- GBLI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Global Indemnity (GBLI) PRE 14APreliminary proxy

Filed: 23 Jun 20, 5:33pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

☐ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under§240.14a-12 | |

GLOBAL INDEMNITY LIMITED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |||

☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

(1) | Title of each class of securities to which transaction applies:

| |||

(2) | Aggregate number of securities to which transaction applies:

| |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

(4) | Proposed maximum aggregate value of transaction:

| |||

(5) | Total fee paid:

| |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid:

| |||

(2) | Form, Schedule or Registration Statement No.:

| |||

(3) | Filing Party:

| |||

(4) | Date Filed:

| |||

GLOBAL INDEMNITY LIMITED

SPECIAL SCHEME MEETING AND EXTRAORDINARY GENERAL MEETING OF HOLDERS

OF ORDINARY SHARES TO BE HELD ON [●], 2020

[●], 2020

Dear Holders of A ordinary shares and B ordinary shares (the “shareholders”) of Global Indemnity Limited (“GI Cayman”):

After a review by our board of directors (the “Board”) and management team, we have decided to simplify and streamline the organizational, statutory and regulatory structure of the Global Indemnity group of companies by reorganizing the Global Indemnity group of companies to reduce the number of jurisdictions governing our business and operations. As part of the transaction, by way of a scheme of arrangement and amalgamation under Cayman Islands law, GI Cayman will merge with and into a newly formed exempted company incorporated under Cayman Islands law (“New CayCo”), with New Cayco surviving, and the ultimate parent company of our group of companies will become a limited liability company formed under the laws of the State of Delaware (“Delaware”) (“GI Delaware”) and, following the transaction, it is proposed that New CayCo will merge with and into GI Delaware. Additionally, as part of the transaction, the business of Global Indemnity Reinsurance Company, Ltd. (“GI Bermuda”) will be assumed by the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries (the “GI Bermuda Transaction”). We are making this proxy statement available in connection with the solicitation by the Board of proxies to be voted at the special meetings of our shareholders to be convened for the purposes set forth in the accompanying proxy statement.

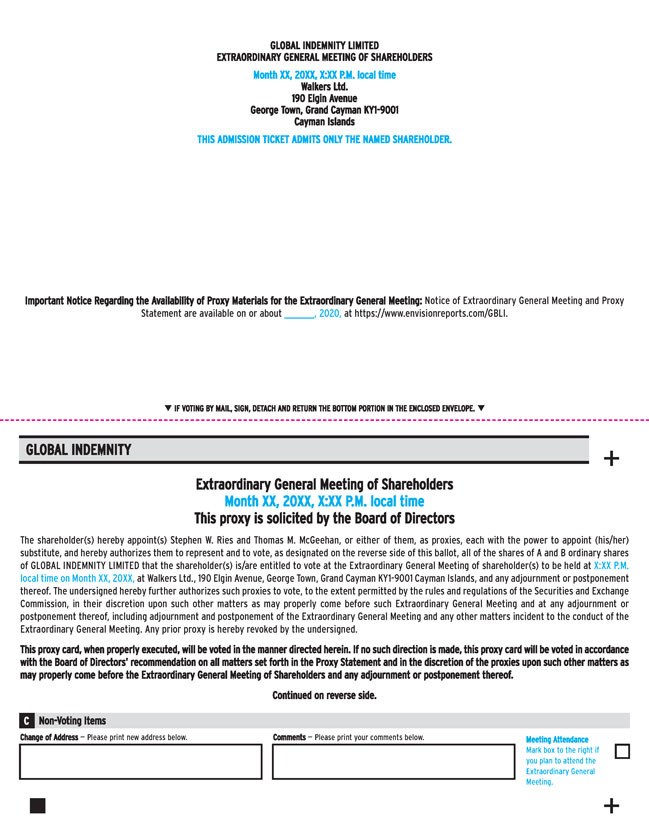

On [•], 2020, commencing at [●] [a.m./p.m.], Cayman Islands Time, we will hold two special meetings of our shareholders at the offices of Walkers, located at 190 Elgin Avenue, George Town, Grand Cayman, KY1-9001, Cayman Islands and will broadcast the special meetings via live webcast. The special meetings are being broadcast via live webcast due to the public health threat and travel restrictions caused by the COVID-19 pandemic. You will not be able to attend the special meetings physically in person. Shareholders as of the close of business on [●], 2020 (the “Voting Record Time”) will be entitled to attend and vote at the special meetings. In order to participate in the special meetings, registered shareholders must register for the special meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your proxy cards sent in respect of the special meetings. Registered shareholders who have validly registered for the special meetings will be provided a link to the special meetings one hour prior to the start of the special meetings. If you hold your GI Cayman shares in ‘street name’ through a broker or nominee you should contact your broker to receive a voting instruction form for use at the special meetings. You will be required to provide proof of your beneficial ownership of your GI Cayman shares as of the Voting Record Time, such as a bank or brokerage account statement or letter from your bank, broker or other nominee to register for the shareholder meetings. In order to participate in the special meetings, holders of GI Cayman shares in ‘street name’ through a broker or nominee must register for the special meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your voting instruction form. Such holders will be provided a link to the special meetings one hour prior to the start of the special meetings. Due to the virtual format, only the formal business of the special meetings will be conducted. Shareholders are encouraged to submit their votes in advance of the special meetings, following the procedure outlined further below.

At these meetings, you will be asked to vote on a number of proposals, including proposals for a “scheme of arrangement” pursuant to Sections 86 and 87 of the Cayman Islands Companies Law (2020 Revision), as

amended, modified orre-enacted from time to time (the “Cayman Companies Law”), that would result in a change in the ultimate parent company of the Global Indemnity group of companies from the present holding company that is incorporated in the Cayman Islands to a holding company that is formed in Delaware and a proposal that would result in the business of GI Bermuda being assumed by the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries, as described in the accompanying proxy statement.

While a complex multi-national business structure has served us and our shareholders well for many years, changes in the U.S. tax laws and other compelling reasons support reorganizing the Global Indemnity group of companies at this time. After considering various factors, the Board unanimously determined that this reorganization of the Global Indemnity group of companies will, among other benefits, simplify and streamline the organizational, statutory and regulatory structure of the Global Indemnity group of companies as a result of the transaction outlined in the accompanying proxy statement. The Board believes that the proposed entity reorganization of the Global Indemnity group of companies pursuant to the proposed scheme of arrangement and the other related proposals will achieve a more appropriate structure for the Global Indemnity group of companies. The reasons for the transaction and the other proposals are discussed in further detail in the accompanying proxy statement.

For you, our shareholders, much will remain unchanged following the time the scheme of arrangement and the GI Bermuda Transaction come into effect, although there will be some differences, given the changes in the governing laws of our ultimate parent company, its classification as a partnership for U.S. federal income tax purposes, the U.S. federal income tax consequences of the transaction, and the form of securities you will hold. If the scheme of arrangement is approved and becomes effective, it will result in holders of GI Cayman ordinary shares at the scheme record time (expected to be [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020) (the “Scheme Record Time”) holding the same number of GI Delaware common shares as they presently hold in GI Cayman and GI Delaware will become the ultimate parent company of the Global Indemnity group of companies. Completion of the proposed scheme of arrangement will result in the cancellation of your A ordinary shares and/or B ordinary shares (the A ordinary shares and B ordinary shares, together, the “GI Cayman ordinary shares”) in GI Cayman, and the immediate issuance to you of an equal number of class A common shares and/or class B common shares, respectively, issued by Global Indemnity Group, LLC, a Delaware limited liability company which will become our new ultimate parent company (“GI Delaware”). For U.S. federal income tax purposes, GI Delaware will be treated as a partnership and you, our shareholders, will be treated as partners in such partnership.

If the scheme of arrangement takes effect, your rights with respect to the GI Delaware common shares will be substantially the same as those currently in effect with respect to the GI Cayman ordinary shares. Upon the scheme of arrangement becoming effective, holders of GI Delaware common shares will have the same proportionate interest in the profits, net assets and dividends of the Global Indemnity group of companies as they had immediately prior to the effective date of the scheme of arrangement as a holder of GI Cayman ordinary shares.

Just as is the case today with your GI Cayman A ordinary shares, upon completion of the transaction, the class A common shares of GI Delaware, our ultimate parent company, will be listed on the Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “GBLI” and will be registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended, and be subject to the same SEC reporting requirements, the mandates of the Sarbanes-Oxley Act of 2002 and the applicable corporate governance rules of Nasdaq. We will continue to report our financial results in U.S. dollars and under U.S. generally accepted accounting principles. GI Delaware will in the ordinary course make available customary financial information and other reports filed with the SEC, consistent with our established current practices.

