LETTER OF TRANSMITTAL TO TENDER SHARES OF

BRAVO BRIO RESTAURANT GROUP, INC.

IN CONNECTION WITH ITS OFFER TO PURCHASE FOR CASH

ITS COMMON SHARES FOR AN AGGREGATE PURCHASE PRICE

OF NOT MORE THAN $50 MILLION

AT A PER SHARE PURCHASE PRICE NOT LESS THAN $12.50 PER SHARE

NOR GREATER THAN $14.50 PER SHARE

|

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 12:00 MIDNIGHT, NEW YORK CITY TIME, AT THE END OF THE DAY OF DECEMBER 10, 2014, UNLESS THE OFFER IS EXTENDED OR TERMINATED (SUCH TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION TIME”). |

The Depositary for the Offer is:

WELLS FARGO BANK, N.A.

By Hand, Express Mail, Courier or Other Expedited Service (to the building):

(By 5:00 p.m., New York City time, on December 10, 2014, otherwise the guaranteed delivery process should be followed)

Wells Fargo Bank, N.A.

Shareowner Services

Voluntary Corporate Actions

161 North Concord Exchange

South St. Paul, Minnesota 55075

Method of delivery of the certificate(s) is at the option and risk of the owner thereof. Delivery of this Letter of Transmittal and all other documents to an address other than as set forth above will not constitute a valid delivery to the Depositary. This Letter of Transmittal properly completed and duly executed, together with certificates representing shares being tendered and all other required documents, must be received prior to the Expiration Time.

The tender offer is not being made to (nor will tender of shares be accepted from or on behalf of) holders in any jurisdiction in which the making or acceptance of the tender offer would not be in compliance with the laws of such jurisdiction.

Please be sure to read this Letter of Transmittal and the accompanying Instructions carefully before you complete this Letter of Transmittal. All capitalized terms used and not defined herein shall have the same meanings as in the Offer to Purchase.

|

| | | |

BOX 1 DESCRIPTION OF SHARES TENDERED |

| NAME(S) AND ADDRESS(ES) OF REGISTERED HOLDER(S) (IF BLANK, PLEASE FILL IN EXACTLY AS NAME(S) APPEAR(S) ON SHARE CERTIFICATE(S)) AND/OR ACCOUNT STATEMENT | CERTIFICATES TENDERED (ATTACH ADDITIONAL LIST IF NECESSARY) |

| CERTIFICATE NUMBER(S) | TOTAL NUMBER OF SHARES REPRESENTED BY CERTIFICATE(S) | NUMBER OF SHARES TENDERED* |

| | | |

| | | |

| | | |

| | | |

| | | |

| TOTAL SHARES TENDERED |

* If you wish to tender fewer than all shares represented by any certificate listed above, please indicate in this column the number of shares you wish to tender. Otherwise, all shares represented by such certificate will be deemed to have been tendered.

I/we, the undersigned, hereby tender to Bravo Brio Restaurant Group, Inc., an Ohio corporation (the “Company”), the share(s) identified above pursuant to the Company’s offer to purchase for cash its common shares, no par value per share, pursuant to (i) auction tenders at prices specified by the tendering shareholders of not less than $12.50 nor greater than $14.50 per share or (ii) purchase price tenders, in either case upon the terms and subject to the conditions described in the Offer to Purchase, dated November 12, 2014 (the “Offer to Purchase”), and this Letter of Transmittal (which, together with the Offer to Purchase, as they may be amended or supplemented from time to time, constitute the “Offer”). This Letter of Transmittal is to be completed only if (a) certificates for shares are being forwarded herewith or (b) a tender of book-entry shares is being made to the account maintained by The Depository Trust Company (“DTC”) pursuant to Section 3 of the Offer to Purchase and the tender is not being made pursuant to DTC’s Automated Tender Offer Program (“ATOP”). I/we certify that I/we have complied with all requirements as stated in the instructions on the reverse side, am/are the registered holder(s) of the shares represented by the enclosed certificate(s), have full authority to tender these certificate (s), and give the instructions in this Letter of Transmittal and warrant that the shares represented by the enclosed certificate(s) are free and clear of all liens, charges, encumbrances, security interests, claims, restrictions and equities whatsoever and that when, as and if the shares tendered hereby are accepted for payment by the Company, the Company will acquire good title thereto, free and clear of all liens, charges, encumbrances, security interests, claims, restrictions and equities and the same will not be subject to any adverse claim or right. I/we make the representation and warranty to the Company set forth in Section 3 of the Offer to Purchase and understand that the tender of shares made hereby constitutes an acceptance of the terms and conditions of the Offer (including if the Offer is extended or amended, the terms and conditions of such extension or amendment). Subject to, and effective upon, acceptance for purchase of, and payment for, shares tendered herewith in accordance with the terms of the Offer, I/we hereby (a) irrevocably sell, assign and transfer to, or upon the order of, the Company, all right, title and interest in and to all shares that are being tendered hereby, (b) waive any and all rights with respect to the shares, (c) release and discharge the Company from any and all claims I/we may have now, or may have in the future, arising out of, or related to, the shares and (d) irrevocably constitute and appoint the Depositary as my/our true and lawful agent and attorney-in-fact with respect to any such tendered shares, with full power of substitution and resubstitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (i) deliver certificates representing such shares, or transfer ownership of such shares on the account books maintained by DTC, together, in any such case, with all accompanying evidences of transfer and authenticity, to the Company, (ii) present such shares for transfer on the relevant security register and (iii) receive all benefits or otherwise exercise all rights of beneficial ownership of such shares (except that the Depositary will have no rights to, or control over, funds from the Company, except as agent for tendering holders, for the consideration payable pursuant to the Offer).

