Building a Leading ENT / Allergy Specialty Company Corporate Presentation May 14, 2024

2 Forward-Looking Statements This presentation and our accompanying remarks contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, statements relating to: the potential benefits of the recent FDA approval of XHANCE for the treatment of chronic rhinosinusitis without nasal polyps (also referred to as chronic sinusitis); the benefit of XHANCE for treatment of chronic sinusitis; our commercial plans and expectations for XHANCE; the generation of XHANCE prescriptions and net revenues and factors impacting the generation of future prescriptions and net revenues; projected GAAP operating expenses (selling, general and administrative expenses and research and development expenses) and stock-based compensation for 2024; projected XHANCE net revenues for 2024; projected XHANCE average net revenue per prescription for 2024; expectation for positive income from operations (GAAP) for full year 2025; expectation that base planned efforts focused on a specialty prescriber audience can grow XHANCE peak year net revenues to more than $300 million; expected net proceeds from the registered direct offering completed on May 10, 2024; expectation that cash and cash equivalents (including net proceeds from registered direct offering) will be sufficient to fund operations and debt service obligations through 2025; impact of changes to XHANCE co- pay assistance program; potential market expansion and growth opportunities; and other statements regarding to our future operations, financial performance, prospects, intentions, strategies, objectives and other future events. Forward-looking statements are based upon management’s current expectations and assumptions and are subject to a number of risks, uncertainties and other factors that could cause actual results and events to differ materially and adversely from those indicated by such forward-looking statements including, among others: impact of, and the uncertainties caused by, physician and patient acceptance of XHANCE (including its new indication); our ability to maintain adequate third party reimbursement for XHANCE (including for its new indication); our ability to efficiently generate XHANCE prescriptions and net revenues; the prevalence of chronic sinusitis and market opportunities for XHANCE may be smaller than expected; unexpected costs and expenses; our ability to achieve our financial guidance; potential for varying interpretation of the results from the ReOpen Program; our ability to comply with the covenants and other terms of the A&R Pharmakon Note Purchase Agreement; risks and uncertainties relating to intellectual property and competition; and the risks, uncertainties and other factors discussed in the “Risk Factors” section and elsewhere in our most recent Form 10-K and Form 10-Q filings with the Securities and Exchange Commission (SEC) (including our Form 10-K to be filed with the SEC on March 7, 2024) – which are available at http://www.sec.gov. As a result, you are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements made in this presentation speak only as of the date of this presentation, and we undertake no obligation to update such forward-looking statements, whether as a result of new information, future developments or otherwise. Market, Industry and Other Data This presentation and our accompanying remarks contain estimates, projections, market research and other information concerning markets for XHANCE and the size of those markets, the prevalence of certain medical conditions, XHANCE market access, and other physician, patient, payor and prescription data. Unless otherwise expressly stated, we obtain this information from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources, as well as from our own internal estimates and research.

3 Today’s Agenda Introduction, Key Takeaways and CS Launch Update Ramy Mahmoud, MD, MPH Q1 2024 Performance and FY 2024 Financial Guidance Jonathan Neely Closing Remarks Ramy Mahmoud, MD, MPH

4 Key Takeaways • New indication creates a significant near-term growth opportunity with up to a 10x multiple on the TAM based on patients who are currently treated by a physician • Current specialty sales force of 75 reps, and phased modest incremental commercial investment, sufficient to achieve peak net revenue of at least $300M and positive income from operations for full year 2025 XHANCE Chronic Sinusitis Launch Building from a stronger base Return to strong growth in 2024 • Success in 2023 and Q1 2024 with a disciplined approach to operating expenses provided runway to initiate CS launch and supports plan to drive growth with modest incremental investment • Focus on growing profitable prescriptions is a key driver for Q1 2024 performance and our increase to full year 2024 XHANCE net revenue per prescription guidance • New indication creates opportunity for commercial team to promote a "first and only" clinical efficacy and safety profile • Initial expectation for FY 2024 XHANCE net revenue is for growth of 20% to 34%; increasing net revenue per prescription expectation to at least $230 (previously expected to be approximately $220)