The purpose of the accompanying proxy statement is to explain the proposed scheme of arrangement and the other proposals and why the Board believes the scheme of arrangement and the other proposals will achieve a more appropriate structure for the Global Indemnity group of companies. As such, the proxy statement provides important information about the meetings and the proposals described above. We encourage you to read the

entire document carefully.You should carefully read and consider the “Risk Factors” beginning on page [●]for a discussion of potential risks before voting. You are entitled to vote by attending the meetings or by appointing a proxy. It is not necessary that the proxy appointed by you be a current shareholder of GI Cayman.

Your vote is very important. The Board has unanimously determined that the proposals above are advisable and recommends that you vote “FOR” all of the above proposals.

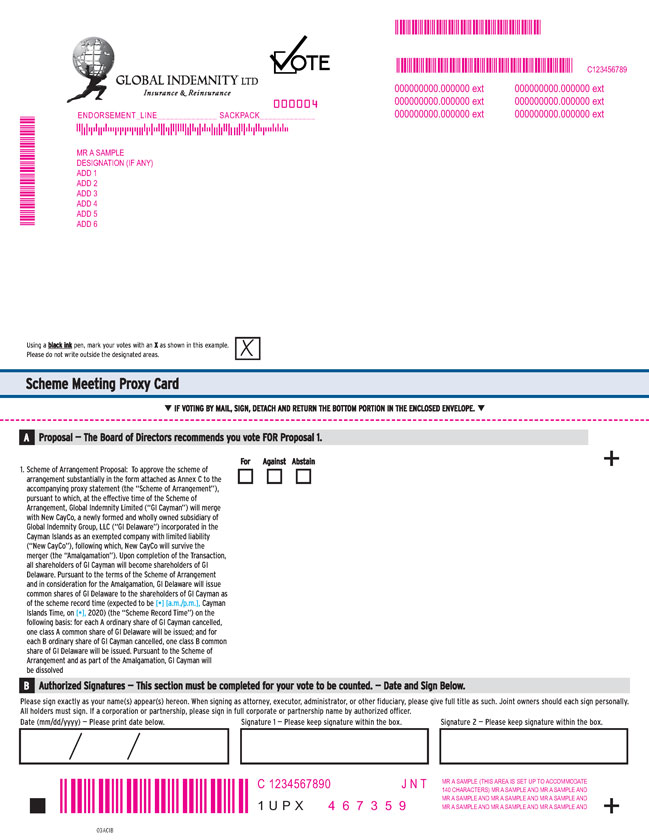

If you are a registered shareholder, to ensure that your GI Cayman ordinary shares are voted in accordance with your wishes, please properly mark, date, sign and return both the accompanying proxy cards (one blue for the scheme meeting, and one white for the extraordinary general meeting) by courier in the enclosed, postage-paid envelope (as applicable) as promptly as possible. In order for your proxies to be voted, Computershare LLC must receive your proxy cards at 2950 Express Drive South, Suite 210, Islandia, NY 11749, at least forty eight hours prior to the commencement of the relevant shareholder meeting but not later than [●] [a.m./p.m.] (Eastern Time) on [●], 2020.

If you hold your GI Cayman ordinary shares in “street name” through a bank, broker, trustee, custodian or other nominee (which we generally refer to as “brokers” or “nominees”), please follow the voting instructions provided by your broker, which may include an option to instruct the broker or nominee by telephone on how to vote. Please note that holders of GI Cayman ordinary shares through brokers or nominees may be required to submit voting instructions to their applicable broker or nominee at or prior to the deadline applicable to registered holders of GI Cayman ordinary shares and such holders should therefore follow the separate instructions that will be provided by their applicable broker or nominee.

If you have any questions about the meetings or require assistance, please call Georgeson LLC, our proxy solicitor, at(866) 767-8989 (toll-free within the United States) or at(781) 575-2137 (outside the United States).

On behalf of GI Cayman’s Board, thank you for your continued support.

Sincerely,

Cynthia Y. Valko Chief Executive Officer |

Saul A. Fox Chairman of the Board of Directors |

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued in the contemplated scheme of arrangement or determined if the accompanying proxy statement is truthful or complete. Any representation to the contrary is a criminal offense.

The accompanying proxy statement related to the GI Cayman ordinary shares is dated [●], 2020 and is first being mailed to GI Cayman’s shareholders on or about [●], 2020.

SUMMARY OF NOTICES OF THE SPECIAL SCHEME MEETING

AND THE EXTRAORDINARY GENERAL

MEETING OF THE HOLDERS OF GLOBAL INDEMNITY LIMITED A ORDINARY SHARES AND B

ORDINARY SHARES

TO BE HELD ON [●], 2020

To the holders of A ordinary shares and B ordinary shares of Global Indemnity Limited (together the A ordinary shares and B ordinary shares, the “GI Cayman ordinary shares”):

On [●], 2020, Global Indemnity Limited, a Cayman Islands exempted company (“GI Cayman”), will hold a special meeting (the “scheme meeting”) of the holders of GI Cayman ordinary shares (the “shareholders”), which will commence at [●] [a.m./p.m.], Cayman Islands Time, and an extraordinary general meeting (the “extraordinary general meeting”) of shareholders, which will commence at [●] [a.m./p.m.], Cayman Islands Time (or as soon thereafter as the scheme meeting concludes or is adjourned), in order to approve certain proposals, including a proposal for a scheme of arrangement pursuant to Sections 86 and 87 of the Cayman Islands Companies Law (2020 Revision), as amended, modified orre-enacted from time to time (the “Cayman Companies Law”). We sometimes refer to these meetings together as the “shareholder meetings.”

We will hold the shareholder meetings at the offices of Walkers, located at 190 Elgin Avenue, George Town, Grand Cayman, KY1-9001, Cayman Islands and will broadcast the shareholder meetings via live webcast. The shareholder meetings are being broadcast via live webcast due to the public health threat and travel restrictions caused by the COVID-19 pandemic. You will not be able to attend the shareholder meetings physically in person. Shareholders as of the close of business on [●], 2020 (the “Voting Record Time”) will be entitled to attend and vote at the shareholder meetings. In order to participate in the shareholder meetings, registered shareholders must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your proxy cards sent in respect of the shareholder meetings. Registered shareholders who have validly registered for the shareholder meetings will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings. If you hold your GI Cayman shares in ‘street name’ through a broker or nominee you should contact your broker to receive a voting instruction form for use at the shareholder meetings. You will be required to provide proof of your beneficial ownership of your GI Cayman shares as of the Voting Record Time, such as a bank or brokerage account statement or letter from your bank, broker or other nominee to register for the shareholder meetings. In order to participate in the shareholder meetings, holders of GI Cayman shares in ‘street name’ through a broker or nominee must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your voting instruction form. Such holders will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings. Due to the virtual format, only the formal business of the shareholder meetings will be conducted. Shareholders are encouraged to submit their votes in advance of the shareholder meetings, following the procedure outlined further below.

Shareholders are being asked to vote on the following matters:

At the scheme meeting:

| • | To approve the scheme of arrangement substantially in the form attached as Annex C to the accompanying proxy statement (the “Scheme of Arrangement”), pursuant to which, at the effective time of the Scheme of Arrangement, GI Cayman will merge with and into New CayCo, a newly formed and wholly owned subsidiary of GI Delaware incorporated in the Cayman Islands as an exempted company with limited liability (“New CayCo”), following which, New CayCo will survive the merger (the “Amalgamation”). |

| • | Upon completion of the Transaction, all shareholders of GI Cayman will become shareholders of GI Delaware. Pursuant to the terms of the Scheme of Arrangement and in consideration for the Amalgamation, GI Delaware will issue common shares of GI Delaware to the shareholders of GI Cayman as of the scheme record time (expected to be [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020) (the |

“Scheme Record Time”) on the following basis: for each A ordinary share of GI Cayman cancelled, one class A common share of GI Delaware will be issued; and for each B ordinary share of GI Cayman cancelled, one class B common share of GI Delaware will be issued. Pursuant to the Scheme of Arrangement and as part of the Amalgamation, GI Cayman will be dissolved. |

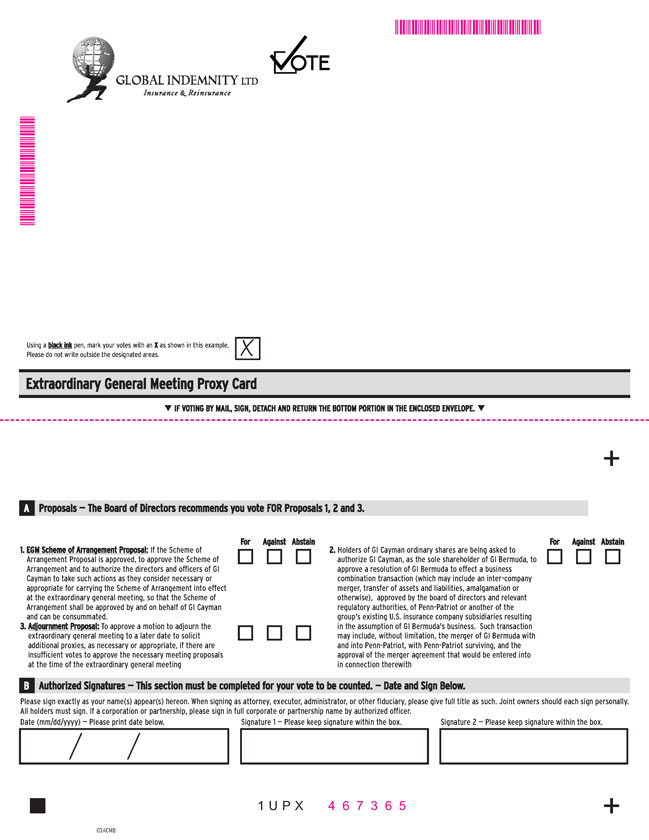

We refer to this proposal (Proposal Number One) as the “Scheme of Arrangement Proposal.”