READ THE INSTRUCTIONS CAREFULLY BEFORE COMPLETING THIS LETTER OF TRANSMITTAL

|

| | | | |

| Indicate below the order (by certificate number) in which shares are to be purchased in the event of proration. If you do not designate an order, if less than all shares tendered are purchased due to proration, shares will be selected for purchase by the Depositary. |

| 1st________________ | 2nd________________ | 3rd________________ | 4th________________ | 5th________________ |

|

| | | | |

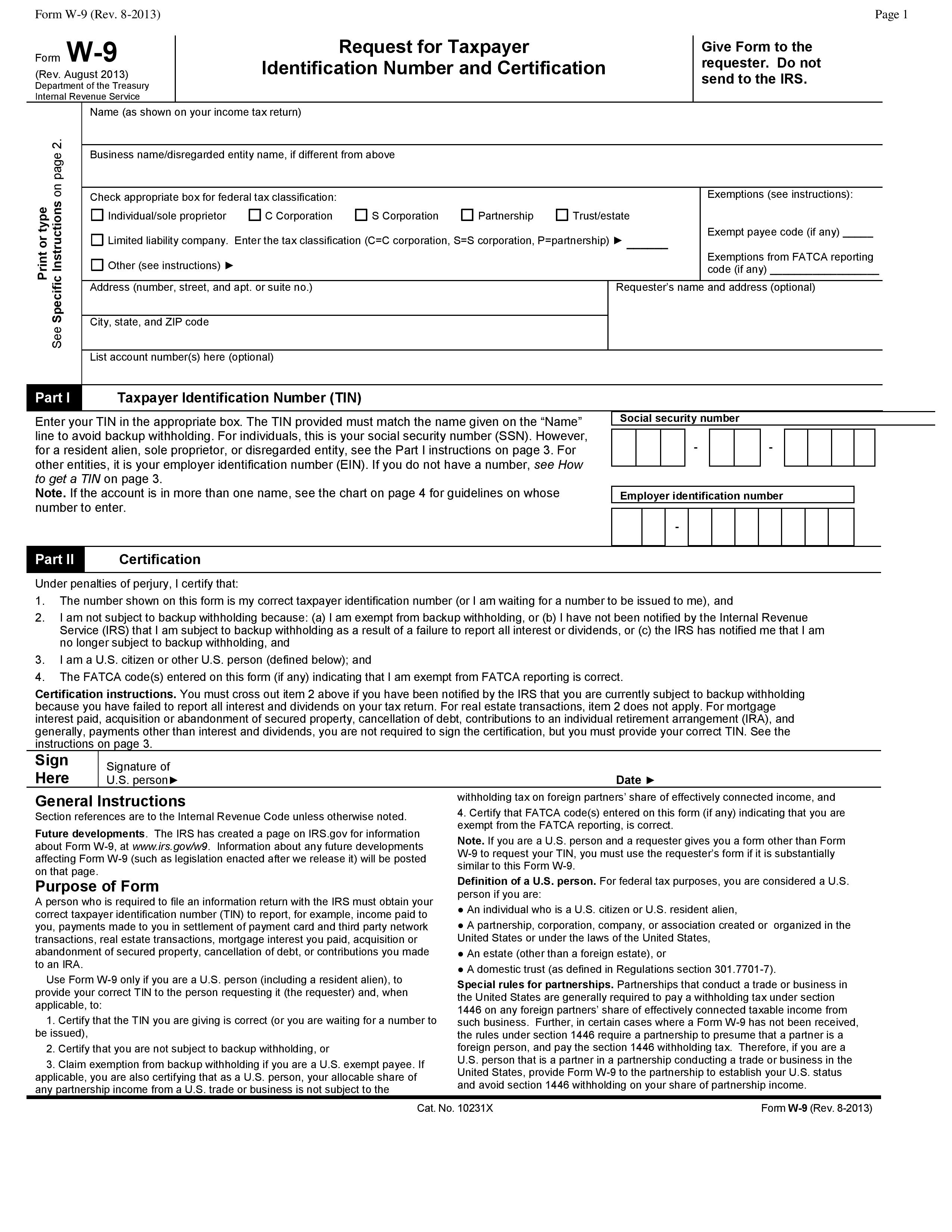

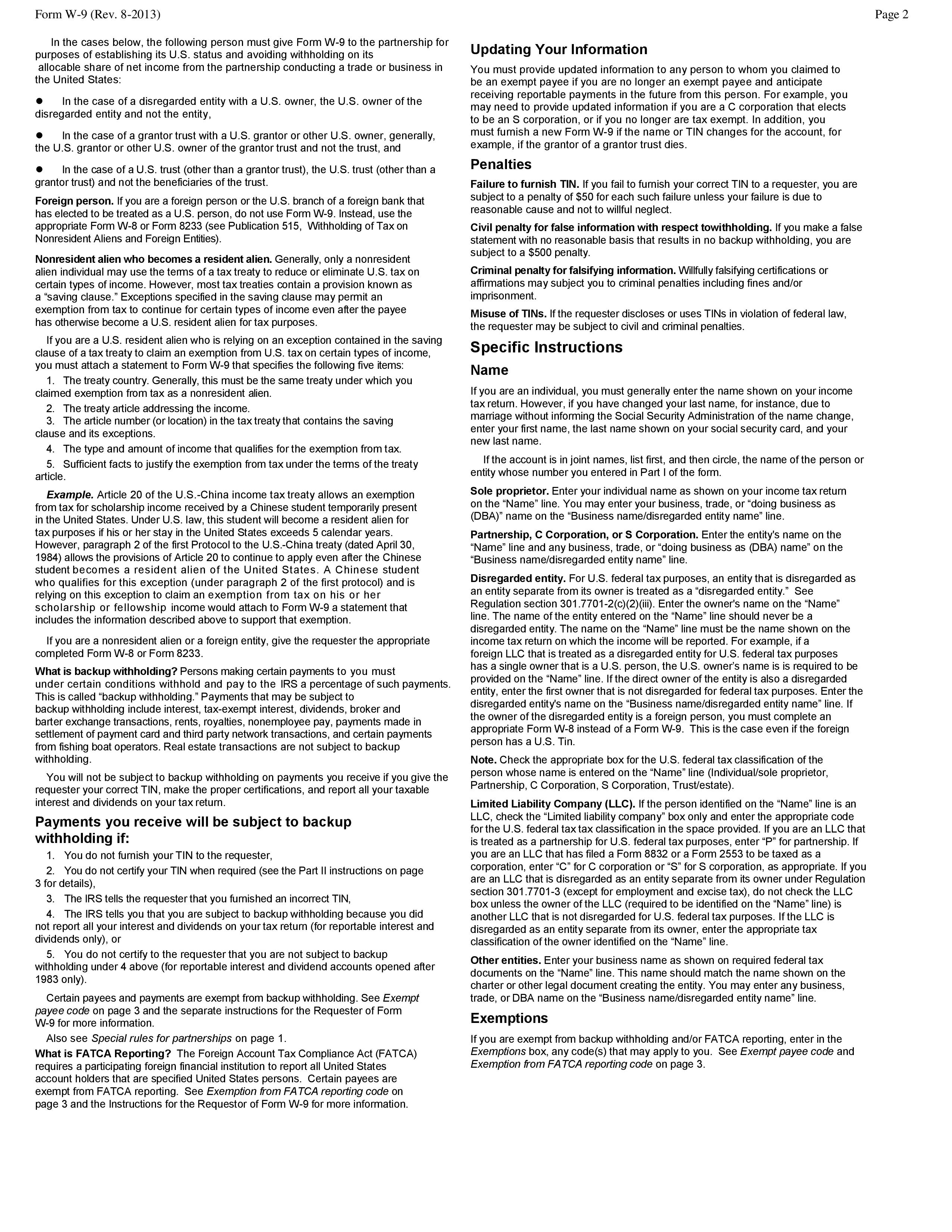

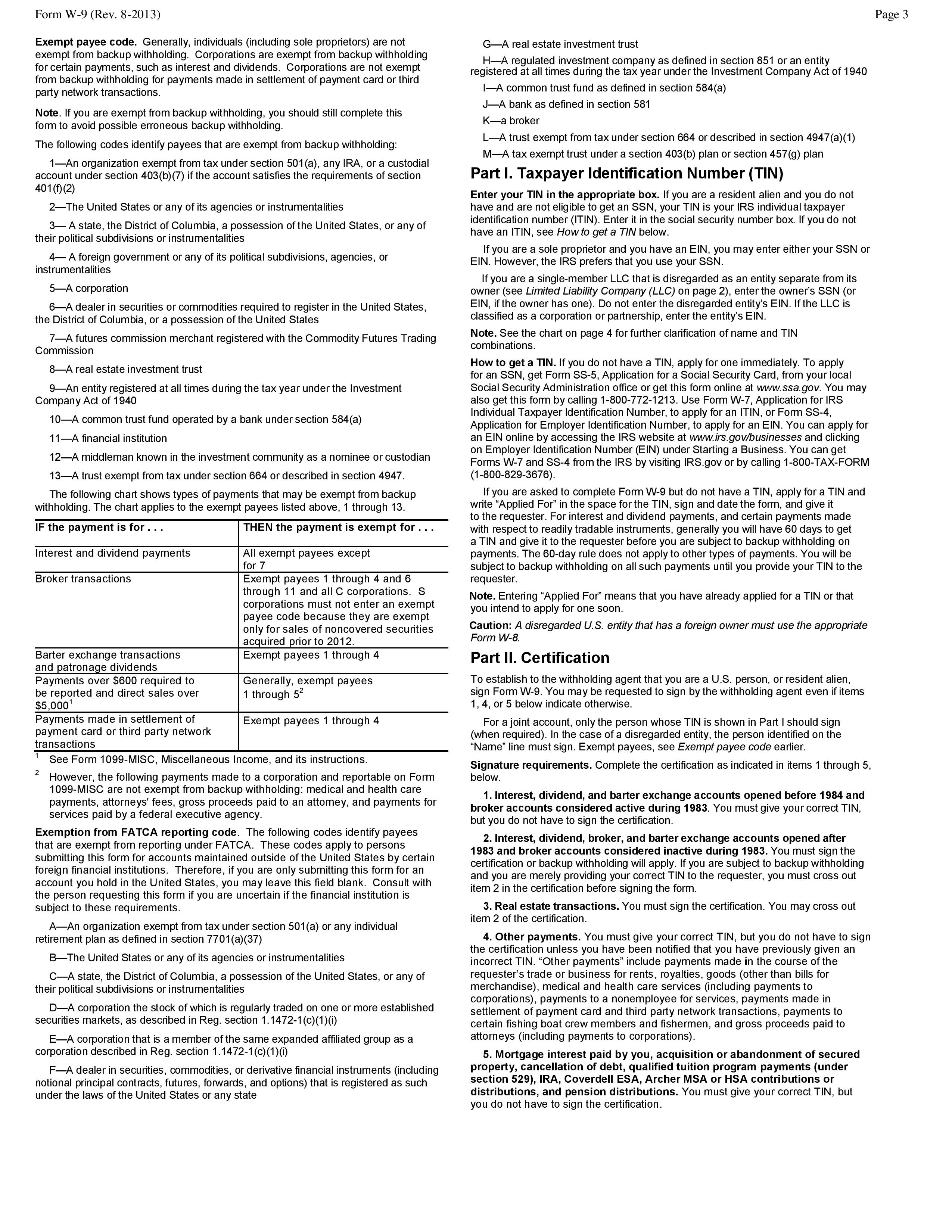

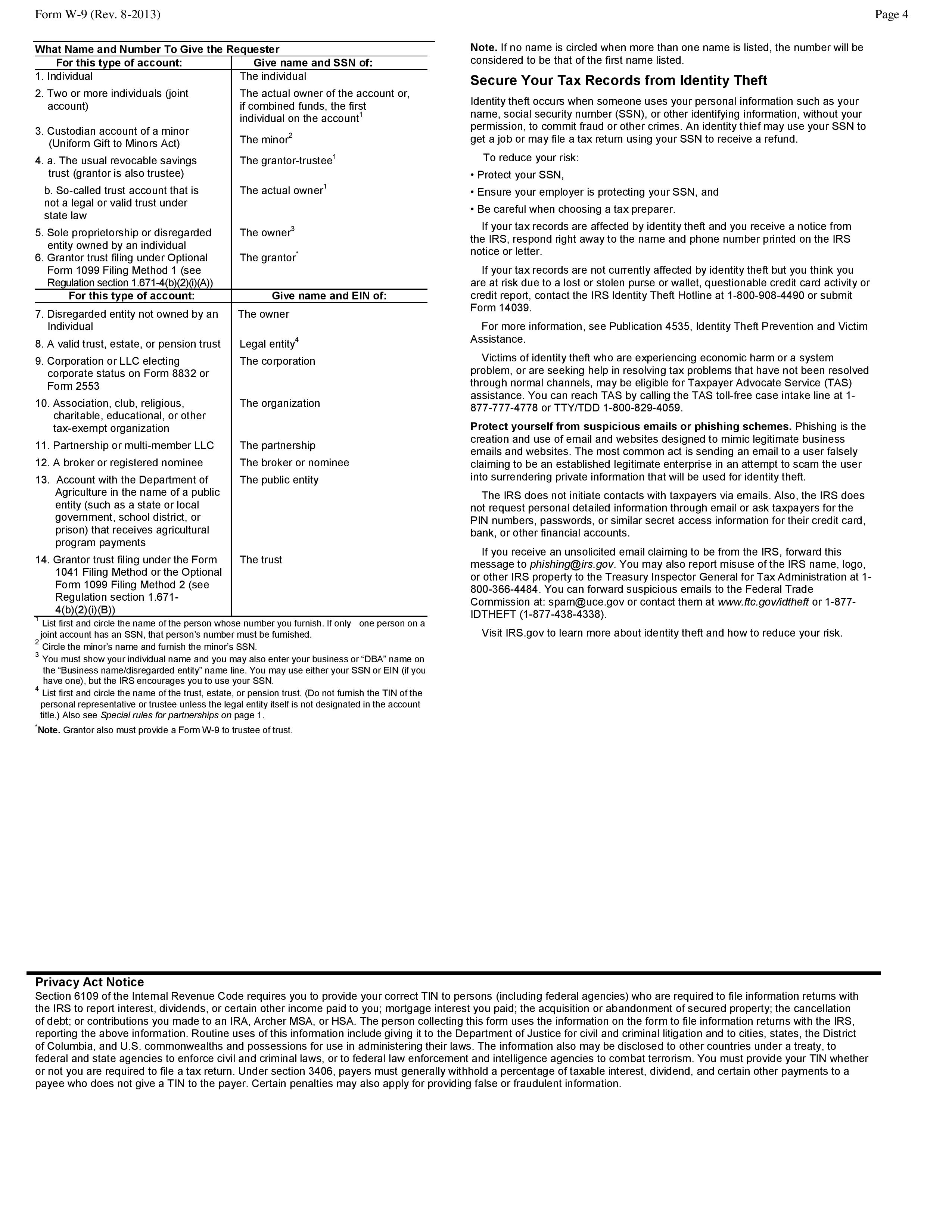

Box 2 PLEASE SEE THE SECTION ENTITLED “IMPORTANT U.S. TAX INFORMATION FOR HOLDERS” AND THE ACCOMPANYING IRS FORM W-9 AND INSTRUCTIONS THERETO TO CERTIFY YOUR EMPLOYER IDENTIFICATION NUMBER OR SOCIAL SECURITY NUMBER IF YOU ARE A U.S. TAXPAYER.