5 Post Offering Cash and Cash Equivalents of ~$100 Million Expected to Fund Operations and Debt Service Obligations Through 2025 Recent $55 million raised in a registered direct offering, priced "at the market" on May 8th • Post-offering cash and cash equivalents of ~$100 million • Sufficient to fund operations including re-launching XHANCE and debt service obligations through 2025 • Expected to produce income from operations (GAAP) for full year 2025 Improved Debt Terms • Waiver on the “going concern” covenant until the filing of December 31, 2025 financial statements • Reduction of minimum liquidity covenant from $30 million to $20 million following the date of the first quarterly payment of principal due on September 30, 2025 • $4.7 million of outstanding amendment and waiver fees converted to equity Stronger balance sheet and revised debt terms extend runway to pursue growth opportunities

CS Launch Updates

7 Attending 10 National and 20 Regional ENT and Allergy Specific Congresses Exhibits/Booth Product Theaters Promotional Dinner Programs Sales Force Congress Activity Non-Personal Promotion Peer-to-Peer Education 75 Sales Reps Deployed 35K Total Sales Calls >150 CS Peer-to-Peer Speaker Programs reaching ~ 1K HCPs Q2 Planned Launch Activities to Drive New Growth 50% Increase in Samples 8.5K Specialty HCPs Targeted 22K HCPs targeted through strategic non-personal promotion delivering up to 1.5M HCP impressions and 50K engagements Display SEM Endemic Media HCP & Patient Social Media 3rd Party Partnerships