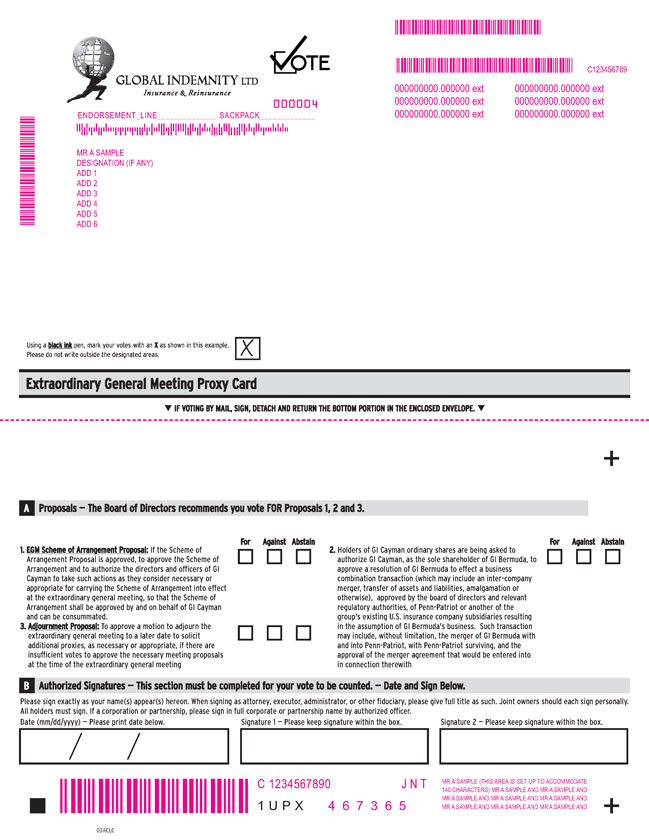

At the extraordinary general meeting:

| • | If the Scheme of Arrangement Proposal is approved, to approve the Scheme of Arrangement and to authorize the directors and officers of GI Cayman to take such actions as they consider necessary or appropriate for carrying the Scheme of Arrangement into effect at the extraordinary general meeting, so that the Scheme of Arrangement shall be approved by and on behalf of GI Cayman and can be consummated. |

We refer to this proposal (Proposal Number Two) as the “Scheme EGM Proposal.”

| • | If the Scheme of Arrangement Proposal is approved, to authorize GI Cayman, as the sole shareholder of GI Bermuda, to approve a resolution of GI Bermuda to effect a business combination transaction (which may include an inter-company merger, transfer of assets and liabilities, amalgamation or otherwise), approved by the board of directors and relevant regulatory authorities, with Penn-Patriot Insurance Company, an indirect wholly-owned insurance subsidiary of GI Cayman (“Penn-Patriot”), or another of the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries, resulting in the assumption of GI Bermuda’s business by the Global Indemnity group of companies’ existing U.S. insurance Company subsidiaries. Such transaction may include, without limitation, the merger of GI Bermuda with and into Penn-Patriot, with Penn-Patriot surviving, and the approval of the merger agreement that would be entered into in connection therewith. |

We refer to this proposal (Proposal Number Three) as the “GI Bermuda Transaction Proposal.”

| • | To approve a motion to adjourn the extraordinary general meeting to a later date to solicit additional proxies, as necessary or appropriate, if there are insufficient votes to approve the necessary meeting proposals at the time of the extraordinary general meeting. |

We refer to this proposal (Proposal Number Four) as the “Adjournment Proposal.”

The proposals contemplated by the accompanying proxy statement, including the Scheme of Arrangement Proposal, the Scheme EGM Proposal, the GI Bermuda Transaction Proposal and the Adjournment Proposal, are sometimes referred to herein as the “meeting proposals.”

The transactions contemplated by the Scheme of Arrangement and the accompanying proxy statement, including the Scheme of Arrangement Proposal, the Scheme EGM Proposal, the GI Bermuda Transaction Proposal and the other actions by GI Cayman and/or its affiliates described in the accompanying proxy statement are sometimes referred to herein as the “Transaction.”

Approval of each of the Scheme of Arrangement Proposal, the Scheme EGM Proposal and the GI Bermuda Transaction Proposal by our shareholders is a condition to the Scheme of Arrangement becoming effective.

The formal notices of the scheme meeting and the extraordinary general meeting are provided as attachments to the accompanying proxy statement as Annexes A and B, respectively, and should be read closely. This summary does not constitute the formal notice in respect of either of those meetings.

If any other matters properly come before either of the shareholder meetings or any adjournments of either of the shareholder meetings, the persons named in the proxy card will have the authority to vote the GI Cayman ordinary shares represented by all properly executed proxies in their discretion. The Board of GI Cayman

currently does not know of any matters to be raised at the shareholder meetings other than the meeting proposals contained in this proxy statement.

The Board of GI Cayman has set the close of business, Cayman Islands Time, on [●], 2020 as the record date (the “Voting Record Time”) for the scheme meeting and for the extraordinary general meeting. This means that only those persons who were GI Cayman shareholders at the close of business on [●], 2020 will be entitled to receive notice of, and to attend and vote, at the shareholder meetings and any adjournments thereof.

The scheme meeting has been convened at [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020, pursuant to an Order of the Cayman Islands Grand Court (the “Cayman Court”) granted on [●], 2020. The extraordinary general meeting also has been scheduled for [●], 2020, and will commence at [●] [a.m./p.m.], Cayman Islands Time (or as soon thereafter as the scheme meeting concludes or is adjourned). If the GI Cayman shareholders approve each of the Scheme of Arrangement Proposal, the Scheme EGM Proposal and the GI Bermuda Transaction Proposal and the other conditions to the Scheme of Arrangement have been satisfied or waived, we will seek the Cayman Court’s sanction of the Scheme of Arrangement. Sanction of the Cayman Court must be obtained as a condition to the Scheme of Arrangement becoming effective. We expect the sanction hearing to be held at the Law Courts, George Town, Grand Cayman at [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020 (the “Sanction Hearing”), further details of which will be advertised by GI Cayman on its website and in The Wall Street Journal and certain Cayman Islands newspapers in accordance with directions that we intend to request from the Cayman Court. GI Cayman shareholders who voted at the scheme meeting or gave instructions to their broker or nominee to vote at the scheme meeting (as applicable) have the right to attend the Sanction Hearing and to appear in person or be represented by counsel to support or oppose the sanction of the Scheme of Arrangement. We expect that the Cayman Court will make facilities available for applicable GI Cayman shareholders to attend the Sanction Hearing in person via live webcast (if they wish). If you are a GI Cayman shareholder who wishes to appear in person or by counsel at the Sanction Hearing and present evidence or arguments in support of or opposition to the Scheme of Arrangement, we expect that the Cayman Court will require that you give notice of your intention to do so to GI Cayman’s Cayman Islands legal advisers, Walkers, at 190 Elgin Avenue, George Town, Grand CaymanKY1-9001, Cayman Islands, at a time prior to the date of the Sanction Hearing. GI Cayman will not object to the participation in the Sanction Hearing by any person who holds shares through a broker or any other person with a legitimate interest in the proceedings and all such persons will have a right to participate.

The accompanying proxy statement and proxy cards (one blue for the scheme meeting, and one white for the extraordinary general meeting) are first being sent on or about [●], 2020 to the GI Cayman shareholders and contain additional information on how to attend the shareholder meetings and vote any GI Cayman ordinary shares you own in person or by proxy via live webcast at the shareholder meetings.