(Must be signed by registered holder(s) exactly as name(s) appear(s) on stock certificate(s) or on a security position listing or by person(s) authorized to become registered holder(s) by certificates and documents transmitted herewith. If signature is by a trustee, administrator, guardian, attorney-in-fact, agent, officer of a corporation, or other person acting in a fiduciary or representative capacity, please state full title and see Instruction 13.)

X X SIGNATURE(S) OF REGISTERED HOLDER(S) OR AUTHORIZED SIGNATORY Dated:

Name(s): (PLEASE PRINT) Capacity (full title): Address: (INCLUDING ZIP CODE) |

| I/we understand that the tender of shares constitutes a representation and warranty to the Company that the undersigned has/have a NET LONG POSITION in the shares or other securities exercisable or exchangeable therefore and that such tender complies with Rule 14e-4 promulgated under the Securities Exchange Act of 1934, as amended. I/we authorize the Company to withhold all applicable taxes and tax-related items legally payable by the undersigned. |

APPLY MEDALLION GUARANTEE STAMP BELOW |

|

| | | | | | | |

Box 3 Auction Price Tender: Price (in Dollars) per Share at Which Shares are Being Tendered: |

| By checking one of the following boxes below instead of the box under Box 4, “Purchase Price Tender,” you are tendering shares at the price checked. This election could result in none of your shares being purchased if the purchase price selected by the Company for the shares is less than the price checked below. If you wish to tender shares at more than one price, you must complete a separate Letter of Transmittal for each price at which you tender shares. The same shares cannot be tendered at more than one price, unless previously and validly withdrawn. (See Section 3 and Section 4 of the Offer to Purchase and Instruction 3 to this Letter of Transmittal) |

