Broker Dealer Kit Filed pursuant to Rule 433Registration Statement No. 333-217042 GLADSTONE LAND A Gladstone Farmland Land Real Corporation Estate Investment Trust $150,000,000 Series B Preferred Stock Risk Factors: An investment in shares of Gladstone Land Corp. Series B Preferred Stock involves a high degree of risk. In consultation with your own financial and legal advisers, you should carefully consider, among other matters, the risk factors summarized on page 6 of this brochure and delineated in the “Risk Factors” sections of the prospectus supplement and in our most recent Annual Report on Form10-K and Quarterly Reports on Form10-Q and other information we will file from time to time with the SEC before deciding whether an investment in shares of Gladstone Series BPreferred Stock is suitable for you. SPRING VALLEY ROAD, WATSONVILLE, CA

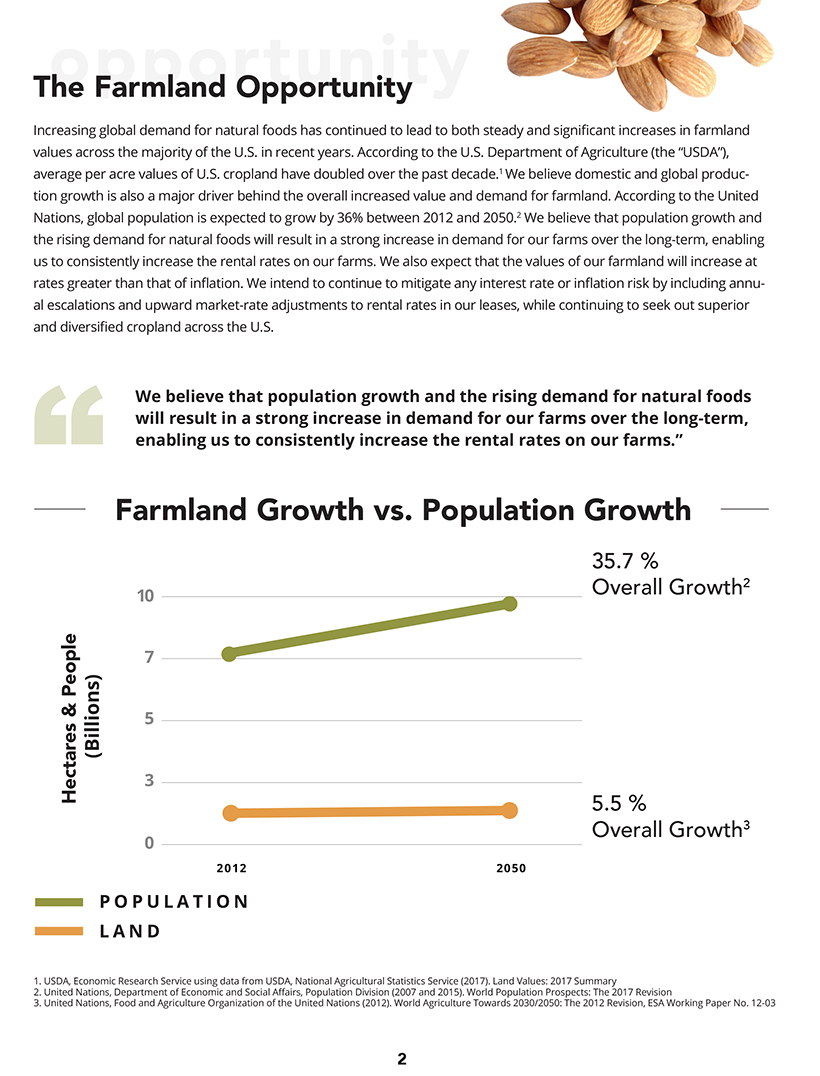

The Farmland Opportunity Increasing global demand for natural foods has continued to lead to both steady and significant increases in farmland values across the majority of the U.S. in recent years. According to the U.S. Department of Agriculture (the “USDA”), average per acre values of U.S. cropland have doubled over the past decade.1 We believe domestic and global production growth is also a major driver behind the overall increased value and demand for farmland. According to the United Nations, global population is expected to grow by 36% between 201 2 and 2050.2 We believe that population growth and the rising demand for natural foods will result in a strong increase in demand for our farms over the long-term, enabling us to consistently increase the rental rates on our farms. We also expect that the values of our farm land will increase at rates greater than that of inflation. We intend to continue to mitigate any interest rate or inflation risk by including annual escalations and upward market-rate adjustments to rental rates in our leases, while continuing to seek out superior and diversified cropland across the U.S. We believe that population growth and the rising demand for natural foods will result in a strong increase in demand for our farms over the long-term, enabling us to consistently increase the rental rates on our farms.” Farmland Growth vs. Population Growth 1. USDA, Economic Research Service using data from USDA, National Agricultural Statistics Service (2017). Land Values: 2017 Summary 2. United Nations, Department of Economic and Social Affairs, Population Division (2007 and 2015). World Population Prospects: The 2017 Revision 3. United Nations, Food and Agriculture Organization of the United Nations (2012). World Agriculture Towards 2030/2050: The 2012 Revision, ESA Working PaperNo. 12-03