If you hold your GI Cayman ordinary shares in the name of a bank, broker, trustee, custodian or other nominee (which we generally refer to as “brokers” or “nominees”), and you plan to attend the shareholder meetings, you must contact your broker or nominee for details on how to register your attendance at the shareholder meetings. It will be necessary for you to present proof of your beneficial ownership of those GI Cayman ordinary shares as of the Voting Record Time, such as a bank or brokerage account statement or letter from your broker or other nominee to register for the shareholder meetings. In addition, you may not vote your GI Cayman ordinary shares in person via live webcast at the shareholder meetings unless you obtain an “instrument of proxy” or “legal proxy” from the broker or nominee that holds your GI Cayman ordinary shares. You will need to follow the instructions of your broker or nominee in order to obtain such an “instrument of proxy” or “legal proxy.”

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE SHAREHOLDER MEETINGS, PLEASE TAKE THE NECESSARY STEPS TO VOTE IN ADVANCE OF THE SHAREHOLDER MEETINGS.

IF YOU ARE A REGISTERED SHAREHOLDER, YOU SHOULD PROPERLY MARK, DATE, SIGN AND RETURN BOTH ACCOMPANYING PROXY CARDS (ONE BLUE FOR THE SCHEME MEETING, AND ONE WHITE FOR THE EXTRAORDINARY GENERAL MEETING) IN THE ENCLOSED, POSTAGE-PAID ENVELOPE AS PROMPTLY AS POSSIBLE.

IN ORDER FOR YOUR PROXIES TO BE VOTED, COMPUTERSHARE LLC MUST RECEIVE YOUR PROXY CARDS AT 2950 EXPRESS DRIVE SOUTH, SUITE 210, ISLANDIA, NY 11749, NOT LATER THAN [●] [A.M./P.M.] (EASTERN TIME) ON [●], 2020, AT LEAST FORTY EIGHT HOURS PRIOR TO THE COMMENCEMENT OF THE RELEVANT SHAREHOLDER MEETING.

IF YOU HOLD YOUR GI CAYMAN ORDINARY SHARES IN “STREET NAME” THROUGH A BROKER OR NOMINEE, PLEASE FOLLOW THE VOTING INSTRUCTIONS PROVIDED TO YOU BY SUCH BROKER OR NOMINEE, WHICH MAY INCLUDE AN OPTION TO INSTRUCT THE BROKER OR NOMINEE BY TELEPHONE ON HOW TO VOTE. PLEASE NOTE THAT HOLDERS OF GI CAYMAN ORDINARY SHARES THROUGH A BROKER OR NOMINEE MAY BE REQUIRED TO SUBMIT VOTING INSTRUCTIONS TO THEIR APPLICABLE BROKER OR NOMINEE AT OR PRIOR TO THE DEADLINE APPLICABLE FOR THE SUBMISSION BY GI CAYMAN SHAREHOLDERS AND SUCH HOLDERS SHOULD THEREFORE FOLLOW THE SEPARATE INSTRUCTIONS THAT WILL BE PROVIDED BY SUCH NOMINEE.

The accompanying proxy statement incorporates documents by reference. Please see “Where You Can Find More Information” beginning on page [●] of the accompanying proxy statement for a listing of documents incorporated by reference. These documents are available to any person, including any beneficial owner, upon request by contacting us at:

Corporate Secretary c/o Global Indemnity Limited

Attn: Walkers Corporate Limited

Cayman Corporate Centre

27 Hospital Road

George Town, Grand CaymanKY1-9008

Cayman Islands

Telephone: +1 345 814 7600

Email:info@global-indemnity.com

To ensure timely delivery of these documents, any request should be made no later than [●], 2020. The exhibits to these documents will generally not be made available unless such exhibits are specifically incorporated by reference in the accompanying proxy statement.

| Page | ||||

| 2 | ||||

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE OTHER PROPOSALS | 6 | |||

| 20 | ||||

| 32 | ||||

| 35 | ||||

| 36 | ||||

| 41 | ||||

| 42 | ||||

| 54 | ||||

| 55 | ||||

| 58 | ||||

| 59 | ||||

| 69 | ||||

COMPARISON OF RIGHTS OF SHAREHOLDERS AND POWERS OF THE BOARD OF DIRECTORS | 79 | |||

| 113 | ||||

| 119 | ||||

| 122 | ||||

| 125 | ||||

| 126 | ||||

| 127 | ||||

| 128 | ||||

| 129 | ||||

| 130 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 | ||||

ANNEX [F] — FORM OF GI DELAWARE LIMITED LIABILITY COMPANY AGREEMENT | F-1 | |||

GLOBAL INDEMNITY LIMITED

PROXY STATEMENT

For the Special Scheme Meeting and the Extraordinary General Meeting

of the Holders of Global Indemnity Limited A Ordinary Shares and B Ordinary Shares

to be held on [●], 2020

This proxy statement which also constitutes the “scheme circular” required to be sent to shareholders under Cayman Islands law, is furnished to the holders of A ordinary shares and B ordinary shares (the “shareholders”) of Global Indemnity Limited, a Cayman Islands exempted company (“GI Cayman”), in connection with the solicitation of proxies on behalf of the board of directors of GI Cayman (the “Board”) to be voted at the special scheme meeting of shareholders (the “scheme meeting”) and the extraordinary general meeting of shareholders (the “extraordinary general meeting”) to be held on [●], 2020, and any adjournments thereof, at the times and place and for the purposes set forth in the accompanying notices of the scheme meeting and the extraordinary general meeting. We sometimes refer to these meetings together as the “shareholder meetings.” This proxy statement and the accompanying proxy cards (one blue proxy card for the scheme meeting, and one white proxy card for the extraordinary general meeting) are first being sent to shareholders on or about [●], 2020. Pleaseproperlymark, date, sign and return both enclosed proxy cards (one blue for the scheme meeting, and one white for the extraordinary general meeting)to ensure that all of your GI Cayman A ordinary shares, par value $0.0001 per share, and B ordinary shares, par value $0.0001 per share (together, the “GI Cayman ordinary shares”), are represented at the shareholder meetings.

GI Cayman ordinary shares represented by valid proxies will be voted in accordance with instructions contained therein or, in the absence of such instructions, “FOR” each of the meeting proposals set forth in this proxy statement. You may revoke your proxy at any time before it is exercised at the shareholder meetings by timely delivery of a properly executed, later-dated proxy with respect to the shareholder meetings to Computershare LLC at 2950 Express Drive South, Suite 210, Islandia, NY 11749.

GI Cayman has set the close of business, Cayman Islands Time, on [●], 2020 as the record date (the “Voting Record Time”) for the scheme meeting and for the extraordinary general meeting. This means that only those persons who were GI Cayman shareholders at the close of business on [●], 2020 will be entitled to attend and vote, at the shareholder meetings and any adjournments thereof. As of the Voting Record Time, [●] GI Cayman A ordinary shares and [●] GI Cayman B ordinary shares were issued and outstanding.

Only GI Cayman shareholders as of the Voting Record Time are invited to attend the shareholder meetings. For registered shareholders we have enclosed two proxy cards—one blue proxy card for the scheme meeting, and one white proxy card for the extraordinary general meeting. Please properly mark, date, sign and return both proxy cards.

If you hold your GI Cayman ordinary shares in “street name” beneficially through a bank, broker, trustee, custodian or other nominee (which we generally refer to as “brokers” or “nominees”), you must follow the procedures required by your broker or nominee to appoint or revoke a proxy with respect to the shareholder meetings. You should contact your broker or nominee directly for more information on these procedures.

In order to participate in the shareholder meetings, registered shareholders must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your proxy cards sent in respect of the shareholder meetings. Registered shareholders who have validly registered for the shareholder meetings will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings.

1

If you hold your GI Cayman shares in ‘street name’ through a broker or nominee you should contact your broker to receive a voting instruction form for use at the shareholder meetings. You will be required to provide proof of your beneficial ownership of your GI Cayman shares as of the Voting Record Time, such as a bank or brokerage account statement or letter from your bank, broker or other nominee to register for the shareholder meetings. In order to participate in the shareholder meetings, holders of GI Cayman shares in ‘street name’ through a broker or nominee must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your voting instruction form. Such holders will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings. In addition, you may not vote your GI Cayman ordinary shares in person via live webcast at the shareholder meetings unless you obtain an “instrument of proxy” or “legal proxy” from the broker or nominee that holds your GI Cayman ordinary shares. You will need to follow the instructions of your broker or nominee in order to obtain such an “instrument of proxy” or “legal proxy.” Due to the virtual format, only the formal business of the shareholder meetings will be conducted. Shareholders are encouraged to submit their votes in advance of the shareholder meetings, following the procedure outlined further below.

In Proposal Number One (the “Scheme of Arrangement Proposal”), we are seeking your approval at the scheme meeting of a scheme of arrangement pursuant to Sections 86 and 87 of the Cayman Islands Companies Law (2020 Revision), as amended, modified orre-enacted from time to time (the “Cayman Companies Law”), substantially in the form attached as Annex C to this proxy statement (the “Scheme of Arrangement”), which if effective, will result in you owning common shares of Global Indemnity Group, LLC, a newly formed limited liability company (“GI Delaware”) in the State of Delaware (“Delaware”), instead of GI Cayman ordinary shares. Please see “Proposal Number One: The Scheme of Arrangement Proposal.”

