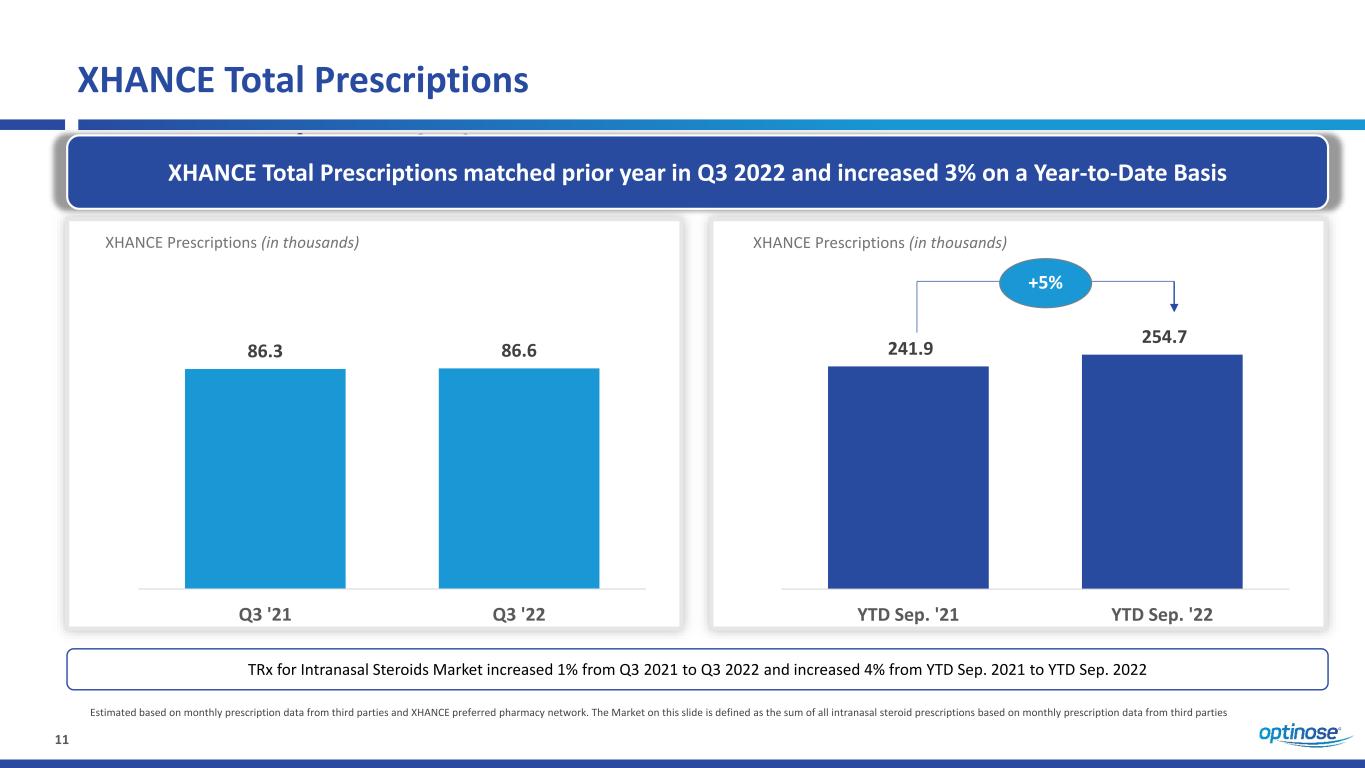

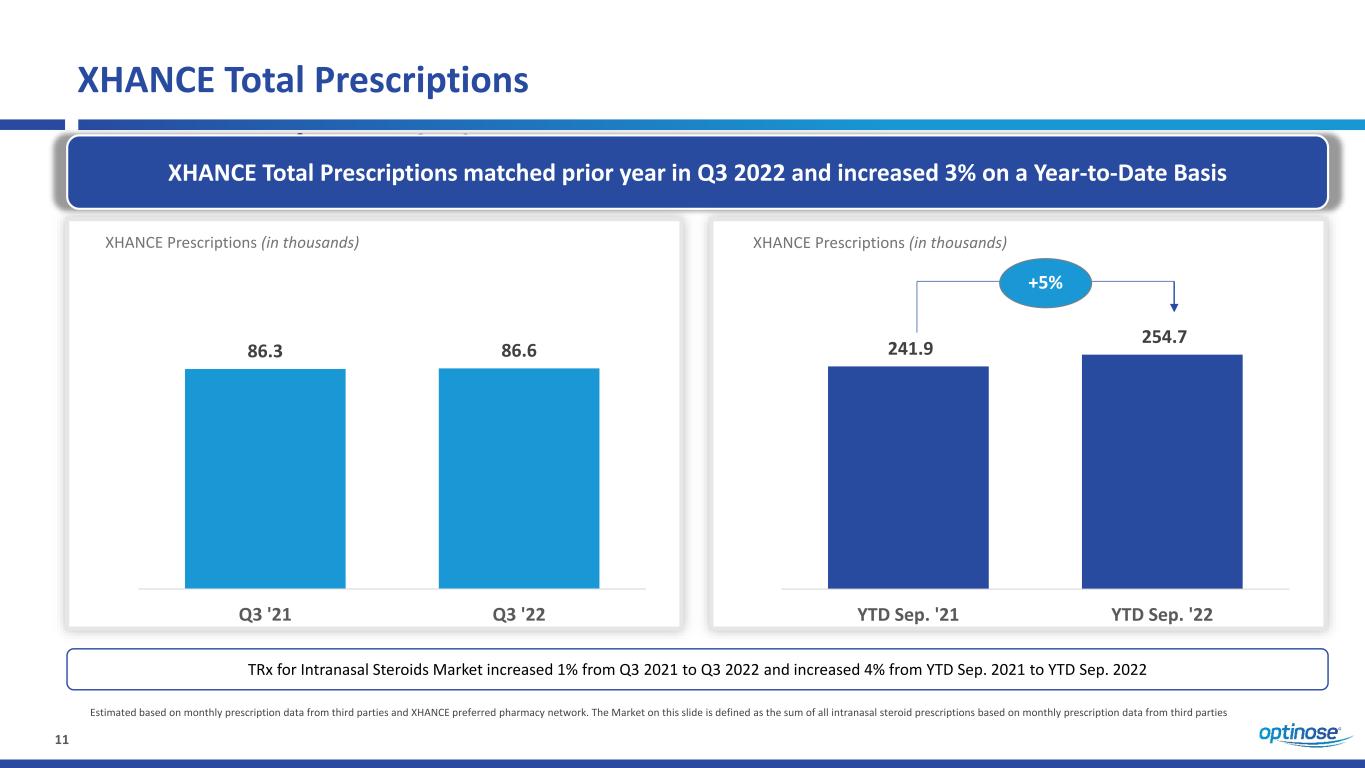

11 XHANCE Total Prescriptions Revised Co-Pay Assistance Program is Suppressing TRx of Unprofitable High-Deductible Type in 2022XHANCE Total Prescriptions matched prior year in Q3 2022 and increased 3% on a Year-to-Date Basis Estimated based on monthly prescription data from third parties and XHANCE preferred pharmacy network. The Market on this slide is defined as the sum of all intranasal steroid prescriptions based on monthly prescription data from third parties 86.3 86.6 Q3 '21 Q3 '22 TRx for Intranasal Steroids Market increased 1% from Q3 2021 to Q3 2022 and increased 4% from YTD Sep. 2021 to YTD Sep. 2022 241.9 254.7 YTD Sep. '21 YTD Sep. '22 XHANCE Prescriptions (in thousands) +5% XHANCE Prescriptions (in thousands) XHANCE Total Prescriptions