Gladstone Land’s Investment Focus We focus on acquiring high-value farmland that we lease to farmers, primarily on atriple-net lease basis. Our primary focus is on annual fresh produce (fruits and vegetables), while our secondary focus is on permanent crops (such as blueberries, grapes and nuts). FARM AND FARMER CHARACTERISTICSOn-site water sources High-value crops like fruits and vegetables Established rental markets with abundance of strong operators Tenant farmers/operators with established histories and substantial farming resources • Family-owned farms where sale-leaseback transactions free up capital for farmers, often to invest in and improve their operations TRANSACTION STRUCTURES $2 million to $50 million transaction sizes Favorable lease characteristics: Triple Net – we own the land, and the farmers/operators are required to pay taxes, insurance, maintenance and other operating costs Lease Term –5-10+ year duration withbuilt-in rent escalations and upward market resets DIVERSIFICATION1 75 farms in our portfolio Farms located across nine states Greater than 63,000 acres of land More than 39 different crop types farmed by 52 unrelated farmer tenants EXISTING STATES CROP TYPES & # OF FARMS [GRAPHIC APPEARS HERE] 1. As of March 31, 2018

More About Gladstone Land We are a farmland real estate investment trust that specializes in purchasing farms and farm-related properties and leasing them to farmers. We have owned farmland since our incorporation in 1997, when we began operating strawberry farms through our former subsidiary, Coastal Berry Company, LLC, an entity that provided growing, packaging, marketing and distribution of fresh berries and other agricultural products. We sold Coastal Berry’s operations to Dole Food Company while keeping ownership of the land. Since then, our operations have consisted solely of leasing our farms to third-party tenants. At our Initial Public Offering in 2013, we became the first ever publicly-traded farmland REIT. We are led by David Gladstone, who has more than 30 years of experience in the investment and farming industry, and the management team with collectively more than 100 years of farming and farming-related experience. Note: Some of the statements made relate to Gladstone Land’s common stock and LAND’s investment adviser. There is no assurance that the shares of Series B Preferred Stock will achieve similar future results. * As of March 31, 2018 ** Our affiliated investment advisor

Offering Summary Gladstone Land Corporation’s Series B Preferred Stock Offering is designed with the goals of potentially providing investors with steady income and preservation of capital.1 There can be no assurance that we will achieve these objectives. SHARES: Series B Cumulative Redeemable Preferred Stock The Series B Cumulative Redeemable Preferred Stock (“Shares”) will rank senior to Gladstone Land’s Common Stock and on parity with its Series A Preferred Stock with respect to payment of dividends and distribution of amounts on liquidation, dissolution and winding up. SHARE PRICE & DIVIDEND RATE: $25.00 per Share. 6.0% annualized dividend Minimum initial investment of $5,000. No minimum for qualified retirement accounts. 6.0% annualized dividend, or $1.50 per Share per year annualized, intended to be paid monthly in 12 distributions of $0.125 per Share.1 Dividends on the Series B Shares are cumulative and must be paid in preference to dividends on common stock. SIZE: $150,000,000 TERM: Earlier of 5 years or 6,000,000 shares sold The earlier of five (5) years from the offering’s initial prospectus filing or the sale of all 6,000,000 Shares being offered. COMMISSIONS, FEES, AND EXPENSES Gladstone Land, through Gladstone Securities, will pay all commissions and expenses associated with the sale of the Shares. Preferred shareholders pay no sales charges to Gladstone Land or Gladstone Securities in connection with the offering. Gladstone Land and Gladstone Securities will not pay selling co other) accounts, as described in the prospectus supplement.Investment Features Diversified Portfolio We already own a portfolio of 75 farms that comprise more than 63,000 acres of land across 9 states with current fair value of approximately $537 million, as of March 31, 2018. Inflation Hedge The prices of produce crops have historically outpaced inflation.2 We primarily own farms that grow produce crops. Also, we seek to structure our leases with built-in contractual rent escalators. We have averaged over a 9.0% increase in rental rates on all lease renewals since our IPO in January 2013.3 Public Listing We anticipate applying to list the Shares on NASDAQ or another national securities exchange within one calendar year after the offering ends, but there can be no assurance that we will achieve this objective. There is currently no public market for the Shares, and we do not expect a public market to develop prior to listing the Shares on an exchange, if at all. Redemption Feature Each investor may request redemption of all or a portion of his/her Shares at $22.50 per Share at any time.4 Transparency While the Shares are not listed on any exchange, our Common Stock is listed on NASDAQ under the symbol “LAND”. As such, we file annual, quarterly, and periodic reports with the SEC. Because the Shares are not traded, it may be difficult to determine the value of the Shares or your return on investment. 1. There is no guarantee of capital preservation or continuous dividends. 2. Bureau of Labor Statistics, United States Department of Labor, CPI Detailed Report, Data for 1985-2016 3. There can be no guarantee that rental rates on lease renewals will continue to increase. 4. Gladstone Land’s obligation to redeem Shares is limited to the extent that its Board of Directors determines that it does not have sufficient funds available or it is restricted by applicable law from making such redemption.