In Proposal Number Two (the “Scheme EGM Proposal”), we are seeking your approval at the extraordinary general meeting of the Scheme of Arrangement and to authorize the directors and officers of GI Cayman to take such actions as they consider necessary or appropriate for carrying the Scheme of Arrangement into effect at the extraordinary general meeting, so that the Scheme of Arrangement shall be approved by and on behalf of GI Cayman and can be consummated. Please see “Proposal Number Two: The Scheme EGM Proposal.”

In Proposal Number Three (the “GI Bermuda Transaction Proposal”), we are seeking your approval at the extraordinary general meeting to authorize GI Cayman, as the sole shareholder of Global Indemnity Reinsurance Company, Ltd., a Bermuda exempted company (“GI Bermuda”), to approve a resolution of GI Bermuda to effect a business combination transaction (which may include an inter-company merger, transfer of assets and liabilities, amalgamation or otherwise), approved by the board of directors and relevant regulatory authorities, with Penn-Patriot Insurance Company, an indirect wholly-owned insurance subsidiary of GI Cayman (“Penn-Patriot”), or another of the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries, resulting in the assumption of GI Bermuda’s business by the Global Indemnity group of companies’ existing U.S. insurance Company subsidiaries. Such transaction may include, without limitation, the merger of GI Bermuda with and into Penn-Patriot, with Penn-Patriot surviving, and the approval of the merger agreement that would be entered into in connection therewith. Please see “Proposal Number Three: The GI Bermuda Transaction Proposal.”

In Proposal Number Four (the “Adjournment Proposal”), we may seek your approval at the extraordinary general meeting to authorize the chairman of the extraordinary general meeting to adjourn the meeting if there are insufficient votes to approve the necessary meeting proposals at the extraordinary general meeting, as necessary or appropriate. Please see “Proposal Number Four: The Adjournment Proposal.”

2

If the Scheme of Arrangement is approved and becomes effective, then the Amalgamation will occur. Pursuant to the terms of the Scheme of Arrangement and in consideration for the Amalgamation, GI Delaware will issue common shares of GI Delaware to the shareholders of GI Cayman as of the Scheme Record Time on the following basis: for each A ordinary share of GI Cayman cancelled, one class A common share of GI Delaware will be issued; and for each B ordinary share of GI Cayman cancelled, one class B common share of GI Delaware will be issued. Pursuant to the Scheme of Arrangement and as part of the Amalgamation, GI Cayman will be dissolved.

Several steps are required in order for us to effect the Scheme of Arrangement, including convening and holding the scheme meeting at which GI Cayman shareholders will consider and, if thought fit, approve the Scheme of Arrangement. The scheme meeting has been convened at [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020 pursuant to an Order of the Cayman Islands Grand Court (the “Cayman Court”) granted on [●], 2020. Notice of the scheme meeting is set out at Annex A to this proxy statement. If each of the Scheme of Arrangement Proposal, the Scheme EGM Proposal and the GI BermudaTransaction Proposal are approved by the GI Cayman shareholders and the other conditions to the Scheme of Arrangement have been satisfied or waived, we will seek the Cayman Court’s sanction of the Scheme of Arrangement.

If we obtain the requisite approvals from our shareholders and the Cayman Court’s sanction of the Scheme of Arrangement, and if all of the other conditions to the Scheme of Arrangement, as described herein, are satisfied or, if permitted by applicable law, waived, we intend to file the order of the Cayman Court sanctioning the Scheme of Arrangement with the Cayman Islands Registrar of Companies (the “Sanction Order”). Upon delivery of the Sanction Order with the Cayman Islands Registrar of Companies, the Scheme of Arrangement will become effective in accordance with its terms (the “Effective Time”). We presently expect the Effective Time to occur before the opening of trading of the GI Delaware class A common shares on the Nasdaq Global Select Market (“Nasdaq”) on the trading day immediately following the date of delivery of the Sanction Order to the Cayman Islands Registrar of Companies. The exact date and timing of the Effective Time will depend on factors such as any postponement or adjournment of the hearing before the Cayman Court regarding sanction of the Scheme of Arrangement (the “Sanction Hearing”).

At the Effective Time, the following steps will occur effectively simultaneously in the following order:

| 1. | GI Cayman will merge with and into New CayCo, a newly formed and wholly owned subsidiary of GI Delaware incorporated in the Cayman Islands as an exempted company with limited liability (“New CayCo”), following which, New CayCo will survive the merger (the “Amalgamation”); |

| 2. | in consideration for the Amalgamation, GI Delaware will issue an equal number of GI Delaware common shares to GI Cayman shareholders at the scheme record time (expected to be [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020) (the “Scheme Record Time”), on the following basis: for each GI Cayman A ordinary share cancelled, one GI Delaware class A common share shall be issued; and/or for each GI Cayman B ordinary share cancelled, one GI Delaware class B common share shall be issued; and |

| 3. | pursuant to the Scheme of Arrangement and as part of the Amalgamation, GI Cayman will be dissolved. |

As a result of the Scheme of Arrangement, the GI Cayman shareholders will become holders of all of the GI Delaware common shares and GI Delaware will own all of the outstanding ordinary shares in GI Cayman. The members of the Board in office two business days prior to the effective time of the Scheme of Arrangement will be appointed as the members of the board of directors of GI Delaware effective as of one business day prior to the Effective Time.

3

After the Effective Time, you will continue to own an interest in the ultimate parent company of the Global Indemnity group of companies, which will indirectly conduct the same business operations as currently conducted indirectly by GI Cayman, through the same group of subsidiaries of GI Cayman prior to the Effective Time. The number of GI Delaware common shares you will own will be the same as the number of GI Cayman ordinary shares you own immediately prior to the Effective Time, and your relative ownership interest in the Global Indemnity group of companies will remain unchanged as a result of the Scheme of Arrangement.

At [●], 2020, [●] GI Cayman A ordinary shares and [●] GI Cayman B ordinary shares were issued and outstanding.

The transactions contemplated by the Scheme of Arrangement and this proxy statement, including the Scheme of Arrangement Proposal, the Scheme EGM Proposal, the GI Bermuda Transaction Proposal and the other actions by GI Cayman and/or its affiliates described in this proxy statement are sometimes referred to herein collectively as the “Transaction.”

If, and only if, the Transaction is consummated, GI Cayman will be merged with and into New CayCo (a direct wholly owned-subsidiary of GI Delaware, which will then be merged with and into GI Delaware subsequent to the Transaction), and, as a result, Penn-Patriot or another of the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries will become a direct, wholly-owned subsidiary of GI Delaware.

4

The following diagrams depict a simplified organizational structure of the relevant material members of the Global Indemnity group of companies as presently in effect and as we expect to be in effect immediately after the Transaction, assuming the GI Bermuda Transaction is a merger of GI Bermuda with and into Penn-Patriot, with Penn-Patriot surviving. In the following diagrams, red boxes indicatenon-U.S. entities and blue boxes indicate U.S. entities.

Before | After | |

|

|

We use the terms “GI,” “Global Indemnity,” “we,” “our company,” “the company,” “the Company,” “our” and “us” in this proxy statement to refer to GI Cayman and its subsidiaries, prior to the Transaction, and to refer to GI Delaware and its subsidiaries, after the Transaction.

5

QUESTIONS AND ANSWERS ABOUT THE TRANSACTION AND THE OTHER PROPOSALS

The following questions and answers are intended to address briefly some commonly asked questions regarding the Transaction and the shareholder meetings. These questions and answers highlight only some of the information contained in this proxy statement. They may not contain all the information that is important to you. To understand the Transaction, meeting proposals and voting procedures more fully, and for a more complete legal description of the Transaction, you should read carefully the entire proxy statement, including the annexes. The Scheme of Arrangement, substantially in the form attached as Annex C to this proxy statement, is the legal document that governs the Transaction. The limited liability company agreement of GI Delaware, substantially in the form attached to this proxy statement as Annex [●], will govern GI Delaware after the completion of the Scheme of Arrangement.

| 1. Q: | Why am I receiving this document? |

| A: | Holders of GI Cayman ordinary shares are being solicited by the Board to approve certain actions relating to the proposed Transaction which, once effective, will result in a change in the ultimate parent company of the Global Indemnity group of companies from GI Cayman to GI Delaware as set out in more detail in this proxy statement. Pursuant to the Scheme of Arrangement, ordinary shares in GI Cayman will be mandatorily exchanged for common shares in GI Delaware on aone-for-one basis. |

The Transaction will be a taxable exchange for U.S. federal income tax purposes, and you will be treated as a partner in a publicly traded partnership following the Transaction. Please refer to “Material Tax Considerations Relating to the Transaction” for a description of certain material U.S. federal and Cayman Islands tax consequences of the Transaction to GI Cayman shareholders.

| 2. Q: | What am I being asked to vote on at the shareholder meetings? |

| A: | The Scheme of Arrangement and certain other meeting proposals require holders of GI Cayman ordinary shares to vote on certain matters at both the scheme meeting and extraordinary general meeting. This document contains information to assist you in making your voting decisions at both the scheme meeting and the extraordinary general meeting in relation to the meeting proposals. |

It is important that for the scheme meeting as many votes as possible are cast so that the Cayman Court may be satisfied that there is a fair representation of the opinions of the GI Cayman shareholders.