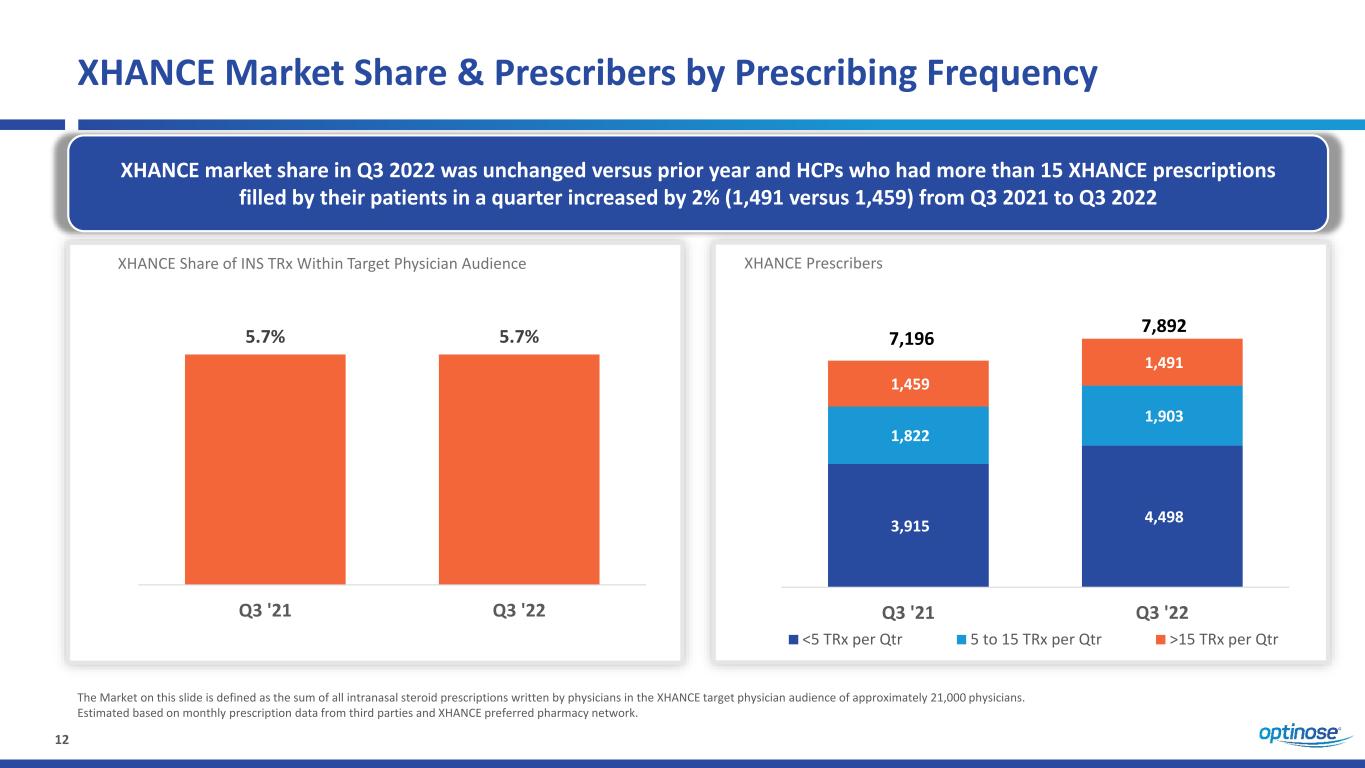

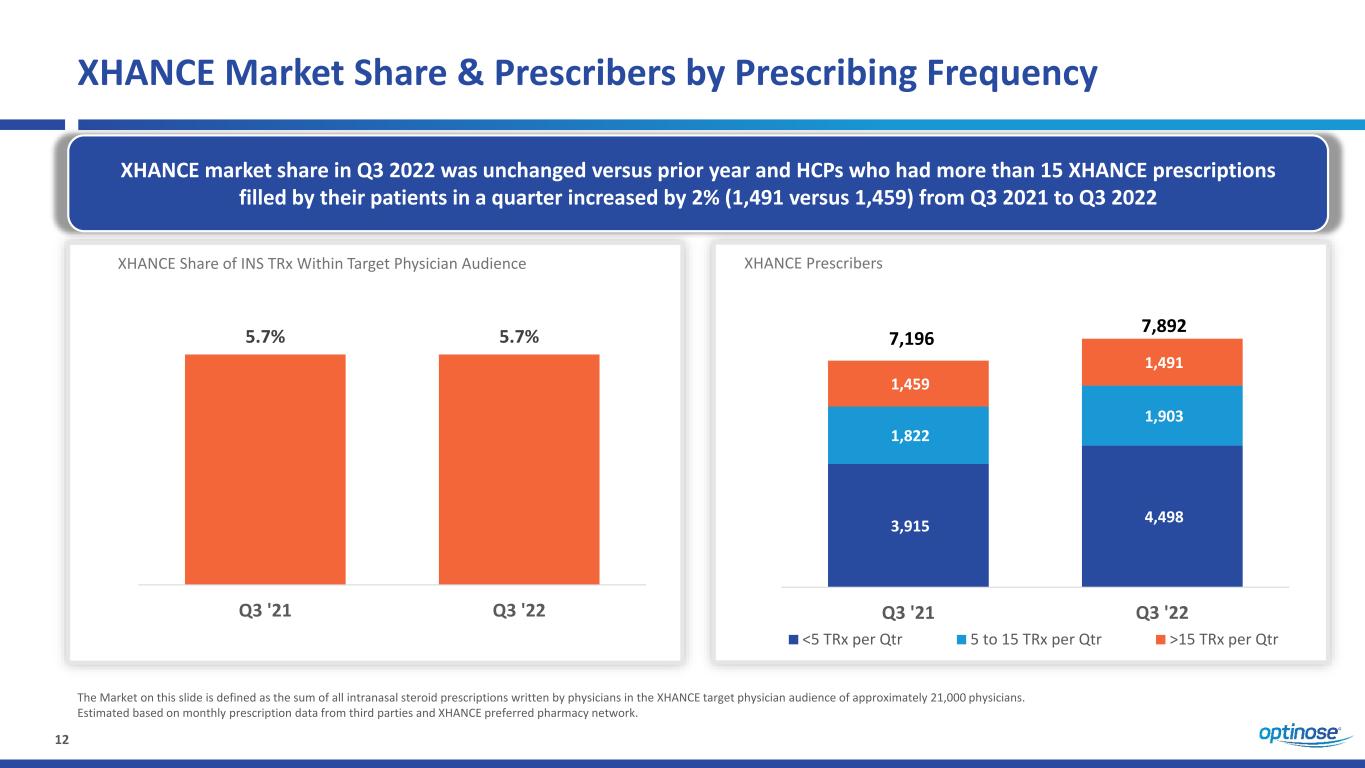

12 XHANCE Market Share & Prescribers by Prescribing Frequency The Market on this slide is defined as the sum of all intranasal steroid prescriptions written by physicians in the XHANCE target physician audience of approximately 21,000 physicians. Estimated based on monthly prescription data from third parties and XHANCE preferred pharmacy network. 5.7% 5.7% Q3 '21 Q3 '22 XHANCE Share of INS TRx Within Target Physician Audience 3,915 4,498 1,822 1,903 1,459 1,491 Q3 '21 Q3 '22 <5 TRx per Qtr 5 to 15 TRx per Qtr >15 TRx per Qtr XHANCE Prescribers 7,892 7,196 XHANCE market share in Q3 2022 was unchanged versus prior year and HCPs who had more than 15 XHANCE prescriptions filled by their patients in a quarter increased by 2% (1,491 versus 1,459) from Q3 2021 to Q3 2022