PRICE (IN DOLLARS) PER SHARE AT WHICH SHARES ARE BEING TENDERED CHECK ONLY ONE BOX IF MORE THAN ONE BOX IS CHECKED OR IF NO BOX IS CHECKED, THERE IS NO PROPER TENDER OF SHARES FOR AN AUCTION PRICE TENDER |

| (Shareholders who desire to tender shares at more than one price must complete a separate Letter of Transmittal for each price at which shares are tendered.) |

| o | $12.50 | o | $13.10 | o | $13.70 | o | $14.30 |

| o | $12.60 | o | $13.20 | o | $13.80 | o | $14.40 |

| o | $12.70 | o | $13.30 | o | $13.90 | o | $14.50 |

| o | $12.80 | o | $13.40 | o | $14.00 | | |

| o | $12.90 | o | $13.50 | o | $14.10 | | |

| o | $13.00 | o | $13.60 | o | $14.20 | | |

Box 4 Purchase Price Tender: |

| o | By checking this one box instead of one of the price boxes in Box 3, “Auction Price Tender: Price (in Dollars) per Share at Which Shares are Being Tendered,” you are tendering shares and are willing to accept the purchase price selected by the Company in accordance with the terms of the Offer. This action will maximize the chance of having the Company purchase your shares pursuant to the Offer (subject to proration). Note that this election is deemed to be a tender of shares at the minimum price under the Offer of $12.50 per share and could cause the purchase price in the Offer to be lower and could result in the tendered shares being purchased at the minimum price under the Offer of $12.50 per share. (See Section 3 of the Offer to Purchase and Instruction 4 to this Letter of Transmittal) |

Box 5 ODD LOTS |

| As described in Section 1 of the Offer to Purchase, under certain conditions, shareholders holding a total of fewer than 100 shares may have their shares tendered at or below the Purchase Price accepted for payment before any proration of other tendered shares. This preference is not available to partial tenders or to beneficial or record holders of 100 or more shares in the aggregate, even if these holders have separate accounts or certificates representing fewer than 100 shares. Accordingly, this section is to be completed only if shares are being tendered by or on behalf of a person owning, beneficially or of record, an aggregate of fewer than 100 shares. The undersigned either (check one box): |

| o | is the beneficial or record owner of an aggregate of fewer than 100 shares, all of which are being tendered; or |

| o | is a broker, dealer, commercial bank, trust company or other nominee shareholder that (a) is tendering for the beneficial owner(s) shares with respect to which it is the record holder and (b) believes, based upon representations made to it by the beneficial owner(s), that each such person is the beneficial owner of an aggregate of fewer than 100 shares and is tendering all of such shares. |

| |

| In addition, the undersigned is tendering either (check one box): |

| o | at the purchase price, as the same will be determined by the Company in accordance with the terms of the Offer (persons checking this box need not indicate the price per share above); or |

| o | at the price per share indicated above in the section captioned “Auction Price Tender: Price (in Dollars) per Share at Which Shares Are Being Tendered.” |

|

| | | | | | | |

Box 6 CONDITIONAL TENDER As described in Section 6 of the Offer to Purchase, a tendering shareholder may condition his or her tender of shares upon the Company purchasing all or a specified minimum number of the shares tendered. Unless at least the minimum number of shares you indicate below is purchased by the Company pursuant to the terms of the Offer, none of the shares tendered by you will be purchased. It is the tendering shareholder’s responsibility to calculate the minimum number of shares that must be purchased from the shareholder in order for the shareholder to qualify for sale (rather than distribution) treatment for U.S. federal income tax purposes. Shareholders are urged to consult with their own tax advisors before completing this section. No assurances can be provided that a conditional tender will achieve the intended U.S. federal income tax result for any shareholder tendering shares. Unless this box is checked and a minimum number of shares is specified, your tender will be deemed unconditional. |

| |

| o | The minimum number of shares that must be purchased from me/us, if any are purchased from me/us, is: ______________ shares. |

| |

| If, because of proration, the minimum number of shares designated will not be purchased, the Company may accept conditional tenders by random lot, if necessary. However, to be eligible for purchase by random lot, the tendering shareholder must have tendered all of the shares of the Company that they hold and checked this box: |

| |

| o | The tendered shares represent all of the shares of the Company held by the undersigned. |

Box 7 Special Payment Instructions Fill in ONLY if you want the proceeds of this transaction to be issued in another name. |

Name: __________________________________________________________________________________________________________ (PLEASE PRINT) |

Address: ________________________________________________________________________________________________________ |

________________________________________________________________________________________________________________ (INCLUDE ZIP CODE) |

________________________________________________________________________________________________________________ (Tax Identification or Social Security Number) (Recipient must complete the accompanying IRS Form W-9) |

|

|

Box 8 Special Delivery Instructions Fill in ONLY if check for cash and/or Certificate(s) for shares not tendered or not purchased are to be sent to someone other than the undersigned or to the undersigned at an address other than that shown on the front of this card. |

Name: __________________________________________________________________________________________________________ (PLEASE PRINT)

|

Address: ________________________________________________________________________________________________________

|

________________________________________________________________________________________________________________ (INCLUDE ZIP CODE)

|

|

| | | | |

| METHOD OF DELIVERY |

| | |

| o | CHECK HERE IF CERTIFICATES FOR TENDERED SHARES ARE ENCLOSED HEREWITH. |

| | | | | |

| o | CHECK HERE IF CERTIFICATES FOR TENDERED SHARES ARE BEING DELIVERED PURSUANT TO A NOTICE OF GUARANTEED DELIVERY PREVIOUSLY SENT TO THE DEPOSITARY AND COMPLETE THE FOLLOWING: |

Name of Tendering Shareholder(s): ________________________________________________________________________ |

Date of Execution of Notice of Guaranteed Delivery: _____________________________________________________________________ |