Dealer Manager (Member FINRA/SIPC) National Accounts Manager info@gladstonesecurities.com (844)386-2587 info@evoalts.com Evolv Capital (“Evolv”) is acting as National Accounts Manager on this offering, and is a third party not affiliated with Gladstone Securities LLC or Gladstone Land Corporation. Securities offered through the Dealer Manager, Gladstone Securities, LLC, Member FINRA/SIPC. Evolv is a branch office of IAA. Advisory services offered through International Assets Investment Management, LLC, SEC Registered Investment Advisor. RISK FACTORS Please consult the prospectus supplement for this offering for a recitation of the risk factors of this offering. If any of the risks contained in or incorporated by reference into the prospectus supplementor the accompanying prospectus develop into actual events, our business, financial condition, liquidity, results of operations, FFO, adjusted funds from operations or our prospects could be materially and adversely affected, we may be unable to timely pay the dividends accrued on the Series B Preferred Stock, the value of the Series B Preferred Stock could decline and you may lose all or part of your investment. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. Some statements in the prospectus supplement, including statements in the risk factors, constitute forward-looking statements. See the “Forward-Looking Statements” and “Risk Factors” sections in the prospectus supplement, the accompanying prospectus and in our regular filings with the SEC for additional risks which may affect us or the shares of our Series B Preferred Stock (the “Shares”). There will initially be no public market for the Shares as we do not intend to apply for quotation on NASDAQ until after the Termination Date, and even after listing, if achieved, a liquid secondary trading market may not develop and the features of the Shares may not provide you with favorable liquidity options. The Shares will not be rated. Dividend payments on the Series B Preferred Stock are not guaranteed. We operate as a holding company dependent upon the asset and operations of our subsidiaries, and because of our structure, we may not be able to generate the funds necessary to make distributions on the Shares. We will be required to terminate this offering if both our common stock and the Series A Preferred Stock are no longer listed on NASDAQ or another national securities exchange. The ability to redeem shares of Shares may be limited. The Shares will bear a risk of redemption by us. The cash distributions you receive may be less frequent or lower in amount than you expect. Upon the sale of any individual property, holders of Shares do not have a priority over holders of our common stock regarding return of capital. Your percentage of ownership may become diluted if we incur additional debt or issue new shares of stock or other securities, and incurrence of indebtedness and issuances of additional preferred stock or other securities by us may further subordinate the rights of the holders of our common stock and preferred stock. Our ability to pay dividends and/or redeem shares of Shares may be limited by Maryland law. Our charter contains restrictions upon ownership and transfer of the Shares, which may impair the ability of holders to acquire or dispose of the Shares. Holders of the Shares will be subject to inflation risk. An investment in the Shares bears interest rate risk. Holders of the Shares will bear reinvestment risk. Holders of Shares will have extremely limited voting rights. Our management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other stockholders may not approve. We may be unable to invest a significant portion of the net proceeds of this offering on acceptable terms. We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Shares less attractive to investors. We elected to take advantage of the option to delay adoption of new or revised accounting standards until they are required to be adopted by private companies; consequently, our current and prior financial statements may not be comparable to those of other public companies. We have paid, may continue to pay, or may in the future pay, distributions from offering proceeds, borrowings or the sale of assets to the extent our cash flow from operations or earnings are not sufficient to fund declared distributions. Rates of distribution to holders of our common stock and preferred stock will not necessarily be indicative of our operating results. If we make distributions from sources other than our cash flows from operations or earnings, we will have fewer funds available for the acquisition of properties and your overall return may be reduced. If the properties we acquire or invest in do not produce the cash flow that we expect in order to meet our REIT minimum distribution requirement, we may decide to borrow funds to meet the REIT minimum distribution requirements, which could adversely affect our overall financial performance. Gladstone Securities, the dealer manager in this offering, is our affiliate, and we established the offering price and other terms for the Shares pursuant to discussions between us and our affiliated dealer manager; as a result, the actual value of your investment may be substantially less than what you pay. Payment of fees to our Adviser and its affiliates, including our affiliated dealer manager will reduce the cash available for investment and distribution and will increase the risk that you will not be able to recover the amount of your investment in our shares of Shares. If you fail to meet the fiduciary and other standards under ERISA or the Code as a result of an investment in this offering, you could be subject to liability and civil or criminal penalties. Gladstone Land Corporation (“LAND”) has filed a registration statement (including a prospectus) and a prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the prospectus supplement and other documents that LAND has filed with the SEC for more complete information about LAND and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Gladstone Securities, LAND’s dealer manager for this offering, will arrange to send you the prospectus and prospectus supplement if you request it by calling toll-free at (833)849-5993.