Scheme Meeting

At the scheme meeting, GI Cayman shareholders are being asked to vote on the Scheme of Arrangement Proposal which, if effective, will result in you owning common shares of GI Delaware, a newly formed Delaware limited liability company, instead of the GI Cayman ordinary shares, and further result in GI Delaware becoming the new publicly traded ultimate parent company of the Global Indemnity group of companies.

Extraordinary General Meeting

If the Scheme of Arrangement Proposal is approved at the scheme meeting, GI Cayman shareholders are being asked to vote on the following matters at the extraordinary general meeting for the purpose of giving effect to the Scheme of Arrangement and the Transaction as follows:

| • | to approve the Scheme of Arrangement and that the directors and officers of GI Cayman be authorized to take such actions as they may consider necessary or appropriate for carrying the Scheme of Arrangement into effect; and |

6

| • | to authorize GI Cayman, as the sole shareholder of GI Bermuda, to approve a resolution of GI Bermuda to effect a business combination transaction (which may include an inter-company merger, transfer of assets and liabilities, amalgamation or otherwise), approved by the board of directors and relevant regulatory authorities, with Penn-Patriot or another of the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries, resulting in the assumption of GI Bermuda’s business by the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries. Such transaction may include, without limitation, the merger of GI Bermuda with and into Penn-Patriot, with Penn-Patriot surviving, and the approval of the merger agreement that would be entered into in connection therewith. |

If there are insufficient votes to approve the necessary meeting proposals at the time of the general extraordinary meeting, GI Cayman ordinary shareholders may be asked to authorize the chairman of the extraordinary general meeting to adjourn the meeting, as necessary or appropriate.

The proposals contemplated by this proxy statement, including the Scheme of Arrangement Proposal, the Scheme EGM Proposal, the GI Bermuda Transaction Proposal and the Adjournment Proposal, are sometimes referred to herein as the “meeting proposals.”

Please see “Proposal Number One: The Scheme of Arrangement Proposal,” “Proposal Number Two: The Scheme EGM Proposal,” “Proposal Number Three: The GI Bermuda Transaction Proposal” and “Proposal Number Four: The Adjournment Proposal.”

| 3. Q: | Why is Global Indemnity proposing the Transaction? |

| A: | While a complex multi-national business structure has served us and our shareholders well for many years, changes in the U.S. tax laws and other compelling business reasons support reorganizing the Global Indemnity group of companies at this time. After considering various factors, the Board unanimously determined to undertake the Transaction for, among others, the following reasons: |

| • | The passage by the United States of the Tax Cuts and Jobs Act in 2017, as well as certain other changes innon-U.S. tax laws, have eliminated certain tax benefits attributable to having a foreign holding company structure. The Transaction recognizes that the additional complexity and compliance costs of our foreign structure outweigh the limited tax benefits to the Global Indemnity group of companies following this change in the law. |

| • | The Transaction will streamline the organizational structure of the Global Indemnity group of companies. The number of entities above the U.S. insurance companies will be reduced from 6 to 3, and substantially all foreign subsidiaries will be eliminated, resulting in inter-company efficiencies. |

| • | The Transaction will reduce the number of nations governing the Global Indemnity group of companies from 4 to 1 and will reduce the number of nations in which the Global Indemnity group of companies are subject to material taxation from 3 to 1, making the United States the only governing and taxing nation. We anticipate that this will achieve long-term administrative cost savings by reducing the management resources required to reconcile and manage the differences in governing laws and taxation innon-U.S. jurisdictions. |

| • | The Transaction will move the ultimate parent company of the Global Indemnity group of companies to Delaware, which is a highly reputable jurisdiction for organizing business entities in the United States. Delaware has sophisticated entity laws that are continuously modernized and its extensive history of resolving business disputes has created a predictable legal framework for management and shareholders. In addition, the reputation of Delaware entity law among regulatory authorities, investors and creditors is highly favorable. |

| • | The Transaction will result in the business of GI Bermuda being assumed by the Global Indemnity group of companies’ existing U.S. insurance company subsidiaries and thereby will consolidate the primary regulation of the Global Indemnity group of companies to the United States. |

7

| • | Following the Transaction, the Global Indemnity group of companies’ income generating activities will be 100% U.S. based, and the expected expense savings and operating efficiencies are expected to largely offset the anticipated increase in prospective tax liabilities resulting from the Transaction. |

| • | The Transaction will not result in any material transaction-related taxes to the Global Indemnity group of companies. |

| • | The Transaction may result in a clearer business proposition to U.S. investment and business partners. Currently, the public shares of GI Cayman trade at approximately 50% of book value per share, which we believe is due in part to our complicated multi-national structure, which serves as a practical barrier to raising new equity capital or utilizing our shares as acquisition currency. The United States of America is a leading international financial center, attracts a high volume ofnon-resident financial activity from Europe, China and other countries with substantial capital to invest and is a significant hub for institutional investment. As a result, having the Global Indemnity group of companies’ parent company become a United States based company will offer investors the ability to invest directly in a U.S. limited liability company, and may, over time, enhance the value and liquidity of the Company’s publicly traded securities, including access to the public equity markets and the utilization of our shares as acquisition currency. |

Please see “Proposal Number One: The Scheme of Arrangement Proposal—Reasons for the Transaction.”

| 4. Q: | How does the Board of Directors recommend that I vote? |

| A: | Our Board unanimously recommends that our shareholders vote “FOR” each of the meeting proposals set forth in this proxy statement. |

| 5. Q: | Who can vote at the shareholder meetings? |

| A: | All persons who are registered holders of GI Cayman ordinary shares at the Voting Record Time (being the record date for the shareholder meetings as of the close of business on [●], 2020) are shareholders of record for the purposes of voting at the shareholder meetings and will be entitled to attend and vote, in person via live webcast or by proxy, at the shareholder meetings and any adjournments thereof. |

You should have received two proxy cards with this proxy statement; one blue proxy card for the scheme meeting and one white proxy card for the extraordinary general meeting. You can only appoint a proxy using the procedures set out in this proxy statement and in the relevant proxy card. To ensure that your GI Cayman ordinary shares are voted in accordance with your wishes, please properly mark, date, sign and return both the accompanying proxy cards (one blue for the scheme meeting, and one white for the extraordinary general meeting) in the enclosed, postage-paid envelope as promptly as possible. In order for your proxies to be voted, Computershare LLC must receive your proxy cards at 2950 Express Drive South, Suite 210, Islandia, NY 11749, at least forty eight hours prior to the commencement of the relevant meeting but not later than [●] [a.m./p.m.] (Eastern Time) on [●], 2020.

A proxy appointed to attend the shareholder meetings via live webcast on your behalf does not need to be a shareholder of GI Cayman but must attend the shareholder meetings to represent you. You may appoint more than one proxy provided that each proxy is appointed to exercise rights attached to different GI Cayman ordinary shares. You may not appoint more than one proxy to exercise rights attached to any one GI Cayman ordinary share.

8

If you hold your GI Cayman ordinary shares in “street name” through a bank, broker, trustee, custodian or other nominee (which we generally refer to as “brokers” or “nominees”), please follow the voting instructions provided by your broker, which may include an option to instruct the broker or nominee by telephone on how to vote. Please note that holders of GI Cayman ordinary shares through brokers or nominees may be required to submit voting instructions to their applicable broker or nominee at or prior to the deadline applicable to registered holders of GI Cayman ordinary shares and such holders should therefore follow the separate instructions that will be provided by their applicable broker or nominee.

If the GI Cayman ordinary shares are not registered in your own name and you plan to vote your GI Cayman ordinary shares in person via live webcast at either or both the shareholder meetings, you must contact your bank, broker or other nominee to (i) obtain a proxy card from the shareholder of record and or (ii) have your GI Cayman ordinary shares registered directly in your name on GI Cayman’s register of shareholders.

Appointment of a proxy does not preclude you from attending either or both of the shareholder meetings and voting in person via live webcast. Attending the shareholder meetings in person via live webcast will not in and of itself revoke a previously submitted proxy card. However, any votes cast by you or your proxy at either of the shareholder meetings will revoke a previously submitted proxy card for such shareholder meeting.