INSTRUCTIONS FOR COMPLETING THE LETTER OF TRANSMITTAL

| |

| 1. | Please indicate the total number of certificated share(s) you are tendering in Box 1. |

| |

| 2. | Sign and date this Letter of Transmittal in Box 2 after completing all other applicable sections and return this form in the enclosed envelope. If your shares are represented by physical certificates, include them in the enclosed envelope as well. |

PLEASE SEE THE SECTION ENTITLED “IMPORTANT U.S. TAX INFORMATION FOR HOLDERS” AND THE ACCOMPANYING IRS FORM W-9 AND INSTRUCTIONS THERETO TO CERTIFY YOUR EMPLOYER IDENTIFICATION NUMBER OR SOCIAL SECURITY NUMBER IF YOU ARE A U.S. TAXPAYER. Please note that the applicable withholding agent may withhold a portion of your proceeds as required by the IRS if the Employer Identification Number or Social Security Number is not properly certified on our records. If you are a non--U.S. person, in order to establish an exemption from backup withholding, please complete and submit an IRS Form W-8BEN, W-8BEN-E, W-8IMY (with any required attachments), W-8ECI, or W8EXP, as applicable (which may be obtained from the IRS website (www.irs.gov)).

| |

| 3. | Indication of price at which shares are being tendered: Auction Price Tender. If you want to tender your shares at a specific price within the $12.50 to $14.50 range, you must properly complete the pricing section of this Letter of Transmittal, which is called “Auction Price Tender: Price (in Dollars) per Share at Which Shares are Being Tendered.” For shares to be properly tendered for an Auction Price Tender, you must check ONLY ONE PRICE BOX in the pricing section in Box 3. If more than one price box is checked in Box 3 or no price box is checked in Box 3, your shares will not be validly tendered for an Auction Price Tender. If you want to tender portions of your shares at different prices, you must complete a separate Letter of Transmittal for each price at which you want to tender each such portion of your shares. However, the same shares cannot be tendered at more than one price, unless previously and validly withdrawn as provided in Section 4 of the Offer to Purchase. |

| |

| 4. | Indication of price at which shares are being tendered: Purchase Price Tender. If you are tendering your shares and willing to accept the Purchase Price determined by the Company in accordance with the terms of the Offer, you must check the box in Box 4 instead of one of the price boxes in Box 3. This election will maximize the chance of having the Company purchase your shares pursuant to the Offer (subject to proration). Note that this election is deemed to be a tender of shares at the minimum price under the Offer of $12.50 per share for purposes of determining the Purchase Price in the Offer, and could cause the Purchase Price in the Offer to be lower and could result in your shares being purchased at the minimum price under the Offer of $12.50 per share. See Section 3 of the Offer to Purchase. |

| |

| 5. | Please see Section 1 of the Offer to Purchase for additional information regarding Box 5. |

| |

| 6. | The conditional tender alternative is made available for shareholders seeking to take steps to have payment for shares sold pursuant to the Offer treated as received in a sale of such shares by the shareholder, rather than as a distribution to the shareholder, for U.S. federal income tax purposes. Accordingly, a shareholder may tender shares subject to the condition that all or a specified minimum number of the shareholder’s shares tendered must be purchased if any shares tendered are purchased. It is the tendering shareholder’s responsibility to calculate the minimum number of shares that must be purchased from the shareholder in order for the shareholder to qualify as a sale rather than distribution treatment. Each shareholder is urged to consult his or her own tax advisor. See Section 6 of the Offer to Purchase. |

If you want to make a conditional tender, you must indicate this in Box 6 and, if applicable, the Notice of Guaranteed Delivery. In Box 6 and, if applicable, the Notice of Guaranteed Delivery, you must calculate and appropriately indicate the minimum number of shares that must be purchased if any are to be purchased.

As discussed in Section 6 of the Offer to Purchase, proration may affect whether the Company accepts conditional tenders and may result in shares tendered pursuant to a conditional tender being deemed withdrawn if the minimum number of shares would not be purchased. If, because of proration (due to more than the number of shares sought being properly tendered), the minimum number of shares that you designate will not be purchased, the Company may accept conditional tenders by random lot, if necessary. However, to be eligible for purchase by random lot, you must have tendered all of your shares and check the box so indicating. Upon selection by random lot, if any, the Company will limit its purchase in each case to the designated minimum number of Shares.

| |

| 7. | If you want the proceeds of this transaction to be issued in another name, fill in Box 7 with the information for the new account name. If you complete Box 7, your signature(s) must be guaranteed. |

| |

| 8. | Complete Box 8 only if the proceeds of this transaction are to be mailed to a person other than the registered holder or sent to the registered holder at a different address. |

| |

| 9. | If any certificate representing shares that you own has been lost or destroyed, please contact the Depositary at (800) 468-9716 or by fax at (800) 734-9952 promptly to obtain instructions as to the steps that must be taken in order to replace the certificate. This Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost or destroyed certificates have been followed. Please contact the Depositary immediately to permit timely processing of the replacement documentation. |

| |

| 10. | Shareholders who cannot deliver their certificates and all other required documents to the Depositary or complete the procedures for book-entry transfer prior to the Expiration Time may tender their shares by properly completing and duly executing the Notice of Guaranteed Delivery pursuant to the guaranteed delivery procedures set forth in Section 3 of the Offer to Purchase and thereafter timely delivering the shares subject to such notice of guaranteed delivery in accordance with such procedures. |