Q1 2024 Performance

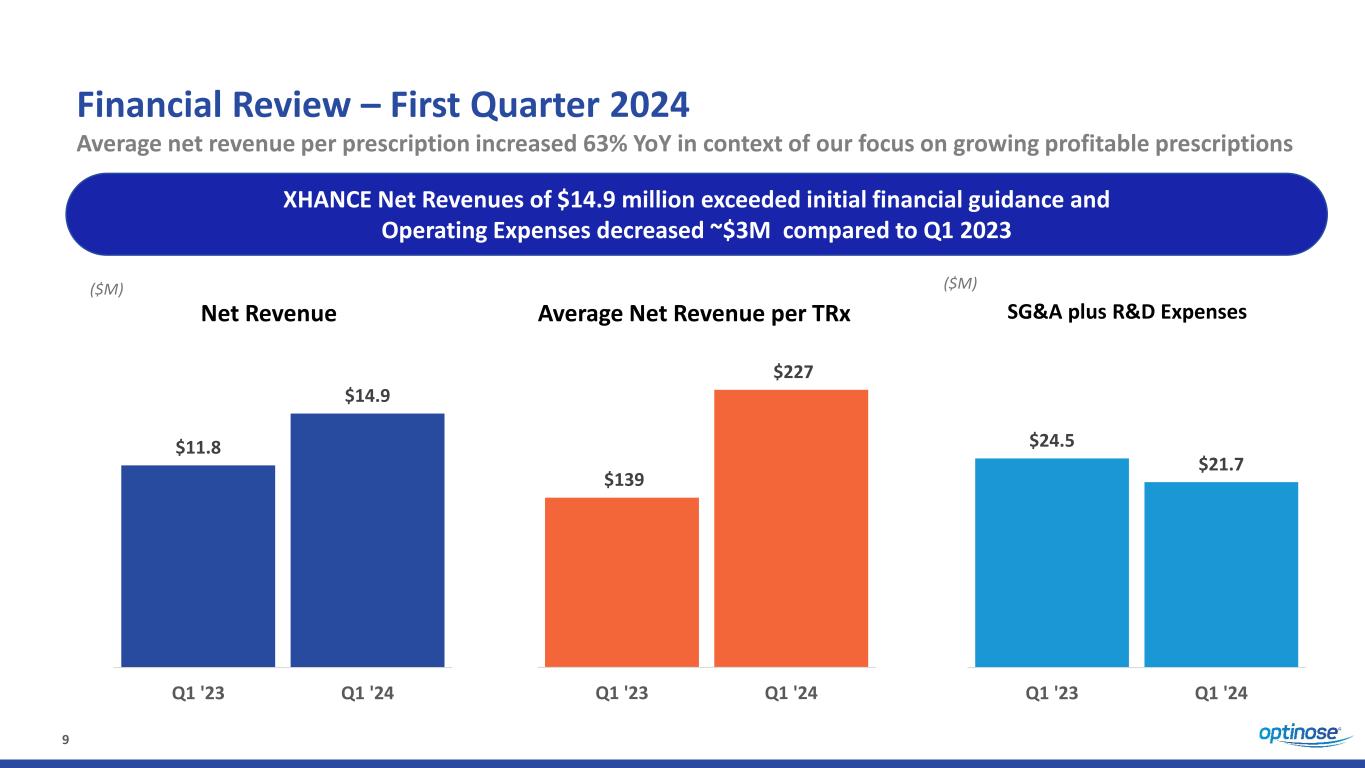

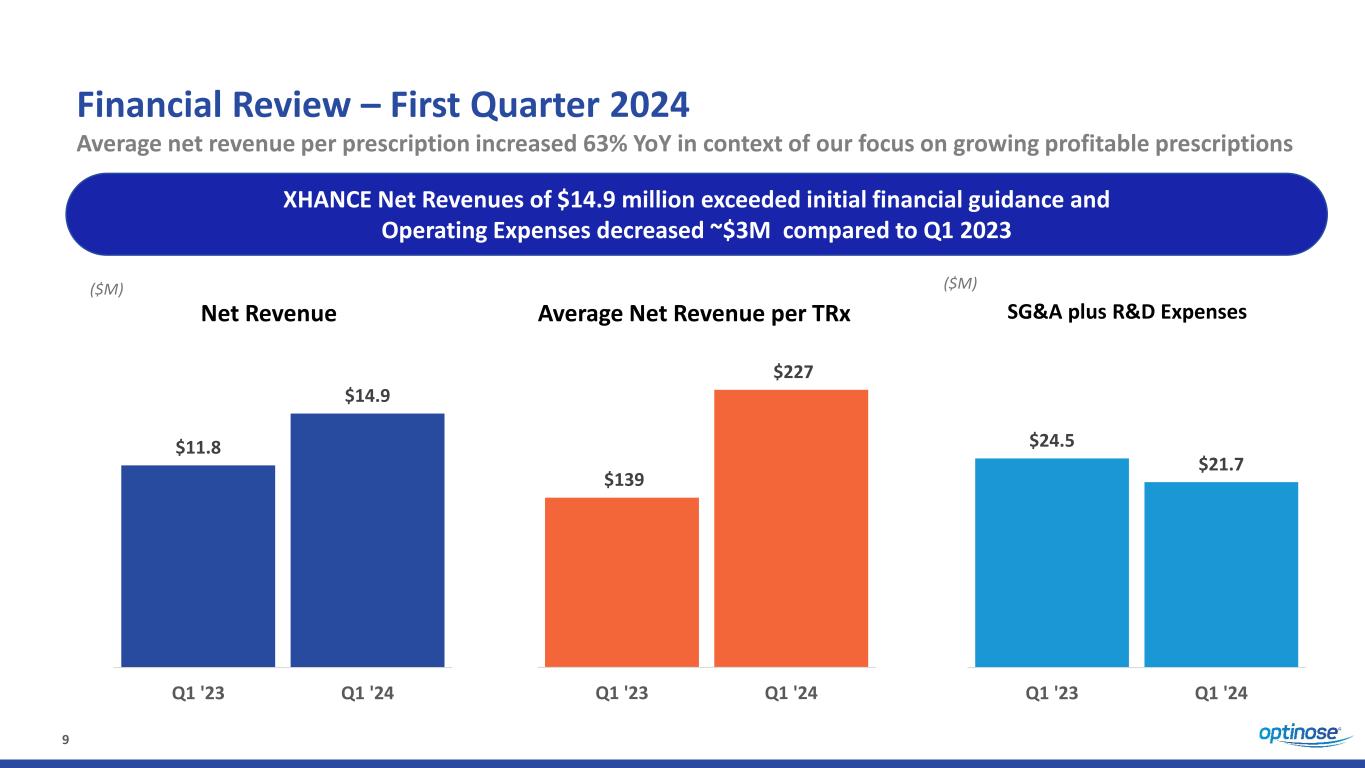

9 Financial Review – First Quarter 2024 Average net revenue per prescription increased 63% YoY in context of our focus on growing profitable prescriptions XHANCE Net Revenues of $14.9 million exceeded initial financial guidance and Operating Expenses decreased ~$3M compared to Q1 2023 $24.5 $21.7 Q1 '23 Q1 '24 ($M) SG&A plus R&D Expenses $11.8 $14.9 Q1 '23 Q1 '24 ($M) Net Revenue Average Net Revenue per TRx $139 $227 Q1 '23 Q1 '24