Q3 2022 Financial Update

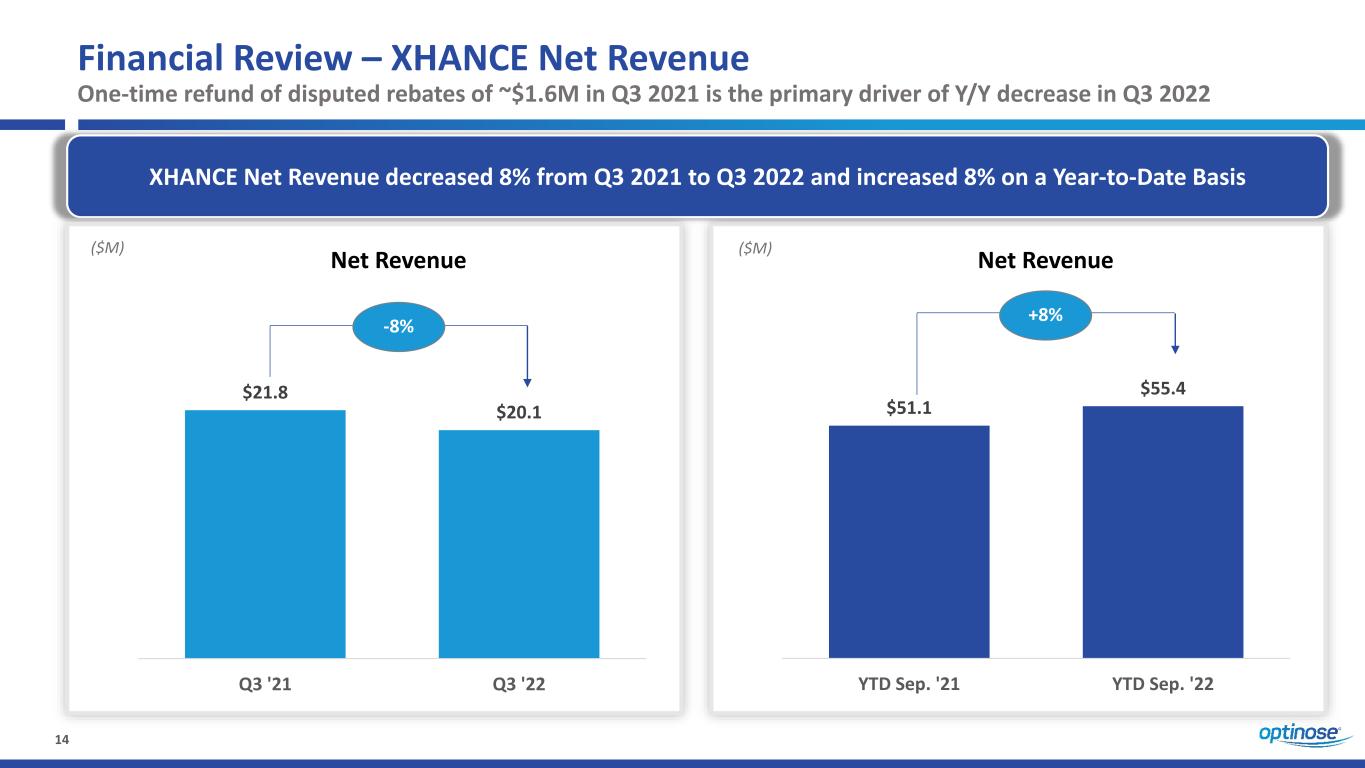

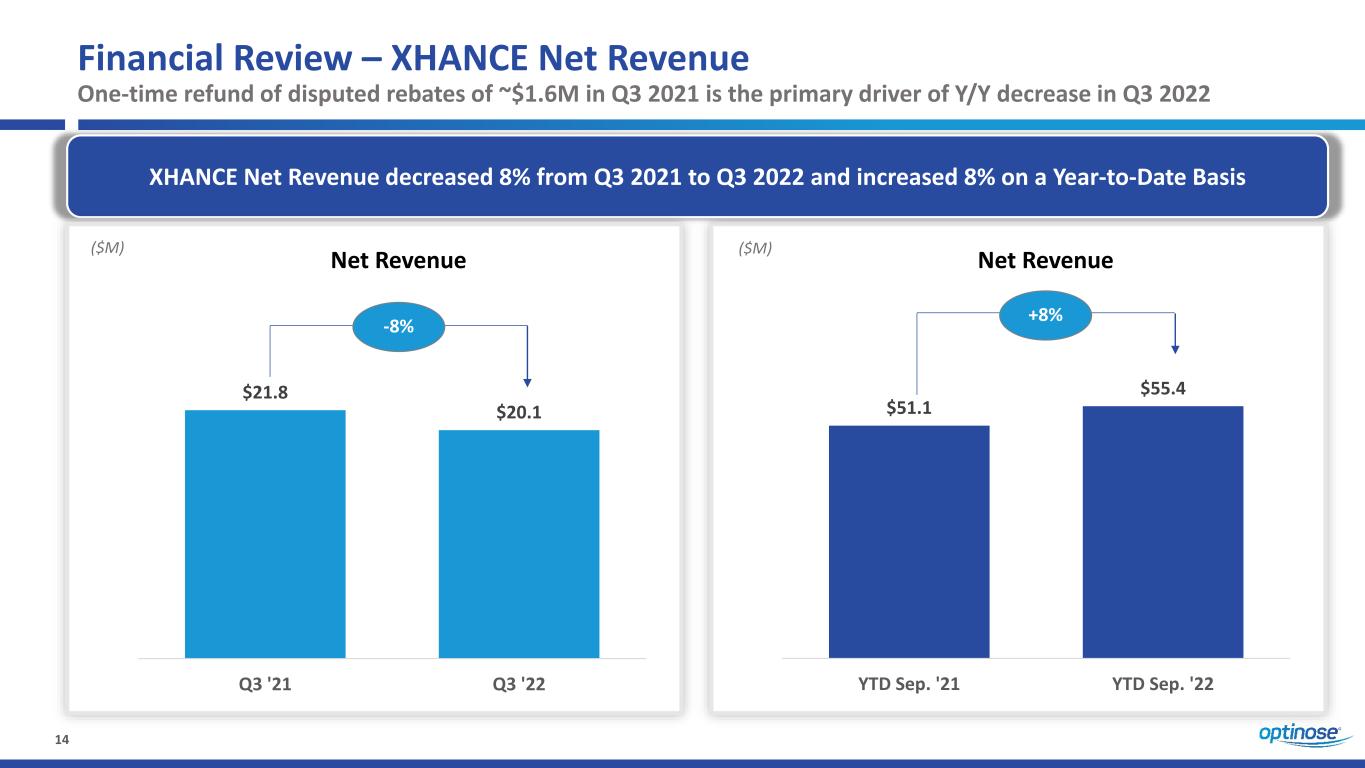

14 Financial Review – XHANCE Net Revenue One-time refund of disputed rebates of ~$1.6M in Q3 2021 is the primary driver of Y/Y decrease in Q3 2022 XHANCE Net Revenue decreased 8% from Q3 2021 to Q3 2022 and increased 8% on a Year-to-Date Basis $21.8 $20.1 Q3 '21 Q3 '22 ($M) -8% Net Revenue Net Revenue $51.1 $55.4 YTD Sep. '21 YTD Sep. '22 ($M) +8%