| |

| 11. | All questions as to the number of shares to be accepted, the Purchase Price to be paid for shares to be accepted and the validity, form, eligibility, including time of receipt, and acceptance for payment of any tender of shares will be determined by the Company, in its sole discretion, and will be final and binding on all parties absent a finding to the contrary by a court of competent jurisdiction. The Company reserves the absolute right to reject any or all tenders of any shares that it determines are not in proper form or the acceptance for payment of or payment for any shares which it determines may be unlawful. The Company also reserves the absolute right to waive any of the conditions of the Offer prior to the Expiration Time with respect to all tendered shares. The Company also reserves the absolute right to waive any defect or irregularity in any tender with respect to any particular shares, whether or not the Company waives similar defects or irregularities in the case of any other shareholder. No tender of shares will be deemed to have been validly made until all defects or irregularities have been cured by the tendering shareholder or waived by the Company. The Company will not be liable for failure to waive any condition of the Offer, or any defect or irregularity in any tender of shares. None of the Company, the Depositary, the Information Agent, the Dealer Manager or any other person will be obligated to give notice of any defects or irregularities in tenders, nor will any of them incur any liability for failure to give any such notice. See Section 3 of the Offer to Purchase for additional information. |

| |

| 12. | All questions as to the form and validity, including the time of receipt, of any notice of withdrawal will be determined by the Company, in its sole discretion, and such determination will be final and binding on all parties absent a finding to the contrary by a court of competent jurisdiction. The Company reserves the absolute right to waive any defect or irregularity in the notice of withdrawal or method of withdrawal of shares by any shareholder, whether or not the Company waives similar defects or irregularities in the case of any other shareholder. None of the Company, the Depositary, the Information Agent, the Dealer Manager or any other person will be obligated to give notice of any defects or irregularities in any notice of withdrawal, nor will any of them incur liability for failure to give any such notice. See Section 4 of the Offer to Purchase for additional information. |

| |

| 13. | If any of the shares tendered hereby are owned of record by two or more joint owners, all such persons must sign this Letter of Transmittal. If any shares tendered hereby are registered in different names on several certificates, it will be necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations of certificates. If this Letter of Transmittal or any certificate or stock power is signed by a trustee, executor, administrator, guardian, attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, he or she should so indicate when signing, and proper evidence satisfactory to the Company of his or her authority to so act must be submitted with this Letter of Transmittal. |

If this Letter of Transmittal is signed by the registered owner(s) of the shares tendered hereby, no endorsements of certificates or separate stock powers are required unless payment of the purchase price is to be made, or certificates for shares not tendered or accepted for payment are to be issued, to a person other than the registered owner(s) or payment of the purchase price or certificates for shares not tendered or accepted for payment are to be sent to registered owner(s) at an address other than the one in the Company’s records. If this Letter of Transmittal is signed by a person other than the registered owner(s) of the shares tendered hereby, or if payment is to be made or certificate(s) for shares not tendered or not accepted for payment are to be issued to a person other than the registered owner (s), the certificate(s) representing such shares must be properly endorsed for transfer or accompanied by appropriate stock powers, in either case signed exactly as the name(s) of the registered owner(s) appear(s) on the certificates(s). The signature(s) on any

such certificate(s) or stock power(s) must be guaranteed by an eligible institution. See Section 3 of the Offer to Purchase. Signature guarantees are also required if Box 7, “Special Payment Instructions” is completed.

The tendering holder will, upon request, execute and deliver any additional documents deemed by the Depositary or the Company to be necessary or desirable to complete the sale, assignment and transfer of the shares tendered hereby.

| |

| 14. | If the space provided in Box 1 above is inadequate, the certificate numbers and/or the number of shares should be listed on a separately signed schedule that should be attached hereto. |

| |

| 15. | Partial Tenders. If fewer than all the shares represented by any certificate submitted to the Depositary are to be tendered, fill in the number of shares that are to be tendered in Box 1. In that case, if any tendered shares are purchased, new certificate(s) for the remainder of the shares that were evidenced by the old certificate(s) will be sent to the registered holder(s), unless otherwise provided in the appropriate box on this Letter of Transmittal, promptly after the acceptance for payment of, and payment for, the shares tendered herewith. All shares represented by certificates delivered to the Depositary will be deemed to have been tendered unless otherwise indicated. |

| |

| 16. | In participating in the Offer, the tendering shareholder acknowledges that: (1) the Offer is established voluntarily by the Company, it is discretionary in nature and it may be extended, modified, suspended or terminated by the Company as provided in the Offer to Purchase; (2) the tendering shareholder is voluntarily participating in the Offer; (3) the future value of the shares is unknown and cannot be predicted with certainty; (4) the tendering shareholder has received the Offer to Purchase and the Letter of Transmittal, as amended or supplemented; (5) any foreign exchange obligations triggered by the tendering shareholder’s tender of shares or the receipt of proceeds are solely his or her responsibility; and (6) regardless of any action that the Company takes with respect to any or all income/capital gains tax, social security or insurance tax, transfer tax or other tax-related items (“Tax Items”) related to the Offer and the disposition of shares, the tendering shareholder acknowledges that the ultimate liability for all Tax Items is and remains his or her sole responsibility. In that regard, the tendering shareholder authorizes the Company to withhold all applicable Tax Items that the applicable withholding agent is legally required to withhold. The tendering shareholder consents to the collection, use and transfer, in electronic or other form, of the tendering shareholder’s personal data as described in this document by and among, as applicable, the Company, its subsidiaries, and third party administrators for the exclusive purpose of implementing, administering and managing his or her participation in the Offer. No authority herein conferred or agreed to be conferred shall be affected by, and all such authority shall survive, the death or incapacity of the undersigned. All obligations of the undersigned hereunder shall be binding upon the heirs, personal and legal representatives, administrators, trustees in bankruptcy, successors and assigns of the undersigned. |

IMPORTANT U.S. TAX INFORMATION FOR HOLDERS

This is a summary only of certain U.S. federal income tax considerations. Shareholders should read the Offer to Purchase for a more detailed summary, and shareholders (including those shareholders holding vested but unexercised options and restricted stock) should consult with their own tax advisors regarding the tax consequences with respect to their particular circumstances.