2024 Outlook

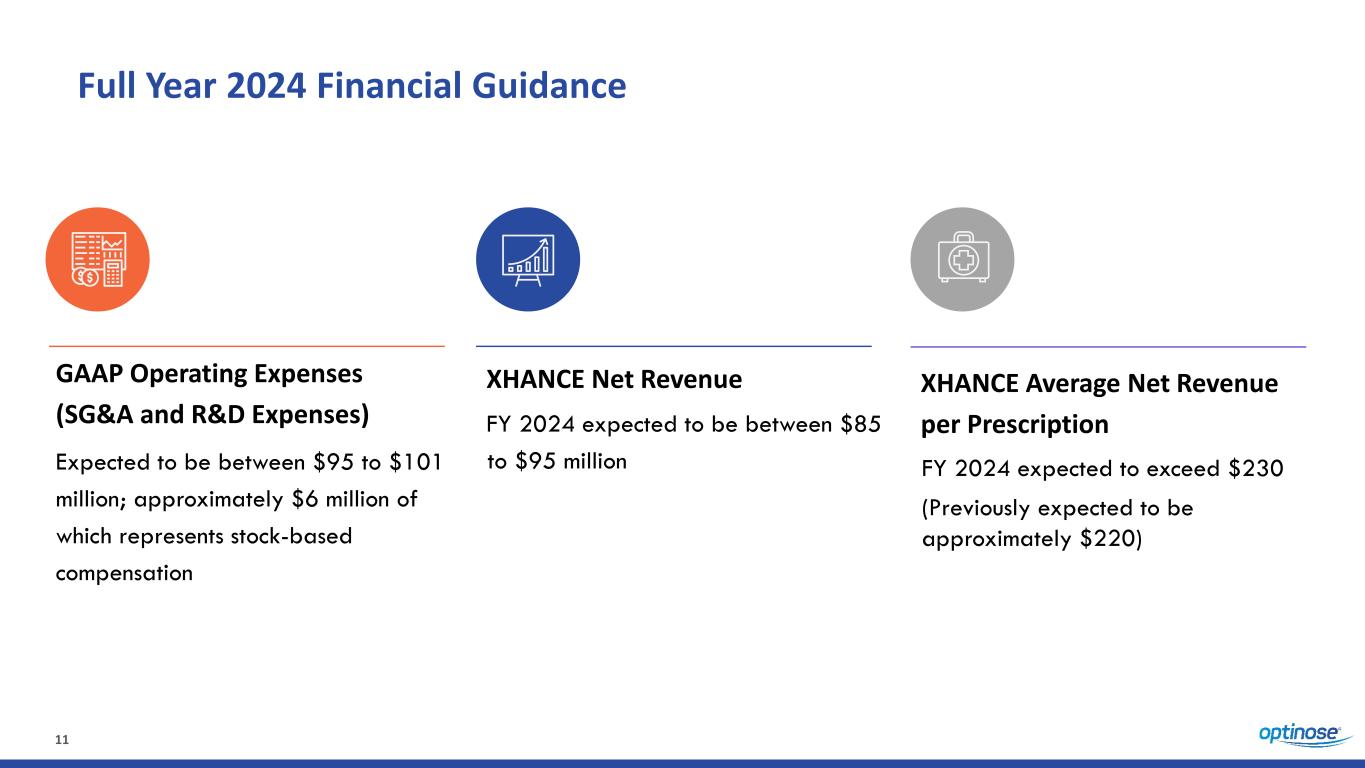

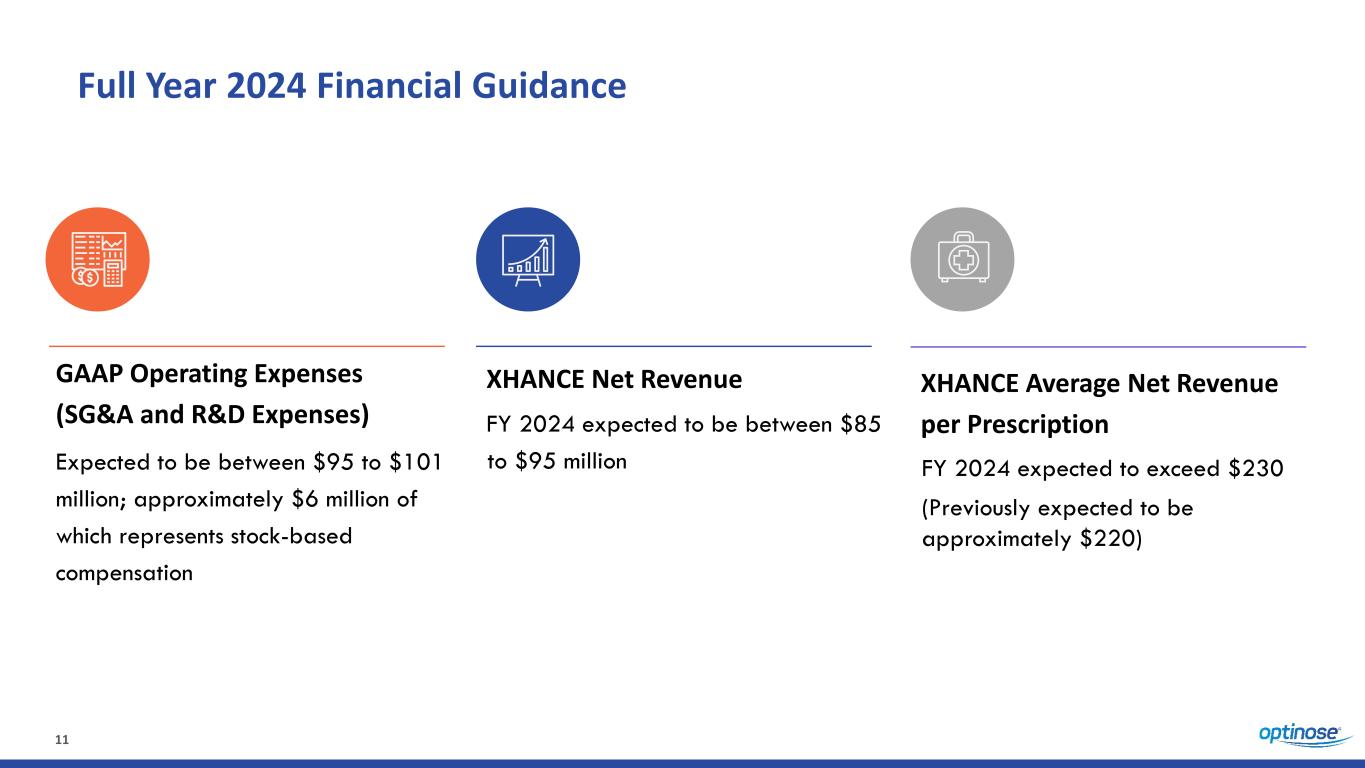

11 Full Year 2024 Financial Guidance GAAP Operating Expenses (SG&A and R&D Expenses) Expected to be between $95 to $101 million; approximately $6 million of which represents stock-based compensation XHANCE Net Revenue FY 2024 expected to be between $85 to $95 million XHANCE Average Net Revenue per Prescription FY 2024 expected to exceed $230 (Previously expected to be approximately $220)

Closing Remarks

13 Optinose – Financial Outlook for XHANCE in Chronic Sinusitis Our Leadership team is focused on meeting or exceeding these objectives Growth With the new CS indication XHANCE has peak net revenue potential of at least $300M in specialty physician audience Efficiency XHANCE launching into greatly expanded market with existing 75 territory sales force and established insurance coverage Profitability Increased revenue opportunity and sales efficiency support expectation of positive income from operations (GAAP) for Full Year 2025 We believe strong growth and profitability are possible in our current ENT and Allergy segment

14 Optinose – Incremental Growth Opportunities Additional growth potential exists both within and beyond our current ENT/Allergy audience Expand in Specialty: We believe there are ROI positive opportunities to expand sales territories (to as many as ~115) in ENT and Allergy based on success/capital availability PCP and DTC: Potential to secure a partner with direct sales infrastructure, and/or create value with other selling models, targeting the ~7 million CS patients in primary care today, and to use DTC to activate the ~20 million people with CS not actively seeking care Major Markets Outside the USA: The first-ever CS approval may create opportunities for value creation outside the U.S. and we have maintained patents in select major markets Leverage: Our capabilities and infrastructure make Optinose an ideal partner to develop and/or commercialize additional products in our specialty space of ENT and Allergy