In order to participate in the shareholder meetings, registered shareholders must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your proxy cards sent in respect of the shareholder meetings. Registered shareholders who have validly registered for the shareholder meetings will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings. If you hold your GI Cayman shares in ‘street name’ through a broker or nominee you should contact your broker to receive a voting instruction form for use at the shareholder meetings. In order to participate in the shareholder meetings, holders of GI Cayman shares in ‘street name’ through a broker or nominee must register for the shareholder meetings at https://register.proxypush.com/GBLI, by [●] [a.m./p.m.], Cayman Islands Time, on [●], 2020, by using one of the control numbers found on your voting instruction form. Such holders will be provided a link to the shareholder meetings one hour prior to the start of the shareholder meetings.

Please see “The Shareholder Meetings—Voting Record Time; Voting Rights” and “Annex D – Expected Timetable of Principal Events.”

| 6. Q: | Why are there two meetings being held for GI Cayman shareholders? |

| A: | The two separate shareholder meetings, being the scheme meeting and the subsequent extraordinary general meeting, are being called for different purposes. The extraordinary general meeting will be held immediately after the scheme meeting. |

The sole purpose of the scheme meeting is to seek approval of the GI Cayman shareholders of the Scheme of Arrangement in accordance with applicable Cayman Islands law prior to GI Cayman seeking sanction of the Scheme of Arrangement from the Cayman Court. The scheme meeting has been convened at [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020 pursuant to an Order of the Cayman Court granted on [●], 2020. Notice of the scheme meeting is set out at Annex A to this proxy statement.

The subsequent extraordinary general meeting is being held to pass the remaining meeting proposals in connection with the Scheme of Arrangement, which are required to implement the Transaction (being the Scheme EGM Proposal and the GI Bermuda Transaction Proposal). GI Cayman shareholders can direct how their GI Cayman ordinary shares should be voted at the scheme meeting and the extraordinary general meeting.

Please see “The Shareholder Meetings—Proxies” and “The Shareholder Meetings—How You Can Vote.”

9

| 7. Q: | Why is the approval of the Cayman Court required? |

The Scheme of Arrangement is a formal procedure under the Cayman Companies Law which is commonly used to carry out corporate reorganizations involving Cayman Islands companies. Under the Cayman Companies Law, the Scheme of Arrangement requires the approval of both the GI Cayman shareholders at the shareholder meetings and also the sanction of the Cayman Court. In determining whether to exercise its discretion to sanction the Scheme of Arrangement, the Cayman Court will determine, amongst other things, whether the Scheme of Arrangement is fair to the GI Cayman shareholders.

If the relevant approvals are obtained, all GI Cayman shareholders will be bound by the terms of the Scheme of Arrangement when it becomes effective, regardless of whether or how they voted (that is, including any GI Cayman shareholder who did not vote to approve the Scheme of Arrangement Proposal or who voted against the Scheme of Arrangement Proposal) thereby providing certainty and equality of treatment for GI Cayman shareholders. The implementation of the Scheme of Arrangement must satisfy certain legal requirements for the protection of GI Cayman shareholders and creditors and therefore requires the approval of the Cayman Court.

| 8. Q: | Am I required to vote at the shareholder meetings? |

| A: | It is important that as many GI Cayman shareholders as possible cast their votes at both the scheme meeting and the extraordinary general meeting. In particular, it is important that as many votes as possible are cast at the scheme meeting so as to demonstrate to the Cayman Court that there is a fair representation of GI Cayman shareholders. |

The Board believes that the Transaction is advisable and urges you to read this proxy statement carefully and, if eligible, to vote in favor of the meeting proposals.

| 9. Q: | How do I vote if I am a registered shareholder? |

| A: | Whether or not you plan to attend the shareholder meetings in person via live webcast, we urge you to vote your GI Cayman ordinary shares by way of proxy. All GI Cayman ordinary shares represented by valid proxy cards that we receive through this solicitation and that are not revoked will be voted in accordance with your instructions as noted on the relevant proxy card. |

We have enclosed two proxy cards (one blue proxy card for the scheme meeting, and one white proxy card for the extraordinary general meeting). By submitting your proxy card, you are legally authorizing another person to vote your GI Cayman ordinary shares by proxy in accordance with your instructions. You may appoint any person as your proxy and it is not a requirement that this person be a current shareholder of GI Cayman. The enclosed proxy card designates the chairman of the relevant shareholder meeting to vote your GI Cayman ordinary shares in accordance with the voting instructions you indicate in your proxy card at each of the shareholder meetings. If you wish to appoint another person as your proxy, you can strike out the chairman of the relevant shareholder meeting and replace it with the name of such other person.

In addition, if any other matters (other than the meeting proposals contained in this proxy statement) properly come before either of the shareholder meetings or any adjournments of those meetings, the persons named in the proxy card will have the authority to vote your GI Cayman ordinary shares on those matters in their discretion. The Board currently does not know of any matters to be raised at the shareholder meetings other than the meeting proposals contained in this proxy statement.

You may submit your proxy card either by mail or courier. Please let us know whether you plan to attend each of the shareholder meetings in person via live webcast by marking the appropriate box on

10

your proxy card. In order for your proxy card to be validly submitted and for your GI Cayman ordinary shares to be voted at the shareholder meetings in accordance with your proxy card, Computershare LLC must receive your proxy card by courier as promptly as possible at 2950 Express Drive South, Suite 210, Islandia, NY 11749, not later than [●] [a.m./p.m.] (Eastern Time) on [●], 2020, (that is, it must be received at least forty eight hours prior to the commencement of the relevant shareholder meeting).

If you do not wish to vote all of your GI Cayman ordinary shares in the same manner on any particular proposal(s), you may specify your vote by clearly hand-marking the proxy card to indicate how you want to vote your GI Cayman ordinary shares.

At the scheme meeting, you may specify whether your GI Cayman ordinary shares should be voted for or against the Scheme of Arrangement Proposal. At the extraordinary general meeting, you may specify whether your GI Cayman ordinary shares should be (i) voted for or against the other meeting proposals or (ii) abstained from voting.

If you do not specify on the enclosed proxy cards that are submitted how you want to vote your GI Cayman ordinary shares, your GI Cayman ordinary shares will be voted in accordance with the Board’s unanimous recommendation as described above such that any unspecified GI Cayman ordinary shares will be voted “FOR” each of the meeting proposals as set forth in this proxy statement.

Please see “The Shareholder Meetings—Proxies” and “The Shareholder Meetings—How You Can Vote.”

| 10. Q: | How can I vote if I hold my shares in “street name”? |

| A: | Shareholders who hold their shares in “street name” beneficially through a broker or nominee must vote their GI Cayman ordinary shares by following the procedures established by their broker or nominee. |

Under Nasdaq rules, brokers and nominees who hold GI Cayman ordinary shares on behalf of customers will not have the authority to vote without direction on the Scheme of Arrangement Proposal, the Scheme EGM Proposal or the GI Bermuda Transaction Proposal. If you hold your GI Cayman ordinary shares through a broker or nominee and you do not instruct your broker or nominee on how to vote your GI Cayman ordinary shares prior to the shareholder meetings, your broker or nominee, or the depository through which your broker holds your shares, will not be able to vote your GI Cayman ordinary shares at the shareholder meetings or affect the outcome of the vote, which is based on shares voting. Under Nasdaq rules, brokers and nominees who hold shares on behalf of customers have the authority to vote on “routine” proposals when they have not received instructions from beneficial owners, but are precluded from exercising their voting discretion with respect to proposals for“non-routine” matters. We believe that the Scheme of Arrangement Proposal, the Scheme EGM Proposal and the GI Bermuda Transaction Proposal are proposals fornon-routine matters. As a result, there may be broker“non-votes” with respect to each of these meeting proposals.

If you hold GI Cayman ordinary shares through a broker or nominee, we recommend that you contact your broker or nominee directly for more information on the procedures by which your GI Cayman ordinary shares can be voted. Your broker or nominee will not be able to vote your GI Cayman ordinary shares unless it receives appropriate instructions from you.

In addition, you may not vote your GI Cayman ordinary shares in person via live webcast at the shareholder meetings unless you obtain an “instrument of proxy” or “legal proxy” from your broker or nominee that holds your GI Cayman ordinary shares. You will need to follow the instructions of your broker or nominee in order to obtain such an “instrument of proxy” or “legal proxy.”