In order to avoid backup withholding on payments pursuant to the Offer, any shareholder that is a United States Holder (as defined in the Offer to Purchase) tendering shares must, unless an exemption applies, provide the applicable withholding agent with such shareholder’s correct taxpayer identification number (“TIN”), certify under penalties of perjury that such TIN is correct (or that such United States Holder is waiting for a TIN to be issued), and provide certain other certifications by completing the IRS Form W-9 included in this Letter of Transmittal. If a United States Holder does not provide his, her or its correct TIN or fails to provide the required certifications, the IRS may impose certain penalties on such United States Holder and payment to such United States Holder pursuant to the Offer may be subject to backup withholding. All United States Holders tendering shares pursuant to the Offer should complete and sign the enclosed IRS Form W-9 to provide the information and certification necessary to avoid backup withholding (unless an applicable exemption exists and is proved in a manner satisfactory to the applicable withholding agent). To the extent that a United States Holder designates another United States person to receive payment, such other person may be required to provide a properly completed IRS Form W-9.

Backup withholding is not an additional tax. Rather, the amount of the backup withholding may be credited against the U.S. federal income tax liability of the person subject to the backup withholding. If backup withholding results in an overpayment of tax, a refund can be obtained by timely providing the required information to the IRS.

If a United States Holder has not been issued a TIN and has applied for a TIN (or intends to apply for a TIN in the near future), then such United States Holder should write “Applied For” in the space for the TIN in Part I of the IRS Form W-9 and should sign and date the IRS Form W-9. If the applicable withholding agent has not been provided with a properly certified TIN by the time of payment, backup withholding will apply. If the shares are held in more than one name or are not in the name of the actual owner, you should consult the instructions on the enclosed IRS Form W-9 for additional guidance on which name and TIN to report.

Certain shareholders (including, among others, corporations, individual retirement accounts and certain foreign individuals and entities) are not subject to backup withholding but may be required to provide evidence of their exemption from backup withholding. Exempt United States Holders should supply the applicable “Exempt payee code” on the IRS Form W-9. See the enclosed IRS Form W-9 for more instructions.

Non-United States Holders (as defined in the Offer to Purchase) should not complete an IRS Form W-9. Instead, to establish an exemption from backup withholding, a Non-United States Holder (or a United States Holder’s non-U.S. designee, if any) should properly complete and submit an IRS Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)), IRS Form W-8BEN-E (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)), or other applicable IRS Form W-8, signed under penalties of perjury, attesting to such exempt status (each of which may be obtained on the IRS website (www.irs.gov)). The applicable withholding agent will generally withhold tax at a 30 percent rate (subject to certain exceptions) on payments made to Non-United States Holders pursuant to the Offer. See Sections 3 and 13 of the Offer to Purchase.

A foreign financial institution or non-financial foreign entity that tenders shares which are accepted for purchase pursuant to the Offer will generally be subject to withholding tax imposed under Sections 1471 to 1474 of the Code (such Sections commonly referred to as the Foreign Account Tax Compliance Act, or “FATCA”) and the final U.S. Treasury regulations promulgated thereunder at a rate of 30 percent of the gross proceeds payable to such foreign financial institution or non-financial foreign entity unless such foreign financial institution or non-financial foreign entity provides to the applicable withholding agent an applicable IRS Form W-8 demonstrating that FATCA withholding is not required. If the applicable withholding agent withholds tax under FATCA, it will not also withhold the 30 percent U.S. federal income tax described in the immediately preceding paragraph. See Section 13 of the Offer to Purchase.

NON-UNITED STATES HOLDERS (AS DEFINED IN THE OFFER TO PURCHASE) MAY BE SUBJECT TO U.S. FEDERAL WITHHOLDING TAX AT A 30 PERCENT RATE ON THE SALE OF SHARES PURSUANT TO THE OFFER, EVEN IF NO SUCH WITHHOLDING WOULD APPLY IF THOSE SAME SHARES WERE SOLD ON THE OPEN MARKET. IN ADDITION, NON-UNITED STATES HOLDERS MAY BE SUBJECT TO THIS 30 PERCENT WITHHOLDING TAX ON THE SALE OF SHARES PURSUANT TO THE OFFER OR TO 30 PERCENT WITHHOLDING UNDER FATCA EVEN IF THE TRANSACTION IS NOT SUBJECT TO U.S. FEDERAL INCOME TAX. NON-UNITED STATES HOLDERS ARE URGED TO CONSULT THEIR TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME TAX WITHHOLDING RULES, INCLUDING ELIGIBILITY FOR A WITHHOLDING TAX REDUCTION OR EXEMPTION, AND THE REFUND PROCEDURE.

Shareholders are urged to consult their own tax advisors to determine whether they are exempt from these backup withholding and reporting requirements.

The Depositary for the offer is

WELLS FARGO BANK, N.A.

By Hand, Express Mail, Courier or Other Expedited Service:

(By 5:00 p.m., New York City time on Expiration Date)

Wells Fargo Bank, N.A.

Shareowner Services

Voluntary Corporate Actions

161 North Concord Exchange

South St. Paul, Minnesota 55075

Delivery of this Letter of Transmittal and all other documents to an address other than as set forth above will not constitute a valid delivery to the Depositary. This Letter of Transmittal properly completed and duly executed, together with certificates representing shares being tendered and all other required documents must be received prior to the Expiration Time.

Any questions or requests for assistance may be directed to the Information Agent at its telephone number and address listed below. Requests for additional copies of the Offer to Purchase and this Letter of Transmittal may be directed either to the Information Agent or the Dealer Manager at their respective telephone numbers and addresses listed below. You may also contact your broker, dealer, commercial bank, trust company or other nominee shareholder for assistance concerning the Offer.

The Information Agent for the Offer is:

D. F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Banks and Brokers call collect: (212) 269-5550

All others call toll free: (800) 499-8410

Email: BBRG@dfking.com

The Dealer Manager for the Offer is:

Jefferies

520 Madison Avenue

New York, New York 10022

Call Toll Free: (877) 547-6340