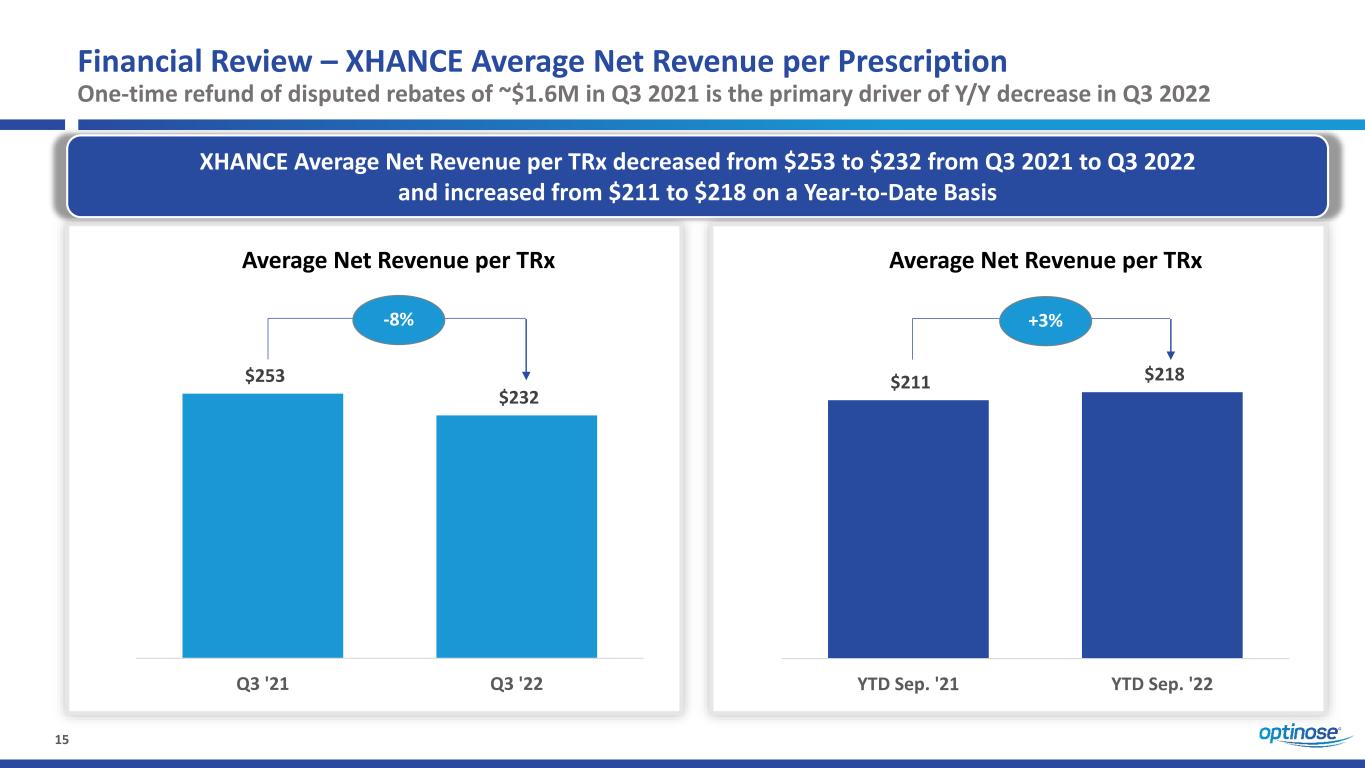

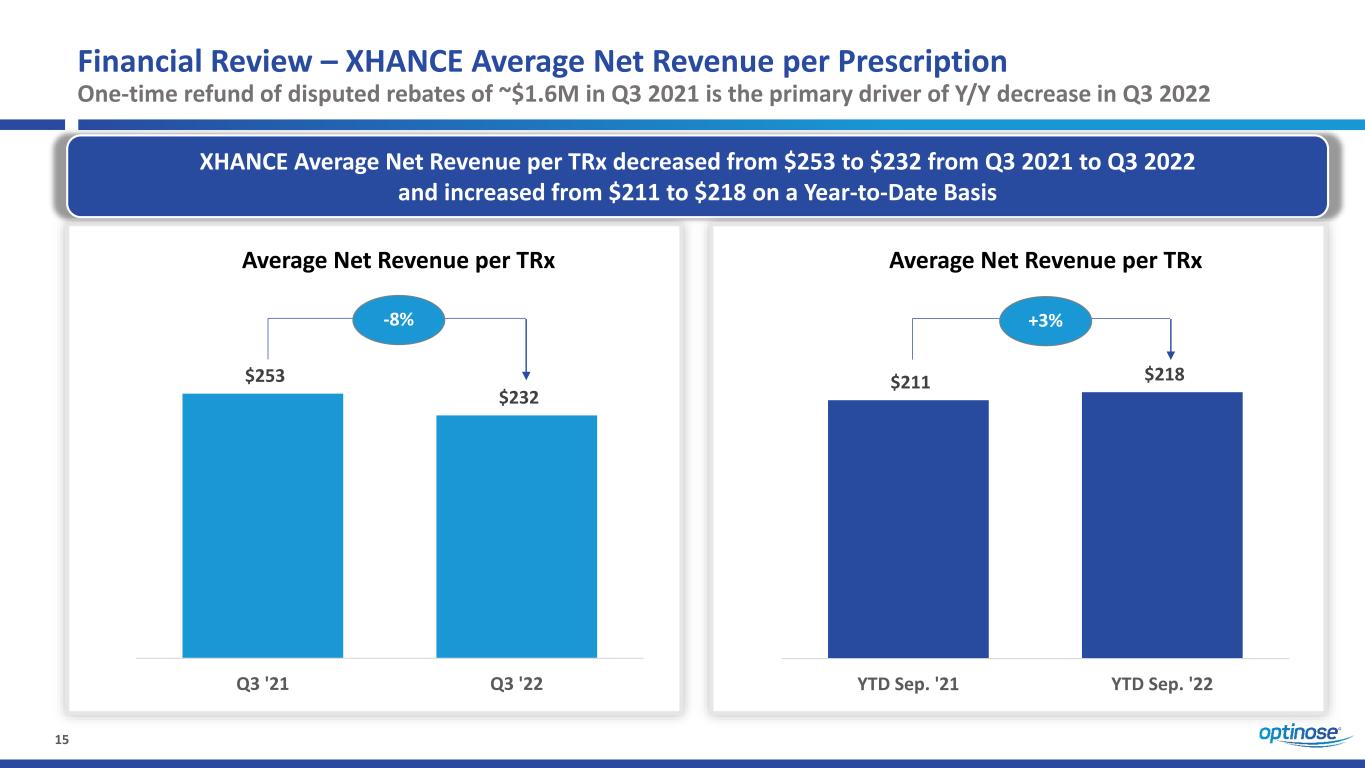

15 $253 $232 Q3 '21 Q3 '22 Financial Review – XHANCE Average Net Revenue per Prescription One-time refund of disputed rebates of ~$1.6M in Q3 2021 is the primary driver of Y/Y decrease in Q3 2022 XHANCE Average Net Revenue per TRx decreased from $253 to $232 from Q3 2021 to Q3 2022 and increased from $211 to $218 on a Year-to-Date Basis $211 $218 YTD Sep. '21 YTD Sep. '22 +3% Average Net Revenue per TRx Average Net Revenue per TRx -8%

16 Financial Guidance XHANCE Net Revenue ‒ Expected to be between $74 - $78 million ‒ Previously expected to be between $85 - $92 million XHANCE Average Net Revenue per Prescription ‒ FY 2022 expected to be approximately $220 ‒ Previously expected to exceed $220 Operating Expense (GAAP) ‒ Expected to be between $127 – $131 million; approximately $9 million of which represents stock-based compensation; ‒ Previously expected to be between $129 – $134 million; approximately $9 million of which represents stock-based compensation; ‒ FY 2023 expected to decrease materially compared to FY 2022

Closing Remarks

18 Key Takeaways Met with FDA in Q3 2022 to Discuss CS Data Submission CS is a 10-fold Market Opportunity for XHANCE Focused on Improving Profitability in 2023 While Preparing to Capitalize on a CS launch Expect to Submit sNDA in Early 2023 1 Millionth XHANCE Prescription Filled in Q3 2022

19 Investor Relations – NASDAQ: OPTN Optinose Investor Contact Jonathan Neely, VP, Investor Relations and Business Development 267-521-0531 Investors@optinose.com As of September 30, 2022: – $61.1 million in cash – Debt: $130 million – 83.5 million common shares o/s – 14.0 million options, warrants & RSUs o/s 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. investors@optinose.com www.optinose.com @optinose Analyst Coverage 1 BMO: Gary Nachman Cantor Fitzgerald: Brandon Folkes Cowen: Ken Cacciatore Jefferies: Glen Santangelo Piper Sandler: David Amsellem

Building a Leading ENT / Allergy Specialty Company C o r p o r a t e P r e s e n t a t i o n N o v e m b e r 1 0 , 2 0 2 2