11

Please see “The Shareholder Meetings—How You Can Vote.” Please also see “The Shareholder Meetings—Votes of Shareholders Required for Approval” for further information on how shares held in the “street name” of a broker will be considered for purposes of the “majority in number” approval requirement.

| 11. Q: | What will I receive for my GI Cayman ordinary shares? |

| A: | If the Scheme of Arrangement becomes effective, you will receive one GI Delaware class A common share for each GI Cayman A ordinary share and one GI Delaware class B common share for each GI Cayman B ordinary share held by you as of the Scheme Record Time which is expected to be [●] [a.m./p.m.] (Cayman Islands Time) on [●], 2020, being the date immediately prior to the completion of the Transaction. |

Please also see Annex D “Expected Timetable of Principal Events” for further information

| 12. Q: | What quorum and shareholder votes of GI Cayman shareholders are required to approve the meeting proposals at the shareholder meetings? |

| A: | A quorum is required for the transaction of business at each of the shareholder meetings. At the scheme meeting, at least two shareholders must be present, in person via live webcast or represented by proxy to satisfy quorum requirements. At the extraordinary general meeting, at least one or more shareholders holding at least a majority of the paid up voting share capital of GI Cayman present in person via live webcast or by proxy and entitled to vote at that meeting shall satisfy quorum requirements. |

Scheme Meeting

To be approved, the Scheme of Arrangement Proposal must receive the affirmative vote of both (i) a majority in number of those holders of the GI Cayman ordinary shares at the Voting Record Time who are entitled to vote and who are present (either in person via live webcast or represented by proxy) and who vote at the scheme meeting, and representing (ii) at least 75% or more of the nominal value of the GI Cayman ordinary shares voted at the scheme meeting. Broker“non-votes,” if any, and abstentions, will be disregarded and will have no effect on the outcome of the vote.

At the scheme meeting, each shareholder of record will be entitled to one vote per GI Cayman A ordinary share and one vote per B ordinary share held by such shareholder.

Extraordinary General Meeting

To be approved, the Scheme EGM Proposal must receive the affirmative vote of at leasttwo-thirds and the GI Bermuda Transaction Proposal and the Adjournment Proposal must receive more than 50% of the votes cast by the holders of GI Cayman ordinary shares at the extraordinary general meeting. Broker“non-votes,” if any, and abstentions, will be disregarded and will have no effect on the outcome of the vote.

At the extraordinary general meeting, shareholders of record as of the Voting Record Time who hold GI Cayman A ordinary shares shall be entitled to one vote per GI Cayman A ordinary share held and shareholders of record who hold GI Cayman B ordinary shares shall be entitled to ten votes per GI Cayman B ordinary share held.

Please see “The Shareholder Meetings—Votes of Shareholders Required for Approval.”

For purposes of determining a quorum, abstentions and broker“non-votes” present in person via live webcast or by proxy are counted as represented.

12

At the Voting Record Time there were [●] A ordinary shares and [●] B ordinary shares issued and outstanding.

Please see “The Shareholder Meetings—Quorum.”

| 13. Q: | What happens at the Sanction Hearing? |

| A: | GI Cayman shareholders who voted at the scheme meeting or gave instructions to their broker or nominee to vote at the scheme meeting (as applicable) will have the right to attend the Sanction Hearing and to appear in person or be represented by counsel to support or oppose the sanction of the Scheme of Arrangement. If you are a shareholder who wishes to appear in person or by counsel at the Sanction Hearing and present evidence or arguments in support of or opposition to the Scheme of Arrangement, we expect that the Cayman Court will require that you give notice of your intention to do so to GI Cayman’s Cayman Islands legal advisers, Walkers, at 190 Elgin Avenue, George Town, Grand CaymanKY1-9001, Cayman Islands, at a time prior to the date of the Sanction Hearing. In addition the Cayman Court has wide discretion to hear from other interested parties. GI Cayman will not object to the participation in the Sanction Hearing by any beneficial holder of GI Cayman ordinary shares who provides sufficient evidence that they hold GI Cayman ordinary shares through a custodian, broker or other nominee holder, or any other person with a legitimate interest in the proceedings and all such persons will have a right to participate. |

At the Sanction Hearing, the Cayman Court will conduct a hearing at which the fairness of the terms and conditions of the Scheme of Arrangement will be considered. Subject to the approval of the Scheme of Arrangement by the GI Cayman shareholders, the Sanction Hearing will be held at the Law Courts, George Town, Grand Cayman on [●], 2020, before the Cayman Court. We expect that the Cayman Court will make facilities available for applicable GI Cayman shareholders to attend the Sanction Hearing in person via live webcast (if they wish).

| 14. Q: | When do you expect the Transaction to be consummated? |

| A: | Assuming the GI Cayman shareholders approve the meetings proposals at the relevant shareholder meetings and the Cayman Court sanctions the Scheme of Arrangement and the other conditions to the completion of the Transaction are satisfied (or waived, as applicable), the Scheme of Arrangement and Transaction are expected to become effective on [●], 2020. |

The Scheme of Arrangement will become effective in accordance with its terms once a copy of the Sanction Order has been delivered to the Cayman Islands Registrar of Companies.

If the Scheme of Arrangement becomes effective under Cayman Companies Law, it will be binding on all GI Cayman shareholders irrespective of whether or not they attended or voted in favor of each of the meeting proposals at the shareholder meetings.

Please see “Proposal Number One: The Scheme of Arrangement Proposal—Effective Time of the Transaction” and “Proposal Number One: The Scheme of Arrangement Proposal—Amendment, Termination or Delay.”

| 15. Q: | What happens if the Transaction is not completed? |

| A: | If the Scheme of Arrangement has not become effective on or before [●], 2020 (or such later date as GI Cayman may determine and the Cayman Court may allow), the Scheme of Arrangement will lapse by its terms and not come into effect resulting in the Transaction not being consummated. |

13

If the Transaction is not completed, including as a result of the GI Cayman shareholders not approving any of the meeting proposals in this proxy statement, the Cayman Court not sanctioning the Scheme of Arrangement or GI Cayman failing to obtain the necessary approvals from the Virginia State Corporation Commission, Bureau of Insurance (the “Virginia Bureau”), the Pennsylvania Insurance Department, Arizona Department of Insurance, Indiana Department of Insurance and/or confirmation ofno-objection from the Bermuda Monetary Authority, then GI Cayman shareholders will not receive any GI Delaware common shares and will remain shareholders of GI Cayman and GI Cayman A ordinary shares will continue to be listed and traded on the Nasdaq under the symbol “GBLI.”

| 16. Q: | Are there risks associated with the Transaction that I should consider in deciding how to vote? |

| A: | Yes. There are a number of risks relating to the Transaction that are discussed in this proxy statement and in other documents incorporated herein by reference. You should read and carefully consider the risk factors set forth in the section entitled “Risk Factors” beginning on page [●] of this proxy statement when deciding how to vote. |

| 17. Q: | Will the Transaction affect Global Indemnity’s future operations? |

| A: | We believe that the Transaction will improve overall operational efficiency of the Global Indemnity group and have no material impact on how we conduct ourday-to-day operations. The location of our future operations will depend on the needs of our business, independent of our jurisdiction of incorporation. |

| 18. Q: | Will the Transaction dilute my economic interest? |

| A: | No, your relative economic ownership in Global Indemnity will not be diluted. At the Effective Time, your ordinary shares in GI Cayman will be cancelled and exchanged for common shares in GI Delaware on aone-to-one basis. |

| 19. Q: | Will the Transaction impact Global Indemnity’s ability to access the capital and bank markets in the future? |

| A: | We do not expect that the Transaction will have any adverse effect on our ability to access the capital markets or bank credit markets. |

| 20. Q: | Will I be able to trade my GI Cayman A ordinary shares during the time between the date of this proxy statement and the Effective Time? |

| A: | Yes. You will be able to trade your GI Cayman A ordinary shares during the time between the date of this proxy statement and the last business day prior to the Effective Time. The Effective Time is expected to be on or around [●], 2020. GI Cayman A ordinary shares will continue to trade on Nasdaq under the symbol “GBLI” during this period. |

| 21. Q: | How will the Transaction affect the stock exchange listing of GI Cayman A ordinary shares? |

| A: | There should be no disruption in the trading of GI Cayman A ordinary shares. We will submit a notification form with Nasdaq and expect that, following the consummation of the Transaction, the GI Delaware class A common shares will be listed on Nasdaq under the symbol “GBLI,” the same symbol under which the GI Cayman A ordinary shares are currently listed. |

14

| 22. Q: | How will the Transaction affect Global Indemnity’s financial reporting and the information Global Indemnity provides to its shareholders? |

| A: | Upon completion of the Transaction, we will remain subject to the U.S. Securities and Exchange Commission (the “SEC”) reporting requirements, the mandates of the Sarbanes-Oxley Act and the applicable corporate governance rules of Nasdaq, and we will continue to report our consolidated financial results in U.S. dollars and in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). We will continue to file reports on Forms10-K,10-Q and8-K with the SEC, as we currently do. We will in the ordinary course make available customary financial information and other reports filed with the SEC, consistent with our established current practices. |

| 23. Q: | Who is GI Delaware? |