15 Key Takeaways • New indication creates a significant near-term growth opportunity with up to a 10x multiple on the TAM based on patients who are currently treated by a physician • Current specialty sales force of 75 reps, and phased modest incremental commercial investment, sufficient to achieve peak net revenue of at least $300M and positive income from operations for full year 2025 XHANCE Chronic Sinusitis Launch Building from a stronger base Return to strong growth in 2024 • Success in 2023 and Q1 2024 with a disciplined approach to operating expenses provided runway to initiate CS launch and supports plan to drive growth with modest incremental investment • Focus on growing profitable prescriptions is a key driver for Q1 2024 performance and our increase to full year 2024 XHANCE net revenue per prescription guidance • New indication creates opportunity for commercial team to promote a "first and only" clinical efficacy and safety profile • Initial expectation for FY 2024 XHANCE net revenue is for growth of 20% to 34%; increasing net revenue per prescription expectation to at least $230 (previously expected to be approximately $220)

16 Investor Relations – NASDAQ: OPTN Optinose Investor ContactAnalyst Coverage 1 Jefferies: Glen Santangelo Lake Street: Thomas Flaten Piper Sandler: David Amsellem H. C. Wainwright: Matthew Caufield 1 - Optinose is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding the Company’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of Optinose or its management. Optinose does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Jonathan Neely, VP, Investor Relations and Business Development 267-521-0531 Investors@optinose.com As of March 31, 2024: $51.6 million in cash Debt: $130 million 113 million common shares o/s 46 million options, warrants & RSUs o/s @optinose investors@optinose.com www.optinose.com

Building a Leading ENT / Allergy Specialty Company Corporate Presentation May 14, 2024